PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1774598

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1774598

Cyclopentane Market by Function, Application, and Region - Global Forecast to 2030

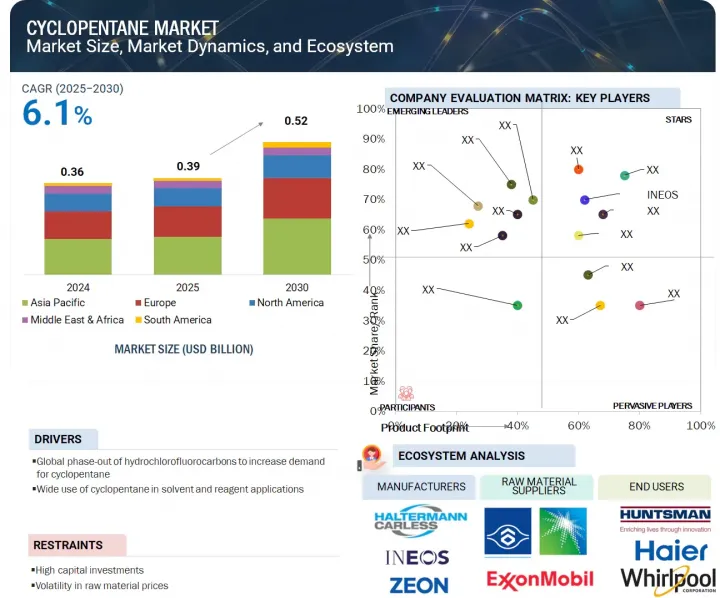

The global cyclopentane market is projected to grow from USD 0.39 billion in 2025 to USD 0.52 billion by 2030, at a CAGR of 6.1% during the forecast period. The cyclopentane market is witnessing robust growth, driven by rising demand for eco-friendly blowing agents and increasing environmental regulations phasing out ozone-depleting substances like HCFCs. Its low global warming potential and zero ozone depletion potential make cyclopentane a preferred substitute in insulation and refrigeration applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) and Volume (Kiloton) |

| Segments | By Function, Application, and Region. |

| Regions covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

Rapid urbanization, expanding cold-chain logistics, and the push for energy-efficient appliances further contribute to its growing adoption. Industries such as construction, refrigeration, and automotive are increasingly relying on cyclopentane-based insulation to meet sustainability targets.

"Based on function, the solvents & reagents segment is expected to account for the second-largest market share during the forecast period."

The solvents & reagents segment is expected to account for the second-largest share of the market in terms of value during the forecast period. This reflects cyclopentane's growing utilization in various chemical processes and industrial applications where its stability, volatility, and low environmental impact make it a suitable choice. Its effectiveness as a solvent and reagent in multiple formulations contributes to its expanding role across different end-use industries, supporting its strong market presence beyond primary applications like blowing agents.

"Based on application, the insulating construction materials segment will account for the second-largest share during the forecast period."

The insulating construction materials are expected to account for the second-largest share of the cyclopentane market in terms of volume during the forecast period. Rapid urbanization, infrastructure growth, and rising construction activity, especially in emerging economies, are driving the demand for effective insulation solutions. Cyclopentane-based insulation materials are extensively used in residential, commercial, and industrial buildings due to their ability to enhance energy efficiency and help reduce heating and cooling costs. Additionally, the shift toward sustainable building practices and stricter energy efficiency regulations is further boosting the adoption of cyclopentane in construction insulation. Its low environmental impact and superior thermal insulation properties make it a preferred alternative to traditional blowing agents in the building materials sector.

"Europe expected to account for the second-largest share during the forecast period."

The Europe region is expected to account for the second-largest share of the cyclopentane market in terms of value during the forecast period. Europe is expected to maintain a strong position in the cyclopentane market, holding a significant share during the forecast period. The region's focus on energy efficiency, stringent environmental regulations, and commitment to phasing out ozone-depleting substances are key drivers of cyclopentane adoption. Moreover, well-established construction and refrigeration industries, along with the shift toward sustainable insulation materials, continue to support the region's demand for cyclopentane-based products.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors Level- 25%, Managers Level- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

Haltermann Carless Group GmbH (Germany), Junyuan Petroleum Group (China), INEOS (UK), Zeon Corporation (Japan), and Puyang Zhongwei Fine Chemical Co., Ltd. (China) are some of the major players operating in the cyclopentane market. These players have adopted expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the cyclopentane market based on function, application, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles cyclopentane manufacturers, comprehensively analyzing their market shares and core competencies, and tracks and analyzes competitive developments, such as product launches, acquisitions, agreements, and others.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the cyclopentane market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of drivers (global phase-out of hydrochlorofluorocarbons to increase demand for cyclopentane, wide use of cyclopentane in solvent and reagent applications), opportunities (increasing use of blowing agents in construction, automotive, and appliance industries, pressing need for cyclopentane in thermal energy storage systems), restraints (high capital investments, volatility in raw material prices), and challenges (flammability of cyclopentane) influencing the growth of the cyclopentane market.

- Product development/innovation: Detailed insights on upcoming technologies and research & development activities in the cyclopentane market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the cyclopentane market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the cyclopentane market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Haltermann Carless Group GmbH (Germany), Junyuan Petroleum Group (China), INEOS (UK), Zeon Corporation (Japan), and Puyang Zhongwei Fine Chemical Co., Ltd. (China) in the cyclopentane market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CYCLOPENTANE MARKET

- 4.2 CYCLOPENTANE MARKET, BY REGION

- 4.3 CYCLOPENTANE MARKET, BY FUNCTION

- 4.4 CYCLOPENTANE MARKET, BY APPLICATION

- 4.5 CYCLOPENTANE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Global phase-out of hydrochlorofluorocarbons

- 5.2.1.2 Wide use of cyclopentane in solvent and reagent applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investments

- 5.2.2.2 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of blowing agents in construction and automotive industries

- 5.2.3.2 Pressing need for cyclopentane in thermal energy storage systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Flammability of cyclopentane

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM/MARKET MAP

- 6.4 REGULATORY LANDSCAPE

- 6.4.1 INTRODUCTION

- 6.4.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Catalytic hydrogenation

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Refrigeration and cooling systems

- 6.5.1 KEY TECHNOLOGIES

- 6.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 2709)

- 6.7.2 EXPORT SCENARIO (HS CODE 2709)

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 CYCLOPENTANE AND TETRAHYDROFURAN AUTO-IGNITION AT HIGH TEMPERATURE

- 6.9.2 CYCLOPENTANE COGEN HEAT EXCHANGE PIPELINE

- 6.9.3 LONG-TERM THERMAL CONDUCTIVITY OF CYCLOPENTANE WATER-BLOWN RIGID POLYURETHANE FOAMS

- 6.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.11 PATENT ANALYSIS

- 6.11.1 METHODOLOGY

- 6.12 INVESTMENT AND FUNDING SCENARIO

- 6.13 IMPACT OF GENERATIVE AI/AI ON CYCLOPENTANE MARKET

- 6.13.1 INTRODUCTION

- 6.13.1.1 Enhanced process efficiency:

- 6.13.1.2 Improved supply chain management:

- 6.13.1.3 Support for regulatory compliances:

- 6.13.1.4 Advancement in product development:

- 6.13.1.5 Sustainability and environmental accountability:

- 6.13.1.6 Scalable digital transformation:

- 6.13.1 INTRODUCTION

- 6.14 IMPACT OF 2025 US TARIFF - CYCLOPENTANE MARKET

- 6.14.1 KEY TARIFF RATES

- 6.14.2 PRICE IMPACT ANALYSIS

- 6.14.3 KEY IMPACT ON COUNTRIES/REGIONS**

- 6.14.3.1 US

- 6.14.3.2 Europe

- 6.14.3.3 Asia Pacific

- 6.14.4 IMPACT ON END-USE INDUSTRIES

7 CYCLOPENTANE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 RESIDENTIAL REFRIGERATORS

- 7.2.1 RISING DEMAND FOR MAINTAINING INTERIOR TEMPERATURE TO DRIVE MARKET

- 7.3 COMMERCIAL REFRIGERATORS

- 7.3.1 EXCELLENT INSULATING QUALITIES AND LOW HEAT CONDUCTIVITY TO BOOST MARKET

- 7.4 INSULATED CONTAINERS & SIPPERS

- 7.4.1 PRESSING NEED FOR STRONG, LIGHTWEIGHT, AND HIGHLY EFFICIENT INSULATION TO FUEL MARKET

- 7.5 INSULATING CONSTRUCTION MATERIALS

- 7.5.1 WIDE USE FOR PRESERVING ENVIRONMENT BY REDUCING ENERGY USAGE TO BOOST MARKET

- 7.6 ELECTRICAL & ELECTRONICS

- 7.6.1 GROWING CONSUMER DEMAND DUE TO LOW ENVIRONMENTAL IMPACT AND EFFECTIVE THERMAL INSULATION TO FUEL MARKET

- 7.7 PERSONAL CARE PRODUCTS

- 7.7.1 DEMAND FOR ENERGY-EFFICIENT COLD CHAIN STORAGE AND TEMPERATURE-SENSITIVE TRANSPORTATION TO BOOST MARKET

- 7.8 FUEL & FUEL ADDITIVES

- 7.8.1 INCREASING FOCUS ON ENERGY CONSERVATION AND EFFICIENCY TO FUEL GROWTH

- 7.9 OTHER APPLICATIONS

8 CYCLOPENTANE MARKET, BY FUNCTION

- 8.1 INTRODUCTION

- 8.2 BLOWING AGENTS & REFRIGERANTS

- 8.2.1 RISING DEMAND DUE TO FORMATION OF CELLULAR FOAM STRUCTURE AND EFFECTIVE COOLANTS TO DRIVE MARKET

- 8.3 SOLVENTS & REAGENTS

- 8.3.1 DEMAND FROM PHARMACEUTICAL, CHEMICAL, AND ELECTRICAL & ELECTRONICS INDUSTRIES TO BOOST MARKET

- 8.4 OTHER FUNCTIONS

9 CYCLOPENTANE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Rise in demand for refrigerants to boost market

- 9.2.2 SOUTH KOREA

- 9.2.2.1 Increasing demand for eco-friendly blowing agents to drive market

- 9.2.3 JAPAN

- 9.2.3.1 Government investments in clean energy to surge demand

- 9.2.4 INDIA

- 9.2.4.1 Rapid industrialization and government initiatives toward phase out of HCFCs to drive market

- 9.2.5 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Increasing environmental regulations to boost market

- 9.3.2 CANADA

- 9.3.2.1 Rising environmental concerns to fuel market

- 9.3.3 MEXICO

- 9.3.3.1 Economic growth and expanding automotive and construction industries to boost market

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Increasing demand for residential and commercial refrigerators, insulating construction materials, and electrical and electronics to drive market

- 9.4.2 FRANCE

- 9.4.2.1 Emphasis on energy efficiency, sustainable construction, and eco-friendly manufacturing practices to fuel market

- 9.4.3 UK

- 9.4.3.1 Transition to more sustainable solutions to boost market

- 9.4.4 ITALY

- 9.4.4.1 Shift toward sustainability and efficiency across key applications to drive demand

- 9.4.5 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Energy conservation goals to boost market

- 9.5.1.2 Rest of GCC countries

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Economic diversification and sustainability to drive market

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.1.1 Expanding construction, refrigeration, and food processing sectors to fuel market growth

- 9.6.2 ARGENTINA

- 9.6.2.1 Commitment to international environmental protocols to propel market

- 9.6.3 REST OF SOUTH AMERICA

- 9.6.1 BRAZIL

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 CYCLOPENTANE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022-2025

- 10.3 REVENUE ANALYSIS, 2019-2024

- 10.3.1 KEY PLAYERS' REVENUE ANALYSIS, 2019-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 HALTERMANN CARLESS GROUP GMBH

- 10.5.2 INEOS

- 10.5.3 YNCC

- 10.5.4 HALDIA PETROCHEMICALS LTD.

- 10.5.5 ZEON

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Function footprint

- 10.6.5.4 Application footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.7.5.1 Detailed list of key startups/SMES

- 10.7.5.2 Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 MAJOR PLAYERS

- 11.1.1 HALTERMANN CARLESS GROUP GMBH

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 INEOS

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Right to win

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 ZEON CORPORATION

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 HALDIA PETROCHEMICALS LIMITED

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.5 YEOCHUN NCC CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.6 TRECORA LLC

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.7 LIAONING YUFENG CHEMICAL CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.8 MARUZEN PETROCHEMICAL

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 JUNSEI CHEMICAL CO.,LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 JUNYUAN PETROLEUM GROUP

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.10.3.1 Right to win

- 11.1.10.3.2 Strategic choices

- 11.1.10.3.3 Weaknesses and competitive threats

- 11.1.11 COSUTIN INDUSTRIAL CO., LIMITED

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.12 SK GEOCENTRIC CO., LTD.

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.13 PUYANG ZHONGWEI FINE CHEMICAL CO., LTD.

- 11.1.13.1 Business overview

- 11.1.13.2 Products/Solutions/Services offered

- 11.1.13.3 MnM view

- 11.1.13.3.1 Right to win

- 11.1.13.3.2 Strategic choices

- 11.1.13.3.3 Weaknesses and competitive threats

- 11.1.14 KANTO KAGAKU

- 11.1.14.1 Business overview

- 11.1.14.2 Products/Solutions/Services offered

- 11.1.15 MERCK KGAA

- 11.1.15.1 Business overview

- 11.1.15.2 Products/Solutions/Services offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Expansions

- 11.1.1 HALTERMANN CARLESS GROUP GMBH

- 11.2 OTHER PLAYERS

- 11.2.1 SPECTRUM CHEMICAL

- 11.2.2 CHEMSCENE

- 11.2.3 VIZAG CHEMICALS INTERNATIONAL

- 11.2.4 NATIONAL ANALYTICAL CORPORATION

- 11.2.5 KISHIDA CHEMICAL CO., LTD.

- 11.2.6 SHANDONG YUEAN CHEMICAL INDUSTRY CO., LTD.

- 11.2.7 ENC GLOBAL CO., LTD.

- 11.2.8 SINTECO S.R.L.

- 11.2.9 ZHENGZHOU MEIYA CHEMICAL PRODUCTS CO., LTD.

- 11.2.10 HUNAN JINGZHENG EQUIPMENT MANUFACTURE CO.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 INTERCONNECTED MARKETS

- 12.4 BLOWING AGENT MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- 12.4.3 POLYURETHANE FOAM (PU)

- 12.4.3.1 Appliances

- 12.4.3.2 Apparel

- 12.4.3.3 Automotive

- 12.4.3.4 Building & construction

- 12.4.3.5 Electronics

- 12.4.3.6 Flooring

- 12.4.3.7 Furnishing

- 12.4.3.8 Marine

- 12.4.3.9 Medical

- 12.4.3.10 Packaging

- 12.4.4 POLYSTYRENE FOAM (PS)

- 12.4.4.1 Building & construction

- 12.4.4.2 Food packaging

- 12.4.4.3 Transportation

- 12.4.4.4 Other applications

- 12.4.5 PHENOLIC FOAM

- 12.4.5.1 Building & construction

- 12.4.5.2 Insulation

- 12.4.5.3 Other applications

- 12.4.6 POLYOLEFIN FOAM

- 12.4.6.1 Automotive

- 12.4.6.2 Medical

- 12.4.6.3 Building & construction

- 12.4.6.4 Packaging

- 12.4.6.5 Other applications

- 12.4.7 OTHER FOAMS

- 12.4.7.1 Automotive

- 12.4.7.2 Building & construction

- 12.4.7.3 Packaging

- 12.4.7.4 Other applications

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

List of Tables

- TABLE 1 CYCLOPENTANE MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 HCFC REPLACEMENT FOR VARIOUS APPLIANCES

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS: CYCLOPENTANE MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 6 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 7 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 8 INFLATION RATE: AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 9 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 AND 2023 (USD BILLION)

- TABLE 10 CYCLOPENTANE MARKET: ECOSYSTEM

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 CYCLOPENTANE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 IMPORT DATA FOR HS CODE 2709-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 16 EXPORT DATA FOR HS CODE 2709-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 17 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR NAPHTHA, 2025 (USD/KG)

- TABLE 18 AVERAGE SELLING PRICE TREND OF CYCLOPENTANE, BY REGION, 2022-2024 (USD/TON)

- TABLE 19 CYCLOPENTANE MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 20 CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 21 CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 22 RESIDENTIAL REFRIGERATORS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 23 RESIDENTIAL REFRIGERATORS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 24 COMMERCIAL REFRIGERATORS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 25 COMMERCIAL REFRIGERATORS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 26 INSULATED CONTAINERS & SIPPERS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 27 INSULATED CONTAINERS & SIPPERS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 28 INSULATING CONSTRUCTION MATERIALS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 29 INSULATING CONSTRUCTION MATERIALS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 30 ELECTRICAL & ELECTRONICS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 31 ELECTRICAL & ELECTRONICS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 32 PERSONAL CARE PRODUCTS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 33 PERSONAL CARE PRODUCTS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 34 FUEL & FUEL ADDITIVES: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 35 FUEL & FUEL ADDITIVES: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 36 OTHER APPLICATIONS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 37 OTHER APPLICATIONS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 38 CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 39 CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 40 CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 41 CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 42 BLOWING AGENTS & REFRIGERANTS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 43 BLOWING AGENTS & REFRIGERANTS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 BLOWING AGENTS & REFRIGERANTS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 45 BLOWING AGENTS & REFRIGERANTS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 46 SOLVENTS & REAGENTS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 SOLVENTS & REAGENTS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 SOLVENTS & REAGENTS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 49 SOLVENTS & REAGENTS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 50 OTHER FUNCTIONS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 OTHER FUNCTIONS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 OTHER FUNCTIONS: CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 53 OTHER FUNCTIONS: CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 54 CYCLOPENTANE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 CYCLOPENTANE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 CYCLOPENTANE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 57 CYCLOPENTANE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 58 ASIA PACIFIC: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 59 ASIA PACIFIC: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 61 ASIA PACIFIC: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 62 ASIA PACIFIC: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 63 ASIA PACIFIC: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 65 ASIA PACIFIC: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 66 ASIA PACIFIC: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 67 ASIA PACIFIC: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 68 CHINA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 69 CHINA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 70 CHINA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 71 CHINA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 72 CHINA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 73 CHINA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 74 SOUTH KOREA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 75 SOUTH KOREA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 76 SOUTH KOREA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 77 SOUTH KOREA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 78 SOUTH KOREA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 79 SOUTH KOREA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 80 JAPAN: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 81 JAPAN: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 82 JAPAN: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 83 JAPAN: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 84 JAPAN: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 85 JAPAN: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 86 INDIA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 87 INDIA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 88 INDIA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 89 INDIA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 90 INDIA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 91 INDIA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 92 REST OF ASIA PACIFIC: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 95 REST OF ASIA PACIFIC: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 96 REST OF ASIA PACIFIC: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 97 REST OF ASIA PACIFIC: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 98 NORTH AMERICA: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 101 NORTH AMERICA: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 102 NORTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 105 NORTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 106 NORTH AMERICA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 107 NORTH AMERICA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 108 US: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 109 US: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 110 US: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 111 US: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 112 US: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 113 US: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 114 CANADA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 115 CANADA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 116 CANADA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 117 CANADA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 118 CANADA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 119 CANADA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 120 MEXICO: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 121 MEXICO: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 122 MEXICO: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 123 MEXICO: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 124 MEXICO: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 125 MEXICO: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 126 EUROPE: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 127 EUROPE: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 EUROPE: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 129 EUROPE: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 130 EUROPE: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 131 EUROPE: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 132 EUROPE: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 133 EUROPE: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 134 EUROPE: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 135 EUROPE: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 136 GERMANY: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 137 GERMANY: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 138 GERMANY: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 139 GERMANY: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 140 GERMANY: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 141 GERMANY: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 142 FRANCE: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 143 FRANCE: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 144 FRANCE: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 145 FRANCE: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 146 FRANCE: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 147 FRANCE: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 148 UK: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 149 UK: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 150 UK: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 151 UK: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 152 UK: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 153 UK: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 154 ITALY: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 155 ITALY: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 156 ITALY: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 157 ITALY: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 158 ITALY: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 159 ITALY: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 160 REST OF EUROPE: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 161 REST OF EUROPE: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 162 REST OF EUROPE: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 163 REST OF EUROPE: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 164 REST OF EUROPE: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 165 REST OF EUROPE: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 166 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 169 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 170 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 173 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 174 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 175 MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 176 SAUDI ARABIA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 177 SAUDI ARABIA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 178 SAUDI ARABIA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 179 SAUDI ARABIA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 180 SAUDI ARABIA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 181 SAUDI ARABIA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 182 REST OF GCC COUNTRIES: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 183 REST OF GCC COUNTRIES: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 184 REST OF GCC COUNTRIES: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 185 REST OF GCC COUNTRIES: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 186 REST OF GCC COUNTRIES: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 187 REST OF GCC COUNTRIES: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 188 SOUTH AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 189 SOUTH AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 190 SOUTH AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 191 SOUTH AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 192 SOUTH AFRICA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 193 SOUTH AFRICA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 194 REST OF MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 197 REST OF MIDDLE EAST & AFRICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 198 REST OF MIDDLE EAST AND AFRICA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 199 REST OF MIDDLE EAST AND AFRICA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 200 SOUTH AMERICA: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 201 SOUTH AMERICA: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 202 SOUTH AMERICA: CYCLOPENTANE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 203 SOUTH AMERICA: CYCLOPENTANE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 204 SOUTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 205 SOUTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 207 SOUTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 208 SOUTH AMERICA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 209 SOUTH AMERICA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 210 BRAZIL: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 211 BRAZIL: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 212 BRAZIL: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 213 BRAZIL: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 214 BRAZIL: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 215 BRAZIL: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 216 ARGENTINA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 217 ARGENTINA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 218 ARGENTINA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 219 ARGENTINA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 220 ARGENTINA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 221 ARGENTINA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 222 REST OF SOUTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 223 REST OF SOUTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 224 REST OF SOUTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2019-2022 (KILOTON)

- TABLE 225 REST OF SOUTH AMERICA: CYCLOPENTANE MARKET, BY FUNCTION, 2023-2030 (KILOTON)

- TABLE 226 REST OF SOUTH AMERICA: CYCLOPENTANE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 227 REST OF SOUTH AMERICA: CYCLOPENTANE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 228 CYCLOPENTANE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 229 CYCLOPENTANE MARKET: REGION FOOTPRINT

- TABLE 230 CYCLOPENTANE MARKET: FUNCTION FOOTPRINT

- TABLE 231 CYCLOPENTANE MARKET: APPLICATION FOOTPRINT

- TABLE 232 CYCLOPENTANE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 233 CYCLOPENTANE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 234 CYCLOPENTANE MARKET: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 235 CYCLOPENTANE MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 236 CYCLOPENTANE MARKET: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 237 HALTERMANN CARLESS GROUP GMBH: COMPANY OVERVIEW

- TABLE 238 HALTERMANN CARLESS GROUP GMBH: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 239 HALTERMANN CARLESS GROUP GMBH: PRODUCT LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 240 INEOS: COMPANY OVERVIEW

- TABLE 241 INEOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 ZEON CORPORATION: COMPANY OVERVIEW

- TABLE 243 ZEON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 ZEON CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 245 HALDIA PETROCHEMICALS LIMITED: COMPANY OVERVIEW

- TABLE 246 HALDIA PETROCHEMICALS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 YEOCHUN NCC CO., LTD.: COMPANY OVERVIEW

- TABLE 248 YEOCHUN NCC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 TRECORA LLC: COMPANY OVERVIEW

- TABLE 250 TRECORA LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 LIAONING YUFENG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 252 LIAONING YUFENG CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 253 MARUZEN PETROCHEMICAL: COMPANY OVERVIEW

- TABLE 254 MARUZEN PETROCHEMICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 JUNSEI CHEMICAL CO.,LTD.: COMPANY OVERVIEW

- TABLE 256 JUNSEI CHEMICAL CO.,LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 JUNYUAN PETROLEUM GROUP: COMPANY OVERVIEW

- TABLE 258 JUNYUAN PETROLEUM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 COSUTIN INDUSTRIAL CO., LIMITED: COMPANY OVERVIEW

- TABLE 260 COSUTIN INDUSTRIAL CO., LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 SK GEOCENTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 262 SK GEOCENTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 PUYANG ZHONGWEI FINE CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 264 PUYANG ZHONGWEI FINE CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 265 KANTO KAGAKU: COMPANY OVERVIEW

- TABLE 266 KANTO KAGAKU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 MERCK KGAA: COMPANY OVERVIEW

- TABLE 268 MERCK KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 MERCK KGAA: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 270 SPECTRUM CHEMICAL: COMPANY OVERVIEW

- TABLE 271 CHEMSCENE: COMPANY OVERVIEW

- TABLE 272 VIZAG CHEMICALS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 273 NATIONAL ANALYTICAL CORPORATION: COMPANY OVERVIEW

- TABLE 274 KISHIDA CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 275 SHANDONG YUEAN CHEMICAL INDUSTRY CO., LTD. : COMPANY OVERVIEW

- TABLE 276 ENC GLOBAL CO., LTD. COMPANY OVERVIEW

- TABLE 277 SINTECO S.R.L.: COMPANY OVERVIEW

- TABLE 278 ZHENGZHOU MEIYA CHEMICAL PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 279 HUNAN JINGZHENG EQUIPMENT MANUFACTURE CO.: COMPANY OVERVIEW

- TABLE 280 BLOWING AGENT MARKET, BY FOAM, 2020-2023 (KILOTON)

- TABLE 281 BLOWING AGENT MARKET, BY FOAM, 2024-2029 (KILOTON)

- TABLE 282 BLOWING AGENT MARKET, BY FOAM, 2020-2023 (USD MILLION)

- TABLE 283 BLOWING AGENT MARKET, BY FOAM, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 CYCLOPENTANE MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CYCLOPENTANE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR CYCLOPENTANE

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF CYCLOPENTANE

- FIGURE 7 CYCLOPENTANE MARKET: DATA TRIANGULATION

- FIGURE 8 BLOWING AGENTS & REFRIGERANTS SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 INCREASING USE OF BLOWING AGENTS IN CONSTRUCTION AND AUTOMOTIVE INDUSTRIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 BLOWING AGENTS & REFRIGERANTS SEGMENT TO WITNESS HIGH GROWTH BETWEEN 2025 AND 2030

- FIGURE 13 INSULATED CONTAINERS & SIPPERS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CYCLOPENTANE MARKET

- FIGURE 16 CRUDE OIL FIRST PURCHASE PRICES, 2011-2024

- FIGURE 17 CYCLOPENTANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 19 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 20 VALUE CHAIN ANALYSIS OF CYCLOPENTANE MARKET

- FIGURE 21 CYCLOPENTANE: MARKET MAP

- FIGURE 22 IMPORT DATA FOR HS CODE 2709-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA FOR HS CODE 2709-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR NAPHTHA, 2025

- FIGURE 25 CYCLOPENTANE MARKET: AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/TON)

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CYCLOPENTANE ECOSYSTEM

- FIGURE 27 MAJOR PATENTS RELATED TO CYCLOPENTANE, 2014-2024

- FIGURE 28 CYCLOPENTANE MARKET: INVESTMENT AND FUNDING SCENARIO, 2018-2024 (USD MILLION)

- FIGURE 29 INSULATED CONTAINERS & SIPPERS TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 30 BLOWING AGENTS & REFRIGERANTS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF CYCLOPENTANE MARKET DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC: CYCLOPENTANE MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: CYCLOPENTANE MARKET SNAPSHOT

- FIGURE 34 EUROPE: CYCLOPENTANE MARKET SNAPSHOT

- FIGURE 35 CYCLOPENTANE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2019-2024 (USD BILLION)

- FIGURE 36 CYCLOPENTANE MARKET SHARE ANALYSIS, 2024

- FIGURE 37 CYCLOPENTANE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 38 CYCLOPENTANE MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 39 CYCLOPENTANE MARKET: COMPANY FOOTPRINT

- FIGURE 40 CYCLOPENTANE MARKET: COMPANY EVALUATION MATRIX, STARTUPS/ SMES, 2024

- FIGURE 41 CYCLOPENTANE MARKET: EV/EBITDA

- FIGURE 42 CYCLOPENTANE MARKET: ENTERPRISE VALUE (USD BILLION)

- FIGURE 43 CYCLOPENTANE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 44 INEOS: COMPANY SNAPSHOT

- FIGURE 45 ZEON CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 HALDIA PETROCHEMICALS LIMITED: COMPANY SNAPSHOT

- FIGURE 47 MERCK KGAA: COMPANY SNAPSHOT