PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1829987

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1829987

Electric Ship Market by Point of Sale (Newbuild & Line Fit vs. Retrofit), Technology (Fully Electric vs. Hybrid), Ship Type (Commercial, Defense), Solution (Storage, Conversion, Generation, Distribution, Drive) and Region - Global Forecast to 2032

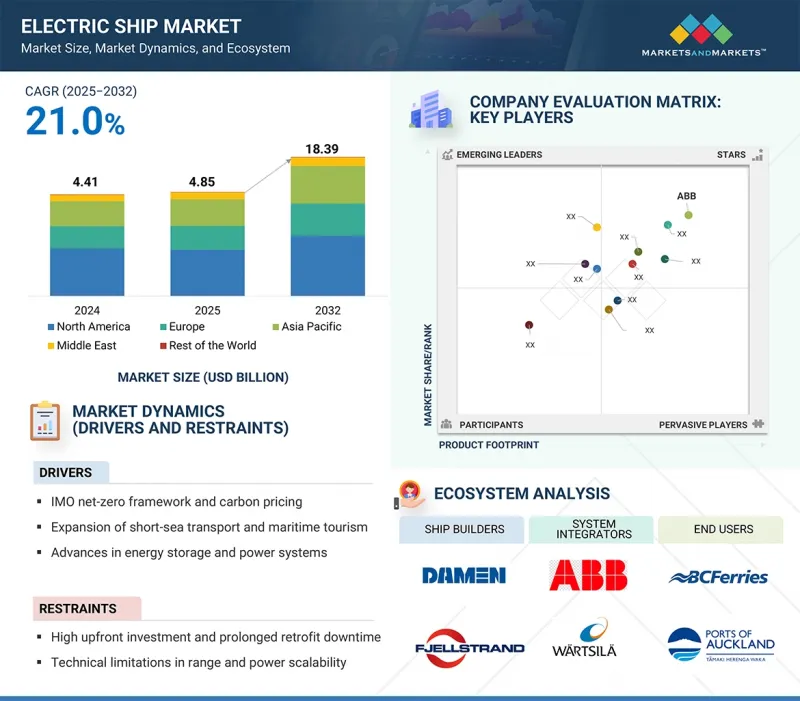

The electric ship market is expected to reach USD 18.39 billion by 2032, from USD 4.85 billion in 2025, with a CAGR of 21.0%. The market is growing due to regulatory push, economic factors, and technological advances that facilitate faster progress. International and regional authorities are implementing stricter emissions regulations, prompting shipowners to replace traditional propulsion systems with low-emission alternatives.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Point of Sale, Technology, Ship Type, Solution and Region |

| Regions covered | North America, Europe, APAC, RoW |

Electrification has become the most practical option, especially for ferries and cargo ships, where route predictability and frequent port access are supported by battery and hybrid systems. This regulatory environment increases compliance pressure and shifts investment priorities among shipyards, port operators, and technology providers.

"Ferries are expected to be the largest passenger ship segment during the forecast period."

Ferries are expected to be at the forefront of the electric ship market due to their unique operating style, regulatory requirements, and cost-effectiveness. They typically operate within a limited range, allowing for regular charging over short distances, especially depending on how often they visit ports. This setup aligns well with current battery and hybrid technologies. The predictability of their operations makes it easier to implement electrification without disrupting schedules, making ferries a practical option for large-scale adoption of electric vessels. Furthermore, ferries often serve urban and coastal routes where emissions regulations are more stringent, driving operators to seek low-emission alternatives.

"Manned is expected to be the largest autonomy segment during the forecast period."

Manned ships are expected to dominate the electric ship market, as most vessels in global operations are crewed. The operation, maintenance, and adherence to international safety standards for passenger ferries, short-haul cargo ships, offshore service vessels, and naval platforms rely on human labor. Consequently, electrification efforts are primarily focused on these manned ships, enabling upgrades to propulsion and energy systems without the need to modify existing models. This enhances operational efficiency since manned vessels typically follow fixed routes, facilitating the implementation of charging facilities and hybrid-electric systems. Meanwhile, hybrid propulsion helps shipowners reduce fuel consumption and emissions while maintaining operational range, making it easier to comply with stricter emissions regulations.

"Asia Pacific is expected to be the second-largest market for electric ships during the forecast period."

The Asia Pacific region is expected to become the second-largest market for electric ships, driven by its strong position in the global shipbuilding industry, increasing regulatory alignment, and significant investments in maritime decarbonization efforts. Key shipbuilding countries such as China, South Korea, and Japan are actively pursuing strategies to electrify both their commercial and defense fleets. China, in particular, has launched state-supported projects that include the development of battery-powered and hybrid ferries, alongside initiatives to enhance port charging infrastructure. Meanwhile, Japan and South Korea are exploring pilot programs for fully electric vessels and hybrid solutions for larger ships, leveraging their advanced manufacturing capabilities and robust maritime research and development.

Breakdown of the profile of primary participants in the electric ship market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East - 10%, and Rest of the World - 5%

Major companies profiled in the report include ABB (Switzerland), Wartisilia (Finland), Schottel Group (Germany), Corvus Energy (Norway), and Siemens (Germany), among others.

Research Coverage:

This market study covers the electric ship market across various segments and subsegments. It aims to estimate the market's size and growth potential in different regions. The study also provides an in-depth competitive analysis of the key market players, including their company profiles, insights into their products and business offerings, recent developments, and the key strategies they have adopted.

Reasons to buy this report:

The report will assist market leaders and new entrants with estimates of the revenue figures for the overall Electric Ship Market. It will help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides insights into market trends and key drivers, restraints, challenges, and opportunities.

The report covers the following key pointers:

- In-depth Analysis of Key Drivers (IMO net-zero framework & carbon pricing, expansion of short-sea transport and maritime tourism, advances in energy storage and power systems, and decarbonization and sustainability goals), Restraints (high upfront investment and prolonged retrofit downtime, technical limitations in range and power scalability, uncertain regulatory standards and compliance burden), Opportunities (potential of high-powered batteries, scale battery and fuel cell technologies for long-range shipping, and leverage government incentives for clean shipbuilding programs), and Challenges (supply chain constraints for critical materials, high capital costs and financing barriers, and charging and port infrastructure readiness)

- Market Penetration: Comprehensive information on electric ships offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and new product launches in the electric ship market

- Market Development: Comprehensive information about lucrative markets; the report analyzes the electric ship market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the electric ship market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the electric ship market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.1.1 Surge in maritime tourism

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.2.2.1 Advanced batteries for electric ships

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Regional split

- 2.3.1.2 Market size estimation methdology (demand-side analysis)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRIC SHIP MARKET

- 4.2 ELECTRIC SHIP MARKET, BY PROPULSION

- 4.3 ELECTRIC SHIP MARKET, BY HYBRID PROPULSION

- 4.4 ELECTRIC SHIP MARKET, BY COMMERCIAL VESSEL

- 4.5 ELECTRIC SHIP MARKET, BY PASSENGER VESSEL

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Implementation of Net-Zero Framework with GHG pricing

- 5.2.1.2 Rise in short-sea transport and coastal tourism

- 5.2.1.3 Advances in energy storage and power systems

- 5.2.1.4 Decarbonization and sustainability goals

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront investment and prolonged retrofit downtime

- 5.2.2.2 Technical limitations in range and power scalability

- 5.2.2.3 Fragmented regulatory standards and compliance burden

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovations in energy storage solutions

- 5.2.3.2 Scaling of battery and fuel cell technologies for long-range shipping

- 5.2.3.3 Government incentives for clean shipbuilding programs

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain constraints for critical materials

- 5.2.4.2 Lack of adequate charging and port infrastructure

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 SHIP BUILDERS

- 5.4.2 SYSTEM INTEGRATORS

- 5.4.3 END USERS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CHINA STATE SHIPBUILDING CORPORATION'S FULLY ELECTRIC CONTAINER SHIP

- 5.5.2 INCAT TASMANIA'S HULL 096 FERRY

- 5.5.3 WARTSILA AND WETA'S FULLY ELECTRIC HIGH-SPEED FERRY

- 5.5.4 HD HYUNDAI'S MMC HIGH-PRESSURE ELECTRIC PROPULSION DRIVE

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 KEY CONFERENCES AND EVENTS

- 5.8 REGULATORY LANDSCAPE

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Energy storage systems

- 5.9.1.2 Electric propulsion and motors

- 5.9.1.3 Smart power distribution and energy management

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 HVDC shipboard grids

- 5.9.2.2 Fuel cells

- 5.9.2.3 Permanent magnet propulsion rods

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Renewable energy integration

- 5.9.3.2 Digital twins and simulation platforms

- 5.9.3.3 Charging and shore power infrastructure

- 5.9.1 KEY TECHNOLOGIES

- 5.10 NEWBUILD VS. RETROFIT VESSELS

- 5.11 TRADE DATA

- 5.11.1 IMPORT SCENARIO (HS CODE 8901)

- 5.11.2 EXPORT SCENARIO (HS CODE 8901)

- 5.12 PATENT ANALYSIS

- 5.13 MACROECONOMIC OUTLOOK

- 5.13.1 NORTH AMERICA

- 5.13.2 EUROPE

- 5.13.3 ASIA PACIFIC

- 5.13.4 MIDDLE EAST

- 5.13.5 REST OF THE WORLD

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND OF ELECTRIC SHIPS OFFERED BY KEY PLAYERS

- 5.14.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 BUSINESS MODELS

- 5.17 TECHNOLOGY ROADMAP

- 5.18 IMPACT OF AI

- 5.18.1 INTRODUCTION

- 5.18.2 ADOPTION OF AI IN MARINE BY TOP COUNTRIES

- 5.18.3 IMPACT OF AI ON MARINE USE CASES

- 5.18.4 IMPACT OF AI ON ELECTRIC SHIP MARKET

- 5.19 US 2025 TARIFF

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 ELECTRIC SHIP MARKET, BY AUTONOMY (MARKET SIZE & FORECAST TO 2032, USD)

- 6.1 INTRODUCTION

- 6.2 MANNED

- 6.2.1 ALIGNMENT WITH EXISTING MARITIME PRACTICES TO DRIVE MARKET

- 6.3 REMOTELY OPERATED

- 6.3.1 IMPROVED OPERATIONAL FEASIBILITY TO DRIVE MARKET

- 6.4 AUTONOMOUS

- 6.4.1 FAVORABLE REGULATORY FRAMEWORKS AND SUPPORTING INFRASTRUCTURE AT PORTS TO DRIVE MARKET

7 ELECTRIC SHIP MARKET, BY POINT OF SALE (MARKET SIZE & FORECAST TO 2032, USD)

- 7.1 INTRODUCTION

- 7.2 FULLY ELECTRIC

- 7.2.1 PREVALENCE OF BATTERY-POWERED VESSELS TO DRIVE MARKET

- 7.2.2 BATTERY-POWERED

- 7.2.3 ELECTRO-SOLAR & BATTERY-POWERED

- 7.2.4 FUEL CELL & BATTERY-POWERED

- 7.3 HYBRID

- 7.3.1 EXTENSIVE USE IN VESSELS WITH VARIABLE DUTY CYCLES TO DRIVE MARKET

- 7.3.2 DIESEL & BATTERY-POWERED

- 7.3.3 LPG/LNG & BATTERY-POWERED

8 ELECTRIC SHIP MARKET, BY POWER CAPACITY (MARKET SIZE & FORECAST TO 2032, USD)

- 8.1 INTRODUCTION

- 8.2 <75 KW

- 8.2.1 LARGE-SCALE ADOPTION IN SMALLER VESSELS TO DRIVE MARKET

- 8.3 75-150 KW

- 8.3.1 NEED FOR LONGER OPERATING HOURS AND HIGHER SERVICE SPEEDS TO DRIVE MARKET

- 8.4 151-745 KW

- 8.4.1 FERRY ELECTRIFICATION PROGRAMS AND DECARBONIZATION POLICIES TO DRIVE MARKET

- 8.5 746-7,560 KW

- 8.5.1 EMPHASIS ON SYSTEM RELIABILITY AND ENDURANCE TO DRIVE MARKET

- 8.6 >7,560 KW

- 8.6.1 INTRODUCTION OF ALTERNATIVE ENERGY SOURCES INTO OCEANGOING SHIPPING TO DRIVE MARKET

9 ELECTRIC SHIP MARKET, BY RANGE (MARKET SIZE & FORECAST TO 2032, USD)

- 9.1 INTRODUCTION

- 9.2 <50 KM

- 9.2.1 COMMERCIAL VIABILITY FOR ELECTRIC PROPULSION ADOPTION TO DRIVE MARKET

- 9.3 50-100 KM

- 9.3.1 REGIONAL CONNECTIVITY NEEDS TO DRIVE MARKET

- 9.4 101-1,000 KM

- 9.4.1 VESSEL OPERATIONS REQUIRING EXTENDED ENDURANCE AND CONSISTENT PERFORMANCE TO DRIVE MARKET

- 9.5 >1,000 KM

- 9.5.1 CONTINUOUS HIGH-POWER OUTPUT REQUIREMENT FOR PROLONGED PERIOD TO DRIVE MARKET

10 ELECTRIC SHIP MARKET, BY TONNAGE (MARKET SIZE & FORECAST TO 2032, USD)

- 10.1 INTRODUCTION

- 10.2 <500 DWT

- 10.2.1 REDUCED PROPULSION DEMAND DUE TO LIMITED CARGO AND PASSENGER CAPACITY TO DRIVE MARKET

- 10.3 500-5,000 DWT

- 10.3.1 OPERATIONAL DEMANDS FOR SCALABLE AND MODULAR PROPULSION SOLUTIONS TO DRIVE MARKET

- 10.4 5,001-15,000 DWT

- 10.4.1 NEED FOR HIGHER PROPULSION CAPACITY AND ENDURANCE TO DRIVE MARKET

- 10.5 >15,000 DWT

- 10.5.1 EXTENSIVE USE OF HYBRID CONFIGURATIONS TO DRIVE MARKET

11 ELECTRIC SHIP MARKET, BY SHIP TYPE (MARKET SIZE & FORECAST TO 2032, USD)

- 11.1 INTRODUCTION

- 11.2 COMMERCIAL

- 11.2.1 STRINGENT ENVIRONMENTAL REGULATIONS AND EXPANSION OF CHARGING INFRASTRUCTURE TO DRIVE MARKET

- 11.2.2 PASSENGER VESSELS

- 11.2.2.1 Yachts

- 11.2.2.2 Ferries

- 11.2.2.3 Cruise ships

- 11.2.2.4 Motorboats

- 11.2.3 CARGO VESSELS

- 11.2.3.1 Container vessels

- 11.2.3.2 Bulk carriers

- 11.2.3.3 Tankers

- 11.2.3.4 General cargo ships

- 11.2.4 OTHERS

- 11.2.4.1 Fishing vessels

- 11.2.4.2 Tugs & workboats

- 11.2.4.3 Research vessels

- 11.2.4.4 Dredgers

- 11.2.4.5 Submarines

- 11.3 DEFENSE

- 11.3.1 NAVAL MODERNIZATION PROGRAMS TO DRIVE MARKET

- 11.3.2 DESTROYERS

- 11.3.3 FRIGATES

- 11.3.4 CORVETTES

- 11.3.5 OFFSHORE SUPPORT VESSELS

- 11.3.6 AIRCRAFT CARRIERS

- 11.3.7 SUBMARINES

12 ELECTRIC SHIP MARKET, BY REGION (MARKET SIZE & FORECAST TO 2032, USD)

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 PESTLE ANALYSIS

- 12.2.2 US

- 12.2.2.1 Rise of maritime electrification to drive market

- 12.2.3 CANADA

- 12.2.3.1 Advances in electric shipping through fleet renewal and integrated infrastructure programs to drive market

- 12.3 EUROPE

- 12.3.1 PESTLE ANALYSIS

- 12.3.2 NORWAY

- 12.3.2.1 Shift from traditional fossil-fuel-powered vessels to electric alternatives to drive market

- 12.3.3 SWEDEN

- 12.3.3.1 Robust national sustainability agenda to drive market

- 12.3.4 NETHERLANDS

- 12.3.4.1 Transition to zero-emission shipping to drive market

- 12.3.5 FINLAND

- 12.3.5.1 Advanced shipbuilding expertise to drive market

- 12.3.6 DENMARK

- 12.3.6.1 Favorable environmental regulations to drive market

- 12.3.7 UK

- 12.3.7.1 Regulatory push for zero-emission shipping to drive market

- 12.3.8 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 PESTLE ANALYSIS

- 12.4.2 CHINA

- 12.4.2.1 Domestic battery and power electronics leadership to drive market

- 12.4.3 JAPAN

- 12.4.3.1 Government-led autonomy initiatives to drive market

- 12.4.4 AUSTRALIA

- 12.4.4.1 Infrastructure modernization and innovation agility to drive market

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Policy-backed fleets, green power supply, and shipyard dominance to drive market

- 12.4.6 INDIA

- 12.4.6.1 Infrastructure modernization and solar innovation to drive market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST

- 12.5.1 PESTLE ANALYSIS

- 12.5.2 GCC

- 12.5.2.1 Saudi Arabia

- 12.5.2.1.1 Increase in marine travel to drive market

- 12.5.2.2 UAE

- 12.5.2.2.1 Port modernization and green shipping initiatives to drive market

- 12.5.2.1 Saudi Arabia

- 12.5.3 ISRAEL

- 12.5.3.1 Technology integration and naval modernization to drive market

- 12.5.4 TURKEY

- 12.5.4.1 Compliance with international trade and shipping regulations to drive market

- 12.6 REST OF THE WORLD

- 12.6.1 PESTLE ANALYSIS

- 12.6.2 AFRICA

- 12.6.2.1 Urban transit modernization and tourism-led initiatives to drive market

- 12.6.3 LATIN AMERICA

- 12.6.3.1 Inland waterway scale and eco-tourism to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2021-2024

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Point of sale footprint

- 13.7.5.4 Ship type footprint

- 13.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2025

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 List of start-ups/SMEs

- 13.8.5.2 Competitive benchmarking of start-ups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 13.9.2 DEALS

- 13.9.3 OTHERS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ABB

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/developments

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 WARTSILA

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches/developments

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Others

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 SCHOTTEL GROUP

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Others

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 CORVUS ENERGY

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.3.2 Others

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 GE VERNOVA

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Others

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 KONGSBERG

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Others

- 14.1.7 VARD AS

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Others

- 14.1.8 SIEMENS

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 LECLANCHE SA

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches/developments

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Others

- 14.1.10 BAE SYSTEMS

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Others

- 14.1.11 SAFT

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.12 NORWEGIAN ELECTRIC SYSTEMS

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.3.2 Others

- 14.1.13 EVERLLENCE

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches/developments

- 14.1.13.3.2 Deals

- 14.1.13.3.3 Others

- 14.1.14 ECHANDIA AB

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.14.3.2 Others

- 14.1.15 ANGLO BELGIAN CORPORATION NV

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.15.3.2 Others

- 14.1.16 DANFOSS

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.16.3.2 Others

- 14.1.17 FJELLSTRAND AS

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Product launches/developments

- 14.1.17.3.2 Others

- 14.1.18 SOBY SHIPYARD

- 14.1.18.1 Business overview

- 14.1.18.2 Products offered

- 14.1.19 MITSUBISHI SHIPBUILDING CO., LTD.

- 14.1.19.1 Business overview

- 14.1.19.2 Products offered

- 14.1.20 DAMEN SHIPYARDS GROUP

- 14.1.20.1 Business overview

- 14.1.20.2 Products offered

- 14.1.20.3 Recent developments

- 14.1.20.3.1 Product launches/developments

- 14.1.20.3.2 Deals

- 14.1.20.3.3 Others

- 14.1.21 BALTIC WORKBOATS AS

- 14.1.21.1 Business overview

- 14.1.21.2 Products offered

- 14.1.21.3 Recent developments

- 14.1.21.3.1 Deals

- 14.1.21.3.2 Others

- 14.1.22 COCHIN SHIPYARD LIMITED

- 14.1.22.1 Business overview

- 14.1.22.2 Products offered

- 14.1.22.3 Recent developments

- 14.1.22.3.1 Product launches/developments

- 14.1.22.3.2 Deals

- 14.1.22.3.3 Others

- 14.1.1 ABB

- 14.2 OTHER PLAYERS

- 14.2.1 ECO MARINE POWER CO., LTD.

- 14.2.2 EST FLOATTECH

- 14.2.3 SHIFT

- 14.2.4 INCAT CROWTHER

- 14.2.5 INGETEAM, S.A.

- 14.2.6 VOITH TURBO MARINE

- 14.2.7 YARA

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATE

- TABLE 2 BATTERY CAPACITY/POWER REQUIREMENTS OF SHIPS

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SHIP TYPE (%)

- TABLE 5 KEY BUYING CRITERIA, BY SHIP TYPE

- TABLE 6 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NEWBUILD VS. RETROFIT VESSELS, 2021-2024 (UNITS)

- TABLE 12 NEWBUILD VS. RETROFIT VESSELS, 2025-2032 (UNITS)

- TABLE 13 IMPORT DATA FOR HS CODE 8901-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 8901-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 PATENT ANALYSIS

- TABLE 16 AVERAGE SELLING PRICE TREND OF ELECTRIC SHIPS OFFERED BY KEY PLAYERS, 2021-2024 (USD MILLION)

- TABLE 17 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2024 (USD MILLION)

- TABLE 18 BUSINESS MODELS IN ELECTRIC SHIP MARKET

- TABLE 19 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 20 KEY PRODUCT-RELATED TARIFF FOR ELECTRIC SHIPS

- TABLE 21 ANTICIPATED CHANGES IN PRICES AND POTENTIAL IMPACT ON END-USE MARKETS

- TABLE 22 ELECTRIC SHIP MARKET, BY AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 23 ELECTRIC SHIP MARKET, BY AUTONOMY, 2025-2032 (USD MILLION)

- TABLE 24 NEWBUILD & LINE FIT VS. RETROFIT, 2021-2024 (USD MILLION)

- TABLE 25 NEWBUILD & LINE FIT VS. RETROFIT, 2025-2032 (USD MILLION)

- TABLE 26 ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 27 ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 28 FULLY ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 FULLY ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 30 HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 31 HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 32 ELECTRIC SHIP MARKET, BY POWER CAPACITY, 2021-2024 (USD MILLION)

- TABLE 33 ELECTRIC SHIP MARKET, BY POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 34 ELECTRIC SHIP MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 35 ELECTRIC SHIP MARKET, BY RANGE, 2025-2032 (USD MILLION)

- TABLE 36 ELECTRIC SHIP MARKET, BY TONNAGE, 2021-2024 (USD MILLION)

- TABLE 37 ELECTRIC SHIP MARKET, BY TONNAGE, 2025-2032 (USD MILLION)

- TABLE 38 ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 39 ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 40 COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 41 COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 42 PASSENGER VESSELS: COMMERCIAL ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 43 PASSENGER VESSELS: COMMERCIAL ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 44 CARGO VESSELS: COMMERCIAL ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 CARGO VESSELS: COMMERCIAL ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 46 OTHERS: COMMERCIAL ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 47 OTHERS: COMMERCIAL ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 48 DEFENSE ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 49 DEFENSE ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 50 ELECTRIC SHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 ELECTRIC SHIP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 NORTH AMERICA: ELECTRIC SHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 53 NORTH AMERICA: ELECTRIC SHIP MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 54 NORTH AMERICA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 55 NORTH AMERICA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 56 NORTH AMERICA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 57 NORTH AMERICA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 58 NORTH AMERICA: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 NORTH AMERICA: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 60 NORTH AMERICA: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 62 NORTH AMERICA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 64 NORTH AMERICA: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 66 NORTH AMERICA: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 NORTH AMERICA: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 68 NORTH AMERICA: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 NORTH AMERICA: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 70 NORTH AMERICA: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 71 NORTH AMERICA: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 72 US: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 73 US: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 74 US: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 75 US: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 76 US: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 77 US: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 78 CANADA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 79 CANADA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 80 CANADA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 81 CANADA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 82 CANADA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 83 CANADA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 84 EUROPE: ELECTRIC SHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 EUROPE: ELECTRIC SHIP MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 86 EUROPE: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 87 EUROPE: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 88 EUROPE: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 89 EUROPE: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 90 EUROPE: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 EUROPE: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 92 EUROPE: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 EUROPE: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 94 EUROPE: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 95 EUROPE: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 96 EUROPE: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 97 EUROPE: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 98 EUROPE: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 EUROPE: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 100 EUROPE: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 101 EUROPE: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 102 EUROPE: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 EUROPE: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 104 NORWAY: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 105 NORWAY: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 106 NORWAY: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 107 NORWAY: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 108 NORWAY: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 109 NORWAY: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 110 SWEDEN: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 111 SWEDEN: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 112 SWEDEN: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 113 SWEDEN: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 114 SWEDEN: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 115 SWEDEN: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 116 NETHERLANDS: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 117 NETHERLANDS: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 118 NETHERLANDS: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 119 NETHERLANDS: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 120 NETHERLANDS: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 121 NETHERLANDS: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 122 FINLAND: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 123 FINLAND: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 124 FINLAND: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 125 FINLAND: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 126 FINLAND: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 127 FINLAND: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 128 DENMARK: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 129 DENMARK: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 130 DENMARK: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 131 DENMARK: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 132 DENMARK: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 133 DENMARK: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 134 UK: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 135 UK: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 136 UK: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 137 UK: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 138 UK: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 139 UK: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 140 REST OF EUROPE: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 141 REST OF EUROPE: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 142 REST OF EUROPE: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 143 REST OF EUROPE: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 144 REST OF EUROPE: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 145 REST OF EUROPE: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ELECTRIC SHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ELECTRIC SHIP MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 150 ASIA PACIFIC: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 152 ASIA PACIFIC: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 153 ASIA PACIFIC: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 154 ASIA PACIFIC: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 156 ASIA PACIFIC: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 158 ASIA PACIFIC: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 160 ASIA PACIFIC: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 161 ASIA PACIFIC: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 162 ASIA PACIFIC: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 163 ASIA PACIFIC: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 164 ASIA PACIFIC: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 166 CHINA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 167 CHINA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 168 CHINA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 169 CHINA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 170 CHINA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 171 CHINA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 172 JAPAN: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 173 JAPAN: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 174 JAPAN: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 175 JAPAN: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 176 JAPAN: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 177 JAPAN: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 178 AUSTRALIA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 179 AUSTRALIA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 180 AUSTRALIA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 181 AUSTRALIA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 182 AUSTRALIA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 183 AUSTRALIA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 184 SOUTH KOREA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 185 SOUTH KOREA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 186 SOUTH KOREA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 187 SOUTH KOREA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 188 SOUTH KOREA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 189 SOUTH KOREA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 190 INDIA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 191 INDIA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 192 INDIA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 193 INDIA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 194 INDIA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 195 INDIA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 202 MIDDLE EAST: ELECTRIC SHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 203 MIDDLE EAST: ELECTRIC SHIP MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 204 MIDDLE EAST: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 205 MIDDLE EAST: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 206 MIDDLE EAST: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 207 MIDDLE EAST: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 208 MIDDLE EAST: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 209 MIDDLE EAST: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 210 MIDDLE EAST: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 211 MIDDLE EAST: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 212 MIDDLE EAST: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 213 MIDDLE EAST: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 214 MIDDLE EAST: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 215 MIDDLE EAST: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 216 MIDDLE EAST: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 217 MIDDLE EAST: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 218 MIDDLE EAST: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 219 MIDDLE EAST: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 220 MIDDLE EAST: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 221 MIDDLE EAST: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 222 GCC: ELECTRIC SHIP MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 223 GCC: ELECTRIC SHIP MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 224 GCC: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 225 GCC: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 226 GCC: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 227 GCC: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 228 GCC: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 229 GCC: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 230 SAUDI ARABIA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 231 SAUDI ARABIA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 232 SAUDI ARABIA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 233 SAUDI ARABIA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 234 SAUDI ARABIA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 235 SAUDI ARABIA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 236 UAE: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 237 UAE: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 238 UAE: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 239 UAE: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 240 UAE: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 241 UAE: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 242 ISRAEL: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 243 ISRAEL: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 244 ISRAEL: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 245 ISRAEL: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 246 ISRAEL: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 247 ISRAEL: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 248 TURKEY: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 249 TURKEY: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 250 TURKEY: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 251 TURKEY: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 252 TURKEY: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 253 TURKEY: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 254 REST OF THE WORLD: ELECTRIC SHIP MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 255 REST OF THE WORLD: ELECTRIC SHIP MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 256 REST OF THE WORLD: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 257 REST OF THE WORLD: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 258 REST OF THE WORLD: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 259 REST OF THE WORLD: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 260 REST OF THE WORLD: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 261 REST OF THE WORLD: FULLY ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 262 REST OF THE WORLD: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 263 REST OF THE WORLD: HYBRID ELECTRIC SHIP MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 264 REST OF THE WORLD: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 265 REST OF THE WORLD: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 266 REST OF THE WORLD: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 267 REST OF THE WORLD: COMMERCIAL ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 268 REST OF THE WORLD: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 269 REST OF THE WORLD: ELECTRIC PASSENGER VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 270 REST OF THE WORLD: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 271 REST OF THE WORLD: ELECTRIC CARGO VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 272 REST OF THE WORLD: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 273 REST OF THE WORLD: OTHER COMMERCIAL VESSEL MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 274 AFRICA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 275 AFRICA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 276 AFRICA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 277 AFRICA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 278 AFRICA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 279 AFRICA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 280 LATIN AMERICA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 281 LATIN AMERICA: ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- TABLE 282 LATIN AMERICA: ELECTRIC SHIP MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 283 LATIN AMERICA: ELECTRIC SHIP MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 284 LATIN AMERICA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 285 LATIN AMERICA: ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- TABLE 286 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- TABLE 287 ELECTRIC SHIP MARKET: DEGREE OF COMPETITION

- TABLE 288 REGION FOOTPRINT

- TABLE 289 POINT OF SALE FOOTPRINT

- TABLE 290 SHIP TYPE FOOTPRINT

- TABLE 291 LIST OF START-UPS/SMES

- TABLE 292 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 293 ELECTRIC SHIP MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2025

- TABLE 294 ELECTRIC SHIP MARKET: DEALS, 2021-2025

- TABLE 295 ELECTRIC SHIP MARKET: OTHERS, 2021-2025

- TABLE 296 ABB: COMPANY OVERVIEW

- TABLE 297 ABB: PRODUCTS OFFERED

- TABLE 298 ABB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 299 ABB: DEALS

- TABLE 300 ABB: OTHERS

- TABLE 301 WARTSILA: COMPANY OVERVIEW

- TABLE 302 WARTSILA: PRODUCTS OFFERED

- TABLE 303 WARTSILA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 304 WARTSILA: DEALS

- TABLE 305 WARTSILA: OTHERS

- TABLE 306 SCHOTTEL GROUP: COMPANY OVERVIEW

- TABLE 307 SCHOTTEL GROUP: PRODUCTS OFFERED

- TABLE 308 SCHOTTEL GROUP: DEALS

- TABLE 309 SCHOTTEL GROUP: OTHERS

- TABLE 310 CORVUS ENERGY: COMPANY OVERVIEW

- TABLE 311 CORVUS ENERGY: PRODUCTS OFFERED

- TABLE 312 CORVUS ENERGY: DEALS

- TABLE 313 CORVUS ENERGY: OTHERS

- TABLE 314 GE VERNOVA: COMPANY OVERVIEW

- TABLE 315 GE VERNOVA: PRODUCTS OFFERED

- TABLE 316 GE VERNOVA: DEALS

- TABLE 317 GE VERNOVA: OTHERS

- TABLE 318 KONGSBERG: COMPANY OVERVIEW

- TABLE 319 KONGSBERG: PRODUCTS OFFERED

- TABLE 320 KONGSBERG: OTHERS

- TABLE 321 VARD AS: COMPANY OVERVIEW

- TABLE 322 VARD AS: PRODUCTS OFFERED

- TABLE 323 VARD AS: OTHERS

- TABLE 324 SIEMENS: COMPANY OVERVIEW

- TABLE 325 SIEMENS: PRODUCTS OFFERED

- TABLE 326 LECLANCHE SA: COMPANY OVERVIEW

- TABLE 327 LECLANCHE SA: PRODUCTS OFFERED

- TABLE 328 LECLANCHE SA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 329 LECLANCHE SA: DEALS

- TABLE 330 LECLANCHE SA: OTHERS

- TABLE 331 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 332 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 333 BAE SYSTEMS: OTHERS

- TABLE 334 SAFT: COMPANY OVERVIEW

- TABLE 335 SAFT: PRODUCTS OFFERED

- TABLE 336 NORWEGIAN ELECTRIC SYSTEMS: COMPANY OVERVIEW

- TABLE 337 NORWEGIAN ELECTRIC SYSTEMS: PRODUCTS OFFERED

- TABLE 338 NORWEGIAN ELECTRIC SYSTEMS: DEALS

- TABLE 339 NORWEGIAN ELECTRIC SYSTEMS: OTHERS

- TABLE 340 EVERLLENCE: COMPANY OVERVIEW

- TABLE 341 EVERLLENCE: PRODUCTS OFFERED

- TABLE 342 EVERLLENCE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 343 EVERLLENCE: DEALS

- TABLE 344 EVERLLENCE: OTHERS

- TABLE 345 ECHANDIA AB: COMPANY OVERVIEW

- TABLE 346 ECHANDIA AB: PRODUCTS OFFERED

- TABLE 347 ECHANDIA AB: DEALS

- TABLE 348 ECHANDIA AB: OTHERS

- TABLE 349 ANGLO BELGIAN CORPORATION NV: COMPANY OVERVIEW

- TABLE 350 ANGLO BELGIAN CORPORATION NV: PRODUCTS OFFERED

- TABLE 351 ANGLO BELGIAN CORPORATION NV: DEALS

- TABLE 352 ANGLO BELGIAN CORPORATION NV: OTHERS

- TABLE 353 DANFOSS: COMPANY OVERVIEW

- TABLE 354 DANFOSS: PRODUCTS OFFERED

- TABLE 355 DANFOSS: DEALS

- TABLE 356 DANFOSS: OTHERS

- TABLE 357 FJELLSTRAND AS: COMPANY OVERVIEW

- TABLE 358 FJELLSTRAND AS: PRODUCTS OFFERED

- TABLE 359 FJELLSTRAND AS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 360 FJELLSTRAND AS: OTHERS

- TABLE 361 SOBY SHIPYARD: COMPANY OVERVIEW

- TABLE 362 SOBY SHIPYARD: PRODUCTS OFFERED

- TABLE 363 MITSUBISHI SHIPBUILDING CO., LTD.: COMPANY OVERVIEW

- TABLE 364 MITSUBISHI SHIPBUILDING CO., LTD.: PRODUCTS OFFERED

- TABLE 365 DAMEN SHIPYARDS GROUP: COMPANY OVERVIEW

- TABLE 366 DAMEN SHIPYARDS GROUP: PRODUCTS OFFERED

- TABLE 367 DAMEN SHIPYARDS GROUP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 368 DAMEN SHIPYARDS GROUP: DEALS

- TABLE 369 DAMEN SHIPYARDS GROUP: OTHERS

- TABLE 370 BALTIC WORKBOATS AS: COMPANY OVERVIEW

- TABLE 371 BALTIC WORKBOATS AS: PRODUCTS OFFERED

- TABLE 372 BALTIC WORKBOATS AS: DEALS

- TABLE 373 BALTIC WORKBOATS AS: OTHERS

- TABLE 374 COCHIN SHIPYARD LIMITED: COMPANY OVERVIEW

- TABLE 375 COCHIN SHIPYARD LIMITED: PRODUCTS OFFERED

- TABLE 376 COCHIN SHIPYARD LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 377 COCHIN SHIPYARD LIMITED: DEALS

- TABLE 378 COCHIN SHIPYARD LIMITED: OTHERS

- TABLE 379 ECO MARINE POWER CO., LTD.: COMPANY OVERVIEW

- TABLE 380 EST FLOATTECH: COMPANY OVERVIEW

- TABLE 381 SHIFT: COMPANY OVERVIEW

- TABLE 382 INCAT CROWTHER: COMPANY OVERVIEW

- TABLE 383 INGETEAM, S.A.: COMPANY OVERVIEW

- TABLE 384 VOITH TURBO MARINE: COMPANY OVERVIEW

- TABLE 385 YARA: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ELECTRIC SHIP MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 COMMERCIAL TO BE LARGER THAN DEFENSE DURING FORECAST PERIOD

- FIGURE 8 MANNED SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 9 NEWBUILD & LINE FIT SEGMENT TO ACQUIRE HIGHER SHARE DURING FORECAST PERIOD

- FIGURE 10 POWER DRIVE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 <500 DWT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 EUROPE TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 RISING ADOPTION OF ELECTRIC PROPULSION TO DRIVE MARKET

- FIGURE 14 FULLY ELECTRIC TO HOLD HIGHER SHARE THAN HYBRID IN 2025

- FIGURE 15 DIESEL & BATTERY-POWERED TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 16 PASSENGER VESSELS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 17 FERRIES TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 18 ELECTRIC SHIP MARKET DYNAMICS

- FIGURE 19 COMMON LITHIUM-ION BATTERIES

- FIGURE 20 RELATIVE FEASIBILITY OF ENERGY STORAGE TECHNOLOGIES

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 ECOSYSTEM ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SHIP TYPE

- FIGURE 24 KEY BUYING CRITERIA, BY SHIP TYPE

- FIGURE 25 IMPORT DATA FOR HS CODE 8901-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 26 EXPORT DATA FOR HS CODE 8901-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 27 PATENT ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICING TREND ELECTRIC SHIPS OFFERED BY KEY PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 29 AVERAGE SELLING PRICING TREND, BY REGION, 2020-2024 (USD MILLION)

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 31 BUSINESS MODELS IN ELECTRIC SHIP MARKET

- FIGURE 32 TECHNOLOGY ROADMAP OF ELECTRIC SHIP MARKET

- FIGURE 33 EVOLUTION OF ELECTRIC SHIP TECHNOLOGIES

- FIGURE 34 AI IN MARINE INDUSTRY

- FIGURE 35 ADOPTION OF AI IN MARINE INDUSTRY BY TOP COUNTRIES

- FIGURE 36 IMPACT OF AI ON DIFFERENT MARINE VESSELS

- FIGURE 37 IMPACT OF AI ON ELECTRIC SHIP MARKET

- FIGURE 38 ELECTRIC SHIP MARKET, BY AUTONOMY, 2025-2032 (USD MILLION)

- FIGURE 39 ELECTRIC SHIP MARKET, BY POINT OF SALE, 2025-2032 (USD MILLION)

- FIGURE 40 ELECTRIC SHIP MARKET, BY POWER CAPACITY, 2025-2032 (USD MILLION)

- FIGURE 41 ELECTRIC SHIP MARKET, BY RANGE, 2025-2032 (USD MILLION)

- FIGURE 42 ELECTRIC SHIP MARKET, BY TONNAGE, 2025-2032 (USD MILLION)

- FIGURE 43 ELECTRIC SHIP MARKET, BY SHIP TYPE, 2025-2032 (USD MILLION)

- FIGURE 44 ELECTRIC SHIP MARKET, BY REGION, 2025-2032 (USD MILLION)

- FIGURE 45 NORTH AMERICA: ELECTRIC SHIP MARKET SNAPSHOT

- FIGURE 46 EUROPE: ELECTRIC SHIP MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: ELECTRIC SHIP MARKET SNAPSHOT

- FIGURE 48 MIDDLE EAST: ELECTRIC SHIP MARKET SNAPSHOT

- FIGURE 49 REST OF THE WORLD: ELECTRIC SHIP MARKET SNAPSHOT

- FIGURE 50 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- FIGURE 51 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 52 BRAND/PRODUCT COMPARISON

- FIGURE 53 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 54 COMPANY VALUATION (USD BILLION)

- FIGURE 55 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 56 COMPANY FOOTPRINT

- FIGURE 57 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2025

- FIGURE 58 ABB: COMPANY SNAPSHOT

- FIGURE 59 WARTSILA: COMPANY SNAPSHOT

- FIGURE 60 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 61 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 62 SIEMENS: COMPANY SNAPSHOT

- FIGURE 63 BAE SYSTEMS: COMPANY SNAPSHOT