PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1808087

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1808087

Pet Insurance Market by Policy Coverage, Animal Type, Provider Type, Sales Channel & Region - Global Forecast to 2030

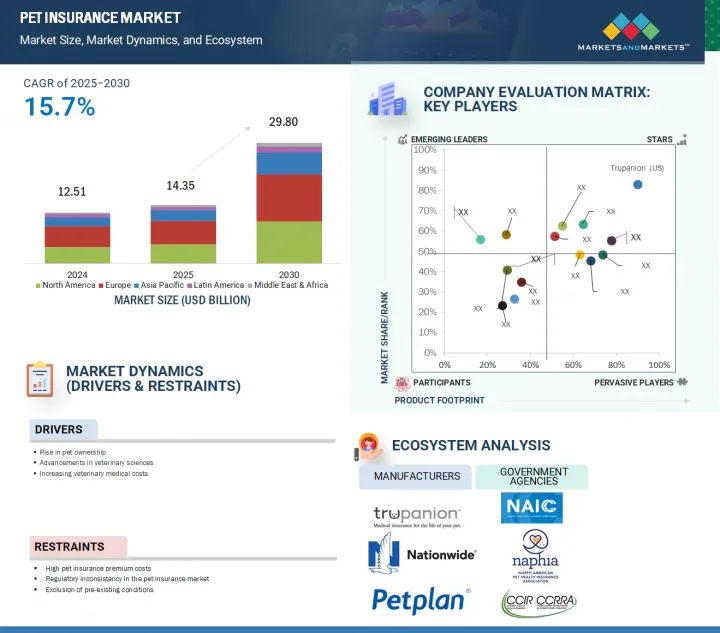

The pet insurance market is projected to grow from USD 29.80 billion in 2025 to USD 14.35 billion by 2030, with a CAGR of 15.7%. This increase is driven by several key factors that reflect the evolving landscape of animal health and disease management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Policy Coverage, Sales Channel, Provider Type, Animal Type, Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

One of the main factors is the steady increase in pet ownership worldwide, especially among younger groups who increasingly see pets as important family members. This cultural shift has raised expectations for high-quality veterinary care, boosting the need for financial tools like pet insurance to cover related costs.

Another significant factor is the rising cost of veterinary treatments, which has led pet owners to seek financial protection through insurance. Advanced diagnostics, surgeries, and chronic disease management have become more accessible but also more expensive, prompting a greater demand for comprehensive insurance coverage that can offset these high medical expenses. The increasing humanization of pets, with owners treating their animals as family members and prioritizing their health and well-being, is another growth factor. This cultural shift has resulted in greater awareness and acceptance of pet insurance, particularly in developed regions. Additionally, the expansion of digital distribution channels and personalized policy options is making insurance more accessible and tailored to individual pet needs, further boosting market adoption.

"By policy coverage, the wellness/preventive care add-ons segment is projected to grow at the highest CAGR during the forecast period."

The wellness/preventive care add-ons segment is expected to experience the highest growth in the pet insurance market, driven by a focus on proactive pet health management. Pet owners are increasingly aware of the long-term benefits of routine care, such as vaccinations, dental cleanings, flea and tick prevention, and annual wellness exams. These services help detect health issues early, reduce the risk of serious illnesses, and ultimately lower overall veterinary costs. As a result, more consumers are choosing wellness add-ons to supplement their accident and illness coverage. Insurers are also promoting these options as value-added features that enhance customer retention, encourage policy upgrades, and support the growing trend of pet humanization and holistic care.

"By animal type, the dogs segment accounted for the largest market share in 2024."

In 2024, the dogs segment led the pet insurance market because of higher ownership rates and greater healthcare use compared to other pets. Dogs are more likely to need veterinary care for accidents, chronic conditions, hereditary issues, and behavioral problems, which results in higher medical costs over their lifetime. This encourages owners to buy insurance as a financial safety net. Additionally, many dog breeds tend to be prone to specific health issues, increasing the need for comprehensive coverage. Insurers often customize and promote their plans mainly for dog owners, further strengthening their dominance in the insured pet market.

"The Asia Pacific region is expected to witness the highest growth rate during the forecast period."

The Asia Pacific is poised for the highest growth in the pet insurance market due to a rapid increase in pet ownership, rising disposable incomes, and a cultural shift toward viewing pets as family members. Urbanization and evolving lifestyles, especially among younger populations in countries like China, India, and Southeast Asian nations, have driven up demand for quality veterinary care. As access to veterinary services improves across the region, awareness of the financial risks related to pet health issues also grows, leading more pet owners to consider insurance. Furthermore, the expansion of digital platforms and mobile-based insurance options has made it easier for consumers to buy and manage pet insurance, speeding up market growth in this region.

Breakdown of supply-side primary interviews:

- By Company Type: Tier 1 (45%), Tier 2 (20%), and Tier 3 (35%)

- By Designation: C-level Executives (35%), Directors (25%), and Other Designations (40%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and the Middle East & Africa (5%)

Breakdown of demand-side primary interviews:

- By End User: Individual Pet Owners (40%), Veterinary Hospitals & Clinics (25%), Insurance Brokers & Agents (20%), and Pet Retailers & E-commerce Platforms (15%)

- By Designation: Pet Owners (35%), Veterinary Practice Managers (27%), Insurance Sales Professionals (22%), and Procurement/Benefits Managers (16%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and the Middle East & Africa (5%)

Research Coverage

The market study analyzes the pet insurance market across various segments. Its goal is to estimate the market size and growth potential based on policy coverage, sales channels, provider types, animal types, and regions. The study also provides an in-depth competitive analysis of key market players, including their company profiles, insights into their products and business offerings, recent developments, and strategic market approaches.

Reasons to Buy the Report

The report can assist established companies and newer or smaller firms understand market trends, enabling them to capture a larger market share. Firms that acquire the report can implement one or more of the five strategies outlined below.

This report provides insights into the following points:

- Analysis of key drivers (rise in pet ownership, advancements in veterinary sciences, increasing veterinary medical costs), restraints (high pet insurance premium costs, regulatory inconsistency, exclusion of pre-existing conditions), opportunities (customizable plans and wellness add-ons, embedded insurance models), and challenges (insufficiencies in processing insurance claims) influencing the growth of the pet insurance market.

- Product Development/Innovation: Detailed insights on upcoming technologies and product launches in the pet insurance market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of pet insurance products across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the pet insurance market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the pet insurance market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 LIMITATIONS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH METHODOLOGY DESIGN

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 GROWTH RATE ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PET INSURANCE MARKET OVERVIEW

- 4.2 ASIA PACIFIC: PET INSURANCE MARKET, BY POLICY COVERAGE & COUNTRY (2024)

- 4.3 PET INSURANCE MARKET: REGIONAL MIX

- 4.4 PET INSURANCE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 PET INSURANCE MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Rise in pet ownership

- 5.1.1.2 Rapid advancements in veterinary services

- 5.1.1.3 Increasing pet expenditure

- 5.1.1.4 Rising incidence of chronic & hereditary conditions

- 5.1.2 RESTRAINTS

- 5.1.2.1 High pet insurance premium costs

- 5.1.2.2 Regulatory inconsistencies across jurisdictions

- 5.1.2.3 Exclusion of pre-existing conditions

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Customizable plans & wellness add-ons

- 5.1.3.2 Embedded insurance models

- 5.1.4 CHALLENGES

- 5.1.4.1 Inefficiencies in insurance claims processing

- 5.1.1 DRIVERS

- 5.2 INDUSTRY TRENDS

- 5.2.1 DIGITAL DISTRIBUTION & DIRECT SALES

- 5.2.2 WEARABLE & TELEMEDICINE INTEGRATION IN PET INSURANCE

- 5.2.3 MULTI-PET, BREED, AND AGE-SPECIFIC PLANS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 AI & ML

- 5.3.1.2 Telemedicine/Tele-veterinary platforms

- 5.3.1.3 Mobile apps & digital platforms

- 5.3.2 ADJACENT TECHNOLOGIES

- 5.3.2.1 EHR for pets

- 5.3.3 COMPLEMENTARY TECHNOLOGIES

- 5.3.3.1 Pet e-commerce platforms

- 5.3.1 KEY TECHNOLOGIES

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 REGULATORY ANALYSIS

- 5.5.1 REGULATORY LANDSCAPE

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.2.1 North America

- 5.5.2.2 Europe

- 5.5.2.3 Rest of the World

- 5.6 PATENT ANALYSIS

- 5.6.1 PATENT PUBLICATION TRENDS FOR PET INSURANCE

- 5.6.2 JURISDICTION & TOP APPLICANT ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY POLICY COVERAGE, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY POLICY COVERAGE, 2022-2024

- 5.7.3 AVERAGE SELLING PRICE FOR ACCIDENT & ILLNESS OR ACCIDENT-ONLY INSURANCE PLANS, BY KEY PLAYER, 2024

- 5.7.4 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.7.4.1 Average selling price of accident & illness coverage (monthly premium) and accident-only coverage (monthly premium), by region, 2024

- 5.7.4.2 Average selling price trend of accident & illness coverage (monthly premium), by region, 2022-2024

- 5.7.4.3 Average selling price trend of accident-only coverage (monthly premium), by region, 2022-2024

- 5.7.4.4 Average selling price trend of wellness/preventive care add-ons (monthly premium), by region, 2022-2024

- 5.8 KEY CONFERENCES & EVENTS, 2025-2026

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 END-USER PERSPECTIVE & UNMET NEEDS

- 5.11 IMPACT OF AI/GENERATIVE ON PET INSURANCE MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 MARKET POTENTIAL IN PET INSURANCE ECOSYSTEM

- 5.11.3 AI-USE CASES

- 5.11.4 KEY COMPANIES IMPLEMENTING AI IN PET INSURANCE

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 VALUE CHAIN ANALYSIS

- 5.14 SUPPLY CHAIN ANALYSIS

- 5.15 INVESTMENT & FUNDING SCENARIO

6 PET INSURANCE MARKET, BY POLICY COVERAGE

- 6.1 INTRODUCTION

- 6.2 ACCIDENT & ILLNESS

- 6.2.1 PROVISION AGAINST UNEXPECTED INJURIES AND PREFERRED CHOICE FOR MOST PET OWNERS TO BOOST DEMAND

- 6.3 ACCIDENT-ONLY

- 6.3.1 BASIC COVERAGE ABILITIES TO SUPPORT MARKET GROWTH

- 6.4 WELLNESS/PREVENTIVE CARE ADD-ONS

- 6.4.1 HIGH AWARENESS OF LONG-TERM BENEFITS OF PREVENTIVE HEALTH MANAGEMENT TO PROPEL MARKET

7 PET INSURANCE MARKET, BY SALES CHANNEL

- 7.1 INTRODUCTION

- 7.2 DIRECT SALES

- 7.2.1 DIGITAL PLATFORMS AND INSTANT ENROLLMENT TO DRIVE MARKET

- 7.3 AGENCY SALES

- 7.3.1 PERSONALIZED GUIDANCE AND LOCAL TRUST TO BOOST DEMAND

- 7.4 BROKER SALES

- 7.4.1 MULTI-INSURER ACCESS AND EXPERT ADVICE TO DRIVE GROWTH

- 7.5 BANCASSURANCE

- 7.5.1 BANK LOYALTY PROGRAMS AND EMBEDDED INSURANCE MODELS TO FUEL UPTAKE

- 7.6 OTHER SALES CHANNELS

8 PET INSURANCE MARKET, BY PROVIDER TYPE

- 8.1 INTRODUCTION

- 8.2 PRIVATE PROVIDERS

- 8.2.1 FLEXIBLE COVERAGE AND DIGITAL INNOVATION TO DRIVE MARKET

- 8.3 PUBLIC PROVIDERS

- 8.3.1 AFFORDABLE PLANS AND GOVERNMENT WELFARE INITIATIVES TO BOOST DEMAND

9 PET INSURANCE MARKET, BY ANIMAL TYPE

- 9.1 INTRODUCTION

- 9.2 DOGS

- 9.2.1 HIGH PET OWNERSHIP AND RISING VET CARE COSTS TO BOOST DEMAND

- 9.3 CATS

- 9.3.1 RISING FELINE ADOPTION AND CHRONIC ILLNESS AWARENESS DRIVE GROWTH

- 9.4 OTHER ANIMAL TYPES

10 PET INSURANCE MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 High veterinary healthcare expenditure to drive market

- 10.2.3 CANADA

- 10.2.3.1 Growth in pet adoption rates to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 High veterinary costs to boost market growth

- 10.3.3 UK

- 10.3.3.1 High volume of claim submissions to fuel market

- 10.3.4 FRANCE

- 10.3.4.1 Entry of new insurance providers to boost demand

- 10.3.5 ITALY

- 10.3.5.1 Growing focus on Insurtech to boost demand

- 10.3.6 SPAIN

- 10.3.6.1 Implementation of legal mandates for liability coverage to drive market

- 10.3.7 SWEDEN

- 10.3.7.1 High pet insurance penetration to propel market

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Rising middle-class expenditure and high focus on advanced vet treatments to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Rising population of pet dogs & cats to fuel market

- 10.4.4 INDIA

- 10.4.4.1 Increasing focus on preventive health coverage to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Regulatory guidelines for pet insurance policies to support market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Growth in pet awareness and high-pedigree status to aid market

- 10.4.7 THAILAND

- 10.4.7.1 Focus on premium pet care to support market growth

- 10.4.8 NEW ZEALAND

- 10.4.8.1 Growing emphasis on animal welfare and preventive care drives market

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Rise in pet-related expenditure to support market uptake

- 10.5.3 MEXICO

- 10.5.3.1 Implementation of animal-welfare awareness to aid market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Kingdom of Saudi Arabia (KSA)

- 10.6.2.1.1 Changing cultural attitudes and launch of pet insurance policies to fuel uptake

- 10.6.2.2 United Arab Emirates (UAE)

- 10.6.2.2.1 High expat pet ownership to boost demand

- 10.6.2.3 Other GCC Countries

- 10.6.2.1 Kingdom of Saudi Arabia (KSA)

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN PET INSURANCE MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS

- 11.4.1 US MARKET SHARE ANALYSIS OF KEY PLAYERS IN PET INSURANCE MARKET (2024)

- 11.4.2 RANKING OF KEY MARKET PLAYERS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Policy coverage footprint

- 11.5.5.4 Animal type footprint

- 11.5.5.5 Provider type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 DYNAMIC COMPANIES

- 11.6.3 STARTING BLOCKS

- 11.6.4 RESPONSIVE COMPANIES

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startup/SME players

- 11.6.5.2 Competitive benchmarking of key emerging players/startups

- 11.7 BRAND/PRODUCT COMPARISON

- 11.7.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.8 COMPANY VALUATION & FINANCIAL METRICS

- 11.8.1 FINANCIAL METRICS

- 11.8.2 COMPANY VALUATION

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 SERVICE LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 TRUPANION

- 12.1.1.1 Business overview

- 12.1.1.2 Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Service launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 NATIONWIDE (SUBSIDIARY OF NATIONWIDE MUTUAL INSURANCE COMPANY)

- 12.1.2.1 Business overview

- 12.1.2.2 Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 PET PLAN LIMITED

- 12.1.3.1 Business overview

- 12.1.3.2 Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses & competitive threats

- 12.1.4 ANICOM HOLDINGS, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses & competitive threats

- 12.1.5 HEALTHY PAWS

- 12.1.5.1 Business overview

- 12.1.5.2 Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 PETS BEST INSURANCE SERVICES, LLC

- 12.1.6.1 Business overview

- 12.1.6.2 Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Other developments

- 12.1.7 PUMPKIN INSURANCE SERVICES INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Service launches

- 12.1.7.3.2 Deals

- 12.1.8 SPOT PET INSURANCE SERVICES, LLC

- 12.1.8.1 Business overview

- 12.1.8.2 Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 FIGO PET INSURANCE LLC

- 12.1.9.1 Business overview

- 12.1.9.2 Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Other developments

- 12.1.10 AGRIA PET INSURANCE LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Services offered

- 12.1.11 PETPARTNERS, INC.

- 12.1.11.1 Business overview

- 12.1.11.2 Services offered

- 12.1.12 ASPCA

- 12.1.12.1 Business overview

- 12.1.12.2 Services offered

- 12.1.13 PET PROTECT LIMITED

- 12.1.13.1 Business overview

- 12.1.13.2 Services offered

- 12.1.14 EMBRACE PET INSURANCE AGENCY, LLC

- 12.1.14.1 Business overview

- 12.1.14.2 Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Service launches

- 12.1.14.3.2 Deals

- 12.1.14.3.3 Other developments

- 12.1.15 GETSAFE

- 12.1.15.1 Business overview

- 12.1.15.2 Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Expansions

- 12.1.15.3.3 Other developments

- 12.1.1 TRUPANION

- 12.2 OTHER PLAYERS

- 12.2.1 WAGGEL LIMITED

- 12.2.2 NAPO LIMITED

- 12.2.3 MANY GROUP LTD.

- 12.2.4 EVERYPAW

- 12.2.5 LASSIE AB

- 12.2.6 DALMA

- 12.2.7 IPET INSURANCE CO., LTD.

- 12.2.8 AGILA HAUSTIERVERSICHERUNG AG

- 12.2.9 WAGMO INC.

- 12.2.10 FELIX

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PET INSURANCE MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 STANDARD CURRENCY CONVERSION RATES (USD UNITS)

- TABLE 3 PET INSURANCE MARKET: ASSUMPTIONS ANALYSIS

- TABLE 4 PET INSURANCE MARKET: RISK ASSESSMENT ANALYSIS

- TABLE 5 NUMBER OF US HOUSEHOLDS THAT OWN PETS IN 2024, BY ANIMAL TYPE (MILLION)

- TABLE 6 PET INSURANCE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 PET INSURANCE MARKET: MAJOR PATENTS

- TABLE 11 AVERAGE SELLING PRICE OF KEY PLAYERS, BY POLICY COVERAGE, 2024

- TABLE 12 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY POLICY COVERAGE, 2022-2024

- TABLE 13 AVERAGE SELLING PRICE TREND OF ACCIDENT & ILLNESS COVERAGE (MONTHLY PREMIUM), BY REGION, 2022-2024

- TABLE 14 AVERAGE SELLING PRICE TREND OF ACCIDENT-ONLY COVERAGE (MONTHLY PREMIUM), BY REGION, 2022-2024

- TABLE 15 AVERAGE SELLING PRICE TREND OF WELLNESS/PREVENTIVE CARE ADD-ONS (MONTHLY PREMIUM), BY REGION, 2022-2024

- TABLE 16 PET INSURANCE MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PET INSURANCE SERVICES (%)

- TABLE 18 KEY BUYING CRITERIA FOR PET INSURANCE SERVICES

- TABLE 19 KEY COMPANIES IMPLEMENTING AI IN PET INSURANCE

- TABLE 20 PET INSURANCE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 21 PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 22 PET INSURANCE POLICY COVERAGE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 23 KEY PLAYERS PROVIDING ACCIDENT & ILLNESS POLICY COVERAGE

- TABLE 24 PET INSURANCE MARKET FOR ACCIDENT & ILLNESS POLICY COVERAGE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 25 KEY PLAYERS PROVIDING ACCIDENT-ONLY POLICY COVERAGE

- TABLE 26 PET INSURANCE MARKET FOR ACCIDENT-ONLY POLICY COVERAGE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 27 KEY PLAYERS PROVIDING WELLNESS/PREVENTIVE CARE ADD-ONS

- TABLE 28 PET INSURANCE MARKET FOR WELLNESS/PREVENTIVE CARE ADD-ONS POLICY COVERAGE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 29 PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 30 PET INSURANCE MARKET FOR DIRECT SALES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 PET INSURANCE MARKET FOR AGENCY SALES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 PET INSURANCE MARKET FOR BROKER SALES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 PET INSURANCE MARKET FOR BANCASSURANCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 34 PET INSURANCE MARKET FOR OTHER SALES CHANNELS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 36 PET INSURANCE MARKET FOR PRIVATE PROVIDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 PET INSURANCE MARKET FOR PUBLIC PROVIDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 39 KEY PLAYERS PROVIDING PET INSURANCE FOR DOGS

- TABLE 40 PET INSURANCE MARKET FOR DOGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 KEY PLAYERS PROVIDING PET INSURANCE FOR CATS

- TABLE 42 PET INSURANCE MARKET FOR CATS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 KEY PLAYERS PROVIDING PET INSURANCE FOR OTHER ANIMAL TYPES

- TABLE 44 PET INSURANCE MARKET FOR OTHER ANIMAL TYPES, BY COUNTRY,

- TABLE 45 PET INSURANCE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: PET INSURANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 51 US: KEY MACROINDICATORS

- TABLE 52 US: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 53 US: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 54 US: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 55 US: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 56 CANADA: KEY MACROINDICATORS

- TABLE 57 CANADA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 58 CANADA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 59 CANADA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 60 CANADA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 61 EUROPE: PET INSURANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 63 EUROPE: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 65 EUROPE: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 66 GERMANY: KEY MACROINDICATORS

- TABLE 67 GERMANY: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 68 GERMANY: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 69 GERMANY: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 70 GERMANY: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 71 UK: KEY MACROINDICATORS

- TABLE 72 UK: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 73 UK: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 74 UK: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 75 UK: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 76 FRANCE: KEY MACROINDICATORS

- TABLE 77 FRANCE: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 78 FRANCE: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 79 FRANCE: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 80 FRANCE: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 81 ITALY: KEY MACROINDICATORS

- TABLE 82 ITALY: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 83 ITALY: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 84 ITALY: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 85 ITALY: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 86 SPAIN: KEY MACROINDICATORS

- TABLE 87 SPAIN: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 88 SPAIN: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 89 SPAIN: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 90 SPAIN: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 91 SWEDEN: KEY MACROINDICATORS

- TABLE 92 SWEDEN: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 93 SWEDEN: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 94 SWEDEN: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 95 SWEDEN: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 96 REST OF EUROPE: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 97 REST OF EUROPE: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 98 REST OF EUROPE: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 99 REST OF EUROPE: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: PET INSURANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 105 CHINA: KEY MACROINDICATORS

- TABLE 106 CHINA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 107 CHINA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 108 CHINA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 109 CHINA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 110 JAPAN: KEY MACROINDICATORS

- TABLE 111 JAPAN: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 112 JAPAN: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 113 JAPAN: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 114 JAPAN: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 115 INDIA: KEY MACROINDICATORS

- TABLE 116 INDIA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 117 INDIA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 118 INDIA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 119 INDIA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 120 AUSTRALIA: KEY MACROINDICATORS

- TABLE 121 AUSTRALIA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 122 AUSTRALIA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 123 AUSTRALIA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 124 AUSTRALIA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 125 SOUTH KOREA: KEY MACRO INDICATORS

- TABLE 126 SOUTH KOREA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 127 SOUTH KOREA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 128 SOUTH KOREA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 129 SOUTH KOREA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 130 THAILAND: KEY MACROINDICATORS

- TABLE 131 THAILAND: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 132 THAILAND: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 133 THAILAND: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 134 THAILAND: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 135 NEW ZEALAND: KEY MACROINDICATORS

- TABLE 136 NEW ZEALAND: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 137 NEW ZEALAND: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 138 NEW ZEALAND: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 139 NEW ZEALAND: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 141 REST OF ASIA PACIFIC: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 143 REST OF ASIA PACIFIC: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 144 LATIN AMERICA: PET INSURANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 LATIN AMERICA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 147 LATIN AMERICA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 148 LATIN AMERICA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 149 BRAZIL: KEY MACROINDICATORS

- TABLE 150 BRAZIL: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 151 BRAZIL: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 152 BRAZIL: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 153 BRAZIL: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 154 MEXICO: KEY MACROINDICATORS

- TABLE 155 MEXICO: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 156 MEXICO: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 157 MEXICO: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 158 MEXICO: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 159 REST OF LATIN AMERICA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 160 REST OF LATIN AMERICA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 161 REST OF LATIN AMERICA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF LATIN AMERICA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 168 GCC COUNTRIES: PET INSURANCE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 169 GCC COUNTRIES: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 170 GCC COUNTRIES: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 171 GCC COUNTRIES: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 172 GCC COUNTRIES: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 173 KINGDOM OF SAUDI ARABIA: KEY MACROINDICATORS

- TABLE 174 KINGDOM OF SAUDI ARABIA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 175 KINGDOM OF SAUDI ARABIA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 176 KINGDOM OF SAUDI ARABIA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 177 KINGDOM OF SAUDI ARABIA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 178 UNITED ARAB EMIRATES: KEY MACROINDICATORS

- TABLE 179 UNITED ARAB EMIRATES: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 180 UNITED ARAB EMIRATES: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 181 UNITED ARAB EMIRATES: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 182 UNITED ARAB EMIRATES: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 183 OTHER GCC COUNTRIES: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 184 OTHER GCC COUNTRIES: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 185 OTHER GCC COUNTRIES: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 186 OTHER GCC COUNTRIES: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY POLICY COVERAGE, 2023-2030 (USD MILLION)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY SALES CHANNEL, 2023-2030 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY PROVIDER TYPE, 2023-2030 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: PET INSURANCE MARKET, BY ANIMAL TYPE, 2023-2030 (USD MILLION)

- TABLE 191 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN PET INSURANCE MARKET

- TABLE 192 PET INSURANCE MARKET: DEGREE OF COMPETITION

- TABLE 193 US PET INSURANCE MARKET: DEGREE OF COMPETITION

- TABLE 194 PET INSURANCE MARKET: REGION FOOTPRINT

- TABLE 195 PET INSURANCE MARKET: POLICY COVERAGE FOOTPRINT

- TABLE 196 PET INSURANCE MARKET: ANIMAL TYPE FOOTPRINT

- TABLE 197 PET INSURANCE MARKET: PROVIDER TYPE FOOTPRINT

- TABLE 198 PET INSURANCE MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 199 PET INSURANCE MARKET: COMPETITIVE BENCHMARKING OF KEY EMERGING PLAYERS/STARTUPS

- TABLE 200 PET INSURANCE MARKET: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 201 PET INSURANCE MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 202 PET INSURANCE MARKET: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 203 PET INSURANCE MARKET: OTHER DEVELOPMENTS, JANUARY 2022-MARCH 2025

- TABLE 204 TRUPANION: COMPANY OVERVIEW

- TABLE 205 TRUPANION: SERVICES OFFERED

- TABLE 206 TRUPANION: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 207 TRUPANION: DEALS, JANUARY 2022-JULY 2025

- TABLE 208 TRUPANION: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 209 NATIONWIDE MUTUAL INSURANCE COMPANY: COMPANY OVERVIEW

- TABLE 210 NATIONWIDE: SERVICES OFFERED

- TABLE 211 NATIONWIDE: DEALS, JANUARY 2022-JULY 2025

- TABLE 212 NATIONWIDE: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 213 PET PLAN LIMITED: COMPANY OVERVIEW

- TABLE 214 PET PLAN LIMITED: SERVICES OFFERED

- TABLE 215 ANICOM HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 216 ANICOM HOLDINGS, INC.: SERVICES OFFERED

- TABLE 217 HEALTHY PAWS: COMPANY OVERVIEW

- TABLE 218 HEALTHY PAWS: SERVICES OFFERED

- TABLE 219 HEALTHY PAWS: DEALS, JANUARY 2022-JULY 2025

- TABLE 220 PETS BEST INSURANCE SERVICES, LLC: COMPANY OVERVIEW

- TABLE 221 PETS BEST INSURANCE SERVICES, LLC: SERVICES OFFERED

- TABLE 222 PETS BEST INSURANCE SERVICES, LLC: DEALS, JANUARY 2022-JULY 2025

- TABLE 223 PETS BEST INSURANCE SERVICES, LLC: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 224 PUMPKIN INSURANCE SERVICES INC.: COMPANY OVERVIEW

- TABLE 225 PUMPKIN INSURANCE SERVICES INC.: SERVICES OFFERED

- TABLE 226 PUMPKIN INSURANCE SERVICES INC.: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 227 PUMPKIN INSURANCE SERVICES INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 228 SPOT PET INSURANCE SERVICES, LLC: COMPANY OVERVIEW

- TABLE 229 SPOT PET INSURANCE SERVICES, LLC: SERVICES OFFERED

- TABLE 230 SPOT PET INSURANCE SERVICES, LLC: DEALS, JANUARY 2022-JULY 2025

- TABLE 231 FIGO PET INSURANCE LLC: COMPANY OVERVIEW

- TABLE 232 FIGO PET INSURANCE LLC: SERVICES OFFERED

- TABLE 233 FIGO PET INSURANCE LLC: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 234 AGRIA PET INSURANCE LTD.: COMPANY OVERVIEW

- TABLE 235 AGRIA PET INSURANCE LTD.: SERVICES OFFERED

- TABLE 236 PETPARTNERS, INC.: COMPANY OVERVIEW

- TABLE 237 PETPARTNERS, INC.: SERVICES OFFERED

- TABLE 238 ASPCA: COMPANY OVERVIEW

- TABLE 239 ASPCA: SERVICES OFFERED

- TABLE 240 PET PROTECT LIMITED: COMPANY OVERVIEW

- TABLE 241 PET PROTECT LIMITED: SERVICES OFFERED

- TABLE 242 EMBRACE PET INSURANCE AGENCY, LLC: COMPANY OVERVIEW

- TABLE 243 EMBRACE PET INSURANCE AGENCY, LLC: SERVICES OFFERED

- TABLE 244 EMBRACE PET INSURANCE AGENCY, LLC: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 245 EMBRACE PET INSURANCE AGENCY, LLC: DEALS, JANUARY 2022-JULY 2025

- TABLE 246 EMBRACE PET INSURANCE AGENCY, LLC: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 247 GETSAFE: COMPANY OVERVIEW

- TABLE 248 GETSAFE: SERVICES OFFERED

- TABLE 249 GETSAFE: DEALS, JANUARY 2022-JULY 2025

- TABLE 250 GETSAFE: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 251 GETSAFE: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 252 WAGGEL LIMITED: COMPANY OVERVIEW

- TABLE 253 NAPO LIMITED: COMPANY OVERVIEW

- TABLE 254 MANY GROUP LTD.: COMPANY OVERVIEW

- TABLE 255 EVERYPAW: COMPANY OVERVIEW

- TABLE 256 LASSIE AB: COMPANY OVERVIEW

- TABLE 257 DALMA: COMPANY OVERVIEW

- TABLE 258 IPET INSURANCE CO., LTD.: COMPANY OVERVIEW

- TABLE 259 AGILA HAUSTIERVERSICHERUNG AG: COMPANY OVERVIEW

- TABLE 260 WAGMO INC.: COMPANY OVERVIEW

- TABLE 261 FELIX: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PET INSURANCE MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 PET INSURANCE MARKET: RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION (SUPPLY SIDE)

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION (DEMAND SIDE)

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: TRUPANION

- FIGURE 9 REVENUE ANALYSIS OF TOP FIVE COMPANIES: PET INSURANCE MARKET (2024)

- FIGURE 10 PET INSURANCE MARKET: DEMAND-SIDE ANALYSIS

- FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF PET INSURANCE MARKET (2025-2030)

- FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 13 TOP-DOWN APPROACH

- FIGURE 14 BOTTOM-UP APPROACH

- FIGURE 15 DATA TRIANGULATION METHODOLOGY

- FIGURE 16 PET INSURANCE MARKET, BY POLICY COVERAGE, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 PET INSURANCE MARKET, BY SALES CHANNEL, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 PET INSURANCE MARKET, BY PROVIDER TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 PET INSURANCE MARKET, BY ANIMAL TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 GEOGRAPHIC SNAPSHOT OF PET INSURANCE MARKET

- FIGURE 21 RISE IN PET OWNERSHIP TO PROPEL MARKET

- FIGURE 22 ACCIDENT & ILLNESS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN CHINA IN 2024

- FIGURE 23 ASIA PACIFIC REGION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 26 PET INSURANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 EUROPE: PET POPULATION, 2021-2023

- FIGURE 28 US: PET EXPENDITURE, DOGS VS. CATS, 2024 (USD)

- FIGURE 29 PET INSURANCE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 PET INSURANCE MARKET: NUMBER OF GRANTED PATENT APPLICATIONS (JANUARY 2014-JULY 2025)

- FIGURE 31 TOP APPLICANT COUNTRIES/REGIONS FOR PET INSURANCE PATENTS (JANUARY 2014-MAY 2025)

- FIGURE 32 AVERAGE SELLING PRICE FOR ACCIDENT & ILLNESS OR ACCIDENT-ONLY INSURANCE PLANS, BY KEY PLAYER, 2024

- FIGURE 33 AVERAGE SELLING PRICE OF ACCIDENT & ILLNESS AND ACCIDENT-ONLY COVERAGE, BY REGION, 2024

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PET INSURANCE SERVICES

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 36 AI-USE CASES

- FIGURE 37 PET INSURANCE MARKET: ECOSYSTEM MARKET MAP

- FIGURE 38 PET INSURANCE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 39 PET INSURANCE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 40 INVESTMENT & FUNDING SCENARIO FOR PET INSURANCE MARKET PLAYERS

- FIGURE 41 PET INSURANCE MARKET: GEOGRAPHIC SNAPSHOT

- FIGURE 42 EUROPE: PET INSURANCE MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: DOG POPULATION GROWTH, BY COUNTRY, 2024

- FIGURE 44 ASIA PACIFIC: CAT POPULATION GROWTH, BY COUNTRY, 2024

- FIGURE 45 ASIA PACIFIC: PET INSURANCE MARKET SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN PET INSURANCE MARKET (2020-2024)

- FIGURE 47 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PET INSURANCE MARKET (2024)

- FIGURE 48 US MARKET SHARE ANALYSIS OF KEY PLAYERS IN PET INSURANCE MARKET (2024)

- FIGURE 49 RANKING OF KEY PLAYERS IN PET INSURANCE MARKET, 2024

- FIGURE 50 PET INSURANCE MARKET: COMPANY EVALUATION MATRIX, 2024

- FIGURE 51 PET INSURANCE MARKET: COMPANY FOOTPRINT

- FIGURE 52 PET INSURANCE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 PET INSURANCE MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 54 EV/EBITDA OF KEY VENDORS

- FIGURE 55 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 56 TRUPANION: COMPANY SNAPSHOT (2024)

- FIGURE 57 NATIONWIDE MUTUAL INSURANCE COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 58 ANICOM HOLDINGS, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 59 AGRIA PET INSURANCE LTD.: COMPANY SNAPSHOT (2024)