PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1869554

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1869554

Organic Feed Market by Ingredient Source (Cereals & Grains, Oilseed Meals & Pulses, Fibers & Forage, Additives), Form (Pellets, Crumbles, Mashes), Livestock, Nutrient Source, Farm Size, Manufacturing Technology, and Region - Global Forecast to 2030

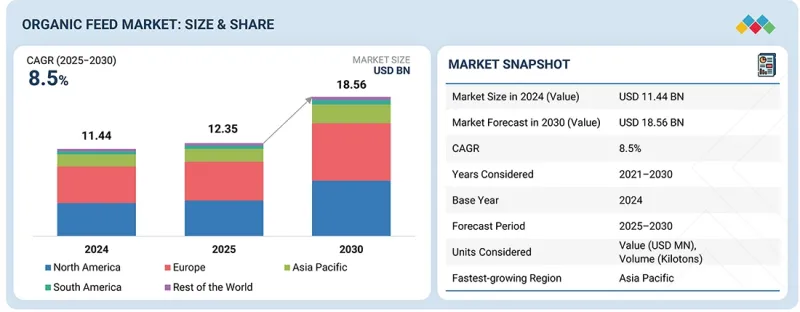

The organic feed market is estimated at USD 12.35 billion in 2025 and is projected to reach USD 18.56 billion by 2030, at a CAGR of 8.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (KT) |

| Segments | By Ingredient Source, Form, Nutrient Source, Livestock, Farm Size, Manufacturing Technology, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

The global organic feed market is experiencing significant growth, driven by the increasing adoption of organic livestock farming practices, expansion of organic farmland, and innovation in feed formulations. The provision of organic feed and organic animal products is a sustainable solution to meet the growing demand for high-quality feed and animal protein.

Conventional farming or feed production involves the heavy use of pesticides and insecticides, which poses significant harm to both animals and human health. These crop protection products can contaminate agricultural commodities, resulting in crop contamination and subsequent losses. To address these concerns, agricultural producers are increasingly turning to organic farming. However, high production costs, pricing, time, and complexity associated with the organic certification process, as well as the lack of commercially available and permitted organic feed supplements and additives, are restraining factors for the organic feed market.

"Pellet form of organic feed is expected to hold a significant share during the forecast period"

The pelleted form is the most common and preferred form of organic feed, prepared by applying moisture, heat, and pressure to the mashed form of the feed. Pellets also contain a higher level of binders compared to the mashed form of organic feed. The pelleted form of organic feed encourages early intake of organic feed. Pelleting also reduces wastage, as it is easy to feed to the animals, easy to store, and is also preferred by backyard chicken farmers. The pellet sizes differ based on the animal and their age. Small pellets are beneficial for animals, as they enhance performance and early growth rates. These factors drive the use of pelletized compound organic feed. However, the pelleted organic feed is more expensive than the mashed form.

"Cereals & grains segment is expected to hold a strong market share among the ingredient sources in the organic feed market"

The cereals & grains segment holds a significant share in the organic feed market as they serve as the primary energy source in animal diets, supplying essential carbohydrates, starch, and moderate protein content for growth and maintenance. Ingredients such as organic corn, wheat, barley, oats, and rice form the nutritional and economic foundation of most feed formulations. Wider availability, established organic certification systems, and compatibility across livestock types, particularly poultry, ruminants, and swine, further reinforce their dominance. Additionally, growing organic grain cultivation and integrating the supply chain support consistent sourcing and cost efficiency, thereby strengthening this segment's market share.

"North America is expected to dominate the global organic feed market during the forecast period"

The US is one of the largest livestock-producing countries in North America. According to the United States Department of Agriculture (USDA), the demand for poultry meat & poultry products, swine meat, and organic foods is expected to grow; therefore, investments are made to increase production capacity. Furthermore, the increasing trend of precision feeding techniques in the region, driven by demand for quality feed, has resulted in increased expenditure and a focus on livestock nutrition, which has, in turn, boosted the demand for organic ingredients in livestock feed.

According to the USDA, consumer demand for organically produced goods continues to grow in the US, creating opportunities for farmers in a wide range of products. The region is one of the largest producers and consumers of major ingredients involved in manufacturing organic feed, such as corn, soybean, and wheat. This is projected to further increase the demand for organic feed in the region.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the organic feed market.

- By Company Type: Tier 1 - 30%, Tier 2 - 25%, and Tier 3 - 45%

- By Designation: Directors - 30%, Managers - 25%, Others - 45%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 40%, and Rest of the World -10%

Prominent companies in the market include Cargill, Incorporated (US), Purina Animal Nutrition LLC (US), ForFarmers Group (Netherlands), Bern Aqua NV (ADM) (Belgium), Aller Aqua A/S (Denmark), The Organic Feed Company (UK), Scratch & Peck (US), Country Heritage Feeds (Australia), Green Mountain Feeds (US), Unique Organics Ltd (India), Kreamer Feed (Nature's Best Organic Feeds) (US), Yorktown Organics, LLC (US), Modesto Milling Inc. (US), Hindustan Animal Feeds (India), Ardent Mills (US), and others.

Research Coverage

This research report categorizes the organic feed market by ingredient source (cereals & grains, oilseeds, meals & pulses, fibers & forage, additives, and other ingredient sources), by form (pellets, crumbles, mashes, and other forms), by nutrient source (energy, protein, fiber, minerals & vitamins, and performance additives), by livestock (poultry, ruminants, swine, aquatic animals, and companion animals), by farm size (large-scale commercial farms (>500 acres), medium-scale farms (50-500 acres), and small-scale farms (<50 acres)), by manufacturing technology (qualitative) (hammer-milling & grinding, pelleting, expander, extrusion, other manufacturing technologies), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope encompasses detailed information on the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the organic feed industry. A thorough analysis of the key industry players has been done to provide insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the organic feed market. This report provides a competitive analysis of emerging startups in the organic feed market ecosystem. Furthermore, the study covers industry-specific trends, including technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others.

Reasons to Buy This Report

The report provides market leaders/new entrants with information on the closest approximations of revenue numbers for the overall organic feed and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (growing organic livestock farming), restraints (high production costs and pricing), opportunities (emergence of plant-based & alternative feed ingredients), and challenges (limited supply of organic feed ingredients) influencing the growth of the organic feed market

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the organic feed market

- Market Development: Comprehensive information about lucrative markets-analysis of organic feed across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the organic feed market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Cargill, Incorporated (US), Purina Animal Nutrition LLC (US), ForFarmers Group (Netherlands), Bern Aqua NV (ADM) (Belgium), Aller Aqua A/S (Denmark), The Organic Feed Company (UK), Scratch & Peck (US), Country Heritage Feeds (Australia), Green Mountain Feeds (US), Unique Organics Ltd (India), Kreamer Feed (Nature's Best Organic Feeds) (US), Yorktown Organics, LLC (US), Modesto Milling Inc. (US), Hindustan Animal Feeds (India), Ardent Mills (US), and other players in the organic feed market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE AND SEGMENTATION

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 BASE NUMBER CALCULATION

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ORGANIC FEED MARKET

- 4.2 ORGANIC FEED MARKET, BY FORM AND REGION

- 4.3 ORGANIC FEED MARKET, BY INGREDIENT SOURCE

- 4.4 ORGANIC FEED MARKET, BY LIVESTOCK

- 4.5 ORGANIC FEED MARKET, BY NUTRIENT SOURCE

- 4.6 ORGANIC FEED MARKET, BY FARM SIZE

- 4.7 ORGANIC FEED MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Shift from organic certification to brand differentiation

- 5.2.1.2 Feed-to-fork integration by large retailers

- 5.2.1.3 Rise of functional organic feed additives

- 5.2.1.4 Transition to circular bioeconomy models

- 5.2.2 RESTRAINTS

- 5.2.2.1 Certification bottlenecks and bureaucratic delays

- 5.2.2.2 Organic input volatility

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Localized micro-milling and contract farming

- 5.2.3.2 Rising investment in organic protein alternatives

- 5.2.3.3 Convergence with regenerative agriculture

- 5.2.4 CHALLENGES

- 5.2.4.1 Fragmented certification ecosystem

- 5.2.4.2 Scaling organic aquafeed production

- 5.2.4.3 Inconsistent organic seed supply chain

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN ORGANIC FEED MARKET

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.5.1 KEY MOVES AND STRATEGIC FOCUS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMICS OUTLOOK

- 6.2.1 INTRODUCTION

- 6.2.2 AGRICULTURAL COMMODITY CYCLES

- 6.2.3 SUSTAINABILITY & CARBON-POLICY INCENTIVES

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 INPUTS & ORGANIC CROP PRODUCTION

- 6.3.2 RAW MATERIAL SOURCING & AGGREGATION

- 6.3.3 ORGANIC FEED MILLING & PROCESSING

- 6.3.4 PACKAGING, LABELING, & ORGANIC CERTIFICATION COMPLIANCE

- 6.3.5 DISTRIBUTION & LOGISTICS

- 6.3.6 END-USE BY ORGANIC LIVESTOCK & POULTRY FARMERS

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY LIVESTOCK

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 230400)

- 6.7.2 EXPORT SCENARIO (HS CODE 230400)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 CIRCULAR INSECT PROTEIN INTEGRATION TO STRENGTHEN ORGANIC FEED SUPPLY RESILIENCE

- 6.11.2 DIGITALIZED LOW-TEMPERATURE FEED PROCESSING FOR ORGANIC QUALITY & COMPLIANCE

- 6.11.3 REGIONAL ORGANIC FEED ECOSYSTEM DEVELOPMENT THROUGH LOCALIZED SOURCING & TRACEABILITY

- 6.12 IMPACT OF 2025 US TARIFF - ORGANIC FEED MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRIES/REGIONS

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

7 TECHNOLOGY ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 7.1 KEY TECHNOLOGIES

- 7.1.1 FEED FORMULATION TECHNOLOGIES

- 7.1.2 FEED PRODUCTION TECHNOLOGIES

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 PRECISION FEEDING AND FARM MANAGEMENT SYSTEMS

- 7.2.2 BLOCKCHAIN FOR TRACEABILITY AND TRANSPARENCY

- 7.2.3 IOT AND SENSORS

- 7.3 ADJACENT TECHNOLOGIES

- 7.3.1 ALTERNATIVE PROTEIN SOURCES

- 7.3.2 REGENERATIVE AGRICULTURE

- 7.3.3 GENETIC TECHNOLOGIES

- 7.3.4 AQUAPONICS AND INTEGRATED SYSTEMS

- 7.4 PATENT ANALYSIS

- 7.4.1 INTRODUCTION

- 7.4.2 METHODOLOGY

- 7.4.3 DOCUMENT TYPE

- 7.4.4 JURISDICTION ANALYSIS

- 7.4.5 LIST OF MAJOR PATENTS

- 7.5 FUTURE APPLICATIONS

- 7.5.1 CARBON-NEGATIVE FEED FORMULATIONS

- 7.5.2 BLOCKCHAIN-BASED FEED TRACEABILITY APPS

- 7.5.3 AI-BASED FEED OPTIMIZATION MODELS

- 7.5.4 BIOACTIVE FUNCTIONAL FEEDS

- 7.5.5 SMART-FEED SILOS & SELF-MONITORING SYSTEMS

- 7.6 IMPACT OF AI/GEN AI ON ANIMAL NUTRITION INDUSTRY

- 7.6.1 TOP USE CASES AND MARKET POTENTIAL

- 7.6.2 BEST PRACTICES IN LIVESTOCK FEED PROCESSING

- 7.6.3 CASE STUDIES OF AI IMPLEMENTATION IN ORGANIC FEED MARKET

- 7.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.6.5 READINESS TO ADOPT GENERATIVE AI IN ORGANIC FEED MARKET

- 7.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 7.7.1 CARGILL - CIRCULAR PROTEIN INNOVATION THROUGH INSECT-BASED FEED SOLUTIONS

- 7.7.2 INNOVAFEED - UPCYCLING ORGANIC BY-PRODUCTS INTO HIGH-PROTEIN FEED INGREDIENTS

- 7.7.3 BUHLER GROUP - SMART FEED MILLS FOR SUSTAINABLE ORGANIC PRODUCTION

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.1.3 LABELING REQUIREMENTS AND CLAIMS

- 8.1.4 ANTICIPATED REGULATORY CHANGES IN NEXT 5-10 YEARS

- 8.1.4.1 Stronger traceability and digital audit requirements

- 8.1.4.2 Harmonization and mutual recognition of organic standards

- 8.1.4.3 Mandatory digital labeling and provenance claims

- 8.1.4.4 Defined pathways for novel/alternative proteins

- 8.2 SUSTAINABILITY INITIATIVES

- 8.2.1 SUSTAINABLE SOURCING

- 8.2.2 CARBON FOOTPRINT REDUCTION INITIATIVES

- 8.2.3 CIRCULAR ECONOMY APPROACHES

- 8.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

9 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 9.5 MARKET PROFITABILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES, BY INGREDIENT SOURCE

10 ORGANIC FEED MARKET, BY INGREDIENT SOURCE (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 10.1 INTRODUCTION

- 10.2 CEREALS & GRAINS

- 10.2.1 PROVIDING ESSENTIAL CARBOHYDRATES FOR ANIMAL GROWTH AND PRODUCTIVITY

- 10.2.2 CORN

- 10.2.3 WHEAT

- 10.2.4 BARLEY

- 10.2.5 OTHER CEREALS & GRAINS (OATS, TRITICALE, RYE, SORGHUM, RICE, MILLET)

- 10.3 OILSEEDS, MEALS, & PULSES

- 10.3.1 POWERING HEALTHY, SUSTAINABLE ANIMAL NUTRITION NATURALLY

- 10.3.2 SOYBEAN

- 10.3.3 RAPESEED

- 10.3.4 PEAS

- 10.3.5 OTHER OILSEEDS, MEALS, & PULSES

- 10.4 FIBERS & FORAGE

- 10.4.1 SUPPORTING OPTIMAL GUT FUNCTION, NUTRIENT ABSORPTION, AND OVERALL WELL-BEING IN LIVESTOCK

- 10.5 ADDITIVES

- 10.5.1 ENRICHING ORGANIC NUTRITION WITH ESSENTIAL BOOSTERS

- 10.5.2 VITAMINS

- 10.5.3 MINERALS

- 10.5.4 FUNCTIONAL ADDITIVES

11 ORGANIC FEED MARKET, BY FORM (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 11.1 INTRODUCTION

- 11.2 PELLETS

- 11.2.1 EFFICIENCY MEETS SUSTAINABILITY IN EVERY PELLET

- 11.3 CRUMBLES

- 11.3.1 NUTRIENT-RICH CRUMBLES FOR SUSTAINABLE LIVESTOCK GROWTH

- 11.4 MASHES

- 11.4.1 BLENDED NATURALLY, WIDELY USED IN RUMINANTS AND LAYER POULTRY FOR NATURAL NUTRITION

- 11.5 OTHER FORMS

12 ORGANIC FEED MARKET, BY LIVESTOCK (MARKET SIZE & FORECAST TO 2030 - USD MILLION & KILOTONS)

- 12.1 INTRODUCTION

- 12.2 POULTRY

- 12.2.1 ORGANIC NUTRITION FOR SUSTAINABLE POULTRY PRODUCTION

- 12.2.2 BROILERS

- 12.2.3 LAYERS

- 12.2.4 BREEDERS

- 12.2.5 OTHER POULTRY

- 12.3 RUMINANTS

- 12.3.1 SUPPORTING SUSTAINABLE DAIRY AND MEAT PRODUCTION

- 12.3.2 DAIRY CATTLE

- 12.3.3 BEEF CATTLE

- 12.3.4 CALVES

- 12.3.5 OTHER RUMINANTS (GOATS AND LAMBS)

- 12.4 SWINE

- 12.4.1 ENSURING STRONGER IMMUNITY, EFFICIENT GROWTH, AND GREENER PORK INDUSTRY

- 12.4.2 STARTER

- 12.4.3 GROWER

- 12.4.4 SOW

- 12.5 AQUATIC ANIMALS

- 12.5.1 DRIVING SUSTAINABLE AQUACULTURE WITH NATURAL INGREDIENTS AND RESPONSIBLE FARMING PRACTICES

- 12.5.2 FISH

- 12.5.3 CRUSTACEANS

- 12.5.4 MOLLUSKS

- 12.5.5 OTHER AQUATIC ANIMALS

- 12.6 COMPANION ANIMALS

- 12.6.1 SUPPORTING VITALITY, LONGEVITY, AND OVERALL WELL-BEING IN HOUSEHOLD PETS

13 ORGANIC FEED MARKET, BY FARM SIZE (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 13.1 INTRODUCTION

- 13.2 LARGE-SCALE COMMERCIAL FARMS (>500 ACRES)

- 13.2.1 LARGE FARMS LEADING ORGANIC REVOLUTION

- 13.3 MEDIUM-SCALE FARMS (50-500 ACRES)

- 13.3.1 BALANCING PRODUCTIVITY AND SUSTAINABILITY IN ORGANIC FARMING

- 13.4 SMALL-SCALE FARMS (<50 ACRES)

- 13.4.1 NURTURING LOCAL FIELDS TO GLOBAL ORGANIC GROWTH

14 ORGANIC FEED MARKET, BY NUTRIENT SOURCE (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 14.1 INTRODUCTION

- 14.2 ENERGY SOURCES

- 14.2.1 POWERING LIVESTOCK METABOLISM WITH CLEAN, SUSTAINABLE ENERGY

- 14.3 PROTEIN SOURCES

- 14.3.1 SUPPORTING GROWTH, REPAIR, AND PRODUCTIVITY

- 14.4 FIBER SOURCES

- 14.4.1 PROMOTING DIGESTIVE WELLNESS AND NUTRIENT EFFICIENCY

- 14.5 MINERAL & VITAMIN SOURCES

- 14.5.1 ENSURING OVERALL HEALTH AND IMMUNITY

- 14.6 PERFORMANCE ADDITIVES

- 14.6.1 BOOSTING EFFICIENCY AND ANIMAL WELL-BEING-NATURALLY

15 ORGANIC FEED MARKET, BY MANUFACTURING TECHNOLOGY

- 15.1 INTRODUCTION

- 15.2 HAMMER-MILLING & GRINDING

- 15.3 PELLETING

- 15.4 EXPANDER

- 15.5 EXTRUSION

- 15.6 OTHER MANUFACTURING TECHNOLOGIES

16 ORGANIC FEED MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - USD MILLION & KILOTONS)

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Growing focus on innovation, sustainability, and certified organic integrity in livestock nutrition to drive market

- 16.2.2 CANADA

- 16.2.2.1 Emphasis on sustainable livestock production through trusted organic feed solutions to drive market

- 16.2.3 MEXICO

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 GERMANY

- 16.3.1.1 Green transition to boost demand for organic feed

- 16.3.2 UK

- 16.3.2.1 Promotion of sustainable agricultural practices to drive market

- 16.3.3 FRANCE

- 16.3.3.1 Sustainable consumption trends to drive market

- 16.3.4 SPAIN

- 16.3.4.1 Robust agricultural base and growing consumer awareness to drive market

- 16.3.5 ITALY

- 16.3.5.1 Green feed initiatives and livestock system transition to drive market

- 16.3.6 NETHERLANDS

- 16.3.6.1 Increase in organic farming activity to drive market

- 16.3.7 REST OF EUROPE

- 16.3.1 GERMANY

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Green agricultural vision to drive market

- 16.4.2 INDIA

- 16.4.2.1 Shift toward natural nutrition to drive market

- 16.4.3 JAPAN

- 16.4.3.1 Focus on sustainability, animal welfare, and food safety to drive market

- 16.4.4 AUSTRALIA & NEW ZEALAND

- 16.4.4.1 Emphasis on organic production systems and traceable feed ingredients to drive market

- 16.4.5 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.5.1.1 Focus on nurturing sustainable livestock with organic nutrition to drive market

- 16.5.2 ARGENTINA

- 16.5.2.1 Strengthening sustainable livestock through clean and traceable feed systems to drive market

- 16.5.3 REST OF SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.6 REST OF THE WORLD

- 16.6.1 AFRICA

- 16.6.1.1 Increasing focus on livestock sustainability through natural and resource-efficient feed innovation to drive market

- 16.6.2 MIDDLE EAST

- 16.6.2.1 Rising concerns over food safety and import dependency to drive market

- 16.6.1 AFRICA

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 17.3 REVENUE ANALYSIS

- 17.4 MARKET SHARE ANALYSIS

- 17.5 BRAND/PRODUCT COMPARISON

- 17.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.6.1 STARS

- 17.6.2 EMERGING LEADERS

- 17.6.3 PERVASIVE PLAYERS

- 17.6.4 PARTICIPANTS

- 17.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.6.5.1 Company footprint

- 17.6.5.2 Regional footprint

- 17.6.5.3 Ingredient source footprint

- 17.6.5.4 Form footprint

- 17.6.5.5 Livestock footprint

- 17.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.7.1 PROGRESSIVE COMPANIES

- 17.7.2 RESPONSIVE COMPANIES

- 17.7.3 DYNAMIC COMPANIES

- 17.7.4 STARTING BLOCKS

- 17.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.7.5.1 Detailed list of key startups/SMEs

- 17.7.5.2 Competitive benchmarking of key startups/SMEs

- 17.8 COMPANY VALUATION AND FINANCIAL METRICS

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

- 17.9.4 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 CARGILL, INCORPORATED

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Services/Solutions offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches & enhancements

- 18.1.1.3.2 Deals

- 18.1.1.3.3 Expansions

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses & competitive threats

- 18.1.2 PURINA ANIMAL NUTRITION LLC

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Services/Solutions offered

- 18.1.2.3 Recent developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses & competitive threats

- 18.1.3 FORFARMERS UK

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Services/Solutions offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Deals

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses & competitive threats

- 18.1.4 ADM

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Services/Solutions offered

- 18.1.4.3 Recent developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses & competitive threats

- 18.1.5 SCRATCH & PECK

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Services/Solutions offered

- 18.1.5.3 Recent developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses & competitive threats

- 18.1.6 ALLER AQUA A/S

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Services/Solutions offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Other developments

- 18.1.6.4 MnM view

- 18.1.7 THE ORGANIC FEED COMPANY

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Services/Solutions offered

- 18.1.7.3 Recent developments

- 18.1.7.4 MnM view

- 18.1.8 COUNTRY HERITAGE FEEDS

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Services/Solutions offered

- 18.1.8.3 Recent developments

- 18.1.8.4 MnM view

- 18.1.9 GREEN MOUNTAIN FEEDS

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Services/Solutions offered

- 18.1.9.3 Recent developments

- 18.1.9.4 MnM view

- 18.1.10 UNIQUE ORGANICS LTD.

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Services/Solutions offered

- 18.1.10.3 Recent developments

- 18.1.10.4 MnM view

- 18.1.11 KREAMER FEED

- 18.1.11.1 Business overview

- 18.1.11.2 Products/Services/Solutions offered

- 18.1.11.3 Recent developments

- 18.1.11.4 MnM view

- 18.1.12 YORKTOWN ORGANICS, LLC

- 18.1.12.1 Business overview

- 18.1.12.2 Products/Services/Solutions offered

- 18.1.12.3 Recent developments

- 18.1.12.4 MnM view

- 18.1.13 MODESTO MILLING INC.

- 18.1.13.1 Business overview

- 18.1.13.2 Products/Services/Solutions offered

- 18.1.13.3 Recent developments

- 18.1.13.4 MnM view

- 18.1.14 HINDUSTAN ANIMAL FEEDS

- 18.1.14.1 Business overview

- 18.1.14.2 Products/Services/Solutions offered

- 18.1.14.3 Recent developments

- 18.1.14.4 MnM view

- 18.1.15 ARDENT MILLS

- 18.1.15.1 Business overview

- 18.1.15.2 Products/Services/Solutions offered

- 18.1.15.3 Recent developments

- 18.1.15.4 MnM view

- 18.1.1 CARGILL, INCORPORATED

- 18.2 OTHER PLAYERS

- 18.2.1 CIZERON BIO

- 18.2.1.1 Business overview

- 18.2.1.2 Products/Services/Solutions offered

- 18.2.1.3 Recent developments

- 18.2.1.4 MnM view

- 18.2.2 JONES FEED MILLS LTD.

- 18.2.2.1 Business overview

- 18.2.2.2 Products/Services/Solutions offered

- 18.2.2.3 Recent developments

- 18.2.2.4 MnM view

- 18.2.3 COYOTE CREEK FARM

- 18.2.3.1 Business overview

- 18.2.3.2 Products/Services/Solutions offered

- 18.2.3.3 Recent developments

- 18.2.3.4 MnM view

- 18.2.4 PETERSON ORGANIC FEEDS

- 18.2.4.1 Business overview

- 18.2.4.2 Products/Services/Solutions offered

- 18.2.4.3 Recent developments

- 18.2.4.4 MnM view

- 18.2.5 FARMSTEAD ORGANICS

- 18.2.5.1 Business overview

- 18.2.5.2 Products/Services/Solutions offered

- 18.2.5.3 Recent developments

- 18.2.5.4 MnM view

- 18.2.6 CANADIAN ORGANIC FEEDS LTD.

- 18.2.7 AUS ORGANIC FEEDS

- 18.2.8 BIOMUHLE + KRAUTERFUTTER GMBH

- 18.2.9 BLUE STEM ORGANIC FEED MILL

- 18.2.10 GRAHAM'S ORGANICS

- 18.2.1 CIZERON BIO

19 ADJACENT & RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 STUDY LIMITATIONS

- 19.3 FEED ADDITIVES MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.4 COMPOUND FEED MARKET

- 19.4.1 MARKET DEFINITION

- 19.4.2 MARKET OVERVIEW

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES ON ORGANIC FEED MARKET

- TABLE 3 ROLES OF COMPANIES IN ORGANIC FEED ECOSYSTEM

- TABLE 4 LEADING IMPORTERS OF HS CODE 230400-COMPLIANT PRODUCTS, 2024 (USD BILLION)

- TABLE 5 LEADING EXPORTERS OF HS CODE 230400-COMPLIANT PRODUCTS, 2024 (USD BILLION)

- TABLE 6 ORGANIC FEED MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 7 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 8 ORGANIC FEED MARKET: TOTAL NUMBER OF PATENTS, 2015-OCTOBER 2025

- TABLE 9 TOP USE CASES AND MARKET POTENTIAL

- TABLE 10 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 11 ORGANIC FEED MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 12 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 INTERNATIONAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 GLOBAL INDUSTRY STANDARDS IN ORGANIC FEED MARKET

- TABLE 19 LABELING REQUIREMENTS AND CLAIMS IN ORGANIC FEED MARKET

- TABLE 20 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN ORGANIC FEED MARKET

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY FORM

- TABLE 22 KEY BUYING CRITERIA, BY FORM

- TABLE 23 UNMET NEEDS IN ORGANIC FEED MARKET, BY END-USE INDUSTRY

- TABLE 24 COST DYNAMICS IN ORGANIC FEED MARKET

- TABLE 25 MARGIN OPPORTUNITIES IN ORGANIC FEED MARKET, BY INGREDIENT SOURCE

- TABLE 26 ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2021-2024 (USD MILLION)

- TABLE 27 ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 28 CEREALS & GRAINS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 CEREALS & GRAINS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 CEREALS & GRAINS: ORGANIC FEED MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 31 CEREALS & GRAINS: ORGANIC FEED MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 32 OILSEEDS, MEALS, & PULSES: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 OILSEEDS, MEALS, & PULSES: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 OILSEEDS, MEALS, & PULSES: ORGANIC FEED MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 35 OILSEEDS, MEALS, & PULSES: ORGANIC FEED MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 36 FIBERS & FORAGE: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 FIBERS & FORAGE: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 ADDITIVES: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 ADDITIVES: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 ADDITIVES: ORGANIC FEED MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 41 ADDITIVES: ORGANIC FEED MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 42 ORGANIC FEED MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 43 ORGANIC FEED MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 44 PELLETS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 PELLETS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 CRUMBLES: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 CRUMBLES: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 MASHES: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 MASHES: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 OTHER FORMS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 OTHER FORMS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 53 ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 54 ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (KILOTONS)

- TABLE 55 ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (KILOTONS)

- TABLE 56 POULTRY: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 POULTRY: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 POULTRY: ORGANIC FEED MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 59 POULTRY: ORGANIC FEED MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 60 POULTRY: ORGANIC FEED MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 61 POULTRY: ORGANIC FEED MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 62 RUMINANTS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 RUMINANTS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 RUMINANTS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 65 RUMINANTS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 66 RUMINANTS: ORGANIC FEED MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 67 RUMINANTS: ORGANIC FEED MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 68 SWINE: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 SWINE: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 SWINE: ORGANIC FEED MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 71 SWINE: ORGANIC FEED MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 72 SWINE: ORGANIC FEED MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 73 SWINE: ORGANIC FEED MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 74 AQUATIC ANIMALS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 AQUATIC ANIMALS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 AQUATIC ANIMALS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 77 AQUATIC ANIMALS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 78 AQUATIC ANIMALS: ORGANIC FEED MARKET, BY SUBTYPE, 2021-2024 (USD MILLION)

- TABLE 79 AQUATIC ANIMALS: ORGANIC FEED MARKET, BY SUBTYPE, 2025-2030 (USD MILLION)

- TABLE 80 COMPANION ANIMALS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 COMPANION ANIMALS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 COMPANION ANIMALS: ORGANIC FEED MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 83 COMPANION ANIMALS: ORGANIC FEED MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 84 ORGANIC FEED MARKET, BY FARM SIZE, 2021-2024 (USD MILLION)

- TABLE 85 ORGANIC FEED MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 86 ORGANIC FEED MARKET, BY NUTRIENT SOURCE, 2021-2024 (USD MILLION)

- TABLE 87 ORGANIC FEED MARKET, BY NUTRIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 88 ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 ORGANIC FEED MARKET, BY REGION, 2021-2024 (KILOTONS)

- TABLE 91 ORGANIC FEED MARKET, BY REGION, 2025-2030 (KILOTONS)

- TABLE 92 NORTH AMERICA: ORGANIC FEED MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: ORGANIC FEED MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: ORGANIC FEED MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: ORGANIC FEED MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (KILOTONS)

- TABLE 101 NORTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (KILOTONS)

- TABLE 102 US: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 103 US: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 104 CANADA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 105 CANADA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 106 MEXICO: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 107 MEXICO: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 108 EUROPE: ORGANIC FEED MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 EUROPE: ORGANIC FEED MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2021-2024 (USD MILLION)

- TABLE 111 EUROPE: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: ORGANIC FEED MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 113 EUROPE: ORGANIC FEED MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 115 EUROPE: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (KILOTONS)

- TABLE 117 EUROPE: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (KILOTONS)

- TABLE 118 GERMANY: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 119 GERMANY: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 120 UK: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 121 UK: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 122 FRANCE: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 123 FRANCE: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 124 SPAIN: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 125 SPAIN: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 126 ITALY: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 127 ITALY: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 128 NETHERLANDS: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 129 NETHERLANDS: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 130 REST OF EUROPE: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 131 REST OF EUROPE: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: ORGANIC FEED MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ORGANIC FEED MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2021-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: ORGANIC FEED MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 137 ASIA PACIFIC: ORGANIC FEED MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (KILOTONS)

- TABLE 141 ASIA PACIFIC: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (KILOTONS)

- TABLE 142 CHINA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 143 CHINA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 144 INDIA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 145 INDIA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 146 JAPAN: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 147 JAPAN: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 148 AUSTRALIA & NZ: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 149 AUSTRALIA & NZ: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 152 SOUTH AMERICA: ORGANIC FEED MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 153 SOUTH AMERICA: ORGANIC FEED MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 154 SOUTH AMERICA: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2021-2024 (USD MILLION)

- TABLE 155 SOUTH AMERICA: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 156 SOUTH AMERICA: ORGANIC FEED MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ORGANIC FEED MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 159 SOUTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 160 SOUTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (KILOTONS)

- TABLE 161 SOUTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (KILOTONS)

- TABLE 162 BRAZIL: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 163 BRAZIL: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 164 ARGENTINA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 165 ARGENTINA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 166 REST OF SOUTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 167 REST OF SOUTH AMERICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 168 REST OF THE WORLD: ORGANIC FEED MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 REST OF THE WORLD: ORGANIC FEED MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 170 REST OF THE WORLD: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2021-2024 (USD MILLION)

- TABLE 171 REST OF THE WORLD: ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025-2030 (USD MILLION)

- TABLE 172 REST OF THE WORLD: ORGANIC FEED MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 173 REST OF THE WORLD: ORGANIC FEED MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 174 REST OF THE WORLD: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 175 REST OF THE WORLD: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 176 REST OF THE WORLD: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (KILOTONS)

- TABLE 177 REST OF THE WORLD: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (KILOTONS)

- TABLE 178 AFRICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 179 AFRICA: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 180 MIDDLE EAST: ORGANIC FEED MARKET, BY LIVESTOCK, 2021-2024 (USD MILLION)

- TABLE 181 MIDDLE EAST: ORGANIC FEED MARKET, BY LIVESTOCK, 2025-2030 (USD MILLION)

- TABLE 182 OVERVIEW OF STRATEGIES ADOPTED BY KEY ORGANIC FEED MARKET PLAYERS, 2022-MARCH 2025

- TABLE 183 ORGANIC FEED MARKET: MARKET SHARE ANALYSIS, 2024

- TABLE 184 ORGANIC FEED MARKET: REGIONAL FOOTPRINT

- TABLE 185 ORGANIC FEED MARKET: INGREDIENT SOURCE FOOTPRINT

- TABLE 186 ORGANIC FEED MARKET: FORM FOOTPRINT

- TABLE 187 ORGANIC FEED MARKET: LIVESTOCK FOOTPRINT

- TABLE 188 ORGANIC FEED MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 189 ORGANIC FEED MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 190 ORGANIC FEED MARKET: PRODUCT LAUNCHES/ENHANCEMENTS, JUNE 2022-MARCH 2025

- TABLE 191 ORGANIC FEED MARKET: DEALS, 2022-SEPTEMBER 2025

- TABLE 192 ORGANIC FEED MARKET: EXPANSIONS, 2022-SEPTEMBER 2025

- TABLE 193 ORGANIC FEED MARKET: OTHER DEVELOPMENTS, 2022-SEPTEMBER 2025

- TABLE 194 CARGILL, INCORPORATED: COMPANY OVERVIEW

- TABLE 195 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 196 CARGILL, INCORPORATED: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 197 CARGILL, INCORPORATED: DEALS

- TABLE 198 CARGILL, INCORPORATED: EXPANSIONS

- TABLE 199 PURINA ANIMAL NUTRITION LLC: COMPANY OVERVIEW

- TABLE 200 PURINA ANIMAL NUTRITION LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 FORFARMERS UK: COMPANY OVERVIEW

- TABLE 202 FORFARMERS UK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 203 FORFARMERS UK: DEALS

- TABLE 204 ADM: COMPANY OVERVIEW

- TABLE 205 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 206 SCRATCH & PECK: COMPANY OVERVIEW

- TABLE 207 SCRATCH & PECK: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 208 ALLER AQUA A/S: COMPANY OVERVIEW

- TABLE 209 ALLER AQUA A/S: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 ALLER AQUA A/S: OTHER DEVELOPMENTS

- TABLE 211 THE ORGANIC FEED COMPANY: COMPANY OVERVIEW

- TABLE 212 THE ORGANIC FEED COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 COUNTRY HERITAGE FEEDS: COMPANY OVERVIEW

- TABLE 214 COUNTRY HERITAGE FEEDS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 215 GREEN MOUNTAIN FEEDS: COMPANY OVERVIEW

- TABLE 216 GREEN MOUNTAIN FEEDS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 217 UNIQUE ORGANICS LTD.: COMPANY OVERVIEW

- TABLE 218 UNIQUE ORGANICS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 219 KREAMER FEED: COMPANY OVERVIEW

- TABLE 220 KREAMER FEED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 221 YORKTOWN ORGANICS, LLC: COMPANY OVERVIEW

- TABLE 222 YORKTOWN ORGANICS, LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 223 MODESTO MILLING INC.: COMPANY OVERVIEW

- TABLE 224 MODESTO MILLING INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 225 HINDUSTAN ANIMAL FEEDS: COMPANY OVERVIEW

- TABLE 226 HINDUSTAN ANIMAL FEEDS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 ARDENT MILLS: COMPANY OVERVIEW

- TABLE 228 ARDENT MILLS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 229 CIZERON BIO: COMPANY OVERVIEW

- TABLE 230 CIZERON BIO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 231 JONES FEED MILLS LTD.: COMPANY OVERVIEW

- TABLE 232 JONES FEED MILLS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 233 COYOTE CREEK FARM: COMPANY OVERVIEW

- TABLE 234 COYOTE CREEK FARM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 235 PETERSON ORGANIC FEEDS: COMPANY OVERVIEW

- TABLE 236 PETERSON ORGANIC FEEDS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 237 FARMSTEAD ORGANICS: COMPANY OVERVIEW

- TABLE 238 FARMSTEAD ORGANICS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 239 MARKETS ADJACENT TO ORGANIC FEED MARKET

- TABLE 240 FEED ADDITIVES MARKET, BY FORM, 2020-2023 (USD MILLION)

- TABLE 241 FEED ADDITIVES MARKET, BY FORM, 2024-2029 (USD MILLION)

- TABLE 242 COMPOUND FEED MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 243 COMPOUND FEED MARKET, BY SOURCE, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 ORGANIC FEED MARKET: RESEARCH DESIGN

- FIGURE 2 ORGANIC FEED MARKET: BOTTOM-UP APPROACH

- FIGURE 3 ORGANIC FEED MARKET: TOP-DOWN APPROACH

- FIGURE 4 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 APPROACH 2: DEMAND-SIDE ANALYSIS

- FIGURE 6 ORGANIC FEED MARKET: DATA TRIANGULATION

- FIGURE 7 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 8 ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025-2030

- FIGURE 9 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ORGANIC FEED MARKET (2021-2024)

- FIGURE 10 DISRUPTIVE TRENDS IMPACTING ORGANIC FEED MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 11 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN ORGANIC FEED MARKET, 2025

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 13 HIGH DEMAND FOR ORGANIC FEED IN LIVESTOCK NUTRITION INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 14 PELLETS SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARES IN 2025

- FIGURE 15 CEREALS & GRAINS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 16 POULTRY SEGMENT TO LEAD MARKET IN 2025

- FIGURE 17 ENERGY SOURCE SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 18 LARGE-SCALE COMMERCIAL FARMS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 19 FRANCE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 ORGANIC FEED MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 ORGANIC FEED MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 ORGANIC FEED MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 ORGANIC FEED MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 ORGANIC FEED MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE OF ORGANIC FEED OFFERED BY KEY PLAYERS, BY LIVESTOCK, 2025 (USD/TON)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF ORGANIC FEED, BY REGION, 2021-2025 (USD/TON)

- FIGURE 27 IMPORT DATA RELATED TO HS CODE 230400-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 28 EXPORT DATA RELATED TO HS CODE 230400-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 29 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 32 JURISDICTION OF US REGISTERED HIGHEST PERCENTAGE OF PATENTS, JANUARY 2015-OCTOBER 2025

- FIGURE 33 FUTURE APPLICATIONS

- FIGURE 34 ORGANIC FEED MARKET DECISION-MAKING FACTORS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY FORM

- FIGURE 36 KEY BUYING CRITERIA, BY FORM

- FIGURE 37 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 38 ORGANIC FEED MARKET, BY INGREDIENT SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 39 ORGANIC FEED MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 40 ORGANIC FEED MARKET, BY LIVESTOCK, 2025 VS. 2030 (USD MILLION)

- FIGURE 41 ORGANIC FEED MARKET, BY FARM SIZE, 2025 VS. 2030 (USD MILLION)

- FIGURE 42 ORGANIC FEED MARKET, BY NUTRIENT SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 43 ASIA PACIFIC TO RECORD FASTEST GROWTH IN ORGANIC FEED MARKET DURING FORECAST PERIOD

- FIGURE 44 NORTH AMERICA: REGIONAL SNAPSHOT

- FIGURE 45 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024 (USD BILLION)

- FIGURE 47 MARKET SHARE ANALYSIS, 2024

- FIGURE 48 ORGANIC FEED MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 49 ORGANIC FEED MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 ORGANIC FEED MARKET: COMPANY FOOTPRINT

- FIGURE 51 ORGANIC FEED MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 COMPANY VALUATION FOR MAJOR PLAYERS IN ORGANIC FEED MARKET

- FIGURE 53 EV/EBITDA OF MAJOR PLAYERS

- FIGURE 54 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 55 FORFARMERS UK: COMPANY SNAPSHOT

- FIGURE 56 ADM: COMPANY SNAPSHOT

- FIGURE 57 UNIQUE ORGANICS LTD.: COMPANY SNAPSHOT