PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1801775

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1801775

Vehicle Subscription Services Market by Region (Europe, Asia Pacific (excl. China), North America, and China), Future Trends, Pricing Analysis, Product Landscape, Consumer Analysis, and Competitive Landscape - Global Forecast to 2035

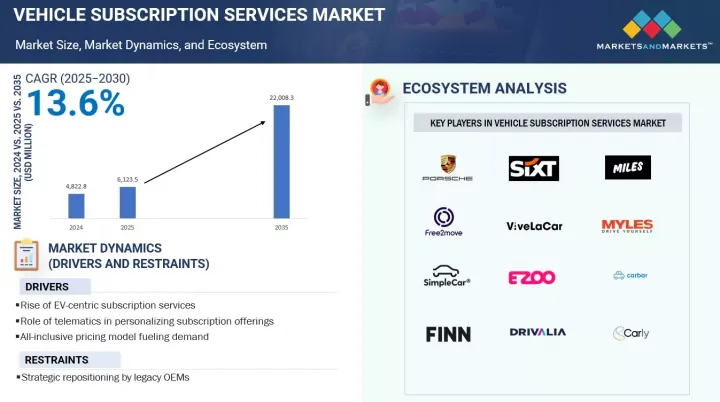

The vehicle subscription services market is expected to grow from USD 4,822.8 million in 2024 to USD 22,008.3 million by 2035, with a CAGR of 13.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Million) |

| Segments | Vehicle Subscription Services Market by Region, North America, and China), Future Trends, Pricing Analysis, Product Landscape, Consumer Analysis, and Competitive Landscape - Global Forecast to 2035 |

| Regions covered | North America, Europe, Asia Pacific, and China |

Urbanization and regulatory pressures on vehicle ownership significantly drive this market. Cities worldwide are making it difficult to own and operate private vehicles through costs like insurance, maintenance, and repairs, along with high taxes on fuel-based vehicles. As a result, urban residents, especially in megacities, are shifting toward flexible mobility solutions.

Additionally, the rise in vehicle subscription services is fueled by a global increase in business travel, hybrid work culture, and relocation flexibility. With professionals often moving between cities or working from multiple locations, the demand for adaptable, short-term, high-quality mobility options has risen. In regions like Europe, North America, and parts of Southeast Asia, many corporate employees and consultants now prefer subscription vehicles over rentals or taxis for long-term stays or intercity commutes. Unlike car rental models that lack personalization or fleet flexibility, subscription services provide a sense of ownership without the financial burden, especially with monthly swap options. This demand is further supported by companies offering vehicle subscriptions as part of employee benefits packages, including cars for personal and professional use.

Key consumer retention strategies of vehicle subscription service providers

Vehicle subscription providers are heavily investing in personalization, making each user's experience unique and tailored to their preferences. Telematics plays a key role in this process. By analyzing driving habits, frequency, mileage, and location data, platforms can offer customized packages, upgrade options, or usage-based pricing that keeps consumers engaged and satisfied. For instance, a low-mileage urban driver could be offered a compact EV plan with occasional upgrade credits, while a weekend traveler might receive discounted SUV swaps. This approach helps build emotional loyalty by making users feel understood and cared for, rather than selling a generic service.

Asia Pacific witnesses significant growth in vehicle subscription services

Asia Pacific's rapid urbanization and the growth of megacities make flexible mobility solutions more attractive than car ownership. Subscription services, which often include door-to-door delivery, all-inclusive pricing, and short-term contracts, fit with the lifestyles of busy urban professionals. Additionally, the expanding startup ecosystem and venture capital activity in the region have spurred mobility innovation. Investors are funding asset-light models that scale quickly and incorporate digital payments, AI-driven pricing, and app-based fleet management. Governments are also beginning to support subscription models, especially for EVs, as part of their green mobility initiatives. As more EVs enter the market and users look for trial options before buying, subscriptions provide an ideal solution. This combination of technological readiness, urban pressure, and financial pragmatism positions Asia Pacific as a high-growth region for vehicle subscription adoption.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 30%, Third-party Providers - 60%, and Vehicle Subscription Platform Providers - 10%

- By Designation: C-level - 40%, Directors - 40%, and Others - 20%

- By Region: North America - 21%, Europe - 50%, Asia Pacific - 10%, and China - 16%

Established players such as Miles Mobility (Germany), FINN (Germany), Autonomy (US), Free2Move (Germany), Myle (India), Drivalia (UK), REVV (India), LeasePlan (Germany), Mocean Subscription (Germany), and Ezoo (UK) lead the vehicle subscription services market.

Key Benefits of Buying this Report:

The report will assist market leaders and new entrants by providing information on the closest estimates. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report helps stakeholders grasp the market's pulse and offers information on key market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (rapid urbanization and shift in lifestyle preferences), restraints (high operational complexity and margins dilution), and opportunities (shift from ownership to usership), influencing market growth

Product Development/Innovation: Detailed insights on upcoming technologies and new vehicle range & services of the vehicle subscription services market

Market Development: Comprehensive information about the lucrative market - the report analyzes the vehicle subscription services market across varied regions

Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the vehicle subscription services market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Miles Mobility, FINN, Autonomy, Free2Move, Myle, Drivalia, REVV, LeasePlan, Mocean Subscription, and Ezoo

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

2 RESEARCH OBJECTIVES, SCOPE, AND METHODOLOGY

- 2.1 RESEARCH OBJECTIVES AND METHODOLOGY

- 2.2 RESEARCH SCOPE

3 MARKET OVERVIEW

- 3.1 OWNERSHIP MODEL

- 3.2 MARKET EVOLUTION

- 3.3 VALUE CHAIN ANALYSIS

- 3.4 SUBSCRIPTION VS. LEASE VS. PURCHASE

- 3.5 STRATEGIC BRANDING

- 3.6 CUSTOMER ANALYSIS

- 3.7 CUSTOMER RETENTION STRATEGIES

- 3.8 SHIFT TOWARD SOFTWARE-AS-A-SERVICE

4 KEY TRENDS

- 4.1 RISE OF EV SUBSCRIPTION SERVICES

- 4.2 ADOPTION OF TELEMATICS

- 4.3 EXPANDING BUSINESS REACH THROUGH PARTNERSHIPS

5 REGIONAL ANALYSIS

- 5.1 EUROPE: VEHICLE SUBSCRIPTION SERVICES LANDSCAPE

- 5.2 EUROPE: COMPETITIVE MAPPING

- 5.3 NORTH AMERICA: VEHICLE SUBSCRIPTION SERVICES LANDSCAPE

- 5.4 NORTH AMERICA: COMPETITIVE MAPPING

- 5.5 ASIA PACIFIC (EXCL. CHINA): VEHICLE SUBSCRIPTION SERVICES LANDSCAPE

- 5.6 CHINA: VEHICLE SUBSCRIPTION SERVICES LANDSCAPE

- 5.7 ASIA PACIFIC (EXCL. CHINA) AND CHINA: COMPETITIVE MAPPING

6 PRICING ANALYSIS

- 6.1 REGIONAL

- 6.2 SUBSCRIPTION VS. LEASE. VS. PURCHASE

- 6.3 ICE VS. EV MODEL

7 COMPANY PROFILES

- 7.1 FINN

- 7.2 AUTONOMY

- 7.3 BIPI

- 7.4 MYLES

- 7.5 FREE2MOVE

8 CHALLENGES

9 CONCLUSION

10 APPENDIX