PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1811736

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1811736

LEO PNT Market by Hardware (GNSS Module, Time Synchronization, Backhaul Module, Navigation Signal Generation, Signal Transmission Module), End Use (Government & Defense and Others), Frequency, Satellite Mass and Region - Global Forecast to 2030

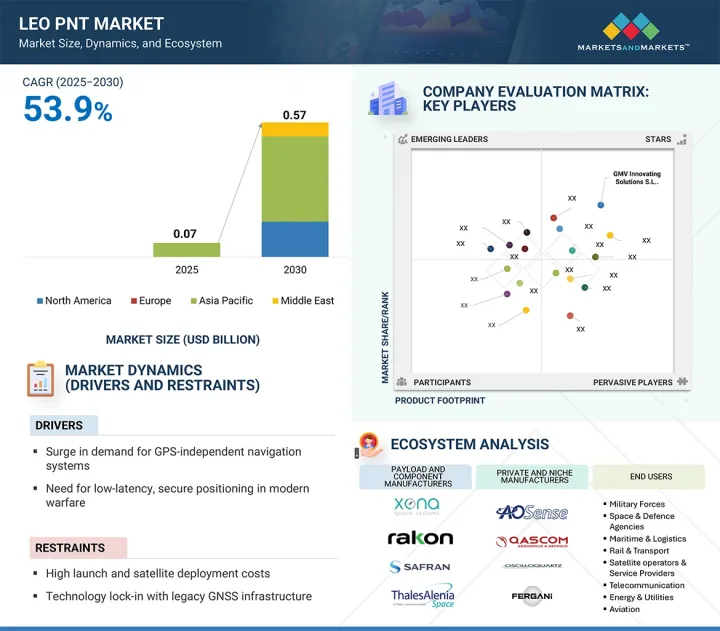

The LEO PNT market is expected to reach USD 0.57 billion by 2030, from USD 0.07 billion in 2025, with a CAGR of 53.9%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Hardware, Satellite Mass, End Use, and Frequency |

| Regions covered | North America, Europe, APAC, RoW |

The market is driven by increasing demand for reliable navigation solutions beyond traditional GNSS, especially in defense, aviation, and infrastructure. Growth is also boosted by higher investments in small satellite constellations and advancements in atomic clocks, GNSS receivers, and authentication technologies. Public-private partnerships and elevated demand in commercial sectors such as logistics and autonomous systems will further accelerate market growth.

"By hardware, signal transmission module is expected to hold the largest share."

The signal transmission module segment holds the largest share of the LEO PNT market because it is widely used for delivering accurate navigation, time synchronization, and secure communication. Its role in controlling signal transmission among users and satellites keeps it ahead in aviation, defense, and strategic infrastructure markets. Additional applications of high-frequency and interference-resistant signals also help maintain its market leadership.

"By satellite mass, CubeSat is expected to record the highest CAGR."

CubeSat represents the fastest-growing segment of the LEO PNT market, driven by factors such as the affordability of launches due to the compactness of small satellites, the potential for rapid expansion of satellite constellations, and the availability of more space for testbed PNT missions. These satellites can carry advanced payloads such as GNSS receivers, atomic clocks, and signal authentication modules, making them attractive for both military and commercial applications. Additionally, increasing government-sponsored initiatives for small satellites and rising individual investments are contributing to the growth of CubeSat applications in secure and distributed PNT architectures.

"North America is expected to be the fastest-growing market for LEO PNT."

North America is witnessing the fastest growth in the LEO PNT market. This growth can be attributed to strong government spending, defense upgrade projects, and the early adoption of next-generation satellite navigation technology. The presence of major market players, combined with a heightened demand for backup PNT solutions due to vulnerabilities in GNSS, is also fueling local growth. The increasing commercial use of PNT in aviation, logistics, and autonomous systems further positions North America as the fastest-growing region during the forecast period.

Breakdown of Primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier-1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation: C-level-25%, D-level-30%, and Others-45%

- By Region: North America-45%, Europe-25%, Asia Pacific-20%, Middle East-10%.

GMV Innovating Solutions S.L. (Spain), Safran (France), Thales Alenia Space (France), Xona Space Systems, Inc. (US), TrustPoint, Inc. (US), Hexagon AB (Sweden), L3Harris Technologies, Inc. (US), and Airbus (Netherlands) are some of the leading players in the LEO PNT market.

Research Coverage

The report on the LEO PNT market offers an analysis from 2025 to 2030. It covers various industry and technology trends, as well as drivers, restraints, challenges, and opportunities that influence market growth. This study also includes an in-depth competitive analysis of key players in the market, featuring company profiles, key insights related to LEO PNT and business offerings, significant developments, and the main strategies adopted by these companies.

Key Benefits of Buying this Report:

This report assists market leaders and new entrants by providing approximate revenue figures for the overall LEO PNT Market and its subsegments. It covers the entire ecosystem of the LEO PNT Market, helping stakeholders understand the competitive landscape and gain insights to better position their businesses and develop appropriate go-to-market strategies. Additionally, the report offers insights into the market's current trends and key factors such as drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers such as a surge in demand for GPS-independent navigation systems, the need for low-latency, secure positioning in modern warfare, and the integration of LEO PNT into autonomous and connected systems

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets - the report analyses the LEO PNT market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the LEO PNT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like GMV Innovating Solutions S.L. (Spain), Safran (France), Thales Alenia Space (France), Xona Space Systems, Inc. (US), TrustPoint, Inc. (US), Hexagon AB (Sweden), L3Harris Technologies, Inc (US), and Airbus (Netherlands)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology (demand side)

- 2.3.1.2 Market size illustration: France's CubeSat LEO PNT market

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LEO PNT MARKET

- 4.2 LEO PNT MARKET, BY SATELLITE MASS

- 4.3 LEO PNT MARKET, BY END USE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand for GPS-independent navigation systems

- 5.2.1.2 Need for low-latency, secure positioning in modern warfare

- 5.2.1.3 Integration of LEO PNT into autonomous and connected systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High launch and satellite deployment costs

- 5.2.2.2 Technology lock-in with legacy GNSS infrastructure

- 5.2.2.3 Orbital congestion and spectrum regulation challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Commercialization of LEO PNT-as-a-Service

- 5.2.3.2 Export potential to non-GNSS nations or allies

- 5.2.3.3 Expansion into denied/degraded environments

- 5.2.4 CHALLENGES

- 5.2.4.1 Long development cycles and uncertain ROI

- 5.2.4.2 Cybersecurity and signal integrity vulnerabilities

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY SATELLITE MASS

- 5.6 VOLUME DATA

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.8.1 TARIFF DATA

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.3 KEY REGULATIONS

- 5.8.3.1 North America

- 5.8.3.2 Europe

- 5.8.3.3 Asia Pacific

- 5.8.3.4 Middle East

- 5.9 TRADE DATA

- 5.9.1 IMPORT SCENARIO (HS CODE 880260)

- 5.9.2 EXPORT SCENARIO (HS CODE 880260)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ASSURED PNT FOR DEFENSE IN GNSS-DENIED ENVIRONMENTS

- 5.12.2 TIMING SYNCHRONIZATION FOR CRITICAL INFRASTRUCTURE

- 5.12.3 PRECISION CLOCKS FOR NEXT-GEN NAVIGATION SATELLITES

- 5.12.4 SDR-BASED NAVIGATION PAYLOAD FOR REGIONAL PNT SERVICES

- 5.13 BUSINESS MODELS

- 5.13.1 SUBSYSTEM OEM SALES

- 5.13.2 PNT-AS-A-SERVICE

- 5.13.3 CUSTOM PAYLOAD INTEGRATION

- 5.14 TOTAL COST OF OWNERSHIP

- 5.15 BILL OF MATERIALS

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 TECHNOLOGY ROADMAP

- 5.18 TECHNOLOGY ANALYSIS

- 5.18.1 KEY TECHNOLOGIES

- 5.18.1.1 Carrier phase-based LEO ranging

- 5.18.1.2 Chip-scale atomic clocks

- 5.18.1.3 Frequency-diverse PNT waveforms

- 5.18.1.4 Two-way time transfer protocols

- 5.18.1.5 Software-defined transponders

- 5.18.2 COMPLEMENTARY TECHNOLOGIES

- 5.18.2.1 Sensor fusion

- 5.18.2.2 Cryptographic signal authentication

- 5.18.2.3 Electronically steered antennas

- 5.18.1 KEY TECHNOLOGIES

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 NORTH AMERICA

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.19.4 MIDDLE EAST

- 5.20 IMPACT OF MEGATRENDS

- 5.20.1 AI-ENABLED AUTONOMY FOR LEO SATELLITE CONSTELLATIONS

- 5.20.2 TIME-SENSITIVE NETWORKING IN 5G AND 6G

- 5.20.3 GAN-BASED RF AMPLIFIERS

- 5.20.4 MINIATURIZATION AND SPACE-QUALIFICATION OF PRECISION TIMING

- 5.20.5 OPTICAL COMMUNICATIONS AND CROSSLINK INFRASTRUCTURE

- 5.21 PATENT ANALYSIS

- 5.22 IMPACT OF AI

- 5.22.1 AI IN ATOMIC CLOCK DRIFT MODELING

- 5.22.2 AI-ENABLED SOFTWARE TRANSPONDER LOGIC

- 5.22.3 AI IN ANTENNA BEAM CONTROL

- 5.22.4 AI IN POWER AMPLIFIER MANAGEMENT

- 5.22.5 AI IN GNSS SIGNAL PROCESSING

- 5.23 MARKET SCENARIO ANALYSIS

- 5.24 US 2025 TARIFF

- 5.24.1 INTRODUCTION

- 5.24.2 KEY TARIFF RATES

- 5.24.3 PRICE IMPACT ANALYSIS

- 5.24.4 IMPACT ON COUNTRY/REGION

- 5.24.4.1 US

- 5.24.4.2 Europe

- 5.24.4.3 Asia Pacific

- 5.24.5 IMPACT ON END-USE INDUSTRIES

- 5.24.5.1 Commercial

- 5.24.5.2 Defense

- 5.24.5.3 Government

6 LEO PNT MARKET, BY HARDWARE

- 6.1 INTRODUCTION

- 6.2 USE CASE

- 6.3 GNSS MODULE

- 6.3.1 INTEGRATING ANTENNA-TO-RECEIVER PNT FUNCTIONALITY FOR COMPACT LEO PAYLOADS

- 6.3.2 GNSS ANTENNA

- 6.3.3 GNSS RECEIVER

- 6.4 TIME SYNCHRONIZATION

- 6.4.1 ESTABLISHING SUB-MICROSECOND COHERENCE ACROSS LEO-BASED PNT ARCHITECTURES

- 6.4.2 ATOMIC CLOCK

- 6.4.3 CLOCK MONITORING & CONTROL UNIT

- 6.4.4 OCXO/PLL/DISTRIBUTION NETWORK

- 6.5 BACKHAUL MODULE

- 6.5.1 ENABLING HIGH-CAPACITY DATA UPLINK FOR PNT COMMAND, CONTROL, AND SYNCHRONIZATION

- 6.5.2 BACKHAUL ANTENNA

- 6.5.3 BACKHUAL RECEIVER

- 6.6 NAVIGATION SIGNAL GENERATION

- 6.6.1 ALLOWING REAL-TIME, SOFTWARE-DEFINED PNT BROADCASTS IN DYNAMIC LEO ENVIRONMENTS

- 6.6.2 NAVIGATION SIGNAL GENERATION UNIT

- 6.6.3 FREQUENCY GENERATION & UP-CONVERSION UNIT

- 6.7 SIGNAL TRANSMISSION MODULE

- 6.7.1 PROVIDING PRECISION SIGNALS TO END USERS THROUGH ROBUST TRANSMISSION CHAINS

- 6.7.2 HIGH-POWER AMPLIFIER

- 6.7.3 RF FILTER

- 6.7.4 ANTENNA

- 6.7.5 INTER-SATELLITE LINK

7 LEO SATELLITE MARKET, BY SATELLITE MASS

- 7.1 INTRODUCTION

- 7.2 USE CASE

- 7.3 CUBESAT

- 7.3.1 ACCELERATING PNT INNOVATION THROUGH LOW-COST DEMONSTRATION PLATFORMS

- 7.4 SMALLSAT

- 7.4.1 ENABLING RESILIENT SATELLITE ARCHITECTURES FOR SECURE AND SCALABLE NAVIGATION SERVICES

- 7.4.2 MICROSAT

- 7.4.3 MINISAT

8 LEO SATELLITE MARKET, BY FREQUENCY

- 8.1 INTRODUCTION

- 8.2 USE CASE

- 8.3 VHF & UHF-BAND

- 8.3.1 ENHANCING SIGNAL PENETRATION AND RELIABILITY IN CHALLENGING ENVIRONMENTS

- 8.4 L-BAND

- 8.4.1 DELIVERING CORE PNT FUNCTIONALITY WITH BROAD TERMINAL COMPATIBILITY

- 8.5 S-BAND

- 8.5.1 ENABLING AGILE PNT SIGNAL MANAGEMENT FOR DYNAMIC ENVIRONMENTS

- 8.6 C-BAND

- 8.6.1 SUPPORTING HIGH-CAPACITY PNT SIGNAL DELIVERY FOR ENCRYPTED AND SECURE APPLICATIONS

- 8.7 KU & KA-BAND

- 8.7.1 FACILITATING HIGH-CAPACITY, LOW-LATENCY PNT THROUGH NEXT-GENERATION HIGH-FREQUENCY INNOVATION

9 LEO PNT MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 USE CASE

- 9.3 GOVERNMENT & DEFENSE

- 9.3.1 STRENGTHENING MULTI-DOMAIN DEFENSE OPERATIONS WITH SECURE, HIGH-RESILIENCE NAVIGATION SOLUTIONS

- 9.3.2 PLATFORM NAVIGATION IN GNSS-DENIED ENVIRONMENT

- 9.3.3 DISMOUNTED FORCE POSITIONING

- 9.3.4 SECURE TIMING FOR TACTICAL NETWORK

- 9.3.5 TEST & TRAINING RANGE TIME/POSITION INSTRUMENTATION

- 9.4 CIVIL AVIATION & UAS

- 9.4.1 ENHANCING AIRSPACE SAFETY AND UAS INTEGRATION WITH HIGH-ACCURACY, LOW-LATENCY POSITIONING SYSTEMS

- 9.4.2 PBN/RNP PERFORMANCE SUPPORT

- 9.4.3 AIRPORT SURFACE OPERATIONS COORDINATION

- 9.4.4 UTM/BVLOS DRONE NAVIGATION & GEOFENCING

- 9.5 MARITIME & OFFSHORE

- 9.5.1 DRIVING RELIABLE MARITIME AND OFFSHORE OPERATIONS WITH LOW-LATENCY, INTERFERENCE-RESILIENT LEO PNT SYSTEMS

- 9.5.2 PORT NAVIGATION & PILOTAGE

- 9.5.3 VESSEL TRAFFIC SERVICES TIMING

- 9.5.4 DYNAMIC POSITIONING & STATION KEEPING

- 9.5.5 OFFSHORE PLATFORM/WIND-FARM POSITIONING & TIMING

- 9.5.6 SEARCH & RESCUE LOCALIZATION

- 9.6 AUTOMOTIVE & MOBILITY

- 9.6.1 ENABLING NEXT-GENERATION AUTONOMOUS AND CONNECTED MOBILITY WITH LOCALIZATION

- 9.6.2 LANE-LEVEL LOCALIZATION FOR ADAS/AV

- 9.6.3 FLEET TELEMATICS & ROAD-ASSET TRACKING

- 9.6.4 RAIL/METRO TIMING & LOCALIZATION FOR SIGNALING

- 9.7 TELECOM & POWER

- 9.7.1 STRENGTHENING CRITICAL INFRASTRUCTURES WITH LOW-LATENCY PNT

- 9.7.2 5G/6G NETWORK SYNCHRONIZATION & BACKHAUL TIMING

- 9.7.3 POWER-GRID SYNCHROPHASOR TIMING & PROTECTION

- 9.7.4 DATA-CENTER/ENTERPRISE GRANDMASTER HOLDOVER

- 9.8 CONSTRUCTION & PRECISION AGRICULTURE

- 9.8.1 TRANSFORMING INFRASTRUCTURE DEVELOPMENT AND FARMING THROUGH LEO PNT

- 9.8.2 SURVEY/GEOMATICS PRECISE POSITIONING

- 9.8.3 CONSTRUCTION MACHINE GUIDANCE

- 9.8.4 PRECISION AGRICULTURE GUIDANCE & OPERATIONS

- 9.9 INDUSTRIAL & LOGISTICS

- 9.9.1 ENABLING PRECISE INDUSTRIAL OPERATIONS AND GLOBAL SUPPLY CHAIN EFFICIENCY

- 9.9.2 INDUSTRIAL LOCALIZATION IN HARSH/NEAR-INDOOR SITES

- 9.9.3 YARD/WAREHOUSE/PORT LOGISTICS ASSET TRACKING

- 9.10 OTHER END USES

10 LEO PNT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 US

- 10.2.2.1 Federal PNT initiatives and procurement programs reinforce leadership in space-based navigation

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 FRANCE

- 10.3.2.1 National space sovereignty goals and ESA-backed subsystem development support expansion

- 10.3.3 UK

- 10.3.3.1 Sovereign funding and SME-led innovation sustain momentum

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 CHINA

- 10.4.2.1 Military-led LEO navigation programs and vertically integrated hardware production propel growth

- 10.4.3 JAPAN

- 10.4.3.1 Government-backed LEO augmentation research and component-level specialization fuel expansion

- 10.4.4 AUSTRALIA

- 10.4.4.1 Defense-led space strategy and allied partnerships prompt growth

- 10.5 MIDDLE EAST

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 GCC

- 10.5.2.1 UAE

- 10.5.2.1.1 Public-private partnerships and knowledge transfer agreements fuel demand

- 10.5.2.1 UAE

- 10.5.3 TURKEY

- 10.5.3.1 Defense-led satellite programs and indigenous subsystem development strengthen market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2025

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Satellite mass footprint

- 11.7.5.4 Frequency footprint

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 List of start-ups/SMEs

- 11.8.5.2 Competitive benchmarking of start-ups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GMV INNOVATING SOLUTIONS S.L.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SAFRAN

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 THALES ALENIA SPACE

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 XONA SPACE SYSTEMS, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 TRUSTPOINT, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 HEXAGON AB

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 L3HARRIS TECHNOLOGIES, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Other developments

- 12.1.8 AIRBUS

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 CACI INTERNATIONAL INC

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Other developments

- 12.1.10 MICROCHIP TECHNOLOGY INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Other developments

- 12.1.11 GENERAL DYNAMICS CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Other developments

- 12.1.12 RUAG GROUP

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Deals

- 12.1.12.3.3 Other developments

- 12.1.13 NORTHROP GRUMMAN

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Other developments

- 12.1.14 HONEYWELL INTERNATIONAL INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.14.3.3 Other developments

- 12.1.15 FUGRO

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.16 RAKON LIMITED

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches

- 12.1.16.3.2 Other developments

- 12.1.17 TELEDYNE TECHNOLOGIES INCORPORATED

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.18 SATELLES, INC.

- 12.1.18.1 Business overview

- 12.1.18.2 Products offered

- 12.1.1 GMV INNOVATING SOLUTIONS S.L.

- 12.2 OTHER PLAYERS

- 12.2.1 SKYKRAFT PTY LTD

- 12.2.2 QASCOM

- 12.2.3 AOSENSE, INC.

- 12.2.4 ARKEDGE SPACE INC.

- 12.2.5 INFLEQTION, INC.

- 12.2.6 OSCILLOQUARTZ

- 12.2.7 ACCUBEAT LTD.

- 12.2.8 BLILEY TECHNOLOGIES

- 12.2.9 FERGANI

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 DEFENSE-DRIVEN DEMAND FOR SECURE NAVIGATION COMPONENTS

- TABLE 3 SIGNAL INTEGRITY AND CYBER THREATS AT COMPONENT LEVEL

- TABLE 4 LEO PNT SATELLITE VOLUME, BY REGION, 2025-2030 (UNITS)

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 TARIFF DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, 2024

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SATELLITE MASS (%)

- TABLE 15 KEY BUYING CRITERIA, BY HARDWARE

- TABLE 16 BUSINESS MODELS IN LEO PNT MARKET

- TABLE 17 BILL OF MATERIALS, BY HARDWARE

- TABLE 18 BILL OF MATERIALS FOR CUBESAT VS. SMALLSAT

- TABLE 19 PATENT ANALYSIS

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 KEY PRODUCT-RELATED TARIFF FOR SATELLITE NON-TERRESTRIAL NETWORKS

- TABLE 22 ANTICIPATED CHANGE IN PRICES AND POTENTIAL IMPACT ON END-USE MARKETS

- TABLE 23 LEO PNT MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 24 LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 25 LEO PNT MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 26 LEO PNT MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 27 LEO PNT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 LEO PNT MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 29 NORTH AMERICA: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: LEO PNT MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 31 NORTH AMERICA: LEO PNT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 32 US: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 33 EUROPE: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 34 EUROPE: LEO PNT MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 35 EUROPE: LEO PNT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 36 FRANCE: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 37 UK: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 38 ASIA PACIFIC: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 39 ASIA PACIFIC: LEO PNT MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 40 ASIA PACIFIC: LEO PNT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 CHINA: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 42 JAPAN: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 43 AUSTRALIA: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 44 MIDDLE EAST: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 45 MIDDLE EAST: LEO PNT MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 46 MIDDLE EAST: LEO PNT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 UAE: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 48 TURKEY: LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- TABLE 49 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 50 LEO PNT MARKET: DEGREE OF COMPETITION

- TABLE 51 REGION FOOTPRINT

- TABLE 52 SATELLITE MASS FOOTPRINT

- TABLE 53 FREQUENCY FOOTPRINT

- TABLE 54 LIST OF START-UPS/SMES

- TABLE 55 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 56 LEO PNT MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 57 LEO PNT MARKET: DEALS, 2021-2025

- TABLE 58 LEO PNT MARKET: OTHER DEVELOPMENTS, 2021-2025

- TABLE 59 GMV INNOVATING SOLUTIONS S.L.: COMPANY OVERVIEW

- TABLE 60 GMV INNOVATING SOLUTIONS S.L.: PRODUCTS OFFERED

- TABLE 61 GMV INNOVATING SOLUTIONS S.L.: DEALS

- TABLE 62 GMV INNOVATING SOLUTIONS S.L.: OTHER DEVELOPMENTS

- TABLE 63 SAFRAN: COMPANY OVERVIEW

- TABLE 64 SAFRAN: PRODUCTS OFFERED

- TABLE 65 SAFRAN: PRODUCT LAUNCHES

- TABLE 66 SAFRAN: DEALS

- TABLE 67 SAFRAN: OTHER DEVELOPMENTS

- TABLE 68 THALES ALENIA SPACE: COMPANY OVERVIEW

- TABLE 69 THALES ALENIA SPACE: PRODUCTS OFFERED

- TABLE 70 THALES ALENIA SPACE: DEALS

- TABLE 71 THALES ALENIA SPACE: OTHER DEVELOPMENTS

- TABLE 72 XONA SPACE SYSTEMS, INC. COMPANY OVERVIEW

- TABLE 73 XONA SPACE SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 74 XONA SPACE SYSTEMS, INC.: DEALS

- TABLE 75 XONA SPACE SYSTEMS, INC.: OTHER DEVELOPMENTS

- TABLE 76 TRUSTPOINT, INC.: COMPANY OVERVIEW

- TABLE 77 TRUSTPOINT, INC.: PRODUCTS OFFERED

- TABLE 78 TRUSTPOINT, INC.: PRODUCT LAUNCHES

- TABLE 79 TRUSTPOINT, INC.: DEALS

- TABLE 80 TRUSTPOINT, INC.: OTHER DEVELOPMENTS

- TABLE 81 HEXAGON AB: COMPANY OVERVIEW

- TABLE 82 HEXAGON AB: PRODUCTS OFFERED

- TABLE 83 HEXAGON AB: DEALS

- TABLE 84 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 85 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 86 L3HARRIS TECHNOLOGIES, INC.: OTHER DEVELOPMENTS

- TABLE 87 AIRBUS: COMPANY OVERVIEW

- TABLE 88 AIRBUS: PRODUCTS OFFERED

- TABLE 89 AIRBUS: DEALS

- TABLE 90 CACI INTERNATIONAL INC: COMPANY OVERVIEW

- TABLE 91 CACI INTERNATIONAL INC: PRODUCTS OFFERED

- TABLE 92 CACI INTERNATIONAL INC: DEALS

- TABLE 93 CACI INTERNATIONAL INC: OTHER DEVELOPMENTS

- TABLE 94 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 95 MICROCHIP TECHNOLOGY INC.: PRODUCTS OFFERED

- TABLE 96 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 97 MICROCHIP TECHNOLOGY INC.: OTHER DEVELOPMENTS

- TABLE 98 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 99 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 100 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 101 GENERAL DYNAMICS CORPORATION: OTHER DEVELOPMENTS

- TABLE 102 RUAG GROUP: COMPANY OVERVIEW

- TABLE 103 RUAG GROUP: PRODUCTS OFFERED

- TABLE 104 RUAG GROUP: PRODUCT LAUNCHES

- TABLE 105 RUAG GROUP: DEALS

- TABLE 106 RUAG GROUP: OTHER DEVELOPMENTS

- TABLE 107 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 108 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 109 NORTHROP GRUMMAN: OTHER DEVELOPMENTS

- TABLE 110 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 111 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 112 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 113 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 114 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 115 FUGRO: COMPANY OVERVIEW

- TABLE 116 FUGRO: PRODUCTS OFFERED

- TABLE 117 FUGRO: DEALS

- TABLE 118 RAKON LIMITED: COMPANY OVERVIEW

- TABLE 119 RAKON LIMITED: PRODUCTS OFFERED

- TABLE 120 RAKON LIMITED: PRODUCT LAUNCHES

- TABLE 121 RAKON LIMITED: OTHER DEVELOPMENTS

- TABLE 122 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 123 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS OFFERED

- TABLE 124 SATELLES, INC.: COMPANY OVERVIEW

- TABLE 125 SATELLES, INC.: PRODUCTS OFFERED

- TABLE 126 SKYKRAFT PTY LTD: COMPANY OVERVIEW

- TABLE 127 QASCOM: COMPANY OVERVIEW

- TABLE 128 AOSENSE, INC.: COMPANY OVERVIEW

- TABLE 129 ARKEDGE SPACE INC.: COMPANY OVERVIEW

- TABLE 130 INFLEQTION, INC.: COMPANY OVERVIEW

- TABLE 131 OSCILLOQUARTZ: COMPANY OVERVIEW

- TABLE 132 ACCUBEAT LTD.: COMPANY OVERVIEW

- TABLE 133 BLILEY TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 134 FERGANI: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LEO PNT MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 L-BAND TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 8 SMALLSAT TO BE LARGER THAN CUBESAT DURING FORECAST PERIOD

- FIGURE 9 BACKHAUL MODULE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 AUTOMOTIVE & MOBILITY TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO HOLD LEADING POSITION IN 2025

- FIGURE 12 GROWING USE OF LEO SATELLITES FOR TRACKING, MONITORING, AND SURVEILLANCE TO DRIVE MARKET

- FIGURE 13 SMALLSAT TO SURPASS CUBESAT DURING FORECAST PERIOD

- FIGURE 14 GOVERNMENT & DEFENSE TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 15 LEO PNT MARKET DYNAMICS

- FIGURE 16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 17 VALUE CHAIN ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD MILLION)

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 20 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 21 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SATELLITE MASS

- FIGURE 23 KEY BUYING CRITERIA, BY HARDWARE

- FIGURE 24 BUSINESS MODELS IN LEO PNT MARKET

- FIGURE 25 BREAKDOWN OF TOTAL COST OF OWNERSHIP

- FIGURE 26 BILL OF MATERIALS, BY HARDWARE

- FIGURE 27 NUMBER AND VALUE OF DEALS IN EUROPEAN START-UPS, 2020-2024 (USD BILLION)

- FIGURE 28 TECHNOLOGY ROADMAP

- FIGURE 29 EVOLUTION OF LEO PNT TECHNOLOGIES

- FIGURE 30 IMPACT OF MEGATRENDS

- FIGURE 31 PATENT ANALYSIS

- FIGURE 32 IMPACT OF AI ON LEO PNT MARKET

- FIGURE 33 LEO PNT SATELLITE LAUNCHES, 2025-2030

- FIGURE 34 LEO PNT MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- FIGURE 35 LEO PNT MARKET, BY SATELLITE MASS, 2025-2030 (USD MILLION)

- FIGURE 37 LEO PNT MARKET, BY END USE, 2025-2030 (USD MILLION)

- FIGURE 38 LEO PNT MARKET, BY REGION, 2025-2030 (USD MILLION)

- FIGURE 39 NORTH AMERICA: LEO PNT MARKET SNAPSHOT

- FIGURE 40 EUROPE: LEO PNT MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: LEO PNT MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST: LEO PNT MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF TOP THREE PLAYERS, 2021-2024

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2025

- FIGURE 45 BRAND/PRODUCT COMPARISON

- FIGURE 46 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 47 COMPANY VALUATION (USD BILLION)

- FIGURE 48 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 COMPANY FOOTPRINT

- FIGURE 50 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 51 SAFRAN: COMPANY SNAPSHOT

- FIGURE 52 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 53 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 54 AIRBUS: COMPANY SNAPSHOT

- FIGURE 55 CACI INTERNATIONAL INC: COMPANY SNAPSHOT

- FIGURE 56 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 57 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 RUAG GROUP: COMPANY SNAPSHOT

- FIGURE 59 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 60 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 61 FUGRO: COMPANY SNAPSHOT

- FIGURE 62 RAKON LIMITED: COMPANY SNAPSHOT

- FIGURE 63 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT