PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1936012

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1936012

Gas Sensor Market By Gas Type (Oxygen, Carbon Monoxide, Carbon Dioxide, Volatile Organic Compounds, Hydrocarbons), Technology (Electrochemical, Infrared, Solid-State/Metal-Oxide-Semiconductors), Output Type, Connectivity- Global Forecast to 2033

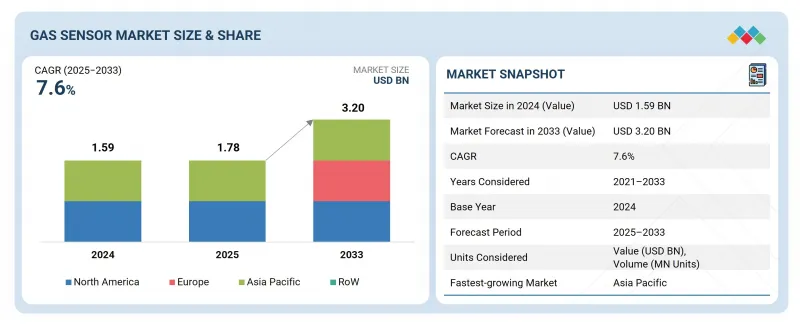

The global gas sensor market is expected to grow from USD 1.78 billion in 2025 to USD 3.20 billion by 2033, with a compound annual growth rate (CAGR) of 7.6% from 2025 to 2033. This growth is driven by increasing demand in key industries such as oil & gas, chemicals, mining, and power. Additionally, the demand for miniaturized wireless gas sensors is rising due to advancements in IoT, building automation, and modern control systems. These sensors are valued for their low power consumption, high performance, and small size.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Units Considered | Value (USD Billion) |

| Segments | By Gas Type, Technology, Connectivity and region |

| Regions covered | North America, Europe, APAC, RoW |

Furthermore, the integration of gas sensors into smartphones and wearable devices for continuous environmental or atmospheric air quality monitoring is expected to boost demand in the coming years.

"By output type, digital segment to grow at highest CAGR during forecast period"

The digital segment of the gas sensor market is expected to register a higher CAGR due to rising demand for more advanced, intelligent, and connected gas sensing solutions. Digital gas sensors provide several benefits over their analog equivalents, including better accuracy, the ability to connect with smart systems, and advanced signal processing features. As industries adopt digitalization and Internet of Things (IoT) technologies, the need for gas sensors that can connect to digital networks, send data remotely, and integrate into automated systems is increasing.

"Wired segment to capture largest share of gas sensor market in 2025"

The wired segment holds a larger share of the overall market due to its established infrastructure and reliability in industrial applications. Wired gas sensors are commonly used in environments where stable and continuous data transmission is essential and where power supply and connectivity are reliable. Industries such as manufacturing, petrochemical, automotive, and healthcare prefer wired sensors for their durability and direct connection to control systems, ensuring precise and uninterrupted data monitoring. Wired gas sensors are often considered more secure and stable for certain applications because they are less susceptible to interference and signal loss issues that can affect wireless technologies.

"China to be largest market for gas sensors in Asia Pacific."

China is expected to maintain its dominance in the gas sensor market across Asia Pacific during the forecast period. Process industries, especially chemical production and petroleum refining, along with public utilities like electric power generation, will remain the primary consumers of gas sensors in the country. Sectors such as oil & gas, infrastructure, and water & wastewater treatment, among others, are projected to drive the growth of the gas sensor market. Additionally, increasing public awareness about the health impacts of air pollution is also boosting demand for smart air quality monitors, smart bands, air purifiers, and air cleaners that are equipped with gas sensors.

Extensive primary interviews were conducted with key industry experts in the gas sensor market to determine and verify the market size for various segments and subsegments. The breakdown of primary participants for the report is shown below: The study includes insights from a range of industry experts, from component suppliers to Tier 1 companies and OEMs. The breakdown of the primary respondents is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 45%, and Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 340%, and Others - 20%

- By Region: North America - 25%, Europe - 20%, Asia Pacific - 45%, and RoW - 10%

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives, researchers, and members of various gas sensor organizations.

Honeywell International Inc. (US), MSA Safety Incorporated (US), Amphenol Corporation (US), Figaro Engineering Inc. (Japan), Alphasense (UK), Sensirion AG (Switzerland), Process Sensing Technologies (UK), ams-OSRAM AG (Austria), MEMBRAPOR (Switzerland), and Senseair AB (US), among others, are the key players in the gas sensor market.

The study includes an in-depth competitive analysis of these key players in the gas sensor market, as well as their company profiles, recent developments, and key market strategies.

Research Coverage:

This research report categorizes the gas sensor market by output type (analog and digital), connectivity (wired and wireless), product (gas analyzers & monitors, gas detectors, air quality monitors, air purifiers/air cleaners, HVAC systems, medical equipment, and consumer devices), technology (electrochemical, photoionization detection (PID), solid-state/metal-oxide-semiconductors (MOS), catalytic, infrared, laser, zirconia, holographic, and others), gas type (oxygen (O2), carbon monoxide (CO), carbon dioxide (CO2), ammonia (NH3), chlorine (Cl), hydrogen sulfide (H2S), nitrogen oxides (NOx), volatile organic compounds, methane (CH4), hydrocarbons, and hydrogen), end use (automotive & transportation, smart cities & building automation, oil & gas industry, water & wastewater treatment, food & beverage industry, power stations, medical industry, metal & chemical industry, mining, consumer electronics, and government & regulatory bodies), and region (North America, Europe, Asia Pacific, and RoW). The report outlines the key drivers, restraints, challenges, and opportunities in the gas sensor market and provides forecasts until 2033. It also includes leadership mapping and analysis of all companies within the gas sensor ecosystem.

Key Benefits of Buying the Report

The report will assist market leaders and new entrants by providing estimated revenue figures for the overall gas sensor market and its subsegments. It will help stakeholders understand the competitive landscape and gain insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report offers information on the market pulse, including key drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand in oil & gas, chemicals, mining, and power sectors, implementation of health and safety regulations, integration of gas sensors into HVAC systems and air quality monitors, surge in demand for autonomous vehicles) restraints (intense pricing pressure resulting in declining average selling prices), opportunities (incorporation of Internet of Things, cloud computing, and big data technologies, growing adoption in consumer electronics, increasing demand for miniaturized wireless gas sensors) and challenges (complex manufacturing process) influencing the growth of the gas sensor market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the gas sensor market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the gas sensor market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the gas sensor market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players, such as Honeywell International Inc. (US), MSA Safety Incorporated (US), Amphenol Corporation (US), Figaro Engineering Inc. (Japan), Alphasense (UK), Sensirion AG (Switzerland), Process Sensing Technologies (UK), ams-OSRAM AG (Austria), MEMBRAPOR (Switzerland), and Senseair AB (US) in the gas sensor market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN GAS SENSOR MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GAS SENSOR MARKET

- 3.2 GAS SENSOR MARKET, BY PRODUCT

- 3.3 GAS SENSOR MARKET, BY TECHNOLOGY

- 3.4 GAS SENSOR MARKET, BY TYPE

- 3.5 GAS SENSOR MARKET, BY END USE

- 3.6 GAS SENSOR MARKET, BY CONNECTIVITY AND OUTPUT TYPE

- 3.7 GAS SENSOR MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising demand in oil & gas, chemicals, mining, and power sectors

- 4.2.1.2 Implementation of health and safety regulations

- 4.2.1.3 Integration of gas sensors into HVAC systems and air quality monitors

- 4.2.1.4 Surge in demand for autonomous vehicles

- 4.2.2 RESTRAINTS

- 4.2.2.1 Intense pricing pressure resulting in declining average selling prices

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Incorporation of Internet of Things, cloud computing, and big data technologies

- 4.2.3.2 Growing adoption in consumer electronics

- 4.2.3.3 Increasing demand for miniaturized wireless gas sensors

- 4.2.4 CHALLENGES

- 4.2.4.1 Complex manufacturing process

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN GAS SENSORS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 MARKET DYNAMICS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL AUTOMOTIVE AND TRANSPORTATION INDUSTRY

- 5.3.4 TRENDS IN GLOBAL SMART CITIES AND BUILDING-AUTOMATION INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 TRADE ANALYSIS

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2024 AND 2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ION SCIENCE PARTNERED WITH BLACKLINE SAFETY CORP. TO TACKLE PROBLEM OF HUMIDITY INFLUENCING VOC READINGS

- 5.11.2 CO2METER USED GAS SENSORS AS CO2 ALARMS FOR CO2 LEAK DETECTION

- 5.11.3 STORAGE CONTROL SYSTEMS LTD. DEVELOPED SPRINTIR CO2 SENSOR FOR FAST AND ACCURATE READING

- 5.12 IMPACT OF 2025 US TARIFFS

- 5.12.1 KEY TARIFF RATES

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT ON VARIOUS COUNTRIES/REGIONS

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON VERTICALS

6 TECHNOLOGICAL ADVANCEMENT, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 TECHNOLOGICAL ADVANCEMENTS

- 6.1.1 KEY TECHNOLOGIES

- 6.1.1.1 Miniaturization

- 6.1.1.2 Microelectromechanical system (MEMS) gas sensors

- 6.1.1.3 Nanomaterial integration

- 6.1.2 COMPLEMENTARY TECHNOLOGIES

- 6.1.2.1 E-nose

- 6.1.3 ADJACENT TECHNOLOGIES

- 6.1.3.1 Printed gas sensors

- 6.1.3.2 Zeolite material-based gas sensors

- 6.1.3.3 Wearable technology

- 6.1.1 KEY TECHNOLOGIES

- 6.2 TECHNOLOGY/PRODUCT ROADMAP

- 6.3 PATENT ANALYSIS

- 6.4 IMPACT OF AI ON GAS SENSORS

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 BEST PRACTICES IN GAS SENSOR MARKET

- 6.4.3 CASE STUDIES OF AI IMPLEMENTATION IN GAS SENSOR MARKET

- 6.4.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.4.5 CLIENTS' READINESS TO ADOPT AI IN GAS SENSOR MARKET

7 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.3 STANDARDS AND REGULATIONS RELATED TO GAS SENSORS

- 7.3.1 STANDARDS

- 7.3.1.1 AS4641

- 7.3.1.2 ISO 19891-1

- 7.3.1.3 Restriction of Hazardous Substances Directive

- 7.3.1.4 ATmosphere EXplosible

- 7.3.1.5 Edison Testing Laboratories

- 7.3.1.6 Safety Integrity Level 1

- 7.3.1.7 Material safety data sheet

- 7.3.1.8 National and regional legislation

- 7.3.1.9 List of standards for gas sensors

- 7.3.1 STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END USERS

9 GAS SENSOR MARKET, BY PRODUCT

- 9.1 INTRODUCTION

- 9.2 GAS ANALYZERS & MONITORS

- 9.2.1 GROWING USE FOR PRECISION AND REAL-TIME MONITORING TO DRIVE SEGMENTAL GROWTH

- 9.3 GAS DETECTORS

- 9.3.1 INCREASING WORKPLACE SAFETY CONCERNS IN HAZARDOUS INDUSTRIES TO PROPEL DEMAND FOR ADVANCED GAS DETECTORS

- 9.4 AIR QUALITY MONITORS

- 9.4.1 RISING AWARENESS OF AIR POLLUTION DRIVING DEMAND FOR ADVANCED AIR QUALITY MONITORS IN SMART CITIES AND HOMES

- 9.5 AIR PURIFIERS/AIR CLEANERS

- 9.5.1 GROWING DEMAND FOR SMART AIR PURIFIERS EQUIPPED WITH VOC SENSORS TO BOOST MARKET

- 9.6 HVAC SYSTEMS

- 9.6.1 INCREASING ADOPTION OF NATURAL REFRIGERANTS FUELING NEED FOR ADVANCED GAS SENSORS IN HVAC SYSTEMS

- 9.7 MEDICAL EQUIPMENT

- 9.7.1 GROWING ADOPTION OF GAS SENSORS IN HEALTHCARE AND MEDICAL LABS ACCELERATING MARKET GROWTH

- 9.8 CONSUMER DEVICES

- 9.8.1 AI-ENHANCED GAS SENSORS INCREASINGLY ADOPTED IN SMART CONSUMER DEVICES

10 GAS SENSOR MARKET, BY OUTPUT TYPE

- 10.1 INTRODUCTION

- 10.2 ANALOG

- 10.2.1 HIGH DEMAND IN INDUSTRIAL WORKPLACES TO DRIVE MARKET GROWTH

- 10.3 DIGITAL

- 10.3.1 HIGH TECHNICAL PERFORMANCE AND LOW MAINTENANCE COST TO FUEL DEMAND

11 GAS SENSOR MARKET, BY CONNECTIVITY

- 11.1 INTRODUCTION

- 11.2 WIRED

- 11.2.1 INCREASED INTEGRATION INTO BROADER WIRED NETWORKS IN INDUSTRIAL IOT SETUPS TO DRIVE MARKET

- 11.3 WIRELESS

- 11.3.1 NEED FOR IMMEDIATE DETECTION AND REPORTING OF HAZARDOUS CONDITIONS IN CRITICAL INDUSTRIES DRIVING ADOPTION

12 GAS SENSOR MARKET, BY TECHNOLOGY

- 12.1 INTRODUCTION

- 12.2 ELECTROCHEMICAL

- 12.2.1 GROWTH OF HEALTHCARE SECTOR DRIVING DEMAND FOR ELECTROCHEMICAL GAS SENSORS

- 12.3 PHOTOIONIZATION DETECTION

- 12.3.1 HIGH DEMAND IN INDUSTRIAL ENVIRONMENTS FOR MONITORING VOCS TO DRIVE MARKET GROWTH

- 12.4 SOLID-STATE/METAL-OXIDE-SEMICONDUCTOR

- 12.4.1 GROWTH OF INDUSTRIAL, AUTOMOBILE, AND HEALTHCARE SECTORS TO FUEL MARKET GROWTH

- 12.5 CATALYTIC

- 12.5.1 USE IN AMMONIA AND METHANE GAS SENSORS FOR AUTOMOTIVE AND INDUSTRIAL SECTORS TO DRIVE GROWTH

- 12.6 INFRARED

- 12.6.1 DEMAND IN INDUSTRIAL AND INDOOR AIR QUALITY MONITORING APPLICATIONS TO SUPPORT MARKET GROWTH

- 12.6.1.1 Non-dispersive infrared (NDIR)

- 12.6.1.2 Tunable diode laser spectroscopy (TDLS)

- 12.6.1 DEMAND IN INDUSTRIAL AND INDOOR AIR QUALITY MONITORING APPLICATIONS TO SUPPORT MARKET GROWTH

- 12.7 LASER

- 12.7.1 INCREASING ADOPTION IN INDUSTRIAL, COMMERCIAL, AND DEFENSE APPLICATIONS TO DRIVE MARKET

- 12.8 ZIRCONIA

- 12.8.1 ADOPTION IN STEEL PRODUCTION, POWER PLANTS, BOILERS, AND FOOD INDUSTRY FOR OXYGEN MONITORING TO DRIVE MARKET

- 12.9 HOLOGRAPHIC

- 12.9.1 HOLOGRAPHIC GAS SENSORS COMMONLY USED FOR ENVIRONMENTAL MONITORING AND HEALTHCARE DIAGNOSTICS

- 12.10 OTHER TECHNOLOGIES

13 GAS SENSOR MARKET, BY TYPE

- 13.1 INTRODUCTION

- 13.2 OXYGEN

- 13.2.1 ADVANCEMENTS IN ANESTHESIA AND CRITICAL CARE FUELING DEMAND FOR PRECISE OXYGEN MONITORING

- 13.3 CARBON MONOXIDE

- 13.3.1 INCREASING AWARENESS OF INDOOR AIR POLLUTION TO DRIVE DEMAND

- 13.4 CARBON DIOXIDE

- 13.4.1 ENVIRONMENTAL REGULATIONS REQUIRING CO2 MONITORING IN INDUSTRIAL PROCESSES TO PROPEL MARKET GROWTH

- 13.5 AMMONIA

- 13.5.1 GROWTH OF SMART CITIES AND DEMAND IN INDUSTRIAL APPLICATIONS TO BOOST MARKET GROWTH

- 13.6 CHLORINE

- 13.6.1 DEMAND IN WATER & WASTEWATER TREATMENT PLANTS TO FUEL MARKET GROWTH

- 13.7 HYDROGEN SULFIDE

- 13.7.1 USE IN OIL & GAS, WATER & WASTEWATER TREATMENT, AND SEWER AND SANITATION APPLICATIONS TO DRIVE MARKET

- 13.8 NITROGEN OXIDE

- 13.8.1 GROWTH OF AUTOMOTIVE & TRANSPORTATION SECTOR TO INCREASE DEMAND

- 13.9 VOLATILE ORGANIC COMPOUNDS

- 13.9.1 HIGH DEMAND FOR VOC SENSORS IN DYES, PLASTICS, SOLVENTS, AND PAINTS MANUFACTURING TO BOOST MARKET GROWTH

- 13.10 METHANE

- 13.10.1 HIGH DEMAND IN MINING AND OIL & GAS INDUSTRIES TO BOOST MARKET GROWTH

- 13.11 HYDROCARBONS

- 13.11.1 INCREASING USE OF NATURAL GAS IN RESIDENTIAL, INDUSTRIAL, AND TRANSPORTATION APPLICATIONS DRIVING MARKET

- 13.12 HYDROGEN

- 13.12.1 SURGING DEMAND IN REFINERIES, PETROCHEMICAL PLANTS, AND CHEMICAL MANUFACTURING TO DRIVE MARKET

14 GAS SENSOR MARKET, BY END USE

- 14.1 INTRODUCTION

- 14.2 AUTOMOTIVE & TRANSPORTATION

- 14.2.1 INCREASED DEPLOYMENT OF PARTICULATE MATTER SENSORS TO ADDRESS POLLUTION IN VEHICLE CABINS TO DRIVE MARKET

- 14.3 SMART CITIES & BUILDING AUTOMATION

- 14.3.1 URBANIZATION AND RISING CONCERNS ABOUT HEALTH RISKS DUE TO POLLUTION TO DRIVE MARKET

- 14.4 OIL & GAS

- 14.4.1 INCREASING FOCUS ON METHANE EMISSION CONTROL AND SAFETY REGULATIONS TO FUEL DEMAND

- 14.5 WATER & WASTEWATER TREATMENT

- 14.5.1 GROWING AWARENESS OF GREENHOUSE GAS EMISSIONS AND SAFETY STANDARDS DRIVING MARKET

- 14.6 FOOD & BEVERAGES

- 14.6.1 USE OF CO2 IN FOOD PROCESSING AND STORAGE DRIVING DEMAND FOR GAS DETECTION SYSTEMS IN FOOD & BEVERAGE INDUSTRY

- 14.7 POWER STATIONS

- 14.7.1 RISING INTEGRATION OF HYDROGEN IN POWER GENERATION FUELS INCREASING DEMAND FOR ADVANCED GAS SENSORS

- 14.8 MEDICAL

- 14.8.1 DEMAND FOR WEARABLE HEALTHCARE DEVICES EQUIPPED WITH GAS SENSORS TO REVOLUTIONIZE REMOTE PATIENT MONITORING

- 14.9 METALS & CHEMICALS

- 14.9.1 HIGH DEMAND FOR ADVANCED GAS SENSORS TO MONITOR HAZARDOUS EMISSIONS TO DRIVE MARKET

- 14.10 MINING

- 14.10.1 INCREASED DEMAND FOR PORTABLE GAS SENSORS FOR DETECTING TOXIC GASES IN MINES TO BOOST MARKET

- 14.11 CONSUMER ELECTRONICS

- 14.11.1 ADVANCEMENTS IN SENSOR MINIATURIZATION AND SMART TECHNOLOGY TO ACCELERATE ADOPTION

- 14.12 GOVERNMENT & REGULATORY BODIES

- 14.12.1 INCREASINGLY STRINGENT REGULATIONS ON AIR QUALITY AND SAFETY STANDARDS TO BOOST MARKET GROWTH

15 GAS SENSOR MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 15.2.2 US

- 15.2.2.1 High demand in oil & gas and automotive sectors and presence of key players to drive market

- 15.2.3 CANADA

- 15.2.3.1 Growing investments in infrastructure development to drive market growth

- 15.2.4 MEXICO

- 15.2.4.1 Stringent regulations on industrial safety and air quality and adoption of advanced technologies to fuel market growth

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 15.3.2 UK

- 15.3.2.1 Stringent government regulations regarding environmental monitoring and emissions reduction to propel market growth

- 15.3.3 GERMANY

- 15.3.3.1 Strong automotive industry driving adoption of gas sensors in Germany

- 15.3.4 FRANCE

- 15.3.4.1 Investments in infrastructure development and presence of major automobile manufacturers to fuel market growth

- 15.3.5 ITALY

- 15.3.5.1 Rising demand in manufacturing sector to support market growth

- 15.3.6 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 15.4.2 CHINA

- 15.4.2.1 Rapid industrialization and urbanization fueling demand for gas sensors

- 15.4.3 JAPAN

- 15.4.3.1 Adoption of innovative sensor technologies in various industries to curb air pollution to support market growth

- 15.4.4 INDIA

- 15.4.4.1 Government-led initiatives and investments in petrochemical sector to drive market

- 15.4.5 SOUTH KOREA

- 15.4.5.1 Increasing use of IoT-integrated sensors for real-time monitoring to boost demand

- 15.4.6 REST OF ASIA PACIFIC

- 15.5 REST OF THE WORLD (ROW)

- 15.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 15.5.2 MIDDLE EAST & AFRICA

- 15.5.2.1 Rising oil & gas exploration activities to contribute to market growth

- 15.5.2.2 GCC countries

- 15.5.2.3 Rest of Middle East & Africa

- 15.5.3 SOUTH AMERICA

- 15.5.3.1 Growth in automotive, oil & gas, chemicals, and mining industries to drive demand

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 16.3 MARKET SHARE ANALYSIS, 2024

- 16.4 REVENUE ANALYSIS, 2020-2024

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Gas type footprint

- 16.7.5.4 Connectivity footprint

- 16.7.5.5 End use footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 16.8.5.1 Detailed list of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 HONEYWELL INTERNATIONAL INC.

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 MSA SAFETY INCORPORATED

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.3.2 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 AMPHENOL CORPORATION

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Key strengths

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses and competitive threats

- 17.1.4 SENSIRION AG

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.3.2 Deals

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 AMS-OSRAM AG

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 MnM view

- 17.1.5.3.1 Key strengths

- 17.1.5.3.2 Strategic choices

- 17.1.5.3.3 Weaknesses and competitive threats

- 17.1.6 FIGARO ENGINEERING INC.

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches

- 17.1.6.3.2 Expansions

- 17.1.7 ALPHASENSE

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches

- 17.1.7.3.2 Deals

- 17.1.8 PROCESS SENSING TECHNOLOGIES

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.8.3.2 Deals

- 17.1.9 MEMBRAPOR

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.10 SENSEAIR AB (ASAHI KASEI MICRODEVICES)

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.11 NISSHA CO., LTD.

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches

- 17.1.12 FUJI ELECTRIC CO., LTD.

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.13 RENESAS ELECTRONICS CORPORATION

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.14 DANFOSS

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.15 GASERA LTD.

- 17.1.15.1 Business overview

- 17.1.15.2 Products/Solutions/Services offered

- 17.1.16 INFINEON TECHNOLOGIES AG

- 17.1.16.1 Business overview

- 17.1.16.2 Products/Solutions/Services offered

- 17.1.16.3 Recent developments

- 17.1.16.3.1 Product launches

- 17.1.1 HONEYWELL INTERNATIONAL INC.

- 17.2 OTHER PLAYERS

- 17.2.1 NITERRA CO., LTD.

- 17.2.2 BREEZE TECHNOLOGIES

- 17.2.3 ELICHENS

- 17.2.4 BOSCH SENSORTEC GMBH

- 17.2.5 EDINBURGH SENSORS

- 17.2.6 GASTEC CORPORATION

- 17.2.7 NEMOTO & CO., LTD.

- 17.2.8 SPEC SENSORS

- 17.2.9 SIA MIPEX

- 17.2.10 CUBIC SENSOR AND INSTRUMENT CO., LTD.

- 17.2.11 WINSEN

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 List of key secondary sources

- 18.1.1.2 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 List of primary interview participants

- 18.1.2.2 Breakdown of primary interviews

- 18.1.2.3 Key industry insights

- 18.1.3 SECONDARY AND PRIMARY RESEARCH

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 18.2.2 TOP-DOWN APPROACH

- 18.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 18.2.1 BOTTOM-UP APPROACH

- 18.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 18.4 RESEARCH ASSUMPTIONS

- 18.5 RISK ANALYSIS

- 18.6 RESEARCH LIMITATIONS

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS

List of Tables

- TABLE 1 GAS SENSOR MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 3 COMPANIES AND THEIR ROLE IN GAS SENSOR ECOSYSTEM

- TABLE 4 PRICING RANGE OF GAS SENSOR OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 5 IMPORT DATA (HS CODE: 902710), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 6 EXPORT DATA (HS CODE: 902710), BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 GAS SENSOR MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 9 EVOLUTION OF GAS SENSOR TECHNOLOGIES

- TABLE 10 LIST OF APPLIED/GRANTED PATENTS RELATED TO GAS SENSOR MARKET, 2021-2025

- TABLE 11 TOP USE CASES AND MARKET POTENTIAL

- TABLE 12 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 13 GAS SENSOR MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 14 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 21 UNMET NEEDS IN GAS SENSOR MARKET, BY VERTICAL

- TABLE 22 GAS SENSOR MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 23 GAS SENSOR MARKET, BY PRODUCT, 2025-2033 (USD MILLION)

- TABLE 24 GAS SENSOR MARKET, BY OUTPUT TYPE, 2021-2024 (USD MILLION)

- TABLE 25 GAS SENSOR MARKET, BY OUTPUT TYPE, 2025-2033 (USD MILLION)

- TABLE 26 ANALOG: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 ANALOG: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 28 DIGITAL: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 DIGITAL: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 30 GAS SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 31 GAS SENSOR MARKET, BY CONNECTIVITY, 2025-2033 (USD MILLION)

- TABLE 32 WIRED: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 WIRED: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 34 WIRELESS: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 WIRELESS: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 36 GAS SENSOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 37 GAS SENSOR MARKET, BY TECHNOLOGY, 2025-2033 (USD MILLION)

- TABLE 38 INFRARED GAS SENSOR MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 39 INFRARED GAS SENSOR MARKET, BY TECHNOLOGY, 2025-2033 (USD MILLION)

- TABLE 40 GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 41 GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 42 GAS SENSOR MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 43 GAS SENSOR MARKET, BY TYPE, 2025-2033 (MILLION UNITS)

- TABLE 44 OXYGEN: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 45 OXYGEN: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 46 CARBON MONOXIDE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 47 CARBON MONOXIDE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 48 CARBON DIOXIDE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 49 CARBON DIOXIDE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 50 AMMONIA: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 51 AMMONIA: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 52 CHLORINE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 53 CHLORINE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 54 HYDROGEN SULFIDE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 55 HYDROGEN SULFIDE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 56 NITROGEN OXIDE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 57 NITROGEN OXIDE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 58 VOLATILE ORGANIC COMPOUNDS: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 59 VOLATILE ORGANIC COMPOUNDS: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 60 METHANE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 61 METHANE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 62 HYDROCARBONS: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 63 HYDROCARBONS: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 64 HYDROGEN: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 65 HYDROGEN: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 66 GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 67 GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 68 AUTOMOTIVE & TRANSPORTATION: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 AUTOMOTIVE & TRANSPORTATION: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 70 AUTOMOTIVE & TRANSPORTATION: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 AUTOMOTIVE & TRANSPORTATION: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 72 AUTOMOTIVE & TRANSPORTATION: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 73 AUTOMOTIVE & TRANSPORTATION: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 74 SMART CITIES & BUILDING AUTOMATION: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 SMART CITIES & BUILDING AUTOMATION: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 76 SMART CITIES & BUILDING AUTOMATION: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 SMART CITIES & BUILDING AUTOMATION: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 78 SMART CITIES & BUILDING AUTOMATION: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 SMART CITIES & BUILDING AUTOMATION: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 80 OIL & GAS: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 81 OIL & GAS: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 82 OIL & GAS: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 OIL & GAS: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 84 OIL & GAS: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 OIL & GAS: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 86 WATER & WASTEWATER TREATMENT: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 87 WATER & WASTEWATER TREATMENT: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 88 WATER & WASTEWATER TREATMENT: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 WATER & WASTEWATER TREATMENT: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 90 WATER & WASTEWATER TREATMENT: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 91 WATER & WASTEWATER TREATMENT: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 92 FOOD & BEVERAGES: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 FOOD & BEVERAGES: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 94 FOOD & BEVERAGES: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 FOOD & BEVERAGES: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 96 FOOD & BEVERAGES: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 FOOD & BEVERAGES: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 98 POWER STATIONS: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 99 POWER STATIONS: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 100 POWER STATIONS: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 POWER STATIONS: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 102 POWER STATIONS: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 103 POWER STATIONS: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 104 MEDICAL: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 105 MEDICAL: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 106 MEDICAL: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 107 MEDICAL: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 108 MEDICAL: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 109 MEDICAL: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 110 METALS & CHEMICALS: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 111 METALS & CHEMICALS: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 112 METALS & CHEMICALS: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 METALS & CHEMICALS: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 114 METALS & CHEMICALS: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 METALS & CHEMICALS: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 116 MINING: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 117 MINING: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 118 MINING: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 MINING: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 120 MINING: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 MINING: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 122 CONSUMER ELECTRONICS: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 123 CONSUMER ELECTRONICS: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 124 CONSUMER ELECTRONICS: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 CONSUMER ELECTRONICS: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 126 CONSUMER ELECTRONICS: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 127 CONSUMER ELECTRONICS: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 128 GOVERNMENT & REGULATORY BODIES: GAS SENSOR MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 129 GOVERNMENT & REGULATORY BODIES: GAS SENSOR MARKET, BY TYPE, 2025-2033 (USD MILLION)

- TABLE 130 GOVERNMENT & REGULATORY BODIES: GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 131 GOVERNMENT & REGULATORY BODIES: GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 132 GOVERNMENT & REGULATORY BODIES: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 GOVERNMENT & REGULATORY BODIES: ASIA PACIFIC GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 134 GAS SENSOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- TABLE 136 NORTH AMERICA: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 138 NORTH AMERICA: GAS SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: GAS SENSOR MARKET, BY CONNECTIVITY, 2025-2033 (USD MILLION)

- TABLE 140 NORTH AMERICA: GAS SENSOR MARKET, BY OUTPUT TYPE, 2021-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: GAS SENSOR MARKET, BY OUTPUT TYPE, 2025-2033 (USD MILLION)

- TABLE 142 NORTH AMERICA: GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 143 NORTH AMERICA: GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 144 US: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 145 US: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 146 CANADA: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 147 CANADA: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 148 MEXICO: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 149 MEXICO: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 150 EUROPE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 151 EUROPE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 152 EUROPE: GAS SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 153 EUROPE: GAS SENSOR MARKET, BY CONNECTIVITY, 2025-2033 (USD MILLION)

- TABLE 154 EUROPE: GAS SENSOR MARKET, BY OUTPUT TYPE, 2021-2024 (USD MILLION)

- TABLE 155 EUROPE: GAS SENSOR MARKET, BY OUTPUT TYPE, 2025-2033 (USD MILLION)

- TABLE 156 EUROPE: GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 157 EUROPE: GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 158 UK: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 159 UK: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 160 GERMANY: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 161 GERMANY: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 162 FRANCE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 163 FRANCE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 164 ITALY: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 165 ITALY: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 166 REST OF EUROPE: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 167 REST OF EUROPE: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 168 ASIA PACIFIC: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 170 ASIA PACIFIC: GAS SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: GAS SENSOR MARKET, BY CONNECTIVITY, 2025-2033 (USD MILLION)

- TABLE 172 ASIA PACIFIC: GAS SENSOR MARKET, BY OUTPUT TYPE, 2021-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: GAS SENSOR MARKET, BY OUTPUT TYPE, 2025-2033 (USD MILLION)

- TABLE 174 ASIA PACIFIC: GAS SENSOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 175 ASIA PACIFIC: GAS SENSOR MARKET, BY COUNTRY, 2025-2033 (USD MILLION)

- TABLE 176 CHINA: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 177 CHINA: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 178 JAPAN: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 179 JAPAN: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 180 INDIA: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 181 INDIA: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 182 SOUTH KOREA: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 183 SOUTH KOREA: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 186 ROW: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 187 ROW: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 188 ROW: GAS SENSOR MARKET, BY CONNECTIVITY, 2021-2024 (USD MILLION)

- TABLE 189 ROW: GAS SENSOR MARKET, BY CONNECTIVITY, 2025-2033 (USD MILLION)

- TABLE 190 ROW: GAS SENSOR MARKET, BY OUTPUT TYPE, 2021-2024 (USD MILLION)

- TABLE 191 ROW: GAS SENSOR MARKET, BY OUTPUT TYPE, 2025-2033 (USD MILLION)

- TABLE 192 ROW: GAS SENSOR MARKET, BY SUBREGION, 2021-2024 (USD MILLION)

- TABLE 193 ROW: GAS SENSOR MARKET, BY SUBREGION, 2025-2033 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: GAS SENSOR MARKET, BY SUBREGION, 2021-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: GAS SENSOR MARKET, BY SUBREGION, 2025-2033 (USD MILLION)

- TABLE 196 GCC: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 197 GCC: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 198 REST OF MIDDLE EAST & AFRICA: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 199 REST OF MIDDLE EAST & AFRICA: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 200 SOUTH AMERICA: GAS SENSOR MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 201 SOUTH AMERICA: GAS SENSOR MARKET, BY END USE, 2025-2033 (USD MILLION)

- TABLE 202 GAS SENSOR MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 203 GAS SENSOR MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 204 GAS SENSOR MARKET: REGION FOOTPRINT

- TABLE 205 GAS SENSOR MARKET: GAS TYPE FOOTPRINT

- TABLE 206 GAS SENSOR MARKET: CONNECTIVITY FOOTPRINT

- TABLE 207 GAS SENSOR MARKET: END USE FOOTPRINT

- TABLE 208 GAS SENSOR MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 209 GAS SENSOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 210 GAS SENSOR MARKET: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2025

- TABLE 211 GAS SENSOR MARKET: DEALS, JANUARY 2021-OCTOBER 2025

- TABLE 212 GAS SENSOR MARKET: OTHER DEVELOPMENTS, JANUARY 2021-OCTOBER 2025

- TABLE 213 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 214 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 216 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 217 MSA SAFETY INCORPORATED: COMPANY OVERVIEW

- TABLE 218 MSA SAFETY INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 MSA SAFETY INCORPORATED: PRODUCT LAUNCHES

- TABLE 220 MSA SAFETY INCORPORATED: DEALS

- TABLE 221 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 222 AMPHENOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 SENSIRION AG: COMPANY OVERVIEW

- TABLE 224 SENSIRION AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 SENSIRION AG: PRODUCT LAUNCHES

- TABLE 226 SENSIRION AG: DEALS

- TABLE 227 AMS-OSRAM AG: COMPANY OVERVIEW

- TABLE 228 AMS-OSRAM AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 FIGARO ENGINEERING INC.: COMPANY OVERVIEW

- TABLE 230 FIGARO ENGINEERING INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 FIGARO ENGINEERING INC.: PRODUCT LAUNCHES

- TABLE 232 FIGARO ENGINEERING INC.: EXPANSIONS

- TABLE 233 ALPHASENSE: COMPANY OVERVIEW

- TABLE 234 ALPHASENSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 ALPHASENSE: PRODUCT LAUNCHES

- TABLE 236 ALPHASENSE: DEALS

- TABLE 237 PROCESS SENSING TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 238 PROCESS SENSING TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 PROCESS SENSING TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 240 PROCESS SENSING TECHNOLOGIES: DEALS

- TABLE 241 MEMBRAPOR: COMPANY OVERVIEW

- TABLE 242 MEMBRAPOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 MEMBRAPOR: PRODUCT LAUNCHES

- TABLE 244 SENSEAIR AB (ASAHI KASEI MICRODEVICES): COMPANY OVERVIEW

- TABLE 245 SENSEAIR AB (ASAHI KASEI MICRODEVICES): PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 246 SENSEAIR AB (ASAHI KASEI MICRODEVICES): PRODUCT LAUNCHES

- TABLE 247 NISSHA CO., LTD.: COMPANY OVERVIEW

- TABLE 248 NISSHA CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 NISSHA CO., LTD.: PRODUCT LAUNCHES

- TABLE 250 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 251 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 253 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 DANFOSS: COMPANY OVERVIEW

- TABLE 255 DANFOSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 GASERA LTD.: COMPANY OVERVIEW

- TABLE 257 GASERA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 259 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 261 GAS SENSOR MARKET: RESEARCH ASSUMPTIONS

- TABLE 262 GAS SENSOR MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 GAS SENSOR MARKET SEGMENTATION

- FIGURE 2 MARKET HIGHLIGHTS AND KEY INSIGHTS

- FIGURE 3 GAS SENSOR MARKET, IN TERMS OF VALUE, 2025-2033

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN GAS SENSOR MARKET, JANUARY 2021-OCTOBER 2025

- FIGURE 5 DISRUPTIVE TRENDS INFLUENCING GAS SENSOR DEMAND

- FIGURE 6 HIGH-GROWTH SEGMENTS IN GAS SENSOR MARKET

- FIGURE 7 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 INCREASING FOCUS ON AIR QUALITY MONITORING AND MULTI-GAS DETECTION TO FUEL MARKET

- FIGURE 9 AIR QUALITY MONITORS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 SOLID-STATE/METAL-OXIDE-SEMICONDUCTORS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE BY 2033

- FIGURE 11 VOLATILE ORGANIC COMPOUNDS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 SMART CITIES & BUILDING AUTOMATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 WIRED AND ANALOG SEGMENTS TO ACCOUNT FOR LARGEST MARKET SHARES IN 2025

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR IN GAS SENSOR MARKET BETWEEN 2025 AND 2033

- FIGURE 15 GAS SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 GAS SENSOR MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 17 GAS SENSOR MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 18 GAS SENSOR MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 19 GAS SENSOR MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 20 GAS SENSOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 GAS SENSOR MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 GAS SENSOR MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE OF GAS SENSORS, 2024 (USD)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF GAS SENSORS, BY TYPE, 2021-2023 (USD)

- FIGURE 25 AVERAGE SELLING PRICE OF OXYGEN (O2) GAS SENSORS, BY REGION, 2021-2024 (USD)

- FIGURE 26 IMPORT DATA (HS CODE: 902710), BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 27 EXPORT DATA (HS CODE: 902710), BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2024 AND 2025 (USD MILLION)

- FIGURE 30 GAS SENSOR MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 31 DECISION-MAKING FACTORS IN GAS SENSOR MARKET

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 34 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 35 AIR QUALITY MONITORS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 ANALOG SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 WIRELESS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 SOLID-STATE/METAL-OXIDE-SEMICONDUCTOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 39 VOLATILE ORGANIC COMPOUNDS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 40 SMART CITIES & BUILDING AUTOMATION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 41 GAS SENSOR MARKET, BY REGION, 2025-2033 (USD MILLION)

- FIGURE 42 NORTH AMERICA: GAS SENSOR MARKET SNAPSHOT

- FIGURE 43 EUROPE: GAS SENSOR MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: GAS SENSOR MARKET SNAPSHOT

- FIGURE 45 GAS SENSOR MARKET SHARE ANALYSIS, 2024

- FIGURE 46 GAS SENSOR MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 47 COMPANY VALUATION

- FIGURE 48 FINANCIAL METRICS

- FIGURE 49 GAS SENSOR MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 50 GAS SENSOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 GAS SENSOR MARKET: COMPANY FOOTPRINT

- FIGURE 52 GAS SENSOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 54 MSA SAFETY INCORPORATED: COMPANY SNAPSHOT

- FIGURE 55 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 SENSIRION AG: COMPANY SNAPSHOT

- FIGURE 57 AMS-OSRAM AG: COMPANY SNAPSHOT

- FIGURE 58 NISSHA CO., LTD.: COMPANY SNAPSHOT

- FIGURE 59 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 DANFOSS: COMPANY SNAPSHOT

- FIGURE 62 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 63 GAS SENSOR MARKET: RESEARCH DESIGN

- FIGURE 64 GAS SENSOR MARKET: RESEARCH FLOW

- FIGURE 65 GAS SENSOR MARKET: BOTTOM-UP APPROACH

- FIGURE 66 GAS SENSOR MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 67 GAS SENSOR MARKET: TOP-DOWN APPROACH

- FIGURE 68 GAS SENSOR MARKET: DATA TRIANGULATION