PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1883071

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1883071

Pharmaceutical-Grade Sodium Chloride Market by Grade (API-NaCl, HD-NaCl), Application (Injectables /Intravenous Solutions, Dialysis, Oral Rehydration Salts, Hemofiltration Solutions, Mechanical Cleansing Solutions), and Region - Global Forecast to 2030

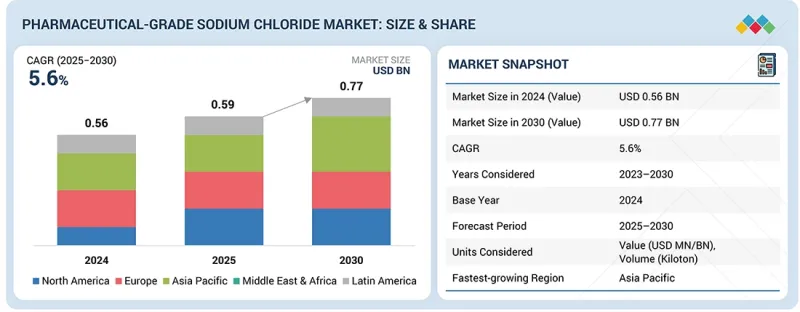

The pharmaceutical-grade sodium chloride market size is estimated to be USD 0.59 billion in 2025 and is projected to reach USD 0.77 billion by 2030, at a CAGR of 5.6% from 2025 to 2030. The pharmaceutical-grade sodium chloride market will expand owing to the rise in the demand for intravenous fluids, the injectable formulations, and dialysis solutions as the prevalence of chronic diseases like chronic kidney disease (CKD), diabetes, and dehydration disorders continues to rise.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Segments | Grade, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The increased production of pharmaceuticals and biologics, including in the emerging economies, is also contributing to the demand for high-purity sodium chloride that is pharmacopeially acceptable. Investment in infrastructure facilities, government expenditure on critical care, and enhancements to supply chain facilities are also driving the market's growth.

"HD-NaCl segment is projected to exhibit the highest CAGR from 2025 to 2030"

The HD-NaCl is expected to record the highest CAGR in the pharmaceutical-grade sodium chloride market during the forecast period, owing to the rising demand for critical care therapies and hydration therapies provided in hospitals. Consumption of HD sodium chloride is on the rise. It is cheaper and can be produced in large quantities, making it the preferred choice over API sodium chloride for large-scale pharmaceutical and clinical usage.

"Dialysis segment is projected to capture the largest market share in 2030"

The largest application in the pharmaceutical-grade sodium chloride market is dialysis due to the rapidly rising incidences of CKD associated with older people, diabetes, and hypertension. The growth of dialysis facilities and the introduction of home dialysis units worldwide only escalates the market demand. The dialytic modalities of hemodialysis and peritoneal dialysis necessitate constant and high-volume utilization of pharmaceutical-grade sodium chloride to formulate the dialysates.

"Asia Pacific pharmaceutical-grade sodium chloride market is projected to grow at the highest CAGR during the forecast period"

The Asia Pacific is experiencing high growth in the pharmaceutical-grade sodium chloride market due to the rapid development of the pharmaceutical and biologics production industry, as well as increased investment in hospital and dialysis infrastructure. Favorable government policies and low cost of production deter competitive imported pharmaceutical-grade sodium chloride production. The increased use of modern healthcare in India, China, and Southeast Asia is reinforcing market acceleration.

By Company Type: Tier 1 - 25%, Tier 2 - 42%, and Tier 3 - 33%

By Designation: C-level Executives - 20%, Directors - 30%, and Others - 50%

By Region: North America - 20%, Europe - 10%, Asia Pacific - 40%, South America - 10%, and Middle East & Africa - 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: K+S Aktiengesellschaft (Germany), Sudwestdeutsche Salzwerke AG (Germany), Dominion Salt (New Zealand), Morton Salt, Inc. (US), and Salinen Austria AG (Austria), among other companies, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the pharmaceutical-grade sodium chloride market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the pharmaceutical-grade sodium chloride market based on grade (API-NaCl and HD-NaCl), application (injectables/intravenous solutions, dialysis, oral rehydration salts, hemofiltration solutions, mechanical cleansing solutions, and other applications), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, expansions, and acquisitions, associated with the market. This report also covers a competitive analysis of upcoming startups in the pharmaceutical-grade sodium chloride market ecosystem.

Reasons to Buy the Report

The report will provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall pharmaceutical-grade sodium chloride market and its subsegments. This report will help stakeholders understand the competitive landscape, gain deeper insights into positioning their businesses more effectively, and develop suitable go-to-market strategies. The report will help stakeholders understand the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

Analysis of key drivers (Rising dialysis treatments), restraints (Complex regulatory approvals), opportunities (Rising healthcare investment in developing regions), and challenges (Audits and documentation burdens)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the pharmaceutical-grade sodium chloride market

- Market Development: Comprehensive information about profitable markets-the report analyzes the pharmaceutical-grade sodium chloride market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the pharmaceutical-grade sodium chloride market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as K+S Aktiengesellschaft (Germany), Sudwestdeutsche Salzwerke AG (Germany), Dominion Salt (New Zealand), Morton Salt, Inc. (US), Salinen Austria AG (Austria)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF STRATEGIC CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: ASIA PACIFIC MARKET SIZE AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 3.2 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE AND REGION

- 3.3 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM

- 3.4 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION

- 3.5 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising dialysis treatments

- 4.2.1.2 Strong demand for pharmaceutical-grade sodium chloride in North America and Europe

- 4.2.1.3 Emerging markets driving healthcare expansion and increasing demand

- 4.2.2 RESTRAINTS

- 4.2.2.1 Complex regulatory approvals

- 4.2.2.2 Dependence on stable supply of raw salt

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising healthcare investment in developing regions

- 4.2.3.2 Partnerships with hospitals and pharmaceutical companies

- 4.2.4 CHALLENGES

- 4.2.4.1 Strict audits and documentation burdens

- 4.2.4.2 Competition from local low-cost producers

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 4.3.1.1 Need for higher purity and specialized grades

- 4.3.1.2 Digitalization and supply chain transparency

- 4.3.1.3 Enhanced technical support and quality services

- 4.3.1.4 Flexible and long-term supply models

- 4.3.1.5 Skilled quality teams and regulatory assurance

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.3.2.1 Expansion into emerging and underserved markets

- 4.3.2.2 Development of specialty and high-performance grades

- 4.3.2.3 Digital quality systems and traceability platforms

- 4.3.2.4 Enhanced technical services and regulatory support

- 4.3.2.5 Integrated supply and capacity-reliability solutions

- 4.3.1 UNMET NEEDS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES' ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC ANALYSIS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECASTS

- 5.2.3 URBANIZATION AND DEMOGRAPHIC SHIFTS

- 5.2.4 TRADE AND GLOBAL SUPPLY CHAIN DYNAMICS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL PROCUREMENT AND ACQUISITION

- 5.3.2 PROCESSING, REFINING, AND QUALITY ASSURANCE

- 5.3.3 DISTRIBUTION, LOGISTICS, AND SUPPLY CHAIN MANAGEMENT

- 5.3.4 CONVERSION TO END-USE PHARMACEUTICAL PRODUCTS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO

- 5.6.2 EXPORT SCENARIO

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 EFFICIENT PRODUCTION OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE FROM ROCK SALT AT ENASEL, ALGERIA

- 5.9.2 TRANSFORMING LOW-QUALITY SOLAR SALT INTO PHARMACEUTICAL-GRADE SODIUM CHLORIDE IN BANGLADESH

- 5.10 IMPACT OF 2025 US TARIFF ON PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 KEY IMPACT ON VARIOUS REGIONS

- 5.10.5 IMPACT ON APPLICATIONS

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 VACUUM SALT PRODUCTION

- 6.1.2 MECHANICAL VAPOR RECOMPRESSION (MVR) & MULTIPLE-EFFECT EVAPORATION (MEE)

- 6.1.3 RECRYSTALLIZATION

- 6.1.4 COLD BRINE LEACHING & CHEMICAL PRECIPITATION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 PARTICLE SIZE CONTROL, SIEVING, AND GRANULATION

- 6.2.2 DRYING TECHNOLOGY (HOT AIR & FLUID BED DRYING)

- 6.2.3 PAT & PROCESS AUTOMATION (SCADA, DCS, INLINE QUALITY MONITORING)

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 STERILE INTRAVENOUS FLUID, DIALYSIS, AND ORS PRODUCTION SYSTEMS

- 6.3.2 CLEANROOM, HVAC, AND GMP PACKAGING TECHNOLOGIES

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027) | DIGITAL TRANSITION AND PRODUCTION OPTIMIZATION PHASE

- 6.4.2 MID-TERM (2027-2030): SUSTAINABLE PRODUCTION & SUPPLY CHAIN INTEGRATION

- 6.4.3 LONG-TERM (2030-2035+): BIOPROCESS INTEGRATION & ON-SITE PHARMACEUTICAL BRINE SYSTEMS

- 6.5 PATENT ANALYSIS

- 6.5.1 INTRODUCTION

- 6.5.2 APPROACH

- 6.5.3 TOP APPLICANTS

- 6.6 FUTURE APPLICATIONS

- 6.6.1 ADVANCED APPLICATIONS IN INJECTABLES, DIALYSIS, AND BIOPROCESSING SYSTEMS

- 6.7 IMPACT OF AI/GEN AI ON PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.3 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.8.1 K+S AKTIENGESELLSCHAFT ENABLES CRITICAL PHARMACEUTICAL SUPPLY SUPPORT DURING GLOBAL COVID-19 VACCINATION ROLLOUT

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE

- 7.2.1.1 Carbon Impact Reduction

- 7.2.1.2 Eco-Applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE

- 7.3 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS APPLICATIONS

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES, BY APPLICATION

9 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE

- 9.1 INTRODUCTION

- 9.2 HD-NACL

- 9.2.1 UNMATCHED STABILITY, HEIGHT, AND LIFTING POWER TO DRIVE DEMAND

- 9.3 API-NACL

- 9.3.1 HIGH REGULATORY COMPLIANCE, PURITY ASSURANCE, AND FUNCTIONAL PERFORMANCE TO AUGMENT DEMAND

10 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM

- 10.1 INTRODUCTION

- 10.2 LIQUID

- 10.2.1 GROWING DEMAND FOR ORAL ELECTROLYTE THERAPIES TO DRIVE DEMAND

- 10.3 SOLID

- 10.3.1 RISING GLOBAL HOSPITALIZATION RATES TO AUGMENT DEMAND

11 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 DIALYSIS

- 11.2.1 GROWING DIALYSIS PATIENT POPULATION TO FUEL MARKET GROWTH

- 11.3 INJECTABLES

- 11.3.1 GROWING USE OF IV THERAPIES AND SURGICAL PROCEDURES TO DRIVE DEMAND

- 11.4 ORAL REHYDRATION SALTS

- 11.4.1 GROWING GLOBAL NEED FOR EFFECTIVE DEHYDRATION MANAGEMENT TO DRIVE DEMAND

- 11.5 HEMOFILTRATION SOLUTIONS

- 11.5.1 ADVANCED RENAL REPLACEMENT REQUIREMENTS TO ACCELERATE DEMAND

- 11.6 MECHANICAL CLEANING SOLUTIONS

- 11.6.1 INCREASING SURGICAL ACTIVITIES AND HOSPITAL HYGIENE STANDARDS TO DRIVE DEMAND

- 11.7 OTHER APPLICATIONS

12 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Pharmaceutical industry and shift toward advanced drug development to drive market

- 12.2.2 JAPAN

- 12.2.2.1 Accelerating aging population and rising healthcare demand to drive market

- 12.2.3 INDIA

- 12.2.3.1 Growing generic injectable drug industry to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Rapidly aging population and rising healthcare demand to propel market

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Rising renal replacement therapy demand to boost consumption

- 12.3.2 FRANCE

- 12.3.2.1 Growing adoption of home hemodialysis

- 12.3.3 UK

- 12.3.3.1 CKD prevalence and aging population to accelerate market

- 12.3.4 ITALY

- 12.3.4.1 Expanding healthcare infrastructure to drive demand

- 12.3.5 SPAIN

- 12.3.5.1 Strong organ donation infrastructure and rising dialysis volume to accelerate market growth

- 12.3.6 NETHERLANDS

- 12.3.6.1 Increasing CKD incidence and elderly population expansion to support market growth

- 12.3.7 IRELAND

- 12.3.7.1 Increasing incidence of kidney failure and expanding renal care needs to boost market

- 12.3.8 TURKEY

- 12.3.8.1 High incidence of end-stage kidney disease to boost market

- 12.3.9 RUSSIA

- 12.3.9.1 Expanding dialysis centers and rising CKD burden to propel market

- 12.3.10 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 Aging population increasing hospital and infusion needs to boost market

- 12.4.2 CANADA

- 12.4.2.1 Rising CKD and expanding dialysis needs to boost market

- 12.4.3 MEXICO

- 12.4.3.1 Rapidly aging population to propel the market

- 12.4.1 US

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Rising CKD burden and rapid population aging fueling the demand

- 12.5.2 ARGENTINA

- 12.5.2.1 Healthcare modernization and rising chronic disease burden to augment market

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 GCC COUNTRIES

- 12.6.1.1 Saudi Arabia

- 12.6.1.1.1 High CKD and diabetes burden paired with Vision 2030 healthcare expansion to drive market

- 12.6.1.2 UAE

- 12.6.1.2.1 High diabetes and CKD burden to boost market

- 12.6.1.3 Rest of GCC countries

- 12.6.1.1 Saudi Arabia

- 12.6.2 SOUTH AFRICA

- 12.6.2.1 Expanding healthcare & dialysis infrastructure to drive market

- 12.6.3 REST OF MIDDLE EAST & AFRICA

- 12.6.1 GCC COUNTRIES

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Grade footprint

- 13.7.5.4 Product form footprint

- 13.7.5.5 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.6 DETAILED LIST OF KEY STARTUPS/SMES

- 13.8.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 EXPANSIONS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 K+S AKTIENGESELLSCHAFT

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 SUDWESTDEUTSCHE SALZWERKE AG

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Key strengths

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 DOMINION SALT

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Key strengths

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 MORTON SALT, INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 SALINEN AUSTRIA AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 MERCK KGAA

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Expansions

- 14.1.6.4 MnM view

- 14.1.7 GROUPE SALINS

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.4 MnM view

- 14.1.8 HUB SALT

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 MnM view

- 14.1.9 JIANGSU PROVINCE QINFEN PHARMACEUTICAL CO., LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 MnM view

- 14.1.10 US SALT

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.1 K+S AKTIENGESELLSCHAFT

- 14.2 OTHER PLAYERS

- 14.2.1 NANDU CHEMICALS

- 14.2.2 MACCO ORGANIQUES, S.R.O.

- 14.2.3 J J CHEMICALS

- 14.2.4 SALT MINERALS GMBH

- 14.2.5 HITECH MINERALS AND CHEMICALS GROUP

- 14.2.6 TIANJIN HENGHAIXIN INTERNATIONAL TRADING CO., LTD.

- 14.2.7 MARKHOR SALT CO.

- 14.2.8 ABHAY AQUA CHEM

- 14.2.9 HAWKINS

- 14.2.10 RCI LABSCAN LIMITED

- 14.2.11 GLENTHAM LIFE SCIENCES LIMITED

- 14.2.12 FENGCHEN GROUP CO., LTD

- 14.2.13 DHANRAJ SUGAR PVT. LTD.

- 14.2.14 SD FINE-CHEM LTD

- 14.2.15 VM CHEMICALS

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 Key industry insights

- 15.1.1 SECONDARY DATA

- 15.2 MARKET SIZE ESTIMATION

- 15.3 BASE NUMBER CALCULATION

- 15.3.1 DEMAND-SIDE APPROACH

- 15.3.2 SUPPLY-SIDE APPROACH

- 15.4 MARKET FORECAST APPROACH

- 15.4.1 SUPPLY SIDE

- 15.4.2 DEMAND SIDE

- 15.5 DATA TRIANGULATION

- 15.6 FACTOR ANALYSIS

- 15.7 RESEARCH ASSUMPTIONS

- 15.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 GLOBAL GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 3 ROLE OF COMPANIES IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE OFFERED BY KEY PLAYERS, BY GRADE, 2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE, BY REGION, 2023-2025 (USD/KG)

- TABLE 6 IMPORT DATA FOR HS CODE 250100-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 250100-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: LIST OF MAJOR PATENTS: 2024

- TABLE 10 TOP USE CASES AND MARKET POTENTIAL

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 GLOBAL INDUSTRY STANDARDS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- TABLE 17 CERTIFICATIONS, LABELING, ECO-STANDARDS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- TABLE 19 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 20 UNMET NEEDS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET IN KEY APPLICATIONS

- TABLE 21 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 22 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTONS)

- TABLE 23 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (USD MILLION)

- TABLE 24 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (KILOTONS)

- TABLE 25 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 26 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTONS)

- TABLE 27 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 29 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 31 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 32 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 33 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (USD MILLION)

- TABLE 34 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (KILOTON)

- TABLE 35 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 37 CHINA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 38 CHINA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 39 CHINA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 40 CHINA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 41 JAPAN: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 42 JAPAN: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 43 JAPAN: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 44 JAPAN: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 45 INDIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 46 INDIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 47 INDIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 48 INDIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 49 SOUTH KOREA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 50 SOUTH KOREA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 51 SOUTH KOREA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 52 SOUTH KOREA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 53 REST OF ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 54 REST OF ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 55 REST OF ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 56 REST OF ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 57 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 59 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 60 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 61 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (KILOTON)

- TABLE 63 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 65 GERMANY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 66 GERMANY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 67 GERMANY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 68 GERMANY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 69 FRANCE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 70 FRANCE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 71 FRANCE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 72 FRANCE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 73 UK: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 74 UK: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 75 UK: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 76 UK: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 77 ITALY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 78 ITALY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 79 ITALY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 80 ITALY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 81 SPAIN: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 82 SPAIN: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 83 SPAIN: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 84 SPAIN: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 85 NETHERLANDS: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 86 NETHERLANDS: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 87 NETHERLANDS: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 88 NETHERLANDS: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 89 IRELAND: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 90 IRELAND: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 91 IRELAND: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 92 IRELAND: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 93 TURKEY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 94 TURKEY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 95 TURKEY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 96 TURKEY: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 97 RUSSIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 98 RUSSIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 99 RUSSIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 100 RUSSIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 101 REST OF EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 102 REST OF EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 103 REST OF EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 104 REST OF EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 105 NORTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 NORTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 107 NORTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 109 NORTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (USD MILLION)

- TABLE 110 NORTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (KILOTON)

- TABLE 111 NORTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 113 US: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 114 US: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 115 US: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 116 US: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 117 CANADA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 118 CANADA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 119 CANADA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 120 CANADA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 121 MEXICO: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 122 MEXICO: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 123 MEXICO: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 124 MEXICO: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 125 SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 127 SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 128 SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE, BY GRADE, 2023-2030 (KILOTON)

- TABLE 129 SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (USD MILLION)

- TABLE 130 SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (KILOTON)

- TABLE 131 SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 132 SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 133 BRAZIL: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 134 BRAZIL: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 135 BRAZIL: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 136 BRAZIL: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 137 ARGENTINA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 138 ARGENTINA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 139 ARGENTINA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 140 ARGENTINA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 141 REST OF SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 142 REST OF SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 143 REST OF SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 144 REST OF SOUTH AMERICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 145 MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 147 MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 149 MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM, 2023-2030 (KILOTON)

- TABLE 151 MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 153 GCC COUNTRIES: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 154 GCC COUNTRIES: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 155 GCC COUNTRIES: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 156 GCC COUNTRIES: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 157 SAUDI ARABIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 158 SAUDI ARABIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 159 SAUDI ARABIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 160 SAUDI ARABIA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 161 UAE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 162 UAE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 163 UAE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 164 UAE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 165 REST OF GCC COUNTRIES: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 166 REST OF GCC COUNTRIES: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 167 REST OF GCC COUNTRIES: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 168 REST OF GCC COUNTRIES: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 169 SOUTH AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 170 SOUTH AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 171 SOUTH AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 172 SOUTH AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE, 2023-2030 (KILOTON)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION, 2023-2030 (KILOTON)

- TABLE 177 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS BETWEEN JANUARY 2021 AND NOVEMBER 2025

- TABLE 178 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: DEGREE OF COMPETITION

- TABLE 179 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: REGION FOOTPRINT

- TABLE 180 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: GRADE FOOTPRINT

- TABLE 181 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: PRODUCT FORM FOOTPRINT

- TABLE 182 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: APPLICATION FOOTPRINT

- TABLE 183 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 184 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 185 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: DEALS, JANUARY 2021-NOVEMBER 2025

- TABLE 186 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: EXPANSIONS, JANUARY 2021-NOVEMBER 2025

- TABLE 187 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: OTHER DEVELOPMENTS, JANUARY 2021-NOVEMBER 2025

- TABLE 188 K+S AKTIENGESELLSCHAFT: COMPANY OVERVIEW

- TABLE 189 K+S AKTIENGESELLSCHAFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 K+S AKTIENGESELLSCHAFT: OTHERS

- TABLE 191 SUDWESTDEUTSCHE SALZWERKE AG: COMPANY OVERVIEW

- TABLE 192 SUDWESTDEUTSCHE SALZWERKE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 DOMINION SALT: COMPANY OVERVIEW

- TABLE 194 DOMINION SALT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 MORTON SALT, INC.: COMPANY OVERVIEW

- TABLE 196 MORTON SALT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SALINEN AUSTRIA AG: COMPANY OVERVIEW

- TABLE 198 SALINEN AUSTRIA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 MERCK KGAA: COMPANY OVERVIEW

- TABLE 200 MERCK KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 MERCK KGAA: EXPANSIONS

- TABLE 202 GROUPE SALINS: COMPANY OVERVIEW

- TABLE 203 GROUPE SALINS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 GROUPE SALINS: DEALS

- TABLE 205 HUB SALT: COMPANY OVERVIEW

- TABLE 206 HUB SALT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 JIANGSU PROVINCE QINFEN PHARMACEUTICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 208 JIANGSU PROVINCE QINFEN PHARMACEUTICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 US SALT: COMPANY OVERVIEW

- TABLE 210 US SALT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 NANDU CHEMICALS: COMPANY OVERVIEW

- TABLE 212 MACCO ORGANIQUES, S.R.O.: COMPANY OVERVIEW

- TABLE 213 J J CHEMICALS: COMPANY OVERVIEW

- TABLE 214 SALT MINERALS GMBH: COMPANY OVERVIEW

- TABLE 215 HITECH MINERALS AND CHEMICALS GROUP: COMPANY OVERVIEW

- TABLE 216 TIANJIN HENGHAIXIN INTERNATIONAL TRADING CO., LTD.: COMPANY OVERVIEW

- TABLE 217 MARKHOR SALT CO.: COMPANY OVERVIEW

- TABLE 218 ABHAY AQUA CHEM: COMPANY OVERVIEW

- TABLE 219 HAWKINS: COMPANY OVERVIEW

- TABLE 220 RCI LABSCAN LIMITED: COMPANY OVERVIEW

- TABLE 221 GLENTHAM LIFE SCIENCES LIMITED: COMPANY OVERVIEW

- TABLE 222 FENGCHEN GROUP CO., LTD: COMPANY OVERVIEW

- TABLE 223 DHANRAJ SUGAR PVT. LTD.: COMPANY OVERVIEW

- TABLE 224 SD FINE-CHEM LTD: COMPANY OVERVIEW

- TABLE 225 VM CHEMICALS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PHARMACEUTICAL-GRADE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, 2025-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET (2021-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET DURING FORECAST PERIOD

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 8 HIGH DEMAND FOR DIALYSIS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 LIQUID SEGMENT DOMINATED PHARMACEUTICAL-GRADE MARKET IN 2024

- FIGURE 11 DIALYSIS SEGMENT ACCOUNTED FOR LARGEST SHARE OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET IN 2024

- FIGURE 12 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 CHRONIC KIDNEY DISEASE RISING AS LEADING CAUSE OF DEATH WORLDWIDE

- FIGURE 15 CHRONIC KIDNEY DISEASE PREVALENCE: EUROPE COMPARED TO GLOBAL LEVELS

- FIGURE 16 NUMBER OF PEOPLE AGED 65 YEARS OR OVER, BY REGION (2022 VS. 2050)

- FIGURE 17 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 NUMBER OF PEOPLE LIVING IN URBAN AND RURAL AREAS, WORLD (2010-2024)

- FIGURE 19 GLOBAL TRADE IN MERCHANDISE, 2014-2024

- FIGURE 20 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE OFFERED BY KEY PLAYERS, BY GRADE, 2024 (USD/KG)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE, BY REGION, 2023-2025 (USD/KG)

- FIGURE 24 IMPORT SCENARIO FOR HS CODE 250100-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 25 EXPORT SCENARIO FOR HS CODE 250100-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 LIST OF MAJOR PATENTS RELATED TO PHARMACEUTICAL-GRADE SODIUM CHLORIDE, 2015-2024

- FIGURE 28 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PHARMACEUTICAL-GRADE SODIUM CHLORIDE, 2015-2024

- FIGURE 29 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET DECISION-MAKING FACTORS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- FIGURE 31 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 32 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 33 HD-NACL SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 34 LIQUID SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 35 DIALYSIS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 36 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET SNAPSHOT

- FIGURE 38 EUROPE: PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET SNAPSHOT

- FIGURE 39 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 40 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET SHARE ANALYSIS, 2024

- FIGURE 41 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: COMPANY VALUATION

- FIGURE 42 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: FINANCIAL MATRIX (EV/EBITDA RATIO)

- FIGURE 43 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA

- FIGURE 44 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 45 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: COMPANY FOOTPRINT

- FIGURE 47 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- FIGURE 49 SUDWESTDEUTSCHE SALZWERKE AG: COMPANY SNAPSHOT

- FIGURE 50 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 51 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: RESEARCH DESIGN

- FIGURE 52 BREAKDOWN OF INTERVIEWS WITH EXPERTS

- FIGURE 53 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 54 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 55 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: APPROACH 1

- FIGURE 56 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- FIGURE 57 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET: DATA TRIANGULATION