PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1787265

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1787265

Surgical Instrument Tracking Systems Market by Component (Software, Hardware, Services), Technology (Barcode, Radiofrequency Identification), End User (Hospitals, Ambulatory Surgical Centers, Other End Users), Region - Global Forecast to 2030

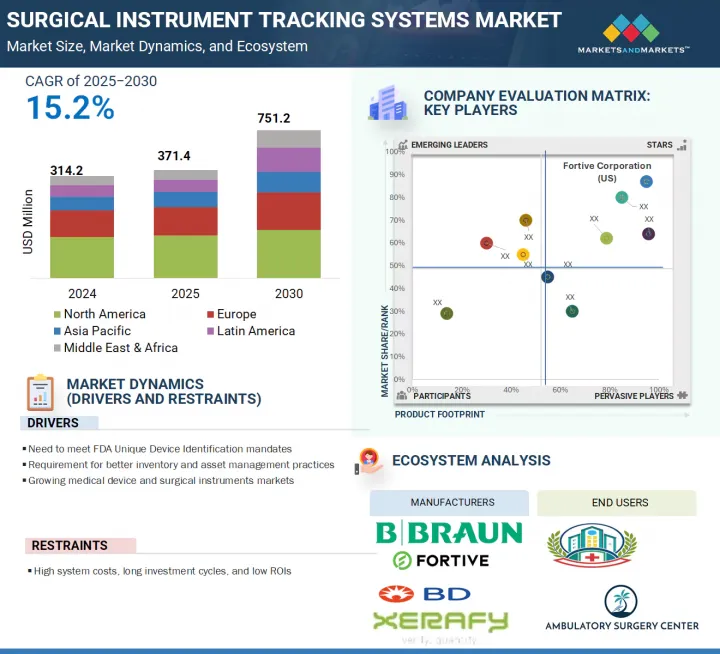

The global surgical instrument tracking systems market is projected to reach USD 751.2 million by 2030 from USD 371.4 million in 2025, at a CAGR of 15.2% during the forecast period. The surgical instrument tracking systems market is seeing consistent growth due to various factors. Growth in this market is mainly driven by the growing prevalence of chronic diseases requiring surgical interventions and severe traumatic injuries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Component, Technology, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

Owing to the increasing growth in such incidences, the volume of elective surgical procedures is increasing, which is driving the demand for surgical instrument tracking systems products. In addition, rising demand for effective blood loss management and increasing availability of advanced surgical instrument tracking systems products are expected to drive market. However, the high cost of surgical instrument tracking systems products, dearth of skilled professionals, and stringent regulatory framework are expected to hamper the growth of this market during the forecast period.

The readers segment of the surgical instrument tracking systems market, by type of hardware, led the market in 2024.

Based on the component, the surgical instrument tracking systems market is divided into software, hardware, and services. Among these, the hardware segment is expected to grow at the fastest rate during the forecast period. The hardware segment is further segmented into readers, tags, and other hardware components. Among these, the readers segment is expected to grow at the fastest rate during the forecast period, owing to the increasing adoption of RFID and barcode technologies in hospitals for efficient tracking and management of surgical instruments. RFID readers, available in handheld, fixed, and mobile forms, offer real-time data capture through radio waves, enabling fast and accurate instrument identification, minimizing human errors, and streamlining surgical workflows. The growing demand to reduce data entry errors, improve supply chain efficiency, and prevent loss or misplacement of valuable surgical tools further accelerates the deployment of readers. Additionally, as healthcare institutions prioritize digital transformation and automation, the integration of readers with software platforms facilitates enhanced visibility, asset tracking, and regulatory compliance. The rising need for cost-effective, scalable tracking solutions and continuous advancements in reader technology reinforce the segment's rapid growth trajectory across global healthcare facilities.

The RFID segment of the surgical instrument tracking systems market is expected to grow at the fastest rate during the forecast period.

The surgical instrument tracking systems market, based on technology, is divided into barcode and Radiofrequency Identification (RFID). The Radiofrequency Identification (RFID) segment is projected to be the fastest-growing segment in the surgical instrument tracking systems market over the forecast period. This is due to its superior capabilities over traditional barcode systems. RFID enables high-speed, batch, and non-line-of-sight scanning, allowing for efficient tracking of multiple instruments simultaneously, even in challenging environments where labels may be unreadable. Its ability to store and update dynamic data, offer higher transmission rates, and operate under extreme sterilization conditions makes it highly suitable for surgical workflows. Additionally, RFID tags uniquely identify each instrument, facilitating real-time visibility and better inventory management. For hospitals and medical device manufacturers, RFID simplifies compliance with regulations like UDI, reduces manual errors, and improves workflow accuracy. Despite higher upfront costs and low adoption in emerging markets, the increasing need for automation, safety, and traceability in surgical procedures is expected to drive the accelerated adoption of RFID technology during the forecast period, particularly in advanced healthcare settings.

In 2024, the North America region accounted for the highest market share in the surgical instrument tracking systems market.

The global surgical instrument tracking systems market is segmented into five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North American region accounted for the largest share across the surgical instrument tracking systems market. North America accounts for the highest share in the surgical instrument tracking systems market, primarily due to the strong presence of advanced healthcare infrastructure, high surgical volumes, and stringent regulatory mandates. The region is bifurcated into the US and Canada, with the US holding the largest share owing to early adoption of innovative healthcare technologies and the enforcement of the FDA's Unique Device Identification (UDI) regulations. These regulations mandate comprehensive tracking of medical instruments, driving widespread deployment of tracking solutions. Furthermore, hospitals and surgical centers in the region are focused on improving workflow efficiency, minimizing surgical errors, and enhancing patient safety, all of which contribute to the increased demand for surgical instrument tracking systems. The presence of leading market players and robust investments in healthcare IT also support the dominance of North America in this market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 40%, Tier 2- 30%, and Tier 3- 30%

- By Designation: C Level- 50%, Director Level- 30%, and Others- 20%

- By Region: North America- 30%, Europe- 25%, Asia Pacific- 20%, Latin America- 15%, and Middle East & Africa- 10%.

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the surgical instrument tracking systems market include Fortive Corporation (US), Becton, Dickinson and Company (US), Getinge AB (Sweden), STERIS (US), Securitas Healthcare LLC (US), Mobile Aspects (US), Integra LifeSciences Holdings Corporation (US), Xerafy (Singapore), B. Braun Melsungen AG (Germany), SpaTrack Medical Limited (UK), Syrma SGS (India), Scanlan International, Inc. (US), Case Medical (US), ASANUS Medizintechnik GmbH (Germany), Keir Surgical Ltd. (Canada), TechnoSource Australia Pty Ltd. (Australia), NuTrace (US), ASSA ABLOY AB (Sweden), ScanCARE Pty. Ltd. (US), RFID Discovery (UK), Healthtech Pivot LLP (India), RMS Omega Healthcare (US), Avery Dennison Corporation (US), Caretag (Denmark), and RapID Surgical (US).

Research Coverage

This report studies the surgical instrument tracking systems market based on component, technology, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to gain a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (Need to meet FDA Unique Device Identification mandates, requirement for better inventory and asset management practices, Growing medical device and surgical instruments market), restraints (high system costs, long investment cycles and low ROIs), opportunities (Emerging economies, development of active RFID technology for instruments), challenges (Technology limitations)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the surgical instrument tracking systems market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the surgical instrument tracking systems market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the surgical instrument tracking systems industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as Fortive Corporation (US), Becton, Dickinson and Company (US), Getinge AB (Sweden), STERIS (US), Securitas Healthcare LLC (US), Mobile Aspects (US), Xerafy (Singapore), B. Braun SE (Germany), SpaTrack Medical Limited (UK), Syrma SGS (India), Scanlan International, Inc. (US), and Case Medical (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET RANKING ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET OVERVIEW

- 4.2 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER & COUNTRY, 2024

- 4.3 GEOGRAPHIC SNAPSHOT

- 4.4 REGIONAL MIX: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, 2022-2030 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent FDA requirements for UDI mandates

- 5.2.1.2 Growing requirement for enhanced inventory & asset management practices

- 5.2.2 RESTRAINTS

- 5.2.2.1 High system costs, extended investment cycles, and low ROIs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of active RFID technology for instruments

- 5.2.3.2 High growth potential of emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological limitations

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 ADVANCED DIGITIZATION & IMPROVED AUTOMATION IN SURGICAL INSTRUMENT TRACKING SYSTEMS

- 5.3.2 AI & ANALYTICS FOR PREDICTIVE MAINTENANCE

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Cloud-based & on-premise instrument tracking technologies

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Real-time location systems technologies

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Machine learning & predictive analytics

- 5.4.1 KEY TECHNOLOGIES

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIER

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY ANALYSIS

- 5.10.2.1 North America

- 5.10.2.1.1 US

- 5.10.2.1.2 Canada

- 5.10.2.2 Europe

- 5.10.2.3 Asia Pacific

- 5.10.2.4 Latin America

- 5.10.2.5 Middle East & Africa

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 INSIGHTS: JURISDICTIONS & TOP APPLICANT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 ADJACENT MARKET ANALYSIS

- 5.13.1 TRACK & TRACE SOLUTIONS MARKET

- 5.14 UNMET NEEDS/END-USER EXPECTATIONS

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 IMPACT OF AI/GENERATIVE AI ON SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET

- 5.18 TRUMP TARIFF IMPACT ON SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 KEY IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 END-USE INDUSTRY IMPACT

6 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 BARCODE

- 6.2.1 LOW INSTALLATION COSTS DRIVE MARKET

- 6.3 RADIO-FREQUENCY IDENTIFICATION (RFID)

- 6.3.1 HIGHER DATA STORAGE CAPACITY & FASTER DATA TRANSMISSION RATE TO PROPEL MARKET

- 6.4 OTHER TECHNOLOGIES

7 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 SOFTWARE

- 7.2.1 FREQUENT NEED FOR UPGRADES AND INTRODUCTION OF NEW SOFTWARE APPLICATIONS TO DRIVE MARKET

- 7.3 HARDWARE

- 7.3.1 READERS

- 7.3.1.1 Real-time data capture & tracking to boost demand

- 7.3.2 TAGS

- 7.3.2.1 Durability & long-read range features to fuel market uptake

- 7.3.3 OTHER HARDWARE COMPONENTS

- 7.3.1 READERS

- 7.4 SERVICES

- 7.4.1 RECURRING REQUIREMENT TO PROPEL MARKET

8 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 PUBLIC HOSPITALS

- 8.2.1.1 Need to curtail healthcare expenditure to fuel market

- 8.2.2 PRIVATE HOSPITALS

- 8.2.2.1 High investments in healthcare modernization to boost demand

- 8.2.1 PUBLIC HOSPITALS

- 8.3 OTHER END USERS

9 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 High healthcare expenditure to drive market

- 9.2.3 CANADA

- 9.2.3.1 Increasing establishment of hospitals and surgical centers to boost demand

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Favorable regulatory framework to fuel uptake

- 9.3.3 UK

- 9.3.3.1 Expanding focus on digitization to drive talmarket

- 9.3.4 FRANCE

- 9.3.4.1 Increasing geriatric population and subsequent rise in surgical procedures to boost demand

- 9.3.5 ITALY

- 9.3.5.1 Modernization of healthcare infrastructure to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Growing emphasis on patient safety for alignment of EU quality standards to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Increasing incidence of age-related conditions to fuel uptake

- 9.4.3 CHINA

- 9.4.3.1 High incidence of infectious diseases to propel market

- 9.4.4 INDIA

- 9.4.4.1 Modernization of healthcare infrastructure to drive market

- 9.4.5 AUSTRALIA

- 9.4.5.1 Growing focus on asset management to support market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Demand for high-value surgical instruments to fuel uptake

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing reliance on medical device imports to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Focus on AI to support market uptake

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Adoption of advanced technologies to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Component footprint

- 10.5.5.4 Technology footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SME players

- 10.6.5.2 Competitive benchmarking of key emerging players/startups

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 FORTIVE CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Services offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses & competitive threats

- 11.1.2 BECTON, DICKINSON AND COMPANY (BD)

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses & competitive threats

- 11.1.3 STERIS

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses & competitive threats

- 11.1.4 SECURITAS AB

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 GETINGE AB

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 ASSA ABLOY AB

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 B BRAUN SE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Services offered

- 11.1.8 SYRMA SGS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Services offered

- 11.1.9 MOBILE ASPECTS

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Services offered

- 11.1.10 XERAFY

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Services offered

- 11.1.1 FORTIVE CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 SPATRACK MEDICAL LIMITED

- 11.2.2 SCANLAN INTERNATIONAL, INC.

- 11.2.3 CASE MEDICAL

- 11.2.4 ASANUS MEDIZINTECHNIK GMBH

- 11.2.5 NB AUTOMATION INC.

- 11.2.6 TECHNOSOURCE AUSTRALIA PTY LTD.

- 11.2.7 NUTRACE

- 11.2.8 SCANCARE PTY. LTD.

- 11.2.9 RFID DISCOVERY

- 11.2.10 HEALTHTECH PIVOT LLP

- 11.2.11 RMS OMEGA HEALTHCARE

- 11.2.12 AVERY DENNISON CORPORATION

- 11.2.13 RAPID SURGICAL

- 11.2.14 CARETAG

- 11.2.15 BIOENABLE TECHNOLOGIES PVT. LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES

- TABLE 3 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: STUDY ASSUMPTIONS

- TABLE 4 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 5 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SURGICAL INSTRUMENT TRACKING SYSTEMS, BY COMPONENT

- TABLE 7 KEY BUYING CRITERIA FOR SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY RANK

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS

- TABLE 14 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: UNMET NEEDS

- TABLE 15 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 17 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 18 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR BARCODE TECHNOLOGY, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 19 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR BARCODE TECHNOLOGY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 20 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 21 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR RADIO-FREQUENCY IDENTIFICATION TECHNOLOGY, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 22 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 23 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 24 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 25 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 26 KEY SOFTWARE OFFERED BY LEADING PLAYERS

- TABLE 27 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR SOFTWARE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 28 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR SOFTWARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 29 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 30 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 32 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR READERS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 34 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR READERS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR TAGS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 36 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR TAGS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 37 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR OTHER HARDWARE COMPONENTS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 38 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR OTHER HARDWARE COMPONENTS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 KEY SERVICES OFFERED BY LEADING PLAYERS

- TABLE 40 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR SERVICES, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 41 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR SERVICES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 42 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 43 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 44 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 45 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 47 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR PUBLIC HOSPITALS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 49 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR PUBLIC HOSPITALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 50 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR PRIVATE HOSPITALS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 51 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR PRIVATE HOSPITALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 52 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR OTHER END USERS, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 53 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR OTHER END USERS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 55 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 57 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 62 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 67 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 68 US: KEY MACROINDICATORS

- TABLE 69 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 70 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 71 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 72 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 74 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 75 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 76 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 77 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 78 US: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 79 CANADA: KEY MACROINDICATORS

- TABLE 80 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 81 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 82 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 83 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 84 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 85 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 86 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 87 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 88 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 89 CANADA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 91 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 93 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 95 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 97 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 99 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 100 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 101 EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 102 GERMANY: KEY MACROINDICATORS

- TABLE 103 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 104 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 105 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 106 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 108 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 109 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 110 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 111 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 112 GERMANY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 UK: KEY MACROINDICATORS

- TABLE 114 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 115 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 116 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 117 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 118 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 119 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 120 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 121 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 122 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 123 UK: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 124 FRANCE: KEY MACROINDICATORS

- TABLE 125 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 126 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 127 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 128 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 130 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 131 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 132 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 133 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 134 FRANCE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 135 ITALY: KEY MACROINDICATORS

- TABLE 136 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 137 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 138 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 139 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 140 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 141 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 142 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 143 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 144 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 145 ITALY: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 146 SPAIN: KEY MACROINDICATORS

- TABLE 147 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 148 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 149 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 150 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 152 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 153 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 154 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 155 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 156 SPAIN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 158 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 159 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 160 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 162 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 163 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 164 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 165 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 166 REST OF EUROPE: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 176 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 JAPAN: KEY MACROINDICATORS

- TABLE 180 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 181 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 182 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 183 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 184 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 185 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 186 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 187 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 188 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 189 JAPAN: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 190 CHINA: KEY MACROINDICATORS

- TABLE 191 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 192 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 193 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 194 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 195 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 196 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 197 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 198 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 199 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 200 CHINA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 INDIA: KEY MACROINDICATORS

- TABLE 202 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 203 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 204 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 205 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 206 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 207 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 208 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 209 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 210 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 211 INDIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 212 AUSTRALIA: KEY MACROINDICATORS

- TABLE 213 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 214 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 215 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 216 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 217 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 218 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 219 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 220 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 221 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 222 AUSTRALIA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 223 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 224 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 225 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 226 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 227 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 228 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 229 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 230 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 231 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 232 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 233 SOUTH KOREA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 234 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 235 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 236 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 244 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 245 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 246 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 247 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 248 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 249 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 250 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 251 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 252 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 253 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 254 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 255 LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 256 BRAZIL: KEY MACROINDICATORS

- TABLE 257 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 258 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 259 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 260 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 261 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 262 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 263 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 264 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 265 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 266 BRAZIL: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 267 MEXICO: KEY MACROINDICATORS

- TABLE 268 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 269 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 270 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 271 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 272 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 273 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 274 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 275 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 276 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 277 MEXICO: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 278 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 280 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 281 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 284 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 285 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 286 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 287 REST OF LATIN AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 288 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 290 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 292 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 294 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 298 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 300 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 301 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 302 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 303 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 304 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 305 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 306 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 307 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 308 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 309 GCC COUNTRIES: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 310 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2022-2024 (USD MILLION)

- TABLE 311 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 312 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 313 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HARDWARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 314 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 315 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 318 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET FOR HOSPITALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 320 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURING COMPANIES

- TABLE 321 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: DEGREE OF COMPETITION

- TABLE 322 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: REGION FOOTPRINT

- TABLE 323 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: COMPONENT FOOTPRINT

- TABLE 324 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 325 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: END-USER FOOTPRINT

- TABLE 326 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 327 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 328 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 329 FORTIVE CORPORATION: COMPANY OVERVIEW

- TABLE 330 FORTIVE CORPORATION: PRODUCTS/SERVICES OFFERED

- TABLE 331 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 332 BECTON, DICKINSON AND COMPANY: PRODUCTS/SERVICES OFFERED

- TABLE 333 STERIS: COMPANY OVERVIEW

- TABLE 334 STERIS: PRODUCTS/SERVICES OFFERED

- TABLE 335 SECURITAS AB: COMPANY OVERVIEW

- TABLE 336 SECURITAS AB: PRODUCTS/SERVICES OFFERED

- TABLE 337 SECURITAS AB: DEALS, JANUARY 2022-JUNE 2025

- TABLE 338 GETINGE AB: COMPANY OVERVIEW

- TABLE 339 GETINGE AB: PRODUCTS/SERVICES OFFERED

- TABLE 340 ASSA ABLOY AB: COMPANY OVERVIEW

- TABLE 341 ASSA ABLOY AB: PRODUCTS/SERVICES OFFERED

- TABLE 342 ASSA ABLOY AB: DEALS, JANUARY 2022-JUNE 2025

- TABLE 343 B BRAUN SE: COMPANY OVERVIEW

- TABLE 344 B BRAUN SE: PRODUCTS/SERVICES OFFERED

- TABLE 345 SYRMA SGS: COMPANY OVERVIEW

- TABLE 346 SYRMA SGS: PRODUCTS/SERVICES OFFERED

- TABLE 347 MOBILE ASPECTS: COMPANY OVERVIEW

- TABLE 348 MOBILE ASPECTS: PRODUCTS/SERVICES OFFERED

- TABLE 349 XERAFY: COMPANY OVERVIEW

- TABLE 350 XERAFY: PRODUCTS/SERVICES OFFERED

- TABLE 351 SPATRACK MEDICAL LIMITED: COMPANY OVERVIEW

- TABLE 352 SCANLAN INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 353 CASE MEDICAL: COMPANY OVERVIEW

- TABLE 354 ASANUS MEDIZINTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 355 NB AUTOMATION INC.: COMPANY OVERVIEW

- TABLE 356 TECHNOSOURCE AUSTRALIA PTY LTD.: COMPANY OVERVIEW

- TABLE 357 NUTRACE: COMPANY OVERVIEW

- TABLE 358 SCANCARE PTY. LTD.: COMPANY OVERVIEW

- TABLE 359 RFID DISCOVERY: COMPANY OVERVIEW

- TABLE 360 HEALTHTECH PIVOT LLP: COMPANY OVERVIEW

- TABLE 361 RMS OMEGA HEALTHCARE: COMPANY OVERVIEW

- TABLE 362 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- TABLE 363 RAPID SURGICAL: COMPANY OVERVIEW

- TABLE 364 CARETAG: COMPANY OVERVIEW

- TABLE 365 BIOENABLE TECHNOLOGIES PVT. LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 PRIMARY BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025-2030)

- FIGURE 8 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: CAGR PROJECTIONS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 14 RISING REQUIRMENT TO MEET FDA UID MANDATES AND GROWING NEED FOR ASSET MANAGEMENT TO PROPEL MARKET

- FIGURE 15 HOSPITALS SEGMENT IN US ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 16 EMERGING ECONOMIES TO GROW AT HIGHER CAGRS DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC REGION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 21 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SURGICAL INSTRUMENT TRACKING SYSTEMS

- FIGURE 24 KEY BUYING CRITERIA FOR SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET

- FIGURE 25 NUMBER OF PATENTS PUBLISHED (JANUARY 2015-JUNE 2024)

- FIGURE 26 TOP APPLICANT COUNTRIES/REGIONS FOR SURGICAL INSTRUMENT TRACKING SYSTEMS (JANUARY 2015- JUNE 2025)

- FIGURE 27 TRACK & TRACE SOLUTIONS MARKET: MARKET OVERVIEW

- FIGURE 28 TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 29 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: INVESTMENT & FUNDING ACTIVITIES

- FIGURE 30 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: IMPACT OF AI/GEN AI

- FIGURE 31 GEOGRAPHIC SNAPSHOT

- FIGURE 32 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS IN SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET (2022-2024)

- FIGURE 35 MARKET SHARE ANALYSIS OF KEY PLAYERS IN SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET (2024)

- FIGURE 36 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 37 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: COMPANY FOOTPRINT

- FIGURE 38 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 39 EV/EBITDA OF KEY VENDORS

- FIGURE 40 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 41 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 42 FORTIVE CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 43 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 44 STERIS: COMPANY SNAPSHOT (2024)

- FIGURE 45 SECURITAS AB: COMPANY SNAPSHOT (2024)

- FIGURE 46 GETINGE AB: COMPANY SNAPSHOT (2024)

- FIGURE 47 ASSA ABLOY AB: COMPANY SNAPSHOT (2024)

- FIGURE 48 B BRAUN SE: COMPANY SNAPSHOT (2024)

- FIGURE 49 SYRMA SGS: COMPANY SNAPSHOT (2024)