PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1811759

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1811759

Smart Appliances Market by Product (Refrigerator, Washing Machine & Dryer, Dishwasher, Oven & Cooktop, AC, Water Heater, Microwave, Coffee Maker, Air Purifier, Cooker, Vacuum Cleaning Robot), Connectivity Type, Sales Channel - Global Forecast to 2030

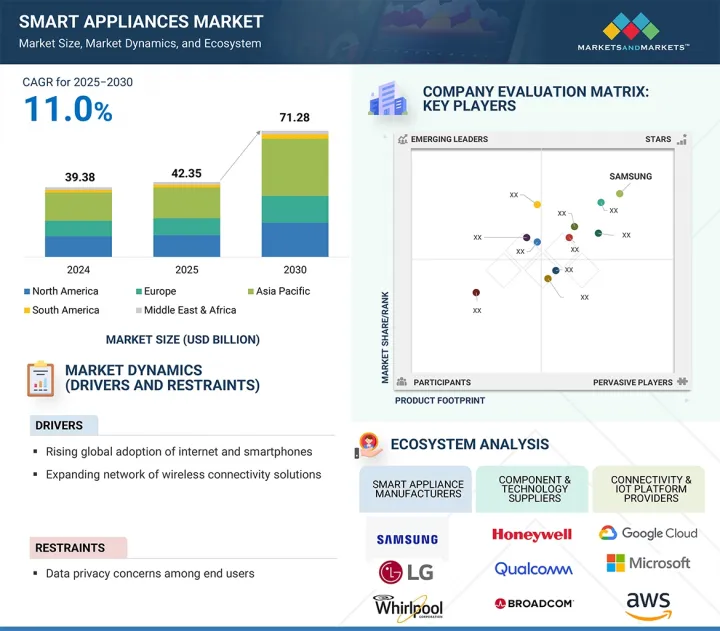

The smart appliances market is valued at USD 39.38 billion in 2025 and is projected to reach USD 71.28 billion by 2030, registering a CAGR of 11.0% during the forecast period. The smart appliances market is experiencing significant growth as consumers increasingly adopt connected and automated home solutions. Core appliances such as refrigerators, washing machines & dryers, dishwashers, ovens & cooktops, and air conditioners are integrating advanced features like Wi-Fi connectivity, AI-driven automation, and remote control to improve convenience, energy efficiency, and operational management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Connectivity Type, Sales Channel and Region |

| Regions covered | North America, Europe, APAC, RoW |

Water heaters, microwaves, coffee makers, vacuum cleaning robots, air purifiers, and cooking robots are also gaining popularity by offering personalized settings, predictive maintenance alerts, and seamless interoperability with other smart devices. The combined adoption of these appliances is driving market expansion, fueled by rising consumer demand for intelligent, energy-efficient, and smart home solutions.

"The online sales channel segment is expected to grow at the highest CAGR during the forecast period."

The online sales channel segment in the smart appliances market is projected to grow at the highest CAGR during the forecast period due to technological advances, changing consumer behavior, and improved digital infrastructure. Rising internet access and widespread smartphone use are enabling more consumers to explore and buy smart appliances easily from e-commerce sites, brand websites, and digital marketplaces like Amazon and Flipkart. Innovative features such as AI-based personalized recommendations, virtual product demos, and augmented reality tools help customers visualize appliance arrangement and functions before purchasing, boosting confidence and reducing hesitation. Moreover, the growing preference for contactless shopping has shifted consumer reliance toward online channels. Attractive offers, including flexible financing, subscription services, same-day delivery, and loyalty programs, further motivate online buying. These factors, along with ongoing investments by manufacturers and retailers in digital marketing and omnichannel strategies, are fueling the rapid growth of online sales segment.

"Air Conditioners are expected to hold the largest market share in the smart appliances market during the study period."

The air conditioner segment is expected to dominate the smart appliances market during the forecast period due to increasing demand for energy-efficient and connected climate control solutions in both residential and commercial spaces. Growing urbanization and rising disposable incomes are pushing consumers to adopt smart air conditioning systems that offer remote control, programmable scheduling, and integration with voice assistants and home automation platforms. Additionally, technological advancements such as IoT-enabled sensors, adaptive cooling, and AI-powered energy management improve user comfort while decreasing electricity use, making these appliances more appealing. Seasonal temperature changes, along with the need to maintain optimal indoor air quality, further boost their popularity. Major manufacturers like Samsung (South Korea), LG Electronics (South Korea), and Panasonic Corporation (Japan) are actively launching smart, feature-rich air conditioners, boosting market penetration. The combination of convenience, energy efficiency, and advanced features makes air conditioners a key revenue-generating segment within the smart appliances market.

"Germany to dominate European smart appliances market in 2024."

Germany leads the smart appliances market in Europe during the forecast period, driven by strong domestic innovation, supportive government policies, and a tech-savvy consumer base. In February 2025, BSH Home Appliances launched advanced Bosch and Siemens dishwashers featuring Steam Treatment, Self-Cleaning Filters, and Extra Clean Zones, meeting the rising demand for energy-efficient and high-performance appliances. Additionally, Vorwerk introduced the Thermomix(R) TM7 in Berlin, a multifunctional cooking robot with AI-assisted recipes and voice control, highlighting the trend toward multifunctional kitchen devices in premium households. At CES 2025, BSH showcased its Matter-enabled smart appliances, including connected refrigerators and dishwashers designed for seamless integration with popular smart home ecosystems, reinforcing Germany's leadership in smart home technology. Government initiatives, such as implementing dynamic electricity tariffs and nationwide smart meter rollouts starting in 2025, further support smart appliance adoption by promoting energy efficiency and sustainability. These developments underline Germany's commitment to integrating advanced technologies into everyday household appliances, positioning it as a leader in the European smart appliances market.

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: Directors - 35%, Managers - 25%, , and Others - 40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 30%, and Rest of the World - 05%

SAMSUNG (South Korea), LG Electronics (South Korea), Panasonic Corporation (Japan), Whirlpool (US), GE Appliances, a Haier company (US), AB Electrolux (Sweden), Midea (China), BSH Hausgerate GmbH (Germany), Xiaomi (China), and Miele & Cie. KG (Germany) are some of the key players in the smart appliances market.

The study includes a detailed competitive analysis of these major smart appliance players, covering their company profiles, recent developments, and key market activities and strategies.

Research Coverage

This research report categorizes the smart appliances market by product (refrigerators, washing machines and dryers, dishwashers, ovens and cooktops, air conditioners, water heaters, microwaves, coffee makers, vacuum cleaning robots, air purifiers, cookers and cooking robots, other smart appliances), by connectivity type (Wi-Fi, Bluetooth), by sales channel (online, offline), by vertical (residential, commercial), and by region (North America, Europe, the Asia Pacific, and the Rest of the World). The report's scope includes detailed information on key factors such as drivers, restraints, challenges, and opportunities that influence the growth of the smart appliances market. A comprehensive analysis of the major industry players offers insights into their business overview, solutions, products, key strategies, contracts, partnerships, agreements, new product launches, mergers and acquisitions, and other recent developments related to the smart appliances market. This report also covers the competitive landscape of the upcoming startups in the smart appliances market.

Reasons to buy this report

The report will assist market leaders and newcomers with information on approximate revenue figures for the overall smart appliances market and its subsegments. It will also help stakeholders understand the competitive landscape and gain better insights to position their businesses more effectively and develop appropriate go-to-market strategies. Additionally, the report helps stakeholders grasp the market pulse and offers details on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising global adoption of internet and smartphones, expanding network of wireless connectivity solutions), restraints (data privacy concerns among end users), opportunities (voice assistant integration and smart ecosystem connectivity, cloud based analytics for performance optimization and service innovation), and challenges (high costs associated with installation of smart appliances, interoperability issues among devices from different manufacturers)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the smart appliances market

- Market Development: Comprehensive information about lucrative markets-the report analyses the smart appliances market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the smart appliances market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players in the smart appliances market, such as SAMSUNG (South Korea), LG Electronics (South Korea), Panasonic Corporation (Japan), Whirlpool (US), GE Appliances, a Haier company (US), AB Electrolux (Sweden), Midea (China), BSH Hausgerate GmbH (Germany), Xiomi (China), and Miele & Cie. KG (Germany), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Intended participants and key opinion leaders in primary interviews

- 2.1.2.2 List of major participants in primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH APPROACH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 STUDY ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART APPLIANCES MARKET

- 4.2 NORTH AMERICA: SMART APPLIANCES MARKET, BY COUNTRY AND PRODUCT

- 4.3 ASIA PACIFIC: SMART APPLIANCES MARKET, BY PRODUCT

- 4.4 SMART APPLIANCES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global adoption of internet and smartphones

- 5.2.1.2 Expanding network of wireless connectivity solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy concerns among consumers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Better voice assistant integration and smart ecosystem connectivity

- 5.2.3.2 Cloud-based analytics for performance optimization and service innovation

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of smart appliance installation

- 5.2.4.2 Interoperability issues among devices from different manufacturers

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 ROLE IN ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF SMART APPLIANCES, BY KEY PLAYER, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF SMART APPLIANCES, BY PRODUCT, 2022-2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF SMART APPLIANCES, BY REGION, 2022-2024

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 COMBINING AI AND BIG DATA FOR AUTONOMOUS DRIVING SERVICES

- 5.7.2 SOLVING SOCIAL ISSUES USING ROBOTS

- 5.7.3 SAMSUNG'S NEW INNOVATIVE TECHNOLOGY BASED ON AI

- 5.7.4 ADAPTIVE INTELLIGENCE TECHNOLOGY IN SMART APPLIANCES

- 5.8 PORTER'S FIVE FORCE ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 PANASONIC TO PROVIDE FACE RECOGNITION SYSTEM AT DENMARK FOOTBALL STADIUM FOR BETTER SECURITY

- 5.9.2 JOHNSON CONTROLS TO HELP HOUSING AUTHORITY BY UPGRADING ITS SECURITY SYSTEM

- 5.9.3 INNOVATIVE SURVEILLANCE SOLUTION OFFERED BY JOHNSON CONTROLS TO HELP RESEARCHERS AT NOAA

- 5.9.4 LESCO LIGHTING TECHNOLOGY TO PROVIDE EXPERT INDOOR ARCHITECTURAL LIGHTING IN MODERN WORKSPACE

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA FOR HS CODE 845011, 2020-2024

- 5.10.2 EXPORT DATA FOR HS CODE 845011, 2020-2024

- 5.11 PATENT ANALYSIS

- 5.11.1 LIST OF MAJOR PATENTS

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 TARRIF & REGULATORY ANALYSIS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 TARIFF ANALYSIS

- 5.13.3 REGULATORY STANDARDS

- 5.14 IMPACT OF AI/GEN AI ON SMART APPLIANCES MARKET

- 5.14.1 INTRODUCTION

- 5.14.2 AI-SPECIFIC USE CASES

- 5.15 IMPACT OF 2025 US TARIFF ON SMART APPLIANCES MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 PRICE IMPACT ANALYSIS

- 5.15.4 IMPACT ON COUNTRIES/REGIONS

- 5.15.4.1 North America

- 5.15.4.1.1 US

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.4.1 North America

- 5.15.5 IMPACT ON END-USE INDUSTRIES

6 SMART APPLIANCES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 REFRIGERATORS

- 6.2.1 GROWING ADOPTION OF AI-POWERED ENERGY OPTIMIZATION FEATURES TO BOOST MARKET DEMAND

- 6.3 WASHING MACHINES & DRYERS

- 6.3.1 AI-BASED FABRIC CARE AND PREDICTIVE MAINTENANCE FEATURES TO DRIVE MARKET DEMAND

- 6.4 DISHWASHERS

- 6.4.1 INTEGRATION OF AI FOR LOAD SENSING AND CUSTOMIZED WASH CYCLES TO FUEL MARKET GROWTH

- 6.5 OVENS & COOKTOPS

- 6.5.1 PRODUCT INNOVATIONS WITH AI-DRIVEN RECIPE RECOMMENDATIONS TO PROPEL MARKET GROWTH

- 6.6 AIR CONDITIONERS

- 6.6.1 INCREASING CONSUMER DEMAND FOR ENERGY-EFFICIENT COOLING SOLUTIONS TO FUEL MARKET GROWTH

- 6.7 WATER HEATERS

- 6.7.1 ADOPTION OF CONNECTED HOME TECHNOLOGIES AND INCREASED AWARENESS OF SUSTAINABLE ENERGY USAGE TO DRIVE DEMAND

- 6.8 MICROWAVES

- 6.8.1 GROWING POPULARITY OF AI-INTEGRATED COOKING ASSISTANCE TO SUPPORT MARKET GROWTH

- 6.9 COFFEE MAKERS

- 6.9.1 INCREASING CONSUMER PREFERENCE FOR CUSTOMIZABLE BREWING FEATURES TO EXPEDITE MARKET DEMAND

- 6.10 VACUUM CLEANING ROBOTS

- 6.10.1 RISING ADOPTION OF AI-DRIVEN, AUTOMATED HOME CLEANING SOLUTIONS TO PROPEL MARKET GROWTH

- 6.11 AIR PURIFIERS

- 6.11.1 INCREASING AWARENESS ABOUT INDOOR AIR QUALITY AND RISING DEMAND FOR PERSONALIZED FILTRATION TO AID MARKET GROWTH

- 6.12 COOKERS/COOKING ROBOTS

- 6.12.1 GROWING DEMAND FOR AUTOMATED COOKING SOLUTIONS AND RECIPE-GUIDED PREPARATION TO DRIVE MARKET

- 6.13 OTHER SMART APPLIANCES

7 SMART APPLIANCES MARKET, BY CONNECTIVITY

- 7.1 INTRODUCTION

- 7.2 WIFI

- 7.2.1 ADOPTION OF SMART HOME TECHNOLOGIES AND HIGH PENETRATION OF IOT-BASED SOLUTIONS TO DRIVE MARKET

- 7.3 BLUETOOTH

- 7.3.1 BETTER INTEGRATION WITH MOBILE APPLICATIONS TO FUEL MARKET DEMAND IN REMOTE OR RURAL AREAS

8 SMART APPLIANCES MARKET, BY SALES CHANNEL

- 8.1 INTRODUCTION

- 8.2 ONLINE

- 8.2.1 EXPANSION OF E-COMMERCE PLATFORMS AND DIGITAL MARKETPLACES TO BOOST DEMAND

- 8.2.2 E-COMMERCE

- 8.2.3 DIRECT-TO-CONSUMER (D2C)

- 8.3 OFFLINE

- 8.3.1 PERSONALIZED IN-STORE ASSISTANCE AND CONSULTATION TO FUEL MARKET GROWTH

- 8.3.2 LARGE FORMAT RETAIL STORES

- 8.3.3 EXCLUSIVE BRAND OUTLETS

- 8.3.4 HYPERMARKETS/SUPERMARKETS

- 8.3.5 DISTRIBUTORS & WHOLESALERS

- 8.3.6 INSTITUTIONAL B2B SALES

9 SMART APPLIANCES MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 RESIDENTIAL

- 9.2.1 GROWING ADOPTION OF IOT AND AI-ENABLED SMART APPLIANCES TO AUGMENT MARKET GROWTH

- 9.3 COMMERCIAL

- 9.3.1 GROWING DEMAND FOR ENERGY-EFFICIENT AND COST-OPTIMIZED SOLUTIONS TO FUEL MARKET DEMAND

10 SMART APPLIANCES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Need for connected, energy-efficient, and easy-to-use home solutions to boost demand

- 10.2.2 CANADA

- 10.2.2.1 Growing consumer preference for connected and energy-monitoring solutions to propel market growth

- 10.2.3 MEXICO

- 10.2.3.1 Rising adoption of smart devices among households to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 UK

- 10.3.1.1 Adoption of connected homes, supportive regulations, and technological advancements to augment market growth

- 10.3.2 GERMANY

- 10.3.2.1 Integration of IoT and smart home platforms with appliances to drive market growth

- 10.3.3 FRANCE

- 10.3.3.1 Integration of voice assistants in smart appliances and high consumer demand for connected home solutions to drive market

- 10.3.4 ITALY

- 10.3.4.1 Product innovations and expansions by global and local manufacturers to stimulate demand

- 10.3.5 REST OF EUROPE

- 10.3.1 UK

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Expansion of 5G infrastructure with seamless smart home connectivity to support market growth

- 10.4.2 JAPAN

- 10.4.2.1 High geriatric population to drive adoption of smart and assistive appliances

- 10.4.3 INDIA

- 10.4.3.1 E-commerce platforms with better accessibility and exclusive product launches to boost market demand

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Strong presence of key players and rapid integration of AI into household devices to drive market competitiveness

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 REST OF THE WORLD

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Better internet access and strong presence of key global players to boost innovation and competition

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Expansion of high-speed internet and popularity of smart home ecosystems to support market growth

- 10.5.3 AFRICA

- 10.5.3.1 Improving internet penetration to enable smart appliance adoption

- 10.5.1 SOUTH AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 REVENUE ANALYSIS, 2020-2024

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- 11.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.4.5.1 Company footprint

- 11.4.5.2 Region footprint

- 11.4.5.3 Vertical footprint

- 11.4.5.4 Product footprint

- 11.4.5.5 Connectivity footprint

- 11.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- 11.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.5.5.1 Competitive benchmarking of key startups/SMEs

- 11.6 COMPETITIVE SCENARIO

- 11.6.1 PRODUCT LAUNCHES

- 11.6.2 DEALS

- 11.6.3 EXPANSIONS

- 11.6.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SAMSUNG

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 LG ELECTRONICS

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 MIDEA

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 WHIRLPOOL

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 PANASONIC CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 GE APPLIANCES, A HAIER COMPANY

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Other developments

- 12.1.7 AB ELECTROLUX

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.8 BSH HAUSGERATE GMBH

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product laaunches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Expansions

- 12.1.9 XIAOMI

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.10 MIELE & CIE. KG

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.1 SAMSUNG

- 12.2 OTHER PLAYERS

- 12.2.1 SHARP CORPORATION

- 12.2.2 FISHER & PAYKEL APPLIANCES LTD.

- 12.2.3 TOVALA

- 12.2.4 HANGZHOU ROBAM APPLIANCES CO., LTD.

- 12.2.5 JUNE

- 12.2.6 DREAME

- 12.2.7 MIRC ELECTRONICS LIMITED

- 12.2.8 HAVELLS INDIA LTD.

- 12.2.9 GODREJ ENTERPRISES

- 12.2.10 BAJAJ ELECTRICALS LIMITED

- 12.2.11 IFB APPLIANCES

- 12.2.12 BYONDNXT SMART HOME PRIVATE LIMITED

- 12.2.13 GEEK TECHNOLOGY

- 12.2.14 ECOVACS

- 12.2.15 CURRENT BACKYARD LLC

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SMART APPLIANCES MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 SMART APPLIANCES MARKET: SUMMARY OF CHANGES

- TABLE 3 SMART APPLIANCES MARKET: LIST OF MAJOR SECONDARY SOURCES

- TABLE 4 SMART APPLIANCES MARKET: INTENDED PARTICIPANTS AND KEY OPINION LEADERS IN PRIMARY INTERVIEWS

- TABLE 5 SMART APPLIANCES MARKET: LIST OF MAJOR PARTICIPANTS IN PRIMARY INTERVIEWS

- TABLE 6 SMART APPLIANCES MARKET: STUDY ASSUMPTIONS

- TABLE 7 SMART APPLIANCES MARKET: RISK ANALYSIS

- TABLE 8 SMART APPLIANCES MARKET: ROLE IN ECOSYSTEM

- TABLE 9 AVERAGE SELLING PRICE TREND OF SMART APPLIANCES, BY KEY PLAYER, 2024 (USD)

- TABLE 10 SMART APPLIANCES MARKET: PORTER'S FIVE FORCES

- TABLE 11 CASE STUDY 1: PANASONIC TO PROVIDE FACE RECOGNITION SYSTEM AT DENMARK FOOTBALL STADIUM FOR BETTER SECURITY

- TABLE 12 CASE STUDY 2: JOHNSON CONTROLS TO HELP HOUSING AUTHORITY BY UPGRADING ITS SECURITY SYSTEM

- TABLE 13 CASE STUDY 3: INNOVATIVE SURVEILLANCE SOLUTION OFFERED BY JOHNSON CONTROLS TO HELP RESEARCHERS AT NOAA

- TABLE 14 CASE STUDY 4: LESCO LIGHTING TECHNOLOGY TO PROVIDE EXPERT INDOOR ARCHITECTURAL LIGHTING IN MODERN WORKSPACE

- TABLE 15 IMPORT SCENARIO FOR HS CODE 845011, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 EXPORT SCENARIO FOR HS CODE 845011, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 17 SMART APPLIANCES MARKET: LIST OF MAJOR PATENTS, 2018-2025

- TABLE 18 LIST OF KEY CONFERENCES & EVENTS IN SMART APPLIANCES MARKET, JANUARY 2025-DECEMBER 2026

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 MFN TARIFF FOR HS CODE 845011-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2023

- TABLE 24 LIST OF REGULATORY STANDARDS IN SMART APPLIANCES MARKET

- TABLE 25 US-ADJUSTED RECIPROCAL TARIFF RATES, 2025 (USD BILLION)

- TABLE 26 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 27 SMART APPLIANCES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 28 SMART APPLIANCES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 29 SMART APPLIANCES MARKET, BY PRODUCT, 2021-2024 (MILLION UNITS)

- TABLE 30 SMART APPLIANCES MARKET, BY PRODUCT, 2025-2030 (MILLION UNITS)

- TABLE 31 REFRIGERATORS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 REFRIGERATORS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 REFRIGERATORS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 34 REFRIGERATORS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 35 REFRIGERATORS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 36 REFRIGERATORS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 37 REFRIGERATORS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 38 REFRIGERATORS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 39 WASHING MACHINES & DRYERS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 WASHING MACHINES & DRYERS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 WASHING MACHINES & DRYERS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 42 WASHING MACHINES & DRYERS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 43 WASHING MACHINES & DRYERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 44 WASHING MACHINES & DRYERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 45 WASHING MACHINES & DRYERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 46 WASHING MACHINES & DRYERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 47 DISHWASHERS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 DISHWASHERS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 DISHWASHERS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 50 DISHWASHERS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 51 DISHWASHERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 52 DISHWASHERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 53 DISHWASHERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 54 DISHWASHERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 55 OVENS & COOKTOPS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 OVENS & COOKTOPS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 OVENS & COOKTOPS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 58 OVENS & COOKTOPS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 59 OVENS & COOKTOPS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 60 OVENS & COOKTOPS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 61 OVENS & COOKTOPS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 62 OVENS & COOKTOPS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 63 AIR CONDITIONERS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 AIR CONDITIONERS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 AIR CONDITIONERS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 66 AIR CONDITIONERS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 67 AIR CONDITIONERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 68 AIR CONDITIONERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 69 AIR CONDITIONERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 70 AIR CONDITIONERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 71 WATER HEATERS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 WATER HEATERS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 WATER HEATERS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 74 WATER HEATERS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 75 WATER HEATERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 76 WATER HEATERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 77 WATER HEATERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 78 WATER HEATERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 79 MICROWAVES: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 MICROWAVES: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 MICROWAVES: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 82 MICROWAVES: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 83 MICROWAVES: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 84 MICROWAVES: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 85 MICROWAVES: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 86 MICROWAVES: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 87 COFFEE MAKERS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 COFFEE MAKERS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 COFFEE MAKERS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 90 COFFEE MAKERS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 91 COFFEE MAKERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 92 COFFEE MAKERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 93 COFFEE MAKERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 94 COFFEE MAKERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 95 VACUUM CLEANING ROBOTS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 VACUUM CLEANING ROBOTS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 VACUUM CLEANING ROBOTS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 98 VACUUM CLEANING ROBOTS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 99 VACUUM CLEANING ROBOTS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 100 VACUUM CLEANING ROBOTS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 101 VACUUM CLEANING ROBOTS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 102 VACUUM CLEANING ROBOTS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 103 AIR PURIFIERS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 AIR PURIFIERS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 AIR PURIFIERS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 106 AIR PURIFIERS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 107 AIR PURIFIERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 108 AIR PURIFIERS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 109 AIR PURIFIERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 110 AIR PURIFIERS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 111 COOKERS/COOKING ROBOTS: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 COOKERS/COOKING ROBOTS: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 COOKERS/COOKING ROBOTS: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 114 COOKERS/COOKING ROBOTS: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 115 COOKERS/COOKING ROBOTS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 116 COOKERS/COOKING ROBOTS: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 117 COOKERS/COOKING ROBOTS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 118 COOKERS/COOKING ROBOTS: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 119 OTHER SMART APPLIANCES: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 OTHER SMART APPLIANCES: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 OTHER SMART APPLIANCES: SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 122 OTHER SMART APPLIANCES: SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 123 OTHER SMART APPLIANCES: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 124 OTHER SMART APPLIANCES: SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 125 OTHER SMART APPLIANCES: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 126 OTHER SMART APPLIANCES: SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 127 SMART APPLIANCES MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 128 SMART APPLIANCES MARKET, BY CONNECTIVITY, 2025-2030 (USD MILLION)

- TABLE 129 SMART APPLIANCES MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 130 SMART APPLIANCES MARKET, BY SALES CHANNEL, 2025-2030 (USD MILLION)

- TABLE 131 SMART APPLIANCES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 132 SMART APPLIANCES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 133 SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: SMART APPLIANCES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 NORTH AMERICA: SMART APPLIANCES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: SMART APPLIANCES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 138 NORTH AMERICA: SMART APPLIANCES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: SMART APPLIANCES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: SMART APPLIANCES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: SMART APPLIANCES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 142 EUROPE: SMART APPLIANCES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: SMART APPLIANCES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: SMART APPLIANCES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: SMART APPLIANCES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: SMART APPLIANCES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 147 REST OF THE WORLD: SMART APPLIANCES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 REST OF THE WORLD: SMART APPLIANCES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 149 REST OF THE WORLD: SMART APPLIANCES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 150 REST OF THE WORLD: SMART APPLIANCES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 151 SMART APPLIANCES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 152 SMART APPLIANCES MARKET: REGION FOOTPRINT

- TABLE 153 SMART APPLIANCES MARKET: VERTICAL FOOTPRINT

- TABLE 154 SMART APPLIANCES MARKET: PRODUCT FOOTPRINT

- TABLE 155 SMART APPLIANCES MARKET: CONNECTIVITY FOOTPRINT

- TABLE 156 SMART APPLIANCES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY REGION, VERTICAL, PRODUCT, AND CONNECTIVITY

- TABLE 157 SMART APPLIANCES MARKET: PRODUCT LAUNCHES, JANUARY 2023-JULY 2025

- TABLE 158 SMART APPLIANCES MARKET: DEALS, JANUARY 2023-JULY 2025

- TABLE 159 SMART APPLIANCES MARKET: EXPANSIONS, JANUARY 2023-JULY 2025

- TABLE 160 SMART APPLIANCES MARKET: OTHER DEVELOPMENTS, JANUARY 2023-JULY 2025

- TABLE 161 SAMSUNG: COMPANY OVERVIEW

- TABLE 162 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 SAMSUNG: PRODUCT LAUNCHES

- TABLE 164 SAMSUNG: DEALS

- TABLE 165 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 166 LG ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 LG ELECTRONICS: PRODUCT LAUNCHES

- TABLE 168 LG ELECTRONICS: DEALS

- TABLE 169 MIDEA: COMPANY OVERVIEW

- TABLE 170 MIDEA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 MIDEA: PRODUCT LAUNCHES

- TABLE 172 MIDEA: DEALS

- TABLE 173 WHIRLPOOL: COMPANY OVERVIEW

- TABLE 174 WHIRLPOOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 WHIRLPOOL: PRODUCT LAUNCHES

- TABLE 176 WHIRLPOOL: DEALS

- TABLE 177 PANASONIC CORPORATION: COMPANY OVERVIEW

- TABLE 178 PANASONIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 PANASONIC CORPORATION: PRODUCT LAUNCHES

- TABLE 180 PANASONIC CORPORATION: DEALS

- TABLE 181 GE APPLIANCES, A HAIER COMPANY: COMPANY OVERVIEW

- TABLE 182 GE APPLIANCES, A HAIER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 GE APPLIANCES, A HAIER COMPANY: PRODUCT LAUNCHES

- TABLE 184 GE APPLIANCES, A HAIER COMPANY: OTHER DEVELOPMENTS

- TABLE 185 AB ELECTROLUX: COMPANY OVERVIEW

- TABLE 186 AB ELECTROLUX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 AB ELECTROLUX: PRODUCT LAUNCHES

- TABLE 188 BSH HAUSGERATE GMBH: COMPANY OVERVIEW

- TABLE 189 BSH HAUSGERATE GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 BSH HAUSGERATE GMBH: PRODUCT LAUNCHES

- TABLE 191 BSH HAUSGERATE GMBH: DEALS

- TABLE 192 BSH HAUSGERATE GMBH: EXPANSIONS

- TABLE 193 XIAOMI: COMPANY OVERVIEW

- TABLE 194 XIAOMI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 XIAOMI: PRODUCT LAUNCHES

- TABLE 196 XIAOMI: DEALS

- TABLE 197 MIELE & CIE. KG: COMPANY OVERVIEW

- TABLE 198 MIELE & CIE. KG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 199 MIELE & CIE. KG: PRODUCT LAUNCHES

- TABLE 200 SHARP CORPORATION: COMPANY OVERVIEW

- TABLE 201 FISHER & PAYKEL APPLIANCES LTD.: COMPANY OVERVIEW

- TABLE 202 TOVALA: COMPANY OVERVIEW

- TABLE 203 HANGZHOU ROBAM APPLIANCES CO., LTD.: COMPANY OVERVIEW

- TABLE 204 JUNE: COMPANY OVERVIEW

- TABLE 205 DREAME: COMPANY OVERVIEW

- TABLE 206 MIRC ELECTRONICS LIMITED: COMPANY OVERVIEW

- TABLE 207 HAVELLS INDIA LTD.: COMPANY OVERVIEW

- TABLE 208 GODREJ ENTERPRISES: COMPANY OVERVIEW

- TABLE 209 BAJAJ ELECTRICALS LIMITED: COMPANY OVERVIEW

- TABLE 210 IFB APPLIANCES: COMPANY OVERVIEW

- TABLE 211 BYONDNXT SMART HOME PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 212 GEEK TECHNOLOGY: COMPANY OVERVIEW

- TABLE 213 ECOVACS: COMPANY OVERVIEW

- TABLE 214 CURRENT BACKYARD LLC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SMART APPLIANCES MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 SMART APPLIANCES MARKET: YEARS CONSIDERED

- FIGURE 3 SMART APPLIANCES MARKET: RESEARCH DESIGN

- FIGURE 4 SMART APPLIANCES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 SMART APPLIANCES MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 6 SMART APPLIANCES MARKET: BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 SMART APPLIANCES MARKET: SECONDARY AND PRIMARY RESEARCH APPROACH

- FIGURE 8 SMART APPLIANCES MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 9 SMART APPLIANCES MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY-SIDE ANALYSIS)

- FIGURE 10 SUPPLY-SIDE MARKET SIZE ESTIMATION METHODOLOGY: IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM SALES OF SMART APPLIANCES

- FIGURE 11 SMART APPLIANCES MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 12 SMART APPLIANCES MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 13 SMART APPLIANCES MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 14 AIR CONDITIONERS HELD LARGEST SMART APPLIANCES PRODUCTS MARKET SHARE IN 2025

- FIGURE 15 WI-FI TO CAPTURE LARGER CONNECTIVITY MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 16 RESIDENTIAL VERTICAL TO COMMAND GREATER MARKET SHARE BETWEEN 2025 AND 2030

- FIGURE 17 ASIA PACIFC TO GROW AT HIGHEST CAGR DURING STUDY PERIOD

- FIGURE 18 INCREASING ADOPTION OF IOT AND AI TECHNOLOGIES IN SMART APPLIANCES TO DRIVE MARKET

- FIGURE 19 US AND REFRIGERATORS TO HOLD LARGEST NORTH AMERICAN SMART APPLIANCES MARKET SHARE IN 2025

- FIGURE 20 AIR CONDITIONERS TO COMMAND LARGEST ASIA PACIFIC MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 INDIA TO GROW AT HIGHEST GROWTH RATE FROM 2025 TO 2030

- FIGURE 22 SMART APPLIANCES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 DRIVERS FOR SMART APPLIANCES MARKET AND THEIR IMPACTS

- FIGURE 24 RESTRAINT FOR SMART APPLIANCES MARKET AND ITS IMPACT

- FIGURE 25 OPPORTUNITIES FOR SMART APPLIANCES MARKET AND THEIR IMPACTS

- FIGURE 26 CHALLENGES FOR SMART APPLIANCES MARKET AND THEIR IMPACTS

- FIGURE 27 SMART APPLIANCES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 SMART APPLIANCES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 SMART APPLIANCES MARKET: TRENDS/DISTRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 30 AVERAGE SELLING PRICE TREND OF SMART APPLIANCES, BY KEY PLAYER, 2024 (USD)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF SMART APPLIANCES, BY PRODUCT, 2022-2024 (USD)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF SMART APPLIANCES, BY REGION, 2022-2024 (USD)

- FIGURE 33 SMART APPLIANCES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 IMPORT DATA FOR HS CODE 845011, 2020-2024 (USD MILLION)

- FIGURE 35 EXPORT DATA FOR HS CODE 845011, 2020-2024 (USD MILLION)

- FIGURE 36 NUMBER OF PATENTS APPLIED/GRANTED IN SMART APPLIANCES MARKET, 2014-2024

- FIGURE 37 AI-SPECIFIC USE CASES IN SMART APPLIANCES MARKET

- FIGURE 38 VACUUM CLEANING ROBOTS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 WI-FI TO DOMINATE SMART APPLIANCES MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 40 ONLINE SALES CHANNEL TO REGISTER HIGHER CAGR FROM 2025 TO 2030

- FIGURE 41 RESIDENTIAL TO DOMINATE SMART APPLIANCES VERTICAL MARKET DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC SMART APPLIANCES MARKET TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 43 NORTH AMERICA: SMART APPLIANCES MARKET SNAPSHOT

- FIGURE 44 EUROPE: SMART APPLIANCES MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: SMART APPLIANCES MARKET SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN SMART APPLIANCES MARKET (2020-2024)

- FIGURE 47 MARKET SHARE ANALYSIS OF KEY PLAYERS IN SMART APPLIANCES MARKET (2024)

- FIGURE 48 SMART APPLIANCES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 SMART APPLIANCES MARKET: COMPANY FOOTPRINT

- FIGURE 50 SMART APPLIANCES MARKET: COMPANY EVALUATION MATRIX (SMES/STARTUPS), 2024

- FIGURE 51 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 52 LG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 53 MIDEA: COMPANY SNAPSHOT

- FIGURE 54 WHIRLPOOL: COMPANY SNAPSHOT

- FIGURE 55 PANASONIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 GE APPLIANCES, A HAIER COMPANY: COMPANY SNAPSHOT

- FIGURE 57 AB ELECTROLUX: COMPANY SNAPSHOT

- FIGURE 58 XIAOMI: COMPANY SNAPSHOT