PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1823726

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1823726

Data Center Power Market by Electrical Solution, Data Center Size, Data Center Type - Global Forecast to 2030

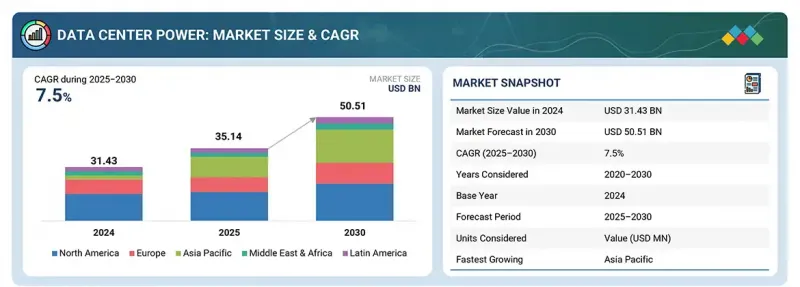

The global data center power market is expected to grow from USD 35.14 billion in 2025 to USD 50.51 billion by 2030 at a compounded annual growth rate (CAGR) of 7.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Component, Tier Type, Data Center Size (Power Capacity), Data Center Type, Enterprise Vertical |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

Rising sustainability targets and supportive energy policies are accelerating the adoption of advanced data center power systems worldwide. Operators are investing in AI-driven power management, renewable integration, and grid-interactive solutions to reduce emissions, improve efficiency, and ensure uptime. These advancements enhance scalability, operational resilience, and compliance with green standards.

However, reliance on traditional power infrastructure remains a restraint, as many data centers still operate with legacy systems that limit efficiency and flexibility. Transitioning to modern, intelligent power architectures demands significant capital, skilled expertise, and integration efforts, making cost and complexity major hurdles in the growth of the data center power market.

"Based on enterprise vertical, the telecommunications segment is estimated to hold the largest market share in 2025"

Telecommunications data centers form the backbone of global connectivity, supporting mobile networks, internet services, VoIP platforms, and cloud communication systems. Any disruption in power can degrade network performance, interrupt services, or impact critical infrastructure such as 5G base stations, leading to service outages and customer dissatisfaction. Vendors provide UPS systems, PDUs, on-site generators, and battery energy storage to ensure continuous, reliable electricity for these high-demand workloads.

Redundant and fault-tolerant power architectures with multiple distribution paths maintain uptime for high-density network operations, ensuring seamless connectivity across diverse geographies. Real-time monitoring, predictive maintenance, and energy management platforms optimize electricity consumption, prevent downtime, and reduce operational costs. Modular and scalable power solutions allow telecommunications data centers to expand capacity rapidly to accommodate growing subscriber bases, IoT traffic, and edge computing deployments without affecting ongoing operations.

Intelligent load balancing and optimized energy delivery safeguard sensitive networking equipment, supporting uninterrupted data flow and minimizing latency. Vendors supplying resilient, high-performance, and efficiently managed power infrastructure enable telecommunications providers to sustain continuous service, meet SLA requirements, and enhance operational reliability. These solutions form a robust foundation for powering telecom data centers, ensuring reliable connectivity, high availability, and efficient network operations.

"Based on tier type, the tier IV segment is expected to grow at the highest CAGR during the forecast period"

Tier IV data centers represent the highest standard of power reliability and fault tolerance, designed to support mission-critical workloads that cannot afford any interruption. Fully redundant and dual-powered systems ensure that every component-from UPS and PDUs to generators and energy storage-can continue functioning even in the event of multiple failures. This design guarantees uninterrupted power delivery, minimizing risk to critical IT infrastructure and protecting business continuity under all circumstances.

For solution providers, Tier IV demands meticulous planning and precise deployment to integrate multiple independent power paths, redundant cooling systems, and robust monitoring platforms. Components must be carefully synchronized to maintain continuous operation, while advanced power management software delivers real-time visibility, predictive analytics, and automated responses to potential anomalies.

Scalability and future readiness are essential, as Tier IV facilities often need to accommodate rapidly growing workloads without compromising fault tolerance. Energy efficiency is enhanced through load balancing, peak shaving, and renewable energy integration, reducing operational costs while maintaining resilience.

By delivering uncompromised uptime and optimized performance, Tier IV data centers provide a foundation for the most demanding applications and services. Vendors supporting this tier enable organizations to achieve the ultimate in operational reliability, energy efficiency, and scalable, future-proof power infrastructure.

"North America will lead in the market share, while Asia Pacific emerges as the fastest-growing market during the forecast period"

North America is the largest market for data center power solutions, supported by the concentration of hyperscale facilities, cloud service providers, and colocation operators. The US and Canada are witnessing heavy investments in renewable integration, battery energy storage, and AI-driven power management to meet surging energy demand and sustainability goals. Strong regulatory support, advanced digital infrastructure, and continuous expansion of hyperscale campuses further strengthen the region's leadership.

In contrast, Asia Pacific represents the fastest-growing data center power market, with rapid capacity expansion in countries like China, India, Singapore, and Australia. Explosive growth in cloud adoption, 5G rollouts, and digital transformation initiatives are fueling demand for scalable, energy-efficient, and reliable power solutions. Government-backed green energy programs, increasing investments by global tech firms, and rising colocation activity are accelerating adoption, positioning APAC as a high-growth hub for data center power technologies.

Breakdown of primaries

Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant data center power market companies were interviewed to gain insights into this market.

- By Company: Tier I: 40%, Tier II: 25%, and Tier III: 35%

- By Designation: C-Level Executives: 45%, Director Level: 30%, and Others: 25%

- By Region: North America: 30%, Europe: 20%, Asia Pacific: 25%, Rest of the World: 15%

Some of the significant data center power market vendors are Schneider Electric (France), Vertiv (US), ABB (Switzerland), Eaton (Ireland), Delta Electronics (Taiwan), Huawei (China), Legrand (France), Toshiba (Japan), Siemens (Germany), Mitsubishi Electric (Japan), Kehua Tech (China), Rittal (Germany), Socomec (France), Cyber Power Systems (US), Anord Mardix (Ireland), Cummins (US), Rosenberger OSI (Germany), Belden (US), Panduit (US), AEG Power Solutions (Netherlands), Riello UPS (Italy), Rolls-Royce (UK), ZincFive (US), 42U (US), and nVent (US).

Research Coverage

The market report covered the data center power market across segments. We estimated the market size and growth potential for many segments based on electrical solution, service, data center tier type, data center size (power capacity), data center type, enterprise vertical, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to buy this report:

This research provides the most accurate revenue estimates for the entire data center power industry and its subsegments, benefiting both established leaders and new entrants. Stakeholders will gain valuable insights into the competitive landscape, enabling them to better position their companies and develop effective go-to-market strategies. The report outlines key market drivers, constraints, opportunities, and challenges, helping industry players understand the current state of the market.

The report provides insights into the following pointers:

- Analysis of key drivers (high-performance computing driving ultra-dense power requirements), restraints (water scarcity and localized resource risks restrain data center growth), opportunities (geothermal energy enhances sustainable and reliable power for data centers), and challenges (power challenges threatening data center growth), influencing the growth of the data center power market

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the data center power market

- Market Development: In-depth details regarding profitable markets, examining the global data center power market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, and new solutions and services

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and offerings of the top competitors in the data center power industry, such as Schneider Electric (France), Vertiv (US), ABB (Switzerland), Eaton (Ireland), Delta Electronics (Taiwan), Huawei (China), Legrand (France), Toshiba (Japan), Siemens (Germany), Mitsubishi Electric (Japan), Kehua Tech (China), Rittal (Germany), Socomec (France), Cyber Power Systems (US), Anord Mardix (Ireland), Cummins (US), Rosenberger OSI (Germany), Belden (US), Panduit (US), AEG Power Solutions (Netherlands), Riello UPS (Italy), Rolls-Royce (UK), ZincFive (US), 42U (US), and nVent (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF DATA CENTER POWER MARKET

- 4.2 DATA CENTER POWER MARKET, BY COMPONENT

- 4.3 DATA CENTER POWER MARKET, BY DATA CENTER TYPE

- 4.4 DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL

- 4.5 DATA CENTER POWER MARKET: REGIONAL SCENARIO

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in data centers worldwide

- 5.2.1.2 High-performance computing driving ultra-dense power requirements

- 5.2.1.3 Rising AI workloads escalating energy consumption and grid pressure

- 5.2.1.4 Growing need for power resilience and guaranteed uptime

- 5.2.2 RESTRAINTS

- 5.2.2.1 Water scarcity and localized resource risks restrain data center growth

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Geothermal energy enhances sustainable and reliable power for data centers

- 5.2.3.2 Nuclear energy drives high-capacity, low-emission power solutions for data centers

- 5.2.4 CHALLENGES

- 5.2.4.1 Power challenges threatening data center growth

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 ABB'S MODULAR UPS SOLUTION EMPOWERED FICOLO'S UNDERGROUND DATA CENTER EXPANSION

- 5.3.2 CONVERGE ICT SOLUTIONS EXPANDED ITS DATA CENTER WITH HUAWEI SMARTLI UPS

- 5.3.3 CZECH ICT LEADER UPGRADED DATA CENTER POWER WITH ABB'S CONCEPTPOWER DPA 500 UPS

- 5.3.4 POWERING UP WITH VEGETABLE OILS

- 5.3.5 HITACHI ENERGY PROVIDED POWER STRUCTURE FOR TURKIYE'S MOST ADVANCED DATA CENTER

- 5.4 ECOSYSTEM

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 TRADE ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF SOLUTION PROVIDERS, BY REGION, 2025

- 5.7.2 INDICATIVE PRICING OF SOLUTION PROVIDERS, BY SOLUTION, 2025

- 5.8 PATENT ANALYSIS

- 5.8.1 LIST OF MAJOR PATENTS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Silicon carbide (SiC) & gallium nitride (GaN) semiconductors

- 5.9.1.2 Solid-state circuit breakers (SSCBs)

- 5.9.1.3 Nuclear small modular reactors (SMRs)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Digital twin

- 5.9.2.2 Energy management platforms (DCIM, EMS)

- 5.9.2.3 Remote monitoring & gateways

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Microgrids & demand response

- 5.9.3.2 Grid-interactive UPS/Energy-as-a-service models

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS BASED ON REGION

- 5.10.2.1 North America

- 5.10.2.2 Europe

- 5.10.2.3 Asia Pacific

- 5.10.2.4 Middle East & South Africa

- 5.10.2.5 Latin America

- 5.10.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.10.3.1 General data protection regulation

- 5.10.3.2 SEC Rule 17a-4

- 5.10.3.3 ISO/IEC 27001

- 5.10.3.4 System and organization controls 2 type II

- 5.10.3.5 Financial industry regulatory authority

- 5.10.3.6 Freedom of information act

- 5.10.3.7 Health insurance portability and accountability act

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 IMPACT OF AI/GEN AI ON DATA CENTER POWER MARKET

- 5.17.1 CASE STUDY

- 5.17.1.1 Compass and Schneider Electric utilized AI to transform data center maintenance

- 5.17.2 VENDOR INITIATIVES

- 5.17.2.1 Enhancing data center reliability with AI-powered predictive maintenance

- 5.17.1 CASE STUDY

- 5.18 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.1.1 United States

- 5.18.4.1.2 Canada

- 5.18.4.1.3 Mexico

- 5.18.4.2 Europe

- 5.18.4.2.1 Germany

- 5.18.4.2.2 France

- 5.18.4.3 APAC

- 5.18.4.3.1 China

- 5.18.4.3.2 India

- 5.18.4.3.3 Australia

- 5.18.4.1 North America

6 DATA CENTER POWER MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: DATA CENTER POWER MARKET DRIVERS

- 6.2 ELECTRICAL SOLUTIONS

- 6.2.1 UNINTERRUPTIBLE POWER SUPPLY (UPS) SYSTEMS

- 6.2.1.1 Ensuring Uninterrupted Operations with UPS Systems

- 6.2.1.2 By type

- 6.2.1.2.1 Modular UPS

- 6.2.1.2.2 Monolithic UPS

- 6.2.1.3 By technology

- 6.2.1.3.1 Double Conversion

- 6.2.1.3.2 Line-interactive

- 6.2.1.3.3 Standby

- 6.2.2 POWER DISTRIBUTION UNITS (PDUS)

- 6.2.2.1 Reducing Downtime Risks with Intelligent PDUs

- 6.2.2.2 Intelligent PDUs

- 6.2.2.3 Metered PDUs

- 6.2.2.4 Basic PDUs

- 6.2.3 ON-SITE POWER GENERATION & ENERGY STORAGE

- 6.2.3.1 Turning Grid Instability into Reliability with On-site Power Systems

- 6.2.3.2 Generators

- 6.2.3.2.1 Maintaining Operations under Grid Failure with Generators

- 6.2.3.2.2 Diesel

- 6.2.3.2.3 Gas

- 6.2.3.3 Battery energy storage system (BESS)

- 6.2.3.3.1 Storing Energy for Instant Backup and Cost Optimization

- 6.2.3.3.2 Lithium-ion

- 6.2.3.3.3 Lead Acid

- 6.2.4 POWER MANAGEMENT SOFTWARE & DCIM

- 6.2.4.1 Turning Real-time Insights into Reliable Data Center Power Performance

- 6.2.5 OTHER ELECTRICAL SOLUTIONS (CABLING INFRASTRUCTURE, SWITCHGEARS, BUSWAYS)

- 6.2.1 UNINTERRUPTIBLE POWER SUPPLY (UPS) SYSTEMS

- 6.3 SERVICES

- 6.3.1 DESIGN & CONSULTING

- 6.3.1.1 Building Optimized Power Strategies for Long-term Reliability

- 6.3.2 INTEGRATION & DEPLOYMENT

- 6.3.2.1 Transforming Power Designs into Seamless Data Center Operations

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Sustaining Reliable Performance Through Proactive Support and Maintenance

- 6.3.1 DESIGN & CONSULTING

7 DATA CENTER POWER MARKET, BY TIER TYPE

- 7.1 INTRODUCTION

- 7.1.1 TIER TYPE: DATA CENTER POWER MARKET DRIVERS

- 7.2 TIER I & II

- 7.2.1 ENABLING AFFORDABLE BACKUP AND BASIC POWER CONTINUITY

- 7.3 TIER III

- 7.3.1 DELIVERING REDUNDANT AND RESILIENT POWER FOR CRITICAL WORKLOADS

- 7.4 TIER IV

- 7.4.1 MAXIMIZING POWER RESILIENCE WITH TIER IV DATA CENTER ARCHITECTURE

8 DATA CENTER POWER MARKET, BY DATA CENTER SIZE (POWER CAPACITY)

- 8.1 INTRODUCTION

- 8.1.1 DATA CENTER SIZE (POWER CAPACITY): DATA CENTER POWER MARKET DRIVERS

- 8.2 SMALL-SIZED DATA CENTER (LESS THAN 1 MW)

- 8.2.1 ENABLING RELIABLE LOCALIZED OPERATIONS IN SUB-1 MW FACILITIES

- 8.3 MID-SIZED DATA CENTER (1 MW TO 5 MW)

- 8.3.1 BALANCING EFFICIENCY AND RELIABILITY IN MID-SIZED DATA CENTERS

- 8.4 LARGE DATA CENTER (5 MW TO 10 MW)

- 8.4.1 DELIVERING HIGH-DENSITY, RELIABLE POWER IN LARGE DATA CENTERS

- 8.5 MEGA-SIZED DATA CENTER (10 MW TO 100 MW)

- 8.5.1 POWERING HIGH-IMPACT OPERATIONS WITH MEGA-SIZED DATA CENTERS

- 8.6 MASSIVE DATA CENTER (OVER 100 MW)

- 8.6.1 ENABLING HYPERSCALE POWER AND RESILIENCE IN MASSIVE DATA CENTERS

9 DATA CENTER POWER MARKET, BY DATA CENTER TYPE

- 9.1 INTRODUCTION

- 9.1.1 DATA CENTER TYPE: DATA CENTER POWER MARKET DRIVERS

- 9.2 COLOCATION DATA CENTERS

- 9.2.1 DELIVERING RELIABLE MULTI-TENANT POWER TO COLOCATION DATA CENTERS

- 9.2.2 COLOCATION DATA CENTERS: USE CASES

- 9.2.2.1 Multi-tenant Uptime Assurance

- 9.2.2.2 Scalable client deployment

- 9.2.2.3 Shared energy optimization

- 9.3 CLOUD/HYPERSCALE DATA CENTERS

- 9.3.1 POWERING SCALABLE AND RESILIENT HYPERSCALE CLOUD INFRASTRUCTURE

- 9.3.2 CLOUD/HYPERSCALE DATA CENTERS: USE CASES

- 9.3.2.1 High-density Load Management

- 9.3.2.2 Global Scalability and Redundancy

- 9.3.2.3 Sustainable energy integration

- 9.4 ENTERPRISES

- 9.4.1 OPTIMIZING POWER CONTINUITY FOR CRITICAL ENTERPRISE WORKLOADS

- 9.4.2 ENTERPRISES: USE CASES

- 9.4.2.1 Business-critical Application Continuity

- 9.4.2.2 Incremental scalability

- 9.4.2.3 Operational cost management

10 DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 ENTERPRISE VERTICAL: DATA CENTER POWER MARKET DRIVERS

- 10.2 BFSI

- 10.2.1 ENSURING UNINTERRUPTED POWER FOR CRITICAL FINANCIAL OPERATIONS

- 10.2.2 BFSI: USE CASES

- 10.2.2.1 Real-time Transaction Continuity

- 10.2.2.2 Fraud detection analytics

- 10.2.2.3 Regulatory reporting & compliance

- 10.3 GOVERNMENT & PUBLIC SECTOR

- 10.3.1 ENSURING CONTINUOUS POWER FOR CRITICAL GOVERNMENT SERVICES AND PUBLIC SAFETY

- 10.3.2 GOVERNMENT & PUBLIC SECTOR: USE CASES

- 10.3.2.1 Citizen services continuity

- 10.3.2.2 Secure data storage

- 10.3.2.3 Emergency response systems

- 10.4 HEALTHCARE & LIFE SCIENCES

- 10.4.1 CONTINUOUS OPERATION FOR EHR SYSTEMS AND IMAGING WORKLOADS

- 10.4.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 10.4.2.1 Electronic health record access

- 10.4.2.2 Medical imaging & diagnostics

- 10.4.2.3 Clinical research & trials

- 10.5 MANUFACTURING

- 10.5.1 POWERING SMART FACTORIES AND INDUSTRIAL AUTOMATION WITH RELIABLE DATA CENTER INFRASTRUCTURE

- 10.5.2 MANUFACTURING: USE CASES

- 10.5.2.1 Industrial IoT Operations

- 10.5.2.2 Production automation

- 10.5.2.3 Supply chain data analytics

- 10.6 RETAIL & E-COMMERCE

- 10.6.1 POWERING SEAMLESS ONLINE TRANSACTIONS AND RETAIL OPERATIONS WITH RELIABLE DATA CENTER INFRASTRUCTURE

- 10.6.2 RETAIL & E-COMMERCE: USE CASES

- 10.6.2.1 Online transaction uptime

- 10.6.2.2 Inventory & fulfillment systems

- 10.6.2.3 Customer data analytics

- 10.7 TELECOMMUNICATIONS

- 10.7.1 ENABLING UNINTERRUPTED NETWORK OPERATIONS AND CONNECTIVITY THROUGH ROBUST DATA CENTER POWER

- 10.7.2 TELECOMMUNICATIONS: USE CASE

- 10.7.2.1 Network operations centers

- 10.7.2.2 IoT & Edge Computing

- 10.7.2.3 Telecom billing & customer management

- 10.8 TECHNOLOGY & SOFTWARE

- 10.8.1 POWERING HIGH-PERFORMANCE COMPUTING AND SOFTWARE SERVICES WITH RELIABLE DATA CENTER INFRASTRUCTURE

- 10.8.2 TECHNOLOGY & SOFTWARE: USE CASES

- 10.8.2.1 Cloud platform uptime

- 10.8.2.2 Software development pipelines

- 10.8.2.3 AI/ML workloads

- 10.9 OTHER ENTERPRISE VERTICALS (EDUCATION, RESEARCH, ENERGY & UTILITIES)

11 DATA CENTER POWER MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: DATA CENTER POWER MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Surging Energy Demand from Hyperscale and AI Expansion

- 11.2.4 CANADA

- 11.2.4.1 Sustainable Growth and Clean Energy Integration in Canada's Data Center Power Market

- 11.3 EUROPE

- 11.3.1 EUROPE: DATA CENTER POWER MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Frontier-Ethos Partnership Targets 5 GW of Colocated Capacity in UK

- 11.3.4 GERMANY

- 11.3.4.1 Rising Energy Needs of Germany's Data Center Industry

- 11.3.5 FRANCE

- 11.3.5.1 Franco-Emirati investment highlights France's AI data center expansion

- 11.3.6 ITALY

- 11.3.6.1 Regulatory Reforms and Legislative Support for Expansion

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: DATA CENTER POWER MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Powering Sustainable Growth in China's Data Center Market

- 11.4.4 JAPAN

- 11.4.4.1 Public-Private Collaboration to Align Data Centers with Renewables

- 11.4.5 INDIA

- 11.4.5.1 Sustainability and Carbon Reduction in India's Data Center Industry

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GULF COOPERATION COUNCIL

- 11.5.3.1 High-density PDUs and Backup Solutions Strengthen GCC Data Center Reliability

- 11.5.3.2 KSA

- 11.5.3.3 UAE

- 11.5.3.4 Rest of GCC

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Integrating Renewable Energy into Data Center Power Infrastructure

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: DATA CENTER POWER MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Optimizing Energy Consumption with Smart Power Solutions

- 11.6.4 MEXICO

- 11.6.4.1 Scalable and Sustainable Power Solutions in Mexican Data Centers

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 (IT INFRASTRUCTURE)

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Component footprint

- 12.6.5.4 Data center type footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.8.1 COMPANY VALUATION OF KEY VENDORS

- 12.8.2 FINANCIAL METRICS OF KEY VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- 13.2.1 SCHNEIDER ELECTRIC

- 13.2.1.1 Business overview

- 13.2.1.2 Products/solutions/services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 ABB

- 13.2.2.1 Business overview

- 13.2.2.2 Products/solutions/services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches and enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 EATON

- 13.2.3.1 Business overview

- 13.2.3.2 Products/solutions/services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 DELTA ELECTRONICS

- 13.2.4.1 Business overview

- 13.2.4.2 Products/solutions/services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 VERTIV

- 13.2.5.1 Business overview

- 13.2.5.2 Products/solutions/services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches and enhancements

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 HUAWEI

- 13.2.6.1 Business overview

- 13.2.6.2 Products/solutions/services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches and enhancements

- 13.2.6.3.2 Deals

- 13.2.7 LEGRAND

- 13.2.7.1 Business overview

- 13.2.7.2 Products/solutions/services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches and enhancements

- 13.2.7.3.2 Deals

- 13.2.8 TOSHIBA

- 13.2.8.1 Business overview

- 13.2.8.2 Products/solutions/services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches and enhancements

- 13.2.9 SIEMENS

- 13.2.9.1 Business overview

- 13.2.9.2 Products/solutions/services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.10 MITSUBISHI ELECTRIC

- 13.2.10.1 Business overview

- 13.2.10.2 Products/solutions/services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Deals

- 13.2.1 SCHNEIDER ELECTRIC

- 13.3 OTHER PLAYERS

- 13.3.1 KEHUA TECH

- 13.3.2 RITTAL

- 13.3.3 SOCOMEC

- 13.3.4 CYBER POWER SYSTEM

- 13.3.5 ANORD MARDIX

- 13.3.6 CUMMINS

- 13.3.7 ROSENBERGER OSI

- 13.3.8 BELDEN

- 13.3.9 PANDUIT

- 13.3.10 AEG POWER SOLUTIONS

- 13.3.11 RIELLO UPS

- 13.3.12 ROLLS-ROYCE

- 13.3.13 ZINCFIVE

- 13.3.14 42U

- 13.3.15 NVENT

14 ADJACENT/RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 DATA CENTER SOLUTIONS MARKET

- 14.3 MODULAR DATA CENTER MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 CUSTOMIZATION OPTIONS

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DATA CENTER POWER MARKET SIZE AND GROWTH, 2020-2024 (USD BILLION, YOY GROWTH %)

- TABLE 4 DATA CENTER POWER MARKET SIZE AND GROWTH, 2025-2030 (USD BILLION, YOY GROWTH %)

- TABLE 5 ROLE OF PLAYERS IN DATA CENTER POWER MARKET: ECOSYSTEM

- TABLE 6 IMPORT DATA, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 7 EXPORT DATA, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 8 INDICATIVE PRICING ANALYSIS, BY SOLUTION, 2025

- TABLE 9 LIST OF MAJOR PATENTS, 2014-2024

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 PORTER'S FIVE FORCES ANALYSIS: DATA CENTER POWER MARKET

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP DATA CENTER TYPES

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE DATA CENTER TYPES

- TABLE 17 DATA CENTER POWER MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 19 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USER MARKET DUE TO TARIFF IMPACT

- TABLE 20 DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 21 DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 22 DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2020-2024 (USD MILLION)

- TABLE 23 DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2025-2030 (USD MILLION)

- TABLE 24 ELECTRICAL SOLUTIONS: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 ELECTRICAL SOLUTIONS: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 UNINTERRUPTIBLE POWER SUPPLY (UPS) SYSTEMS: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 UNINTERRUPTIBLE POWER SUPPLY (UPS) SYSTEMS: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 POWER DISTRIBUTION UNITS (PDUS): DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 POWER DISTRIBUTION UNITS (PDUS): DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 ON-SITE POWER GENERATION & ENERGY STORAGE: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 ON-SITE POWER GENERATION & ENERGY STORAGE: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 POWER MANAGEMENT SOFTWARE & DCIM: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 INCIDENT MANAGEMENT: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 OTHER ELECTRICAL SOLUTIONS: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 OTHER ELECTRICAL SOLUTIONS: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 DATA CENTER POWER MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 37 DATA CENTER POWER MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 38 SERVICES: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 SERVICES: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 DESIGN & CONSULTING: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 DESIGN & CONSULTING: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 INTEGRATION & DEPLOYMENT: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 INTEGRATION & DEPLOYMENT: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 SUPPORT & MAINTENANCE: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 SUPPORT & MAINTENANCE: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 DATA CENTER POWER MARKET, BY TIER TYPE, 2020-2024 (USD MILLION)

- TABLE 47 DATA CENTER POWER MARKET, BY TIER TYPE, 2025-2030 (USD MILLION)

- TABLE 48 TIER I & II: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 TIER I & II: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 TIER III: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 TIER III: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 TIER IV: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 TIER IV: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 DATA CENTER POWER MARKET, BY DATA CENTER SIZE (POWER CAPACITY), 2020-2024 (USD MILLION)

- TABLE 55 DATA CENTER POWER MARKET, BY DATA CENTER SIZE (POWER CAPACITY), 2025-2030 (USD MILLION)

- TABLE 56 SMALL-SIZED DATA CENTER (LESS THAN 1 MW): DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 SMALL-SIZED DATA CENTER (LESS THAN 1 MW): DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 MID-SIZED DATA CENTER (1 MW TO 5 MW): DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 MID-SIZED DATA CENTER (1 MW TO 5 MW): DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 LARGE DATA CENTER (5 MW TO 10 MW): DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 LARGE DATA CENTER (5 MW TO 10 MW): DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 MEGA-SIZED DATA CENTER (10 MW TO 100 MW): DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 MEGA-SIZED DATA CENTER (10 MW TO 100 MW): DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 MASSIVE DATA CENTER (OVER 100 MW): DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 MASSIVE DATA CENTER (OVER 100 MW): DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 67 DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 68 COLOCATION DATA CENTERS: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 COLOCATION DATA CENTERS: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 CLOUD/HYPERSCALE DATA CENTERS: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 CLOUD/HYPERSCALE DATA CENTERS: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 ENTERPRISES: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 ENTERPRISES: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 75 DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 76 BFSI: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 BFSI: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 GOVERNMENT & PUBLIC SECTOR: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 GOVERNMENT & PUBLIC SECTOR: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 HEALTHCARE & LIFE SCIENCES: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 HEALTHCARE & LIFE SCIENCES: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 MANUFACTURING: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 MANUFACTURING: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 RETAIL & E-COMMERCE: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 RETAIL & E-COMMERCE: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 TELECOMMUNICATIONS: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 TELECOMMUNICATIONS: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 TECHNOLOGY & SOFTWARE: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 TECHNOLOGY & SOFTWARE: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 OTHER ENTERPRISE VERTICALS: DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 OTHER ENTERPRISE VERTICALS: DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 DATA CENTER POWER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 93 DATA CENTER POWER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: DATA CENTER POWER MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: DATA CENTER POWER MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: DATA CENTER POWER MARKET, BY TIER TYPE, 2020-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: DATA CENTER POWER MARKET, BY TIER TYPE, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: DATA CENTER POWER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: DATA CENTER POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 US: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 111 US: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 112 CANADA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 113 CANADA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 115 EUROPE: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2020-2024 (USD MILLION)

- TABLE 117 EUROPE: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: DATA CENTER POWER MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 119 EUROPE: DATA CENTER POWER MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: DATA CENTER POWER MARKET, BY TIER TYPE, 2020-2024 (USD MILLION)

- TABLE 121 EUROPE: DATA CENTER POWER MARKET, BY TIER TYPE, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 123 EUROPE: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 125 EUROPE: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 127 EUROPE: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: DATA CENTER POWER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 129 EUROPE: DATA CENTER POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 UK: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 131 UK: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 132 GERMANY: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 133 GERMANY: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 134 FRANCE: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 135 FRANCE: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 136 ITALY: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 137 ITALY: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 138 REST OF EUROPE: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 139 REST OF EUROPE: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2020-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: DATA CENTER POWER MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: DATA CENTER POWER MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: DATA CENTER POWER MARKET, BY TIER TYPE, 2020-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: DATA CENTER POWER MARKET, BY TIER TYPE, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DATA CENTER POWER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: DATA CENTER POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 CHINA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 157 CHINA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 158 JAPAN: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 159 JAPAN: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 160 INDIA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 161 INDIA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2020-2024 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2025-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY TIER TYPE, 2020-2024 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY TIER TYPE, 2025-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 GCC: DATA CENTER POWER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 181 GCC: DATA CENTER POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 182 GCC: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 183 GCC: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 184 SAUDI ARABIA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 185 SAUDI ARABIA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 186 UAE: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 187 UAE: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 188 REST OF GCC: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 189 REST OF GCC: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 190 SOUTH AFRICA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 191 SOUTH AFRICA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 192 REST OF MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 193 REST OF MIDDLE EAST & AFRICA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 195 LATIN AMERICA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2020-2024 (USD MILLION)

- TABLE 197 LATIN AMERICA: DATA CENTER POWER MARKET, BY ELECTRICAL SOLUTION, 2025-2030 (USD MILLION)

- TABLE 198 LATIN AMERICA: DATA CENTER POWER MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 199 LATIN AMERICA: DATA CENTER POWER MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 200 LATIN AMERICA: DATA CENTER POWER MARKET, BY TIER TYPE, 2020-2024 (USD MILLION)

- TABLE 201 LATIN AMERICA: DATA CENTER POWER MARKET, BY TIER TYPE, 2025-2030 (USD MILLION)

- TABLE 202 LATIN AMERICA: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 203 LATIN AMERICA: DATA CENTER POWER MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 204 LATIN AMERICA: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2020-2024 (USD MILLION)

- TABLE 205 LATIN AMERICA: DATA CENTER POWER MARKET, BY DATA CENTER TYPE, 2025-2030 (USD MILLION)

- TABLE 206 LATIN AMERICA: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2020-2024 (USD MILLION)

- TABLE 207 LATIN AMERICA: DATA CENTER POWER MARKET, BY ENTERPRISE VERTICAL, 2025-2030 (USD MILLION)

- TABLE 208 LATIN AMERICA: DATA CENTER POWER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 209 LATIN AMERICA: DATA CENTER POWER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 210 BRAZIL: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 211 BRAZIL: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 212 MEXICO: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 213 MEXICO: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 214 REST OF LATIN AMERICA: DATA CENTER POWER MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 215 REST OF LATIN AMERICA: DATA CENTER POWER MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 216 DATA CENTER POWER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 217 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 218 DATA CENTER POWER MARKET: REGION FOOTPRINT

- TABLE 219 DATA CENTER POWER MARKET: COMPONENT FOOTPRINT

- TABLE 220 DATA CENTER POWER MARKET: DATA CENTER TYPE FOOTPRINT

- TABLE 221 DATA CENTER POWER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 222 DATA CENTER SOLUTIONS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 223 DATA CENTER POWER MARKET: PRODUCT LAUNCHES, AUGUST 2023-JUNE 2025

- TABLE 224 DATA CENTER POWER MARKET: DEALS, FEBRUARY 2023-JUNE 2025

- TABLE 225 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 226 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 228 SCHNEIDER ELECTRIC: DEALS

- TABLE 229 ABB: COMPANY OVERVIEW

- TABLE 230 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 ABB: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 232 ABB: DEALS

- TABLE 233 EATON: COMPANY OVERVIEW

- TABLE 234 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 EATON: PRODUCT LAUNCHES

- TABLE 236 EATON: DEALS

- TABLE 237 DELTA ELECTRONICS: COMPANY OVERVIEW

- TABLE 238 DELTA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 DELTA ELECTRONICS: PRODUCT LAUNCHES

- TABLE 240 DELTA ELECTRONICS: DEALS

- TABLE 241 VERTIV: COMPANY OVERVIEW

- TABLE 242 VERTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 VERTIV: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 244 VERTIV: DEALS

- TABLE 245 HUAWEI: COMPANY OVERVIEW

- TABLE 246 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 HUAWEI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 248 HUAWEI: DEALS

- TABLE 249 LEGRAND: COMPANY OVERVIEW

- TABLE 250 LEGRAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 LEGRAND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 LEGRAND: DEALS

- TABLE 253 TOSHIBA: COMPANY OVERVIEW

- TABLE 254 TOSHIBA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 TOSHIBA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 256 SIEMENS: COMPANY OVERVIEW

- TABLE 257 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 SIEMENS: DEALS

- TABLE 259 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

- TABLE 260 MITSUBISHI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 MITSUBISHI ELECTRIC: DEALS

- TABLE 262 DATA CENTER SOLUTIONS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 263 DATA CENTER SOLUTIONS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 264 DATA CENTER SOLUTIONS MARKET, BY DATA CENTER SIZE, 2020-2024 (USD MILLION)

- TABLE 265 DATA CENTER SOLUTIONS MARKET, BY DATA CENTER SIZE, 2025-2030 (USD MILLION)

- TABLE 266 MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 267 MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 268 MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 269 MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2024-2030 (USD MILLION)

List of Figures

- FIGURE 1 DATA CENTER POWER MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA CENTER POWER MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 DATA CENTER POWER MARKET: RESEARCH FLOW

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 DATA CENTER POWER MARKET: DEMAND-SIDE APPROACH

- FIGURE 10 GLOBAL DATA CENTER POWER MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 11 FASTEST-GROWING SEGMENTS IN DATA CENTER POWER MARKET, 2025-2030

- FIGURE 12 DATA CENTER POWER MARKET: REGIONAL SNAPSHOT

- FIGURE 13 RISING DATA CENTER REQUIREMENTS, SUSTAINABILITY GOALS, AND DEMAND FOR ENERGY EFFICIENCY TO DRIVE DATA CENTER POWER MARKET

- FIGURE 14 ELECTRICAL SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 15 CLOUD/HYPERSCALE DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 16 TELECOMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 18 DATA CENTER POWER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 DATA CENTER POWER MARKET ECOSYSTEM

- FIGURE 20 DATA CENTER POWER MARKET: SUPPLY CHAIN

- FIGURE 21 IMPORT DATA, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 22 EXPORT DATA, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 23 AVERAGE SELLING PRICE, BY REGION (2025)

- FIGURE 24 NUMBER OF PATENTS PUBLISHED, 2014-2024

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS: DATA CENTER POWER MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP DATA CENTER TYPES

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE DATA CENTER TYPES

- FIGURE 28 DATA CENTER POWER MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 LEADING GLOBAL DATA CENTER POWER MARKET VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2025

- FIGURE 30 IMPACT OF AI/GEN AI ON DATA CENTER POWER MARKET

- FIGURE 31 ELECTRICAL SOLUTIONS SEGMENT TO HOLD LARGER MARKET IN 2030

- FIGURE 32 TIER III TO HOLD LARGEST MARKET

- FIGURE 33 LARGE DATA CENTER (5 MW TO 10 MW) TO ACCOUNT FOR LARGEST MARKET IN 2025

- FIGURE 34 CLOUD/HYPERSCALE DATA CENTER TO HOLD LARGEST MARKET IN 2030

- FIGURE 35 TELECOMMUNICATIONS TO ACCOUNT FOR LARGEST MARKET IN 2030

- FIGURE 36 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET BY 2030

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY VENDORS, 2020-2024

- FIGURE 40 DATA CENTER POWER MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 41 DATA CENTER POWER MARKET: VENDOR PRODUCTS/BRANDS COMPARISON

- FIGURE 42 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 43 DATA CENTER POWER MARKET: COMPANY FOOTPRINT

- FIGURE 44 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 45 COMPANY VALUATION OF KEY VENDORS

- FIGURE 46 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 47 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 48 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 49 ABB: COMPANY SNAPSHOT

- FIGURE 50 EATON: COMPANY SNAPSHOT

- FIGURE 51 DELTA ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 52 VERTIV: COMPANY SNAPSHOT

- FIGURE 53 LEGRAND: COMPANY SNAPSHOT

- FIGURE 54 SIEMENS: COMPANY SNAPSHOT

- FIGURE 55 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT