PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1883072

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1883072

Satellite Ground Station Market by Platform (Fixed, Portable, Vehicle-mounted, Shipborne, Airborne, Container-mounted), Solution (Hardware, Software, Ground Station as a Service), Function, Frequency, Orbit, End User, Region - Global Forecast to 2030

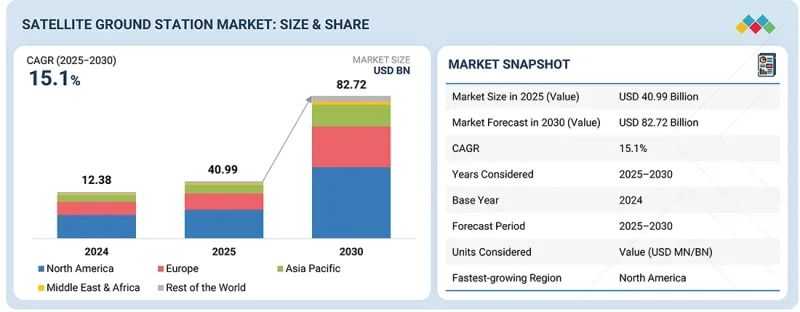

The satellite ground station market is projected to reach USD 82.72 billion by 2030 from USD 40.99 billion in 2025 at a CAGR of 15.1% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform, Solution, Function and Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising demand for satellite ground stations is driven by the rapid expansion of multi-orbit satellite constellations requiring dense, high-capacity ground networks for data transport and TT&C operations.

"By end user, the commercial segment is expected to hold the largest market share."

Based on end user, the commercial segment is expected to hold the largest share of the satellite ground station market during the forecast period, primarily driven by the rapid scale-up of private satellite constellations, teleport expansions, and cloud-integrated ground services. Commercial operators are increasingly investing in virtualized baseband, multi-orbit antennas, and automated TT&C infrastructure to support higher throughput and lower latency requirements. The rise of Earth-observation data services, global broadband networks, and mobility solutions across aviation and maritime sectors is further propelling commercial demand. Additionally, flexible capacity leasing models and GSaaS platforms are enabling startups and non-satellite enterprises to access high-quality ground infrastructure without owning physical assets. This shift is accelerating market growth and solidifying commercial players as the dominant demand center globally.

"By function, the communication segment is projected to hold the largest market share."

Based on function, the communication segment is projected to hold the largest market share during the forecast period, propelled by the rising demand for high-capacity satellite connectivity across commercial, government, and defense applications. The accelerated deployment of multi-orbit satellite networks, expansion of broadband and mobility services, and the need for resilient, wide-area communication infrastructure are driving significant upgrades in ground antennas, RF systems, and gateway architectures. Additionally, the growing adoption of cloud-integrated ground systems and the surge in data-intensive applications, such as video, IoT, and secure mission communications, further reinforce the dominance of the communication segment of the satellite ground segment market.

"North America is projected to hold the largest market share."

North America is expected to acquire the largest market share during the forecast period, driven by the rapid expansion of military SATCOM modernization programs, commercial constellation deployments, and federal investment in resilient ground infrastructure. The US leads globally with multi-orbit architectures supporting LEO, MEO, GEO, and deep space missions, alongside strong participation from key players such as SpaceX, Amazon Kuiper, Kratos, RTX, and Northrop Grumman. Government initiatives, such as the US Space Force's SATCOM C2 modernization, NASA's Near-Space Network upgrades, and NOAA's EO ground segment programs, are further accelerating regional adoption. Additionally, the presence of cloud hyperscalers and GSaaS providers is enabling the shift to virtualized and AI-enabled ground operations. These factors collectively position North America as the most technologically advanced and investment-heavy satellite ground station market worldwide.

The breakup of the profile of primary participants in the satellite ground station market:

- By Company Type: Tier 1 - 40%, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: C-Level Executives- 25%, Managers - 25%, Others - 40%

- By Region: North America - 30%, Europe - 10%, Asia Pacific - 40%, Middle East -15%, Latin America -3%, Africa -2%

RTX (US), General Dynamics Corporation (US), Kongsberg (Norway), Airbus (Netherlands), Elbit System Limited (Israel), Boeing (US), Aselsan A.S. (Turkey), L3Harris Technologies, Inc. (US), Northrop Grumman (US), GMV Innovating Solutions S.L. (Spain), Kratos Defense & Security Solutions (US), and Lockheed Martin Corporation (US) are some of the key market players that have well-equipped and strong distribution networks across North America, Europe, the Asia Pacific, the Middle East, and the Rest of the World.

Research Coverage:

The study covers the satellite ground station market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on platform, solution, function, frequency, orbit, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

This report segments the satellite ground station market across five key regions: North America, Europe, the Asia Pacific, the Middle East, and the Rest of the World, and their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects, including agreements, collaborations, product launches, contracts, expansions, acquisitions, and partnerships, associated with the satellite ground station market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the satellite ground station market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulate effective go-to-market strategies. The report imparts valuable insights into market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights into the following pointers:

- Analysis of key drivers and factors, such as the rapid growth of satellite constellations, requiring precise navigation and control

- Market Penetration: Comprehensive information on satellite ground station solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the satellite ground station market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the Satellite Ground Station market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the satellite ground station market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the satellite ground station market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 DISRUPTIVE TRENDS SHAPING MARKET

- 2.3 KEY MARKET PARTICIPANTS: SHARED INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SATELLITE GROUND STATION MARKET

- 3.2 DEFENSE SATELLITE GROUND STATION MARKET, BY END USER

- 3.3 COMMERCIAL SATELLITE GROUND STATION MARKET, BY END USER

- 3.4 SATELLITE GROUND STATION MARKET, BY HARDWARE

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rapid adoption of cloud-integrated and virtualized ground infrastructure

- 4.2.1.2 Surge in satellite deployments

- 4.2.1.3 Elevated demand for satellite-based services

- 4.2.1.4 Need for Earth observation imagery and analytics

- 4.2.2 RESTRAINTS

- 4.2.2.1 Stringent regulatory and certification requirements

- 4.2.2.2 Substantial installation and maintenance costs

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of optical and quantum communication technologies

- 4.2.3.2 AI-driven automation and intelligent network orchestration

- 4.2.4 CHALLENGES

- 4.2.4.1 Increasing network complexity from multi-orbit and multi-constellation operations

- 4.2.4.2 Weather-related signal disruptions and environmental constraints

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTER-CONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL SPACE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 R&D ENGINEERS

- 5.3.2 RAW MATERIAL SUPPLIERS

- 5.3.3 COMPONENT/PRODUCT MANUFACTURERS

- 5.3.4 ASSEMBLERS, INTEGRATORS, AND SERVICE PROVIDERS

- 5.3.5 END USERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- 5.5 TRADE DATA

- 5.5.1 IMPORT SCENARIO (HS CODE 880260)

- 5.5.2 EXPORT SCENARIO (HS CODE 880260)

- 5.6 KEY CONFERENCES AND EVENTS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING ANALYSIS, BY PLATFORM

- 5.8.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.9 USE CASE ANALYSIS

- 5.9.1 REAL-TIME EARTH OBSERVATION DATA DOWNLINK FOR CLIMATE AND DISASTER MONITORING

- 5.9.2 MULTI-ORBIT CONNECTIVITY AND GSAAS FOR LEO CONSTELLATIONS

- 5.9.3 SECURE GOVERNMENT AND DEFENSE COMMUNICATIONS NETWORK EXPANSION

- 5.10 BUSINESS MODELS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 VIRTUALIZED GROUND STATIONS

- 6.1.2 OPTICAL GROUND STATIONS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 EDGE COMPUTING AND CLOUD INTEGRATION

- 6.2.2 PHASED-ARRAY AND ELECTRONICALLY STEERABLE ANTENNAS

- 6.3 TECHNOLOGY TRENDS

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GEN AI/GEN AI

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 AMAZON WEB SERVICES: PIONEERING CLOUD-NATIVE GROUND INFRASTRUCTURE

- 6.7.2 KONGSBERG SATELLITE SERVICES: BUILDING WORLD'S MOST EXTENSIVE GROUND NETWORK

- 6.7.3 MICROSOFT AZURE ORBITAL: INTEGRATING SPACE CONNECTIVITY WITH CLOUD INTELLIGENCE

7 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.2 SUSTAINABILITY INITIATIVES

- 8.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

9 SATELLITE GROUND STATION MARKET, BY PLATFORM

- 9.1 INTRODUCTION

- 9.2 FIXED

- 9.2.1 EXPANSION OF HIGH-THROUGHPUT SATELLITE CONSTELLATIONS AND CLOUD-INTEGRATED GATEWAY NETWORKS

- 9.2.2 USE CASE: NATIONAL SATELLITE COMMUNICATION GATEWAY

- 9.3 PORTABLE 93 9.3.1 HEIGHTENED DEMAND FOR FIELD-DEPLOYABLE, REAL-TIME COMMUNICATION SYSTEMS

- 9.3.2 USE CASE: RAPID-DEPLOYMENT SATCOM FOR DISASTER RESPONSE

- 9.3.3 HAND-HELD

- 9.3.4 BACKPACK/BAG-MOUNTED

- 9.4 MOBILE

- 9.4.1 RAPID ADOPTION OF AGILE AND TACTICAL SATELLITE COMMUNICATION SYSTEMS

- 9.4.2 USE CASE: DEPLOYABLE GROUND INFRASTRUCTURE FOR US SPACE FORCE

- 9.4.3 VEHICLE-MOUNTED

- 9.4.3.1 Groundborne

- 9.4.3.2 Shipborne

- 9.4.3.3 Airborne

- 9.4.4 CONTAINER/TRAILER-MOUNTED

10 SATELLITE GROUND STATION MARKET, BY SOLUTION

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 INCREASED OPERATIONAL EFFICIENCY IN SCIENTIFIC MISSIONS

- 10.2.2 ANTENNA SYSTEMS

- 10.2.3 RF SYSTEMS

- 10.2.3.1 Transmit RF systems

- 10.2.3.2 Receiver RF systems

- 10.2.3.3 System clocks

- 10.2.4 BASEBAND & RECORDING HARDWARE

- 10.2.5 STORAGE & NETWORKING UNITS

- 10.2.6 POWER & RACKS

- 10.3 SOFTWARE

- 10.3.1 GROWING ADOPTION OF VIRTUALIZED AND SOFTWARE-DEFINED GROUND SYSTEMS

- 10.3.2 MISSION CONTROL & FLIGHT DYNAMICS

- 10.3.3 BASEBAND/VIRTUAL MODEMS & WAVEFORMS

- 10.3.4 CYBERSECURITY & KEY MANAGEMENT

- 10.3.5 NETWORK M&C/ORCHESTRATION

- 10.4 GROUND STATION AS A SERVICE

- 10.4.1 RISING DEMAND FOR ON-DEMAND, CLOUD-INTEGRATED SATELLITE OPERATIONS

- 10.4.2 CONTACT/PASS SERVICES

- 10.4.3 DATA HANDLING & DELIVERY

- 10.4.4 MISSION OPERATIONS & VALUE-ADDED SERVICES

11 SATELLITE GROUND STATION MARKET, BY FUNCTION

- 11.1 INTRODUCTION

- 11.2 NAVIGATION

- 11.2.1 NEED FOR PRECISE PNT SERVICES TO SUPPORT AVIATION, DEFENSE, AND AUTONOMOUS SYSTEMS

- 11.2.2 USE CASE: ENHANCING GNSS INTEGRITY FOR AVIATION SAFETY

- 11.3 EARTH OBSERVATION

- 11.3.1 DEMAND FOR REAL-TIME, HIGH-RESOLUTION GEOSPATIAL INTELLIGENCE FROM COMMERCIAL AND GOVERNMENT SECTORS

- 11.3.2 USE CASE: RAPID DOWNLINK FOR DISASTER MONITORING

- 11.4 COMMUNICATION

- 11.4.1 RISE IN BANDWIDTH DEMAND AND EXPANSION OF MULTI-ORBIT BROADBAND NETWORKS

- 11.4.2 USE CASE: GLOBAL BROADBAND THROUGH MULTI-ORBIT GATEWAYS

- 11.5 SPACE RESEARCH

- 11.5.1 SCIENTIFIC MISSIONS AND DEEP-SPACE EXPLORATION PROGRAMS REQUIRING HIGH-PRECISION TT&C INFRASTRUCTURE

- 11.5.2 USE CASE: DEEP-SPACE TRACKING FOR LUNAR SURFACE MISSIONS

- 11.6 OTHER FUNCTIONS

12 SATELLITE GROUND STATION MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 DEFENSE

- 12.2.1 NEED FOR RESILIENT, MOBILE SATCOM TO SUPPORT BATTLEFIELD CONNECTIVITY AND ISR OPERATIONS

- 12.2.2 USE CASE: TACTICAL SATCOM MODERNIZATION FOR MILITARY OPERATIONS

- 12.2.3 AIR FORCE

- 12.2.4 ARMY

- 12.2.5 NAVY

- 12.3 GOVERNMENT

- 12.3.1 RELIANCE ON SATELLITE CONNECTIVITY FOR DISASTER RESPONSE AND EMERGENCY COMMUNICATION

- 12.3.2 USE CASE: SATELLITE-BASED EARLY WARNING AND PUBLIC SAFETY MONITORING

- 12.3.3 PUBLIC SAFETY & CIVIL AGENCIES

- 12.3.4 SPACE AGENCIES & RESEARCH CENTERS

- 12.4 COMMERCIAL

- 12.4.1 EXPANSION OF MULTI-ORBIT SATELLITE CONSTELLATIONS REQUIRING SCALABLE, HIGH-THROUGHPUT GATEWAY INFRASTRUCTURE

- 12.4.2 USE CASE: EXPANDING GLOBAL BROADBAND THROUGH MULTI-ORBIT GATEWAY DEPLOYMENT

- 12.4.3 SATELLITE & TELEPORT OPERATORS

- 12.4.4 CARRIERS & SERVICE PROVIDERS

- 12.4.5 ENTERPRISES & MOBILITY

13 SATELLITE GROUND STATION MARKET, BY FREQUENCY

- 13.1 INTRODUCTION

- 13.2 X-BAND

- 13.2.1 USE OF SECURE, WEATHER-RESILIENT LINKS IN DEFENSE, GOVERNMENT, AND EARTH OBSERVATION MISSIONS

- 13.3 C-BAND

- 13.3.1 EXPANSION OF HYBRID TERRESTRIAL-SATELLITE NETWORKS BY TELECOM OPERATORS

- 13.4 S-BAND

- 13.4.1 SURGE IN SMALL-SATELLITE DEPLOYMENTS AND COMMERCIAL LAUNCH CADENCE

- 13.5 L-BAND

- 13.5.1 LOW-POWER, HIGH-RELIABILITY CONNECTIVITY FOR NAVIGATION AND MOBILITY SERVICES

- 13.6 KU- AND KA-BAND

- 13.6.1 RISE IN IFC, MARITIME BROADBAND, ENTERPRISE NETWORKS, AND REMOTE-INDUSTRY COMMUNICATION

- 13.7 UHF/VHF/HF-BAND

- 13.7.1 MODERNIZATION OF TACTICAL COMMUNICATION ARCHITECTURES

- 13.8 OPTICAL /LASER

- 13.8.1 CRITICAL ROLE OF ULTRA-HIGH-SPEED, SECURE, AND INTERFERENCE-FREE SATELLITE DATA LINKS

- 13.9 OTHER FREQUENCY BANDS

14 SATELLITE GROUND STATION MARKET, BY ORBIT

- 14.1 INTRODUCTION

- 14.2 LEO

- 14.2.1 LARGE-SCALE DEPLOYMENT IN COMMUNICATIONS SATELLITES

- 14.3 MEO

- 14.3.1 HIGH DEMAND FOR NAVIGATION SATELLITES

- 14.4 GEO

- 14.4.1 EXTENSIVE USE IN BROADCAST, ENTERPRISE CONNECTIVITY, MOBILITY, AND DEFENSE COMMUNICATION

- 14.5 OTHER ORBITS

15 SATELLITE GROUND STATION MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Rapid transition toward virtualized and cloud-integrated ground infrastructure to drive market

- 15.2.2 CANADA

- 15.2.2.1 High domestic demand for satellite-based services to drive market

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 RUSSIA

- 15.3.1.1 Sovereign data security and strategic autonomy to drive market

- 15.3.2 UK

- 15.3.2.1 Proliferation of LEO/MEO constellations to drive market

- 15.3.3 GERMANY

- 15.3.3.1 Increased investments by private companies to drive market

- 15.3.4 FRANCE

- 15.3.4.1 Earth observation and science missions by domestic space agencies to drive market

- 15.3.5 REST OF EUROPE

- 15.3.1 RUSSIA

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Dependence on self-made space technology to drive market

- 15.4.2 INDIA

- 15.4.2.1 Lucrative space initiatives to drive market

- 15.4.3 JAPAN

- 15.4.3.1 Growth of multi-orbit constellations to drive market

- 15.4.4 SINGAPORE

- 15.4.4.1 Fewer government restrictions to drive market

- 15.4.5 AUSTRALIA

- 15.4.5.1 Growing focus on sovereign space operations to drive market

- 15.4.6 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 MIDDLE EAST

- 15.5.1 UAE

- 15.5.1.1 Expansion of national space infrastructure to drive market

- 15.5.2 SAUDI ARABIA

- 15.5.2.1 Need for secure satellite communications to drive market

- 15.5.3 REST OF MIDDLE EAST

- 15.5.1 UAE

- 15.6 REST OF THE WORLD

- 15.6.1 AFRICA

- 15.6.1.1 Need for surveillance and security to drive market

- 15.6.2 LATIN AMERICA

- 15.6.2.1 Need for cost-effective solutions in space research to drive market

- 15.6.1 AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 16.3 REVENUE ANALYSIS, 2021-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 BRAND/PRODUCT COMPARISON

- 16.6 COMPANY VALUATION AND FINANCIAL METRICS

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Solution footprint

- 16.7.5.4 Function footprint

- 16.7.5.5 Orbit footprint

- 16.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.8.5.1 List of start-ups/SMEs

- 16.8.5.2 Competitive benchmarking of start-ups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.9.2 DEALS

- 16.9.3 OTHERS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 RTX

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Deals

- 17.1.1.3.2 Others

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 GENERAL DYNAMICS CORPORATION

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches/developments

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Others

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 AIRBUS

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches/developments

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Others

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 L3HARRIS TECHNOLOGIES, INC.

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches/developments

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Others

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 LOCKHEED MARTIN CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Others

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 KONGSBERG

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches/developments

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Others

- 17.1.7 ELBIT SYSTEMS LTD.

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches/developments

- 17.1.7.3.2 Others

- 17.1.8 BOEING

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches/developments

- 17.1.8.3.2 Deals

- 17.1.8.3.3 Others

- 17.1.9 ASELSAN A.S.

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches/developments

- 17.1.9.3.2 Others

- 17.1.10 NORTHROP GRUMMAN

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches/developments

- 17.1.10.3.2 Deals

- 17.1.10.3.3 Others

- 17.1.11 BAE SYSTEMS

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches/developments

- 17.1.11.3.2 Deals

- 17.1.11.3.3 Others

- 17.1.12 MITSUBISHI ELECTRIC CORPORATION

- 17.1.12.1 Business overview

- 17.1.12.2 Products offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches/developments

- 17.1.12.3.2 Deals

- 17.1.12.3.3 Others

- 17.1.13 THALES

- 17.1.13.1 Business overview

- 17.1.13.2 Products offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product launches/developments

- 17.1.13.3.2 Deals

- 17.1.13.3.3 Others

- 17.1.14 HONEYWELL INTERNATIONAL INC.

- 17.1.14.1 Business overview

- 17.1.14.2 Products offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product launches/developments

- 17.1.14.3.2 Deals

- 17.1.14.3.3 Others

- 17.1.15 SPACEX

- 17.1.15.1 Business overview

- 17.1.15.2 Products offered

- 17.1.15.3 Recent developments

- 17.1.15.3.1 Product launches/developments

- 17.1.15.3.2 Deals

- 17.1.15.3.3 Others

- 17.1.16 TERMA

- 17.1.16.1 Business overview

- 17.1.16.2 Products offered

- 17.1.16.3 Recent developments

- 17.1.16.3.1 Product launches/developments

- 17.1.16.3.2 Deals

- 17.1.16.3.3 Others

- 17.1.17 LEONARDO S.P.A.

- 17.1.17.1 Business overview

- 17.1.17.2 Products offered

- 17.1.17.3 Recent developments

- 17.1.17.3.1 Product launches/developments

- 17.1.17.3.2 Deals

- 17.1.17.3.3 Others

- 17.1.18 EXAIL TECHNOLOGIES

- 17.1.18.1 Business overview

- 17.1.18.2 Products offered

- 17.1.18.3 Recent developments

- 17.1.18.3.1 Product launches/developments

- 17.1.18.3.2 Deals

- 17.1.18.3.3 Others

- 17.1.19 INDRA SISTEMAS, S.A.

- 17.1.19.1 Business overview

- 17.1.19.2 Products offered

- 17.1.19.3 Recent developments

- 17.1.19.3.1 Product launches/developments

- 17.1.19.3.2 Deals

- 17.1.19.3.3 Others

- 17.1.20 AMAZON

- 17.1.20.1 Business overview

- 17.1.20.2 Products offered

- 17.1.20.3 Recent developments

- 17.1.20.3.1 Product launches/developments

- 17.1.20.3.2 Deals

- 17.1.20.3.3 Others

- 17.1.21 GMV INNOVATING SOLUTIONS S.L.

- 17.1.21.1 Business overview

- 17.1.21.2 Products offered

- 17.1.21.3 Recent developments

- 17.1.21.3.1 Deals

- 17.1.21.3.2 Others

- 17.1.22 KRATOS

- 17.1.22.1 Business overview

- 17.1.22.2 Products offered

- 17.1.22.3 Recent developments

- 17.1.22.3.1 Deals

- 17.1.22.3.2 Others

- 17.1.23 VIASAT, INC.

- 17.1.23.1 Business overview

- 17.1.23.2 Products offered

- 17.1.23.3 Recent developments

- 17.1.23.3.1 Product launches/developments

- 17.1.23.3.2 Deals

- 17.1.23.3.3 Others

- 17.1.24 SAFRAN

- 17.1.24.1 Business overview

- 17.1.24.2 Products offered

- 17.1.24.3 Recent developments

- 17.1.24.3.1 Product launches/developments

- 17.1.24.3.2 Deals

- 17.1.24.3.3 Others

- 17.1.1 RTX

- 17.2 OTHER PLAYERS

- 17.2.1 DHRUVA SPACE PRIVATE LIMITED

- 17.2.2 NORTHWOOD SPACE

- 17.2.3 INTELLIAN TECHNOLOGIES, INC.

- 17.2.4 LEAF SPACE

- 17.2.5 REMOS SPACE SYSTEMS AB

- 17.2.6 YORK SPACE SYSTEM

- 17.2.7 INFOSTELLAR

- 17.2.8 RBC SIGNALS LLC

- 17.2.9 ATSRALINTU SPACE TECHNOLOGIES

- 17.2.10 CORAC ENGINEERING

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary sources

- 18.1.2.2 Key data from primary sources

- 18.1.2.3 Breakdown of primary interviews

- 18.1.1 SECONDARY DATA

- 18.2 FACTOR ANALYSIS

- 18.2.1 DEMAND-SIDE INDICATORS

- 18.2.2 SUPPLY-SIDE INDICATORS

- 18.3 MARKET SIZE ESTIMATION

- 18.3.1 BOTTOM-UP APPROACH

- 18.3.1.1 Market size estimation methodology for demand side

- 18.3.1.2 Market size estimation methodology for GSaaS market

- 18.3.2 TOP-DOWN APPROACH

- 18.3.1 BOTTOM-UP APPROACH

- 18.4 DATA TRIANGULATION

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 RESEARCH LIMITATIONS

- 18.7 RISK ASSESSMENT

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 COMPANY LONG LIST

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 IMPACT OF CLOUD-INTEGRATED AND VIRTUALIZED GROUND INFRASTRUCTURE ON SATELLITE GROUND STATION MARKET

- TABLE 3 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- TABLE 4 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2029

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 KEY CONFERENCES AND EVENTS, 2026

- TABLE 9 INDICATIVE PRICING ANALYSIS, BY PLATFORM (USD MILLION)

- TABLE 10 INDICATIVE PRICING ANALYSIS, BY REGION (USD MILLION)

- TABLE 11 COMPARISON BETWEEN BUSINESS MODELS

- TABLE 12 PATENT ANALYSIS

- TABLE 13 AUTONOMOUS MISSION MANAGEMENT: AI-DRIVEN GROUND AUTOMATION

- TABLE 14 QUANTUM-SECURED COMMUNICATIONS: ULTRA-SECURE DATA LINKS

- TABLE 15 OPTICAL DATA DOWNLINK: LASER-BASED HIGH-SPEED COMMUNICATION

- TABLE 16 TOP USE CASES AND MARKET POTENTIAL

- TABLE 17 BEST PRACTICES

- TABLE 18 CASE STUDIES OF AI IMPLEMENTATION

- TABLE 19 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 21 KEY BUYING CRITERIA, BY END USER

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 GLOBAL INDUSTRY STANDARDS

- TABLE 28 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

- TABLE 29 SATELLITE GROUND STATION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 30 SATELLITE GROUND STATION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 31 MOBILE SATELLITE GROUND STATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 32 MOBILE SATELLITE GROUND STATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 VEHICLE-MOUNTED SATELLITE GROUND STATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 34 VEHICLE-MOUNTED SATELLITE GROUND STATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 35 SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 36 SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 37 SATELLITE GROUND STATION MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 38 SATELLITE GROUND STATION MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 39 SATELLITE GROUND STATION MARKET, BY FUNCTION, 2021-2024 (USD MILLION)

- TABLE 40 SATELLITE GROUND STATION MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- TABLE 41 SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 42 SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 43 DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 44 DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 45 GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 46 GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 47 SATELLITE GROUND STATION MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 48 SATELLITE GROUND STATION MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 49 SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 50 SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 51 SATELLITE GROUND STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 SATELLITE GROUND STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 58 NORTH AMERICA: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 60 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 64 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 65 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 NORTH AMERICA: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 US: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 68 US: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 69 US: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 70 US: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 71 US: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 72 US: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 73 CANADA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 74 CANADA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 75 CANADA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 76 CANADA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 77 CANADA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 78 CANADA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 80 EUROPE: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 82 EUROPE: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 83 EUROPE: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 84 EUROPE: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 86 EUROPE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 RUSSIA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 94 RUSSIA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 95 RUSSIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 96 RUSSIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 97 RUSSIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 98 RUSSIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 99 UK: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 100 UK: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101 UK: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 102 UK: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 103 UK: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 104 UK: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 105 GERMANY: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 106 GERMANY: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 107 GERMANY: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 108 GERMANY: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 109 GERMANY: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 110 GERMANY: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 111 FRANCE: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 112 FRANCE: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 113 FRANCE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 114 FRANCE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 115 FRANCE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 116 FRANCE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 117 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 118 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 119 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 120 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 121 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 122 REST OF EUROPE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 123 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 CHINA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 138 CHINA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 139 CHINA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 140 CHINA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 141 CHINA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 142 CHINA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 143 INDIA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 144 INDIA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 145 INDIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 146 INDIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 147 INDIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 148 INDIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 149 JAPAN: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 150 JAPAN: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 151 JAPAN: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 152 JAPAN: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 153 JAPAN: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 154 JAPAN: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 155 SINGAPORE: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 156 SINGAPORE: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 157 SINGAPORE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 158 SINGAPORE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 159 SINGAPORE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 160 SINGAPORE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 161 AUSTRALIA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 162 AUSTRALIA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 163 AUSTRALIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 164 AUSTRALIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 165 AUSTRALIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 166 AUSTRALIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 182 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 184 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 185 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 UAE: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 188 UAE: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 189 UAE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 190 UAE: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 191 UAE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 192 UAE: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 193 SAUDI ARABIA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 194 SAUDI ARABIA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 195 SAUDI ARABIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 196 SAUDI ARABIA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 197 SAUDI ARABIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 198 SAUDI ARABIA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 200 REST OF MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 205 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 206 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 207 REST OF THE WORLD: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 208 REST OF THE WORLD: DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 209 REST OF THE WORLD: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 210 REST OF THE WORLD: GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 211 REST OF THE WORLD SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 212 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 213 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 214 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 215 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2021-2024 (USD MILLION)

- TABLE 216 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- TABLE 217 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 218 REST OF THE WORLD: SATELLITE GROUND STATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 219 AFRICA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 220 AFRICA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 221 AFRICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 222 AFRICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 223 AFRICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 224 AFRICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 225 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 226 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 227 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 228 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2021-2024 (USD MILLION)

- TABLE 230 LATIN AMERICA: SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- TABLE 231 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 232 SATELLITE GROUND STATION MARKET: DEGREE OF COMPETITION

- TABLE 233 REGION FOOTPRINT

- TABLE 234 SOLUTION FOOTPRINT

- TABLE 235 FUNCTION FOOTPRINT

- TABLE 236 ORBIT FOOTPRINT

- TABLE 237 LIST OF START-UPS/SMES

- TABLE 238 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 239 SATELLITE GROUND STATION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2025

- TABLE 240 SATELLITE GROUND STATION MARKET: DEALS, 2021-2025

- TABLE 241 SATELLITE GROUND STATION MARKET: OTHERS, 2021-2025

- TABLE 242 RTX: COMPANY OVERVIEW

- TABLE 243 RTX: PRODUCTS OFFERED

- TABLE 244 RTX: DEALS

- TABLE 245 RTX: OTHERS

- TABLE 246 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 247 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 248 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 249 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 250 GENERAL DYNAMICS CORPORATION: OTHERS

- TABLE 251 AIRBUS: COMPANY OVERVIEW

- TABLE 252 AIRBUS: PRODUCTS OFFERED

- TABLE 253 AIRBUS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 254 AIRBUS: DEALS

- TABLE 255 AIRBUS: OTHERS

- TABLE 256 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 257 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 258 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 259 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 260 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 261 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 262 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 263 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 264 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 265 LOCKHEED MARTIN CORPORATION: OTHERS

- TABLE 266 KONGSBERG: COMPANY OVERVIEW

- TABLE 267 KONGSBERG: PRODUCTS OFFERED

- TABLE 268 KONGSBERG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 269 KONGSBERG: DEALS

- TABLE 270 KONGSBERG: OTHERS

- TABLE 271 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 272 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 273 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 274 ELBIT SYSTEMS LTD.: OTHERS

- TABLE 275 BOEING: COMPANY OVERVIEW

- TABLE 276 BOEING: PRODUCTS OFFERED

- TABLE 277 BOEING: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 278 BOEING: DEALS

- TABLE 279 BOEING: OTHERS

- TABLE 280 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 281 ASELSAN A.S.: PRODUCTS OFFERED

- TABLE 282 ASELSAN A.S.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 283 ASELSAN A.S.: OTHERS

- TABLE 284 NORTHROP GRUMMAN: COMPANY OVERVIEW

- TABLE 285 NORTHROP GRUMMAN: PRODUCTS OFFERED

- TABLE 286 NORTHROP GRUMMAN: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 287 NORTHROP GRUMMAN: DEALS

- TABLE 288 NORTHROP GRUMMAN: OTHERS

- TABLE 289 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 290 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 291 BAE SYSTEMS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 292 BAE SYSTEMS: DEALS

- TABLE 293 BAE SYSTEMS: OTHERS

- TABLE 294 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 295 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 296 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 297 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 298 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- TABLE 299 THALES: COMPANY OVERVIEW

- TABLE 300 THALES: PRODUCTS OFFERED

- TABLE 301 THALES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 302 THALES: DEALS

- TABLE 303 THALES: OTHERS

- TABLE 304 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 305 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 306 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 307 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 308 HONEYWELL INTERNATIONAL INC.: OTHERS

- TABLE 309 SPACEX: COMPANY OVERVIEW

- TABLE 310 SPACEX: PRODUCTS OFFERED

- TABLE 311 SPACEX: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 312 SPACEX: DEALS

- TABLE 313 SPACEX: OTHERS

- TABLE 314 TERMA: COMPANY OVERVIEW

- TABLE 315 TERMA: PRODUCTS OFFERED

- TABLE 316 TERMA: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 317 TERMA: DEALS

- TABLE 318 TERMA: OTHERS

- TABLE 319 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 320 LEONARDO S.P.A.: PRODUCTS OFFERED

- TABLE 321 LEONARDO S.P.A.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 322 LEONARDO S.P.A.: DEALS

- TABLE 323 LEONARDO S.P.A.: OTHERS

- TABLE 324 EXAIL TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 325 EXAIL TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 326 EXAIL TECHNOLOGIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 327 EXAIL TECHNOLOGIES: DEALS

- TABLE 328 EXAIL TECHNOLOGIES: OTHERS

- TABLE 329 INDRA SISTEMAS, S.A.: COMPANY OVERVIEW

- TABLE 330 INDRA SISTEMAS, S.A.: PRODUCTS OFFERED

- TABLE 331 INDRA SISTEMAS, S.A.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 332 INDRA SISTEMAS, S.A.: DEALS

- TABLE 333 INDRA SISTEMAS, S.A.: OTHERS

- TABLE 334 AMAZON: COMPANY OVERVIEW

- TABLE 335 AMAZON: PRODUCTS OFFERED

- TABLE 336 AMAZON: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 337 AMAZON: DEALS

- TABLE 338 AMAZON: OTHERS

- TABLE 339 GMV INNOVATING SOLUTIONS S.L.: COMPANY OVERVIEW

- TABLE 340 GMV INNOVATING SOLUTIONS S.L.: PRODUCTS OFFERED

- TABLE 341 GMV INNOVATING SOLUTIONS S.L.: DEALS

- TABLE 342 GMV INNOVATING SOLUTIONS S.L.: OTHERS

- TABLE 343 KRATOS: COMPANY OVERVIEW

- TABLE 344 KRATOS: PRODUCTS OFFERED

- TABLE 345 KRATOS: DEALS

- TABLE 346 KRATOS: OTHERS

- TABLE 347 VIASAT, INC.: COMPANY OVERVIEW

- TABLE 348 VIASAT, INC.: PRODUCTS OFFERED

- TABLE 349 VIASAT, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 350 VIASAT, INC.: DEALS

- TABLE 351 VIASAT, INC.: OTHERS

- TABLE 352 SAFRAN: COMPANY OVERVIEW

- TABLE 353 SAFRAN: PRODUCTS OFFERED

- TABLE 354 SAFRAN: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 355 SAFRAN: DEALS

- TABLE 356 SAFRAN: OTHERS

- TABLE 357 DHRUVA SPACE PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 358 NORTHWOOD SPACE: COMPANY OVERVIEW

- TABLE 359 INTELLIAN TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 360 LEAF SPACE: COMPANY OVERVIEW

- TABLE 361 REMOS SPACE SYSTEMS AB: COMPANY OVERVIEW

- TABLE 362 YORK SPACE SYSTEMS: COMPANY OVERVIEW

- TABLE 363 INFOSTELLAR: COMPANY OVERVIEW

- TABLE 364 RBC SIGNALS LLC: COMPANY OVERVIEW

- TABLE 365 ATSRALINTU SPACE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 366 CORAC ENGINEERING: COMPANY OVERVIEW

- TABLE 367 COMPANY LONG LIST

List of Figures

- FIGURE 1 SATELLITE GROUND STATION MARKET SEGMENTATION

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 DISRUPTIVE TRENDS SHAPING MARKET

- FIGURE 4 KEY MARKET PARTICIPANTS: SHARED INSIGHTS AND STRATEGIC DEVELOPMENTS

- FIGURE 5 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- FIGURE 6 NORTH AMERICA TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 7 EXTENSIVE USE OF SATELLITE GROUND STATIONS FOR HANDLING DATA FROM COMMUNICATION AND EARTH OBSERVATION SATELLITES TO DRIVE MARKET

- FIGURE 8 AIR FORCE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 PUBLIC SAFETY & CIVIL AGENCIES TO EXHIBIT FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 10 ANTENNA SYSTEM TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 11 SATELLITE GROUND STATION MARKET DYNAMICS

- FIGURE 12 VALUE CHAIN ANALYSIS

- FIGURE 13 ECOSYSTEM ANALYSIS

- FIGURE 14 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 15 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 16 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 17 BUSINESS MODELS

- FIGURE 18 EMERGING TECHNOLOGY TRENDS

- FIGURE 19 PATENT ANALYSIS

- FIGURE 20 FUTURE APPLICATIONS

- FIGURE 21 IMPACT OF AI/GEN AI

- FIGURE 22 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- FIGURE 23 DECISION-MAKING FACTORS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 25 KEY BUYING CRITERIA, BY END USER

- FIGURE 26 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 27 SATELLITE GROUND STATION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- FIGURE 28 MOBILE SATELLITE GROUND STATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- FIGURE 29 VEHICLE-MOUNTED SATELLITE GROUND STATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- FIGURE 30 SATELLITE GROUND STATION MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- FIGURE 31 SATELLITE GROUND STATION MARKET, BY HARDWARE, 2025-2030 (USD MILLION)

- FIGURE 32 SATELLITE GROUND STATION MARKET, BY FUNCTION, 2025-2030 (USD MILLION)

- FIGURE 33 SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- FIGURE 34 DEFENSE SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- FIGURE 35 GOVERNMENT SATELLITE GROUND STATION MARKET, BY END USER, 2025-2030 (USD MILLION)

- FIGURE 36 SATELLITE GROUND STATION MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- FIGURE 37 SATELLITE GROUND STATION MARKET, BY ORBIT, 2025-2030 (USD MILLION)

- FIGURE 38 SATELLITE GROUND STATION MARKET, BY REGION, 2025-2030

- FIGURE 39 NORTH AMERICA: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 40 EUROPE: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 43 REST OF THE WORLD: SATELLITE GROUND STATION MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 46 BRAND/PRODUCT COMPARISON

- FIGURE 47 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 48 COMPANY VALUATION (USD BILLION)

- FIGURE 49 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 COMPANY FOOTPRINT

- FIGURE 51 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 52 RTX: COMPANY SNAPSHOT

- FIGURE 53 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 AIRBUS: COMPANY SNAPSHOT

- FIGURE 55 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 56 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 58 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 59 BOEING: COMPANY SNAPSHOT

- FIGURE 60 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 61 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- FIGURE 62 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 63 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 THALES: COMPANY SNAPSHOT

- FIGURE 65 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 66 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 67 EXAIL TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 68 INDRA SISTEMAS, S.A.: COMPANY SNAPSHOT

- FIGURE 69 AMAZON: COMPANY SNAPSHOT

- FIGURE 70 KRATOS: COMPANY SNAPSHOT

- FIGURE 71 VIASAT, INC.: COMPANY SNAPSHOT

- FIGURE 72 SAFRAN: COMPANY SNAPSHOT

- FIGURE 73 RESEARCH DESIGN MODEL

- FIGURE 74 RESEARCH DESIGN

- FIGURE 75 BOTTOM-UP APPROACH

- FIGURE 76 TOP-DOWN APPROACH

- FIGURE 77 DATA TRIANGULATION