PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1798382

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1798382

Nuclear Medicine Equipment Market by Product (Imaging: PET, SPECT, Gamma; GM Counter, Dose Calibrator), Software (Image Management, PACS, Treatment, Analytic, Workflow), Therapy (Onco, Cardio, Neuro, Ortho), End User & Region - Global Forecasts to 2030

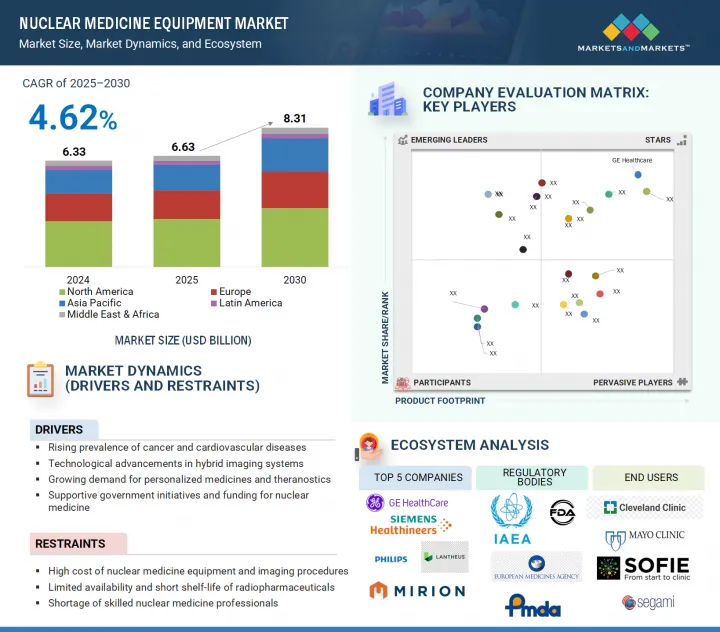

The nuclear medicine equipment market was valued at USD 6.63 billion in 2025 and is estimated to reach USD 8.31 billion by 2030, registering a CAGR of 4.62% during the forecast period. The growing prevalence of chronic diseases such as cancer and cardiovascular disorders, as well as the rising demand for early and accurate diagnostic imaging, are driving market growth in nuclear medicine equipment.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Therapeutic Area, Dimension, End User, Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

Furthermore, increased awareness of personalized medicine, expanded applications of radiotheranostics, supportive government initiatives, and improved access to radiopharmaceuticals are all contributing to market growth. Technological innovations, such as AI integration and mobile/remote access, will improve diagnostic efficiency and create significant opportunities for market players.

The 3D segment dominated the nuclear medicine equipment market, by dimension, in 2024.

Based on dimension, the 3D segment is expected to hold the largest share of the nuclear medicine equipment market in 2024. This is due to the superior imaging capabilities of 3D systems, which provide higher spatial resolution, greater anatomical detail, and more accurate localization of lesions than 2D imaging. These benefits are especially useful in oncology, cardiology, and neurology, where accurate visualization is essential for diagnosis, staging, and treatment planning. The growing adoption of advanced modalities such as PET/CT and SPECT/CT, which provide 3D imaging by default, combined with rising demand for quantitative imaging and personalized treatment approaches, contributes to the 3D segment's dominance.

The North American market accounted for the largest share in the nuclear medicine equipment market in 2024.

The North American market dominated the nuclear medicine equipment market in 2024. This dominance is accelerated by various factors such as advanced healthcare infrastructure and the widespread use of nuclear medicine procedures. The US National Academies (NCBI) report that nearly 20 million nuclear medicine procedures using radiopharmaceuticals and imaging instruments are carried out annually in the US alone, with increasing growth in hybrid PET/CT and SPECT/CT systems. Moreover, the rise in chronic diseases, especially cancer, which is predicted to account for over 2 million new cases and 6,12,000 deaths in the US by 2024, makes early and accurate diagnosis technologies even more crucial in North America. The main factors contributing to North America's dominance in the global nuclear medicine equipment market are favorable reimbursement policies, substantial R&D spending by both the public and private sectors, and the presence of major industry players such as GE Healthcare, Siemens Healthineers, and Cardinal Health.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the nuclear medicine equipment marketplace.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1 (41%), Tier 2 (31%), and Tier 3 (28%)

- By Designation - C-level (44%), Directors (31%), and Others (25%)

- By Region - North America (45%), Europe (28%), Asia Pacific (20%), Latin America (4%), Middle East & Africa (3%)

Key Players in the Nuclear Medicine Equipment Market

Prominent players in the nuclear medicine equipment market include Hermes Medical Solutions (Sweden), DOSIsoft (France), Segami Corporation (US), GE HealthCare (US), Siemens Healthineers AG (Germany), Koninklijke Philips N.V. (Netherlands), Mirion Technologies, Inc. (US), Comecer S.p.A. (Italy), Syntermed (US), UltraSPECT Inc. (US), LabLogic Systems Ltd. (UK), Mediso Ltd. (Hungary), CANON MEDICAL SYSTEMS CORPORATION (Japan), Catalyst Medtech (US), Lemer Pax (France), Spectrum Dynamics Medical (US), Neusoft Medical Systems Co., Ltd. (China), Brainlab AG(Germany), Mirada Medical(UK), Trasis (Belgium), SOFIE (US), ITM Isotope Technologies Munich SE (Germany), Positrigo AG (Switzerland), PAIRE (France).

Players adopted organic as well as inorganic growth strategies such as product launches and enhancements, and investments, partnerships, collaborations, joint ventures, funding, acquisition, expansions, agreements, contracts, and alliances to increase their offerings, cater to the unmet needs of customers, increase their profitability, and expand their presence in the global market.

The study includes an in-depth competitive analysis of these key players in the nuclear medicine equipment market, with their company profiles, recent developments, and key market strategies.

Research Coverage

- The report studies the nuclear medicine equipment market based on product type, therapeutic area, dimension, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micro-markets with respect to their growth trends, prospects, and contributions to the total nuclear medicine equipment market.

- The report forecasts the revenue of market segments with respect to five major regions.

Reasons to Buy the Report

The report can help established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the following five strategies.

This report provides insights into the following pointers:

- Analysis of key drivers (rising prevalence of cancer and cardiovascular diseases, technological advancements in hybrid imaging systems, growing demand for personalized medicines and theranostics), restraints (high cost of nuclear medicine equipment and imaging procedures, limited availability and short shelf-life of radiopharmaceuticals), opportunities (development of novel radiotracers and targeted imaging agents, integration of AI and data analytics in imaging workflows), and challenges (stringent regulatory approval processes for equipment and radiopharmaceuticals, shortage of skilled nuclear medicine professionals, radioactive waste management and safety concerns) influencing the industry macro dynamics of nuclear medicine equipment market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the nuclear medicine equipment market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of nuclear medicine equipment across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the nuclear medicine equipment market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the nuclear medicine equipment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from primary experts

- 2.1.1 SECONDARY RESEARCH

- 2.2 RESEARCH METHODOLOGY

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 MARKET SHARE ESTIMATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF NUCLEAR MEDICINE EQUIPMENT MARKET

- 4.2 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA

- 4.3 GEOGRAPHIC SNAPSHOT OF NUCLEAR MEDICINE EQUIPMENT MARKET

- 4.4 NUCLEAR MEDICINE EQUIPMENT MARKET: REGIONAL MIX

- 4.5 NUCLEAR MEDICINE EQUIPMENT MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid expansion of theranostics

- 5.2.1.2 Technological advancements in hybrid imaging modalities

- 5.2.1.3 Favorable government support and expanding healthcare infrastructure

- 5.2.1.4 Advancements in radiotracers and radiopharmaceuticals

- 5.2.1.5 Integration of AI into nuclear medicine equipment

- 5.2.2 RESTRAINTS

- 5.2.2.1 Capital-intensive nature of equipment

- 5.2.2.2 Short half-life of radiopharmaceuticals

- 5.2.2.3 High maintenance and operational costs

- 5.2.2.4 Shortage of trained personnel

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing preference for personalized and precision medicine

- 5.2.3.2 Telemedicine and cloud-native platforms & mobile/remote imaging capabilities

- 5.2.4 CHALLENGES

- 5.2.4.1 Global isotope supply chain instability

- 5.2.4.2 Cybersecurity and data privacy issues in imaging IT

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 INDUSTRY TRENDS

- 5.4.1 SHIFT TOWARD HYBRID AND MULTI-MODALITY IMAGING SYSTEMS

- 5.4.2 ADVANCEMENTS IN DETECTOR TECHNOLOGIES AND IMAGE QUALITY

- 5.4.3 GROWING DEMAND FOR COMPACT AND VERSATILE SYSTEMS

- 5.4.4 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND AUTOMATION

- 5.4.5 CONNECTIVITY AND CLOUD-ENABLED WORKFLOWS

- 5.5 PRICING ANALYSIS

- 5.5.1 INTRODUCTION

- 5.5.2 INDICATIVE PRICE OF NUCLEAR MEDICINE EQUIPMENT, BY KEY PLAYER

- 5.5.3 INDICATIVE PRICE OF NUCLEAR MEDICINE EQUIPMENT, BY REGION

- 5.5.4 AVERAGE SELLING PRICE OF NUCLEAR CARDIOLOGY REPORTING SOFTWARE

- 5.5.5 PRICING MODELS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Hybrid imaging systems

- 5.9.1.2 Digital detection technology

- 5.9.1.3 Artificial Intelligence (AI) and advanced image reconstruction techniques

- 5.9.1.4 Time-of-Flight (TOF) technology

- 5.9.1.5 Solid-state detector technology

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Radiopharmaceutical development and theranostics

- 5.9.2.2 Advanced computing and big data analytics

- 5.9.2.3 Robotics and automated dose dispensing systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Magnetic Resonance Imaging (MRI) integration

- 5.9.3.2 Computed Tomography (CT) advancements

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 901814

- 5.11.2 EXPORT DATA FOR HS CODE 901814

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 PRECISION IN NUCLEAR MEDICINE WITH NATIONAL STANDARD TRACEABILITY

- 5.13.2 MULTI-MODALITY IMAGE FUSION FOR IMPROVED DIAGNOSTICS

- 5.13.3 REMOTE CONSULTATION WITH CLOUD-BASED NUCLEAR MEDICINE ANALYSIS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF DATA FOR HS CODE 901814

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 REGULATORY ANALYSIS

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 BARGAINING POWER OF SUPPLIERS

- 5.15.2 BARGAINING POWER OF BUYERS

- 5.15.3 THREAT OF NEW ENTRANTS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 END-USER ANALYSIS

- 5.17.1 UNMET NEEDS

- 5.17.2 END-USER EXPECTATIONS

- 5.18 BUSINESS MODEL

- 5.18.1 DIRECT EQUIPMENT SALES MODEL

- 5.18.2 SERVICE AND MAINTENANCE CONTRACTS

- 5.18.3 PAY-PER-SCAN (OR PAY-PER-USE) MODEL

- 5.18.4 EQUIPMENT LEASING AND FINANCING SOLUTIONS

- 5.18.5 INTEGRATED SOLUTIONS AND MANAGED SERVICES

- 5.18.6 SOFTWARE AND DATA ANALYTICS SUBSCRIPTION

- 5.19 IMPACT OF AI/GEN AI

- 5.19.1 INTRODUCTION

- 5.19.2 MARKET POTENTIAL OF AI/GEN AI

- 5.19.3 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION

- 5.19.3.1 AI-based low-dose PET image reconstruction

- 5.19.3.2 Dose-aware diffusion models for 3D low-dose PET

- 5.19.4 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.19.4.1 Medical image analysis software

- 5.19.4.2 Radiology information systems

- 5.19.4.3 Clinical decision support systems

- 5.19.5 USER READINESS AND IMPACT ASSESSMENT

- 5.19.5.1 User readiness

- 5.19.5.1.1 User A: Hospitals

- 5.19.5.1.2 User B: Diagnostic imaging centers

- 5.19.5.2 Impact assessment

- 5.19.5.2.1 User A: Hospitals

- 5.19.5.2.2 User B: Diagnostic imaging centers

- 5.19.5.1 User readiness

- 5.20 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.3.1 Capital equipment (cyclotrons, PET/SPECT systems)

- 5.20.3.2 Gamma cameras

- 5.20.3.3 Key materials: semiconductors, detectors, shielding

- 5.20.3.4 Service parts, maintenance, and global supply chains

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRIES

- 5.20.5.1 Hospitals

- 5.20.5.2 Diagnostic imaging centers

- 5.20.5.3 Cancer treatment centers

- 5.20.5.4 Other end users

- 5.20.6 CONCLUSION

6 NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE

- 6.1 INTRODUCTION

- 6.2 IMAGING MODALITIES

- 6.2.1 PET

- 6.2.1.1 Standalone PET

- 6.2.1.1.1 Increasing demand for cost-efficient, high-throughput oncological imaging to boost market

- 6.2.1.2 Hybrid PET

- 6.2.1.2.1 Ability to provide functional and anatomical information in single scan to aid growth

- 6.2.1.1 Standalone PET

- 6.2.2 SPECT

- 6.2.2.1 Standalone SPECT

- 6.2.2.1.1 Wide use in thyroid studies, renal scans, and bone imaging to encourage growth

- 6.2.2.2 Hybrid SPECT

- 6.2.2.2.1 Need for improved diagnostic accuracy and clinical confidence to propel market

- 6.2.2.1 Standalone SPECT

- 6.2.3 GAMMA/SCINTILLATION CAMERAS

- 6.2.3.1 Clinical versatility and lower cost to expedite growth

- 6.2.1 PET

- 6.3 NON-IMAGING MODALITIES

- 6.3.1 GM COUNTERS

- 6.3.1.1 Ease of use, portability, and critical role in maintaining workplace safety to spur growth

- 6.3.2 DOSE CALIBRATORS

- 6.3.2.1 Increasing development in digital interfaces, automatic isotope recognition, and real-time data logging to bolster growth

- 6.3.3 PROBE COUNTING SYSTEMS

- 6.3.3.1 Technological advancements in probe counting systems to contribute to growth

- 6.3.4 GAMMA WELL COUNTERS

- 6.3.4.1 Growing use of gamma well counters in laboratory-based applications to propel market

- 6.3.5 OTHER NON-IMAGING MODALITIES

- 6.3.1 GM COUNTERS

7 NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA

- 7.1 INTRODUCTION

- 7.2 ONCOLOGY

- 7.2.1 IMPROVEMENTS IN IMAGING ACCURACY AND TREATMENT PLANNING TO STIMULATE GROWTH

- 7.3 NEUROLOGY

- 7.3.1 ESCALATING GLOBAL BURDEN OF NEURODEGENERATIVE DISORDERS AND OTHER NEUROLOGICAL CONDITIONS TO AID GROWTH

- 7.4 CARDIOLOGY

- 7.4.1 PERSISTENT GLOBAL BURDEN OF CARDIOVASCULAR DISEASES TO FACILITATE GROWTH

- 7.5 ORTHOPEDICS

- 7.5.1 GROWING PREVALENCE OF DEGENERATIVE JOINT DISEASES, SPORTS INJURIES, AND OSTEOPOROSIS TO BOOST MARKET

- 7.6 THYROID

- 7.6.1 GLOBAL PREVALENCE OF HYPER- AND HYPOTHYROIDISM AND THYROID CANCER TO AUGMENT GROWTH

- 7.7 OTHER THERAPEUTIC AREAS

8 NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION

- 8.1 INTRODUCTION

- 8.2 2D

- 8.2.1 WIDE AVAILABILITY, EASE OF INTEGRATION, AND ESTABLISHED PRESENCE IN CLINICAL WORKFLOW TO AID GROWTH

- 8.3 3D

- 8.3.1 GROWING RELIANCE ON ADVANCED IMAGING TECHNOLOGIES TO FUEL MARKET

9 NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 CONTINUOUS TECHNOLOGICAL ADVANCEMENTS TO FOSTER GROWTH

- 9.3 DIAGNOSTIC IMAGING CENTERS

- 9.3.1 GROWING DEMAND FOR EARLY AND PRECISE DIAGNOSIS TO DRIVE MARKET

- 9.4 CANCER TREATMENT CENTERS

- 9.4.1 ESCALATING GLOBAL INCIDENCE OF CANCER TO PROMOTE GROWTH

- 9.5 OTHER END USERS

10 NUCLEAR MEDICINE EQUIPMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Advancements in PET and SPECT equipment for personalized care to aid growth

- 10.2.3 CANADA

- 10.2.3.1 Increasing adoption of advanced imaging technologies to support growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Increasing adoption of hybrid imaging systems to spur growth

- 10.3.3 UK

- 10.3.3.1 Favorable clinical guidelines supporting wider use of PET-CT to fuel market

- 10.3.4 FRANCE

- 10.3.4.1 Shift to hybrid imaging to accelerate growth

- 10.3.5 ITALY

- 10.3.5.1 Robust network of scanners to facilitate growth

- 10.3.6 SPAIN

- 10.3.6.1 Growing integration of cutting-edge technologies into clinical practice to propel market

- 10.3.7 SWEDEN

- 10.3.7.1 Rapid shift toward PET procedures to accelerate growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 JAPAN

- 10.4.2.1 Ongoing innovations in equipment and growing reliance on nuclear imaging for accurate detection to drive market

- 10.4.3 CHINA

- 10.4.3.1 Rapid investments in medical infrastructure and technological advancements in image analysis to spur growth

- 10.4.4 INDIA

- 10.4.4.1 Substantial cancer and cardiovascular disease burden to encourage growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Universal health coverage to bolster growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 Strong diagnostic imaging network and widespread adoption of hybrid imaging technologies to contribute to growth

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.5.2 GCC COUNTRIES

- 10.5.2.1 Growing healthcare needs and favorable government support to boost market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.6.2 BRAZIL

- 10.6.2.1 Healthcare modernization efforts to accelerate growth

- 10.6.3 MEXICO

- 10.6.3.1 Expanding healthcare infrastructure to bolster growth

- 10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN NUCLEAR MEDICINE EQUIPMENT MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 POSITRON EMISSION TOMOGRAPHY (PET) EQUIPMENT

- 11.4.2 SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT) EQUIPMENT

- 11.5 MARKET RANKING ANALYSIS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 System type footprint

- 11.8.5.4 Therapeutic area footprint

- 11.8.5.5 Dimension footprint

- 11.8.5.6 End-user footprint

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of startups/SMEs

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES AND APPROVALS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GE HEALTHCARE

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and approvals

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SIEMENS HEALTHINEERS AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 KONINKLIJKE PHILIPS N.V.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches and approvals

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 MIRION TECHNOLOGIES, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and approvals

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 CANON MEDICAL SYSTEMS CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 HERMES MEDICAL SOLUTIONS

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches and approvals

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.7 DOSISOFT SA

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches and approvals

- 12.1.7.3.2 Deals

- 12.1.8 SEGAMI CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 WINKGEN MEDICAL SYSTEMS GMBH & CO. KG

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches and approvals

- 12.1.9.3.2 Deals

- 12.1.10 COMECER S.P.A.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches and approvals

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Expansions

- 12.1.11 SYNTERMED INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 ULTRASPECT INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.13 LABLOGIC SYSTEMS LTD.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches and approvals

- 12.1.13.3.2 Deals

- 12.1.13.3.3 Expansions

- 12.1.14 MEDISO LTD.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches and approvals

- 12.1.15 CATALYST MEDTECH

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Other developments

- 12.1.16 LEMER PAX

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches and approvals

- 12.1.16.3.2 Deals

- 12.1.17 SPECTRUM DYNAMICS MEDICAL

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Product launches and approvals

- 12.1.17.3.2 Deals

- 12.1.18 NEUSOFT MEDICAL SYSTEMS CO., LTD.

- 12.1.18.1 Business overview

- 12.1.18.2 Recent developments

- 12.1.18.2.1 Product launches and approvals

- 12.1.18.2.2 Deals

- 12.1.19 BRAINLAB SE

- 12.1.19.1 Business overview

- 12.1.19.2 Products offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Product launches and approvals

- 12.1.19.3.2 Deals

- 12.1.20 MIRADA MEDICAL

- 12.1.20.1 Business overview

- 12.1.20.2 Products offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Product launches and approvals

- 12.1.20.3.2 Deals

- 12.1.1 GE HEALTHCARE

- 12.2 OTHER PLAYERS

- 12.2.1 TRASIS

- 12.2.2 SOFIE

- 12.2.3 ITM ISOTOPE TECHNOLOGIES MUNICH SE

- 12.2.4 POSITRIGO AG

- 12.2.5 PAIRE

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 NUCLEAR MEDICINE EQUIPMENT MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD, 2021-2024

- TABLE 3 NUCLEAR MEDICINE EQUIPMENT MARKET: RESEARCH ASSUMPTIONS

- TABLE 4 NUCLEAR MEDICINE EQUIPMENT MARKET: RISK ASSESSMENT

- TABLE 5 NUCLEAR MEDICINE EQUIPMENT MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 6 INDICATIVE PRICE OF NUCLEAR MEDICINE EQUIPMENT, BY KEY PLAYER, 2024 (USD)

- TABLE 7 INDICATIVE PRICE OF NUCLEAR MEDICINE EQUIPMENT, BY REGION, 2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE OF NUCLEAR CARDIOLOGY REPORTING SOFTWARE, 2024 (USD)

- TABLE 9 NUCLEAR MEDICINE EQUIPMENT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR NUCLEAR MEDICINE EQUIPMENT MARKET, 2025

- TABLE 11 IMPORT DATA FOR HS CODE 901814, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORTS DATA FOR HS CODE 901814, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 NUCLEAR MEDICINE EQUIPMENT MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 TARIFF DATA FOR HS CODE 901814

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REGULATORY STANDARDS IN NUCLEAR MEDICINE

- TABLE 19 REGULATORY REQUIREMENTS IN NORTH AMERICA

- TABLE 20 REGULATORY REQUIREMENTS IN EUROPE

- TABLE 21 REGULATORY REQUIREMENTS IN ASIA PACIFIC

- TABLE 22 REGULATORY REQUIREMENTS IN LATIN AMERICA

- TABLE 23 REGULATORY REQUIREMENTS IN MIDDLE EAST & AFRICA

- TABLE 24 NUCLEAR MEDICINE EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 26 KEY BUYING CRITERIA FOR END USERS

- TABLE 27 UNMET NEEDS IN NUCLEAR MEDICINE EQUIPMENT MARKET

- TABLE 28 END-USER EXPECTATIONS IN NUCLEAR MEDICINE EQUIPMENT MARKET

- TABLE 29 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 30 NUCLEAR MEDICINE EQUIPMENT, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 31 NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 32 NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (UNITS)

- TABLE 34 PET EQUIPMENT OFFERED BY MAJOR PLAYERS

- TABLE 35 NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 36 NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 NUCLEAR MEDICINE EQUIPMENT MARKET FOR STANDALONE PET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 NUCLEAR MEDICINE EQUIPMENT MARKET FOR HYBRID PET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 SPECT EQUIPMENT OFFERED BY MAJOR PLAYERS

- TABLE 40 NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 41 NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 NUCLEAR MEDICINE EQUIPMENT MARKET FOR STANDALONE SPECT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 NUCLEAR MEDICINE EQUIPMENT MARKET FOR HYBRID SPECT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 GAMMA/SCINTILLATION CAMERAS OFFERED BY MAJOR PLAYERS

- TABLE 45 NUCLEAR MEDICINE EQUIPMENT MARKET FOR GAMMA/SCINTILLATION CAMERAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 47 NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 GM COUNTERS OFFERED BY MAJOR PLAYERS

- TABLE 49 NUCLEAR MEDICINE EQUIPMENT MARKET FOR GM COUNTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 DOSE CALIBRATORS OFFERED BY MAJOR PLAYERS

- TABLE 51 NUCLEAR MEDICINE EQUIPMENT MARKET FOR DOSE CALIBRATORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 PROBE COUNTING SYSTEMS OFFERED BY MAJOR PLAYERS

- TABLE 53 NUCLEAR MEDICINE EQUIPMENT MARKET FOR PROBE COUNTING SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 GAMMA WELL COUNTERS OFFERED BY MAJOR PLAYERS

- TABLE 55 NUCLEAR MEDICINE EQUIPMENT MARKET FOR GAMMA WELL COUNTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 NUCLEAR MEDICINE EQUIPMENT MARKET FOR OTHER NON-IMAGING MODALITIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 58 NUCLEAR MEDICINE EQUIPMENT FOR ONCOLOGY OFFERED BY MAJOR PLAYERS

- TABLE 59 NUCLEAR MEDICINE EQUIPMENT MARKET FOR ONCOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 NUCLEAR MEDICINE EQUIPMENT FOR NEUROLOGY OFFERED BY MAJOR PLAYERS

- TABLE 61 NUCLEAR MEDICINE EQUIPMENT MARKET FOR NEUROLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 NUCLEAR MEDICINE EQUIPMENT FOR CARDIOLOGY OFFERED BY MAJOR PLAYERS

- TABLE 63 NUCLEAR MEDICINE EQUIPMENT MARKET FOR CARDIOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 NUCLEAR MEDICINE EQUIPMENT FOR ORTHOPEDICS OFFERED BY MAJOR PLAYERS

- TABLE 65 NUCLEAR MEDICINE EQUIPMENT MARKET FOR ORTHOPEDICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 NUCLEAR MEDICINE EQUIPMENT FOR THYROID OFFERED BY MAJOR PLAYERS

- TABLE 67 NUCLEAR MEDICINE EQUIPMENT MARKET FOR THYROID, BY REGION, 2023-2030 (USD MILLION)

- TABLE 68 NUCLEAR MEDICINE EQUIPMENT MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 69 NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 70 NUCLEAR MEDICINE 2D EQUIPMENT OFFERED BY MAJOR PLAYERS

- TABLE 71 NUCLEAR MEDICINE 2D EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 NUCLEAR MEDICINE 3D EQUIPMENT OFFERED BY MAJOR PLAYERS

- TABLE 73 NUCLEAR MEDICINE 3D EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 75 NUCLEAR MEDICINE EQUIPMENT FOR HOSPITALS OFFERED BY MAJOR PLAYERS

- TABLE 76 NUCLEAR MEDICINE EQUIPMENT MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 NUCLEAR MEDICINE EQUIPMENT FOR DIAGNOSTIC IMAGING CENTERS OFFERED BY MAJOR PLAYERS

- TABLE 78 NUCLEAR MEDICINE EQUIPMENT MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 79 NUCLEAR MEDICINE EQUIPMENT FOR CANCER TREATMENT CENTERS OFFERED BY MAJOR PLAYERS

- TABLE 80 NUCLEAR MEDICINE EQUIPMENT MARKET FOR CANCER TREATMENT CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 NUCLEAR MEDICINE EQUIPMENT FOR OTHER END USERS OFFERED BY MAJOR PLAYERS

- TABLE 82 NUCLEAR MEDICINE EQUIPMENT MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 NUCLEAR MEDICINE EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 85 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 94 US: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 95 US: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 96 US: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 US: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 US: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 99 US: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 100 US: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 101 US: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 102 CANADA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 103 CANADA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 CANADA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CANADA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 CANADA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 CANADA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 108 CANADA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 109 CANADA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 110 EUROPE: KEY MACROECONOMIC INDICATORS

- TABLE 111 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 113 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 114 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE 2023-2030 (USD MILLION)

- TABLE 117 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 119 EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 120 GERMANY: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 121 GERMANY: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 GERMANY: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 123 GERMANY: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 124 GERMANY: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 GERMANY: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 126 GERMANY: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 127 GERMANY: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 128 UK: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 129 UK: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 130 UK: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 UK: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 UK: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 UK: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 134 UK: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 135 UK: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 136 FRANCE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 137 FRANCE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 FRANCE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 FRANCE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 FRANCE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 FRANCE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 142 FRANCE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 143 FRANCE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 144 ITALY: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 145 ITALY: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 ITALY: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 ITALY: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 ITALY: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 ITALY: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 150 ITALY: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 151 ITALY: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 152 SPAIN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 153 SPAIN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 SPAIN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 SPAIN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 SPAIN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 SPAIN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 158 SPAIN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 159 SPAIN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 160 SWEDEN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 161 SWEDEN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 SWEDEN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 SWEDEN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 SWEDEN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 SWEDEN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 166 SWEDEN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 167 SWEDEN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 168 REST OF EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 REST OF EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 REST OF EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 REST OF EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 173 REST OF EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 174 REST OF EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 175 REST OF EUROPE: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 177 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 184 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 185 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 186 JAPAN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 187 JAPAN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 JAPAN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 JAPAN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 JAPAN: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 JAPAN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 192 JAPAN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 193 JAPAN: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 194 CHINA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 195 CHINA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 CHINA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 CHINA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 CHINA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 CHINA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 200 CHINA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 201 CHINA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 202 INDIA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 203 INDIA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 INDIA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 INDIA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 INDIA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 INDIA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 208 INDIA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 209 INDIA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 210 SOUTH KOREA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 211 SOUTH KOREA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE 2023-2030 (USD MILLION)

- TABLE 212 SOUTH KOREA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 SOUTH KOREA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 SOUTH KOREA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 SOUTH KOREA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 216 SOUTH KOREA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 217 SOUTH KOREA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 218 AUSTRALIA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 219 AUSTRALIA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 AUSTRALIA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 AUSTRALIA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 AUSTRALIA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 AUSTRALIA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 224 AUSTRALIA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 225 AUSTRALIA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 REST OF ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 REST OF ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 232 REST OF ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 233 REST OF ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 235 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 244 GCC COUNTRIES: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 245 GCC COUNTRIES: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 246 GCC COUNTRIES: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 247 GCC COUNTRIES: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 GCC COUNTRIES: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 249 GCC COUNTRIES: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 250 GCC COUNTRIES: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 251 GCC COUNTRIES: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 253 REST OF MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 254 REST OF MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 255 REST OF MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 REST OF MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 260 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 261 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 262 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 263 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 264 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 265 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 268 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 269 LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 270 BRAZIL: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 271 BRAZIL: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 272 BRAZIL: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 273 BRAZIL: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 BRAZIL: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 BRAZIL: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 276 BRAZIL: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 277 BRAZIL: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 278 MEXICO: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 279 MEXICO: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 280 MEXICO: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 281 MEXICO: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 282 MEXICO: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE 2023-2030 (USD MILLION)

- TABLE 283 MEXICO: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 284 MEXICO: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 285 MEXICO: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 286 REST OF LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2023-2030 (USD MILLION)

- TABLE 287 REST OF LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 288 REST OF LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR SPECT, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 289 REST OF LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR PET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 290 REST OF LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET FOR NON-IMAGING MODALITIES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 291 REST OF LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2023-2030 (USD MILLION)

- TABLE 292 REST OF LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2023-2030 (USD MILLION)

- TABLE 293 REST OF LATIN AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 294 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN NUCLEAR MEDICINE EQUIPMENT MARKET, JANUARY 2022-JUNE 2025

- TABLE 295 NUCLEAR MEDICINE EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 296 POSITRON EMISSION TOMOGRAPHY (PET) EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 297 SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT) EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 298 NUCLEAR MEDICINE EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 299 NUCLEAR MEDICINE EQUIPMENT MARKET: SYSTEM TYPE FOOTPRINT

- TABLE 300 NUCLEAR MEDICINE EQUIPMENT MARKET: THERAPEUTIC AREA FOOTPRINT

- TABLE 301 NUCLEAR MEDICINE EQUIPMENT MARKET: DIMENSION FOOTPRINT

- TABLE 302 NUCLEAR MEDICINE EQUIPMENT MARKET: END-USER FOOTPRINT

- TABLE 303 NUCLEAR MEDICINE EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 304 NUCLEAR MEDICINE EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF SMES/STARTUPS

- TABLE 305 NUCLEAR MEDICINE EQUIPMENT MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 306 NUCLEAR MEDICINE EQUIPMENT MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 307 NUCLEAR MEDICINE EQUIPMENT MARKET: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 308 NUCLEAR MEDICINE EQUIPMENT MARKET: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 309 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 310 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 311 GE HEALTHCARE: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 312 GE HEALTHCARE: DEALS, JANUARY 2022-JUNE 2025

- TABLE 313 GE HEALTHCARE: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 314 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 315 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 316 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 317 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-JUNE 2025

- TABLE 318 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 319 KONINKLIJKE PHILIPS N.V.: PRODUCTS OFFERED

- TABLE 320 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 321 KONINKLIJKE PHILIPS N.V: DEALS, JANUARY 2022-JUNE 2025

- TABLE 322 MIRION TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 323 MIRION TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 324 MIRION TECHNOLOGIES, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 325 MIRION TECHNOLOGIES, INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 326 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 327 CANON MEDICAL SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 328 CANON MEDICAL SYSTEMS CORPORATION: DEALS, JANUARY 2022-JUNE 2025

- TABLE 329 HERMES MEDICAL SOLUTIONS: COMPANY OVERVIEW

- TABLE 330 HERMES MEDICAL SOLUTIONS: PRODUCTS OFFERED

- TABLE 331 HERMES MEDICAL SOLUTIONS: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 332 HERMES MEDICAL SOLUTIONS: DEALS, JANUARY 2022-JUNE 2025

- TABLE 333 HERMES MEDICAL SOLUTIONS: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 334 DOSISOFT SA: COMPANY OVERVIEW

- TABLE 335 DOSISOFT SA: PRODUCTS OFFERED

- TABLE 336 DOSISOFT SA: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 337 DOSISOFT SA: DEALS, JANUARY 2022-JUNE 2025

- TABLE 338 SEGAMI CORPORATION: COMPANY OVERVIEW

- TABLE 339 SEGAMI CORPORATION: PRODUCTS OFFERED

- TABLE 340 WINKGEN MEDICAL SYSTEMS GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 341 WINKGEN MEDICAL SYSTEMS GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 342 WINKGEN MEDICAL SYSTEMS GMBH & CO. KG: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 343 WINKGEN MEDICAL SYSTEMS GMBH & CO. KG: DEALS, JANUARY 2022-JUNE 2025

- TABLE 344 COMECER S.P.A.: COMPANY OVERVIEW

- TABLE 345 COMECER S.P.A.: PRODUCTS OFFERED

- TABLE 346 COMECER S.P.A.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 347 COMECER S.P.A.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 348 COMECER S.P.A.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 349 SYNTERMED INC.: COMPANY OVERVIEW

- TABLE 350 SYNTERMED INC.: PRODUCTS OFFERED

- TABLE 351 SYNTERMED INC.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 352 ULTRASPECT INC.: PRODUCTS OFFERED

- TABLE 353 LABLOGIC SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 354 LABLOGIC SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 355 LABLOGIC SYSTEMS LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 356 LABLOGIC SYSTEMS LTD.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 357 LABLOGIC SYSTEMS LTD.: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 358 MEDISO LTD.: COMPANY OVERVIEW

- TABLE 359 MEDISO LTD.: PRODUCTS OFFERED

- TABLE 360 MEDISO LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 361 CATALYST MEDTECH: COMPANY OVERVIEW

- TABLE 362 CATALYST MEDTECH: PRODUCTS OFFERED

- TABLE 363 CATALYST MEDTECH: DEALS, JANUARY 2022-JUNE 2025

- TABLE 364 CATALYST MEDTECH: OTHER DEVELOPMENTS, JANUARY 2022-JUNE 2025

- TABLE 365 LEMER PAX: COMPANY OVERVIEW

- TABLE 366 LEMER PAX: PRODUCTS OFFERED

- TABLE 367 LEMER PAX: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 368 LEMER PAX: DEALS, JANUARY 2022-JUNE 2025

- TABLE 369 SPECTRUM DYNAMICS MEDICAL: COMPANY OVERVIEW

- TABLE 370 SPECTRUM DYNAMICS MEDICAL: PRODUCTS OFFERED

- TABLE 371 SPECTRUM DYNAMICS MEDICAL: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 372 SPECTRUM DYNAMICS MEDICAL: DEALS, JANUARY 2022-JUNE 2025

- TABLE 373 NEUSOFT MEDICAL SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 374 NEUSOFT MEDICAL SYSTEMS CO., LTD.: PRODUCTS OFFERED

- TABLE 375 NEUSOFT MEDICAL SYSTEMS CO., LTD.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 376 NEUSOFT MEDICAL SYSTEMS CO., LTD.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 377 BRAINLAB SE: COMPANY OVERVIEW

- TABLE 378 BRAINLAB SE: PRODUCTS OFFERED

- TABLE 379 BRAINLAB SE: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 380 BRAINLAB SE: DEALS, JANUARY 2022-JUNE 2025

- TABLE 381 MIRADA MEDICAL: COMPANY OVERVIEW

- TABLE 382 MIRADA MEDICAL: PRODUCTS OFFERED

- TABLE 383 MIRADA MEDICAL: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 384 MIRADA MEDICAL: DEALS, JANUARY 2022-JUNE 2025

- TABLE 385 TRASIS: COMPANY OVERVIEW

- TABLE 386 SOFIE: COMPANY OVERVIEW

- TABLE 387 ITM ISOTOPE TECHNOLOGIES MUNICH SE: COMPANY OVERVIEW

- TABLE 388 POSITRIGO AG: COMPANY OVERVIEW

- TABLE 389 PAIRE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 NUCLEAR MEDICINE EQUIPMENT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DYNAMICS

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 NUCLEAR MEDICINE EQUIPMENT MARKET, BY SYSTEM TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 NUCLEAR MEDICINE EQUIPMENT MARKET, BY DIMENSION, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 NUCLEAR MEDICINE EQUIPMENT MARKET, BY THERAPEUTIC AREA, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 NUCLEAR MEDICINE EQUIPMENT MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 NUCLEAR MEDICINE EQUIPMENT MARKET: REGIONAL SNAPSHOT

- FIGURE 15 GROWING ADOPTION OF ADVANCED IMAGING MODALITIES AND EXPANSION OF THERANOSTICS TO DRIVE MARKET

- FIGURE 16 ONCOLOGY SEGMENT AND JAPAN LED ASIA PACIFIC MARKET IN 2024

- FIGURE 17 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 EMERGING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 20 NUCLEAR MEDICINE EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 REVENUE SHIFT AND NEW REVENUE POCKETS IN NUCLEAR MEDICINE EQUIPMENT MARKET

- FIGURE 22 AVERAGE SELLING PRICE OF NUCLEAR CARDIOLOGY REPORTING SOFTWARE, 2024 (USD)

- FIGURE 23 NUCLEAR MEDICINE EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 NUCLEAR MEDICINE EQUIPMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2015-2025

- FIGURE 26 NUCLEAR MEDICINE EQUIPMENT MARKET: PATENT ANALYSIS, 2015-2025

- FIGURE 27 NUCLEAR MEDICINE EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 29 KEY BUYING CRITERIA FOR END USERS

- FIGURE 30 MARKET POTENTIAL OF AI/GEN AI ON NUCLEAR MEDICINE EQUIPMENT ACROSS INDUSTRIES

- FIGURE 31 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 32 NORTH AMERICA: NUCLEAR MEDICINE EQUIPMENT MARKET SNAPSHOT, 2024

- FIGURE 33 ASIA PACIFIC: NUCLEAR MEDICINE EQUIPMENT MARKET SNAPSHOT, 2024

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS IN NUCLEAR MEDICINE EQUIPMENT MARKET, 2020-2024

- FIGURE 35 NUCLEAR MEDICINE EQUIPMENT MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 36 POSITRON EMISSION TOMOGRAPHY (PET) EQUIPMENT MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 37 SINGLE-PHOTON EMISSION COMPUTED TOMOGRAPHY (SPECT) EQUIPMENT MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 38 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 39 NUCLEAR MEDICINE EQUIPMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 40 EV/EBITDA OF KEY VENDORS

- FIGURE 41 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA

- FIGURE 42 NUCLEAR MEDICINE EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 NUCLEAR MEDICINE EQUIPMENT MARKET: COMPANY FOOTPRINT

- FIGURE 44 NUCLEAR MEDICINE EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 46 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2024)

- FIGURE 47 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 48 MIRION TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 49 CANON MEDICAL SYSTEMS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 50 NEUSOFT MEDICAL SYSTEMS CO., LTD.: COMPANY SNAPSHOT (2024)