PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1914125

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1914125

Aluminum Foil Packaging Market by Product Type (Bags & Pouches, Wraps & Rolls, Blisters), Packaging Type (Semi-rigid, Flexible, Others), Type (Backed Foil, Rolled Foil), Application (Food, Beverages, Pharmaceuticals), & Region - Global Forecast to 2030

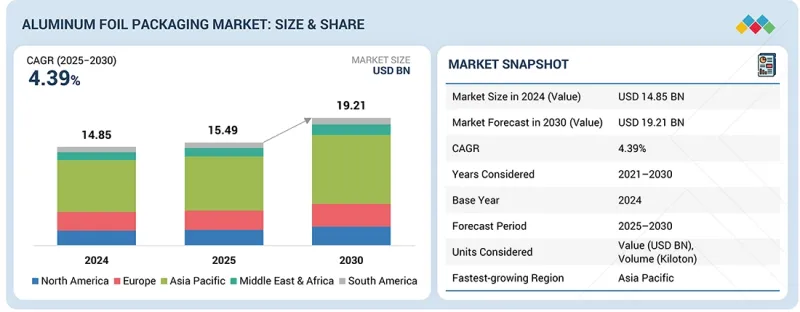

The aluminum foil packaging market is projected to grow from USD 15.49 billion in 2025 to USD 19.21 billion by 2030, at a CAGR of 4.39% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) / Volume (Kiloton) |

| Segments | Product Type, Type, Packaging Type, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The aluminum foil packaging market is poised for rapid growth, primarily driven by an increase in e-commerce sales, rising demand from various end users like food, beverages, and pharmaceuticals, the adoption of sustainable and eco-friendly packaging solutions, and the advantage of long shelf life offered to food products.

"Blisters are projected to be the fastest-growing segment during the forecast period."

Blister packaging is anticipated to be the fastest-growing segment in the aluminum foil packaging market. This growth is driven by the increasing demands of various sectors and consumers worldwide. A significant factor behind this trend is the pharmaceutical industry, which benefits from blister aluminum foil's superior barriers against moisture, light, oxygen, and contaminants. This packaging is particularly effective in preserving the stability, efficacy, and safety of medications, such as tablets, capsules, and unit-dose products. The rising demand for these products is driven by aging populations, the growing prevalence of chronic diseases, and increased global access to healthcare.

Blister packaging offers high-performance features, including tamper-evidence and child-resistance, which meet strict regulatory requirements and enhance patient safety. These advantages explain why pharmaceutical manufacturers prefer blister foil over other types of containers.

"The rolled foil segment is projected to be the second-fastest-growing segment during the forecast period."

The rolled foil packaging segment is expected to experience the second-fastest growth in the aluminum foil packaging market. This growth can be attributed to its versatility as an economical aluminum foil wrapping solution, which remains relevant for both household and foodservice applications. Rolled foil is primarily used for cooking, baking, grilling, and food storage due to its excellent barrier properties against moisture, light, oxygen, and odors. These properties help preserve food freshness and prevent contamination. The demand for retail aluminum foil rolls is being driven by the increasing number of urban families, rising disposable incomes, and a growing trend towards convenience-oriented cooking, particularly in emerging economies. Additionally, the expansion of quick-service restaurants, catering services, and cloud kitchens has led to a surge in the bulk usage of rolled foil for wrapping, portioning, and retaining heat during food preparation and delivery.

"The beverages segment is expected to register the second-fastest growth during the forecast period."

Beverages account for the second-fastest-growing segment in the aluminum foil packaging market, primarily due to the crucial role these packages play in protecting products, extending shelf life, and enhancing brand image across various beverage formats. Aluminum foil is widely used in drink cartons, lids, and lidding, especially in the aseptic packaging of juices, dairy-based drinks, functional beverages, and ready-to-drink teas and coffees. In these applications, aluminum foil serves as a superior barrier against oxygen, light, moisture, and microbial contamination, which is essential for preserving flavor, nutritional value, and product safety without the need for refrigeration. The increasing demand for foil-based packaging is driven by the growing global appetite for packaged and long shelf-life beverages, fueled by urbanization, busy lifestyles, and the expansion of cold-chain logistics in emerging markets.

"In terms of value, Europe is expected to account for the second-largest market share in the aluminum foil packaging market."

Europe is the second-largest market for aluminum foil packaging, primarily due to its advanced food and beverage sector, a strong emphasis on packaging safety by regulatory authorities, and well-established sustainability practices. A significant portion of the region's population relies on packaged and processed foods, pharmaceuticals, and beverages, all of which benefit from the superior barrier properties, hygiene, and product protection provided by aluminum foil. Strict EU regulations regarding food contact materials, the integrity of pharmaceutical packaging, and shelf-life preservation further enhance the advantages of aluminum foil over other materials, contributing to steady demand. Additionally, Europe is a global leader in sustainability and circular economy initiatives, with a highly developed aluminum recycling system and recycling rates that surpass those of most other regions.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million

Companies Covered

RusAL (Russia), Hulamin (South Africa), Hindalco Industries Ltd. (India), China Hongqiao Group Limited (China), Amcor plc (Switzerland), Kibar Holding (Turkey), Constantia Flexibles (Austria), Reynolds Consumer Products (US), GARMCO (Bahrain), Novolex (US), and Raviraj Foils Limited (India), among others, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the aluminum foil packaging market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the aluminum foil packaging market based on product type (bags & pouches, wraps & rolls, blisters, containers, and other product types), packaging type (semi-rigid, flexible, and other packaging types), type (backed foil, rolled foil, and other types), application (food, beverages, pharmaceuticals, personal care & cosmetics, and other applications), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope encompasses detailed information regarding the drivers, restraints, challenges, and opportunities that influence the growth of the aluminum foil packaging market. A detailed analysis of key industry players has been conducted to provide insights into their business overview, products offered, and key strategies, including partnerships, collaborations, product launches, expansions, and acquisitions, associated with the aluminum foil packaging market. This report covers a competitive analysis of upcoming startups in the aluminum foil packaging market ecosystem.

Reasons to Buy the Report

The report will provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall aluminum foil packaging market and its subsegments. This report will help stakeholders understand the competitive landscape, gain deeper insights into positioning their businesses more effectively, and develop suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (long shelf life of food products, high demand for aluminum foils from end-use industries, growth of e-commerce sector, and increasing sustainability concerns), restraints (volatile prices of raw materials and easy availability of substitutes), opportunities (upcoming regulations and government initiatives and demand from food-delivery and retail-ready meals), and challenges (recyclability of multi-layer aluminum foils and economic imbalance of trade).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the aluminum foil packaging market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the aluminum foil packaging market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aluminum foil packaging market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as RusAL (Russia), Hulamin (South Africa), Hindalco Industries Ltd. (India), China Hongqiao Group Limited (China), Amcor plc (Switzerland), Kibar Holding (Turkey), Constantia Flexibles (Austria), Reynolds Consumer Products (US), GARMCO (Bahrain), Novolex (US), and Raviraj Foils Limited (India).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM FOIL PACKAGING MARKET

- 3.2 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE

- 3.3 ALUMINUM FOIL PACKAGING MARKET, BY TYPE

- 3.4 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE

- 3.5 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION

- 3.6 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE AND COUNTRY, 2024

- 3.7 ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Long shelf life of food products

- 4.2.1.2 High demand for aluminum foil from end-use industries

- 4.2.1.3 Growth of e-commerce sector

- 4.2.1.4 Increasing concerns about sustainability

- 4.2.2 RESTRAINTS

- 4.2.2.1 Volatile raw material prices

- 4.2.2.2 Easy availability of substitutes

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Upcoming regulations and government initiatives

- 4.2.3.2 Demand from food delivery and retail-ready meals

- 4.2.4 CHALLENGES

- 4.2.4.1 Recyclability of multi-layer aluminum foils

- 4.2.4.2 Economic imbalance of trade

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 RELIABLE, SCALABLE RECYCLING FOR THIN FOIL & MULTILAYER LAMINATE STREAMS

- 4.3.2 MONO-MATERIAL FOIL SOLUTIONS THAT ENABLE SIMPLE RECYCLING

- 4.3.3 PREMIUM AESTHETICS WITH SUSTAINABLE DISPOSAL PATHWAYS

- 4.3.4 SMART FOIL LIDS FOR FRESHNESS INDICATORS AND DIGITAL ENGAGEMENT

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.4.2.1 Food Beverages

- 4.4.2.2 Food Pharma

- 4.4.2.3 Food Personal Care & Cosmetics

- 4.4.2.4 Beverage Pharma

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

- 4.5.1.1 Expansion of thin-gauge aluminum foil capacity by RusAL

- 4.5.1.2 Plastic-free aluminum-paper foil for sustainable wine & spirits by Amcor plc

- 4.5.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS

- 4.5.2.1 Constantia Flexibles' acquisition of Drukpol Flexo

- 4.5.2.2 Reynolds Consumer Products' new product launch

- 4.5.3 TIER 3 PLAYERS: STRENGTHENS ECO-EFFICIENCY WITH ZERO WASTE MILESTONE

- 4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION

5 INDUSTRY TRENDS

- 5.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.2 PRICING ANALYSIS

- 5.2.1 PRICING ANALYSIS, BY KEY PLAYER

- 5.2.2 PRICING ANALYSIS, BY REGION

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT DATA (HS CODE 7607)

- 5.5.2 EXPORT DATA (HS CODE 7607)

- 5.6 KEY CONFERENCES AND EVENTS, 2025

- 5.7 PORTER'S FIVE FORCES' ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CONSTANTIA FLEXIBLES: REINVENTING BEVERAGE INNOVATION THROUGH RECYCLABLE ALUMINUM CAPSULES

- 5.8.2 HOLOFLEX: ADVANCED ANTI-COUNTERFEIT FOIL TECHNOLOGY THAT ELIMINATES MARKET FAKE DRUGS

- 5.8.3 AMCOR PLC: DEVELOPMENT OF PLASTIC-FREE ALUMINUM/PAPER FOIL

- 5.9 MACROECONOMIC ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 GDP TRENDS AND FORECASTS

- 5.9.3 RISING POPULATION AND URBANIZATION

- 5.9.4 TRENDS IN GLOBAL FOOD & BEVERAGE INDUSTRY

- 5.9.5 TRENDS IN GLOBAL PERSONAL CARE & COSMETIC INDUSTRY

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 IMPACT OF 2025 US TARIFF ON ALUMINUM FOIL PACKAGING MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 1.16.2. KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 KEY IMPACT ON VARIOUS COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 END-USE SECTOR IMPACT

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 ANTIMICROBIAL FOILS

- 6.1.2 PRINTING METHODOLOGIES

- 6.1.2.1 Rotogravure

- 6.1.2.2 Lithography

- 6.1.2.3 Flexography

- 6.1.2.4 Digital printing

- 6.1.2.5 High barrier foil technology

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 NANOTECHNOLOGY

- 6.2.2 COLD-FORMING ALUMINUM FOIL

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 LIGHTWEIGHTING VIA HIGHER-STRENGTH ALLOY FOILS

- 6.3.2 ADVANCED RECYCLING VALUE CHAINS & CIRCULAR-ECONOMY SYSTEMS

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027) | TRANSITION & DIGITAL ADOPTION PHASE

- 6.4.2 MID-TERM (2027-2030): CIRCULARITY SCALING, MATERIAL RE-ENGINEERING, & ADVANCED AUTOMATION PHASE

- 6.4.3 LONG-TERM (2030-2035+): FULLY SMART CIRCULAR FOIL ECOSYSTEM, NEXT-GEN COATINGS, & NET-ZERO PRODUCTION PHASE

- 6.5 PATENT ANALYSIS

- 6.5.1 INTRODUCTION

- 6.5.2 APPROACH

- 6.5.3 DOCUMENT TYPE

- 6.5.4 JURISDICTION ANALYSIS

- 6.5.5 TOP APPLICANTS

- 6.6 FUTURE APPLICATIONS

- 6.6.1 SMART SENSOR-INTEGRATED FOIL PACKAGING (IOT/CONDITION MONITORING)

- 6.6.2 PHARMACEUTICAL MICRO-DOSING & SMART-DISPENSING FOIL BLISTER SYSTEMS

- 6.6.3 SHAPE-MORPHING & ADAPTIVE ALUMINUM FOIL PACKAGING (PROGRAMMABLE PACKAGING)

- 6.6.4 HIGH-BARRIER RECYCLABLE FOIL-BASED MONO-MATERIAL STRUCTURES

- 6.7 IMPACT OF AI/GEN AI ON ALUMINUM FOIL PACKAGING MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 BEST PRACTICES IN E-COMMERCE PACKAGING

- 6.7.3 CASE STUDIES OF AI IMPLEMENTATION IN ALUMINUM FOIL PACKAGING MARKET

- 6.7.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ALUMINUM FOIL PACKAGING MARKET

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CIRCULAR ECONOMY AND RECYCLING INITIATIVES

- 7.2.2 CIRCULAR POLICY MANDATES

- 7.2.3 CORPORATE INNOVATION AND CIRCULAR SOLUTIONS

- 7.2.4 RECYCLING PERFORMANCE ALLIANCES

- 7.2.5 DESIGN-FOR-CIRCULARITY

- 7.2.6 DIGITAL TRACEABILITY AND CIRCULAR MARKET MECHANISMS

- 7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.4 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 7.5 DECISION-MAKING PROCESS

- 7.6 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.6.2 BUYING CRITERIA

- 7.7 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.8 UNMET NEEDS FROM VARIOUS APPLICATIONS

- 7.9 MARKET PROFITABILITY

- 7.9.1 REVENUE POTENTIAL

- 7.9.2 COST DYNAMICS

- 7.9.3 MARGIN OPPORTUNITIES BY END-USE APPLICATIONS

- 7.9.3.1 Food (Medium to High Margins)

- 7.9.3.2 Beverages (Medium Margins)

- 7.9.3.3 Pharmaceuticals (High Margins)

- 7.9.3.4 Personal Care & Cosmetics (Medium to High Margins)

8 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 BAGS & POUCHES

- 8.2.1 HIGH BARRIER PROTECTION, LIGHTWEIGHT CONSTRUCTION, AND FLEXIBLE FORMABILITY TO DRIVE ADOPTION

- 8.3 WRAPS & ROLLS

- 8.3.1 THERMAL STABILITY, BARRIER PROTECTION, AND RISING HOUSEHOLD USAGE TO DRIVE DEMAND

- 8.4 BLISTERS

- 8.4.1 GROWTH IN PHARMACEUTICAL INDUSTRY, REGULATORY FOCUS, AND UNIT-DOSE PACKAGING ADOPTION TO ACCELERATE DEMAND

- 8.5 CONTAINERS

- 8.5.1 RISING PREFERENCE FOR LIGHTWEIGHT RIGID FORMATS, ENHANCED HYGIENE STANDARDS, AND RECYCLING BENEFITS TO DRIVE ADOPTION

- 8.6 OTHER PRODUCT TYPES

9 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 FOOD

- 9.2.1 RISING PACKAGED FOOD PRODUCTION TO DRIVE DEMAND FOR ALUMINUM FOIL PACKAGING

- 9.3 BEVERAGES

- 9.3.1 GROWING BEVERAGE PRODUCTION AND SUSTAINABILITY FOCUS TO DRIVE DEMAND

- 9.4 PHARMACEUTICALS

- 9.4.1 GROWTH IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- 9.5 PERSONAL CARE & COSMETICS

- 9.5.1 GROWING PERSONAL CARE & COSMETICS INDUSTRY TO DRIVE DEMAND FOR ALUMINUM FOIL PACKAGING

- 9.6 OTHER APPLICATIONS

10 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE

- 10.1 INTRODUCTION

- 10.2 SEMI-RIGID PACKAGING

- 10.2.1 RISING DEMAND FOR HEAT-RESISTANT, HIGH-BARRIER, AND DURABLE SEMI-RIGID FOIL PACKAGING TO DRIVE MARKET

- 10.3 FLEXIBLE PACKAGING

- 10.3.1 RISING ADOPTION OF FLEXIBLE, HIGH-BARRIER, AND RECYCLABLE ALUMINUM FOIL SOLUTIONS TO PROPEL MARKET

- 10.4 OTHER PACKAGING TYPES

11 ALUMINUM FOIL PACKAGING MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 ROLLED FOIL

- 11.2.1 RISING DEMAND FOR LIGHTWEIGHT, HIGH-BARRIER, AND RECYCLABLE SOLUTIONS TO DRIVE GROWTH

- 11.3 BACKED FOIL

- 11.3.1 GROWING DEMAND FOR HIGH-BARRIER, DURABLE, AND CUSTOMIZABLE BACKED FOILS TO DRIVE MARKET

- 11.4 OTHER TYPES

12 ALUMINUM FOIL PACKAGING MARKET, BY THICKNESS

- 12.1 INTRODUCTION

- 12.2 7-50 MICRONS

- 12.3 51-100 MICRONS

- 12.4 OTHERS

13 ALUMINUM FOIL PACKAGING MARKET, BY TECHNOLOGY

- 13.1 INTRODUCTION

- 13.2 COLD FORM FOIL

- 13.3 HOT SEAL FOIL

14 ALUMINUM FOIL PACKAGING MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 CHINA

- 14.2.1.1 Rapid expansion of food delivery services to propel market

- 14.2.2 INDIA

- 14.2.2.1 Rapid growth in food delivery, digital commerce, and healthcare spending to drive demand

- 14.2.3 JAPAN

- 14.2.3.1 Rising packaging shipments, sustainability focus, and convenience-driven food consumption support packaging demand

- 14.2.4 AUSTRALIA

- 14.2.4.1 Government initiatives toward sustainability and convenient packaging to drive market

- 14.2.5 REST OF ASIA PACIFIC

- 14.2.1 CHINA

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Government initiatives toward circular economy to boost market

- 14.3.2 ITALY

- 14.3.2.1 Rising demand from retail, food, and healthcare industries to drive market

- 14.3.3 UK

- 14.3.3.1 Growth of healthcare industry to offer lucrative opportunities

- 14.3.4 FRANCE

- 14.3.4.1 Increase in retail sales of packaged foods to drive market

- 14.3.5 SPAIN

- 14.3.5.1 Increasing demand for aluminum foil in various end-use industries to propel market

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 NORTH AMERICA

- 14.4.1 US

- 14.4.1.1 Rising consumption of packaged food and large pharmaceutical industry to propel market

- 14.4.2 CANADA

- 14.4.2.1 Growing household expenditure on food and personal care products to accelerate demand

- 14.4.3 MEXICO

- 14.4.3.1 Rising food and personal care consumption to support market growth

- 14.4.1 US

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.5.1.1 Saudi Arabia

- 14.5.1.1.1 Increasing opportunities in end-use industries to fuel market

- 14.5.1.2 UAE

- 14.5.1.2.1 Rising food safety standards and convenience food trends to propel market

- 14.5.1.3 Rest of GCC countries

- 14.5.1.1 Saudi Arabia

- 14.5.2 SOUTH AFRICA

- 14.5.2.1 Growing local generics production, expanding F&B sector, and healthcare packaging regulation support to drive demand

- 14.5.3 REST OF MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.6 SOUTH AMERICA

- 14.6.1 BRAZIL

- 14.6.1.1 Strong demand from food, beverage, and healthcare sectors to drive demand

- 14.6.2 ARGENTINA

- 14.6.2.1 Dynamic food and personal care industries to support market growth

- 14.6.3 REST OF SOUTH AMERICA

- 14.6.1 BRAZIL

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES

- 15.3 MARKET SHARE ANALYSIS

- 15.4 REVENUE ANALYSIS OF KEY PLAYERS

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.6 BRAND COMPARISON

- 15.6.1 RUSAL (ALUMINUM FOIL PRODUCTS)

- 15.6.2 HULAMIN (PACKAGING FOIL SOLUTIONS)

- 15.6.3 HINDALCO INDUSTRIES LTD. (ALUMINIUM FOIL & CONVERTER PRODUCTS)

- 15.6.4 CHINA HONGQIAO GROUP LIMITED (ALUMINIUM PACKAGING STOCK)

- 15.6.5 AMCOR PLC (ALUMINUM-BASED FLEXIBLE PACKAGING)

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Type footprint

- 15.7.5.4 Product type footprint

- 15.7.5.5 Packaging type footprint

- 15.7.5.6 Thickness footprint

- 15.7.5.7 Technology footprint

- 15.7.5.8 Application footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIOS

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 RUSAL

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 HULAMIN

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 MnM view

- 16.1.2.3.1 Key strengths

- 16.1.2.3.2 Strategic choices

- 16.1.2.3.3 Weaknesses and competitive threats

- 16.1.3 HINDALCO INDUSTRIES LTD.

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 CHINA HONGQIAO GROUP LIMITED

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 AMCOR PLC

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 KIBAR HOLDING

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Expansions

- 16.1.6.4 MnM view

- 16.1.6.4.1 Key strengths

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 CONSTANTIA FLEXIBLES

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Deals

- 16.1.7.3.2 Expansions

- 16.1.7.4 MnM view

- 16.1.7.4.1 Key strengths

- 16.1.7.4.2 Strategic choices

- 16.1.7.4.3 Weaknesses and competitive threats

- 16.1.8 REYNOLDS CONSUMER PRODUCTS

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches

- 16.1.8.4 MnM view

- 16.1.8.4.1 Key strengths

- 16.1.8.4.2 Strategic choices

- 16.1.8.4.3 Weaknesses and competitive threats

- 16.1.9 GARMCO

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.9.3.2 Expansions

- 16.1.9.4 MnM view

- 16.1.9.4.1 Key strengths

- 16.1.9.4.2 Strategic choices

- 16.1.9.4.3 Weaknesses and competitive threats

- 16.1.10 NOVOLEX

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Deals

- 16.1.10.4 MnM view

- 16.1.10.4.1 Key strengths

- 16.1.10.4.2 Strategic choices

- 16.1.10.4.3 Weaknesses and competitive threats

- 16.1.11 RAVIRAJ FOILS LIMITED

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 MnM view

- 16.1.11.3.1 Key strengths

- 16.1.11.3.2 Strategic choices

- 16.1.11.3.3 Weaknesses and competitive threats

- 16.1.1 RUSAL

- 16.2 OTHER PLAYERS

- 16.2.1 PENNY PLATE, LLC

- 16.2.2 JINDAL (INDIA) LIMITED

- 16.2.3 PG FOILS LTD.

- 16.2.4 EUROFOIL LUXEMBOURG SA

- 16.2.5 ALUFOIL PRODUCTS CO.

- 16.2.6 FLEXIFOIL PACKAGING PVT LTD

- 16.2.7 ALIBERICO

- 16.2.8 CARCANO ANTONIO S.P.A.

- 16.2.9 D&W FINE PACK

- 16.2.10 HANDI-FOIL CORPORATION

- 16.2.11 COPPICE

- 16.2.12 SYMETAL

- 16.2.13 WYDA SOUTH AFRICA

- 16.2.14 AMPCO

- 16.2.15 LSKB ALUMINIUM FOILS PVT. LTD.

- 16.2.16 TAKAMUL INDUSTRIES

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.1.2 List of secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key primary participants

- 17.1.2.2 Key data from primary sources

- 17.1.2.3 Breakdown of interviews with experts

- 17.1.2.4 Key industry insights

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 TOP-DOWN APPROACH

- 17.2.2 BOTTOM-UP APPROACH

- 17.3 BASE NUMBER CALCULATION

- 17.3.1 SUPPLY-SIDE APPROACH

- 17.4 GROWTH FORECAST

- 17.5 DATA TRIANGULATION

- 17.6 RESEARCH ASSUMPTIONS

- 17.7 FACTOR ANALYSIS

- 17.8 RESEARCH LIMITATIONS

- 17.9 RISK ASSESSMENT

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USE OF ALUMINUM FOIL PACKAGING IN VARIOUS END-USE INDUSTRIES

- TABLE 2 AVERAGE SELLING PRICE OF ALUMINUM FOIL PACKAGING OFFERED BY KEY PLAYERS, BY PRODUCT TYPE (USD/KG)

- TABLE 3 AVERAGE SELLING PRICE OF ALUMINUM FOIL PACKAGING, BY REGION, 2021-2024 (USD/KG)

- TABLE 4 ALUMINUM FOIL PACKAGING MARKET: ECOSYSTEM

- TABLE 5 IMPORT DATA FOR HS CODE 7607-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 6 EXPORT DATA FOR HS CODE 7607-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 ALUMINUM FOIL PACKAGING: KEY CONFERENCES AND EVENTS, 2025

- TABLE 8 ALUMINUM FOIL PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 WORLD GDP ANNUAL PERCENTAGE CHANGE OF ADVANCED ECONOMIES, 2024-2026

- TABLE 10 WORLD GDP ANNUAL PERCENTAGE CHANGE OF EMERGING MARKET AND DEVELOPING ECONOMIES, 2024-2026

- TABLE 11 ALUMINUM FOIL MARKET: TOTAL NUMBER OF PATENTS, JANUARY 2015-DECEMBER 2024

- TABLE 12 ALUMINUM FOIL PACKAGING MARKET: LIST OF MAJOR PATENTS, 2024

- TABLE 13 TOP USE CASES AND MARKET POTENTIAL

- TABLE 14 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 15 ALUMINUM FOIL PACKAGING MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 GLOBAL INDUSTRY STANDARDS IN ALUMINUM FOIL PACKAGING MARKET

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS IN ALUMINUM FOIL PACKAGING

- TABLE 24 UNMET NEEDS IN ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION

- TABLE 25 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 26 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 27 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 28 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 29 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 30 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 31 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 32 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 33 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 34 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 35 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 36 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 37 ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 38 ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 39 ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 40 ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 41 ALUMINUM FOIL PACKAGING MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 42 ALUMINUM FOIL PACKAGING MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 ALUMINUM FOIL PACKAGING MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 44 ALUMINUM FOIL PACKAGING MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 45 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 46 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 48 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 49 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 50 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 52 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 53 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 54 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 55 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 56 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 57 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 58 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 59 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 60 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 61 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 62 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 64 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 65 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 66 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 67 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 68 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 69 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 70 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 71 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 72 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 73 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 74 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 75 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 76 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 77 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 78 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 79 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 80 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 81 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 82 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 83 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 84 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 85 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 86 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 87 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 88 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 89 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 90 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 91 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 92 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 93 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 94 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 95 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 96 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 97 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 98 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 99 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 100 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 101 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 102 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 103 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 104 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 105 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 106 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 107 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 108 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 109 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 110 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 111 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 112 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 113 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 116 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 117 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 120 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 121 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 124 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 125 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 126 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 127 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 128 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 129 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 130 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 131 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 132 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 133 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 134 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 135 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 136 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 137 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 138 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 139 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 140 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 141 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 142 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 143 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 144 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 145 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 146 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 147 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 148 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 149 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 150 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 151 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 152 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 153 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 154 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 155 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 156 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 157 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 158 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 159 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 160 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 161 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 162 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 163 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 164 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 165 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 166 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 167 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 168 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 169 UK: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 170 UK: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 171 UK: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 172 UK: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 173 UK: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 174 UK: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 175 UK: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 176 UK: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 177 UK: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 178 UK: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 179 UK: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 180 UK: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 181 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 182 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 183 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 184 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 185 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 186 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 187 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 188 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 189 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 190 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 191 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 192 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 193 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 194 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 195 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 196 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 197 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 198 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 199 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 200 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 201 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 202 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 203 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 204 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 205 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 206 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 207 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 208 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 209 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 210 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 211 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 212 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 213 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 214 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 215 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 216 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 217 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 218 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 219 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 220 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 221 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 222 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 223 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 224 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 225 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 226 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 227 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 228 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 229 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 230 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 231 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 232 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 233 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 234 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 235 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 236 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 237 US: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 238 US: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 239 US: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 240 US: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 241 US: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 242 US: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 243 US: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 244 US: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 245 US: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 246 US: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 247 US: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 248 US: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 249 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 250 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 251 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 252 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 253 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 254 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 255 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 256 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 257 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 258 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 259 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 260 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 261 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 262 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 263 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 264 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 265 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 266 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 267 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 268 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 269 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 270 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 271 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 272 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 273 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 276 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 277 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 280 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 281 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 284 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 285 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 286 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 288 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 289 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 290 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 292 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 293 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 294 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 295 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 296 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 297 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 298 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 299 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 300 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 301 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 302 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 303 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 304 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 305 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 306 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 307 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 308 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 309 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 310 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 311 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 312 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 313 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 314 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 315 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 316 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 317 UAE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 318 UAE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 319 UAE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 320 UAE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 321 UAE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 322 UAE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 323 UAE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 324 UAE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 325 UAE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 326 UAE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 327 UAE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 328 UAE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 329 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 330 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 331 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 332 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 333 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 334 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 335 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 336 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 337 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 338 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 339 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 340 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 341 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 342 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 343 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 344 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 345 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 346 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 347 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 348 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 349 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 350 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 351 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 352 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 353 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 354 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 355 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 356 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 357 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 358 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 359 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 360 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 361 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 362 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 363 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 364 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 365 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 366 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 367 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 368 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 369 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 370 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 371 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 372 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 373 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 374 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 375 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 376 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 377 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (USD MILLION)

- TABLE 378 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (USD MILLION)

- TABLE 379 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2021-2023 (KILOTON)

- TABLE 380 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE, 2024-2030 (KILOTON)

- TABLE 381 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 382 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 383 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 384 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 385 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 386 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 387 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 388 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 389 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 390 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 391 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 392 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 393 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 394 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 395 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 396 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 397 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 398 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 399 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 400 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 401 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 402 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 403 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 404 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 405 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 406 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 407 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 408 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 409 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 410 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 411 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 412 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 413 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (USD MILLION)

- TABLE 414 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 415 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021-2023 (KILOTON)

- TABLE 416 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024-2030 (KILOTON)

- TABLE 417 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 418 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 419 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 420 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024-2030 (KILOTON)

- TABLE 421 ALUMINUM FOIL PACKAGING MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-NOVEMBER 2025

- TABLE 422 ALUMINUM FOIL PACKAGING MARKET: DEGREE OF COMPETITION, 2024

- TABLE 423 ALUMINUM FOIL PACKAGING MARKET: REGION FOOTPRINT, 2024

- TABLE 424 ALUMINUM FOIL PACKAGING MARKET: TYPE FOOTPRINT, 2024

- TABLE 425 ALUMINUM FOIL PACKAGING MARKET: PRODUCT TYPE FOOTPRINT, 2024

- TABLE 426 ALUMINUM FOIL PACKAGING MARKET: PACKAGING TYPE FOOTPRINT, 2024

- TABLE 427 ALUMINUM FOIL PACKAGING MARKET: THICKNESS FOOTPRINT, 2024

- TABLE 428 ALUMINUM FOIL PACKAGING MARKET: TECHNOLOGY FOOTPRINT, 2024

- TABLE 429 ALUMINUM FOIL PACKAGING MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 430 ALUMINUM FOIL PACKAGING MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 431 ALUMINUM FOIL PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 432 ALUMINUM FOIL PACKAGING MARKET: PRODUCT LAUNCHES, JANUARY 2020-NOVEMBER 2025

- TABLE 433 ALUMINUM FOIL PACKAGING MARKET: DEALS, JANUARY 2020-NOVEMBER 2025

- TABLE 434 ALUMINUM FOIL PACKAGING MARKET: EXPANSIONS, JANUARY 2020-NOVEMBER 2025

- TABLE 435 RUSAL: COMPANY OVERVIEW

- TABLE 436 RUSAL: PRODUCTS OFFERED

- TABLE 437 RUSAL: PRODUCT LAUNCHES, JANUARY 2020-NOVEMBER 2025

- TABLE 438 RUSAL: DEALS, JANUARY 2020-NOVEMBER 2025

- TABLE 439 RUSAL: EXPANSIONS, JANUARY 2020-NOVEMBER 2025

- TABLE 440 HULAMIN: COMPANY OVERVIEW

- TABLE 441 HULAMIN: PRODUCTS OFFERED

- TABLE 442 HINDALCO INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 443 HINDALCO INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 444 HINDALCO INDUSTRIES LTD.: DEALS, JANUARY 2020-NOVEMBER 2025

- TABLE 445 HINDALCO INDUSTRIES LTD.: EXPANSIONS, JANUARY 2020-NOVEMBER 2025

- TABLE 446 CHINA HONGQIAO GROUP LIMITED: BUSINESS OVERVIEW

- TABLE 447 CHINA HONGQIAO GROUP LIMITED: PRODUCTS OFFERED

- TABLE 448 CHINA HONGQIAO GROUP LIMITED: EXPANSIONS, JANUARY 2020-NOVEMBER 2025

- TABLE 449 AMCOR PLC: COMPANY OVERVIEW

- TABLE 450 AMCOR PLC: PRODUCTS OFFERED

- TABLE 451 AMCOR PLC: PRODUCT LAUNCHES, JANUARY 2020-NOVEMBER 2025

- TABLE 452 AMCOR PLC: DEALS, JANUARY 2020-NOVEMBER 2025

- TABLE 453 AMCOR PLC: EXPANSIONS, JANUARY 2020-NOVEMBER 2025

- TABLE 454 KIBAR HOLDING: COMPANY OVERVIEW

- TABLE 455 KIBAR HOLDING: PRODUCTS OFFERED

- TABLE 456 KIBAR HOLDING: EXPANSIONS, JANUARY 2020-NOVEMBER 2025

- TABLE 457 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW

- TABLE 458 CONSTANTIA FLEXIBLES: PRODUCTS OFFERED

- TABLE 459 CONSTANTIA FLEXIBLES: DEALS, JANUARY 2020-NOVEMBER 2025

- TABLE 460 CONSTANTIA FLEXIBLES: EXPANSIONS, JANUARY 2020-NOVEMBER 2025

- TABLE 461 REYNOLDS CONSUMER PRODUCTS: COMPANY OVERVIEW

- TABLE 462 REYNOLDS CONSUMER PRODUCTS: PRODUCTS OFFERED

- TABLE 463 REYNOLDS CONSUMER PRODUCTS: PRODUCT LAUNCHES, JANUARY 2020-NOVEMBER 2025

- TABLE 464 GARMCO: COMPANY OVERVIEW

- TABLE 465 GARMCO: PRODUCTS OFFERED

- TABLE 466 GARMCO: DEALS, JANUARY 2020-NOVEMBER 2025

- TABLE 467 GARMCO: EXPANSIONS, JANUARY 2020-NOVEMBER 2025

- TABLE 468 NOVOLEX: COMPANY OVERVIEW

- TABLE 469 NOVOLEX: PRODUCTS OFFERED

- TABLE 470 NOVOLEX: DEALS, JANUARY 2020-NOVEMBER 2025

- TABLE 471 RAVIRAJ FOILS LIMITED: COMPANY OVERVIEW

- TABLE 472 RAVIRAJ FOILS LIMITED: PRODUCTS OFFERED

- TABLE 473 PENNY PLATE, LLC: COMPANY OVERVIEW

- TABLE 474 JINDAL (INDIA) LIMITED: COMPANY OVERVIEW

- TABLE 475 PG FOILS LTD.: COMPANY OVERVIEW

- TABLE 476 EUROFOIL LUXEMBOURG SA: COMPANY OVERVIEW

- TABLE 477 ALUFOIL PRODUCTS CO.: COMPANY OVERVIEW

- TABLE 478 FLEXIFOIL PACKAGING PVT LTD: COMPANY OVERVIEW

- TABLE 479 ALIBERICO: COMPANY OVERVIEW

- TABLE 480 CARCANO ANTONIO S.P.A.: COMPANY OVERVIEW

- TABLE 481 D&W FINE PACK: COMPANY OVERVIEW

- TABLE 482 HANDI-FOIL CORPORATION: COMPANY OVERVIEW

- TABLE 483 COPPICE: COMPANY OVERVIEW

- TABLE 484 SYMETAL: COMPANY OVERVIEW

- TABLE 485 WYDA SOUTH AFRICA: COMPANY OVERVIEW

- TABLE 486 AMPCO: COMPANY OVERVIEW

- TABLE 487 LSKB ALUMINIUM FOILS PVT. LTD.: COMPANY OVERVIEW

- TABLE 488 TAKAMUL INDUSTRIES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ALUMINUM FOIL PACKAGING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL ALUMINUM FOIL PACKAGING MARKET, 2021-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ALUMINUM FOIL PACKAGING MARKET (2021-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF ALUMINUM FOIL PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN ALUMINUM FOIL PACKAGING MARKET, 2025-2030

- FIGURE 7 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 8 INCREASING DEMAND IN FOOD AND PHARMACEUTICAL APPLICATIONS TO DRIVE MARKET

- FIGURE 9 BLISTERS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 10 ROLLED FOIL SEGMENT TO LEAD DURING FORECAST PERIOD

- FIGURE 11 FLEXIBLE SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 FOOD APPLICATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 SEMI-RIGID PACKAGING SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC ALUMINUM FOIL PACKAGING MARKET IN 2024

- FIGURE 14 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 15 ALUMINUM FOIL PACKAGING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 GLOBAL PHARMACEUTICAL SALES, 2022-2024 (USD MILLION)

- FIGURE 17 GLOBAL BEAUTY MARKET GROWTH RATE, 2021-2024

- FIGURE 18 GLOBAL B2B ECOMMERCE GROSS MERCHANDISE VOLUME (GMV), 2017-2026 (USD BILLION)

- FIGURE 19 ALUMINUM PRICES, JANUARY-NOVEMBER 2025

- FIGURE 20 RECYCLING RATE OF ALL ALUMINUM PACKAGING IN UK, 2021-2024

- FIGURE 21 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ALUMINUM PACKAGING MANUFACTURERS

- FIGURE 22 AVERAGE SELLING PRICE OF ALUMINUM FOIL PACKAGING OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

- FIGURE 23 ALUMINUM FOIL PACKAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 ALUMINUM FOIL PACKAGING MARKET: ECOSYSTEM

- FIGURE 25 IMPORT DATA FOR HS CODE 7607-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 26 EXPORT DATA FOR HS CODE 7607-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 27 ALUMINUM FOIL PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 GLOBAL POPULATION ESTIMATES IN CITIES, TOWNS, AND RURAL AREAS

- FIGURE 29 PACKAGED FOOD SALES, 2024 VS. 2028 (MILLION TONS)

- FIGURE 30 RETAIL SALES OF COSMETICS IN MAJOR COUNTRIES, 2024 (USD BILLION)

- FIGURE 31 INVESTOR DEAL AND FUNDING TREND, 2021-2024 (USD MILLION)

- FIGURE 32 PATENT ANALYSIS, BY DOCUMENT TYPE, JANUARY 2015-DECEMBER 2024

- FIGURE 33 JURISDICTION OF CHINA REGISTERED HIGHEST PERCENTAGE OF PATENTS, 2015-2024

- FIGURE 34 LIST OF MAJOR PATENTS RELATED TO ALUMINUM FOIL, 2015-2024

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 37 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 38 BAGS & POUCHES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 FOOD SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 40 SEMI-RIGID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 ROLLED FOIL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO REGISTER HIGHEST GROWTH IN ALUMINUM FOIL PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 43 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET SNAPSHOT

- FIGURE 45 EUROPE: ALUMINUM FOIL PACKAGING MARKET SNAPSHOT

- FIGURE 46 ALUMINUM FOIL PACKAGING MARKET SHARE ANALYSIS, 2024

- FIGURE 47 REVENUE ANALYSIS OF KEY COMPANIES IN ALUMINUM FOIL PACKAGING MARKET

- FIGURE 48 ALUMINUM FOIL PACKAGING MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 49 ALUMINUM FOIL PACKAGING MARKET: EV/EBITDA RATIO, 2024

- FIGURE 50 ALUMINUM FOIL PACKAGING MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA, 2024

- FIGURE 51 ALUMINUM FOIL PACKAGING MARKET: BRAND COMPARISON

- FIGURE 52 ALUMINUM FOIL PACKAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 ALUMINUM FOIL PACKAGING MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 54 ALUMINUM FOIL PACKAGING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 RUSAL: COMPANY SNAPSHOT

- FIGURE 56 HULAMIN: COMPANY SNAPSHOT

- FIGURE 57 HINDALCO INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 58 CHINA HONGQIAO GROUP LIMITED: COMPANY SNAPSHOT

- FIGURE 59 AMCOR PLC: COMPANY SNAPSHOT

- FIGURE 60 REYNOLDS CONSUMER PRODUCTS: COMPANY SNAPSHOT

- FIGURE 61 ALUMINUM FOIL PACKAGING MARKET: RESEARCH DESIGN

- FIGURE 62 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 63 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 64 ALUMINUM FOIL PACKAGING MARKET: APPROACH 1

- FIGURE 65 ALUMINUM FOIL PACKAGING MARKET: DATA TRIANGULATION