PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1826560

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1826560

Vehicle Electrification Market by Product Type (Start-Stop, EPS, EHPS, Liquid Heater PTC, Electric A/C Compressor, Electric Vacuum Pump, Electric Oil Pump, Electric Water Pump, ISG), Propulsion, DOH, Vehicle Type, and Region - Global Forecast to 2032

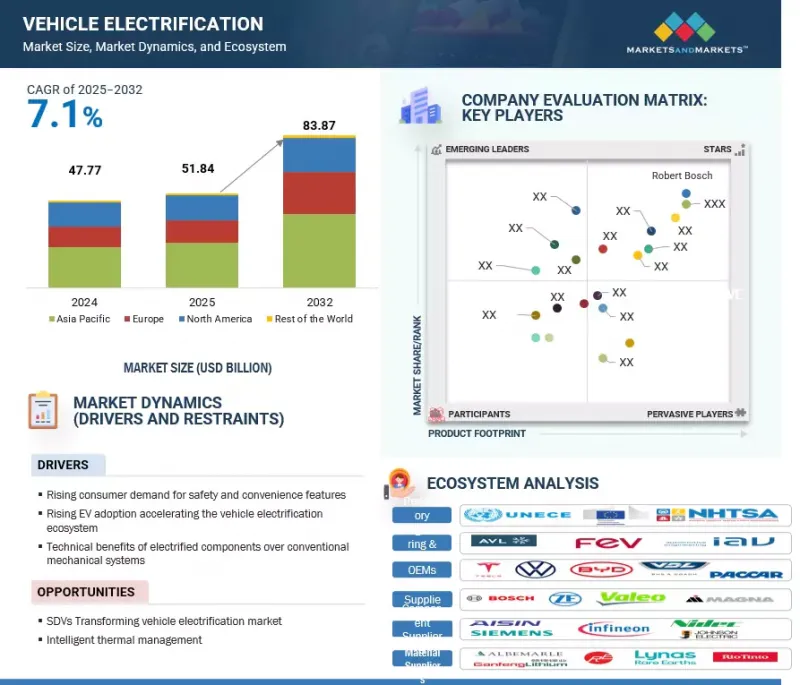

The vehicle electrification market is projected to grow from USD 56.94 billion in 2025 to USD 91.30 billion by 2032 at a CAGR of 7.0%. OEMs continue transitioning from conventional systems to advanced electrified components such as start-stop systems, electric oil pumps, and electric vacuum pumps to meet strict emissions regulations and enhance fuel efficiency across all vehicle types, driving the market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Product Type, Propulsion, DOH, Vehicle Type, and Region |

| Regions covered | North America, Europe, Asia Pacific, and RoW |

For instance, Cummins recently highlighted idle reduction technologies, including stop-start, neutral idle, and automatic engine shutdown, capable of delivering up to 17% fuel-economy improvements in ICE powertrains for fleet applications. Component suppliers are also promoting energy-efficient electric oil and vacuum pumps that reduce parasitic loads compared to mechanical counterparts. Still, the higher cost of electric vehicles remains a constraint, especially for price-sensitive markets such as India and South Asia countries, where integration of these advanced systems must balance performance gains with affordability.

"By degree of hybridization, the ICE & micro hybrid vehicle is projected to be the largest segment during the forecast period."

The ICE & micro hybrid vehicle segment accounts for the largest share within the global vehicle electrification market by degree of hybridization, primarily due to their wide deployment in mainstream passenger cars and their compatibility with existing automotive infrastructure. Micro hybrids, which commonly integrate start-stop systems and electric power steering (EPS), have become standard equipment, especially in cost-sensitive and high-volume markets across the Asia Pacific and North America. Electric power steering is being increasingly adopted in ICE and micro-hybrid platforms. It helps reduce engine loads, enhance energy efficiency, and support advanced driver assistance systems. Additionally, electrified auxiliaries such as electric vacuum pumps, electric A/C compressors, and coolant pumps, among others, within the 48 V mild-hybrid architecture would further enhance vehicle efficiency. Alternatively, rising integration of ISG technology in newer models for dynamic energy management would present a lucrative growth opportunity in the ICE & micro-hybrid vehicle electrification by 2032.

"The electric coolant pump segment is projected to be among the fastest-growing propulsion segments throughout the forecast period."

The electric coolant pump segment is emerging with a significant growth component across 48 V mild-hybrid, HEV, PHEV, and BEV architectures, addressing thermal precision needs in these vehicles. Unlike mechanically driven variants, electric coolant pumps offer precise, variable control over coolant flow, enabling efficient and targeted heat dissipation for power electronics, batteries, and turbocharged engines. Their integration is especially pronounced in 48V architectures, where it supports the efficient operation of auxiliary systems without relying on the engine. The shift to 48V electrical systems is enabling more advanced auxiliary electrification, such as electric coolant pumps that provide precise, on-demand cooling. This improves vehicle efficiency, helps control emissions, and allows for smaller, more efficient cooling systems, which are especially important as car makers move toward fully electric vehicles. 12V electric coolant pump leads the global installation rate owing to its higher installation base in electric & hybrid light-duty vehicles, as these vehicles have lower voltage and power requirements and are usually fitted with a 12V electrical system for main and auxiliary applications such as batteries, inverters, power electronics, lighting, and others. Further, these pumps with a wattage range of <150 W are typically used in smaller vehicles or auxiliary cooling systems where lower power consumption and flow rates are sufficient. Recent OEM and supplier developments have accelerated this trend. For instance, in 2024, Rheinmetall secured a substantial order of electric coolant pumps for several million units, rated between 50 watts and 2000 watts, for hybrid vehicle production through 2030, with service support extending to 2045, demonstrating supplier confidence in long-term demand. Additionally, in India, Concentric AB won a ~USD 6.6 million (70 MSEK) contract to supply its electric coolant pump for a new battery electric bus platform, with production scheduled to begin in late 2025. With stricter emissions rules, the growing popularity of fast-charging electric cars, and more requirements for mild hybrids, electric coolant pumps are becoming a key part of automakers' plans for vehicle electrification during the forecasted period.

"Europe is projected to be the second-largest market for vehicle electrification in 2025."

Europe is projected to be the second-largest market for vehicle electrification, driven by significant government incentives and robust industry engagement across its leading economies. The region's electrification landscape is characterized by a diversified portfolio encompassing all propulsion vehicles from ICE to HEVs to PHEVs and BEVs. Germany, as Europe's largest automotive hub, leads with rapid growth in BEV sales, surpassing ~158 thousand units in early 2025, supported strongly by OEMs like Volkswagen and BMW advancing electrified platforms and powertrain architectures. France and the UK similarly support the market's growth with strong policy support and OEM electrification roadmaps, with the UK's Vehicle Emissions Trading Scheme facilitating a near 30% EV sales share in 2024. Moreover, Europe's advanced charging infrastructure, with over 1 million public points by Q1 2025, supports BEV and PHEV adoption. Key suppliers, including Continental, Bosch, and Denso, are developing electrified components such as electric oil pumps, integrated inverters, and battery thermal management systems tailored for Europe's regulatory and market needs. Mild hybrids remain significant transitional technologies that enhance fuel efficiency and emissions performance on ICE platforms, supported by innovations in electric water pumps and electric oil pump systems. Growth in hybrid adoption is seen in countries like Spain and Italy, while improved battery technologies and incentives strengthen PHEV and HEV segments. Combined support from infrastructure, OEMs, suppliers, and regulatory frameworks positions Europe for sustained vehicle electrification growth, covering both electrified ICE/mild hybrids and full electric vehicles over the forecasted period.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in this market.

Here is the breakdown of the interviews conducted:

- By Company Type: Supplier - 60%, OEMs - 20%, Tier I - 20%

- By Designation: D Level - 30%, C Level - 60%, and Others - 10%

- By Region: North America - 15%, Europe - 45%, Asia Pacific - 30%, RoW - 10%

The key players in the vehicle electrification market are Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation (Japan), BorgWarner Inc. (US), and Aptiv (Ireland). Major companies' key strategies to maintain their position in the global vehicle electrification market are strong global networking, mergers and acquisitions, partnerships, and technological advancements.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the vehicle electrification market and the sub-segments. The report also discusses ups and downs in vehicle electrification, allowing component suppliers to plan their strategies. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report further provides insights into the following points:

- Market Dynamics: Analysis of key drivers (rising consumer demand for safety and convenience features, rising EV adoption accelerating the vehicle electrification ecosystem and technical benefits of electrified components over conventional mechanical systems), restraints (high cost of electric components), opportunities (SDVs transforming the vehicle electrification market, intelligent thermal management), and challenges (integration with ICE platforms) influencing the growth of the vehicle electrification market

- Product Development/Innovation: Detailed insights into upcoming technologies and product & service launches in the vehicle electrification market

- Market Development: Comprehensive market information (the report analyzes the authentication and brand protection market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the vehicle electrification market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation (Japan), BorgWarner Inc. (US), and Aptiv (Ireland) in the vehicle electrification market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources for vehicle production

- 2.1.1.2 Secondary sources for market sizing

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VEHICLE ELECTRIFICATION MARKET

- 4.2 VEHICLE ELECTRIFICATION MARKET, BY VEHICLE TYPE

- 4.3 VEHICLE ELECTRIFICATION MARKET, BY DEGREE OF HYBRIDIZATION

- 4.4 VEHICLE ELECTRIFICATION MARKET, BY PROPULSION AND PRODUCT

- 4.5 VEHICLE ELECTRIFICATION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Elevated consumer demand for safety and convenience features

- 5.2.1.2 Rise in global adoption of EVs

- 5.2.1.3 Technical benefits of electrified components over mechanical systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of electric components

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift toward software-defined vehicles

- 5.2.3.2 Need for intelligent thermal management

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex integration with ICE platforms

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE, BY PRODUCT

- 6.3.2 AVERAGE SELLING PRICE, BY REGION

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (841330)

- 6.4.2 EXPORT SCENARIO (841330)

- 6.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 IMPLEMENTATION OF START-STOP SYSTEMS IN DIESEL VEHICLES

- 6.7.2 SHIFT TOWARD ELECTRIC POWER STEERING

- 6.7.3 DEVELOPMENT OF ADVANCED HIGH-VOLTAGE COMPONENTS

- 6.8 INVESTMENT AND FUNDING SCENARIO

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 High-voltage integrated e-axle systems

- 6.9.1.2 Advanced ECUs and software-defined components

- 6.9.2 COMPLEMENTARY TECHNOLOGIES

- 6.9.2.1 Electric coolant pumps by non-sealed materials

- 6.9.2.1.1 Shaft materials

- 6.9.2.1.2 Bearing materials

- 6.9.2.1 Electric coolant pumps by non-sealed materials

- 6.9.3 ADJACENT TECHNOLOGIES

- 6.9.3.1 Connectivity & IoT-enabled components

- 6.9.1 KEY TECHNOLOGIES

- 6.10 PATENT ANALYSIS

- 6.11 OVERVIEW OF VEHICLE HYBRIDIZATION STAGES

- 6.11.1 MICRO HYBRID

- 6.11.2 MILD HYBRID

- 6.11.3 FULL HYBRID

- 6.11.4 PHEV/RANGE-EXTENDED EV (REEV)

- 6.11.5 BEV/EXTENDED-RANGE EV (EREV)

- 6.12 PLATFORM MODULARIZATION AND STANDARDIZATION TRENDS

- 6.13 ELECTRIC COOLANT PUMP CONSUMPTION BY TOP 10 ELECTRIC PASSENGER CAR OEMS

- 6.14 ELECTRIC COOLANT PUMP CONSUMPTION BY TOP 10 COMMERCIAL VEHICLE OEMS

- 6.15 TOP 10 SUPPLIER PRICING ANALYSIS

- 6.16 TOP 10 OEM PRICING ANALYSIS

- 6.17 ELECTRIC COOLANT PUMP: WHO SUPPLIES TO WHOM

- 6.18 ELECTRIC COOLANT PUMP: SUPPLIER CONTRACTS

- 6.19 REGULATORY LANDSCAPE

- 6.19.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.19.2 EV INCENTIVES, BY COUNTRY

- 6.19.2.1 Netherlands

- 6.19.2.2 Germany

- 6.19.2.3 France

- 6.19.2.4 UK

- 6.19.2.5 China

- 6.19.2.6 US

- 6.19.3 COMPONENT-LEVEL CARBON FOOTPRINT ANALYSIS

- 6.20 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.20.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.20.2 KEY BUYING CRITERIA

7 VEHICLE ELECTRIFICATION MARKET, BY PROPULSION AND PRODUCT

- 7.1 INTRODUCTION

- 7.2 START-STOP SYSTEM

- 7.2.1 RAPID ADOPTION OF MILD-HYBRID VEHICLES AND FOCUS ON BATTERY LONGEVITY

- 7.2.1.1 ICE Start-Stop System

- 7.2.1.2 EV Start-Stop System

- 7.2.1 RAPID ADOPTION OF MILD-HYBRID VEHICLES AND FOCUS ON BATTERY LONGEVITY

- 7.3 ELECTRIC POWER STEERING

- 7.3.1 ADAS INTEGRATION, REDUCTION OF MECHANICAL LOSSES, AND INCREASING REGULATORY PRESSURE FOR EFFICIENCY

- 7.3.1.1 ICE Electric Power Steering

- 7.3.1.2 EV Electric Power Steering

- 7.3.1 ADAS INTEGRATION, REDUCTION OF MECHANICAL LOSSES, AND INCREASING REGULATORY PRESSURE FOR EFFICIENCY

- 7.4 ELECTRO-HYDRAULIC POWER STEERING

- 7.4.1 NEED FOR HIGH TORQUE ASSIST WITHOUT CONSTANT ENGINE LOAD

- 7.4.1.1 ICE Electro-hydraulic Power Steering

- 7.4.1.2 EV Electro-hydraulic Power Steering

- 7.4.1 NEED FOR HIGH TORQUE ASSIST WITHOUT CONSTANT ENGINE LOAD

- 7.5 LIQUID HEATER PTC

- 7.5.1 NEED FOR EFFICIENT CABIN HEATING

- 7.5.1.1 ICE Liquid Heater PTC

- 7.5.1.2 EV Liquid Heater PTC

- 7.5.1 NEED FOR EFFICIENT CABIN HEATING

- 7.6 ELECTRIC A/C COMPRESSOR

- 7.6.1 EV ADOPTION REQUIRING ENGINE-INDEPENDENT HVAC

- 7.6.1.1 ICE Electric A/C Compressor

- 7.6.1.2 EV Electric A/C Compressor

- 7.6.1 EV ADOPTION REQUIRING ENGINE-INDEPENDENT HVAC

- 7.7 ELECTRIC VACUUM PUMP

- 7.7.1 INCREASING HYBRID/ELECTRIC VEHICLE PENETRATION AND INTEGRATION WITH AUTONOMOUS BRAKING SYSTEMS

- 7.7.1.1 ICE Electric Vacuum Pump

- 7.7.1.2 EV Electric Vacuum Pump

- 7.7.1 INCREASING HYBRID/ELECTRIC VEHICLE PENETRATION AND INTEGRATION WITH AUTONOMOUS BRAKING SYSTEMS

- 7.8 ELECTRIC OIL PUMP

- 7.8.1 NEED FOR INDEPENDENT THERMAL MANAGEMENT

- 7.8.1.1 ICE Electric Oil Pump

- 7.8.1.2 EV Electric Oil Pump

- 7.8.1 NEED FOR INDEPENDENT THERMAL MANAGEMENT

- 7.9 ELECTRIC WATER PUMP

- 7.9.1 NEED FOR PRECISE COOLANT FLOW CONTROL FOR BATTERY PACKS

- 7.9.1.1 ICE Electric Water Pump

- 7.9.1.2 EV Electric Water Pump

- 7.9.1 NEED FOR PRECISE COOLANT FLOW CONTROL FOR BATTERY PACKS

- 7.10 INTEGRATED STARTER GENERATOR

- 7.10.1 GROWING ADOPTION OF 48V MILD HYBRID VEHICLES

- 7.10.1.1 ICE Integrated Starter Generator

- 7.10.1.2 EV Integrated Starter Generator

- 7.10.1 GROWING ADOPTION OF 48V MILD HYBRID VEHICLES

- 7.11 PRIMARY INSIGHTS

8 VEHICLE ELECTRIFICATION MARKET, BY VEHICLE TYPE

- 8.1 INTRODUCTION

- 8.2 PASSENGER CAR

- 8.2.1 EXPANSION OF MODULAR, ELECTRIFIED COMPONENTS ACROSS HYBRID AND BEV PLATFORMS

- 8.3 LIGHT COMMERCIAL VEHICLE

- 8.3.1 RISING ADOPTION OF HIGH-DUTY ELECTRIC COMPONENTS FOR PAYLOAD OPERATION

- 8.4 TRUCK

- 8.4.1 ELEVATED DEMAND FOR HIGH-POWER ELECTRIC PUMPS AND HVAC COMPRESSORS IN CLASS-8 AND MEDIUM-DUTY MODELS

- 8.5 BUS

- 8.5.1 INTEGRATION OF ELECTRIFIED AUXILIARIES FOR EFFICIENCY AND RELIABILITY

- 8.6 PRIMARY INSIGHTS

9 VEHICLE ELECTRIFICATION MARKET, BY DEGREE OF HYBRIDIZATION

- 9.1 INTRODUCTION

- 9.2 ICE & MICRO HYBRID VEHICLE

- 9.2.1 LOW-VOLTAGE HYBRIDIZATION IN PASSENGER AND COMMERCIAL VEHICLES

- 9.3 HEV

- 9.3.1 RISE IN STRATEGIC SUPPLIER-OEM PARTNERSHIPS

- 9.4 PHEV

- 9.4.1 ADVANCEMENTS IN POWER ELECTRONICS, THERMAL MANAGEMENT, AND BATTERY SUPPLY

- 9.5 BEV

- 9.5.1 INCREASED CONSUMER DEMAND FOR ZERO-EMISSION MOBILITY

- 9.6 PRIMARY INSIGHTS

10 VEHICLE ELECTRIFICATION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 CHINA

- 10.2.2.1 Strong NEV policies, OEM leadership, and supplier expansion to drive market

- 10.2.3 JAPAN

- 10.2.3.1 Leadership in hybrid and plug-in hybrid technologies to drive market

- 10.2.4 INDIA

- 10.2.4.1 OEM momentum and supplier localization to drive market

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Strong OEM and supplier ecosystem to drive market

- 10.2.6 REST OF ASIA PACIFIC

- 10.3 NORTH AMERICA

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 US

- 10.3.2.1 Stringent regulatory push to drive market

- 10.3.3 CANADA

- 10.3.3.1 ZEV mandates and supplier investments to drive market

- 10.3.4 MEXICO

- 10.3.4.1 Strict CO2 standards and localized production to drive market

- 10.4 EUROPE

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 GERMANY

- 10.4.2.1 High EV production and elevated domestic demand to drive market

- 10.4.3 NETHERLANDS

- 10.4.3.1 Substantial EV adoption and V2G innovation to drive market

- 10.4.4 FRANCE

- 10.4.4.1 OEM programs, battery projects, and supplier scale-up to drive market

- 10.4.5 UK

- 10.4.5.1 Awareness of clean transport to drive market

- 10.4.6 SPAIN

- 10.4.6.1 Increasing demand for e-drives and power electronics to drive market

- 10.4.7 ITALY

- 10.4.7.1 Concentrated OEM investment and active supplier deals to drive market

- 10.4.8 REST OF EUROPE

- 10.5 REST OF THE WORLD

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 BRAZIL

- 10.5.2.1 Rising demand for fuel-efficient vehicles to drive market

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Growing demand for cleaner and more fuel-efficient vehicles to drive market

- 10.5.4 OTHERS

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 ELECTRIC COOLANT PUMP MARKET SHARE ANALYSIS, 2024

- 11.4 ELECTRIC COMPRESSOR MARKET SHARE ANALYSIS, 2024

- 11.5 E-AXLE MARKET SHARE ANALYSIS, 2024

- 11.5.1 CHINESE E-AXLE MARKET SHARE ANALYSIS, 2024

- 11.6 REVENUE ANALYSIS, 2021-2024

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Vehicle type footprint

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 List of start-ups/SMEs

- 11.8.5.2 Competitive benchmarking of start-ups/SMEs

- 11.9 COMPANY VALUATION AND FINANCIAL METRICS

- 11.10 BRAND/PRODUCT COMPARISON

- 11.11 COMPETITIVE SCENARIO

- 11.11.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 11.11.2 DEALS

- 11.11.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ROBERT BOSCH GMBH

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.3.3 Others

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 CONTINENTAL AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 APTIV

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.3.3 Others

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 DENSO CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches/developments

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 MITSUBISHI MOTORS CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 BORGWARNER INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.3.2 Others

- 12.1.7 JOHNSON ELECTRIC HOLDINGS LIMITED

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches/developments

- 12.1.8 MAGNA INTERNATIONAL INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 AISIN CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent development

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Others

- 12.1.10 NIDEC CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches/developments

- 12.1.10.3.2 Expansions

- 12.1.10.3.3 Others

- 12.1.11 PANASONIC AUTOMOTIVE SYSTEMS CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.1 ROBERT BOSCH GMBH

- 12.2 OTHER PLAYERS

- 12.2.1 JTEKT CORPORATION

- 12.2.2 ASTEMO, LTD.

- 12.2.3 ZF FRIEDRICHSHAFEN AG

- 12.2.4 VALEO

- 12.2.5 GKN AUTOMOTIVE LTD.

- 12.2.6 SCHAEFFLER AG

- 12.2.7 MAHLE GMBH

- 12.2.8 DANA LIMITED

- 12.2.9 BROSE FAHRZEUGTEILE SE & CO. KG

- 12.2.10 KEB AUTOMATION

- 12.2.11 TECO CORPORATION

- 12.2.12 YASA LIMITED

13 RECOMMENDATIONS

- 13.1 ASIA PACIFIC TO BE LEADING MARKET FOR VEHICLE ELECTRIFICATION

- 13.2 STEERING SYSTEMS EMERGE AS KEY ENABLER OF VEHICLE ELECTRIFICATION

- 13.3 PASSENGER CARS TO BE PREVALENT GLOBALLY

- 13.4 CONCLUSION

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.4.1 48V MARKET, BY COMPONENT AND REGION

- 14.4.1.1 Asia Pacific

- 14.4.1.1.1 Start-Stop System

- 14.4.1.1.2 Electric Power Steering

- 14.4.1.1.3 Liquid Heater PTC

- 14.4.1.1.4 Electric A/C Compressor

- 14.4.1.1.5 Electric Vacuum Pump

- 14.4.1.1.6 Electric Oil Pump

- 14.4.1.1.7 Electric Water Pump

- 14.4.1.1.8 Integrated Starter Generator

- 14.4.1.2 Europe

- 14.4.1.2.1 Start-Stop System

- 14.4.1.2.2 Electric Power Steering

- 14.4.1.2.3 Liquid Heater PTC

- 14.4.1.2.4 Electric A/C Compressor

- 14.4.1.2.5 Electric Vacuum Pump

- 14.4.1.2.6 Electric Oil Pump

- 14.4.1.2.7 Electric Water Pump

- 14.4.1.2.8 Integrated Starter Generator

- 14.4.1.3 North America

- 14.4.1.3.1 Start-Stop System

- 14.4.1.3.2 Electric Power Steering

- 14.4.1.3.3 Liquid Heater PTC

- 14.4.1.3.4 Electric A/C Compressor

- 14.4.1.3.5 Electric Vacuum Pump

- 14.4.1.3.6 Electric Oil Pump

- 14.4.1.3.7 Electric Water Pump

- 14.4.1.3.8 Integrated Starter Generator

- 14.4.1.4 Rest of the World

- 14.4.1.4.1 Start-Stop System

- 14.4.1.4.2 Electric Power Steering

- 14.4.1.4.3 Liquid Heater PTC

- 14.4.1.4.4 Electric A/C Compressor

- 14.4.1.4.5 Electric Vacuum Pump

- 14.4.1.4.6 Electric Oil Pump

- 14.4.1.4.7 Electric Water Pump

- 14.4.1.4.8 Integrated Starter Generator

- 14.4.1.1 Asia Pacific

- 14.4.1 48V MARKET, BY COMPONENT AND REGION

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY PRODUCT

- TABLE 2 USD EXCHANGE RATE, 2021-2024

- TABLE 3 TECHNICAL BENEFITS OF ELECTRIFIED COMPONENTS

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE, BY PRODUCT, 2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE, BY REGION, 2024 (USD)

- TABLE 7 GERMANY: IMPORT DATA FOR HS CODE 841330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 8 CHINA: IMPORT DATA FOR HS CODE 841330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 9 US: IMPORT DATA FOR HS CODE 841330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 10 FRANCE: IMPORT DATA FOR HS CODE 841330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 11 US: EXPORT DATA FOR HS CODE 841330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 12 GERMANY: EXPORT DATA FOR HS CODE 841330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 13 MEXICO: EXPORT DATA FOR HS CODE 841330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 14 CHINA: EXPORT DATA FOR HS CODE 841330-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 15 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 LIST OF FUNDINGS, 2022-2024

- TABLE 17 RECENT E-AXLE DEVELOPMENTS

- TABLE 18 OEM INNOVATIONS AND FOCUS AREAS

- TABLE 19 CHARACTERISTICS OF STAINLESS STEEL CLASSIFICATIONS

- TABLE 20 PROPERTIES OF SILICON NITRIDE-BASED CERAMIC BALLS

- TABLE 21 PATENT ANALYSIS

- TABLE 22 HYBRIDIZATION STAGES AND TYPICAL SPECS

- TABLE 23 PLATFORM MODULARIZATION AND STANDARDIZATION TRENDS

- TABLE 24 ELECTRIC COOLANT PUMP CONSUMPTION BY ELECTRIC PASSENGER CAR OEMS, 2018-2030 (THOUSAND UNITS)

- TABLE 25 ELECTRIC COOLANT PUMP CONSUMPTION BY ELECTRIC COMMERCIAL VEHICLE OEMS, 2018-2030 (THOUSAND UNITS)

- TABLE 26 TOP 10 SUPPLIER PRICING

- TABLE 27 TOP 10 OEM PRICING

- TABLE 28 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 NETHERLANDS: EV INCENTIVES

- TABLE 32 NETHERLANDS: EV CHARGING STATION INCENTIVES

- TABLE 33 GERMANY: EV INCENTIVES

- TABLE 34 GERMANY: EV CHARGING STATION INCENTIVES

- TABLE 35 FRANCE: EV INCENTIVES

- TABLE 36 FRANCE: EV CHARGING STATION INCENTIVES

- TABLE 37 UK: EV INCENTIVES

- TABLE 38 UK: EV CHARGING STATION INCENTIVES

- TABLE 39 CHINA: EV INCENTIVES

- TABLE 40 CHINA: EV CHARGING STATION INCENTIVES

- TABLE 41 US: EV INCENTIVES

- TABLE 42 US: EV CHARGING STATION INCENTIVES

- TABLE 43 COMPONENT-LEVEL CARBON FOOTPRINT ANALYSIS

- TABLE 44 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE (%)

- TABLE 45 KEY BUYING CRITERIA, BY VEHICLE TYPE

- TABLE 46 OVERVIEW OF ELECTRIFIED VEHICLE COMPONENTS BY PRODUCT, VOLTAGE, AND APPLICATION

- TABLE 47 VEHICLE ELECTRIFICATION MARKET, BY PROPULSION AND PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 48 VEHICLE ELECTRIFICATION MARKET, BY PROPULSION AND PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 49 VEHICLE ELECTRIFICATION MARKET, BY PROPULSION AND PRODUCT, 2021-2024 (USD MILLION)

- TABLE 50 VEHICLE ELECTRIFICATION MARKET, BY PROPULSION AND PRODUCT, 2025-2032 (USD MILLION)

- TABLE 51 GLOBAL START-STOP SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 52 GLOBAL START-STOP SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 53 GLOBAL START-STOP SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 GLOBAL START-STOP SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 ICE START-STOP SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 56 ICE START-STOP SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 57 ICE START-STOP SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 ICE START-STOP SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 EV START-STOP SYSTEM MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 60 EV START-STOP SYSTEM MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 61 EV START-STOP SYSTEM MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 EV START-STOP SYSTEM MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 GLOBAL ELECTRIC POWER STEERING MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 64 GLOBAL ELECTRIC POWER STEERING MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 65 GLOBAL ELECTRIC POWER STEERING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 GLOBAL ELECTRIC POWER STEERING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 ICE ELECTRIC POWER STEERING MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 68 ICE ELECTRIC POWER STEERING MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 69 ICE ELECTRIC POWER STEERING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 ICE ELECTRIC POWER STEERING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 EV ELECTRIC POWER STEERING MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 72 EV ELECTRIC POWER STEERING MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 73 EV ELECTRIC POWER STEERING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 EV ELECTRIC POWER STEERING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 GLOBAL ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 76 GLOBAL ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 77 GLOBAL ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 GLOBAL ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 ICE ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 80 ICE ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 81 ICE ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 ICE ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 83 EV ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 84 EV ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 85 EV ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 EV ELECTRO-HYDRAULIC POWER STEERING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 87 GLOBAL LIQUID HEATER PTC MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 88 GLOBAL LIQUID HEATER PTC MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 89 GLOBAL LIQUID HEATER PTC MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 GLOBAL LIQUID HEATER PTC MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 ICE LIQUID HEATER PTC MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 92 ICE LIQUID HEATER PTC MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 93 ICE LIQUID HEATER PTC MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 ICE LIQUID HEATER PTC MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 EV LIQUID HEATER PTC MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 96 EV LIQUID HEATER PTC MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 97 EV LIQUID HEATER PTC MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 EV LIQUID HEATER PTC MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 99 GLOBAL ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 100 GLOBAL ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 101 GLOBAL ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 GLOBAL ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 103 ICE ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 104 ICE ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 105 ICE ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 ICE ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 107 EV ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 108 EV ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 109 EV ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 EV ELECTRIC A/C COMPRESSOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 GLOBAL ELECTRIC VACUUM PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 112 GLOBAL ELECTRIC VACUUM PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 113 GLOBAL ELECTRIC VACUUM PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 GLOBAL ELECTRIC VACUUM PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 115 ICE ELECTRIC VACUUM PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 116 ICE ELECTRIC VACUUM PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 117 ICE ELECTRIC VACUUM PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 ICE ELECTRIC VACUUM PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 119 EV ELECTRIC VACUUM PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 120 EV ELECTRIC VACUUM PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 121 EV ELECTRIC VACUUM PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 EV ELECTRIC VACUUM PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 123 GLOBAL ELECTRIC OIL PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 124 GLOBAL ELECTRIC OIL PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 125 GLOBAL ELECTRIC OIL PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 GLOBAL ELECTRIC OIL PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 127 ICE ELECTRIC OIL PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 128 ICE ELECTRIC OIL PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 129 ICE ELECTRIC OIL PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 ICE ELECTRIC OIL PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 131 EV ELECTRIC OIL PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 132 EV ELECTRIC OIL PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 133 EV ELECTRIC OIL PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 EV ELECTRIC OIL PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 135 GLOBAL ELECTRIC WATER PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 136 GLOBAL ELECTRIC WATER PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 137 GLOBAL ELECTRIC WATER PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 138 GLOBAL ELECTRIC WATER PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 139 ICE ELECTRIC WATER PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 140 ICE ELECTRIC WATER PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 141 ICE ELECTRIC WATER PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 ICE ELECTRIC WATER PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 143 EV ELECTRIC WATER PUMP MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 144 EV ELECTRIC WATER PUMP MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 145 EV ELECTRIC WATER PUMP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 EV ELECTRIC WATER PUMP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 147 GLOBAL INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 148 GLOBAL INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 149 GLOBAL INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 150 GLOBAL INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 151 ICE INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 152 ICE INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 153 ICE INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 154 ICE INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 155 EV INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 156 EV INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 157 EV INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 158 EV INTEGRATED STARTER GENERATOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 159 VEHICLE ELECTRIFICATION MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 160 VEHICLE ELECTRIFICATION MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 161 VEHICLE ELECTRIFICATION MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 162 VEHICLE ELECTRIFICATION MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 163 PASSENGER CAR ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 164 PASSENGER CAR ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 165 PASSENGER CAR ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 166 PASSENGER CAR ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 167 LIGHT COMMERCIAL VEHICLE ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 168 LIGHT COMMERCIAL VEHICLE ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 169 LIGHT COMMERCIAL VEHICLE ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 LIGHT COMMERCIAL VEHICLE ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 171 TRUCK ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 172 TRUCK ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 173 TRUCK ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 174 TRUCK ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 175 BUS ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 176 BUS ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 177 BUS ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 BUS ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 179 VEHICLE ELECTRIFICATION MARKET, BY DEGREE OF HYBRIDIZATION, 2021-2024 (THOUSAND UNITS)

- TABLE 180 VEHICLE ELECTRIFICATION MARKET, BY DEGREE OF HYBRIDIZATION, 2025-2032 (THOUSAND UNITS)

- TABLE 181 VEHICLE ELECTRIFICATION MARKET, BY DEGREE OF HYBRIDIZATION, 2021-2024 (USD MILLION)

- TABLE 182 VEHICLE ELECTRIFICATION MARKET, BY DEGREE OF HYBRIDIZATION, 2025-2032 (USD MILLION)

- TABLE 183 ICE & MICRO HYBRID VEHICLE ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 184 ICE & MICRO HYBRID VEHICLE ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 185 ICE & MICRO HYBRID VEHICLE ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 186 ICE & MICRO HYBRID VEHICLE ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 187 HEV ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 188 HEV ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 189 HEV ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 190 HEV ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 191 PHEV ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 192 PHEV ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 193 PHEV ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 194 PHEV ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 195 BEV ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 196 BEV ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 197 BEV ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 198 BEV ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 199 VEHICLE ELECTRIFICATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 200 VEHICLE ELECTRIFICATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 201 VEHICLE ELECTRIFICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 202 VEHICLE ELECTRIFICATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 203 ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 204 ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 205 ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 206 ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 207 CHINA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 208 CHINA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 209 CHINA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 210 CHINA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 211 JAPAN: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 212 JAPAN: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 213 JAPAN: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 214 JAPAN: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 215 INDIA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 216 INDIA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 217 INDIA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 218 INDIA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 219 SOUTH KOREA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 220 SOUTH KOREA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 221 SOUTH KOREA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 222 SOUTH KOREA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 224 REST OF ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 225 REST OF ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 227 NORTH AMERICA: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 228 NORTH AMERICA: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 229 NORTH AMERICA: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 230 NORTH AMERICA: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 231 US: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 232 US: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 233 US: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 234 US: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 235 CANADA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 236 CANADA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 237 CANADA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 238 CANADA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 239 MEXICO: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 240 MEXICO: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 241 MEXICO: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 242 MEXICO: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 243 EUROPE: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 244 EUROPE: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 245 EUROPE: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 246 EUROPE: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 247 GERMANY: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 248 GERMANY: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 249 GERMANY: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 250 GERMANY: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 251 NETHERLANDS: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 252 NETHERLANDS: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 253 NETHERLANDS: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 254 NETHERLANDS: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 255 FRANCE: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 256 FRANCE: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 257 FRANCE: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 258 FRANCE: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 259 UK: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 260 UK: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 261 UK: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 262 UK: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 263 SPAIN: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 264 SPAIN: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 265 SPAIN: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 266 SPAIN: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 267 ITALY: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 268 ITALY: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 269 ITALY: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 270 ITALY: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 271 REST OF EUROPE: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 272 REST OF EUROPE: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 273 REST OF EUROPE: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 274 REST OF EUROPE: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 275 REST OF THE WORLD: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 276 REST OF THE WORLD: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 277 REST OF THE WORLD: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 278 REST OF THE WORLD: VEHICLE ELECTRIFICATION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 279 BRAZIL: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 280 BRAZIL: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 281 BRAZIL: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 282 BRAZIL: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 283 SOUTH AFRICA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 284 SOUTH AFRICA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 285 SOUTH AFRICA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 286 SOUTH AFRICA: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 287 OTHERS: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (THOUSAND UNITS)

- TABLE 288 OTHERS: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (THOUSAND UNITS)

- TABLE 289 OTHERS: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 290 OTHERS: VEHICLE ELECTRIFICATION MARKET, BY PRODUCT, 2025-2032 (USD MILLION)

- TABLE 291 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- TABLE 292 ELECTRIC COOLANT PUMP MARKET SHARE ANALYSIS, 2024

- TABLE 293 ELECTRIC COMPRESSOR MARKET SHARE ANALYSIS, 2024

- TABLE 294 E-AXLE MARKET SHARE ANALYSIS, 2024

- TABLE 295 CHINESE E-AXLE MARKET SHARE ANALYSIS, 2024

- TABLE 296 REGION FOOTPRINT

- TABLE 297 VEHICLE TYPE FOOTPRINT

- TABLE 298 LIST OF START-UPS/SMES

- TABLE 299 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 300 VEHICLE ELECTRIFICATION MARKET: PRODUCT LAUNCHES/ DEVELOPMENTS, 2022-2025

- TABLE 301 VEHICLE ELECTRIFICATION MARKET: DEALS, 2022-2025

- TABLE 302 VEHICLE ELECTRIFICATION MARKET: EXPANSIONS, 2022-2025

- TABLE 303 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 304 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 305 ROBERT BOSCH GMBH: DEALS

- TABLE 306 ROBERT BOSCH GMBH: EXPANSIONS

- TABLE 307 ROBERT BOSCH GMBH: OTHERS

- TABLE 308 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 309 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 310 CONTINENTAL AG: EXPANSIONS

- TABLE 311 APTIV: COMPANY OVERVIEW

- TABLE 312 APTIV: PRODUCTS OFFERED

- TABLE 313 APTIV: DEALS

- TABLE 314 APTIV: EXPANSIONS

- TABLE 315 APTIV: OTHERS

- TABLE 316 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 317 DENSO CORPORATION: PRODUCTS OFFERED

- TABLE 318 DENSO CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 319 DENSO CORPORATION: DEALS

- TABLE 320 MITSUBISHI MOTORS CORPORATION: COMPANY OVERVIEW

- TABLE 321 MITSUBISHI MOTORS CORPORATION: PRODUCTS OFFERED

- TABLE 322 MITSUBISHI MOTORS CORPORATION: DEALS

- TABLE 323 BORGWARNER INC.: COMPANY OVERVIEW

- TABLE 324 BORGWARNER INC.: PRODUCTS OFFERED

- TABLE 325 BORGWARNER INC.: EXPANSIONS

- TABLE 326 BORGWARNER INC.: OTHERS

- TABLE 327 JOHNSON ELECTRIC HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 328 JOHNSON ELECTRIC HOLDINGS LIMITED: PRODUCTS OFFERED

- TABLE 329 JOHNSON ELECTRIC HOLDINGS LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 330 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 331 MAGNA INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 332 MAGNA INTERNATIONAL INC.: DEALS

- TABLE 333 MAGNA INTERNATIONAL INC.: EXPANSIONS

- TABLE 334 AISIN CORPORATION: COMPANY OVERVIEW

- TABLE 335 AISIN CORPORATION: PRODUCTS OFFERED

- TABLE 336 AISIN CORPORATION: DEALS

- TABLE 337 AISIN CORPORATION: OTHERS

- TABLE 338 NIDEC CORPORATION: COMPANY OVERVIEW

- TABLE 339 NIDEC CORPORATION: PRODUCTS OFFERED

- TABLE 340 NIDEC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 341 NIDEC CORPORATION: EXPANSIONS

- TABLE 342 NIDEC CORPORATION: OTHERS

- TABLE 343 PANASONIC AUTOMOTIVE SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 344 PANASONIC AUTOMOTIVE SYSTEMS CO., LTD.: PRODUCTS OFFERED

- TABLE 345 JTEKT CORPORATION: COMPANY OVERVIEW

- TABLE 346 ASTEMO, LTD.: COMPANY OVERVIEW

- TABLE 347 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW

- TABLE 348 VALEO: COMPANY OVERVIEW

- TABLE 349 GKN AUTOMOTIVE LTD.: COMPANY OVERVIEW

- TABLE 350 SCHAEFFLER AG: COMPANY OVERVIEW

- TABLE 351 MAHLE GMBH: COMPANY OVERVIEW

- TABLE 352 DANA LIMITED: COMPANY OVERVIEW

- TABLE 353 BROSE FAHRZEUGTEILE SE & CO. KG: COMPANY OVERVIEW

- TABLE 354 KEB AUTOMATION: COMPANY OVERVIEW

- TABLE 355 TECO CORPORATION: COMPANY OVERVIEW

- TABLE 356 YASA LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 VEHICLE ELECTRIFICATION MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 8 REPORT SUMMARY

- FIGURE 9 VEHICLE ELECTRIFICATION MARKET, BY REGION

- FIGURE 10 VEHICLE ELECTRIFICATION MARKET, BY VEHICLE TYPE

- FIGURE 11 RISING USE OF ELECTRIFIED COMPONENTS TO REDUCE ENERGY LOSSES TO DRIVE MARKET

- FIGURE 12 PASSENGER CAR TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 13 BEV TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 14 LIQUID HEATER PTC TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO BE LEADING REGIONAL MARKET IN 2025

- FIGURE 16 VEHICLE ELECTRIFICATION MARKET DYNAMICS

- FIGURE 17 SUPPLY CHAIN ANALYSIS

- FIGURE 18 ECOSYSTEM MAP

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 INVESTMENT AND FUNDING SCENARIO, 2022-2025

- FIGURE 23 PATENT ANALYSIS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY VEHICLE TYPE

- FIGURE 25 KEY BUYING CRITERIA, BY VEHICLE TYPE

- FIGURE 26 VEHICLE ELECTRIFICATION, BY PROPULSION AND PRODUCT, 2025 VS. 2032 (USD MILLION)

- FIGURE 27 VEHICLE ELECTRIFICATION, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 28 VEHICLE ELECTRIFICATION MARKET, BY DEGREE OF HYBRIDIZATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 29 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 30 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 31 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 32 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 33 ASIA PACIFIC: VEHICLE ELECTRIFICATION MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 35 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 36 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 37 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 38 NORTH AMERICA: VEHICLE ELECTRIFICATION MARKET SNAPSHOT

- FIGURE 39 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 40 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 41 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 42 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 43 EUROPE: VEHICLE ELECTRIFICATION MARKET SNAPSHOT

- FIGURE 44 REST OF THE WORLD: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 45 REST OF THE WORLD: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 46 REST OF THE WORLD: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 47 REST OF THE WORLD: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 48 ELECTRIC COOLANT PUMP MARKET SHARE ANALYSIS, 2024

- FIGURE 49 ELECTRIC COMPRESSOR MARKET SHARE ANALYSIS, 2024

- FIGURE 50 E-AXLE MARKET SHARE ANALYSIS, 2024

- FIGURE 51 CHINESE E-AXLE MARKET SHARE ANALYSIS, 2024

- FIGURE 52 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2021-2024

- FIGURE 53 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 54 COMPANY FOOTPRINT

- FIGURE 55 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 56 COMPANY VALUATION (USD BILLION)

- FIGURE 57 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 58 BRAND/PRODUCT COMPARISON

- FIGURE 59 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 60 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 61 APTIV: COMPANY SNAPSHOT

- FIGURE 62 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 MITSUBISHI MOTORS CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 BORGWARNER INC.: COMPANY SNAPSHOT

- FIGURE 65 JOHNSON ELECTRIC HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 66 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 67 AISIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 NIDEC CORPORATION: COMPANY SNAPSHOT