PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1883070

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1883070

Fixed-Wing VTOL UAV Market by Range (VLOS, EVLOS, BVLOS), MTOW (<25 Kg, 25-170 Kg, >170 Kg), Application (Military, Government & Law Enforcement, Commercial), Endurance, Mode of Operation, Propulsion, Point of Sale, and Region - Global Forecast to 2030

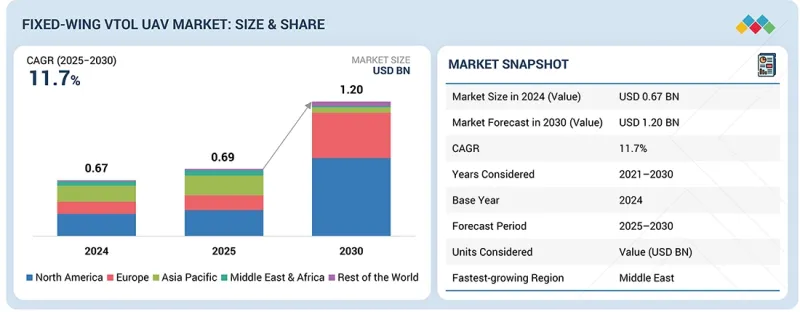

The fixed-wing VTOL UAV market is projected to reach USD 1.20 billion by 2030 from USD 0.69 billion in 2025, registering a CAGR of 11.7% during the forecast period. Market expansion is driven by the rising demand for long-endurance and high-reliability UAVs across defense, law enforcement, and commercial operations. Increasing investments in unmanned ISR missions, coupled with the rapid adoption of hybrid-electric propulsion and autonomous flight technologies, are enhancing operational flexibility and range.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Application, Range, Mode of Operation, Endurance and Region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, regulatory support for unmanned aerial systems and modernization of fleet infrastructure across emerging economies is accelerating market growth.

"By application, the military segment is projected to account for the largest market share during the forecast period."

The military application segment is expected to remain the dominant contributor to the fixed-wing VTOL UAV market, driven by the growing emphasis on intelligence, surveillance, target acquisition, and reconnaissance operations. Defense organizations are increasingly deploying these UAVs for tactical missions that demand vertical take-off and landing capability, high payload endurance, and long operational range. The integration of electro-optical, infrared, and synthetic aperture radar payloads is enhancing mission precision and situational awareness.

Furthermore, the introduction of hybrid-electric propulsion systems and AI-enabled autonomous navigation is optimizing power management and endurance in military UAV fleets. Programs emphasizing persistent ISR, border security, and battlefield support continue to drive procurement. As countries invest in fleet modernization and next-generation tactical UAV programs, the military segment's share is reinforced by sustained defense spending and rapid advancements in vertical-lift and fixed-wing hybrid architectures.

"By MTOW, the >170 kilograms segment is projected to grow at the highest CAGR during the forecast period."

The >170 kilograms segment is projected to register the fastest growth in the fixed-wing VTOL UAV market between 2025 and 2030, driven by the increasing deployment of large UAV platforms capable of carrying heavier payloads for extended missions. These systems are being integrated into intelligence, surveillance, and logistics operations where endurance, range, and multi-sensor capabilities are critical. The adoption of hybrid-electric propulsion and advanced aerodynamic designs allows these UAVs to achieve superior flight efficiency while meeting evolving military and commercial requirements. Additionally, major defense organizations and aerospace manufacturers are investing in scalable heavy-lift VTOL systems for persistent ISR, cargo delivery, and maritime applications, reinforcing the segment's position as the key growth driver in the global fixed-wing VTOL UAV market.

"The Middle East is projected to grow at the highest rate during the forecast period."

The Middle East is projected to register the highest growth rate in the fixed-wing VTOL UAV market through 2030, driven by accelerating defense modernization, heightened border surveillance needs, and the growing adoption of unmanned systems for ISR operations. Governments of many countries in the region are actively investing in indigenous UAV production programs and collaborative ventures with international manufacturers to strengthen tactical and long-range aerial capabilities.

The market's rapid expansion is further supported by the region's evolving counter-terrorism initiatives, cross-border security monitoring, and investments in autonomous aerial systems for reconnaissance and logistics. Countries such as the UAE, Saudi Arabia, and Israel are at the forefront of this growth, leveraging hybrid-electric propulsion technologies and endurance-optimized UAVs for multi-mission use.

On the commercial front, the integration of UAVs into infrastructure inspection, pipeline monitoring, and environmental assessment projects is broadening the regional application base. Combined, these factors position the Middle East as the fastest-growing market for fixed-wing VTOL UAVs, supported by defense-led procurement, cross-sector operational adoption, and strong government emphasis on unmanned capability development.

The breakdown of profiles for primary participants in the fixed-wing VTOL UAV market is provided below:

- By Company Type: Tier 1 - 55%, Tier 2 - 20%, and Tier 3 - 25%

- By Designation: C Level - 75%, Manager Level - 75%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 30%, Middle East - 10%, Latin America - 10%, Africa - 5%

Research Coverage:

This market study covers the fixed-wing VTOL UAV market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different parts and regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall fixed-wing VTOL UAV market. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and will provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market drivers (Increasing use in military and security applications, expansion of BVLOS and autonomous flight regulations, advancements in hybrid electric and distributed propulsion systems, rising demand for advanced aerial inspection and monitoring, growing commercial and dual use applications), restraints (fragmented regulatory frameworks and certification delays, energy density and power limitations of electric systems, high development and maintenance costs, dependence on skilled technicians and operational expertise), opportunities (advancements in hybrid electric and hydrogen propulsion technologies, growth of defense modernization programs, integration of cloud-based analytics and AI-driven mission systems), challenges (complex airworthiness certification for VTOL configurations, market fragmentation across competing platform architecture, supply chain dependence on advanced components, public acceptance and airspace integration constraints)

- Market Penetration: Comprehensive information on fixed-wing VTOL UAVs offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the fixed-wing VTOL UAV market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the fixed-wing VTOL UAV market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the fixed-wing VTOL UAV market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.3 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 BUSINESS MODELS

- 3.2 TOTAL COST OF OWNERSHIP

- 3.3 BILL OF MATERIALS

4 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 4.1 DECISION-MAKING PROCESS

- 4.2 BUYERS STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 4.2.1 BUYING EVALUATION CRITERIA

- 4.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 4.4 KEY EMERGING TECHNOLOGIES

- 4.4.1 ARTIFICIAL INTELLIGENCE IN UNMANNED AERIAL VEHICLE (UAV)

- 4.4.2 MID-AIR REFUELING OF DRONES

- 4.4.3 UAV WITH LIDAR SYSTEM

- 4.5 COMPLEMENTARY TECHNOLOGIES

- 4.5.1 BEYOND VISUAL LINE OF SIGHT (BVLOS) OPERATIONS

- 4.5.2 INCREASED AUTONOMY IN TRAFFIC MANAGEMENT

- 4.5.3 ENERGY HARVESTING

- 4.6 ADJACENT TECHNOLOGIES

- 4.6.1 SATELLITE COMMUNICATION (SATCOM) SYSTEMS

- 4.6.2 ELECTRO-OPTICAL/INFRARED (EO/IR) SENSOR PAYLOADS

- 4.7 TECHNOLOGY ROADMAP

- 4.8 EMERGING TECHNOLOGY TRENDS

- 4.9 PATENT ANALYSIS

- 4.10 IMPACT OF AI/ GENERATIVE AI ON FIXED-WING VTOL UAV MARKET

- 4.10.1 USE CASES AND MARKET POTENTIAL

- 4.10.2 BEST PRACTICES IN FIXED-WING VTOL UAV DEVELOPMENT

- 4.10.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use in military and security applications

- 5.2.1.2 Expansion of beyond visual line of sight and autonomous flight regulations

- 5.2.1.3 Advancements in hybrid-electric and distributed propulsion systems

- 5.2.1.4 Rising demand for advanced aerial inspection and monitoring

- 5.2.1.5 Growing commercial and dual-use applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmented regulatory frameworks and certification delays

- 5.2.2.2 Energy density and power limitations of electric systems

- 5.2.2.3 High development and maintenance costs

- 5.2.2.4 Shortage of trained personnel and operational expertise

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of fixed-wing VTOL leasing and service-based business model

- 5.2.3.2 Integration with national digital infrastructure and emerging aerospace ecosystems

- 5.2.3.3 Integration of cloud-based analytics and AI-driven mission systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex airworthiness certification for VTOL configurations

- 5.2.4.2 Market fragmentation across competing platform architectures

- 5.2.4.3 Supply chain dependence on advanced components

- 5.2.4.4 Public acceptance and airspace integration issues

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 PROMINENT COMPANIES

- 5.3.2 PRIVATE AND SMALL ENTERPRISES

- 5.3.3 END USERS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIALS

- 5.4.2 RESEARCH & DEVELOPMENT (R&D)

- 5.4.3 COMPONENT MANUFACTURING

- 5.4.4 OEMS

- 5.4.5 END USERS

- 5.4.6 AFTER-SALES SERVICES

- 5.5 TARIFF AND REGULATORY LANDSCAPE

- 5.5.1 TARIFF DATA

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.3 REGULATORY FRAMEWORK

- 5.6 INDICATIVE PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING ANALYSIS, BY MTOW

- 5.6.2 INDICATIVE PRICING ANALYSIS BY ENDURANCE

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 8806)

- 5.7.2 EXPORT SCENARIO (HS CODE 8806)

- 5.8 USE CASE ANALYSIS

- 5.8.1 QUANTUM SYSTEMS' TRINITY PRO FOR LONG-ENDURANCE MAPPING MISSIONS

- 5.8.2 WINGTRAONE GEN II FOR ENVIRONMENTAL MONITORING AND FORESTRY OPERATIONS

- 5.8.3 TEXTRON SYSTEMS' AEROSONDE HYBRID VTOL FOR MARITIME INTELLIGENCE MISSIONS

- 5.8.4 ALTI TRANSITION FOR BORDER SURVEILLANCE AND RAPID RESPONSE MISSIONS

- 5.9 VOLUME DATA

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 MACROECONOMIC OUTLOOK

- 5.12.1 INTRODUCTION

- 5.12.2 NORTH AMERICA

- 5.12.3 EUROPE

- 5.12.4 ASIA PACIFIC

- 5.12.5 MIDDLE EAST

- 5.12.6 REST OF THE WORLD

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 IMPACT OF 2025 US TARIFFS

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 PRICE IMPACT ANALYSIS

- 5.14.4 IMPACT ON COUNTRY/REGION

- 5.14.4.1 US

- 5.14.4.2 Europe

- 5.14.4.3 Asia Pacific

- 5.14.5 IMPACT ON END-USE INDUSTRIES

- 5.14.5.1 Commercial

- 5.14.5.2 Government and military

6 FIXED-WING VTOL UAV MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 MILITARY

- 6.2.1 USE CASE- JUMP 20 BY AEROVIRONMENT INC.

- 6.2.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

- 6.2.2.1 Increasing defense investments in long-endurance ISR assets to drive growth

- 6.2.3 COMBAT OPERATIONS

- 6.2.3.1 Ongoing military modernization programs emphasizing autonomous strike capability to drive growth

- 6.2.4 DELIVERY

- 6.2.4.1 Defense initiatives aimed at reducing human involvement in supply chain operations to drive growth

- 6.3 COMMERCIAL

- 6.3.1 USE CASE: CW-007 BY JOUAV

- 6.3.2 REMOTE SENSING

- 6.3.2.1 Enables repeatable flight paths with reduced operational fatigue compared to rotary systems

- 6.3.3 INSPECTION & MONITORING

- 6.3.3.1 Enhances accuracy and reduces inspection downtime

- 6.3.4 PRODUCT DELIVERY

- 6.3.4.1 Transition toward automated and sustainable supply chain systems to drive growth

- 6.3.5 SURVEYING & MAPPING

- 6.3.5.1 Hybrid configuration supports high-efficiency flight paths

- 6.3.6 AERIAL IMAGING

- 6.3.6.1 Combination of endurance, stability, and image accuracy to drive growth

- 6.3.7 INDUSTRIAL WAREHOUSING

- 6.3.7.1 Hybrid mobility enables efficient navigation between indoor and outdoor zones

- 6.3.8 PASSENGER & PUBLIC TRANSPORTATION

- 6.3.8.1 Exploring advanced air mobility solutions for sustainable urban transport

- 6.3.9 OTHERS

- 6.4 GOVERNMENT & LAW ENFORCEMENT

- 6.4.1 USE CASE: PD-2 UAS BY UKRSPECSYSTEMS

- 6.4.2 BORDER MANAGEMENT

- 6.4.2.1 Advancements in encrypted communication links and all-weather endurance technologies to drive growth

- 6.4.3 TRAFFIC MONITORING

- 6.4.3.1 Growing urban surveillance demand supporting UAV integration in smart mobility programs to drive growth

- 6.4.4 FIREFIGHTING & DISASTER MANAGEMENT

- 6.4.4.1 Hybrid configuration supports extended surveillance of affected zones

- 6.4.5 SEARCH & RESCUE

- 6.4.5.1 Technological advances in AI-assisted detection and autonomous navigation to drive growth

- 6.4.6 POLICE OPERATIONS & INVESTIGATION

- 6.4.6.1 Growing deployment of fixed-wing VTOL UAVs enhancing investigative efficiency and urban policing capabilities

- 6.4.7 MARITIME SECURITY

- 6.4.7.1 Expanding maritime domain awareness initiatives to drive UAV procurement across coastal regions

7 FIXED-WING VTOL UAV MARKET, BY ENDURANCE

- 7.1 INTRODUCTION

- 7.2 <5 HOURS

- 7.2.1 GOVERNMENT INITIATIVES PROMOTING UAV-BASED URBAN OPERATIONS TO DRIVE GROWTH

- 7.3 5-10 HOURS

- 7.3.1 RISING DEMAND FOR MID-ENDURANCE UAVS SUPPORTING DIVERSE SURVEILLANCE AND MAPPING APPLICATIONS TO DRIVE GROWTH

- 7.4 >10 HOURS

- 7.4.1 INCREASING FOCUS ON LONG-ENDURANCE UAVS TO DRIVE MARKET PENETRATION IN DEFENSE AND STRATEGIC APPLICATIONS

8 FIXED-WING VTOL UAV MARKET, BY MTOW

- 8.1 INTRODUCTION

- 8.2 <25 KILOGRAMS

- 8.2.1 RISING ADOPTION OF LIGHTWEIGHT UAVS IN AGRICULTURE, SURVEYING, AND EMERGENCY RESPONSE TO DRIVE SEGMENTAL GROWTH

- 8.3 25-170 KILOGRAMS

- 8.3.1 RISING DEFENSE PROCUREMENT, INFRASTRUCTURE MONITORING, AND COMMERCIAL INSPECTION CONTRACTS TO DRIVE DEMAND FOR MEDIUM-WEIGHT UAVS

- 8.4 >170 KILOGRAMS

- 8.4.1 EMERGING DEMAND FOR UNMANNED CARGO DELIVERY IN REMOTE REGIONS TO DRIVE DEMAND FOR HEAVY-LIFT UAVS

9 FIXED-WING VTOL UAV MARKET, BY MODE OF OPERATION

- 9.1 INTRODUCTION

- 9.2 REMOTELY PILOTED

- 9.2.1 INDUSTRIAL OPERATORS PRIORITIZING REAL-TIME SITUATIONAL CONTROL AND ACCOUNTABILITY TO DRIVE GROWTH

- 9.3 OPTIONALLY PILOTED

- 9.3.1 INCREASING USE IN RESEARCH, DEFENSE TESTING, AND LONG-DURATION SURVEILLANCE APPLICATIONS TO DRIVE GROWTH

- 9.4 FULLY AUTONOMOUS

- 9.4.1 ADVANCEMENTS IN ONBOARD PROCESSING, AI, AND AUTONOMOUS DECISION-MAKING TO DRIVE GROWTH

10 FIXED-WING VTOL UAV MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- 10.2 ELECTRIC

- 10.2.1 EXPANDING USE OF ELECTRIC PROPULSION SYSTEMS SUPPORTING LOW-EMISSION AND SHORT-RANGE UAV OPERATIONS

- 10.3 HYBRID

- 10.3.1 DEFENSE AND INDUSTRIAL USERS SEEKING RELIABILITY UNDER VARIABLE MISSION PROFILES TO DRIVE GROWTH

- 10.4 GASOLINE

- 10.4.1 WIDE UTILIZATION IN DEFENSE SURVEILLANCE, BORDER PATROL, AND LONG-RANGE RECONNAISSANCE TO DRIVE GROWTH

11 FIXED-WING VTOL UAV MARKET, BY RANGE

- 11.1 INTRODUCTION

- 11.2 VISUAL LINE OF SIGHT (VLOS)

- 11.2.1 WIDESPREAD OPERATOR TRAINING PROGRAMS AND INCREASING GOVERNMENT PERMISSIONS FOR LOW-ALTITUDE UAV ACTIVITY TO DRIVE GROWTH

- 11.3 EXTENDED VISUAL LINE OF SIGHT (EVLOS)

- 11.3.1 GROWING REGULATORY ACCEPTANCE OF EVLOS FRAMEWORKS FOR INSPECTION, MAPPING, AND INFRASTRUCTURE MONITORING TASKS TO DRIVE GROWTH

- 11.4 BEYOND VISUAL LINE OF SIGHT (BVLOS)

- 11.4.1 SUITABLE FOR LONG-RANGE SURVEILLANCE, LOGISTICS, AND DEFENSE OPERATIONS

12 FIXED-WING VTOL UAV MARKET, BY POINT OF SALE

- 12.1 INTRODUCTION

- 12.2 OEM

- 12.2.1 COLLABORATIONS BETWEEN AEROSPACE FIRMS AND TECHNOLOGY PROVIDERS TO ENHANCE VERTICAL TAKE-OFF EFFICIENCY AND AUTOMATION TO DRIVE GROWTH

- 12.3 AFTERMARKET

- 12.3.1 INTRODUCTION OF PREDICTIVE MAINTENANCE PROGRAMS USING AI-BASED DIAGNOSTICS AND CONDITION-MONITORING SYSTEMS TO DRIVE GROWTH

13 FIXED-WING VTOL UAV MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Defense modernization and commercial integration to drive market

- 13.2.2 CANADA

- 13.2.2.1 Expanding commercial UAV use and government-led innovation to drive market

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 UK

- 13.3.1.1 Investments in electric and hybrid propulsion technologies to drive market

- 13.3.2 FRANCE

- 13.3.2.1 Defense-led development and strong industrial ecosystem to drive market

- 13.3.3 GERMANY

- 13.3.3.1 Industrial strength and defense collaboration to reinforce UAV advancement

- 13.3.4 ITALY

- 13.3.4.1 Expanding defense programs and technology partnerships to strengthen national UAV capability

- 13.3.5 RUSSIA

- 13.3.5.1 Indigenous development and defense procurement to shape national UAV landscape

- 13.3.6 SWEDEN

- 13.3.6.1 Need for defense innovation and cross-border collaboration to drive UAV development

- 13.3.7 REST OF EUROPE

- 13.3.1 UK

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Rapid indigenous scaling and export-oriented production to drive market

- 13.4.2 INDIA

- 13.4.2.1 Expanding defense procurement and indigenous manufacturing to drive market

- 13.4.3 JAPAN

- 13.4.3.1 Technological advancements and regulatory clarity to accelerate UAV integration

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Defense modernization and innovation-led industry to shape UAV ecosystem's growth

- 13.4.5 AUSTRALIA

- 13.4.5.1 Expanding defense programs and commercial integration to advance UAV capability

- 13.4.6 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 MIDDLE EAST

- 13.5.1 UAE

- 13.5.1.1 Indigenous manufacturing and defense partnerships to advance UAV capability

- 13.5.2 SAUDI ARABIA

- 13.5.2.1 Defense diversification and local production initiatives to strengthen UAV ecosystem

- 13.5.3 ISRAEL

- 13.5.3.1 Advanced R&D and global exports to reinforce UAV leadership

- 13.5.4 TURKEY

- 13.5.4.1 Indigenous development and defense export to drive UAV prominence

- 13.5.5 REST OF MIDDLE EAST

- 13.5.1 UAE

- 13.6 REST OF THE WORLD

- 13.6.1 LATIN AMERICA

- 13.6.1.1 Focus on defense modernization and industrial collaboration to support growth

- 13.6.2 AFRICA

- 13.6.2.1 Emphasis on security modernization and regional cooperation to foster UAV adoption

- 13.6.1 LATIN AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY VALUATION AND FINANCIAL METRICS

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Application footprint

- 14.7.5.4 Propulsion footprint

- 14.7.5.5 Point of sale footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.8.5.1 List of startups/SMEs

- 14.8.5.2 Competitive benchmarking of startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 ALTI UNMANNED

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 UKRSPECSYSTEMS

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 AEROVIRONMENT, INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.3.2 Others

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 LOCKHEED MARTIN CORPORATION

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product Launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 TEXTRON SYSTEMS

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Others

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 VERTICAL TECHNOLOGIES

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.7 CARBONIX

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.8 IDEAFORGE TECHNOLOGY INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Others

- 15.1.9 QUANTUM-SYSTEMS GMBH

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Others

- 15.1.10 BLUEBIRD AERO SYSTEMS

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 AUTEL ROBOTICS

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.12 THREOD SYSTEMS AS

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.13 JOUAV

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.14 GARUDA ROBOTICS PTE. LTD.

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.15 ASTERIA AEROSPACE LIMITED

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Others

- 15.1.1 ALTI UNMANNED

- 15.2 OTHER PLAYERS

- 15.2.1 A-TECHSYN

- 15.2.2 AVY BY

- 15.2.3 ELROY AIR

- 15.2.4 WINGTRA AG

- 15.2.5 FLIGHTWAVE AEROSPACE SYSTEMS

- 15.2.6 ELEVONX

- 15.2.7 FIXAR-AERO LLC

- 15.2.8 CENSYS TECHNOLOGIES

- 15.2.9 SKYETON

- 15.2.10 VTOL AVIATION INDIA PVT. LTD.

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Breakdown of primaries

- 16.1.1 SECONDARY DATA

- 16.2 FACTOR ANALYSIS

- 16.2.1 INTRODUCTION

- 16.2.2 DEMAND-SIDE INDICATORS

- 16.2.3 SUPPLY-SIDE INDICATORS

- 16.3 MARKET SIZE ESTIMATION

- 16.3.1 BOTTOM-UP APPROACH

- 16.3.2 TOP-DOWN APPROACH

- 16.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 16.5 RISK ANALYSIS

- 16.6 RESEARCH LIMITATIONS

- 16.7 RESEARCH ASSUMPTIONS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2020-2024

- TABLE 3 COMPARISON BETWEEN BUSINESS MODELS

- TABLE 4 COST BREAKDOWN OF VTOL UAV, BY WEIGHT CLASS (TYPICAL RANGES)

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 6 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 7 LIST OF MAJOR PATENTS FOR FIXED-WING VTOL UAV, 2020-2025

- TABLE 8 TOP USE CASES AND MARKET POTENTIAL

- TABLE 9 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 10 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 11 FIXED-WING VTOL UAV MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 12 TARIFF DATA FOR FIXED-WING VTOL UAV, HS CODE 8806, 2024

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 16 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 17 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 18 INDICATIVE PRICING ANALYSIS, BY MTOW, 2025 (USD MILLION)

- TABLE 19 INDICATIVE PRICING ANALYSIS, BY ENDURANCE, 2025 (USD MILLION)

- TABLE 20 IMPORT DATA FOR HS CODE 8806, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 21 EXPORT DATA FOR HS CODE 8806, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 22 FIXED-WING VTOL UAV MARKET, VOLUME DATA, 2021-2024 (UNITS)

- TABLE 23 FIXED-WING VTOL UAV MARKET, VOLUME DATA, 2025-2030 (UNITS)

- TABLE 24 FIXED-WING VTOL UAV MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 25 IMPOSED BY US FOR DRONES AND THEIR SYSTEMS, BY COUNTRY

- TABLE 26 KEY MODEL-WISE PRICE IMPACT ANALYSIS

- TABLE 27 FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 28 FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 29 FIXED-WING VTOL UAV MARKET, BY MILITARY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 30 FIXED-WING VTOL UAV MARKET, BY MILITARY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 31 FIXED-WING VTOL UAV MARKET, BY COMMERCIAL APPLICATION, 2021-2024 (USD MILLION)

- TABLE 32 FIXED-WING VTOL UAV MARKET, BY COMMERCIAL APPLICATION, 2025-2030 (USD MILLION)

- TABLE 33 FIXED-WING VTOL UAV MARKET, BY GOVERNMENT & LAW ENFORCEMENT APPLICATION, 2021-2024 (USD MILLION)

- TABLE 34 FIXED-WING VTOL UAV MARKET, BY GOVERNMENT & LAW ENFORCEMENT, 2025-2030 (USD MILLION)

- TABLE 35 FIXED-WING VTOL UAV MARKET, BY ENDURANCE, 2021-2024 (USD MILLION)

- TABLE 36 FIXED-WING VTOL UAV MARKET, BY ENDURANCE, 2025-2030 (USD MILLION)

- TABLE 37 FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 38 FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 39 FIXED-WING VTOL UAV MARKET, BY MODE OF OPERATION, 2021-2024 (USD MILLION)

- TABLE 40 FIXED-WING VTOL UAV MARKET, BY MODE OF OPERATION, 2025-2030 (USD MILLION)

- TABLE 41 FIXED-WING VTOL UAV MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 42 FIXED-WING VTOL UAV MARKET, BY PROPULSION, 2025-2030 (USD MILLION)

- TABLE 43 FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 44 FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 45 FIXED-WING VTOL UAV MARKET, BY POINT OF SALE, 2021-2024 (USD MILLION)

- TABLE 46 FIXED-WING VTOL UAV MARKET, BY POINT OF SALE, 2025-2030 (USD MILLION)

- TABLE 47 FIXED-WING VTOL UAV MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 FIXED-WING VTOL UAV MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: FIXED-WING VTOL UAV MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 NORTH AMERICA: FIXED-WING VTOL UAV MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 57 US: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 58 US: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 59 US: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 60 US: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 61 US: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 62 US: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 63 CANADA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 64 CANADA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 CANADA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 66 CANADA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 67 CANADA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 68 CANADA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 69 EUROPE: FIXED-WING VTOL UAV MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 EUROPE: FIXED-WING VTOL UAV MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 72 EUROPE: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 74 EUROPE: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 76 EUROPE: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 77 UK: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 UK: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 UK: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 80 UK: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 81 UK: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 82 UK: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 83 FRANCE: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 84 FRANCE: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 FRANCE: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 86 FRANCE: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 87 FRANCE: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 88 FRANCE: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 89 GERMANY: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 90 GERMANY: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 91 GERMANY: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 92 GERMANY: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 93 GERMANY: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 94 GERMANY: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 95 ITALY: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 96 ITALY: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 ITALY: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 98 ITALY: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 99 ITALY: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 100 ITALY: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 101 RUSSIA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 102 RUSSIA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 RUSSIA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 104 RUSSIA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 105 RUSSIA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 106 RUSSIA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 107 SWEDEN: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 108 SWEDEN: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 SWEDEN: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 110 SWEDEN: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 111 SWEDEN: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 112 SWEDEN: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 REST OF EUROPE: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 REST OF EUROPE: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 116 REST OF EUROPE: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 118 REST OF EUROPE: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 122 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 127 CHINA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 128 CHINA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 CHINA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 130 CHINA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 131 CHINA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 132 CHINA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 133 INDIA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 INDIA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 135 INDIA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 136 INDIA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 137 INDIA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 138 INDIA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 139 JAPAN: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 140 JAPAN: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 141 JAPAN: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 142 JAPAN: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 143 JAPAN: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 144 JAPAN: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 145 SOUTH KOREA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 SOUTH KOREA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 SOUTH KOREA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 148 SOUTH KOREA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH KOREA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 151 AUSTRALIA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 152 AUSTRALIA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 AUSTRALIA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 154 AUSTRALIA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 155 AUSTRALIA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 156 AUSTRALIA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 171 UAE: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 172 UAE: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 173 UAE: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 174 UAE: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 175 UAE: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 176 UAE: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 177 SAUDI ARABIA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 178 SAUDI ARABIA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 179 SAUDI ARABIA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 180 SAUDI ARABIA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 181 SAUDI ARABIA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 182 SAUDI ARABIA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 183 ISRAEL: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 184 ISRAEL: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 185 ISRAEL: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 186 ISRAEL: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 187 ISRAEL: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 188 ISRAEL: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 189 TURKEY: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 190 TURKEY: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 191 TURKEY: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 192 TURKEY: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 193 TURKEY: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 194 TURKEY: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 196 REST OF MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 REST OF MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 198 REST OF MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 201 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 202 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 203 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 204 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 206 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 207 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 208 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 209 LATIN AMERICA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 210 LATIN AMERICA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 211 LATIN AMERICA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 212 LATIN AMERICA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 213 LATIN AMERICA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 214 LATIN AMERICA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 215 AFRICA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 216 AFRICA: FIXED-WING VTOL UAV MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 217 AFRICA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2021-2024 (USD MILLION)

- TABLE 218 AFRICA: FIXED-WING VTOL UAV MARKET, BY RANGE, 2025-2030 (USD MILLION)

- TABLE 219 AFRICA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 220 AFRICA: FIXED-WING VTOL UAV MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 221 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 222 FIXED-WING VTOL UAV MARKET: DEGREE OF COMPETITION

- TABLE 223 FIXED-WING VTOL UAV MARKET: REGION FOOTPRINT

- TABLE 224 FIXED-WING VTOL UAV MARKET: APPLICATION FOOTPRINT

- TABLE 225 FIXED-WING VTOL UAV MARKET: PROPULSION FOOTPRINT

- TABLE 226 FIXED-WING VTOL UAV MARKET: POINT OF SALE FOOTPRINT

- TABLE 227 FIXED-WING VTOL UAV MARKET: LIST OF START-UPS/SMES

- TABLE 228 FIXED-WING VTOL UAV MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 229 FIXED-WING VTOL UAV MARKET: DEALS, JANUARY 2021-SEPTEMBER 2025

- TABLE 230 FIXED-WING VTOL UAV MARKET: OTHER DEVELOPMENTS, JANUARY 2021-SEPTEMBER 2025

- TABLE 231 ALTI UNMANNED: COMPANY OVERVIEW

- TABLE 232 ALTI UNMANNED: PRODUCTS OFFERED

- TABLE 233 ALTI UNMANNED: DEALS

- TABLE 234 UKRSPECSYSTEMS: COMPANY OVERVIEW

- TABLE 235 UKRSPECSYSTEMS: PRODUCTS OFFERED

- TABLE 236 UKRSPECSYSTEMS: DEALS

- TABLE 237 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- TABLE 238 AEROVIRONMENT, INC.: PRODUCTS OFFERED

- TABLE 239 AEROVIRONMENT, INC.: DEALS

- TABLE 240 AEROVIRONMENT, INC.: OTHERS

- TABLE 241 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 242 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 243 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 244 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 245 TEXTRON SYSTEMS: COMPANY OVERVIEW

- TABLE 246 TEXTRON SYSTEMS: PRODUCTS OFFERED

- TABLE 247 TEXTRON SYSTEMS: OTHERS

- TABLE 248 VERTICAL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 249 VERTICAL TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 250 CARBONIX: COMPANY OVERVIEW

- TABLE 251 CARBONIX: PRODUCTS OFFERED

- TABLE 252 IDEAFORGE TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 253 IDEAFORGE TECHNOLOGY INC.: PRODUCTS OFFERED

- TABLE 254 IDEAFORGE TECHNOLOGY INC: OTHERS

- TABLE 255 QUANTUM-SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 256 QUANTUM-SYSTEMS GMBH: PRODUCTS OFFERED

- TABLE 257 QUANTUM-SYSTEMS GMBH: DEALS

- TABLE 258 QUANTUM-SYSTEMS GMBH: OTHERS

- TABLE 259 BLUEBIRD AERO SYSTEMS: COMPANY OVERVIEW

- TABLE 260 BLUEBIRD AERO SYSTEMS: PRODUCTS OFFERED

- TABLE 261 BLUEBIRD AERO SYSTEMS: DEALS

- TABLE 262 AUTEL ROBOTICS: COMPANY OVERVIEW

- TABLE 263 AUTEL ROBOTICS: PRODUCTS OFFERED

- TABLE 264 THREOD SYSTEMS AS: COMPANY OVERVIEW

- TABLE 265 THREOD SYSTEMS AS: PRODUCTS OFFERED

- TABLE 266 JOUAV: COMPANY OVERVIEW

- TABLE 267 JOUAV: PRODUCTS OFFERED

- TABLE 268 GARUDA ROBOTICS PTE. LTD.: COMPANY OVERVIEW

- TABLE 269 GARUDA ROBOTICS PTE. LTD.: PRODUCTS OFFERED

- TABLE 270 ASTERIA AEROSPACE LIMITED: COMPANY OVERVIEW

- TABLE 271 ASTERIA AEROSPACE LIMITED: PRODUCTS OFFERED

- TABLE 272 ASTERIA AEROSPACE LIMITED: OTHERS

List of Figures

- FIGURE 1 FIXED-WING VTOL UAV MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 OEM TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 4 MIDDLE EAST TO BE DOMINANT REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 5 BUSINESS MODELS IN FIXED-WING VTOL UAV MARKET

- FIGURE 6 TOTAL COST OF OWNERSHIP FOR FIXED-WING VTOL UAV

- FIGURE 7 FIXED-WING VTOL UAV MARKET DECISION-MAKING FACTORS

- FIGURE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 9 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 10 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 11 TECHNOLOGY ROADMAP (2020-2035)

- FIGURE 12 EMERGING TECHNOLOGY TRENDS

- FIGURE 13 TOP 10 PATENT APPLICANTS IN LAST 10 YEARS

- FIGURE 14 FIXED-WING VTOL UAV MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 FIXED-WING VTOL UAV MARKET: ECOSYSTEM ANALYSIS

- FIGURE 16 FIXED-WING VTOL UAV MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- FIGURE 17 FIXED-WING VTOL UAV MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 IMPORT DATA FOR HS CODE 8806, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 19 EXPORT DATA FOR HS CODE 8806, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 20 FIXED-WING VTOL UAV MARKET: INVESTMENT AND FUNDING LANDSCAPE (2019-2024)

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 COMMERCIAL SEGMENT TO LEAD MARKET N 2025

- FIGURE 23 < 5 HOURS SEGMENT TO LEAD MARKET IN 2025

- FIGURE 24 >170 KG SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 FULLY AUTONOMOUS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 26 ELECTRIC SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 27 BEYOND VISUAL LINE OF SIGHT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 28 OEM SEGMENT TO HOLD DOMINANT MARKET SHARE IN 2025

- FIGURE 29 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 30 NORTH AMERICA: FIXED-WING VTOL UAV MARKET SNAPSHOT

- FIGURE 31 EUROPE: FIXED-WING VTOL UAV MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: FIXED-WING VTOL UAV MARKET SNAPSHOT

- FIGURE 33 MIDDLE EAST: FIXED-WING VTOL UAV MARKET SNAPSHOT

- FIGURE 34 REST OF THE WORLD: FIXED-WING VTOL UAV MARKET SNAPSHOT

- FIGURE 35 REVENUE ANALYSIS OF FIXED-WING VTOL UAV MARKET, 2021-2024 (USD MILLION)

- FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 37 BRAND/PRODUCT COMPARISON

- FIGURE 38 COMPANY VALUATION (USD BILLION), 2025

- FIGURE 39 FINANCIAL METRICS (EV/EBIDTA), 2025

- FIGURE 40 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 41 FIXED-WING VTOL UAV MARKET: COMPANY FOOTPRINT

- FIGURE 42 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 43 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- FIGURE 44 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 TEXTRON SYSTEMS: COMPANY SNAPSHOT

- FIGURE 46 RESEARCH FLOW

- FIGURE 47 RESEARCH DESIGN

- FIGURE 48 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 49 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 50 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 51 DATA TRIANGULATION