PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1927589

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1927589

Optical Sorter Market by Offering (Feed System, Optical System, Image Processing, Separation System), Type (Cameras, NIR, Hyperspectral, XRT), Platform (Belt, Freefall, Lane), Application (Food & Beverages, Recycling) - Global Forecast to 2032

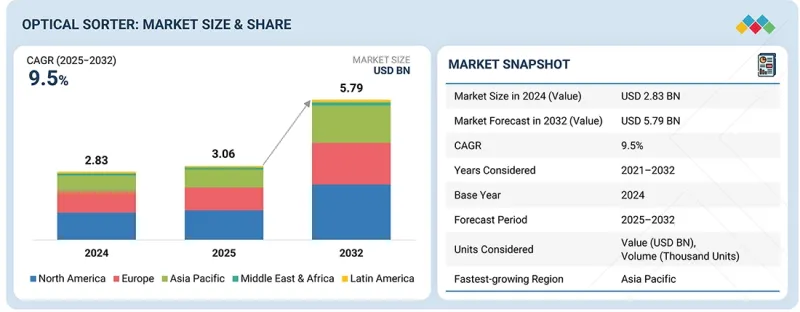

The optical sorter market is projected to grow from USD 3.06 billion in 2025 to USD 5.79 billion by 2032, at a CAGR of 9.5%. The industry has experienced significant advancements in recent years. The increasing focus on automation enhances productivity in the recycling industry.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Type, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

As recycling facilities face growing pressure to handle larger volumes of waste more efficiently and cost-effectively, manual sorting processes are proving insufficient. Optical sorters provide a technologically advanced solution, enabling the high-speed and accurate separation of materials such as plastics, glass, and metals. This improves throughput and boosts material recovery rates and purity, meeting economic and environmental objectives.

"The belt segment is projected to account for the largest market during the forecast period."

By platform, the growth of the belt segment is driven by its ability to handle high volumes with consistent material presentation and superior sorting accuracy. Belt-based systems provide a stable, flat surface that supports precise detection and ejection, making them suitable for a wide range of applications in food processing, recycling, and mining. Additionally, their compatibility with advanced multi-sensor technologies, gentle handling of fragile or irregular materials, and easy integration into automated production lines further reinforce their dominance in the platform segment.

"The recycling segment is projected to record the highest growth during the forecast period."

The growing demand for recycling applications is due to the rising waste generation, stricter recycling regulations, and strong global focus on circular economy initiatives. Governments and municipalities are increasingly investing in advanced sorting technologies to improve material recovery rates, purity levels, and operational efficiency. Optical sorters enable accurate separation of plastics, paper, metals, and e-waste at high speeds, reducing landfill dependency and manual labor, which is driving rapid adoption across recycling facilities.

"North America is projected to account for the largest share in the optical sorter market during the forecast period."

North America is projected to account for the largest share of the optical sorter market primarily due to the region's high adoption of advanced automation technologies, strong presence of large-scale food processing, recycling, and mining industries, and early integration of AI- and sensor-based sorting systems. Countries, such as the US and Canada, have stringent food safety, quality control, and waste management regulations, which drive continuous investment in high-precision optical sorting solutions to improve compliance, reduce contamination, and enhance operational efficiency. The region also benefits from a well-established industrial infrastructure, high labor costs that encourage automation, strong R&D capabilities, and the presence of leading optical sorter manufacturers and technology providers, all of which accelerate technology adoption and large-scale deployments across multiple end-use industries.

Given below is the breakdown of primary interviews:

- By Company Type: Tier 1 - 20%, Tier 2 - 45%, and Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 40%, and Others - 25%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 35%, and RoW - 10%

Prominent players profiled in this report include TOMRA Systems ASA (Norway), Hefei Meyer Optoelectronic Technology INC. (China), Buhler (Switzerland), STEINERT (Germany), Key Technology (US), Sesotec Group (Germany), PELLENC ST (France), Binder+Co (Austria), SATAKE CORPORATION (Japan), and Hefei Taihe Intelligent Technology Co., Ltd (China).

Research Coverage:

The report defines, describes, and forecasts the optical sorter market by offering (Hardware, software & services), type (Traditional cameras, NIR sorters, hyperspectral cameras & combined sorters, lasers, other types), platform (Belt, freefall, lane, hybrid), application (Food & beverages, recycling, mining, pharmaceutical, other applications), and region (North America, Europe, Asia Pacific, and RoW). It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market's growth. Additionally, it analyzes competitive developments, including acquisitions, product launches, expansions, and actions taken by key players to grow in the market.

Reasons to Buy This Report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue for the overall optical sorter market and its subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market's pulse and provide information on key drivers, restraints, opportunities, and challenges.

The report provides insights into the following points:

- Analysis of Key Drivers (Rising deployment of sustainable packaging solutions, high emphasis on environmental and sustainability goals), restraints (Low defect-detection accuracy or sensitivity, integration with IoT and AI technologies), opportunities (Implementation of stringent waste management regulations), and challenges (Limitations of infrared and other sorting technologies) in the optical sorter market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the optical sorter market

- Market Development: Comprehensive information about lucrative markets across various regions

- Market Diversification: Exhaustive information about products launched, untapped geographies, recent developments, and investments in the optical sorter market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players, including TOMRA Systems ASA (Norway), Hefei Meyer Optoelectronic Technology INC. (China), Buhler (Switzerland), STEINERT (Germany), and Key Technology (US) in the optical sorter market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN OPTICAL SORTER MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OPTICAL SORTER MARKET

- 3.2 OPTICAL SORTER MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

- 3.3 OPTICAL SORTER MARKET IN NORTH AMERICA, BY APPLICATION

- 3.4 OPTICAL SORTER MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Growing focus on automation to increase productivity in recycling industry

- 4.2.1.2 Rising deployment of sustainable packaging solutions

- 4.2.1.3 High emphasis on environmental and sustainability goals

- 4.2.2 RESTRAINTS

- 4.2.2.1 Requirement for high upfront investment

- 4.2.2.2 Low defect-detection accuracy or sensitivity

- 4.2.2.3 Issues in sorting plastic waste

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rapid advances in detection and imaging technologies

- 4.2.3.2 Implementation of stringent waste management regulations

- 4.2.3.3 Integration with IoT and AI technologies

- 4.2.4 CHALLENGES

- 4.2.4.1 Limitations of infrared and other sorting technologies

- 4.2.4.2 Disrupted supply chains and consumer health concerns

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL RECYCLING INDUSTRY

- 5.3.4 TRENDS IN GLOBAL FOOD & BEVERAGES INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 PRICING RANGE OF OPTICAL SORTERS, BY RECYCLING APPLICATION, 2024

- 5.6.2 PRICING TREND OF OPTICAL SORTERS, BY APPLICATION, 2021-2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF OPTICAL SORTERS, BY REGION, 2021-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 843710)

- 5.7.2 EXPORT SCENARIO (HS CODE 843710)

- 5.8 KEY CONFERENCES AND EVENTS, 2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ANDEAN VALLEY ADOPTS BUHLER'S SORTEX OPTICAL- SORTING SOLUTION TO OPTIMIZE QUINOA PROCESSING

- 5.11.2 STEINBEIS POLYVERT USES SESOTEC'S ADVANCED SORTING TECHNOLOGY TO PRODUCE HIGH-QUALITY RECYCLED GRANULATE

- 5.11.3 ALBA AND HEFEI MEYER OPTOELECTRONIC TECHNOLOGY JOIN HANDS TO RECYCLE FOOD-GRADE RPET USING SORTING MACHINES

- 5.11.4 CIRREC AND TOMRA PARTNER TO INSTALL ADVANCED FLAKE SORTING UNITS TO ENABLE FINE POLYMER AND COLOR SEPARATION

- 5.11.5 PENN WASTE LEVERAGES PELLENC ST SORTERS TO ENHANCE OPERATIONAL THROUGHPUT

- 5.12 IMPACT OF 2025 US TARIFF - OPTICAL SORTER MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRIES/REGIONS

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON APPLICATIONS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 NEAR-INFRARED (NIR) SPECTROSCOPY

- 6.1.2 HIGH-RESOLUTION CAMERA SYSTEMS

- 6.1.3 AI-POWERED IMAGE ANALYTICS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ROBOTIC EJECTION SYSTEMS

- 6.2.2 AUTOMATED CONVEYOR SYSTEMS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 X-RAY SORTING SYSTEMS

- 6.3.2 HYPERSPECTRAL IMAGING

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): AI ENABLED ARCHITECTURE OPTIMIZATION AND CLOUD INTEGRATION

- 6.4.2 MID-TERM (2027-2030): HETEROGENEOUS INTEGRATION & DESIGN ECOSYSTEM EXPANSION

- 6.4.3 LONG-TERM (2030-2035+): UNIVERSAL RECONFIGURABLE COMPUTING AND SYSTEM-LEVEL CONVERGENCE

- 6.5 PATENT ANALYSIS, 2015-2024

- 6.6 IMPACT OF AI/GEN AI ON OPTICAL SORTER MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES FOLLOWED BY OEMS IN OPTICAL SORTER MARKET

- 6.6.3 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION IN OPTICAL SORTER MARKET

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI/GEN AI-INTEGRATED OPTICAL SORTERS

7 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 STANDARDS

- 7.1.3 GOVERNMENT REGULATIONS

- 7.1.4 CERTIFICATIONS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS APPLICATIONS

9 OPTICAL SORTER TECHNOLOGIES

- 9.1 INTRODUCTION

- 9.2 HYPERSPECTRAL IMAGING

- 9.3 RED, GREEN, AND BLUE (RGB) IMAGING

- 9.4 X-RAY SORTING

- 9.5 OTHER TECHNOLOGIES

10 OVERVIEW OF OPTICAL SORTER THROUGHPUT

- 10.1 INTRODUCTION

- 10.2 <1 TON/HOUR (SMALL-SCALE)

- 10.3 1-5 TONS/HOUR (MEDIUM-SCALE)

- 10.4 6-20 TONS/HOUR (LARGE-SCALE)

- 10.5 >20 TONS/HOUR (MEGA-SCALE)

11 OPTICAL SORTER MARKET, BY OFFERING

- 11.1 INTRODUCTION

- 11.2 HARDWARE

- 11.2.1 ABILITY TO ENSURE SUPERIOR DETECTION AND REMOVAL OF CONTAMINANTS IN INDUSTRIES TO SPUR DEMAND

- 11.2.2 FEED SYSTEMS

- 11.2.3 OPTICAL SYSTEMS

- 11.2.4 IMAGE PROCESSING UNITS

- 11.2.5 SEPARATION SYSTEMS

- 11.3 SOFTWARE & SERVICES

- 11.3.1 RAPID INTEGRATION WITH INDUSTRIAL IOT PLATFORMS TO BOLSTER SEGMENTAL GROWTH

- 11.4 CLASSIFICATION BASED ON SCALE OF END USERS

- 11.4.1 LARGE-SCALE OPERATIONS

- 11.4.2 SMALL- AND MEDIUM-SCALE OPERATIONS

12 OPTICAL SORTER MARKET, BY TYPE

- 12.1 INTRODUCTION

- 12.2 TRADITIONAL CAMERAS

- 12.2.1 COST EFFICIENCY AND SIMPLICITY ATTRIBUTES TO FUEL SEGMENTAL GROWTH

- 12.3 NIR SORTERS

- 12.3.1 HIGH DEMAND FROM MODERN RECYCLING FACILITIES TO BOLSTER SEGMENTAL GROWTH

- 12.4 HYPERSPECTRAL CAMERAS & COMBINED SORTERS

- 12.4.1 RISING NEED TO ACCURATELY PROCESS COMPLEX WASTE STREAMS TO AUGMENT SEGMENTAL GROWTH

- 12.5 LASERS

- 12.5.1 FOCUS ON MEETING STRINGENT QUALITY STANDARDS IN RECYCLING OPERATIONS TO BOOST SEGMENTAL GROWTH

- 12.6 OTHER TYPES

13 OPTICAL SORTER MARKET, BY PLATFORM

- 13.1 INTRODUCTION

- 13.2 BELT

- 13.2.1 GROWING EMPHASIS ON ENERGY-EFFICIENT OPERATIONS AND DOWNTIME REDUCTION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 13.3 FREEFALL

- 13.3.1 RISING AUTOMATION IN RECYCLING INDUSTRIES TO EXPEDITE SEGMENTAL GROWTH

- 13.4 LANE

- 13.4.1 INCREASING USE IN FOOD PROCESSING TO ACCELERATE SEGMENTAL GROWTH

- 13.5 HYBRID

- 13.5.1 INCREASING WASTE COMPLEXITY, REGULATORY PRESSURES, AND CORPORATE SUSTAINABILITY TARGETS TO SPUR DEMAND

14 OPTICAL SORTER MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 FOOD & BEVERAGE

- 14.2.1 VEGETABLES & FRUITS

- 14.2.1.1 Focus on minimizing waste and complying with stringent safety regulations to fuel segmental growth

- 14.2.2 DRIED FRUITS & NUTS

- 14.2.2.1 Increasing consumption of high-purity healthy snacks to augment segmental growth

- 14.2.3 MEATS & SEAFOODS

- 14.2.3.1 Shift toward packaged, processed, and ready-to-cook products to foster segmental growth

- 14.2.4 GRAINS, CEREALS & PULSES

- 14.2.4.1 Increasing consumer preference for clean-label packaged staples to expedite segmental growth

- 14.2.5 DAIRY PRODUCTS

- 14.2.5.1 Rising need to detect impurities, discoloration, and foreign particles to augment segmental growth

- 14.2.6 SPICES

- 14.2.6.1 Requirement to meet stringent quality certifications, residue safety standards, and uniform color grading to drive market

- 14.2.7 PROCESSED FOODS

- 14.2.7.1 Mounting demand for convenience foods and frozen meals to bolster segmental growth

- 14.2.1 VEGETABLES & FRUITS

- 14.3 RECYCLING

- 14.3.1 PLASTICS

- 14.3.1.1 Rising need for high-purity recycled products to accelerate segmental growth

- 14.3.1.2 PET recycling

- 14.3.1.3 Film recycling

- 14.3.1.4 Other plastics

- 14.3.2 PAPERS

- 14.3.2.1 Strong focus on reducing manual labor costs and enhancing throughput to contribute to segmental growth

- 14.3.3 ORGANIC WASTES

- 14.3.3.1 Rising implementation of composting and bioenergy initiatives to boost segmental growth

- 14.3.4 CONSTRUCTION & DEMOLITION

- 14.3.4.1 Increasing government regulations promoting sustainable construction and waste management to drive market

- 14.3.5 E-SCRAPS

- 14.3.5.1 Rapid increase in electronic waste generation and focus on resource recovery to drive market

- 14.3.6 METALS

- 14.3.6.1 High emphasis on enhancing recycling efficiency to facilitate segmental growth

- 14.3.6.2 WEEE sorting

- 14.3.6.3 ASR sorting

- 14.3.6.4 Aluminum recycling

- 14.3.7 GLASS

- 14.3.7.1 Utilization of high-precision sensor technology to augment segmental growth

- 14.3.8 WASTES

- 14.3.8.1 Need to comply with environmental regulations to boost segmental growth

- 14.3.1 PLASTICS

- 14.4 MINING

- 14.4.1 INDUSTRIAL MINERALS

- 14.4.1.1 Reliance on advanced technologies to improve downstream processing yields to foster segmental growth

- 14.4.2 PRECIOUS METALS

- 14.4.2.1 Increasing extraction efficiency requirements to accelerate segmental growth

- 14.4.3 OTHER MINING APPLICATIONS

- 14.4.1 INDUSTRIAL MINERALS

- 14.5 PHARMACEUTICAL

- 14.5.1 TABLET & CAPSULE INSPECTION

- 14.5.1.1 Deployment of innovative technologies to detect micro-defects to fuel segmental growth

- 14.5.2 PACKAGING INSPECTION

- 14.5.2.1 Growing need for automated packaging verification to meet safety and serialization regulations to drive market

- 14.5.3 MEDICAL DEVICE COMPONENT SORTING

- 14.5.3.1 Rising production of precision devices requiring high-accuracy component validation to boost segmental growth

- 14.5.4 DRUG SUBSTANCE PURIFICATION

- 14.5.4.1 Emphasis on cleaner purification streams and reducing downstream filtration burdens to expedite segmental growth

- 14.5.1 TABLET & CAPSULE INSPECTION

- 14.6 OTHER APPLICATIONS

15 OPTICAL SORTER MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 15.2.2 US

- 15.2.2.1 Increasing waste generation and environmental goals to bolster market growth

- 15.2.3 CANADA

- 15.2.3.1 High pressure to address plastic pollution to accelerate market growth

- 15.2.4 MEXICO

- 15.2.4.1 Evolving regulatory frameworks to curb waste to boost market growth

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 15.3.2 UK

- 15.3.2.1 Rising regulatory pressure on waste management to accelerate market growth

- 15.3.3 GERMANY

- 15.3.3.1 Rapid industrial innovation to contribute to market growth

- 15.3.4 FRANCE

- 15.3.4.1 Increasing urban populations and evolving lifestyles to augment market growth

- 15.3.5 SPAIN

- 15.3.5.1 Mounting investment in recycling initiatives to expedite market growth

- 15.3.6 ITALY

- 15.3.6.1 High expertise in advanced plastic-recycling technologies to boost market growth

- 15.3.7 POLAND

- 15.3.7.1 Strong focus on meeting hygiene, quality control, and throughput requirements to fuel market growth

- 15.3.8 NORDICS

- 15.3.8.1 Regulatory frameworks and circular economy policies to accelerate market growth

- 15.3.9 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 15.4.2 CHINA

- 15.4.2.1 Rapid industrialization and domestic plastic recycling rate to augment market growth

- 15.4.3 JAPAN

- 15.4.3.1 Increasing need to minimize errors and enhance efficiency in industries to drive market

- 15.4.4 SOUTH KOREA

- 15.4.4.1 Government policies to provide long-term, low-interest loans to small recycling firms to fuel market growth

- 15.4.5 INDIA

- 15.4.5.1 Mounting demand for fast-moving consumer goods to bolster market growth

- 15.4.6 AUSTRALIA

- 15.4.6.1 Growing emphasis on effective waste management to expedite market growth

- 15.4.7 INDONESIA

- 15.4.7.1 Strong focus on development of recycling infrastructure to accelerate market growth

- 15.4.8 MALAYSIA

- 15.4.8.1 Shift preference toward advanced recycling to contribute to market growth

- 15.4.9 THAILAND

- 15.4.9.1 High commitment to increase recycling volumes to drive market

- 15.4.10 VIETNAM

- 15.4.10.1 Growing awareness of environmental issues and regulatory pressure to expedite market growth

- 15.4.11 REST OF ASIA PACIFIC

- 15.5 ROW

- 15.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 15.5.2 MIDDLE EAST

- 15.5.2.1 Bahrain

- 15.5.2.1.1 Strong focus on improving waste management ecosystem to facilitate market growth

- 15.5.2.2 Kuwait

- 15.5.2.2.1 Growing awareness of food safety and quality standards to boost market growth

- 15.5.2.3 Oman

- 15.5.2.3.1 Increasing focus on food quality and safety to expedite market growth

- 15.5.2.4 Qatar

- 15.5.2.4.1 Greater emphasis on productivity, quality assurance, and streamlined operations in industries to drive market

- 15.5.2.5 Saudi Arabia

- 15.5.2.5.1 Rising adoption of automation technologies to augment market growth

- 15.5.2.6 UAE

- 15.5.2.6.1 Sustainability, advanced recycling, and automation targets to bolster market growth

- 15.5.2.7 Rest of Middle East

- 15.5.2.1 Bahrain

- 15.5.3 AFRICA

- 15.5.3.1 South Africa

- 15.5.3.1.1 Emergence as major producer and global exporter of precious minerals to drive market

- 15.5.3.2 Other African countries

- 15.5.3.1 South Africa

- 15.5.4 SOUTH AMERICA

- 15.5.4.1 Brazil

- 15.5.4.1.1 Rise in plastic waste production to boost market growth

- 15.5.4.2 Argentina

- 15.5.4.2.1 Growing demand for recycled plastic products to expedite market growth

- 15.5.4.3 Rest of South America

- 15.5.4.1 Brazil

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2023-SEPTEMBER 2025

- 16.3 REVENUE ANALYSIS, 2020-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Application footprint

- 16.7.5.4 Type footprint

- 16.7.5.5 Offering footprint

- 16.7.5.6 Platform footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.8.5.1 Detailed list of startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 BUHLER

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Expansions

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses/Competitive threats

- 17.1.2 TOMRA SYSTEMS ASA

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Expansions

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths/Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses/Competitive threats

- 17.1.3 STEINERT

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Expansions

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses/Competitive threats

- 17.1.4 SESOTEC GROUP

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses/Competitive threats

- 17.1.5 PELLENC ST

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Expansions

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses/Competitive threats

- 17.1.6 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.6.3.2 Expansions

- 17.1.7 BINDER+CO

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.8 SATAKE CORPORATION

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.8.3.2 Deals

- 17.1.9 HEFEI TAIHE INTELLIGENT TECHNOLOGY CO., LTD.

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.10 CP MANUFACTURING, LLC

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.10.3.2 Deals

- 17.1.10.3.3 Expansions

- 17.1.11 REDWAVE

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches

- 17.1.11.3.2 Deals

- 17.1.12 KEY TECHNOLOGY

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches

- 17.1.12.3.2 Deals

- 17.1.1 BUHLER

- 17.2 OTHER PLAYERS

- 17.2.1 NATIONAL RECOVERY TECHNOLOGIES, LLC

- 17.2.2 RAYTEC VISION SPA

- 17.2.3 ANGELON

- 17.2.4 MAF RODA AGROBOTIC

- 17.2.5 NEWTEC A/S

- 17.2.6 CIMBRIA

- 17.2.7 DAEWON GSI

- 17.2.8 ELICA ASM

- 17.2.9 TECHIK INSTRUMENT

- 17.2.10 ALLGAIER WERKE

- 17.2.11 UNITEC S.P.A.

- 17.2.12 AWETA

- 17.2.13 MACHINEX INDUSTRIES INC.

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 List of key secondary sources

- 18.1.1.2 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 List of primary interview participants

- 18.1.2.2 Key data from primary sources

- 18.1.2.3 Breakdown of primaries

- 18.1.2.4 Key industry insights

- 18.1.3 SECONDARY AND PRIMARY RESEARCH

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 18.2.2 TOP-DOWN APPROACH

- 18.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 18.2.1 BOTTOM-UP APPROACH

- 18.3 MARKET FORECAST APPROACH

- 18.3.1 SUPPLY SIDE

- 18.3.2 DEMAND SIDE

- 18.4 DATA TRIANGULATION

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 RESEARCH LIMITATIONS

- 18.7 RISK ANALYSIS

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

List of Tables

- TABLE 1 OPTICAL SORTER MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 OPTICAL SORTER MARKET: SUMMARY OF CHANGES

- TABLE 3 OPTICAL SORTER MARKET: STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES

- TABLE 5 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 6 ROLE OF COMPANIES IN OPTICAL SORTER ECOSYSTEM

- TABLE 7 PRICING RANGE OF OPTICAL SORTERS, BY RECYCLING APPLICATION, 2024 (USD)

- TABLE 8 PRICING TREND OF OPTICAL SORTERS FOR VARIOUS APPLICATIONS, 2021-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF OPTICAL SORTERS, BY REGION, 2021-2024 (USD)

- TABLE 10 IMPORT DATA FOR HS CODE 843710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT DATA FOR HS CODE 843710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 LIST OF CONFERENCES AND EVENTS, 2026

- TABLE 13 BUHLER'S SORTEX OPTICAL-SORTING SOLUTION SPEEDS UP QUINOA PROCESSING IN ANDEAN VALLEY

- TABLE 14 SESOTEC'S ADVANCED SORTING TECHNOLOGY HELPS STEINBEIS POLYVERT GENERATE QUALITY RECYCLED GRANULATE

- TABLE 15 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY'S POLYMER SORTING MACHINES SUPPORT ALBA'S FOOD-GRADE RPET RECYCLING BUSINESS

- TABLE 16 TOMRA'S FLAKE SORTING UNITS ASSIST CIRREC IN POLYMER AND COLOR SEPARATION

- TABLE 17 PELLENC ST SORTERS IMPROVE QUALITY OF RECYCLABLE MATERIALS OF PENN WASTE

- TABLE 18 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 19 EXPECTED CHANGE IN PRICES AND IMPACT ON APPLICATIONS DUE TO TARIFFS

- TABLE 20 LIST OF KEY PATENTS, 2024

- TABLE 21 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 22 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION

- TABLE 23 INTERCONNECTED ECOSYSTEM AND IMPACT ON OPTICAL SORTER MARKET PLAYERS

- TABLE 24 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 OPTICAL SORTER STANDARDS

- TABLE 29 OPTICAL SORTER REGULATIONS

- TABLE 30 OPTICAL SORTER CERTIFICATIONS

- TABLE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 32 KEY BUYING CRITERIA FOR THREE APPLICATIONS

- TABLE 33 UNMET NEEDS, BY APPLICATION

- TABLE 34 OPTICAL SORTER MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 35 OPTICAL SORTER MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 36 OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 37 OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 38 TRADITIONAL CAMERAS: OPTICAL SORTER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 39 TRADITIONAL CAMERAS: OPTICAL SORTER MARKET, BY PLATFORM, 2025-2032 (USD MILLION)

- TABLE 40 TRADITIONAL CAMERAS: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 TRADITIONAL CAMERAS: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 42 NIR SORTERS: OPTICAL SORTER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 43 NIR SORTERS: OPTICAL SORTER MARKET, BY PLATFORM, 2025-2032 (USD MILLION)

- TABLE 44 NIR SORTERS: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 45 NIR SORTERS: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 46 HYPERSPECTRAL CAMERAS & COMBINED SORTERS: OPTICAL SORTER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 47 HYPERSPECTRAL CAMERAS & COMBINED SORTERS: OPTICAL SORTER MARKET, BY PLATFORM, 2025-2032 (USD MILLION)

- TABLE 48 HYPERSPECTRAL CAMERAS & COMBINED SORTERS: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 49 HYPERSPECTRAL CAMERAS & COMBINED SORTERS: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 50 LASERS: OPTICAL SORTER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 51 LASERS: OPTICAL SORTER MARKET, BY PLATFORM, 2025-2032 (USD MILLION)

- TABLE 52 LASERS: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 53 LASERS: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 54 OTHER TYPES: OPTICAL SORTER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 55 OTHER TYPES: OPTICAL SORTER MARKET, BY PLATFORM, 2025-2032 (USD MILLION)

- TABLE 56 OTHER TYPES: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 57 OTHER TYPES: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 58 OPTICAL SORTER MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 59 OPTICAL SORTER MARKET, BY PLATFORM, 2025-2032 (USD MILLION)

- TABLE 60 BELT: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 61 BELT: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 62 FREEFALL: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 FREEFALL: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 64 LANE: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 65 LANE: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 66 HYBRID: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 67 HYBRID: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 68 OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 69 OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 70 OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 71 OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 72 FOOD & BEVERAGE: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 73 FOOD & BEVERAGE: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 74 FOOD & BEVERAGE: OPTICAL SORTER MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 75 FOOD & BEVERAGE: OPTICAL SORTER MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 76 FOOD & BEVERAGE: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 FOOD & BEVERAGE: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 78 FOOD & BEVERAGE: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 FOOD & BEVERAGE: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 80 FOOD & BEVERAGE: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 FOOD & BEVERAGE: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 82 FOOD & BEVERAGE: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 FOOD & BEVERAGE: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 84 FOOD & BEVERAGE: OPTICAL SORTER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 FOOD & BEVERAGE: OPTICAL SORTER MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 86 VEGETABLES & FRUITS: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 VEGETABLES & FRUITS: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 88 DRIED FRUITS & NUTS: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 DRIED FRUITS & NUTS: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 MEATS & SEAFOODS: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 MEATS & SEAFOODS: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 GRAINS, CEREALS & PULSES: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 GRAINS, CEREALS & PULSES: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 94 DAIRY PRODUCTS: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 DAIRY PRODUCTS: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 SPICES: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 SPICES: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 98 PROCESSED FOODS: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 PROCESSED FOODS: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 100 RECYCLING: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 101 RECYCLING: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 102 RECYCLING: OPTICAL SORTER MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 103 RECYCLING: OPTICAL SORTER MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 104 RECYCLING: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 RECYCLING: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 106 RECYCLING: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 RECYCLING: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 108 RECYCLING: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 RECYCLING: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 110 RECYCLING: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 RECYCLING: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 112 RECYCLING: OPTICAL SORTER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 RECYCLING: OPTICAL SORTER MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 114 MINING: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 115 MINING: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 116 MINING: OPTICAL SORTER MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 117 MINING: OPTICAL SORTER MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 118 MINING: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 MINING: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 120 MINING: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 MINING: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 122 MINING: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 MINING: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 124 MINING: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 125 MINING: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 126 MINING: OPTICAL SORTER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 MINING: OPTICAL SORTER MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 128 PHARMACEUTICAL: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 129 PHARMACEUTICAL: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 130 PHARMACEUTICAL: OPTICAL SORTER MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 131 PHARMACEUTICAL: OPTICAL SORTER MARKET, BY USE CASE, 2025-2032 (USD MILLION)

- TABLE 132 PHARMACEUTICAL: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 133 PHARMACEUTICAL: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 134 PHARMACEUTICAL: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 135 PHARMACEUTICAL: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 136 PHARMACEUTICAL: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 PHARMACEUTICAL: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 138 PHARMACEUTICAL: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 139 PHARMACEUTICAL: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 140 PHARMACEUTICAL: OPTICAL SORTER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 141 PHARMACEUTICAL: OPTICAL SORTER MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 142 OTHER APPLICATIONS: OPTICAL SORTER MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 143 OTHER APPLICATIONS: OPTICAL SORTER MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 144 OTHER APPLICATIONS: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 145 OTHER APPLICATIONS: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 146 OTHER APPLICATIONS: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 147 OTHER APPLICATIONS: OPTICAL SORTER MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 148 OTHER APPLICATIONS: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 OTHER APPLICATIONS: OPTICAL SORTER MARKET IN EUROPE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 150 OTHER APPLICATIONS: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 OTHER APPLICATIONS: OPTICAL SORTER MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 152 OTHER APPLICATIONS: OPTICAL SORTER MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 153 OTHER APPLICATIONS: OPTICAL SORTER MARKET IN ROW, BY REGION, 2025-2032 (USD MILLION)

- TABLE 154 OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 155 OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 156 NORTH AMERICA: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 157 NORTH AMERICA: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 158 NORTH AMERICA: OPTICAL SORTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 159 NORTH AMERICA: OPTICAL SORTER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 160 US: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 US: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 162 EUROPE: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 163 EUROPE: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 164 EUROPE: OPTICAL SORTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 EUROPE: OPTICAL SORTER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 166 ASIA PACIFIC: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 168 ASIA PACIFIC: OPTICAL SORTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: OPTICAL SORTER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 170 ROW: OPTICAL SORTER MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 171 ROW: OPTICAL SORTER MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 172 ROW: OPTICAL SORTER MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 173 ROW: OPTICAL SORTER MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 174 MIDDLE EAST: OPTICAL SORTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 175 MIDDLE EAST: OPTICAL SORTER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 176 AFRICA: OPTICAL SORTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 177 AFRICA: OPTICAL SORTER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 178 SOUTH AMERICA: OPTICAL SORTER MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 179 SOUTH AMERICA: OPTICAL SORTER MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 180 OPTICAL SORTER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY COMPANIES, JANUARY 2023-SEPTEMBER 2025

- TABLE 181 OPTICAL SORTER MARKET: DEGREE OF COMPETITION, 2024

- TABLE 182 OPTICAL SORTER MARKET: REGION FOOTPRINT

- TABLE 183 OPTICAL SORTER MARKET: APPLICATION FOOTPRINT

- TABLE 184 OPTICAL SORTER MARKET: TYPE FOOTPRINT

- TABLE 185 OPTICAL SORTER MARKET: OFFERING FOOTPRINT

- TABLE 186 OPTICAL SORTER MARKET: PLATFORM FOOTPRINT

- TABLE 187 OPTICAL SORTER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 188 OPTICAL SORTER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 189 OPTICAL SORTER MARKET: PRODUCT LAUNCHES, JANUARY 2023-SEPTEMBER 2025

- TABLE 190 OPTICAL SORTER MARKET: DEALS, JANUARY 2023-SEPTEMBER 2025

- TABLE 191 OPTICAL SORTER MARKET: EXPANSIONS, JANUARY 2023 - SEPTEMBER 2025

- TABLE 192 BUHLER: COMPANY OVERVIEW

- TABLE 193 BUHLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 BUHLER: PRODUCT LAUNCHES

- TABLE 195 BUHLER: DEALS

- TABLE 196 BUHLER: EXPANSIONS

- TABLE 197 TOMRA SYSTEMS ASA: COMPANY OVERVIEW

- TABLE 198 TOMRA SYSTEMS ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 TOMRA SYSTEMS ASA: PRODUCT LAUNCHES

- TABLE 200 TOMRA SYSTEMS ASA: DEALS

- TABLE 201 TOMRA SYSTEMS ASA: EXPANSIONS

- TABLE 202 STEINERT: COMPANY OVERVIEW

- TABLE 203 STEINERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 STEINERT: PRODUCT LAUNCHES

- TABLE 205 STEINERT: DEALS

- TABLE 206 STEINERT: EXPANSIONS

- TABLE 207 SESOTEC GROUP: COMPANY OVERVIEW

- TABLE 208 SESOTEC GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 SESOTEC GROUP: PRODUCT LAUNCHES

- TABLE 210 SESOTEC GROUP: DEALS

- TABLE 211 PELLENC ST: COMPANY OVERVIEW

- TABLE 212 PELLENC ST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 PELLENC ST PRODUCT LAUNCHES

- TABLE 214 PELLENC ST: DEALS

- TABLE 215 PELLENC ST: EXPANSIONS

- TABLE 216 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 217 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 218 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.: DEALS

- TABLE 219 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.: EXPANSIONS

- TABLE 220 BINDER+CO: COMPANY OVERVIEW

- TABLE 221 BINDER+CO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 SATAKE CORPORATION: COMPANY OVERVIEW

- TABLE 223 SATAKE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 SATAKE CORPORATION: PRODUCT LAUNCHES

- TABLE 225 SATAKE CORPORATION: DEALS

- TABLE 226 HEFEI TAIHE INTELLIGENT TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 227 HEFEI TAIHE INTELLIGENT TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 CP MANUFACTURING, LLC: COMPANY OVERVIEW

- TABLE 229 CP MANUFACTURING, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 CP MANUFACTURING, LLC: PRODUCT LAUNCHES

- TABLE 231 CP MANUFACTURING, LLC: DEALS

- TABLE 232 CP MANUFACTURING, LLC: EXPANSIONS

- TABLE 233 REDWAVE: COMPANY OVERVIEW

- TABLE 234 REDWAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 REDWAVE: PRODUCT LAUNCHES

- TABLE 236 REDWAVE: DEALS

- TABLE 237 KEY TECHNOLOGY: COMPANY OVERVIEW

- TABLE 238 KEY TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 KEY TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 240 KEY TECHNOLOGY: DEALS

- TABLE 241 NATIONAL RECOVERY TECHNOLOGIES, LLC: COMPANY OVERVIEW

- TABLE 242 RAYTEC VISION SPA: COMPANY OVERVIEW

- TABLE 243 ANGELON: COMPANY OVERVIEW

- TABLE 244 MAF RODA AGROBOTIC: COMPANY OVERVIEW

- TABLE 245 NEWTEC A/S: COMPANY OVERVIEW

- TABLE 246 CIMBRIA: COMPANY OVERVIEW

- TABLE 247 DAEWON GSI: COMPANY OVERVIEW

- TABLE 248 ELICA ASM: COMPANY OVERVIEW

- TABLE 249 TECHIK INSTRUMENT: COMPANY OVERVIEW

- TABLE 250 ALLGAIER WERKE: COMPANY OVERVIEW

- TABLE 251 UNITEC S.P.A.: COMPANY OVERVIEW

- TABLE 252 AWETA: COMPANY OVERVIEW

- TABLE 253 MACHINEX INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 254 MAJOR SECONDARY SOURCES

- TABLE 255 KEY INDUSTRY EXPERTS FROM DIFFERENT COMPANIES PARTICIPATED IN INTERVIEWS, BY DESIGNATION

- TABLE 256 OPTICAL SORTER MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 OPTICAL SORTER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 OPTICAL SORTER MARKET: DURATION COVERED

- FIGURE 3 OPTICAL SORTER MARKET HIGHLIGHTS AND KEY INSIGHTS

- FIGURE 4 GLOBAL OPTICAL SORTER MARKET, 2025-2032

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN OPTICAL SORTER MARKET, 2023-2025

- FIGURE 6 DISRUPTIVE TRENDS IMPACTING OPTICAL SORTER MARKET GROWTH

- FIGURE 7 HIGH-GROWTH SEGMENTS IN OPTICAL SORTER MARKET, 2025-2032

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 9 IMPLEMENTATION OF RECYCLING MANDATES AND STRINGENT FOOD REGULATIONS TO DRIVE OPTICAL SORTER MARKET

- FIGURE 10 FOOD & BEVERAGE SEGMENT AND US TO DOMINATE NORTH AMERICAN OPTICAL SORTER MARKET IN 2025

- FIGURE 11 FOOD & BEVERAGE SEGMENT TO HOLD LARGEST SHARE OF OPTICAL SORTER MARKET IN NORTH AMERICA IN 2032

- FIGURE 12 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL OPTICAL SORTER MARKET FROM 2025 TO 2032

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 IMPACT ANALYSIS: DRIVERS

- FIGURE 15 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 16 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 17 IMPACT ANALYSIS: CHALLENGES

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 OPTICAL SORTER VALUE CHAIN ANALYSIS

- FIGURE 20 OPTICAL SORTER ECOSYSTEM

- FIGURE 21 PRICING RANGE OF OPTICAL SORTERS FOR RECYCLING APPLICATIONS, 2024

- FIGURE 22 AVERAGE SELLING PRICE TREND OF OPTICAL SORTERS IN VARIOUS REGIONS, 2021-2024

- FIGURE 23 IMPORT DATA FOR HS CODE 843710-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 24 EXPORT DATA FOR HS CODE 843710-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO

- FIGURE 27 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 28 DECISION-MAKING FACTORS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 31 OPTICAL SORTER ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 32 HARDWARE SEGMENT TO HOLD LARGER MARKET SHARE IN 2025 AND 2032

- FIGURE 33 TRADITIONAL CAMERAS SEGMENT TO DOMINATE OPTICAL SORTER MARKET FROM 2025 TO 2032

- FIGURE 34 BELT SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 35 RECYCLING SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2025 TO 2032

- FIGURE 36 NORTH AMERICA TO DOMINATE OPTICAL SORTER MARKET BETWEEN 2025 AND 2030

- FIGURE 37 NORTH AMERICA: OPTICAL SORTER MARKET SNAPSHOT

- FIGURE 38 EUROPE: OPTICAL SORTER MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: OPTICAL SORTER MARKET SNAPSHOT

- FIGURE 40 OPTICAL SORTER MARKET: REVENUE ANALYSIS OF TOP TWO PLAYERS, 2020-2024

- FIGURE 41 MARKET SHARE ANALYSIS OF COMPANIES OFFERING OPTICAL SORTERS, 2024

- FIGURE 42 COMPANY VALUATION

- FIGURE 43 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 44 BRAND/PRODUCT COMPARISON

- FIGURE 45 OPTICAL SORTER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 OPTICAL SORTER MARKET: COMPANY FOOTPRINT

- FIGURE 47 OPTICAL SORTER MARKET: COMPANY EVALUATION MATRIX (SMES/STARTUPS), 2024

- FIGURE 48 BUHLER: COMPANY SNAPSHOT

- FIGURE 49 TOMRA SYSTEMS ASA: COMPANY SNAPSHOT

- FIGURE 50 HEFEI MEYER OPTOELECTRONIC TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 51 BINDER+CO: COMPANY SNAPSHOT

- FIGURE 52 OPTICAL SORTER MARKET: RESEARCH DESIGN

- FIGURE 53 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 54 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 55 BREAKDOWN OF PRIMARY PARTICIPANTS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 56 CORE INSIGHTS FROM INDUSTRY PLAYERS

- FIGURE 57 OPTICAL SORTER MARKET: RESEARCH APPROACH

- FIGURE 58 OPTICAL SORTER MARKET: RESEARCH FLOW

- FIGURE 59 MARKET SIZE ESTIMATION (SUPPLY SIDE): REVENUE FROM SALES OF OPTICAL SORTER PRODUCTS, SOLUTIONS, AND SERVICES

- FIGURE 60 OPTICAL SORTER MARKET: BOTTOM-UP APPROACH

- FIGURE 61 OPTICAL SORTER MARKET: TOP-DOWN APPROACH

- FIGURE 62 OPTICAL SORTER MARKET: DATA TRIANGULATION

- FIGURE 63 OPTICAL SORTER MARKET: RESEARCH ASSUMPTIONS