PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1819099

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1819099

Industrial Oxygen Generator Market by Gas Type and Flow Rate, Size, Design, Technology, End-Use Industry, and Region - Global Forecast to 2030

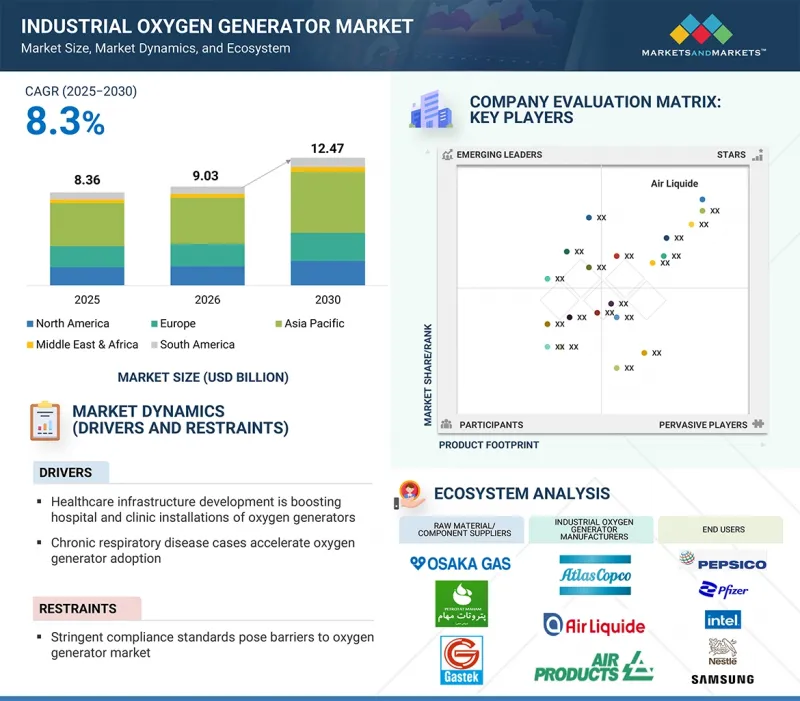

The industrial oxygen generator market is estimated to grow from USD 8.36 billion in 2025 to USD 12.47 billion in 2030, at a CAGR of 8.3%. Plug & play oxygen generators hold the second-largest position in the design segment. These oxygen generators are built for rapid deployment, minimal installation complexity, and straightforward operation, ideal for facilities lacking extensive technical infrastructure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (units) |

| Segments | By Gas Type and Flow Rate, By Size, By Design, By Technology, By End-Use Industry, And Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Representing a lucrative segment for manufacturers, these systems are often container-assembled or skid-mounted for straightforward on-site installation, requiring minimal effort, and this design approach significantly reduces installation time and costs for end-users, making the products highly attractive, particularly for facilities seeking rapid deployment. Improved safety is another advantage, as in-house oxygen generators eliminate the need for handling and storing hazardous oxygen cylinders. Manufacturers in this segment focus on compact, preassembled designs that can be operational within hours of delivery, integrating compressors, automated control panels, and weatherproof, vibration-resistant enclosures to ensure reliability across varied environments.

''In terms of value, membrane-based technology type accounted for the third-largest share of the overall industrial oxygen generator market.''

Membrane-based oxygen generators present a different set of design and performance considerations compared to PSA units. These systems rely on selective permeation through polymeric membranes, and the key manufacturing focus is on material science - developing membrane fibers with stable selectivity and flow performance over years of operation. Companies like Air Liquide have optimized compact membrane modules that deliver steady oxygen streams without moving parts, reducing mechanical wear and maintenance needs. From a production standpoint, the engineering challenge lies in ensuring consistent separation efficiency across varying feed air qualities and environmental conditions. Manufacturers invest in pre-filtration and conditioning subsystems to protect membrane integrity, while designing compact, lightweight housings that appeal to mobile or space-constrained installations.

"During the forecast period, the aquaculture end-use industry is projected to witness the third-largest share."

In aquaculture, oxygen generators are critical for maintaining optimal dissolved oxygen levels, which directly impact fish health, growth rates, and production efficiency. Modern systems are designed to deliver a stable oxygen supply under varying environmental conditions, supporting both land-based and offshore farming operations. Atlas Copco's OGV+ VPSA oxygen generators are widely deployed in aquaculture facilities, offering robust and energy-efficient oxygen generation for consistent oxygenation of tanks and sea cages. Linde PLC's ADSOSS-O VPSA units serve large-scale fish farming operations, integrating with oxygen distribution networks to ensure uniform aeration and minimal oxygen loss. These systems are designed for ease of integration, low maintenance, and reliable performance, enabling aquaculture operators to reduce reliance on bulk oxygen deliveries and improve long-term cost efficiency while supporting healthier and more productive aquatic ecosystems.

"During the forecast period, the industrial oxygen generator market in the European region is projected to witness the second-largest market share."

Europe is one of the largest markets in the oxygen generator sector due to its advanced healthcare infrastructure, robust industrial base, and strict environmental regulations. The region's substantial demand comes from hospitals, clinics, and long-term care facilities that require reliable, high-purity oxygen for a large aging and chronically ill population, especially given the high prevalence of respiratory diseases like COPD and asthma. Europe's well-established industries, ranging from metal processing to wastewater treatment and pharmaceuticals, drive continuous demand for both medical and industrial oxygen generators. Governments and regulatory bodies in Europe enforce rigorous standards for air quality and emissions, which have encouraged investment in cleaner, on-site oxygen generation technologies across sectors.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

- By Designation- C Level - 33%, Director Level - 33%, and Managers - 34%

- By Region- North America - 20%, Europe - 25%, Asia Pacific - 25%, Middle East & Africa - 15%, and Latin America - 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies include Air Liquide (France), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), Linde plc (UK), OXYMAT (Denmark), CAIRE Inc. (US), INMATEC GaseTechnologie GmbH & Co. KG (Germany), Oxygen Generating Systems International (US), PCI Gases (US), GENERON (US), and SYSADVANCE (Portugal).

Research Coverage

This research report categorizes the industrial oxygen generator market by gas type and flow rate (Industrial oxygen, Medical Oxygen), Size (Stationary, Portable), Design (Cylinder, Plug & Play), Technology (Pressure Swing Adsorption (PSA) Based Generator, Membrane-Based Generator, Cryogenic-Based Industrial Generator), End-Use Industry Region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the industrial oxygen generator market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the industrial oxygen generator market are all covered. This report includes a competitive analysis of upcoming startups in the industrial oxygen generator market ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall industrial oxygen generator market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Healthcare infrastructure development boosting hospital and clinic installations of oxygen generators, Chronic respiratory disease cases accelerate oxygen generator adoption, Reducing energy footprints in industrial and medical oxygen supply, stell capacity expansion demands smarter oxygen supply ), restraints (stringent compliance standards pose barriers to oxygen generator market), opportunities (rising aquaculture demand positions oxygen generators for market growth, expanding, ozone applications with high-purity oxygen technology) and challenges (installation and integration costs slowing market expansion, specialized maintenance needs create barriers in oxygen generator operations).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the industrial oxygen generator market

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial oxygen generator market across varied regions

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the industrial oxygen generator market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as (France), Air Products and Chemicals, Inc. (US), Atlas Copco (Sweden), Linde plc (UK), OXYMAT (Denmark), CAIRE Inc. (US), INMATEC GaseTechnologie GmbH & Co. KG (Germany), Oxygen Generating Systems International (US), PCI Gases (US), GENERON (US), and SYSADVANCE (Portugal) among others in the industrial oxygen generator market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL OXYGEN GENERATOR MARKET

- 4.2 INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE

- 4.3 INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE

- 4.4 INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN

- 4.5 INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY

- 4.6 INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 4.7 INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising development of healthcare infrastructure

- 5.2.1.2 Increasing prevalence of chronic respiratory diseases

- 5.2.1.3 Sustainable oxygen supply through reduced energy use

- 5.2.1.4 Expanding steel production capacity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent compliance standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand in aquaculture industry

- 5.2.3.2 Rising demand for high-purity oxygen in ozone generation

- 5.2.3.3 Modernization of power infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 High installation and integration costs

- 5.2.4.2 Specialized maintenance needs

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 ATLAS COPCO OXYGEN GENERATOR ENHANCES BIOGAS STABILITY AT LEEMING FACILITY

- 5.8.2 SEMP OPTIMIZES WASTEWATER TREATMENT WITH NOVAIR ON-SITE OXYGEN GENERATION

- 5.8.3 ATLAS COPCO OGP2 SECURES RELIABLE OXYGEN SUPPLY FOR UK VETERINARY CENTRE

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATIONS

- 5.9.1.1 Europe

- 5.9.1.2 Asia Pacific

- 5.9.1.3 North America

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATIONS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Pressure swing adsorption (PSA)

- 5.10.1.2 Membrane separation

- 5.10.1.3 Cryogenic oxygen generation

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 IoT and smart monitoring systems

- 5.10.2.2 Energy recovery systems

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO (HS CODE 840510)

- 5.12.2 IMPORT SCENARIO (HS CODE 840510)

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.14.2 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2022-2030

- 5.14.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 PATENT ANALYSIS

- 5.16.1 APPROACH

- 5.16.2 DOCUMENT TYPES

- 5.16.3 PUBLICATION TRENDS

- 5.16.4 INSIGHTS

- 5.16.5 LEGAL STATUS OF PATENTS

- 5.16.6 JURISDICTION ANALYSIS

- 5.16.7 TOP COMPANIES/APPLICANTS

- 5.16.8 TOP 10 PATENT OWNERS (US)

- 5.17 IMPACT OF 2025 US TARIFF ON INDUSTRIAL OXYGEN GENERATOR MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE

- 6.1 INTRODUCTION

- 6.2 INDUSTRIAL

- 6.2.1 FOCUS ON ENHANCING OXYGEN SUPPLY EFFICIENCY ACROSS INDUSTRIAL FLOW RATES TO BOOST DEMAND

- 6.2.2 UP TO 50 NM3/HR

- 6.2.3 50-200 NM3/HR

- 6.2.4 200-1,000 NM3/HR

- 6.2.5 ABOVE 1,000 NM3/HR

- 6.3 MEDICAL

- 6.3.1 NEED TO ENSURE CONSISTENT AND SAFE OXYGEN SUPPLY ACROSS MEDICAL FACILITIES TO FUEL DEMAND

- 6.3.2 UP TO 2 NM3/HR

- 6.3.3 2.1-14 NM3/HR

- 6.3.4 15-50 NM3/HR

- 6.3.5 ABOVE 50 NM3/HR

7 INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE

- 7.1 INTRODUCTION

- 7.2 STATIONARY

- 7.2.1 HIGH-PURITY AND CONTINUOUS OXYGEN SUPPLY FEATURES TO DRIVE DEMAND

- 7.3 PORTABLE 93 7.3.1 RISING USE OF PORTABLE OXYGEN GENERATORS FOR DECENTRALIZED AND REMOTE APPLICATIONS TO DRIVE MARKET

8 INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN

- 8.1 INTRODUCTION

- 8.2 CYLINDER

- 8.2.1 INCREASING INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 8.3 PLUG & PLAY

- 8.3.1 GROWING USE IN MEDICAL AND INDUSTRIAL APPLICATIONS TO PROPEL MARKET

9 INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 PRESSURE SWING ADSORPTION (PSA)-BASED

- 9.2.1 HIGH EFFICIENCY, OPERATIONAL RELIABILITY, AND ABILITY TO CONSISTENTLY PROVIDE OXYGEN AT DESIRED PURITY LEVEL TO FUEL DEMAND

- 9.3 MEMBRANE-BASED

- 9.3.1 HIGH POWER EFFICIENCY IN MEMBRANE OXYGEN GENERATION TO PROPEL DEMAND

- 9.4 CRYOGENIC-BASED

- 9.4.1 GROWING USE OF CRYOGENIC SOLUTIONS IN ENERGY & POWER INDUSTRY TO DRIVE MARKET

10 INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 MEDICAL & HEALTHCARE

- 10.2.1 RISING OXYGEN GENERATION FOR EMERGENCY, INSTITUTIONAL, AND HOME CARE NEEDS TO DRIVE MARKET

- 10.3 CHEMICALS & PETROCHEMICALS

- 10.3.1 NEED TO MEET HIGH-PURITY, HIGH-VOLUME OXYGEN DEMAND IN HARSH INDUSTRIAL ENVIRONMENTS TO PROPEL MARKET

- 10.4 MINING & METAL PROCESSING

- 10.4.1 RISING NEED FOR OXYGEN IN MINERAL PROCESSING AND SMELTING TO DRIVE DEMAND

- 10.5 POWER GENERATION

- 10.5.1 SHIFT TOWARD OXYGEN-ENRICHED COMBUSTION FOR HIGHER EFFICIENCY AND LOWER EMISSIONS TO PROPEL DEMAND

- 10.6 AQUACULTURE

- 10.6.1 USE TO MAINTAIN OPTIMAL DISSOLVED OXYGEN LEVELS TO FUEL MARKET GROWTH

- 10.7 WATER TREATMENT

- 10.7.1 RISING DEMAND IN HIGH-PURITY PROCESSES TO DRIVE MARKET

- 10.8 OTHER END-USE INDUSTRIES

11 INDUSTRIAL OXYGEN GENERATOR MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Rising demand from aquaculture and power generation industries to drive market

- 11.2.2 CANADA

- 11.2.2.1 Infrastructure upgrades and expanding healthcare sector to boost market growth

- 11.2.3 MEXICO

- 11.2.3.1 Increasing adoption in energy and aquaculture industries to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Rising demand from aquaculture industry to drive market

- 11.3.2 FRANCE

- 11.3.2.1 Enhancement of efficiency in power generation using oxygen technologies to drive demand

- 11.3.3 UK

- 11.3.3.1 Booming healthcare sector to fuel demand

- 11.3.4 ITALY

- 11.3.4.1 Expanding on-site oxygen generator market to fuel demand

- 11.3.5 SPAIN

- 11.3.5.1 Growing industrial sector to fuel demand

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Expanding healthcare industry to fuel demand

- 11.4.2 JAPAN

- 11.4.2.1 Increasing industrial demand to drive market

- 11.4.3 INDIA

- 11.4.3.1 Growing medical & healthcare industries to propel market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Stringent government policies regarding medical equipment to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing use in mining & metals industry to boost market

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Increasing demand across healthcare, metal, chemical, aquaculture, and water treatment industries to drive market

- 11.5.2 ARGENTINA

- 11.5.2.1 Modernization of industrial sector to drive market

- 11.5.3 COLUMBIA

- 11.5.3.1 Booming industrial sector to fuel demand

- 11.5.4 CHILE

- 11.5.4.1 Increased demand in aquaculture industry to drive market

- 11.5.5 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 Saudi Arabia

- 11.6.1.1.1 Vision 2030 and NEOM megaproject to support market growth

- 11.6.1.2 UAE

- 11.6.1.2.1 Government-led initiatives for industrial diversification, healthcare expansion, and sustainability to drive market

- 11.6.1.3 Rest of GCC countries

- 11.6.1.1 Saudi Arabia

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Enhancement of sustainability through on-site oxygen generation to fuel demand

- 11.6.3 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Gas type and flow rate footprint

- 12.7.5.4 Size footprint

- 12.7.5.5 Design footprint

- 12.7.5.6 Technology footprint

- 12.7.5.7 End-use industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 EXPANSIONS

- 12.9.3 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 AIR LIQUIDE

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 AIR PRODUCTS AND CHEMICALS, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 ATLAS COPCO GROUP

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 LINDE PLC

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 Recent developments

- 13.1.4.4.1 Expansions

- 13.1.4.5 MnM view

- 13.1.4.5.1 Key strengths/Right to win

- 13.1.4.5.2 Strategic choices

- 13.1.4.5.3 Weaknesses/Competitive threats

- 13.1.5 OXYMAT

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 CAIRE INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Expansions

- 13.1.6.4 MnM view

- 13.1.7 INMATEC GASETECHNOLOGIE GMBH & CO. KG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.8 OXYGEN GENERATING SYSTEMS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.9 PCI GASES

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 GENERON

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.11 SYSADVANCE

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.12 SUMER A.S.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 MnM view

- 13.1.13 OXYVITAL

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 MnM view

- 13.1.14 ORECO A/S

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 MnM view

- 13.1.15 FRITZ STEPHAN GMBH

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 MnM view

- 13.1.16 OZCAN KARDESLER

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 MnM view

- 13.1.17 BEACONMEDAES

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.17.3 MnM view

- 13.1.18 GAZ SYSTEMES

- 13.1.18.1 Business overview

- 13.1.18.2 Products/Solutions/Services offered

- 13.1.18.3 MnM view

- 13.1.19 MIL'S

- 13.1.19.1 Business overview

- 13.1.19.2 Products/Solutions/Services offered

- 13.1.19.3 MnM view

- 13.1.1 AIR LIQUIDE

- 13.2 OTHER PLAYERS

- 13.2.1 NOXERIOR

- 13.2.2 ADVANCED GAS TECHNOLOGIES INC.

- 13.2.3 PNEUMATECH

- 13.2.4 AMCAREMED MEDICAL GAS SYSTEM

- 13.2.5 SUMITOMO SEIKA CHEMICALS CO., LTD.

- 13.2.6 INGERSOLL RAND

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INDUSTRIAL OXYGEN GENERATOR MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES (%)

- TABLE 3 KEY BUYING CRITERIA FOR KEY END-USE INDUSTRIES

- TABLE 4 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030

- TABLE 5 ROLES OF COMPANIES IN INDUSTRIAL OXYGEN GENERATOR ECOSYSTEM

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 INDUSTRIAL OXYGEN GENERATOR MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 10 AVERAGE SELLING PRICE TREND OF INDUSTRIAL OXYGEN GENERATORS, BY REGION, 2022-2030 (USD/UNIT)

- TABLE 11 AVERAGE SELLING PRICE TREND OF INDUSTRIAL OXYGEN GENERATORS, BY END-USE INDUSTRY, 2022-2030 (USD/UNIT)

- TABLE 12 INDICATIVE PRICING ANALYSIS OF INDUSTRIAL OXYGEN GENERATORS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- TABLE 13 TOTAL PATENT COUNT, 2014-2024

- TABLE 14 TOP 10 PATENT OWNERS, 2014-2014

- TABLE 15 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 16 INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (USD MILLION)

- TABLE 17 INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (USD MILLION)

- TABLE 18 INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (UNITS)

- TABLE 19 INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (UNITS)

- TABLE 20 INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (USD MILLION)

- TABLE 21 INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 22 INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (UNITS)

- TABLE 23 INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (UNITS)

- TABLE 24 INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (USD MILLION)

- TABLE 25 INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 26 INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (UNITS)

- TABLE 27 INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (UNITS)

- TABLE 28 INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 29 INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 30 INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (UNITS)

- TABLE 31 INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (UNITS)

- TABLE 32 INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 33 INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 34 INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 35 INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 36 INDUSTRIAL OXYGEN GENERATOR MARKET, BY REGION, 2022-2024 (UNITS)

- TABLE 37 INDUSTRIAL OXYGEN GENERATOR MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 38 INDUSTRIAL OXYGEN GENERATOR MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 39 INDUSTRIAL OXYGEN GENERATOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNITS)

- TABLE 41 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 42 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (UNITS)

- TABLE 45 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (UNITS)

- TABLE 46 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (USD MILLION)

- TABLE 47 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (UNITS)

- TABLE 49 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (UNITS)

- TABLE 50 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (USD MILLION)

- TABLE 51 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (UNITS)

- TABLE 53 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (UNITS)

- TABLE 54 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (USD MILLION)

- TABLE 55 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (UNITS)

- TABLE 57 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (UNITS)

- TABLE 58 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 61 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 62 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 64 US: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 65 US: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 66 US: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 67 US: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 68 CANADA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 69 CANADA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 70 CANADA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 71 CANADA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 72 MEXICO: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 73 MEXICO: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 74 MEXICO: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 75 MEXICO: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 76 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNITS)

- TABLE 77 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 78 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 79 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (UNITS)

- TABLE 81 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (UNITS)

- TABLE 82 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (USD MILLION)

- TABLE 83 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (USD MILLION)

- TABLE 84 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (UNITS)

- TABLE 85 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (UNITS)

- TABLE 86 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (USD MILLION)

- TABLE 87 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 88 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (UNITS)

- TABLE 89 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (UNITS)

- TABLE 90 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (USD MILLION)

- TABLE 91 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 92 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (UNITS)

- TABLE 93 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (UNITS)

- TABLE 94 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 95 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 96 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 97 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 98 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 99 EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 100 GERMANY: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 101 GERMANY: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 102 GERMANY: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 103 GERMANY: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 104 FRANCE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 105 FRANCE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 106 FRANCE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 107 FRANCE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 108 UK: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 109 UK: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 110 UK: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 111 UK: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 112 ITALY: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 113 ITALY: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 114 ITALY: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 115 ITALY: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 116 SPAIN: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 117 SPAIN: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 118 SPAIN: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 119 SPAIN: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 121 REST OF EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 122 REST OF EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 123 REST OF EUROPE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNITS)

- TABLE 125 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 126 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (UNITS)

- TABLE 129 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (UNITS)

- TABLE 130 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (USD MILLION)

- TABLE 131 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (UNITS)

- TABLE 133 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (UNITS)

- TABLE 137 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (UNITS)

- TABLE 138 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (UNITS)

- TABLE 141 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (UNITS)

- TABLE 142 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 145 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 146 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 148 CHINA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 149 CHINA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 150 CHINA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 151 CHINA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 JAPAN: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 153 JAPAN: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 154 JAPAN: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 155 JAPAN: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 INDIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 157 INDIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 158 INDIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 159 INDIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 SOUTH KOREA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 161 SOUTH KOREA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 162 SOUTH KOREA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 163 SOUTH KOREA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 164 AUSTRALIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 165 AUSTRALIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 166 AUSTRALIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 167 AUSTRALIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 169 REST OF ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 170 REST OF ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 172 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNITS)

- TABLE 173 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 174 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 175 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 176 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (UNITS)

- TABLE 177 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (UNITS)

- TABLE 178 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (USD MILLION)

- TABLE 179 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (USD MILLION)

- TABLE 180 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (UNITS)

- TABLE 181 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (UNITS)

- TABLE 182 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (USD MILLION)

- TABLE 183 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 184 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (UNITS)

- TABLE 185 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (UNITS)

- TABLE 186 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (UNITS)

- TABLE 189 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (UNITS)

- TABLE 190 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 191 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 193 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 194 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 195 SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 196 BRAZIL: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 197 BRAZIL: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 198 BRAZIL: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 199 BRAZIL: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 200 ARGENTINA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 201 ARGENTINA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 202 ARGENTINA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 203 ARGENTINA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 204 COLUMBIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 205 COLUMBIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 206 COLUMBIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 207 COLUMBIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 208 CHILE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 209 CHILE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 210 CHILE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 211 CHILE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 213 REST OF SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 214 REST OF SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (UNITS)

- TABLE 217 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (UNITS)

- TABLE 218 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (UNITS)

- TABLE 221 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (UNITS)

- TABLE 222 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2022-2024 (USD MILLIONS)

- TABLE 223 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY GAS TYPE AND FLOW RATE, 2025-2030 (USD MILLIONS)

- TABLE 224 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (UNITS)

- TABLE 225 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (UNITS)

- TABLE 226 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2022-2024 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY SIZE, 2025-2030 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (UNITS)

- TABLE 229 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (UNITS)

- TABLE 230 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2022-2024 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY DESIGN, 2025-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (UNITS)

- TABLE 233 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (UNITS)

- TABLE 234 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2022-2024 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 237 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 238 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 240 SAUDI ARABIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 241 SAUDI ARABIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 242 SAUDI ARABIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 243 SAUDI ARABIA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 244 UAE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 245 UAE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 246 UAE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 247 UAE: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 248 REST OF GCC COUNTRIES: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 249 REST OF GCC COUNTRIES: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 250 REST OF GCC COUNTRIES: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 251 REST OF GCC COUNTRIES: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 252 SOUTH AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 253 SOUTH AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 254 SOUTH AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 255 SOUTH AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 256 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (UNITS)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (UNITS)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL OXYGEN GENERATOR MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 260 INDUSTRIAL OXYGEN GENERATOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS, JANUARY 2021-JUNE 2025

- TABLE 261 INDUSTRIAL OXYGEN GENERATOR MARKET: DEGREE OF COMPETITION, 2024

- TABLE 262 INDUSTRIAL OXYGEN GENERATOR MARKET: REGION FOOTPRINT

- TABLE 263 INDUSTRIAL OXYGEN GENERATOR MARKET: GAS TYPE AND FLOW RATE FOOTPRINT

- TABLE 264 INDUSTRIAL OXYGEN GENERATOR MARKET: SIZE FOOTPRINT

- TABLE 265 INDUSTRIAL OXYGEN GENERATOR MARKET: DESIGN FOOTPRINT

- TABLE 266 INDUSTRIAL OXYGEN GENERATOR MARKET: TECHNOLOGY FOOTPRINT

- TABLE 267 INDUSTRIAL OXYGEN GENERATOR MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 268 INDUSTRIAL OXYGEN GENERATOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 269 INDUSTRIAL OXYGEN GENERATOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 270 INDUSTRIAL OXYGEN GENERATOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 271 INDUSTRIAL OXYGEN GENERATOR MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 272 INDUSTRIAL OXYGEN GENERATOR: DEALS, JANUARY 2021-JUNE 2025

- TABLE 273 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 274 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 AIR LIQUIDE: EXPANSIONS

- TABLE 276 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 277 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 278 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

- TABLE 279 ATLAS COPCO GROUP: COMPANY OVERVIEW

- TABLE 280 ATLAS COPCO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 ATLAS COPCO GROUP: DEALS

- TABLE 282 LINDE PLC: COMPANY OVERVIEW

- TABLE 283 LINDE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 LINDE PLC.: DEALS

- TABLE 285 LINDE PLC: EXPANSIONS

- TABLE 286 OXYMAT: COMPANY OVERVIEW

- TABLE 287 OXYMAT.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 OXYMAT: DEALS

- TABLE 289 CAIRE INC.: COMPANY OVERVIEW

- TABLE 290 CAIRE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 CAIRE INC.: PRODUCT LAUNCHES

- TABLE 292 CAIRE INC.: EXPANSIONS

- TABLE 293 INMATEC GASETECHNOLOGIE GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 294 INMATEC GASETECHNOLOGIE GMBH & CO. KG: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 295 OXYGEN GENERATING SYSTEMS: COMPANY OVERVIEW

- TABLE 296 OXYGEN GENERATING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 PCI GASES: COMPANY OVERVIEW

- TABLE 298 PCI GASES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 GENERON: COMPANY OVERVIEW

- TABLE 300 GENERON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 SYSADVANCE: COMPANY OVERVIEW

- TABLE 302 SYSADVANCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 SUMER A.S.: COMPANY OVERVIEW

- TABLE 304 SUMER A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 OXYVITAL: COMPANY OVERVIEW

- TABLE 306 OXYVITAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 ORECO A/S: COMPANY OVERVIEW

- TABLE 308 ORECO A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 FRITZ STEPHAN GMBH: COMPANY OVERVIEW

- TABLE 310 FRITZ STEPHAN GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 OZCAN KARDESLER: COMPANY OVERVIEW

- TABLE 312 OZCAN KARDESLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 BEACONMEDAES: COMPANY OVERVIEW

- TABLE 314 BEACONMEDAES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 GAZ SYSTEMES: COMPANY OVERVIEW

- TABLE 316 GAZ SYSTEMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 MIL'S: COMPANY OVERVIEW

- TABLE 318 MIL'S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 NOXERIOR: COMPANY OVERVIEW

- TABLE 320 ADVANCED GAS TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 321 PNEUMATECH: COMPANY OVERVIEW

- TABLE 322 AMCAREMED MEDICAL GAS SYSTEM: COMPANY OVERVIEW

- TABLE 323 SUMITOMO SEIKA CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 324 INGERSOLL RAND: COMPANY OVERVIEW

List of Figures

- FIGURE 1 INDUSTRIAL OXYGEN GENERATOR MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 INDUSTRIAL OXYGEN GENERATOR MARKET: RESEARCH DESIGN

- FIGURE 3 INDUSTRIAL OXYGEN GENERATOR MARKET: BOTTOM-UP APPROACH

- FIGURE 4 INDUSTRIAL OXYGEN GENERATOR MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 INDUSTRIAL OXYGEN GENERATOR MARKET: DATA TRIANGULATION

- FIGURE 8 MEDICAL SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 9 STATIONARY SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 10 CYLINDER SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 11 PSA-BASED SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 12 MEDICAL & HEALTHCARE SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 14 GROWING DEMAND AND PRODUCTION CAPACITIES IN EMERGING ECONOMIES OF ASIA PACIFIC TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 INDUSTRIAL SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 STATIONARY SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 17 PLUG & PLAY SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 18 PSA-BASED SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 AQUACULTURE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 INDUSTRIAL OXYGEN GENERATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 INDUSTRIAL OXYGEN GENERATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END-USE INDUSTRIES

- FIGURE 24 KEY BUYING CRITERIA FOR KEY END-USE INDUSTRIES

- FIGURE 25 INDUSTRIAL OXYGEN GENERATOR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 INDUSTRIAL OXYGEN GENERATOR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 EXPORT DATA FOR HS CODE 840510-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 IMPORT DATA FOR HS CODE 840510-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF INDUSTRIAL OXYGEN GENERATORS, BY REGION, 2022-2024 (USD/UNIT)

- FIGURE 31 AVERAGE SELLING PRICE TREND OF INDUSTRIAL GENERATORS, BY END-USE INDUSTRY, 2022-2024 (USD/UNIT)

- FIGURE 32 AVERAGE SELLING PRICE TREND OF INDUSTRIAL OXYGEN GENERATORS OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/UNIT)

- FIGURE 33 INDUSTRIAL OXYGEN GENERATOR MARKET: INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 34 TOTAL NUMBER OF PATENTS, 2014-2024

- FIGURE 35 NUMBER OF PATENTS YEAR-WISE FROM 2014 TO 2024

- FIGURE 36 PATENT ANALYSIS, BY LEGAL STATUS, 2014-2024

- FIGURE 37 TOP JURISDICTION, BY DOCUMENT, 2014-2024

- FIGURE 38 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS, 2014-2024

- FIGURE 39 MEDICAL SEGMENT TO HOLD LARGER SHARE OF INDUSTRIAL OXYGEN GENERATOR MARKET IN 2025

- FIGURE 40 STATIONARY SEGMENT TO HOLD LARGER SHARE OF INDUSTRIAL OXYGEN GENERATOR MARKET IN 2025

- FIGURE 41 CYLINDER SEGMENT TO HOLD LARGER SHARE OF INDUSTRIAL OXYGEN GENERATOR MARKET IN 2025

- FIGURE 42 PRESSURE SWING ADSORPTION (PSA)-BASED SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL OXYGEN GENERATOR MARKET IN 2025

- FIGURE 43 MEDICAL & HEALTHCARE SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL OXYGEN GENERATOR MARKET IN 2025

- FIGURE 44 NORTH AMERICA: INDUSTRIAL OXYGEN GENERATOR MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: INDUSTRIAL OXYGEN GENERATOR MARKET SNAPSHOT

- FIGURE 46 INDUSTRIAL OXYGEN GENERATOR MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 47 INDUSTRIAL OXYGEN GENERATOR MARKET SHARE ANALYSIS, 2024

- FIGURE 48 INDUSTRIAL OXYGEN GENERATOR MARKET: COMPANY VALUATION OF KEY COMPANIES, 2024 (USD BILLION)

- FIGURE 49 INDUSTRIAL OXYGEN GENERATOR MARKET: FINANCIAL METRICS OF KEY COMPANIES, 2024

- FIGURE 50 INDUSTRIAL OXYGEN GENERATOR MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 51 INDUSTRIAL OXYGEN GENERATOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 INDUSTRIAL OXYGEN GENERATOR MARKET: COMPANY FOOTPRINT

- FIGURE 53 INDUSTRIAL OXYGEN GENERATOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 AIR LIQUIDE: COMPANY SNAPSHOT

- FIGURE 55 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 56 ATLAS COPCO GROUP: COMPANY SNAPSHOT

- FIGURE 57 LINDE PLC: COMPANY SNAPSHOT