PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1906294

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1906294

Fab Automation Market By Offering (Harfware, Software), Wafer Size, End User - Global Forecast to 2032

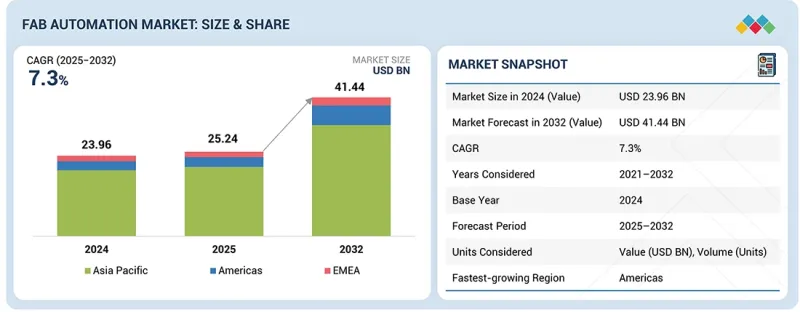

The fab automation market is projected to reach USD 25.24 billion in 2025 and USD 41.44 billion by 2032, registering a CAGR of 7.3% between 2025 and 2032. The market is projected to witness substantial growth during the forecast period, driven by the increasing complexity of semiconductor manufacturing and the global push toward higher yields, faster cycle times, and greater operational consistency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Deployment Type, Wafer Size, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

Expanding 300 mm capacity, advanced-node production, and heterogeneous integration are accelerating the adoption of automated material handling systems (AMHS), robotics, manufacturing execution systems (MES), advanced process control (APC), yield management software (YMS), and AI-enabled analytics. These solutions enable fabs to achieve precision handling, real-time process optimization, and predictive maintenance, ensuring compliance with ultra-clean manufacturing standards. Growth is further supported by large-scale investments in new greenfield fabs, government semiconductor incentives, and the rising demand for chips powering AI, 5G, automotive electronics, and high-performance computing. However, high implementation costs, integration complexity, and the need for skilled technical resources may present operational challenges. Strengthening interoperability, modular deployments, and partnerships across the automation ecosystem will be essential to sustaining long-term market expansion.

"By end user, the outsourced semiconductor assembly & test (OSAT) providers segment is expected to register the highest CAGR between 2025 and 2032."

The outsourced semiconductor assembly and test (OSAT) providers segment is expected to register the highest CAGR in the fab automation market between 2025 and 2032, driven by the rapid growth of advanced packaging, heterogeneous integration, and chiplet-based architectures. OSAT facilities are experiencing rising demand for high-precision, contamination-free, and high-throughput automation solutions to support complex processes such as wafer-level packaging (WLP), fan-out technologies, 2.5D/3D stacking, and advanced test operations. To manage increasing device complexity and shrinking tolerances, OSATs are deploying Automated Material Handling Systems (AMHS), robotics, smart inspection systems, Manufacturing Execution Systems (MES), Advanced Process Control (APC), and AI-enabled analytics to enhance yield, reduce operational variability, and maintain traceability across packaging and test workflows. The expansion of AI, HPC, automotive electronics, and 5G applications is further driving OSAT customers to demand faster cycle times, scalable production, and higher reliability. As packaging becomes a critical differentiator in semiconductor performance, OSATs are accelerating investments in digital transformation, automation upgrades, and cleanroom optimization. The combination of rising outsourcing trends, advanced packaging demand, and the need for cost-efficient, high-volume production positions OSAT providers as a pivotal and fast-growing end-user segment in the global fab automation market.

"Based on offering, the hardware segment is projected to account for the largest market share in 2032."

The hardware segment is projected to account for the largest share of the fab automation market by 2032, driven by the rapid expansion of semiconductor manufacturing capacity and the increasing demand for high-throughput, contamination-controlled production environments. As fabs scale advanced-node and 300mm lines, demand for robust hardware, including automated material handling systems (AMHS), robotics, wafer-handling equipment, environmental control systems, power and utility automation systems, and communication and networking hardware, continues to rise. These systems form the physical backbone of automated fabs, enabling precise wafer transport, maintaining stable cleanroom conditions, ensuring uninterrupted utility management, and ensuring reliable equipment connectivity. The surge in logic, memory, and advanced packaging production driven by AI, HPC, automotive electronics, and 5G applications is further accelerating investments in automation hardware. Greenfield fabs in the Asia Pacific, the US, and Europe are increasingly prioritizing end-to-end automated infrastructure to ensure yield consistency, reduce cycle time, and enhance operational resilience. Additionally, the modernization of brownfield facilities is boosting the adoption of next-generation robotics, AMHS upgrades, and advanced contamination control systems. As semiconductor processes become more complex and throughput requirements rise, hardware will remain the foundational and most heavily invested offering within the global fab automation landscape.

"The Americas region is projected to exhibit the highest CAGR from 2025 to 2032."

The Americas region is projected to exhibit the highest CAGR in the fab automation market from 2025 to 2032, driven by substantial investments in advanced semiconductor manufacturing, modernization of existing fabs, and renewed government focus on strengthening domestic chip production. The region, comprising the US and the Rest of the Americas, is advancing multiple greenfield and brownfield projects aimed at supporting leading-edge logic, memory, and heterogeneous integration technologies. As new fabs emphasize high-throughput, contamination-free, and energy-efficient operations, demand is rising for automated material handling systems (AMHS), robotics, environmental control systems, advanced metrology hardware, and factory communication infrastructure. The US leads regional growth, fueled by substantial capital expenditure from IDMs, foundries, and OSATs, alongside incentives under national semiconductor policies that prioritize automation, digital transformation, and workforce optimization. Increasing adoption of sub-10 nm and EUV-enabled processes is further accelerating the need for precision handling equipment and intelligent automation platforms. Meanwhile, countries in the Rest of the Americas are expanding backend assembly, test, and packaging capabilities, creating additional demand for scalable, cost-efficient automation solutions. Collectively, strong policy support, rising semiconductor consumption, and large-scale capacity expansion position the Americas as a high-growth hub for next-generation fab automation.

The break-up of the profile of primary participants in the fab automation market-

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation: C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region: Americas - 40%, EMEA - 25%, Asia Pacific - 35%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the fab automation market with a significant global presence include Daifuku (Japan), Murata Machinery (Japan), Atlas Copco (Sweden), Rorze Automation (Japan), and Ebara (Japan).

Research Coverage

The report segments the fab automation market and forecasts its size by offering, deployment type, wafer size, end user, and region. It also comprehensively reviews the drivers, restraints, opportunities, and challenges that influence market growth. The report encompasses both qualitative and quantitative aspects of the market.

Reasons to Buy the Report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the overall fab automation market and related segments. This report will help stakeholders understand the competitive landscape and gain valuable insights to strengthen their market position and develop effective go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (expansion of advanced-node and EUV-enabled manufacturing requiring high-throughput automation; rapid growth in 300 mm fab capacity; rising process complexity across logic, memory, and advanced packaging; increasing adoption of AI/ML-driven predictive analytics and digital-twin platforms; government incentives accelerating greenfield fab construction), restraints (high capital expenditure for automation hardware and integration; limited interoperability between legacy and next-generation systems; shortages of skilled automation and software specialists; extended equipment lead times due to vendor concentration), opportunities (deployment of advanced automation for 2.5D/3D packaging and heterogeneous integration; emergence of autonomous, AI-enabled fabs; large-scale automation demand from new fabs in the US, Asia, and Europe; adoption of modular AMHS and collaborative robotics; sustainability-focused automation solutions for energy and cleanroom efficiency), and challenges (stringent ultra-clean manufacturing requirements increasing contamination and reliability risks; integration complexity across multi-vendor MES, APC, YMS, and AMHS ecosystems; maintaining automation performance at high wafer volumes and EUV process sensitivities; geopolitical disruptions affecting semiconductor equipment supply chains; high complexity and cost of modernizing brownfield fabs without production impact)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and strategies such as new product launches, expansions, contracts, partnerships, and acquisitions in the fab automation market

- Market Development: Comprehensive information about lucrative markets-the report analyses the fab automation market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the fab automation market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Daifuku (Japan), Murata Machinery (Japan), Atlas Copco (Sweden), Rorze Automation (Japan), Ebara (Japan), FANUC (Japan), Kawasaki Heavy Industries (Japan), Hirata Corporation (Japan), Yaskawa (Japan), and KUKA AG (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN FAB AUTOMATION MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FAB AUTOMATION MARKET

- 3.2 FAB AUTOMATION MARKET, BY OFFERING

- 3.3 FAB AUTOMATION MARKET, BY WAFER SIZE

- 3.4 FAB AUTOMATION MARKET, BY DEPLOYMENT TYPE

- 3.5 FAB AUTOMATION MARKET, BY END USER

- 3.6 FAB AUTOMATION MARKET, BY REGION

- 3.7 FAB AUTOMATION MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising demand for high-throughput, high-yield semiconductor manufacturing across AI, HPC, automotive, and 5G applications

- 4.2.1.2 Expansion of advanced-node fabs requiring deep automation to sustain process stability

- 4.2.1.3 Increasing adoption of AMHS, robotics, and contamination-free transport to reduce human intervention

- 4.2.1.4 Increasing integration of MES, APC, YMS, and ECS platforms to enhance real-time process control and production efficiency

- 4.2.1.5 Government-backed investments and incentive programs accelerating greenfield fabs and capacity expansion

- 4.2.2 RESTRAINTS

- 4.2.2.1 High capital investment requirements for full fab automation deployment, particularly in brownfield facilities

- 4.2.2.2 Interoperability challenges between legacy tools and modern automation systems

- 4.2.2.3 Limited availability of skilled automation engineers for system integration and fab-level optimization

- 4.2.2.4 Supply chain constraints for automation components and cleanroom systems, resulting in extended deployment timelines

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 AI/ML-driven automation enabling predictive maintenance, intelligent scheduling, and yield enhancement

- 4.2.3.2 Rising automation demand in OSAT facilities driven by advanced packaging and throughput requirements

- 4.2.3.3 Expansion of 300 mm fabs and modernization of 200 mm facilities, driving long-term automation upgrade cycles

- 4.2.3.4 Growing adoption of digital twins and simulation platforms to optimize fab workflows and equipment layouts

- 4.2.4 CHALLENGES

- 4.2.4.1 Complex coordination and orchestration across multi-layer automation architectures in large semiconductor fabs

- 4.2.4.2 Ensuring real-time, low-latency communication across distributed automation networks under heavy data loads

- 4.2.4.3 Ensuring ultra-clean automated handling as device geometries shrink and contamination sensitivity intensifies

- 4.2.4.4 Long deployment and integration timelines create operational risks in upgrading automation within running fabs

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.4.1 MARKET DYNAMICS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN MANUFACTURING & INDUSTRIAL AUTOMATION INDUSTRY

- 5.3.4 TRENDS IN SEMICONDUCTOR MANUFACTURING INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY OFFERING, 2024

- 5.6.2 AVERAGE SELLING PRICE, BY REGION, 2021-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 8479)

- 5.7.2 EXPORT SCENARIO (HS CODE 8479)

- 5.8 KEY CONFERENCES AND EVENTS, 2026-2027

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 TSMC'S CLEANROOM THROUGHPUT IMPROVEMENT WITH DAIFUKU'S NEO-AMHS PLATFORM

- 5.11.2 SAMSUNG ELECTRONICS' AUTOMATION UPGRADE USING MURATA MACHINERY'S WAFER-HANDLING ROBOTICS

- 5.11.3 GLOBALFOUNDRIES' APC/YMS TRANSFORMATION WITH APPLIED MATERIALS AUTOMATION SOFTWARE SOLUTIONS

- 5.12 IMPACT OF 2025 US TARIFF - FAB AUTOMATION MARKET

- 5.12.1 KEY TARIFF RATES

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT ON COUNTRIES/REGIONS

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON END USERS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 AI-DRIVEN ADVANCED PROCESS CONTROL (APC) & PREDICTIVE AUTOMATION

- 6.1.2 MODULAR & COLLABORATIVE AMHS PLATFORMS

- 6.1.3 DIGITAL TWIN & VIRTUAL FAB SIMULATION PLATFORMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 EDGE COMPUTING & REAL-TIME DATA INFRASTRUCTURE

- 6.2.2 HIGH-PRECISION CLEANROOM ENVIRONMENTAL CONTROL & MONITORING SYSTEMS

- 6.2.3 SECURE FAB COMMUNICATION NETWORKS & INDUSTRIAL IOT CONNECTIVITY

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 ADVANCED PACKAGING & HETEROGENEOUS INTEGRATION AUTOMATION

- 6.3.2 SEMICONDUCTOR MATERIALS DELIVERY & CHEMICAL MANAGEMENT SYSTEMS

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): AUTOMATION MODERNIZATION & AI-AUGMENTED OPERATIONS

- 6.4.2 MID-TERM (2027-2030): HYPER-AUTOMATION & ADVANCED PACKAGING INTEGRATION

- 6.4.3 LONG-TERM (2030-2035+): AUTONOMOUS FABS & SYSTEM-LEVEL CONVERGENCE

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON FAB AUTOMATION MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN FAB AUTOMATION MARKET

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN FAB AUTOMATION MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN FAB AUTOMATION MARKET

7 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2 INDUSTRY STANDARDS

- 7.2.1 SEMI STANDARDS (GEM, GEM300, E84, E87, EDA/INTERFACE A)

- 7.2.2 ISO CLEANROOM & ENVIRONMENTAL CONTROL STANDARDS (ISO 14644 SERIES)

- 7.2.3 ISO 10218 & IEC 61508 - ROBOTICS SAFETY & FUNCTIONAL SAFETY STANDARDS

- 7.2.4 OPC UA FOR FAB EQUIPMENT COMMUNICATION

- 7.2.5 ANSI/ISA-95 - MANUFACTURING INTEGRATION STANDARD

- 7.2.6 SEMI S2 - ENVIRONMENTAL, HEALTH & SAFETY (EHS) STANDARD

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END USERS

9 FAB AUTOMATION MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 AUTOMATED MATERIAL HANDLING SYSTEMS

- 9.2.1.1 AI-orchestrated throughput growth to fuel AMHS demand in fab automation

- 9.2.2 ROBOTICS & HANDLING EQUIPMENT

- 9.2.2.1 AI-enabled precision and vision integration to drive demand

- 9.2.3 ENVIRONMENTAL CONTROL SYSTEMS

- 9.2.3.1 Humidity and AMC control to increase demand for advanced environmental control systems

- 9.2.4 POWER & UTILITY AUTOMATION SYSTEMS

- 9.2.4.1 Power quality and energy-efficiency mandates to accelerate adoption of utility & power automation systems in fabs

- 9.2.5 COMMUNICATION & NETWORKING HARDWARE

- 9.2.5.1 Low-latency, deterministic connectivity requirements to drive market

- 9.2.1 AUTOMATED MATERIAL HANDLING SYSTEMS

- 9.3 SOFTWARE

- 9.3.1 MANUFACTURING EXECUTION SYSTEMS

- 9.3.1.1 Model-driven traceability and real-time dispatch to accelerate adoption

- 9.3.2 EQUIPMENT CONTROL SOFTWARE

- 9.3.2.1 Real-time tool-state coordination and recipe enforcement to drive adoption

- 9.3.3 ADVANCED PROCESS CONTROL

- 9.3.3.1 Shrinking process windows and high-mix production to drive APC integration

- 9.3.4 YIELD MANAGEMENT SOFTWARE

- 9.3.4.1 Defect density reduction and multi-source data fusion to increase adoption

- 9.3.5 AI/ML & PREDICTIVE ANALYTICS PLATFORMS

- 9.3.5.1 Predictive maintenance and lot-flow optimization to accelerate AI/ML deployment

- 9.3.6 SIMULATION & DIGITAL TWIN SOFTWARE

- 9.3.6.1 Capacity planning and virtual process optimization to expand digital twin usage

- 9.3.7 MIDDLEWARE & COMMUNICATION PROTOCOL SOFTWARE

- 9.3.7.1 Interoperability requirements and multi-vendor tool integration to fuel middleware adoption

- 9.3.1 MANUFACTURING EXECUTION SYSTEMS

- 9.4 SERVICES

- 9.4.1 PROFESSIONAL SERVICES

- 9.4.1.1 System integration complexity and node migration timelines to increase demand

- 9.4.2 MANAGED SERVICES

- 9.4.2.1 Predictive maintenance and 24/7 operational assurance to accelerate managed services adoption

- 9.4.1 PROFESSIONAL SERVICES

10 FAB AUTOMATION MARKET, BY AUTOMATION LAYER

- 10.1 INTRODUCTION

- 10.2 MATERIAL HANDLING AUTOMATION

- 10.3 EQUIPMENT AUTOMATION

- 10.4 PROCESS AUTOMATION

- 10.5 FACTORY AUTOMATION SOFTWARE

- 10.6 AI/ANALYTICS AUTOMATION

11 FAB AUTOMATION MARKET, BY WAFER SIZE

- 11.1 INTRODUCTION

- 11.2 <150 MM

- 11.2.1 INCREASED SPECIALTY-DEVICE PRODUCTION TO DRIVE ADOPTION

- 11.3 200 MM

- 11.3.1 GROWTH IN POWER AND ANALOG DEVICES TO INCREASE DEMAND

- 11.4 300 MM

- 11.4.1 ADVANCED PACKAGING DEMAND AND HIGH-VOLUME TEST REQUIREMENTS TO DRIVE MARKET

12 FAB AUTOMATION MARKET, BY DEPLOYMENT TYPE

- 12.1 INTRODUCTION

- 12.2 GREENFIELD FABS

- 12.2.1 ADVANCED NODE CAPACITY EXPANSION AND HIGH-THROUGHPUT MANUFACTURING REQUIREMENTS TO DRIVE MARKET

- 12.3 BROWNFIELD FABS

- 12.3.1 RETROFIT INVESTMENTS AND LEGACY-ASSET UTILIZATION TO SUPPORT MARKET GROWTH

13 FAB AUTOMATION MARKET, BY FAB TYPE

- 13.1 INTRODUCTION

- 13.2 ADVANCED NODE FABS (<=7 NM)

- 13.3 MAINSTREAM NODE FABS (10-28 NM)

- 13.4 MATURE NODE FABS (28-90 NM)

- 13.5 LEGACY NODE FABS (>90 NM)

14 FAB AUTOMATION MARKET, BY AUTOMATION LEVEL

- 14.1 INTRODUCTION

- 14.2 FULLY AUTOMATED

- 14.3 SEMI-AUTOMATED

15 FAB AUTOMATION MARKET, BY END USER

- 15.1 INTRODUCTION

- 15.2 INTEGRATED DEVICE MANUFACTURERS

- 15.2.1 COMPLEX PRODUCT PORTFOLIOS AND MULTI-FAB MANUFACTURING COORDINATION TO DRIVE MARKET

- 15.3 FOUNDRIES

- 15.3.1 HIGH-MIX PRODUCTION LOADS AND ADVANCED-NODE CAPACITY REQUIREMENTS TO PROPEL MARKET

- 15.4 OUTSOURCED SEMICONDUCTOR ASSEMBLY & TEST PROVIDERS

- 15.4.1 ADVANCED PACKAGING DEMAND AND HIGH-VOLUME TEST REQUIREMENTS TO DRIVE MARKET

- 15.5 RESEARCH FABS

- 15.5.1 HIGH-ACCURACY EXPERIMENTATION AND ACCELERATED PROTOTYPING DEMAND TO DRIVE MARKET

16 FAB AUTOMATION MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 AMERICAS

- 16.2.1 US

- 16.2.1.1 Federal incentives and advanced-node capacity expansion to drive adoption

- 16.2.2 REST OF AMERICAS

- 16.2.1 US

- 16.3 ASIA PACIFIC

- 16.3.1 CHINA

- 16.3.1.1 China's 300 mm expansion and localized automation ecosystem to drive market

- 16.3.2 JAPAN

- 16.3.2.1 Government subsidies and new 300 mm fab investments to accelerate demand

- 16.3.3 SOUTH KOREA

- 16.3.3.1 Memory-led capacity expansion and mega-cluster investments to accelerate demand

- 16.3.4 TAIWAN

- 16.3.4.1 Advanced-node expansion and foundry-led manufacturing growth to drive automation

- 16.3.5 INDIA

- 16.3.5.1 Government-backed fab expansion and growing domestic demand to drive adoption

- 16.3.6 REST OF ASIA PACIFIC

- 16.3.1 CHINA

- 16.4 EMEA

- 16.4.1 EUROPE

- 16.4.1.1 Advanced-node investments and power-semiconductor expansion to drive market

- 16.4.2 MIDDLE EAST & AFRICA

- 16.4.2.1 Government-led technology initiatives and emerging electronics manufacturing to support market growth

- 16.4.1 EUROPE

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-OCTOBER 2025

- 17.3 MARKET SHARE ANALYSIS, 2024

- 17.4 REVENUE ANALYSIS, 2021-2024

- 17.5 COMPANY VALUATION AND FINANCIAL METRICS

- 17.6 BRAND/PRODUCT COMPARISON

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.7.5.1 Company footprint

- 17.7.5.2 Region footprint

- 17.7.5.3 Offering footprint

- 17.7.5.4 Wafer size footprint

- 17.7.5.5 Deployment type footprint

- 17.7.5.6 End user footprint

- 17.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.8.5.1 Detailed list of key startups/SMEs

- 17.8.5.2 Competitive benchmarking of key startups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 EXPANSIONS

18 COMPANY PROFILES

- 18.1 INTRODUCTION

- 18.2 KEY PLAYERS

- 18.2.1 DAIFUKU CO., LTD.

- 18.2.1.1 Business overview

- 18.2.1.2 Products/Solutions/Services offered

- 18.2.1.3 Recent developments

- 18.2.1.3.1 Expansions

- 18.2.1.4 MnM view

- 18.2.1.4.1 Key strengths

- 18.2.1.4.2 Strategic choices

- 18.2.1.4.3 Weaknesses and competitive threats

- 18.2.2 MURATA MACHINERY

- 18.2.2.1 Business overview

- 18.2.2.2 Products/Solutions/Services offered

- 18.2.2.3 MnM view

- 18.2.2.3.1 Key strengths

- 18.2.2.3.2 Strategic choices

- 18.2.2.3.3 Weaknesses and competitive threats

- 18.2.3 EBARA CORPORATION

- 18.2.3.1 Business overview

- 18.2.3.2 Products/Solutions/Services offered

- 18.2.3.3 MnM view

- 18.2.3.3.1 Key strengths

- 18.2.3.3.2 Strategic choices

- 18.2.3.3.3 Weaknesses and competitive threats

- 18.2.4 RORZE CORPORATION

- 18.2.4.1 Business overview

- 18.2.4.2 Products/Solutions/Services offered

- 18.2.4.3 MnM view

- 18.2.4.3.1 Key strengths

- 18.2.4.3.2 Strategic choices

- 18.2.4.3.3 Weaknesses and competitive threats

- 18.2.5 FANUC

- 18.2.5.1 Business overview

- 18.2.5.2 Products/Solutions/Services offered

- 18.2.5.3 MnM view

- 18.2.5.3.1 Key strengths

- 18.2.5.3.2 Strategic choices

- 18.2.5.3.3 Weaknesses and competitive threats

- 18.2.6 HIRATA CORPORATION

- 18.2.6.1 Business overview

- 18.2.6.2 Products/Solutions/Services offered

- 18.2.7 KUKA AG

- 18.2.7.1 Business overview

- 18.2.7.2 Products/Solutions/Services offered

- 18.2.8 YASKAWA ELECTRIC CORPORATION

- 18.2.8.1 Business overview

- 18.2.8.2 Products/Solutions/Services offered

- 18.2.9 KAWASAKI HEAVY INDUSTRIES

- 18.2.9.1 Business overview

- 18.2.9.2 Products/Solutions/Services offered

- 18.2.1 DAIFUKU CO., LTD.

- 18.3 OTHER PLAYERS

- 18.3.1 ATLAS COPCO

- 18.3.2 THIRA-UTECH

- 18.3.3 DAIHEN CORPORATION

- 18.3.4 BROOKS AUTOMATION

- 18.3.5 MIRLE AUTOMATION

- 18.3.6 SYNUS TECH

- 18.3.7 SHINKO ELECTRIC INDUSTRIES

- 18.3.8 MEETFUTURE

- 18.3.9 FABMATICS

- 18.3.10 TAIYO INC.

- 18.3.11 SINEVA

- 18.3.12 CASTEC INTERNATIONAL

- 18.3.13 SYSTEMA GMBH

- 18.3.14 KYOWA ELECTRIC & INSTRUMENT

- 18.3.15 AMHS TECHNOLOGIES

- 18.3.16 ATS AUTOMATION

- 18.3.17 NIDEC CORPORATION

- 18.3.18 GENMARK AUTOMATION

- 18.3.19 JEL CORPORATION

- 18.3.20 KENSINGTON LABS

- 18.3.21 SIEMENS

- 18.3.22 ROCKWELL AUTOMATION

- 18.4 END USERS

- 18.4.1 FOUNDRIES

- 18.4.1.1 Taiwan Semiconductor Manufacturing Company Limited

- 18.4.1.2 Samsung

- 18.4.1.3 GlobalFoundries

- 18.4.1.4 SMIC

- 18.4.1.5 United Microelectronics Corporation

- 18.4.2 IDM FIRMS

- 18.4.2.1 Intel Corporation

- 18.4.2.2 Texas Instruments Incorporated

- 18.4.2.3 Infineon Technologies AG

- 18.4.3 OSAT COMPANIES

- 18.4.3.1 ASE Technology Holding Co., Ltd.

- 18.4.3.2 Amkor Technology

- 18.4.1 FOUNDRIES

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY AND PRIMARY RESEARCH

- 19.1.2 SECONDARY DATA

- 19.1.2.1 List of key secondary sources

- 19.1.2.2 Key data from secondary sources

- 19.1.3 PRIMARY DATA

- 19.1.3.1 List of primary interview participants

- 19.1.3.2 Breakdown of primaries

- 19.1.3.3 Key data from primary sources

- 19.1.3.4 Key industry insights

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.2 TOP-DOWN APPROACH

- 19.3 DATA TRIANGULATION

- 19.4 RESEARCH ASSUMPTIONS

- 19.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS

List of Tables

- TABLE 1 FAB AUTOMATION MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 FAB AUTOMATION MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 3 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 4 ROLE OF PLAYERS IN FAB AUTOMATION ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF FAB AUTOMATION SOLUTIONS OFFERED BY KEY PLAYERS, 2024 (USD MILLION, PER SYSTEM/PROJECT),

- TABLE 6 AVERAGE SELLING PRICE OF FAB AUTOMATION SYSTEMS, BY REGION, 2021-2024 (USD MILLION, PER LARGE FAB PROJECT)

- TABLE 7 IMPORT DATA FOR HS CODE 8479-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 EXPORT DATA FOR HS CODE 8479-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 FAB AUTOMATION MARKET: KEY CONFERENCES AND EVENTS, 2026-2027

- TABLE 10 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 11 FAB AUTOMATION MARKET: LIST OF GRANTED PATENTS, JANUARY 2021-NOVEMBER 2025

- TABLE 12 TOP USE CASES AND MARKET POTENTIAL

- TABLE 13 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 14 FAB AUTOMATION MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 15 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 16 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN FAB AUTOMATION MARKET

- TABLE 17 AMERICAS: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EMEA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS (%)

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 22 UNMET NEEDS IN FAB AUTOMATION MARKET, BY END USER

- TABLE 23 FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 24 FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 25 HARDWARE: FAB AUTOMATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 26 HARDWARE: FAB AUTOMATION MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 27 HARDWARE: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 HARDWARE: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 29 HARDWARE: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 30 HARDWARE: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 31 HARDWARE: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 32 HARDWARE: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 33 HARDWARE: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 HARDWARE: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2025-2032 (USD MILLION)

- TABLE 35 AUTOMATED MATERIAL HANDLING SYSTEMS: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 AUTOMATED MATERIAL HANDLING SYSTEMS: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 AUTOMATED MATERIAL HANDLING SYSTEMS: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 AUTOMATED MATERIAL HANDLING SYSTEMS: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 39 AUTOMATED MATERIAL HANDLING SYSTEMS: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 AUTOMATED MATERIAL HANDLING SYSTEMS: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 41 AUTOMATED MATERIAL HANDLING SYSTEMS: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 AUTOMATED MATERIAL HANDLING SYSTEMS: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 45 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 47 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 49 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2025-2032 (USD MILLION)

- TABLE 51 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET, 2021-2024 (UNITS)

- TABLE 52 ROBOTICS & HANDLING EQUIPMENT: FAB AUTOMATION MARKET, 2025-2032 (UNITS)

- TABLE 53 ENVIRONMENTAL CONTROL SYSTEMS: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 ENVIRONMENTAL CONTROL SYSTEMS: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 ENVIRONMENTAL CONTROL SYSTEMS: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 ENVIRONMENTAL CONTROL SYSTEMS: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 57 ENVIRONMENTAL CONTROL SYSTEMS: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 ENVIRONMENTAL CONTROL SYSTEMS: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 59 ENVIRONMENTAL CONTROL SYSTEMS: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 ENVIRONMENTAL CONTROL SYSTEMS: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 POWER & UTILITY AUTOMATION SYSTEMS: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 POWER & UTILITY AUTOMATION SYSTEMS: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 POWER & UTILITY AUTOMATION SYSTEMS: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 POWER & UTILITY AUTOMATION SYSTEMS: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 65 POWER & UTILITY AUTOMATION SYSTEMS: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 POWER & UTILITY AUTOMATION SYSTEMS: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 67 POWER & UTILITY AUTOMATION SYSTEMS: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 POWER & UTILITY AUTOMATION SYSTEMS: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 COMMUNICATION & NETWORKING HARDWARE: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 COMMUNICATION & NETWORKING HARDWARE: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 COMMUNICATION & NETWORKING HARDWARE: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 COMMUNICATION & NETWORKING HARDWARE: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 73 COMMUNICATION & NETWORKING HARDWARE: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 COMMUNICATION & NETWORKING HARDWARE: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 75 COMMUNICATION & NETWORKING HARDWARE: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 COMMUNICATION & NETWORKING HARDWARE: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2025-2032 (USD MILLION)

- TABLE 77 SOFTWARE: FAB AUTOMATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 78 SOFTWARE: FAB AUTOMATION MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 79 SOFTWARE: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 SOFTWARE: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 81 SOFTWARE: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 SOFTWARE: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 83 SOFTWARE: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 84 SOFTWARE: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 85 SOFTWARE: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 SOFTWARE: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2025-2032 (USD MILLION)

- TABLE 87 SERVICES: FAB AUTOMATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 88 SERVICES: FAB AUTOMATION MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 89 SERVICES: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 SERVICES: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 SERVICES: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 SERVICES: FAB AUTOMATION MARKET IN AMERICAS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 93 SERVICES: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 SERVICES: FAB AUTOMATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 95 SERVICES: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 SERVICES: FAB AUTOMATION MARKET IN EMEA, BY REGION, 2025-2032 (USD MILLION)

- TABLE 97 FAB AUTOMATION MARKET, BY WAFER SIZE, 2021-2024 (USD MILLION)

- TABLE 98 FAB AUTOMATION MARKET, BY WAFER SIZE, 2025-2032 (USD MILLION)

- TABLE 99 FAB AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2021-2024 (USD MILLION)

- TABLE 100 FAB AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2025-2032 (USD MILLION)

- TABLE 101 FAB AUTOMATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 102 FAB AUTOMATION MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 103 INTEGRATED DEVICE MANUFACTURERS: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 INTEGRATED DEVICE MANUFACTURERS: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 105 FOUNDRIES: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 FOUNDRIES: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 107 OUTSOURCED SEMICONDUCTOR ASSEMBLY & TEST PROVIDERS: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 OUTSOURCED SEMICONDUCTOR ASSEMBLY & TEST PROVIDERS: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 109 RESEARCH FABS: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 RESEARCH FABS: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 113 AMERICAS: FAB AUTOMATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 AMERICAS: FAB AUTOMATION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 115 AMERICAS: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 116 AMERICAS: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 117 AMERICAS: FAB AUTOMATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 118 AMERICAS: FAB AUTOMATION MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 119 AMERICAS: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 120 AMERICAS: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 121 US: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 122 US: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 123 US: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 124 US: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 125 REST OF AMERICAS: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 126 REST OF AMERICAS: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 127 REST OF AMERICAS: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 128 REST OF AMERICAS: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 129 ASIA PACIFIC: FAB AUTOMATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: FAB AUTOMATION MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 131 ASIA PACIFIC: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 133 ASIA PACIFIC: FAB AUTOMATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: FAB AUTOMATION MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 135 ASIA PACIFIC: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 137 CHINA: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 138 CHINA: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 139 CHINA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 140 CHINA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 141 JAPAN: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 142 JAPAN: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 143 JAPAN: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 144 JAPAN: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 145 SOUTH KOREA: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 146 SOUTH KOREA: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 147 SOUTH KOREA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 148 SOUTH KOREA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 149 TAIWAN: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 150 TAIWAN: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 151 TAIWAN: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 152 TAIWAN: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 153 INDIA: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 154 INDIA: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 155 INDIA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 156 INDIA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 161 EMEA: FAB AUTOMATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 EMEA: FAB AUTOMATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 163 EMEA: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 164 EMEA: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 165 EMEA: FAB AUTOMATION MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 166 EMEA: FAB AUTOMATION MARKET, BY END USER, 2025-2032 (USD MILLION)

- TABLE 167 EMEA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 168 EMEA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 169 EUROPE: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 170 EUROPE: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 171 EUROPE: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 172 EUROPE: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: FAB AUTOMATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: FAB AUTOMATION MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: FAB AUTOMATION MARKET, BY HARDWARE TYPE, 2025-2032 (USD MILLION)

- TABLE 177 FAB AUTOMATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-OCTOBER 2025

- TABLE 178 FAB AUTOMATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 179 FAB AUTOMATION MARKET: REGION FOOTPRINT

- TABLE 180 FAB AUTOMATION MARKET: OFFERING FOOTPRINT

- TABLE 181 FAB AUTOMATION MARKET: WAFER SIZE FOOTPRINT

- TABLE 182 FAB AUTOMATION MARKET: DEPLOYMENT TYPE FOOTPRINT

- TABLE 183 FAB AUTOMATION MARKET: END USER FOOTPRINT

- TABLE 184 FAB AUTOMATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 FAB AUTOMATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 186 FAB AUTOMATION MARKET: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 187 FAB AUTOMATION MARKET: EXPANSIONS, JANUARY 2021-OCTOBER 2025

- TABLE 188 DAIFUKU CO., LTD.: COMPANY OVERVIEW

- TABLE 189 DAIFUKU CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 DAIFUKU CO., LTD.: EXPANSIONS

- TABLE 191 MURATA MACHINERY: COMPANY OVERVIEW

- TABLE 192 MURATA MACHINERY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 EBARA CORPORATION: COMPANY OVERVIEW

- TABLE 194 EBARA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 RORZE CORPORATION: BUSINESS OVERVIEW

- TABLE 196 RORZE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 FANUC: COMPANY OVERVIEW

- TABLE 198 FANUC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 HIRATA CORPORATION: COMPANY OVERVIEW

- TABLE 200 HIRATA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 KUKA AG: COMPANY OVERVIEW

- TABLE 202 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 204 YASKAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 KAWASAKI HEAVY INDUSTRIES: BUSINESS OVERVIEW

- TABLE 206 KAWASAKI HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 ATLAS COPCO: COMPANY OVERVIEW

- TABLE 208 THIRA-UTECH: COMPANY OVERVIEW

- TABLE 209 DAIHEN CORPORATION: COMPANY OVERVIEW

- TABLE 210 BROOKS AUTOMATION: COMPANY OVERVIEW

- TABLE 211 MIRLE AUTOMATION: COMPANY OVERVIEW

- TABLE 212 SYNUS TECH: COMPANY OVERVIEW

- TABLE 213 SHINKO ELECTRIC INDUSTRIES: COMPANY OVERVIEW

- TABLE 214 MEETFUTURE: COMPANY OVERVIEW

- TABLE 215 FABMATICS: COMPANY OVERVIEW

- TABLE 216 TAIYO INC.: COMPANY OVERVIEW

- TABLE 217 SINEVA: COMPANY OVERVIEW

- TABLE 218 CASTEC INTERNATIONAL: COMPANY OVERVIEW

- TABLE 219 SYSTEMA GMBH: COMPANY OVERVIEW

- TABLE 220 KYOWA ELECTRIC & INSTRUMENT: COMPANY OVERVIEW

- TABLE 221 AMHS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 222 ATS AUTOMATION: COMPANY OVERVIEW

- TABLE 223 NIDEC CORPORATION: COMPANY OVERVIEW

- TABLE 224 GENMARK AUTOMATION: COMPANY OVERVIEW

- TABLE 225 JEL CORPORATION: COMPANY OVERVIEW

- TABLE 226 KENSINGTON LABS: COMPANY OVERVIEW

- TABLE 227 SIEMENS: COMPANY OVERVIEW

- TABLE 228 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 229 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 230 SAMSUNG: COMPANY OVERVIEW

- TABLE 231 GLOBALFOUNDRIES: COMPANY OVERVIEW

- TABLE 232 SMIC: COMPANY OVERVIEW

- TABLE 233 UNITED MICROELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 234 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 235 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 236 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 237 ASE TECHNOLOGY HOLDING CO., LTD.: COMPANY OVERVIEW

- TABLE 238 AMKOR TECHNOLOGY: COMPANY OVERVIEW

- TABLE 239 FAB AUTOMATION MARKET: RESEARCH ASSUMPTIONS

- TABLE 240 FAB AUTOMATION MARKET: RISK ASSESSMENT

List of Figures

- FIGURE 1 FAB AUTOMATION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 FAB AUTOMATION MARKET: YEARS CONSIDERED

- FIGURE 3 MARKET SCENARIO

- FIGURE 4 GLOBAL FAB AUTOMATION MARKET, 2021-2032

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN FAB AUTOMATION MARKET, 2021-2025

- FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF FAB AUTOMATION MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN FAB AUTOMATION MARKET, 2025-2032

- FIGURE 8 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 9 ADVANCED NODE EXPANSION, 300 MM FAB GROWTH, AND AUTOMATION TO INCREASE DEMAND

- FIGURE 10 HARDWARE SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 11 300 MM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 12 BROWNFIELD FABS TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 FOUNDRIES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 FAB AUTOMATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 IMPACT ANALYSIS: DRIVERS

- FIGURE 18 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 19 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 20 IMPACT ANALYSIS: CHALLENGES

- FIGURE 21 FAB AUTOMATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 FAB AUTOMATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 FAB AUTOMATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE TREND FOR FAB AUTOMATION SYSTEMS, BY REGION, 2021-2024 (USD MILLION, PER LARGE FAB PROJECT)

- FIGURE 25 IMPORT DATA FOR HS CODE 8479-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 26 EXPORT DATA FOR HS CODE 8479-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 29 FAB AUTOMATION MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 30 DECISION-MAKING FACTORS IN FAB AUTOMATION MARKET

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 33 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 34 HARDWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 35 300 MM SEGMENT IS PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 BROWNFIELD FABS SEGMENT TO ACCOUNT FOR MAJORITY MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 FOUNDRIES SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 38 AMERICAS TO REGISTER HIGHEST CAGR IN FAB AUTOMATION MARKET DURING FORECAST PERIOD

- FIGURE 39 AMERICAS: FAB AUTOMATION MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: FAB AUTOMATION MARKET SNAPSHOT

- FIGURE 41 MARKET SHARE ANALYSIS OF COMPANIES OFFERING FAB AUTOMATION SOLUTIONS, 2024

- FIGURE 42 FAB AUTOMATION MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2024

- FIGURE 43 FAB AUTOMATION MARKET: COMPANY VALUATION

- FIGURE 44 FAB AUTOMATION MARKET PLAYERS: EV/EBITDA

- FIGURE 45 FAB AUTOMATION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 FAB AUTOMATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 FAB AUTOMATION MARKET: COMPANY FOOTPRINT

- FIGURE 48 FAB AUTOMATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 49 DAIFUKU CO., LTD.: COMPANY SNAPSHOT

- FIGURE 50 EBARA CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 FANUC: COMPANY SNAPSHOT

- FIGURE 52 HIRATA CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 KAWASAKI HEAVY INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 55 FAB AUTOMATION MARKET: RESEARCH DESIGN

- FIGURE 56 FAB AUTOMATION MARKET: RESEARCH APPROACH

- FIGURE 57 FAB AUTOMATION MARKET: BOTTOM-UP APPROACH

- FIGURE 58 FAB AUTOMATION MARKET: TOP-DOWN APPROACH

- FIGURE 59 FAB AUTOMATION MARKET: DATA TRIANGULATION