PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1928853

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1928853

Merging Unit Market By Type (Standalone, Integrated), Voltage (Low, Medium, High), Configuration (With Relay, Without Relay), End User (Utilities, Industrial, Commercial, Data Centers, Renewable Energy, Transportation, Others), Region - Forecast to 2030

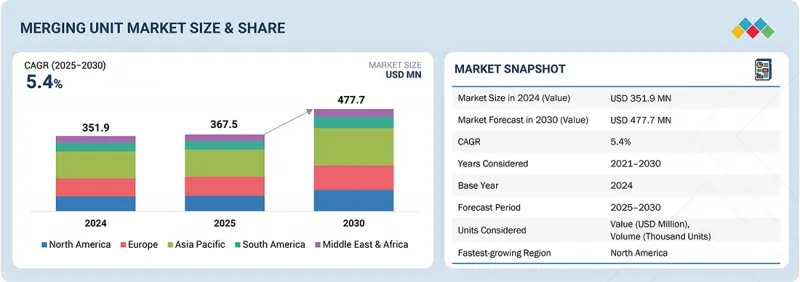

The global merging unit market is estimated to be valued at USD 367.4 million in 2025 and USD 477.7 million by 2030, exhibiting a CAGR of 5.4% during the forecast period. The need to boost infrastructure development in key markets, such as renewable energy, industrial, and utilities, spurs the demand for merging units. India is witnessing a resurgence of state-driven investment in infrastructure through the National Infrastructure Pipeline and increased capital expenditure, which is witnessing renewed investment in mature assets, including power and transportation, and the growth of new digital-related infrastructure. Such endeavours entail major overhauls in electrical and control systems, and the number of merging units involved in these systems is large and highly complex. They need to be handled efficiently to create a secure environment with a guarantee of expediency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Thousand Units) |

| Segments | By Type, Voltage, Configuration, and End User. |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

In the US, infrastructure continues to be chronically underfunded and deteriorated, and federal infrastructure investment policy is targeting greatly upgrading energy, transport, and digital networks, including trillion-dollar spending, with the signature legislation of the Infrastructure Investment and Jobs Act. This high level of infrastructure development increases the demand for merging units to drive motor efficiency, ease installation, and enable operations and maintenance.

"By configuration, the with relay output segment is expected to hold the largest market share in 2030."

The merging unit market by configuration has relay output as its major segment, as it offers direct interface capabilities for substation protection and control systems. It is common in places where immediate switching or tripping operations are necessary. With the help of relay outputs, merging units can communicate with relays and switchgear, which in turn ensures protection coordination, fault isolation, and system automation at high speed and is reliable. The said configuration is compatible with old and new substation designs; thus, it is adopted rapidly in retrofit and greenfield projects, which makes it the most useful capital and industries paying for operational reliability and seamless integration highly.

"By end user, the renewable energy segment is likely to record the highest CAGR from 2025 to 2030."

Considering the rise of wind, solar, and hybrid power plants that need sophisticated grid integration and efficient protection systems, renewable energy is likely to be the fastest-growing end-user segment in the merging unit market. Merging units are the means for real-time digitalization and exact control of variable energy flows. They help grid stability and compliance with the changing IEC 61850 protocols. The desire for remote monitoring, better automation, and decentralized grid architectures is also a significant factor in the renewables sector, as operators make it a point to install intelligent substations to optimize performance and reliability in the networks that are getting increasingly complex.

"By region, Europe is estimated to be the second-largest market during the forecast period."

Europe is expected to be the second-largest region in the merging unit market due to the extensive and advanced investment in grid modernization, the integration of renewable energy, and the implementation of progressive energy policies. Utilities in Europe and transmission system operators emphasize upgrading substations to digital standards, especially with the widespread use of IEC 61850 devices. The fast installation of wind and solar power plants, the strong electrification support, and the emphasis on sustainability are some major factors leading to a high demand for advanced substation automation. Incentives provided by the government, regulatory mandates, and partnerships among the major manufacturers also facilitate the uptake of merging units in the regional power sector, which is diverse and mature.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

By Designation: C-level Executives - 30%, Directors - 20%, and Others - 50%

By Region: North America - 20%, Europe - 24%, Asia Pacific - 36%, Middle East & Africa - 8%, and South America - 12%

Notes: The tiers of companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million.

Other designations include sales managers, engineers, and regional managers.

GE Vernova (US), Hitachi Electric (Switzerland), Arteche (France), Schweitzer Engineering Laboratories, Inc. (US), and Ingeteam (Spain) are some major players in the merging unit market. The study includes an in-depth competitive analysis of these key players, including their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the global merging unit market by voltage, application, power rating, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the merging unit market.

Key Benefits of Buying the Report

- It provides an analysis of key drivers (Rapid digital substation deployment aligned with IEC 61850 standards), restraints (Limited technical expertise to support digital protection systems), opportunities (Massive retrofit potential in aging transmission & distribution infrastructure), and challenges (Stringent cybersecurity requirements to protect merging units as critical interfaces in digital substations) influencing the growth of the merging unit market.

- Market Development: Comprehensive information about lucrative markets-the report analyzes the merging unit market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the merging unit market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as GE Vernova (US), Hitachi Energy (Switzerland), Arteche (Spain), Schweitzer Engineering Laboratories, Inc. (US), Ingeteam (Spain), ABB (Switzerland), Siemens (Germany), Schneider Electric (France), NR Electric Co., Ltd (Jiangsu), Toshiba Corporation (France), Powercap Electric SDN. BHD. (Malaysia), CYG Sunri Co., Ltd. (China), Efacec (Portugal), and Power Grid Components (Alabama), among others, are in the merging unit market.

- Product Innovation/Development: Schneider Electric unveiled its One Digital Grid Platform, a unified architecture that combines protection, control, automation, and "stand-alone merging unit" capability under its PowerLogic P7 platform. The platform is aimed at simplifying operations for utilities, accelerating grid digitalisation, and enabling faster deployment of IEC 61850 process-bus systems. Similarly, Hitachi Energy's SAM600 3.0 is a modular process interface unit that can function as a merging unit, a switchgear control unit, or in a single device. As a merging unit, it converts analog signals from instrument transformers into IEC 61850 digital data for process-bus architectures. As a switchgear control unit, it interfaces directly with breakers and switches to reduce copper wiring and simplify substation layouts.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS IN MERGING UNIT MARKET

- 2.4 HIGH GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MERGING UNIT MARKET

- 3.2 MERGING UNIT MARKET, BY TYPE

- 3.3 MERGING UNIT MARKET, BY END USER

- 3.4 MERGING UNIT MARKET, BY CONFIGURATION

- 3.5 MERGING UNIT MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- 3.6 MERGING UNIT MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rapid deployment of digital substations

- 4.2.1.2 Growing focus on grid modernization & reliability

- 4.2.1.3 Increasing renewable energy integration

- 4.2.1.4 Technological advancements in communication, automation, and digital systems

- 4.2.2 RESTRAINTS

- 4.2.2.1 High capital investment

- 4.2.2.2 Vulnerabilities to cyberattacks

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rapid industrialization and modernization of urban infrastructure in emerging economies

- 4.2.3.2 Integration of AI & advanced analytics

- 4.2.4 CHALLENGES

- 4.2.4.1 Shortage of skilled workforce

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.1.2 BARGAINING POWER OF SUPPLIERS

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 THREAT OF NEW ENTRANTS

- 5.1.5 THREAT OF SUBSTITUTES

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 TRENDS IN DIGITAL SUBSTATIONS

- 5.2.3 TRENDS IN GRID MODERNIZATION

- 5.2.4 TECHNOLOGY & STANDARDIZATION-RISKS AND OPPORTUNITIES

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.5.2 AVERAGE SELLING PRICE OF MERGING UNITS ACROSS KEY REGIONS, 2021-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 8536)

- 5.6.2 EXPORT SCENARIO (HS CODE 8536)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 POWERLINK QUEENSLAND DIGITAL SUBSTATIONS (HITACHI ENERGY)

- 5.9.2 SP GROUP JURONG DATA CENTER GRID

- 5.9.3 HYDRO-QUEBEC'S IEC 61850 DIGITAL SUBSTATION PILOT FOR GRID MODERNIZATION

- 5.9.4 NATIONAL GRID-DEESIDE DIGITAL SUBSTATION DEMONSTRATION PROJECT

- 5.9.5 STATNETT-DIGITAL SUBSTATION RESEARCH AND DEVELOPMENT PROJECT

- 5.10 IMPACT OF 2025 US TARIFFS-MERGING UNIT MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRIES/REGIONS

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.4.4 Middle East & Africa

- 5.10.4.5 South America

- 5.10.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 PTP TIME SYNCHRONIZATION

- 6.1.2 PROCESS BUS

- 6.2 TECHNOLOGY/PRODUCT ROADMAP

- 6.3 PATENT ANALYSIS

- 6.4 FUTURE APPLICATIONS

- 6.5 IMPACT OF AI/GENERATIVE AI ON MERGING UNIT MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES FOLLOWED BY MANUFACTURERS/OEMS IN MERGING UNIT MARKET

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN THE MERGING UNIT MARKET

- 6.5.4 INTERCONNECTED ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT & ECO-APPLICATIONS OF MERGING UNITS

- 7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.3.1 SUSTAINABILITY IMPACT

- 7.3.2 REGULATORY & POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

- 7.4.1 CERTIFICATIONS

- 7.4.2 LABELING, DECLARATIONS, AND ECO-TRANSPARENCY

- 7.4.3 ECO-STANDARDS & REGULATORY COMPLIANCE

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS END USERS/END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES, BY END USER

9 MERGING UNIT MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 STANDALONE

- 9.2.1 EMPHASIS ON TRANSITIONING TO DIGITAL ARCHITECTURE TO FUEL MARKET GROWTH

- 9.3 INTEGRATED

- 9.3.1 PREDICTIVE MAINTENANCE ACROSS MODERN POWER SYSTEMS TO OFFER GROWTH OPPORTUNITIES

10 MERGING UNIT MARKET, BY VOLTAGE

- 10.1 INTRODUCTION

- 10.2 LOW VOLTAGE

- 10.2.1 COMPATIBILITY WITH CONVENTIONAL LOW-VOLTAGE CTS AND VTS

- 10.3 MEDIUM

- 10.3.1 GROWING APPLICATION IN DISTRIBUTION SUBSTATIONS, MV SWITCHGEAR, AND RMUS TO DRIVE MARKET

- 10.4 HIGH

- 10.4.1 DRIVING ADVANCED GRID RELIABILITY THROUGH HIGH-PRECISION DIGITAL TRANSMISSION SYSTEMS

11 MERGING UNIT MARKET, BY CONFIGURATION

- 11.1 INTRODUCTION

- 11.2 WITH RELAY OUTPUT

- 11.2.1 ENHANCING PROTECTION COORDINATION THROUGH EMBEDDED CONTROL CAPABILITIES

- 11.3 WITHOUT RELAY OUTPUT

- 11.3.1 ENABLING PURE DIGITAL MEASUREMENT FOR SCALABLE PROCESS-BUS ARCHITECTURES

12 MERGING UNIT MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 UTILITIES

- 12.2.1 MERGING UNITS DRIVE UTILITY DIGITALIZATION AND GRID RELIABILITY IMPROVEMENTS IN DIGITAL SUBSTATIONS

- 12.3 INDUSTRIAL

- 12.3.1 INDUSTRIAL DIGITALIZATION AND GRID MODERNIZATION ACCELERATE MERGING UNIT ADOPTION IN PROCESS FACILITIES

- 12.4 COMMERCIAL

- 12.4.1 DIGITAL UPGRADES IN COMMERCIAL BUILDINGS SET BENCHMARK FOR MERGING UNIT ADOPTION ACROSS INDUSTRIES

- 12.5 RENEWABLE ENERGY

- 12.5.1 MERGING UNIT DEPLOYMENT IN RENEWABLE SUBSTATIONS TO SECURE GRID STABILITY

- 12.6 DATA CENTER

- 12.6.1 RISING NUMBER OF DATA CENTERS TO PROPEL MERGING UNITS DEMAND

- 12.7 TRANSPORTATION

- 12.7.1 ELECTRIFICATION OF RAILWAYS, METRO NETWORKS, AND EV INFRASTRUCTURE DRIVES MERGING UNIT MARKET

- 12.8 OTHER END USERS

13 MERGING UNIT MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Accelerated digital grid modernization fueling rapid adoption of merging units in the US

- 13.2.2 CANADA

- 13.2.2.1 Promotion of smarter and resilient electricity infrastructure to drive market

- 13.2.3 MEXICO

- 13.2.3.1 Government-led initiatives to modernize power sector to boost demand

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 UK

- 13.3.1.1 Growing number of offshore wind projects to drive market

- 13.3.2 GERMANY

- 13.3.2.1 Adoption of digital control and protection systems to fuel market growth

- 13.3.3 ITALY

- 13.3.3.1 Government initiatives to promote energy transition to fuel market growth

- 13.3.4 FRANCE

- 13.3.4.1 Growing share of renewables in national energy mix to offer growth opportunities

- 13.3.5 REST OF EUROPE

- 13.3.1 UK

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Rapid urbanization and industrial growth to offer growth opportunities

- 13.4.2 JAPAN

- 13.4.2.1 Aging infrastructure modernization and smart energy transition driving adoption

- 13.4.3 SOUTH KOREA

- 13.4.3.1 Application of digital twin technologies and AI-based predictive analytics to drive market

- 13.4.4 INDIA

- 13.4.4.1 Rapid transmission network expansion to boost demand

- 13.4.5 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Renewable expansion and grid modernization initiatives accelerating merging unit deployment in Brazil

- 13.5.2 ARGENTINA

- 13.5.2.1 Renewables, mining demand, and grid upgrades propel merging unit adoption in Argentina

- 13.5.3 REST OF SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 GCC COUNTRIES

- 13.6.1.1 Saudi Arabia

- 13.6.1.1.1 Increasing government initiatives to drive market

- 13.6.1.2 UAE

- 13.6.1.2.1 Smart and renewable energy integration to propel market

- 13.6.1.3 Rest of GCC Countries

- 13.6.1.1 Saudi Arabia

- 13.6.2 SOUTH AFRICA

- 13.6.2.1 Strengthening grid reliability amid rising demand

- 13.6.3 REST OF MIDDLE EAST & AFRICA

- 13.6.1 GCC COUNTRIES

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Type footprint

- 14.7.5.4 Configuration footprint

- 14.7.5.5 End-user footprint

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 PRODUCT LAUNCHES

- 14.8.2 DEALS

- 14.8.3 EXPANSIONS

- 14.8.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 GE VERNOVA

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 MnM view

- 15.1.1.3.1 Key strategies/Right to win

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses and competitive threats

- 15.1.2 HITACHI ENERGY

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strategies/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 ARTECHE

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strategies/Right to win

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses and competitive threats

- 15.1.4 SCHWEITZER ENGINEERING LABORATORIES, INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strategies/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 INGETEAM

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strategies/Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses and competitive threats

- 15.1.6 ABB

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.3.2 Expansions

- 15.1.6.3.3 Other developments

- 15.1.7 SIEMENS

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Expansions

- 15.1.8 SCHNEIDER ELECTRIC

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.9 TOSHIBA CORPORATION

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 NR ELECTRIC CO., LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 POWERCAP ELECTRIC SDN. BHD.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 CYG SUNRI CO., LTD.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 EFACEC

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 POWER GRID COMPONENTS INC.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Deals

- 15.1.1 GE VERNOVA

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY AND PRIMARY RESEARCH

- 16.1.2 SECONDARY DATA

- 16.1.2.1 Key data from secondary sources

- 16.1.2.2 List of key secondary sources

- 16.1.3 PRIMARY DATA

- 16.1.3.1 Key data from primary sources

- 16.1.3.2 Key industry insights

- 16.1.3.3 List of primary interview participants

- 16.1.3.4 Breakdown of primaries

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.2 TOP-DOWN APPROACH

- 16.3 MARKET FORECAST APPROACH

- 16.3.1 DEMAND SIDE

- 16.3.1.1 Demand-side assumptions

- 16.3.1.2 Demand-side calculations

- 16.3.2 SUPPLY SIDE

- 16.3.2.1 Supply-side assumptions

- 16.3.2.2 Supply-side calculations

- 16.3.1 DEMAND SIDE

- 16.4 DATA TRIANGULATION

- 16.5 FACTOR ANALYSIS

- 16.6 RESEARCH ASSUMPTIONS

- 16.7 RESEARCH LIMITATIONS

- 16.8 RISK ANALYSIS

- 16.8.1 MERGING UNIT MARKET: RISK ANALYSIS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 MERGING UNIT MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 RENEWABLE POWER CAPACITY BY REGION, 2025

- TABLE 3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 4 MERGING UNIT MARKET: PORTER'S FIVE FORCES ANALYSIS, 202

- TABLE 5 ROLES OF COMPANIES IN MERGING UNIT ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE TREND OF MERGING UNITS, BY REGION, 2021-2024 (USD/UNIT)

- TABLE 7 IMPORT DATA FOR HS CODE 8536-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 8536-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 MERGING UNIT MARKET: KEY CONFERENCES AND EVENTS, 2026

- TABLE 10 SP GROUP JURONG DATA CENTER GRID

- TABLE 11 HYDRO-QUEBEC'S IEC 61850 DIGITAL SUBSTATION PILOT FOR GRID MODERNIZATION

- TABLE 12 NATIONAL GRID-DEESIDE DIGITAL SUBSTATION DEMONSTRATION PROJECT

- TABLE 13 STATNETT-DIGITAL SUBSTATION RESEARCH AND DEVELOPMENT PROJECT

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 SP GROUP JURONG DATA CENTRE GRID

- TABLE 16 MERGING UNIT MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2024-2025

- TABLE 17 FUTURE APPLICATIONS

- TABLE 18 TOP USE CASES AND MARKET POTENTIAL

- TABLE 19 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 20 MERGING UNIT MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 21 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- TABLE 27 KEY BUYING CRITERIA, BY END USER

- TABLE 28 UNMET NEEDS IN THE MERGING UNIT MARKET, BY END USER

- TABLE 29 MERGING UNIT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 30 MERGING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 STANDALONE MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 STANDALONE MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 INTEGRATED MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 INTEGRATED MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 MERGING UNIT MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 36 MERGING UNIT MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 37 LOW-VOLTAGE MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 LOW-VOLTAGE MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 MEDIUM-VOLTAGE MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 40 MEDIUM-VOLTAGE MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 HIGH-VOLTAGE MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 HIGH-VOLTAGE MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 MERGING UNIT MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 44 MERGING UNIT MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 45 WITH RELAY OUTPUT: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 WITH RELAY OUTPUT: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 WITHOUT RELAY OUTPUT: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 WITHOUT RELAY OUTPUT: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 50 MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 51 UTILITIES: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 UTILITIES: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 INDUSTRIAL: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 INDUSTRIAL: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 COMMERCIAL: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 COMMERCIAL: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 RENEWABLE ENERGY: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 RENEWABLE ENERGY: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 DATA CENTER: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 DATA CENTER: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 TRANSPORTATION: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 TRANSPORTATION: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 OTHER END USERS: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 OTHER END USERS: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 MERGING UNIT MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 68 MERGING UNIT MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 69 NORTH AMERICA: MERGING UNIT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: MERGING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: MERGING UNIT MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: MERGING UNIT MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: MERGING UNIT MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: MERGING UNIT MARKET, BY CONFIGURATION 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: MERGING UNIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: MERGING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 US: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 80 US: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 81 CANADA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 82 CANADA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 83 MEXICO: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 84 MEXICO: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: MERGING UNIT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 86 EUROPE: MERGING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 87 EUROPE: MERGING UNIT MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: MERGING UNIT MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: MERGING UNIT MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: MERGING UNIT MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 91 EUROPE: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 93 EUROPE: MERGING UNIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: MERGING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 UK: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 96 UK: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 97 GERMANY: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 98 GERMANY: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 99 ITALY: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 100 ITALY: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 101 FRANCE: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 102 FRANCE: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 103 REST OF EUROPE: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 104 REST OF EUROPE: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MERGING UNIT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: MERGING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: MERGING UNIT MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MERGING UNIT MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MERGING UNIT MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MERGING UNIT MARKET, BY CONFIGURATION, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MERGING UNIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MERGING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 CHINA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 116 CHINA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 117 JAPAN: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 118 JAPAN: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 119 SOUTH KOREA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 120 SOUTH KOREA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 121 INDIA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 122 INDIA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 125 SOUTH AMERICA: MERGING UNIT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 126 SOUTH AMERICA: MERGING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 127 SOUTH AMERICA: MERGING UNIT MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 128 SOUTH AMERICA: MERGING UNIT MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 129 SOUTH AMERICA: MERGING UNIT MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 130 SOUTH AMERICA: MERGING UNIT MARKET, BY CONFIGURATION 2025-2030 (USD MILLION)

- TABLE 131 SOUTH AMERICA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 132 SOUTH AMERICA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 133 SOUTH AMERICA: MERGING UNIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 SOUTH AMERICA: MERGING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 BRAZIL: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 136 BRAZIL: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 137 ARGENTINA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 138 ARGENTINA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 139 REST OF SOUTH AMERICA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 140 REST OF SOUTH AMERICA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY VOLTAGE, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY CONFIGURATION, 2021-2024 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY CONFIGURATION 2025-2030 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 151 GCC COUNTRIES: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 152 GCC COUNTRIES: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 153 GCC COUNTRIES: MERGING UNIT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 154 GCC COUNTRIES: MERGING UNIT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 SAUDI ARABIA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 156 SAUDI ARABIA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 157 UAE: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 158 UAE: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 159 REST OF GCC COUNTRIES: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 160 REST OF GCC COUNTRIES: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH AFRICA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 162 SOUTH AFRICA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: MERGING UNIT MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 165 OVERVIEW OF KEY STRATEGIES ADOPTED BY KEY PLAYERS, MAY 2020-SEPTEMBER 2025

- TABLE 166 MERGING UNIT MARKET: DEGREE OF COMPETITION

- TABLE 167 MERGING UNIT MARKET: REGION FOOTPRINT

- TABLE 168 MERGING UNIT MARKET: TYPE FOOTPRINT

- TABLE 169 MERGING UNIT MARKET: CONFIGURATION FOOTPRINT

- TABLE 170 MERGING UNIT MARKET: END-USER FOOTPRINT

- TABLE 171 MERGING UNIT MARKET: PRODUCT LAUNCHES, MAY 2021-SEPTEMBER 2025

- TABLE 172 MERGING UNIT MARKET: DEALS, MAY 2021-SEPTEMBER 2025

- TABLE 173 MERGING UNIT MARKET: EXPANSIONS, MAY 2021-SEPTEMBER 2025

- TABLE 174 MERGING UNIT MARKET: OTHER DEVELOPMENTS, MAY 2021-SEPTEMBER 2025

- TABLE 175 GE VERNOVA: COMPANY OVERVIEW

- TABLE 176 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 HITACHI ENERGY: COMPANY OVERVIEW

- TABLE 178 HITACHI ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 HITACHI ENERGY: PRODUCT LAUNCHES

- TABLE 180 ARTECHE: COMPANY OVERVIEW

- TABLE 181 ARTECHE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 182 SCHWEITZER ENGINEERING LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 183 SCHWEITZER ENGINEERING LABORATORIES, INC.: PRODUCTS/ SOLUTIONS/ SERVICES OFFERED

- TABLE 184 SCHWEITZER ENGINEERING LABORATORIES, INC.: PRODUCT LAUNCHES

- TABLE 185 INGETEAM: COMPANY OVERVIEW

- TABLE 186 INGETEAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 ABB: COMPANY OVERVIEW

- TABLE 188 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 ABB: DEALS

- TABLE 190 ABB: EXPANSIONS

- TABLE 191 ABB: OTHER DEVELOPMENTS

- TABLE 192 SIEMENS: COMPANY OVERVIEW

- TABLE 193 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 SIEMENS: EXPANSIONS

- TABLE 195 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 196 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 198 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 199 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 NR ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 201 NR ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 POWERCAP ELECTRIC SDN. BHD.: COMPANY OVERVIEW

- TABLE 203 POWERCAP ELECTRIC SDN. BHD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 CYG SUNRI CO., LTD.: COMPANY OVERVIEW

- TABLE 205 CYG SUNRI CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 EFACEC: COMPANY OVERVIEW

- TABLE 207 EFACEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 POWER GRID COMPONENTS INC.: COMPANY OVERVIEW

- TABLE 209 POWER GRID COMPONENTS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 POWER GRID COMPONENTS INC.: DEALS

List of Figures

- FIGURE 1 MERGING UNIT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL MERGING UNIT MARKET, 2021-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN MERGING UNIT MARKET, 2021-2025

- FIGURE 5 DISRUPTIONS INFLUENCING MERGING UNIT MARKET GROWTH

- FIGURE 6 HIGH-GROWTH SEGMENTS IN MERGING UNIT MARKET, 2024

- FIGURE 7 NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 8 INCREASING RENEWABLE ENERGY INTEGRATION TO DRIVE MARKET GROWTH

- FIGURE 9 STANDALONE SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 10 RENEWABLE ENERGY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 WITH RELAY OUTPUT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 12 UTILITIES SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC MERGING UNIT MARKET IN 2030

- FIGURE 13 CANADA TO RECORD HIGHEST CAGR IN GLOBAL MERGING UNIT MARKET

- FIGURE 14 MERGING UNIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 AVERAGE ANNUAL INVESTMENT SPENDING ON ELECTRICITY GRIDS IN NET-ZERO SCENARIO, 2022-2030

- FIGURE 16 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 MERGING UNIT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 KEY PARTICIPANTS IN MERGING UNIT ECOSYSTEM

- FIGURE 19 MERGING UNIT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE TREND OF MERGING UNITS, BY REGION, 2021-2024 (USD/UNIT)

- FIGURE 21 IMPORT SCENARIO FOR HS CODE 8536-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 22 EXPORT SCENARIO FOR HS CODE 8536-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 23 MERGING UNIT MARKET: TRENDS/DISRUPTIONS INFLUENCING CUSTOMERS' BUSINESSES

- FIGURE 24 MERGING UNIT MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 25 IMPACT OF AI/GENERATIVE AI ON MERGING UNIT MARKET

- FIGURE 26 MERGING UNIT MARKET: DECISION-MAKING FACTORS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 28 KEY BUYING CRITERIA, BY END USER

- FIGURE 29 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 30 STANDALONE SEGMENT ACCOUNTED FOR HIGHER MARKET SHARE IN 2024

- FIGURE 31 HIGH-VOLTAGE MERGING UNITS TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 32 MERGING UNITS WITH RELAY OUTPUT TO LEAD MARKET IN 2024

- FIGURE 33 UTILITIES LED MERGING UNIT END-USER MARKET IN 2024

- FIGURE 34 NORTH AMERICA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MERGING UNIT MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MERGING UNIT MARKET SNAPSHOT

- FIGURE 37 MARKET SHARE ANALYSIS OF COMPANIES OFFERING MERGING UNITS,2024

- FIGURE 38 REVENUE ANALYSIS OF OTHER KEY PLAYERS IN MERGING UNIT MARKET, 2020-2024

- FIGURE 39 COMPANY VALUATION

- FIGURE 40 FINANCIAL METRICS

- FIGURE 41 MERGING UNIT MARKET: PRODUCT COMPARISON

- FIGURE 42 MERGING UNIT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 MERGING UNIT MARKET: COMPANY FOOTPRINT

- FIGURE 44 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 45 ARTECHE: COMPANY SNAPSHOT

- FIGURE 46 ABB: COMPANY SNAPSHOT

- FIGURE 47 SIEMENS: COMPANY SNAPSHOT

- FIGURE 48 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 49 MERGING UNIT MARKET: RESEARCH DESIGN

- FIGURE 50 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 51 MERGING UNIT MARKET: BOTTOM-UP APPROACH

- FIGURE 52 MERGING UNIT MARKET: TOP-DOWN APPROACH

- FIGURE 53 REGIONAL ANALYSIS

- FIGURE 54 COUNTRY-LEVEL ANALYSIS

- FIGURE 55 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF MERGING UNITS

- FIGURE 56 MERGING UNIT MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 57 MERGING UNIT MARKET: DATA TRIANGULATION

- FIGURE 58 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR MERGING UNITS