PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1808093

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1808093

Agricultural Food Loss Reduction Solutions Market by Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Horticultural & Specialty Crops, Root & Tuber Crops), Technology, Solution Type, End User and Region - Global Forecast to 2030

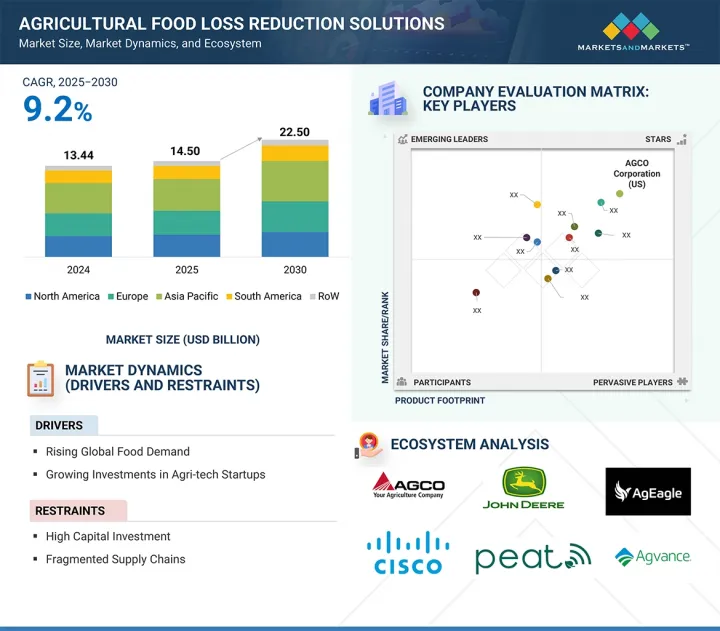

The agricultural food loss reduction solutions market is estimated at USD 14.50 billion in 2025 and is projected to reach USD 22.50 billion by 2030, at a CAGR of 9.2%. The agricultural food loss reduction solutions market is emerging as a critical segment within the global agri-tech and supply chain industries, driven by rising concerns around food security, sustainability, and resource efficiency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (KT) |

| Segments | By Solution Type, Technology, Crop Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

With nearly one-third of global food production lost or wasted before reaching consumers, governments, organizations, and private stakeholders are increasingly investing in advanced cold chain logistics, improved storage and packaging, precision agriculture, and AI-enabled inventory management.

Developing regions, where food loss is often linked to poor infrastructure, are witnessing major technological interventions, while developed economies are scaling automation and digital platforms to optimize food distribution. Despite strong growth potential, the market faces restraints such as high capital costs for advanced technologies, limited adoption among smallholder farmers due to inadequate credit access, and infrastructure gaps in emerging economies. Additionally, fragmented supply chains and a lack of standardization in technology deployment hinder widespread implementation, slowing down adoption in cost-sensitive markets.

"Cereals & Grains segment is projected to dominate the market during forecast period"

The cereal & grains segment holds a significant share in the agricultural food loss reduction solutions market due to the high levels of post-harvest losses recorded across harvesting, collection, threshing, cleaning, drying, packing, transportation, and storage. According to data from the International Journal of Agriculture Sciences in 2022, crops such as sorghum (14.60%), mustard (14.10%), and pigeon pea (12.86%) demonstrate considerable total losses, with an average loss across most grains and pulses ranging from 10% to over 15%. Sesame recorded the highest post-harvest loss at 15.80%, while wheat, gram, and green gram experienced losses exceeding 10%.

These significant losses across multiple stages of the supply chain underline the critical need for effective food loss reduction solutions tailored to this segment, presenting a strong market opportunity for stakeholders to develop and implement targeted interventions, such as improved storage infrastructure, efficient processing systems, and mechanized post-harvest technologies to minimize waste and enhance food security.

"Sensor-based technology systems segment will hold a significant market share during the forecast period"

Sensor-based technologies will hold a significant share in the agricultural food loss reduction solutions market, driven by the need for real-time monitoring, operational efficiency, and minimization of post-harvest losses. These technologies, including radar level sensors, temperature sensors, and IoT-enabled systems, are increasingly being adopted to improve storage management, detect spoilage conditions early, and optimize inventory.

A notable example is the case study dated February 14, 2025, where a farm implemented Jiwei's Smart Grain Bin Level Sensors, resulting in a 30% reduction in grain loss. The radar sensors provided accurate, non-contact measurements and seamless integration with inventory systems, significantly improving grain storage efficiency and reducing operational downtime. This development highlights the tangible benefits of smart sensor integration and reflects a broader industry shift toward data-driven farming practices. As demand for food security and sustainable agriculture rises, sensor-based solutions are poised to become central to reducing losses across the agricultural value chain.

"North America leads market share, while Asia Pacific emerges as the fastest-growing region for food loss solutions"

North America, led by the United States, is projected to hold the largest share of the agricultural food loss reduction solutions market. Strong private-sector participation, government funding, and innovative technologies such as AI-enabled freshness tracking, smart packaging, waste-to-energy infrastructure, and advanced cold chains are driving adoption. Divert, Apeel Sciences, and Hazel Technologies are investing heavily in solutions that minimize post-harvest and distribution-level losses, reinforcing the region's dominance.

Meanwhile, Asia Pacific is expected to witness the fastest growth during the forecast period, supported by rising food demand, urbanization, and government-backed cold chain expansions. India and China are scaling IoT-based monitoring, modular storage hubs, and AI-powered logistics to reduce inefficiencies. Rapid investment from agri-tech startups and increasing collaboration with international players are positioning Asia Pacific as a high-growth hub for food loss reduction technologies.

Breakdown of primaries

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the agricultural food loss reduction solutions market.

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXOs - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 20%, Asia Pacific - 30%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include Deere & Company (US), DJI (China), Lineage Inc. (US), Buhler Group (Switzerland), and Cargill (US).

Research Coverage

This research report categorizes the agricultural food loss reduction solutions market by solution type (pre-harvest loss prevention technologies, harvest technologies, post-harvest loss reduction solutions, service & software solutions), technology (sensor technology, cold chain and refrigeration technologies, packaging technologies, data & analytics technologies, robotics & automations), crop type (cereals & grains, fruits & vegetables, oilseeds & pulses, horticultural & specialty crops, root & tuber crops), end users (individual/smallholder farmers, commercial farms and agribusinesses, agricultural cooperatives, logistics and warehousing providers, food processors and manufacturers), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the agricultural food loss reduction solution. A thorough analysis of the key industry players has provided insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the market. This report covers the competitive analysis of upcoming startups. Furthermore, industry-specific trends such as technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others, are also covered in the study.

Reasons to Buy This Report

The report will offer market leaders/new entrants' information on the closest approximate revenue numbers for the overall agricultural food loss reduction solutions and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points.

- Analysis of key drivers (Increased food losses at the farm stage & transportation drive the demand), restraints (High capital investment in reefer transport limits cold chain expansion in rural areas), opportunities (High post-harvest loss rates across crops create a clear demand for advanced loss-mitigation solutions), and challenges (Unpredictable weather patterns and extreme events can affect crop yields and increase food loss) influencing the growth of the agricultural food loss reduction solutions market

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the agricultural food loss reduction solutions market

- Market Development: Comprehensive information about the lucrative market analysis of the agricultural food loss reduction solutions across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the agricultural food loss reduction solutions market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Lineage, Inc. (US), Americold (US), DECCO Postharvest (US), AgroFresh (Pennsylvania), JBT (US), Sealed Air (US), Amcor Plc (Switzerland), Multivac (Germany), Smurfit Westrock (Ireland), GrainPro Inc (US), and other players in the agricultural food loss reduction solutions market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.3.1 SUPPLY-SIDE

- 2.3.2 DEMAND-SIDE

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.5 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- 4.2 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- 4.3 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE AND COUNTRY

- 4.4 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY AND REGION

- 4.5 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE

- 4.6 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE

- 4.7 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL POPULATION GROWTH AND FOOD DEMAND

- 5.2.2 GOVERNMENT EXPENDITURE AND DEVELOPMENT AID IN FOOD LOSS REDUCTION

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Population growth and rising food demand

- 5.3.1.2 Climate and environmental pressures

- 5.3.2 RESTRAINTS

- 5.3.2.1 High initial investment costs

- 5.3.2.2 Infrastructure gaps in emerging markets

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological innovations

- 5.3.3.2 Circular economy models

- 5.3.4 CHALLENGES

- 5.3.4.1 Fragmented supply chains

- 5.3.4.2 Financial inclusion barriers

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Super Hosokawa Co., Ltd. - AI-driven Demand Forecasting (Japan)

- 5.4.3.2 Zest AI Tool at Nestle Factory (United Kingdom)

- 5.4.4 IMPACT ON AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 FARM PRODUCTION & HARVESTING

- 6.3.2 POST-HARVEST HANDLING

- 6.3.3 STORAGE & WAREHOUSING

- 6.3.4 PROCESSING & PACKAGING

- 6.3.5 TRANSPORTATION & DISTRIBUTION

- 6.3.6 RETAIL & CONSUMPTION

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO (HS CODE 8418)

- 6.4.2 IMPORT SCENARIO (HS CODE 8418)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Cold Chain and Temperature Control Logistics Technology

- 6.5.1.2 Sensor and IoT-Based Monitoring & Control

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Modified Atmosphere Packaging

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Precision Agriculture Technology

- 6.5.1 KEY TECHNOLOGIES

- 6.6 INDICATIVE PRICING ANALYSIS

- 6.6.1 INDICATIVE PRICING TREND: SOLUTION TYPE, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 SUPPLY SIDE

- 6.7.2 DEMAND SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 REGULATORY FRAMEWORK

- 6.12.1 INTRODUCTION

- 6.12.2 NORTH AMERICA

- 6.12.2.1 US

- 6.12.2.2 Canada

- 6.12.2.3 Mexico

- 6.12.3 EUROPE

- 6.12.3.1 European Union (EU)

- 6.12.3.2 France

- 6.12.3.3 Italy

- 6.12.3.4 Germany

- 6.12.4 ASIA PACIFIC

- 6.12.4.1 China

- 6.12.4.2 India

- 6.12.4.3 Japan

- 6.12.4.4 Australia/New Zealand

- 6.12.4.5 Singapore

- 6.12.5 SOUTH AMERICA

- 6.12.5.1 Brazil

- 6.12.5.2 Argentina

- 6.12.5.3 Chile

- 6.12.6 REST OF THE WORLD (ROW)

- 6.12.6.1 Gulf Cooperation Council (e.g., UAE, Saudi Arabia)

- 6.12.6.2 South Africa

- 6.12.6.3 Kenya/East Africa

- 6.12.6.4 EAEU/CIS (e.g., Kazakhstan, Russia, Belarus)

- 6.13 IMPACT OF 2025 US TARIFF - AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 DISRUPTION IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS

- 6.13.4 PRICE IMPACT ANALYSIS

- 6.13.5 IMPACT ON COUNTRY/REGION

- 6.13.5.1 US

- 6.13.5.2 Canada & Mexico

- 6.13.5.3 South America

- 6.13.6 IMPACT ON END-USE INDUSTRY

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 THREAT OF NEW ENTRANTS

- 6.14.2 THREAT OF SUBSTITUTES

- 6.14.3 BARGAINING POWER OF SUPPLIERS

- 6.14.4 BARGAINING POWER OF BUYERS

- 6.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.15.2 BUYING CRITERIA

- 6.16 CASE STUDY ANALYSIS

- 6.17 INVESTMENT AND FUNDING SCENARIO

7 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE

- 7.1 INTRODUCTION

- 7.2 PRE-HARVEST LOSS PREVENTION TECHNOLOGIES

- 7.2.1 PRECISION AGRICULTURE TOOLS

- 7.2.1.1 Driving smarter food loss reduction across farming systems

- 7.2.2 PEST AND DISEASE FORECASTING SYSTEMS

- 7.2.2.1 Helping farmers cut losses via timely, predictive actions

- 7.2.3 SOIL HEALTH MONITORING SENSORS

- 7.2.3.1 Safeguarding food systems and reducing agricultural loss

- 7.2.4 NUTRIENT MANAGEMENT SOLUTIONS

- 7.2.4.1 Minimizing losses and enhancing sustainable crop productivity

- 7.2.1 PRECISION AGRICULTURE TOOLS

- 7.3 HARVEST TECHNOLOGIES

- 7.3.1 MECHANIZED HARVESTERS

- 7.3.1.1 Driving efficiency and minimizing waste with mechanized harvesters

- 7.3.2 RIPENESS AND MATURITY DETECTORS

- 7.3.2.1 Driving efficiency, reducing food waste, and improving profitability

- 7.3.3 MANUAL HARVESTING TOOLS

- 7.3.3.1 Supporting smallholder farmers, reducing crop losses, and boosting productivity

- 7.3.1 MECHANIZED HARVESTERS

- 7.4 POST-HARVEST LOSS REDUCTION TECHNOLOGIES

- 7.4.1 COLD-CHAIN & LOGISTICS INFRASTRUCTURE

- 7.4.1.1 Ensuring global food security, sustainability, and loss reduction

- 7.4.2 HERMETIC STORAGE SOLUTIONS

- 7.4.2.1 Safeguarding harvests, cutting grain losses, and boosting global food security

- 7.4.3 MODIFIED ATMOSPHERE PACKAGING

- 7.4.3.1 Extending cereal shelf life, minimizing food loss

- 7.4.4 CONTROLLED ATMOSPHERE STORAGE

- 7.4.4.1 Extending grain life, reducing losses, and ensuring food security

- 7.4.5 DRYING, CURING, & EVAPORATIVE COOLING TECHNOLOGIES

- 7.4.5.1 Extending shelf life and preventing spoilage

- 7.4.6 BIO-PRESERVATION & TREATMENT TECHNOLOGIES

- 7.4.6.1 Extending freshness, reducing waste, and securing food quality

- 7.4.1 COLD-CHAIN & LOGISTICS INFRASTRUCTURE

- 7.5 SERVICE & SOFTWARE SOLUTIONS

- 7.5.1 SUPPLY CHAIN TRACEABILITY SOLUTIONS

- 7.5.1.1 Enhancing food loss reduction

- 7.5.2 REMOTE SENSING AND IOT-BASED LOSS DETECTION SYSTEMS

- 7.5.2.1 Driving agricultural food loss prevention

- 7.5.3 AI-BASED FARM ADVISORY AND DECISION SUPPORT

- 7.5.3.1 Reducing crop losses and boosting sustainability

- 7.5.4 DATA ANALYTICS AND FORECASTING TOOLS

- 7.5.4.1 Minimizing post-harvest food loss

- 7.5.1 SUPPLY CHAIN TRACEABILITY SOLUTIONS

8 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 SENSOR TECHNOLOGIES

- 8.2.1 IOT SENSORS

- 8.2.1.1 Empowering global food waste reduction across supply chains

- 8.2.2 RFID AND QR CODES SYSTEMS

- 8.2.2.1 Revolutionizing food waste reduction through smarter tracking, pricing, and freshness monitoring

- 8.2.3 SATELLITE AND DRONE IMAGING

- 8.2.3.1 Driving food waste reduction through smarter monitoring

- 8.2.1 IOT SENSORS

- 8.3 COLD CHAIN AND REFRIGERATION TECHNOLOGIES

- 8.3.1 SAFEGUARDING FOOD QUALITY AND CUTTING WASTE ACROSS GLOBAL SUPPLY CHAINS

- 8.4 DATA & ANALYTICS TECHNOLOGIES

- 8.4.1 MACHINE LEARNING AND BIG DATA ANALYTICS

- 8.4.1.1 Unlocking smarter solutions for global food loss reduction

- 8.4.2 PREDICTIVE MODELING AND YIELD FORECASTING

- 8.4.2.1 Driving smarter agriculture and reducing global food waste

- 8.4.1 MACHINE LEARNING AND BIG DATA ANALYTICS

- 8.5 ROBOTICS AND AUTOMATION

- 8.5.1 AUTOMATED HARVESTING SYSTEMS

- 8.5.1.1 Driving efficiency to reduce post-harvest agricultural food losses

- 8.5.2 SORTING AND GRADING ROBOTS

- 8.5.2.1 Transforming post-harvest food loss reduction

- 8.5.1 AUTOMATED HARVESTING SYSTEMS

9 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE

- 9.1 INTRODUCTION

- 9.2 CEREALS & GRAINS

- 9.2.1 ADVANCING COLLABORATIVE TECH AND PARTNERSHIPS FOR SUSTAINABLE SOLUTIONS TO DRIVE MARKET

- 9.3 FRUITS & VEGETABLES

- 9.3.1 TRANSFORMING SUPPLY CHAINS TO CUT FRUITS & VEGETABLES WASTE

- 9.4 OILSEEDS & PULSES

- 9.4.1 DRIVING DIGITAL INNOVATIONS TO MINIMIZE OILSEED AND PULSE LOSSES FOR SUSTAINABLE FOOD SECURITY AND PROFITABILITY

- 9.5 HORTICULTURAL & SPECIALTY CROPS

- 9.5.1 HARNESSING DIGITAL TOOLS TO REDUCE LOSSES IN HORTICULTURAL AND SPECIALTY CROPS GLOBALLY

- 9.6 OTHER CROP TYPES

- 9.6.1 ADVANCING POST-HARVEST INNOVATIONS TO REDUCE LOSSES IN ROOT AND TUBER CROPS WORLDWIDE

10 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 INDIVIDUAL/SMALLHOLDER FARMERS

- 10.2.1 EMPOWERING SMALLHOLDER FARMERS TO DRIVE FOOD LOSS REDUCTION

- 10.3 COMMERCIAL FARMERS & AGRIBUSINESSES

- 10.3.1 BUILDING SMARTER, EFFICIENT SUPPLY CHAINS TO TACKLE GLOBAL FOOD WASTE

- 10.4 AGRICULTURAL CO-OPERATIVES

- 10.4.1 REDUCING FOOD WASTE, ENHANCING FARMER INCOMES, AND DRIVING SUSTAINABLE GROWTH GLOBALLY

- 10.5 LOGISTICS & WAREHOUSING PROVIDERS

- 10.5.1 ENHANCING FOOD SECURITY THROUGH SMARTER LOGISTICS, COLD CHAINS, AND DIGITAL WAREHOUSING

- 10.6 FOOD PROCESSORS & MANUFACTURERS

- 10.6.1 EMPOWERING FOOD PROCESSORS WITH INNOVATIVE TECHNOLOGIES FOR EFFECTIVE LOSS REDUCTION

11 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Federal and industry collaboration to halve food loss and waste by 2030

- 11.2.2 CANADA

- 11.2.2.1 Canada accelerates food waste reduction with innovation, upcycling, and annual loss prevention efforts

- 11.2.3 MEXICO

- 11.2.3.1 Mexico advances food loss solutions with public-private partnerships, tech innovation, and global sustainability goals

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Germany scales food waste reduction with national strategy, retail innovation, and sustainable supply chain partnerships

- 11.3.2 UK

- 11.3.2.1 UK combats food waste with agritech innovation, retail leadership, and national reduction roadmap

- 11.3.3 FRANCE

- 11.3.3.1 France accelerates food waste reduction with circular economy solutions

- 11.3.4 SPAIN

- 11.3.4.1 Spain's food waste law spurs innovation in agricultural food loss reduction and retail sustainability

- 11.3.5 ITALY

- 11.3.5.1 Italy's food waste initiatives drive market growth in agricultural loss reduction and retail sustainability

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 China advances agricultural food loss reduction with policy and innovation

- 11.4.2 INDIA

- 11.4.2.1 India accelerates cold chain innovation to cut food loss and strengthen farmer incomes

- 11.4.3 JAPAN

- 11.4.3.1 Collaborative insurance, business, and community models driving Japan's food loss reduction

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Driving food loss reduction with national strategies, innovation, and community partnerships

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Brazil strengthens food loss reduction with tech innovations, policy reforms, and global partnerships

- 11.5.2 ARGENTINA

- 11.5.2.1 Argentina advances food loss reduction with AI, waste innovation, and strategic food bank partnerships

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD

- 11.6.1 MIDDLE EAST

- 11.6.1.1 Awareness campaigns, technological innovation, and sustainable waste policies driving market growth

- 11.6.2 AFRICA

- 11.6.2.1 Tackling Africa's food loss crisis through innovation, policy, and strategic partnerships

- 11.6.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET RANKING ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 EV/EBITDA

- 12.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Technology footprint

- 12.7.5.4 Solution type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DEERE & COMPANY

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 CNH INDUSTRIAL N.V.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 AGCO

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 CARRIER

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 CISCO SYSTEMS, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 ORBCOMM

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.4 MnM view

- 13.1.7 HEXAGON AB AND/OR ITS SUBSIDIARIES

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.4 MnM view

- 13.1.8 METOS BY PESSL INSTRUMENTS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product Launches

- 13.1.8.4 MnM view

- 13.1.9 ECOROBOTIX

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.4 MnM view

- 13.1.10 TEEJET TECHNOLOGIES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.4 MnM view

- 13.1.11 DJI

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product Launches

- 13.1.11.4 MnM view

- 13.1.12 AGEAGLE AERIAL SYSTEMS INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.4 MnM view

- 13.1.13 MONNIT CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.4 MnM view

- 13.1.14 INFRATAB, INC

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.4 MnM view

- 13.1.15 SAP SE OR AN SAP AFFILIATE COMPANY

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.4 MnM view

- 13.1.1 DEERE & COMPANY

- 13.2 OTHER PLAYERS

- 13.2.1 NAIO TECHNOLOGIES INC

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.4 MnM view

- 13.2.2 ROBOTICS PLUS

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.4 MnM view

- 13.2.3 FFROBOTICS

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 MnM view

- 13.2.4 XAG CO., LTD.

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product Launches

- 13.2.4.4 MnM view

- 13.2.5 PHENOLITE BY HIPHEN

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.5.4 MnM view

- 13.2.6 TEMPCUBE

- 13.2.7 VERIGO

- 13.2.8 AGROBOT

- 13.2.9 HARVESTCROO

- 13.2.10 ONETHIRD

- 13.2.1 NAIO TECHNOLOGIES INC

14 ADJACENT AND RELATED MARKET

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 COLD CHAIN MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH LIMITATIONS

- TABLE 4 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 5 KEY FUNDING COMMITMENTS

- TABLE 6 EXPORT SCENARIO FOR HS CODE 8418: TOP 5 COUNTRIES, 2020-2024 (USD THOUSAND)

- TABLE 7 EXPORT SCENARIO FOR HS CODE 8418: TOP 5 COUNTRIES, 2020-2024 (TONS)

- TABLE 8 IMPORT SCENARIO FOR HS CODE 8418: TOP 5 COUNTRIES, 2020-2024 (USD THOUSAND)

- TABLE 9 IMPORT SCENARIO OF HS CODE 8418: TOP 5 COUNTRIES, 2020-2024 (TONS)

- TABLE 10 AVERAGE SELLING PRICE TREND, BY SOURCE, 2020-2024 (USD THOUSAND/PER UNIT OR ANNUALIZED COSTS)

- TABLE 11 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 PATENTS PERTAINING TO AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET AND RELATED PATENTS, 2021-2024

- TABLE 13 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 EXPECTED IMPACT LEVEL ON TARGET PRODUCTS WITH RELEVANT HS CODES DUE TO TRUMP TARIFF IMPACT

- TABLE 21 EXPECTED TARIFF IMPACT ON END-USE INDUSTRIES: AGRICULTURE FOOD LOSS REDUCTION SOLUTIONS

- TABLE 22 IMPACT OF PORTER'S FIVE FORCES ON AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES (%)

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE CROP TYPES

- TABLE 25 WALMART USED BLOCKCHAIN TO REVOLUTIONIZE FOOD TRACEABILITY

- TABLE 26 ECOTUTU'S SOLAR-POWERED COLD STORAGE TACKLED POST-HARVEST LOSSES IN NIGERIA

- TABLE 27 APEEL SCIENCES TACKLED FOOD WASTE WITH PLANT-BASED EDIBLE COATING THAT EXTENDS FRESH PRODUCE SHELF LIFE

- TABLE 28 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 29 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 30 PRE-HARVEST LOSS PREVENTION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 PRE-HARVEST LOSS PREVENTION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 PRE-HARVEST LOSS PREVENTION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2020-2024 (USD MILLION)

- TABLE 33 PRE-HARVEST LOSS PREVENTION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2025-2030 (USD MILLION)

- TABLE 34 HARVEST TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 HARVEST TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 HARVEST TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2020-2024 (USD MILLION)

- TABLE 37 HARVEST TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2025-2030 (USD MILLION)

- TABLE 38 POST-HARVEST LOSS REDUCTION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 POST-HARVEST LOSS REDUCTION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 POST-HARVEST LOSS REDUCTION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2020-2024 (USD MILLION)

- TABLE 41 POST-HARVEST LOSS REDUCTION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2025-2030 (USD MILLION)

- TABLE 42 SERVICE & SOFTWARE SOLUTIONS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 SERVICE & SOFTWARE SOLUTIONS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SERVICE & SOFTWARE SOLUTIONS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2020-2024 (USD MILLION)

- TABLE 45 SERVICE & SOFTWARE SOLUTIONS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2025-2030 (USD MILLION)

- TABLE 46 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 47 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 48 SENSOR TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 SENSOR TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 SENSOR TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2020-2024 (USD MILLION)

- TABLE 51 SENSOR TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2025-2030 (USD MILLION)

- TABLE 52 COLD CHAIN AND REFRIGERATION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 COLD CHAIN AND REFRIGERATION TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 DATA & ANALYTICS TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 DATA & ANALYTICS TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 DATA & ANALYTICS TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2020-2024 (USD MILLION)

- TABLE 57 DATA & ANALYTICS TECHNOLOGIES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2025-2030 (USD MILLION)

- TABLE 58 ROBOTICS AND AUTOMATION: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 ROBOTICS AND AUTOMATION: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 ROBOTICS AND AUTOMATION: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2020-2024 (USD MILLION)

- TABLE 61 ROBOTICS AND AUTOMATION: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SUB-SEGMENT, 2025-2030 (USD MILLION)

- TABLE 62 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 63 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 64 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (KT)

- TABLE 65 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (KT)

- TABLE 66 CEREALS & GRAINS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 CEREALS & GRAINS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 FRUITS & VEGETABLES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 FRUITS & VEGETABLES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 OILSEEDS & PULSES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 OILSEEDS & PULSES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 HORTICULTURAL & SPECIALTY CROPS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 HORTICULTURAL & SPECIALTY CROPS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 OTHER CROP TYPES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 OTHER CROP TYPES: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 77 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 78 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (MILLION TONS)

- TABLE 81 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 82 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 90 US: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 91 US: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 92 US: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 93 US: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 94 CANADA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 95 CANADA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 96 CANADA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 97 CANADA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 98 MEXICO: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 99 MEXICO: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 100 MEXICO: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 101 MEXICO: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 102 EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 103 EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 105 EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 107 EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 108 EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 109 EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 110 GERMANY: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 111 GERMANY: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 112 GERMANY: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 113 GERMANY: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 114 UK: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 115 UK: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 116 UK: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 117 UK: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 118 FRANCE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 119 FRANCE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 120 FRANCE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 121 FRANCE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 122 SPAIN: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 123 SPAIN: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 124 SPAIN: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 125 SPAIN: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 126 ITALY: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 127 ITALY: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 128 ITALY: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 129 ITALY: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 130 REST OF EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 131 REST OF EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 132 REST OF EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 133 REST OF EUROPE: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 142 CHINA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 143 CHINA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 144 CHINA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 145 CHINA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 146 INDIA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 147 INDIA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 148 INDIA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 149 INDIA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 150 JAPAN: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 151 JAPAN: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 152 JAPAN: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 153 JAPAN: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 154 AUSTRALIA & NEW ZEALAND: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 155 AUSTRALIA & NEW ZEALAND: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 156 AUSTRALIA & NEW ZEALAND: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 157 AUSTRALIA & NEW ZEALAND: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 162 SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 163 SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 164 SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 165 SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 166 SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 167 SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 168 SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 169 SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 170 BRAZIL: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 171 BRAZIL: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 172 BRAZIL: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 173 BRAZIL: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 174 ARGENTINA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 175 ARGENTINA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 176 ARGENTINA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 177 ARGENTINA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 179 REST OF SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 182 ROW: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 183 ROW: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 184 ROW: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 185 ROW: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 186 ROW: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 187 ROW: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 188 ROW: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 189 ROW: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 191 MIDDLE EAST: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 193 MIDDLE EAST: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 194 AFRICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 195 AFRICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 196 AFRICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2020-2024 (USD MILLION)

- TABLE 197 AFRICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025-2030 (USD MILLION)

- TABLE 198 OVERVIEW OF STRATEGIES ADOPTED BY KEY AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS VENDORS

- TABLE 199 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: DEGREE OF COMPETITION

- TABLE 200 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: REGION FOOTPRINT

- TABLE 201 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 202 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: SOLUTION TYPE FOOTPRINT

- TABLE 203 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 204 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 205 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 206 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: PRODUCT LAUNCHES, MAY 2023-JULY 2025

- TABLE 207 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: DEALS, DECEMBER 2022-JUNE 2025

- TABLE 208 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 209 DEERE & COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 DEERE & COMPANY: DEALS

- TABLE 211 CNH INDUSTRIAL N.V.: COMPANY OVERVIEW

- TABLE 212 CNH INDUSTRIAL N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 CNH INDUSTRIAL N.V.: DEALS

- TABLE 214 AGCO: COMPANY OVERVIEW

- TABLE 215 AGCO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 216 AGCO: DEALS

- TABLE 217 CARRIER: COMPANY OVERVIEW

- TABLE 218 CARRIER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 219 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 220 CISCO SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 CISCO SYSTEMS INC.: DEALS

- TABLE 222 ORBCOMM: COMPANY OVERVIEW

- TABLE 223 ORBCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 HEXAGON AB AND/OR ITS SUBSIDIARIES: COMPANY OVERVIEW

- TABLE 225 HEXAGON AB AND/OR ITS SUBSIDIARIES: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 226 HEXAGON AB AND/OR ITS SUBSIDIARIES: DEALS

- TABLE 227 METOS BY PESSL INSTRUMENTS: COMPANY OVERVIEW

- TABLE 228 METOS BY PESSL INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 METOS BY PESSL INSTRUMENTS: PRODUCT LAUNCHES

- TABLE 230 ECOROBOTIX: COMPANY OVERVIEW

- TABLE 231 ECOROBOTIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 ECOROBOTIX: DEALS

- TABLE 233 TEEJET TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 234 TEEJET TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 DJI: COMPANY OVERVIEW

- TABLE 236 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 DJI: PRODUCT LAUNCHES

- TABLE 238 AGEAGLE AERIAL SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 239 AGEAGLE AERIAL SYSTEMS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 AGEAGLE AERIAL SYSTEMS INC.: DEALS

- TABLE 241 MONNIT CORPORATION: COMPANY OVERVIEW

- TABLE 242 MONNIT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 INFRATAB, INC.: COMPANY OVERVIEW

- TABLE 244 INFRATAB, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 SAP SE OR AN SAP AFFILIATE COMPANY: COMPANY OVERVIEW

- TABLE 246 SAP SE OR AN SAP AFFILIATE COMPANY: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 247 NAIO TECHNOLOGIES INC: COMPANY OVERVIEW

- TABLE 248 NAIO TECHNOLOGIES INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 ROBOTICS PLUS: COMPANY OVERVIEW

- TABLE 250 ROBOTICS PLUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 FFROBOTICS: COMPANY OVERVIEW

- TABLE 252 FFROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 XAG CO., LTD.: COMPANY OVERVIEW

- TABLE 254 XAG CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 XAG CO., LTD.: PRODUCT LAUNCHES

- TABLE 256 PHENOLITE BY HIPHEN: COMPANY OVERVIEW

- TABLE 257 PHENOLITE BY HIPHEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 PHENOLITE BY HIPHEN: DEALS

- TABLE 259 TEMPCUBE: COMPANY OVERVIEW

- TABLE 260 VERIGO: COMPANY OVERVIEW

- TABLE 261 AGROBOT: COMPANY OVERVIEW

- TABLE 262 HARVESTCROO: COMPANY OVERVIEW

- TABLE 263 ONETHIRD: COMPANY OVERVIEW

- TABLE 264 ADJACENT MARKET TO AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- TABLE 265 COLD CHAIN MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 266 COLD CHAIN MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: RESEARCH DESIGN

- FIGURE 2 KEY DATA FROM SECONDARY SOURCES

- FIGURE 3 KEY INDUSTRY INSIGHTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY, DESIGNATION, AND REGION

- FIGURE 5 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS: MARKET SIZE ESTIMATION - BOTTOM-UP APPROACH

- FIGURE 6 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS: MARKET SIZE ESTIMATION - TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 DATA TRIANGULATION: SUPPLY-SIDE

- FIGURE 9 DATA TRIANGULATION: DEMAND-SIDE

- FIGURE 10 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION

- FIGURE 15 ROBUST GOVERNMENT POLICIES AND FUNDING PROGRAMS TO SUPPORT WIDESPREAD IMPLEMENTATION OF POST-HARVEST TECHNOLOGIES

- FIGURE 16 US ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 17 POST-HARVEST LOSS REDUCTION TECHNOLOGIES SEGMENT AND US TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2025

- FIGURE 18 SENSOR TECHNOLOGY SEGMENT TO DOMINATE MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 19 POST-HARVEST LOSS REDUCTION TECHNOLOGIES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 CEREALS & GRAINS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 LOGISTICS & WAREHOUSING PROVIDERS SEGMENT TO LEAD MARKET BY 2030

- FIGURE 22 HISTORIC AND PROJECTED GLOBAL POPULATION

- FIGURE 23 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET DYNAMICS

- FIGURE 24 ADOPTION OF GEN AI IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS

- FIGURE 25 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 EXPORT DATA FOR HS CODE 8418: TOP 5 COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 28 IMPORT DATA FOR HS CODE 8418: TOP 5 COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 29 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: ECOSYSTEM

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS AND RELATED MARKETS, 2014-2024

- FIGURE 33 PORTER'S FIVE FORCES ANALYSIS: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TECHNOLOGIES

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE CROP TYPES

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 37 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 38 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 39 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 40 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY END USER, 2025 VS. 2030 (USD BILLION)

- FIGURE 41 INDIA TO RECORD FASTEST GROWTH FROM 2025 TO 2030

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST THREE YEARS, 2022-2024 (USD BILLION)

- FIGURE 45 SHARE OF LEADING COMPANIES IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, 2024

- FIGURE 46 RANKING OF TOP FIVE PLAYERS IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, 2024

- FIGURE 47 COMPANY VALUATION OF KEY AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS VENDORS

- FIGURE 48 EV/EBITDA OF KEY COMPANIES

- FIGURE 49 BRAND/PRODUCT COMPARISON ANALYSIS, BY SOLUTION TYPE

- FIGURE 50 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: COMPANY FOOTPRINT

- FIGURE 52 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 54 CNH INDUSTRIAL N.V.: COMPANY SNAPSHOT

- FIGURE 55 AGCO: COMPANY SNAPSHOT

- FIGURE 56 CARRIER: COMPANY SNAPSHOT

- FIGURE 57 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 58 HEXAGON AB AND/OR ITS SUBSIDIARIES: COMPANY SNAPSHOT

- FIGURE 59 AGEAGLE AERIAL SYSTEMS INC.: COMPANY SNAPSHOT

- FIGURE 60 SAP SE OR AN SAP AFFILIATE COMPANY: COMPANY SNAPSHOT