PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1881289

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1881289

Recreational Boat Market by Boat Type (Yachts, Sailboats, Personal Watercrafts, Inflatables), Boat Size, Engine Location, Engine Type, Material, Activity Type, Power Source, Power Range, Distribution Channel, Region - Global Forecast to 2032

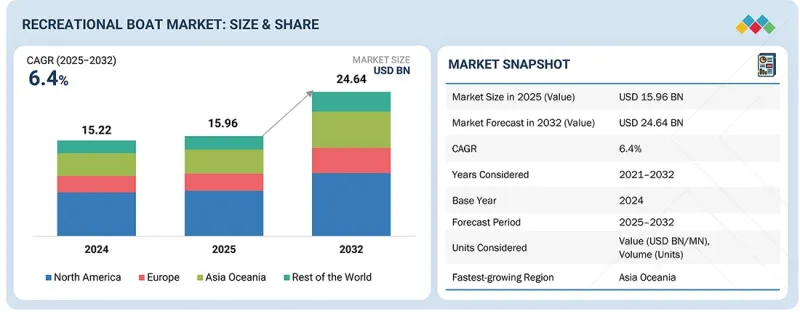

The recreational boat market is expected to grow from USD 15.96 billion in 2025 to USD 24.64 billion by 2032, at a compound annual growth rate (CAGR) of 6.4% during the forecast period. Rising disposable incomes are fueling the global recreational boat market, as more people can now afford luxury and leisure activities, particularly in North America and coastal Europe, where marine infrastructure and water tourism are well-established and expanding rapidly.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD BN/MN) and Volume (Units) |

| Segments | Boat Type, Boat Size, Engine Placement, Engine Type, Power Range, Material Type, Activity Type, Power Source, Distribution Channel, and Region |

| Regions covered | North America, Asia, Oceania, Europe, and Rest of the World |

Opportunities will arise as companies such as Brunswick Corporation and Groupe Beneteau introduce electric and hybrid models, reducing ownership and operation costs while appealing to environmentally conscious buyers. Technological advances, such as autonomous navigation, digital platforms, and modular interiors, are shaping the market's transformation, making boating safer, more accessible, and more attractive to a broader demographic. Diverse rental and fractional ownership models lower entry barriers, addressing younger buyers in urban centers and retirees in premium tourist regions. As a result, the industry grows by aligning product innovations and pricing strategies to specific regional trends and consumer segments, with sustainable boating gaining momentum.

"Outboard engine boats are expected to be the largest segment during the forecast period."

Outboard engine boats are expected to hold the highest share in the recreational boat market due to their advantages, such as quicker installation, easier maintenance, more usable interior space, and simpler upgrades, all of which suit small to mid-sized boats popular for fishing and leisure activities in coastal and inland waters. The demand for these boats is also driven by their portability, lower draft requirements, and better suitability for casual boating activities. International Trade Center data on marine exports show outboard making up over 80% of export value in 2024. North America is at the forefront of this market due to its extensive lake networks and high rates of boat ownership. Asia Oceania is also experiencing rapid expansion driven by the tourism and commercial fishing sectors. For instance, Yamaha Motor Company launched HARMO 2.0 electric outboard propulsion system in November 2024 to cater to the rising demand for outboard propulsion systems. Outboard position engine boats will thus continue to hold a substantial market share during the forecast period, attributed to their strong alignment with user-friendly design, adaptable performance, and forward-looking propulsion trends.

"Electric boats are expected to be the fastest-growing segment during the forecast period."

Electric boats are rapidly gaining traction in the recreational boat market, propelled by environmental regulations and consumer interest in sustainable leisure activities. Europe and North America lead this transition, supported by government incentives, rigorous emission laws, and increased investments in charging infrastructure. Electric propulsion offers several significant advantages, including lower operating costs, minimal maintenance, quieter operation, zero direct emissions, and the ability to utilize renewable power sources, such as solar panels. Ongoing government support initiatives through rebates, subsidies, and infrastructure investments in charging networks, enabling broader adoption of electric boats. Public initiatives, including the US Federal Transit Administration's USD 316 million grant (2024) and the EU Horizon Europe's USD 9.09 million STEESMAT project (2025), further accelerate the adoption of clean energy. Manufacturers like Yamaha, Brunswick Corporation, and Malibu Boats are advancing electric propulsion with high-capacity batteries and integrated solar systems. For instance, Germany's ABT Marian M 800-R features a 121.5 kWh battery, reaching 85 km/h and an 80 km range, while Navalt's Marsel 5 solar-electric catamaran accommodates 24 passengers with near-zero emissions.

"Asia Oceania is expected to exhibit the highest growth rate, with personal watercraft boats experiencing the fastest growth during the forecast period."

China's recreational boat market is expected to grow at a CAGR of 5.5% CAGR during the forecast period due to the rapid development of marina infrastructure in coastal areas like Hainan and increased demand from the rising middle class for tourism and family outings, which boosts sales of small luxury crafts. India's growth is expected to be slightly higher than China's, driven by rapid growth in local tourism activity and a government push through multiple policy initiatives, such as the River Cruise tourism project. Japan is also expected to see a growth rate close to China's. This growth is enabled by better engines, which have reduced fuel costs and comply with local noise regulations. In Asia Oceania, the personal watercraft boat segment is expected to grow at the fastest rate because these boats are less expensive, require minimal storage space, and are popular among the young generation of customers. For instance, Kawasaki's Ultra 310 LX/LXS and the STX 160X 2025 jet ski model with quiet electric options sells in large numbers in Japan's urban areas for city escapes, while Yamaha's compact PWC line, which includes FX SVHO and FX Cruise HO, is popular in India's local tourism industry.

In-depth interviews were conducted with managers, marketing directors, other innovation & technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEM - 50%, Tier I - 16%, Tier II - 13%, and Tourism/Rental Platforms - 21%

- By Designation: Managers - 30%, Directors - 15%, and Others - 55%

- By Region: North America - 30%, Europe - 20%, Asia Oceania - 40%, and Rest of the World - 10%

The recreational boat market is dominated by established players, including Brunswick Corporation (US), Yamaha Motor Corporation (Japan), Groupe Beneteau (France), Ferretti Group, and Malibu Boats (US). These companies have been developing new products, adopting expansion strategies, and undertaking collaborations, partnerships, and mergers & acquisitions to gain traction in the recreational boat market.

Research Coverage:

The report covers the recreational boat market, by boat type (yachts, sailboats, personal watercraft boats, inflatable boats), activity type (cruising & watersports, fishing), boat size (<30 feet, 30-50 feet, >50 feet), material type (aluminum, steel, fiberglass), engine location (outboard, inboard), engine type (ICE, electric), power source (engine-powered, sail-powered, human-powered), power range (<100 kW, 100-200 kW, >200 kW), distribution channel (boat dealership, boat shows, online boat sales), and Region (Asia Oceania, Europe, North America, and Rest of the World). It also covers the competitive landscape and company profiles of the major players in the recreational boat ecosystem.

Key Benefits of Buying Report:

- The report will help market leaders and new entrants in this market by providing information on the closest approximations of revenue numbers for the overall recreational boat market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights, enabling them to better position their businesses and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 BY BOAT TYPE

- 1.2.2 BY ENGINE TYPE

- 1.2.3 BY POWER SOURCE

- 1.2.4 BY ENGINE LOCATION

- 1.2.5 BY ACTIVITY TYPE

- 1.2.6 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 List of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RECREATIONAL BOAT MARKET: FACTOR ANALYSIS

- 2.4.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.5 RISK ASSESSMENT AND ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RECREATIONAL BOAT MARKET

- 4.2 RECREATIONAL BOAT MARKET, BY BOAT TYPE

- 4.3 RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE

- 4.4 RECREATIONAL BOAT MARKET, BY ENGINE LOCATION

- 4.5 RECREATIONAL BOAT MARKET, BY POWER SOURCE

- 4.6 RECREATIONAL BOAT MARKET, BY BOAT SIZE

- 4.7 RECREATIONAL BOAT MARKET, BY ENGINE TYPE

- 4.8 RECREATIONAL BOAT MARKET, BY MATERIAL TYPE

- 4.9 RECREATIONAL BOAT MARKET, BY POWER RANGE

- 4.10 RECREATIONAL BOAT MARKET GROWTH RATE, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of disposable incomes and tourism industry

- 5.2.1.2 Shifting trend of boat buyers

- 5.2.1.3 Adoption of electric and hybrid propulsion systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Strict pollution norms for recreational boats

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Demand for higher horsepower engines

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of boat ownership

- 5.2.4.2 Limited electric charging and docking infrastructure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PRICING ANALYSIS

- 6.2 RECREATIONAL BOAT MARKET: PRICING ANALYSIS, BY BOAT TYPE (2024)

- 6.3 RECREATIONAL BOAT MARKET: BY COMPANY-WISE PRICING ANALYSIS (USD) FOR FIBERGLASS AND ALUMINUM BOATS

- 6.4 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR JON AND UTILITY BOATS (2024)

- 6.5 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR PONTOONS (2024)

- 6.6 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR CANOE (2024)

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 COMPONENT MANUFACTURERS

- 6.7.2 ENGINE MANUFACTURERS

- 6.7.3 OEMS

- 6.7.4 DISTRIBUTORS, DEALERS, AND SERVICE PROVIDERS

- 6.8 SUPPLY CHAIN ANALYSIS

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 MALIBU BOATS RECOVERED FROM SERVER OUTAGE IN MINUTES USING CLOUDENDURE DISASTER RECOVERY ON AWS

- 6.9.2 BRUNSWICK PARTNERED WITH MESH SYSTEMS FOR CZONE CLOUD ENABLEMENT AND PLATFORM MIGRATION

- 6.9.3 GROUPE BENETEAU ADOPTED KEEPER FOR SECURE ENTERPRISE PASSWORD MANAGEMENT

- 6.9.4 BALLARD'S FUEL CELL-BASED PROPULSION FOR SHIPS

- 6.9.5 FULL CARBON FIBER-BASED BOATS BY CARBON MARINE

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT DATA

- 6.10.2 EXPORT DATA

- 6.11 KEY CONFERENCES AND EVENTS IN 2025-2026

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.13 INVESTMENT AND FUNDING SCENARIO

7 STRATEGIC ADOPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 7.1 IMPACT OF AI/GEN AI

- 7.2 KEY EMERGING TECHNOLOGIES

- 7.2.1 CARBON FIBER AND GRAPHENE

- 7.2.2 AUTONOMOUS DOCKING

- 7.2.3 IOT-BASED NAVIGATION SYSTEM

- 7.3 COMPLEMENTARY TECHNOLOGIES

- 7.3.1 COMMUNICATIONS INFRASTRUCTURE

- 7.3.2 BATTERY AND ENERGY STORAGE TECHNOLOGIES

- 7.4 FUTURE TECHNOLOGIES

- 7.4.1 AUTONOMOUS RECREATIONAL BOATS

- 7.4.2 HYBRID MARINE PROPULSION

- 7.5 PATENT ANALYSIS

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.2 RECREATIONAL BOAT MARKET: COUNTRY-WISE REGULATIONS

- 8.3 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.6 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

9 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 9.1 KEY STAKEHOLDERS AND BUYING CRITERIA

- 9.1.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.1.2 BUYING CRITERIA

- 9.1.2.1 Yacht

- 9.1.2.2 Sailboat

- 9.1.2.3 Personal watercraft

10 RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE

- 10.1 INTRODUCTION

- 10.2 BOAT BRANDS

- 10.3 CRUISING AND WATERSPORTS

- 10.3.1 RISING INTEREST IN SAILING, YACHTING, KAYAKING, AND JET SKIING TO DRIVE MARKET

- 10.4 FISHING

- 10.4.1 EXPANDING RECREATIONAL AND COMMERCIAL FISHING ACTIVITIES TO DRIVE MARKET

- 10.5 KEY INDUSTRY INSIGHTS

11 RECREATIONAL BOAT MARKET, BY BOAT TYPE

- 11.1 INTRODUCTION

- 11.2 POPULAR RECREATIONAL BOAT PROVIDERS

- 11.3 YACHT

- 11.3.1 USED IN LARGE-SCALE TOURISM OPERATIONS

- 11.4 SAILBOAT

- 11.4.1 DEVOID OF ENGINE REPAIRS AND MAINTENANCE COSTS

- 11.5 PERSONAL WATERCRAFT

- 11.5.1 ELECTRIFICATION TREND TO GAIN TRACTION IN THIS SEGMENT

- 11.6 INFLATABLE BOAT

- 11.6.1 USED FOR RESCUE, RECREATIONAL, AND EMERGENCY OPERATIONS

- 11.7 OTHERS

- 11.8 KEY INDUSTRY INSIGHTS

12 RECREATIONAL BOAT MARKET, BY BOAT SIZE

- 12.1 INTRODUCTION

- 12.2 BOAT CATEGORIZATION AND TOP BRANDS

- 12.3 <30 FEET

- 12.3.1 LARGEST SEGMENT IN TERMS OF VOLUME

- 12.4 30-50 FEET

- 12.4.1 IDEAL FOR WATER SPORTS AND GROUP TOURISM

- 12.5 >50 FEET

- 12.5.1 GROWTH IN SALES DUE TO STATE-SPONSORED TOURISM INITIATIVES

- 12.6 KEY INDUSTRY INSIGHTS

13 RECREATIONAL BOAT MARKET, BY DISTRIBUTION CHANNEL

- 13.1 INTRODUCTION

- 13.2 BOAT DEALERSHIPS

- 13.3 BOAT SHOWS

- 13.4 ONLINE BOAT SALES

14 RECREATIONAL BOAT MARKET, BY ENGINE LOCATION

- 14.1 INTRODUCTION

- 14.2 POPULAR RECREATIONAL BOAT PROVIDERS WORLDWIDE

- 14.3 OUTBOARD

- 14.3.1 EASY INSTALLATION AND MAINTENANCE TO DRIVE DEMAND

- 14.4 INBOARD

- 14.4.1 HIGH PERFORMANCE FOR LARGER LUXURY AND MOTOR YACHTS

- 14.5 OTHERS

- 14.6 KEY INDUSTRY INSIGHTS

15 RECREATIONAL BOAT MARKET, BY ENGINE TYPE

- 15.1 INTRODUCTION

- 15.2 BOAT CATEGORIZATION AND TOP BRANDS

- 15.3 INTERNAL COMBUSTION (IC)

- 15.3.1 MOST COMMONLY USED BOATS WORLDWIDE

- 15.4 ELECTRIC

- 15.4.1 LIMITS EMISSION AND CARBON FOOTPRINTS

- 15.5 KEY INDUSTRY INSIGHTS

16 RECREATIONAL BOAT MARKET, BY MATERIAL TYPE

- 16.1 INTRODUCTION

- 16.2 MATERIAL-WISE RECREATIONAL BOAT PROVIDERS WORLDWIDE

- 16.3 ALUMINUM

- 16.3.1 LESS MAINTENANCE AND COST-EFFECTIVENESS TO DRIVE DEMAND

- 16.4 STEEL

- 16.4.1 DURABILITY AND ABRASION RESISTANCE TO DRIVE DEMAND

- 16.5 FIBERGLASS

- 16.5.1 ABILITY TO BE MOLDED INTO ANY DESIRED SHAPE OR SIZE TO DRIVE DEMAND

- 16.6 OTHERS

- 16.7 KEY INDUSTRY INSIGHTS

17 RECREATIONAL BOAT MARKET, BY POWER RANGE

- 17.1 INTRODUCTION

- 17.2 ELECTRIC RECREATIONAL BOAT POWER RANGE CATEGORIZATION

- 17.3 UP TO 100 KW

- 17.3.1 LIGHTWEIGHT WITH SLOW TO MODERATE SPEED

- 17.4 100 KW-200 KW

- 17.4.1 SUITABLE FOR DAY CRUISING AND WATERSPORTS

- 17.5 ABOVE 200 KW

- 17.5.1 FASTEST-GROWING SEGMENT DRIVEN BY MULTI-MOTOR BATTERY ADVANCEMENTS

- 17.6 KEY INDUSTRY INSIGHTS

18 RECREATIONAL BOAT MARKET, BY POWER SOURCE

- 18.1 INTRODUCTION

- 18.1.1 POPULAR RECREATIONAL BOAT PROVIDERS WORLDWIDE

- 18.2 ENGINE POWERED

- 18.2.1 HIGHEST-SELLING BOATS IN NORTH AMERICA AND EUROPE

- 18.3 SAIL POWERED

- 18.3.1 ENVIRONMENT-FRIENDLY AND REQUIRE MANUAL LABOR

- 18.4 HUMAN POWERED

- 18.4.1 HIGH DEMAND IN WATERSPORTS TO DRIVE GROWTH

- 18.5 KEY INDUSTRY INSIGHTS

19 RECREATIONAL BOAT MARKET, BY REGION

- 19.1 INTRODUCTION

- 19.2 NORTH AMERICA

- 19.2.1 MACROECONOMIC OUTLOOK

- 19.2.2 US

- 19.2.2.1 Presence of top recreational boating destinations to drive market

- 19.2.3 CANADA

- 19.2.3.1 Second-largest recreational boat market in North America

- 19.2.4 MEXICO

- 19.2.4.1 Growing influence from US and Canadian markets to drive market

- 19.3 EUROPE

- 19.3.1 MACROECONOMIC OUTLOOK

- 19.3.2 GERMANY

- 19.3.2.1 Increasing emission norms to regulate market

- 19.3.3 FRANCE

- 19.3.3.1 Largest market in Europe and top exporter

- 19.3.4 SPAIN

- 19.3.4.1 Growth in imports to drive market

- 19.3.5 UK

- 19.3.5.1 Presence of top European cruising operators to drive market

- 19.3.6 ITALY

- 19.3.6.1 Strong demand during summer season to drive market

- 19.4 ASIA OCEANIA

- 19.4.1 MACROECONOMIC OUTLOOK

- 19.4.2 INDIA

- 19.4.2.1 Growth of marine tourism to drive market

- 19.4.3 JAPAN

- 19.4.3.1 Presence of top outboard engine producers to drive market

- 19.4.4 CHINA

- 19.4.4.1 Expanding population of high-net-worth individuals to drive market

- 19.4.5 SOUTH KOREA

- 19.4.5.1 Rising income of upper middle-class to drive demand

- 19.4.6 AUSTRALIA

- 19.4.6.1 Increasing registrations of personal watercraft to drive market

- 19.4.7 NEW ZEALAND

- 19.4.7.1 Government policies for boater safety to drive market

- 19.5 REST OF THE WORLD

- 19.5.1 MACROECONOMIC OUTLOOK

- 19.5.2 BRAZIL

- 19.5.2.1 Growth of watersports tourism to drive market

- 19.5.3 RUSSIA

- 19.5.3.1 Fast-growing demand for cruising and recreational fishing to drive market

20 COMPETITIVE LANDSCAPE

- 20.1 OVERVIEW

- 20.2 MARKET SHARE ANALYSIS, 2024

- 20.3 REVENUE ANALYSIS OF TOP/LISTED PLAYERS

- 20.4 COMPANY VALUATION AND FINANCIAL METRICS

- 20.4.1 COMPANY VALUATION

- 20.4.2 FINANCIAL METRICS

- 20.5 BRAND COMPARISON

- 20.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 20.6.1 STARS

- 20.6.2 EMERGING LEADERS

- 20.6.3 PERVASIVE PLAYERS

- 20.6.4 PARTICIPANTS

- 20.6.5 COMPANY FOOTPRINT

- 20.7 COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- 20.7.1 PROGRESSIVE COMPANIES

- 20.7.2 RESPONSIVE COMPANIES

- 20.7.3 DYNAMIC COMPANIES

- 20.7.4 STARTING BLOCKS

- 20.7.5 COMPETITIVE BENCHMARKING

- 20.8 COMPETITIVE SCENARIO

- 20.8.1 PRODUCT LAUNCHES

- 20.8.2 DEALS

- 20.8.3 EXPANSIONS

21 COMPANY PROFILES

- 21.1 KEY PLAYERS

- 21.1.1 BRUNSWICK CORPORATION

- 21.1.1.1 Business overview

- 21.1.1.2 Products offered

- 21.1.1.3 Recent developments

- 21.1.1.3.1 Product launches

- 21.1.1.3.2 Deals

- 21.1.1.3.3 Expansions

- 21.1.1.4 MnM view

- 21.1.1.4.1 Right to win

- 21.1.1.4.2 Strategic choices

- 21.1.1.4.3 Weaknesses and competitive threats

- 21.1.2 YAMAHA MOTOR COMPANY

- 21.1.2.1 Business overview

- 21.1.2.2 Products offered

- 21.1.2.3 Recent developments

- 21.1.2.3.1 Product launches

- 21.1.2.3.2 Deals

- 21.1.2.4 MnM view

- 21.1.2.4.1 Right to win

- 21.1.2.4.2 Strategic choices

- 21.1.2.4.3 Weaknesses and competitive threats

- 21.1.3 GROUPE BENETEAU

- 21.1.3.1 Business overview

- 21.1.3.2 Products offered

- 21.1.3.3 Recent developments

- 21.1.3.3.1 Product launches

- 21.1.3.3.2 Deals

- 21.1.3.4 MnM view

- 21.1.3.4.1 Right to win

- 21.1.3.4.2 Strategic choices

- 21.1.3.4.3 Weaknesses and competitive threats

- 21.1.4 MALIBU BOATS

- 21.1.4.1 Business overview

- 21.1.4.2 Products offered

- 21.1.4.3 Recent developments

- 21.1.4.3.1 Product launches

- 21.1.4.3.2 Deals

- 21.1.4.4 MnM view

- 21.1.4.4.1 Right to win

- 21.1.4.4.2 Strategic choices

- 21.1.4.4.3 Weaknesses and competitive threats

- 21.1.5 FERRETTI GROUP

- 21.1.5.1 Business overview

- 21.1.5.2 Products offered

- 21.1.5.3 Recent developments

- 21.1.5.3.1 Product launches

- 21.1.5.3.2 Deals

- 21.1.5.3.3 Expansions

- 21.1.5.4 MnM view

- 21.1.5.4.1 Right to win

- 21.1.5.4.2 Strategic choices

- 21.1.5.4.3 Weaknesses and competitive threats

- 21.1.6 POLARIS INC.

- 21.1.6.1 Business overview

- 21.1.6.2 Products offered

- 21.1.6.3 Recent developments

- 21.1.6.3.1 Product launches

- 21.1.7 MASTERCRAFT BOAT COMPANY

- 21.1.7.1 Business overview

- 21.1.7.2 Products offered

- 21.1.7.3 Recent developments

- 21.1.7.3.1 Product launches

- 21.1.7.3.2 Deals

- 21.1.7.3.3 Expansions

- 21.1.8 BOMBARDIER RECREATIONAL PRODUCTS

- 21.1.8.1 Business overview

- 21.1.8.2 Products offered

- 21.1.8.3 Recent developments

- 21.1.8.3.1 Product launches

- 21.1.8.3.2 Expansions

- 21.1.8.3.3 Others

- 21.1.9 MARINE PRODUCTS CORPORATION

- 21.1.9.1 Business overview

- 21.1.9.2 Products offered

- 21.1.9.3 Recent developments

- 21.1.9.3.1 Product launches

- 21.1.10 AZIMUT BENETTI GROUP

- 21.1.10.1 Business overview

- 21.1.10.2 Products offered

- 21.1.10.3 Recent developments

- 21.1.10.3.1 Product launches

- 21.1.10.3.2 Deals

- 21.1.11 SUNSEEKER INTERNATIONAL

- 21.1.11.1 Business overview

- 21.1.11.2 Products offered

- 21.1.11.3 Recent developments

- 21.1.11.3.1 Product launches

- 21.1.11.3.2 Deals

- 21.1.11.3.3 Others

- 21.1.12 BASS PRO GROUP

- 21.1.12.1 Business overview

- 21.1.12.2 Products offered

- 21.1.12.3 Recent developments

- 21.1.12.3.1 Product launches

- 21.1.12.3.2 Deals

- 21.1.12.3.3 Expansions

- 21.1.13 BRYTON MARINE GROUP

- 21.1.13.1 Business overview

- 21.1.13.2 Products offered

- 21.1.13.3 Recent developments

- 21.1.13.3.1 Product launches

- 21.1.13.3.2 Deals

- 21.1.1 BRUNSWICK CORPORATION

- 21.2 OTHER PLAYERS

- 21.2.1 MAHINDRA & MAHINDRA

- 21.2.2 CATALINA YACHTS

- 21.2.3 ZODIAC MARINE

- 21.2.4 ISLAND PACKET YACHTS

- 21.2.5 HALLBERG-RASSY

- 21.2.6 OYSTER YACHTS

- 21.2.7 WINNEBAGO INDUSTRIES

- 21.2.8 MONTEREY BOATS

- 21.2.9 S2 YACHTS

- 21.2.10 SMOKER CRAFT

- 21.2.11 OCEAN ALEXANDER

22 RECOMMENDATIONS

- 22.1 NORTH AMERICA TO BE FASTEST-GROWING REGION IN RECREATIONAL BOAT MARKET DURING FORECAST PERIOD

- 22.2 ELECTRIC ENGINE BOATS TO WITNESS HIGHER GROWTH RATE THAN ICE BOATS DURING FORECAST PERIOD

- 22.3 CONCLUSION

23 APPENDIX

- 23.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 23.2 DISCUSSION GUIDE

- 23.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 23.4 CUSTOMIZATION OPTIONS

- 23.5 RELATED REPORTS

- 23.6 AUTHOR DETAILS

List of Tables

- TABLE 1 RECREATIONAL BOAT MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 CURRENCY EXCHANGE RATES, 2020-2024

- TABLE 3 RECREATIONAL BOAT MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 4 BREAKDOWN OF BOAT OWNERSHIP COSTS

- TABLE 5 REGION-WISE ELECTRIFICATION SCENARIO

- TABLE 6 RECREATIONAL BOAT MARKET: PRICING ANALYSIS, BY BOAT TYPE (2024)

- TABLE 7 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR FIBERGLASS AND ALUMINUM BOATS (2024)

- TABLE 8 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR JON AND UTILITY BOATS (2024)

- TABLE 9 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR PONTOONS (2024)

- TABLE 10 RECREATIONAL BOAT MARKET: COMPANY-WISE PRICING ANALYSIS (USD) FOR CANOE (2024)

- TABLE 11 RECREATIONAL BOAT MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 12 US: IMPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 13 MEXICO: IMPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 14 CHINA: IMPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 15 JAPAN: IMPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 16 INDIA: IMPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 17 GERMANY: IMPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 18 US: EXPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 19 MEXICO: EXPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 20 CHINA: EXPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 21 JAPAN: EXPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 22 INDIA: EXPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 23 GERMANY: EXPORT SHARE, BY COUNTRY, 2020-2024 (VALUE %)

- TABLE 24 RECREATIONAL BOAT MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 25 OEM-WISE DEVELOPMENTS

- TABLE 26 PATENT REGISTRATIONS IN RECREATIONAL BOAT MARKET, JANUARY 2024-SEPTEMBER 2025

- TABLE 27 RECREATIONAL BOAT MARKET: COUNTRY-WISE REGULATIONS

- TABLE 28 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 33 KEY BUYING CRITERIA FOR RECREATIONAL BOATS

- TABLE 34 RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 35 RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 36 RECREATIONAL BOAT MARKET, ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 37 RECREATIONAL BOAT MARKET, ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 38 POPULAR BOAT PROVIDERS WORLDWIDE

- TABLE 39 CRUISING AND WATERSPORTS: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 40 CRUISING AND WATERSPORTS: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 41 CRUISING AND WATERSPORTS: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 CRUISING AND WATERSPORTS: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 FISHING: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 44 FISHING: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 45 FISHING: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 FISHING: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 RECREATIONAL BOAT MARKET, BY BOAT TYPE, 2021-2024 (UNITS)

- TABLE 48 RECREATIONAL BOAT MARKET, BY BOAT TYPE, 2025-2032 (UNITS)

- TABLE 49 RECREATIONAL BOAT MARKET, BY BOAT TYPE, 2021-2024 (USD MILLION)

- TABLE 50 RECREATIONAL BOAT MARKET, BY BOAT TYPE, 2025-2032 (USD MILLION)

- TABLE 51 POPULAR RECREATIONAL BOAT PROVIDERS

- TABLE 52 YACHT: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 53 YACHT: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 54 YACHT: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 YACHT: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 56 SAILBOAT: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 57 SAILBOAT: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 58 SAILBOAT: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 SAILBOAT: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 60 PERSONAL WATERCRAFT: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 61 PERSONAL WATERCRAFT: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 62 PERSONAL WATERCRAFT: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 PERSONAL WATERCRAFT: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 64 INFLATABLE BOAT: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 65 INFLATABLE BOAT: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 66 INFLATABLE BOAT: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 INFLATABLE BOAT: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 68 OTHERS: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 69 OTHERS: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 70 OTHERS: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 OTHERS: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 72 RECREATIONAL BOAT MARKET, BY BOAT SIZE, 2021-2024 (UNITS)

- TABLE 73 RECREATIONAL BOAT MARKET, BY BOAT SIZE, 2025-2032 (UNITS)

- TABLE 74 RECREATIONAL BOAT MARKET, BY BOAT SIZE, 2021-2024 (USD MILLION)

- TABLE 75 RECREATIONAL BOAT MARKET, BY BOAT SIZE, 2025-2032 (USD MILLION)

- TABLE 76 BOAT CATEGORIZATION AND TOP BRANDS WORLDWIDE

- TABLE 77 <30 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 78 <30 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 79 <30 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 <30 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 81 30-50 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 82 30-50 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 83 30-50 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 30-50 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 85 >50 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 86 >50 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 87 >50 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 >50 FEET: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 89 RECREATIONAL BOAT MARKET, BY ENGINE LOCATION, 2021-2024 (UNITS)

- TABLE 90 RECREATIONAL BOAT MARKET, BY ENGINE LOCATION, 2025-2032 (UNITS)

- TABLE 91 RECREATIONAL BOAT MARKET, BY ENGINE LOCATION, 2021-2024 (USD MILLION)

- TABLE 92 RECREATIONAL BOAT MARKET, BY ENGINE LOCATION, 2025-2032 (USD MILLION)

- TABLE 93 POPULAR RECREATIONAL BOAT PROVIDERS BY BOAT TYPE WORLDWIDE

- TABLE 94 OUTBOARD: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 95 OUTBOARD: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 96 OUTBOARD: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 OUTBOARD: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 98 INBOARD: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 99 INBOARD: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 100 INBOARD: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 INBOARD: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 102 OTHERS: RECREATIONAL BOAT MARKET BY ENGINE LOCATION, BY REGION, 2021-2024 (UNITS)

- TABLE 103 OTHERS: RECREATIONAL BOAT MARKET BY ENGINE LOCATION, BY REGION, 2025-2032 (UNITS)

- TABLE 104 OTHERS: RECREATIONAL BOAT MARKET BY ENGINE LOCATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 OTHERS: RECREATIONAL BOAT MARKET BY ENGINE LOCATION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 106 RECREATIONAL BOAT MARKET, BY ENGINE TYPE, 2021-2024 (UNITS)

- TABLE 107 RECREATIONAL BOAT MARKET, BY ENGINE TYPE, 2025-2032 (UNITS)

- TABLE 108 RECREATIONAL BOAT MARKET, BY ENGINE TYPE, 2021-2024 (USD MILLION)

- TABLE 109 RECREATIONAL BOAT MARKET, BY ENGINE TYPE, 2025-2032 (USD MILLION)

- TABLE 110 BOAT CATEGORIZATION AND TOP BRANDS

- TABLE 111 IC: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 112 IC: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 113 IC: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 IC: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 115 ELECTRIC: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 116 ELECTRIC: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 117 ELECTRIC: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 ELECTRIC: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 119 RECREATIONAL BOAT MARKET, BY MATERIAL TYPE, 2021-2024 (UNITS)

- TABLE 120 RECREATIONAL BOAT MARKET, BY MATERIAL TYPE, 2025-2032 (UNITS)

- TABLE 121 RECREATIONAL BOAT MARKET, BY MATERIAL TYPE, 2021-2024 (USD MILLION)

- TABLE 122 RECREATIONAL BOAT MARKET, BY MATERIAL TYPE, 2025-2032 (USD MILLION)

- TABLE 123 MATERIAL-WISE RECREATIONAL BOAT PROVIDERS WORLDWIDE

- TABLE 124 ALUMINUM: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 125 ALUMINUM: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 126 ALUMINUM: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 ALUMINUM: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 128 STEEL: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 129 STEEL: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 130 STEEL: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 131 STEEL: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 132 FIBERGLASS: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 133 FIBERGLASS: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 134 FIBERGLASS: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 FIBERGLASS: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 136 OTHERS: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 137 OTHERS: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 138 OTHERS: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 139 OTHERS: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 140 RECREATIONAL BOAT MARKET, BY POWER RANGE, 2021-2024 (UNITS)

- TABLE 141 RECREATIONAL BOAT MARKET, BY POWER RANGE, 2025-2032 (UNITS)

- TABLE 142 RECREATIONAL BOAT MARKET, BY POWER RANGE, 2021-2024 (USD MILLION)

- TABLE 143 RECREATIONAL BOAT MARKET, BY POWER RANGE, 2025-2032 (USD MILLION)

- TABLE 144 ELECTRIC RECREATIONAL BOAT POWER RANGE CATEGORIZATION

- TABLE 145 UP TO 100 KW: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 146 UP TO 100 KW: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 147 UP TO 100 KW: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 148 UP TO 100 KW: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 149 100 KW-200 KW: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 150 100 KW-200 KW: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 151 100 KW-200 KW: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 152 100 KW-200 KW: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 153 ABOVE 200 KW: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 154 ABOVE 200 KW: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 155 ABOVE 200 KW: RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 156 ABOVE 200 KW: RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 157 RECREATIONAL BOAT MARKET, BY POWER SOURCE, 2021-2024 (UNITS)

- TABLE 158 RECREATIONAL BOAT MARKET, BY POWER SOURCE, 2025-2032 (UNITS)

- TABLE 159 RECREATIONAL BOAT MARKET, BY POWER SOURCE, 2021-2024 (USD MILLION)

- TABLE 160 RECREATIONAL BOAT MARKET, BY POWER SOURCE, 2025-2032 (USD MILLION)

- TABLE 161 POPULAR RECREATIONAL BOAT PROVIDERS WORLDWIDE

- TABLE 162 ENGINE-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 163 ENGINE-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 164 ENGINE-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 165 ENGINE-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 166 SAIL-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 167 SAIL-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 168 SAIL-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 169 SAIL-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 170 HUMAN-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 171 HUMAN-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 172 HUMAN-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 173 HUMAN-POWERED RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 174 RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (UNITS)

- TABLE 175 RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (UNITS)

- TABLE 176 RECREATIONAL BOAT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 177 RECREATIONAL BOAT MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 178 NORTH AMERICA: RECREATIONAL BOAT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 179 NORTH AMERICA: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 180 NORTH AMERICA: RECREATIONAL BOAT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 181 NORTH AMERICA: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 182 US: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 183 US: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 184 US: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 185 US: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 186 CANADA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 187 CANADA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 188 CANADA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 189 CANADA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 190 MEXICO: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 191 MEXICO: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 192 MEXICO: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 193 MEXICO: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 194 EUROPE: RECREATIONAL BOAT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 195 EUROPE: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 196 EUROPE: RECREATIONAL BOAT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 197 EUROPE: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 198 GERMANY: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 199 GERMANY: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 200 GERMANY: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 201 GERMANY: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 202 FRANCE: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 203 FRANCE: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 204 FRANCE: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 205 FRANCE: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 206 SPAIN: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 207 SPAIN: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 208 SPAIN: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 209 SPAIN: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 210 UK: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 211 UK: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 212 UK: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 213 UK: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 214 ITALY: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 215 ITALY: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 216 ITALY: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 217 ITALY: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 218 ASIA OCEANIA: RECREATIONAL BOAT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 219 ASIA OCEANIA: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 220 ASIA OCEANIA: RECREATIONAL BOAT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 221 ASIA OCEANIA: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 222 INDIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 223 INDIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 224 INDIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 225 INDIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 226 JAPAN: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 227 JAPAN: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 228 JAPAN: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 229 JAPAN: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 230 CHINA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 231 CHINA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 232 CHINA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 233 CHINA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 234 SOUTH KOREA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 235 SOUTH KOREA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 236 SOUTH KOREA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 237 SOUTH KOREA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 238 AUSTRALIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 239 AUSTRALIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 240 AUSTRALIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 241 AUSTRALIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 242 NEW ZEALAND: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 243 NEW ZEALAND: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 244 NEW ZEALAND: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 245 NEW ZEALAND: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 246 REST OF THE WORLD: RECREATIONAL BOAT MARKET, BY COUNTRY, 2021-2024 (UNITS)

- TABLE 247 REST OF THE WORLD: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (UNITS)

- TABLE 248 REST OF THE WORLD: RECREATIONAL BOAT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 249 REST OF THE WORLD: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 250 BRAZIL: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 251 BRAZIL: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 252 BRAZIL: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 253 BRAZIL: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 254 RUSSIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (UNITS)

- TABLE 255 RUSSIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (UNITS)

- TABLE 256 RUSSIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2021-2024 (USD MILLION)

- TABLE 257 RUSSIA: RECREATIONAL BOAT MARKET, BY ACTIVITY TYPE, 2025-2032 (USD MILLION)

- TABLE 258 DEGREE OF COMPETITION, 2024

- TABLE 259 RECREATIONAL BOAT MARKET: REGION FOOTPRINT, 2024

- TABLE 260 RECREATIONAL BOAT MARKET: ACTIVITY TYPE FOOTPRINT, 2024

- TABLE 261 RECREATIONAL BOAT MARKET: POWER SOURCE FOOTPRINT, 2024

- TABLE 262 RECREATIONAL BOAT MARKET: ENGINE TYPE FOOTPRINT, 2024

- TABLE 263 RECREATIONAL BOAT MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 264 RECREATIONAL BOAT MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- TABLE 265 RECREATIONAL BOAT MARKET: PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2025

- TABLE 266 RECREATIONAL BOAT MARKET: DEALS, JANUARY 2020-OCTOBER 2025

- TABLE 267 RECREATIONAL BOAT MARKET: EXPANSIONS, JANUARY 2020-OCTOBER 2025

- TABLE 268 BRUNSWICK CORPORATION: COMPANY OVERVIEW

- TABLE 269 BRUNSWICK CORPORATION: PRODUCTS OFFERED

- TABLE 270 BRUNSWICK CORPORATION: PRODUCT LAUNCHES

- TABLE 271 BRUNSWICK CORPORATION: DEALS

- TABLE 272 BRUNSWICK CORPORATION: EXPANSIONS

- TABLE 273 YAMAHA MOTOR COMPANY: COMPANY OVERVIEW

- TABLE 274 YAMAHA MOTOR COMPANY: PRODUCTS OFFERED

- TABLE 275 YAMAHA MOTOR COMPANY: PRODUCT LAUNCHES

- TABLE 276 YAMAHA MOTOR COMPANY: DEALS

- TABLE 277 GROUPE BENETEAU: COMPANY OVERVIEW

- TABLE 278 GROUPE BENETEAU: PRODUCTS OFFERED

- TABLE 279 GROUPE BENETEAU: PRODUCT LAUNCHES

- TABLE 280 GROUPE BENETEAU: DEALS

- TABLE 281 MALIBU BOATS: COMPANY OVERVIEW

- TABLE 282 MALIBU BOATS: PRODUCTS OFFERED

- TABLE 283 MALIBU BOATS: PRODUCT LAUNCHES

- TABLE 284 MALIBU BOATS: DEALS

- TABLE 285 FERRETTI GROUP: COMPANY OVERVIEW

- TABLE 286 FERRETTI GROUP: PRODUCTS OFFERED

- TABLE 287 FERRETTI GROUP: PRODUCT LAUNCHES

- TABLE 288 FERRETTI GROUP: DEALS

- TABLE 289 FERRETTI GROUP: EXPANSIONS

- TABLE 290 POLARIS INC.: COMPANY OVERVIEW

- TABLE 291 POLARIS INC.: PRODUCTS OFFERED

- TABLE 292 POLARIS INC.: PRODUCT LAUNCHES

- TABLE 293 MASTERCRAFT BOAT COMPANY: COMPANY OVERVIEW

- TABLE 294 MASTERCRAFT BOAT COMPANY: PRODUCTS OFFERED

- TABLE 295 MASTERCRAFT BOAT COMPANY: PRODUCT LAUNCHES

- TABLE 296 MASTERCRAFT BOAT COMPANY: DEALS

- TABLE 297 MASTERCRAFT BOAT COMPANY: EXPANSIONS

- TABLE 298 BOMBARDIER RECREATIONAL PRODUCTS: COMPANY OVERVIEW

- TABLE 299 BOMBARDIER RECREATIONAL PRODUCTS: PRODUCTS OFFERED

- TABLE 300 BOMBARDIER RECREATIONAL PRODUCTS: PRODUCT LAUNCHES

- TABLE 301 BOMBARDIER RECREATIONAL PRODUCTS: DEALS

- TABLE 302 BOMBARDIER RECREATIONAL PRODUCTS: EXPANSIONS

- TABLE 303 BOMBARDIER RECREATIONAL PRODUCTS: OTHERS

- TABLE 304 MARINE PRODUCTS CORPORATION: COMPANY OVERVIEW

- TABLE 305 MARINE PRODUCTS CORPORATION: PRODUCTS OFFERED

- TABLE 306 MARINE PRODUCTS CORPORATION: PRODUCT LAUNCHES

- TABLE 307 AZIMUT BENETTI GROUP: COMPANY OVERVIEW

- TABLE 308 AZIMUT BENETTI GROUP: PRODUCTS OFFERED

- TABLE 309 AZIMUT BENETTI GROUP: PRODUCT LAUNCHES

- TABLE 310 AZIMUT BENETTI GROUP: DEALS

- TABLE 311 SUNSEEKER INTERNATIONAL: COMPANY OVERVIEW

- TABLE 312 SUNSEEKER INTERNATIONAL: PRODUCTS OFFERED

- TABLE 313 SUNSEEKER INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 314 SUNSEEKER INTERNATIONAL: DEALS

- TABLE 315 SUNSEEKER INTERNATIONAL: OTHERS

- TABLE 316 BASS PRO GROUP: COMPANY OVERVIEW

- TABLE 317 BASS PRO GROUP: PRODUCTS OFFERED

- TABLE 318 BASS PRO GROUP: PRODUCT LAUNCHES

- TABLE 319 BASS PRO GROUP: DEALS

- TABLE 320 BASS PRO GROUP: EXPANSIONS

- TABLE 321 BRYTON MARINE GROUP: COMPANY OVERVIEW

- TABLE 322 BRYTON MARINE GROUP: PRODUCTS OFFERED

- TABLE 323 BRYTON MARINE GROUP: PRODUCT LAUNCHES

- TABLE 324 BRYTON MARINE GROUP: DEALS

- TABLE 325 MAHINDRA & MAHINDRA: COMPANY OVERVIEW

- TABLE 326 CATALINA YACHTS: COMPANY OVERVIEW

- TABLE 327 ZODIAC MARINE: COMPANY OVERVIEW

- TABLE 328 ISLAND PACKET YACHTS: COMPANY OVERVIEW

- TABLE 329 HALLBERG-RASSY: COMPANY OVERVIEW

- TABLE 330 OYSTER YACHTS: COMPANY OVERVIEW

- TABLE 331 WINNEBAGO INDUSTRIES: COMPANY OVERVIEW

- TABLE 332 MONTEREY BOATS: COMPANY OVERVIEW

- TABLE 333 S2 YACHTS: COMPANY OVERVIEW

- TABLE 334 SMOKER CRAFT: COMPANY OVERVIEW

- TABLE 335 OCEAN ALEXANDER: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RECREATIONAL BOAT MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 RECREATIONAL BOAT MARKET: RESEARCH DESIGN

- FIGURE 3 RECREATIONAL BOAT MARKET: RESEARCH DESIGN MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 RECREATIONAL BOAT MARKET: BOTTOM-UP APPROACH

- FIGURE 7 RECREATIONAL BOAT MARKET: TOP-DOWN APPROACH

- FIGURE 8 RECREATIONAL BOAT MARKET: DATA TRIANGULATION

- FIGURE 9 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 10 RECREATIONAL BOAT MARKET DYNAMICS

- FIGURE 11 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN RECREATIONAL BOAT MARKET, 2024

- FIGURE 12 DISRUPTIVE TRENDS IMPACTING GROWTH OF RECREATIONAL BOAT MARKET DURING FORECAST PERIOD

- FIGURE 13 YACHT TO BE DOMINANT BOAT TYPE IN 2025

- FIGURE 14 NORTH AMERICA TO LEAD MARKET IN 2025

- FIGURE 15 GROWING DEMAND FOR WATER TOURISM AND INCREASING DISPOSABLE INCOMES TO DRIVE MARKET

- FIGURE 16 YACHT BOAT TYPE TO DOMINATE DURING FORECAST PERIOD (2025-2032)

- FIGURE 17 CRUISING AND WATERSPORTS TO BE LEADING ACTIVITY TYPE DURING FORECAST PERIOD (2025-2032)

- FIGURE 18 OUTBOARD TO BE LARGEST SEGMENT DURING FORECAST PERIOD (2025-2032)

- FIGURE 19 ENGINE-POWERED BOAT TO BE LARGEST SEGMENT DURING FORECAST PERIOD (2025-2032)

- FIGURE 20 30 FT TO 50 FT SEGMENT TO GROW AT FASTEST RATE DURING FORECAST PERIOD (2025-2032)

- FIGURE 21 ELECTRIC TO BE FASTER-GROWING ENGINE TYPE THAN INTERNAL COMBUSTION (IC) DURING FORECAST PERIOD (2025-2032)

- FIGURE 22 ALUMINUM TO BE LEADING MATERIAL TYPE DURING FORECAST PERIOD (2025-2032)

- FIGURE 23 ABOVE 200 KW TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD (2025-2032)

- FIGURE 24 NORTH AMERICA TO BE LARGEST MARKET IN 2025

- FIGURE 25 RECREATIONAL BOAT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 INTERNATIONAL TOURIST ARRIVALS

- FIGURE 27 CARBON FOOTPRINT PER GALLON FOR DIFFERENT TYPES OF MARINE FUELS

- FIGURE 28 RECREATIONAL BOAT MARKET: BUSINESS ENVIRONMENT

- FIGURE 29 RECREATIONAL BOAT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 30 RECREATIONAL BOAT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 33 IOT-BASED NAVIGATION SYSTEM

- FIGURE 34 PATENT ANALYSIS, 2015-2025

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 36 KEY BUYING CRITERIA FOR RECREATIONAL BOATS

- FIGURE 37 CRUISING AND WATERSPORTS SEGMENT TO HAVE LARGER MARKET SHARE THAN FISHING SEGMENT IN 2032

- FIGURE 38 YACHT SEGMENT TO WITNESS STABLE GROWTH DURING FORECAST PERIOD

- FIGURE 39 30-50 FEET SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 40 OUTBOARD SEGMENT TO LEAD RECREATIONAL BOAT MARKET IN 2032

- FIGURE 41 ELECTRIC SEGMENT TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 42 ALUMINUM BOATS TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 43 UP TO 100 KW SEGMENT TO LEAD MARKET IN 2032

- FIGURE 44 ENGINE-POWERED BOAT SEGMENT TO LEAD MARKET IN 2032

- FIGURE 45 NORTH AMERICA TO WITNESS HIGHEST CAGR IN RECREATIONAL BOAT MARKET DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: RECREATIONAL BOAT MARKET SNAPSHOT

- FIGURE 47 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 48 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 49 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 50 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024 (USD TRILLION)

- FIGURE 51 EUROPE: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 52 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 53 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 54 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 55 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 56 ASIA OCEANIA: RECREATIONAL BOAT MARKET SNAPSHOT

- FIGURE 57 ASIA OCEANIA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 58 ASIA OCEANIA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 59 ASIA OCEANIA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 60 ASIA OCEANIA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 61 REST OF THE WORLD: RECREATIONAL BOAT MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- FIGURE 62 REST OF THE WORLD: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 63 REST OF THE WORLD: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 64 REST OF THE WORLD: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 65 REST OF THE WORLD: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, BY COUNTRY

- FIGURE 66 RECREATIONAL BOAT MARKET SHARE ANALYSIS, 2024

- FIGURE 67 REVENUE ANALYSIS FOR TOP/LISTED PLAYERS, 2020-2024

- FIGURE 68 COMPANY VALUATION FOR KEY PLAYERS, 2024 (USD BILLION)

- FIGURE 69 EV/EBITDA OF KEY PLAYERS, 2024

- FIGURE 70 BRAND COMPARISON IN RECREATIONAL BOAT MARKET

- FIGURE 71 RECREATIONAL BOAT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 72 RECREATIONAL BOAT MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 73 RECREATIONAL BOAT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 74 BRUNSWICK CORPORATION: COMPANY SNAPSHOT

- FIGURE 75 YAMAHA MOTOR COMPANY: COMPANY SNAPSHOT

- FIGURE 76 GROUPE BENETEAU: COMPANY SNAPSHOT

- FIGURE 77 MALIBU BOATS: COMPANY SNAPSHOT

- FIGURE 78 FERRETTI GROUP: COMPANY SNAPSHOT

- FIGURE 79 POLARIS INC.: COMPANY SNAPSHOT

- FIGURE 80 MASTERCRAFT BOAT COMPANY: COMPANY SNAPSHOT

- FIGURE 81 BOMBARDIER RECREATIONAL PRODUCTS: COMPANY SNAPSHOT

- FIGURE 82 MARINE PRODUCTS CORPORATION: COMPANY SNAPSHOT