PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1876442

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1876442

CT Simulators Market by Technology, Product Type, Application, End User - Global Forecast to 2030

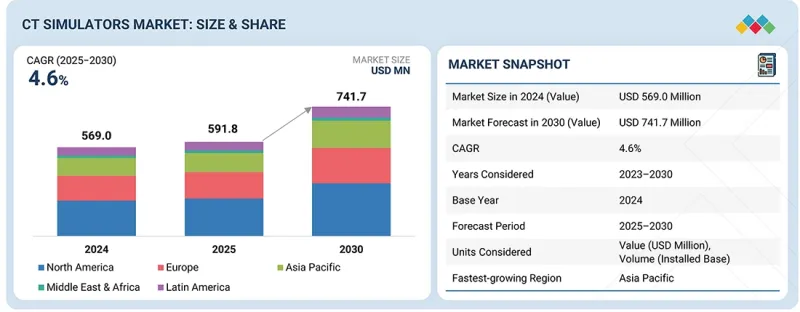

The global CT simulators market is projected to reach USD 741.7 million by 2030, up from USD 598.1 million in 2025, at a CAGR of 4.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) |

| Segments | Product Type, Technology, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

The CT simulators market is experiencing strong growth driven by technological advancements, increasing disease rates, and strategic investments in healthcare infrastructure. These factors collectively enhance the efficiency, accuracy, and availability of CT simulation, resulting in improved patient outcomes in both diagnostic and therapeutic settings. Continuous innovation in CT simulation, including 3D/4D imaging, real-time capabilities, and portable solutions, has enhanced diagnostic accuracy and operational efficiency.

The integration of AI and machine learning further enhances image analysis and treatment planning, enabling automated anomaly detection, precise anatomical mapping, and personalized therapy, thereby improving patient outcomes and care quality.

"Multi-slice CT simulators dominated the market in 2024."

The multi-slice CT simulators segment contributes to the CT simulator market, driven by several key factors. Their superior imaging capabilities offer high-resolution visualization of anatomical structures, which is vital for accurate radiation therapy planning, ensuring precise tumor targeting while reducing exposure to surrounding healthy tissue. Advanced technology allows for faster scan times, increasing patient throughput and operational efficiency. Additionally, the growing prevalence of cancer and chronic diseases has boosted demand for precise diagnostic and treatment planning solutions. The increasing adoption of minimally invasive procedures, which rely on detailed imaging for accurate guidance, further strengthens the market position of multi-slice CT simulators.

"The independent radiotherapy segment held the largest share of the CT simulators market in 2024."

Independent radiotherapy centers hold the largest share of the CT simulators market due to their increasing number, technology focus, and high equipment utilization. According to the International Atomic Energy Agency (IAEA) and WHO's DIRAC database, over 60-65% of newly installed radiotherapy units worldwide are located in stand-alone or private cancer centers, especially across North America, Europe, and parts of the Asia Pacific. These centers heavily invest in dedicated imaging infrastructure, with each site typically needing at least one high-performance multi-slice CT simulator for treatment planning and quality assurance.

Independent radiotherapy centers mainly focus on cancer treatment workflows, where accurate imaging and simulation are essential for radiation therapy planning. Unlike hospitals, which can share diagnostic CT scanners among departments, radiotherapy centers need dedicated CT simulators optimized specifically for therapy planning-making adoption necessary rather than optional. These centers often manage a steady flow of oncology patients but do not have the complex departmental dependencies typical of hospitals. Therefore, they seek dedicated, high-throughput CT simulators that provide quick image acquisition, automated contouring, and seamless integration with Treatment Planning Systems (TPS) to reduce turnaround times.

"The Asia Pacific regional segment is expected to register the highest CAGR in the CT simulators market during the forecast period."

The Asia-Pacific region is showing the fastest growth in the CT simulator market, driven by the rising prevalence of chronic conditions such as cancer, cardiovascular diseases, and respiratory disorders. This trend is significantly increasing the demand for advanced diagnostic and treatment planning technologies, including CT simulators. Ongoing technological innovation-such as the integration of artificial intelligence (AI), advanced 3D/4D imaging techniques, and low-dose CT scanning-is improving both the performance and accessibility of CT simulators throughout the region. Large investments in healthcare infrastructure, especially in emerging economies like India and China, are supporting the quick adoption of cutting-edge medical technologies. Additionally, growing public awareness about the importance of early disease detection is boosting the use of advanced imaging tools in both urban and rural healthcare settings. Together, these factors establish the Asia-Pacific region as the main driver of CT simulator market growth during the forecast period.

A breakdown of the primary participants referred to for this report is provided below:

- By Company: Tier 1 (35%), Tier 2 (45%), and Tier 3 (20%)

- By Designation: C-level Executives (35%), Director-level Executives (25%), and Others (40%)

- By Region: North America (40%), Europe (30%), Asia Pacific (20%), Latin America (5%), and the Middle East & Africa (5%)

Prominent players in the CT simulators market include Siemens Healthineers (Germany), GE Healthcare (US), Philips Healthcare (Netherlands), Canon Medical Systems Corporation (Japan), Varian Medical Systems (US), Elekta (Switzerland), Fujifilm Corporation (US), Fluke Biomedical (US), Ziehm Imaging Gmbh (Germany), among others.

Research Coverage

- The report studies the CT simulators market based on product type, technology, application, end user, and region

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting market growth

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders

- The report studies micro markets with respect to their growth trends, prospects, and contributions to the global CT simulators market

- The report forecasts the revenue of market segments with respect to five major regions

Key Benefits of Buying this Report

This report is valuable for both new and experienced players in the market, providing essential information to identify potential investment opportunities. It offers a comprehensive overview of both major and minor players, supporting effective risk analysis and informed investment decisions. The report includes precise segmentation by end users and geographic regions, giving detailed insights into niche market segments. Additionally, it highlights key trends, growth drivers, challenges, and opportunities, aiding strategic decision-making through a balanced approach analysis.

Through this report, readers get insightful views into the following parameters:

- Analysis of key drivers (Growing adoption of image-guided and adaptive radiotherapy (IGRT/ART), Global push toward hypofractionation and stereotactic body radiotherapy (SBRT), Rising cancer incidence and increasing diagnostic CT utilization), restraints (Recent advances in AI-driven CBCT-to-synthetic CT (sCT) conversions as replacement, Perceived overlap with diagnostic CT or PET/CT scans), opportunities (AI and PCCT unlocking high-performance simulation opportunities, Use of hybrid CT-linac and CT-on-rails solutions), challenges (High capital costs), relating to the growth of the CT simulators market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the CT simulators market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the CT simulators market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the CT simulators market

- Competitive Assessment: A comprehensive analysis of market share, product offerings, and leading strategies of major players, such as Siemens Healthineers (Germany), GE Healthcare (US), Philips Healthcare (Netherlands), Canon Medical Systems Corporation (Japan), Varian Medical Systems (US), Elekta (Switzerland), Fujifilm Corporation (US), Fluke Biomedical (US), Ziehm Imaging Gmbh (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.1.3 Objectives of secondary research

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key supply- and demand-side participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Objectives of primary research

- 2.1.2.5 Key primary insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation

- 2.2.1.2 Customer-based market estimation

- 2.2.1.3 Primary interviews

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 GROWTH RATE ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 CT SIMULATORS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: GROWTH OPPORTUNITIES, BY END USER AND COUNTRY

- 4.3 CT SIMULATORS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of image-guided and adaptive radiotherapy (IGRT/ART)

- 5.2.1.2 Global push toward hypofractionation and stereotactic body radiotherapy (SBRT)

- 5.2.1.3 Rising cancer incidence and increasing diagnostic CT utilization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Recent advances in AI-driven CBCT-to-synthetic CT (sCT) conversions as replacement

- 5.2.2.2 Perceived overlap with diagnostic CT or PET/CT scans

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 AI and PCCT unlocking high-performance simulation opportunities

- 5.2.3.2 Use of hybrid CT-linac and CT-on-rails solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 High capital costs

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS & WHITE SPACES

- 5.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, AND AI ADOPTION

- 6.1 TECHNOLOGY ANALYSIS

- 6.1.1 KEY TECHNOLOGIES

- 6.1.1.1 Radiotherapy planning software/Value-based software

- 6.1.1.2 Flat-table couch & laser positioning

- 6.1.1.3 4D CT & motion management

- 6.1.2 COMPLEMENTARY TECHNOLOGIES

- 6.1.2.1 Linear accelerators (LINACs)

- 6.1.2.2 Dosimetry tools

- 6.1.2.3 Treatment verification systems

- 6.1.3 ADJACENT TECHNOLOGIES

- 6.1.3.1 MRI simulators

- 6.1.3.2 Cone-beam CT (CBCT) in LINACs

- 6.1.3.3 Photon and proton therapy delivery systems

- 6.1.1 KEY TECHNOLOGIES

- 6.2 PATENT ANALYSIS

- 6.2.1 INNOVATIONS AND PATENT REGISTRATIONS

- 6.3 FUTURE APPLICATIONS

- 6.4 IMPACT OF AI/GEN AI ON CT SIMULATORS MARKET

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 AI USE CASES

- 6.4.3 BEST PRACTICES IN CT SIMULATION

- 6.4.4 CASE STUDIES OF AI IMPLMENTATION

- 6.4.5 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.4.6 CLIENT'S READINESS TO ADOPT GENERATIVE AI

- 6.5 SUCCESS STORIES & REAL-WORLD APPLICATIONS

7 SUSTAINABILITY & REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS & COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 REGULATORY FRAMEWORK

- 7.1.2.1 North America

- 7.1.2.1.1 US

- 7.1.2.1.2 Canada

- 7.1.2.2 Europe

- 7.1.2.2.1 UK

- 7.1.2.2.2 Germany

- 7.1.2.2.3 France

- 7.1.2.2.4 Italy

- 7.1.2.2.5 Spain

- 7.1.2.3 Asia Pacific

- 7.1.2.3.1 Japan

- 7.1.2.3.2 China

- 7.1.2.3.3 India

- 7.1.2.4 Latin America

- 7.1.2.4.1 Brazil

- 7.1.2.4.2 Mexico

- 7.1.2.5 Middle East & Africa

- 7.1.2.5.1 UAE

- 7.1.2.5.2 South Africa

- 7.1.2.1 North America

- 7.1.3 CERTIFICATIONS, LABELLING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 KEY STAKEHOLDERS & BUYING EVALUATION CRITERIA

- 8.1.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.1.2 KEY BUYING CRITERIA

- 8.2 DECISION-MAKING PROCESS

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM END USERS

- 8.4.1 UNMET NEEDS FROM END USERS

9 INDUSTRY TREND

- 9.1 PORTER'S FIVE FORCES ANALYSIS

- 9.1.1 THREAT OF NEW ENTRANTS

- 9.1.2 THREAT OF SUBSTITUTES

- 9.1.3 BARGAINING POWER OF SUPPLIERS

- 9.1.4 BARGAINING POWER OF BUYERS

- 9.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 9.2 MACROECONOMIC INDICATORS

- 9.2.1 INTRODUCTION

- 9.2.2 HEALTHCARE EXPENDITURE & INFRASTRUCTURE OUTLOOK

- 9.2.3 TRENDS IN GLOBAL CT INDUSTRY

- 9.3 VALUE CHAIN ANALYSIS

- 9.3.1 RESEARCH & DEVELOPMENT

- 9.3.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING

- 9.3.3 DISTRIBUTION AND MARKETING & SALES

- 9.3.4 AFTER-SALES SERVICES

- 9.4 SUPPLY CHAIN ANALYSIS

- 9.4.1 PROMINENT COMPANIES

- 9.4.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 9.4.3 END USERS

- 9.5 ECOSYSTEM ANALYSIS

- 9.5.1 ROLE IN ECOSYSTEM

- 9.6 PRICING ANALYSIS

- 9.6.1 AVERAGE SELLING PRICE TREND OF CT SIMULATORS, BY KEY PLAYER, 2022-2024

- 9.6.2 AVERAGE SELLING PRICE TREND OF CT SIMULATORS, BY REGION, 2022-2024

- 9.7 TRADE ANALYSIS

- 9.7.1 IMPORT DATA FOR HS CODE 9022.12

- 9.7.2 EXPORT DATA FOR HS CODE 9022.12

- 9.8 KEY CONFERENCES & EVENTS, 2025-2026

- 9.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 9.10 INVESTMENT & FUNDING SCENARIO

- 9.11 CASE STUDY ANALYSIS

- 9.11.1 SEAMLESS WORKFLOW INTEGRATION BY SIEMENS HEALTHINEERS (VARIAN) TO STRENGTHEN CT SIMULATORS MARKET POSITION

- 9.11.2 INNOVATION BY GE HEALTHCARE TO ENHANCE CT SIMULATION EFFICIENCY AND PRECISION

- 9.11.3 PHILIPS BIG BORE CT TO EXPAND GLOBAL ADOPTION IN RADIOTHERAPY SIMULATION

- 9.12 IMPACT OF 2025 US TARIFF ON CT SIMULATORS MARKET

- 9.12.1 INTRODUCTION

- 9.12.2 KEY TARIFF RATES

- 9.12.3 PRICE IMPACT ANALYSIS

- 9.12.4 IMPACT ON COUNTRIES/REGIONS

- 9.12.4.1 North America

- 9.12.4.1.1 US

- 9.12.4.2 Europe

- 9.12.4.3 Asia Pacific

- 9.12.4.1 North America

- 9.12.5 IMPACT ON END-USE INDUSTRIES

10 CT SIMULATORS MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 2D/3D CT SIMULATION TECHNOLOGY

- 10.2.1 CONVENTIONAL NEEDS AND SIZABLE DEMAND IN LOW-RESOURCE SETTINGS TO DRIVE MARKET DEMAND

- 10.3 3D/4D CT SIMULATION TECHNOLOGY

- 10.3.1 HIGH THROUGHPUT ABILITY AND EFFICIENCY TO PROPEL MARKET GROWTH

11 CT SIMULATORS MARKET, BY PRODUCT TYPE

- 11.1 INTRODUCTION

- 11.2 SINGLE-SLICE CT SIMULATORS

- 11.2.1 LOW-VOLUME APPLICATIONS AND COST-EFFECTIVENESS TO MAINTAIN STABLE DEMAND

- 11.3 MULTI-SLICE CT SIMULATORS

- 11.3.1 HIGH THROUGHPUT ABILITY AND EFFICIENCY TO FUEL MARKET DEMAND

12 CT SIMULATORS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 IMAGE-GUIDED RADIATION THERAPY

- 12.2.1 HIGH-QUALITY CT SIMULATION TO NEED IGRT WORKFLOW FOR DRIVING DEMAND

- 12.3 3D CONFORMAL RADIATION THERAPY

- 12.3.1 CT SIMULATION TO PROVIDE VOLUMETRIC DATASETS FOR CONFORMAL BEAM SHAPING IN 3D CRT

- 12.4 BRACHYTHERAPY

- 12.4.1 OAR DELINEATION AND ACCURATE APPLICATOR VERIFICATION TO PROPEL DEMAND

- 12.5 ADAPTIVE RADIOTHERAPY/SURFACE-GUIDED RADIOTHERAPY

- 12.5.1 RISING ADOPTION OF CT SIMULATORS IN ADAPTIVE RADIOTHERAPY TO BOOST WORKFLOW PRECISION AND CLINICAL EFFICIENCY

- 12.6 PROTON THERAPY

- 12.6.1 CT SIMULATORS TO PROVIDE ESSENTIAL IMAGING SUPPORT FOR ACCURATE PROTON THERAPY PLANNING

- 12.7 OTHER APPLICATIONS

13 CT SIMULATORS MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 INDEPENDENT RADIOTHERAPY CENTERS

- 13.2.1 GROWING INCIDENCE OF CANCER GLOBALLY TO PROPEL DEMAND FOR ADVANCED DIAGNOSTIC AND PLANNING TOOLS

- 13.3 HOSPITALS

- 13.3.1 RISING TREND OF INTEGRATED ONCOLOGY CARE SERVICES TO SUPPORT MARKET GROWTH

- 13.4 OTHER END USERS

14 CT SIMULATORS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 US to dominate North American CT simulators market during study period

- 14.2.3 CANADA

- 14.2.3.1 Increased demand for advanced imaging technologies to support market growth

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Aging population with high burden of chronic diseases to augment market growth

- 14.3.3 UK

- 14.3.3.1 Need for faster cancer treatment and better image quality at lower radiation doses to support market growth

- 14.3.4 ITALY

- 14.3.4.1 Increasing investments in CT simulators to drive market

- 14.3.5 SPAIN

- 14.3.5.1 Increasing demand for integration of CT simulation solutions in radiation oncology department to propel market

- 14.3.6 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 JAPAN

- 14.4.2.1 Increase in adoption of high-precision radiotherapy protocols to fuel market

- 14.4.3 CHINA

- 14.4.3.1 Expanding radiotherapy capacity across hospitals and cancer centers to aid market growth

- 14.4.4 INDIA

- 14.4.4.1 Improvements in healthcare infrastructure and rising incidence of cancer to boost market growth

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Growing radiotherapy utilization to support market growth

- 14.4.6 AUSTRALIA

- 14.4.6.1 Expanding radiotherapy utilization to propel market growth

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 LATIN AMERICA

- 14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 14.5.2 BRAZIL

- 14.5.2.1 Collaborative programs and partnerships to expand access to radiotherapy technologies and boost market

- 14.5.3 MEXICO

- 14.5.3.1 Rising demand for radiotherapy planning to promote market growth

- 14.5.4 REST OF LATIN AMERICA

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 14.6.2 GCC COUNTRIES

- 14.6.2.1 Need for advanced cancer treatment to spur market growth

- 14.6.3 REST OF MIDDLE EAST & AFRICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CT SIMULATORS MARKET

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.4.1 MARKET RANKING OF KEY PLAYERS

- 15.5 COMPANY VALUATION & FINANCIAL METRICS

- 15.5.1 FINANCIAL METRICS

- 15.5.2 COMPANY VALUATION

- 15.6 BRAND/PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 PERVASIVE PLAYERS

- 15.7.3 EMERGING LEADERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Product type footprint

- 15.7.5.4 Technology footprint

- 15.7.5.5 Application footprint

- 15.7.5.6 End-user footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 SIEMENS HEALTHINEERS AG

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.3.4 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses & competitive threats

- 16.1.2 PHILIPS HEALTHCARE

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses & competitive threats

- 16.1.3 GE HEALTHCARE

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses & competitive threats

- 16.1.4 CANON MEDICAL SYSTEMS CORPORATION

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses & competitive threats

- 16.1.5 ELEKTA

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses & competitive threats

- 16.1.6 FUJIFILM HEALTHCARE

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.7 ZIEHM IMAGING GMBH

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches & approvals

- 16.1.7.3.2 Deals

- 16.1.8 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.9 NEUSOFT MEDICAL SYSTEMS CO., LTD.

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product approvals

- 16.1.9.3.2 Deals

- 16.1.10 HITACHI HIGH-TECH CORPORATION

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Other developments

- 16.1.11 SHINVA MEDICAL INSTRUMENT CO., LTD.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.12 ACCURAY INCORPORATED

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.1 SIEMENS HEALTHINEERS AG

- 16.2 OTHER PLAYERS

- 16.2.1 DMS HEALTH

- 16.2.2 NORTH STAR IMAGING INC.

- 16.2.3 FLUKE BIOMEDICAL

- 16.2.4 PRIZMED IMAGING

- 16.2.5 KONING HEALTH

- 16.2.6 PLANMECA OY

- 16.2.7 PINSENG HEALTHCARE

- 16.2.8 SCANLAB

- 16.2.9 ARINETA LTD.

- 16.2.10 RYOEI

- 16.2.11 BRAINLAB SE

- 16.2.12 RADIOLOGY ONCOLOGY SYSTEMS

- 16.2.13 BLOCK IMAGING, INC.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 CT SIMULATORS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 CT SIMULATORS MARKET: STUDY ASSUMPTIONS

- TABLE 3 CT SIMULATORS MARKET: RISK ANALYSIS

- TABLE 4 CT SIMULATORS MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 5 CT SIMULATORS MARKET: UNMET NEEDS & WHITE SPACES

- TABLE 6 STRATEGIC MOVES BY TIER 1, TIER 2, AND TIER 3 PLAYERS IN CT SIMULATORS MARKET

- TABLE 7 CT SIMULATORS MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2024

- TABLE 8 KEY COMPANIES IMPLEMENTING AI/GEN AI IN CT SIMULATORS MARKET

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANISATIONS

- TABLE 14 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF CT SIMULATORS, BY PRODUCT TYPE

- TABLE 15 KEY BUYING CRITERIA OF CT SIMULATORS, BY END USER

- TABLE 16 UNMET NEED ANALYSIS IN CT SIMULATORS MARKET

- TABLE 17 CT SIMULATORS MARKET: PORTER'S FIVE FORCES

- TABLE 18 MACROECONOMIC INDICATORS FOR NORTH AMERICA

- TABLE 19 MACROECONOMIC INDICATORS FOR EUROPE

- TABLE 20 MACROECONOMIC INDICATORS FOR ASIA PACIFIC

- TABLE 21 MACROECONOMIC INDICATORS FOR LATIN AMERICA

- TABLE 22 MACROECONOMIC INDICATORS FOR MIDDLE EAST & AFRICA

- TABLE 23 CT SIMULATORS MARKET: ROLE IN ECOSYSTEM

- TABLE 24 KEY PARAMETERS IMPACTING PRICES FOR CT SIMULATORS

- TABLE 25 AVERAGE SELLING PRICE TREND OF CT SIMULATORS, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 26 AVERAGE SELLING PRICE TREND OF CT SIMULATORS, BY REGION, 2022-2024 (USD)

- TABLE 27 IMPORT SCENARIO FOR HS CODE 9022.12 BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 28 EXPORT SCENARIO FOR HS CODE 9022.12, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 29 CT SIMULATORS MARKET: KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 30 CASE STUDY 1: SEAMLESS WORKFLOW INTEGRATION BY SIEMENS HEALTHINEERS (VARIAN) TO STRENGTHEN CT SIMULATORS MARKET POSITION

- TABLE 31 CASE STUDY 2: INNOVATION BY GE HEALTHCARE TO ENHANCE CT SIMULATION EFFICIENCY AND PRECISION

- TABLE 32 CASE STUDY 3: PHILIPS BIG BORE CT TO EXPAND GLOBAL ADOPTION IN RADIOTHERAPY SIMULATION

- TABLE 33 KEY TARIFF RATES IN CT SIMULATORS MARKET, 2025

- TABLE 34 CT SIMULATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 35 CT SIMULATORS MARKET FOR 2D/3D SIMULATION TECHNOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 CT SIMULATORS MARKET FOR 3D/4D SIMULATION TECHNOLOGY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 NUMBER OF UNITS SOLD IN NORTH AMERICAN CT SIMULATORS MARKET, 2024

- TABLE 38 NUMBER OF UNITS SOLD IN EUROPEAN CT SIMULATORS MARKET, 2024

- TABLE 39 NUMBER OF UNITS SOLD IN ASIA PACIFIC CT SIMULATORS MARKET, 2024

- TABLE 40 NUMBER OF UNITS SOLD IN LATIN AMERICAN AND MIDDLE EASTERN & AFRICAN CT SIMULATORS MARKET, 2024

- TABLE 41 CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 42 SINGLE-SLICE CT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: SINGLE-SLICE CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 EUROPE: SINGLE-SLICE CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 ASIA-PACIFIC: SINGLE-SLICE CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 LATIN AMERICA: SINGLE-SLICE CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 MIDDLE EAST & AFRICA: SINGLE-SLICE CT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 MULTI-SLICE CT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: MULTI-SLICE CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 EUROPE: MULTI-SLICE CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: MULTI-SLICE CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 LATIN AMERICA: MULTI-SLICE CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 MIDDLE EAST & AFRICA: CT SIMULATORS MARKET FOR MULTI-SLICE CT SIMULATORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 CT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 55 CT SIMULATORS MARKET FOR IMAGE-GUIDED RADIATION THERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 CT SIMULATORS MARKET FOR 3D CONFORMAL RADIATION THERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 CT SIMULATORS MARKET FOR BRACHYTHERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 CT SIMULATORS MARKET FOR ADAPTIVE RADIOTHERAPY/SURFACE-GUIDED RADIOTHERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 CT SIMULATORS MARKET FOR PROTON THERAPY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 CT SIMULATORS MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 CT SIMULATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 62 CT SIMULATORS MARKET FOR INDEPENDENT RADIOTHERAPY CENTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 CT SIMULATORS MARKET FOR HOSPITALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 CT SIMULATORS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 CT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 67 NORTH AMERICA: CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: CT SIMULATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: CT SCANNERS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: CT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: CT SIMULATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 72 US: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 73 CANADA: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 74 EUROPE: KEY MACROINDICATORS

- TABLE 75 EUROPE: CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 EUROPE: CT SIMULATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: CT SCANNERS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: CT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 79 EUROPE: CT SIMULATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 80 GERMANY: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 81 UK: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 82 ITALY: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 83 SPAIN: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 84 REST OF EUROPE: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 86 ASIA PACIFIC: CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 ASIA PACIFIC: CT SIMULATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CT SCANNERS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: CT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 90 ASIA PACIFIC: CT SIMULATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 91 JAPAN: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 92 CHINA: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 93 INDIA: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 94 SOUTH KOREA: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 95 AUSTRALIA: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 97 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 98 LATIN AMERICA: CT SIMULATORS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 LATIN AMERICA: CT SIMULATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 100 LATIN AMERICA: CT SCANNERS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 101 LATIN AMERICA: CT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 102 LATIN AMERICA: CT SIMULATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 103 BRAZIL: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 104 MEXICO: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 105 REST OF LATIN AMERICA: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 107 MIDDLE EAST & AFRICA: CT SIMULATORS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: CT SIMULATORS MARKET, BY TECHNOLOGY, 2023-2030 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: CT SCANNERS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: CT SIMULATORS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: CT SIMULATORS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 112 GCC COUNTRIES: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 113 REST OF MIDDLE EAST & AFRICA: CT SIMULATORS MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 114 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN CT SIMULATORS MARKET, 2022-2025

- TABLE 115 CT SIMULATORS MARKET: DEGREE OF COMPETITION

- TABLE 116 CT SIMULATORS MARKET: REGION FOOTPRINT

- TABLE 117 CT SIMULATORS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 118 CT SIMULATORS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 119 CT SIMULATORS MARKET: APPLICATION FOOTPRINT

- TABLE 120 CT SIMULATORS MARKET: END-USER FOOTPRINT

- TABLE 121 CT SIMULATORS MARKET: DETAILED LIST OF KEY STARTUPS/SME PLAYERS

- TABLE 122 CT SIMULATORS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME PLAYERS, BY PRODUCT TYPE AND REGION

- TABLE 123 CT SIMULATORS MARKET: PRODUCT LAUNCHES, JANUARY 2022-SEPTEMBER 2025

- TABLE 124 CT SIMULATORS MARKET: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 125 CT SIMULATORS MARKET: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 126 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- TABLE 127 SIEMENS HEALTHINEERS AG: PRODUCTS OFFERED

- TABLE 128 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES, JANUARY 2022-SEPTEMBER 2025

- TABLE 129 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 130 SIEMENS HEALTHINEERS AG: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 131 SIEMENS HEALTHINEERS AG: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 132 PHILIPS HEALTHCARE: COMPANY OVERVIEW

- TABLE 133 PHILIPS HEALTHCARE: PRODUCTS OFFERED

- TABLE 134 PHILIPS HEALTHCARE: PRODUCT LAUNCHES, JANUARY 2022-SEPTEMBER 2025

- TABLE 135 PHILIPS HEALTHCARE: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 136 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 137 GE HEALTHCARE: PRODUCTS OFFERED

- TABLE 138 GE HEALTHCARE: PRODUCT LAUNCHES, JANUARY 2022-SEPTEMBER 2025

- TABLE 139 GE HEALTHCARE: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 140 GE HEALTHCARE: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 141 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- TABLE 142 CANON MEDICAL SYSTEMS CORPORATION: PRODUCTS OFFERED

- TABLE 143 CANON MEDICAL SYSTEMS CORPORATION: PRODUCT LAUNCHES, JANUARY 2022-SEPTEMBER 2025

- TABLE 144 CANON MEDICAL SYSTEMS CORPORATION: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 145 CANON MEDICAL SYSTEMS CORPORATION: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 146 ELEKTA: COMPANY OVERVIEW

- TABLE 147 ELEKTA: PRODUCTS OFFERED

- TABLE 148 ELEKTA: PRODUCT LAUNCHES, JANUARY 2022-SEPTEMBER 2025

- TABLE 149 ELEKTA: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 150 ELEKTA: EXPANSIONS, JANUARY 2022-SEPTEMBER 2025

- TABLE 151 FUJIFILM HEALTHCARE: COMPANY OVERVIEW

- TABLE 152 FUJIFILM HEALTHCARE: PRODUCTS OFFERED

- TABLE 153 FUJIFILM CORPORATION: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 154 ZIEHM IMAGING GMBH: COMPANY OVERVIEW

- TABLE 155 ZIEHN IMAGING GMBH: PRODUCTS OFFERED

- TABLE 156 ZIEHN IMAGING GMBH: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 157 ZIEHN IMAGING GMBH: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 158 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: COMPANY OVERVIEW

- TABLE 159 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: PRODUCTS OFFERED

- TABLE 160 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 161 NEUSOFT MEDICAL SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 162 NEUSOFT MEDICAL SYSTEMS CO., LTD.: PRODUCTS OFFERED

- TABLE 163 NEUSOFT MEDICAL SYSTEMS CO., LTD.: PRODUCT APPROVALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 164 NEUSOFT MEDICAL SYSTEMS CO., LTD.: DEALS, JANUARY 2022-SEPTEMBER 2025

- TABLE 165 HITACHI HIGH-TECH CORPORATION: COMPANY OVERVIEW

- TABLE 166 HITACHI HIGH-TECH CORPORATION: PRODUCTS OFFERED

- TABLE 167 HITACHI HIGH-TECH CORPORATION: OTHER DEVELOPMENTS, JANUARY 2022-SEPTEMBER 2025

- TABLE 168 SHINVA MEDICAL INSTRUMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 169 SHINVA MEDICAL INSTRUMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 170 ACCURAY INCORPORATED: COMPANY OVERVIEW

- TABLE 171 ACCURAY INCORPORATED: PRODUCTS OFFERED

- TABLE 172 DMS HEALTH: COMPANY OVERVIEW

- TABLE 173 NORTH STAR IMAGING INC.: COMPANY OVERVIEW

- TABLE 174 FLUKE BIOMIDICAL: COMPANY OVERVIEW

- TABLE 175 PRIZMED IMAGING: COMPANY OVERVIEW

- TABLE 176 KONING HEALTH: COMPANY OVERVIEW

- TABLE 177 PLANMECA OY: COMPANY OVERVIEW

- TABLE 178 PINSENG HEALTHCARE: COMPANY OVERVIEW

- TABLE 179 SCANLAB: COMPANY OVERVIEW

- TABLE 180 ARINETA LTD.: COMPANY OVERVIEW

- TABLE 181 RYOEI: COMPANY OVERVIEW

- TABLE 182 BRAINLAB SE: COMPANY OVERVIEW

- TABLE 183 RADIOLOGY ONCOLOGY SYSTEMS: COMPANY OVERVIEW

- TABLE 184 BLOCK IMAGING, INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CT SIMULATORS MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 CT SIMULATORS MARKET: YEARS CONSIDERED

- FIGURE 3 CT SIMULATORS MARKET: RESEARCH DATA

- FIGURE 4 CT SIMULATORS MARKET: RESEARCH DESIGN

- FIGURE 5 CT SIMULATORS MARKET: KEY SECONDARY SOURCES

- FIGURE 6 CT SIMULATORS MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 7 KEY PRIMARY SOURCES (DEMAND AND SUPPLY SIDES) IN CT SIMULATORS MARKET

- FIGURE 8 KEY SUPPLY- AND DEMAND-SIDE PARTICIPANTS IN CT SIMULATORS MARKET

- FIGURE 9 CT SIMULATORS MARKET: BREAKDOWN OF PRIMARY INTERVIEWS (BY COMPANY TYPE, DESIGNATION, AND REGION)

- FIGURE 10 CT SIMULATORS MARKET: KEY INSIGHTS FROM PRIMARY EXPERTS

- FIGURE 11 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 12 CT SIMULATORS MARKET: COMPANY REVENUE ESTIMATION

- FIGURE 13 CT SIMULATORS MARKET SIZE ESTIMATION METHODOLOGY (END USER AND REVENUE MAPPING-BASED)

- FIGURE 14 CT SIMULATORS MARKET: TOP-DOWN APPROACH

- FIGURE 15 GROWTH PROJECTIONS ON REVENUE IMPACT OF KEY MACROINDICATORS

- FIGURE 16 CT SIMULATORS MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 17 CT SIMULATORS MARKET, BY PRODUCT TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 CT SIMULATORS MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 CT SIMULATORS MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 CT SIMULATORS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 CT SIMULATORS MARKET: REGIONAL SNAPSHOT

- FIGURE 22 INCREASED PROCEDURE CASELOAD AND ADOPTION OF ADAPTIVE RADIOTHERAPY TO GROW MARKET DEMAND

- FIGURE 23 CHINA AND HOSPITALS TO COMMAND LARGEST MARKET SHARES IN 2024

- FIGURE 24 CHINA TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 25 CT SIMULATORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 CT SIMULATORS MARKET: TOP COMPANIES/APPLICANTS AND NUMBER OF PATENTS GRANTED, 2014-2024

- FIGURE 27 KEY AI USE CASES IN CT SIMULATORS MARKET

- FIGURE 28 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR CT SIMULATORS, BY PRODUCT TYPE

- FIGURE 29 KEY BUYING CRITERIA OF CT SIMULATORS, BY END USER

- FIGURE 30 CT SIMULATORS MARKET: UNMET NEED ANALYSIS

- FIGURE 31 CT SIMULATORS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 CT SIMULATORS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 33 CT SIMULATORS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 34 CT SIMULATORS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 35 AVERAGE SELLING PRICE TREND OF CT SIMULATORS, BY KEY PLAYER, 2022-2024 (USD)

- FIGURE 36 AVERAGE SELLING PRICE TREND OF CT SIMULATORS, BY REGION, 2022-2024 (USD)

- FIGURE 37 IMPORT SCENARIO FOR HS CODE 9022.12, 2020-2024 (USD THOUSAND)

- FIGURE 38 EXPORT SCENARIO FOR HS CODE 9022.12, 2020-2024 (USD THOUSAND)

- FIGURE 39 CT SIMULATORS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 40 FUNDING AND NUMBER OF DEALS IN CT SIMULATORS MARKET, 2019-2023 (USD MILLION)

- FIGURE 41 NUMBER OF DEALS IN CT SIMULATORS MARKET, BY KEY PLAYER, 2019-2023

- FIGURE 42 VALUE OF DEALS IN CT SIMULATORS MARKET, BY KEY PLAYER, 2019-2023 (USD)

- FIGURE 43 NORTH AMERICA: CT SIMULATORS MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: CT SIMULATORS MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS IN CT SIMULATORS MARKET, 2020-2024 (USD MILLION)

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS IN CT SIMULATORS MARKET (2024)

- FIGURE 47 MARKET RANKING OF KEY PLAYERS IN CT SIMULATORS MARKET (2024)

- FIGURE 48 EV/EBITDA OF TOP THREE PLAYERS (2025)

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF TOP THREE PLAYERS (2025)

- FIGURE 50 CT SIMULATORS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 51 CT SIMULATORS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 CT SIMULATORS MARKET: COMPANY FOOTPRINT

- FIGURE 53 CT SIMULATORS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT

- FIGURE 55 PHILIPS HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 56 GE HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 57 CANON MEDICAL SYSTEMS CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 ELEKTA: COMPANY SNAPSHOT

- FIGURE 59 FUJIFILM HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 60 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 HITACHI HIGH-TECH CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 SHINVA MEDICAL INSTRUMENT CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 ACCURAY INCORPORATED: COMPANY SNAPSHOT