PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1788517

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1788517

Crane and Hoist Market by Mobile Cranes (Lattice Boom, Telescopic Boom, Crawler, Rough Terrain, All-Terrain, Truck-Loader), Fixed Cranes (Industrial, Tower, Ship-to-Shore), Operation (Hydraulic, Electric), Hoist Type, Region - Global Forecast to 2030

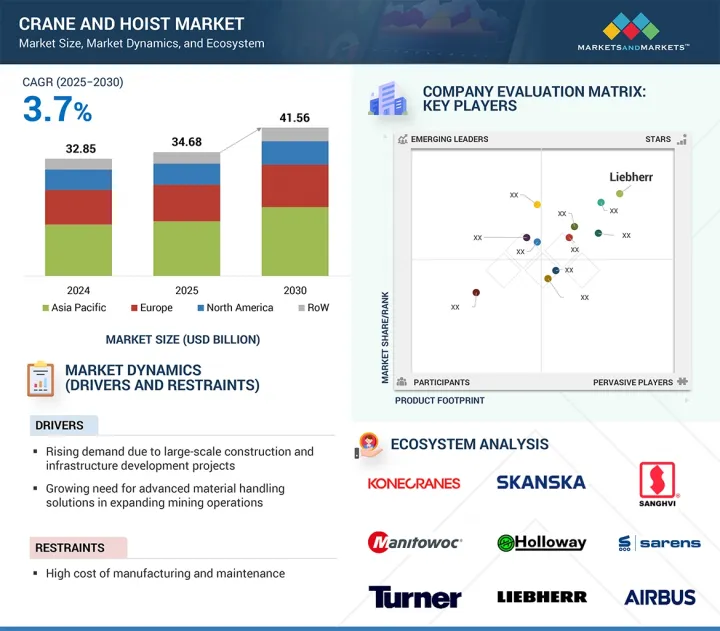

The crane and hoist market is projected to grow from USD 34.68 billion in 2025 to USD 41.56 billion by 2030, at a CAGR of 3.7%. The construction sector continues to be a primary demand driver, with cranes and hoists playing a central role in large-scale development projects across both urban and rural areas. Meanwhile, the mining industry is experiencing heightened adoption of heavy lifting equipment to improve productivity and safety in extraction and transport operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Operation, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

As industries modernize, there is a rising shift toward technologically advanced and automated crane systems that reduce downtime and improve precision. These evolving demands across key sectors are expected to significantly influence the market's direction in the coming years.

"Mobile cranes to record highest CAGR during forecast period"

Mobile cranes are expected to register the highest CAGR during the forecast period. Rapid infrastructure development and increasing demand for flexible lifting solutions have placed mobile cranes at the forefront of modern construction and industrial projects. The outstanding mobility and swift deployment of mobile cranes make them indispensable for job sites that require frequent relocations and rapid execution. By eliminating the need for permanent installations, these cranes dramatically reduce setup time, thereby significantly enhancing overall operational efficiency and productivity. Their versatility not only streamlines workflows but also ensures that projects can adapt quickly to changing demands, solidifying their position as a vital asset in the construction industry. They are especially effective in projects with tight deadlines or space constraints, where fixed cranes may not be practical. Their versatility in operating across varied terrains and adapting to diverse site conditions makes them a reliable option for contractors handling complex schedules. With ongoing investment in infrastructure and growing emphasis on project agility, mobile cranes are playing an increasingly vital role in meeting the evolving demands of both developed and emerging economies.

"Hybrid operation segment to exhibit highest CAGR during forecast period"

The hybrid operation segment is expected to witness the highest CAGR during the forecast period. Hybrid-operated cranes are gaining significant traction as industries prioritize cleaner and more energy-efficient machinery. These cranes utilize diesel generators and electric power sources, with many models incorporating advanced battery energy storage systems (ESS). Through regenerative braking-particularly during load descent-excess energy is captured and stored for future lifting operations. This cuts fuel consumption and reduces greenhouse gas emissions and operating costs. Hybrid systems are especially impactful in rubber-tired gantry (RTG) cranes, offering an environmentally friendly alternative to conventional diesel-only models. With rising environmental awareness and rapid advancements in battery technology, hybrid cranes are becoming an attractive solution for ports, construction sites, and industrial facilities. Manufacturers are increasingly investing in research and partnerships to accelerate the development and deployment of hybrid crane technologies.

"Construction industry to record highest CAGR during forecast period"

The construction industry is expected to record the highest CAGR in the crane and hoist market during the forecast period. Increasing capital allocation toward infrastructure development-encompassing roads, bridges, railways, airports, and other substantial projects-has significantly heightened the demand for advanced lifting equipment. As a result, the construction sector is emerging as a key driver in the crane and hoist market, necessitating sophisticated lifting solutions to meet the complexities of modern construction requirements. Cranes are indispensable in moving heavy materials, assembling structural elements, and supporting intricate construction workflows. At the same time, global urbanization is driving a boom in residential and commercial development, requiring even more lifting capacity to keep pace with population growth. Emerging economies such as India, China, Brazil, and the UAE fuel these trends through strong industrialization and economic expansion. Their strategic focus on public and private infrastructure further amplifies the need for reliable, high-capacity cranes. As these nations intensify construction efforts, demand for advanced lifting solutions is expected to surge, positioning the construction sector as the key contributor to market growth.

"Asia Pacific to be fastest-growing market between 2025 and 2030"

The crane and hoist market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. The region's rapid industrial development, combined with a growing population, is driving significant demand for construction and material handling equipment. Countries including China, India, and Australia are witnessing large-scale infrastructure development, fueling the need for efficient lifting solutions across urban, industrial, and transport projects. The increasing adoption of automation and technological upgrades, especially in China and Japan, further strengthens regional market growth. The rapid expansion of key automotive, aerospace, defense, and manufacturing industries in emerging economies generates considerable demand for cutting-edge crane systems. With robust investments from the government and private sectors in infrastructure and industrial development, the Asia Pacific region is positioned as a crucial powerhouse for the growth of the crane and hoist market, setting the stage for unprecedented opportunities and innovations.

Breakdown of primaries

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the crane and hoist market space. The breakdown of primary participants for the report is shown below:

- By Company Type: Tier 1 - 35%, Tier 2 - 35%, and Tier 3 - 30%

- By Designation: C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region: North America -25%, Europe- 30%, Asia Pacific - 30%, and Rest of the World - 15%

Key players in the crane and hoist market are Konecranes (Finland), Liebherr (Switzerland), Tadano Ltd. (Japan), The Manitowoc Company, Inc. (US), Zoomlion Heavy Industry Science & Technology Co., Ltd. (China), Terex Corporation (US), Ingersoll Rand (US), PALFINGER AG (Austria), Columbus McKinnon Corporation (US), KOBE STEEL, LTD. (Japan), XCMG Group (China), Sumitomo Heavy Industries, Ltd. (Japan), ABUS Kransysteme GmbH (Germany), Mammoet (Netherlands), KATO WORKS CO., LTD. (Japan), and others.

The study includes an in-depth competitive analysis of these key players in the crane and hoist market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall crane and hoist market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights into positioning their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (sustainable demand from construction industry; expanding mining industry driving the market; booming shipping industry), restraints (high cost of manufacturing and maintenance), opportunities (growth phase of network, infrastructure, and airline development in Asia Pacific region; expansion of e-commerce in Southeast Asia; adoption of smart technologies in cranes), and challenges (shortage of skilled workforce to handle crane operations)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the crane and hoist market

- Market Development: Comprehensive information about lucrative markets by analyzing the crane and hoist market across varied regions such as North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the crane and hoist market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Konecranes (Finland), Liebherr (Switzerland), Tadano Ltd. (Japan), The Manitowoc Company, Inc. (US), and Zoomlion Heavy Industry Science & Technology Co., Ltd. (China).

- Strategies: Helps stakeholders understand the pulse of the crane and hoist market and provides them information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CRANE AND HOIST MARKET

- 4.2 CRANE MARKET, BY TYPE

- 4.3 CRANE MARKET, BY OPERATION

- 4.4 CRANE AND HOIST MARKET, BY INDUSTRY

- 4.5 CRANE AND HOIST MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing emphasis on infrastructure development

- 5.2.1.2 Increasing need for advanced material handling solutions to support mining operations

- 5.2.1.3 Expansion and modernization of shipping industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of manufacturing and maintenance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Mounting demand for material handling equipment in aviation industry

- 5.2.3.2 Rapid expansion of e-commerce and retail sectors in Southeast Asia

- 5.2.3.3 Integration of smart technologies into cranes and hoists

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled crane technicians and operators

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF MOBILE CRANES OFFERED BY KEY PLAYERS, BY CRANE TYPE, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF ALL-TERRAIN CRANES, 2021-2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF ALL-TERRAIN CRANES, BY REGION, 2021-2024

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Variable frequency drives (VFDs)

- 5.7.1.2 Electromechanical hoisting systems

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Digital twin

- 5.7.2.2 5G

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Building information modeling (BIM)

- 5.7.3.2 Vision and safety systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDIES

- 5.10.1 FPS FOOD PROCESSING SOLUTIONS INSTALLS NORELCO'S CRANES TO ASSIST PRODUCTION PROCESS

- 5.10.2 TRI-STATE OVERHEAD CRANE HELPS CLIENT FROM NORTH AMERICA ENABLE SAFE AND EFFICIENT OPERATIONS WITH MOTORIZED OUTDOOR CRANE WITH FORKLIFT ATTACHMENT

- 5.10.3 TRI-STATE OVERHEAD CRANES PROVIDES CUSTOM ADJUSTABLE LIFTING BEAM FOR 20,000 LB ROTORS FOR CLIENT FROM NORTH AMERICA

- 5.10.4 USG CORPORATION LEVERAGES R&M MATERIAL HANDLING'S CRANE BRIDGE TO SUPPORT MINING OPERATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 842611)

- 5.11.2 EXPORT SCENARIO (HS CODE 842611)

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS

- 5.15 IMPACT OF AI/GEN AI ON CRANE AND HOIST MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 IMPACT OF AI/GEN AI ON CRANE AND HOIST APPLICATIONS

- 5.15.3 TOP USE CASES OF AI/GEN AI AND MARKET POTENTIAL

- 5.16 IMPACT OF 2025 US TARIFF ON CRANE AND HOIST MARKET

- 5.16.1 INTRODUCTION

- 5.16.1.1 Key tariff rates

- 5.16.2 PRICE IMPACT ANALYSIS

- 5.16.3 IMPACT ON COUNTRIES/REGIONS

- 5.16.3.1 US

- 5.16.3.2 Europe

- 5.16.3.3 Asia Pacific

- 5.16.4 IMPACT ON INDUSTRIES

- 5.16.1 INTRODUCTION

6 CRANE BUSINESS TYPES

- 6.1 INTRODUCTION

- 6.2 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS)

- 6.3 AFTERMARKET

7 CRANE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MOBILE

- 7.2.1 BY BOOM TYPE

- 7.2.1.1 Lattice boom

- 7.2.1.2 Telescopic boom

- 7.2.2 BY CRANE TYPE

- 7.2.2.1 Crawler cranes

- 7.2.2.1.1 Ability to handle high load pressure to contribute to segmental growth

- 7.2.2.2 Rough-terrain cranes

- 7.2.2.2.1 Adoption in off-road construction projects to bolster segmental growth

- 7.2.2.3 All-terrain cranes

- 7.2.2.3.1 Higher stability proportional to load capacity to accelerate segmental growth

- 7.2.2.4 Truck loader cranes

- 7.2.2.4.1 Ability to perform diverse material handling tasks to fuel segmental growth

- 7.2.2.1 Crawler cranes

- 7.2.1 BY BOOM TYPE

- 7.3 FIXED

- 7.3.1 INDUSTRIAL CRANES

- 7.3.1.1 Precise, high-speed material handling to augment segmental growth

- 7.3.2 TOWER CRANES

- 7.3.2.1 Ability to support high load-bearing capacity at higher altitudes to expedite segmental growth

- 7.3.3 SHIP-TO-SHORE CRANES

- 7.3.3.1 Increased application in marine and shipping industries to foster segmental growth

- 7.3.1 INDUSTRIAL CRANES

8 CRANE MARKET, BY OPERATION

- 8.1 INTRODUCTION

- 8.2 HYDRAULIC

- 8.2.1 SUPERIOR ABILITY TO LIFT HEAVY LOADS TO BOLSTER SEGMENTAL GROWTH

- 8.3 ELECTRIC

- 8.3.1 GROWING USE IN INDOOR APPLICATIONS TO FUEL SEGMENTAL GROWTH

- 8.4 HYBRID

- 8.4.1 REDUCTION IN FUEL USAGE TO CONTRIBUTE TO SEGMENTAL GROWTH

9 NORTH AMERICAN MOBILE CRANE MARKET, BY LIFTING CAPACITY

- 9.1 INTRODUCTION

- 9.2 0-66 MT

- 9.2.1 LIGHTWEIGHT, MANEUVERABILITY, AND COST EFFICIENCY TO FUEL SEGMENTAL GROWTH

- 9.3 67-80 MT

- 9.3.1 USE FOR COMPLEX TASKS IN INDUSTRIAL, COMMERCIAL, AND INSTITUTIONAL SPACES TO DRIVE MARKET

- 9.4 81-111 MT

- 9.4.1 DEPLOYMENT IN INDUSTRIAL, INFRASTRUCTURE, AND HEAVY CONSTRUCTION SECTORS TO BOOST SEGMENTAL GROWTH

- 9.5 111+ MT

- 9.5.1 INVESTMENT IN OIL EXTRACTION AND PROCESSING FACILITIES TO ACCELERATE SEGMENTAL GROWTH

10 HOIST MARKET, BY TYPE AND OPERATION

- 10.1 INTRODUCTION

- 10.2 BY TYPE

- 10.2.1 WELDED LINK LOAD CHAIN

- 10.2.1.1 Ability to create strong and durable chain suitable for heavy lifting purposes to drive market

- 10.2.2 WIRE ROPE

- 10.2.2.1 Adoption to lift freely movable and guided loads that cannot tilt to boost segmental growth

- 10.2.3 ROLLER LOAD CHAIN

- 10.2.3.1 Low maintenance, small-sized, and cost-effective attributes to contribute to segmental growth

- 10.2.4 OTHER HOIST TYPES

- 10.2.1 WELDED LINK LOAD CHAIN

- 10.3 BY OPERATION

- 10.3.1 PNEUMATIC

- 10.3.1.1 Spark and corrosion resistance attributes to accelerate segmental growth

- 10.3.2 ELECTRIC

- 10.3.2.1 Growing application in automotive sector to contribute to segmental growth

- 10.3.3 HYDRAULIC

- 10.3.3.1 Use to repair cars and lift car engines to foster segmental growth

- 10.3.1 PNEUMATIC

11 CRANE AND HOIST MARKET, BY INDUSTRY

- 11.1 INTRODUCTION

- 11.2 AEROSPACE

- 11.2.1 GROWING RELIANCE ON AUTOMATED PROCESSES TO ENHANCE MANUFACTURING TO FUEL SEGMENTAL GROWTH

- 11.3 AUTOMOTIVE & RAILWAY

- 11.3.1 THRIVING AUTOMOTIVE AND RAILWAY SECTORS IN EMERGING ECONOMIES TO BOOST SEGMENTAL GROWTH

- 11.4 CONSTRUCTION

- 11.4.1 INCREASING DEMAND FOR INFRASTRUCTURE DEVELOPMENT TO DRIVE MARKET

- 11.5 SHIPPING & MATERIAL HANDLING

- 11.5.1 RISING SHIFT TOWARD CONTAINERIZED CARGO TO AUGMENT SEGMENTAL GROWTH

- 11.6 MINING

- 11.6.1 STRONG PRESENCE OF SUBSTANTIAL MINERAL RESERVES TO FUEL SEGMENTAL GROWTH

- 11.7 ENERGY & POWER

- 11.7.1 RISING SHIFT TOWARD RENEWABLE POWER SOURCES TO ACCELERATE SEGMENTAL GROWTH

- 11.8 OTHER INDUSTRIES

12 CRANE AND HOIST MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 High demand from automotive and construction industries to fuel market growth

- 12.2.2 CANADA

- 12.2.2.1 Growing production and utilization of renewable energy sources to drive market

- 12.2.3 MEXICO

- 12.2.3.1 Increasing investment in renewable energy generation to boost market growth

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Significant demand from automotive industry to drive market

- 12.3.2 UK

- 12.3.2.1 Thriving shipping and electric vehicle industries to boost market growth

- 12.3.3 FRANCE

- 12.3.3.1 Increasing investment in manufacturing sector to contribute to market growth

- 12.3.4 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Increasing infrastructure and industrial development to bolster market growth

- 12.4.2 AUSTRALIA

- 12.4.2.1 Rise in mining and mineral processing to fuel market growth

- 12.4.3 JAPAN

- 12.4.3.1 Escalating adoption in shipping & material handling industry to drive market

- 12.4.4 INDIA

- 12.4.4.1 Increasing construction projects to accelerate market growth

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 ROW

- 12.5.1 MIDDLE EAST & AFRICA

- 12.5.1.1 GCC countries

- 12.5.1.1.1 Increasing infrastructure projects to drive market

- 12.5.1.2 Africa & Rest of Middle East

- 12.5.1.1 GCC countries

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Brazil

- 12.5.2.1.1 Mounting demand for modern non-residential infrastructure to fuel market growth

- 12.5.2.2 Rest of South America

- 12.5.2.1 Brazil

- 12.5.1 MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 13.2.1 REVENUE ANALYSIS, 2020-2024

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE PLAYERS

- 13.4.4 PARTICIPANTS

- 13.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.4.5.1 Company footprint

- 13.4.5.2 Region footprint

- 13.4.5.3 Industry footprint

- 13.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- 13.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.5.5.1 Detailed list of key startups/SMEs

- 13.5.5.2 Competitive benchmarking of key startups/SMEs

- 13.6 COMPETITIVE SCENARIO

- 13.6.1 PRODUCT LAUNCHES

- 13.6.2 DEALS

- 13.6.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 LIEBHERR

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Services/Solutions offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 KONECRANES

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Services/Solutions offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 ZOOMLION HEAVY INDUSTRY SCIENCE & TECHNOLOGY CO., LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Services/Solutions offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Key strengths/Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses/Competitive threats

- 14.1.4 TADANO LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Services/Solutions offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 TEREX CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Services/Solutions offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Other developments

- 14.1.6 THE MANITOWOC COMPANY, INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Services/Solutions offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths/Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses/Competitive threats

- 14.1.7 INGERSOLL RAND

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Services/Solutions offered

- 14.1.8 PALFINGER AG

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Services/Solutions offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.9 COLUMBUS MCKINNON CORPORATION

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Services/Solutions offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 KOBE STEEL, LTD.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Services/Solutions offered

- 14.1.1 LIEBHERR

- 14.2 OTHER KEY PLAYERS

- 14.2.1 XCMG GLOBAL

- 14.2.2 SUMITOMO HEAVY INDUSTRIES, LTD.

- 14.2.3 ABUS KRANSYSTEME GMBH

- 14.2.4 MAMMOET

- 14.2.5 KATO WORKS CO., LTD.

- 14.2.6 ALTEC INDUSTRIES

- 14.2.7 VERLINDE

- 14.2.8 SHANGHAI YIYING CRANE MACHINERY CO., LTD.

- 14.2.9 NUCLEON CRANE GROUPS

- 14.2.10 CHENG DAY MACHINERY WORKS CO., LTD.

- 14.2.11 LIUGONG MACHINERY CO., LTD.

- 14.2.12 LOAD KING

- 14.2.13 ELLIOTT EQUIPMENT COMPANY

- 14.2.14 QMC CRANES

- 14.2.15 BRODERSON MANUFACTURING CORP.

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 LIST OF KEY SECONDARY SOURCES

- TABLE 3 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 CRANE AND HOIST MARKET: RISK ANALYSIS

- TABLE 5 ROLE OF COMPANIES IN CRANE AND HOIST ECOSYSTEM

- TABLE 6 PRICING RANGE OF MOBILE CRANES OFFERED BY KEY PLAYERS, BY CRANE TYPE, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF ALL-TERRAIN CRANES, 2021-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF ALL-TERRAIN CRANES, BY REGION, 2021-2024 (IN USD)

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 11 IMPORT DATA FOR HS CODE 842611-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 842611-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 LIST OF MAJOR PATENTS, 2024

- TABLE 14 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 STANDARDS AND REGULATIONS

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 CRANE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 22 CRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 23 CRANE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 24 CRANE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 25 CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 26 CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 MOBILE: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 28 MOBILE: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 29 MOBILE: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 MOBILE: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 MOBILE: CRANE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 32 MOBILE: CRANE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 33 FIXED: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 34 FIXED: CRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 35 FIXED: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 FIXED: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 FIXED: CRANE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 38 FIXED: CRANE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 39 CRANE MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 40 CRANE MARKET, BY OPERATION, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: ROUGH-TERRAIN AND ALL-TERRAIN MOBILE CRANE MARKET, BY LIFTING CAPACITY, 2021-2024 (UNITS)

- TABLE 42 NORTH AMERICA: ROUGH-TERRAIN AND ALL-TERRAIN MOBILE CRANE MARKET, BY LIFTING CAPACITY, 2025-2030 (UNITS)

- TABLE 43 HOIST MARKET, BY HOIST TYPE, 2021-2024 (USD MILLION)

- TABLE 44 HOIST MARKET, BY HOIST TYPE, 2025-2030 (USD MILLION)

- TABLE 45 HOIST MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 46 HOIST MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 47 HOIST MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 HOIST MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: HOIST MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 NORTH AMERICA: HOIST MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 EUROPE: HOIST MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 EUROPE: HOIST MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: HOIST MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 ASIA PACIFIC: HOIST MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 ROW: HOIST MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 ROW: HOIST MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 HOIST MARKET, BY OPERATION, 2021-2024 (USD MILLION)

- TABLE 58 HOIST MARKET, BY OPERATION, 2025-2030 (USD MILLION)

- TABLE 59 CRANE AND HOIST MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 60 CRANE AND HOIST MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 61 AEROSPACE: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 62 AEROSPACE: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 63 AEROSPACE: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 AEROSPACE: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 AUTOMOTIVE & RAILWAY: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 66 AUTOMOTIVE & RAILWAY: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 67 AUTOMOTIVE & RAILWAY: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 AUTOMOTIVE & RAILWAY: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 CONSTRUCTION: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 70 CONSTRUCTION: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 71 CONSTRUCTION: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 CONSTRUCTION: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 SHIPPING & MATERIAL HANDLING: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 74 SHIPPING & MATERIAL HANDLING: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 75 SHIPPING & MATERIAL HANDLING: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 SHIPPING & MATERIAL HANDLING: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 MINING: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 78 MINING: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 79 MINING: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 MINING: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 ENERGY & POWER INDUSTRY: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 82 ENERGY & POWER INDUSTRY: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 83 ENERGY & POWER: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 ENERGY & POWER: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 OTHER INDUSTRIES: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 86 OTHER INDUSTRIES: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 87 OTHER INDUSTRIES: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 OTHER INDUSTRIES CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 CRANE AND HOIST MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 CRANE AND HOIST MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: CRANE AND HOIST MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: CRANE AND HOIST MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: CRANE MARKET, BY MOBILE CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: CRANE MARKET, BY MOBILE CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: CRANE MARKET, BY FIXED CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: CRANE MARKET, BY FIXED CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: CRANE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: CRANE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: CRANE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: CRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: CRANE AND HOIST MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 EUROPE: CRANE AND HOIST MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: CRANE MARKET, BY MOBILE CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 108 EUROPE: CRANE MARKET, BY MOBILE CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: CRANE MARKET, BY FIXED CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 110 EUROPE: CRANE MARKET, BY FIXED CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: CRANE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: CRANE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: CRANE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: CRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: CRANE AND HOIST MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 ASIA PACIFIC: CRANE AND HOIST MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: CRANE MARKET, BY MOBILE CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: CRANE MARKET, BY MOBILE CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: CRANE MARKET, BY FIXED CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: CRANE MARKET, BY FIXED CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: CRANE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: CRANE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: CRANE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: CRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 ROW: CRANE AND HOIST MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 ROW: CRANE AND HOIST MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 ROW: CRANE MARKET, BY CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 130 ROW: CRANE MARKET, BY CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 131 ROW: CRANE MARKET, BY MOBILE CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 132 ROW: CRANE MARKET, BY MOBILE CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ROW: CRANE MARKET, BY FIXED CRANE TYPE, 2021-2024 (USD MILLION)

- TABLE 134 ROW: CRANE MARKET, BY FIXED CRANE TYPE, 2025-2030 (USD MILLION)

- TABLE 135 ROW: CRANE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 ROW: CRANE MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 ROW: CRANE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 138 ROW: CRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 139 MIDDLE EAST: CRANE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 MIDDLE EAST: CRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 SOUTH AMERICA: CRANE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 SOUTH AMERICA: CRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 CRANE AND HOIST MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2023-JULY 2025

- TABLE 144 CRANE & HOIST MARKET: DEGREE OF COMPETITION, 2024

- TABLE 145 CRANE AND HOIST MARKET: REGION FOOTPRINT

- TABLE 146 CRANE AND HOIST MARKET: INDUSTRY FOOTPRINT

- TABLE 147 CRANE AND HOIST MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 148 CRANE AND HOIST MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 149 CRANE AND HOIST MARKET: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 150 CRANE AND HOIST MARKET: DEALS, JANUARY 2023-JULY 2025

- TABLE 151 CRANE AND HOIST MARKET: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 152 LIEBHERR: COMPANY OVERVIEW

- TABLE 153 LIEBHERR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 154 LIEBHERR: PRODUCT LAUNCHES

- TABLE 155 KONECRANES: COMPANY OVERVIEW

- TABLE 156 KONECRANES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 157 KONECRANES: PRODUCT LAUNCHES

- TABLE 158 KONECRANES: DEALS

- TABLE 159 ZOOMLION HEAVY INDUSTRY SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 160 ZOOMLION HEAVY INDUSTRY SCIENCE & TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 161 TADANO LTD.: COMPANY OVERVIEW

- TABLE 162 TADANO LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 163 TADANO LTD.: PRODUCT LAUNCHES

- TABLE 164 TEREX CORPORATION: COMPANY OVERVIEW

- TABLE 165 TEREX CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 166 TEREX CORPORATION: PRODUCT LAUNCHES

- TABLE 167 TEREX CORPORATION: OTHER DEVELOPMENTS

- TABLE 168 THE MANITOWOC COMPANY, INC.: COMPANY OVERVIEW

- TABLE 169 THE MANITOWOC COMPANY, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 THE MANITOWOC COMPANY, INC.: PRODUCT LAUNCHES

- TABLE 171 THE MANITOWOC COMPANY, INC.: DEALS

- TABLE 172 THE MANITOWOC COMPANY, INC.: EXPANSIONS

- TABLE 173 INGERSOLL RAND: COMPANY OVERVIEW

- TABLE 174 INGERSOLL RAND: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 175 PALFINGER AG: COMPANY OVERVIEW

- TABLE 176 PALFINGER AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 PALFINGER AG: DEALS

- TABLE 178 COLUMBUS MCKINNON CORPORATION: COMPANY OVERVIEW

- TABLE 179 COLUMBUS MCKINNON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 180 COLUMBUS MCKINNON CORPORATION: DEALS

- TABLE 181 KOBE STEEL, LTD.: COMPANY OVERVIEW

- TABLE 182 KOBE STEEL, LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 XCMG GLOBAL: COMPANY OVERVIEW

- TABLE 184 SUMITOMO HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 185 ABUS KRANSYSTEME GMBH: COMPANY OVERVIEW

- TABLE 186 MAMMOET: COMPANY OVERVIEW

- TABLE 187 KATO WORKS CO., LTD.: COMPANY OVERVIEW

- TABLE 188 ALTEC INDUSTRIES: COMPANY OVERVIEW

- TABLE 189 VERLINDE: COMPANY OVERVIEW

- TABLE 190 SHANGHAI YIYING CRANE MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 191 NUCLEON CRANE GROUP: COMPANY OVERVIEW

- TABLE 192 CHENG DAY MACHINERY WORKS CO., LTD.: COMPANY OVERVIEW

- TABLE 193 LIUGONG MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 194 LOAD KING: COMPANY OVERVIEW

- TABLE 195 ELLIOTT EQUIPMENT COMPANY: COMPANY OVERVIEW

- TABLE 196 QMC CRANES: COMPANY OVERVIEW

- TABLE 197 BRODERSON MANUFACTURING CORP.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CRANE AND HOIST MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 YEARS CONSIDERED

- FIGURE 3 CRANE AND HOIST MARKET: RESEARCH DESIGN

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARIES

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 KEY INDUSTRY INSIGHTS

- FIGURE 8 CRANE AND HOIST MARKET: BOTTOM-UP APPROACH

- FIGURE 9 CRANE AND HOIST MARKET: TOP-DOWN APPROACH

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 11 CRANE AND HOIST MARKET: DATA TRIANGULATION

- FIGURE 12 CRANE AND HOIST MARKET: RESEARCH ASSUMPTIONS

- FIGURE 13 CRANE AND HOIST MARKET: RESEARCH LIMITATIONS

- FIGURE 14 CRANE MARKET TO HOLD LARGER SHARE THAN HOIST MARKET FROM 2025 TO 2030

- FIGURE 15 MOBILE SEGMENT TO DOMINATE CRANE MARKET DURING FORECAST PERIOD

- FIGURE 16 HYDRAULIC SEGMENT TO HOLD LARGEST SHARE OF CRANE MARKET IN 2025

- FIGURE 17 CONSTRUCTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 CRANE AND HOIST MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 19 HIGH DEMAND FOR MATERIAL HANDLING EQUIPMENT IN CONSTRUCTION AND SHIPPING INDUSTRIES TO DRIVE CRANE AND HOIST MARKET

- FIGURE 20 MOBILE SEGMENT TO DOMINATE CRANE MARKET BETWEEN 2025 AND 2030

- FIGURE 21 HYBRID SEGMENT TO RECORD HIGHEST CAGR IN CRANE MARKET DURING FORECAST PERIOD

- FIGURE 22 CONSTRUCTION INDUSTRY TO HOLD LARGEST SHARE OF CRANE AND HOIST MARKET IN 2030

- FIGURE 23 INDIA TO RECORD HIGHEST CAGR IN GLOBAL CRANE AND HOIST MARKET FROM 2025 TO 2030

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 IMPACT ANALYSIS: DRIVERS

- FIGURE 26 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 27 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 28 IMPACT ANALYSIS: CHALLENGES

- FIGURE 29 VALUE CHAIN ANALYSIS

- FIGURE 30 ECOSYSTEM ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE TREND OF ALL-TERRAIN CRANES, 2021-2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF ALL-TERRAIN CRANES, BY REGION, 2021-2024 (IN USD)

- FIGURE 33 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 36 IMPORT DATA FOR HS CODE 842611-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 37 EXPORT DATA FOR HS CODE 842611-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 38 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 39 KEY USE CASES OF AI/GEN AI IN CRANE AND HOIST MARKET

- FIGURE 40 CRANE MARKET, BY TYPE

- FIGURE 41 MOBILE SEGMENT TO DOMINATE CRANE MARKET DURING FORECAST PERIOD

- FIGURE 42 CRANE MARKET, BY OPERATION

- FIGURE 43 HYDRAULIC SEGMENT TO DOMINATE CRANE MARKET BETWEEN 2025 AND 2030

- FIGURE 44 HOIST MARKET, BY TYPE

- FIGURE 45 WELDED LINK LOAD CHAIN SEGMENT TO DOMINATE HOIST MARKET FROM 2025 TO 2030

- FIGURE 46 MINING INDUSTRY SEGMENT TO DOMINATE HOIST MARKET FROM 2025 TO 2030

- FIGURE 47 CRANE AND HOIST MARKET, BY INDUSTRY

- FIGURE 48 CONSTRUCTION INDUSTRY TO DOMINATE CRANE AND HOIST MARKET DURING FORECAST PERIOD

- FIGURE 49 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL CRANE AND HOIST MARKET FROM 2025 TO 2030

- FIGURE 50 ASIA PACIFIC TO HOLD LARGEST SHARE OF CRANE AND HOIST MARKET IN 2030

- FIGURE 51 NORTH AMERICA: CRANE AND HOIST MARKET SNAPSHOT

- FIGURE 52 EUROPE: CRANE AND HOIST MARKET SNAPSHOT

- FIGURE 53 ASIA PACIFIC: CRANE AND HOIST MARKET SNAPSHOT

- FIGURE 54 CRANE AND HOIST MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 55 MARKET SHARE ANALYSIS COMPANIES OFFERING CRANES AND HOISTS, 2024

- FIGURE 56 CRANE AND HOIST MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 57 CRANE AND HOIST MARKET: COMPANY FOOTPRINT

- FIGURE 58 CRANE AND HOIST MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 59 LIEBHERR: COMPANY SNAPSHOT

- FIGURE 60 KONECRANES: COMPANY SNAPSHOT

- FIGURE 61 ZOOMLION HEAVY INDUSTRY SCIENCE & TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 TADANO LTD.: COMPANY SNAPSHOT

- FIGURE 63 TEREX CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 THE MANITOWOC COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 65 INGERSOLL RAND: COMPANY SNAPSHOT

- FIGURE 66 PALFINGER AG: COMPANY SNAPSHOT

- FIGURE 67 COLUMBUS MCKINNON CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 KOBE STEEL, LTD.: COMPANY SNAPSHOT