PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1895142

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1895142

Pharmaceutical Quality Management Software Market by Process, Application, Size, End User, Region - Global Forecast to 2030

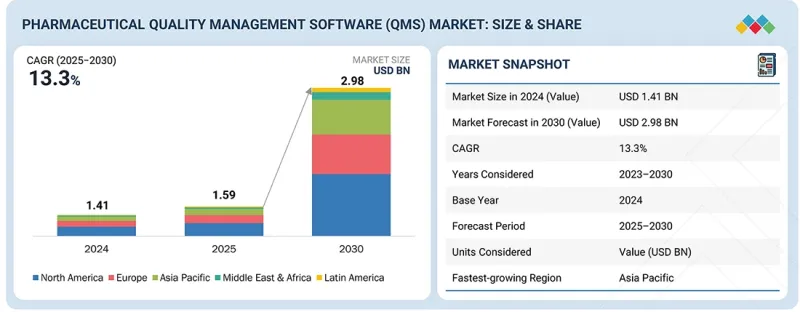

The global pharmaceutical QMS market is projected to reach USD 2.98 billion by 2030 from USD 1.59 billion in 2025, at a CAGR of 13.3% during the forecast period. The pharmaceutical QMS market is experiencing consistent growth, driven by increasing regulatory requirements, the need for streamlined compliance processes, and rising demand for digital transformation in the pharmaceutical industry. Companies are adopting QMS solutions to improve efficiency, minimize errors, and ensure compliance with global standards such as FDA, EMA, and ISO guidelines.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Process, Application, Enterprise Size, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Additionally, the increasing complexity of drug development, clinical trials, and manufacturing operations is further boosting adoption. This trend reflects the industry's move toward integrated, automated, and data-driven quality management systems to enhance overall product quality, patient safety, and accelerate time-to-market efficiency.

"Regulatory compliance under the process segment is expected to register the fastest growth rate during the forecast period."

By process, the regulatory compliance segment is expected to grow the fastest in the pharmaceutical QMS market. This expansion is driven by the growing complexity of global regulatory requirements and the increasing need for pharmaceutical companies to meet stringent quality and safety standards set by agencies such as the FDA, EMA, and WHO. QMS helps organizations efficiently manage audits, documentation, and reporting tasks, thereby reducing the risk of non-compliance and associated penalties. Moreover, the rising demand for automated compliance tracking, real-time data visibility, and centralized document control is boosting the adoption of QMS solutions across the industry.

"CAPA management under the application segment is expected to be the fastest-growing segment during the forecast period."

By application, the CAPA (Corrective and Preventive Action) management segment is expected to be the fastest-growing area in the pharmaceutical QMS market. This growth is fueled by the rising focus on proactively identifying and fixing quality issues to meet regulatory standards. CAPA solutions help pharmaceutical companies systematically investigate root causes, implement corrective actions, and prevent the recurrence of deviations or nonconformities. The increasing integration of automation, data analytics, and real-time monitoring within CAPA processes further boosts efficiency and accuracy. As companies aim to maintain high-quality standards and reduce operational risks, the demand for advanced CAPA capabilities within QMS platforms continues to grow rapidly.

"The Asia Pacific is expected to witness the highest growth rate during the forecast period."

The Asia Pacific is expected to experience the fastest growth in the pharmaceutical QMS market, driven by the rapid expansion of pharmaceutical manufacturing capacities, an increasing number of clinical trials outsourced to the region, and greater regulatory alignment with global standards. Additionally, the rise in digitization efforts, combined with investments in advanced IT infrastructure and automation for compliance, is fueling widespread adoption of integrated QMS platforms to improve quality assurance, simplify documentation, and maintain regulatory compliance across complex, multi-site operations.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the authentication and brand protection marketplace. The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 31%, Tier 2: 28%, and Tier 3: 41%

- By Designation - C-level: 31%, Director-level: 25%, and Others: 44%

- By Region - North America: 32%, Europe: 32%, Asia Pacific: 26%, Middle East & Africa: 5%, Latin America: 5%

Key Players in the Pharmaceutical QMS Market

The key players operating in the Pharmaceutical QMS market include Veeva Systems Inc. (US), MasterControl Solutions, Inc. (US), Honeywell International Inc. (US), IQVIA (US), Qualio, Inc. (US), Hexagon AB (Sweden), AssurX, Inc. (US), QT9 Software (US), Dassault Systemes (France), ComplianceQuest (US), Ideagen (UK), SoftExpert (Brazil), Xybion Digital Inc. (US), Intelex Technologies (Canada), Intellect, Inc. (US), AmpleLogic (India).

Research Coverage:

The report analyzes the pharmaceutical QMS market and aims to estimate its size and future growth potential across various segments based on process, application, enterprise size, end user, and region. It also provides a competitive analysis of the key players in the market, along with their company profiles, product offerings, recent developments, and key market insights strategies.

Reasons to Buy the Report

This report will help both established firms and newer or smaller companies understand the market trends, which can assist them in gaining a larger share of the market. Companies using the report can apply one or a combination of the strategies listed below to strengthen their positions in the market.

This report provides insights into:

- Analysis of key drivers (stringent regulatory compliance pressures are pushing pharma companies to adopt QMS solutions, Globalization of pharmaceutical operations is driving the need for digitalization and automation of QMS systems, cost pressures, reduce errors, and the need for operational efficiency in pharma, Increasing emphasis on risk management and adherence to regulatory standards), restraints (reluctance to adapt to new software solutions, strict data protection laws (GDPR, HIPAA) raise cybersecurity costs and slow software adoption, Concerns regarding data security & privacy), opportunities (increasing demand for specialized cloud-based software solutions in pharma manufacturing, Rising number of small & mid-sized pharma companies to propel market growth, expansion across emerging regions, fuelled by rising pharmaceutical manufacturing activities and evolving regulatory frameworks, adoption of AI and analytics to enable proactive quality management), and challenges (high initial costs of pharma QMS solutions, Variability in regulatory standards across regions, Shortages of skilled R&D and quality professionals with expertise in AI and advanced digital platforms) influencing the growth of the pharmaceutical QMS market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the pharmaceutical QMS market.

- Market Development: Comprehensive information on the lucrative emerging markets, application, process, enterprise size, end user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the pharmaceutical QMS market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the pharmaceutical QMS market, like Veeva Systems, Inc. (US), MasterControl Solutions, Inc. (US), Honeywell International Inc. (US), IQVIA (US), and Dassault Systemes (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMRGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW

- 3.2 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE & REGION

- 3.3 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: GEOGRAPHIC SNAPSHOT

- 3.4 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: DEVELOPED MARKETS VS. EMERGING MARKETS

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Stringent regulatory compliance

- 4.2.1.2 Globalization of pharmaceutical operations

- 4.2.1.3 Growing demand for operational efficiency and reduce human errors

- 4.2.1.4 Increasing emphasis on risk management and adherence to regulatory standards

- 4.2.2 RESTRAINTS

- 4.2.2.1 Reluctance to adopt new software solutions

- 4.2.2.2 Strict data protection laws

- 4.2.2.3 Data security and privacy concerns

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Increasing demand for specialized cloud-based software solutions

- 4.2.3.2 Rising number of small & mid-sized pharma companies

- 4.2.3.3 Expanding pharmaceutical industry in emerging regions

- 4.2.3.4 Adoption of AI and advanced analytics

- 4.2.4 CHALLENGES

- 4.2.4.1 High initial costs of implementing quality management systems

- 4.2.4.2 Variability in regulatory standards

- 4.2.4.3 Shortage of skilled R&D and quality professionals

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF SUBSTITUTES

- 5.1.2 THREAT OF NEW ENTRANTS

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 BARGAINING POWER OF SUPPLIERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL HEALTHCARE IT INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER, 2024

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY REGION, 2024

- 5.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.10 IMPACT OF 2025 US TARIFF

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRY/REGION

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 IMPACT ON END-USE INDUSTRIES

- 5.10.5.1 Pharmaceutical companies

- 5.10.5.2 Biotechnology companies

- 5.10.5.3 Contract Research Organizations (CROs)

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 GENERATIVE AI & MACHINE LEARNING

- 6.1.2 CLOUD COMPUTING & SAAS PLATFORMS

- 6.1.3 ROBOTIC PROCESS AUTOMATION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 MANUFACTURING EXECUTION SYSTEMS (MES)

- 6.2.2 ENTERPRISE RESOURCE PLANNING (ERP) SYSTEMS

- 6.2.3 ELECTRONIC DATA MANAGEMENT SYSTEMS (EDMS)

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.4 PATENT ANALYSIS

- 6.4.1 JURISDICTION ANALYSIS

- 6.4.2 MAJOR PATENTS

- 6.4.3 LIST OF PATENTS

- 6.5 FUTURE APPLICATIONS

- 6.5.1 AUTOMATED AUDIT AND INSPECTION

- 6.5.2 AI-POWERED COMPLIANCE MONITORING

- 6.5.3 ADVANCED ANALYTICS DASHBOARDS

- 6.5.4 MOBILE QMS APPLICATIONS

- 6.5.5 SUPPLIER QUALITY MANAGEMENT AUTOMATION

- 6.6 IMPACT OF AI/GEN AI ON PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET

- 6.6.1 INTRODUCTION

- 6.6.2 MARKET POTENTIAL OF AI/GEN AI IN PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET

- 6.6.3 CASE STUDY RELATED TO AI/GEN AI IMPLEMENTATION

- 6.6.3.1 Use of unified QMS platform for quality documentation

- 6.6.4 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 6.6.4.1 Automated audit simulation

- 6.6.4.2 Real-time monitoring & alerts

- 6.6.4.3 Regulatory & compliance services

- 6.6.4.4 Research laboratories & contract manufacturers

- 6.6.5 USER READINESS AND IMPACT ASSESSMENT

- 6.6.5.1 User readiness

- 6.6.5.1.1 User A: Pharmaceutical companies

- 6.6.5.1.2 User B: Biotechnology companies

- 6.6.5.2 Impact assessment

- 6.6.5.2.1 User A: Pharmaceutical companies

- 6.6.5.2.1.1 Implementation

- 6.6.5.2.1.2 Impact

- 6.6.5.2.2 User B: Biotechnology companies

- 6.6.5.2.2.1 Implementation

- 6.6.5.2.2.2 Impact

- 6.6.5.2.1 User A: Pharmaceutical companies

- 6.6.5.1 User readiness

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 North America

- 7.1.2.2 Europe

- 7.1.2.3 Asia Pacific

- 7.1.2.4 Middle East & Africa

- 7.1.2.5 Latin America

8 CUSTOMER LANDSCAPE & BUYING BEHAVIOUR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYERS STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 KEY BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS

- 9.1 INTRODUCTION

- 9.2 CLINICAL TRIALS

- 9.2.1 NEED TO ENSURE CLINICAL EXCELLENCE AND REGULATORY INTEGRITY TO EXPEDITE GROWTH

- 9.3 REGULATORY COMPLIANCE

- 9.3.1 INCREASING EMPHASIS ON COMPLYING WITH STRINGENT INTERNATIONAL STANDARDS TO AID GROWTH

- 9.4 MANUFACTURING/PRODUCTION

- 9.4.1 GROWING FOCUS ON CONSISTENT PRODUCT QUALITY TO DRIVE MARKET

- 9.5 QUALITY ASSURANCE/QUALITY CONTROL

- 9.5.1 INCREASING FOCUS ON CONTINUOUS MONITORING, DOCUMENTATION, AND CONTROL IN PHARMA PRODUCTION TO FAVOR GROWTH

- 9.6 DISTRIBUTION & SUPPLY CHAIN

- 9.6.1 COMPLEX GLOBAL SUPPLY NETWORKS TO CONTRIBUTE TO GROWTH

- 9.7 COMMERCIALIZATION, MARKETING, AND SALES

- 9.7.1 RISING INTRODUCTION OF COMPLEX THERAPIES AND EVOLVING REGULATIONS TO SUSTAIN GROWTH

- 9.8 POST-MARKET SURVEILLANCE

- 9.8.1 GROWING FOCUS ON PRODUCT PERFORMANCE AND PATIENT SAFETY TO BOOST MARKET

- 9.9 OTHER PROCESSES

10 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 DOCUMENT CONTROL & ESOP

- 10.2.1 NEED TO MANAGE AND CONTROL CRITICAL QUALITY DOCUMENTS TO FACILITATE GROWTH

- 10.3 CAPA (CORRECTIVE AND PREVENTIVE ACTION) MANAGEMENT

- 10.3.1 ABILITY TO ADDRESS DETECTION, RESOLUTION, AND PREVENTION OF QUALITY AND COMPLIANCE ISSUES TO FUEL MARKET

- 10.4 AUDIT & INSPECTION MANAGEMENT

- 10.4.1 INCREASING FOCUS ON EFFECTIVE AUDIT AND INSPECTION MANAGEMENT TO BOLSTER GROWTH

- 10.5 TRAINING MANAGEMENT

- 10.5.1 RISING AUTOMATION AND STANDARDIZATION IN TRAINING ACTIVITIES TO ADVANCE GROWTH

- 10.6 REGULATORY & COMPLIANCE MANAGEMENT

- 10.6.1 EVOLVING GLOBAL REGULATORY REQUIREMENTS TO ACCELERATE GROWTH

- 10.7 SUPPLIER QUALITY MANAGEMENT

- 10.7.1 NEED TO MAINTAIN SUPPLIER RELIABILITY, MATERIAL INTEGRITY, AND REGULATORY COMPLIANCE TO SPUR GROWTH

- 10.8 RISK MANAGEMENT

- 10.8.1 COMPLEX NATURE OF PHARMACEUTICAL OPERATIONS TO ENCOURAGE GROWTH

- 10.9 CHANGE CONTROL MANAGEMENT

- 10.9.1 RISING TRANSITION TOWARD DIGITAL SYSTEMS TO STIMULATE GROWTH

- 10.10 OTHER APPLICATIONS

11 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE

- 11.1 INTRODUCTION

- 11.2 LARGE ENTERPRISES

- 11.2.1 RISING DIGITAL TRANSFORMATION AND COMPLIANCE MODERNIZATION STRATEGIES TO EXPEDITE GROWTH

- 11.3 SMALL & MEDIUM ENTERPRISES

- 11.3.1 INCREASING ADOPTION OF CLOUD-BASED, MODULAR, AND SCALABLE QMS SOLUTIONS TO AID GROWTH

12 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 PHARMACEUTICAL COMPANIES

- 12.2.1 INCREASING INVESTMENTS IN AI AND ANALYTICS-ENABLED QMS PLATFORMS TO PROPEL MARKET

- 12.3 BIOTECHNOLOGY COMPANIES

- 12.3.1 STRONG FOCUS ON INNOVATION, REGULATORY COMPLIANCE, AND MANUFACTURING PRECISION TO FAVOR GROWTH

- 12.4 CONTRACT RESEARCH ORGANIZATIONS

- 12.4.1 INCREASING CLINICAL RESEARCH, DATA MANAGEMENT, AND REGULATORY SUBMISSION ACTIVITIES TO SUSTAIN GROWTH

- 12.5 CONTRACT DEVELOPMENT & MANUFACTURING ORGANIZATIONS

- 12.5.1 CRUCIAL ROLE IN GLOBAL DRUG PRODUCTION, FORMULATION DEVELOPMENT, AND SUPPLY CHAIN MANAGEMENT TO DRIVE MARKET

- 12.6 OTHER END USERS

13 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Growing need for operational excellence in life sciences sector to boost market

- 13.2.3 CANADA

- 13.2.3.1 Increasing digital transformation initiatives and focus on lifecycle quality management to aid growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Robust pharma infrastructure to propel market

- 13.3.3 UK

- 13.3.3.1 Increasing focus on comprehensive patient safety and risk management solutions to spur growth

- 13.3.4 FRANCE

- 13.3.4.1 Strict regulatory environment to foster growth

- 13.3.5 ITALY

- 13.3.5.1 Rising compliance mandates to contribute to growth

- 13.3.6 SPAIN

- 13.3.6.1 Need for scalable, cost-effective, and regulatory-ready systems to augment growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Rising clinical & manufacturing volumes and growing number of biotech companies to drive market

- 13.4.3 JAPAN

- 13.4.3.1 Increasing adoption of cloud systems and electronic records to aid growth

- 13.4.4 INDIA

- 13.4.4.1 Expanding pharmaceutical manufacturing base and increasing regulatory scrutiny from global health authorities to drive market

- 13.4.5 AUSTRALIA

- 13.4.5.1 Increasing shift toward electronic integrated quality ecosystems to promote growth

- 13.4.6 SOUTH KOREA

- 13.4.6.1 Growing focus on lifecycle quality management to propel market

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 13.5.2 BRAZIL

- 13.5.2.1 Growing investments in automated quality systems to drive market

- 13.5.3 MEXICO

- 13.5.3.1 Increasing emphasis on data integrity and electronic documentation to boost market

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 13.6.2 GCC COUNTRIES

- 13.6.2.1 Saudi Arabia

- 13.6.2.1.1 Increasing local manufacturing and enhanced regulatory compliance to promote growth

- 13.6.2.2 UAE

- 13.6.2.2.1 Rising regulatory modernization and national manufacturing initiatives to sustain growth

- 13.6.2.3 Rest of GCC countries

- 13.6.2.1 Saudi Arabia

- 13.6.3 SOUTH AFRICA

- 13.6.3.1 Evolving regulatory expectations and digitalization trends to fuel market

- 13.6.4 REST OF MIDDLE EAST & AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE SHARE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

- 14.5 SOFTWARE COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Process footprint

- 14.6.5.4 Application footprint

- 14.6.5.5 Enterprise size footprint

- 14.6.5.6 End-user footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8.1 COMPANY VALUATION

- 14.8.2 FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES AND APPROVALS

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches and approvals

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 IQVIA

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.3.2 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 VEEVA SYSTEMS INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches and approvals

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 MASTERCONTROL SOLUTIONS, INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 DASSAULT SYSTEMES

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strengths/Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses/Competitive threats

- 15.1.6 QUALIO

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.7 HEXAGON AB

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches and approvals

- 15.1.7.3.2 Deals

- 15.1.8 ASSURX, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.9 QT9 SOFTWARE

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches and approvals

- 15.1.9.3.2 Deals

- 15.1.10 COMPLIANCEQUEST

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 IDEAGEN

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches and approvals

- 15.1.11.3.2 Deals

- 15.1.12 SOFTEXPERT

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.13 INSTEM

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.14 INTELEX TECHNOLOGIES

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches and approvals

- 15.1.14.3.2 Expansions

- 15.1.15 INTELLECT, INC

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches and approvals

- 15.1.16 AMPLELOGIC

- 15.1.16.1 Business overview

- 15.1.16.2 Products offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Deals

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.2 OTHER PLAYERS

- 15.2.1 INSTANTGMP

- 15.2.2 SIMPLERQMS

- 15.2.3 DOT COMPLIANCE LTD.

- 15.2.4 SNIC SOLUTIONS

- 15.2.5 QUALITYZE

- 15.2.6 SCIGENIQ

- 15.2.7 KIVO, INC.

- 15.2.8 GMP SOFTWARE INDIA PVT. LTD.

- 15.2.9 VMT SOFT SOL PVT. LTD.

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Key primary participants

- 16.1.2.3 Breakdown of primary interviews

- 16.1.2.4 Key industry insights

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.3 DATA TRIANGULATION

- 16.4 FACTOR ANALYSIS

- 16.5 RESEARCH ASSUMPTIONS

- 16.5.1 MARKET SIZING ASSUMPTIONS

- 16.5.2 STUDY ASSUMPTIONS

- 16.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- 16.6.1 RESEARCH LIMITATIONS

- 16.6.1.1 Methodology-related limitations

- 16.6.1.2 Scope-related limitations

- 16.6.2 RISK ASSESSMENT

- 16.6.1 RESEARCH LIMITATIONS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE: INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD, 2021-2025

- TABLE 3 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 4 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 INDICATIVE PRICING ANALYSIS FOR PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE, BY KEY PLAYER, 2024 (USD)

- TABLE 7 INDICATIVE PRICING ANALYSIS FOR PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE, BY PRICING PLANS, 2024 (USD)

- TABLE 8 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 CASE STUDY 1: IMPROVED COMPLIANCE & EFFICIENCY WITH CONFIGURABLE EQMS

- TABLE 10 CASE STUDY 2: STREAMLINED CHANGE CONTROL & DOCUMENT MANAGEMENT WITH TRACKWISE DIGITAL

- TABLE 11 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 12 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES, JANUARY 2015-NOVEMBER 2025

- TABLE 13 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: LIST OF PATENTS/PATENT APPLICATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REGULATORY SCENARIO OF NORTH AMERICA

- TABLE 20 REGULATORY SCENARIO OF EUROPE

- TABLE 21 REGULATORY SCENARIO OF ASIA PACIFIC

- TABLE 22 REGULATORY SCENARIO OF MIDDLE EAST & AFRICA

- TABLE 23 REGULATORY SCENARIO OF LATIN AMERICA

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 25 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 26 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: UNMET NEEDS

- TABLE 27 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 28 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR CLINICAL TRIALS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR REGULATORY COMPLIANCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR MANUFACTURING/PRODUCTION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR QUALITY ASSURANCE/QUALITY CONTROL, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR DISTRIBUTION & SUPPLY CHAIN, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR COMMERCIALIZATION, MARKETING, AND SALES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR POST-MARKET SURVEILLANCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR OTHER PROCESSES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 37 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR DOCUMENT & ESOP, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR CAPA (CORRECTIVE & PREVENTIVE ACTION) MANAGEMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR AUDIT & INSPECTION MANAGEMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR TRAINING MANAGEMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR REGULATORY & COMPLIANCE MANAGEMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR SUPPLIER QUALITY MANAGEMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR RISK MANAGEMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR CHANGE CONTROL MANAGEMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 47 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR LARGE ENTERPRISES, REGION, 2023-2030 (USD MILLION)

- TABLE 48 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR SMALL & MEDIUM ENTERPRISES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 50 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 52 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR CONTRACT DEVELOPMENT & MANUFACTURING ORGANIZATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 NORTH AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 59 NORTH AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 61 US: MAJOR COMPANIES IN PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET

- TABLE 62 US: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 63 US: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 64 US: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 65 US: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 66 CANADA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 67 CANADA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 68 CANADA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 69 CANADA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 70 EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 72 EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 73 EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 74 EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 75 GERMANY: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 76 GERMANY: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 77 GERMANY: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 78 GERMANY: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 79 UK: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 80 UK: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 81 UK: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 82 UK: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 83 FRANCE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 84 FRANCE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 FRANCE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 86 FRANCE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 87 ITALY: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 88 ITALY: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 89 ITALY: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 90 ITALY: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 91 SPAIN: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 92 SPAIN: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 93 SPAIN: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 94 SPAIN: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 95 REST OF EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 96 REST OF EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 97 REST OF EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 98 REST OF EUROPE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 103 ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 104 CHINA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 105 CHINA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 106 CHINA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 107 CHINA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 108 JAPAN: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 109 JAPAN: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 110 JAPAN: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 111 JAPAN: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 112 INDIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 113 INDIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 114 INDIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030(USD MILLION)

- TABLE 115 INDIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 116 AUSTRALIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 117 AUSTRALIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 118 AUSTRALIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 119 AUSTRALIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 120 SOUTH KOREA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 121 SOUTH KOREA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 122 SOUTH KOREA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 123 SOUTH KOREA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER 2023-2030 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER 2023-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 130 LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 131 LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 132 LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 133 BRAZIL: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 134 BRAZIL: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 135 BRAZIL: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 136 BRAZIL: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 MEXICO: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 138 MEXICO: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 139 MEXICO: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030(USD MILLION)

- TABLE 140 MEXICO: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 141 REST OF LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 142 REST OF LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030(USD MILLION)

- TABLE 143 REST OF LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030(USD MILLION)

- TABLE 144 REST OF LATIN AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 150 GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 151 GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 152 GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 153 GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 154 GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 155 SAUDI ARABIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 156 SAUDI ARABIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 157 SAUDI ARABIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 158 SAUDI ARABIA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 159 UAE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 160 UAE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 161 UAE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 162 UAE: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 163 REST OF GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 164 REST OF GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 165 REST OF GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030(USD MILLION)

- TABLE 166 REST OF GCC COUNTRIES: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 167 SOUTH AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 168 SOUTH AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 169 SOUTH AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 170 SOUTH AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER 2023-2030 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS, 2023-2030 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE, 2023-2030 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 175 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET, JANUARY 2022-OCTOBER 2025

- TABLE 176 PHARMACEUTICAL QUALITY MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 177 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: REGION FOOTPRINT

- TABLE 178 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: PROCESS FOOTPRINT

- TABLE 179 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: APPLICATION FOOTPRINT

- TABLE 180 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: ENTERPRISE SIZE FOOTPRINT

- TABLE 181 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: END-USER FOOTPRINT

- TABLE 182 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 183 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 184 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 185 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 186 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: EXPANSIONS, JANUARY 2022-OCTOBER 2025

- TABLE 187 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2025

- TABLE 188 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 189 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 190 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 191 HONEYWELL INTERNATIONAL INC.: JANUARY 2022-OCTOBER 2025

- TABLE 192 IQVIA: COMPANY OVERVIEW

- TABLE 193 IQVIA: PRODUCTS OFFERED

- TABLE 194 IQVIA: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 195 IQVIA: OTHER DEVELOPMENTS, JANUARY 2022-OCTOBER 2025

- TABLE 196 VEEVA SYSTEMS INC.: COMPANY OVERVIEW

- TABLE 197 VEEVA SYSTEMS INC.: PRODUCTS OFFERED

- TABLE 198 VEEVA SYSTEMS INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 199 VEEVA SYSTEMS INC.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 200 MASTERCONTROL SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 201 MASTERCONTROL SOLUTIONS, INC.: PRODUCTS OFFERED

- TABLE 202 MASTERCONTROL SOLUTIONS, INC.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 203 DASSAULT SYSTEMES: COMPANY OVERVIEW

- TABLE 204 DASSAULT SYSTEMES: PRODUCTS OFFERED

- TABLE 205 QUALIO: COMPANY OVERVIEW

- TABLE 206 QUALIO: PRODUCTS OFFERED

- TABLE 207 HEXAGON AB: COMPANY OVERVIEW

- TABLE 208 HEXAGON AB: PRODUCTS OFFERED

- TABLE 209 HEXAGON AB: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 210 HEXAGON AB.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 211 ASSURX, INC.: COMPANY OVERVIEW

- TABLE 212 ASSURX, INC.: PRODUCTS OFFERED

- TABLE 213 ASSURX, INC.: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 214 QT9 SOFTWARE: COMPANY OVERVIEW

- TABLE 215 QT9 SOFTWARE: PRODUCTS OFFERED

- TABLE 216 QT9 SOFTWARE: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 217 QT9 SOFTWARE: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 218 COMPLIANCEQUEST: COMPANY OVERVIEW

- TABLE 219 COMPLIANCEQUEST: PRODUCTS OFFERED

- TABLE 220 COMPLIANCEQUEST: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 221 IDEAGEN: COMPANY OVERVIEW

- TABLE 222 IDEAGEN: PRODUCTS OFFERED

- TABLE 223 IDEAGEN: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 224 IDEAGEN: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 225 SOFTEXPERT: COMPANY OVERVIEW

- TABLE 226 SOFTEXPERT: PRODUCTS OFFERED

- TABLE 227 SOFTEXPERT: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 228 INSTEM: COMPANY OVERVIEW

- TABLE 229 INSTEM: PRODUCTS OFFERED

- TABLE 230 INSTEM: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 231 INTELEX TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 232 INTELEX TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 233 INTELEX TECHNOLOGIES: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022- OCTOBER 2025

- TABLE 234 INTELEX TECHNOLOGIES: EXPANSIONS, JANUARY 2022-OCTOBER 2024

- TABLE 235 INTELLECT, INC.: COMPANY OVERVIEW

- TABLE 236 INTELLECT, INC.: PRODUCTS OFFERED

- TABLE 237 INTELLECT, INC.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-OCTOBER 2025

- TABLE 238 AMPLELOGIC: COMPANY OVERVIEW

- TABLE 239 AMPLELOGIC: PRODUCTS OFFERED

- TABLE 240 AMPLELOGIC: DEALS, JANUARY 2022-OCTOBER 2025

- TABLE 241 INSTANTGMP: COMPANY OVERVIEW

- TABLE 242 SIMPLERQMS: COMPANY OVERVIEW

- TABLE 243 DOT COMPLIANCE LTD.: COMPANY OVERVIEW

- TABLE 244 SNIC SOLUTIONS: COMPANY OVERVIEW

- TABLE 245 QUALITYZE: COMPANY OVERVIEW

- TABLE 246 SCIGENIQ: COMPANY OVERVIEW

- TABLE 247 KIVO, INC.: COMPANY OVERVIEW

- TABLE 248 GMP SOFTWARE INDIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 249 VMT SOFT SOL PVT. LTD.: COMPANY OVERVIEW

- TABLE 250 FACTOR ANALYSIS

- TABLE 251 MARKET SIZING ASSUMPTIONS

- TABLE 252 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: RISK ASSESSMENT

List of Figures

- FIGURE 1 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET, 2023-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET, 2023-2030

- FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET, 2025-2030

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 8 INCREASING ENFORCEMENT OF GLOBAL QUALITY STANDARDS AND REGULATORY UPGRADES TO DRIVE MARKET

- FIGURE 9 LARGE ENTERPRISES AND US LED NORTH AMERICAN MARKET IN 2024

- FIGURE 10 CANADA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 11 EMERGING MARKETS TO HAVE HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 12 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 US MEDIAN HEALTHCARE DATA BREACH, 2009-2024

- FIGURE 14 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET: VALUE CHAIN ANALYSIS

- FIGURE 16 NEW REVENUE POCKETS AND REVENUE SHIFT IN PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET

- FIGURE 17 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 18 JURISDICTION ANALYSIS, JANUARY 2015-NOVEMBER 2025

- FIGURE 19 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: PATENT ANALYSIS, JANUARY 2015-NOVEMBER 2024

- FIGURE 20 MARKET POTENTIAL OF AI/GEN AI ON PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET ACROSS INDUSTRIES

- FIGURE 21 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 24 NORTH AMERICA: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET SNAPSHOT

- FIGURE 25 ASIA PACIFIC: PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET SNAPSHOT

- FIGURE 26 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 27 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, 2024

- FIGURE 28 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: SOFTWARE COMPARISON

- FIGURE 29 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 30 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: COMPANY FOOTPRINT

- FIGURE 31 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 32 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 33 EV/EBITDA OF KEY VENDORS

- FIGURE 34 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT (2024)

- FIGURE 35 IQVIA: COMPANY SNAPSHOT (2024)

- FIGURE 36 VEEVA SYSTEMS INC.: COMPANY SNAPSHOT (2024)

- FIGURE 37 DASSAULT SYSTEMES: COMPANY SNAPSHOT (2024)

- FIGURE 38 HEXAGON AB: COMPANY SNAPSHOT (2024)

- FIGURE 39 RESEARCH DESIGN

- FIGURE 40 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND-SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 41 SUPPLY-SIDE MARKET ESTIMATION

- FIGURE 42 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: REVENUE ESTIMATION APPROACH

- FIGURE 43 BOTTOM-UP APPROACH: END-USER SPENDING ON PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE

- FIGURE 44 TOP-DOWN APPROACH

- FIGURE 45 DATA TRIANGULATION

- FIGURE 46 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DYNAMICS, 2025-2030

- FIGURE 47 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS