PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1788516

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1788516

Law Enforcement Software Market by Offering (Solutions, Services), Deployment Mode (On-premises, Cloud), End User (Police Department, Federal & State Agencies, Correctional Institutions, Law Enforcement Agencies), and Region - Global Forecast to 2030

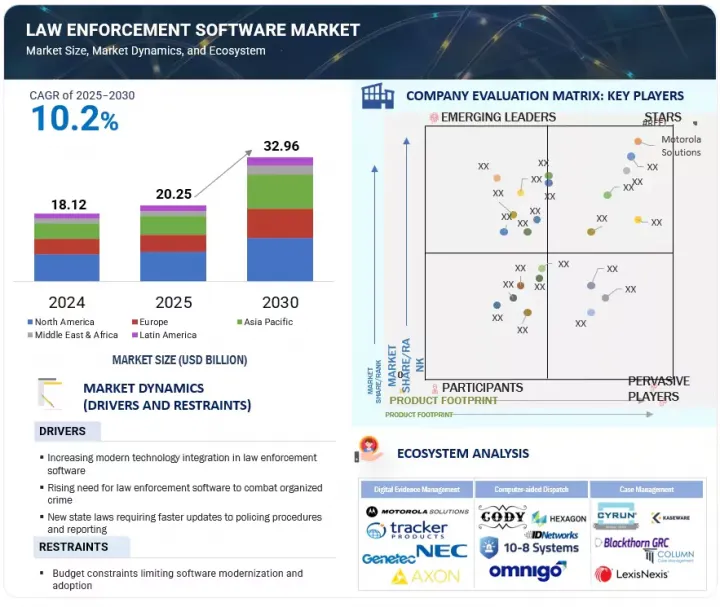

The global law enforcement software market is expected to grow from USD 20.25 billion in 2025 to USD 32.96 billion by 2030 at a compounded annual growth rate (CAGR) of 10.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Offering, Deployment Mode, End User |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Increased government budgets and supportive policies are pivotal in accelerating the adoption of law enforcement software globally. Many governments are prioritizing smart policing initiatives to address rising crime rates, public safety challenges, and demand for transparency. Funding will modernize policing by integrating AI analytics, digital evidence management, and cloud records systems. These investments streamline operations, improve decision-making, and enhance community engagement.

Law enforcement agencies often depend on outdated legacy systems and established workflows, which present a significant restraint. Moving to modern platforms demands considerable time, technical expertise, and financial investment. Consequently, the complexity and expense of integration are likely to be major obstacles to the growth of the law enforcement software market.

"Based on the deployment mode, the on-premises segment is estimated to hold the largest market share in 2025"

Law enforcement agencies prefer on-premises deployment of software solutions due to the need for enhanced control, security, and compliance with data privacy regulations. These agencies manage sensitive information such as criminal records, investigation data, and personal details, requiring secure storage and restricted system access. On-premises deployment provides full ownership of the IT infrastructure, ensuring that critical data remains within the agency's secured internal servers rather than being hosted on external cloud platforms.

Additionally, regulatory policies in several regions mandate local data hosting and in-house system management, reinforcing the adoption of on-premises solutions. Agencies with established IT resources benefit from system customization, stronger security protocols, and seamless integration with existing infrastructure. On-premises solutions focus on data protection, regulatory compliance, and operational control, making it the leading segment in the law enforcement software market during the forecast period.

"Based on the service type, the support & maintenance segment is expected to grow at the highest CAGR during the forecast period"

Law enforcement agencies increasingly prioritize support and maintenance services to ensure their software systems' continuous and effective operation. Regular updates, technical support, and system optimization become essential as these agencies rely on complex solutions such as record management, case management, and crime analytics platforms. Support and maintenance services help agencies address software issues, implement security patches, and upgrade functionalities without disrupting daily operations.

With changing compliance requirements and advancements in technology, law enforcement agencies require continuous support to keep their systems updated and secure. This increasing dependence on specialized service providers to maintain software performance and ensure smooth operations is driving the demand for support and maintenance services. As a result, the support and maintenance segment is expected to grow at the highest CAGR in the law enforcement software market during the forecast period, supported by the need for reliability, system longevity, and regulatory compliance.

"North America will lead in the market share, while Asia Pacific emerges as the fastest-growing market during the forecast period"

North America holds the leading position in the global law enforcement software market, driven by advanced technological infrastructure, high levels of public safety funding, and early adoption of digital tools by law enforcement agencies. The United States, in particular, has been at the forefront, with numerous agencies deploying data analytics, AI-powered surveillance, computer-aided dispatch (CAD), and records management systems (RMS) to improve operational efficiency and public safety outcomes. The presence of established software vendors, strong government initiatives to modernize policing, and increasing investments in cybersecurity also contribute to the region's dominance. Additionally, the ongoing emphasis on transparency and accountability in policing fuels demand for body-worn cameras, digital evidence management systems, and real-time data sharing platforms.

In contrast, Asia Pacific is the fastest-growing law enforcement software market. Rapid urbanization, increasing crime rates, and rising concerns over national security are prompting India, China, and Southeast Asian nations to invest in modern law enforcement technologies. Governments across the region are prioritizing smart city initiatives, which integrate law enforcement systems with traffic management, surveillance, and emergency response solutions. Although the region still faces budget constraints and technological gaps in rural areas, growing collaborations with global vendors, rising adoption of cloud-based solutions, and digital transformation initiatives are accelerating market growth. As a result, the Asia Pacific region is expected to see strong demand for law enforcement software, making it a high-potential area in the coming years.

Breakdown of primaries

Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant law enforcement software market companies were interviewed to gain insights into this market.

- By Company: Tier I: 32%, Tier II: 49%, and Tier III: 19%

- By Designation: C-Level Executives: 33%, Director Level: 22%, and Others: 45%

- By Region: North America: 40%, Europe: 20%, Asia Pacific: 35%, Rest of World: 5%

Some of the significant law enforcement software market vendors are Motorola Solutions (US), Axon Enterprise (US), NICE (Israel), NEC Corporation (Japan), Hexagon (Sweden), Palantir Technologies (US), IBM (US), Nuance Communications (US), Esri (US), and Gentec (Canada).

Research Coverage

The market report covered the law enforcement software market across segments. We estimated the market size and growth potential for many segments based on solution type, service type, deployment mode, end user, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to buy this report:

This research provides the most accurate revenue estimates for the entire law enforcement industry and its subsegments, benefiting both established leaders and new entrants. Stakeholders will gain valuable insights into the competitive landscape, enabling them to better position their companies and develop effective go-to-market strategies. The report outlines key market drivers, constraints, opportunities, and challenges, helping industry players understand the current state of the market.

The report provides insights on the following pointers:

- Analysis of key drivers (law enforcement technology aids in maintaining lower crime rates), restraints (lack of skilled professionals), opportunities (incorporation of big data analytics in public safety), and challenges (integration of logical and physical components of security systems) influencing the growth of the law enforcement software market

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the law enforcement software market

- Market Development: In-depth details regarding profitable markets, examining the global law enforcement software market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, and new software and services

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and offerings of the top competitors in the law enforcement software industry, such as Motorola Solutions (US), Axon Enterprise (US), NICE (Israel), NEC Corporation (Japan), Hexagon (Sweden), Palantir Technologies (US), IBM (US), Nuance Communications (US), Esri (US), Gentec (Canada), LexisNexis Risk Solutions (US), Cyran (US), Matrix Pointe Software (US), Tracker Products (US), CODY Systems (US), Omnigo (US), Column Case Management (US), Kaseware (US), 10-8 Systems (US), Mark43 (US), ID Networks (US), CPI Open Fox (US), Belkasoft (US), and Civic Eye (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAW ENFORCEMENT SOFTWARE MARKET

- 4.2 LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING(2025 VS 2030

- 4.3 LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTION (2025 VS 2030

- 4.4 LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICE (2025 VS 2030)

- 4.5 LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE (2025 VS 2030)

- 4.6 LAW ENFORCEMENT SOFTWARE MARKET, BY END USER (2025 VS 2030)

- 4.7 LAW ENFORCEMENT SOFTWARE MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration of modern technology in law enforcement software

- 5.2.1.2 Deployment of modern law enforcement software in maintaining lower crime rates

- 5.2.1.3 New state laws requiring faster updates to policing procedures and reporting

- 5.2.1.4 Rising need for law enforcement software to combat organized crime

- 5.2.2 RESTRAINTS

- 5.2.2.1 Budget constraints limit software modernization and adoption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of AI and ML technologies

- 5.2.3.2 Enhanced international incident response through CAD-enabled intelligence sharing

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration of logical and physical components of security systems

- 5.2.4.2 Lack of efficient storage and data management capacities

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 JOLIET PD MODERNIZED TRAINING WITH AXON VR

- 5.3.2 KISSIMMEE PD INTELLIGENCE-LED POLICING

- 5.3.3 INTELLIGENCE-DRIVEN LAW ENFORCEMENT PROGRAM KEEPING OFFICERS AND COMMUNITIES SAFE

- 5.3.4 STREAMLINING PROCESSES TO SOLVE CRIMES AND CLOSE CASES FASTER

- 5.3.5 REDLANDS POLICE AND LOCAL BUSINESSES USE GIS TO KEEP SHOPPERS SAFE

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF SOLUTION PROVIDERS, BY REGION, 2025

- 5.6.2 INDICATIVE PRICING OF SERVICE PROVIDERS, BY SOLUTIONS, 2025

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF MAJOR PATENTS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Cloud-Native Architecture

- 5.8.1.2 AI/ML Frameworks

- 5.8.1.3 Geospatial Information Systems

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Robotic process automation

- 5.8.2.2 Natural Language Processing

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Body-worn Cameras

- 5.8.3.2 Digital Forensics and Mobile Extraction Tools

- 5.8.3.3 Facial Recognition Systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS BASED ON REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & South Africa

- 5.9.2.5 Latin America

- 5.9.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.9.3.1 General Data Protection Regulation

- 5.9.3.2 SEC Rule 17a-4

- 5.9.3.3 ISO/IEC 27001

- 5.9.3.4 System and Organization Controls 2 Type II

- 5.9.3.5 Financial Industry Regulatory Authority

- 5.9.3.6 Freedom of Information Act

- 5.9.3.7 Health Insurance Portability and Accountability Act

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12 BUYING CRITERIA

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON LAW ENFORCEMENT SOFTWARE MARKET

- 5.16.1 CASE STUDY

- 5.16.1.1 Bank Fraud Task Force Member Identifies ATM Theft Suspect

- 5.16.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.16.2.1 Real-Time Crime Centers Drive Faster, Informed Emergency Response

- 5.16.2.2 AI-Powered Wearables Revolutionize Field Operations

- 5.16.2.3 AI and GIS Integration Enhances Event Security and Risk Response

- 5.16.1 CASE STUDY

6 LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 OPTIMIZING LAW ENFORCEMENT OPERATIONS THROUGH INTELLIGENT SOFTWARE SOLUTIONS

- 6.2.2 DIGITAL EVIDENCE MANAGEMENT

- 6.2.2.1 Securing integrity and speed in investigations to drive market

- 6.2.2.2 Metadata management

- 6.2.2.3 Chain-of-Custody Tracking

- 6.2.2.4 Evidence presentation & analytics

- 6.2.3 COMPUTER AIDED DISPATCH

- 6.2.3.1 Handles full cycle of incident response by enhancing response efficiency

- 6.2.3.2 Back-end call-taking and incident entry

- 6.2.3.3 Incident tracking and status updates

- 6.2.3.4 Reporting and data analysis

- 6.2.3.5 GIS mapping and tracking

- 6.2.4 CASE MANAGEMENT

- 6.2.4.1 Driving Consistency and Closure with Intelligent Case Management Solutions

- 6.2.4.2 Investigation lifecycle management

- 6.2.4.3 Victim/Witness tracking & contact management

- 6.2.4.4 Court case preparation & disposition tracking

- 6.2.5 INCIDENT MANAGEMENT

- 6.2.5.1 Improves operational readiness and response with smart incident management

- 6.2.5.2 Pre-incident planning & risk assessment

- 6.2.5.3 Post-incident investigation

- 6.2.5.4 Resource & Personnel Allocation Planning

- 6.2.6 RECORD MANAGEMENT

- 6.2.6.1 Centralizes law enforcement data for accuracy, accountability, and compliance

- 6.2.6.2 Incident Reporting

- 6.2.6.3 Evidence & property tracking

- 6.2.6.4 Arrest & booking records

- 6.2.7 JAIL MANAGEMENT

- 6.2.7.1 Streamlines correctional operations with smart jail management systems

- 6.2.7.2 Inmate tracking

- 6.2.7.3 Cell assignment

- 6.2.7.4 Visitation Scheduling

- 6.2.7.5 Court Scheduling

- 6.2.8 DIGITAL POLICING

- 6.2.8.1 Transforms public safety with real-time, predictive, and community-focused tools

- 6.2.8.2 Real-Time Crime Center

- 6.2.8.3 Predictive Policing/Crime Mapping

- 6.2.8.4 Community Policing Tools

- 6.3 SERVICES

- 6.3.1 MAXIMIZING SOLUTION IMPACT THROUGH COMPREHENSIVE LAW ENFORCEMENT SERVICES

- 6.3.2 IMPLEMENTATION & SYSTEM INTEGRATION

- 6.3.3 TRAINING & CONSULTING

- 6.3.4 SUPPORT & MAINTENANCE

7 LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 7.2 CLOUD

- 7.2.1 ENABLING AGILE LAW ENFORCEMENT THROUGH CLOUD DEPLOYMENT

- 7.3 ON-PREMISES

- 7.3.1 ENSURING CONTROL AND CUSTOMIZATION IN LAW ENFORCEMENT OPERATIONS WITH ON-PREMISES SOLUTIONS

8 LAW ENFORCEMENT SOFTWARE MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.1.1 END USERS: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 8.2 POLICE DEPARTMENTS

- 8.2.1 ENHANCING DAILY POLICING THROUGH SMART SOFTWARE SOLUTIONS

- 8.2.2 POLICE DEPARTMENTS: USE CASES

- 8.2.2.1 Patrol Route Optimization with Real-Time Crime Heatmaps

- 8.2.2.2 In-Field Mobile Reporting for Traffic Stops and Incidents

- 8.2.2.3 K-9 Unit Deployment and Activity Logging

- 8.3 LAW ENFORCEMENT AGENCIES

- 8.3.1 DRIVING INTERAGENCY EFFICIENCY THROUGH SCALABLE LAW ENFORCEMENT PLATFORMS

- 8.3.2 LAW ENFORCEMENT AGENCIES: USE CASES

- 8.3.2.1 Centralized Case Collaboration across Units

- 8.3.2.2 Digital Chain-of-Custody for Evidence Handling

- 8.3.2.3 Criminal Intelligence Analysis & Link Mapping

- 8.3.2.4 Multi-Jurisdictional Arrest Warrant Management

- 8.4 FEDERAL & STATE AGENCIES

- 8.4.1 STRENGTHENING NATIONAL SAFETY THROUGH SCALABLE INTELLIGENCE AND COMPLIANCE PLATFORMS

- 8.4.2 FEDERAL & STATE AGENCIES: USE CASES

- 8.4.2.1 Nationwide Criminal Data Integration and Analytics

- 8.4.2.2 Policy Enforcement and Compliance Auditing Tools

- 8.4.2.3 Counterterrorism Intelligence Fusion Platforms

- 8.4.2.4 Statewide Warrant and Offender Registry Management

- 8.5 MUNICIPALITIES

- 8.5.1 EMPOWERING LOCAL LAW ENFORCEMENT WITH COMMUNITY-CENTRIC DIGITAL SOLUTIONS

- 8.5.2 MUNICIPALITIES: USE CASES

- 8.5.2.1 Community Policing Activity Tracker

- 8.5.2.2 Parking and Traffic Violation Software Integration

- 8.5.2.3 Smart City Surveillance and Public Safety Alerts

- 8.5.2.4 Local Ordinance Enforcement Automation

- 8.6 CORRECTIONAL INSTITUTIONS

- 8.6.1 ENHANCING CORRECTIONAL OPERATIONS THROUGH SMART SOFTWARE SYSTEMS

- 8.6.2 CORRECTIONAL INSTITUTIONS: USE CASES

- 8.6.2.1 Inmate Monitoring & Movement Tracking

- 8.6.2.2 Digital Inmate Case Management

- 8.6.2.3 Visitor Scheduling & Background Check Automation

- 8.6.2.4 Emergency Response Simulation and Drill Tracking

- 8.7 OTHER END USERS

9 LAW ENFORCEMENT SOFTWARE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.3 US

- 9.2.3.1 Rising adoption of advanced technologies and solutions for security purposes to drive market

- 9.2.4 CANADA

- 9.2.4.1 Increased security concerns due to rising cyberattacks to fuel adoption of law enforcement services

- 9.3 EUROPE

- 9.3.1 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.3 UK

- 9.3.3.1 Increasing rate of crime and terrorism to drive market

- 9.3.4 GERMANY

- 9.3.4.1 Effective law management and increasing need for airport security and border control to boost demand

- 9.3.5 FRANCE

- 9.3.5.1 Focus of government and regulatory authorities on law and safety to drive market

- 9.3.6 ITALY

- 9.3.6.1 Law enforcement modernization through AI, video analytics, and national data integration to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.3 CHINA

- 9.4.3.1 Extensive industrialization and adoption of cutting-edge technologies to drive demand for law enforcement solutions

- 9.4.4 JAPAN

- 9.4.4.1 Government initiatives enhancing law enforcement and need to add a systematic approach to boost market

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Continuous upgrades in IT infrastructure by law agencies to ensure public safety and manage tourist inflow

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.3 GULF COOPERATION COUNCIL COUNTRIES

- 9.5.3.1 UAE

- 9.5.3.1.1 Need for enabling resilient growth through scalable colocation to boost demand for enforcement software

- 9.5.3.2 Saudi Arabia

- 9.5.3.2.1 Use of AI and real-time intelligence to advance digital transformation of public security and policing systems

- 9.5.3.3 Rest of GCC countries

- 9.5.3.1 UAE

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Low costs and on-demand availability of law enforcement software to drive market

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET DRIVERS

- 9.6.2 LATIN AMERICA: MACROECOMIC OUTLOOK

- 9.6.3 BRAZIL

- 9.6.3.1 Increasing crimes against property and rising intrusions to boost market

- 9.6.4 MEXICO

- 9.6.4.1 Increasing number of government projects and rising instances of data theft and crimes to boost market

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS, 2020-2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.6.1 MOTOROLA SOLUTIONS (COMMANDCENTRAL SUITE)

- 10.6.2 AXON (AXON RECORDS)

- 10.6.3 NICE (EVIDENCENTRAL)

- 10.6.4 NEC CORPORATION (EVIDENCEWORKS)

- 10.6.5 HEXAGON (HXGN ONCALL SUITE)

- 10.6.6 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 10.6.6.1 Company footprint

- 10.6.6.2 Region footprint

- 10.6.6.3 Offering footprint

- 10.6.6.4 End User footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 10.7.5.1 Detailed list of key startups/SMEs

- 10.7.5.2 Competitive benchmarking of startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 10.8.1 COMPANY VALUATION

- 10.8.2 FINANCIAL METRICS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 MAJOR PLAYERS

- 11.2.1 MOTOROLA SOLUTIONS

- 11.2.1.1 Business overview

- 11.2.1.2 Products/Solutions/Services offered

- 11.2.1.3 Recent developments

- 11.2.1.3.1 Product launches and enhancements

- 11.2.1.3.2 Deals

- 11.2.1.4 MnM view

- 11.2.1.4.1 Right to win

- 11.2.1.4.2 Strategic choices

- 11.2.1.4.3 Weaknesses and competitive threats

- 11.2.2 AXON

- 11.2.2.1 Business overview

- 11.2.2.2 Products/Solutions/Services offered

- 11.2.2.3 Recent developments

- 11.2.2.3.1 Product launches and enhancements

- 11.2.2.3.2 Deals

- 11.2.2.4 MnM view

- 11.2.2.4.1 Right to win

- 11.2.2.4.2 Strategic choices

- 11.2.2.4.3 Weaknesses and competitive threats

- 11.2.3 NICE

- 11.2.3.1 Business overview

- 11.2.3.2 Products/Solutions/Services offered

- 11.2.3.3 Recent developments

- 11.2.3.3.1 Product launches and enhancements

- 11.2.3.3.2 Deals

- 11.2.3.4 MnM view

- 11.2.3.4.1 Right to win

- 11.2.3.4.2 Strategic choices

- 11.2.3.4.3 Weaknesses and competitive threats

- 11.2.4 NEC CORPORATION

- 11.2.4.1 Business overview

- 11.2.4.2 Products/Solutions/Services offered

- 11.2.4.3 Recent Developments

- 11.2.4.3.1 Product launches and enhancements

- 11.2.4.3.2 Deals

- 11.2.4.4 MnM view

- 11.2.4.4.1 Right to win

- 11.2.4.4.2 Strategic choices

- 11.2.4.4.3 Weaknesses and competitive threats

- 11.2.5 HEXAGON

- 11.2.5.1 Business overview

- 11.2.5.2 Products/Solutions/Services offered

- 11.2.5.3 Recent developments

- 11.2.5.3.1 Deals

- 11.2.5.4 MnM view

- 11.2.5.4.1 Right to win

- 11.2.5.4.2 Strategic choices

- 11.2.5.4.3 Weaknesses and competitive threats

- 11.2.6 PALANTIR

- 11.2.6.1 Business overview

- 11.2.6.2 Products/Solutions/Services offered

- 11.2.6.3 Recent developments

- 11.2.6.3.1 Deals

- 11.2.6.3.2 Other Deals/Developments

- 11.2.7 IBM

- 11.2.7.1 Business overview

- 11.2.7.2 Products/Solutions/Services offered

- 11.2.7.3 Recent developments

- 11.2.7.3.1 Product launches and enhancements

- 11.2.7.3.2 Deals

- 11.2.8 NUANCE COMMUNICATIONS

- 11.2.8.1 Business overview

- 11.2.8.2 Products/Solutions/Services offered

- 11.2.8.3 Recent developments

- 11.2.8.3.1 Product launches and enhancements

- 11.2.9 ESRI

- 11.2.9.1 Business overview

- 11.2.9.2 Products/Solutions/Services offered

- 11.2.9.3 Recent developments

- 11.2.9.3.1 Product launches and enhancements

- 11.2.9.3.2 Deals

- 11.2.10 GENETEC

- 11.2.10.1 Business overview

- 11.2.10.2 Products/Solutions/Services offered

- 11.2.10.3 Recent developments

- 11.2.10.3.1 Product launches and enhancements

- 11.2.10.3.2 Deals

- 11.2.1 MOTOROLA SOLUTIONS

- 11.3 OTHER PLAYERS

- 11.3.1 LEXISNEXIS RISK SOLUTIONS

- 11.3.2 CYRUN

- 11.3.3 MATRIX POINTE SOFTWARE

- 11.3.4 TRACKER PRODUCTS

- 11.3.5 CODY SYSTEMS

- 11.3.6 OMNIGO

- 11.3.7 COLUMN CASE MANAGEMENT

- 11.3.8 BLACKTHORN GRC

- 11.3.9 KASEWARE

- 11.3.10 10-8 SYSTEMS

- 11.3.11 MARK43

- 11.3.12 ID NETWORKS

- 11.3.13 CPI OPENFOX

- 11.3.14 CIVICEYE

- 11.3.15 BELKASOFT

12 ADJACENT/RELATED MARKET

- 12.1 INTRODUCTION

- 12.1.1 RELATED MARKETS

- 12.1.2 LIMITATIONS

- 12.2 MOBILE VIDEO SURVEILLANCE MARKET

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 LAW ENFORCEMENT SOFTWARE MARKET SIZE AND GROWTH, 2020-2024 (USD BILLION, YOY GROWTH %)

- TABLE 4 LAW ENFORCEMENT SOFTWARE MARKET SIZE AND GROWTH, 2025-2030 (USD BILLION, YOY GROWTH %)

- TABLE 5 ROLE OF PLAYERS IN LAW ENFORCEMENT SOFTWARE MARKET: ECOSYSTEM

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY SOLUTIONS, 2025

- TABLE 7 LIST OF MAJOR PATENTS, 2020-2024

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 PORTER'S FIVE FORCES ANALYSIS: LAW ENFORCEMENT SOFTWARE MARKET

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 15 LAW ENFORCEMENT SOFTWARE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 17 LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 18 LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2020-2024 (USD MILLION)

- TABLE 19 LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2025-2030 (USD MILLION)

- TABLE 20 SOLUTIONS: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 21 SOLUTIONS: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 DIGITAL EVIDENCE MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 23 DIGITAL EVIDENCE MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 COMPUTER-AIDED DISPATCH: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 COMPUTER-AIDED DISPATCH: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 CASE MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 CASE MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 INCIDENT MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 INCIDENT MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 RECORD MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 RECORD MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 JAIL MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 JAIL MANAGEMENT: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 DIGITAL POLICING: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 DIGITAL POLICING: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 37 LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 38 SERVICES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 SERVICES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 IMPLEMENTATION & SYSTEM INTEGRATION: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 IMPLEMENTATION & SYSTEM INTEGRATION: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 TRAINING & CONSULTING: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 TRAINING & CONSULTING: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SUPPORT & MAINTENANCE: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 SUPPORT & MAINTENANCE: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 47 LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 48 CLOUD: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 CLOUD: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 ON-PREMISES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 ON-PREMISES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 LAW ENFORCEMENT SOFTWARE MARKET, BY END USERS, 2020-2024 (USD MILLION)

- TABLE 53 LAW ENFORCEMENT SOFTWARE MARKET, BY END USERS, 2025-2030 (USD MILLION)

- TABLE 54 POLICE DEPARTMENTS: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 POLICE DEPARTMENTS: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 LAW ENFORCEMENT AGENCIES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 LAW ENFORCEMENT AGENCIES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 FEDERAL & STATE AGENCIES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 FEDERAL & STATE AGENCIES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 MUNICIPALITIES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 MUNICIPALITIES: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 CORRECTIONAL INSTITUTIONS: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 CORRECTIONAL INSTITUTIONS: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 OTHER END USERS: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 OTHER END USERS: LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 LAW ENFORCEMENT SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2025-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 73 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 75 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 77 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 US: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 81 US: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 82 CANADA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 83 CANADA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 85 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 86 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS 2020-2024 (USD MILLION)

- TABLE 87 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 89 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 90 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 91 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 93 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 94 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 95 EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 UK: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 97 UK: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 98 GERMANY: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 99 GERMANY: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 100 FRANCE: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 101 FRANCE: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 102 ITALY: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 103 ITALY: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 105 REST OF EUROPE: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2020-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2025-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 113 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 114 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 CHINA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 119 CHINA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 120 JAPAN: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 121 JAPAN: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 122 AUSTRALIA & NEW ZEALAND: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 123 AUSTRALIA & NEW ZEALAND: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2020-2024 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2025-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 GULF COOPERATION COUNCIL: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 139 GULF COOPERATION COUNCIL: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 140 GULF COOPERATION COUNCIL COUNTRIES: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 141 GULF COOPERATION COUNCIL COUNTRIES: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 142 UAE: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 143 UAE: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 144 SAUDI ARABIA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 145 SAUDI ARABIA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 146 REST OF GCC: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 147 REST OF GCC: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 148 SOUTH AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 149 SOUTH AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 152 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 153 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 154 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2020-2024 (USD MILLION)

- TABLE 155 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SOLUTIONS, 2025-2030 (USD MILLION)

- TABLE 156 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 157 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 158 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 159 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 160 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 161 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 162 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 163 LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 BRAZIL: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 165 BRAZIL: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 166 MEXICO: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 167 MEXICO: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 168 REST OF LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 169 REST OF LATIN AMERICA: LAW ENFORCEMENT SOFTWARE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 170 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS

- TABLE 171 LAW ENFORCEMENT SOFTWARE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 172 LAW ENFORCEMENT SOFTWARE MARKET: REGION FOOTPRINT

- TABLE 173 LAW ENFORCEMENT SOFTWARE MARKET: OFFERING FOOTPRINT

- TABLE 174 LAW ENFORCEMENT SOFTWARE MARKET: END USER FOOTPRINT

- TABLE 175 LAW ENFORCEMENT SOFTWARE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 176 LAW ENFORCEMENT SOFTWARE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 177 LAW ENFORCEMENT SOFTWARE MARKET: PRODUCT LAUNCHES, MARCH 2023-JUNE 2025

- TABLE 178 LAW ENFORCEMENT SOFTWARE MARKET: DEALS, FEBRUARY 2024-JULY 2025

- TABLE 179 LAW ENFORCEMENT SOFTWARE MARKET: OTHER DEVELOPMENTS, JUNE 2025

- TABLE 180 MOTOROLA SOLUTIONS: COMPANY OVERVIEW

- TABLE 181 MOTOROLA SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 MOTOROLA SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 183 MOTOROLA SOLUTIONS: DEALS

- TABLE 184 AXON: COMPANY OVERVIEW

- TABLE 185 AXON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 AXON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 187 AXON: DEALS

- TABLE 188 NICE: COMPANY OVERVIEW

- TABLE 189 NICE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 NICE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 191 NICE: DEALS

- TABLE 192 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 193 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 NEC CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 195 NEC CORPORATION: DEALS

- TABLE 196 HEXAGON: COMPANY OVERVIEW

- TABLE 197 HEXAGON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 HEXAGON: DEALS

- TABLE 199 PALANTIR: COMPANY OVERVIEW

- TABLE 200 PALANTIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 PALANTIR: DEALS

- TABLE 202 PALANTIR: OTHER DEALS/DEVELOPMENTS

- TABLE 203 IBM: COMPANY OVERVIEW

- TABLE 204 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 206 IBM: DEALS

- TABLE 207 NUANCE COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 208 NUANCE COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 NUANCE COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 ESRI: COMPANY OVERVIEW

- TABLE 211 1.2.4 ESRI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 ESRI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 213 ESRI: DEALS

- TABLE 214 GENETEC: COMPANY OVERVIEW

- TABLE 215 GENETEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 GENETEC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 217 GENETEC: DEALS

- TABLE 218 MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2020-2023 (USD MILLION)

- TABLE 219 MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 220 MOBILE VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2020-2023 (USD MILLION)

- TABLE 221 MOBILE VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 LAW ENFORCEMENT SOFTWARE MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 LAW ENFORCEMENT SOFTWARE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 LAW ENFORCEMENT SOFTWARE MARKET: RESEARCH FLOW

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 LAW ENFORCEMENT SOFTWARE MARKET: DEMAND-SIDE APPROACH

- FIGURE 10 GLOBAL LAW ENFORCEMENT SOFTWARE MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 11 FASTEST-GROWING SEGMENTS IN LAW ENFORCEMENT SOFTWARE MARKET, 2025-2030

- FIGURE 12 LAW ENFORCEMENT SOFTWARE MARKET: REGIONAL SNAPSHOT

- FIGURE 13 RISING PUBLIC SAFETY NEEDS, REGULATORY MANDATES, AND DEMAND FOR OPERATIONAL EFFICIENCY ARE DRIVING LAW ENFORCEMENT SOFTWARE MARKET

- FIGURE 14 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 DIGITAL EVIDENCE MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 IMPLEMENTATION & INTEGRATION TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 POLICE DEPARTMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 20 LAW ENFORCEMENT SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 LAW ENFORCEMENT SOFTWARE MARKET ECOSYSTEM

- FIGURE 22 LAW ENFORCEMENT SOFTWARE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE, BY REGION, 2025

- FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2014-2024

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: LAW ENFORCEMENT SOFTWARE MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 28 LAW ENFORCEMENT SOFTWARE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 LEADING GLOBAL LAW ENFORCEMENT SOFTWARE MARKET VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUND, 2025

- FIGURE 30 IMPACT OF GEN AI ON LAW ENFORCEMENT SOFTWARE MARKET

- FIGURE 31 SOLUTIONS SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- FIGURE 32 CLOUD SUBSEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 33 POLICE DEPARTMENTS SUBSEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 37 LAW ENFORCEMENT SOFTWARE: MARKET SHARE ANALYSIS, 2024

- FIGURE 38 LAW ENFORCEMENT SOFTWARE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 39 LAW ENFORCEMENT SOFTWARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 LAW ENFORCEMENT SOFTWARE MARKET: BRAND/PRODUCT COMPARISON, BY SOLUTIONS

- FIGURE 41 LAW ENFORCEMENT SOFTWARE MARKET: COMPANY FOOTPRINT

- FIGURE 42 LAW ENFORCEMENT SOFTWARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 COMPANY VALUATION OF KEY VENDORS

- FIGURE 44 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 46 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 47 AXON: COMPANY SNAPSHOT

- FIGURE 48 NICE: COMPANY SNAPSHOT

- FIGURE 49 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 HEXAGON: COMPANY SNAPSHOT

- FIGURE 51 PALANTIR: COMPANY SNAPSHOT

- FIGURE 52 IBM: COMPANY SNAPSHOT