PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1877347

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1877347

Agricultural Robots Market by Robot Type, Application, Offering, End Use, Farming Environment, Farm Size, and Region - Global Forecast to 2030

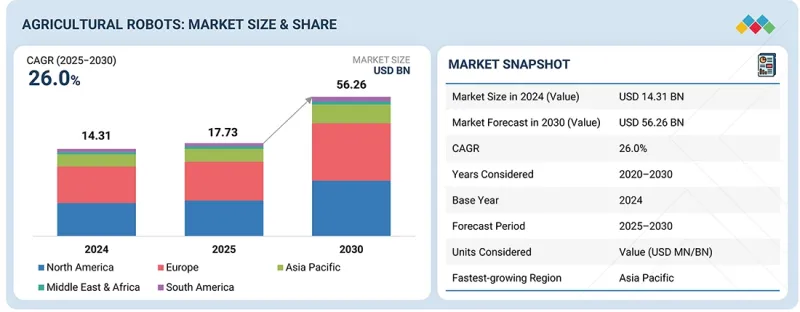

The global market for agricultural robots is estimated to be valued at USD 17.73 billion in 2025. It is projected to reach USD 56.26 billion by 2030, at a CAGR of 26.0% during the forecast period. The adoption of artificial intelligence (AI) in agricultural robots is accelerating the shift toward data-driven and efficient farming operations. AI enables robots to perform complex tasks such as seeding, crop monitoring, weeding, and harvesting with precision and minimal human intervention.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Robot Type, Application, End Use, Farming Environment, Offering, Farm Size, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

By leveraging machine learning and computer vision, these systems optimize resource utilization, improve yield prediction, and reduce operational costs. The integration of AI with autonomous tractors and drones enhances decision-making and scalability across large farms. As technology costs decline, AI-driven agricultural robots are becoming a strategic enabler for sustainable, productive, and resilient agri-business operations.

"The unmanned aerial vehicles segment holds the highest market share in the robot type segment of the agricultural robots market."

The unmanned aerial vehicle (UAV) segment leads the agricultural robots market in terms of market share due to its versatility and efficiency in modern farming. UAVs, also known as drones, are widely used for crop monitoring, field mapping, precision spraying, and soil analysis. Equipped with high-resolution cameras, multispectral sensors, and AI-enabled analytics, they provide real-time insights into crop health, pest infestations, and irrigation needs. Their ability to cover large areas quickly and cost-effectively reduces labor requirements while enhancing productivity. The growing demand for precision agriculture, data-driven decision-making, and sustainable farming practices is driving the rapid adoption of UAVs across global agricultural operations.

"The field farming application segment is projected to grow at a significant rate during the forecast period."

The field farming application segment in the agricultural robots market is projected to grow at a significant rate during the forecast period, driven by increasing adoption of automation and precision agriculture practices. Robots and autonomous machinery are increasingly deployed for activities such as seeding, planting, weeding, irrigation, and harvesting across large-scale farms. These technologies improve operational efficiency, reduce labor dependency, and optimize resource utilization, including water, fertilizers, and pesticides. Advances in AI, machine learning, and IoT-enabled sensors further enhance accuracy and decision-making. The growing demand for higher crop yields and sustainable farming practices is expected to drive robust growth in this segment globally.

North America is expected to hold a significant share of the agricultural robots market.

North America is expected to hold a significant share in the agricultural robots market due to early adoption of advanced technologies and well-established precision farming practices. The region benefits from strong investment in agrarian automation, supportive government initiatives, and high awareness of AI- and robotics-driven solutions. Farmers are increasingly using autonomous tractors, drones, and AI-enabled robots to enhance productivity, optimize resource utilization, and reduce labor dependency. Additionally, the presence of key market players and continuous innovation in robotics and IoT technologies further strengthen North America's position as a leading region in the adoption of smart and sustainable agricultural solutions.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the agricultural robots market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15% and Rest of the World -10%

Prominent companies in the market include Deere & Company (US), DJI (China), CNH Industrial NV (Netherlands), AGCO Corporation (US), Delaval (Sweden), Trimble Inc. (US), Boumatic Robotic (Netherlands), Lely (Netherlands), AgJunction (US), AgEagle Aerial Systems (US), Yanmar Co. (Japan), Deepfield Robotics (Germany), Ecorobotix (Switzerland), Harvest Automation (US), and Naio Technologies (France).

Other players include Robotics Plus (Zealand), Kubota Corporation (Japan), Harvest Cro Robotics (US), Autonomous Tractor Corporation (US), Clearpath Robotics (Canada), Dronedeploy (US), Agrobots (Spain), FFRobotics (Israel), Fullwood Joz (UK), and Monarch Tractors (US).

Research Coverage:

This research report categorizes the agricultural robots market by robot type (unmanned aerial vehicles/drones, milking robotics, driverless tractor, automated harvesting robots), (harvest management, field & crop management, dairy & livestock management, inventory & supply chain management, soil & irrigation management, weather tracking & forecasting), end use (farm produce, dairy & livestock), farming environment (indoor, outdoor), offering (hardware, software, services), farm size (small-sized farm, mid-sized farms, large sized farms) and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report encompasses detailed information regarding the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the agricultural robots market. A detailed analysis of key industry players has been conducted to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments related to the agricultural robots market. This report provides a competitive analysis of emerging startups in the agricultural robots market ecosystem. Furthermore, the study also covers industry-specific trends, including technology analysis, ecosystem and market mapping, patent analysis, and regulatory landscape, among others.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall agricultural robots and the subsegments. This report will help stakeholders understand the competitive landscape and gain valuable insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing demand for food), restraints (supply chain disruption), opportunities (technological innovations), and challenges (regulatory barriers) influencing the growth of the agricultural robots market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the agricultural robots market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the agricultural robots market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the agricultural robots market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Deere & Company (US), DJI (China), CNH Industrial NV (Netherlands), AGCO Corporation (US), Delaval (Sweden), and other players in the agricultural robots market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE AND SEGMENTATION

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.3.6 STAKEHOLDERS

- 1.4 SUMMARY OF STRATEGIC CHANGES IN MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 BASE NUMBER CALCULATION

- 2.3 MARKET FORECAST APPROACH

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURAL ROBOTS MARKET

- 4.2 AGRICULTURAL ROBOTS MARKET, BY OFFERING AND REGION

- 4.3 AGRICULTURAL ROBOTS MARKET, BY FARM SIZE

- 4.4 AGRICULTURAL ROBOTS MARKET, BY APPLICATION

- 4.5 AGRICULTURAL ROBOTS MARKET, BY END USE

- 4.6 AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT

- 4.7 AGRICULTURAL ROBOTS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 REDUCTION IN ARABLE LAND

- 5.2.2 RAPID DIGITALIZATION

- 5.2.3 LIVESTOCK POPULATION TRENDS

- 5.3 MARKET DYNAMICS

- 5.3.1 INTRODUCTION

- 5.3.2 DRIVERS

- 5.3.2.1 Advancement in technologies

- 5.3.2.2 Sustainability goals accelerate adoption of agricultural robots

- 5.3.2.3 Surging labor costs and labor shortages

- 5.3.2.4 Increasing number of dairy, poultry, and swine farms

- 5.3.3 RESTRAINTS

- 5.3.3.1 High initial cost of automation for small farms

- 5.3.3.2 Technological barriers pertaining to fully autonomous robots

- 5.3.3.3 Complex and unstructured farm environments

- 5.3.3.4 Lack of training activities in operating agricultural robots

- 5.3.4 OPPORTUNITIES

- 5.3.4.1 Untapped market potential and scope for automation in agriculture

- 5.3.4.2 Controlled Environment Agriculture (CEA) to drive adoption of agricultural robots

- 5.3.4.3 High adoption of aerial data collection tools in agriculture

- 5.3.4.4 Adoption of software, data, and service-based business models

- 5.3.5 CHALLENGES

- 5.3.5.1 Lack of standardization and regulation of agricultural robot technologies globally

- 5.3.5.2 High cost and complexity of fully autonomous robots

- 5.3.5.3 Integration challenges with existing farm equipment

- 5.3.5.4 Lack of technical knowledge among farmers

- 5.4 UNMET NEEDS AND WHITE SPACES

- 5.4.1 UNMET NEEDS IN AGRICULTURAL ROBOTS MARKET

- 5.4.2 WHITE SPACE OPPORTUNITIES

- 5.5 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5.1 INTERCONNECTED MARKETS

- 5.5.2 CROSS-SECTOR OPPORTUNITIES

- 5.6 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 5.6.1 EMERGING BUSINESS MODELS

- 5.6.2 ECOSYSTEM SHIFTS

- 5.7 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.7.1 KEY MOVES AND STRATEGIC FOCUS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 DEVICE AND COMPONENT MANUFACTURERS

- 6.2.3 SYSTEM INTEGRATORS

- 6.2.4 SERVICE PROVIDERS

- 6.2.5 END USERS

- 6.2.6 POST-SALES SERVICES

- 6.3 ECOSYSTEM ANALYSIS

- 6.3.1 DEMAND SIDE

- 6.3.2 SUPPLY SIDE

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 6.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO OF HS CODE 8433

- 6.5.2 IMPORT SCENARIO OF HS CODE 8433

- 6.6 KEY CONFERENCES AND EVENTS, 2024-2026

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 INVESTMENT AND FUNDING SCENARIO

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 KUBOTA-KILTER COLLABORATION ON AX-1 ULTRA-PRECISE WEEDING ROBOT

- 6.9.2 ENHANCING SOFT-FRUIT HARVESTING THROUGH PLATFORM-AGNOSTIC ROBOTICS INTEGRATION

- 6.9.3 AIGEN'S ELEMENT GEN2 ROBOTIC CREW FOR WEED CONTROL

- 6.10 IMPACT OF 2025 US TARIFF - AGRICULTURAL ROBOTS MARKET

- 6.10.1 INTRODUCTION

- 6.10.2 KEY TARIFF RATES

- 6.10.3 PRICE IMPACT ANALYSIS

- 6.10.4 IMPACT ON COUNTRY/REGION

- 6.10.4.1 US

- 6.10.4.2 Europe

- 6.10.4.3 Asia Pacific

- 6.10.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 AI-POWERED COMPUTER VISION & DEEP LEARNING

- 7.1.2 AERIAL-GROUND COLLABORATIVE SYSTEMS (UAV-UGV INTEGRATION)

- 7.1.3 SWARM ROBOTICS

- 7.1.4 RTK GPS & HIGH-PRECISION POSITIONING

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 IOT SENSORS AND SMART FIELD MONITORING SYSTEMS

- 7.2.2 5G CONNECTIVITY AND EDGE COMPUTING

- 7.2.3 CLOUD-BASED FARM MANAGEMENT PLATFORMS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 7.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 7.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 7.4 PATENT ANALYSIS

- 7.4.1 INTRODUCTION

- 7.4.2 METHODOLOGY

- 7.4.3 DOCUMENT TYPE

- 7.4.4 INSIGHTS

- 7.4.5 LEGAL STATUS OF PATENTS

- 7.4.6 JURISDICTION ANALYSIS

- 7.4.7 TOP APPLICANTS

- 7.4.8 LIST OF PATENTS BY DEERE & CO

- 7.5 FUTURE APPLICATIONS

- 7.5.1 AUTONOMOUS SWARM ROBOTICS: SCALABLE FIELD OPTIMIZATION

- 7.5.2 AI-INTEGRATED HARVESTING ROBOTS: PRECISION YIELD OPTIMIZATION

- 7.5.3 SENSOR-EMBEDDED SOIL MONITORING ROBOTS: REAL-TIME FARM DIAGNOSTICS

- 7.5.4 BIODEGRADABLE FIELD ROBOTS: CIRCULAR AGRICULTURE ENHANCEMENT

- 7.5.5 HYBRID AGRO-ROBOTIC SYSTEMS: UAV-UGV INTEGRATION FOR ADVANCED OPERATIONS

- 7.6 IMPACT OF AI/GEN AI ON AGRICULTURAL ROBOTS MARKET

- 7.6.1 TOP USE CASES AND MARKET POTENTIAL

- 7.6.2 BEST PRACTICES IN AGRICULTURAL ROBOT MANUFACTURING

- 7.6.3 CASE STUDIES OF AI IMPLEMENTATION IN AGRICULTURAL ROBOTS MARKET

- 7.6.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 7.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AGRICULTURAL ROBOTS MARKET

- 7.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 7.7.1 DEERE & COMPANY - AUTONOMOUS TRACTORS & AI SPRAYING

- 7.7.2 AGCO CORPORATION - AUTONOMOUS FIELD ROBOTS

- 7.7.3 CNH INDUSTRIAL N.V. - SPECIALTY CROP ROBOTS & AUTONOMOUS TRACTORS

8 REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 GLOBAL STANDARDS FOR AGRICULTURAL MACHINERY

- 8.1.2 NORTH AMERICA

- 8.1.2.1 United States (US)

- 8.1.2.2 Canada

- 8.1.2.3 Mexico

- 8.1.3 EUROPEAN UNION (EU)

- 8.1.4 ASIA PACIFIC

- 8.1.4.1 India

- 8.1.4.2 China

- 8.1.4.3 Australia

- 8.1.5 REST OF THE WORLD

- 8.1.6 INDUSTRY STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 MARKET PROFITABILITY

- 9.4.1 REVENUE POTENTIAL

- 9.4.2 COST DYNAMICS

- 9.4.3 MARGIN OPPORTUNITIES BY APPLICATION

10 AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE

- 10.1 INTRODUCTION

- 10.2 UNMANNED AERIAL VEHICLES

- 10.2.1 INCREASING DEMAND FOR REAL-TIME CROP MONITORING AND PRECISION SPRAYING TO ENHANCE YIELD TO FUEL MARKET GROWTH

- 10.2.1.1 Fixed-wing drones

- 10.2.1.2 Multi-rotor drones

- 10.2.1.3 Hybrid drones

- 10.2.1 INCREASING DEMAND FOR REAL-TIME CROP MONITORING AND PRECISION SPRAYING TO ENHANCE YIELD TO FUEL MARKET GROWTH

- 10.3 MILKING ROBOTS

- 10.3.1 LABOR SHORTAGE AND NEED FOR CONSISTENT, HIGH-EFFICIENCY DAIRY OPERATIONS TO DRIVE DEMAND

- 10.3.1.1 Automated Milking Rotary Systems

- 10.3.1.2 Box/Stall Milking Systems

- 10.3.1 LABOR SHORTAGE AND NEED FOR CONSISTENT, HIGH-EFFICIENCY DAIRY OPERATIONS TO DRIVE DEMAND

- 10.4 DRIVERLESS TRACTORS

- 10.4.1 DRIVERLESS TRACTORS TO LEAD TO LESS DAMAGE TO SOIL DUE TO AUTOMATED SOFTWARE AND LESS HUMAN ERROR

- 10.4.1.1 Fully Autonomous Tractors

- 10.4.1.2 Semi-autonomous Tractors

- 10.4.1 DRIVERLESS TRACTORS TO LEAD TO LESS DAMAGE TO SOIL DUE TO AUTOMATED SOFTWARE AND LESS HUMAN ERROR

- 10.5 AUTOMATED HARVESTING SYSTEMS

- 10.5.1 REDUCTION OF NEED FOR MANUAL LABOR AND INCREASING OPERATIONAL EFFICIENCY TO DRIVE SEGMENT

- 10.5.1.1 Fruit-picking Robots

- 10.5.1.2 Vegetable Harvesting Robots

- 10.5.1 REDUCTION OF NEED FOR MANUAL LABOR AND INCREASING OPERATIONAL EFFICIENCY TO DRIVE SEGMENT

- 10.6 OTHERS

- 10.6.1 MATERIAL MANAGEMENT ROBOTS

- 10.6.2 SOIL MANAGEMENT ROBOTS

- 10.6.3 CROP MONITORING AND SCOUTING ROBOTS

- 10.6.4 WEEDING AND THINNING ROBOTS

- 10.6.5 PRUNING ROBOTS

- 10.6.6 SPRAYING & IRRIGATION ROBOTS

- 10.6.7 OTHER SPECIALIZED AGRICULTURAL ROBOTS

11 AGRICULTURAL ROBOTS MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 HARVEST MANAGEMENT

- 11.2.1 HARVEST MANAGEMENT APPLICATIONS TO DRIVE UTILIZATION OF UAV AND AUTOMATED HARVESTING SYSTEMS

- 11.3 FIELD FARMING & CROP MANAGEMENT

- 11.3.1 USAGE OF ROBOTS IN PLOWING AND SEEDING TO YIELD BETTER PRODUCTIVITY

- 11.3.2 PLANTING AND SEEDING

- 11.3.3 MONITORING & SCOUTING

- 11.3.4 FERTILIZATION & NUTRIENT MANAGEMENT

- 11.4 DAIRY & LIVESTOCK MANAGEMENT

- 11.4.1 MILKING ROBOTS TO AUTOMATE MANUAL PROCESSES IN DAIRY FARMS

- 11.5 SOIL & IRRIGATION MANAGEMENT

- 11.5.1 USAGE OF DRONES IN SOIL & IRRIGATION MANAGEMENT TO DRIVE MARKET

- 11.6 INVENTORY & SUPPLY CHAIN MANAGEMENT

- 11.6.1 INVENTORY MANAGEMENT TO STREAMLINE TRACKING AND ORGANIZING OF AGRICULTURAL PRODUCTS AND RESOURCES

- 11.6.2 WEATHER TRACKING & MONITORING

- 11.6.2.1 Demand for real-time weather data to drive robotic field optimization

- 11.7 OTHERS

12 AGRICULTURAL ROBOTS MARKET, BY OFFERING

- 12.1 INTRODUCTION

- 12.2 HARDWARE

- 12.2.1 ADOPTION OF PRECISION EQUIPMENT AND REAL-TIME DATA TOOLS TO DRIVE MARKET GROWTH

- 12.2.2 AUTOMATION & CONTROL

- 12.2.3 SENSING & MONITORING

- 12.3 SOFTWARE

- 12.3.1 RISE IN FARM MANAGEMENT, ANALYTICS, AND AI-BASED DECISION TOOLS TO BOOST MARKET GROWTH

- 12.3.2 ON-CLOUD

- 12.3.3 ON-PREMISE

- 12.3.4 AI AND DATA ANALYTICS

- 12.4 SERVICES

- 12.4.1 INCREASING DEPLOYMENT OF LIVESTOCK FARMING DEVICES AND EQUIPMENT

- 12.4.2 SYSTEM INTEGRATION & CONSULTING

- 12.4.3 MANAGED SERVICES

13 AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT

- 13.1 INTRODUCTION

- 13.2 OUTDOOR

- 13.2.1 ADOPTION OF AGRICULTURAL ROBOTS FOR LIVESTOCK MONITORING AND VARIABLE RATE APPLICATION TO DRIVE MARKET GROWTH

- 13.3 INDOOR

- 13.3.1 USAGE OF ROBOTS IN OPTIMIZING RESOURCE USAGE IN HYDROPONICS TO DRIVE MARKET GROWTH

14 AGRICULTURAL ROBOTS MARKET, BY FARM SIZE

- 14.1 INTRODUCTION

- 14.2 SMALL-SIZED FARMS (LESS THAN 100 HECTARES)

- 14.2.1 ADOPTION DRIVEN BY LABOR COST REDUCTION AND PRODUCTIVITY IMPROVEMENT

- 14.3 MID-SIZED FARMS (MORE THAN 100 HECTARES AND LESS THAN 500 HECTARES)

- 14.3.1 ADOPTION DRIVEN BY EFFICIENT RESOURCE MANAGEMENT AND PRECISION FARMING BENEFITS

- 14.4 LARGE-SIZED FARMS (MORE THAN 500 HECTARES)

- 14.4.1 SCALABILITY AND OPERATIONAL EFFICIENCY TO DRIVE MARKET

15 AGRICULTURAL ROBOTS MARKET, BY END USE

- 15.1 INTRODUCTION

- 15.2 FARM PRODUCE

- 15.2.1 CEREALS & GRAINS

- 15.2.1.1 Promotion of innovative and technological advancements in cereals & grains to boost market

- 15.2.1.2 Corn

- 15.2.1.3 Wheat

- 15.2.1.4 Rice

- 15.2.1.5 Other Cereals & Grains

- 15.2.2 OILSEEDS & PULSES

- 15.2.2.1 Assistance of robots in post-harvest operations for oilseeds & pulses to drive market

- 15.2.2.2 Soyabeans

- 15.2.2.3 Sunflowers

- 15.2.2.4 Other oilseeds & pulses

- 15.2.3 FRUITS & VEGETABLES

- 15.2.3.1 Revolutionizing traditional farming practices in fruits & vegetables to propel market growth

- 15.2.3.2 Pome fruits

- 15.2.3.3 Citrus fruits

- 15.2.3.4 Berries

- 15.2.3.5 Root & tuber vegetables

- 15.2.3.6 Leafy vegetables

- 15.2.3.7 Other fruits & vegetables

- 15.2.4 OTHERS

- 15.2.1 CEREALS & GRAINS

- 15.3 DAIRY & LIVESTOCK

- 15.3.1 USAGE OF MILKING ROBOTS IN DAIRY & LIVESTOCK PRODUCE SEGMENT TO DRIVE MARKET

16 AGRICULTURAL ROBOTS MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Leveraging unmanned aerial vehicles for improved farming practices to bolster market growth

- 16.2.2 CANADA

- 16.2.2.1 Constant enhancements and developments in precision farming practices to drive market growth

- 16.2.3 MEXICO

- 16.2.3.1 Adoption of drones and other smart technologies through government's financial support to drive market

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 FRANCE

- 16.3.1.1 Increasing robotic startups in France for agricultural applications to lead to market growth

- 16.3.2 GERMANY

- 16.3.2.1 Government incentives and ongoing collaborative research projects to propel market growth

- 16.3.3 ITALY

- 16.3.3.1 Usage of latest agricultural sensor technologies in Italy to drive market

- 16.3.4 NETHERLANDS

- 16.3.4.1 Technology-driven economy and focus on sustainable agriculture to boost market

- 16.3.5 UK

- 16.3.5.1 Adopting advanced digital technologies to enhance farming practices in UK

- 16.3.6 REST OF EUROPE

- 16.3.1 FRANCE

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Increasing government incentives and investments to boost market

- 16.4.2 INDIA

- 16.4.2.1 Increasing government incentives and investments to boost market

- 16.4.3 JAPAN

- 16.4.3.1 Rising adoption of advanced technology in Japan to drive market growth

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Agriculture drones to be used for surveying farms and assessing crop losses

- 16.4.5 AUSTRALIA

- 16.4.5.1 Usage of agricultural drones in different applications to boost demand in Australia

- 16.4.6 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.5.1.1 Rise in digital agriculture activities to drive market

- 16.5.2 ARGENTINA

- 16.5.2.1 Increase in public-private partnerships for agriculture innovations in Argentina to drive market growth

- 16.5.3 REST OF SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.6 REST OF THE WORLD

- 16.6.1 MIDDLE EAST

- 16.6.1.1 Growth in agriculture monitoring activities in Middle East to boost market

- 16.6.2 AFRICA

- 16.6.2.1 Increase in investments for agriculture innovations in Africa to drive market growth

- 16.6.1 MIDDLE EAST

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 17.3 ANNUAL REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.5.1 STARS

- 17.5.2 EMERGING LEADERS

- 17.5.3 PERVASIVE PLAYERS

- 17.5.4 PARTICIPANTS

- 17.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.5.5.1 Company footprint

- 17.5.5.2 Region footprint

- 17.5.5.3 Robot type footprint

- 17.5.5.4 Offering footprint

- 17.5.5.5 End use footprint

- 17.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.6.1 PROGRESSIVE COMPANIES

- 17.6.2 RESPONSIVE COMPANIES

- 17.6.3 DYNAMIC COMPANIES

- 17.6.4 STARTING BLOCKS

- 17.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.6.5.1 Detailed list of key startups/SMEs

- 17.6.5.2 Competitive benchmarking of key startups/SMEs

- 17.7 COMPANY VALUATION AND FINANCIAL METRICS

- 17.8 PRODUCT COMPARISON

- 17.9 COMPETITIVE SCENARIO AND TRENDS

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 DEERE & COMPANY

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches

- 18.1.1.3.2 Deals

- 18.1.1.4 MnM view

- 18.1.1.4.1 Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 CNH INDUSTRIAL NV

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Deals

- 18.1.2.4 MnM view

- 18.1.2.4.1 Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 AGCO CORPORATION

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.3.2 Deals

- 18.1.3.3.3 Expansions

- 18.1.3.4 MnM view

- 18.1.3.4.1 Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 TRIMBLE INC.

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches

- 18.1.4.3.2 Deals

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 DJI

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches

- 18.1.5.4 MnM view

- 18.1.5.4.1 Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 BOUMATIC

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Product launches

- 18.1.6.3.2 Deals

- 18.1.6.4 MnM view

- 18.1.7 LELY INTERNATIONAL

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Products offered

- 18.1.7.3.2 Deals

- 18.1.7.4 MnM view

- 18.1.8 EAGLENXT

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Product launches

- 18.1.8.3.2 Deals

- 18.1.8.3.3 Other developments

- 18.1.8.4 MnM view

- 18.1.9 KUBOTA CORPORATION

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Product launches

- 18.1.9.3.2 Deals

- 18.1.9.4 MnM view

- 18.1.10 DELAVAL

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Product launches

- 18.1.10.3.2 Deals

- 18.1.10.3.3 Expansions

- 18.1.10.4 MnM view

- 18.1.10.4.1 Right to win

- 18.1.11 HARVEST CROO ROBOTICS

- 18.1.11.1 Business overview

- 18.1.11.2 Products offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Product launches

- 18.1.11.4 MnM view

- 18.1.12 NAIO TECHNOLOGIES

- 18.1.12.1 Business overview

- 18.1.12.2 Products offered

- 18.1.12.3 Recent developments

- 18.1.12.3.1 Product launches

- 18.1.12.3.2 Deals

- 18.1.12.4 MnM view

- 18.1.13 ECOROBOTIX

- 18.1.13.1 Business overview

- 18.1.13.2 Products offered

- 18.1.13.3 MnM view

- 18.1.14 AGROBOTS

- 18.1.14.1 Business overview

- 18.1.14.2 Products offered

- 18.1.14.3 MnM view

- 18.1.15 ROBOTICS PLUS

- 18.1.15.1 Business overview

- 18.1.15.2 Products offered

- 18.1.15.3 Recent developments

- 18.1.15.3.1 Product launches

- 18.1.15.3.2 Deals

- 18.1.15.4 MnM view

- 18.1.1 DEERE & COMPANY

- 18.2 OTHER PLAYERS

- 18.2.1 AUTONOMOUS TRACTOR CORPORATION

- 18.2.1.1 Business overview

- 18.2.1.2 Products offered

- 18.2.1.3 Recent developments

- 18.2.1.3.1 Product launches

- 18.2.1.4 MnM view

- 18.2.2 FFROBOTICS

- 18.2.2.1 Business overview

- 18.2.2.2 Products offered

- 18.2.2.3 MnM view

- 18.2.3 DRONEDEPLOY

- 18.2.3.1 Business overview

- 18.2.3.2 Products offered

- 18.2.3.3 Recent developments

- 18.2.3.3.1 Deals

- 18.2.3.4 MnM view

- 18.2.4 YANMAR CO.

- 18.2.4.1 Business overview

- 18.2.4.2 Products offered

- 18.2.4.3 Recent developments

- 18.2.4.3.1 Product launches

- 18.2.4.4 MnM view

- 18.2.5 CLEARPATH ROBOTICS, INC.

- 18.2.5.1 Business overview

- 18.2.5.2 Products offered

- 18.2.5.3 Recent developments

- 18.2.5.3.1 Product launches

- 18.2.5.3.2 Deals

- 18.2.5.4 MnM view

- 18.2.6 BONSAI ROBOTICS INC.

- 18.2.7 AIGEN

- 18.2.8 TEVEL AEROBOTICS TECHNOLOGIES LTD.

- 18.2.9 SWARMFARM

- 18.2.10 MONARCH TRACTOR

- 18.2.1 AUTONOMOUS TRACTOR CORPORATION

19 ADJACENT AND RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 LIMITATIONS

- 19.3 PRECISION LIVESTOCK FARMING MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.4 MILKING ROBOTS MARKET

- 19.4.1 MARKET DEFINITION

- 19.4.2 MARKET OVERVIEW

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

List of Tables

- TABLE 1 COUNTRIES WITH HIGHEST ESTIMATED POPULATION, BY CATTLE & CHICKEN, 2023

- TABLE 2 PRICES OF VARIOUS AUTONOMOUS ROBOTS (FRUIT-PICKING, PRUNING, WEEDING, SPRAYING, AND MOVING)

- TABLE 3 AGRICULTURAL ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 AGRICULTURAL ROBOTS ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF AGRICULTURAL ROBOT TYPES, BY KEY PLAYER, 2024 (USD/UNIT)

- TABLE 6 AVERAGE SELLING PRICE (ASP) TREND OF AGRICULTURAL ROBOTS, BY TYPE, 2020-2024 (USD/UNIT)

- TABLE 7 AVERAGE SELLING PRICE TREND OF AGRICULTURAL ROBOTS, BY REGION, 2023-2024 (USD/UNIT)

- TABLE 8 EXPORT VALUE OF HS CODE 8433, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 IMPORT VALUE OF HS CODE 8433, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 AGRICULTURAL ROBOTS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2026

- TABLE 11 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 12 AGRICULTURAL ROBOTS MARKET: TOTAL NUMBER OF PATENTS, JANUARY 2016-OCTOBER 2025

- TABLE 13 TOP USE CASES AND MARKET POTENTIAL

- TABLE 14 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 15 AGRICULTURAL ROBOTS MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 16 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 US: ROBOTICS FOR AGRICULTURAL AND INDUSTRIAL USE

- TABLE 23 CANADA: ROBOTIC MACHINERY AND ROBOT USAGE

- TABLE 24 MEXICO: DRONE CATEGORIES

- TABLE 25 EU: DRONE FLYING BASED ON INTENDED OPERATIONS

- TABLE 26 EUROPE: AGRICULTURAL MACHINERY AND ROBOT PRODUCTION STANDARDS

- TABLE 27 CHINA: ARTICLES REGARDING AGRICULTURAL TECHNOLOGIES

- TABLE 28 CHINA: DRONE CLASSIFICATION BASED ON WEIGHT

- TABLE 29 GLOBAL INDUSTRY STANDARDS IN AGRICULTURAL ROBOTS MARKET

- TABLE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY FARMING ENVIRONMENT

- TABLE 31 KEY BUYING CRITERIA FOR FARMING ENVIRONMENT

- TABLE 32 UNMET NEEDS IN AGRICULTURAL ROBOTS MARKET, BY END-USE INDUSTRY

- TABLE 33 AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 34 AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 35 AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (UNITS)

- TABLE 36 AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (UNITS)

- TABLE 37 UNMANNED AERIAL VEHICLES: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 UNMANNED AERIAL VEHICLES: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 UNMANNED AERIAL VEHICLES: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 40 UNMANNED AERIAL VEHICLES: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 41 UNMANNED AERIAL VEHICLE HARDWARE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 42 UNMANNED AERIAL VEHICLE HARDWARE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 43 MILKING ROBOTS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 MILKING ROBOTS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 MILKING ROBOTS: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 46 MILKING ROBOTS: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 47 MILKING ROBOTS: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 48 MILKING ROBOTS: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 DRIVERLESS TRACTORS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 DRIVERLESS TRACTORS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 DRIVERLESS TRACTORS: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 52 DRIVERLESS TRACTORS: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 53 AUTOMATED HARVESTING SYSTEMS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 AUTOMATED HARVESTING SYSTEMS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 AUTOMATED HARVESTING SYSTEMS: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 56 AUTOMATED HARVESTING SYSTEMS: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 57 OTHERS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 OTHERS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 60 AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 HARVEST MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 HARVEST MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 FIELD FARMING & CROP MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 FIELD FARMING & CROP MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 DAIRY & LIVESTOCK MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 DAIRY & LIVESTOCK MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 SOIL & IRRIGATION MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 SOIL & IRRIGATION MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 INVENTORY & SUPPLY CHAIN MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 INVENTORY & SUPPLY CHAIN MANAGEMENT: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 WEATHER TRACKING & MONITORING: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 WEATHER TRACKING & MONITORING: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 OTHER APPLICATIONS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 OTHER APPLICATIONS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 76 AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 77 HARDWARE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 78 HARDWARE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 79 HARDWARE: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 80 HARDWARE: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 SOFTWARE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 82 SOFTWARE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 83 SOFTWARE: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 SOFTWARE: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 SERVICES: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 86 SERVICES: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 87 SERVICES: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 SERVICES: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2020-2024 (USD MILLION)

- TABLE 90 AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 91 AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2020-2024 (UNITS)

- TABLE 92 AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2025-2030 (UNITS)

- TABLE 93 OUTDOOR: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 OUTDOOR: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 INDOOR: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 INDOOR: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2020-2024 (USD MILLION)

- TABLE 98 AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 99 SMALL-SIZED FARMS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 SMALL-SIZED FARMS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 MID-SIZED FARMS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 102 MID-SIZED FARMS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 LARGE-SIZED FARMS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 104 LARGE-SIZED FARMS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 AGRICULTURAL ROBOTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 106 AGRICULTURAL ROBOTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 107 AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2020-2024 (USD MILLION)

- TABLE 108 AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2025-2030 (USD MILLION)

- TABLE 109 FARM PRODUCE: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 110 FARM PRODUCE: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 CEREALS & GRAINS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 112 CEREALS & GRAINS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 CEREALS & GRAINS: AGRICULTURE ROBOTS MARKET, BY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 114 CEREALS & GRAINS: AGRICULTURE ROBOTS MARKET, BY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 115 OILSEEDS & PULSES: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 116 OILSEEDS & PULSES: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 117 OILSEEDS & PULSES: AGRICULTURE ROBOTS MARKET, BY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 118 OILSEEDS & PULSES: AGRICULTURE ROBOTS MARKET, BY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 119 FRUITS & VEGETABLES: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 120 FRUITS & VEGETABLES: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 121 FRUITS & VEGETABLES: AGRICULTURE ROBOTS MARKET, BY SUB-TYPE, 2020-2024 (USD MILLION)

- TABLE 122 FRUITS & VEGETABLES: AGRICULTURE ROBOTS MARKET, BY SUB-TYPE, 2025-2030 (USD MILLION)

- TABLE 123 OTHERS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 124 OTHERS: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 125 DAIRY & LIVESTOCK: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 126 DAIRY & LIVESTOCK: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 128 AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 129 AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (UNITS)

- TABLE 130 AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (UNITS)

- TABLE 131 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT 2020-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 136 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 137 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 138 UNMANNED AERIAL VEHICLES IN NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 139 UNMANNED AERIAL VEHICLES HARDWARE IN NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 140 UNMANNED AERIAL VEHICLES HARDWARE IN NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 MILKING ROBOTS IN NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 142 MILKING ROBOTS IN NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 143 MILKING ROBOTS IN NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 144 MILKING ROBOTS IN NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 DRIVERLESS TRACTORS: NORTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 146 DRIVERLESS TRACTORS: NORTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 147 AUTOMATED HARVESTING SYSTEMS: NORTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 148 AUTOMATED HARVESTING SYSTEMS: NORTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 149 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 152 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 153 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2020-2024 (USD MILLION)

- TABLE 154 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 155 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 156 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 157 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2020-2024 (USD MILLION)

- TABLE 158 NORTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2025-2030 (USD MILLION)

- TABLE 159 US: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 160 US: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 161 CANADA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 162 CANADA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 163 MEXICO: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 164 MEXICO: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 165 EUROPE: AGRICULTURAL ROBOTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 166 EUROPE: AGRICULTURAL ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT 2020-2024 (USD MILLION)

- TABLE 168 EUROPE: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 169 EUROPE: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 170 EUROPE: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 171 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 172 UNMANNED AERIAL VEHICLES IN EUROPE: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 173 UNMANNED AERIAL VEHICLES HARDWARE IN EUROPE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 174 UNMANNED AERIAL VEHICLES HARDWARE IN EUROPE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 175 MILKING ROBOTS IN EUROPE: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 176 MILKING ROBOTS IN EUROPE: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 177 MILKING ROBOTS IN EUROPE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 178 MILKING ROBOTS IN EUROPE: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 DRIVERLESS TRACTORS: EUROPEAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 180 DRIVERLESS TRACTORS: EUROPEAN AGRICULTURAL ROBOTS MARKET, BY TYPE 2025-2030 (USD MILLION)

- TABLE 181 AUTOMATED HARVESTING SYSTEMS: EUROPEAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 182 AUTOMATED HARVESTING SYSTEMS: EUROPEAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 183 EUROPE: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 184 EUROPE: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185 EUROPE: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 186 EUROPE: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 187 EUROPE: AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2020-2024 (USD MILLION)

- TABLE 188 EUROPE: AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 189 EUROPE: AGRICULTURAL ROBOTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 190 EUROPE: AGRICULTURAL ROBOTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 191 EUROPE: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2020-2024 (USD MILLION)

- TABLE 192 EUROPE: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2025-2030 (USD MILLION)

- TABLE 193 FRANCE: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 194 FRANCE: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 195 GERMANY: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 196 GERMANY: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 197 ITALY: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 198 ITALY: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 199 NETHERLANDS: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 200 NETHERLANDS: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 201 UK: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 202 UK: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 203 REST OF EUROPE: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 204 REST OF EUROPE: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 206 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT 2020-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 210 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 211 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 212 UNMANNED AERIAL VEHICLES IN ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 213 UNMANNED AERIAL VEHICLES HARDWARE IN ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 214 UNMANNED AERIAL VEHICLES HARDWARE IN ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 215 MILKING ROBOTS IN ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 216 MILKING ROBOTS IN ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 217 MILKING ROBOTS IN ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 218 MILKING ROBOTS IN ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 DRIVERLESS TRACTORS: ASIA PACIFIC AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 220 DRIVERLESS TRACTORS: ASIA PACIFIC AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 221 AUTOMATED HARVESTING SYSTEMS: ASIA PACIFIC AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 222 AUTOMATED HARVESTING SYSTEMS: ASIA PACIFIC AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 223 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 224 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 225 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 226 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 227 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2020-2024 (USD MILLION)

- TABLE 228 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 229 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 230 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 231 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2020-2024 (USD MILLION)

- TABLE 232 ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2025-2030 (USD MILLION)

- TABLE 233 CHINA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 234 CHINA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 235 INDIA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 236 INDIA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 237 JAPAN: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 238 JAPAN: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 239 SOUTH KOREA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 240 SOUTH KOREA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 241 AUSTRALIA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 242 AUSTRALIA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 245 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 246 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 247 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT 2020-2024 (USD MILLION)

- TABLE 248 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 249 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 250 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 251 UNMANNED AERIAL VEHICLES: SOUTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 252 UNMANNED AERIAL VEHICLES: SOUTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 253 UNMANNED AERIAL VEHICLES HARDWARE IN SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 254 UNMANNED AERIAL VEHICLES HARDWARE IN SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 255 MILKING ROBOTS IN SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 256 MILKING ROBOTS IN SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 257 MILKING ROBOTS IN SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 258 MILKING ROBOTS IN SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 259 DRIVERLESS TRACTORS: SOUTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 260 DRIVERLESS TRACTORS: SOUTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 261 AUTOMATED HARVESTING SYSTEMS: SOUTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 262 AUTOMATED HARVESTING SYSTEMS: SOUTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 263 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 264 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 265 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 266 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 267 AUTOMATED HARVESTING SYSTEMS: SOUTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2020-2024 (USD MILLION)

- TABLE 268 AUTOMATED HARVESTING SYSTEMS: SOUTH AMERICAN AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 269 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 270 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 271 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2020-2024 (USD MILLION)

- TABLE 272 SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2025-2030 (USD MILLION)

- TABLE 273 BRAZIL: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 274 BRAZIL: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 275 ARGENTINA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 276 ARGENTINA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 277 REST OF SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 278 REST OF SOUTH AMERICA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 279 ROW: AGRICULTURAL ROBOTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 280 ROW: AGRICULTURAL ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 281 ROW: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2020-2024 (USD MILLION)

- TABLE 282 ROW: AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT, 2025-2030 (USD MILLION)

- TABLE 283 ROW: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 284 ROW: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 285 UNMANNED AERIAL VEHICLES IN ROW: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 286 UNMANNED AERIAL VEHICLES IN ROW: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 287 UNMANNED AERIAL VEHICLES HARDWARE IN ROW: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 288 UNMANNED AERIAL VEHICLES HARDWARE IN ROW: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 289 MILKING ROBOTS IN ROW: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 290 MILKING ROBOTS IN ROW: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 291 MILKING ROBOTS IN ROW: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 292 MILKING ROBOTS IN ROW: AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 293 DRIVERLESS TRACTORS: ROW AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 294 DRIVERLESS TRACTORS: ROW AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 295 AUTOMATED HARVESTING SYSTEMS: ROW AGRICULTURAL ROBOTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 296 AUTOMATED HARVESTING SYSTEMS: ROW AGRICULTURAL ROBOTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 297 ROW: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 298 ROW: AGRICULTURAL ROBOTS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 299 ROW: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 300 ROW: AGRICULTURAL ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 301 ROW: AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2020-2024 (USD MILLION)

- TABLE 302 ROW: AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2025-2030 (USD MILLION)

- TABLE 303 ROW: AGRICULTURAL ROBOTS MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 304 ROW: AGRICULTURAL ROBOTS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 305 ROW: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2020-2024 (USD MILLION)

- TABLE 306 ROW: AGRICULTURAL ROBOTS MARKET, BY FARM PRODUCE, 2025-2030 (USD MILLION)

- TABLE 307 MIDDLE EAST: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 308 MIDDLE EAST: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 309 AFRICA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2020-2024 (USD MILLION)

- TABLE 310 AFRICA: AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030 (USD MILLION)

- TABLE 311 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AGRICULTURAL ROBOTS MARKET, 2020-2025

- TABLE 312 AGRICULTURAL ROBOTS MARKET: DEGREE OF COMPETITION

- TABLE 313 AGRICULTURAL ROBOTS MARKET: REGION FOOTPRINT

- TABLE 314 AGRICULTURAL ROBOTS MARKET: ROBOT TYPE FOOTPRINT

- TABLE 315 AGRICULTURAL ROBOTS MARKET: OFFERING FOOTPRINT

- TABLE 316 AGRICULTURAL ROBOTS MARKET: END USE FOOTPRINT

- TABLE 317 AGRICULTURAL ROBOTS MARKET: KEY STARTUPS/SMES

- TABLE 318 AGRICULTURAL ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 319 AGRICULTURAL ROBOTS MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020-OCTOBER 2025

- TABLE 320 AGRICULTURAL ROBOTS MARKET: DEALS, JANUARY 2020-OCTOBER 2025

- TABLE 321 AGRICULTURAL ROBOTS MARKET: EXPANSIONS, JANUARY 2020-OCTOBER 2025

- TABLE 322 DEERE & COMPANY: COMPANY OVERVIEW

- TABLE 323 DEERE & COMPANY: PRODUCTS OFFERED

- TABLE 324 DEERE & COMPANY: PRODUCT LAUNCHES

- TABLE 325 DEERE & COMPANY: DEALS

- TABLE 326 CNH INDUSTRIAL NV: COMPANY OVERVIEW

- TABLE 327 CNH INDUSTRIAL NV: PRODUCTS OFFERED

- TABLE 328 CNH INDUSTRIAL NV: DEALS

- TABLE 329 AGCO CORPORATION: COMPANY OVERVIEW

- TABLE 330 AGCO CORPORATION: PRODUCTS OFFERED

- TABLE 331 AGCO CORPORATION: PRODUCT LAUNCHES

- TABLE 332 AGCO CORPORATION: DEALS

- TABLE 333 AGCO CORPORATION: EXPANSIONS

- TABLE 334 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 335 TRIMBLE INC.: PRODUCTS OFFERED

- TABLE 336 TRIMBLE INC.: PRODUCT LAUNCHES

- TABLE 337 TRIMBLE INC.: DEALS

- TABLE 338 DJI: COMPANY OVERVIEW

- TABLE 339 DJI: PRODUCTS OFFERED

- TABLE 340 DJI: PRODUCT LAUNCHES

- TABLE 341 BOUMATIC: COMPANY OVERVIEW

- TABLE 342 BOUMATIC: PRODUCTS OFFERED

- TABLE 343 BOUMATIC: PRODUCT LAUNCHES

- TABLE 344 BOUMATIC: DEALS

- TABLE 345 LELY INTERNATIONAL: COMPANY OVERVIEW

- TABLE 346 LELY INTERNATIONAL: PRODUCTS OFFERED

- TABLE 347 LELY INTERNATIONAL: PRODUCTS OFFERED

- TABLE 348 LELY INTERNATIONAL: DEALS

- TABLE 349 EAGLENXT: COMPANY OVERVIEW

- TABLE 350 EAGLENXT: PRODUCTS OFFERED

- TABLE 351 EAGLENXT: PRODUCT LAUNCHES

- TABLE 352 EAGLENXT: DEALS

- TABLE 353 EAGLENXT: OTHER DEVELOPMENTS

- TABLE 354 KUBOTA CORPORATION: COMPANY OVERVIEW

- TABLE 355 KUBOTA CORPORATION: PRODUCTS OFFERED

- TABLE 356 KUBOTA CORPORATION: PRODUCT LAUNCHES

- TABLE 357 KUBOTA CORPORATION: DEALS

- TABLE 358 DELAVAL: COMPANY OVERVIEW

- TABLE 359 DELAVAL: PRODUCTS OFFERED

- TABLE 360 DELAVAL: PRODUCT LAUNCHES

- TABLE 361 DELAVAL: DEALS

- TABLE 362 DELAVAL: EXPANSIONS

- TABLE 363 HARVEST CROO ROBOTICS: COMPANY OVERVIEW

- TABLE 364 HARVEST CROO ROBOTICS: PRODUCTS OFFERED

- TABLE 365 HARVEST CROO ROBOTICS: PRODUCT LAUNCHES

- TABLE 366 NAIO TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 367 NAIO TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 368 NAIO TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 369 NAIO TECHNOLOGIES: DEALS

- TABLE 370 ECOROBOTIX: COMPANY OVERVIEW

- TABLE 371 ECOROBOTIX: PRODUCTS OFFERED

- TABLE 372 AGROBOTS: COMPANY OVERVIEW

- TABLE 373 AGROBOTS: PRODUCTS OFFERED

- TABLE 374 ROBOTICS PLUS: COMPANY OVERVIEW

- TABLE 375 ROBOTICS PLUS: PRODUCTS OFFERED

- TABLE 376 ROBOTICS PLUS: PRODUCT LAUNCHES

- TABLE 377 ROBOTICS PLUS: DEALS

- TABLE 378 AUTONOMOUS TRACTOR CORPORATION: COMPANY OVERVIEW

- TABLE 379 AUTONOMOUS TRACTOR CORPORATION: PRODUCTS OFFERED

- TABLE 380 AUTONOMOUS TRACTOR CORPORATION: PRODUCT LAUNCHES

- TABLE 381 FFROBOTICS: COMPANY OVERVIEW

- TABLE 382 FFROBOTICS: PRODUCTS OFFERED

- TABLE 383 DRONEDEPLOY: COMPANY OVERVIEW

- TABLE 384 DRONEDEPLOY: PRODUCTS OFFERED

- TABLE 385 DRONEDEPLOY: DEALS

- TABLE 386 YANMAR CO.: COMPANY OVERVIEW

- TABLE 387 YANMAR CO.: PRODUCTS OFFERED

- TABLE 388 YANMAR CO.: PRODUCT LAUNCHES

- TABLE 389 CLEARPATH ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 390 CLEARPATH ROBOTICS, INC.: PRODUCTS OFFERED

- TABLE 391 CLEARPATH ROBOTICS, INC.: PRODUCT LAUNCHES

- TABLE 392 CLEARPATH ROBOTICS, INC.: DEALS

- TABLE 393 BONSAI ROBOTICS INC: BUSINESS OVERVIEW

- TABLE 394 AIGEN: BUSINESS OVERVIEW

- TABLE 395 TEVEL AEROBOTICS TECHNOLOGIES LTD.: BUSINESS OVERVIEW

- TABLE 396 SWARMFARM: BUSINESS OVERVIEW

- TABLE 397 MONARCH TRACTOR: BUSINESS OVERVIEW

- TABLE 398 ADJACENT MARKETS TO AGRICULTURAL ROBOTS

- TABLE 399 PRECISION LIVESTOCK FARMING MARKET, BY SYSTEM TYPE, 2020-2024 (USD MILLION)

- TABLE 400 PRECISION LIVESTOCK FARMING MARKET, BY SYSTEM TYPE, 2025-2030 (USD MILLION)

- TABLE 401 MILKING ROBOTS MARKET, BY SYSTEM TYPE, 2020-2023 (USD MILLION)

- TABLE 402 MILKING ROBOTS MARKET, BY SYSTEM TYPE, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 AGRICULTURAL ROBOTS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AGRICULTURAL ROBOTS MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY DATA FROM PRIMARY SOURCES

- FIGURE 5 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 6 AGRICULTURAL ROBOTS MARKET: BOTTOM-UP APPROACH

- FIGURE 7 AGRICULTURAL ROBOTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 AGRICULTURAL ROBOTS MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 9 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 10 APPROACH 2: DEMAND-SIDE ANALYSIS

- FIGURE 11 AGRICULTURAL ROBOTS MARKET: DATA TRIANGULATION

- FIGURE 12 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 13 GLOBAL AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2025-2030

- FIGURE 14 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AGRICULTURAL ROBOTS MARKET (2021-2024)

- FIGURE 15 DISRUPTIVE TRENDS IMPACTING GROWTH OF AGRICULTURAL ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 16 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN AGRICULTURAL ROBOTS MARKET, 2025

- FIGURE 17 NORTH AMERICA TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 HIGH DEMAND FOR AGRICULTURAL ROBOTS TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 19 HARDWARE SEGMENT AND ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARES IN 2025

- FIGURE 20 LARGE-SIZED FARMS SEGMENT DOMINATED AGRICULTURAL ROBOTS MARKET IN 2025

- FIGURE 21 HARVEST MANAGEMENT SEGMENT DOMINATED AGRICULTURAL ROBOTS MARKET IN 2025

- FIGURE 22 FARM PRODUCE SEGMENT DOMINATED AGRICULTURAL ROBOTS MARKET IN 2025

- FIGURE 23 INDOOR SEGMENT DOMINATED AGRICULTURAL ROBOTS MARKET IN 2025

- FIGURE 24 MEXICO TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 PER CAPITA ARABLE LAND, 2014-2023 (HA)

- FIGURE 26 INSTALLED BASE OF LIVESTOCK RFID TAGS, 2020-2030 (MILLION UNITS)

- FIGURE 27 AGRICULTURAL ROBOTS MARKET DYNAMICS

- FIGURE 28 CATTLE INVENTORY OF MAJOR REGIONS IN 2023 (MILLION UNITS)

- FIGURE 29 AGRICULTURAL ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 AGRICULTURAL ROBOTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 KEY PARTICIPANTS IN AGRICULTURAL ROBOTS ECOSYSTEM

- FIGURE 32 AGRICULTURAL ROBOTS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 33 AVERAGE SELLING PRICE OF AGRICULTURAL ROBOT TYPES, BY KEY PLAYER, 2024 (USD/UNIT)

- FIGURE 34 AVERAGE SELLING PRICE TREND, BY TYPE, 2020-2024 (USD/UNIT)

- FIGURE 35 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2024 (USD/UNIT)

- FIGURE 36 EXPORT VALUE OF HS CODE 8433, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 37 IMPORT VALUE OF HS CODE 8433, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 38 AGRICULTURAL ROBOTS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 39 AGRICULTURAL ROBOTS MARKET: INVESTMENT AND FUNDING SCENARIO OF MAJOR PLAYERS, 2024 (USD MILLION)

- FIGURE 40 PATENT ANALYSIS, BY DOCUMENT TYPE, JANUARY 2016-OCTOBER 2025

- FIGURE 41 PATENT PUBLICATION TRENDS, 2016-2025

- FIGURE 42 AGRICULTURAL ROBOTS MARKET: LEGAL STATUS OF PATENTS, JANUARY 2016-OCTOBER 2025

- FIGURE 43 JURISDICTION OF US REGISTERED HIGHEST PERCENTAGE OF PATENTS, 2016-2025

- FIGURE 44 TOP PATENT APPLICANTS, JANUARY 2016-OCTOBER 2025

- FIGURE 45 FUTURE APPLICATIONS

- FIGURE 46 AGRICULTURAL ROBOTS MARKET: DECISION-MAKING FACTORS

- FIGURE 47 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY FARMING ENVIRONMENT

- FIGURE 48 KEY INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR FARMING ENVIRONMENT

- FIGURE 49 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 50 UNMANNED AERIAL VEHICLES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 51 HARVEST MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 52 AGRICULTURAL ROBOTS MARKET FOR HARDWARE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 53 OUTDOOR TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 54 AGRICULTURAL ROBOTS MARKET, BY FARM SIZE, 2025 VS. 2030 (USD MILLION)

- FIGURE 55 AGRICULTURAL ROBOTS MARKET, BY END USE, 2025 VS. 2030 (USD MILLION)

- FIGURE 56 AGRICULTURAL ROBOTS MARKET: REGIONAL SNAPSHOT

- FIGURE 57 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 58 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 59 ANNUAL REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 60 AGRICULTURAL ROBOTS MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 61 AGRICULTURAL ROBOTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 62 COMPANY FOOTPRINT

- FIGURE 63 AGRICULTURAL ROBOTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 64 COMPANY VALUATION OF KEY VENDORS

- FIGURE 65 EV/EBITDA OF KEY COMPANIES

- FIGURE 66 PRODUCT ANALYSIS, BY KEY PLAYER

- FIGURE 67 DEERE & COMPANY: COMPANY SNAPSHOT

- FIGURE 68 CNH INDUSTRIAL NV: COMPANY SNAPSHOT

- FIGURE 69 AGCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 71 LELY INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 72 EAGLENXT: COMPANY SNAPSHOT

- FIGURE 73 KUBOTA CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 DELAVAL: COMPANY SNAPSHOT