PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1863602

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1863602

Precision Forestry Market by Offering, by Technology, Application, End User and Region - Global Forecast to 2030

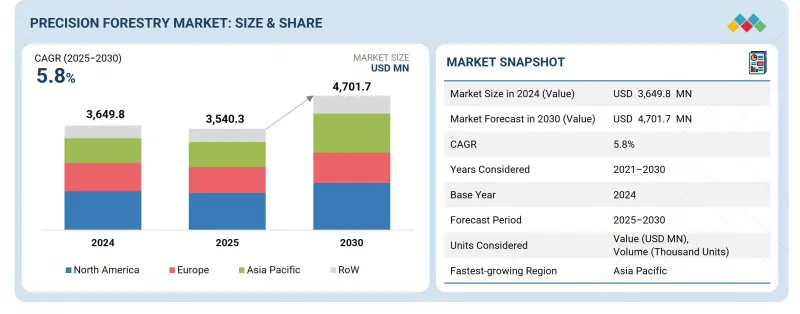

The precision forestry market is projected to reach USD 4,701.07 million by 2030 from USD 3,540.3 million in 2025, at a CAGR of 5.8%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Technology, Application, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth of the precision forestry market is driven by increasing adoption of advanced technologies, sustainable forestry practices, and AI-enabled solutions that enhance efficiency, productivity, and carbon management.

" Widespread application of precision forestry solutions across stakeholder group to drive market"

The global precision forestry market is projected to grow significantly during the forecast period, supported by the increasing adoption of precision forestry technologies by industrial forestry companies, government agencies, environmental & conservation organizations, and commercial forest owners. Industrial forestry companies are increasingly adopting precision forestry solutions to streamline harvesting activities, maximize yield, and strengthen supply chain efficiency through real-time data and analytics. Government agencies are leveraging digital mapping, remote sensing, and analytics platforms to strengthen forest conservation, fire detection, and reforestation programs. The environmental and conservation sector is deploying precision forestry tools for carbon monitoring, biodiversity assessment, and sustainable land-use planning. Meanwhile, commercial forest owners are utilizing precision-driven approaches for tree health monitoring, pest and disease management, and soil analysis to maximize productivity. Together, these segments highlight the growing integration of precision forestry technologies across diverse applications, positioning them as key enablers of sustainable, efficient, and data-driven forest management worldwide.

"Harvesting & operations segment accounted for largest market share in 2024"

The harvesting & operations segment captured the largest market share in 2024 due to the widespread adoption of advanced technologies, such as GPS/GNSS, LiDAR, and onboard sensors, which enhance precision, productivity, and sustainability in timber extraction and field operations. Forestry companies are increasingly leveraging smart harvesters, forwarders, and telematics-enabled equipment to optimize machine performance, reduce wood waste, and ensure sustainable forest management. Additionally, growing emphasis on environmental compliance and operational efficiency has led to the integration of data-driven tools for terrain mapping, machine routing, and real-time monitoring, making harvesting and operations the most mature and extensively implemented application segment in precision forestry.

"Fixed/stationary systems segment to record higher CAGR during forecast period"

The fixed/stationary systems segment is expected to register a higher CAGR during the forecast period in the precision forestry market, driven by the increasing deployment of permanent monitoring, sensing, and data collection infrastructures across forested areas. These systems, which include ground-based LiDAR scanners, environmental sensors, and fixed camera networks, enable continuous and high-accuracy data gathering for forest health assessment, biomass estimation, and fire detection. The increasing adoption of IoT-enabled fixed systems for real-time environmental monitoring, combined with advancements in cloud-based data analytics and automation, is driving demand for these systems. Furthermore, government and forestry agencies are investing in fixed systems for long-term ecosystem management and deforestation tracking, further supporting the segment's accelerated growth compared to mobile or portable systems.

"North America accounted for largest market share in 2024"

North America secured the largest share of the precision forestry market in 2024 due to the early adoption of advanced forestry management technologies and the strong presence of leading companies offering precision forestry solutions, such as Deere & Company (US), Trimble Inc. (US), Caterpillar (US), and Tigercat International Inc. (Canada). The region's well-established digital infrastructure and high investment capacity have accelerated the integration of technologies such as GPS/GNSS, GIS, drones, LiDAR, and advanced data analytics in forestry operations. Additionally, the growing emphasis on sustainable forest management, supported by government initiatives in the US and Canada, has increased the adoption of precision forestry tools for optimizing harvesting, reducing waste, and improving forest health. The presence of major forestry equipment manufacturers and technology providers further strengthens North America's dominance in this market.

Breakdown of Primaries

A variety of executives from key organizations operating in the precision forestry market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-35%, Tier 2- 40%, and Tier 3-25%

- By Designation: C-level Executives-30%, Directors-40%, and Others-30%

- By Region: North America-40%, Europe-32%, Asia Pacific-23%, and RoW-5%

Note: Other designations include sales, marketing, and product managers.

Tier 1 companies include market players with revenues above USD 500 million; tier 2 companies earn revenues between USD 100 million and USD 500 million; and tier 3 companies earn revenues up to USD 100 million.

The precision forestry market is dominated by globally established players such as Deere & Company (US), Ponsse Oyj (Finland), Trimble Inc. (US), Komatsu Ltd. (Japan), Caterpillar (US), Topcon (US), Rottne (Sweden), Tigercat International Inc. (Canada), and Eco Log (Sweden). The study includes an in-depth competitive analysis of these key players in the precision forestry market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the precision forestry market and forecasts its size by offering, technology, application, system architecture, ownership type, end user, and region. It also discusses the market's drivers, restraints, opportunities, and challenges, and gives a detailed view of the market across four main regions: North America, Europe, Asia Pacific, and RoW. The report includes a supply chain analysis and the key players and their competitive analysis in the precision forestry ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (Growing adoption of remote sensing and GIS technologies, rising requirement for sustainable forestry practices, elevating demand for timber and wood-based products, and escalating need to adopt sustainable forest management techniques), restraints (High initial investment and operational costs, and geographical and environmental limitations), opportunities (Inclination toward AI-driven predictive analytics for forest management, integration of blockchain technology to ensure transparency in wood supply chain, and implementation of carbon credit and carbon offset programs), and challenges (Limited awareness of benefits offered by precision forestry solutions, and delayed ROI in precision forestry technologies) influencing the growth of the precision forestry market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product/solution/service launches in the precision forestry market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the precision forestry market across varied regions

- Market Diversification: Exhaustive information about new products/solutions/services, untapped geographies, recent developments, and investments in the precision forestry market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Deere & Company (US), Ponsse Oyj (Finland), Trimble Inc. (US), Komatsu Ltd. (Japan), and Caterpillar (US), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION FORESTRY MARKET

- 4.2 PRECISION FORESTRY MARKET, BY END USER

- 4.3 PRECISION FORESTRY MARKET, BY TECHNOLOGY

- 4.4 PRECISION FORESTRY MARKET, BY APPLICATION

- 4.5 PRECISION FORESTRY MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of remote sensing and GIS technologies

- 5.2.1.2 Rising requirement for sustainable forestry practices

- 5.2.1.3 Elevating demand for timber and wood-based products

- 5.2.1.4 Escalating need to adopt sustainable forest management techniques

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment and operational costs

- 5.2.2.2 Geographical and environmental limitations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Inclination toward AI-driven predictive analytics for forest management

- 5.2.3.2 Integration of blockchain technology to ensure transparency in wood supply chain

- 5.2.3.3 Implementation of carbon credit and carbon offset programs

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited awareness of benefits offered by precision forestry solutions

- 5.2.4.2 Delayed ROI in precision forestry technologies

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF HARDWARE OFFERINGS, BY KEY PLAYER, 2020-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF HARVESTERS, BY REGION, 2020-2024

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Forest management information systems (FMIS)

- 5.8.1.2 Yield mapping

- 5.8.1.3 Forest inventory management software

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Geographic information systems (GIS)

- 5.8.2.2 Artificial intelligence (AI) & machine learning (ML)

- 5.8.2.3 IoT sensors

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Autonomous vehicles & robotics

- 5.8.3.2 Augmented reality (AR) & virtual reality (VR)

- 5.8.3.3 Digital twin technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8432)

- 5.9.2 EXPORT SCENARIO (HS CODE 8432)

- 5.10 PATENT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 STORA ENSO IMPLEMENTS PRECISION FORESTRY SOLUTION TO ENHANCE FOREST MANAGEMENT EFFICIENCY

- 5.12.2 HOLMEN DEPLOYS PRECISION FORESTRY PLATFORM TO IMPROVE BIODIVERSITY CONSERVATION AND REGENERATION EFFORTS

- 5.12.3 EMERSON & SONS LOGGING ADOPTS PRECISION FORESTRY SOLUTION TO ENHANCE EFFICIENCY AND SUSTAINABILITY

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 8432)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI

- 5.17 IMPACT OF 2025 US TARIFF ON PRECISION FORESTRY MARKET

- 5.17.1 INTRODUCTION

- 5.17.1.1 Key tariff rates

- 5.17.2 PRICE IMPACT ANALYSIS

- 5.17.3 IMPACT ON COUNTRIES/REGIONS

- 5.17.3.1 US

- 5.17.3.2 Europe

- 5.17.3.3 Asia Pacific

- 5.17.4 IMPACT ON END USERS

- 5.17.1 INTRODUCTION

6 PRECISION FORESTRY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 HARVESTERS & FORWARDERS

- 6.2.1.1 Heightened focus on enhancing forest productivity and adhering to regulatory policies to drive market

- 6.2.2 UAVS/DRONES

- 6.2.2.1 Potential to support faster assessments and precise resource monitoring to boost adoption

- 6.2.3 GPS/GNSS DEVICES

- 6.2.3.1 Growing focus on optimizing forest mapping, inventory, and operational planning to facilitate implementation

- 6.2.4 CAMERAS

- 6.2.4.1 Versatility in capturing high-resolution visual imagery and multispectral data to boost demand

- 6.2.5 RFID SOLUTIONS & SENSORS

- 6.2.5.1 Proficiency in offering real-time information on forest conditions and timber locations to accelerate demand

- 6.2.6 VARIABLE RATE CONTROLLERS

- 6.2.6.1 Capacity to reduce waste and ensure sustainable resource management to spur deployment

- 6.2.7 OTHER HARDWARE PRODUCTS

- 6.2.1 HARVESTERS & FORWARDERS

- 6.3 SOFTWARE

- 6.3.1 ON-PREMISES

- 6.3.1.1 Requirement for data security and real-time control to fuel segmental growth

- 6.3.2 CLOUD-BASED

- 6.3.2.1 Flexibility, remote accessibility, and seamless data integration features to boost demand

- 6.3.3 HYBRID

- 6.3.3.1 Rising focus on optimizing resource utilization and enhancing forest management accuracy to spike demand

- 6.3.1 ON-PREMISES

- 6.4 SERVICES

- 6.4.1 GREATER EMPHASIS ON MINIMAL DOWNTIME AND SUSTAINED OPERATIONAL PERFORMANCE TO CREATE OPPORTUNITIES

7 PRECISION FORESTRY MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 SMART HARVESTING/CTL

- 7.2.1 NEED TO MAINTAIN HIGH STANDARDS OF FOREST STEWARDSHIP TO FACILITATE ADOPTION

- 7.3 INVENTORY & YIELD MONITORING

- 7.3.1 AFFINITY FOR REAL-TIME AND SITE-SPECIFIC DATA FOR EFFECTIVE REFORESTATION PLANNING TO PROPEL DEPLOYMENT

- 7.4 FIRE DETECTION

- 7.4.1 NECESSITY TO SAFEGUARD FOREST ASSETS AND ENSURE ENVIRONMENTAL CONSERVATION TO FUEL DEMAND

- 7.5 GEOSPATIAL

- 7.5.1 GPS/GNSS

- 7.5.1.1 Proficiency in collecting precise spatial data across large and remote forest areas to drive implementation

- 7.5.2 GIS & MAPPING

- 7.5.2.1 Ability to provide actionable insights for resource optimization and sustainable forest management to augment deployment

- 7.5.3 REMOTE SENSING

- 7.5.3.1 Excellence in detecting early signs of pest infestations, drought stress, and illegal logging to facilitate adoption

- 7.5.4 UNMANNED AERIAL VEHICLES

- 7.5.4.1 Increasing focus on efficient forest restoration and management activities to create opportunities

- 7.5.5 DATA MANAGEMENT & ANALYTICS

- 7.5.5.1 Rising use of AI/ML-powered analytics in predictive forest management to support segmental growth

- 7.5.6 LIDAR

- 7.5.6.1 Potential to assess forest growth patterns and monitor ecological conditions to stimulate demand

- 7.5.1 GPS/GNSS

- 7.6 IOT

- 7.6.1 NEED FOR REAL-TIME TRACKING OF FOREST CONDITIONS, TIMBER MOVEMENT, AND MACHINERY PERFORMANCE TO SPIKE DEMAND

- 7.7 ROBOTICS & SENSORS

- 7.7.1 EMPHASIS ON REDUCING MANUAL LABOR AND IMPROVING SAFETY IN CHALLENGING FOREST ENVIRONMENTS TO BOOST ADOPTION

- 7.8 OTHER TECHNOLOGIES

8 PRECISION FORESTRY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FOREST MANAGEMENT & PLANNING

- 8.2.1 PRESSING NEED TO STREAMLINE WORKFLOWS AND ADHERE TO ENVIRONMENTAL REGULATIONS TO FUEL SEGMENTAL GROWTH

- 8.3 HARVESTING & OPERATIONS

- 8.3.1 INCREASING FOCUS ON OPTIMIZING CUTTING PATTERNS AND TRACK OPERATIONAL PROGRESS IN REAL TIME TO BOOST DEMAND

- 8.4 SILVICULTURE

- 8.4.1 GROWING EMPHASIS ON ENHANCING FOREST QUALITY AND PRODUCTIVITY TO FOSTER SEGMENTAL GROWTH

- 8.5 FIRE MANAGEMENT & DETECTION

- 8.5.1 NECESSITY TO ASSESS FIRE-PRONE ZONES AND IMPROVE SITUATIONAL AWARENESS TO ACCELERATE DEMAND

- 8.6 INVENTORY & LOGISTICS MANAGEMENT

- 8.6.1 RISING USE OF IOT AND BLOCKCHAIN TECHNOLOGIES FOR INVENTORY & LOGISTICS OPTIMIZATION TO PROPEL MARKET

- 8.7 ENVIRONMENTAL & CONSERVATION

- 8.7.1 STRONG FOCUS ON PROMOTING SUSTAINABLE AND RESILIENT FOREST LANDSCAPES TO DRIVE MARKET

- 8.8 REFORESTATION & AFFORESTATION

- 8.8.1 SURGING USE OF DIGITAL AND GEOSPATIAL TOOLS TO OPTIMIZE REFORESTATION PROCESS TO SUPPORT MARKET GROWTH

- 8.9 PEST & DISEASE MANAGEMENT

- 8.9.1 NECESSITY TO SAFEGUARD FOREST THROUGH PREDICTIVE MODELING TO CONTRIBUTE TO MARKET GROWTH

- 8.10 SOIL TESTING

- 8.10.1 RISING DEPLOYMENT OF SOIL SENSORS AND IOT DEVICES FOR REAL-TIME SOIL HEALTH MONITORING TO PROPEL MARKET

- 8.11 WILDLIFE HABITAT MANAGEMENT

- 8.11.1 URGENT NEED TO DETECT ILLEGAL POACHING ACTIVITIES IN REAL TIME TO CREATE OPPORTUNITIES

- 8.12 GENETICS

- 8.12.1 EXPANDING STRATEGIC FOCUS ON IDENTIFYING PLANT GROWTH RATE, WOOD QUALITY, AND PEST RESISTANCE TO SPIKE DEMAND

- 8.13 OTHER APPLICATIONS

9 PRECISION FORESTRY MARKET, BY SYSTEM ARCHITECTURE

- 9.1 INTRODUCTION

- 9.2 FIXED/STATIONARY SYSTEMS

- 9.2.1 HIGH RELIABILITY, LONG-TERM OPERATIONAL CAPABILITY, AND COST EFFICIENCY BENEFITS TO DRIVE SEGMENTAL GROWTH

- 9.3 MOBILE/HANDHELD SYSTEMS

- 9.3.1 NEED TO COLLECT REAL-TIME DATA ACROSS DIVERSE TERRAINS AND CONDUCT SITE-SPECIFIC ASSESSMENTS TO SPUR DEMAND

10 PRECISION FORESTRY MARKET, BY OWNERSHIP TYPE

- 10.1 INTRODUCTION

- 10.2 INDUSTRIAL FORESTRY COMPANIES

- 10.2.1 FOCUS ON ENHANCING DECISION-MAKING THROUGH GEOSPATIAL AND REMOTE SENSING TOOLS TO ACCELERATE MARKET GROWTH

- 10.3 COMMERCIAL FOREST OWNERS

- 10.3.1 INCLINATION TOWARD IMPROVING PROFITABILITY AND COMPETITIVENESS TO SPIKE DEMAND

- 10.4 SMALL LANDOWNERS/PRIVATE FOREST OWNERS

- 10.4.1 EMPHASIS ON STRENGTHENING FOREST HEALTH MONITORING THROUGH AFFORDABLE TECHNOLOGIES TO SPUR DEMAND

11 PRECISION FORESTRY MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 GOVERNMENT AGENCIES

- 11.2.1 STRINGENT CARBON EMISSION TARGETS TO FOSTER MARKET GROWTH

- 11.3 FORESTRY COMPANIES

- 11.3.1 INCLINATION TOWARD MINIMIZING WASTE AND ADHERING TO SUSTAINABLE FOREST MANAGEMENT STANDARDS TO DRIVE MARKET

- 11.4 AGRICULTURE & FARMING COOPERATIVES

- 11.4.1 FOCUS ON MAXIMIZING PRODUCTIVITY AND MAINTAINING ENVIRONMENTAL INTEGRITY TO SPUR ADOPTION

- 11.5 NON-PROFIT ORGANIZATIONS

- 11.5.1 FOREST RESTORATION, BIODIVERSITY PRESERVATION, WILDLIFE HABITAT PROTECTION INITIATIVES TO CREATE OPPORTUNITIES

- 11.6 OTHER END USERS

12 PRECISION FORESTRY MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Government initiatives promoting sustainable forest management to boost demand

- 12.2.3 CANADA

- 12.2.3.1 Emphasis on environmental stewardship, carbon management, and biodiversity conservation to fuel demand

- 12.2.4 MEXICO

- 12.2.4.1 Government support for reforestation and conservation programs to propel market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 UK

- 12.3.2.1 Rising focus on habitat restoration and sustainable timber operations to accelerate market growth

- 12.3.3 GERMANY

- 12.3.3.1 Widespread deployment of smart harvesting/CTL and complementary technologies to support market growth

- 12.3.4 FRANCE

- 12.3.4.1 Sustainable forest management programs to contribute to market growth

- 12.3.5 ITALY

- 12.3.5.1 Efforts toward habitat restoration, carbon credit tracking, and sustainable timber operations to foster market growth

- 12.3.6 SPAIN

- 12.3.6.1 Frequent wildfires in Mediterranean regions to facilitate adoption

- 12.3.7 POLAND

- 12.3.7.1 Reforestation initiatives and environmental monitoring programs to create growth opportunities

- 12.3.8 NORDICS

- 12.3.8.1 Elevating demand for advanced digital precision forestry technologies to stimulate market growth

- 12.3.9 RUSSIA

- 12.3.9.1 Sustainable harvesting and environmental conservation initiatives to promote market growth

- 12.3.10 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Strong focus on industrial-scale timber production and sustainable resource management to facilitate adoption

- 12.4.3 JAPAN

- 12.4.3.1 Emphasis on reducing labor intensity and adopting sustainable forestry practices to contribute to market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Necessity to capture real-time soil and environmental information to spike demand

- 12.4.5 INDIA

- 12.4.5.1 Government-led sustainable forest management programs to stimulate demand

- 12.4.6 AUSTRALIA

- 12.4.6.1 Active forest conservation efforts and structured government efforts to create opportunities

- 12.4.7 INDONESIA

- 12.4.7.1 Need to monitor illegal logging, track forest health, and implement reforestation projects to support market growth

- 12.4.8 MALAYSIA

- 12.4.8.1 Extensive forest land and strong focus on wildfire prevention to foster demand

- 12.4.9 THAILAND

- 12.4.9.1 Rising adoption of IoT sensors for real-time monitoring of soil health, tree growth, and environmental conditions to drive market

- 12.4.10 VIETNAM

- 12.4.10.1 Adoption of smart harvesting/CTL and geospatial technologies to propel market

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.1.1 Government-led afforestation and AI-enabled initiatives to boost adoption

- 12.5.2.2 Kuwait

- 12.5.2.2.1 Afforestation campaigns and urban greening initiatives to drive market

- 12.5.2.3 Oman

- 12.5.2.3.1 National tree-planting programs and technological interventions to create opportunities

- 12.5.2.4 Saudi Arabia

- 12.5.2.4.1 Smart green city projects to spur demand

- 12.5.2.5 UAE

- 12.5.2.5.1 Coastal afforestation and drone-assisted planting initiatives to drive market

- 12.5.2.6 Rest of Middle East

- 12.5.2.1 Bahrain

- 12.5.3 AFRICA

- 12.5.3.1 South Africa

- 12.5.3.1.1 Environmental sustainability, economic development, and climate change mitigation goals to accelerate demand

- 12.5.3.2 Rest of Africa

- 12.5.3.1 South Africa

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Brazil

- 12.5.4.1.1 Focus on environmental conservation to drive demand

- 12.5.4.2 Rest of South America

- 12.5.4.1 Brazil

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Offering footprint

- 13.7.5.4 Technology footprint

- 13.7.5.5 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 DEERE & COMPANY

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 PONSSE OYJ

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 KOMATSU LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 TRIMBLE INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 CATERPILLAR

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 TIGERCAT INTERNATIONAL INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Expansions

- 14.1.7 ROTTNE

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 ECO LOG

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 TOPCON

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Expansions

- 14.1.10 SAMPO ROSENLEW OY

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 DEERE & COMPANY

- 14.2 OTHER PLAYERS

- 14.2.1 TREEMETRICS

- 14.2.2 HITACHI CONSTRUCTION MACHINERY CO., LTD.

- 14.2.3 INSIGHT ROBOTICS

- 14.2.4 KESLA

- 14.2.5 HUSQVARNA GROUP

- 14.2.6 ASTEC INDUSTRIES, INC.

- 14.2.7 NV5 GLOBAL, INC.

- 14.2.8 BOBCAT COMPANY

- 14.2.9 OREGON TOOL, INC.

- 14.2.10 ARBORPRO

- 14.2.11 FIELD TRUTH INC

- 14.2.12 SATPALDA

- 14.2.13 TREEVIA FOREST TECHNOLOGIES

- 14.2.14 AB VOLVO

- 14.2.15 STORA ENSO

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PRECISION FORESTRY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 KEY PARTICIPANTS IN PRIMARY INTERVIEWS

- TABLE 4 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 5 PRECISION FORESTRY MARKET: RISK ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE TREND OF PRECISION FORESTRY HARVESTERS AND FORWARDERS OFFERED BY KEY PLAYERS, 2020-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF HARVESTER OFFERINGS, BY REGION, 2020-2024 (USD)

- TABLE 8 ROLE OF KEY COMPANIES IN ECOSYSTEM

- TABLE 9 IMPORT DATA FOR HS CODE 8432-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 8432-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 KEY PATENTS RELATED TO PRECISION FORESTRY

- TABLE 12 PRECISION FORESTRY MARKET: CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 MFN TARIFF FOR HS CODE 8432-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 KEY REGULATIONS PERTAINING TO PRECISION FORESTRY

- TABLE 19 PRECISION FORESTRY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 21 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 22 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 23 PRECISION FORESTRY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 24 PRECISION FORESTRY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 25 HARDWARE: PRECISION FORESTRY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 HARDWARE: PRECISION FORESTRY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 27 HARDWARE: PRECISION FORESTRY MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 28 HARDWARE: PRECISION FORESTRY MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 29 HARDWARE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 30 HARDWARE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 31 SOFTWARE: PRECISION FORESTRY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 32 SOFTWARE: PRECISION FORESTRY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 SOFTWARE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 34 SOFTWARE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 35 SERVICES: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 36 SERVICES: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 37 PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 38 PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 39 SMART HARVESTING/CTL: PRECISION FORESTRY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 40 SMART HARVESTING/CTL: PRECISION FORESTRY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 41 SMART HARVESTING/CTL: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 SMART HARVESTING/CTL: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 INVENTORY & YIELD MONITORING: PRECISION FORESTRY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 44 INVENTORY & YIELD MONITORING: PRECISION FORESTRY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 45 INVENTORY & YIELD MONITORING: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 INVENTORY & YIELD MONITORING: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 FIRE DETECTION: PRECISION FORESTRY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 48 FIRE DETECTION: PRECISION FORESTRY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 49 FIRE DETECTION: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 FIRE DETECTION: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 GEOSPACIAL: PRECISION FORESTRY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 52 GEOSPACIAL: PRECISION FORESTRY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 53 GEOSPATIAL: PRECISION FORESTRY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 54 GEOSPATIAL: PRECISION FORESTRY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 55 GEOSPATIAL: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 GEOSPATIAL: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 IOT: PRECISION FORESTRY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 58 IOT: PRECISION FORESTRY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 59 IOT: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 IOT: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 ROBOTICS & SENSORS: PRECISION FORESTRY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 62 ROBOTICS & SENSORS: PRECISION FORESTRY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 63 ROBOTICS & SENSORS: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 ROBOTICS & SENSORS: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 OTHER TECHNOLOGIES: PRECISION FORESTRY MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 66 OTHER TECHNOLOGIES: PRECISION FORESTRY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 67 OTHER TECHNOLOGIES: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 OTHER TECHNOLOGIES: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 PRECISION FORESTRY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 70 PRECISION FORESTRY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 FOREST MANAGEMENT & PLANNING: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 FOREST MANAGEMENT & PLANNING: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 HARVESTING & OPERATIONS: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 HARVESTING & OPERATIONS: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 SILVICULTURE: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 SILVICULTURE: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 FIRE MANAGEMENT & DETECTION: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 FIRE MANAGEMENT & DETECTION: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 INVENTORY & LOGISTICS MANAGEMENT: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 INVENTORY & LOGISTICS MANAGEMENT: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 ENVIRONMENTAL & CONSERVATION: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 ENVIRONMENTAL & CONSERVATION: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 REFORESTATION & AFFORESTATION: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 REFORESTATION & AFFORESTATION: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 PEST & DISEASE MANAGEMENT: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 PEST & DISEASE MANAGEMENT: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 SOIL TESTING: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 SOIL TESTING: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 WILDLIFE HABITAT MANAGEMENT: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 WILDLIFE HABITAT MANAGEMENT: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 GENETICS: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 GENETICS: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 OTHER APPLICATIONS: PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 OTHER APPLICATIONS: PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 PRECISION FORESTRY MARKET, BY SYSTEM ARCHITECTURE, 2021-2024 (USD MILLION)

- TABLE 96 PRECISION FORESTRY MARKET, BY SYSTEM ARCHITECTURE, 2025-2030 (USD MILLION)

- TABLE 97 PRECISION FORESTRY MARKET, BY OWNERSHIP TYPE, 2021-2024 (USD MILLION)

- TABLE 98 PRECISION FORESTRY MARKET, BY OWNERSHIP TYPE, 2025-2030 (USD MILLION)

- TABLE 99 PRECISION FORESTRY MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 100 PRECISION FORESTRY MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101 PRECISION FORESTRY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 PRECISION FORESTRY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 PRECISION FORESTRY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 PRECISION FORESTRY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: PRECISION FORESTRY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: PRECISION FORESTRY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 109 US: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 110 US: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 112 CANADA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 113 MEXICO: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 114 MEXICO: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 115 PRECISION FORESTRY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 PRECISION FORESTRY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 PRECISION FORESTRY MARKET IN EUROPE, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 PRECISION FORESTRY MARKET IN EUROPE, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 121 UK: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 122 UK: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 123 GERMANY: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 124 GERMANY: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 125 FRANCE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 126 FRANCE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 127 ITALY: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 128 ITALY: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 129 SPAIN: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 130 SPAIN: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 131 POLAND: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 132 POLAND: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 133 NORDICS: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 134 NORDICS: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 135 RUSSIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 136 RUSSIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 137 REST OF EUROPE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 138 REST OF EUROPE: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 139 PRECISION FORESTRY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 PRECISION FORESTRY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: PRECISION FORESTRY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: PRECISION FORESTRY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 145 CHINA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 146 CHINA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 147 JAPAN: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 148 JAPAN: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH KOREA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 152 INDIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 153 AUSTRALIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 154 AUSTRALIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 155 INDONESIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 156 INDONESIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 157 MALAYSIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 158 MALAYSIA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 159 THAILAND: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 160 THAILAND: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 161 VIETNAM: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 162 VIETNAM: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 165 PRECISION FORESTRY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 166 PRECISION FORESTRY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 167 ROW: PRECISION FORESTRY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 168 ROW: PRECISION FORESTRY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 ROW: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 170 ROW: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST: PRECISION FORESTRY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST: PRECISION FORESTRY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 175 AFRICA: PRECISION FORESTRY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 AFRICA: PRECISION FORESTRY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 AFRICA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 178 AFRICA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 179 SOUTH AMERICA: PRECISION FORESTRY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 SOUTH AMERICA: PRECISION FORESTRY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 182 SOUTH AMERICA: PRECISION FORESTRY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 183 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN PRECISION FORESTRY MARKET, 2021-2025

- TABLE 184 PRECISION FORESTRY MARKET: DEGREE OF COMPETITION, 2024

- TABLE 185 PRECISION FORESTRY MARKET: REGION FOOTPRINT

- TABLE 186 PRECISION FORESTRY MARKET: OFFERING FOOTPRINT

- TABLE 187 PRECISION FORESTRY MARKET: TECHNOLOGY FOOTPRINT

- TABLE 188 PRECISION FORESTRY MARKET: APPLICATION FOOTPRINT

- TABLE 189 PRECISION FORESTRY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 190 PRECISION FORESTRY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 191 PRECISION FORESTRY MARKET: PRODUCT LAUNCHES, JANUARY 2021-SEPTEMBER 2025

- TABLE 192 PRECISION FORESTRY MARKET: DEALS, JANUARY 2021-SEPTEMBER 2025

- TABLE 193 PRECISION FORESTRY MARKET: EXPANSIONS, JANUARY 2021-SEPTEMBER 2025

- TABLE 194 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 195 DEERE & COMPANY: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 196 DEERE & COMPANY: PRODUCT LAUNCHES

- TABLE 197 DEERE & COMPANY: DEALS

- TABLE 198 PONSSE OYJ: COMPANY OVERVIEW

- TABLE 199 PONSSE OYJ: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 200 PONSSE OYJ: PRODUCT LAUNCHES

- TABLE 201 PONSSE OYJ: DEALS

- TABLE 202 KOMATSU LTD.: BUSINESS OVERVIEW

- TABLE 203 KOMATSU LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 204 KOMATSU LTD.: PRODUCT LAUNCHES

- TABLE 205 KOMATSU LTD.: EXPANSIONS

- TABLE 206 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 207 TRIMBLE INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 208 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 209 TRIMBLE INC.: DEALS

- TABLE 210 CATERPILLAR: COMPANY OVERVIEW

- TABLE 211 CATERPILLAR: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 212 CATERPILLAR: PRODUCT LAUNCHES

- TABLE 213 CATERPILLAR: DEALS

- TABLE 214 TIGERCAT INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 215 TIGERCAT INTERNATIONAL INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 216 TIGERCAT INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 217 TIGERCAT INTERNATIONAL INC.: EXPANSIONS

- TABLE 218 ROTTNE: COMPANY OVERVIEW

- TABLE 219 ROTTNE: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 220 ROTTNE: PRODUCT LAUNCHES

- TABLE 221 ROTTNE: DEALS

- TABLE 222 ECO LOG: COMPANY OVERVIEW

- TABLE 223 ECO LOG: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 224 ECO LOG: PRODUCT LAUNCHES

- TABLE 225 TOPCON: COMPANY OVERVIEW

- TABLE 226 TOPCON: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 227 TOPCON: PRODUCT LAUNCHES

- TABLE 228 TOPCON: EXPANSIONS

- TABLE 229 SAMPO ROSENLEW OY: BUSINESS OVERVIEW

- TABLE 230 SAMPO ROSENLEW OY: PRODUCT/SOLUTION/SERVICE OFFERINGS

List of Figures

- FIGURE 1 PRECISION FORESTRY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION COVERED

- FIGURE 3 PRECISION FORESTRY MARKET: RESEARCH DESIGN

- FIGURE 4 DATA SOURCED FROM SECONDARY RESEARCH

- FIGURE 5 DATA SOURCED FROM PRIMARIES

- FIGURE 6 PRIMARY PARTICIPANT BREAKDOWN, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 INSIGHTS FROM KEY INDUSTRY EXPERTS

- FIGURE 8 PROCESS OF CONDUCTING PRIMARY AND SECONDARY RESEARCH

- FIGURE 9 PRECISION FORESTRY MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 1 (SUPPLY SIDE)

- FIGURE 10 PRECISION FORESTRY MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (SUPPLY SIDE)

- FIGURE 11 PRECISION FORESTRY MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 3 (DEMAND SIDE)

- FIGURE 12 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

- FIGURE 13 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

- FIGURE 14 DATA TRIANGULATION: PRECISION FORESTRY MARKET

- FIGURE 15 PRECISION FORESTRY MARKET: RESEARCH LIMITATIONS

- FIGURE 16 PRECISION FORESTRY MARKET SIZE, 2021-2030

- FIGURE 17 SOFTWARE TO BE MOST RAPIDLY EXPANDING SEGMENT BETWEEN 2025 AND 2030

- FIGURE 18 FIXED/STATIONARY SYSTEMS TO EXHIBIT HIGHER CAGR THAN MOBILE/HANDHELD SYSTEMS DURING FORECAST PERIOD

- FIGURE 19 INDUSTRIAL FORESTRY COMPANIES TO EXPERIENCE PRONOUNCED GROWTH DURING FORECAST PERIOD

- FIGURE 20 PRECISION FORESTRY MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 GROWING USE OF REMOTE SENSING AND GIS TECHNOLOGIES ACROSS FORESTRY OPERATIONS TO DRIVE MARKET

- FIGURE 22 FORESTRY COMPANIES TO ACCOUNT FOR MAJORITY OF MARKET SHARE IN 2030

- FIGURE 23 SMART HARVESTING/CTL TECHNOLOGY TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 24 HARVESTING & OPERATIONS APPLICATIONS TO SECURE PROMINENT MARKET SHARE IN 2030

- FIGURE 25 INDIA TO RECORD HIGHEST CAGR IN GLOBAL PRECISION FORESTRY MARKET DURING FORECAST PERIOD

- FIGURE 26 PRECISION FORESTRY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 IMPACT ANALYSIS: DRIVERS

- FIGURE 28 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 29 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 30 IMPACT ANALYSIS: CHALLENGES

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 AVERAGE SELLING PRICE TREND OF PRECISION FORESTRY HARVESTERS, BY KEY PLAYER, 2020-2024

- FIGURE 33 AVERAGE SELLING PRICE TREND OF PRECISION FORESTRY FORWARDERS, BY KEY PLAYER, 2020-2024

- FIGURE 34 AVERAGE SELLING PRICE TREND OF PRECISION FORESTRY HARVESTERS, BY REGION, 2020-2024

- FIGURE 35 PRECISION FORESTRY SUPPLY CHAIN ANALYSIS

- FIGURE 36 PRECISION FORESTRY ECOSYSTEM ANALYSIS

- FIGURE 37 INVESTMENT AND FUNDING SCENARIO

- FIGURE 38 IMPORT SCENARIO FOR HS CODE 8432-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 39 EXPORT SCENARIO FOR HS CODE 8432-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 40 PATENT ANALYSIS, 2015-2024

- FIGURE 41 PORTER'S FIVE FORCES ANALYSIS: PRECISION FORESTRY MARKET

- FIGURE 42 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 43 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 44 IMPACT OF AI/GEN AI ON PRECISION FORESTRY MARKET

- FIGURE 45 SOFTWARE OFFERINGS TO EXHIBIT HIGHEST CAGR IN PRECISION FORESTRY MARKET BETWEEN 2025 AND 2030

- FIGURE 46 SMART HARVESTING/CTL TECHNOLOGY TO RECORD HIGHEST CAGR IN PRECISION FORESTRY MARKET FROM 2025 TO 2030

- FIGURE 47 FIRE MANAGEMENT & DETECTION APPLICATION TO RECORD HIGHEST CAGR IN PRECISION FORESTRY MARKET FROM 2025 TO 2030

- FIGURE 48 FIXED/STATIONARY SYSTEMS TO DOMINATE PRECISION FORESTRY MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 49 INDUSTRIAL FORESTRY COMPANIES TO LEAD PRECISION FORESTRY MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 50 NON-PROFIT ORGANIZATIONS TO DEMONSTRATE ROBUST GROWTH IN PRECISION FORESTRY MARKET DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 52 NORTH AMERICA: PRECISION FORESTRY MARKET SNAPSHOT

- FIGURE 53 EUROPE: PRECISION FORESTRY MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC: PRECISION FORESTRY MARKET SNAPSHOT

- FIGURE 55 ROW: PRECISION FORESTRY MARKET SNAPSHOT

- FIGURE 56 PRECISION FORESTRY MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 57 MARKET SHARE ANALYSIS, 2024

- FIGURE 58 COMPANY VALUATION

- FIGURE 59 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 60 BRAND/PRODUCT COMPARISON

- FIGURE 61 PRECISION FORESTRY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 62 PRECISION FORESTRY MARKET: COMPANY FOOTPRINT

- FIGURE 63 PRECISION FORESTRY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 64 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 65 PONSSE OYJ: COMPANY SNAPSHOT

- FIGURE 66 KOMATSU LTD.: COMPANY SNAPSHOT

- FIGURE 67 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 68 CATERPILLAR: COMPANY SNAPSHOT