PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1869555

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1869555

Building Information Modeling Market By Offering, Deployment Type, Project Lifecycle, End User, Vertical, and Region - Global Forecast to 2030

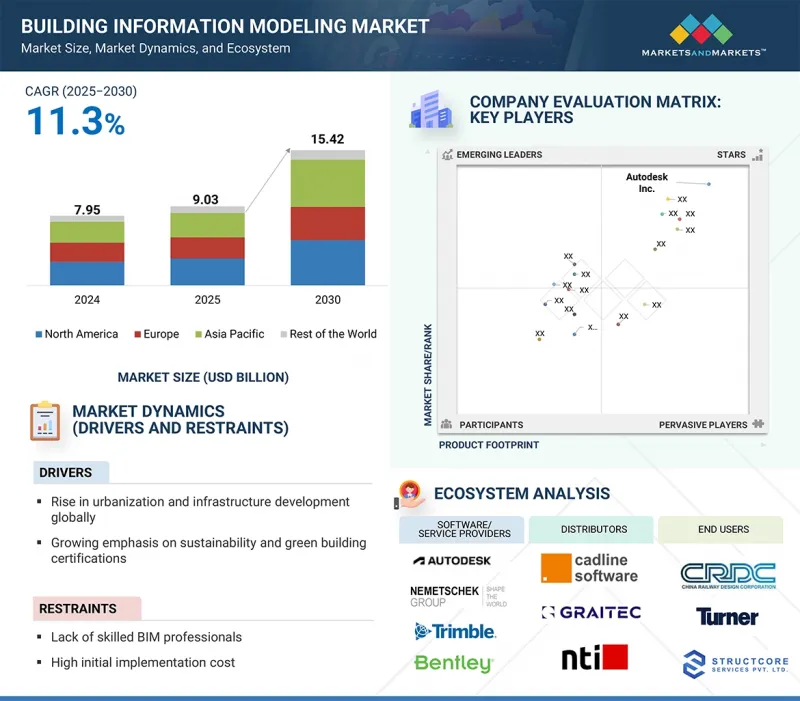

The global building information modeling market is projected to grow from USD 9.03 billion in 2025 to USD 15.42 billion by 2030 at a CAGR of 11.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Deployment Type, Project Lifecycle, End User, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The BIM market is gaining momentum due to rising demand for efficient planning, cost control, and risk reduction in construction projects. Its ability to support sustainability goals, enable real-time data integration, and align with trends like modular construction is driving adoption. Government mandates and integration with technologies like IoT, digital twins, cloud, and AI are further accelerating growth. Together, these factors are establishing BIM as a key enabler of digital transformation in the construction sector.

"Pre-construction phase in the project lifecycle segment is expected to hold the largest market share in 2025."

The pre-construction phase is expected to lead the BIM market as it plays a critical role in setting the foundation for successful project execution. BIM offers significant value during this stage by enabling detailed design visualization, clash detection, cost estimation, and scheduling, all before physical construction begins. This helps stakeholders identify potential design conflicts, optimize resource allocation, and reduce the likelihood of rework and delays. With growing pressure to deliver projects on time and within budget, AEC firms are increasingly leveraging BIM in the pre-construction phase to improve planning accuracy and stakeholder coordination. Moreover, the integration of 5D and 6D BIM in pre-construction is further enhancing decision-making related to cost and sustainability, making it a pivotal stage for BIM adoption.

"Cloud deployment type segment is projected to witness the fastest CAGR in the building information modeling market."

The cloud deployment type is expected to exhibit the fastest CAGR in the BIM market due to its scalability, cost-efficiency, and ease of remote access. As construction teams increasingly operate across multiple locations, cloud-based BIM solutions enable real-time collaboration, seamless data sharing, and centralized project management. These platforms reduce the need for heavy on-premise infrastructure, making them especially attractive to small and mid-sized firms. Moreover, integration with advanced technologies like IoT, AI, and digital twins is more seamless in the cloud environment, driving further adoption. As data security and connectivity improve, the shift toward cloud-based BIM is likely to accelerate significantly. Additionally, cloud deployment supports automatic updates and scalable storage, ensuring that teams always work with the latest data and models. The growing trend of remote and hybrid work models in the AEC industry further reinforces the demand for cloud-based BIM platforms.

"India is expected to witness the highest CAGR in the global building information modeling market."

India is expected to witness the fastest CAGR in the global BIM market due to rapid urbanization, a surge in infrastructure development, and increasing government initiatives promoting digital construction practices. Programs like Smart Cities Mission and PM Gati Shakti are driving demand for efficient planning and execution of large-scale projects, where BIM plays a vital role. Additionally, rising awareness among AEC professionals, expanding real estate and transportation sectors, and growing adoption of cloud-based and mobile BIM solutions are fueling market growth. The push for sustainability, cost-efficiency, and technological modernization is further encouraging BIM uptake across both public and private construction projects in the country. The increasing entry of international construction firms, local software providers, and startups is boosting BIM adoption through competitive pricing and localized solutions. Educational institutions and industry bodies in India are also emphasizing BIM training, helping bridge the skill gap and accelerate its integration into mainstream workflows. This supportive ecosystem positions India as a high-growth market for BIM in the coming years.

Extensive primary interviews were conducted with key industry experts in the building information modeling market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 40%, Managers - 30%, and Others - 30%

- By Region: North America- 40%, Europe - 30%, Asia Pacific - 20%, and RoW - 10%

Autodesk Inc. (US), Nemetschek Group (Germany), Bentley Systems, Incorporated (US), Procore Technologies, Inc. (US), Trimble Inc. (US), Dassault Systemes (France), Schneider Electric (France), Hexagon AB (Sweden), Asite (UK), and Archidata Inc. (Canada) are some of the key players in the building information modeling market.

Research Coverage:

This research report categorizes the building information modeling market based on offering (software, services), deployment type (on-premises, cloud), end user (AEC professionals, consultants & facility managers, and other end users), project lifecycle (pre-construction, construction, and operation), vertical (buildings, industrial, civil infrastructure, oil & gas, utilities, and other verticals), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the building information modeling market and forecasts the same till 2030. Apart from this, the report also consists of leadership mapping and analysis of all the companies included in the building information modeling ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall building information modeling market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rise in urbanization and infrastructure development globally; need for real-time collaboration, improved efficiency, and project visualization across stakeholders; rising adoption of digital twin technology to enhance lifecycle management; growing emphasis on sustainability and green building certifications; increasing need for reduction in rework and errors through model-based planning), restraints (high initial implementation cost; lack of skilled BIM professionals), opportunities (convergence of AR/VR technologies with BIM workflows; leveraging IoT to enhance BIM functionality in modern construction; global harmonization of BIM standards enabling cross-border project delivery; digital skill development programs supporting workforce readiness), and challenges (hardware and infrastructure limitations in emerging markets; lack of universal BIM standards across countries; delayed digital integration within the construction ecosystem) influencing the growth of the building information modeling market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new software & service launches in the building information modeling market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the building information modeling market across varied regions

- Market Diversification: Exhaustive information about new software & services, untapped geographies, recent developments, and investments in the building information modeling market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Autodesk Inc. (US), Nemetschek Group (Germany), Bentley Systems, Incorporated (US), Procore Technologies, Inc. (US), Trimble Inc. (US), Dassault Systemes (France), Schneider Electric (France), Hexagon AB (Sweden), Asite (UK), and Archidata Inc. (Canada), in the building information modeling market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Major primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to obtain market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to obtain market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN BUILDING INFORMATION MODELING MARKET

- 4.2 BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2030

- 4.3 BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE

- 4.4 BUILDING INFORMATION MODELING MARKET, BY VERTICAL

- 4.5 BUILDING INFORMATION MODELING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in global urbanization and infrastructure development

- 5.2.1.2 Need for real-time collaboration, improved efficiency, and project visualization across stakeholders

- 5.2.1.3 Increase in adoption of digital twin technology to enhance lifecycle management

- 5.2.1.4 Growing emphasis on sustainability and green building certifications

- 5.2.1.5 Reduction in rework and errors through model-based planning

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial implementation cost

- 5.2.2.2 Lack of skilled BIM professionals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Convergence of AR/VR technologies with BIM workflows

- 5.2.3.2 Leveraging IoT to enhance BIM functionality in modern construction

- 5.2.3.3 Global harmonization of BIM standards enabling cross-border project delivery

- 5.2.3.4 Digital skill development programs supporting workforce readiness

- 5.2.4 CHALLENGES

- 5.2.4.1 Hardware and infrastructure limitations in emerging markets

- 5.2.4.2 Lack of universal BIM standards across countries

- 5.2.4.3 Delayed digital integration within construction ecosystem

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE PRICING ANALYSIS FOR BUILDING INFORMATION MODELING SOFTWARE

- 5.4.2 INDICATIVE PRICING ANALYSIS FOR BUILDING INFORMATION MODELING SOFTWARE, BY REGION, 2024

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM MAPPING

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 3D Modeling

- 5.8.1.2 Cloud Collaboration

- 5.8.1.3 Clash Detection and Coordination Tools

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Cloud Computing & Edge Processing

- 5.8.2.2 AR/VR in BIM

- 5.8.3 ADJACENT TECHNOLOGY

- 5.8.3.1 GIS (Geographic Information System)

- 5.8.3.2 Digital Twin

- 5.8.1 KEY TECHNOLOGIES

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 PATENT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS

- 5.12 CASE STUDIES

- 5.12.1 J C BAMFORD EXCAVATORS LTD. ACCELERATES ON-SITE COORDINATION WITH REAL-TIME BIM INTEGRATION AT ROYALMOUNT MALL

- 5.12.2 POPULOUS ADOPTS BIM TO STREAMLINE FACADE DESIGN AND INDUSTRIALIZE STADIUM CONSTRUCTION AT KAI TAK SPORTS PARK

- 5.12.3 CHINA CONSTRUCTION FIRST DIVISION GROUP ADOPTS BIM TO PRESERVE HERITAGE AND TRANSFORM CERAMICS FACTORY INTO MIXED-USE LANDMARK IN JINGDEZHEN

- 5.12.4 BEIJING INSTITUTE OF ARCHITECTURAL DESIGN & BEIJING CONSTRUCTION ENGINEERING GROUP ADOPT BIM TO ORCHESTRATE CULTURAL PERFORMANCE CENTER IN SUB CENTER THEATER PROJECT

- 5.13 TARIFFS AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF DATA

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS

- 5.13.3.1 BS EN ISO 19650

- 5.13.3.1.1 BS EN ISO 19650-1

- 5.13.3.1.2 BS EN ISO 19650-2

- 5.13.3.1.3 BS EN ISO 19650-3

- 5.13.3.1.4 BS EN ISO 19650-5

- 5.13.3.1 BS EN ISO 19650

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF ARTIFICIAL INTELLIGENCE ON BUILDING INFORMATION MODELING MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF - BUILDING INFORMATION MODELING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON VERTICAL

6 BUILDING INFORMATION MODELING MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 PLANNING & MODELING

- 6.3 CONSTRUCTION & DESIGN

- 6.4 ASSET MANAGEMENT

- 6.5 BUILDING SYSTEM ANALYSIS & MAINTENANCE SCHEDULING

7 BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE

- 7.1 INTRODUCTION

- 7.2 ON-PREMISES

- 7.2.1 PREFERENCE FOR ENHANCED DATA SECURITY AND LOCALIZED CONTROL TO DRIVE GROWTH

- 7.3 CLOUD

- 7.3.1 RISING DEMAND FOR SCALABLE, COLLABORATIVE, AND COST-EFFICIENT BIM SOLUTIONS TO DRIVE MARKET

8 BUILDING INFORMATION MODELING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 AEC PROFESSIONALS

- 8.2.1 LEVERAGING BIM FOR COLLABORATIVE DESIGN, COST CONTROL, AND PROJECT EFFICIENCY

- 8.3 CONSULTANTS & FACILITY MANAGERS

- 8.3.1 ENHANCING ASSET LIFECYCLE MANAGEMENT THROUGH DATA-DRIVEN BUILDING OPERATIONS

- 8.4 OTHER END USERS

9 BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE

- 9.1 INTRODUCTION

- 9.2 PRE-CONSTRUCTION

- 9.2.1 COMPREHENSIVE EARLY-STAGE VISUALIZATION AND CLASH-FREE PROJECT COORDINATION TO DRIVE ADOPTION

- 9.3 CONSTRUCTION

- 9.3.1 DEMAND FOR ACCURATE SEQUENCING AND EFFICIENT SITE EXECUTION TO DRIVE INTEGRATION

- 9.4 OPERATION

- 9.4.1 DATA-DRIVEN FACILITY MANAGEMENT AND LIFECYCLE EFFICIENCY TO PROMOTE USAGE

10 BUILDING INFORMATION MODELING MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 BUILDINGS

- 10.2.1 DIGITALIZATION AND SMART INFRASTRUCTURE INITIATIVES TO DRIVE MARKET

- 10.2.2 COMMERCIAL

- 10.2.3 RESIDENTIAL

- 10.3 INDUSTRIAL

- 10.3.1 ENHANCING MANUFACTURING EFFICIENCY THROUGH INTEGRATED BIM APPLICATIONS

- 10.4 CIVIL INFRASTRUCTURE

- 10.4.1 GOVERNMENT MANDATES AND PUBLIC SECTOR SPENDING TO DRIVE BIM ADOPTION

- 10.5 OIL & GAS

- 10.5.1 COMPREHENSIVE BIM INTEGRATION FOR SAFETY, OPTIMIZATION, AND COST CONTROL TO DRIVE DEMAND

- 10.6 UTILITIES

- 10.6.1 GROWING IMPLEMENTATION TO REDUCE REWORK AND DELAYS TO DRIVE SEGMENTAL GROWTH

- 10.7 OTHER VERTICALS

11 BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE

- 11.1 INTRODUCTION

- 11.2 SOFTWARE

- 11.2.1 DESIGN & MODELING SOFTWARE

- 11.2.1.1 3D visualization and early coordination to boost demand

- 11.2.2 CONSTRUCTION SIMULATION & SCHEDULING

- 11.2.2.1 Model-based sequencing and 4D simulation to drive segment growth

- 11.2.3 COST ESTIMATION & QUANTITY TAKEOFF

- 11.2.3.1 Automated quantity linking and parametric costing to fuel growth

- 11.2.4 FACILITY & ASSET MANAGEMENT SOFTWARE

- 11.2.4.1 Rising need for post-construction efficiency to drive demand

- 11.2.5 SUSTAINABILITY AND ENERGY ANALYSIS SOFTWARE

- 11.2.5.1 Sustainability goals and need for green compliance to fuel demand

- 11.2.6 OTHER SOFTWARE TYPES

- 11.2.1 DESIGN & MODELING SOFTWARE

- 11.3 SERVICES

- 11.3.1 IMPLEMENTATION AND INTEGRATION SERVICES

- 11.3.1.1 Growing complexity in BIM environments to drive demand

- 11.3.2 SOFTWARE SUPPORT AND MAINTENANCE

- 11.3.2.1 Continuous software upgrades and user reliance to strengthen market

- 11.3.3 TRAINING AND CERTIFICATION

- 11.3.3.1 Skill development and upskilling demand to drive market

- 11.3.4 MODELING AND DOCUMENTATION SERVICES

- 11.3.4.1 Project outsourcing trends to drive demand across AEC sectors

- 11.3.5 CONSULTING AND ADVISORY SERVICES

- 11.3.5.1 Strategic digital transformation goals to drive demand

- 11.3.6 OTHER SERVICES

- 11.3.1 IMPLEMENTATION AND INTEGRATION SERVICES

12 BUILDING INFORMATION MODELING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 Advancing BIM adoption through technological investment and federal programs to drive market

- 12.2.3 CANADA

- 12.2.3.1 BIM implementation in most public projects to drive demand

- 12.2.4 MEXICO

- 12.2.4.1 Urbanization and policy push to lead to gradual expansion of BIM adoption

- 12.3 EUROPE

- 12.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.2 UK

- 12.3.2.1 Government mandates to implement BIM to fuel growth

- 12.3.3 GERMANY

- 12.3.3.1 Government initiatives and pilot projects to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Support for adoption of BIM by French Building Federation and other such organizations to drive demand

- 12.3.5 ITALY

- 12.3.5.1 Growing BIM adoption across construction projects to drive demand

- 12.3.6 SPAIN

- 12.3.6.1 Cost savings and efficiency, especially in upcoming projects, to increase deployment

- 12.3.7 POLAND

- 12.3.7.1 EU alignment and public procurement reforms to drive growth

- 12.3.8 NORDICS

- 12.3.8.1 Advanced BIM integration driven by early mandates and strong public-private collaboration

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.2 CHINA

- 12.4.2.1 Growing government initiatives to address slow adoption by fragmented construction industry to drive demand

- 12.4.3 JAPAN

- 12.4.3.1 Growing adoption of BIM solutions in residential construction to drive demand

- 12.4.4 INDIA

- 12.4.4.1 Growing adoption of sustainability software within construction sector to drive demand

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Government mandates for use of BIM in public domain projects

- 12.4.6 AUSTRALIA

- 12.4.6.1 Government-led frameworks and industry partnerships to drive growth

- 12.4.7 INDONESIA

- 12.4.7.1 Rising BIM integration across public works and smart city initiatives to drive market

- 12.4.8 MALAYSIA

- 12.4.8.1 Regulatory mandates and digital transformation efforts to drive demand

- 12.4.9 THAILAND

- 12.4.9.1 Governmental support and pilot initiatives to drive demand

- 12.4.10 VIETNAM

- 12.4.10.1 Government directives and international collaboration to drive BIM adoption

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 ROW: MACROECONOMIC OUTLOOK

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.1.1 Bahrain leverages BIM for urban modernization

- 12.5.2.2 Kuwait

- 12.5.2.2.1 Kuwait integrates BIM in national housing and transport projects

- 12.5.2.3 Oman

- 12.5.2.3.1 Oman explores digital transformation in construction

- 12.5.2.4 Qatar

- 12.5.2.4.1 Qatar advances BIM for FIFA infrastructure legacy

- 12.5.2.5 Saudi Arabia

- 12.5.2.5.1 Saudi Arabia incorporates BIM in giga-projects

- 12.5.2.6 UAE

- 12.5.2.6.1 UAE strengthens digital construction mandates

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Bahrain

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Brazil

- 12.5.3.1.1 Brazil drives BIM standardization through government mandate

- 12.5.3.2 Argentina

- 12.5.3.2.1 Argentina sees early adoption in public infrastructure

- 12.5.3.3 Other South American Countries

- 12.5.3.1 Brazil

- 12.5.4 AFRICA

- 12.5.4.1 South Africa

- 12.5.4.1.1 Private sector innovation and academic collaboration to drive market

- 12.5.4.2 Other African countries

- 12.5.4.1 South Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: KEY START-UPS/SMES, 2024

- 13.9 COMPETITIVE SITUATIONS AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 AUTODESK INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 NEMETSCHEK GROUP

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 BENTLEY SYSTEMS, INCORPORATED

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 TRIMBLE INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 DASSAULT SYSTEMES

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 SCHNEIDER ELECTRIC

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Others

- 14.1.7 ASITE

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.8 HEXAGON AB

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.9 PROCORE TECHNOLOGIES, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.9.3.4 Others

- 14.1.10 ARCHIDATA INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 AUTODESK INC.

- 14.2 OTHER PLAYERS

- 14.2.1 ACCA SOFTWARE S.P.A.

- 14.2.2 PINNACLE INFOTECH

- 14.2.3 ANGULERIS

- 14.2.4 AFRY AB

- 14.2.5 BECK TECHNOLOGY

- 14.2.6 COMPUTERS AND STRUCTURES, INC.

- 14.2.7 ASUNI SOFT

- 14.2.8 4M

- 14.2.9 SIERRASOFT

- 14.2.10 SAFE SOFTWARE INC.

- 14.2.11 FARO

- 14.2.12 GEO-PLUS

- 14.2.13 CYPE INGENIEROS S.A.

- 14.2.14 MAGICAD GROUP

- 14.2.15 REVIZTO SA

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 KEY SECONDARY SOURCES

- TABLE 3 KEY PRIMARY PARTICIPANTS

- TABLE 4 BREAKDOWN OF PRIMARIES

- TABLE 5 KEY ASSUMPTIONS: MACRO- AND MICRO-ECONOMIC ENVIRONMENT

- TABLE 6 RISK ASSESSMENT

- TABLE 7 INDICATIVE PRICING ANALYSIS FOR BUILDING INFORMATION MODELING SOFTWARE, BY KEY PLAYER, 2024 (USD)

- TABLE 8 INDICATIVE PRICING ANALYSIS OF BIM SOFTWARE, BY REGION, 2024 (USD)

- TABLE 9 BUILDING INFORMATION MODELING MARKET PLAYER: ROLE IN ECOSYSTEM

- TABLE 10 IMPORT DATA, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 LIST OF PATENTS IN BUILDING INFORMATION MODELING, 2023-2025

- TABLE 13 BUILDING INFORMATION MODELING MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 MFN TARIFF FOR HS CODE 8302-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2024

- TABLE 15 MFN TARIFF FOR HS CODE 8302-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 BUILDING INFORMATION MODELING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 24 SOFTWARE: BUILDING INFORMATION MODELING MARKET, BY DEPLOYMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 25 SOFTWARE: BUILDING INFORMATION MODELING MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 26 ON PREMISES: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 ON PREMISES: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 CLOUD: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 CLOUD: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 BUILDING INFORMATION MODELING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 31 BUILDING INFORMATION MODELING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 32 AEC PROFESSIONALS: BUILDING INFORMATION MODELING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 AEC PROFESSIONALS: BUILDING INFORMATION MODELING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 CONSULTANTS & FACILITY MANAGERS: BUILDING INFORMATION MODELING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 CONSULTANTS & FACILITY MANAGERS: BUILDING INFORMATION MODELING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 OTHER END USERS: BUILDING INFORMATION MODELING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 OTHER END USERS: BUILDING INFORMATION MODELING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE, 2021-2024 (USD MILLION)

- TABLE 39 BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE, 2025-2030 (USD MILLION)

- TABLE 40 PRE-CONSTRUCTION: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 41 PRE-CONSTRUCTION: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 42 CONSTRUCTION: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 43 CONSTRUCTION: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 44 OPERATION: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 45 OPERATION: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 46 BUILDING INFORMATION MODELING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 47 BUILDING INFORMATION MODELING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 48 BUILDINGS: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 49 BUILDINGS: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 50 INDUSTRIAL: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 51 INDUSTRIAL: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 52 CIVIL INFRASTRUCTURE: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 53 CIVIL INFRASTRUCTURE: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 54 OIL & GAS: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 55 OIL & GAS: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 56 UTILITIES: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 57 UTILITIES: BUILDING INFORMATION MODELING MARKET IN UTILITIES VERTICAL, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 58 OTHER VERTICALS: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 59 OTHER VERTICALS: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 60 BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 61 BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 62 BUILDING INFORMATION MODELING MARKET, BY SOFTWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 63 BUILDING INFORMATION MODELING MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 64 SOFTWARE: BUILDING INFORMATION MODELING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 65 SOFTWARE: BUILDING INFORMATION MODELING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 66 SOFTWARE: BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE, 2021-2024 (USD MILLION)

- TABLE 67 SOFTWARE: BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE, 2025-2030 (USD MILLION)

- TABLE 68 SOFTWARE: BUILDING INFORMATION MODELING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 SOFTWARE: BUILDING INFORMATION MODELING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 SOFTWARE: BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 71 SOFTWARE: BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 72 SOFTWARE: BUILDING INFORMATION MODELING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 SOFTWARE: BUILDING INFORMATION MODELING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 74 SOFTWARE: BUILDING INFORMATION MODELING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 75 SOFTWARE: BUILDING INFORMATION MODELING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 76 SOFTWARE: BUILDING INFORMATION MODELING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 SOFTWARE: BUILDING INFORMATION MODELING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 BUILDING INFORMATION MODELING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 79 BUILDING INFORMATION MODELING MARKET, BY SERVICE TYPE, 2025-2030 (USD MILLION)

- TABLE 80 SERVICES: BUILDING INFORMATION MODELING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 81 SERVICES: BUILDING INFORMATION MODELING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 82 SERVICES: BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE, 2021-2024 (USD MILLION)

- TABLE 83 SERVICES: BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE, 2025-2030 (USD MILLION)

- TABLE 84 SERVICES: BUILDING INFORMATION MODELING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 SERVICES: BUILDING INFORMATION MODELING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 SERVICES: BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 87 SERVICES: BUILDING INFORMATION MODELING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 SERVICES: BUILDING INFORMATION MODELING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 89 SERVICES: BUILDING INFORMATION MODELING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 SERVICES: BUILDING INFORMATION MODELING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 SERVICES: BUILDING INFORMATION MODELING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 92 SERVICES: BUILDING INFORMATION MODELING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 SERVICES: BUILDING INFORMATION MODELING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 BUILDING INFORMATION MODELING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 BUILDING INFORMATION MODELING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 104 US: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 105 US: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 106 CANADA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 107 CANADA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 108 MEXICO: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 109 MEXICO: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 EUROPE: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 113 EUROPE: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 115 EUROPE: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: BUILDING INFORMATION MODELING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 117 EUROPE: BUILDING INFORMATION MODELING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 118 UK: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 119 UK: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 120 GERMANY: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 121 GERMANY: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 122 FRANCE: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 123 FRANCE: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 124 ITALY: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 125 ITALY: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 126 SPAIN: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 127 SPAIN: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 128 POLAND: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 129 POLAND: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 130 NORDICS: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 131 NORDICS: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 132 REST OF EUROPE: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 133 REST OF EUROPE: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 137 ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 142 CHINA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 143 CHINA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 144 JAPAN: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 145 JAPAN: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 146 INDIA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 147 INDIA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 148 SOUTH KOREA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 149 SOUTH KOREA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 150 AUSTRALIA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 151 AUSTRALIA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 152 INDONESIA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 153 INDONESIA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 154 MALAYSIA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 155 MALAYSIA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 156 THAILAND: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 157 THAILAND: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 158 VIETNAM: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 159 VIETNAM: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 162 ROW: BUILDING INFORMATION MODELING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 163 ROW: BUILDING INFORMATION MODELING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 164 ROW: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 165 ROW: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 166 ROW: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 167 ROW: BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 168 ROW: BUILDING INFORMATION MODELING MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 169 ROW: BUILDING INFORMATION MODELING MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 171 MIDDLE EAST: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 174 SOUTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 175 SOUTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 176 SOUTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 177 SOUTH AMERICA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 178 AFRICA : BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 179 AFRICA: BUILDING INFORMATION MODELING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 AFRICA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2021-2024 (USD MILLION)

- TABLE 181 AFRICA: BUILDING INFORMATION MODELING MARKET, BY OFFERING TYPE, 2025-2030 (USD MILLION)

- TABLE 182 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 183 BUILDING INFORMATION MODELING MARKET: DEGREE OF COMPETITION, 2024

- TABLE 184 REGIONAL FOOTPRINT, 2024

- TABLE 185 OFFERING TYPE FOOTPRINT, 2024

- TABLE 186 VERTICAL FOOTPRINT, 2024

- TABLE 187 END USER FOOTPRINT, 2024

- TABLE 188 APPLICATION FOOTPRINT, 2024

- TABLE 189 BUILDING INFORMATION MODELING MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 190 BUILDING INFORMATION MODELING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (OFFERING TYPE FOOTPRINT), 2024

- TABLE 191 BUILDING INFORMATION MODELING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (END USER FOOTPRINT), 2024

- TABLE 192 BUILDING INFORMATION MODELING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (VERTICAL FOOTPRINT), 2024

- TABLE 193 BUILDING INFORMATION MODELING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION FOOTPRINT), 2024

- TABLE 194 PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 195 DEALS, JANUARY 2020-JUNE 2025

- TABLE 196 EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 197 AUTODESK INC.: COMPANY OVERVIEW

- TABLE 198 AUTODESK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 AUTODESK INC.: PRODUCT LAUNCHES

- TABLE 200 AUTODESK INC.: DEALS

- TABLE 201 AUTODESK INC.: EXPANSIONS

- TABLE 202 NEMETSCHEK GROUP: COMPANY OVERVIEW

- TABLE 203 NEMETSCHEK GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 NEMETSCHEK GROUP: PRODUCT LAUNCHES

- TABLE 205 NEMETSCHEK GROUP: DEALS

- TABLE 206 NEMETSCHEK GROUP: EXPANSIONS

- TABLE 207 BENTLEY SYSTEMS, INCORPORATED: COMPANY OVERVIEW

- TABLE 208 BENTLEY SYSTEMS, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 BENTLEY SYSTEMS, INCORPORATED: PRODUCT LAUNCHES

- TABLE 210 BENTLEY SYSTEMS, INCORPORATED: DEALS

- TABLE 211 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 212 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 214 TRIMBLE INC.: DEALS

- TABLE 215 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 216 DASSAULT SYSTEMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 DASSAULT SYSTEMES: DEALS

- TABLE 218 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 219 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 SCHNEIDER ELECTRIC: DEALS

- TABLE 221 SCHNEIDER ELECTRIC: OTHERS

- TABLE 222 ASITE: COMPANY OVERVIEW

- TABLE 223 ASITE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 ASITE: PRODUCT LAUNCHES

- TABLE 225 ASITE: DEALS

- TABLE 226 ASITE: EXPANSIONS

- TABLE 227 HEXAGON AB: COMPANY OVERVIEW

- TABLE 228 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HEXAGON AB: PRODUCT LAUNCHES

- TABLE 230 HEXAGON AB: DEALS

- TABLE 231 PROCORE TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 232 PROCORE TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 PROCORE TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 234 PROCORE TECHNOLOGIES, INC.: DEALS

- TABLE 235 PROCORE TECHNOLOGIES, INC.: EXPANSIONS

- TABLE 236 PROCORE TECHNOLOGIES, INC.: OTHERS

- TABLE 237 ARCHIDATA INC.: COMPANY OVERVIEW

- TABLE 238 ARCHIDATA INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 BUILDING INFORMATION MODELING MARKET SEGMENTATION

- FIGURE 2 STUDY PERIOD CONSIDERED

- FIGURE 3 BUILDING INFORMATION MODELING MARKET: RESEARCH DESIGN

- FIGURE 4 RESEARCH APPROACH

- FIGURE 5 KEY DATA FROM SECONDARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 KEY DATA FROM PRIMARY SOURCES

- FIGURE 8 KEY INDUSTRY INSIGHTS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 12 APPROACH 1 (SUPPLY-SIDE ANALYSIS): REVENUE GENERATED BY COMPANIES FROM SALES OF BIM PRODUCTS

- FIGURE 13 APPROACH 1 (TOP-DOWN, SUPPLY-SIDE): ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN BUILDING INFORMATION MODELING MARKET

- FIGURE 14 BUILDING INFORMATION MODELING MARKET: DATA TRIANGULATION

- FIGURE 15 BUILDING INFORMATION MODELING MARKET, 2021-2030 (USD MILLION)

- FIGURE 16 BUILDING INFORMATION MODELING MARKET, BY OFFERING, 2025 VS. 2030

- FIGURE 17 BUILDING INFORMATION MODELING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2025 VS. 2030

- FIGURE 18 BUILDING INFORMATION MODELING MARKET, BY VERTICAL, 2025 VS. 2030

- FIGURE 19 BUILDING INFORMATION MODELING MARKET, BY END USER, 2025 VS. 2030

- FIGURE 20 BUILDING INFORMATION MODELING MARKET, BY PROJECT LIFECYCLE, 2025 VS. 2030

- FIGURE 21 BUILDING INFORMATION MODELING MARKET, BY REGION

- FIGURE 22 GLOBAL PUSH FOR COST-EFFICIENT CONSTRUCTION, SUSTAINABILITY, AND IMPROVED COLLABORATION ACROSS STAKEHOLDERS TO DRIVE BIM IMPLEMENTATION

- FIGURE 23 BUILDING INFORMATION MODELING SOFTWARE TO ACCOUNT FOR LARGER MARKET SHARE

- FIGURE 24 PRE-CONSTRUCTION SEGMENT TO LEAD MARKET IN 2030

- FIGURE 25 BUILDINGS TO ACCOUNT FOR LARGEST SHARE OF BUILDING INFORMATION MODELING MARKET

- FIGURE 26 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 BUILDING INFORMATION MODELING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 NUMBER OF PEOPLE LIVING IN URBAN AND RURAL AREAS

- FIGURE 29 DRIVERS AND THEIR IMPACT ON BUILDING INFORMATION MODELING MARKET

- FIGURE 30 RESTRAINTS AND THEIR IMPACT ON BUILDING INFORMATION MODELING MARKET

- FIGURE 31 OPPORTUNITIES AND THEIR IMPACT ON BUILDING INFORMATION MODELING MARKET

- FIGURE 32 CHALLENGES AND THEIR IMPACT ON BUILDING INFORMATION MODELING MARKET

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN BUILDING INFORMATION MODELING MARKET

- FIGURE 34 INDICATIVE PRICING ANALYSIS FOR BUILDING INFORMATION MODELING SOFTWARE, BY KEY PLAYERS, 2024 (USD)

- FIGURE 35 SUPPLY CHAIN OF BUILDING INFORMATION MODELING MARKET

- FIGURE 36 BUILDING INFORMATION MODELING ECOSYSTEM

- FIGURE 37 BUILDING INFORMATION MODELING MARKET: INVESTMENT AND FUNDING, 2018-2025 (USD MILLION)

- FIGURE 38 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8302 FOR KEY COUNTRIES, 2020-2024

- FIGURE 39 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8302 FOR KEY COUNTRIES, 2020-2024

- FIGURE 40 NUMBER OF PATENTS GRANTED IN BUILDING INFORMATION MODELING MARKET, 2014-2024

- FIGURE 41 BUILDING INFORMATION MODELING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 42 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 43 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 44 IMPACT OF GEN AI/AI ON BUILDING INFORMATION MODELING MARKET

- FIGURE 45 ON-PREMISES DEPLOYMENT TO LEAD BUILDING INFORMATION MODELING MARKET DURING FORECAST PERIOD

- FIGURE 46 AEC PROFESSIONALS TO LEAD BUILDING INFORMATION MODELING MARKET DURING FORECAST PERIOD

- FIGURE 47 BUILDING INFORMATION MODELING IN PRE-CONSTRUCTION PHASE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 48 BUILDINGS VERTICAL TO BE LARGEST SEGMENT OF MARKET IN 2025

- FIGURE 49 SOFTWARE SEGMENT TO LEAD BUILDING INFORMATION MODELING MARKET DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 51 INDIA TO WITNESS HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 52 NORTH AMERICA: BUILDING INFORMATION MODELING MARKET SNAPSHOT

- FIGURE 53 EUROPE: BUILDING INFORMATION MODELING MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC: BUILDING INFORMATION MODELING MARKET SNAPSHOT

- FIGURE 55 ROW: BUILDING INFORMATION MODELING MARKET SNAPSHOT

- FIGURE 56 FIVE-YEAR REVENUE ANALYSIS KEY PLAYERS IN BUILDING INFORMATION MODELING MARKET, 2020-2024 (USD MILLION)

- FIGURE 57 BUILDING INFORMATION MODELING: MARKET SHARE ANALYSIS, 2024

- FIGURE 58 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 59 FINANCIAL METRICS, 2025 (EV/EBITDA)

- FIGURE 60 PRODUCT COMPARISON

- FIGURE 61 BUILDING INFORMATION MODELING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 62 COMPANY FOOTPRINT, 2024

- FIGURE 63 BUILDING INFORMATION MODELING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 64 AUTODESK INC.: COMPANY SNAPSHOT

- FIGURE 65 NEMETSCHEK GROUP: COMPANY SNAPSHOT

- FIGURE 66 BENTLEY SYSTEMS, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 67 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 68 DASSAULT SYSTEMES: COMPANY SNAPSHOT

- FIGURE 69 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 70 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 71 PROCORE TECHNOLOGIES, INC.: COMPANY SNAPSHOT