PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1808091

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1808091

India Drone (UAV) Market by Platform (Civil & Commercial, Defense & Government), Type (Fixed Wing, Rotary, Hybrid), Application (ISR, Delivery, Combat Operations, Monitoring, Surveying, Mapping), Point of Sale, Industry and Systems - Forecast to 2030

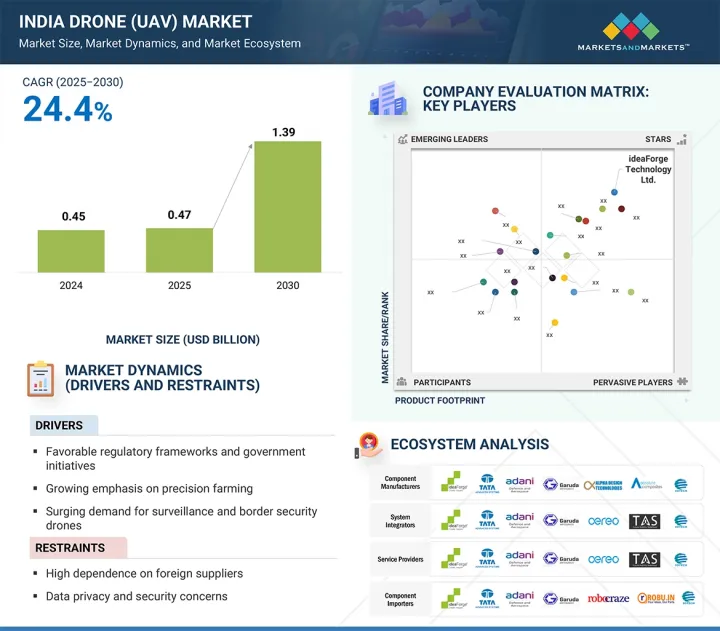

The India drone (UAV) market is estimated to be USD 0.47 billion in 2025. It is projected to reach USD 1.39 billion by 2030, at a CAGR of 24.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, System, Platform, Application, Industry, and Point of Sale |

| Regions covered | North America, Europe, APAC, RoW |

The growing need for drones in various sectors, such as agriculture, defense, and e-commerce, fuels the market's rapid growth. Additionally, government support and initiatives like the Drone Shakti scheme are also playing a crucial role in boosting market growth.

"By platform, the defense & government segment is projected to lead the India drone (UAV) market during the forecast period in terms of value."

The defense & government segment is projected to lead the India drone (UAV) market in terms of value during the forecast period. The growth of the segment is due to the wide use of drones for military, border security, and law enforcement missions. These drones are equipped with advanced payloads, encrypted communications, and rugged designs, which make them essential for intelligence, surveillance, reconnaissance (ISR), disaster response, and strategic deterrence. The defense & government segment covers a full spectrum of platforms, including small UAVs for tactical edge missions, tactical UAVs for extended battlefield intelligence and target tracking, and strategic MALE/HALE systems for persistent, long-duration surveillance and reconnaissance. With rapid defense modernization, indigenization under Atmanirbhar Bharat, and growing security needs, the defense & government segment is projected to command a larger share than the civil & commercial segment, reinforcing its dominance in India's drone ecosystem.

"By point of sale, the aftermarket segment is projected to achieve significant growth during the forecast period."

By point of sale, the aftermarket segment is projected to achieve significant growth during the forecast period. This growth is due to the rising demand for maintenance, repair, upgrades, and component replacement as drone adoption scales across defense, commercial, and industrial applications. With drones deployed for longer and more complex missions, operators require continuous support to ensure performance, compliance, and safety. The growth of indigenous startups and component suppliers fuels demand for spare parts, batteries, sensors, and software upgrades, further propelling the segment's growth. Government regulations mandating periodic certification and airworthiness checks also increase aftermarket activity. As drone fleets expand across agriculture, logistics, surveillance, and defense, the need for lifecycle management services positions the aftermarket segment as the most rapidly growing part of India's drone ecosystem.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, Others - 40%

Paras Aerospace Pvt. Ltd., ideaforge Technology Ltd., Throttle Aerospace Systems Pvt. Ltd., Garuda Aerospace Private Limited, Asteria Aerospace Limited, General Aeronautics Pvt. Ltd., Newspace Research Technologies Pvt. Ltd., IoTechWorld Avigation Pvt Ltd, Adani Defense and Aerospace, Tata Advanced Systems Limited, CDSpace, THANOS, Dhaksha Unmanned Systems Private Limited, Marut Dronetech Pvt Ltd, Hubblefly, and Raphe are some of the leading players operating in the India drone (UAV) market.

Research Coverage

The study covers the India drone (UAV) market across various segments and subsegments. It aims to estimate this market's size and growth potential across different segments based on type, application, industry, platform, point of sale, and system. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key Benefits of Buying this Report

This report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the India drone (UAV) market and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers and factors, such as favorable regulatory frameworks and government initiatives, growing emphasis on precision farming, and surging demand for surveillance and border security drones

- Product Development: In-depth analysis of product innovation/development by companies across country

- Market Development: Comprehensive information about lucrative markets in India

- Market Diversification: Exhaustive information about new solutions, recent developments, and investments in India drone (UAV) market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players in the India drone (UAV) market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 INTRODUCTION

- 1.2 STUDY OBJECTIVES

- 1.3 MARKET DEFINITION

- 1.4 STUDY SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.4.2 INCLUSIONS AND EXCLUSIONS

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary insights

- 2.1.2.2 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- 2.3.1.2 Pricing analysis of drones

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION AND VALIDATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDIA DRONE (UAV) MARKET

- 4.2 INDIA DRONE (UAV) MARKET, BY SYSTEM

- 4.3 INDIA DRONE (UAV) MARKET, BY PLATFORM

- 4.4 INDIA DRONE (UAV) MARKET, BY POINT OF SALE

- 4.5 INDIA DRONE (UAV) MARKET, BY INDUSTRY

- 4.6 INDIA DRONE (UAV) MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Favorable regulatory frameworks and government initiatives

- 5.2.1.2 Growing emphasis on precision farming

- 5.2.1.3 Increasing adoption of drones for commercial applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High dependence on foreign suppliers

- 5.2.2.2 Data privacy and security concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising use of drones in logistics industry

- 5.2.3.2 Need for real-time traffic monitoring and management

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited payload capacity

- 5.2.4.2 Complex integration of advanced technologies in drones

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 PLANNING & REVISED FUNDING

- 5.4.2 RESEARCH & DEVELOPMENT

- 5.4.3 RAW MATERIAL PROCUREMENT & MANUFACTURING

- 5.4.4 ASSEMBLY, TESTING, AND APPROVALS

- 5.4.5 DISTRIBUTION & AFTER-SALE SERVICES

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 COMPONENT MANUFACTURERS

- 5.5.2 SYSTEM INTEGRATORS

- 5.5.3 SERVICE PROVIDERS

- 5.5.4 COMPONENT IMPORTERS

- 5.6 OPERATIONAL DATA

- 5.7 VOLUME DATA

- 5.7.1 PROCUREMENT OF DRONES, BY PLATFORM

- 5.8 BILL OF MATERIALS

- 5.9 CASE STUDIES

- 5.9.1 AERIAL INSPECTION OF 10 MW SOLAR INSTALLATION IN SOUTHERN INDIA

- 5.9.2 INTEGRATION OF DRONE TECHNOLOGY IN TRANSMISSION PROJECT CONSTRUCTION

- 5.9.3 USE OF DRONE-AS-A-SERVICE TECHNOLOGY FOR AGRICULTURAL MONITORING

- 5.10 TOTAL COST OF OWNERSHIP

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF CIVIL & COMMERCIAL DRONE (UAV) PLATFORMS, BY KEY PLAYER

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO (HS CODE: 8806)

- 5.12.2 IMPORT SCENARIO (HS CODE: 8806)

- 5.13 BUSINESS MODELS

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.14.1 FUNDING, BY USE CASE/APPLICATION

- 5.15 MARKET SCENARIO ANALYSIS

- 5.15.1 MOST LIKELY SCENARIO

- 5.16 KEY CONFERENCES & EVENTS

- 5.17 TECHNOLOGY ANALYSIS

- 5.18 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 REGULATORY LANDSCAPE

- 5.19.1 INTRODUCTION

- 5.19.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.19.3 REGULATORY FRAMEWORK

- 5.19.3.1 Drone Rule, 2021

- 5.19.3.2 State policy and regulatory framework for drones

- 5.20 TECHNOLOGY TRENDS

- 5.20.1 HIGH-ALTITUDE PSEUDO-SATELLITES

- 5.20.2 AERIAL TARGET DRONES

- 5.20.3 DRONE MANUFACTURING USING ADVANCED MATERIALS

- 5.20.4 INTEGRATION OF NAVIC INTO DRONES

- 5.20.5 STEALTH COMBAT DRONES

- 5.21 IMPACT OF MEGATRENDS

- 5.21.1 3D PRINTING

- 5.21.2 ARTIFICIAL INTELLIGENCE

- 5.21.3 INTERNET OF THINGS

- 5.22 TECHNOLOGY ROADMAP

- 5.23 PATENT ANALYSIS

- 5.24 IMPACT OF AI/GENERATIVE AI ON INDIA DRONE (UAV) MARKET

- 5.24.1 ENHANCED AUTONOMY AND NAVIGATION

- 5.24.2 REAL-TIME DATA ANALYSIS AND OBJECT DETECTION

- 5.24.3 SWARM INTELLIGENCE AND MULTI-UAV COORDINATION

- 5.24.4 GENERATIVE AI FOR MISSION SIMULATION AND TRAINING

- 5.24.5 PREDICTIVE MAINTENANCE AND SYSTEM HEALTH MONITORING

- 5.25 US 2025 TARIFF

- 5.25.1 INTRODUCTION

- 5.25.2 KEY TARIFF RATES

- 5.25.3 PRICE IMPACT ANALYSIS

- 5.25.4 IMPACT ON COUNTRY

- 5.25.4.1 US

- 5.25.4.2 India

- 5.25.5 IMPACT ON END-USE INDUSTRIES

- 5.25.5.1 Civil & commercial

- 5.25.5.2 Defense

- 5.25.6 MACROECONOMIC OUTLOOK

- 5.25.7 DRONE-AS-A-SERVICE (DAAS) MARKET TRENDS

6 INDIA DRONE (UAV) MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 MILITARY

- 6.2.1 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE

- 6.2.1.1 Rising need for improved battlefield intelligence gathering to drive market

- 6.2.2 COMBAT OPERATIONS

- 6.2.2.1 Growing deployment of UAVs in combat operations to drive market

- 6.2.3 DELIVERY

- 6.2.3.1 Drone delivery systems to support defense medical logistics

- 6.2.1 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE

- 6.3 COMMERCIAL

- 6.3.1 REMOTE SENSING

- 6.3.1.1 Growing demand for drone-enabled remote sensing to support geospatial planning

- 6.3.2 INSPECTION & MONITORING

- 6.3.2.1 Increased use of drones for infrastructure inspection and asset monitoring to drive market

- 6.3.3 PRODUCT DELIVERY

- 6.3.3.1 Rapid expansion of e-commerce and demand for efficient last-mile delivery solutions to drive market

- 6.3.4 SURVEYING & MAPPING

- 6.3.4.1 Rising adoption of drones for geospatial surveying and terrain mapping to drive growth

- 6.3.5 AERIAL IMAGING

- 6.3.5.1 Increased drone usage for high-resolution aerial imaging and visual documentation to boost market

- 6.3.6 INDUSTRIAL WAREHOUSING

- 6.3.6.1 Adoption of drones in Indian warehouses to improve inventory control and logistics operations

- 6.3.7 PASSENGER & PUBLIC TRANSPORTATION

- 6.3.7.1 Emerging role of eVTOL drones in India's urban mobility and transport planning

- 6.3.8 OTHERS

- 6.3.1 REMOTE SENSING

- 6.4 GOVERNMENT & LAW ENFORCEMENT

- 6.4.1 BORDER MANAGEMENT

- 6.4.1.1 Expanded drone deployment for integrated border surveillance and infiltration detection to boost growth

- 6.4.2 TRAFFIC MONITORING

- 6.4.2.1 Adoption of aerial traffic intelligence systems to enhance urban mobility and enforcement

- 6.4.3 FIREFIGHTING & DISASTER MANAGEMENT

- 6.4.3.1 Strategic deployment of drone technology in firefighting and disaster management to drive market

- 6.4.4 POLICE OPERATIONS & INVESTIGATIONS

- 6.4.4.1 Increasing use of drones for crime scene analysis to drive market

- 6.4.5 MARITIME SECURITY

- 6.4.5.1 Drone integration to drive maritime security and anti-piracy operations

- 6.4.1 BORDER MANAGEMENT

- 6.5 CONSUMER

- 6.5.1 PROSUMERS

- 6.5.1.1 Increased use of drones for weddings and other events to drive market

- 6.5.2 HOBBYISTS

- 6.5.2.1 Expanding use of drones for vlogging to drive market

- 6.5.1 PROSUMERS

7 INDIA DRONE (UAV) MARKET, BY INDUSTRY

- 7.1 INTRODUCTION

- 7.2 DEFENSE & SECURITY

- 7.2.1 INDIGENIZATION TO DRIVE DRONE INTEGRATION IN INDIA'S DEFENSE AND SECURITY MARKETS

- 7.3 AGRICULTURE

- 7.3.1 GOVERNMENT SUPPORT TO DRIVE DRONE ADOPTION IN INDIA'S AGRICULTURAL MARKETS

- 7.4 LOGISTICS & TRANSPORTATION

- 7.4.1 NEED FOR TRANSFORMATION IN LOGISTICS AND TRANSPORT TO DRIVE MARKET

- 7.5 ENERGY & POWER

- 7.5.1 NEED FOR EFFICIENCY AND SECURITY IN INDIA'S POWER INFRASTRUCTURE MARKETS TO DRIVE GROWTH

- 7.6 CONSTRUCTION & MINING

- 7.6.1 DRONE ANALYTICS TO DRIVE EFFICIENCY IN CONSTRUCTION AND MINING INDUSTRY

- 7.7 MEDIA & ENTERTAINMENT

- 7.7.1 NEED FOR DRONES FOR MEDIA PRODUCTION TO DRIVE MARKET

- 7.8 INSURANCE

- 7.8.1 FOCUS ON DRONE INTEGRATION TO TRANSFORM INSURANCE RISK AND CLAIMS MARKET TO BOOST DEMAND

- 7.9 WILDLIFE & FORESTRY

- 7.9.1 INCREASING NEED FOR CONSERVATION TO DRIVE INTEGRATION OF DRONES IN INDIA'S WILDLIFE AND FORESTRY MARKETS

- 7.10 ACADEMICS

- 7.10.1 DEMAND FOR DRONES FOR SKILL DEVELOPMENT IN INDIA'S ACADEMIC SECTOR TO BOOST GROWTH

8 INDIA DRONE (UAV) MARKET, BY PLATFORM

- 8.1 INTRODUCTION

- 8.2 CIVIL & COMMERCIAL

- 8.2.1 USE CASE: DEPLOYMENT OF Q6 UAV BY IDEAFORGE TECHNOLOGY LTD.

- 8.2.2 MICRO

- 8.2.2.1 Need for cost-effective and lightweight drones to drive market

- 8.2.3 SMALL

- 8.2.3.1 Rising use of drones in crop monitoring, wildlife conservation, and cinematography to drive market

- 8.2.4 MEDIUM

- 8.2.4.1 Growing adoption of drones in package delivery, meteorological research, and intelligence collection to drive market

- 8.2.5 LARGE

- 8.2.5.1 Increasing demand for passenger drones to drive market

- 8.3 DEFENSE

- 8.3.1 USE CASE: DEPLOYMENT OF RUSTOM-1 BY DRDO

- 8.3.2 SMALL

- 8.3.2.1 Nano

- 8.3.2.1.1 Close-quarter intelligence needs to drive nano UAV adoption in defense sector

- 8.3.2.2 Micro

- 8.3.2.2.1 Tactical mobility needs to drive micro UAV adoption in defense sector

- 8.3.2.3 Mini

- 8.3.2.3.1 Persistent surveillance needs to drive mini UAV adoption in defense sector

- 8.3.2.1 Nano

- 8.3.3 TACTICAL

- 8.3.3.1 Close-range UAVs

- 8.3.3.1.1 Stealth reconnaissance needs to drive adoption of close-range UAVs in defense sector

- 8.3.3.2 Short-range UAVs

- 8.3.3.2.1 Border surveillance needs to drive adoption of short-range UAVs in defense sector

- 8.3.3.3 Medium-range Medium Endurance (MRME)

- 8.3.3.3.1 Brigade-level ISR needs to drive adoption of MRME UAVs

- 8.3.3.4 Long-range medium endurance (LRME)

- 8.3.3.4.1 Corp-level coordination needs to drive adoption of LRME UAVs in defense sector

- 8.3.3.1 Close-range UAVs

- 8.3.4 STRATEGIC

- 8.3.4.1 Persistent intelligence needs to drive adoption of strategic UAVs in defense sector

- 8.3.4.2 Medium-altitude long endurance (MALE) UAVS

- 8.3.4.2.1 Sustained ISR needs to drive adoption of MALE UAVs in defense sector

- 8.3.4.3 High-altitude long endurance (HALE) UAVS

- 8.3.4.3.1 Strategic deterrence needs to drive adoption of HALE UAVs in defense sector

9 INDIA DRONE (UAV) MARKET, BY POINT OF SALE

- 9.1 INTRODUCTION

- 9.2 OEM

- 9.2.1 INDIGENOUS DESIGN, DEVELOPED & MANUFACTURED (IDDM)

- 9.2.1.1 Need for drones with indigenous design and domestic integration to drive market

- 9.2.2 NON-INDIGENOUS

- 9.2.2.1 High-performance or specialized use cases to drive market

- 9.2.1 INDIGENOUS DESIGN, DEVELOPED & MANUFACTURED (IDDM)

- 9.3 AFTERMARKET

- 9.3.1 MRO

- 9.3.1.1 Need for expanding drone MRO support for compliance and lifecycle management to drive market

- 9.3.1.2 Scheduled maintenance

- 9.3.1.2.1 Stringent compliance norms to drive demand for scheduled maintenance drones

- 9.3.1.3 Unscheduled repairs

- 9.3.1.3.1 Fault response and usage frequency to drive need for drones for repair services

- 9.3.1.4 Calibration/diagnostics

- 9.3.1.4.1 Operational accuracy needs to drive use of drones for maintenance services

- 9.3.1.5 Upgrades/retrofits

- 9.3.1.5.1 Need for modular enhancements to drive adoption of retrofit drones

- 9.3.2 REPLACEMENT

- 9.3.2.1 Vehicle

- 9.3.2.1.1 Increased wear and terrain due to stress to drive market

- 9.3.2.2 Payload

- 9.3.2.2.1 Sensor upgrades and mission shifts to drive payload replacement

- 9.3.2.3 Ground control station

- 9.3.2.3.1 System compatibility and field stress to drive ground control station replacements

- 9.3.2.4 Launch & recovery system

- 9.3.2.4.1 Field conditions to drive demand for launch & recovery solutions

- 9.3.2.1 Vehicle

- 9.3.3 SIMULATION & TRAINING

- 9.3.3.1 OEM onboarding training

- 9.3.3.1.1 Need to ensure standardized operational readiness among users to boost demand

- 9.3.3.2 Simulator-based training

- 9.3.3.2.1 Focus on maintaining safety standards to drive adoption of drones for simulator-based training

- 9.3.3.3 Certification-as-a-service

- 9.3.3.3.1 Compliance needs to drive adoption of certification-as-a-service

- 9.3.3.1 OEM onboarding training

- 9.3.1 MRO

10 INDIA DRONE (UAV) MARKET, BY SYSTEM

- 10.1 INTRODUCTION

- 10.2 VEHICLE

- 10.2.1 AIRFRAME

- 10.2.1.1 Focus on design innovation to drive market

- 10.2.2 AVIONICS

- 10.2.2.1 Advancements in sensor technology for enhanced navigation and data collection capabilities to drive market

- 10.2.3 PROPULSION SYSTEMS

- 10.2.3.1 Emphasis on indigenous innovation to drive advancements in propulsion systems

- 10.2.4 SOFTWARE

- 10.2.4.1 Development of AI-powered analytics for efficient data processing and actionable insights to drive market

- 10.2.1 AIRFRAME

- 10.3 PAYLOAD

- 10.3.1 CAMERAS

- 10.3.1.1 Increasing adoption of drones for aerial photography, infrastructure inspection, and urban planning to drive market

- 10.3.2 INTELLIGENCE PAYLOADS

- 10.3.2.1 Growing need for enhanced situational awareness to drive market

- 10.3.3 RADARS

- 10.3.3.1 Demand for indigenous radar technologies to drive growth

- 10.3.4 LIDAR

- 10.3.4.1 Booming demand for high-precision mapping and surveying to drive market

- 10.3.5 GIMBALS

- 10.3.5.1 Growing inclination toward drone photography to drive market

- 10.3.1 CAMERAS

- 10.4 GROUND CONTROL STATION

- 10.4.1 REMOTE MONITORING, MISSION PLANNING, AND ALTITUDE CONTROLLING APPLICATIONS OF UAVS TO DRIVE MARKET

- 10.5 LAUNCH & RECOVERY SYSTEM

- 10.5.1 FOCUS ON MILITARY UAV DEVELOPMENT TO DRIVE NEED FOR LAUNCH & RECOVERY SYSTEMS

11 INDIA DRONE (UAV) MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 FIXED WING

- 11.2.1 CTOL

- 11.2.1.1 Demand for long-range drones to drive adoption of CTOL

- 11.2.2 VTOL

- 11.2.2.1 Need for operational flexibility to drive adoption of VTOL

- 11.2.3 STOL

- 11.2.3.1 Terrain challenges to drive advancements in STOL

- 11.2.1 CTOL

- 11.3 ROTARY WING

- 11.3.1 SINGLE ROTOR

- 11.3.1.1 Need for operational efficiency in defense and industrial markets to drive market

- 11.3.2 MULTI-ROTOR

- 11.3.2.1 Bicopter

- 11.3.2.1.1 Academic innovation to drive adoption of bicopters

- 11.3.2.2 Tricopter

- 11.3.2.2.1 Experimental needs to drive adoption of tricopter drones

- 11.3.2.3 Quadcopter

- 11.3.2.3.1 Need for large-scale deployment of drones to drive market

- 11.3.2.4 Hexacopter

- 11.3.2.4.1 Demand for increased reliability to drive market

- 11.3.2.5 Octocopter

- 11.3.2.5.1 Heavy-lift requirements to drive adoption of octocopters

- 11.3.2.1 Bicopter

- 11.3.1 SINGLE ROTOR

- 11.4 HYBRID WING VTOL

- 11.4.1 INCREASED MISSION VERSATILITY TO DRIVE ADOPTION OF HYBRID WING VTOL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS

- 12.5.5.1 Company footprint

- 12.5.5.2 Platform footprint

- 12.5.5.3 Industry footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 Point of sale footprint

- 12.6 COMPANY EVALUATION MARKET: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES

- 12.7 BRAND AND PRODUCT COMPARISON

- 12.7.1 BRAND COMPARISON

- 12.7.2 PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSION

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 IDEAFORGE TECHNOLOGY LTD.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 BHARAT ELECTRONICS LIMITED (BEL)

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 IOTECHWORLD

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 GARUDA AEROSPACE PRIVATE LIMITED

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 RAPHE

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 ASTERIA AEROSPACE LIMITED

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Other developments

- 13.1.7 NEWSPACE RESEARCH AND TECHNOLOGIES PVT. LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Other developments

- 13.1.8 PARAS AEROSPACE PVT. LTD

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Other developments

- 13.1.9 ADANI DEFENCE AND AEROSPACE

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 DRONIX TECHNOLOGIES PRIVATE LIMITED

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Other developments

- 13.1.11 JOHNNETTE GROUP

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Other developments

- 13.1.12 TATA ADVANCED SYSTEMS LIMITED

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 CDSPACE

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 THANOS

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.15 DROGO DRONES

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.16 SCANDRON PVT. LTD.

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches

- 13.1.16.3.2 Deals

- 13.1.17 DHAKSHA UNMANNED SYSTEMS PRIVATE LIMITED

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.2.1 Other developments

- 13.1.18 MULTIPLEX DRONE PRIVATE LIMITED

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.19 CHATAK

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.20 AEROSIGHT TECHNOLOGIES

- 13.1.20.1 Business overview

- 13.1.20.2 Products/Solutions/Services offered

- 13.1.21 MARUT DRONETECH PVT LTD

- 13.1.21.1 Business overview

- 13.1.21.2 Products/Solutions/Services offered

- 13.1.21.3 Recent developments

- 13.1.21.3.1 Product launches

- 13.1.21.3.2 Deals

- 13.1.21.3.3 Expansion

- 13.1.21.3.4 Other developments

- 13.1.22 URBANMATRIX TECHNOLOGIES

- 13.1.22.1 Business overview

- 13.1.22.2 Products/Solutions/Services offered

- 13.1.22.3 Recent developments

- 13.1.22.3.1 Deals

- 13.1.23 TECHEAGLE

- 13.1.23.1 Business overview

- 13.1.23.2 Products/Solutions/Services offered

- 13.1.23.3 Recent developments

- 13.1.23.3.1 Deals

- 13.1.24 SAGAR DEFENCE ENGINEERING

- 13.1.24.1 Business overview

- 13.1.24.2 Products/Solutions/Services offered

- 13.1.24.3 Recent developments

- 13.1.24.3.1 Deals

- 13.1.24.3.2 Other developments

- 13.1.25 THROTTLE AEROSPACE SYSTEMS PVT. LTD.

- 13.1.25.1 Business overview

- 13.1.25.2 Products/Solutions/Services offered

- 13.1.25.3 Recent developments

- 13.1.25.3.1 Product launches

- 13.1.25.3.2 Deals

- 13.1.26 DCM SHRIRAM

- 13.1.26.1 Business overview

- 13.1.26.2 Products/Solutions/Services offered

- 13.1.26.3 Recent developments

- 13.1.26.3.1 Deals

- 13.1.27 RCHOBBYTECH SOLUTIONS PRIVATE LIMITED

- 13.1.27.1 Business overview

- 13.1.27.2 Products/Solutions/Services offered

- 13.1.28 HUBBLEFLY TECHNOLOGIES

- 13.1.28.1 Business overview

- 13.1.28.2 Products/Solutions/Services offered

- 13.1.28.3 Recent developments

- 13.1.28.3.1 Other developments

- 13.1.29 INDRONES SOLUTIONS PVT. LTD.

- 13.1.29.1 Business overview

- 13.1.29.2 Products/Solutions/Services offered

- 13.1.29.3 Recent developments

- 13.1.29.3.1 Deals

- 13.1.30 D'AVIATORS

- 13.1.30.1 Business overview

- 13.1.30.2 Products/Solutions/Services offered

- 13.1.31 SOLAR GROUP

- 13.1.31.1 Business overview

- 13.1.31.2 Products/Solutions/Services offered

- 13.1.31.3 Recent developments

- 13.1.31.3.1 Other developments

- 13.1.32 SKYLARK DRONES

- 13.1.32.1 Business overview

- 13.1.32.2 Products/Solutions/Services offered

- 13.1.32.3 Recent developments

- 13.1.32.3.1 Product launches

- 13.1.32.3.2 Other developments

- 13.1.1 IDEAFORGE TECHNOLOGY LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 IMPACT OF DEMAND-SIDE INDICATORS

- TABLE 3 IMPACT OF SUPPLY-SIDE INDICATORS

- TABLE 4 AGRICULTURE DRONE USAGE, BY APPLICATION, 2023-2030

- TABLE 5 DRONE INTRUSION CASES, 2021-2022

- TABLE 6 SMALL MILITARY DRONES USED BY INDIAN ARMED FORCES

- TABLE 7 DRONE USAGE BY INDIAN COMPANIES

- TABLE 8 ENDURANCE-BASED MAPPING OF POWER SOURCES

- TABLE 9 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 PROCUREMENT OF DRONES, BY PLATFORM, 2021-2024 (UNITS)

- TABLE 11 OTHER USE CASES OF DRONES IN INDIA

- TABLE 12 TOTAL COST OF OWNERSHIP FOR AGRICULTURE DRONES (USD)

- TABLE 13 PRICE COMPARISON BETWEEN DRONES, BY COUNTRY

- TABLE 14 EXPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 IMPORT DATA FOR HS CODE 8806 -COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 FUNDING, BY USE CASE/APPLICATION

- TABLE 17 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 18 KEY TECHNOLOGIES

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 20 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- TABLE 21 INDIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 KEY PROVISIONS UNDER DRONE RULES, 2021

- TABLE 23 COMPARISON BETWEEN REGULATORY FRAMEWORKS OF 16 COUNTRIES

- TABLE 24 PATENT ANALYSIS

- TABLE 25 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 26 KEY PRODUCT-RELATED TARIFF APPLICABLE FOR INDIAN DRONES (UAVS)

- TABLE 27 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 28 COMPETITIVE LANDSCAPE FOR DRONE-AS-A-SERVICE MARKET

- TABLE 29 INDIA DRONE (UAV) MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 30 INDIA DRONE (UAV) MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 31 MILITARY: INDIA DRONE (UAV) MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 32 MILITARY: INDIA DRONE (UAV) MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 33 INDIA DRONE (UAV) MARKET, BY COMMERCIAL APPLICATION, 2021-2024 (USD MILLION)

- TABLE 34 INDIA DRONE (UAV) MARKET, BY COMMERCIAL APPLICATION, 2025-2030 (USD MILLION)

- TABLE 35 INDIA DRONE (UAV) MARKET, BY GOVERNMENT & LAW ENFORCEMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 36 INDIA DRONE (UAV) MARKET, BY GOVERNMENT & LAW ENFORCEMENT APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 INDIA DRONE (UAV) MARKET, BY CONSUMER APPLICATION, 2021-2024 (USD MILLION)

- TABLE 38 INDIA DRONE (UAV) MARKET, BY CONSUMER APPLICATION, 2025-2030 (USD MILLION)

- TABLE 39 INDIA DRONE (UAV) MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 40 INDIA DRONE (UAV) MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 INDIA DRONE (UAV) MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 42 INDIA DRONE (UAV) MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 43 INDIA DRONE (UAV) MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2021-2024 (UNITS)

- TABLE 44 INDIA DRONE (UAV) MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2025-2030 (UNITS)

- TABLE 45 INDIA DRONE (UAV) MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 46 INDIA DRONE (UAV) MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 47 INDIA DRONE (UAV) MARKET, BY DEFENSE PLATFORM, 2021-2024 (UNITS)

- TABLE 48 INDIA DRONE (UAV) MARKET, BY DEFENSE PLATFORM, 2025-2030 (UNITS)

- TABLE 49 INDIA DRONE (UAV) MARKET, BY DEFENSE PLATFORM, 2021-2024 (USD MILLION)

- TABLE 50 INDIA DRONE (UAV) MARKET, BY DEFENSE PLATFORM, 2025-2030 (USD MILLION)

- TABLE 51 INDIA DRONE (UAV) MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 52 INDIA DRONE (UAV) MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 53 OEM: INDIA DRONE (UAV) MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 54 OEM: INDIA DRONE (UAV) MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 55 AFTERMARKET: INDIA DRONE (UAV) MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 56 AFTERMARKET: INDIA DRONE (UAV) MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 57 INDIA DRONE (UAV) MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 58 INDIA DRONE (UAV) MARKET, BY SYSTEM, 2025-2030 (USD MILLION)

- TABLE 59 INDIA DRONE (UAV) MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 60 INDIA DRONE (UAV) MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 62 INDIA DRONE (UAV) MARKET: DEGREE OF COMPETITION

- TABLE 63 INDIA DRONE (UAV) MARKET: PLATFORM FOOTPRINT

- TABLE 64 INDIA DRONE (UAV) MARKET: INDUSTRY FOOTPRINT

- TABLE 65 INDIA DRONE (UAV) MARKET: APPLICATION FOOTPRINT

- TABLE 66 INDIA DRONE (UAV) MARKET: POINT OF SALE FOOTPRINT

- TABLE 67 INDIA DRONE (UAV) MARKET: KEY STARTUPS/SMES

- TABLE 68 INDIA DRONE (UAV) MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 69 COMPARISON BETWEEN COMMERCIAL DRONE PRODUCTS, 2024

- TABLE 70 COMPARISON BETWEEN MILITARY DRONE PRODUCTS, 2024

- TABLE 71 INDIA DRONE (UAV) MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 72 INDIA DRONE (UAV) MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 73 INDIA DRONE (UAV) MARKET: EXPANSION, JANUARY 2021-JUNE 2025

- TABLE 74 INDIA DRONE (UAV) MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 75 IDEAFORGE TECHNOLOGY LTD.: COMPANY OVERVIEW

- TABLE 76 IDEAFORGE TECHNOLOGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 77 IDEAFORGE TECHNOLOGY LTD.: PRODUCT LAUNCHES

- TABLE 78 IDEAFORGE TECHNOLOGY LTD.: DEALS

- TABLE 79 IDEAFORGE TECHNOLOGY LTD.: OTHER DEVELOPMENTS

- TABLE 80 BHARAT ELECTRONICS LIMITED (BEL): COMPANY OVERVIEW

- TABLE 81 BHARAT ELECTRONICS LIMITED (BEL): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 82 BHARAT ELECTRONICS LIMITED (BEL): DEALS

- TABLE 83 IOTECHWORLD: COMPANY OVERVIEW

- TABLE 84 IOTECHWORLD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 85 IOTECHWORLD: DEALS

- TABLE 86 IOTECHWORLD: OTHER DEVELOPMENTS

- TABLE 87 GARUDA AEROSPACE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 88 GARUDA AEROSPACE PRIVATE LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 89 GARUDA AEROSPACE PRIVATE LIMITED: PRODUCT LAUNCHES

- TABLE 90 GARUDA AEROSPACE PRIVATE LIMITED: DEALS

- TABLE 91 GARUDA AEROSPACE PRIVATE LIMITED: OTHER DEVELOPMENTS

- TABLE 92 RAPHE: COMPANY OVERVIEW

- TABLE 93 RAPHE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 94 RAPHE: PRODUCT LAUNCHES

- TABLE 95 RAPHE: DEALS

- TABLE 96 ASTERIA AEROSPACE LIMITED: COMPANY OVERVIEW

- TABLE 97 ASTERIA AEROSPACE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 98 ASTERIA AEROSPACE LIMITED: DEALS

- TABLE 99 ASTERIA AEROSPACE LIMITED: OTHER DEVELOPMENTS

- TABLE 100 NEWSPACE RESEARCH AND TECHNOLOGIES PVT. LTD.: COMPANY OVERVIEW

- TABLE 101 NEWSPACE RESEARCH AND TECHNOLOGIES PVT. LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 102 NEWSPACE RESEARCH AND TECHNOLOGIES PVT. LTD.: DEALS

- TABLE 103 NEWSPACE RESEARCH AND TECHNOLOGIES PVT. LTD.: OTHER DEVELOPMENTS

- TABLE 104 PARAS AEROSPACE PVT. LTD: COMPANY OVERVIEW

- TABLE 105 PARAS AEROSPACE PVT. LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 106 PARAS DEFENSE & SPACE TECHNOLOGIES LIMITED: PRODUCT LAUNCHES

- TABLE 107 PARAS DEFENSE & SPACE TECHNOLOGIES LIMITED: DEALS

- TABLE 108 PARAS DEFENSE & SPACE TECHNOLOGIES LIMITED: OTHER DEVELOPMENTS

- TABLE 109 ADANI DEFENCE AND AEROSPACE: COMPANY OVERVIEW

- TABLE 110 ADANI DEFENCE AND AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 111 ADANI DEFENCE AND AEROSPACE: PRODUCT LAUNCHES

- TABLE 112 ADANI DEFENCE AND AEROSPACE: DEALS

- TABLE 113 DRONIX TECHNOLOGIES PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 114 DRONIX TECHNOLOGIES PRIVATE LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 115 DRONIX TECHNOLOGIES PRIVATE LIMITED: DEALS

- TABLE 116 DRONIX TECHNOLOGIES PRIVATE LIMITED: OTHER DEVELOPMENTS

- TABLE 117 JOHNNETTE GROUP: COMPANY OVERVIEW

- TABLE 118 JOHNNETTE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 119 JOHNNETTE GROUP: DEALS

- TABLE 120 JOHNNETTE GROUP: OTHER DEVELOPMENTS

- TABLE 121 TATA ADVANCED SYSTEMS LIMITED: COMPANY OVERVIEW

- TABLE 122 TATA ADVANCED SYSTEMS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 CDSPACE: COMPANY OVERVIEW

- TABLE 124 CDSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 125 CDSPACE: DEALS

- TABLE 126 THANOS: COMPANY OVERVIEW

- TABLE 127 THANOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 THANOS: DEALS

- TABLE 129 DROGO DRONES: COMPANY OVERVIEW

- TABLE 130 DROGO DRONES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 DROGO DRONES: PRODUCT LAUNCHES

- TABLE 132 SCANDRON PVT. LTD.: COMPANY OVERVIEW

- TABLE 133 SCANDRON PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 SCANDRON PVT. LTD.: PRODUCT LAUNCHES

- TABLE 135 SCANDRON PVT. LTD.: DEALS

- TABLE 136 DHAKSHA UNMANNED SYSTEMS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 137 DHAKSHA UNMANNED SYSTEMS PRIVATE LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 138 DHAKSHA UNMANNED SYSTEMS PRIVATE LIMITED: OTHER DEVELOPMENTS

- TABLE 139 MULTIPLEX DRONE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 140 MULTIPLEX DRONE PRIVATE LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 141 CHATAK: COMPANY OVERVIEW

- TABLE 142 CHATAK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 AEROSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 144 AEROSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 MARUT DRONETECH PVT LTD: COMPANY OVERVIEW

- TABLE 146 MARUT DRONETECH PVT LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 MARUT DRONETECH PVT LTD: PRODUCT LAUNCHES

- TABLE 148 MARUT DRONETECH PVT LTD: DEALS

- TABLE 149 MARUT DRONETECH PVT LTD: EXPANSION

- TABLE 150 MARUT DRONETECH PVT LTD: OTHER DEVELOPMENTS

- TABLE 151 URBANMATRIX TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 152 URBANMATRIX TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 URBANMATRIX TECHNOLOGIES: DEALS

- TABLE 154 TECHEAGLE: COMPANY OVERVIEW

- TABLE 155 TECHEAGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 TECHEAGLE: DEALS

- TABLE 157 SAGAR DEFENCE ENGINEERING: COMPANY OVERVIEW

- TABLE 158 SAGAR DEFENCE ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 SAGAR DEFENCE ENGINEERING: DEALS

- TABLE 160 SAGAR DEFENCE ENGINEERING: OTHER DEVELOPMENTS

- TABLE 161 THROTTLE AEROSPACE SYSTEMS PVT. LTD.: COMPANY OVERVIEW

- TABLE 162 THROTTLE AEROSPACE SYSTEMS PVT. LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 163 THROTTLE AEROSPACE SYSTEMS PVT. LTD.: PRODUCT LAUNCHES

- TABLE 164 THROTTLE AEROSPACE SYSTEMS PVT. LTD: DEALS

- TABLE 165 DCM SHRIRAM: COMPANY OVERVIEW

- TABLE 166 DCM SHRIRAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 DCM SHRIRAM: DEALS

- TABLE 168 RCHOBBYTECH SOLUTIONS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 169 RCHOBBYTECH SOLUTIONS PRIVATE LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 170 HUBBLEFLY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 171 HUBBLEFLY TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 HUBBLEFLY TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 173 INDRONES SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 174 INDRONES SOLUTIONS PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 INDRONES SOLUTIONS PVT. LTD.: DEALS

- TABLE 176 D'AVIATORS: COMPANY OVERVIEW

- TABLE 177 D'AVIATORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 SOLAR GROUP: COMPANY OVERVIEW

- TABLE 179 SOLAR GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 SOLAR GROUP: OTHER DEVELOPMENTS

- TABLE 181 SKYLARK DRONES: COMPANY OVERVIEW

- TABLE 182 SKYLARK DRONES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 SKYLARK DRONES: PRODUCT LAUNCHES

- TABLE 184 SKYLARK DRONES: OTHER DEVELOPMENTS

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 PAYLOAD SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 7 DEFENSE & SECURITY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 FIXED WING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 MILITARY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 OEM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 FLOURISHING STARTUP SCENARIO AND STRONG GOVERNMENT SUPPORT TO DRIVE MARKET

- FIGURE 12 VEHICLE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 DEFENSE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 SMALL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 OEM SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 16 DEFENSE & SECURITY SEGMENT TO ACCOUNT FOR LARGEST SHARE FROM 2024 TO 2029

- FIGURE 17 MILITARY SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 18 EVOLUTION OF INDIA DRONE (UAV) MARKET

- FIGURE 19 INDIA DRONE (UAV) MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 ROADMAP OF GOVERNMENT POLICIES AND REGULATORY FRAMEWORKS

- FIGURE 21 GOVERNMENT INITIATIVES TO PROMOTE DRONE APPLICATIONS

- FIGURE 22 AGRICULTURE DRONES AND THEIR BENEFITS

- FIGURE 23 AGRICULTURE DRONE USAGE, BY DRONE TYPE, 2023-2030

- FIGURE 24 ADVANTAGES OF DRONES

- FIGURE 25 APPLICATION-BASED BARRIERS TO DRONE MANUFACTURING

- FIGURE 26 IMPORT OF DRONE COMPONENTS, 2023 (%)

- FIGURE 27 CYBER ATTACKS TARGETING FLIGHT CONTROLLERS, STATIONS, DATA LINKS, AND GROUND CONTROLS

- FIGURE 28 FUTURE OF DRONES IN LOGISTICS INDUSTRY

- FIGURE 29 BENEFITS OF DEPLOYING DRONES IN LOGISTICS INDUSTRY

- FIGURE 30 BENEFITS OF DEPLOYING DRONES FOR TRAFFIC MONITORING AND MANAGEMENT

- FIGURE 31 FLIGHT TIME VS. BATTERY CAPACITY

- FIGURE 32 MASS VS. FLIGHT TIME

- FIGURE 33 REVENUE SHIFT AND NEW REVENUE POCKETS FOR INDIA DRONE (UAV) MARKET PLAYERS

- FIGURE 34 VALUE CHAIN ANALYSIS

- FIGURE 35 ECOSYSTEM ANALYSIS

- FIGURE 36 COMMERCIAL DRONE REGISTRATIONS IN INDIA, 2019-2024

- FIGURE 37 DRONE REGISTRATIONS, BY CIVIL & COMMERCIAL PLATFORM, 2019-2024

- FIGURE 38 TOP 20 DRONE MODELS REGISTERED IN INDIA, 2019-2024

- FIGURE 39 DRONE REGISTRATION BY TOP 30 COMPANIES, 2019-2024 (UNITS)

- FIGURE 40 DISTRIBUTION OF KEY COMPONENTS OF COMMERCIAL DRONES

- FIGURE 41 DISTRIBUTION OF KEY COMPONENTS OF MILITARY DRONES

- FIGURE 42 IMPORT AND INDIGENOUS DISTRIBUTION OF DRONE COMPONENTS

- FIGURE 43 TOTAL COST OF OWNERSHIP ASSOCIATED WITH DRONE ACQUISITION

- FIGURE 44 AVERAGE BREAKDOWN OF MAJOR COST CATEGORIES RELATED TO AGRICULTURE DRONES (%)

- FIGURE 45 AVERAGE BREAKDOWN OF COST CATEGORIES FOR HIGHEST-SELLING AGRICULTURE DRONES (%)

- FIGURE 46 AVERAGE BREAKDOWN OF MAJOR COST CATEGORIES FOR STRATEGIC DRONES (%)

- FIGURE 47 AVERAGE SELLING PRICE TREND OF CIVIL & COMMERCIAL DRONE (UAV) PLATFORMS, BY KEY PLAYER, 2024

- FIGURE 48 AVERAGE SELLING PRICE TREND, BY DEFENSE PLATFORM, 2024 (USD MILLION)

- FIGURE 49 EXPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 50 IMPORT DATA FOR HS CODE 89-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 51 BUSINESS MODELS ADOPTED BY KEY PLAYERS

- FIGURE 52 FUNDING BREAKUP OF DRONE TECH STARTUPS, 2025

- FIGURE 53 INVESTMENT AND FUNDING SCENARIO, 2019-2025

- FIGURE 54 MARKET SCENARIO ANALYSIS, 2024-2030

- FIGURE 55 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 56 KEY BUYING CRITERIA FOR KEY APPLICATIONS

- FIGURE 57 STATE POLICY AND REGULATORY FRAMEWORK STATUS

- FIGURE 58 TECHNOLOGY TRENDS

- FIGURE 59 MULTI-FUNCTIONAL MATERIALS USED IN MANUFACTURING DRONES

- FIGURE 60 EVOLUTION OF DRONE TECHNOLOGY

- FIGURE 61 TECHNOLOGY ROADMAP

- FIGURE 62 EMERGING TRENDS

- FIGURE 63 INDIA DRONE (UAV) MARKET: IMPACT OF AI/GEN AI

- FIGURE 64 INDIA DRONE (UAV) MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 65 INDIA DRONE (UAV) MARKET, BY INDUSTRY, 2025 VS. 2030 (USD MILLION)

- FIGURE 66 INDIA DRONE (UAV) MARKET, BY PLATFORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 67 INDIA DRONE (UAV) MARKET, BY CIVIL & COMMERCIAL PLATFORM, 2025-2030 (USD MILLION)

- FIGURE 68 INDIA DRONE (UAV) MARKET, BY DEFENSE PLATFORM, 2025-2030 (USD MILLION)

- FIGURE 69 INDIA DRONE (UAV) MARKET, BY POINT OF SALE, 2025 VS. 2030 (USD MILLION)

- FIGURE 70 INDIA DRONE (UAV) MARKET, BY SYSTEM, 2025 VS. 2030 (USD MILLION)

- FIGURE 71 INDIA DRONE (UAV) MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 72 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 73 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 74 INDIA DRONE (UAV) MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 75 INDIA DRONE (UAV) MARKET: COMPANY FOOTPRINT

- FIGURE 76 INDIA DRONE (UAV) MARKET: COMPANY EVALUATION MARKET (STARTUPS/SMES), 2024

- FIGURE 77 BRAND COMPARISON, 2024

- FIGURE 78 COMPANY VALUATION, 2024

- FIGURE 79 FINANCIAL METRICS, 2024

- FIGURE 80 IDEAFORGE TECHNOLOGY LTD.: COMPANY SNAPSHOT

- FIGURE 81 BHARAT ELECTRONICS LIMITED (BEL): COMPANY SNAPSHOT

- FIGURE 82 ASTERIA AEROSPACE LIMITED: COMPANY SNAPSHOT

- FIGURE 83 DCM SHRIRAM: COMPANY SNAPSHOT

- FIGURE 84 SOLAR GROUP: COMPANY SNAPSHOT