PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1822289

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1822289

Cross Laminated Timber Market by Type, End Use, Industry, and Region - Global Forecast to 2030

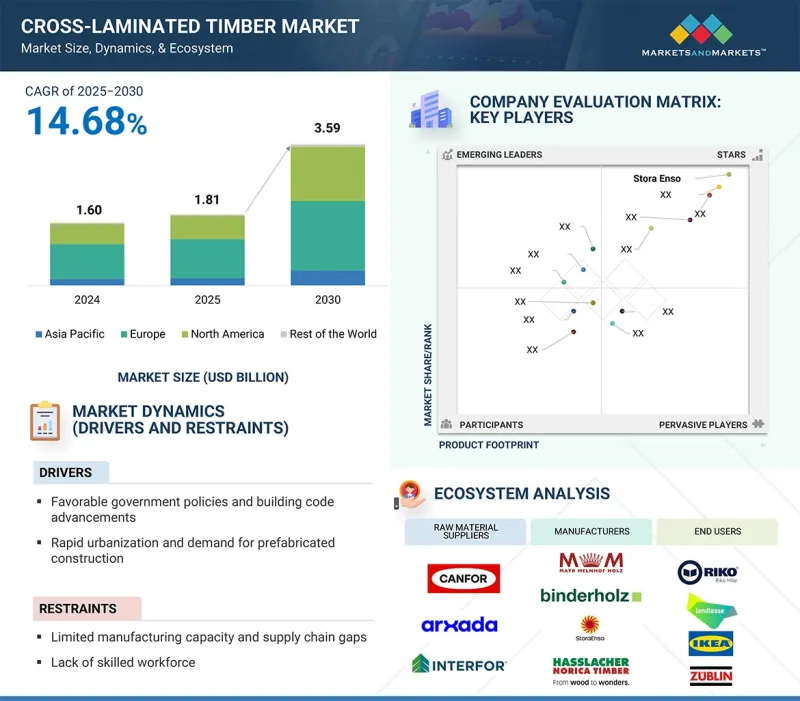

The cross-laminated timber (CLT) market was valued at USD 1.60 billion in 2024 and is projected to reach USD 3.59 billion by 2030, at a CAGR of 14.68% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Thousand Cubic Meter) |

| Segments | Type, End-use, Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, and the Rest of the World |

"Increasing adoption of adhesive-bonded CLT to drive the cross-laminated timber market"

The adhesive-bonded cross-laminated timber (CLT) segment is the largest category in the CLT market and is expected to maintain the largest market share through 2030. Meanwhile, the mechanically fastened segment is steadily developing. The dominance of adhesive-bonded CLT in the market can be attributed to its high structural strength, smooth finish, and precise prefabrication. Adhesive bonding refers to a construction method that permanently joins perpendicular layers of timber using high-performance structural adhesives. This production process minimizes uneven distribution, reduces warping, and provides good resistance to fire, moisture, and vibration, making it highly desirable for construction projects such as walls, floors, and roofs.

Adhesive-bonded CLT panels are particularly suitable for high-rise and mid-rise buildings due to their advantageous strength-to-weight ratio and their potential for clean architectural designs. Moreover, the introduction of bio-based and low-VOC adhesive formulations has improved the environmental performance of these panels, aligning with global trends in green construction. The flexibility of adhesive-bonded CLT in prefabrication, along with its straightforward construction, facilitates faster building processes with less on-site work, making it an ideal material for urban development. Given the increasing demands in the construction industry for speed, strength, sustainability, and design flexibility, it is anticipated that adhesive-bonded CLT will continue to lead the global market. Furthermore, leading manufacturers are capitalizing on research and development, automation, and green certification, reinforcing the position of adhesive-bonded CLT as the top-performing segment in the evolving mass timber construction industry.

"Structural applications continue to dominate the CLT market, by end use"

The structural applications segment is expected to hold the largest market share in the CLT market and will likely remain dominant throughout the forecast period. CLT panels are highly suitable for structures that must bear loads, making them ideal for residential and commercial walls, floors, roofs, and shear walls. Their cross-oriented lamella structure, composed of multiple layers, provides strength, dimensional stability, and fire resistance-qualities essential for structural constructions. With the increasing use of mass timber in sustainable buildings, CLT is increasingly viewed as a cost-effective alternative to concrete and steel due to its lighter weight, smaller carbon footprint, and ease of prefabrication. The dominance of the structural segment is further supported by the rise of mid-rise and tall wood buildings in Europe, North America, and some parts of the Asia Pacific. Construction codes in countries like Austria, Canada, and the US are now accommodating timber construction in taller structures, making structurally stable solutions like CLT increasingly popular. On the other hand, non-structural applications such as cladding, facades, and partitioning are gaining traction primarily due to the aesthetic and thermal properties of CLT, although they remain a small segment of the market. As the construction sector moves toward carbon-neutral practices, the use of CLT is poised to drive a significant shift toward more environmentally friendly buildings. Given its demonstrated effectiveness in managing seismic, thermal, and acoustic loads, the structural end-use segment is set to lead the CLT market.

"Residential sector to register the fastest growth in the CLT market"

The residential sector is the most rapidly growing niche within the CLT market. It is estimated to experience the fastest growth among industry verticals. While non-residential construction-such as schools, commercial buildings, and institutional structures-currently holds a larger market share, the residential segment is expanding quickly due to several factors, including increased urbanization, government housing initiatives, and a shift in consumer preferences toward eco-friendly homes. CLT is becoming increasingly popular in single-family homes, row houses, and low-to-mid-rise apartment complexes. This is largely because of its fast installation method, the mass customization possibilities of designs, and its energy efficiency, which leads to significant energy savings. The ability to prefabricate components off-site contributes to considerable reductions in construction schedules, minimizes on-site construction work, and decreases disturbances to neighboring properties. As a result, CLT is a practical choice for housing construction, particularly in urban and suburban areas. Additionally, buyers are placing more importance on aesthetics, which has led to a growing appreciation for the beauty of exposed timber structures. The influence of biophilic design is also gaining traction, prompting many architects and homeowners to select mass timber as their primary construction material. On the other hand, non-residential applications, such as educational facilities, healthcare buildings, office complexes, and retail spaces, will continue to be significant consumers of CLT, particularly for large-scale projects. Nevertheless, the rising interest in policies supporting sustainable housing, carbon-neutral building requirements, and subsidies for green buildings are creating new trends in residential construction.

"Europe dominates the CLT market, while Asia Pacific is the fastest-growing region"

Europe currently holds the largest share of the CLT market, and this trend is expected to continue in the coming years. This dominance can be attributed to early adoption of CLT, advanced manufacturing ecosystems, and building codes that promote the use of engineered wood for structural applications. Countries such as Austria, Germany, Switzerland, and those in the Nordic region are leaders in mass timber architecture, supported by a strong cultural and industrial heritage in sustainable forestry and its application in construction. The Asia Pacific region is anticipated to experience even faster growth. This increase is driven by rising urbanization rates, sustainability requirements, and a shift toward more modular construction methods. Japan, China, South Korea, and Australia are making significant investments in mass timber buildings, spurred by government pilot programs and updates to building codes. Japan's tradition of timber architecture and its focus on earthquake-resistant structures align well with the properties of CLT. Meanwhile, in China, interest in mass timber is growing due to a heightened awareness of environmental issues and the efficient use of resources.

In-depth interviews were conducted with chief executive officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the cross-laminated timber market

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and the Rest of the World - 5%

The key players profiled in the report include Mayr-Melnhof Holz (Austria), Stora Enso (Finland), Binderholz GmbH (Austria), HASSLACHER Holding GmbH (Austria), Schilliger Holz AG (Switzerland), Eugen Decker Holzindustrie KG (Germany), KLH Massivholz GmbH (Austria), Mercer Mass Timber (Canada), XLam (Australia), and Pfeifer Holding GmbH (Austria)

Research Coverage

This report segments the market for cross-laminated timber based on type, end-use, industry, and region, and provides estimations of value (USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the market for cross-laminated timber.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the cross laminated timber market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on cross-laminated timber offered by top players in the global market.

- Analysis of key drivers (favorable government policies and building code advancements, rapid urbanization, and demand for prefabricated construction), restraints (limited manufacturing capacity and supply chain gaps and lack of skilled workforce), opportunities (growing demand in commercial and institutional buildings and potential in renovation and adaptive reuse projects), and challenges (moisture sensitivity and durability concerns) influencing the growth of the cross-laminated timber market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the cross-laminated timber market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the market for cross-laminated timber across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global cross-laminated timber market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the cross-laminated timber market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY INDUSTRY

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY END USE

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN CROSS-LAMINATED TIMBER MARKET

- 4.2 CROSS-LAMINATED TIMBER MARKET, BY REGION

- 4.3 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE AND COUNTRY

- 4.4 REGIONAL ANALYSIS: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY AND REGION

- 4.5 CROSS-LAMINATED TIMBER MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Favorable government policies and building code advancements

- 5.2.1.2 Rapid urbanization and demand for prefabricated construction

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited manufacturing capacity and supply chain gaps

- 5.2.2.2 Lack of skilled workforce

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand in commercial and institutional buildings

- 5.2.3.2 Potential in renovation and adaptive reuse projects

- 5.2.4 CHALLENGES

- 5.2.4.1 Moisture sensitivity and durability concerns

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE BY INDUSTRY, BY KEY PLAYERS, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF CROSS-LAMINATED TIMBER, BY REGION, 2022-2024

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Cross-lamination configuration and panel engineering

- 6.5.1.2 Protective technologies, fire safety engineering, and sustainability innovations in cross-laminated timber

- 6.5.2 COMPLIMENTARY TECHNOLOGIES

- 6.5.2.1 Weatherproofing and building envelope solutions in cross-laminated timber construction

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 CROSS-LAMINATED TIMBER APPLICATION IN COMMERCIAL OFFICE

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 441882)

- 6.7.2 EXPORT SCENARIO (HS CODE 441882)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 FSC Certification (Forest Stewardship Council)

- 6.8.2.2 EPA TSCA (Toxic Substances Control Act)

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

- 6.13 IMPACT OF AI/GEN AI ON CROSS-LAMINATED TIMBER MARKET

7 CROSS-LAMINATED TIMBER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ADHESIVE BONDED

- 7.2.1 SUPERIOR PROPERTIES AND LOW PRODUCTION COST

- 7.2.2 POLYURETHANE (PUR)

- 7.2.3 MELAMINE-UREA-FORMALDEHYDE (MUF)

- 7.3 MECHANICALLY FASTENED

- 7.3.1 ENHANCED STRENGTH AND STABILITY OF STRUCTURES

- 7.3.2 SELF-TAPPING SCREWS (STS)

- 7.3.3 DOWEL-TYPE FASTENERS

8 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL

- 8.2.1 EVOLUTION OF BUILDING CODES OFFERS OPPORTUNITIES FOR CROSS-LAMINATED TIMBER MARKET

- 8.3 NON-RESIDENTIAL

- 8.3.1 OPPORTUNITIES OFFERED FOR MASS CONSTRUCTION OF TIMBER BUILDINGS

- 8.3.2 PUBLIC

- 8.3.3 INDUSTRIAL

- 8.3.4 OTHERS

9 CROSS-LAMINATED TIMBER MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 STRUCTURAL

- 9.2.1 HIGH DEMAND IN STRUCTURAL END USE SEGMENT

- 9.3 NON-STRUCTURAL

- 9.3.1 USED AS SUBSTITUTES FOR BOLTED MATS

10 CROSS-LAMINATED TIMBER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Large investments by global manufacturers to boost

- 10.2.2 JAPAN

- 10.2.2.1 Investments in infrastructural markets by public and private sectors to boost demand

- 10.2.3 AUSTRALIA AND NEW ZEALAND

- 10.2.3.1 Technology-driven economy to drive market

- 10.2.4 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Presence of major distribution channels to increase demand

- 10.3.2 AUSTRIA

- 10.3.2.1 Investments and government approach toward sustainability to drive market

- 10.3.3 ITALY

- 10.3.3.1 High disposable income and rising FII investments

- 10.3.4 CZECH REPUBLIC

- 10.3.4.1 Emerging market and rising development to propel demand

- 10.3.5 FRANCE

- 10.3.5.1 Government initiatives and enhanced technology in building & construction industry to drive market

- 10.3.6 SWEDEN

- 10.3.6.1 Residential market to drive demand for cross-laminated timber

- 10.3.7 SWITZERLAND

- 10.3.7.1 Domestic demand for Swiss construction to drive growth

- 10.3.8 UK

- 10.3.8.1 BREXIT to hamper industry growth in short term

- 10.3.9 SLOVAKIA

- 10.3.9.1 Increase in housing units boosts demand for cross-laminated timber

- 10.3.10 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Growing sustainable material usage in construction industry to boost market

- 10.4.2 CANADA

- 10.4.2.1 Government investments in building & construction sector to propel market

- 10.4.1 US

- 10.5 REST OF THE WORLD

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 End use footprint

- 11.5.5.5 Industry footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMES

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 PRODUCT COMPARISON ANALYSIS

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 MAYR-MELNHOF HOLZ

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 STORA ENSO

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 BINDERHOLZ GMBH

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansion

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 HASSLACHER HOLDING GMBH

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 SCHILLIGER HOLZ AG

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product Launches

- 12.1.5.3.2 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 EUGEN DECKER HOLZ-INDUSTRIE GMBH & CO. KG

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.7 KLH MASSIVHOLZ GMBH

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.8 MERCER MASS TIMBER

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 XLAM

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 PFEIFER HOLDING GMBH

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.1 MAYR-MELNHOF HOLZ

- 12.2 OTHER COMPANIES

- 12.2.1 LION LUMBER

- 12.2.2 SMARTLAM NORTH AMERICA

- 12.2.3 CLT FINLAND LTD (HOISKO)

- 12.2.4 PEETRI PUIT OU (ARCWOOD)

- 12.2.5 B&K STRUCTURES LTD

- 12.2.6 THEURL AUSTRIAN PREMIUM TIMBER

- 12.2.7 GROUPE LEBEL INC. (IB EWP)

- 12.2.8 NORDIC STRUCTURES

- 12.2.9 D.R. JOHNSON LUMBER CO.

- 12.2.10 W. U. J. DERIX GMBH & CO.

- 12.2.11 URBEM

- 12.2.12 ZUBLIN TIMBER GMBH

- 12.2.13 CROSSLAM AUSTRALIA

- 12.2.14 STERLING STRUCTURAL

- 12.2.15 FRERES ENGINEERED WOOD

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATION

- 13.3 ENGINEERED WOOD ADHESIVES MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 ENGINEERED WOOD ADHESIVES MARKET, BY REGION

- 13.4.1 ASIA PACIFIC

- 13.4.2 NORTH AMERICA

- 13.4.3 EUROPE

- 13.4.4 REST OF THE WORLD

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 CROSS-LAMINATED TIMBER MARKET: RISK ASSESSMENT

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES ON CROSS-LAMINATED TIMBER MARKET

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP INDUSTRY (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP INDUSTRY

- TABLE 5 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 6 PRICING RANGE OF CROSS-LAMINATED TIMBER OFFERED BY KEY PLAYERS, BY INDUSTRY, 2024 (USD/THOUSAND CUBIC METER)

- TABLE 7 PRICING TREND OF CROSS-LAMINATED TIMBER, BY REGION, 2022-2024 (USD/THOUSAND CUBIC METER)

- TABLE 8 ROLES OF COMPANIES IN CROSS-LAMINATED TIMBER ECOSYSTEM

- TABLE 9 IMPORT DATA RELATED TO CROSS-LAMINATED TIMBER, BY REGION, 2022-2024 (USD MILLION)

- TABLE 10 EXPORT DATA RELATED TO CROSS-LAMINATED TIMBER, BY REGION, 2022-2024 (USD MILLION)

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 CROSS-LAMINATED TIMBER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 CROSS-LAMINATED TIMBER MARKET: FUNDING/INVESTMENT SCENARIO, 2020-2025

- TABLE 18 PATENT STATUS: PATENT APPLICATIONS, LIMITED PATENTS, AND GRANTED PATENTS, 2014-2024

- TABLE 19 LIST OF MAJOR PATENTS RELATED TO CROSS-LAMINATED TIMBER, 2014-2024

- TABLE 20 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 22 CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 23 CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 24 CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 ADHESIVE BONDED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 26 ADHESIVE BONDED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 27 ADHESIVE BONDED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 ADHESIVE BONDED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 MECHANICALLY FASTENED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 30 MECHANICALLY FASTENED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 31 MECHANICALLY FASTENED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 MECHANICALLY FASTENED: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 34 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 35 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 36 CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 37 RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 38 RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 39 RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 42 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 43 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY SUB-INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 46 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY SUB-INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 47 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY SUB-INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 48 NON-RESIDENTIAL: CROSS-LAMINATED TIMBER MARKET, BY SUB-INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 NON-RESIDENTIAL (PUBLIC): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 50 NON-RESIDENTIAL (PUBLIC): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 51 NON-RESIDENTIAL (PUBLIC): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 NON-RESIDENTIAL (PUBLIC): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 NON-RESIDENTIAL (INDUSTRIAL): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 54 NON-RESIDENTIAL (INDUSTRIAL): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 55 NON-RESIDENTIAL (INDUSTRIAL): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 NON-RESIDENTIAL (INDUSTRIAL): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 NON-RESIDENTIAL (OTHERS): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 58 NON-RESIDENTIAL (OTHERS): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 59 NON-RESIDENTIAL (OTHERS): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 NON-RESIDENTIAL (OTHERS): CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 62 CROSS-LAMINATED TIMBER MARKET, BY END USE, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 63 CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 64 CROSS-LAMINATED TIMBER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 65 STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 66 STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 67 STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 NON-STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 70 NON-STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 71 NON-STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 NON-STRUCTURAL: CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 74 CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 75 CROSS-LAMINATED TIMBER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 CROSS-LAMINATED TIMBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 78 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 79 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 82 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE 2025-2030 (THOUSAND CUBIC METER)

- TABLE 83 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 86 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY END USE INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 87 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 90 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 91 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 92 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 94 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 95 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 96 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 98 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 99 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 100 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 102 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE 2025-2030 (THOUSAND CUBIC METER)

- TABLE 103 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 104 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 106 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY END USE INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 107 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 108 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 110 EUROPE: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 111 EUROPE: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 112 EUROPE: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 114 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 115 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 116 EUROPE: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 118 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 119 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 122 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE 2025-2030 (THOUSAND CUBIC METER)

- TABLE 123 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 126 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY END USE INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 127 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 130 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 131 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 134 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 135 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 136 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 138 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 139 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 140 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 142 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE 2025-2030 (THOUSAND CUBIC METER)

- TABLE 143 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 144 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 145 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 146 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY END USE INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 147 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 148 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY NON-RESIDENTIAL INDUSTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 150 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 151 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 152 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET IN NON-RESIDENTIAL INDUSTRY, BY SUB-INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2024 (THOUSAND CUBIC METER)

- TABLE 154 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2025-2030 (THOUSAND CUBIC METER)

- TABLE 155 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 156 REST OF THE WORLD: CROSS-LAMINATED TIMBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 157 STRATEGIES ADOPTED BY KEY CROSS-LAMINATED TIMBER MANUFACTURERS

- TABLE 158 CROSS-LAMINATED TIMBER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 159 CROSS-LAMINATED TIMBER MARKET: REGION FOOTPRINT

- TABLE 160 CROSS-LAMINATED TIMBER MARKET: TYPE FOOTPRINT

- TABLE 161 CROSS-LAMINATED TIMBER MARKET: END USE FOOTPRINT

- TABLE 162 CROSS-LAMINATED TIMBER MARKET: INDUSTRY FOOTPRINT

- TABLE 163 CROSS-LAMINATED TIMBER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 164 CROSS-LAMINATED TIMBER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 165 CROSS-LAMINATED TIMBER MARKET: PRODUCT LAUNCHES, JANUARY 2020-APRIL 2025

- TABLE 166 CROSS-LAMINATED TIMBER MARKET: DEALS, JANUARY 2020-APRIL 2025

- TABLE 167 CROSS-LAMINATED TIMBER MARKET: EXPANSIONS, JANUARY 2020-APRIL 2025

- TABLE 168 MAYR-MELNHOF HOLZ: COMPANY OVERVIEW

- TABLE 169 MAYR-MELNHOF HOLZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 MAYR-MELNHOF HOLZ: DEALS

- TABLE 171 MAYR-MELNHOF HOLZ: EXPANSIONS

- TABLE 172 MAYR-MELNHOF HOLZ: OTHER DEVELOPMENTS

- TABLE 173 STORA ENSO: COMPANY OVERVIEW

- TABLE 174 STORA ENSO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 STORA ENSO: EXPANSIONS

- TABLE 176 BINDERHOLZ GMBH: COMPANY OVERVIEW

- TABLE 177 BINDERHOLZ GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 BINDERHOLZ GMBH: EXPANSION

- TABLE 179 HASSLACHER HOLDING GMBH: COMPANY OVERVIEW

- TABLE 180 HASSLACHER HOLDING GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 HASSLACHER HOLDING GMBH: DEALS

- TABLE 182 SCHILLIGER HOLZ AG: COMPANY OVERVIEW

- TABLE 183 SCHILLIGER HOLZ AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 SCHILLIGER HOLZ AG: PRODUCT LAUNCHES

- TABLE 185 SCHILLIGER HOLZ AG: OTHER DEVELOPMENTS

- TABLE 186 EUGEN DECKER HOLZ-INDUSTRIE GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 187 EUGEN DECKER HOLZ-INDUSTRIE GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 EUGEN DECKER HOLZ-INDUSTRIE GMBH & CO. KG: EXPANSION

- TABLE 189 KLH MASSIVHOLZ GMBH: COMPANY OVERVIEW

- TABLE 190 KLH MASSIVHOLZ GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 MERCER MASS TIMBER: COMPANY OVERVIEW

- TABLE 192 MERCER MASS TIMBER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 MERCER MASS TIMBER: DEALS

- TABLE 194 MERCER MASS TIMBER: EXPANSIONS

- TABLE 195 XLAM: COMPANY OVERVIEW

- TABLE 196 XLAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 PFEIFER HOLDING GMBH: COMPANY OVERVIEW

- TABLE 198 PFEIFER HOLDING GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 LION LUMBER: COMPANY OVERVIEW

- TABLE 200 SMARTLAM NORTH AMERICA: COMPANY OVERVIEW

- TABLE 201 CLT FINLAND LTD (HOISKO): COMPANY OVERVIEW

- TABLE 202 PEETRI PUIT OU (ARCWOOD): COMPANY OVERVIEW

- TABLE 203 B&K STRUCTURES LTD: COMPANY OVERVIEW

- TABLE 204 THEURL AUSTRIAN PREMIUM TIMBER: COMPANY OVERVIEW

- TABLE 205 LEBEL INC. (IB EWP): COMPANY OVERVIEW

- TABLE 206 NORDIC STRUCTURES: COMPANY OVERVIEW

- TABLE 207 D.R. JOHNSON LUMBER CO.: COMPANY OVERVIEW

- TABLE 208 W. U. J. DERIX GMBH & CO.: COMPANY OVERVIEW

- TABLE 209 URBEM: COMPANY OVERVIEW

- TABLE 210 ZUBLIN TIMBER GMBH: COMPANY OVERVIEW

- TABLE 211 CROSSLAM AUSTRALIA: COMPANY OVERVIEW

- TABLE 212 STERLING STRUCTURAL: COMPANY OVERVIEW

- TABLE 213 FRERES ENGINEERED WOOD: COMPANY OVERVIEW

- TABLE 214 ENGINEERED WOOD ADHESIVES MARKET, BY REGION, 2021-2029 (KILOTON)

- TABLE 215 ENGINEERED WOOD ADHESIVES MARKET, BY REGION, 2021-2029 (USD MILLION)

- TABLE 216 ASIA PACIFIC: ENGINEERED WOOD ADHESIVES MARKET, BY RESIN TYPE, 2021-2029 (KILOTON)

- TABLE 217 ASIA PACIFIC: ENGINEERED WOOD ADHESIVES MARKET, BY RESIN TYPE, 2021-2029 (USD MILLION)

- TABLE 218 NORTH AMERICA: ENGINEERED WOOD ADHESIVES MARKET, BY RESIN TYPE, 2021-2029 (KILOTON)

- TABLE 219 NORTH AMERICA: ENGINEERED WOOD ADHESIVES MARKET, BY RESIN TYPE, 2021-2029 (USD MILLION)

- TABLE 220 EUROPE: ENGINEERED WOOD ADHESIVES MARKET, BY RESIN TYPE, 2021-2029 (KILOTON)

- TABLE 221 EUROPE: ENGINEERED WOOD ADHESIVES MARKET, BY RESIN TYPE, 2021-2029 (USD MILLION)

- TABLE 222 REST OF THE WORLD: ENGINEERED WOOD ADHESIVES MARKET, BY COUNTRY, 2021-2029 (KILOTON)

- TABLE 223 REST OF THE WORLD: ENGINEERED WOOD ADHESIVES MARKET, BY COUNTRY, 2021-2029 (USD MILLION)

List of Figures

- FIGURE 1 CROSS-LAMINATED TIMBER MARKET SEGMENTATION AND REGIONAL SPREAD

- FIGURE 2 CROSS-LAMINATED TIMBER MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE MARKET SHARE OF KEY PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 - TOP-DOWN

- FIGURE 7 CROSS-LAMINATED TIMBER MARKET: DATA TRIANGULATION

- FIGURE 8 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 9 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 10 ADHESIVE BONDED SEGMENT ACCOUNTED FOR LARGER SHARE OF CROSS-LAMINATED TIMBER MARKET IN 2024

- FIGURE 11 NON-RESIDENTIAL INDUSTRY TO CAPTURE LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 STRUCTURAL SEGMENT TO BE LARGER END USE OF CROSS-LAMINATED TIMBER DURING FORECAST PERIOD

- FIGURE 13 NORTH AMERICA TO BE FASTEST-GROWING CROSS-LAMINATED TIMBER MARKET DURING FORECAST PERIOD

- FIGURE 14 CROSS-LAMINATED TIMBER MARKET TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA TO BE FASTEST-GROWING CROSS-LAMINATED TIMBER MARKET DURING FORECAST PERIOD

- FIGURE 16 GERMANY ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2024

- FIGURE 17 NON-RESIDENTIAL INDUSTRY LED CROSS-LAMINATED TIMBER MARKET IN MOST REGIONS

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 CROSS-LAMINATED TIMBER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 CROSS-LAMINATED TIMBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRY

- FIGURE 22 KEY BUYING CRITERIA FOR TOP INDUSTRY

- FIGURE 23 CROSS-LAMINATED TIMBER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE OF CROSS-LAMINATED TIMBER OFFERED BY KEY PLAYERS, BY INDUSTRY, 2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF CROSS-LAMINATED TIMBER, BY REGION, 2022-2024

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 CROSS-LAMINATED TIMBER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 IMPORT DATA FOR CROSS-LAMINATED TIMBER, BY KEY COUNTRY, 2022-2024

- FIGURE 29 EXPORT DATA FOR CROSS-LAMINATED TIMBER, BY KEY COUNTRY, 2022-2024

- FIGURE 30 PATENTS REGISTERED FOR CROSS-LAMINATED TIMBER, 2014-2024

- FIGURE 31 MAJOR PATENTS RELATED TO CROSS-LAMINATED TIMBER, 2014-2024

- FIGURE 32 LEGAL STATUS OF PATENTS FILED RELATED TO CROSS-LAMINATED TIMBER, 2014-2024

- FIGURE 33 MAXIMUM PATENTS FILED IN JURISDICTION OF US, 2014-2024

- FIGURE 34 IMPACT OF AI/GEN AI ON CROSS-LAMINATED TIMBER MARKET

- FIGURE 35 ADHESIVE BONDED SEGMENT TO DOMINATE CROSS-LAMINATED TIMBER MARKET BETWEEN 2025 AND 2030

- FIGURE 36 NON-RESIDENTIAL SEGMENT TO LEAD CROSS-LAMINATED TIMBER MARKET BETWEEN 2025 AND 2030

- FIGURE 37 STRUCTURAL SEGMENT TO DOMINATE CROSS-LAMINATED TIMBER MARKET BETWEEN 2025 AND 2030

- FIGURE 38 NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC: CROSS-LAMINATED TIMBER MARKET SNAPSHOT

- FIGURE 40 EUROPE: CROSS-LAMINATED TIMBER MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: CROSS-LAMINATED TIMBER MARKET SNAPSHOT

- FIGURE 42 CROSS-LAMINATED TIMBER MARKET SHARE ANALYSIS, 2024

- FIGURE 43 CROSS-LAMINATED TIMBER MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD MILLION)

- FIGURE 44 CROSS-LAMINATED TIMBER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 CROSS-LAMINATED TIMBER MARKET: COMPANY FOOTPRINT

- FIGURE 46 CROSS-LAMINATED TIMBER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 PRODUCT COMPARISON

- FIGURE 48 CROSS-LAMINATED TIMBER MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 49 CROSS-LAMINATED TIMBER MARKET: ENTERPRISE VALUATION (EV) OF KEY PLAYERS

- FIGURE 50 MAYR-MELNHOF HOLZ: COMPANY SNAPSHOT

- FIGURE 51 STORA ENSO: COMPANY SNAPSHOT

- FIGURE 52 MERCER MASS TIMBER: COMPANY SNAPSHOT