PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1928860

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1928860

Probe Pin Market by Pogo Type, Stamping Type, Spring Contact, Non-Spring Contact, Semiconductor Testing (Wafer-level Testing, and Package-level Testing), Frequency Range, and Region - Global Forecast to 2032

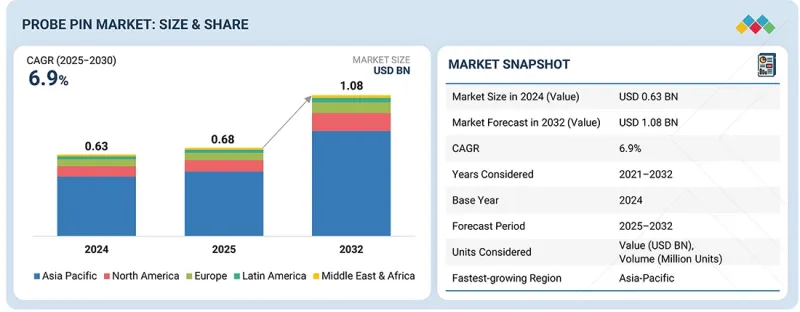

The global probe pin market is estimated to reach USD 1.08 billion by 2032, up from USD 0.68 billion in 2025, at a CAGR of 6.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Pogo Type, Stamping Type, Frequency Range, Semiconductor Testing and Region |

| Regions covered | North America, Europe, APAC, RoW |

The global probe pin market is experiencing steady growth, driven by the increasing complexity of semiconductors, the adoption of advanced packaging, and the shift toward compact, high-performance electronics. Semiconductor fabs and OSATs are increasingly investing in high-precision probe technologies to improve test accuracy, enhance signal integrity, and support fine-pitch and high-frequency requirements across wafer-level, package-level, and PCB testing. The expansion of AI, HPC, 5G, EV power devices, and chiplet-based architectures further increases demand for probes capable of handling higher currents, tighter tolerances, and lower contact resistance. Advancements in micro-spring structures, precision machining, plating technologies, and automated manufacturing are extending probe life, reducing test failures, and improving consistency in high-volume production environments.

"Automotive & EV to register the fastest growth in the end-user industry segment in the probe pin market."

The automotive and electric vehicle (EV) industry is projected to register the fastest growth in the probe pin market during the forecast period, driven by the rapid electrification of vehicles, increasing semiconductor content per car, and the shift toward advanced driver-assistance systems (ADAS), battery management systems (BMS), and power electronics. Modern EVs rely heavily on high-current, high-temperature, and safety-critical semiconductor components that require rigorous wafer-level, package-level, and PCB-level testing. This is significantly boosting demand for durable, low-resistance, and fine-pitch probe pins capable of maintaining stable electrical contact under stringent automotive qualification standards. As automakers and Tier-1 suppliers accelerate investments in on-board computing, infotainment, connectivity modules, and SiC/GaN power devices, probe pin manufacturers are expanding their high-reliability product lines to support complex automotive testing environments. With the rising adoption of EVs across Asia Pacific, Europe, and North America, the automotive segment is expected to outpace all other end-user groups in probe pin consumption.

"Wafer-level testing to account for the largest share in the semiconductor testing application segment in the probe pin market."

Wafer-level testing is expected to account for the largest share of the probe pin market, driven by the rapid transition toward advanced semiconductor manufacturing and the increasing complexity of integrated circuits. As device geometries shrink and packaging technologies evolve, such as 3D stacking, fan-out WLP, and chiplet-based architectures, wafer probe requirements demand ultra-fine-pitch, high-frequency, and high-current probe pins to ensure accurate electrical contact. Semiconductor fabs depend on wafer-level testing for early defect identification, yield improvement, and cost optimization before devices proceed to packaging. This makes fine-pitch and high-density probes critical for validating logic, memory, RF, analog, automotive, and power devices. With the growing adoption of AI accelerators, HPC processors, EV power semiconductors, and 5G communication chips, the wafer-level testing load has increased substantially across leading foundries and OSATs. As a result, probe pin manufacturers are advancing micro-spring designs, plating durability, and precision machining to meet the demanding performance requirements of high-volume wafer probing.

"North America is expected to account for the second-largest market share in 2025."

North America is projected to hold the second-largest share of the global probe pin market, supported by its strong presence of semiconductor manufacturers, advanced packaging innovators, and electronics design houses. The region benefits from major players involved in AI processors, automotive electronics, cloud infrastructure chips, and telecommunications semiconductors, all of which require sophisticated wafer-level and package-level testing. Investments in data centers, EV platforms, aerospace electronics, and defense-grade semiconductor devices further accelerate the adoption of high-precision probe pins. Moreover, the region's strong ecosystem of ATE companies, research institutions, and advanced manufacturing facilities supports continuous innovation in high-frequency and fine-pitch probing technologies. With growing emphasis on domestic semiconductor production, North America is expected to maintain a robust and influential position in the probe pin market.

The break-up of the profile of primary participants in the probe pin market-

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, Tier 3 - 30%

- By Designation Type: Directors - 20%, Managers - 10%, Others - 70%

- By Region Type: Asia Pacific - 45%, Europe - 25%, North America- 20%, Latin America-5%, Rest of the World - 5%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million

The major players in the probe pin market with a significant global presence include FEINMETALL (Germany), INGUN (Germany), CCP Contact Probes Co., Ltd. (Taiwan), Seiken Co., Ltd. (Japan), LEENO Industrial Inc. (South Korea), and others.

Research Coverage

The report segments the probe pin market and forecasts its size by contact type, manufacturing method, frequency range, application, end user industry, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall probe pin market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Growing need for advanced packaging and wafer-level chip-scale packaging, rising SiC & GaN power semiconductor testing, and expansion of OSAT test capacity), restraints (ultra-fine pitch manufacturing limitations, high cost of advanced materials, probe wear, and short life in power testing), opportunities (rapid expansion of automotive electronics and electric vehicle power devices, growth in MEMS, sensor & IoT testing, and development of advanced material coatings and hybrid probe designs), and challenges (low-cost competition from Asian suppliers, and high customization needs and lack of standardization)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the probe pin market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the probe pin market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the probe pin market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including FEINMETALL (Germany), INGUN (Germany), CCP Contact Probes Co., Ltd. (Taiwan), Seiken Co., Ltd. (Japan), and LEENO Industrial Inc. (South Korea).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN PROBE PIN MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PROBE PIN MARKET

- 3.2 PROBE PIN MARKET, BY CONTACT TYPE

- 3.3 PROBE PIN MARKET, BY MANUFACTURING METHOD

- 3.4 PROBE PIN MARKET, BY APPLICATION

- 3.5 PROBE PIN MARKET, BY END-USE INDUSTRY

- 3.6 ASIA PACIFIC PROBE PIN MARKET, BY END-USE INDUSTRY AND COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing adoption of advanced semiconductor packaging

- 4.2.1.2 Growing use of SiC and GaN power devices

- 4.2.1.3 Ongoing expansion of OSAT providers

- 4.2.1.4 Rapid growth of AI processors, high-performance computing chips, and high-speed ICs

- 4.2.2 RESTRAINTS

- 4.2.2.1 Complex manufacturing of ultrafine-pitch probe pins

- 4.2.2.2 High cost of advanced materials

- 4.2.2.3 Probe wear and short life in power testing

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rise of automotive electronics and safety systems

- 4.2.3.2 Rapid expansion of MEMS devices, sensors, and IoT solutions

- 4.2.3.3 Development of advanced material coatings and hybrid probe designs

- 4.2.4 CHALLENGES

- 4.2.4.1 Intense price competition from low-cost suppliers

- 4.2.4.2 High customization requirements and limited standardization

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS

- 4.3.2 WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN SEMICONDUCTOR INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF PROBE PINS OFFERED BY KEY PLAYERS, 2025

- 5.6.2 AVERAGE SELLING PRICE TREND, BY CONTACT TYPE, 2021-2025

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2025

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 9031)

- 5.7.2 EXPORT SCENARIO (HS CODE 9031)

- 5.8 KEY CONFERENCES AND EVENTS, 2026-2027

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 FEINMETALL'S LFRE PROBE PINS FACILITATE FINE-PITCH MEMS TESTING

- 5.11.2 INGUN'S HSS SERIES SPRING PROBES IMPROVE AUTOMOTIVE ECU TEST RELIABILITY

- 5.11.3 COHU'S ZIP RF PROBES ENHANCE RF MODULE TESTING

- 5.11.4 ADVANTEST'S HIGH-DENSITY PROBE INTERFACES BOOST PACKAGING TEST ACCURACY

- 5.11.5 LEENO INDUSTRIAL'S CUSTOM-DESIGNED FINE-PITCH PROBES ENHANCE FINE-PITCH TESTING PERFORMANCE

- 5.12 IMPACT OF 2025 US TARIFF

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRIES/REGIONS

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 FINE-PITCH SPRING PROBE TECHNOLOGY

- 6.1.2 MEMS-BASED PROBE TECHNOLOGY

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 VERTICAL PROBE AND CANTILEVER PROBE ARCHITECTURE

- 6.2.2 ADVANCED PLATING AND COATING

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 PROBE CARD AND TEST INTERFACE TECHNOLOGY

- 6.3.2 AUTOMATED TEST EQUIPMENT

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT TERM (2025-2027): PRECISION MATERIALS, MINIATURIZATION, AND HIGH-CURRENT ENHANCEMENTS

- 6.4.2 MID TERM (2027-2030): MEMS MICRO-PROBE MATURATION AND AUTOMATION-DRIVEN TEST INNOVATION

- 6.4.3 LONG TERM (2030-2035+): UNIVERSAL RECONFIGURABLE COMPUTING AND SYSTEM-LEVEL CONVERGENCE

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 JEDEC & IPC Mechanical and Electrical Test Standards

- 7.1.2.2 IEC & ISO Electrical Safety and Contact Performance Standards

- 7.1.2.3 Moisture Sensitivity, Environmental Reliability, and Plating Standards

- 7.1.2.4 ISO 9001:2015 Quality Management Systems

- 7.1.2.5 ISO 14001 (Environmental Management)

- 7.1.2.6 RoHS & Reach Compliance

- 7.1.2.7 ANSI/ESD S20.20 (Electrostatic Discharge Protection)

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 PROBE PIN PITCH SIZES

- 9.1 INTRODUCTION

- 9.2 <50 µM

- 9.3 50-150 µM

- 9.4 151-500 µM

- 9.5 >500 µM

10 PROBE PIN HEAD TYPES

- 10.1 INTRODUCTION

- 10.2 CONICAL TIP

- 10.3 FLAT TIP

- 10.4 DOME TIP

- 10.5 SERRATED TIP

- 10.6 CROWN TIP

- 10.7 SPEAR TIP

11 PROBE PIN MARKET, BY CONTACT TYPE

- 11.1 INTRODUCTION

- 11.2 SPRING CONTACT

- 11.2.1 RISING DEMAND FOR HIGH-PRECISION AND HIGH-CYCLE SEMICONDUCTOR TESTING

- 11.3 NON-SPRING CONTACT

- 11.3.1 GROWING ADOPTION OF COST-EFFECTIVE PROBE SOLUTIONS IN STANDARDIZED TESTING APPLICATIONS

12 PROBE PIN MARKET, BY MANUFACTURING METHOD

- 12.1 INTRODUCTION

- 12.2 POGO TYPE

- 12.2.1 ELEVATED DEMAND FOR FLEXIBLE AND HIGH-RELIABILITY PROBING IN ADVANCED SEMICONDUCTOR TESTING

- 12.3 STAMPING TYPE

- 12.3.1 INCREASING USE OF COST-OPTIMIZED PROBE PINS IN STANDARDIZED AND LOW-COMPLEXITY TESTING

13 PROBE PIN MARKET, BY FREQUENCY RANGE

- 13.1 INTRODUCTION

- 13.2 <1 GHZ

- 13.2.1 EXTENSIVE USE IN LOW-FREQUENCY AND POWER-ORIENTED TESTING APPLICATIONS

- 13.3 1-10 GHZ

- 13.3.1 BROAD APPLICABILITY IN MAINSTREAM SEMICONDUCTOR AND HIGH-SPEED DIGITAL TESTING

- 13.4 11-40 GHZ

- 13.4.1 RAPID ADOPTION IN RF, HIGH-SPEED INTERFACE, AND ADVANCED DEVICE TESTING

- 13.5 >40 GHZ

- 13.5.1 EMERGING DEMAND FOR ULTRA-HIGH-FREQUENCY AND NEXT-GENERATION COMMUNICATION TESTING

14 PROBE PIN MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 SEMICONDUCTOR TESTING

- 14.2.1 WAFER-LEVEL TESTING

- 14.2.1.1 Continuous scaling of semiconductor nodes and expansion of wafer fabrication capacity

- 14.2.2 PACKAGE-LEVEL TESTING

- 14.2.2.1 Growing high-volume semiconductor production and increasing complexity of packaging technologies

- 14.2.1 WAFER-LEVEL TESTING

- 14.3 OTHER TESTING APPLICATIONS

- 14.3.1 PCB & SUBSTRATE TESTING

- 14.3.1.1 Ongoing production of consumer electronics and growing product complexity

- 14.3.2 DISPLAY PANEL TESTING

- 14.3.2.1 Tightening quality control requirements and rising defect sensitivity in advanced display manufacturing

- 14.3.3 MEMS & SENSOR TESTING

- 14.3.3.1 Expanding adoption of sensors across automotive and industrial applications

- 14.3.4 OTHERS

- 14.3.1 PCB & SUBSTRATE TESTING

15 PROBE PIN MARKET, BY END-USE INDUSTRY

- 15.1 INTRODUCTION

- 15.2 AUTOMOTIVE & EV

- 15.2.1 STRICTER FUNCTIONAL SAFETY REQUIREMENTS AND INCREASED ELECTRONIC CONTENT PER VEHICLE

- 15.3 CONSUMER ELECTRONICS

- 15.3.1 SHORTER PRODUCT LIFE CYCLES AND AGGRESSIVE TIME-TO-MARKET PRESSURES

- 15.4 INDUSTRIAL & IOT EQUIPMENT

- 15.4.1 ONGOING DEPLOYMENT OF SMART FACTORIES AND CONNECTED INFRASTRUCTURE

- 15.5 MEDICAL

- 15.5.1 INCREASING REGULATORY SCRUTINY AND VALIDATION REQUIREMENTS

- 15.6 AEROSPACE & DEFENSE

- 15.6.1 LONGER PROGRAM LIFECYCLES AND STRINGENT QUALIFICATION PROTOCOLS

- 15.7 OTHER END-USE INDUSTRIES

16 PROBE PIN MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 ASIA PACIFIC

- 16.2.1 CHINA

- 16.2.1.1 Large-scale semiconductor capacity expansion and rapid growth in automotive electronics

- 16.2.2 JAPAN

- 16.2.2.1 High-reliability automotive electronics and precision semiconductor manufacturing

- 16.2.3 SOUTH KOREA

- 16.2.3.1 Advanced memory semiconductor leadership and OLED display manufacturing expansion

- 16.2.4 INDIA

- 16.2.4.1 Rapid expansion of electronics manufacturing and government-led semiconductor initiatives

- 16.2.5 TAIWAN

- 16.2.5.1 Advanced node semiconductor manufacturing and high-density wafer-level testing

- 16.2.6 AUSTRALIA

- 16.2.6.1 Growth in industrial automation, defense electronics, and research-driven electronics testing

- 16.2.7 THAILAND

- 16.2.7.1 Rise of electronics assembly and automotive manufacturing

- 16.2.8 VIETNAM

- 16.2.8.1 Rapid expansion of electronics manufacturing and supply chain diversification

- 16.2.9 MALAYSIA

- 16.2.9.1 Significant OSAT presence and robust backend semiconductor capacity

- 16.2.10 INDONESIA

- 16.2.10.1 Rising electronics assembly, automotive component manufacturing, and domestic consumption

- 16.2.11 SINGAPORE

- 16.2.11.1 Advanced semiconductor manufacturing, strong R&D ecosystem, and high-value electronics production

- 16.2.12 REST OF ASIA PACIFIC

- 16.2.1 CHINA

- 16.3 NORTH AMERICA

- 16.3.1 US

- 16.3.1.1 Advanced semiconductor innovation and aerospace and defense electronics testing

- 16.3.2 CANADA

- 16.3.2.1 Automotive electrification, industrial automation, and research-led electronics development

- 16.3.1 US

- 16.4 EUROPE

- 16.4.1 GERMANY

- 16.4.1.1 Robust automotive electronics manufacturing and industrial automation adoption

- 16.4.2 FRANCE

- 16.4.2.1 Aerospace electronics leadership and rising automotive electrification

- 16.4.3 UK

- 16.4.3.1 Strong aerospace, defense, and advanced electronics R&D

- 16.4.4 ITALY

- 16.4.4.1 Automotive electronics production, industrial machinery manufacturing, and power electronics adoption

- 16.4.5 SPAIN

- 16.4.5.1 Growth in automotive electronics manufacturing and industrial automation

- 16.4.6 NETHERLANDS

- 16.4.6.1 Advanced semiconductor equipment ecosystem and high-precision electronics manufacturing

- 16.4.7 NORDICS

- 16.4.8 REST OF EUROPE

- 16.4.1 GERMANY

- 16.5 LATIN AMERICA

- 16.5.1 BRAZIL

- 16.5.1.1 Expansion of automotive manufacturing, electronics assembly, and energy infrastructure

- 16.5.2 ARGENTINA

- 16.5.2.1 Localized production expansion and export-oriented manufacturing initiatives

- 16.5.3 MEXICO

- 16.5.3.1 Nearshoring-driven automotive and electronics manufacturing expansion

- 16.5.4 REST OF LATIN AMERICA

- 16.5.1 BRAZIL

- 16.6 MIDDLE EAST & AFRICA

- 16.6.1 GCC

- 16.6.1.1 Saudi Arabia

- 16.6.1.1.1 Vision-led industrial diversification and rising power electronics deployment

- 16.6.1.2 UAE

- 16.6.1.2.1 Smart infrastructure development, renewable energy projects, and advanced system integration

- 16.6.1.3 Rest of GCC

- 16.6.1.1 Saudi Arabia

- 16.6.2 SOUTH AFRICA

- 16.6.2.1 Automotive assembly, industrial electronics manufacturing, and infrastructure modernization

- 16.6.3 REST OF MIDDLE EAST & AFRICA

- 16.6.1 GCC

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 MARKET SHARE ANALYSIS, 2024

- 17.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.4.1 STARS

- 17.4.2 EMERGING LEADERS

- 17.4.3 PERVASIVE PLAYERS

- 17.4.4 PARTICIPANTS

- 17.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.4.5.1 Company footprint

- 17.4.5.2 Region footprint

- 17.4.5.3 Contact type footprint

- 17.4.5.4 Manufacturing method footprint

- 17.4.5.5 Application footprint

- 17.5 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 17.5.1 PROGRESSIVE COMPANIES

- 17.5.2 RESPONSIVE COMPANIES

- 17.5.3 DYNAMIC COMPANIES

- 17.5.4 STARTING BLOCKS

- 17.5.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 17.5.5.1 List of start-ups/SMEs

- 17.5.5.2 Competitive benchmarking of start-ups/SMEs

- 17.6 BRAND/PRODUCT COMPARISON

- 17.7 COMPETITIVE SCENARIO

- 17.7.1 PRODUCT LAUNCHES

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 FEINMETALL

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Solutions/Services offered

- 18.1.1.3 MnM view

- 18.1.1.3.1 Key strengths/Right to win

- 18.1.1.3.2 Strategic choices

- 18.1.1.3.3 Weaknesses/Competitive threats

- 18.1.2 INGUN

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Solutions/Services offered

- 18.1.2.3 MnM view

- 18.1.2.3.1 Key strengths/Right to win

- 18.1.2.3.2 Strategic choices

- 18.1.2.3.3 Weaknesses/Competitive threats

- 18.1.3 C.C.P. CONTACT PROBES CO., LTD.

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Solutions/Services offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths/Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses/Competitive threats

- 18.1.4 SEIKEN CO., LTD.

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Solutions/Services offered

- 18.1.4.3 MnM view

- 18.1.4.3.1 Key strengths/Right to win

- 18.1.4.3.2 Strategic choices

- 18.1.4.3.3 Weaknesses/Competitive threats

- 18.1.5 LEENO INDUSTRIAL INC.

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Solutions/Services offered

- 18.1.5.3 MnM view

- 18.1.5.3.1 Key strengths/Right to win

- 18.1.5.3.2 Strategic choices

- 18.1.5.3.3 Weaknesses/Competitive threats

- 18.1.6 INCAVO OTAX, INC.

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Solutions/Services offered

- 18.1.7 ISC CO., LTD.

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Solutions/Services offered

- 18.1.8 SMITHS INTERCONNECT

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Solutions/Services offered

- 18.1.9 EVERETT CHARLES TECHNOLOGIES

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Solutions/Services offered

- 18.1.10 PTR HARTMANN GMBH

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Solutions/Services offered

- 18.1.1 FEINMETALL

- 18.2 OTHER PLAYERS

- 18.2.1 KITA MANUFACTURING CO., LTD.

- 18.2.2 HARWIN

- 18.2.3 QA TECHNOLOGY COMPANY, INC.

- 18.2.4 SHANGHAI JIANYANG ELECTRONICS TECHNOLOGY CO., LTD.,

- 18.2.5 SUZHOU SHENGYIFURUI ELECTRONIC TECHNOLOGY CO., LTD.

- 18.2.6 OKINS ELECTRONICS CO., LTD.

- 18.2.7 QUALMAX INC.

- 18.2.8 TESPRO CO., LTD.

- 18.2.9 AIKOSHA CO., LTD.

- 18.2.10 DA-CHUNG CONTACT PROBES ENTERPRISE CO., LTD.

- 18.2.11 SHENZHEN RONGTENGHUI TECHNOLOGY CO., LTD.

- 18.2.12 CFE CORPORATION CO., LTD.

- 18.2.13 XINFUCHENG ELECTRONICS CO., LTD.

- 18.2.14 S.E.R. CORPORATION

- 18.2.15 INTERCONNECT SYSTEMS, INC.

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY DATA

- 19.1.1.1 Secondary sources

- 19.1.1.2 Key data from secondary sources

- 19.1.2 PRIMARY DATA

- 19.1.2.1 List of primary interview participants

- 19.1.2.2 Breakdown of primary interviews

- 19.1.2.3 Key industry insights

- 19.1.2.4 Key data from primary sources

- 19.1.3 SECONDARY AND PRIMARY RESEARCH

- 19.1.1 SECONDARY DATA

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 19.2.2 TOP-DOWN APPROACH

- 19.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 19.2.1 BOTTOM-UP APPROACH

- 19.3 MARKET GROWTH ASSUMPTIONS

- 19.4 DATA TRIANGULATION

- 19.5 RESEARCH ASSUMPTIONS

- 19.6 RESEARCH LIMITATIONS

- 19.7 RISK ASSESSMENT

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- TABLE 2 IMPACT OF PORTER'S FIVE FORCES

- TABLE 3 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2029

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF PROBE PINS OFFERED BY KEY PLAYERS, 2025 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND, BY CONTACT TYPE, 2021-2025 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2025 (USD)

- TABLE 8 IMPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 9031- COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 KEY CONFERENCES AND EVENTS, 2026-2027

- TABLE 11 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 12 PATENT ANALYSIS

- TABLE 13 TOP USE CASES AND MARKET POTENTIAL

- TABLE 14 BEST PRACTICES

- TABLE 15 CASE STUDIES OF AI IMPLEMENTATION

- TABLE 16 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 24 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- TABLE 25 PROBE PIN MARKET, BY CONTACT TYPE, 2021-2024 (USD MILLION)

- TABLE 26 PROBE PIN MARKET, BY CONTACT TYPE, 2025-2032 (USD MILLION)

- TABLE 27 PROBE PIN MARKET, BY CONTACT TYPE, 2021-2024 (MILLION UNITS)

- TABLE 28 PROBE PIN MARKET, BY CONTACT TYPE, 2025-2032 (MILLION UNITS)

- TABLE 29 SPRING CONTACT: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 SPRING CONTACT: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 31 NON-SPRING CONTACT: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 NON-SPRING CONTACT: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 33 PROBE PIN MARKET, BY MANUFACTURING METHOD, 2021-2024 (USD MILLION)

- TABLE 34 PROBE PIN MARKET, BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

- TABLE 35 POGO TYPE: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 POGO TYPE: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 STAMPING TYPE: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 STAMPING TYPE: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 39 PROBE PIN MARKET, BY FREQUENCY RANGE, 2021-2024 (USD MILLION)

- TABLE 40 PROBE PIN MARKET, BY FREQUENCY RANGE, 2025-2032 (USD MILLION)

- TABLE 41 PROBE PIN MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 PROBE PIN MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 43 SEMICONDUCTOR TESTING: PROBE PIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 44 SEMICONDUCTOR TESTING: PROBE PIN MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 45 SEMICONDUCTOR TESTING: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 SEMICONDUCTOR TESTING: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 WAFER-LEVEL TESTING: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 WAFER-LEVEL TESTING: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 PACKAGE-LEVEL TESTING: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 PACKAGE-LEVEL TESTING: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 51 OTHER TESTING APPLICATIONS: PROBE PIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 52 OTHER TESTING APPLICATIONS: PROBE PIN MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 53 OTHER TESTING APPLICATIONS: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 OTHER TESTING APPLICATIONS: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 PCB & SUBSTRATE TESTING: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 PCB & SUBSTRATE TESTING: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 57 DISPLAY PANEL TESTING: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 DISPLAY PANEL TESTING: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 MEMS & SENSOR TESTING: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 MEMS & SENSOR TESTING: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 OTHERS: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 OTHERS: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 64 PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 65 AUTOMOTIVE & EV: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 AUTOMOTIVE & EV: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 CONSUMER ELECTRONICS: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 INDUSTRIAL & IOT EQUIPMENT: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 INDUSTRIAL & IOT EQUIPMENT: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 71 MEDICAL: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 MEDICAL: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 AEROSPACE & DEFENSE: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 AEROSPACE & DEFENSE: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 75 OTHER END-USE INDUSTRIES: PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 OTHER END-USE INDUSTRIES: PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 77 PROBE PIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 PROBE PIN MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 79 ASIA PACIFIC: PROBE PIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 ASIA PACIFIC: PROBE PIN MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 81 ASIA PACIFIC: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 82 ASIA PACIFIC: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 83 ASIA PACIFIC: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2021-2024 (USD MILLION)

- TABLE 84 ASIA PACIFIC: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

- TABLE 85 ASIA PACIFIC: PROBE PIN MARKET, BY CONTACT TYPE, 2021-2024 (USD MILLION)

- TABLE 86 ASIA PACIFIC: PROBE PIN MARKET, BY CONTACT TYPE, 2025-2032 (USD MILLION)

- TABLE 87 CHINA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 88 CHINA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 89 JAPAN: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 90 JAPAN: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 91 SOUTH KOREA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 92 SOUTH KOREA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 93 INDIA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 94 INDIA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 95 TAIWAN: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 96 TAIWAN: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 97 AUSTRALIA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 98 AUSTRALIA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 99 THAILAND: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 100 THAILAND: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 101 VIETNAM: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 102 VIETNAM: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 103 MALAYSIA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 104 MALAYSIA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 105 INDONESIA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 106 INDONESIA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 107 SINGAPORE: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 108 SINGAPORE: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 110 REST OF ASIA PACIFIC: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 111 NORTH AMERICA: PROBE PIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: PROBE PIN MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 113 NORTH AMERICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 115 NORTH AMERICA: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

- TABLE 117 NORTH AMERICA: PROBE PIN MARKET, BY CONTACT TYPE, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: PROBE PIN MARKET, BY CONTACT TYPE, 2025-2032 (USD MILLION)

- TABLE 119 US: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 US: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 121 CANADA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 122 CANADA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 123 EUROPE: PROBE PIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: PROBE PIN MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 125 EUROPE: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 127 EUROPE: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

- TABLE 129 EUROPE: PROBE PIN MARKET, BY CONTACT TYPE, 2021-2024 (USD MILLION)

- TABLE 130 EUROPE: PROBE PIN MARKET, BY CONTACT TYPE, 2025-2032 (USD MILLION)

- TABLE 131 GERMANY: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 132 GERMANY: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 133 FRANCE: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 FRANCE: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 135 UK: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 136 UK: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 137 ITALY: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 ITALY: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 139 SPAIN: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 140 SPAIN: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 141 NETHERLANDS: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 NETHERLANDS: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 143 NORDICS: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 144 NORDICS: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 145 REST OF EUROPE: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 146 REST OF EUROPE: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 147 LATIN AMERICA: PROBE PIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 LATIN AMERICA: PROBE PIN MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 149 LATIN AMERICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 150 LATIN AMERICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 151 LATIN AMERICA: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2021-2024 (USD MILLION)

- TABLE 152 LATIN AMERICA: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

- TABLE 153 LATIN AMERICA: PROBE PIN MARKET, BY CONTACT TYPE, 2021-2024 (USD MILLION)

- TABLE 154 LATIN AMERICA: PROBE PIN MARKET, BY CONTACT TYPE, 2025-2032 (USD MILLION)

- TABLE 155 BRAZIL: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 BRAZIL: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 157 ARGENTINA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 158 ARGENTINA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 159 MEXICO: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 MEXICO: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 161 REST OF LATIN AMERICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 REST OF LATIN AMERICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2021-2024 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY CONTACT TYPE, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY CONTACT TYPE, 2025-2032 (USD MILLION)

- TABLE 171 GCC: PROBE PIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 172 GCC: PROBE PIN MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 173 GCC: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 174 GCC: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 175 SOUTH AFRICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 176 SOUTH AFRICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST & AFRICA: PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 179 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 180 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 181 REGION FOOTPRINT

- TABLE 182 CONTACT TYPE FOOTPRINT

- TABLE 183 MANUFACTURING METHOD FOOTPRINT

- TABLE 184 APPLICATION FOOTPRINT

- TABLE 185 LIST OF START-UPS/SMES

- TABLE 186 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 187 PROBE PIN MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 188 FEINMETALL: COMPANY OVERVIEW

- TABLE 189 FEINMETALL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 INGUN: COMPANY OVERVIEW

- TABLE 191 INGUN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 C.C.P. CONTACT PROBES CO., LTD.: COMPANY OVERVIEW

- TABLE 193 C.C.P. CONTACT PROBES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 C.C.P. CONTACT PROBES CO., LTD.: PRODUCT LAUNCHES

- TABLE 195 SEIKEN CO., LTD.: COMPANY OVERVIEW

- TABLE 196 SEIKEN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 LEENO INDUSTRIAL INC.: COMPANY OVERVIEW

- TABLE 198 LEENO INDUSTRIAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 INCAVO OTAX INC.: COMPANY OVERVIEW

- TABLE 200 INCAVO OTAX INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ISC CO., LTD.: COMPANY OVERVIEW

- TABLE 202 ISC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 SMITHS INTERCONNECT: COMPANY OVERVIEW

- TABLE 204 SMITHS INTERCONNECT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 EVERETT CHARLES TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 206 EVERETT CHARLES TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 PTR HARTMANN GMBH: COMPANY OVERVIEW

- TABLE 208 PTR HARTMANN GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 PROBE PIN MARKET SEGMENTATION

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL PROBE PIN MARKET, 2021-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN PROBE PIN MARKET

- FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF PROBE PIN MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN PROBE PIN MARKET

- FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 8 RISING DEMAND FOR HIGH-PRECISION SEMICONDUCTOR TESTING TO DRIVE MARKET

- FIGURE 9 SPRING CONTACT TO BE LARGER THAN NON-SPRING CONTACT DURING FORECAST PERIOD

- FIGURE 10 POGO TYPE TO ACQUIRE HIGHER MARKET SHARE IN 2032

- FIGURE 11 SEMICONDUCTOR TESTING TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 12 CONSUMER ELECTRONICS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 13 CONSUMER ELECTRONICS AND CHINA ACCOUNTED FOR LARGEST MARKET SHARES IN 2025

- FIGURE 14 PROBE PIN MARKET DYNAMICS

- FIGURE 15 IMPACT ANALYSIS OF DRIVERS ON PROBE PIN MARKET

- FIGURE 16 IMPACT ANALYSIS OF RESTRAINTS ON PROBE PIN MARKET

- FIGURE 17 IMPACT ANALYSIS OF OPPORTUNITIES ON PROBE PIN MARKET

- FIGURE 18 IMPACT ANALYSIS OF CHALLENGES ON PROBE PIN MARKET

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 ECOSYSTEM ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND, BY CONTACT TYPE, 2021-2025 (USD)

- FIGURE 23 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2025 (USD)

- FIGURE 24 IMPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 25 EXPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 28 PATENT ANALYSIS

- FIGURE 29 DECISION-MAKING FACTORS IN PROBE PIN MARKET

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 32 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 33 PROBE PIN MARKET, BY CONTACT TYPE, 2025-2032 (USD MILLION)

- FIGURE 34 PROBE PIN MARKET, BY MANUFACTURING METHOD, 2025-2032 (USD MILLION)

- FIGURE 35 PROBE PIN MARKET, BY FREQUENCY RANGE, 2025-2032 (USD MILLION)

- FIGURE 36 PROBE PIN MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- FIGURE 37 PROBE PIN MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- FIGURE 38 PROBE PIN MARKET, BY REGION, 2025-2032

- FIGURE 39 ASIA PACIFIC: PROBE PIN MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: PROBE PIN MARKET SNAPSHOT

- FIGURE 41 EUROPE: PROBE PIN MARKET SNAPSHOT

- FIGURE 42 LATIN AMERICA: PROBE PIN MARKET SNAPSHOT

- FIGURE 43 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 44 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 COMPANY FOOTPRINT

- FIGURE 46 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 47 BRAND/PRODUCT COMPARISON

- FIGURE 48 RESEARCH DESIGN

- FIGURE 49 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 50 BOTTOM-UP APPROACH

- FIGURE 51 TOP-DOWN APPROACH

- FIGURE 52 MARKET SIZE ESTIMATION (SUPPLY SIDE): REVENUE GENERATED BY PROBE PIN MANUFACTURERS

- FIGURE 53 DATA TRIANGULATION