PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1798380

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1798380

Applicant Tracking System Market by Offering, Functionality - Global Forecast to 2030

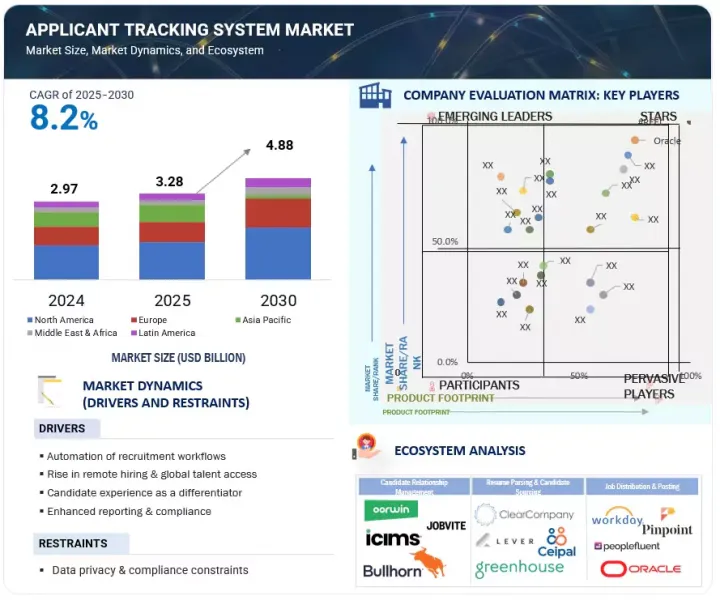

The applicant tracking system (ATS) market is anticipated to rise from about USD 3.28 billion in 2025 to USD 4.88 billion by 2030, at a CAGR of 8.2% during the forecast period. High implementation and maintenance costs remain a significant barrier to adopting applicant tracking systems, particularly for small and medium-sized enterprises (SMEs). Setting up an ATS often requires substantial upfront investment in software licensing, infrastructure, customization, and employee training.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Offering, Functionality, Deployment Type, Organization Size, and Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Additionally, organizations must allocate resources for ongoing maintenance, including periodic software updates, technical support, and system optimization to ensure smooth functionality. These costs can strain the budgets of SMEs that operate with limited financial flexibility. Furthermore, hiring IT specialists or consultants for integration and troubleshooting can add to the overall expense. As a result, many smaller companies hesitate to adopt or upgrade their ATS platforms, limiting the market's penetration across cost-sensitive segments.

Based on service, the support & maintenance segment is expected to register the highest CAGR during the forecast period.

The support & maintenance segment is gaining momentum due to the growing need for continuous system optimization, seamless integration, and compliance management in recruitment workflows. As organizations increasingly rely on ATS platforms, they require ongoing technical assistance to ensure smooth operations, reduce downtime, and keep pace with evolving HR technologies. Vendors are enhancing their service offerings with 24/7 support, regular system updates, performance monitoring, and customized service-level agreements (SLAs). These services help businesses maintain peak system performance, especially as ATS solutions incorporate advanced features like AI-driven analytics and automated candidate management. The complexity of modern recruitment processes, coupled with the demand for uninterrupted functionality, drives enterprises, particularly those with large-scale hiring, to invest more in robust support and maintenance services, fueling strong growth in this segment.

Based on organization size, the large enterprises segment is expected to lead the market during the forecast period.

The large enterprises segment is projected to lead the ATS market, driven by the scale and complexity of their hiring needs. These organizations often manage extensive recruitment operations across multiple regions and departments, requiring robust, scalable, and feature-rich ATS platforms to streamline talent acquisition processes. The need to automate workflows, standardize recruitment procedures, and maintain regulatory compliance further accelerates adoption among large enterprises. Equipped with larger IT budgets, these organizations are more likely to invest in advanced ATS capabilities, including AI-powered candidate sourcing, predictive analytics, and seamless integration with enterprise HR ecosystems. Moreover, ATS is a critical tool in their recruitment strategies and focuses on building a strong employer brand, delivering superior candidate experience, and making data-informed hiring decisions. As a result, large enterprises continue to drive significant demand for ATS solutions, reinforcing their dominance in the overall market landscape.

Based on region, the Asia Pacific region is expected to witness the highest CAGR during the forecast period.

The Asia Pacific (APAC) region is expected to grow at the highest rate in the ATS market due to increasing digitization of HR functions, particularly across emerging economies like Malaysia, India, and Vietnam. Countries in the region are embracing ATS to streamline recruitment, address local talent shortages, and improve hiring efficiency. For instance, in December 2024, MokaHR, an AI-powered recruitment company, highlights that 78% of Malaysian companies reported better-quality hires after implementing ATS, with a Kuala Lumpur-based tech firm reducing its time-to-hire by 35% through automation and centralized candidate data. This trend is reinforced by the region's mobile-first workforce, growing demand for multilingual recruitment tools, and rising awareness around labor law compliance challenges that ATS platforms are uniquely positioned to solve. As digital transformation accelerates, especially among SMEs and startups, more organizations in APAC are adopting ATS to enhance candidate experience, leverage hiring analytics, and secure talent faster in competitive job markets, positioning the region for strong and sustained growth.

Breakdown of Primaries

Chief executive officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant applicant tracking system market companies were interviewed.

- By Company: Tier I: 32%, Tier II: 49%, and Tier III: 19%

- By Designation: C-Level Executives: 33%, Director Level: 22%, and Others: 45%

- By Region: North America: 40%, Europe: 20%, Asia Pacific: 35%, Rest of World: 5%

Some of the significant applicant tracking system market vendors are Oracle (US), iCIMS (US), SAP (Germany), Workday, Inc. (US), Bullhorn (US), Greenhouse Software (US), Smartrecruiters (US), UKG Inc. (US), ADP (US), and Jobvite (US).

Research Coverage:

The market report covered the applicant tracking market across segments. The market size and growth potential for many segments were estimated based on offering, functionality, deployment type, organization size, vertical, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to Buy this Report:

With the most accurate revenue estimates for the entire ATS market and its subsegments, this research will benefit established market leaders and recent entrants. Stakeholders will gain deeper insights into the competitive landscape, enabling them to position their offerings better and develop effective go-to-market strategies. The report highlights key market drivers, restraints, opportunities, and challenges, helping industry players understand the dynamics of the ATS ecosystem and align their strategy with evolving market demands.

The report provides insights into the following pointers:

Analysis of key drivers (Automation of Recruitment Workflows Accelerates ATS adoption, Rise in Remote Hiring & Global Talent Access, Candidate Experience as a Differentiator, Enhanced Reporting & Compliance), restraints (Data Privacy & Compliance Constraints), opportunities (Global Gig-Hiring Modules Unlocking Regional & Emerging Market Growth, Cloud-Native Architectures enabling Scalable Global ATS Deployment, Increasing Penetration of Social Media and the Internet, Emergence of Data Analytics in Recruitment), and challenges (Feature-sprawl Commoditization in a Crowded Field, Implementing ATS Solutions in Existing Infrastructure) influencing the growth of the applicant tracking system market.

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the applicant tracking system market.

- Market Development: In-depth details regarding profitable markets: the paper examines the global applicant tracking system market.

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new software and services, and the applicant tracking system market.

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and service portfolios of the top competitors in the applicant tracking system industry, such as Oracle (US), iCIMS (US), SAP (Germany), Workday, Inc. (US), Bullhorn (US), Greenhouse Software (US), Smartrecruiters (US), UKG Inc. (US), ADP (US), Jobvite (US), Peoplefluent (US), Paychex Inc. (US), Cornerstone (US), Clearcompany (US), BambooHR (US), Infor (US), Zoho Corporation (India), JazzHR (US), Ceipal (US), BreezyHR (US), Lever (US), Oorwin (US), Skeeled (Luxembourg), Manatal (Thailand), Hirelogy (US), and Pinpoint (UK).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN APPLICANT TRACKING SYSTEM MARKET

- 4.2 APPLICANT TRACKING SYSTEM MARKET, BY OFFERING, 2025 VS. 2030

- 4.3 APPLICANT TRACKING SYSTEM MARKET, BY APPLICATIONS, 2025 VS. 2030

- 4.4 APPLICANT TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025 VS. 2030

- 4.5 APPLICANT TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2025 VS. 2030

- 4.6 APPLICANT TRACKING SYSTEM MARKET, BY VERTICAL, 2025 VS. 2030

- 4.7 APPLICANT TRACKING SYSTEM MARKET: REGIONAL SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

Unpacking the Forces Shaping (Applicant Tracking System) Adoption & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Automation of Recruitment Workflows Accelerates ATS Adoption

- 5.2.1.2 Rise in Remote Hiring & Global Talent Access

- 5.2.1.3 Candidate Experience as Differentiator

- 5.2.1.4 Enhanced Reporting & Compliance

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data Privacy and Compliance Constraints

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Global Gig-hiring Modules Unlock Regional and Emerging Market Growth

- 5.2.3.2 Cloud-native Architectures Enable Scalable, Global ATS Deployment

- 5.2.3.3 Increasing Penetration of Social Media & Internet

- 5.2.3.4 Emergence of Data Analytics in Recruitment

- 5.2.4 CHALLENGES

- 5.2.4.1 Feature-sprawl Commoditization in Crowded Field

- 5.2.4.2 Implementing ATS Solutions in Existing Infrastructure

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: GROWING HVAC PARTNERED WITH BULLHORN TO INCREASE TRANSPARENCY ACROSS THEIR BUSINESS

- 5.3.2 CASE STUDY 2: WISTIA ACHIEVED SCALABLE HR SUCCESS WITH COMPREHENSIVE HUMAN RESOURCE INFORMATION SYSTEM

- 5.3.3 CASE STUDY 3: SHORTLIST RECRUITMENT DROVE GLOBAL EFFICIENCY WITH ZOHO'S CLOUD-BASED ATS PLATFORM

- 5.3.4 CASE STUDY 4: MANPOWER MALTA BOOSTED RECRUITMENT EFFICIENCY AND CANDIDATE QUALITY WITH MANATAL'S ATS PLATFORM

- 5.3.5 CASE STUDY 5: CEIPAL ENABLED MANAGED STAFFING TO INCREASE SUBMISSIONS AND REDUCE COSTS DURING COVID-19

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION

- 5.6.2 INDICATIVE PRICING OF KEY PLAYERS, BY SOLUTION

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF MAJOR PATENTS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Predictive Hiring Analytics

- 5.8.1.2 AI/ML

- 5.8.1.3 Conversational AI Chatbots

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Learning Systems

- 5.8.2.2 HR Platforms

- 5.8.2.3 Video Meeting Tools

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Talent Intelligence Platform

- 5.8.3.2 Employee Referral Platform

- 5.8.3.3 Candidate Experience Analytics

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS, BY REGION

- 5.9.2.1 North America

- 5.9.2.2 Europe

- 5.9.2.3 Asia Pacific

- 5.9.2.4 Middle East & South Africa

- 5.9.2.5 Latin America

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 INVESTMENT & FUNDING SCENARIO

- 5.15 IMPACT OF AI/GEN AI ON APPLICANT TRACKING SYSTEM MARKET

- 5.15.1 VENDOR INITIATIVE

- 5.15.1.1 ClearCompany

- 5.15.1.2 Greenhouse Software

- 5.15.2 CASE STUDY

- 5.15.2.1 Use Case 1: NFL dominates high-volume hiring, cuts time-to-fill by 24% with Greenhouse AI-powered features

- 5.15.2.2 Use Case 2: Glow Networks leverages ClearCompany's AI-enabled ATS to scale tech hiring post-acquisition

- 5.15.1 VENDOR INITIATIVE

- 5.16 APPLICANT TRACKING SYSTEM, BY PRODUCT TYPE

- 5.16.1 STANDALONE ATS SOFTWARE

- 5.16.2 INTEGRATED ATS SOFTWARE

- 5.16.3 MOBILE APPLICATIONS

- 5.17 APPLICANT TRACKING SYSTEM, BY END USER

- 5.17.1 HR RECRUITERS

- 5.17.2 STAFFING AGENCIES

- 5.17.3 JOB SEEKERS

6 APPLICANT TRACKING SYSTEM MARKET, BY OFFERING (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.3 SERVICES

- 6.3.1 IMPLEMENTATION & INTEGRATION

- 6.3.1.1 Implementing ATS for efficient recruitment

- 6.3.2 TRAINING & CONSULTING

- 6.3.2.1 Maximizing ATS value with training & consulting

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Support services to resolve recruitment disruptions

- 6.3.1 IMPLEMENTATION & INTEGRATION

7 APPLICANT TRACKING SYSTEM MARKET, BY APPLICATIONS (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 7.1 INTRODUCTION

- 7.1.1 APPLICATIONS: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 7.2 JOB DISTRIBUTION & POSTING

- 7.2.1 AUTOMATING MULTI-CHANNEL JOB DISTRIBUTION

- 7.2.2 JOB CREATION & POSTING

- 7.2.3 JOB-SPECIFIC SHORTLISTING

- 7.2.4 MULTI-CHANNEL JOB BOARD POSTING

- 7.3 RESUME PARSING & CANDIDATE SOURCING

- 7.3.1 IMPROVING CANDIDATE PROFILES THROUGH ENRICHMENT & SCORING

- 7.3.2 RESUME ENRICHMENT & SCORING

- 7.3.3 RESUME OVERLAP RESOLUTION

- 7.3.4 SKILL EXTRACTION AND STANDARDIZATION

- 7.4 INTERVIEW MANAGEMENT

- 7.4.1 STREAMLINING INTERVIEW MANAGEMENT WITH ATS

- 7.4.2 INTERVIEW SCHEDULING & FEEDBACK

- 7.4.3 VIRTUAL MEETING INTEGRATION

- 7.4.4 MULTI-STAGE INTERVIEW COORDINATION

- 7.5 CANDIDATE RELATIONSHIP MANAGEMENT (CRM)

- 7.5.1 TRANSFORMING RECRUITMENT PROACTIVELY

- 7.5.2 TALENT POOLING

- 7.5.3 CANDIDATE ENGAGEMENT

- 7.5.4 CAREER SITE PERSONALIZATION

- 7.6 REPORTING & ANALYTICS

- 7.6.1 ENHANCING HIRING PERFORMANCE WITH ANALYTICS

- 7.6.2 PERFORMANCE TRACKING

- 7.6.3 TIME-TO-HIRE ANALYSIS

- 7.6.4 COMPLIANCE REPORTING

- 7.7 OTHERS

8 APPLICANT TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT TYPES: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 8.2 ON-PREMISES

- 8.2.1 ON-PREMISES ATS FOR SECURE & REGULATED ENVIRONMENT

- 8.3 CLOUD

- 8.3.1 CLOUD ATS FOR REMOTE AND DISTRIBUTED TEAMS

9 APPLICANT TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZES: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 9.2 LARGE ENTERPRISES

- 9.2.1 STREAMLINING MULTI-LOCATION HIRING FOR LARGE ENTERPRISES WITH ADVANCED ATS

- 9.3 MID-SIZED ENTERPRISES

- 9.3.1 EMPOWERING MEDIUM ENTERPRISES WITH RECRUITMENT AUTOMATION

- 9.4 SMALL ENTERPRISES

- 9.4.1 ENHANCED RECRUITMENT IN SMALL ENTERPRISES WITH ATS

10 APPLICANT TRACKING SYSTEM MARKET, BY VERTICAL (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 10.1 INTRODUCTION

- 10.1.1 VERTICALS: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 10.2 IT & TELECOM

- 10.2.1 ENHANCING TECH HIRING UTILIZING ATS

- 10.2.2 IT & TELECOM: USE CASES

- 10.2.2.1 Skill-based candidate matching

- 10.2.2.2 Remote & global hiring

- 10.2.2.3 Employee referral management

- 10.3 RETAIL & CONSUMER GOODS

- 10.3.1 OPTIMIZING RECRUITMENT ACROSS MULTI-LOCATION RETAIL CHAIN

- 10.3.2 RETAIL & CONSUMER GOODS: USE CASES

- 10.3.2.1 Automated interview scheduling

- 10.3.2.2 Seasonal & temporary recruitment

- 10.3.2.3 Multi-location hiring management

- 10.4 BFSI

- 10.4.1 ENHANCING RISK-FREE TALENT ACQUISITION IN BANKING

- 10.4.2 BFSI: USE CASES

- 10.4.2.1 Regulatory-compliant hiring

- 10.4.2.2 Secure candidate management

- 10.4.2.3 Campus hiring for graduates

- 10.5 HEALTHCARE & LIFE SCIENCES

- 10.5.1 SCALABLE RECRUITMENT WITH ATS IN HEALTHCARE FACILITIES

- 10.5.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 10.5.2.1 Scheduling across departments & shifts

- 10.5.2.2 Credential and license verification

- 10.5.2.3 Emergency & surge hiring

- 10.6 MANUFACTURING

- 10.6.1 REDUCING DOWNTIME WITH FASTER PLANT-LEVEL HIRING WITH ATS

- 10.6.2 MANUFACTURING: USE CASES

- 10.6.2.1 High-volume recruitment for production surges

- 10.6.2.2 Apprenticeship & trainee hiring

- 10.6.2.3 Multi-plant recruitment

- 10.7 TRANSPORTATION & LOGISTICS

- 10.7.1 SPEEDING UP FLEET HIRING THROUGH ATS AUTOMATION

- 10.7.2 TRANSPORTATION & LOGISTICS: USE CASES

- 10.7.2.1 Shift and route-based hiring

- 10.7.2.2 Fleet-specific talent pool

- 10.7.2.3 Mobile-friendly applications

- 10.8 GOVERNMENT & DEFENSE

- 10.8.1 ENSURING FAIR & TRANSPARENT HIRING FOR GOVERNMENT JOBS WITH ATS

- 10.8.2 GOVERNMENT & DEFENSE: USE CASES

- 10.8.2.1 Security clearance workflow integration

- 10.8.2.2 Classified position candidate handling

- 10.8.2.3 Public job boarding & internal posting

- 10.9 EDUCATION

- 10.9.1 AUTOMATING CREDENTIAL VERIFICATION IN ACADEMIC HIRING

- 10.9.2 EDUCATION: USE CASES

- 10.9.2.1 Calander-based hiring cycle planning

- 10.9.2.2 Diversity & equal opportunity compliance

- 10.9.2.3 Multi-stakeholder hiring

- 10.10 ENERGY & UTILITIES

- 10.10.1 IMPROVING FIELD TECHNICIAN SOURCING WITH ATS

- 10.10.2 ENERGY & UTILITIES: USE CASES

- 10.10.2.1 Remote & rural site recruitment

- 10.10.2.2 Union & contractual hiring

- 10.10.2.3 Workforce readiness for grid modernization

- 10.11 OTHERS

11 APPLICANT TRACKING SYSTEM MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 NORTH AMERICA: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 11.2.3 US

- 11.2.3.1 AI-native, automation-first ATS platforms to redefine enterprise hiring infrastructure across US through integrated, experience-led recruiting solutions

- 11.2.4 CANADA

- 11.2.4.1 Localized innovation and bilingual automation to drive ATS adoption and ecosystem integration across Canada's regionally diverse hiring landscape

- 11.3 EUROPE

- 11.3.1 EUROPE: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Strong platform partnerships and digital hiring upgrades to expand ATS investment opportunities across UK

- 11.3.4 GERMANY

- 11.3.4.1 Germany's demand for automation and compliance to reshape ATS investment priorities for enterprise vendors

- 11.3.5 FRANCE

- 11.3.5.1 Capitalizing on France's ATS momentum by targeting enterprise-grade digitalization and compliance-focused deployment

- 11.3.6 ITALY

- 11.3.6.1 Capture Italy's ATS momentum by targeting mobile-first workflows and job-board integration

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 AI-powered automation and regulatory alignment to reshape ATS adoption across China's high-volume recruitment market

- 11.4.4 JAPAN

- 11.4.4.1 AI-driven automation and compliance-focused hiring to reshape Japan's ATS landscape

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 NZ police to modernize HR and payroll with cloud-based ATS solutions

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GULF COOPERATION COUNCIL (GCC)

- 11.5.3.1 UAE

- 11.5.3.1.1 UAE accelerates ATS adoption through policy-driven hiring and AI-enabled recruitment systems

- 11.5.3.2 Saudi Arabia

- 11.5.3.2.1 Saudi Arabia advances digital hiring with AI matching and blockchain-based verification across enterprise recruitment systems

- 11.5.3.3 Rest of Gulf Cooperation Council (GCC) Countries

- 11.5.3.1 UAE

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 South African enterprises accelerate ATS adoption to reduce hiring delays and enhance candidate experience through automation and mobile-first solutions

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: APPLICANT TRACKING SYSTEM MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Brazilian enterprises to align ATS investments with AI automation and enterprise system integration to streamline recruitment and boost compliance

- 11.6.4 MEXICO

- 11.6.4.1 Mexico advances hyperscale growth with high-density cooling and multi-campus expansion

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS

- 12.5 PRODUCT/BRAND COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Regional footprint

- 12.6.5.3 Offering footprint

- 12.6.5.4 Application footprint

- 12.6.5.5 Deployment type footprint

- 12.6.5.6 Organization size footprint

- 12.6.5.7 Vertical footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.8.1 COMPANY VALUATION

- 12.8.2 FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- 13.2.1 ORACLE

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 ICIMS

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 SAP

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 WORKDAY, INC.

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 BULLHORN

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 GREENHOUSE SOFTWARE

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.7 SMARTRECRUITERS

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.8 UKG INC.

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.9 ADP

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.10 JOBVITE

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.1 ORACLE

- 13.3 OTHER PLAYERS

- 13.3.1 PEOPLEFLUENT

- 13.3.2 PAYCHEX INC.

- 13.3.3 CORNERSTONE

- 13.3.4 CLEARCOMPANY

- 13.3.5 BAMBOOHR

- 13.3.6 INFOR

- 13.3.7 ZOHO CORPORATION

- 13.3.8 JAZZHR

- 13.3.9 CEIPAL

- 13.3.10 BREEZYHR

- 13.3.11 LEVER

- 13.3.12 OORWIN

- 13.3.13 SKEELED

- 13.3.14 MANATAL

- 13.3.15 HIRELOGY

- 13.3.16 PINPOINT

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 HUMAN CAPITAL MANAGEMENT MARKET

- 14.3 VISITOR MANAGEMENT SYSTEM MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 APPLICANT TRACKING SYSTEM MARKET SIZE AND GROWTH, 2020-2024 (USD MILLION, YOY GROWTH %)

- TABLE 4 APPLICANT TRACKING SYSTEM MARKET SIZE AND GROWTH, 2025-2030 (USD MILLION, YOY GROWTH %)

- TABLE 5 INDICATIVE PRICING OF KEY PLAYERS, BY SOLUTION, 2024

- TABLE 6 LIST OF MAJOR PATENTS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 APPLICANT TRACKING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 APPLICANT TRACKING SYSTEM MARKET: KEY CONFERENCES AND EVENTS IN 2025-2026

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VERTICALS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 15 APPLICANT TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 16 APPLICANT TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 17 SOLUTIONS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 18 SOLUTIONS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19 APPLICANT TRACKING SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 20 APPLICANT TRACKING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 21 SERVICES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 22 SERVICES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 IMPLEMENTATION & INTEGRATION: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 IMPLEMENTATION & INTEGRATION: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 TRAINING & CONSULTING: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 TRAINING & CONSULTING: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 SUPPORT & MAINTENANCE: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 SUPPORT & MAINTENANCE: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 APPLICANT TRACKING SYSTEM MARKET, BY APPLICATIONS, 2020-2024 (USD MILLION)

- TABLE 30 APPLICANT TRACKING SYSTEM MARKET, BY APPLICATIONS, 2025-2030 (USD MILLION)

- TABLE 31 JOB DISTRIBUTION & POSTING: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 JOB DISTRIBUTION & POSTING: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 RESUME PARSING & CANDIDATE SOURCING: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 RESUME PARSING & CANDIDATE SOURCING: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 INTERVIEW MANAGEMENT: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 INTERVIEW MANAGEMENT: APPLICANT TRACKING SYSTEM, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 CANDIDATE RELATIONSHIP MANAGEMENT (CRM): APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 CANDIDATE RELATIONSHIP MANAGEMENT (CRM): APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 REPORTING & ANALYTICS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 REPORTING & ANALYTICS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER APPLICATIONS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 APPLICANT TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 44 APPLICANT TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 45 ON-PREMISES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 ON-PREMISES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CLOUD: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 CLOUD: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 APPLICANT TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 50 APPLICANT TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 51 LARGE ENTERPRISES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 LARGE ENTERPRISES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 MID-SIZED ENTERPRISES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 MID-SIZED ENTERPRISES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 SMALL ENTERPRISES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 SMALL ENTERPRISES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 APPLICANT TRACKING SYSTEM MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 58 APPLICANT TRACKING SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 59 IT & TELECOM: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 IT & TELECOM: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 RETAIL & CONSUMER GOODS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 RETAIL & CONSUMER GOODS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 BFSI: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 BFSI: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 HEALTHCARE & LIFE SCIENCES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 HEALTHCARE & LIFE SCIENCES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 MANUFACTURING: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 MANUFACTURING: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 TRANSPORTATION & LOGISTICS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 TRANSPORTATION & LOGISTICS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 GOVERNMENT & DEFENSE: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 GOVERNMENT & DEFENSE: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 EDUCATION: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 EDUCATION: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 ENERGY & UTILITIES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 ENERGY & UTILITIES: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 OTHER VERTICALS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 OTHER VERTICALS: APPLICANT TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 APPLICATION TRACKING SYSTEM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 APPLICATION TRACKING SYSTEM MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 88 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 90 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 US: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 96 US: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 97 CANADA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 98 CANADA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 100 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 102 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 104 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 106 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 108 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 110 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 112 EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 113 UK: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 114 UK: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 115 GERMANY: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 116 GERMANY: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 117 FRANCE: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 118 FRANCE: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 119 ITALY: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 120 ITALY: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 122 REST OF EUROPE: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 CHINA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 138 CHINA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 139 JAPAN: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 140 JAPAN: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 141 AUSTRALIA & NEW ZEALAND: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 142 AUSTRALIA & NEW ZEALAND: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 144 REST OF ASIA PACIFIC: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 159 GCC: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 160 GCC: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 GCC: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 162 GCC: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 163 UAE: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 164 UAE: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 165 SAUDI ARABIA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 166 SAUDI ARABIA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 167 REST OF GCC: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 168 REST OF GCC: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 169 SOUTH AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 170 SOUTH AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 174 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 175 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 176 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 177 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 178 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 179 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 180 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 181 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD MILLION)

- TABLE 182 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 183 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 184 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 185 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 186 LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 BRAZIL: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 188 BRAZIL: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 189 MEXICO: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 190 MEXICO: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: APPLICATION TRACKING SYSTEM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 193 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN APPLICANT TRACKING SYSTEM MARKET, 2023-2025

- TABLE 194 APPLICANT TRACKING SYSTEM MARKET: DEGREE OF COMPETITION, 2024

- TABLE 195 APPLICANT TRACKING SYSTEM MARKET: REGIONAL FOOTPRINT

- TABLE 196 APPLICANT TRACKING SYSTEM MARKET: OFFERING FOOTPRINT

- TABLE 197 APPLICANT TRACKING SYSTEM MARKET: APPLICATION FOOTPRINT

- TABLE 198 APPLICANT TRACKING SYSTEM MARKET: DEPLOYMENT TYPE FOOTPRINT

- TABLE 199 APPLICANT TRACKING SYSTEM MARKET: ORGANIZATION SIZE FOOTPRINT

- TABLE 200 APPLICANT TRACKING SYSTEM MARKET: VERTICAL FOOTPRINT

- TABLE 201 APPLICANT TRACKING SYSTEM MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 202 APPLICANT TRACKING SYSTEM MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 203 APPLICANT TRACKING SYSTEM MARKET: PRODUCT LAUNCHES, MARCH 2024-JULY 2025

- TABLE 204 APPLICANT TRACKING SYSTEM MARKET: DEALS, FEBRUARY 2023-JULY 2025

- TABLE 205 APPLICANT TRACKING SYSTEM MARKET: EXPANSIONS, FEBRUARY 2024

- TABLE 206 ORACLE: COMPANY OVERVIEW

- TABLE 207 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 ORACLE: PRODUCT LAUNCHES

- TABLE 209 ORACLE: DEALS

- TABLE 210 ICIMS: COMPANY OVERVIEW

- TABLE 211 ICIMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 ICIMS: PRODUCT LAUNCHES

- TABLE 213 ICIMS: DEALS

- TABLE 214 SAP: COMPANY OVERVIEW

- TABLE 215 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 SAP: PRODUCT LAUNCHES

- TABLE 217 SAP: DEALS

- TABLE 218 WORKDAY, INC.: COMPANY OVERVIEW

- TABLE 219 WORKDAY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 WORKDAY, INC.: PRODUCT LAUNCHES

- TABLE 221 WORKDAY, INC.: DEALS

- TABLE 222 BULLHORN: COMPANY OVERVIEW

- TABLE 223 BULLHORN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 BULLHORN: PRODUCT LAUNCHES

- TABLE 225 BULLHORN: DEALS

- TABLE 226 GREENHOUSE SOFTWARE: COMPANY OVERVIEW

- TABLE 227 GREENHOUSE SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 GREENHOUSE SOFTWARE: PRODUCT LAUNCHES

- TABLE 229 GREENHOUSE SOFTWARE: DEALS

- TABLE 230 SMARTRECRUITERS: COMPANY OVERVIEW

- TABLE 231 SMARTRECRUITERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 SMARTRECRUITERS: PRODUCT LAUNCHES

- TABLE 233 SMARTRECRUITERS: DEALS

- TABLE 234 UKG INC.: COMPANY OVERVIEW

- TABLE 235 UKG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 UKG INC.: PRODUCT LAUNCHES

- TABLE 237 UKG INC.: DEALS

- TABLE 238 UKG INC.: EXPANSIONS, FEBRUARY 2024 - FEBRUARY 2024

- TABLE 239 ADP: COMPANY OVERVIEW

- TABLE 240 ADP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 ADP: PRODUCT LAUNCHES

- TABLE 242 ADP: DEALS

- TABLE 243 JOBVITE: COMPANY OVERVIEW

- TABLE 244 JOBVITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 HUMAN CAPITAL MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 246 HUMAN CAPITAL MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 247 VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 248 VISITOR MANAGEMENT SYSTEM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 APPLICANT TRACKING SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 APPLICANT TRACKING SYSTEM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 APPLICANT TRACKING MARKET: RESEARCH FLOW

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 APPLICANT TRACKING SYSTEM MARKET: DEMAND-SIDE APPROACH

- FIGURE 10 GLOBAL APPLICANT TRACKING SYSTEM MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 11 FASTEST-GROWING SEGMENTS IN APPLICANT TRACKING SYSTEM MARKET, 2025-2030

- FIGURE 12 APPLICANT TRACKING SYSTEM MARKET: REGIONAL SNAPSHOT

- FIGURE 13 RISING DEMAND FOR SCALABLE, LOW-MAINTENANCE ATS SOLUTIONS AMONG SMES AND LARGE ENTERPRISES ADOPTING REMOTE WORK MODELS

- FIGURE 14 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 JOB DISTRIBUTION & POSTING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: APPLICANT TRACKING SYSTEM MARKET

- FIGURE 21 APPLICANT TRACKING SYSTEM MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 APPLICANT TRACKING SYSTEM MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE, BY REGION (2024)

- FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2015-2025

- FIGURE 25 APPLICANT TRACKING SYSTEM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 APPLICANT TRACKING SYSTEM MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VERTICALS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 29 APPLICANT TRACKING SYSTEM VENDORS, BY TOTAL FUNDING VALUE AND NUMBER OF FUNDING ROUNDS, 2024

- FIGURE 30 SOLUTIONS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 31 JOB DISTRIBUTION & POSTING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 32 CLOUD SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 33 LARGE ENTERPRISES SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 34 BFSI SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 38 APPLICANT TRACKING SYSTEM MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 39 APPLICANT TRACKING SYSTEM: MARKET SHARE ANALYSIS, 2024

- FIGURE 40 APPLICANT TRACKING SYSTEM MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 41 APPLICANT TRACKING SYSTEM MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 42 APPLICANT TRACKING SYSTEM MARKET: COMPANY FOOTPRINT

- FIGURE 43 APPLICANT TRACKING SYSTEM MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 44 COMPANY VALUATION OF KEY VENDORS

- FIGURE 45 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 46 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 47 ORACLE: COMPANY SNAPSHOT

- FIGURE 48 SAP: COMPANY SNAPSHOT

- FIGURE 49 WORKDAY, INC.: COMPANY SNAPSHOT

- FIGURE 50 ADP: COMPANY SNAPSHOT