PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1854901

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1854901

Patient Experience Technology Market by Offering, Function (Appointment (Online Booking), Registration (Intake), Virtual Care (Telehealth, RPM), Communication, Feedback), End User (Providers, Payers, Pharma & Biotech), Region - Global Forecast to 2030

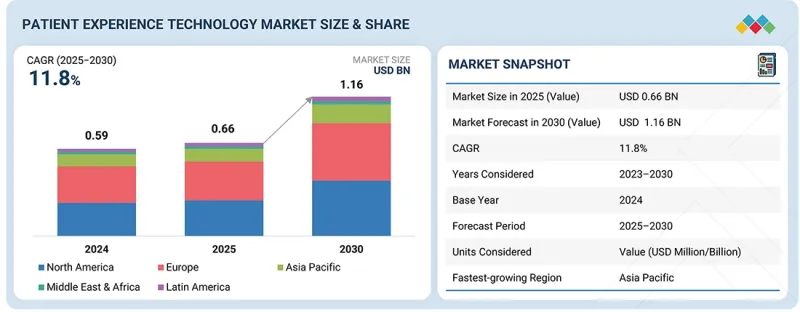

The patient experience technology market is projected to reach USD 1.16 billion by 2030 from USD 0.66 billion in 2025, at a CAGR of 11.8%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Offerings, Functions, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

This growth is driven by increasing expectations for convenience and personalization (appointment scheduling, digital check-in, teletriage), regulatory pushes for patient access/interoperability, and rapid adoption of AI, ambient analytics, and conversational interfaces that automate administrative tasks and surface actionable insights from patient feedback and encounter data.

Vendors are increasingly integrating AI across patient experience platforms. For instance, in December 2023, Qualtrics announced a collaboration with Epic to integrate patient experience data directly into Epic's comprehensive health record (CHR) system. The partnership leverages Qualtrics' AI and natural language processing to fuse clinical and experiential data, enabling providers to deliver more personalized, empathetic care. The integration allows frontline staff to detect and act on patient sentiment, such as frustrations with scheduling, in real time, enhancing responsiveness and care outcomes.

Thus, such developments demonstrate that combining clinical and experiential data can drive more responsive and outcomes-focused patient care.

The cloud-based segment is expected to witness significant market share during the forecast period.

Based on the offering, the patient experience technology market is segmented into software/platform and services. The software segment is divided into on-premise, cloud-based, and hybrid. The cloud-based platform is expected to witness significant market growth during the forecast period due to its scalability, lower upfront costs, and ability to rapidly deploy updates. Healthcare providers increasingly favor cloud solutions for digital check-ins, telehealth triage, patient portals, and AI-driven personalization. Vendors such as Press Ganey, Qualtrics, and Epic are embedding cloud-native analytics, conversational AI, and ambient listening tools that improve flexibility and care access. In February 2025, Press Ganey partnered with Microsoft to develop generative AI-powered solutions that combine Press Ganey's dataset of over 7.6 billion patient encounters with Microsoft's AI, cloud, and ambient listening tools. This collaboration enables predictive analytics for patient safety, real-time actionable insights for providers, and secure data sharing via Azure, demonstrating that cloud-based PX platforms are driving personalization, efficiency, and improved patient experience.

Hence, such strategic collaborations underscore the growing role of cloud-based, AI-enabled patient experience platforms in delivering personalized, efficient, and data-driven care across healthcare settings.

The healthcare payers segment is expected to grow at a considerable CAGR during the forecast period.

By end user, the healthcare payers segment is expected to register the highest CAGR during the forecast period. Payers are increasingly investing in patient experience (PX) platforms to improve member engagement, streamline claims and administrative processes, and enhance overall satisfaction with health plan services. The growing emphasis on value-based care and outcomes-driven reimbursement models is prompting payers to leverage AI, analytics, and patient feedback tools to monitor service quality, predict member needs, and reduce preventable gaps in care.

Digital channels, such as member portals, teletriage, and automated communication tools, are being adopted to provide personalized, real-time support, improve adherence to preventive care, and strengthen patient loyalty. Additionally, regulatory mandates for interoperability and patient access, such as the US Cures Act and Europe's EHDS, are accelerating payer adoption of patient experience technologies. As a result, payers are emerging as a key growth driver in the market, reflecting their strategic focus on member experience and outcomes.

Europe is expected to lead the patient experience technology market in 2025.

During the forecast period, Europe is projected to hold a substantial share of the global patient experience technology market, driven by the widespread adoption of digital health technologies, rising demand for patient-centered care, and a robust regulatory environment that prioritizes data privacy and interoperability. A major trend is the shift toward personalized healthcare, with platforms and tools designed to tailor interventions to individual patient needs, enhancing adherence, satisfaction, and clinical outcomes. Governments, healthcare authorities, and public-private partnerships are playing a pivotal role in promoting patient involvement across the healthcare ecosystem. For instance, in March 2022, the European Health Initiative, a flagship public-private collaboration in life sciences with a USD 2.46 billion budget, established a Science & Innovation Panel that actively integrates patients in every stage of research, ensuring that healthcare solutions reflect real-world patient priorities.

In addition, the European Union's eHealth and Digital Decade initiatives are driving widespread adoption of electronic health records (EHRs), patient portals, and interoperable health systems, creating a fertile environment for patient engagement technologies. For instance, in July 2024, the European Commission released the Digital Decade 2024 study, highlighting progress toward universal access to electronic health records (EHRs) for EU citizens by 2030. The report noted that the EU27-average composite score for eHealth maturity increased from 72% to 79% in 2023, with 22 member states improving their performance.

Digital tools such as mobile health apps, telehealth platforms, AI-driven virtual assistants, and remote monitoring devices are increasingly being integrated into clinical workflows to improve communication, monitor treatment adherence, and support preventive care. Notable European vendors such as Doctrin (Sweden), Infermedica (Poland), and Cegedim (France) are actively expanding their patient engagement offerings, providing cloud-based, AI-enabled solutions that enable hospitals, clinics, and payers to enhance patient experience and operational efficiency.

These trends collectively signal that Europe will continue to be a leading region for patient engagement technology adoption, supported by ongoing government investments, regulatory incentives, and the increasing prioritization of patient empowerment in healthcare delivery.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation - C Level: 42%, Director Level: 31%, and Others: 27%

- By Region - North America: 35%, Europe: 30%, Asia Pacific: 25%, Middle East & Africa: 5%, Latin America: 5%

Key Players

The key players functioning in the patient experience technology market include Press Ganey (US), National Research Corporation (NRC Health) (US), Medallia Inc. (US), Phreesia (US), NiCE (Israel), R1 (US), Epic Systems Corporation (US), IQVIA (US), Qualtrics (US), Relias LLC (US), GetWellNetwork (US), CipherHealth Inc. (US), Kyruus, Inc. (US), Twilio Inc. (US), Relatient (US), Alida (Canada), Certify Health (US), Avaamo (US), Luma Health Inc. (US), Solutionreach (US), and Salesforce, Inc. (US).

Research Coverage

The report analyzes the patient experience technology market. It aims to estimate the market size and future growth potential of various market segments based on component, use case, revenue model, end user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms and new entrants/smaller firms to gauge the market's pulse, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers: Drivers (rising demand for digital engagement platforms and personalized patient care, increasing adoption of telehealth, mobile health apps, and AI-powered analytics, government initiatives and funding for healthcare digital transformation, growing focus on improving patient satisfaction and long-term engagement, and expansion of cloud-based engagement platforms), Restraints (data privacy and cybersecurity concerns, high implementation and integration costs for healthcare providers, limited interoperability between patient engagement systems and existing EHRs), Opportunities (growth opportunities in emerging markets, adoption of AI-driven personalization and predictive analytics for patient care, strategic partnerships among technology platforms, pharma companies, and payers, and rising adoption of virtual reality and augmented reality) and Challenges (need to ensure accuracy and reliability of feedback data, rapid technological evolution) influencing the growth of the patient experience technology market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the patient experience technology market.

- Market Development: Comprehensive information on the lucrative emerging markets, by offerings, functions, end user, and region

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the patient experience technology market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the patient experience technology market such as Press Ganey (US), National Research Corporation (NRC Health) (US), Medallia Inc. (US), Phreesia (US), NiCE (Israel), R1 (US), Epic Systems Corporation (US), IQVIA (US), Qualtrics (US), Relias LLC (US), GetWellNetwork (US), CipherHealth Inc. (US), Kyruus, Inc. (US), Twilio Inc. (US), Relatient (US), Alida (Canada), Certify Health (US), Avaamo (US), Luma Health Inc. (US), Solutionreach (US), Salesforce, Inc. (US), Vital (US), NexHealth (US), Collectly, Inc. (US), Business Integrity Services (US), and Bamboo Health (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary sources

- 2.1.1 SECONDARY DATA

- 2.2 RESEARCH METHODOLOGY

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.5.2 OVERALL STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PATIENT EXPERIENCE TECHNOLOGY MARKET OVERVIEW

- 4.2 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING AND REGION

- 4.3 PATIENT EXPERIENCE TECHNOLOGY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 PATIENT EXPERIENCE TECHNOLOGY MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for digital engagement platforms and personalized patient care

- 5.2.1.2 Increasing adoption of telehealth, mobile health apps, and AI-powered analytics

- 5.2.1.3 Government initiatives and funding for healthcare digital transformation

- 5.2.1.4 Growing focus on improving patient satisfaction and long-term engagement

- 5.2.1.5 Expansion of cloud-based engagement platforms

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and cybersecurity concerns

- 5.2.2.2 High implementation and integration costs for healthcare providers

- 5.2.2.3 Limited interoperability between patient engagement systems and existing electronic health record systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities in emerging market

- 5.2.3.2 Adoption of AI-driven personalization and predictive analytics for patient care

- 5.2.3.3 Strategic partnerships among technology providers, pharma companies, and payers

- 5.2.3.4 Rising adoption of virtual reality and augmented reality

- 5.2.4 CHALLENGES

- 5.2.4.1 Need to ensure accuracy and reliability of feedback data

- 5.2.4.2 Rapid technological evolution

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 INVESTMENTS IN PATIENT ENGAGEMENT AND EXPERIENCE PLATFORMS

- 5.3.2 AI-DRIVEN PERSONALIZATION AND VIRTUAL ASSISTANTS

- 5.3.3 CLOUD-BASED PLATFORMS AND OMNICHANNEL ACCESS

- 5.3.4 TELEHEALTH AND HYBRID CARE MODELS

- 5.3.5 IMMERSIVE TECHNOLOGIES FOR EDUCATION AND ADHERENCE

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Voice-of-the-Patient (VoP) platforms

- 5.9.1.2 Telehealth and virtual care platforms

- 5.9.1.3 Patient portals and personal health records

- 5.9.1.4 Remote Patient Monitoring (RPM)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Interoperability/API and FHIR Infrastructure

- 5.9.2.2 Patient identity management and authentication systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Clinical Decision Support Systems (CDSS)

- 5.9.3.2 Population Health Management (PHM) platforms

- 5.9.3.3 Patient engagement solutions

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS

- 5.10.2 JURISDICTION ANALYSIS

- 5.10.3 MAJOR PATENTS IN PATIENT EXPERIENCE TECHNOLOGY MARKET

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.12 CASE STUDY ANALYSIS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA

- 5.16 END-USER ANALYSIS

- 5.16.1 UNMET NEEDS

- 5.16.2 END-USER EXPECTATIONS

- 5.17 BUSINESS MODELS

- 5.18 IMPACT OF AI/GEN AI ON PATIENT EXPERIENCE TECHNOLOGY MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN PATIENT EXPERIENCE TECHNOLOGY

- 5.18.3 AI USE CASES

- 5.18.4 CASE STUDY ON IMPLEMENTATION OF AI/GEN AI

- 5.18.5 INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.18.5.1 US healthcare technology market

- 5.18.5.2 Patient engagement technology market

- 5.18.6 USER READINESS AND IMPACT ASSESSMENT

- 5.18.6.1 User readiness

- 5.18.6.1.1 Hospitals & health systems

- 5.18.6.1.2 Outpatient & ambulatory care centers

- 5.18.6.1.3 Physician and group practices

- 5.18.6.1.4 Long-term care and post-acute facilities

- 5.18.6.1.5 Others

- 5.18.6.2 Impact assessment

- 5.18.6.2.1 Implementation

- 5.18.6.2.2 Impact

- 5.18.6.1 User readiness

- 5.19 IMPACT OF 2025 US TARIFFS ON PATIENT EXPERIENCE TECHNOLOGY MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 IMPACT ON COUNTRY/REGION

- 5.19.3.1 US

- 5.19.3.2 Europe

- 5.19.3.3 Asia Pacific

- 5.19.4 IMPACT ON END-USE INDUSTRIES

- 5.19.4.1 Healthcare providers

- 5.19.4.2 Healthcare payers

- 5.19.4.3 Pharma & biotech companies

- 5.19.4.4 Others

6 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 SOFTWARE

- 6.2.1 ON-PREMISE SOFTWARE

- 6.2.1.1 Data sovereignty and seamless workflow ability to drive market

- 6.2.2 CLOUD-BASED SOFTWARE

- 6.2.2.1 Lower upfront costs and seamless interoperability to aid growth

- 6.2.3 HYBRID SOFTWARE

- 6.2.3.1 Ability to ensure maximum compliance and control to boost market

- 6.2.1 ON-PREMISE SOFTWARE

- 6.3 SERVICES

- 6.3.1 MANAGED SERVICES

- 6.3.1.1 Rising demand for operational efficiency and risk mitigation to encourage growth

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Need for continuous patient engagement to contribute to growth

- 6.3.1 MANAGED SERVICES

7 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION

- 7.1 INTRODUCTION

- 7.2 APPOINTMENT SCHEDULING

- 7.2.1 GROWING TREND TOWARD OMNICHANNEL, INTELLIGENT PATIENT EXPERIENCE SOLUTIONS TO FUEL MARKET

- 7.3 PATIENT REGISTRATION

- 7.3.1 NEED TO ENHANCE CLINICAL SAFETY AND OPERATIONAL PERFORMANCE TO AUGMENT GROWTH

- 7.4 VIRTUAL CARE

- 7.4.1 EXPANDING REMOTE ACCESS AND CONTINUITY OF CARE TO AID GROWTH

- 7.5 PATIENT COMMUNICATION

- 7.5.1 INCREASING LAUNCHES OF COMMUNICATION PLATFORMS TO BOLSTER GROWTH

- 7.6 BILLING

- 7.6.1 INCREASING PUSH FOR TRANSPARENT AND AUTOMATED FINANCIAL WORKFLOWS TO SPUR GROWTH

- 7.7 FEEDBACK MANAGEMENT

- 7.7.1 NEED FOR REAL-TIME INSIGHTS INTO PATIENT SATISFACTION, CARE QUALITY, AND SERVICE GAPS TO FACILITATE GROWTH

- 7.8 OTHER FUNCTIONS

8 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE PROVIDERS

- 8.2.1 HOSPITALS & HEALTH SYSTEMS

- 8.2.1.1 Growing adoption of advanced digital and AI-driven platforms to bolster market

- 8.2.2 OUTPATIENT & AMBULATORY CARE CENTERS

- 8.2.2.1 Rising demand for preventive care, chronic disease management, and same-day procedures to promote growth

- 8.2.3 PHYSICIANS & GROUP PRACTICES

- 8.2.3.1 Increasing use of predictive analytics and remote monitoring tools to augment growth

- 8.2.4 LONG-TERM CARE & POST-ACUTE FACILITIES

- 8.2.4.1 Growing burden of aging population and chronic diseases to boost market

- 8.2.5 OTHER HEALTHCARE PROVIDERS

- 8.2.1 HOSPITALS & HEALTH SYSTEMS

- 8.3 HEALTHCARE PAYERS

- 8.3.1 INCREASING ADVANCEMENTS IN ARTIFICIAL INTELLIGENCE AND VIRTUAL CARE MODELS TO FUEL MARKET

- 8.4 PHARMA & BIOTECH COMPANIES

- 8.4.1 RISING INTEGRATION OF PATIENT EXPERIENCE TECHNOLOGY TO AID GROWTH

- 8.5 OTHER END USERS

9 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Increasing adoption of digital solutions to contribute to growth

- 9.2.3 CANADA

- 9.2.3.1 Rising focus on healthcare delivery through digital innovation to expedite growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 UK

- 9.3.2.1 Growing focus on digital-first healthcare delivery and patient empowerment to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Aging population and rising prevalence of chronic diseases to spur growth

- 9.3.4 FRANCE

- 9.3.4.1 Favorable policies and commitment to digital transformation to aid growth

- 9.3.5 ITALY

- 9.3.5.1 Expanding regulatory and reimbursement support to fuel market

- 9.3.6 SPAIN

- 9.3.6.1 Growing adoption of telemedicine to boost market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Rapidly growing elderly population to accelerate growth

- 9.4.3 CHINA

- 9.4.3.1 Widespread integration of healthcare services into super-apps to accelerate growth

- 9.4.4 INDIA

- 9.4.4.1 Increasing burden of non-communicable diseases and use of mobile-first platforms to favor growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Booming medical tourism to speed up growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Matured healthcare system and digital infrastructure to promote growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increase utilization of digital ecosystems to spur growth

- 9.5.3 MEXICO

- 9.5.3.1 Growing consumer-driven digital marketplaces to fuel market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Rising healthcare investments to contribute to growth

- 9.6.2.2 Saudi Arabia

- 9.6.2.2.1 Digital health transformation programs to support growth

- 9.6.2.3 UAE

- 9.6.2.3.1 Rising patient expectations and entry of innovative regional platforms to aid growth

- 9.6.2.4 Rest of GCC countries

- 9.6.3 SOUTH AFRICA

- 9.6.3.1 Growing smartphone penetration and supportive regulatory efforts to boost market

- 9.6.4 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PATIENT EXPERIENCE TECHNOLOGY MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/SOFTWARE COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Function footprint

- 10.7.5.5 End-user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 SOLUTION LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 PRESS GANEY

- 11.1.1.1 Business overview

- 11.1.1.2 Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Solution launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 NATIONAL RESEARCH CORPORATION

- 11.1.2.1 Business overview

- 11.1.2.2 Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Solution launches and enhancements

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 MEDALLIA INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Solution launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 PHREESIA

- 11.1.4.1 Business overview

- 11.1.4.2 Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Solution launches and enhancements

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 NICE

- 11.1.5.1 Business overview

- 11.1.5.2 Solutions offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses and competitive threats

- 11.1.6 R1

- 11.1.6.1 Business overview

- 11.1.6.2 Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Solution launches and enhancements

- 11.1.6.3.2 Deals

- 11.1.7 EPIC SYSTEMS CORPORATION

- 11.1.7.1 Business overview

- 11.1.7.2 Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Solution launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 IQVIA

- 11.1.8.1 Business overview

- 11.1.8.2 Solutions offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Solution launches and enhancements

- 11.1.9 QUALTRICS

- 11.1.9.1 Business overview

- 11.1.9.2 Solutions offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.9.3.2 Expansions

- 11.1.9.3.3 Other developments

- 11.1.10 RELIAS LLC

- 11.1.10.1 Business overview

- 11.1.10.2 Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 GETWELLNETWORK, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Solutions offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Solution launches and enhancements

- 11.1.11.3.2 Deals

- 11.1.12 CIPHERHEALTH INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Solutions offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Solution launches and enhancements

- 11.1.12.3.2 Deals

- 11.1.13 KYRUUS, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Solutions offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Solution launches and enhancements

- 11.1.13.3.2 Deals

- 11.1.14 RELATIENT

- 11.1.14.1 Business overview

- 11.1.14.2 Solutions offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Solution launches and enhancements

- 11.1.15 ALIDA

- 11.1.15.1 Business overview

- 11.1.15.2 Solutions offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Other developments

- 11.1.16 TWILIO INC.

- 11.1.16.1 Business overview

- 11.1.16.2 Solutions offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Solution launches and enhancements

- 11.1.16.3.2 Deals

- 11.1.17 AVAAMO

- 11.1.17.1 Business overview

- 11.1.17.2 Solutions offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Solution launches and enhancements

- 11.1.18 CERTIFY HEALTH

- 11.1.18.1 Business overview

- 11.1.18.2 Solutions offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Other developments

- 11.1.19 LUMA HEALTH INC.

- 11.1.19.1 Business overview

- 11.1.19.2 Solutions offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Solution launches and enhancements

- 11.1.19.3.2 Deals

- 11.1.20 SOLUTIONREACH

- 11.1.20.1 Business overview

- 11.1.20.2 Solutions offered

- 11.1.20.3 Recent developments

- 11.1.20.3.1 Solution launches and enhancements

- 11.1.21 SALESFORCE, INC.

- 11.1.21.1 Business overview

- 11.1.21.2 Solutions offered

- 11.1.21.3 Recent developments

- 11.1.21.3.1 Solution launches and enhancements

- 11.1.1 PRESS GANEY

- 11.2 OTHER PLAYERS

- 11.2.1 VITAL

- 11.2.2 NEXHEALTH

- 11.2.3 COLLECTLY, INC.

- 11.2.4 BUSINESS INTEGRITY SERVICES

- 11.2.5 BAMBOO HEALTH

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PATIENT EXPERIENCE TECHNOLOGY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD, 2021-2024

- TABLE 3 PATIENT EXPERIENCE TECHNOLOGY MARKET: FACTOR ANALYSIS

- TABLE 4 PATIENT EXPERIENCE TECHNOLOGY MARKET: RISK ANALYSIS

- TABLE 5 PATIENT EXPERIENCE TECHNOLOGY MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 6 AVERAGE SELLING PRICE TREND OF PATIENT EXPERIENCE SOFTWARE, BY KEY PLAYER, 2022-2025 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF PATIENT EXPERIENCE TECHNOLOGY, BY REGION, 2022-2025 (USD)

- TABLE 8 PATIENT EXPERIENCE TECHNOLOGY MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR PATIENT EXPERIENCE TECHNOLOGY, 2015-2025

- TABLE 10 PATIENT EXPERIENCE TECHNOLOGY MARKET: LIST OF PATENTS/PATENT APPLICATIONS, 2020-2025

- TABLE 11 PATIENT EXPERIENCE TECHNOLOGY MARKET: KEY CONFERENCES AND EVENTS, 2025-2027

- TABLE 12 CASE STUDY 1: IMPROVED PATIENT-CENTERED CARE WITH DIGIVALET PATIENT EXPERIENCE PLATFORM

- TABLE 13 CASE STUDY 2: PAPERLESS ADMISSIONS VIA PWC + SALESFORCE DIGITAL PATIENT PORTAL

- TABLE 14 CASE STUDY 3: TIMELY PATIENT COMMUNICATIONS WITH TWILIO MESSAGING

- TABLE 15 CASE STUDY 4: DIGITAL WAYFINDING & WI-FI ENHANCEMENTS BY WORLDWIDE TECHNOLOGY

- TABLE 16 REGULATORY SCENARIO IN NORTH AMERICA

- TABLE 17 REGULATORY SCENARIO IN EUROPE

- TABLE 18 REGULATORY SCENARIO IN ASIA PACIFIC

- TABLE 19 REGULATORY SCENARIO IN MIDDLE EAST & AFRICA

- TABLE 20 REGULATORY SCENARIO IN LATIN AMERICA

- TABLE 21 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 PATIENT EXPERIENCE TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END USERS (%)

- TABLE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 29 PATIENT EXPERIENCE TECHNOLOGY MARKET: UNMET NEEDS

- TABLE 30 PATIENT EXPERIENCE TECHNOLOGY MARKET: END-USER EXPECTATIONS

- TABLE 31 CASE STUDY: AI-DRIVEN PATIENT EXPERIENCE ENHANCEMENT

- TABLE 32 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 33 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 34 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 35 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR ON-PREMISE SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR CLOUD-BASED SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HYBRID SOFTWARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 39 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY SERVICE, 2023-2030 (USD MILLION)

- TABLE 40 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR MANAGED SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR PROFESSIONAL SERVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 44 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR APPOINTMENT SCHEDULING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR PATIENT REGISTRATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR VIRTUAL CARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR PATIENT COMMUNICATION, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR BILLING, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 49 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR FEEDBACK MANAGEMENT, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR OTHER FUNCTIONS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 52 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 53 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HOSPITALS & HEALTH SYSTEMS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 55 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR OUTPATIENT & AMBULATORY CARE CENTERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR PHYSICIANS & GROUP PRACTICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR LONG-TERM CARE & POST-ACUTE FACILITIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 PATIENT EXPERIENCE TECHNOLOGY MARKET FOR OTHER HEALTHCARE PROVIDERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 PATIENT EXPERIENCE TECHNOLOGY FOR HEALTHCARE PAYERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 PATIENT EXPERIENCE TECHNOLOGY FOR PHARMA & BIOTECH COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 PATIENT EXPERIENCE TECHNOLOGY FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 70 US: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 71 US: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 72 US: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 73 US: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 74 US: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 75 US: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 CANADA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 77 CANADA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 79 CANADA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 80 CANADA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 81 CANADA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 87 EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 89 UK: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 90 UK: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 91 UK: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 92 UK: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 93 UK: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 94 UK: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 95 GERMANY: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 96 GERMANY: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 GERMANY: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 98 GERMANY: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 99 GERMANY: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 100 GERMANY: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 101 FRANCE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 102 FRANCE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 FRANCE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 FRANCE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 105 FRANCE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 106 FRANCE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 107 ITALY: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 108 ITALY: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 ITALY: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 ITALY: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 111 ITALY: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 112 ITALY: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 SPAIN: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 114 SPAIN: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 115 SPAIN: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 SPAIN: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 117 SPAIN: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 118 SPAIN: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 120 REST OF EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 122 REST OF EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 123 REST OF EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 124 REST OF EUROPE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 JAPAN: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 133 JAPAN: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 JAPAN: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 JAPAN: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 136 JAPAN: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 JAPAN: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 CHINA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 139 CHINA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 CHINA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 CHINA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 142 CHINA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 143 CHINA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 144 INDIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 145 INDIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 INDIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 INDIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 148 INDIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 149 INDIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 SOUTH KOREA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 151 SOUTH KOREA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 SOUTH KOREA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 SOUTH KOREA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 154 SOUTH KOREA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 155 SOUTH KOREA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 AUSTRALIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 157 AUSTRALIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 AUSTRALIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 AUSTRALIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 160 AUSTRALIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 161 AUSTRALIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 170 LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 172 LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 173 LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 174 LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 BRAZIL: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 176 BRAZIL: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 BRAZIL: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 BRAZIL: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 179 BRAZIL: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 180 BRAZIL: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 181 MEXICO: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 182 MEXICO: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 MEXICO: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 MEXICO: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 185 MEXICO: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 186 MEXICO: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 REST OF LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 188 REST OF LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 189 REST OF LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 REST OF LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 191 REST OF LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 192 REST OF LATIN AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 201 GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 202 GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 203 GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 204 GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 205 GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 SAUDI ARABIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 207 SAUDI ARABIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 SAUDI ARABIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 SAUDI ARABIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 210 SAUDI ARABIA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 211 SAUDI ARABIA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 UAE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 213 UAE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 UAE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 UAE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 216 UAE: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 217 UAE: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 REST OF GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 219 REST OF GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 REST OF GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 REST OF GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 222 REST OF GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 223 REST OF GCC COUNTRIES: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 SOUTH AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 225 SOUTH AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 SOUTH AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 SOUTH AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 228 SOUTH AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 229 SOUTH AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SOFTWARE, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 REST OF MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR SERVICES, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 233 REST OF MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2023-2030 (USD MILLION)

- TABLE 234 REST OF MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 235 REST OF MIDDLE EAST & AFRICA: PATIENT EXPERIENCE TECHNOLOGY MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PATIENT EXPERIENCE TECHNOLOGY MARKET, JANUARY 2022-SEPTEMBER 2025

- TABLE 237 PATIENT EXPERIENCE TECHNOLOGY MARKET: DEGREE OF COMPETITION

- TABLE 238 PATIENT EXPERIENCE TECHNOLOGY MARKET: REGION FOOTPRINT

- TABLE 239 PATIENT EXPERIENCE TECHNOLOGY MARKET: OFFERING FOOTPRINT

- TABLE 240 PATIENT EXPERIENCE TECHNOLOGY MARKET: FUNCTION FOOTPRINT

- TABLE 241 PATIENT EXPERIENCE TECHNOLOGY MARKET: END-USER FOOTPRINT

- TABLE 242 PATIENT EXPERIENCE TECHNOLOGY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 243 PATIENT EXPERIENCE TECHNOLOGY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 244 PATIENT EXPERIENCE TECHNOLOGY MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 245 PATIENT EXPERIENCE TECHNOLOGY MARKET: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 246 PATIENT EXPERIENCE TECHNOLOGY MARKET: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 247 PRESS GANEY: COMPANY OVERVIEW

- TABLE 248 PRESS GANEY: SOLUTIONS OFFERED

- TABLE 249 PRESS GANEY: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 250 PRESS GANEY: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 251 NATIONAL RESEARCH CORPORATION: COMPANY OVERVIEW

- TABLE 252 NATIONAL RESEARCH CORPORATION: SOLUTIONS OFFERED

- TABLE 253 NATIONAL RESEARCH CORPORATION: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 254 MEDALLIA INC.: COMPANY OVERVIEW

- TABLE 255 MEDALLIA INC.: SOLUTIONS OFFERED

- TABLE 256 MEDALLIA INC.: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 257 MEDALLIA INC.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 258 PHREESIA: COMPANY OVERVIEW

- TABLE 259 PHREESIA: SOLUTIONS OFFERED

- TABLE 260 PHREESIA: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 261 PHREESIA: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 262 NICE: COMPANY OVERVIEW

- TABLE 263 NICE: SOLUTIONS OFFERED

- TABLE 264 R1: COMPANY OVERVIEW

- TABLE 265 R1: SOLUTIONS OFFERED

- TABLE 266 R1: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 267 R1: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 268 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 269 EPIC SYSTEMS CORPORATION: SOLUTIONS OFFERED

- TABLE 270 EPIC SYSTEMS CORPORATION: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 271 EPIC SYSTEMS CORPORATION: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 272 IQVIA: COMPANY OVERVIEW

- TABLE 273 IQVIA: SOLUTIONS OFFERED

- TABLE 274 IQVIA: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 275 QUALTRICS: COMPANY OVERVIEW

- TABLE 276 QUALTRICS: SOLUTIONS OFFERED

- TABLE 277 QUALTRICS: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 278 QUALTRICS: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 279 QUALTRICS: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 280 RELIAS LLC: COMPANY OVERVIEW

- TABLE 281 RELIAS LLC: SOLUTIONS OFFERED

- TABLE 282 RELIAS LLC: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 283 GETWELLNETWORK, INC.: COMPANY OVERVIEW

- TABLE 284 GETWELLNETWORK, INC.: SOLUTIONS OFFERED

- TABLE 285 GETWELLNETWORK, INC.: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 286 GETWELLNETWORK, INC.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 287 CIPHERHEALTH INC.: COMPANY OVERVIEW

- TABLE 288 CIPHERHEALTH INC.: SOLUTIONS OFFERED

- TABLE 289 CIPHERHEALTH INC.: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 290 CIPHERHEALTH INC.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 291 KYRUUS, INC.: COMPANY OVERVIEW

- TABLE 292 KYRUUS, INC.: SOLUTIONS OFFERED

- TABLE 293 KYRUUS, INC.: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 294 KYRUUS, INC.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 295 RELATIENT: COMPANY OVERVIEW

- TABLE 296 RELATIENT: SOLUTIONS OFFERED

- TABLE 297 RELATIENT: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 298 ALIDA: COMPANY OVERVIEW

- TABLE 299 ALIDA: SOLUTIONS OFFERED

- TABLE 300 ALIDA: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 301 TWILIO INC.: COMPANY OVERVIEW

- TABLE 302 TWILIO INC.: SOLUTIONS OFFERED

- TABLE 303 TWILIO INC.: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 304 TWILIO INC.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 305 AVAAMO: COMPANY OVERVIEW

- TABLE 306 AVAAMO: SOLUTIONS OFFERED

- TABLE 307 AVAAMO: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 308 CERTIFY HEALTH: COMPANY OVERVIEW

- TABLE 309 CERTIFY HEALTH: SOLUTIONS OFFERED

- TABLE 310 CERTIFY HEALTH: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 311 LUMA HEALTH INC.: COMPANY OVERVIEW

- TABLE 312 LUMA HEALTH INC.: SOLUTIONS OFFERED

- TABLE 313 LUMA HEALTH INC.: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 314 LUMA HEALTH INC.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 315 SOLUTIONREACH: COMPANY OVERVIEW

- TABLE 316 SOLUTIONREACH: SOLUTIONS OFFERED

- TABLE 317 SOLUTIONREACH: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 318 SALESFORCE, INC.: COMPANY OVERVIEW

- TABLE 319 SALESFORCE, INC.: SOLUTIONS OFFERED

- TABLE 320 SALESFORCE, INC.: SOLUTION LAUNCHES AND ENHANCEMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 321 VITAL: COMPANY OVERVIEW

- TABLE 322 NEXHEALTH: COMPANY OVERVIEW

- TABLE 323 COLLECTLY, INC.: COMPANY OVERVIEW

- TABLE 324 BUSINESS INTEGRITY SERVICES: COMPANY OVERVIEW

- TABLE 325 BAMBOO HEALTH: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PATIENT EXPERIENCE TECHNOLOGY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 SUPPLY-SIDE MARKET ESTIMATION

- FIGURE 8 PATIENT EXPERIENCE TECHNOLOGY MARKET: REVENUE ESTIMATION APPROACH

- FIGURE 9 BOTTOM-UP APPROACH

- FIGURE 10 CAGR PROJECTIONS FROM MARKET DYNAMICS, 2025-2030

- FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 12 TOP-DOWN APPROACH

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- FIGURE 14 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY OFFERING, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY FUNCTION, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 PATIENT EXPERIENCE TECHNOLOGY MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 PATIENT EXPERIENCE TECHNOLOGY MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 18 INCREASING FOCUS ON PATIENT-CENTERED CARE TO DRIVE MARKET

- FIGURE 19 SOFTWARE SEGMENT AND US LED NORTH AMERICAN MARKET IN 2025

- FIGURE 20 INDIA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 EMERGING MARKETS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 22 PATIENT EXPERIENCE TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 PATIENT EXPERIENCE TECHNOLOGY MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 AVERAGE SELLING PRICE TREND OF PATIENT EXPERIENCE TECHNOLOGY, BY REGION, 2022-2025 (USD)

- FIGURE 25 PATIENT EXPERIENCE TECHNOLOGY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 PATIENT EXPERIENCE TECHNOLOGY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 RECENT FUNDING OF PLAYERS IN PATIENT EXPERIENCE TECHNOLOGY MARKET

- FIGURE 28 GLOBAL PATENT PUBLICATION TRENDS IN PATIENT EXPERIENCE TECHNOLOGY, 2015-2025

- FIGURE 29 JURISDICTION ANALYSIS OF PATIENT EXPERIENCE TECHNOLOGY PATENTS, JANUARY 2015-AUGUST 2025

- FIGURE 30 PATIENT EXPERIENCE TECHNOLOGY MARKET: PATENT ANALYSIS, JANUARY 2015-AUGUST 2025

- FIGURE 31 PATIENT EXPERIENCE TECHNOLOGY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 34 MARKET POTENTIAL OF AI/GENERATIVE AI IN ENHANCING PATIENT EXPERIENCE TECHNOLOGY ACROSS INDUSTRIES

- FIGURE 35 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 36 NORTH AMERICA: PATIENT EXPERIENCE TECHNOLOGY MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: PATIENT EXPERIENCE TECHNOLOGY MARKET SNAPSHOT

- FIGURE 38 PATIENT EXPERIENCE TECHNOLOGY MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 39 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PATIENT EXPERIENCE TECHNOLOGY MARKET, 2024

- FIGURE 40 EV/EBITDA OF KEY VENDORS

- FIGURE 41 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 42 PATIENT EXPERIENCE TECHNOLOGY MARKET: BRAND/SOFTWARE COMPARISON

- FIGURE 43 PATIENT EXPERIENCE TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 PATIENT EXPERIENCE TECHNOLOGY MARKET: COMPANY FOOTPRINT

- FIGURE 45 PATIENT EXPERIENCE TECHNOLOGY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 NATIONAL RESEARCH CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 47 PHREESIA: COMPANY SNAPSHOT (2024)

- FIGURE 48 NICE: COMPANY SNAPSHOT (2024)

- FIGURE 49 IQVIA: COMPANY SNAPSHOT (2024)

- FIGURE 50 TWILIO INC.: COMPANY SNAPSHOT (2024)

- FIGURE 51 SALESFORCE, INC.: COMPANY SNAPSHOT (2024)