PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1838151

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1838151

Lawn Mower Market by Type (Riding, Walk-behind, Robotic), Propulsion (ICE, EV), End-user (Residential, Commercial), Autonomy (Autonomous, Non-autonomous), Lawn Size (Small, Medium, Large), Hardware, Software, and Region - Global Forecast to 2032

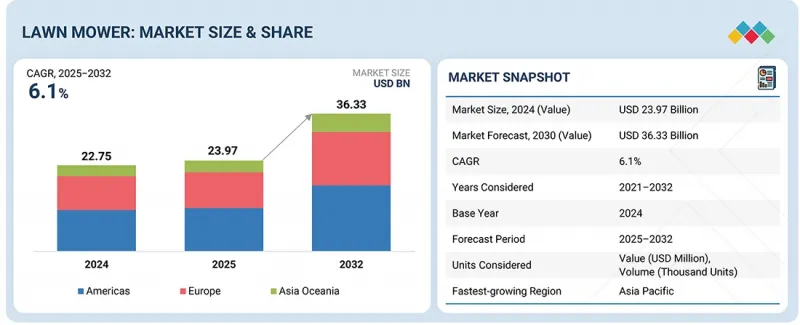

The lawn mower market is projected to reach USD 36.33 billion by 2032, from USD 23.97 billion in 2025, at a CAGR of 6.1%. Due to the increasing demand for efficient and low-maintenance lawn care solutions, the lawn mower market is growing rapidly across North America and Latin America. In the US and Canada, high-energy-density Li-ion and LFP batteries, combined with brushless motors, enable longer runtime and higher reliability, supporting residential lawns and commercial landscaping fleets.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value, Volume (Thousand Units) |

| Segments | by Type, Propulsion, End-user, Autonomy, Lawn Size, Hardware, Software, and Region |

| Regions covered | Asia Oceania, Europe, and the Americas |

Autonomous mowers, equipped with AI navigation and multi-sensor systems, are gaining traction in urban and suburban areas where precision cutting and adaptive terrain management are critical. Advanced blade geometries, mulching systems, and variable-speed drives improve cutting efficiency while reducing energy use, particularly in regions with large property sizes or commercial landscapes, such as golf courses in Mexico and Brazil. Cloud-based diagnostics and fleet management platforms allow predictive maintenance and optimized battery utilization, lowering the total cost of ownership for commercial operators and driving adoption in regions with high operational demands. Modular, upgradable platforms with accessory ecosystems facilitate scalability and technology integration, further strengthening market expansion across these key regions.

"Walk-behind lawn mowers are projected to be the largest market during the forecast period."

The walk-behind type leads to the global market demand for lawn mowers in terms of volume due to their affordability, maneuverability, versatile nature, and suitability for small to medium-sized lawn sizes. The comparatively lower upfront cost with simpler maintenance, gasoline & electrical options availability, and ease of storage make this mower type highly effective for residential & small commercial sectors. The noticeable improvement in the battery-powered walk-behind mowers improves with longer run times and lighter batteries; the electric models are increasingly attractive at an affordable price bracket. Moreover, features like self-propelled drives, adjustable cutting heights, and quieter operation add to their usability in tighter yards and noise-sensitive neighborhoods.

These walk-behind lawn mowers are primarily purchased, contributing to the maximum end-user segment for regular backyard & garden maintenance. On the other hand, small landscaping businesses and municipal authorities use heavy-duty walk-behinds for sidewalks, small parks, etc. The gasoline-powered walk-behinds deliver better performance in more challenging terrain and longer continuous operation, while electric models gain where emissions, noise, and environmental regulation matter. Hence, walk-behind lawn mowers continue to be in the leading position as they hit a sweet spot of cost vs. capability, mainly for residential users.

"Robotic lawn mowers are projected to show the largest share during the forecast period."

The robotic lawn mower segment shows the strongest growth momentum within the electric mower industry, supported by advancements in autonomous navigation, sensor fusion, and AI-based control systems. Boundary-free navigation platforms that use RTK positioning, computer vision, and LiDAR-based mapping have eliminated the installation complexity of perimeter wires and are significantly improving adoption rates. Improvements in battery management are also critical, as lithium-ion and LFP systems now support higher charge-discharge efficiency, faster charging, and longer operational cycles, reducing downtime and extending overall service life. In urban and suburban deployments, regulatory compliance with noise and emission limits is accelerating adoption. IoT-enabled fleet management and predictive maintenance features are beginning to drive uptake in semi-professional landscaping. Manufacturers such as Segway-Ninebot and Ecovacs are scaling production with modular architectures that support multi-zone mapping, over-the-air software updates, and smart home integration. This positions robotic mowers as connected and upgradable platforms within the broader residential energy and automation ecosystem.

"Europe is estimated to be one of the prominent markets during the forecast period."

Europe is estimated to be one of the largest lawn mower markets under the review period. The growth of the European lawn mower market is driven by high homeownership and the widespread presence of private and commercial green spaces, creating steady demand for efficient lawn maintenance solutions. The adoption of electric and battery-powered mowers is increasing, and environmental regulations and consumer preference for low-emission equipment support this. Technological improvements, including AI-enabled robotic mowers, autonomous navigation, and high-performance batteries, enhance efficiency and reduce labor requirements. The rise of compact urban gardens and landscaped commercial properties is further driving demand for precise, automated, and low-maintenance lawn care solutions. The market is becoming increasingly technology-driven, environmentally focused, and aligned with evolving operational and regulatory needs. Leading European lawn mower manufacturers include Husqvarna, which is recognized for its high-quality robotic and traditional mowers; Bosch, known for innovative electric and battery-powered solutions; Stihl, offering durable and reliable residential and commercial equipment; Honda, providing a wide range of petrol and electric models with advanced features; and Makita, specializing in cordless and battery-operated mowers that combine efficiency with ease of use.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 40%, Tier 1 & Tier 2 - 40%, and Others - 20%

- By Designation: CXOs - 35%, Managers - 25%, and Executives - 40%

- By Region: Americas - 30%, Europe - 20%, and Asia Oceania - 50%

The lawn mower market is dominated by established players such as Deere & Company (US), Husqvarna AB (Sweden), Stanley Black & Decker, Inc. (US), The Toro Company (US), and Kubota Corporation (Japan). These companies actively manufacture and develop new and advanced connectors. They have set up R&D facilities and offer best-in-class products to their customers.

Research Coverage

The market study covers the lawn mower market by type (riding lawn mower, walk-behind lawn mower, robotic lawn mower), autonomy (autonomous lawn mower, non-autonomous lawn mower), propulsion (electric lawn mower, internal combustion engine lawn mowers), end-user (residential, commercial), hardware (ultrasonic sensors, lift sensors, tilt sensors, motors, microcontrollers, batteries), lawn size (small lawn size, medium lawn size, large lawn size), distribution channel, and region (Americas, Europe, Asia Oceania). It also covers the competitive landscape and company profiles of the major players in the lawn mower market.

Key Benefits of Purchasing this Report

The study offers a detailed competitive analysis of the key players in the market, including their company profiles, important insights into product and business offerings, recent developments, and main market strategies. The report will assist market leaders and new entrants with estimates of revenue figures for the overall lawn mower market and its subsegments. It helps stakeholders understand the competitive landscape and gain additional insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides information on key market drivers, restraints, challenges, and opportunities, helping stakeholders keep track of market dynamics.

The report provides insights into the following points:

- Analysis of key drivers (increase in demand for lawn mowers in residential and commercial purpose, increase in demand for eco-friendly (battery) mowers, smart city integration & commercial landscaping uptake), restraints (high cost of lawn mowers, competition from artificial/synthetic grass), opportunities [Robotic Lawn Car-as-a-Service (RaaS)], and challenges (seasonal dependency of lawn mowers, technological gap between key players and smaller players) influencing the growth of the lawn mower market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the lawn mower market

- Market Development: Comprehensive information about lucrative markets - the report analyses the lawn mowers across various regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the lawn mower market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Deere & Company (US), Husqvarna AB (Sweden), Stanley Black & Decker, Inc. (US), The Toro Company (US), Kubota Corporation (Japan), in the lawn mower market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviewees from demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Sampling techniques and data collection methods

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAWN MOWER MARKET

- 4.2 LAWN MOWER MARKET, BY TYPE

- 4.3 LAWN MOWER MARKET, BY PROPULSION

- 4.4 LAWN MOWER MARKET, BY AUTONOMY

- 4.5 LAWN MOWER MARKET, BY END USER

- 4.6 LAWN MOWER MARKET, BY LAWN SIZE

- 4.7 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT

- 4.8 ROBOTIC LAWN MOWER SOFTWARE MARKET, BY REGION

- 4.9 LAWN MOWER MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand from residential and commercial sectors

- 5.2.1.2 Elevated demand for eco-friendly mowers

- 5.2.1.3 Rise of smart city initiatives

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of lawn mowers

- 5.2.2.2 Rapid adoption of synthetic grass

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Introduction of subscription-driven services

- 5.2.4 CHALLENGES

- 5.2.4.1 Seasonal dependency of lawn mowers

- 5.2.4.2 Technological gap between large OEMs and smaller players

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 IMPACT OF AI/GEN AI

- 6.2 TRADE ANALYSIS

- 6.2.1 IMPORT SCENARIO (HS CODE 843110)

- 6.2.2 EXPORT SCENARIO (HS CODE 8433110)

- 6.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 PATENT ANALYSIS

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 THINGSCOPE'S BATTERY-POWERED RIDING MOWER PLATFORM

- 6.8.2 BATTERY-POWERED EQUIPMENT FOR KENDAL AT LONGWOOD

- 6.8.3 OXFORD COMPANIES AND A&H LAWN SERVICE'S PHASED ELECTRIFICATION INITIATIVE

- 6.8.4 FMG AND SRS' RESEARCH ON RESIDENTIAL RIDING LAWN MOWERS

- 6.8.5 TORO GROUNDSMASTER 4700-D MOWER FOR HAGLEY PARK

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 Robotic automation with AI

- 6.9.1.2 Battery-powered efficiency

- 6.9.1.3 Smart lawn monitoring

- 6.9.2 COMPLIMENTARY TECHNOLOGIES

- 6.9.2.1 Precision mowing with zero-turn technology

- 6.9.2.2 Integrated GPS navigation

- 6.9.3 ADJACENT TECHNOLOGIES

- 6.9.3.1 Smart home integration

- 6.9.3.2 Solar-powered operation

- 6.9.1 KEY TECHNOLOGIES

- 6.10 PRICING ANALYSIS

- 6.10.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.10.2 AVERAGE SELLING PRICE OF LAWN MOWERS OFFERED BY KEY PLAYERS

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 KEY REGULATIONS

- 6.12 KEY CONFERENCE AND EVENTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 REBATE PROGRAM FOR LAWN MOWERS

- 6.14.1 BY KEY PLAYERS

- 6.14.2 BY GOVERNING BODIES

- 6.15 TOTAL COST OF OWNERSHIP

- 6.16 TOTAL COST OF OWNERSHIP AND RETURN ON INVESTMENT: ICE VS. ELECTRIC LAWN MOWERS

- 6.17 EMISSIONS ANALYSIS

- 6.17.1 ICE VS. ELECTRIC LAWN MOWERS

- 6.17.2 GASOLINE/LP VS. DIESEL LAWN MOWERS

- 6.18 ELECTRIFICATION IN LAWN MOWERS

- 6.19 OEM ANALYSIS

- 6.19.1 BY PROPULSION

- 6.19.2 BY AUTONOMY

- 6.19.3 BY DISTRIBUTION CHANNEL

- 6.20 COST AND PROFITABILITY OUTLOOK: ICE VS. ELECTRIC LAWN MOWERS

7 LAWN MOWER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 RIDING LAWN MOWERS

- 7.2.1 INVESTMENTS IN R&D BY PROMINENT MANUFACTURERS TO DRIVE MARKET

- 7.3 WALK-BEHIND LAWN MOWERS

- 7.3.1 PREDOMINANT USE IN ASIA OCEANIA TO DRIVE MARKET

- 7.4 ROBOTIC LAWN MOWERS

- 7.4.1 RISE OF NEW RESIDENTIAL PROPERTIES TO DRIVE MARKET

- 7.5 PRIMARY INSIGHTS

8 LAWN MOWER MARKET, BY PROPULSION

- 8.1 INTRODUCTION

- 8.2 ELECTRIC

- 8.2.1 STRINGENT GOVERNMENT REGULATIONS TO DRIVE MARKET

- 8.3 ICE

- 8.3.1 ELEVATED DEMAND FOR HIGHER ENGINE TO DECK RATIO TO DRIVE MARKET

- 8.4 PRIMARY INSIGHTS

9 LAWN MOWER MARKET, BY AUTONOMY

- 9.1 INTRODUCTION

- 9.2 AUTONOMOUS

- 9.2.1 ADVANCEMENTS IN ROBOTIC LAWN MOWING SOLUTIONS TO DRIVE MARKET

- 9.3 NON-AUTONOMOUS

- 9.3.1 LOWER COST AND HIGHER POWER OUTPUT TO DRIVE MARKET

- 9.4 PRIMARY INSIGHTS

10 LAWN MOWER MARKET, BY LAWN SIZE

- 10.1 INTRODUCTION

- 10.2 SMALL

- 10.2.1 RAPID URBANIZATION TO DRIVE MARKET

- 10.3 MEDIUM

- 10.3.1 EXPANSION OF COMMERCIAL SPACES TO DRIVE MARKET

- 10.4 LARGE

- 10.4.1 WIDE AVAILABILITY OF GOLF CLUBS TO DRIVE MARKET

- 10.5 PRIMARY INSIGHTS

11 LAWN MOWER MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 RESIDENTIAL

- 11.2.1 RISE IN URBAN SPACES AND LAWN AREAS TO DRIVE MARKET

- 11.3 COMMERCIAL

- 11.3.1 GROWTH OF LANDSCAPING INDUSTRY TO DRIVE MARKET

- 11.4 PRIMARY INSIGHTS

12 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT

- 12.1 INTRODUCTION

- 12.2 ULTRASONIC SENSORS

- 12.2.1 SAFETY COMPLIANCE AND LIABILITY REGULATIONS TO DRIVE MARKET

- 12.3 LIFT SENSORS

- 12.3.1 PREFERENCE FOR MORE SAFETY FEATURES IN ROBOTIC LAWN MOWERS TO DRIVE MARKET

- 12.4 TILT SENSORS

- 12.4.1 CONSUMER DEMAND FOR PREMIUM MOWERS TO DRIVE MARKET

- 12.5 MOTORS

- 12.5.1 DURABILITY, EFFICIENCY, AND EXCELLENT PERFORMANCE OF WHEEL AND BLADE MOTORS TO DRIVE MARKET

- 12.5.2 BLADE MOTORS

- 12.5.3 WHEEL MOTORS

- 12.6 MICROCONTROLLERS

- 12.6.1 HEIGHTENED DEMAND FOR AUTOMATION AND AI-BASED DECISION-MAKING TO DRIVE MARKET

- 12.7 BATTERIES

- 12.7.1 SUSTAINABILITY REQUIREMENTS TO REDUCE FUEL CONSUMPTION TO DRIVE MARKET

- 12.8 PRIMARY INSIGHTS

13 ROBOTIC LAWN MOWER SOFTWARE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 PRIMARY INSIGHTS

14 LAWN MOWER MARKET, BY DISTRIBUTION CHANNEL

- 14.1 INTRODUCTION

- 14.2 ONLINE

- 14.3 RETAIL

15 LAWN MOWER MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA OCEANIA

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Increasing partnership between lawn mowing service providers and manufacturers to drive market

- 15.2.3 INDIA

- 15.2.3.1 Rise in urban landscaping projects and gated communities to drive market

- 15.2.4 JAPAN

- 15.2.4.1 Labor shortages and supportive government initiatives to drive market

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Expansion of green spaces to drive market

- 15.2.6 AUSTRALIA

- 15.2.6.1 Vast residential properties and commercial landscaping demand to drive market

- 15.2.7 NEW ZEALAND

- 15.2.7.1 Need for durable and high-performance mowing solutions to drive market

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK

- 15.3.2 GERMANY

- 15.3.2.1 Consumer preference for high-performance and technologically integrated equipment to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Increased adoption of walk-behind mowers to drive market

- 15.3.4 UK

- 15.3.4.1 Introduction of new technologies and products to drive market

- 15.3.5 ITALY

- 15.3.5.1 Transition toward autonomous mowing solutions to drive market

- 15.3.6 SWEDEN

- 15.3.6.1 Significant presence of robotic lawn mower manufacturers to drive market

- 15.3.7 RUSSIA

- 15.3.7.1 Diverse applications of riding lawn mowers to drive market

- 15.3.8 SPAIN

- 15.3.8.1 Popularity of robotic models to drive market

- 15.3.9 REST OF EUROPE

- 15.4 AMERICAS

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Rising integration of advanced technologies to drive market

- 15.4.3 CANADA

- 15.4.3.1 Growing demand for lawn-care maintenance to drive market

- 15.4.4 MEXICO

- 15.4.4.1 Smart home integration and expansion of residential landscapes to drive market

- 15.4.5 BRAZIL

- 15.4.5.1 Increasing demand from commercial and residential segments to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY EVALUATION MATRIX: LAWN MOWER MANUFACTURERS, 2024

- 16.5.1 STARS

- 16.5.2 EMERGING LEADERS

- 16.5.3 PERVASIVE PLAYERS

- 16.5.4 PARTICIPANTS

- 16.5.5 COMPANY FOOTPRINT

- 16.5.5.1 Company footprint

- 16.5.5.2 Region footprint

- 16.5.5.3 End user footprint

- 16.5.5.4 Propulsion footprint

- 16.6 COMPANY EVALUATION MATRIX: ELECTRIC LAWN MOWER MANUFACTURERS, 2024

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT

- 16.6.5.1 Company footprint

- 16.6.5.2 Region footprint

- 16.6.5.3 Autonomy footprint

- 16.7 COMPANY VALUATION AND FINANCIAL METRICS

- 16.8 BRAND/PRODUCT COMPARISON

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.9.2 DEALS

- 16.9.3 OTHERS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 DEERE & COMPANY

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches/developments

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Others

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 HUSQVARNA GROUP

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches/developments

- 17.1.2.3.2 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 STANLEY BLACK & DECKER, INC.

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches/developments

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Others

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 KUBOTA CORPORATION

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches/developments

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Others

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 THE TORO COMPANY

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Others

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 HONDA MOTOR CO., LTD.

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches/developments

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Others

- 17.1.7 YAMABIKO CORPORATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches/developments

- 17.1.7.3.2 Deals

- 17.1.8 ROBERT BOSCH GMBH

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches/developments

- 17.1.8.3.2 Deals

- 17.1.9 STIHL INCORPORATED

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches/developments

- 17.1.9.3.2 Deals

- 17.1.9.3.3 Others

- 17.1.10 ARIENS CO

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches/developments

- 17.1.1 DEERE & COMPANY

- 17.2 OTHER PLAYERS

- 17.2.1 IROBOT CORPORATION

- 17.2.2 GREENWORKS NORTH AMERICA LLC

- 17.2.3 EGO POWER+

- 17.2.4 AMERICAN LAWN MOWER CO.

- 17.2.5 BRIGGS & STRATTON, LLC

- 17.2.6 BAD BOY MOWERS

- 17.2.7 LASTEC LLC

- 17.2.8 TEXTRON SPECIALIZED VEHICLES

- 17.2.9 AL-KO GERATE GMBH

- 17.2.10 STIGA S.P.A

- 17.2.11 MAMIBOT MANUFACTURING USA INC.

- 17.2.12 ZUCCHETTI CENTRO SISTEMI S.P.A

- 17.2.13 TECHTRONIC INDUSTRIES CO. LTD.

- 17.2.14 GRAZE ROBOTICS

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ASIA OCEANIA TO BE GROWTH HUB FOR LAWN MOWERS

- 18.2 STRATEGIC FOCUS ON ELECTRIFICATION, AUTOMATION, AND DIGITAL CONNECTIVITY

- 18.3 INVESTMENTS IN R&D FOR ROBOTIC LAWN MOWERS

- 18.4 CONCLUSION

19 APPENDIX

- 19.1 INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 ROBOTIC LAWN MOWER MARKET, BY TYPE, AT COUNTRY LEVEL

- 19.4.2 LAWN MOWER MARKET, BY END USER, AT COUNTRY LEVEL

- 19.4.3 COMPANY INFORMATION

- 19.4.3.1 Profiling of up to three additional players

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY END USER

- TABLE 2 MARKET DEFINITION, BY LAWN SIZE

- TABLE 3 MARKET DEFINITION, BY TYPE

- TABLE 4 MARKET DEFINITION, BY PROPULSION

- TABLE 5 CURRENCY EXCHANGE RATES

- TABLE 6 RECENT MEGA PROJECTS REQUIRING LAWN MOWERS

- TABLE 7 UPCOMING SMART CITY PROJECTS

- TABLE 8 HIGH-END VS. BASIC LAWN MOWERS

- TABLE 9 US: IMPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 GERMANY: IMPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 FRANCE: IMPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 BELGIUM: IMPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 13 CANADA: IMPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 14 CHINA: EXPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 15 US: EXPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 16 MEXICO: EXPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 17 BELGIUM: EXPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 18 GERMANY: EXPORT DATA FOR HS CODE 8433110-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 19 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 20 FUNDING DATA, 2021-2025

- TABLE 21 PATENT ANALYSIS

- TABLE 22 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 23 AVERAGE SELLING PRICE OF LAWN MOWERS OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 24 AMERICAS: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 KEY REGULATIONS, BY COUNTRY/REGION

- TABLE 28 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR LAWN MOWERS, BY PROPULSION (%)

- TABLE 30 KEY BUYING CRITERIA FOR LAWN MOWERS, BY PROPULSION

- TABLE 31 LAWN MOWER REBATE PROGRAMS BY KEY PLAYERS

- TABLE 32 LAWN MOWER REBATE PROGRAMS BY GOVERNING BODIES

- TABLE 33 TOTAL COST OF OWNERSHIP FOR LAWN MOWERS

- TABLE 34 TOTAL COST OF OWNERSHIP AND RETURN ON INVESTMENT: ICE VS. ELECTRIC LAWN MOWERS

- TABLE 35 GASOLINE/LP VS. DIESEL MOWERS

- TABLE 36 OEM ANALYSIS, BY PROPULSION

- TABLE 37 OEM ANALYSIS, BY AUTONOMY

- TABLE 38 OEM GO-TO-MARKET AND DISTRIBUTION MAPPING

- TABLE 39 COST AND PROFITABILITY OUTLOOK: ICE VS. ELECTRIC LAWN MOWERS

- TABLE 40 LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 41 LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 42 LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 43 LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 44 RIDING LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 45 RIDING LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 46 RIDING LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 RIDING LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 48 WALK-BEHIND LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 49 WALK-BEHIND LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 50 WALK-BEHIND LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 WALK-BEHIND LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 ROBOTIC LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 53 ROBOTIC LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 54 ROBOTIC LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 ROBOTIC LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 56 LAWN MOWER MARKET, BY PROPULSION, 2021-2024 (THOUSAND UNITS)

- TABLE 57 LAWN MOWER MARKET, BY PROPULSION, 2025-2032 (THOUSAND UNITS)

- TABLE 58 LAWN MOWER MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 59 LAWN MOWER MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 60 ELECTRIC LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 61 ELECTRIC LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 62 ELECTRIC LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 ELECTRIC LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 64 ICE LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 65 ICE LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 66 ICE LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 ICE LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 68 LAWN MOWER MARKET, BY AUTONOMY, 2021-2024 (THOUSAND UNITS)

- TABLE 69 LAWN MOWER MARKET, BY AUTONOMY, 2025-2032 (THOUSAND UNITS)

- TABLE 70 LAWN MOWER MARKET, BY AUTONOMY, 2021-2024 (USD MILLION)

- TABLE 71 LAWN MOWER MARKET, BY AUTONOMY, 2025-2032 (USD MILLION)

- TABLE 72 AUTONOMOUS LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 73 AUTONOMOUS LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 74 AUTONOMOUS LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 AUTONOMOUS LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 76 NON-AUTONOMOUS LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 77 NON-AUTONOMOUS LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 78 NON-AUTONOMOUS LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 NON-AUTONOMOUS LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 80 LAWN MOWER MARKET, BY LAWN SIZE, 2021-2024 (THOUSAND UNITS)

- TABLE 81 LAWN MOWER MARKET, BY LAWN SIZE, 2025-2032 (THOUSAND UNITS)

- TABLE 82 LAWN MOWER MARKET, BY LAWN SIZE, 2021-2024 (USD MILLION)

- TABLE 83 LAWN MOWER MARKET, BY LAWN SIZE, 2025-2032 (USD MILLION)

- TABLE 84 SMALL LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 85 SMALL LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 86 SMALL LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 SMALL LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 88 MEDIUM LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 89 MEDIUM LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 90 MEDIUM LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 MEDIUM LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 LARGE LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 93 LARGE LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 94 LARGE LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 LARGE LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 LAWN MOWER MARKET, BY END USER, 2021-2024 (THOUSAND UNITS)

- TABLE 97 LAWN MOWER MARKET, BY END USER, 2025-2032 (THOUSAND UNITS)

- TABLE 98 LAWN MOWER MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 99 LAWN MOWER MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 100 RESIDENTIAL LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 101 RESIDENTIAL LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 102 RESIDENTIAL LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 RESIDENTIAL LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 104 COMMERCIAL LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 105 COMMERCIAL LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 106 COMMERCIAL LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 COMMERCIAL LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 108 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT, 2021-2024 (THOUSAND UNITS)

- TABLE 109 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT, 2025-2032 (THOUSAND UNITS)

- TABLE 110 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 111 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 112 ULTRASONIC SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 113 ULTRASONIC SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 114 ULTRASONIC SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 115 ULTRASONIC SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 116 LIFT SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 117 LIFT SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 118 LIFT SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 LIFT SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 120 TILT SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 121 TILT SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 122 TILT SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 123 TILT SENSORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 124 BLADE MOTORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 125 BLADE MOTORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 126 BLADE MOTORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 BLADE MOTORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 128 WHEEL MOTORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 129 WHEEL MOTORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 130 WHEEL MOTORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 131 WHEEL MOTORS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 132 MICROCONTROLLERS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 133 MICROCONTROLLERS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 134 MICROCONTROLLERS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 MICROCONTROLLERS: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 136 BATTERIES: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 137 BATTERIES: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 138 BATTERIES: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 139 BATTERIES: ROBOTIC LAWN MOWER HARDWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 140 ROBOTIC LAWN MOWER SOFTWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 141 ROBOTIC LAWN MOWER SOFTWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 142 LAWN MOWER MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 143 LAWN MOWER MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 144 LAWN MOWER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 LAWN MOWER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 ASIA OCEANIA: LAWN MOWER MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 147 ASIA OCEANIA: LAWN MOWER MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 148 ASIA OCEANIA: LAWN MOWER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 ASIA OCEANIA: LAWN MOWER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 150 CHINA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 151 CHINA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 152 CHINA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 153 CHINA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 154 INDIA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 155 INDIA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 156 INDIA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 157 INDIA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 158 JAPAN: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 159 JAPAN: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 160 JAPAN: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 161 JAPAN: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 162 SOUTH KOREA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 163 SOUTH KOREA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 164 SOUTH KOREA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 165 SOUTH KOREA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 166 AUSTRALIA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 167 AUSTRALIA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 168 AUSTRALIA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 169 AUSTRALIA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 170 NEW ZEALAND: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 171 NEW ZEALAND: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 172 NEW ZEALAND: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 173 NEW ZEALAND: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 174 EUROPE: LAWN MOWER MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 175 EUROPE: LAWN MOWER MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 176 EUROPE: LAWN MOWER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 177 EUROPE: LAWN MOWER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 178 GERMANY: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 179 GERMANY: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 180 GERMANY: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 181 GERMANY: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 182 FRANCE: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 183 FRANCE: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 184 FRANCE: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 185 FRANCE: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 186 UK: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 187 UK: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 188 UK: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 189 UK: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 190 ITALY: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 191 ITALY: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 192 ITALY: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 193 ITALY: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 194 SWEDEN: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 195 SWEDEN: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 196 SWEDEN: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 197 SWEDEN: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 198 RUSSIA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 199 RUSSIA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 200 RUSSIA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 201 RUSSIA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 202 SPAIN: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 203 SPAIN: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 204 SPAIN: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 205 SPAIN: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 206 REST OF EUROPE: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 207 REST OF EUROPE: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 208 REST OF EUROPE: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 209 REST OF EUROPE: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 210 AMERICAS: LAWN MOWER MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 211 AMERICAS: LAWN MOWER MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 212 AMERICAS: LAWN MOWER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 213 AMERICAS: LAWN MOWER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 214 US: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 215 US: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 216 US: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 217 US: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 218 CANADA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 219 CANADA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 220 CANADA: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 221 CANADA: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 222 MEXICO: LAWN MOWER MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 223 MEXICO: LAWN MOWER MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 224 MEXICO: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 225 MEXICO: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 226 BRAZIL: LAWN MOWER MARKET, BY TYPE, 2021-2024 (UNITS)

- TABLE 227 BRAZIL: LAWN MOWER MARKET, BY TYPE, 2025-2032 (UNITS)

- TABLE 228 BRAZIL: LAWN MOWER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 229 BRAZIL: LAWN MOWER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 230 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 231 LAWN MOWER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 232 LAWN MOWER MANUFACTURERS: REGION FOOTPRINT

- TABLE 233 LAWN MOWER MANUFACTURERS: END USER FOOTPRINT

- TABLE 234 LAWN MOWER MANUFACTURERS: PROPULSION FOOTPRINT

- TABLE 235 ELECTRIC LAWN MOWER MANUFACTURERS: REGION FOOTPRINT

- TABLE 236 ELECTRIC LAWN MOWER MANUFACTURERS: AUTONOMY FOOTPRINT

- TABLE 237 LAWN MOWER MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2025

- TABLE 238 LAWN MOWER MARKET: DEALS, 2021-2025

- TABLE 239 LAWN MOWER MARKET: OTHERS, 2021-2025

- TABLE 240 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 241 DEERE & COMPANY: PRODUCTS OFFERED

- TABLE 242 DEERE & COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 243 DEERE & COMPANY: DEALS

- TABLE 244 DEERE & COMPANY: OTHERS

- TABLE 245 HUSQVARNA GROUP: COMPANY OVERVIEW

- TABLE 246 HUSQVARNA GROUP: PRODUCTS OFFERED

- TABLE 247 HUSQVARNA GROUP: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 248 HUSQVARNA GROUP: DEALS

- TABLE 249 STANLEY BLACK & DECKER, INC.: COMPANY OVERVIEW

- TABLE 250 STANLEY BLACK & DECKER, INC.: PRODUCTS OFFERED

- TABLE 251 STANLEY BLACK & DECKER, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 252 STANLEY BLACK & DECKER, INC.: DEALS

- TABLE 253 STANLEY BLACK & DECKER, INC.: OTHERS

- TABLE 254 KUBOTA CORPORATION: COMPANY OVERVIEW

- TABLE 255 KUBOTA CORPORATION: PRODUCTS OFFERED

- TABLE 256 KUBOTA CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 257 KUBOTA CORPORATION: DEALS

- TABLE 258 KUBOTA CORPORATION: OTHERS

- TABLE 259 THE TORO COMPANY: COMPANY OVERVIEW

- TABLE 260 THE TORO COMPANY: PRODUCTS OFFERED

- TABLE 261 THE TORO COMPANY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 262 THE TORO COMPANY: DEALS

- TABLE 263 THE TORO COMPANY: OTHERS

- TABLE 264 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

- TABLE 265 HONDA MOTOR CO., LTD.: PRODUCTS OFFERED

- TABLE 266 HONDA MOTOR CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 267 HONDA MOTOR CO., LTD.: DEALS

- TABLE 268 HONDA MOTOR CO., LTD.: OTHERS

- TABLE 269 YAMABIKO CORPORATION: COMPANY OVERVIEW

- TABLE 270 YAMABIKO CORPORATION: PRODUCTS OFFERED

- TABLE 271 YAMABIKO CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 272 YAMABIKO CORPORATION: DEALS

- TABLE 273 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 274 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 275 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 276 ROBERT BOSCH GMBH: DEALS

- TABLE 277 STIHL INCORPORATED: COMPANY OVERVIEW

- TABLE 278 STIHL INCORPORATED: PRODUCTS OFFERED

- TABLE 279 STIHL INCORPORATED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 280 STIHL INCORPORATED: DEALS

- TABLE 281 STIHL INCORPORATED: OTHERS

- TABLE 282 ARIENS CO: COMPANY OVERVIEW

- TABLE 283 ARIENS CO: PRODUCTS OFFERED

- TABLE 284 ARIENS CO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 285 IROBOT CORPORATION: COMPANY OVERVIEW

- TABLE 286 GREENWORKS NORTH AMERICA LLC: COMPANY OVERVIEW

- TABLE 287 EGO POWER+: COMPANY OVERVIEW

- TABLE 288 AMERICAN LAWN MOWER CO.: COMPANY OVERVIEW

- TABLE 289 BRIGGS & STRATTON, LLC: COMPANY OVERVIEW

- TABLE 290 BAD BOY MOWERS: COMPANY OVERVIEW

- TABLE 291 LASTEC LLC: COMPANY OVERVIEW

- TABLE 292 TEXTRON SPECIALIZED VEHICLES: COMPANY OVERVIEW

- TABLE 293 AL-KO GERATE GMBH: COMPANY OVERVIEW

- TABLE 294 STIGA S.P.A: COMPANY OVERVIEW

- TABLE 295 MAMIBOT MANUFACTURING USA INC.: COMPANY OVERVIEW

- TABLE 296 ZUCCHETTI CENTRO SISTEMI S.P.A: COMPANY OVERVIEW

- TABLE 297 TECHTRONIC INDUSTRIES CO. LTD.: COMPANY OVERVIEW

- TABLE 298 GRAZE ROBOTICS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LAWN MOWER MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION NOTES

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 10 MARKET OUTLOOK

- FIGURE 11 ASIA OCEANIA TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 12 WALK-BEHIND LAWN MOWERS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 13 ELECTRIC PROPULSION TO EXHIBIT FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 14 KEY MARKET PLAYERS

- FIGURE 15 RISING ADOPTION OF AUTOMATION, IOT INTEGRATION, AND AI-BASED NAVIGATION TO DRIVE MARKET

- FIGURE 16 RIDING LAWN MOWERS TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 17 ICE TO BE LARGER THAN ELECTRIC DURING FORECAST PERIOD

- FIGURE 18 NON-AUTONOMOUS TO ACQUIRE HIGHER SHARE DURING FORECAST PERIOD

- FIGURE 19 COMMERCIAL SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 20 LARGE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 21 BLADE MOTORS TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 EUROPE TO HOLD HIGHEST SHARE DURING FORECAST PERIOD

- FIGURE 23 AMERICAS TO BE LARGEST MARKET FOR LAWN MOWERS IN 2025

- FIGURE 24 LAWN MOWER MARKET DYNAMICS

- FIGURE 25 KEY PLAYER VS. SMALL PLAYER OFFERINGS

- FIGURE 26 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 SUPPLY CHAIN ANALYSIS

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 ECOSYSTEM MAP

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 31 PATENT ANALYSIS

- FIGURE 32 AVERAGE SELLING PRICE TREND IN ASIA OCEANIA, 2022-2024 (USD)

- FIGURE 33 AVERAGE SELLING PRICE TREND IN EUROPE, 2022-2024 (USD)

- FIGURE 34 AVERAGE SELLING PRICE TREND IN AMERICAS, 2022-2024 (USD)

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PROPULSION

- FIGURE 36 KEY BUYING CRITERIA, BY PROPULSION

- FIGURE 37 TOTAL COST OF OWNERSHIP FOR WALK-BEHIND LAWN MOWERS

- FIGURE 38 EMISSIONS FROM ICE VS. ELECTRIC LAWN MOWERS

- FIGURE 39 GASOLINE/LP VS. DIESEL LAWN MOWERS

- FIGURE 40 ELECTRIFICATION IN LAWN MOWERS BY KEY PLAYERS

- FIGURE 41 LAWN MOWER MARKET, BY TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 42 LAWN MOWER MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 43 LAWN MOWER MARKET, BY AUTONOMY, 2025 VS. 2032 (USD MILLION)

- FIGURE 44 LAWN MOWER MARKET, BY LAWN SIZE, 2025 VS. 2032 (USD MILLION)

- FIGURE 45 LAWN MOWER MARKET, BY END USER, 2025 VS. 2032 (USD MILLION)

- FIGURE 46 ROBOTIC LAWN MOWER HARDWARE MARKET, BY COMPONENT, 2025 VS. 2032 (USD MILLION)

- FIGURE 47 ROBOTIC LAWN MOWER SOFTWARE MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 48 LAWN MOWER MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 49 ASIA OCEANIA: LAWN MOWER MARKET SNAPSHOT

- FIGURE 50 ASIA OCEANIA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 51 ASIA OCEANIA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 52 ASIA OCEANIA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 53 ASIA OCEANIA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 54 EUROPE: LAWN MOWER MARKET SNAPSHOT

- FIGURE 55 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 56 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 57 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 58 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 59 AMERICAS: LAWN MOWER MARKET SNAPSHOT

- FIGURE 60 AMERICAS: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 61 AMERICAS: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 62 AMERICAS: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2023-2026

- FIGURE 63 AMERICAS: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024 (USD TRILLION)

- FIGURE 64 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 65 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020-2024

- FIGURE 66 COMPANY EVALUATION MATRIX (LAWN MOWER MANUFACTURERS), 2024

- FIGURE 67 LAWN MOWER MANUFACTURERS: COMPANY FOOTPRINT

- FIGURE 68 COMPANY EVALUATION MATRIX (ELECTRIC LAWN MOWER MANUFACTURERS), 2024

- FIGURE 69 ELECTRIC LAWN MOWER MANUFACTURERS: COMPANY FOOTPRINT

- FIGURE 70 COMPANY VALUATION (USD BILLION)

- FIGURE 71 FINANCIAL METRICS (EV/EBIDTA)

- FIGURE 72 BRAND/PRODUCT COMPARISON

- FIGURE 73 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 74 HUSQVARNA GROUP: COMPANY SNAPSHOT

- FIGURE 75 STANLEY BLACK & DECKER, INC.: COMPANY SNAPSHOT

- FIGURE 76 KUBOTA CORPORATION: COMPANY SNAPSHOT

- FIGURE 77 THE TORO COMPANY: COMPANY SNAPSHOT

- FIGURE 78 HONDA MOTOR CO., LTD.: COMPANY SNAPSHOT

- FIGURE 79 YAMABIKO CORPORATION: COMPANY SNAPSHOT

- FIGURE 80 ROBERT BOSCH GMBH: COMPANY SNAPSHOT