PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1812632

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1812632

Acrylic Resins Market by Chemistry, Property, Solvency, Application, End-use Industry (Building & Construction, Industrial, Paper & Paperboard, Consumer Goods, Electrical & Electronics, and Packaging), and Region - Global Forecast to 2030

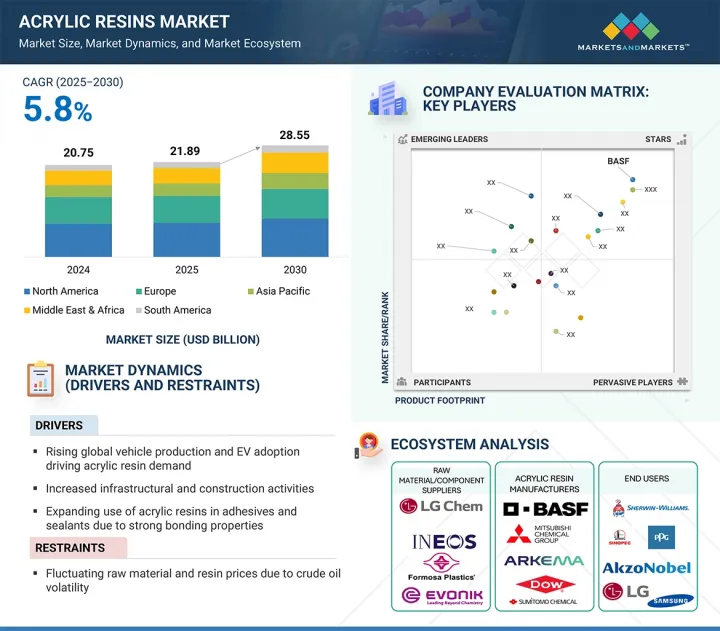

The acrylic resins market is expected to reach USD 28.55 billion by 2030 from USD 21.89 billion in 2025, at a CAGR of 5.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) / Volume (Kilotons) |

| Segments | Chemistry, Property, Solvency, Application, End-use industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The acrylic resins market is witnessing solid growth opportunities, partly fueled by an increasing demand for durable, sustainable, and high-performance materials in a variety of sectors, including construction, automotive, and electronics. Acrylic resins are beneficial for coatings and adhesives because they increase durability, yield attractive color and glossy finish, act as excellent weathering and UV radiation resistant barriers, and have inherently excellent resistance to other chemicals.

As new issues are introduced to the market, regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are now restricting the amounts of volatile organic compounds (VOCs) and hazardous materials allowed within resin systems. To address this issue, the manufacturers of acrylic resins are developing and introducing sustainable, low-VOC, and waterborne acrylic-style resins. In concentrating on and regulating VOCs, this focus has certainly allowed green chemistry to advance more rapidly and more environmentally sensitive products to be developed. In addition, industry demand will continually elevate innovative smart formulation technologies, such as self-healing systems, antimicrobial acrylic coatings, etc. As industries continue to focus (and be legally obligated with stricter regulations) on environmental compliance and durability and performance, it is thought that acrylates and acrylics will be a component of the matrix of the future.

"The building & construction segment accounted for the largest share of the acrylic resins market in 2024."

In 2024, the acrylic resins market was led by the building and construction sector, driven by a rise in durable, weather-resistant coatings, adhesives, and sealants used in residential, commercial, and infrastructure projects. There is growing construction activity worldwide, and acrylic resins offer an overall ecological benefit in terms of stability against UV radiation (sunlight), color retention, flexibility, wear resistance, and durability-all of which are crucial for exterior paints and protective coatings when long-term performance is needed. The ongoing trend of global urbanization and increased infrastructure investment, especially in developing economies, has created significant opportunities for the continued application of acrylic-based materials in construction. Where stricter environmental regulations favor low-VOC and waterborne acrylics across all segments of building and construction, product adoption based on acrylic resin is higher.

"Water-based acrylic resins dominated the market by solvency type in 2024."

Waterborne acrylics held the largest portion of the acrylic resins market in 2024, with increased biodiversity protections from regulators and environmentalists and increasing restrictions on solvent-based products. Waterborne acrylics possess lower VOC emissions than solvent-based acrylics and have better environmental and health profiles, while maintaining performance properties, including adhesion and durability. They are used extensively in architectural coatings, sealants, and adhesives, where sustainability and safe compliance with environmental regulations are very important. Manufacturers' and end users' systemic transition to sustainable, environmentally friendly products has contributed to the increased popularity of water-based acrylic resin formulations worldwide.

"North America dominated the regional market for acrylic resins market in 2024."

In 2024, North America accounted for the largest share of the acrylic resins market. The industrial sector is relatively mature, including automotive, construction, and electronics manufacturing. North America has some of the strictest environmental regulations, including low-VOC requirements from the EPA, which lends a mindset to accelerate the use of advanced waterborne and otherwise environmentally friendly acrylic resin formulations. In addition, robust demand for high-performance coatings, adhesives, and sealants in new construction and aftermarket refinishing drives market growth. Additionally, the presence of the largest chemical manufacturers and commitment to investment in research & development help solidify North America's position as the largest acrylic resins market in the world.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: BASF (Germany), Dow (US), Mitsubishi Chemical Group Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), Arkema (France), DIC CORPORATION (Japan), Covestro AG (Germany), Mitsui Chemicals, Inc. (Japan), Trinseo (US), and Asahi Kasei Corporation (Japan) are covered in the report.

The study includes an in-depth competitive analysis of these key players in the acrylic resins market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the acrylic resins market based on Chemistry (Methacrylates, Acrylates, and Hybrid), Solvency (Solvent based and Water based), Property (thermosetting and thermoplastics), application ( Paints & Coatings, Adhesives & Sealants, DIY Coatings, and Elastomers ), end-use industry (Building & Construction, Industrial, Paper & Paperboard, Consumer Goods, Electrical & Electronics, Packaging), and Region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the acrylic resins market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, collaborations, mergers, acquisitions, product launches, and expansions, associated with the acrylic resins market. This report covers a competitive analysis of upcoming startups in the acrylic resins market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall acrylic resins market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Assessing the major drivers (increased global vehicle production and electric vehicle adoption boost acrylic resin demand, rising infrastructure and construction activities, and growing demand for acrylic resins in adhesives and sealants given superior bonding performance), restraints (volatile raw material and resin prices due to crude oil price fluctuations, environmental concerns regarding low biodegradability of acrylic resins coming into play with disposal), opportunities (rapid growth of photopolymer and 3D-printing resin uses and growing market for bio-based and sustainable resin alternatives), and challenges (stringent environmental regulations and related compliance costs).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the acrylic resins market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the acrylic resins market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the acrylic resins market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as BASF (Germany), Dow (US), Mitsubishi Chemical Group Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), Arkema (France), DIC CORPORATION (Japan), Covestro AG (Germany), Mitsui Chemicals, Inc. (Japan), Trinseo (US), and Asahi Kasei Corporation (Japan), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 RISK ASSESSMENT

- 2.7 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ACRYLIC RESINS MARKET

- 4.2 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.3 ACRYLIC RESINS MARKET, BY CHEMISTRY

- 4.4 ACRYLIC RESINS MARKET, BY SOLVENCY

- 4.5 ACRYLIC RESINS MARKET, BY PROPERTY

- 4.6 ACRYLIC RESINS MARKET, BY APPLICATION

- 4.7 ACRYLIC RESINS MARKET, BY END-USE INDUSTRY

- 4.8 ACRYLIC RESINS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global vehicle production and adoption of EVs

- 5.2.1.2 Increasing infrastructural and construction activities

- 5.2.1.3 Expanding use in adhesives and sealants due to strong bonding properties

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating prices of raw materials and resins

- 5.2.2.2 Environmental concerns over limited biodegradability of acrylic resins

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid expansion of photopolymer and 3D-printing resin applications

- 5.2.3.2 Expanding market for bio-based and sustainable resin alternatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent environmental regulations and compliance burdens

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 BARGAINING POWER OF BUYERS

- 6.1.3 INTENSITY OF COMPETITIVE RIVALRY

- 6.1.4 THREAT OF NEW ENTRANTS

- 6.1.5 THREAT OF SUBSTITUTES

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 REGULATORY LANDSCAPE

- 6.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.6.2 REGULATIONS

- 6.6.2.1 IS 14765 (2000) - Specification for Acrylic Resin for Surface Coatings

- 6.6.2.2 ASTM D5095 - Standard Specification for Acrylic Emulsion for Textured Coatings

- 6.6.2.3 UN GHS - Globally Harmonized System of Classification and Labeling of Chemicals

- 6.6.2.4 OSHA Hazard Communication Standard (29 CFR 1910.1200)

- 6.6.2.5 REACH Regulation (EC) No. 1907/2006 - Registration, Evaluation, Authorization and Restriction of Chemicals

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 3906)

- 6.7.2 EXPORT SCENARIO (HS CODE 3906)

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.8.2 AVERAGE SELLING PRICE TREND, BY REGION, 2024-2030

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 Solution polymerization technology

- 6.9.1.2 Emulsion polymerization technology

- 6.9.2 COMPLEMENTARY TECHNOLOGIES

- 6.9.2.1 UV-curable acrylic systems

- 6.9.2.2 Controlled Radical Polymerization (CRP)

- 6.9.3 ADJACENT TECHNOLOGIES

- 6.9.3.1 Bio-based acrylic resin technology

- 6.9.3.2 Nanocomposite and hybrid acrylic materials

- 6.9.1 KEY TECHNOLOGIES

- 6.10 PATENT ANALYSIS

- 6.10.1 METHODOLOGY

- 6.10.2 DOCUMENT TYPES

- 6.10.3 INSIGHTS

- 6.10.4 LEGAL STATUS OF PATENTS

- 6.10.5 JURISDICTION ANALYSIS

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 DURABLE ROAD MARKING SYSTEM USING METHYL METHACRYLATE (MMA)-BASED ACRYLIC RESIN

- 6.11.2 UV-CURABLE ACRYLIC RESIN COATINGS FOR AUTOMOTIVE INTERIORS

- 6.11.3 ACRYLIC RESIN-BASED PROTECTIVE COATING FOR OFFSHORE WIND TURBINE BLADES

- 6.11.4 ACRYLIC RESIN FLOOR COATING IN FOOD PROCESSING FACILITY

- 6.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 IMPACT OF GEN AI/AI ON ACRYLIC RESINS MARKET

- 6.14.1 AI IN ACRYLIC RESIN MANUFACTURING AND PROCESS OPTIMIZATION

- 6.14.2 AI-DRIVEN QUALITY CONTROL AND COMPUTER VISION

- 6.14.3 GEN AI FOR FORMULATION DESIGN AND R&D ACCELERATION

- 6.15 MACROECONOMIC ANALYSIS

- 6.15.1 INTRODUCTION

- 6.15.2 GDP TRENDS AND FORECASTS

- 6.16 IMPACT OF 2025 US TARIFF ON ACRYLIC RESINS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 China/South Korea/Taiwan

- 6.16.4.3 Europe

- 6.16.4.4 Mexico and Canada

- 6.16.5 IMPACT ON END-USE INDUSTRIES

- 6.16.5.1 Building & construction

- 6.16.5.2 Industrial (coatings, adhesives, industrial films)

- 6.16.5.3 Paper & paperboard

7 ACRYLIC RESINS MARKET, BY CHEMISTRY

- 7.1 INTRODUCTION

- 7.2 METHACRYLATES

- 7.2.1 HARDNESS, DURABILITY, AND SUSTAINABILITY TO DRIVE MARKET GROWTH

- 7.3 ACRYLATES

- 7.3.1 EASY AVAILABILITY, VERSATILITY, AND GREEN CHEMISTRY APPROACHES TO BOOST DEMAND

- 7.4 HYBRID

- 7.4.1 INCREASED ADOPTION IN HIGH-PERFORMANCE COATING APPLICATIONS TO ACCELERATE MARKET DEMAND

8 ACRYLIC RESINS MARKET, BY PROPERTY

- 8.1 INTRODUCTION

- 8.2 THERMOSETTING

- 8.2.1 HIGH STRENGTH, CHEMICAL RESISTANCE, AND LONG TERM STABILITY TO DRIVE MARKET

- 8.3 THERMOPLASTICS

- 8.3.1 EXCELLENT CLARITY, IMPACT RESISTANCE, AND PROCESSABILITY TO SUPPORT GROWTH

9 ACRYLIC RESINS MARKET, BY SOLVENCY

- 9.1 INTRODUCTION

- 9.2 SOLVENT-BASED

- 9.2.1 HIGH DURABILITY AND PREMIUM APPEARANCE TO DRIVE NICHE DEMAND

- 9.3 WATER-BASED

- 9.3.1 ENVIRONMENTAL COMPLIANCE AND SAFETY ADVANTAGES TO BOOST RAPID ADOPTION

- 9.4 OTHER SOLVENCIES

10 ACRYLIC RESINS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 PAINTS & COATINGS

- 10.2.1 WIDE SUBSTRATE COMPATIBILITY AND SUPERIOR PERFORMANCE TO DRIVE MARKET DEMAND

- 10.3 ADHESIVES & SEALANTS

- 10.3.1 HIGH-GROWTH APPLICATIONS ACROSS INDUSTRIES TO BOOST CONSUMPTION

- 10.4 DIY COATINGS

- 10.4.1 ENHANCED WEATHERING, OXIDATION RESISTANCE, AND EXCELLENT COLOR AND GLOSS RETENTION TO FUEL MARKET

- 10.5 ELASTOMERS

- 10.5.1 ADVANCEMENTS IN COMPONENT DESIGN TO PROPEL DEMAND

- 10.6 OTHER APPLICATIONS

11 ACRYLIC RESINS MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 BUILDING & CONSTRUCTION

- 11.2.1 DEMAND FOR INTERNAL JOINTS, FIXTURES, FILLINGS, AND CRACK REPAIR TO BOOST MARKET

- 11.3 INDUSTRIAL

- 11.3.1 VERSATILITY AND DURABILITY IN AUTOMOTIVE, MACHINERY, FURNITURE, AND MANUFACTURING SECTORS TO DRIVE MARKET

- 11.4 PAPER & PAPERBOARD

- 11.4.1 STRENGTH, HARDNESS, SURFACE TEXTURE, PRINTABILITY, AND BARRIER RESISTANCE TO BOOST MARKET

- 11.5 CONSUMER GOODS

- 11.5.1 HIGH FINISHING AND BONDING PROPERTIES TO SUSTAIN DEMAND

- 11.6 ELECTRICAL & ELECTRONICS

- 11.6.1 FAST CURING AND HIGH ADHESION TO DRIVE MARKET GROWTH

- 11.7 PACKAGING

- 11.7.1 SUPERIOR GLOSS, PRINTABILITY, AND BARRIER PERFORMANCE TO FUEL ADOPTION

- 11.8 OTHER END-USE INDUSTRIES

12 ACRYLIC RESINS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Robust industrial base, strong consumer demand, and stringent regulations to drive market

- 12.2.2 CANADA

- 12.2.2.1 Diversified industrial base and strong focus on sustainable manufacturing to support market growth

- 12.2.3 MEXICO

- 12.2.3.1 Demand for development of water infrastructure, sanitation, and expanding industrial base to boost market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Sustainability, innovation, and industrial growth to propel demand

- 12.3.2 FRANCE

- 12.3.2.1 Expanding pharmaceutical, chemical, and specialty manufacturing sectors to propel demand

- 12.3.3 UK

- 12.3.3.1 Advanced chemical, construction, and manufacturing sectors to drive demand

- 12.3.4 ITALY

- 12.3.4.1 Strong industrial base and design-driven consumer goods sector to fuel market growth

- 12.3.5 SPAIN

- 12.3.5.1 Focus on sustainable manufacturing and industrial innovation to support demand

- 12.3.6 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Robust construction, home furnishing, electronics, and automotive sectors to boost market

- 12.4.2 JAPAN

- 12.4.2.1 Rising demand for high-performance materials across architectural coatings, electronics, automotive, and packaging sectors to drive demand

- 12.4.3 INDIA

- 12.4.3.1 Increasing domestic demand, export potential, and policy support to boost growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Durability, weather resistance, and functionality in electronics, automotive, construction, and shipbuilding to drive market

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Government initiatives to catalyze market development

- 12.5.1.2 UAE

- 12.5.1.2.1 Focus on construction, real estate, transportation, and logistics sectors to support growth

- 12.5.1.3 Rest of GCC countries

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Water treatment and agrochemical challenges to propel demand

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Industrial diversification and sustainability goals to drive growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Industrial recovery and expanding construction, packaging, and automotive production to drive market

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 PRODUCT/BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Chemistry footprint

- 13.7.5.4 Solvency footprint

- 13.7.5.5 Application footprint

- 13.7.5.6 End-use industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 BASF

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 DOW

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 MITSUBISHI CHEMICAL GROUP CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 SUMITOMO CHEMICAL CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 ARKEMA

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 DIC CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.4 MnM view

- 14.1.6.4.1 Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses and competitive threats

- 14.1.7 COVESTRO AG

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.4 MnM view

- 14.1.7.4.1 Right to win

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses and competitive threats

- 14.1.8 MITSUI CHEMICALS, INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Expansions

- 14.1.8.4 MnM view

- 14.1.8.4.1 Right to win

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses and competitive threats

- 14.1.9 TRINSEO

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Expansions

- 14.1.9.4 MnM view

- 14.1.9.4.1 Right to win

- 14.1.9.4.2 Strategic choices

- 14.1.9.4.3 Weaknesses and competitive threats

- 14.1.10 ASAHI KASEI CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.10.3.1 Right to win

- 14.1.10.3.2 Strategic choices

- 14.1.10.3.3 Weaknesses and competitive threats

- 14.1.1 BASF

- 14.2 OTHER PLAYERS

- 14.2.1 SYNTHOMER PLC

- 14.2.2 LUBRIZOL

- 14.2.3 NIPPON SHOKUBAI CO., LTD.

- 14.2.4 RESONAC HOLDINGS CORPORATION

- 14.2.5 ROHM GMBH

- 14.2.6 YIP'S CHEMICAL HOLDINGS LIMITED

- 14.2.7 CHANSIEH ENTERPRISES CO., LTD

- 14.2.8 JOTUN

- 14.2.9 GEO

- 14.2.10 FUJIKURA KASEI CO., LTD.

- 14.2.11 ETERNAL MATERIALS CO., LTD.

- 14.2.12 ALLNEX GMBH

- 14.2.13 KAMSONS

- 14.2.14 AEKYUNG

- 14.2.15 BERGER PAINTS INDIA

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MEDIUM-TERM DEMAND FOR OIL, BY REGION, 2024-2030 (MILLION BARRELS PER DAY)

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES ON ACRYLIC RESINS MARKET

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- TABLE 4 KEY BUYING CRITERIA FOR KEY END-USE INDUSTRIES

- TABLE 5 ROLES OF COMPANIES IN ACRYLIC RESINS ECOSYSTEM

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 10 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS

- TABLE 11 IMPORT DATA RELATED TO HS CODE 3906-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 EXPORT DATA RELATED TO HS CODE 3906-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 PRICING ANALYSIS OF ACRYLIC RESINS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 14 AVERAGE SELLING PRICE TREND OF ACRYLIC RESINS, BY REGION, 2023-2030 (USD/KG)

- TABLE 15 ACRYLIC RESINS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 GLOBAL GDP GROWTH PROJECTION, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 17 ACRYLIC RESINS MARKET, BY CHEMISTRY, 2022-2024 (USD MILLION)

- TABLE 18 ACRYLIC RESINS MARKET, BY CHEMISTRY, 2025-2030 (USD MILLION)

- TABLE 19 ACRYLIC RESINS MARKET, BY CHEMISTRY, 2022-2024 (KILOTON)

- TABLE 20 ACRYLIC RESINS MARKET, BY CHEMISTRY, 2025-2030 (KILOTON)

- TABLE 21 ACRYLIC RESINS MARKET, BY PROPERTY, 2022-2024 (USD MILLION)

- TABLE 22 ACRYLIC RESINS MARKET, BY PROPERTY, 2025-2030 (USD MILLION)

- TABLE 23 ACRYLIC RESINS MARKET, BY PROPERTY, 2022-2024 (KILOTON)

- TABLE 24 ACRYLIC RESINS MARKET, BY PROPERTY, 2025-2030 (KILOTON)

- TABLE 25 ACRYLIC RESINS MARKET, BY SOLVENCY, 2022-2024 (USD MILLION)

- TABLE 26 ACRYLIC RESINS MARKET, BY SOLVENCY, 2025-2030 (USD MILLION)

- TABLE 27 ACRYLIC RESINS MARKET, BY SOLVENCY, 2022-2024 (KILOTON)

- TABLE 28 ACRYLIC RESINS MARKET, BY SOLVENCY, 2025-2030 (KILOTON)

- TABLE 29 ACRYLIC RESINS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 30 ACRYLIC RESINS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 31 ACRYLIC RESINS MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 32 ACRYLIC RESINS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 33 ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 34 ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 36 ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 37 ACRYLIC RESINS MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 38 ACRYLIC RESINS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 ACRYLIC RESINS MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 40 ACRYLIC RESINS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 41 NORTH AMERICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 42 NORTH AMERICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 44 NORTH AMERICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 45 NORTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 46 NORTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 48 NORTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 49 US: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 50 US: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 US: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 52 US: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 53 CANADA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 54 CANADA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 CANADA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 56 CANADA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 57 MEXICO: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 58 MEXICO: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 MEXICO: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 60 MEXICO: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 61 EUROPE: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 62 EUROPE: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 EUROPE: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 64 EUROPE: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 65 EUROPE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 66 EUROPE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 EUROPE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 68 EUROPE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 69 GERMANY: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 70 GERMANY: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 GERMANY: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 72 GERMANY: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 73 FRANCE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 74 FRANCE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 75 FRANCE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 76 FRANCE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 77 UK: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 78 UK: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 UK: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 80 UK: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 81 ITALY: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 82 ITALY: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 83 ITALY: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 84 ITALY: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 85 SPAIN: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 86 SPAIN: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87 SPAIN: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 88 SPAIN: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 89 REST OF EUROPE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 90 REST OF EUROPE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 REST OF EUROPE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 92 REST OF EUROPE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 93 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 94 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 96 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 97 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 98 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 100 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 101 CHINA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 102 CHINA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 CHINA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 104 CHINA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 105 JAPAN: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 106 JAPAN: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 107 JAPAN: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 108 JAPAN: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 109 INDIA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 110 INDIA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 INDIA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 112 INDIA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 113 SOUTH KOREA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 114 SOUTH KOREA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 115 SOUTH KOREA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 116 SOUTH KOREA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 117 REST OF ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 120 REST OF ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 121 MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 124 MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 129 GCC COUNTRIES: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 130 GCC COUNTRIES: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 GCC COUNTRIES: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 132 GCC COUNTRIES: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 133 SAUDI ARABIA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 134 SAUDI ARABIA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 SAUDI ARABIA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 136 SAUDI ARABIA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 137 UAE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 138 UAE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 UAE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 140 UAE: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 141 REST OF GCC COUNTRIES: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 142 REST OF GCC COUNTRIES: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 REST OF GCC COUNTRIES: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 144 REST OF GCC COUNTRIES: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 145 SOUTH AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 146 SOUTH AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 SOUTH AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 148 SOUTH AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 152 REST OF MIDDLE EAST & AFRICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 153 SOUTH AMERICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 154 SOUTH AMERICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 SOUTH AMERICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 156 SOUTH AMERICA: ACRYLIC RESINS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 157 SOUTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 158 SOUTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 SOUTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 160 SOUTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 161 BRAZIL: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY 2022-2024 (USD MILLION)

- TABLE 162 BRAZIL: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 BRAZIL: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 164 BRAZIL: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 165 ARGENTINA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 166 ARGENTINA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 ARGENTINA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 168 ARGENTINA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 169 REST OF SOUTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 172 REST OF SOUTH AMERICA: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 173 ACRYLIC RESINS MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-AUGUST 2025

- TABLE 174 ACRYLIC RESINS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 175 ACRYLIC RESINS MARKET: REGION FOOTPRINT

- TABLE 176 ACRYLIC RESINS MARKET: CHEMISTRY FOOTPRINT

- TABLE 177 ACRYLIC RESINS MARKET: SOLVENCY FOOTPRINT

- TABLE 178 ACRYLIC RESINS MARKET: APPLICATION FOOTPRINT

- TABLE 179 ACRYLIC RESINS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 180 ACRYLIC RESINS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 181 ACRYLIC RESINS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 182 ACRYLIC RESINS MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 183 ACRYLIC RESINS MARKET: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 184 ACRYLIC RESINS MARKET: EXPANSIONS, JANUARY 2020-AUGUST 2025

- TABLE 185 BASF: COMPANY OVERVIEW

- TABLE 186 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 BASF: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 188 BASF: EXPANSIONS, JANUARY 2020-AUGUST 2025

- TABLE 189 DOW: COMPANY OVERVIEW

- TABLE 190 DOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 DOW: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 192 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 193 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 194 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 195 SUMITOMO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 196 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SUMITOMO CHEMICAL CO., LTD.: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 198 SUMITOMO CHEMICAL CO., LTD.: EXPANSIONS, JANUARY 2020-AUGUST 2025

- TABLE 199 ARKEMA: COMPANY OVERVIEW

- TABLE 200 ARKEMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ARKEMA: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 202 ARKEMA: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 203 DIC CORPORATION: COMPANY OVERVIEW

- TABLE 204 DIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 DIC CORPORATION: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 206 COVESTRO AG: COMPANY OVERVIEW

- TABLE 207 COVESTRO AG: PRODUCTS/SOLUTIONS/SERVICES/ OFFERED

- TABLE 208 COVESTRO AG: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 209 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 210 MITSUI CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 MITSUI CHEMICALS, INC.: EXPANSIONS, JANUARY 2020-AUGUST 2025

- TABLE 212 TRINSEO: COMPANY OVERVIEW

- TABLE 213 TRINSEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 TRINSEO: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 215 TRINSEO: EXPANSIONS, JANUARY 2020-AUGUST 2025

- TABLE 216 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 217 ASAHI KASEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 SYNTHOMER PLC: COMPANY OVERVIEW

- TABLE 219 LUBRIZOL: COMPANY OVERVIEW

- TABLE 220 NIPPON SHOKUBAI CO., LTD.: COMPANY OVERVIEW

- TABLE 221 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 222 ROHM GMBH: COMPANY OVERVIEW

- TABLE 223 YIP'S CHEMICAL HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 224 CHANSIEH ENTERPRISES CO., LTD: COMPANY OVERVIEW

- TABLE 225 JOTUN: COMPANY OVERVIEW

- TABLE 226 GEO: COMPANY OVERVIEW

- TABLE 227 FUJIKURA KASEI CO., LTD.: COMPANY OVERVIEW

- TABLE 228 ETERNAL MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 229 ALLNEX GMBH: COMPANY OVERVIEW

- TABLE 230 KAMSONS: COMPANY OVERVIEW

- TABLE 231 AEKYUNG: COMPANY OVERVIEW

- TABLE 232 BERGER PAINTS INDIA: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ACRYLIC RESINS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 ACRYLIC RESINS MARKET: RESEARCH DESIGN

- FIGURE 3 ACRYLIC RESINS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 ACRYLIC RESINS MARKET: TOP-DOWN APPROACH

- FIGURE 5 ACRYLIC RESINS MARKET: DATA TRIANGULATION

- FIGURE 6 HYBRID TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 7 WATER-BASED TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 8 THERMOPLASTICS TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 9 ELASTOMERS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 PACKAGING TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ACRYLIC RESINS MARKET

- FIGURE 13 BUILDING & CONSTRUCTION SEGMENT AND CHINA LED ACRYLIC RESINS MARKET IN 2024

- FIGURE 14 ACRYLATES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 WATER-BASED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 THERMOPLASTICS TO BE LARGER SEGMENT DURING FORECAST PERIOD

- FIGURE 17 PAINTS & COATINGS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 18 BUILDING & CONSTRUCTION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 19 MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ACRYLIC RESINS MARKET

- FIGURE 21 SALES OF NEW VEHICLES - ALL TYPES, 2019-2024 (UNITS)

- FIGURE 22 URBAN POPULATION TREND (2000-2030)

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS OF ACRYLIC RESINS MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 25 KEY BUYING CRITERIA, BY KEY END-USE INDUSTRY

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN ACRYLIC RESINS MARKET

- FIGURE 27 ACRYLIC RESINS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 IMPORT DATA RELATED TO HS CODE 3906-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 30 EXPORT DATA RELATED TO HS CODE 3906-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF ACRYLIC RESINS OFFERED BY KEY PLAYERS, 2024 (USD/KG)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF ACRYLIC RESINS, BY REGION, 2024-2030 (USD/KG)

- FIGURE 34 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 36 TOP 10 PATENT OWNERS DURING LAST TEN YEARS, 2015-2024

- FIGURE 37 ACRYLIC RESINS MARKET: INVESTOR DEALS AND FUNDING TRENDS, 2018-2024 (USD MILLION)

- FIGURE 38 ACRYLATES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 THERMOPLASTICS TO BE LARGER SEGMENT DURING FORECAST PERIOD

- FIGURE 40 WATER-BASED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 41 PAINTS & COATINGS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 42 BUILDING & CONSTRUCTION END-USE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 43 INDIA TO BE FASTEST-GROWING MARKET FOR ACRYLIC RESINS DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: ACRYLIC RESINS MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: ACRYLIC RESINS MARKET SNAPSHOT

- FIGURE 46 ACRYLIC RESINS MARKET SHARE ANALYSIS, 2024

- FIGURE 47 ACRYLIC RESINS MARKET: REVENUE ANALYSIS OF KEY COMPANIES IN LAST FIVE YEARS, 2020-2024 (USD BILLION)

- FIGURE 48 ACRYLIC RESINS MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 49 ACRYLIC RESINS MARKET: FINANCIAL MATRIX: EV/EBITDA RATIO, 2024

- FIGURE 50 ACRYLIC RESINS MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA, 2024

- FIGURE 51 ACRYLIC RESINS MARKET: PRODUCT/BRAND COMPARISON

- FIGURE 52 ACRYLIC RESINS MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 53 ACRYLIC RESINS MARKET: COMPANY FOOTPRINT

- FIGURE 54 ACRYLIC RESINS MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 55 ACRYLIC RESINS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- FIGURE 56 BASF: COMPANY SNAPSHOT

- FIGURE 57 DOW: COMPANY SNAPSHOT

- FIGURE 58 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 ARKEMA: COMPANY SNAPSHOT

- FIGURE 61 DIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 63 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 64 TRINSEO: COMPANY SNAPSHOT

- FIGURE 65 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT