PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1887993

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1887993

Vector Database Market By Vector Database Solution (Vector Generation & Indexing, Vector Search & Query Processing, Vector Storage & Retrieval), AI Language Processing, Computer Vision, Recommendation Systems - Global Forecast to 2030

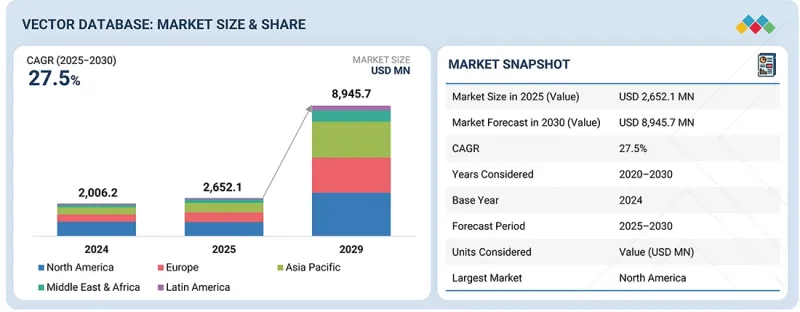

The global vector database market is projected to grow from USD 2,652.1 million in 2025 to USD 8,945.7 million by 2030, at a compound annual growth rate (CAGR) of 27.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2025 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Offering, By Type, By Technology/AI Application, By Deployment Type, By Data Type, By Vertical |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

The rising adoption of AI, multimodal models, and real-time applications is accelerating the demand for advanced vector databases among global enterprises. Organizations are increasingly investing in high-performance vector search, efficient indexing, and low-latency retrieval to power recommendation engines, RAG pipelines, fraud detection, and personalized user experiences. These systems enhance scalability, improve inference speed, and support complex embeddings, which are essential for modern AI workloads.

However, reliance on traditional relational and document databases remains a restraint, as many enterprises still operate legacy architectures that limit the ability to run vector workloads efficiently. Migrating to vector-native systems requires significant re-engineering, embedding pipelines, and integration efforts, making both cost and implementation complexity key challenges. While demand continues to surge with the expansion of AI adoption, the transition from legacy data infrastructure remains one of the primary barriers to the growth of the vector database market.

"Based on data type, the hybrid & multimodal is estimated to hold the largest market share in 2025"

Hybrid and multimodal data represent one of the most advanced frontiers of the vector database market, enabling seamless integration and analysis of diverse data types-text, images, audio, video, and structured inputs-within a unified search and retrieval framework. Vector databases transform each modality into embeddings within a shared or comparable vector space, enabling cross-modal queries such as finding images relevant to a text description or retrieving videos that match an audio snippet. This capability powers applications such as multimodal search engines, AI copilots, and personalized recommendation systems that rely on contextual understanding across various formats. Hybrid data processing also combines traditional structured or keyword-based search with vector similarity, ensuring both precision and semantic depth. For instance, an enterprise can blend metadata filtering with semantic retrieval to produce context-rich, explainable results. The ability to handle multimodal embeddings efficiently is made possible through scalable indexing and retrieval mechanisms, such as HNSW or disk-based storage architectures, which are optimized for large and complex vectors. As AI models increasingly fuse language and vision (e.g., CLIP, GPT-4V), vector databases are evolving to support dynamic, multimodal data pipelines. This integration drives innovation across various sectors, including e-commerce, media, and healthcare, enabling holistic and intelligent data interaction and discovery.

"Based on technology type, the computer vision segment is expected to grow at the highest CAGR during the forecast period."

Computer vision plays a pivotal role in expanding the capabilities of vector databases by enabling machines to interpret, analyze, and derive insights from visual data such as images and videos. Through the use of image and video embeddings, visual inputs are transformed into high-dimensional vectors that capture semantic meaning, allowing vector databases to perform similarity searches based on content rather than metadata or labels. This transformation enables applications such as visual recommendation engines, image-based search, and automated tagging systems. Object detection, another key component, enhances the analytical precision of computer vision by identifying and classifying objects within visual frames, supporting real-time monitoring, surveillance, and industrial automation use cases. Beyond these, computer vision in vector databases underpins advanced applications such as facial recognition, anomaly detection, and scene understanding, where the ability to retrieve semantically similar visual data accelerates analysis. The integration of computer vision with vector databases enables multimodal search, where textual and visual queries coexist, thereby enriching user interaction and AI workflows. By combining deep learning models with scalable vector indexing, organizations can efficiently process massive volumes of unstructured visual content, driving breakthroughs across retail, healthcare, autonomous systems, and digital media analytics.

"North America will lead in terms of market share, while Asia Pacific will emerge as the fastest-growing market."

North America is the largest market for vector databases, driven by the rapid deployment of AI workloads, large-scale enterprise modernization, and the dominance of cloud and hyperscale platforms. The US and Canada are witnessing substantial investment in multimodal AI, real-time analytics, and RAG-based applications, which require high-performance vector search and scalable embedding storage. Mature digital ecosystems, extensive GPU infrastructure, and early adoption of enterprise-grade vector solutions further reinforce the region's leading position.

In contrast, the Asia Pacific represents the fastest-growing vector database market, driven by accelerated digital transformation in countries such as China, India, Japan, South Korea, and Singapore. Surging demand for AI-enabled personalization, e-commerce intelligence, fintech fraud detection, and autonomous systems is driving the adoption of scalable and cost-efficient vector search platforms. Government initiatives in AI innovation, the expansion of cloud infrastructure, and rising startup activity are further boosting uptake, positioning the APAC region as a significant hub for high-growth vector database technologies.

Breakdown of primaries

Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant companies in the vector database market were interviewed to gain insights into this market.

- By Company: Tier I: 40%, Tier II: 25%, and Tier III: 35%

- By Designation: C-Level Executives: 45%, Director Level: 30%, and Others: 25%

- By Region: North America: 30%, Europe: 20%, Asia Pacific: 25%, Rest of the World: 15%

Some of the significant vector database market vendors are Microsoft (US), Elastic (US), MongoDB (US), Google (US), AWS (US), Redis (US), Alibaba Cloud (US), DataStax (US), SingleStore (US), Pinecone (US), Zilliz (US), KX (US), Marqo.ai (US), ActiveLoop (US), Supabase (US), Jina AI (Germany), Typesense (US), Weaviate (Netherlands), GSI Technology (US), Kinetica (US), Qdrant (Germany), ClickHouse (US), OpenSearch(US), Vespa.ai (Norway), and LanceDB (US).

Research Coverage

The market report covered the vector database market across segments. We estimated the market size and growth potential for many segments based on offering, type, technology/AI application, deployment type, data type, vertical, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to buy this report:

This research provides the most accurate revenue estimates for the entire vector database industry and its subsegments, benefiting both established leaders and new entrants. Stakeholders will gain valuable insights into the competitive landscape, enabling them to position their companies better and develop effective go-to-market strategies. The report outlines key market drivers, constraints, opportunities, and challenges, helping industry players understand the current state of the market.

The report provides insights into the following pointers:

- Analysis of key drivers (explosion of unstructured and high-dimensional data), restraints (rapidly evolving AI and embedding models), opportunities (growing need for scalable storage and retrieval of LLM embeddings), and challenges (data privacy and security concerns) influencing the growth of the vector database market

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and service and product introductions in the market

- Market Development: In-depth details regarding profitable markets, examining the global vector database market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, and new solutions and services

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and offerings of the top competitors in the vector database industry, such as Microsoft (US), Elastic (US), MongoDB (US), Google (US), AWS (US), Redis (US), Alibaba Cloud (US), DataStax (US), SingleStore (US), Pinecone (US), Zilliz (US), KX (US), Marqo.ai (US), ActiveLoop (US), Supabase (US), Jina AI (Germany), Typesense (US), Weaviate (Netherlands), GSI Technology (US), Kinetica (US), Qdrant (Germany), ClickHouse (US), OpenSearch(US), Vespa.ai (Norway), and LanceDB (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 MARKET ESTIMATION APPROACHES

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: STRATEGIC INSIGHTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VECTOR DATABASE MARKET

- 4.2 VECTOR DATABASE MARKET, BY TYPE

- 4.3 VECTOR DATABASE MARKET, BY OFFERING

- 4.4 VECTOR DATABASE MARKET, BY VERTICAL

- 4.5 VECTOR DATABASE MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Explosion of unstructured and high-dimensional data

- 5.2.1.2 Demand for real-time search and personalization

- 5.2.1.3 Growing demand for solutions to process low-latency queries

- 5.2.1.4 Huge investments in vector databases

- 5.2.2 RESTRAINTS

- 5.2.2.1 High compute and storage costs

- 5.2.2.2 Rapidly evolving AI and embedding models

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing need for scalable storage and retrieval of LLM embeddings in AI workflows

- 5.2.3.2 Expansion of retrieval-augmented generation (RAG) to enable more accurate AI outputs

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization across vector indexing techniques

- 5.2.4.2 Data privacy and security concerns

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN VECTOR DATABASES

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 5.5.1 EMERGING BUSINESS MODELS

- 5.5.2 ECOSYSTEM SHIFTS

- 5.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMICS INDICATORS

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN GLOBAL ICT INDUSTRY

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE OF VECTOR DATABASE SOLUTIONS, BY REGION, 2025

- 6.5.2 INDICATIVE PRICING ANALYSIS OF VECTOR DATABASE SOLUTIONS, BY KEY PLAYER, 2025

- 6.6 KEY CONFERENCES AND EVENTS, 2026

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 INVESTMENT AND FUNDING SCENARIO

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 PINECONE ENABLED VANGUARD TO BOOST CUSTOMER SUPPORT WITH FASTER CALLS AND 12% MORE ACCURATE RESPONSES

- 6.9.2 L'OREAL IMPROVED APP PERFORMANCE AND VELOCITY WITH MONGODB ATLAS

- 6.9.3 FILEVINE AND ZILLIZ CLOUD: TRANSFORMING LEGAL CASE MANAGEMENT WITH VECTOR SEARCH

- 6.9.4 SUPERLINKED REVOLUTIONIZED PERSONALIZATION WITH REDIS ENTERPRISE'S VECTOR DATABASE

- 6.9.5 ELASTIC HELPED GLOBAL E-COMMERCE RETAILER ENHANCE PRODUCT DISCOVERY AND RECOMMENDATIONS

- 6.9.6 ELASTIC ENABLED SEMANTIC AND HYBRID SEARCH FOR GLOBAL FINANCIAL SERVICES PROVIDER

- 6.9.7 ELASTIC HELPED MAJOR TELECOM AND MEDIA PROVIDER ENHANCE CONTENT DISCOVERY

- 6.10 IMPACT OF 2025 US TARIFF - VECTOR DATABASE MARKET

- 6.10.1 INTRODUCTION

- 6.10.2 KEY TARIFF RATES

- 6.10.3 PRICE IMPACT ANALYSIS

- 6.10.4 IMPACT ON COUNTRY/REGION

- 6.10.4.1 North America

- 6.10.4.1.1 US

- 6.10.4.1.2 Canada

- 6.10.4.1.3 Mexico

- 6.10.4.2 Europe

- 6.10.4.2.1 Germany

- 6.10.4.2.2 France

- 6.10.4.2.3 UK

- 6.10.4.3 Asia Pacific

- 6.10.4.3.1 China

- 6.10.4.3.2 India

- 6.10.4.1 North America

7 TECHNOLOGICAL ADVANCEMENTS: AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 EMBEDDING MODELS (TEXT, IMAGE, AUDIO, MULTIMODAL)

- 7.1.2 APPROXIMATE NEAREST NEIGHBOR (ANN) SEARCH ALGORITHMS

- 7.1.3 VECTOR INDEXING AND STORAGE ENGINES

- 7.1.4 GPU AND AI ACCELERATORS

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 LARGE LANGUAGE MODELS (LLMS)

- 7.2.2 RETRIEVAL-AUGMENTED GENERATION (RAG) FRAMEWORKS

- 7.2.3 DATA ORCHESTRATION AND ETL PIPELINES

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT-TERM (2025-2027) | FOUNDATION & AI ALIGNMENT

- 7.3.2 MID-TERM (2027-2030) | STANDARDIZATION & ECOSYSTEM EXPANSION

- 7.3.3 LONG-TERM (2030-2035+) | MASS ADOPTION & INTELLIGENT RETRIEVAL

- 7.4 PATENT ANALYSIS

- 7.4.1 LIST OF MAJOR PATENTS

- 7.5 IMPACT OF AI/GENERATIVE AI ON VECTOR DATABASE MARKET

- 7.5.1 CASE STUDY

- 7.5.1.1 Automating CSR generation through retrieval-augmented generation (RAG)

- 7.5.2 VENDOR INITIATIVES

- 7.5.2.1 Zilliz expands to Azure North Europe, accelerating AI-powered vector search for European enterprises

- 7.5.2.2 Redis redefines vector database intelligence with Vector Sets, LangCache, and Featureform integration

- 7.5.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.5.1 CASE STUDY

8 REGULATORY LANDSCAPE

- 8.1 INTRODUCTION

- 8.2 REGIONAL REGULATIONS AND COMPLIANCE

- 8.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.2.2 REGULATIONS, BY REGION

- 8.2.2.1 North America

- 8.2.2.2 Europe

- 8.2.2.3 Asia Pacific

- 8.2.2.4 Middle East & Africa

- 8.2.2.5 Latin America

- 8.2.3 INDUSTRY STANDARDS

- 8.2.3.1 General Data Protection Regulation

- 8.2.3.2 SEC Rule 17a-4

- 8.2.3.3 ISO/IEC 27001

- 8.2.3.4 COBIT (Control Objectives for Information and Related Technologies)

- 8.2.3.5 ISA (International Society of Automation)

- 8.2.3.6 System and Organization Controls 2 Type II

- 8.2.3.7 Financial Industry Regulatory Authority

- 8.2.3.8 Freedom of Information Act

- 8.2.3.9 Health Insurance Portability and Accountability Act

9 CUSTOMER LANDSCAPE AND BUYING BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 9.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

10 VECTOR DATABASE MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 NATIVE VECTOR DBS

- 10.2.1 OPTIMIZED SINGLE-MODALITY VECTOR MANAGEMENT FUELS GROWTH IN VECTOR DATABASE MARKET

- 10.3 MULTIMODAL VECTOR DBS

- 10.3.1 MULTIMODAL VECTOR INTEGRATION ENHANCES DATA DIVERSITY, DRIVING VECTOR DATABASE MARKET GROWTH

11 VECTOR DATABASE MARKET, BY OFFERING

- 11.1 INTRODUCTION

- 11.2 VECTOR DATABASE SOLUTIONS

- 11.2.1 VECTOR GENERATION & INDEXING

- 11.2.1.1 Vector Generation & Indexing Enhances Speed and Precision in Data Processing

- 11.2.1.2 Embedding Models

- 11.2.1.3 Index Structures

- 11.2.2 VECTOR SEARCH & QUERY PROCESSING

- 11.2.2.1 Vector Search & Query Processing Enables Real-time, High-accuracy Information Retrieval

- 11.2.2.2 Approximate Nearest Neighbor (ANN)

- 11.2.2.3 Multimodal Search

- 11.2.2.4 Query Ranking & Scoring Optimization

- 11.2.3 VECTOR STORAGE & RETRIEVAL

- 11.2.3.1 Scalable Vector Storage & Retrieval Solutions Improve Performance and Data Accessibility

- 11.2.3.2 In-memory

- 11.2.3.3 Disk-based

- 11.2.3.4 Hybrid Storage

- 11.2.1 VECTOR GENERATION & INDEXING

- 11.3 SERVICES

- 11.3.1 PROFESSIONAL SERVICES

- 11.3.1.1 Professional Services Drives Effective Deployment and Customization of Vector Databases

- 11.3.1.2 Implementation & Integration

- 11.3.1.3 Training & Consulting

- 11.3.1.4 Support & Maintenance

- 11.3.2 MANAGED SERVICES

- 11.3.2.1 Managed Services Delivering Consistent Operations and Optimized Vector Database Management

- 11.3.1 PROFESSIONAL SERVICES

12 VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION

- 12.1 INTRODUCTION

- 12.2 NATURAL LANGUAGE PROCESSING

- 12.2.1 NATURAL LANGUAGE PROCESSING ENABLES PRECISE TEXT ANALYSIS AND FASTER CUSTOMER INTERACTIONS

- 12.2.2 SEMANTIC SEARCH

- 12.2.3 TEXT EMBEDDING

- 12.2.4 SENTIMENT ANALYSIS

- 12.2.5 CHATBOTS & VIRTUAL ASSISTANTS

- 12.2.6 OTHERS

- 12.3 COMPUTER VISION

- 12.3.1 COMPUTER VISION AUTOMATES VISUAL INSPECTION AND IMPROVES DETECTION ACCURACY

- 12.3.2 IMAGE/VIDEO EMBEDDING

- 12.3.3 OBJECT DETECTION

- 12.3.4 OTHERS

- 12.4 RECOMMENDATION SYSTEMS

- 12.4.1 RECOMMENDATION SYSTEMS PERSONALIZE OFFERS TO BOOST SALES AND USER ENGAGEMENT

- 12.4.2 COLLABORATIVE FILTERING

- 12.4.3 CONTENT-BASED FILTERING

- 12.4.4 SESSION-BASED RECOMMENDATIONS

- 12.4.5 OTHERS

- 12.5 OTHERS (GRAPH-AUGMENTED RETRIEVAL AND AUDIO & SPEECH)

13 VECTOR DATABASE MARKET, BY DEPLOYMENT TYPE

- 13.1 INTRODUCTION

- 13.2 CLOUD

- 13.2.1 CLOUD DEPLOYMENT DRIVES SCALABILITY AND COST EFFICIENCY FOR GROWING DATA NEEDS

- 13.3 ON-PREMISES

- 13.3.1 ON-PREMISES DEPLOYMENT ENSURES DATA CONTROL AND COMPLIANCE FOR SENSITIVE WORKLOADS

14 VECTOR DATABASE MARKET, BY DATA TYPE

- 14.1 INTRODUCTION

- 14.2 SIMPLE TEXT DATA

- 14.2.1 SIMPLE TEXT DATA ENABLES EFFICIENT PROCESSING OF LARGE-SCALE UNSTRUCTURED INFORMATION

- 14.3 HYBRID & MULTIMODAL DATA

- 14.3.1 HYBRID & MULTIMODAL DATA INTEGRATES DIVERSE FORMATS TO IMPROVE CONTEXTUAL SEARCH ACCURACY

- 14.4 ADVANCED DATA

- 14.4.1 ADVANCED DATA SUPPORTS COMPLEX ANALYTICS THROUGH RICH, HIGH-DIMENSIONAL INFORMATION

15 VECTOR DATABASE MARKET, BY VERTICAL

- 15.1 INTRODUCTION

- 15.2 BFSI

- 15.2.1 BFSI IMPROVES DATA-DRIVEN DECISION-MAKING THROUGH EFFICIENT SIMILARITY SEARCHES

- 15.2.2 BFSI: USE CASES

- 15.2.2.1 Fraud Detection

- 15.2.2.2 Credit Risk Assessment

- 15.2.2.3 Customer Support Automation

- 15.3 RETAIL & E-COMMERCE

- 15.3.1 RETAIL & E-COMMERCE ENHANCE PRODUCT DISCOVERY WITH SCALABLE VECTOR SEARCH

- 15.3.2 RETAIL & E-COMMERCE: USE CASES

- 15.3.2.1 Visual Search

- 15.3.2.2 Personalized Recommendations

- 15.3.2.3 Dynamic Pricing

- 15.4 HEALTHCARE & LIFE SCIENCES

- 15.4.1 HEALTHCARE & LIFE SCIENCES ACCELERATE COMPLEX DATA MATCHING FOR RESEARCH AND DIAGNOSTICS

- 15.4.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 15.4.2.1 Medical Imaging Retrieval

- 15.4.2.2 Genomic Sequence Matching

- 15.4.2.3 Clinical Trial Matching

- 15.5 IT & ITES

- 15.5.1 IT & ITES ENABLE FAST SEMANTIC CODE AND LOG RETRIEVAL FOR BETTER DEVELOPMENT AND SECURITY

- 15.5.2 IT & ITES: USE CASES

- 15.5.2.1 Code Search & Reuse

- 15.5.2.2 Intelligent Ticket Routing

- 15.5.2.3 Cybersecurity Threat Detection

- 15.6 MEDIA & ENTERTAINMENT

- 15.6.1 MEDIA & ENTERTAINMENT FACILITATE MULTIMODAL CONTENT SEARCH AND METADATA MANAGEMENT

- 15.6.2 MEDIA & ENTERTAINMENT: USE CASES

- 15.6.2.1 Content-based Video Recommendation

- 15.6.2.2 Automated Metadata Tagging

- 15.6.2.3 Copyright Infringement Detection

- 15.7 MANUFACTURING & IIOT

- 15.7.1 MANUFACTURING & IIOT SUPPORT REAL-TIME SENSOR DATA ANALYSIS FOR OPERATIONAL INSIGHTS

- 15.7.2 MANUFACTURING & IIOT: USE CASES

- 15.7.2.1 Predictive Maintenance

- 15.7.2.2 Quality Control

- 15.7.2.3 Supply Chain Optimization

- 15.8 GOVERNMENT & DEFENSE

- 15.8.1 GOVERNMENT & DEFENSE STRENGTHEN MULTISOURCE DATA FUSION FOR INTELLIGENCE APPLICATIONS

- 15.8.2 GOVERNMENT & DEFENSE: USE CASES

- 15.8.2.1 Intelligence Analysis

- 15.8.2.2 Surveillance and Object Recognition

- 15.8.2.3 Cybersecurity Monitoring

- 15.9 AUTOMOTIVE & TRANSPORTATION

- 15.9.1 AUTOMOTIVE & TRANSPORTATION ENHANCING SENSOR DATA PROCESSING FOR ADVANCED ANALYTICS

- 15.9.2 AUTOMOTIVE & TRANSPORTATION: USE CASES

- 15.9.2.1 Autonomous Vehicle Perception

- 15.9.2.2 Route Optimization

- 15.9.2.3 Predictive Maintenance

- 15.10 OTHER VERTICALS (EDUCATION & RESEARCH, ENERGY & UTILITIES, ROBOTICS)

16 VECTOR DATABASE MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.1.1 NORTH AMERICA

- 16.1.2 US

- 16.1.2.1 Government AI Initiatives and Expanding Data Ecosystems Accelerate US Vector Database Market Growth

- 16.1.3 CANADA

- 16.1.3.1 AI Infrastructure Expansion and Startup Innovation Drive Canada's Vector Database Market

- 16.2 EUROPE

- 16.2.1 UK

- 16.2.1.1 AI-led Research Transformation and Data Modernization Fuel UK's Vector Database Growth

- 16.2.2 GERMANY

- 16.2.2.1 AI Infrastructure Expansion and Retail Intelligence Accelerate Germany's Vector Database Market

- 16.2.3 FRANCE

- 16.2.3.1 Advancing AI-driven Retail Infrastructure to Propel France's Vector Database Adoption

- 16.2.4 ITALY

- 16.2.4.1 AI Infrastructure Expansion and Smart City Initiatives Propel Italy's Vector Database Potential

- 16.2.5 REST OF EUROPE

- 16.2.1 UK

- 16.3 ASIA PACIFIC

- 16.3.1 CHINA

- 16.3.1.1 National AI Strategy and Robotics Innovation Power Vector Database Growth in China

- 16.3.2 JAPAN

- 16.3.2.1 Rising AI Adoption in Healthcare Demand for Advanced Data Management Frameworks in Japan

- 16.3.3 AUSTRALIA & NEW ZEALAND

- 16.3.3.1 Neocloud Growth, Sovereign AI Projects, and GPU Clouds Expand Vector Database Demand in Australia & New Zealand

- 16.3.4 REST OF ASIA PACIFIC

- 16.3.1 CHINA

- 16.4 MIDDLE EAST & AFRICA

- 16.4.1 GCC COUNTRIES

- 16.4.1.1 KSA

- 16.4.1.1.1 Saudi Arabia Accelerates AI and Gaming Infrastructure, Boosting Demand for Vector Databases

- 16.4.1.2 UAE

- 16.4.1.2.1 UAE Accelerates AI-led Economic Shift With Expanding Vector Infrastructure

- 16.4.1.3 Rest of GCC Countries

- 16.4.1.1 KSA

- 16.4.2 SOUTH AFRICA

- 16.4.2.1 AI-powered Public Services Push South Africa Toward Advanced Vector Data Platforms

- 16.4.3 REST OF MIDDLE EAST & AFRICA

- 16.4.1 GCC COUNTRIES

- 16.5 LATIN AMERICA

- 16.5.1 BRAZIL

- 16.5.1.1 Strengthening Brazil's AI and Gaming Infrastructure Through Vector-centric Technologies

- 16.5.2 MEXICO

- 16.5.2.1 AI-driven Cultural and Healthcare Advances Strengthen Mexico's Vector Database Needs

- 16.5.3 REST OF LATIN AMERICA

- 16.5.1 BRAZIL

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 17.3 REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 PRODUCT COMPARISON

- 17.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.6.1 STARS

- 17.6.2 EMERGING LEADERS

- 17.6.3 PERVASIVE PLAYERS

- 17.6.4 PARTICIPANTS

- 17.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.6.5.1 Company footprint

- 17.6.5.2 Region footprint

- 17.6.5.3 Offering footprint

- 17.6.5.4 Vertical footprint

- 17.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.7.1 PROGRESSIVE COMPANIES

- 17.7.2 RESPONSIVE COMPANIES

- 17.7.3 DYNAMIC COMPANIES

- 17.7.4 STARTING BLOCKS

- 17.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 17.7.5.1 Detailed list of key startups/SMEs

- 17.7.5.2 Competitive benchmarking of key startups/SMEs

- 17.8 COMPANY VALUATION AND FINANCIAL METRICS

- 17.8.1 COMPANY VALUATION OF KEY VENDORS

- 17.8.2 FINANCIAL METRICS OF KEY VENDORS

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

18 COMPANY PROFILES

- 18.1 INTRODUCTION

- 18.2 MAJOR PLAYERS

- 18.2.1 MICROSOFT

- 18.2.1.1 Business overview

- 18.2.1.2 Products/Solutions/Services offered

- 18.2.1.3 Recent developments

- 18.2.1.3.1 Product launches/enhancements

- 18.2.1.3.2 Deals

- 18.2.1.4 MnM view

- 18.2.1.4.1 Right to win

- 18.2.1.4.2 Strategic choices

- 18.2.1.4.3 Weaknesses and competitive threats

- 18.2.2 ELASTIC

- 18.2.2.1 Business overview

- 18.2.2.2 Products/Solutions/Services offered

- 18.2.2.3 Recent developments

- 18.2.2.3.1 Product launches/enhancements

- 18.2.2.3.2 Deals

- 18.2.2.4 MnM view

- 18.2.2.4.1 Right to win

- 18.2.2.4.2 Strategic choices

- 18.2.2.4.3 Weaknesses and competitive threats

- 18.2.3 MONGODB

- 18.2.3.1 Business overview

- 18.2.3.2 Products/Solutions/Services offered

- 18.2.3.3 Recent developments

- 18.2.3.3.1 Product launches/enhancements

- 18.2.3.3.2 Deals

- 18.2.3.4 MnM view

- 18.2.3.4.1 Right to win

- 18.2.3.4.2 Strategic choices

- 18.2.3.4.3 Weaknesses and competitive threats

- 18.2.4 GOOGLE

- 18.2.4.1 Business overview

- 18.2.4.2 Products/Solutions/Services offered

- 18.2.4.3 Recent developments

- 18.2.4.3.1 Product launches/enhancements

- 18.2.4.3.2 Deals

- 18.2.4.4 MnM view

- 18.2.4.4.1 Right to win

- 18.2.4.4.2 Strategic choices

- 18.2.4.4.3 Weaknesses and competitive threats

- 18.2.5 AWS

- 18.2.5.1 Business overview

- 18.2.5.2 Products/Solutions/Services offered

- 18.2.5.3 Recent developments

- 18.2.5.3.1 Product launches/enhancements

- 18.2.5.3.2 Deals

- 18.2.5.4 MnM view

- 18.2.5.4.1 Right to win

- 18.2.5.4.2 Strategic choices

- 18.2.5.4.3 Weaknesses and competitive threats

- 18.2.6 REDIS

- 18.2.6.1 Business overview

- 18.2.6.2 Products/Solutions/Services offered

- 18.2.6.3 Recent developments

- 18.2.6.3.1 Product launches/enhancements

- 18.2.6.3.2 Deals

- 18.2.7 ALIBABA CLOUD

- 18.2.7.1 Business overview

- 18.2.7.2 Products/Solutions/Services offered

- 18.2.7.3 Recent developments

- 18.2.7.3.1 Product launches/enhancements

- 18.2.7.3.2 Deals

- 18.2.8 DATASTAX

- 18.2.8.1 Business overview

- 18.2.8.2 Products/Solutions/Services offered

- 18.2.8.3 Recent developments

- 18.2.8.3.1 Product launches/enhancements

- 18.2.8.3.2 Deals

- 18.2.9 SINGLESTORE

- 18.2.9.1 Business overview

- 18.2.9.2 Products/Solutions/Services offered

- 18.2.9.3 Recent developments

- 18.2.9.3.1 Deals

- 18.2.10 PINECONE

- 18.2.10.1 Business overview

- 18.2.10.2 Products/Solutions/Services offered

- 18.2.10.3 Recent developments

- 18.2.10.3.1 Product launches/enhancements

- 18.2.10.3.2 Deals

- 18.2.1 MICROSOFT

- 18.3 OTHER PLAYERS

- 18.3.1 ZILLIZ

- 18.3.2 KX

- 18.3.3 MARQO.AI

- 18.3.4 ACTIVELOOP

- 18.3.5 SUPABASE

- 18.3.6 JINA AI

- 18.3.7 TYPESENSE

- 18.3.8 GSI TECHNOLOGY

- 18.3.9 KINETICA

- 18.3.10 QDRANT

- 18.3.11 WEAVIATE

- 18.3.12 CLICKHOUSE

- 18.3.13 OPENSEARCH

- 18.3.14 VESPA.AI

- 18.3.15 LANCEDB

19 ADJACENT/RELATED MARKETS

- 19.1 INTRODUCTION

- 19.1.1 RELATED MARKETS

- 19.1.2 LIMITATIONS

- 19.2 GENERATIVE AI MARKET

- 19.3 NATURAL LANGUAGE PROCESSING (NLP) MARKET

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2019-2024

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 FACTOR ANALYSIS

- TABLE 5 RESEARCH ASSUMPTIONS

- TABLE 6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- TABLE 7 IMPACT OF PORTER'S FIVE FORCES ON VECTOR DATABASE MARKET

- TABLE 8 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 9 ROLE OF PLAYERS IN VECTOR DATABASE MARKET ECOSYSTEM

- TABLE 10 INDICATIVE PRICING ANALYSIS OF VECTOR DATABASE SOLUTIONS, BY KEY PLAYER, 2025

- TABLE 11 VECTOR DATABASE MARKET: KEY CONFERENCES AND EVENTS, 2026

- TABLE 12 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USER MARKET DUE TO TARIFF IMPACT

- TABLE 14 LIST OF MAJOR PATENTS, 2023-2025

- TABLE 15 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 22 VECTOR DATABASE MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES

- TABLE 23 VECTOR DATABASE MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 24 VECTOR DATABASE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 NATIVE VECTOR DBS: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 NATIV VECTOR DBS: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 MULTIMODAL VECTOR DBS: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 MULTIMODAL VECTOR DBS: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 VECTOR DATABASE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 30 VECTOR DATABASE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 31 VECTOR DATABASE SOLUTIONS: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 VECTOR DATABASE SOLUTIONS: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2020-2024 (USD MILLION)

- TABLE 34 VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2025-2030 (USD MILLION)

- TABLE 35 VECTOR GENERATION & INDEXING: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 VECTOR GENERATION & INDEXING: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 VECTOR SEARCH & QUERY PROCESSING: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 VECTOR SEARCH & QUERY PROCESSING: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 VECTOR STORAGE & RETRIEVAL: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 VECTOR STORAGE & RETRIEVAL: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 SERVICES: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 SERVICES: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 44 VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 45 PROFESSIONAL SERVICES: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 PROFESSIONAL SERVICES: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 IMPLEMENTATION & INTEGRATION: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (U USD MILLION)

- TABLE 48 IMPLEMENTATION & INTEGRATION: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 TRAINING & CONSULTATION: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 TRAINING & CONSULTATION: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 SUPPORT & MAINTENANCE: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 SUPPORT & MAINTENANCE: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 MANAGED SERVICES: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 MANAGED SERVICES: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2020-2024 (USD MILLION)

- TABLE 56 VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 NATURAL LANGUAGE PROCESSING: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 NATURAL LANGUAGE PROCESSING: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 COMPUTER VISION: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 COMPUTER VISION: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 RECOMMENDATION SYSTEMS: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 RECOMMENDATION SYSTEMS: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 OTHERS: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 OTHERS: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 VECTOR DATABASE MARKET, BY DEPLOYMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 66 VECTOR DATABASE MARKET, BY DEPLOYMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 67 CLOUD: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 CLOUD: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 ON-PREMISES: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 ON-PREMISES: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 VECTOR DATABASE MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 72 VECTOR DATABASE MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 73 SIMPLE TEXT DATA: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 SIMPLE TEXT DATA: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 HYBRID & MULTIMODAL DATA: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 HYBRID & MULTIMODAL DATA: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 ADVANCED DATA: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 ADVANCED DATA: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 VECTOR DATABASE MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 80 VECTOR DATABASE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 81 BFSI: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 82 BFSI: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 RETAIL & E-COMMERCE: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 RETAIL & E-COMMERCE: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 HEALTHCARE & LIFE SCIENCES: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 HEALTHCARE & LIFE SCIENCES: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 IT & ITES: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 IT & ITES: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 MEDIA & ENTERTAINMENT: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 MEDIA & ENTERTAINMENT: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 MANUFACTURING & IIOT: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 MANUFACTURING & IIOT: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 GOVERNMENT & DEFENSE: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 GOVERNMENT & DEFENSE: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 AUTOMOTIVE & TRANSPORTATION: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 AUTOMOTIVE & TRANSPORTATION: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 OTHER VERTICALS: VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 98 OTHER VERTICALS: VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 VECTOR DATABASE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 100 VECTOR DATABASE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: VECTOR DATABASE MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: VECTOR DATABASE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: VECTOR DATABASE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: VECTOR DATABASE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: VECTOR DATABASE MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: VECTOR DATABASE MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: VECTOR DATABASE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2020-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: VECTOR DATABASE MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: VECTOR DATABASE MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: VECTOR DATABASE MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: VECTOR DATABASE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: VECTOR DATABASE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: VECTOR DATABASE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 US: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 122 US: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 123 CANADA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 124 CANADA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: VECTOR DATABASE MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 126 EUROPE: VECTOR DATABASE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: VECTOR DATABASE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 128 EUROPE: VECTOR DATABASE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2020-2024 (USD MILLION)

- TABLE 130 EUROPE: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: VECTOR DATABASE MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 132 EUROPE: VECTOR DATABASE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 134 EUROPE: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2020-2024 (USD MILLION)

- TABLE 136 EUROPE: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 138 EUROPE: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: VECTOR DATABASE MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 140 EUROPE: VECTOR DATABASE MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: VECTOR DATABASE MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 142 EUROPE: VECTOR DATABASE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 143 EUROPE: VECTOR DATABASE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 144 EUROPE: VECTOR DATABASE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 UK: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 146 UK: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 147 GERMANY: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 148 GERMANY: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 149 FRANCE: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 150 FRANCE: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 151 ITALY: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 152 ITALY: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 153 REST OF EUROPE: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 154 REST OF EUROPE: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: VECTOR DATABASE MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 156 ASIA PACIFIC: VECTOR DATABASE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 ASIA PACIFIC: VECTOR DATABASE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: VECTOR DATABASE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2020-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2025-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: VECTOR DATABASE MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 162 ASIA PACIFIC: VECTOR DATABASE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 163 ASIA PACIFIC: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 164 ASIA PACIFIC: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2020-2024 (USD MILLION)

- TABLE 166 ASIA PACIFIC: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: VECTOR DATABASE MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: VECTOR DATABASE MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: VECTOR DATABASE MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: VECTOR DATABASE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: VECTOR DATABASE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: VECTOR DATABASE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 CHINA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 176 CHINA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 177 JAPAN: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 178 JAPAN: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 179 AUSTRALIA & NEW ZEALAND: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 180 AUSTRALIA & NEW ZEALAND: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2020-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2025-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2020-2024 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 203 GCC COUNTRIES: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 204 GCC COUNTRIES: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 205 GCC COUNTRIES: VECTOR DATABASE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 206 GCC COUNTRIES: VECTOR DATABASE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 207 KSA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 208 KSA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 209 UAE: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 210 UAE: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 211 REST OF GCC COUNTRIES: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 212 REST OF GCC COUNTRIES: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH AFRICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 214 SOUTH AFRICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 217 LATIN AMERICA: VECTOR DATABASE MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 218 LATIN AMERICA: VECTOR DATABASE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 LATIN AMERICA: VECTOR DATABASE MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 220 LATIN AMERICA: VECTOR DATABASE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 221 LATIN AMERICA: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2020-2024 (USD MILLION)

- TABLE 222 LATIN AMERICA: VECTOR DATABASE MARKET, BY VECTOR DATABASE SOLUTION, 2025-2030 (USD MILLION)

- TABLE 223 LATIN AMERICA: VECTOR DATABASE MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 224 LATIN AMERICA: VECTOR DATABASE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 225 LATIN AMERICA: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 226 LATIN AMERICA: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 227 LATIN AMERICA: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2020-2024 (USD MILLION)

- TABLE 228 LATIN AMERICA: VECTOR DATABASE MARKET, BY TECHNOLOGY/AI APPLICATION, 2025-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 230 LATIN AMERICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 231 LATIN AMERICA: VECTOR DATABASE MARKET, BY DATA TYPE, 2020-2024 (USD MILLION)

- TABLE 232 LATIN AMERICA: VECTOR DATABASE MARKET, BY DATA TYPE, 2025-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: VECTOR DATABASE MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 234 LATIN AMERICA: VECTOR DATABASE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 235 LATIN AMERICA: VECTOR DATABASE MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 236 LATIN AMERICA: VECTOR DATABASE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 237 BRAZIL: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 238 BRAZIL: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 239 MEXICO: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 240 MEXICO: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 241 REST OF LATIN AMERICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 242 REST OF LATIN AMERICA: VECTOR DATABASE MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 243 OVERVIEW OF STRATEGIES ADOPTED BY KEY VENDORS, 2023-2025

- TABLE 244 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 245 VECTOR DATABASE MARKET: REGION FOOTPRINT

- TABLE 246 VECTOR DATABASE MARKET: OFFERING FOOTPRINT

- TABLE 247 VECTOR DATABASE MARKET: VERTICAL FOOTPRINT

- TABLE 248 VECTOR DATABASE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 249 VECTOR DATABASE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 250 VECTOR DATABASE MARKET: PRODUCT LAUNCHES, 2021 TO OCTOBER 2025

- TABLE 251 VECTOR DATABASE MARKET: DEALS, 2021-NOVEMBER 2025

- TABLE 252 MICROSOFT: COMPANY OVERVIEW

- TABLE 253 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 MICROSOFT: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 255 MICROSOFT: DEALS

- TABLE 256 ELASTIC: COMPANY OVERVIEW

- TABLE 257 ELASTIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 ELASTIC: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 259 ELASTIC: DEALS

- TABLE 260 MONGODB: COMPANY OVERVIEW

- TABLE 261 MONGODB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 MONGODB: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 263 MONGODB: DEALS

- TABLE 264 GOOGLE: COMPANY OVERVIEW

- TABLE 265 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 GOOGLE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 267 GOOGLE: DEALS

- TABLE 268 AWS: COMPANY OVERVIEW

- TABLE 269 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 AWS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 271 AWS: DEALS

- TABLE 272 REDIS: COMPANY OVERVIEW

- TABLE 273 REDIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 REDIS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 275 REDIS: DEALS

- TABLE 276 ALIBABA CLOUD: COMPANY OVERVIEW

- TABLE 277 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 ALIBABA CLOUD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 279 ALIBABA CLOUD: DEALS

- TABLE 280 DATASTAX: COMPANY OVERVIEW

- TABLE 281 DATASTAX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 DATASTAX: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 283 DATASTAX: DEALS

- TABLE 284 SINGLESTORE: COMPANY OVERVIEW

- TABLE 285 SINGLESTORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 SINGLESTORE: DEALS

- TABLE 287 PINECONE: COMPANY OVERVIEW

- TABLE 288 PINECONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 PINECONE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 290 PINECONE: DEALS

- TABLE 291 GENERATIVE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 292 GENERATIVE AI MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 293 GENERATIVE AI MARKET, BY DATA MODALITY, 2020-2024 (USD MILLION)

- TABLE 294 GENERATIVE AI MARKET, BY DATA MODALITY, 2025-2032 (USD MILLION)

- TABLE 295 NATURAL LANGUAGE PROCESSING MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 296 NATURAL LANGUAGE PROCESSING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 297 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 298 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 VECTOR DATABASE MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 VECTOR DATABASE MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 VECTOR DATABASE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 10 VECTOR DATABASE MARKET: RESEARCH FLOW

- FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 12 BOTTOM-UP APPROACH FROM SUPPLY SIDE - COLLECTIVE REVENUE OF VENDORS

- FIGURE 13 VECTOR DATABASE MARKET: DEMAND-SIDE APPROACH

- FIGURE 14 RESEARCH LIMITATIONS

- FIGURE 15 MARKET SCENARIO

- FIGURE 16 GLOBAL VECTOR DATABASE MARKET, 2025-2030 (USD MILLION)

- FIGURE 17 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN VECTOR DATABASE MARKET (2020-2025)

- FIGURE 18 DISRUPTIVE TRENDS IMPACTING GROWTH OF VECTOR DATABASE MARKET

- FIGURE 19 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN VECTOR DATABASE MARKET, 2024

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 21 HIGH DEMAND IN IT & ITES, HEALTHCARE, AND MEDIA & ENTERTAINMENT VERTICALS TO CREATE LUCRATIVE OPPORTUNITIES FOR VECTOR DATABASE PROVIDERS

- FIGURE 22 NATIVE VECTOR DBS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 23 VECTOR DATABASE SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 24 IT & ITES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 25 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 26 VECTOR DATABASE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 VECTOR DATABASE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INTERNATIONAL INVESTMENT IN DIGITAL ECONOMY

- FIGURE 29 VECTOR DATABASE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 VECTOR DATABASE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE, BY REGION, 2023-2025

- FIGURE 32 VECTOR DATABASE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 33 LEADING VECTOR DATABASE MARKET VENDORS, BY NUMBER OF INVESTORS AND FUNDING ROUNDS, 2025

- FIGURE 34 PATENTS APPLIED AND PUBLISHED, 2014-2024

- FIGURE 35 IMPACT OF AI/GEN AI ON VECTOR DATABASE MARKET

- FIGURE 36 VECTOR DATABASE MARKET: DECISION-MAKING FACTORS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 39 VECTOR DATABASE MARKET: ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 40 NATIVE VECTOR DB TO HOLD LARGER MARKET

- FIGURE 41 VECTOR DATABASE SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE

- FIGURE 42 VECTOR SEARCH & QUERY PROCESSING SEGMENT TO HOLD LARGER MARKET SHARE

- FIGURE 43 NLP TO HOLD LARGEST MARKET SIZE

- FIGURE 44 CLOUD TO ACCOUNT FOR LARGEST MARKET SIZE

- FIGURE 45 HYBRID & MULTIMODAL DATA TO HOLD LARGEST MARKET

- FIGURE 46 IT & ITES TO ACCOUNT FOR LARGEST MARKET SIZE

- FIGURE 47 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET BY 2030

- FIGURE 48 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 50 REVENUE ANALYSIS OF KEY VENDORS, 2020-2024

- FIGURE 51 SHARE ANALYSIS OF KEY PLAYERS IN VECTOR DATABASE MARKET, 2024

- FIGURE 52 VECTOR DATABASE MARKET: COMPARATIVE ANALYSIS OF VENDOR PRODUCTS

- FIGURE 53 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 54 VECTOR DATABASE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 VECTOR DATABASE MARKET: COMPANY FOOTPRINT

- FIGURE 56 VECTOR DATABASE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 COMPANY VALUATION OF KEY VENDORS

- FIGURE 58 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 59 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 60 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 61 ELASTIC: COMPANY SNAPSHOT

- FIGURE 62 MONGODB: COMPANY SNAPSHOT

- FIGURE 63 GOOGLE: COMPANY SNAPSHOT

- FIGURE 64 AWS: COMPANY SNAPSHOT

- FIGURE 65 ALIBABA CLOUD: COMPANY SNAPSHOT