PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1780343

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1780343

X-Ray Detectors Market by Technology (FPD, Line scan, CCD, CR), Application (Medical, Vet, Defence, Industry) - Global Forecast to 2030

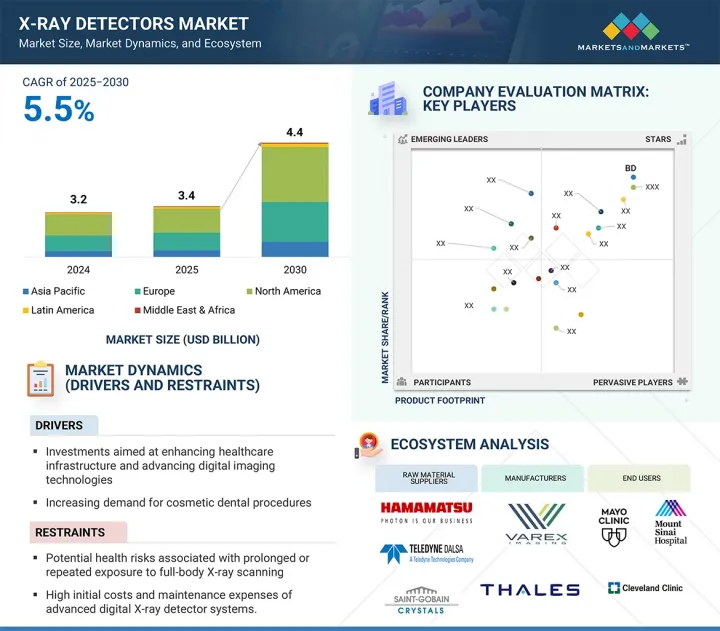

The global market for X-ray detectors is projected to grow from USD 3.4 billion in 2025 to reach USD 4.4 billion in 2030, at a CAGR of 5.5% over the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Technology, Type, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and Latin America |

The industry's growth is driven by multiple factors, such as the need for timely disease detection, the emphasis on early diagnosis, a growing patient population, and rising investments in modernizing healthcare infrastructure and digital imaging solutions. The demand for advanced diagnostic tools continues to increase, further broadening the clinical applications of X-ray detectors. Additionally, innovations like portable X-ray systems, AI-enabled imaging analysis applications, and increased sensitivity in detectors are enhancing the efficiency and accuracy of diagnostic imaging.

By technology, the flat-panel detectors segment is expected to grow at the highest CAGR during the forecast period.

The X-ray detectors market is segmented by technology into flat-panel, computed radiography, line scans, charge-coupled devices, and photo-counting detectors. The flat-panel detectors segment is expected to grow at the highest CAGR during the forecast period. The growing demand for mobile X-ray systems in emergency departments, ICUs, and underserved areas drives hospitals to adopt lightweight, wireless flat-panel detectors. These advanced detectors offer fast, flexible, and high-resolution imaging, significantly enhancing bedside X-ray capabilities and supporting improved patient care in critical and high-pressure clinical environments. Additionally, portable and cable-free flat-panel detectors minimize the need to transfer critically ill patients from their point of care to central imaging facilities, thereby reducing risk and improving efficiency. During emergencies, public health situations, or in temporary or field-medicine environments, these easily portable and battery-operated X-ray units will help further reduce delays.

By portability type, the fixed flat-panel detectors segment accounted for the largest market share in 2024.

Based on the portability type, the market for X-ray detectors is divided into portable and fixed flat-panel detectors. The growth of fixed flat-panel detectors (FPDs) in X-ray imaging is driven by their widespread use in high-throughput clinical environments such as radiology departments, diagnostic centers, and hospitals where consistent, high-quality imaging is essential. Fixed FPDs offer superior image resolution, fast acquisition times, and enhanced durability, making them ideal for applications like chest radiography, orthopedic imaging, and mammography. Additionally, increasing investment in hospital infrastructure, rising demand for digital radiography systems, and the need for efficient workflow integration with PACS are further accelerating the adoption of fixed FPDs in routine diagnostic imaging.

By application, the medical applications segment accounted for the largest share of the market.

Based on the application, the market for X-ray detectors is divided into medical, dental, security/defense, veterinary, industrial, and other applications. The increase in demand for X-ray detectors used in medical imaging procedures arises principally from an ever-growing need to provide timely and accurate diagnoses of chronic ailments, e.g., cancer, cardiovascular diseases, and musculoskeletal disorders. Technological refinements in the detector systems directed towards the highest spatial resolution, lowest radiation dose, and fastest image acquisition simultaneously enhance diagnostic accuracy and clinical efficiency. The shift toward digital radiography, coupled with the rising use of portable and mobile imaging devices, is also crucial in increasing detector adoption, particularly as healthcare systems modernize and expand, especially in emerging markets.

By region, North America accounted for the largest market share in 2024.

The market for X-ray detectors encompasses five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The North American X-ray detector market is growing vigorously, driven by the high regional focus on enhancing the efficiency of healthcare, patient safety, and correct diagnosis. The trend towards less invasive and faster diagnosis procedures is compelling healthcare providers to adopt more advanced imaging devices that support rapid clinical decision-making. Furthermore, initiatives taken by the governments to enhance healthcare infrastructure, combined with the push towards digitalization in healthcare organizations, encourage the transition from conventional imaging systems to high-performance digital X-ray detectors. Moreover, the growing emphasis on decentralized healthcare provision is fuelling the demand for point-of-care and mobile imaging solutions.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 60% and Demand Side 40%

- By Designation: Managers - 20%, CXO & Directors - 30%, and Executives - 50%

- By Region: North America -40%, Europe -30%, Asia Pacific -20%, Latin America -5%, and the Middle East & Africa- 5%

List of Key Companies Profiled in the Report:

The prominent players in the X-ray detectors market are Varex Imaging (US), Canon (Japan), Thales Group (France), Analogic Corporation (US), Agfa-Gevaert Group (Belgium), Carestream Health (US), Drtech (South Korea), Detection Technology PLC (Finland), Fujifilm Holdings Corporation (Japan), and Hamamatsu Photonics K.K (Japan), among others.

Research Coverage:

This report studies the X-ray detectors market based on technology, type, application, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets concerning their growth trends. It forecasts the revenue of the market segments relating to five central regions (and the respective countries in these regions).

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing the closest approximations of the X-ray detectors market's revenue numbers and subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business better and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (investments to advance healthcare facilities and digital imaging technologies, rising target patient population), restraints (high cost of x-ray detectors, health hazards of full-body scanning), opportunities (rising healthcare expenditure across emerging economies and rising technological advancements), and challenges (lack of animal healthcare awareness in emerging countries and the increasing adoption of refurbished x-ray units).

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product approvals/launches in the X-ray detectors market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the X-ray detectors market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/approvals, pipeline analysis, acquisitions, partnerships, agreements, collaborations, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the X-ray detectors market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Customer-based market estimation

- 2.2.1.3 CAGR projections

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 GROWTH FORECAST MODEL

- 2.4 DATA TRIANGULATION APPROACH

- 2.5 MARKET SHARE ESTIMATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 X-RAY DETECTORS MARKET OVERVIEW

- 4.2 REGIONAL SNAPSHOT OF X-RAY DETECTORS MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising investments in healthcare infrastructure and digital imaging technologies

- 5.2.1.2 Growing demand for X-ray detectors in security and industrial applications

- 5.2.1.3 Technological advancements in X-ray detectors

- 5.2.1.4 Increasing target patient population

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of X-ray detectors

- 5.2.2.2 Health concerns associated with full-body X-ray scanning

- 5.2.2.3 Stringent regulatory and compliance requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for portable and mobile imaging

- 5.2.3.2 Growth opportunities in developing and emerging markets

- 5.2.3.3 Emerging non-medical uses of X-ray detectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled radiologists and technicians

- 5.2.4.2 Rising adoption of refurbished X-ray units

- 5.2.4.3 Hospital budget constraints

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF FLAT PANEL DETECTORS

- 5.4.2 AVERAGE SELLING PRICE, BY KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & DEVELOPMENT

- 5.5.2 RAW MATERIAL PROCUREMENT & PRODUCT DEVELOPMENT

- 5.5.3 MARKETING, SALES, AND DISTRIBUTION

- 5.5.4 POST-SALES SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.6.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.6.4 END USERS

- 5.7 ECOSYSTEM MARKET MAP

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Flat panel detectors

- 5.9.1.2 Photon counting detectors

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Artificial intelligence and machine learning

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Computed tomography

- 5.9.3.2 Magnetic resonance imaging

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 902214)

- 5.11.2 EXPORT SCENARIO (HS CODE 902214)

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY GUIDELINES

- 5.13.1.1 North America

- 5.13.1.1.1 US

- 5.13.1.1.2 Canada

- 5.13.1.2 Europe

- 5.13.1.2.1 UK

- 5.13.1.2.2 France

- 5.13.1.2.3 Germany

- 5.13.1.3 Asia Pacific

- 5.13.1.3.1 China

- 5.13.1.3.2 Japan

- 5.13.1.3.3 India

- 5.13.1.4 Latin America

- 5.13.1.4.1 Brazil

- 5.13.1.4.2 Mexico

- 5.13.1.5 Middle East & Africa

- 5.13.1.1 North America

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1 REGULATORY GUIDELINES

- 5.14 PORTER'S FIVE FORCE ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA

- 5.16 UNMET NEEDS

- 5.17 IMPACT OF AI ON X-RAY DETECTORS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI ON X-RAY DETECTORS

- 5.17.3 AI USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI

- 5.17.5 FUTURE OF GENERATIVE AI ON X-RAY DETECTORS MARKET

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 X-RAY DETECTORS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 FLAT PANEL DETECTORS

- 6.2.1 INCREASING LAUNCHES OF FLAT PANEL DETECTORS BY KEY PLAYERS TO FUEL MARKET

- 6.3 COMPUTED RADIOGRAPHY DETECTORS

- 6.3.1 WIRELESS COMMUNICATION AND REMOTE MONITORING CAPABILITIES TO PROMOTE GROWTH

- 6.4 LINE-SCAN DETECTORS

- 6.4.1 INCREASING ADOPTION OF X-RAY DETECTORS IN SECURITY APPLICATIONS AND MEDICAL IMAGING TO FAVOR GROWTH

- 6.5 CHARGE-COUPLED DEVICE DETECTORS

- 6.5.1 COST-EFFECTIVENESS AND FAST PROCESSING CAPABILITIES TO AID GROWTH

- 6.6 PHOTON-COUNTING DETECTORS

- 6.6.1 RISING NEED FOR HIGH-RESOLUTION IMAGING WITH LOW RADIATION TO EXPEDITE GROWTH

7 FLAT PANEL DETECTORS MARKET

- 7.1 INTRODUCTION

- 7.2 BY TYPE

- 7.2.1 CESIUM IODIDE FLAT PANEL DETECTORS

- 7.2.1.1 High detective quantum efficiency to foster growth

- 7.2.2 GADOLINIUM OXYSULFIDE FLAT PANEL DETECTORS

- 7.2.2.1 Affordability, mechanical resilience, and adaptability to support growth

- 7.2.3 AMORPHOUS SILICON FLAT PANEL DETECTORS

- 7.2.3.1 Superior image quality and minimized radiation exposure to favor growth

- 7.2.4 AMORPHOUS SELENIUM FLAT PANEL DETECTORS

- 7.2.4.1 Enhanced sensitivity, robust durability, and extended lifespan to drive market

- 7.2.5 CMOS FLAT PANEL DETECTORS

- 7.2.5.1 Increasing use of CMOS in medical imaging, industrial inspection, and scientific research to aid growth

- 7.2.6 OTHER FLAT PANEL DETECTORS

- 7.2.1 CESIUM IODIDE FLAT PANEL DETECTORS

- 7.3 BY PANEL TYPE

- 7.3.1 LARGE-AREA FLAT PANEL DETECTORS

- 7.3.1.1 Broader imaging coverage and improved workflow efficiency to amplify growth

- 7.3.2 MEDIUM-AREA FLAT PANEL DETECTORS

- 7.3.2.1 Increasing adoption of detectors in medical and industrial applications to stimulate growth

- 7.3.3 SMALL-AREA FLAT PANEL DETECTORS

- 7.3.3.1 Faster image acquisition and compact design to facilitate growth

- 7.3.1 LARGE-AREA FLAT PANEL DETECTORS

- 7.4 BY PORTABILITY

- 7.4.1 PORTABLE FLAT PANEL DETECTORS

- 7.4.1.1 Reduced radiation exposure and user-friendly operation to encourage growth

- 7.4.2 FIXED FLAT PANEL DETECTORS

- 7.4.2.1 Consistent and efficient imaging performance to contribute to growth

- 7.4.1 PORTABLE FLAT PANEL DETECTORS

- 7.5 BY PLATFORM

- 7.5.1 DIGITAL FLAT PANEL DETECTORS

- 7.5.1.1 Increasing use of detectors for digital mammography and angiography to accelerate growth

- 7.5.2 RETROFIT FLAT PANEL DETECTORS

- 7.5.2.1 Ability to improve diagnostic capabilities and streamline workflow to promote growth

- 7.5.1 DIGITAL FLAT PANEL DETECTORS

8 X-RAY DETECTORS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 MEDICAL APPLICATIONS

- 8.2.1 STATIC IMAGING APPLICATIONS

- 8.2.1.1 Chest imaging application

- 8.2.1.1.1 Need for diagnostic precision and improved patient outcomes to boost market

- 8.2.1.2 Orthopedics application

- 8.2.1.2.1 Increasing prevalence of obesity and related lifestyle disorders to spur growth

- 8.2.1.3 Mammography application

- 8.2.1.3.1 Growing incidence of breast cancer to propel market

- 8.2.1.4 Oncology application

- 8.2.1.4.1 Growing emphasis on early detection and timely treatment to drive market

- 8.2.1.5 Other static imaging applications

- 8.2.1.1 Chest imaging application

- 8.2.2 DYNAMIC IMAGING

- 8.2.2.1 Fluoroscopy application

- 8.2.2.1.1 Rising health awareness to bolster growth

- 8.2.2.2 Surgical imaging

- 8.2.2.2.1 Growing preference for minimally invasive techniques to fuel market

- 8.2.2.3 Cardiovascular imaging application

- 8.2.2.3.1 Rising demand for early diagnosis and effective management of cardiovascular diseases to propel market

- 8.2.2.4 Spinal imaging application

- 8.2.2.4.1 Growing integration of digital radiography to boost market

- 8.2.2.1 Fluoroscopy application

- 8.2.1 STATIC IMAGING APPLICATIONS

- 8.3 DENTAL APPLICATIONS

- 8.3.1 INCREASING PREVALENCE OF DENTAL CARIES AND PERIODONTAL DISEASES TO AID GROWTH

- 8.4 SECURITY/DEFENSE APPLICATIONS

- 8.4.1 HOMELAND SECURITY

- 8.4.1.1 Need for surveillance in high-security environments to support growth

- 8.4.2 PUBLIC & PRIVATE ENTERPRISES

- 8.4.2.1 Evolving security needs to accelerate growth

- 8.4.3 DEFENSE

- 8.4.3.1 Rising use of X-ray detection systems in border checkpoints and crossings to facilitate growth

- 8.4.1 HOMELAND SECURITY

- 8.5 VETERINARY APPLICATIONS

- 8.5.1 RISING PET ADOPTION AND GROWING FOCUS ON ANIMAL HEALTH TO BOOST MARKET

- 8.6 INDUSTRIAL APPLICATIONS

- 8.6.1 NON-DESTRUCTIVE TESTING

- 8.6.1.1 Stricter safety norms and aging infrastructure to contribute to growth

- 8.6.2 ELECTRONIC INSPECTION

- 8.6.2.1 Rising need for precision in electronics to augment growth

- 8.6.1 NON-DESTRUCTIVE TESTING

- 8.7 OTHER APPLICATIONS

9 X-RAY DETECTORS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Rising incidence of chronic conditions to spur growth

- 9.2.3 CANADA

- 9.2.3.1 Favorable government initiatives to bolster growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Booming automotive and defense sectors to aid growth

- 9.3.3 FRANCE

- 9.3.3.1 Shifting demography toward elderly population to facilitate growth

- 9.3.4 UK

- 9.3.4.1 Strategic investments in digital health technologies to foster growth

- 9.3.5 ITALY

- 9.3.5.1 Growing focus on security to boost market

- 9.3.6 SPAIN

- 9.3.6.1 Growing focus on digital health transformation to propel market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Growing elderly population to drive market

- 9.4.3 CHINA

- 9.4.3.1 Decreasing prices of flat panel detectors to boost market

- 9.4.4 INDIA

- 9.4.4.1 Rising disposable incomes to facilitate growth

- 9.4.5 AUSTRALIA

- 9.4.5.1 Increasing focus on early detection and preventive care to boost market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Favorable insurance coverage to expedite growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Rising disease burden to contribute to growth

- 9.5.3 MEXICO

- 9.5.3.1 Increasing number of hospitals to expedite growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Increasing adoption of AI and cloud-based imaging technologies to foster growth

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN X-RAY DETECTORS MARKET

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Technology footprint

- 10.7.5.4 Type footprint

- 10.7.5.5 Application footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 VAREX IMAGING

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and approvals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 THALES

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and approvals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 CANON INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and approvals

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 IRAY GROUP

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 KONICA MINOLTA, INC.

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and approvals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 AGFA-GEVAERT GROUP

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and approvals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Key strengths

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 CARESTREAM HEALTH

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and approvals

- 11.1.7.3.2 Deals

- 11.1.8 FUJIFILM HOLDINGS CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 ANALOGIC CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 HAMAMATSU PHOTONICS K.K.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 TELEDYNE TECHNOLOGIES INCORPORATED

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.12 DRTECH

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches and approvals

- 11.1.13 DETECTION TECHNOLOGY PLC

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product launches and approvals

- 11.1.13.3.2 Expansions

- 11.1.14 RIGAKU HOLDINGS CORPORATION

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 NEW MEDICAL IMAGING CO., LTD

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches and approvals

- 11.1.15.3.2 Expansions

- 11.1.1 VAREX IMAGING

- 11.2 OTHER PLAYERS

- 11.2.1 ASTEL

- 11.2.2 MOXTEK, INC.

- 11.2.3 JPI HEALTHCARE SOLUTIONS

- 11.2.4 IBIS S.R.L.

- 11.2.5 VIEWORKS CO., LTD

- 11.2.6 KA IMAGING

- 11.2.7 ACTEON

- 11.2.8 RAYENCE

- 11.2.9 DECTRIS AG

- 11.2.10 BMI BIOMEDICAL INTERNATIONAL S.R.L.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 X-RAY DETECTORS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 X-RAY DETECTORS MARKET: RISK ASSESSMENT

- TABLE 3 AVERAGE SELLING PRICE OF DETECTORS, BY KEY PLAYER, 2024 (USD THOUSAND)

- TABLE 4 AVERAGE SELLING PRICE TREND OF DETECTORS, BY REGION, 2022-2024 (USD THOUSAND)

- TABLE 5 X-RAY DETECTORS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 X-RAY DETECTORS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2022-2024

- TABLE 7 IMPORT SCENARIO FOR HS CODE 902214, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT SCENARIO FOR HS CODE 902214, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 X-RAY DETECTORS MARKET: KEY CONFERENCES AND EVENTS 2025-2026

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST AND AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 X-RAY DETECTORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 17 KEY BUYING CRITERIA, BY END USER

- TABLE 18 X-RAY DETECTORS MARKET: UNMET NEEDS

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 21 FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 COMPUTED RADIOGRAPHY DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 23 LINE-SCAN DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 24 CHARGE-COUPLED DEVICE DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 PHOTON-COUNTING DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 28 CESIUM IODIDE FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 GADOLINIUM OXYSULFIDE FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 AMORPHOUS SILICON FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 AMORPHOUS SELENIUM FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 CMOS FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 OTHER FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 FLAT PANEL DETECTORS MARKET, BY PANEL TYPE, 2023-2030 (USD MILLION)

- TABLE 35 LARGE-AREA FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 MEDIUM-AREA FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 SMALL-AREA FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 FLAT PANEL DETECTORS MARKET, BY PORTABILITY, 2023-2030 (USD MILLION)

- TABLE 39 PORTABLE FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 FIXED FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 FLAT PANEL DETECTORS MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 42 DIGITAL FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 RETROFIT FLAT PANEL DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 X-RAY DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 45 X-RAY DETECTORS MARKET FOR MEDICAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 46 X-RAY DETECTORS MARKET FOR STATIC IMAGING APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 47 X-RAY DETECTORS MARKET FOR CHEST IMAGING APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 X-RAY DETECTORS MARKET FOR ORTHOPEDICS APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 X-RAY DETECTORS MARKET FOR MAMMOGRAPHY APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 X-RAY DETECTORS MARKET FOR ONCOLOGY APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 X-RAY DETECTORS MARKET FOR OTHER STATIC IMAGING APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 X-RAY DETECTORS MARKET FOR DYNAMIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 53 X-RAY DETECTORS MARKET FOR FLUOROSCOPY APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 X-RAY DETECTORS MARKET FOR SURGICAL IMAGING, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 X-RAY DETECTORS MARKET FOR CARDIOVASCULAR IMAGING APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 X-RAY DETECTORS MARKET FOR SPINAL IMAGING APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 X-RAY DETECTORS MARKET FOR DENTAL APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 X-RAY DETECTORS MARKET FOR SECURITY/DEFENSE APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 59 X-RAY DETECTORS MARKET FOR HOMELAND SECURITY APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 X-RAY DETECTORS MARKET FOR PUBLIC & PRIVATE ENTERPRISES APPLICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 X-RAY DETECTORS MARKET FOR DEFENSE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 X-RAY DETECTORS MARKET FOR VETERINARY APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 X-RAY DETECTORS MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 64 X-RAY DETECTORS MARKET FOR INDUSTRIAL APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 X-RAY DETECTORS MARKET FOR NON-DESTRUCTIVE TESTING (NDT), BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 X-RAY DETECTORS MARKET FOR ELECTRONIC INSPECTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 X-RAY DETECTORS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 X-RAY DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: MACROECONOMIC OUTLOOK

- TABLE 70 NORTH AMERICA: X-RAY DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: X-RAY DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: X-RAY DETECTORS MARKET FOR MEDICAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: X-RAY DETECTORS MARKET FOR STATIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: X-RAY DETECTORS MARKET FOR DYNAMIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: X-RAY DETECTORS MARKET FOR SECURITY/DEFENSE APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: X-RAY DETECTORS MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: FLAT PANEL DETECTORS MARKET, BY PANEL TYPE, 2023-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: FLAT PANEL DETECTORS MARKET, BY PORTABILITY, 2023-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: FLAT PANEL DETECTORS MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 82 US: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 83 US: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 84 CANADA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 85 CANADA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: MACROECONOMIC OUTLOOK

- TABLE 87 EUROPE: X-RAY DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: X-RAY DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: X-RAY DETECTORS MARKET FOR MEDICAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: X-RAY DETECTORS MARKET FOR STATIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 EUROPE: X-RAY DETECTORS MARKET FOR DYNAMIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: X-RAY DETECTORS MARKET FOR SECURITY/DEFENSE APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 94 EUROPE: X-RAY DETECTORS MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 EUROPE: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 EUROPE: FLAT PANEL DETECTORS MARKET, BY PANEL TYPE, 2023-2030 (USD MILLION)

- TABLE 97 EUROPE: FLAT PANEL DETECTORS MARKET, BY PORTABILITY, 2023-2030 (USD MILLION)

- TABLE 98 EUROPE: FLAT PANEL DETECTORS MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 99 GERMANY: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 100 GERMANY: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 FRANCE: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 UK: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 104 UK: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 ITALY: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 106 ITALY: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 SPAIN: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 108 SPAIN: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 110 REST OF EUROPE: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- TABLE 112 ASIA PACIFIC: X-RAY DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: X-RAY DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: X-RAY DETECTORS MARKET FOR MEDICAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: X-RAY DETECTORS MARKET FOR STATIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: X-RAY DETECTORS MARKET FOR DYNAMIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 ASIA PACIFIC: X-RAY DETECTORS MARKET FOR SECURITY/DEFENSE APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: X-RAY DETECTORS MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 ASIA PACIFIC: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: FLAT PANEL DETECTORS MARKET, BY PANEL TYPE, 2023-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: FLAT PANEL DETECTORS MARKET, BY PORTABILITY, 2023-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: FLAT PANEL DETECTORS MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 124 JAPAN: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 125 JAPAN: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 CHINA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 127 CHINA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 INDIA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 129 INDIA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 AUSTRALIA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 131 AUSTRALIA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 SOUTH KOREA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 133 SOUTH KOREA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 LATIN AMERICA: MACROECONOMIC OUTLOOK

- TABLE 137 LATIN AMERICA: X-RAY DETECTORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 LATIN AMERICA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 139 LATIN AMERICA: X-RAY DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 140 LATIN AMERICA: X-RAY DETECTORS MARKET FOR MEDICAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 LATIN AMERICA: X-RAY DETECTORS MARKET FOR STATIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 LATIN AMERICA: X-RAY DETECTORS MARKET FOR DYNAMIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 LATIN AMERICA: X-RAY DETECTORS MARKET FOR SECURITY/DEFENSE APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 LATIN AMERICA: X-RAY DETECTORS MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 LATIN AMERICA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: FLAT PANEL DETECTORS MARKET, BY PANEL TYPE, 2023-2030 (USD MILLION)

- TABLE 147 LATIN AMERICA: FLAT PANEL DETECTORS MARKET, BY PORTABILITY, 2023-2030 (USD MILLION)

- TABLE 148 LATIN AMERICA: FLAT PANEL DETECTORS MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 149 BRAZIL: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 150 BRAZIL: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 MEXICO: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 152 MEXICO: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 REST OF LATIN AMERICA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 154 REST OF LATIN AMERICA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- TABLE 156 MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET FOR MEDICAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET FOR STATIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET FOR DYNAMIC IMAGING, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET FOR SECURITY/DEFENSE APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET FOR INDUSTRIAL APPLICATIONS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: FLAT PANEL DETECTORS MARKET, BY PANEL TYPE, 2023-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: FLAT PANEL DETECTORS MARKET, BY PORTABILITY, 2023-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: FLAT PANEL DETECTORS MARKET, BY PLATFORM, 2023-2030 (USD MILLION)

- TABLE 168 GCC COUNTRIES: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 169 GCC COUNTRIES: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST & AFRICA: X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: FLAT PANEL DETECTORS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN X-RAY DETECTORS MARKET

- TABLE 173 X-RAY DETECTORS MARKET: DEGREE OF COMPETITION

- TABLE 174 X-RAY DETECTORS MARKET: REGION FOOTPRINT

- TABLE 175 X-RAY DETECTORS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 176 X-RAY DETECTORS MARKET: TYPE FOOTPRINT

- TABLE 177 X-RAY MARKET DETECTORS: APPLICATION FOOTPRINT

- TABLE 178 X-RAY DETECTORS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 179 X-RAY DETECTORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 180 X-RAY DETECTORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 181 X-RAY DETECTORS MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 182 X-RAY DETECTORS MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 183 X-RAY DETECTORS MARKET: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 184 VAREX IMAGING: COMPANY OVERVIEW

- TABLE 185 VAREX IMAGING: PRODUCTS OFFERED

- TABLE 186 VAREX IMAGING: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 187 THALES: COMPANY OVERVIEW

- TABLE 188 THALES: PRODUCTS OFFERED

- TABLE 189 THALES: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 190 CANON INC.: COMPANY OVERVIEW

- TABLE 191 CANON INC.: PRODUCTS OFFERED

- TABLE 192 CANON INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 193 CANON INC: DEALS, JANUARY 2021-APRIL 2025

- TABLE 194 CANON INC.: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 195 IRAY GROUP: COMPANY OVERVIEW

- TABLE 196 IRAY GROUP: PRODUCTS OFFERED

- TABLE 197 KONICA MINOLTA, INC.: COMPANY OVERVIEW

- TABLE 198 KONICA MINOLTA, INC.: PRODUCTS OFFERED

- TABLE 199 KONICA MINOLTA, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 200 AGFA-GEVAERT GROUP: COMPANY OVERVIEW

- TABLE 201 AGFA-GEVAERT GROUP.: PRODUCTS OFFERED

- TABLE 202 AGFA-GEVAERT GROUP: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 203 CARESTREAM HEALTH: COMPANY OVERVIEW

- TABLE 204 CARESTREAM HEALTH: PRODUCTS OFFERED

- TABLE 205 CARESTREAM HEALTH: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 206 CARESTREAM HEALTH: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 207 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 208 FUJIFILM HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 209 ANALOGIC CORPORATION: COMPANY OVERVIEW

- TABLE 210 ANALOGIC CORPORATION: PRODUCTS OFFERED

- TABLE 211 ANALOGIC CORPORATION: DEALS, JANUARY 2021-APRIL 2025

- TABLE 212 HAMAMATSU PHOTONICS K.K.: COMPANY OVERVIEW

- TABLE 213 HAMAMATSU PHOTONICS K.K.: PRODUCTS OFFERED

- TABLE 214 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 215 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 216 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS, JANUARY 2021-APRIL 2025

- TABLE 217 DRTECH: COMPANY OVERVIEW

- TABLE 218 DRTECH: PRODUCTS OFFERED

- TABLE 219 DRTECH: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 220 DETECTION TECHNOLOGY PLC: COMPANY OVERVIEW

- TABLE 221 DETECTION TECHNOLOGY PLC: PRODUCTS OFFERED

- TABLE 222 DETECTION TECHNOLOGY PLC: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 223 DETECTION TECHNOLOGY PLC: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 224 RIGAKU HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 225 RIGAKU HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 226 NEW MEDICAL IMAGING CO., LTD.: COMPANY OVERVIEW

- TABLE 227 NEW MEDICAL IMAGING CO., LTD.: PRODUCTS OFFERED

- TABLE 228 NEW MEDICAL IMAGING CO., LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-APRIL 2025

- TABLE 229 NEW MEDICAL IMAGING CO., LTD.: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 230 ASTEL: COMPANY OVERVIEW

- TABLE 231 MOXTEK, INC.: COMPANY OVERVIEW

- TABLE 232 JPI HEALTHCARE SOLUTIONS: COMPANY OVERVIEW

- TABLE 233 IBIS S.R.L.: COMPANY OVERVIEW

- TABLE 234 VIEWORKS CO., LTD.: COMPANY OVERVIEW

- TABLE 235 KA IMAGING: COMPANY OVERVIEW

- TABLE 236 ACTEON: COMPANY OVERVIEW

- TABLE 237 RAYENCE: COMPANY OVERVIEW

- TABLE 238 DECTRIS AG: COMPANY OVERVIEW

- TABLE 239 BMI BIOMEDICAL INTERNATIONAL S.R.L.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 X-RAY DETECTORS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 X-RAY DETECTORS MARKET: YEARS CONSIDERED

- FIGURE 3 X-RAY DETECTORS MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 MARKET SIZE ESTIMATION FOR X-RAY DETECTORS MARKET: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- FIGURE 8 BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION: X-RAY DETECTORS MARKET

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 X-RAY DETECTORS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 FLAT PANEL DETECTORS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 X-RAY DETECTORS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 GEOGRAPHIC SNAPSHOT OF X-RAY DETECTORS MARKET

- FIGURE 15 INCREASING TECHNOLOGICAL INNOVATIONS AND LAUNCH OF NEW PRODUCTS TO DRIVE MARKET

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 X-RAY MARKET DETECTOR: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 X-RAY DETECTORS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 19 AVERAGE SELLING PRICE OF FLAT PANEL DETECTORS, 2024 (USD THOUSAND)

- FIGURE 20 AVERAGE SELLING PRICE TREND OF DETECTORS, BY REGION, 2022-2024 (USD THOUSAND)

- FIGURE 21 X-RAY DETECTORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 X-RAY DETECTORS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 X-RAY DETECTORS MARKET: ECOSYSTEM MARKET MAP

- FIGURE 24 X-RAY DETECTORS MARKET: INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 25 NUMBER OF DEALS IN MARKET, BY KEY PLAYER, 2019-2023

- FIGURE 26 VALUE OF DEALS IN MARKET, BY KEY PLAYER, 2019-2023 (USD)

- FIGURE 27 X-RAY DETECTORS MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 28 X-RAY DETECTORS MARKET: IMPORT SCENARIO FOR HS CODE 902214, BY COUNTRY, 2020-2024

- FIGURE 29 X-RAY DETECTORS MARKET: EXPORT SCENARIO FOR HS CODE 902214, BY COUNTRY, 2020-2024

- FIGURE 30 X-RAY DETECTORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 32 KEY BUYING CRITERIA, BY END USER

- FIGURE 33 REVENUE ANALYSIS OF MAJOR PLAYERS IN X-RAY DETECTORS MARKET, 2021-2024

- FIGURE 34 MARKET SHARE ANALYSIS OF KEY PLAYERS IN X-RAY DETECTORS MARKET, 2024

- FIGURE 35 RANKING OF KEY PLAYERS IN X-RAY DETECTORS MARKET, 2024

- FIGURE 36 EV/EBITDA OF KEY VENDORS

- FIGURE 37 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 38 X-RAY DETECTORS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 39 X-RAY DETECTORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 X-RAY DETECTORS MARKET: COMPANY FOOTPRINT

- FIGURE 41 X-RAY DETECTORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 VAREX IMAGING: COMPANY SNAPSHOT (2024)

- FIGURE 43 THALES: COMPANY SNAPSHOT (2024)

- FIGURE 44 CANON INC.: COMPANY SNAPSHOT (2024)

- FIGURE 45 KONICA MINOLTA, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 46 AGFA-GEVAERT GROUP: COMPANY SNAPSHOT (2024)

- FIGURE 47 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 48 HAMAMATSU PHOTONICS K.K.: COMPANY SNAPSHOT (2024)

- FIGURE 49 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT (2024)

- FIGURE 50 DETECTION TECHNOLOGY PLC: COMPANY SNAPSHOT (2024)