PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1786131

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1786131

Expandable Graphite Market by Flake Size, Application (Flame Retardant, Conductive Additive, Flexible Graphite), End-use Industry (Electronics & Energy Storage, Automotive, Building & Construction), and Region - Global Forecast to 2030

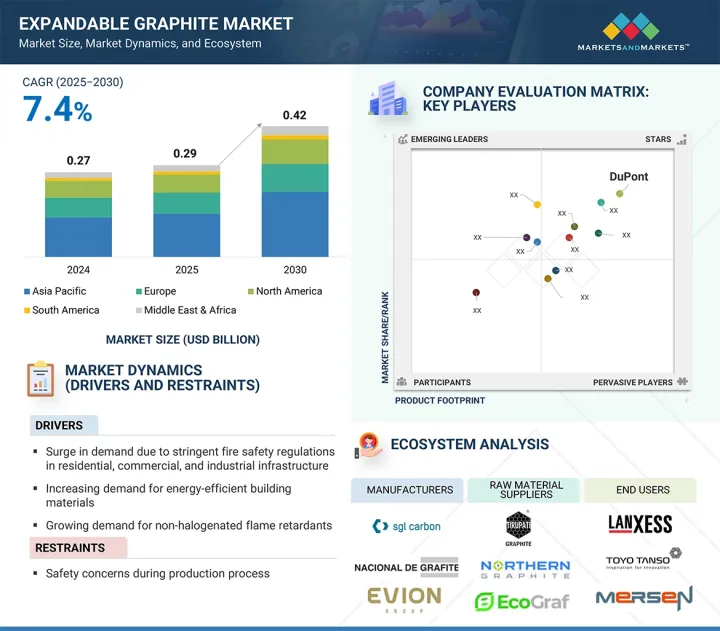

The global expandable graphite market is projected to grow from USD 0.29 billion in 2025 to USD 0.42 billion by 2030, at a CAGR of 7.4% during the forecast period. The growing demand for effective thermal management in contemporary electronics and energy storage systems is a key factor driving the expansion of the expandable graphite market. As devices and batteries become increasingly compact and powerful, managing excess heat is essential for ensuring optimal performance and safety.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Tons) |

| Segments | Flake Size, Application, and End-use Industry |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

Expandable graphite provides exceptional thermal conductivity and high-temperature stability, making it a highly valuable conductive additive in applications such as lithium-ion batteries, fuel cells, and various thermal interface materials. Furthermore, the ongoing transition toward electric vehicles and energy-efficient electronics amplifies the need for reliable and environmentally friendly thermal management solutions, elevating the significance of expandable graphite within these sectors.

"Flexible graphite segment to account for second-largest market share during forecast period"

The flexible graphite segment is anticipated to capture the second-largest market share, in terms of volume, within the expandable graphite sector during the forecast period. This growth is primarily fueled by the increasing demand for durable, heat-resistant, and corrosion-resistant sealing and gasketing materials across diverse industries. Flexible graphite, which is derived from expandable graphite, finds extensive application in gaskets, seals, and linings in industrial manufacturing, chemical processing, and power generation due to its exceptional resilience in high-temperature and chemically aggressive environments. Its adaptability, reliability, and environmental compatibility position it as a preferred alternative to traditional sealing materials, particularly as industries increasingly prioritize sustainable and high-performance solutions.

"Medium & large flakes segment to account for second-largest market share during forecast period"

The medium & large flake segment is anticipated to maintain the second-largest market share during the forecast period. These flake sizes are highly regarded for their balanced properties, which provide optimal expansion volume and exceptional purity, making them ideal for diverse applications. Medium and large flake expandable graphite is predominantly utilized in flame retardants, flexible graphite products, and thermal management materials, where moderate expansion and uniformity are crucial. The versatility of these flake sizes enables them to meet the stringent technical requirements of key industries, including building and construction, automotive, and electronics, all of which are experiencing steady global growth. As demand for efficient and multifunctional materials continues to rise across various end-use sectors, medium & large flake expandable graphite is positioned to secure a significant market share.

"Europe to account for second-largest market share during forecast period"

The Europe segment is projected to maintain the second-largest share of the expandable graphite market during the forecast period, driven by the region's strong commitment to fire safety regulations, sustainability standards, and energy efficiency initiatives. Expandable graphite is increasingly utilized as a non-toxic flame retardant in construction materials, aligning with Europe's stringent fire protection standards, particularly in residential and commercial sectors.

Additionally, its applications in thermal management systems, gaskets, and fuel cell components are gaining momentum within the region's advanced automotive, aerospace, and electronics industries. The ongoing investments by European countries in renewable energy and electric vehicles further amplify the demand for high-performance, environmentally friendly materials such as expandable graphite. With rising industrial demand and a robust regulatory framework promoting the adoption of sustainable materials, Europe is poised to be a significant contributor to the global expandable graphite market.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 25%, Managers- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

SGL Carbon (Germany), NeoGraf (US), Yichang Xincheng Graphite Co., Ltd. (China), Graphit Kropfmuhl GmbH (Germany), Nacional de Grafite (Brazil), and Qingdao Xinghe Graphite Co., Ltd. (China) are some of the major players operating in the expandable graphite market. These players have adopted acquisitions, agreements, and expansion to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the expandable graphite market based on flake size, end-use industry, application, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles expandable graphite manufacturers, comprehensively analyzing their market shares and core competencies, and tracks and analyzes competitive developments, such as partnerships, agreements, product launches, and joint ventures.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the expandable graphite market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of critical drivers (Surge in demand due to stringent fire safety regulations in residential, commercial, and industrial infrastructure; increasing demand for energy-efficient building materials; and growing demand for non-halogenated flame retardants), restraints (Safety concerns during production process), opportunities (Increasing bans on hazardous fire-resistance materials), and challenges (Supply chain disruptions and geopolitical risks) influencing the growth of the expandable graphite market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the expandable graphite market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the expandable graphite market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the expandable graphite market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as SGL Carbon (Germany), NeoGraf (US), Yichang Xincheng Graphite Co., Ltd. (China), Graphit Kropfmuhl GmbH (Germany), Nacional de Grafite (Brazil), Qingdao Xinghe Graphite Co., Ltd. (China), and others in the expandable graphite market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EXPANDABLE GRAPHITE MARKET

- 4.2 EXPANDABLE GRAPHITE MARKET, BY REGION

- 4.3 EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY

- 4.4 EXPANDABLE GRAPHITE MARKET, BY APPLICATION

- 4.5 EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE

- 4.6 EXPANDABLE GRAPHITE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand due to stringent fire safety regulations in residential, commercial, and industrial infrastructure

- 5.2.1.2 Increasing demand for energy-efficient building materials

- 5.2.1.3 Growing demand for non-halogenated flame retardants

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety concerns during production process

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing bans on hazardous fire-resistant materials

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions and geopolitical risks

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 THREAT OF NEW ENTRANTS

- 6.4.2 THREAT OF SUBSTITUTES

- 6.4.3 BARGAINING POWER OF SUPPLIERS

- 6.4.4 BARGAINING POWER OF BUYERS

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF EXPANDABLE GRAPHITE, BY REGION 2022-2024

- 6.6.2 AVERAGE SELLING PRICE TREND OF EXPANDABLE GRAPHITE, BY FLAKE SIZE, 2024

- 6.7 REGULATORY LANDSCAPE

- 6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2025

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Graphite intercalation & thermal expansion technology

- 6.10.2 COMPLEMENTARY TECHNOLOGIES

- 6.10.2.1 Spheroidization of graphite

- 6.10.1 KEY TECHNOLOGIES

- 6.11 TRADE ANALYSIS

- 6.11.1 IMPORT SCENARIO (HS CODE 250410)

- 6.11.2 EXPORT SCENARIO (HS CODE 250410)

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.13 IMPACT OF GENERATIVE AI ON EXPANDABLE GRAPHITE MARKET

- 6.13.1 PROCESS OPTIMIZATION & QUALITY CONTROL

- 6.13.2 DIGITAL TWINS & PREDICTIVE ANALYTICS

- 6.13.3 MATERIALS DISCOVERY & FORMULATION

- 6.13.4 SUPPLY CHAIN & SUSTAINABILITY TRACKING

- 6.13.5 EQUIPMENT MAINTENANCE & AUTOMATION

- 6.14 IMPACT OF 2025 US TARIFF - EXPANDABLE GRAPHITE MARKET

- 6.14.1 KEY TARIFF RATES

- 6.14.2 PRICE IMPACT ANALYSIS

- 6.14.3 KEY IMPACT ON COUNTRY/REGION

- 6.14.3.1 US

- 6.14.3.2 Europe

- 6.14.3.3 Asia Pacific

- 6.14.4 IMPACT ON END-USE INDUSTRIES

- 6.14.4.1 Electronics & energy storage

- 6.14.4.2 Automotive

- 6.14.4.3 Building & construction

- 6.14.4.4 Industrial manufacturing

- 6.14.4.5 Aerospace & defence

7 EXPANDABLE GRAPHITE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 NATURAL EXPANDABLE GRAPHITE

- 7.2.1 RISING DEMAND FOR NON-HALOGENATED FLAME RETARDANTS TO DRIVE MARKET

- 7.3 SYNTHETIC EXPANDABLE GRAPHITE

- 7.3.1 RISING DEMAND FROM ELECTRONICS AND ENERGY STORAGE INDUSTRIES TO BOOST MARKET

8 EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE

- 8.1 INTRODUCTION

- 8.2 MEDIUM & LARGE FLAKES

- 8.2.1 INCREASING DEMAND FOR FLAME RETARDANTS, GASKETS, AND THERMAL INSULATION TO DRIVE MARKET

- 8.3 JUMBO FLAKES

- 8.3.1 SURGE IN DEMAND FOR ADVANCED FIRE PROTECTION AND THERMAL INSULATION SOLUTIONS CONTINUES TO DRIVE MARKET

9 EXPANDABLE GRAPHITE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 FLAME RETARDANT

- 9.2.1 SURGE IN HIGHLY EFFECTIVE, HALOGEN-FREE FLAME-RETARDANT ADDITIVES TO DRIVE MARKET

- 9.3 CONDUCTIVE ADDITIVE

- 9.3.1 INCREASING DEMAND FOR HIGH-PERFORMANCE BATTERIES, CONDUCTIVE POLYMERS, AND THERMAL MANAGEMENT TO BOOST DEMAND

- 9.4 FLEXIBLE GRAPHITE

- 9.4.1 SUPERIOR THERMAL CONDUCTIVITY, CHEMICAL RESISTANCE, AND ADAPTABILITY FOR HIGH-PERFORMANCE SEALING TO BOOST DEMAND

- 9.5 OTHER APPLICATIONS

10 EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 ELECTRONICS & ENERGY STORAGE

- 10.2.1 SURGE IN DEMAND FOR THERMAL MANAGEMENT, CONDUCTIVITY, AND EFFICIENCY TO DRIVE MARKET

- 10.3 AUTOMOTIVE

- 10.3.1 RISING EV SECTOR AND LIGHTWEIGHT MATERIALS TO DRIVE MARKET

- 10.4 BUILDING & CONSTRUCTION

- 10.4.1 FIRE SAFETY AND THERMAL INSULATION TO DRIVE MARKET

- 10.5 INDUSTRIAL MANUFACTURING

- 10.5.1 SURGE IN DEMAND FOR FLAME-RETARDANT TEXTILES, HIGH-PERFORMANCE LUBRICANTS, AND CONDUCTIVE CARBON BRUSHES TO BOOST MARKET

- 10.6 AEROSPACE & DEFENSE

- 10.6.1 LIGHTWEIGHT FLAME RESISTANCE AND STRINGENT AEROSPACE SAFETY STANDARDS TO DRIVE MARKET

- 10.7 OTHER END-USE INDUSTRIES

11 EXPANDABLE GRAPHITE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 EUROPE

- 11.2.1 GERMANY

- 11.2.1.1 Rising demand for fire safety and booming battery sector to drive market

- 11.2.2 UK

- 11.2.2.1 Expandable graphite market to gain momentum with industrial and automotive industries growth

- 11.2.3 FRANCE

- 11.2.3.1 Growing energy, construction, and aerospace sectors to drive market

- 11.2.4 ITALY

- 11.2.4.1 Fire safety and e-mobility boom to drive market

- 11.2.5 SPAIN

- 11.2.5.1 Surge in fire safety regulations and growing battery production to drive market

- 11.2.6 REST OF EUROPE

- 11.2.1 GERMANY

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Surge in renewable energy integration and EV adoption to drive market

- 11.3.2 CANADA

- 11.3.2.1 Initiative for graphite independence to fuel market

- 11.3.3 MEXICO

- 11.3.3.1 Expanding end-use industries to boost market

- 11.3.1 US

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Rapid expansion of EV sector and stringent green building initiatives to drive market

- 11.4.2 JAPAN

- 11.4.2.1 Advancements in EV sector and sustainable construction initiatives to drive market

- 11.4.3 INDIA

- 11.4.3.1 Increasing investment in expandable graphite to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Commitment to ecofriendly initiatives and sustainable development to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Commitment to sustainable construction to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 UAE

- 11.5.1.1.1 Significant advancements in EV and sustainable construction initiatives to propel growth

- 11.5.1.2 Saudi Arabia

- 11.5.1.2.1 Significant growth in EVs to drive growth

- 11.5.1.3 Rest of GCC Countries

- 11.5.1.1 UAE

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growing automotive sector and increasing adoption of EVs to drive market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 EV surge and energy storage growth to drive market

- 11.6.2 CHILE

- 11.6.2.1 Surge amid mining boom, renewable energy push, and fire-safe construction demand to drive market

- 11.6.3 ARGENTINA

- 11.6.3.1 Surges with lithium growth and fire safety reforms to drive market

- 11.6.4 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Application footprint

- 12.6.5.4 End-use industry footprint

- 12.6.5.5 Flake size footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SGL CARBON

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 NEOGRAF

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses/Competitive threats

- 13.1.3 YICHANG XINCHENG GRAPHITE CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses/Competitive threats

- 13.1.4 GRAPHIT KROPFMUHL GMBH

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 NACIONAL DE GRAFITE

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 QINGDAO XINGHE GRAPHITE CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Key strengths/Right to win

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses/Competitive threats

- 13.1.7 EVION GROUP

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 QINGDAO YANXIN GRAPHITE PRODUCTS CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 QINGDAO BRAIDE GRAPHITE CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 SHIJIAZHUANG ADT CARBONIC MATERIAL FACTORY

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 JAMES DURRANS GROUP

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 NIPPON KOKUEN GROUP

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 GEORG H. LUH GMBH

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 CDI PRODUCTS

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.15 GRAPHITE CENTRAL

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.16 LKAB MINERALS

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.17 ASBURY CARBONS

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.1 SGL CARBON

- 13.2 OTHER PLAYERS

- 13.2.1 QINGDAO MEILIKUN GRAPHITE PRODUCTS FACTORY CO., LTD.

- 13.2.2 HEBEI JIN'AO TRADING CO., LTD.

- 13.2.3 SEALMAX

- 13.2.4 ZHONGPU INDUSTRIAL LTD.

- 13.2.5 NANJING GRF CARBON MATERIAL CO., LTD.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 INTERCONNECTED MARKETS

- 14.4 GRAPHITE MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 GRAPHITE MARKET, BY PURITY

- 14.4.4 HIGH PURITY

- 14.4.4.1 Demand for precision and performance across industries to boost market

- 14.4.5 LOW PURITY

- 14.4.5.1 Need to power cost-effective industrial solutions to drive market

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 EXPANDABLE GRAPHITE MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY, 2022-2024 (%)

- TABLE 3 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 4 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 AND 2023 (USD BILLION)

- TABLE 6 ROLE OF COMPANIES IN EXPANDABLE GRAPHITE ECOSYSTEM

- TABLE 7 EXPANDABLE GRAPHITE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 10 AVERAGE SELLING PRICE TREND OF EXPANDABLE GRAPHITE, BY REGION, 2022-2024 (USD/KG)

- TABLE 11 AVERAGE SELLING PRICE TREND OF EXPANDABLE GRAPHITE, BY FLAKE SIZE, 2024 (USD/KG)

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EXPANDABLE GRAPHITE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 16 EXPANDABLE GRAPHITE MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 17 IMPORT DATA FOR NATURAL GRAPHITE POWDER OR FLAKES (HS CODE 250410)

- TABLE 18 EXPORT DATA FOR NATURAL GRAPHITE POWDER OR FLAKES (HS CODE 250410)

- TABLE 19 EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 20 EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 21 EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 22 EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 23 MEDIUM & LARGE FLAKES: EXPANDABLE GRAPHITE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 MEDIUM & LARGE FLAKES: EXPANDABLE GRAPHITE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 25 MEDIUM & LARGE FLAKES: EXPANDABLE GRAPHITE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 26 MEDIUM & LARGE FLAKES: EXPANDABLE GRAPHITE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 27 JUMBO FLAKES: EXPANDABLE GRAPHITE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 28 JUMBO FLAKES: EXPANDABLE GRAPHITE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 JUMBO FLAKES: EXPANDABLE GRAPHITE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 30 JUMBO FLAKES: EXPANDABLE GRAPHITE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 31 EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2020-2023 (TON)

- TABLE 32 EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2024-2030 (TON)

- TABLE 33 EXPANDABLE GRAPHITE MARKET IN FLAME RETARDANT, BY REGION, 2020-2023 (TON)

- TABLE 34 EXPANDABLE GRAPHITE MARKET IN FLAME RETARDANT, BY REGION, 2024-2030 (TON)

- TABLE 35 EXPANDABLE GRAPHITE MARKET IN CONDUCTIVE ADDITIVE, BY REGION, 2020-2023 (TON)

- TABLE 36 EXPANDABLE GRAPHITE MARKET IN CONDUCTIVE ADDITIVE, BY REGION, 2024-2030 (TON)

- TABLE 37 EXPANDABLE GRAPHITE MARKET IN FLEXIBLE GRAPHITE, BY REGION, 2020-2023 (TON)

- TABLE 38 EXPANDABLE GRAPHITE MARKET IN FLEXIBLE GRAPHITE, BY REGION, 2024-2030 (TON)

- TABLE 39 EXPANDABLE GRAPHITE MARKET IN OTHER APPLICATIONS, BY REGION, 2020-2023 (TON)

- TABLE 40 EXPANDABLE GRAPHITE MARKET IN OTHER APPLICATIONS, BY REGION, 2024-2030 (TON)

- TABLE 41 EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2020-2023 (TON)

- TABLE 42 EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2024-2030 (TON)

- TABLE 43 EXPANDABLE GRAPHITE MARKET IN ELECTRONICS & ENERGY STORAGE, BY REGION, 2020-2023 (TON)

- TABLE 44 EXPANDABLE GRAPHITE MARKET IN ELECTRONICS & ENERGY STORAGE, BY REGION, 2024-2030 (TON)

- TABLE 45 EXPANDABLE GRAPHITE MARKET IN AUTOMOTIVE, BY REGION, 2020-2023 (TON)

- TABLE 46 EXPANDABLE GRAPHITE MARKET IN AUTOMOTIVE, BY REGION, 2024-2030 (TON)

- TABLE 47 EXPANDABLE GRAPHITE MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2020-2023 (TON)

- TABLE 48 EXPANDABLE GRAPHITE MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2024-2030 (TON)

- TABLE 49 EXPANDABLE GRAPHITE MARKET IN INDUSTRIAL MANUFACTURING, BY REGION, 2020-2023 (TON)

- TABLE 50 EXPANDABLE GRAPHITE MARKET IN INDUSTRIAL MANUFACTURING, BY REGION, 2024-2030 (TON)

- TABLE 51 EXPANDABLE GRAPHITE MARKET IN AEROSPACE & DEFENSE, BY REGION, 2020-2023 (TON)

- TABLE 52 EXPANDABLE GRAPHITE MARKET IN AEROSPACE & DEFENSE, BY REGION, 2024-2030 (TON)

- TABLE 53 EXPANDABLE GRAPHITE MARKET IN OTHERS, BY REGION, 2020-2023 (TON)

- TABLE 54 EXPANDABLE GRAPHITE MARKET IN OTHERS, BY REGION, 2024-2030 (TON)

- TABLE 55 EXPANDABLE GRAPHITE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 EXPANDABLE GRAPHITE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 EXPANDABLE GRAPHITE MARKET, BY REGION, 2020-2023 (TON)

- TABLE 58 EXPANDABLE GRAPHITE MARKET, BY REGION, 2024-2030 (TON)

- TABLE 59 EUROPE: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 60 EUROPE: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 61 EUROPE: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 62 EUROPE: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (TON)

- TABLE 63 EUROPE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 64 EUROPE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 65 EUROPE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 66 EUROPE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 67 EUROPE: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2020-2023 (TON)

- TABLE 68 EUROPE: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2024-2030 (TON)

- TABLE 69 EUROPE: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2020-2023 (TON)

- TABLE 70 EUROPE: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2024-2030 (TON)

- TABLE 71 GERMANY: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 72 GERMANY: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 73 GERMANY: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 74 GERMANY: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 75 UK: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 76 UK: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 77 UK: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 78 UK: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 79 FRANCE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 80 FRANCE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 81 FRANCE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 82 FRANCE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 83 ITALY: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 84 ITALY: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 85 ITALY: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 86 ITALY: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 87 SPAIN: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 88 SPAIN: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 89 SPAIN: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 90 SPAIN: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 91 REST OF EUROPE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 92 REST OF EUROPE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 93 REST OF EUROPE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 94 REST OF EUROPE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 95 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 98 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (TON)

- TABLE 99 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 100 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 102 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 103 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2020-2023 (TON)

- TABLE 104 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2024-2030 (TON)

- TABLE 105 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2020-2023 (TON)

- TABLE 106 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2024-2030 (TON)

- TABLE 107 US: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 108 US: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 109 US: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 110 US: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 111 CANADA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 112 CANADA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 113 CANADA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 114 CANADA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 115 MEXICO: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 116 MEXICO: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 117 MEXICO: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 118 MEXICO: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 119 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 120 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 122 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (TON)

- TABLE 123 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 124 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 126 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 127 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2020-2023 (TON)

- TABLE 128 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2024-2030 (TON)

- TABLE 129 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2020-2023 (TON)

- TABLE 130 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2024-2030 (TON)

- TABLE 131 CHINA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 132 CHINA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 133 CHINA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 134 CHINA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 135 JAPAN: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 136 JAPAN: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 137 JAPAN: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 138 JAPAN: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 139 INDIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 140 INDIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 141 INDIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 142 INDIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 143 SOUTH KOREA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 144 SOUTH KOREA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 145 SOUTH KOREA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 146 SOUTH KOREA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 147 AUSTRALIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 148 AUSTRALIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 149 AUSTRALIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 150 AUSTRALIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 151 REST OF ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 154 REST OF ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 155 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 158 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (TON)

- TABLE 159 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 162 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 163 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2020-2023 (TON)

- TABLE 164 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2024-2030 (TON)

- TABLE 165 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2020-2023 (TON)

- TABLE 166 MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2024-2030 (TON)

- TABLE 167 UAE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 168 UAE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 169 UAE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 170 UAE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 171 SAUDI ARABIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 172 SAUDI ARABIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 173 SAUDI ARABIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 174 SAUDI ARABIA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 175 REST OF GCC COUNTRIES: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 176 REST OF GCC COUNTRIES: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 177 REST OF GCC COUNTRIES: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 178 REST OF GCC COUNTRIES: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 179 SOUTH AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 180 SOUTH AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 181 SOUTH AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 182 SOUTH AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 187 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 188 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 189 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2020-2023 (TON)

- TABLE 190 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY COUNTRY, 2024-2030 (TON)

- TABLE 191 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 192 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 193 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 194 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 195 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2020-2023 (TON)

- TABLE 196 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY, 2024-2030 (TON)

- TABLE 197 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2020-2023 (TON)

- TABLE 198 SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY APPLICATION, 2024-2030 (TON)

- TABLE 199 BRAZIL: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 200 BRAZIL: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 201 BRAZIL: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 202 BRAZIL: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 203 CHILE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 204 CHILE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 205 CHILE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 206 CHILE: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 207 ARGENTINA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 208 ARGENTINA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 209 ARGENTINA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 210 ARGENTINA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 211 REST OF SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2020-2023 (TON)

- TABLE 214 REST OF SOUTH AMERICA: EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE, 2024-2030 (TON)

- TABLE 215 EXPANDABLE GRAPHITE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2025

- TABLE 216 EXPANDABLE GRAPHITE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 217 EXPANDABLE GRAPHITE MARKET: REGION FOOTPRINT (17 COMPANIES)

- TABLE 218 EXPANDABLE GRAPHITE MARKET: APPLICATION FOOTPRINT (17 COMPANIES)

- TABLE 219 EXPANDABLE GRAPHITE MARKET: END-USE INDUSTRY FOOTPRINT (17 COMPANIES)

- TABLE 220 EXPANDABLE GRAPHITE MARKET: FLAKE SIZE FOOTPRINT (17 COMPANIES)

- TABLE 221 EXPANDABLE GRAPHITE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 222 EXPANDABLE GRAPHITE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 223 EXPANDABLE GRAPHITE MARKET: DEALS, JANUARY 2019-JUNE 2025

- TABLE 224 SGL CARBON: COMPANY OVERVIEW

- TABLE 225 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 SGL CARBON: EXPANSIONS

- TABLE 227 NEOGRAF: COMPANY OVERVIEW

- TABLE 228 NEOGRAF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 YICHANG XINCHENG GRAPHITE CO., LTD.: COMPANY OVERVIEW

- TABLE 230 YICHANG XINCHENG GRAPHITE CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 231 GRAPHIT KROPFMUHL GMBH: COMPANY OVERVIEW

- TABLE 232 GRAPHIT KROPFMUHL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 NACIONAL DE GRAFITE: COMPANY OVERVIEW

- TABLE 234 NACIONAL DE GRAFITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 QINGDAO XINGHE GRAPHITE CO., LTD.: COMPANY OVERVIEW

- TABLE 236 QINGDAO XINGHE GRAPHITE CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 237 EVION GROUP: COMPANY OVERVIEW

- TABLE 238 EVION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 EVION GROUP: DEALS

- TABLE 240 QINGDAO YANXIN GRAPHITE PRODUCTS CO., LTD.: COMPANY OVERVIEW

- TABLE 241 QINGDAO YANXIN GRAPHITE PRODUCTS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 QINGDAO BRAIDE GRAPHITE CO., LTD.: COMPANY OVERVIEW

- TABLE 243 QINGDAO BRAIDE GRAPHITE CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 244 SHIJIAZHUANG ADT CARBONIC MATERIAL FACTORY: COMPANY OVERVIEW

- TABLE 245 SHIJIAZHUANG ADT CARBONIC MATERIAL FACTORY: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 246 JAMES DURRANS GROUP: COMPANY OVERVIEW

- TABLE 247 JAMES DURRANS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 NIPPON KOKUEN GROUP: COMPANY OVERVIEW

- TABLE 249 NIPPON KOKUEN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 GEORG H. LUH GMBH: COMPANY OVERVIEW

- TABLE 251 GEORG H. LUH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 CDI PRODUCTS: COMPANY OVERVIEW

- TABLE 253 CDI PRODUCTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 CDI PRODUCTS: DEALS

- TABLE 255 GRAPHITE CENTRAL: COMPANY OVERVIEW

- TABLE 256 GRAPHITE CENTRAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 LKAB MINERALS: COMPANY OVERVIEW

- TABLE 258 LKAB MINERALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 ASBURY CARBONS: COMPANY OVERVIEW

- TABLE 260 ASBURY CARBONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 QINGDAO MEILIKUN GRAPHITE PRODUCTS FACTORY CO., LTD.: COMPANY OVERVIEW

- TABLE 262 HEBEI JIN'AO TRADING CO., LTD.: COMPANY OVERVIEW

- TABLE 263 SEALMAX: COMPANY OVERVIEW

- TABLE 264 ZHONGPU INDUSTRIAL LTD.: COMPANY OVERVIEW

- TABLE 265 NANJING GRF CARBON MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 266 GRAPHITE MARKET, BY PURITY, 2020-2023 (KILOTON)

- TABLE 267 GRAPHITE MARKET, BY PURITY, 2024-2030 (KILOTON)

List of Figures

- FIGURE 1 EXPANDABLE GRAPHITE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 EXPANDABLE GRAPHITE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR EXPANDABLE GRAPHITE

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF EXPANDABLE GRAPHITE MARKET (1/2)

- FIGURE 7 EXPANDABLE GRAPHITE MARKET: DATA TRIANGULATION

- FIGURE 8 JUMBO FLAKES SEGMENT TO HOLD LARGER MARKET SHARE IN 2025

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 RISING DEMAND FOR NON-HALOGENATED, FLAME-RETARDANT MATERIALS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 ASIA PACIFIC TO RECORD HIGHEST CAGR IN EXPANDABLE GRAPHITE MARKET DURING FORECAST PERIOD

- FIGURE 12 ELECTRONICS & ENERGY STORAGE TO RECORD HIGHEST CAGR IN EXPANDABLE GRAPHITE MARKET DURING FORECAST PERIOD

- FIGURE 13 FLAME RETARDANT SEGMENT TO RECORD HIGHEST CAGR IN EXPANDABLE GRAPHITE MARKET DURING FORECAST PERIOD

- FIGURE 14 MEDIUM & LARGE FLAKES TO RECORD HIGHER CAGR IN EXPANDABLE GRAPHITE MARKET THROUGH 2030

- FIGURE 15 CHINA TO GROW AT HIGHEST RATE IN EXPANDABLE GRAPHITE MARKET DURING FORECAST PERIOD

- FIGURE 16 EXPANDABLE GRAPHITE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 INVESTMENT IN ENERGY EFFICIENCY IN BUILDING AND CONSTRUCTION

- FIGURE 18 EXPANDABLE GRAPHITE VALUE CHAIN

- FIGURE 19 PARTICIPANTS IN EXPANDABLE GRAPHITE ECOSYSTEM

- FIGURE 20 EXPANDABLE GRAPHITE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 23 AVERAGE SELLING PRICE OF EXPANDABLE GRAPHITE, BY REGION 2022-2024 (USD/KG)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF EXPANDABLE GRAPHITE, BY FLAKE SIZE, 2024 (USD/KG)

- FIGURE 25 MAJOR PATENTS RELATED TO EXPANDABLE GRAPHITE, 2014-2024

- FIGURE 26 IMPORT DATA RELATED TO HS CODE 250410, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 27 EXPORT DATA RELATED TO HS CODE 250410, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING LITHIUM-ION BATTERY ECOSYSTEM

- FIGURE 29 MEDIUM & LARGE FLAKES TO BE FASTER-GROWING MARKET SEGMENT

- FIGURE 30 FLAME RETARDANT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 31 ELECTRONICS & ENERGY STORAGE TO BE FASTEST-GROWING SEGMENT

- FIGURE 32 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 33 EUROPE: EXPANDABLE GRAPHITE MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: EXPANDABLE GRAPHITE MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: EXPANDABLE GRAPHITE MARKET SNAPSHOT

- FIGURE 36 EXPANDABLE GRAPHITE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 37 EXPANDABLE GRAPHITE MARKET SHARE ANALYSIS, 2024

- FIGURE 38 EXPANDABLE GRAPHITE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 39 EXPANDABLE GRAPHITE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 EXPANDABLE GRAPHITE MARKET: COMPANY FOOTPRINT (17 COMPANIES)

- FIGURE 41 EXPANDABLE GRAPHITE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 EXPANDABLE GRAPHITE MARKET: EV/EBITDA

- FIGURE 43 EXPANDABLE GRAPHITE MARKET: ENTERPRISE VALUE (USD BILLION)

- FIGURE 44 EXPANDABLE GRAPHITE MARKET: YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 45 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 46 EVION GROUP: COMPANY SNAPSHOT