PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1936064

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1936064

Aluminum Extrusion Market by Product, Alloy Grade, Surface Finish, End-use Industry, and Region - Global Forecast to 2030

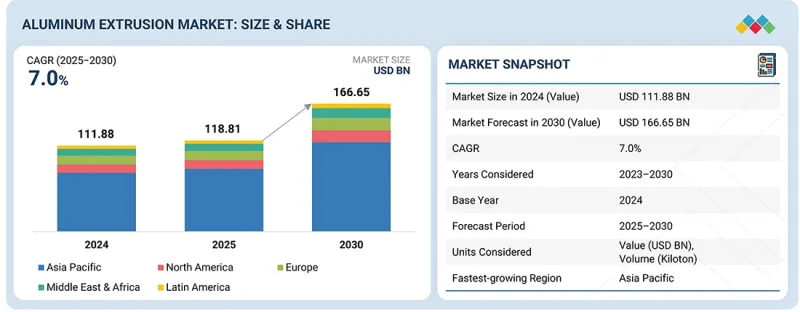

The aluminum extrusion market is estimated at USD 111.88 billion in 2024 and is projected to reach USD 166.65 billion by 2030, at a CAGR of 7.0% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | By Type, By Alloy Grade, By Surface Finish, By End-use Industry, and By Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East & Africa |

Solid profiles dominated the overall aluminum extrusion market owing to the simplicity in manufacturing and structural solidity. Solid profiles include shapes like rods, bars, flat bars, angles (L-profiles), channels (U or C shapes), and beams, offering high material density for strength without internal openings. They are extruded using straightforward solid dies, making production faster and more cost-effective than complex profiles like semi-hollow and hollow profiles.

''By alloy grade, 6xxx alloy grade accounted for the largest share of the overall aluminum extrusion market in 2024.''

6xxx series aluminum alloys dominate the aluminum extrusion market due to their optimal combination of extrudability, medium-to-high strength, corrosion resistance, and heat-treatable properties. These alloys, primarily alloyed with magnesium (Mg) and silicon (Si) to form magnesium silicide, enable complex shapes and thin-walled profiles essential for extrusions.

6xxx alloys offer excellent formability during extrusion, good weldability with 4xxx or 5xxx fillers, and superior surface finish for anodizing or painting. Common tempers like T5 or T6 enhance strength via precipitation hardening at 160-182°C. They balance tensile strength (18-58 ksi) with ductility, though sensitive to cracking if not managed.

''The mill-finished segment is estimated to be the most preferred surface finish of aluminum extrusion during the forecast period.''

The mill-finished segment is expected to dominate the market and register the highest CAGR during the forecast period. Lower production costs from skipping finishing processes make mill-finished extrusions attractive for high-volume manufacturing, especially amid rising raw material prices and inflation pressures. This segment benefits from shorter lead times, enabling quick supply to industrial users who apply custom finishes later.

''The construction & infrastructure end-use industry dominated the aluminum extrusion market in 2024.'

The construction & infrastructure sector is projected to grow at the highest CAGR of 6.9% during the forecast period, in terms of value. The construction industry is also one of the major end users of aluminum extruded products. Aluminum is considered one of the most viable building materials due to the wide range of benefits it offers, such as light strength-to-weight ratio, sustainability, recyclability, and versatility. Aluminum is widely used in construction as it helps building projects qualify for green building status under the Leadership in Energy and Environmental Design (LEED) standards.

"Asia Pacific is estimated to account for the largest share in the overall aluminum extrusion market."

Asia Pacific holds the dominant share in the global aluminum extrusion market. This leadership stems from rapid industrialization, urbanization, and surging demand across key sectors. Robust economic growth in countries like China, India, Japan, and South Korea fuels infrastructure projects and high-rise construction, which heavily rely on extruded aluminum for its lightweight strength and corrosion resistance.

The automotive industry in the region prioritizes lightweight materials for fuel-efficient vehicles amid strict emissions rules, with China as the world's largest auto market. Electronics, machinery, and renewable energy sectors (like solar frames) further boost usage due to aluminum's conductivity and versatility.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided based on the following three categories:

- By Company Type - Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

- By Designation - C Level - 33%, Director Level - 33%, and Others - 34%

- By Region - North America - 20%, Europe - 25%, Asia Pacific - 25%, Middle East & Africa -20%, South America - 10%.

The report provides a comprehensive analysis of company profiles:

Prominent companies include Jindal Aluminum Limited (India), Hindalco Industries Ltd. (India), Alcoa Corporation (US), Aluminum Corporation of China Limited (China), RUSAL (Russia), Century Aluminum Company (US), Norsk Hydro ASA (Norway), Constellium (France), Kaiser Aluminum (US), Hammerer Aluminum Industries (Austria), Banco Aluminium Private Limited (India), Maan Aluminium Limited (India), Shenzhen Oriental Turdo Ironwares Co., Ltd. (China), ETEM (Greece), and Alom Group (India).

Research Coverage

This research report categorizes the aluminum extrusion market by product (solid profiles, semi-hollow profiles, and hollow profiles), alloy grade (6xxx, 1xxx, 5xxx, and other grades), surface finish (mill-finished, anodized, and powder coated), end-use industry (construction & infrastructure, automotive & mass transport, electrical & electronics, and machinery & equipment), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the aluminum extrusion market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers & acquisitions, and recent developments in the aluminum extrusion market are all covered. This report includes a competitive analysis of upcoming startups in the aluminum extrusion market ecosystem.

Reasons to buy this report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aluminum extrusion market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand from automotive sector, Cross-industry adoption), restraints (Capital Intensity, High Energy Consumption), opportunities (Advanced manufacturing technologies, Unmet needs for premium alloys or services), and challenges (Raw material cost volatility, Energy consumption and sustainability) influencing the growth of the aluminum extrusion market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aluminum extrusion market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the aluminum extrusion market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aluminum extrusion market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players, such as Jindal Aluminum Limited (India), Hindalco Industries Ltd. (India), Alcoa Corporation (US), Aluminum Corporation of China Limited (China), RUSAL (Russia), Century Aluminum Company (US), Norsk Hydro ASA (Norway), Constellium (France), Kaiser Aluminum (US), Hammerer Aluminum Industries (Austria), Banco Aluminium Private Limited (India), Maan Aluminium Limited (India), Shenzhen Oriental Turdo Ironwares Co., Ltd. (China), ETEM (Greece), and Alom Group (India) in the aluminum extrusion market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM EXTRUSION MARKET

- 3.2 ALUMINUM EXTRUSION MARKET, BY PRODUCT AND REGION

- 3.3 ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE

- 3.4 ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH

- 3.5 ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 3.6 ALUMINUM EXTRUSION MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising demand from automotive sector

- 4.2.1.2 Cross-industry adoption

- 4.2.2 RESTRAINTS

- 4.2.2.1 Capital intensity

- 4.2.2.2 High energy consumption

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Advanced manufacturing technologies

- 4.2.3.2 Unmet needs for premium alloys or services

- 4.2.4 CHALLENGES

- 4.2.4.1 Raw material cost volatility

- 4.2.4.2 Energy consumption and sustainability

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN ALUMINUM EXTRUSION MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 BARGAINING POWER OF SUPPLIERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE & MASS TRANSPORT INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AEROSPACE & DEFENSE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE BY KEY PLAYERS

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 760421)

- 5.6.2 EXPORT SCENARIO (HS CODE 760421)

- 5.7 KEY CONFERENCES AND EVENTS, 2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 HIGH-STRENGTH ALUMINUM ALLOYS IN ADVANCED AIRCRAFT PROGRAM

- 5.9.2 ALCOA ALLOY ADVANCEMENTS: A210 EXTRUSTRONG & C611 EZCAST

- 5.9.3 PROJECT M-LIGHTEN: CONSTELLIUM & GORDON MURRAY GROUP PARTNERSHIP

- 5.10 IMPACT OF 2025 US TARIFF ON ALUMINUM EXTRUSION MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRIES/REGIONS

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 IMPACT ON END-USE INDUSTRIES

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 EXTRUSION TECHNOLOGY

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 LASER POWDER BED FUSION

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.4 ANALYSIS

- 6.4.1 INTRODUCTION

- 6.4.2 METHODOLOGY

- 6.4.3 DOCUMENT TYPE

- 6.4.4 INSIGHTS

- 6.4.5 LEGAL STATUS OF PATENTS

- 6.4.6 JURISDICTION ANALYSIS

- 6.4.7 TOP APPLICANTS

- 6.4.8 LIST OF PATENTS BY JIANGSU GIANSUN PRECISION TECH GROUP CO., LTD.

- 6.4.9 LIST OF PATENTS BY SUZHOU WORTEL PRECISION MOLD MACHINERY CO., LTD.

- 6.4.10 LIST OF PATENTS BY HEBEI AOYI NEW MAT CO., LTD.

- 6.5 FUTURE APPLICATIONS

- 6.5.1 AUTOMOTIVE & MASS TRANSPORT: LIGHTWEIGHTING & STRUCTURAL COMPONENTS

- 6.5.2 BUILDING & CONSTRUCTION: WINDOW FRAMES, FACADES, AND PROFILES

- 6.5.3 ELECTRICAL & ELECTRONICS: HEAT SINKS & ENCLOSURES

- 6.6 IMPACT OF AI/GEN AI ON ALUMINUM EXTRUSION MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN ALUMINUM EXTRUSION PROCESSING

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN ALUMINUM EXTRUSION MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ALUMINUM EXTRUSION MARKET

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 ALCOA CORPORATION: INNOVATING EV STRUCTURES WITH MEGACASTING ALUMINUM EXTRUDED COMPONENTS

- 6.7.2 CONSTELLIUM: REVOLUTIONIZING COMPONENTS WITH AHEADD CP1

- 6.7.3 BOEING: AI-DRIVEN AUTOMATION FOR 777X AND 737 ASSEMBLY

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ALUMINUM EXTRUDED PRODUCTS

- 7.2.1.1 Eco-applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ALUMINUM EXTRUDED PRODUCTS

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES, BY END-USE INDUSTRY

9 ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE

- 9.1 INTRODUCTION

- 9.2 6XXX

- 9.2.1 OPTIMAL COMBINATION OF EXTRUDABILITY AND HEAT-TREATABLE PROPERTIES TO DRIVE DEMAND

- 9.3 1XXX

- 9.3.1 SUPERIOR CONDUCTIVITY TO DRIVE ADOPTION IN ELECTRICAL & ELECTRONICS INDUSTRY

- 9.4 5XXX

- 9.4.1 MAGNESIUM ADDITION OFFERS ADDITIONAL STRENGTH AND EXCELLENT CORROSION RESISTANCE TO PROPEL GROWTH

- 9.5 OTHER GRADES

10 ALUMINUM EXTRUSION MARKET, BY PRODUCT

- 10.1 INTRODUCTION

- 10.2 SOLID PROFILES

- 10.2.1 SIMPLICITY IN MANUFACTURING AND STRUCTURAL SOLIDITY TO DRIVE DEMAND

- 10.2.2 RODS & BARS

- 10.2.3 ANGLES & CHANNELS

- 10.2.4 BEAMS

- 10.3 SEMI-HOLLOW PROFILES

- 10.3.1 GROWING DEMAND FROM CONSTRUCTION & INFRASTRUCTURE TO DRIVE MARKET

- 10.3.2 WINDOW FRAMES & TRACK SYSTEMS

- 10.3.3 C-SHAPED PROFILES

- 10.4 HOLLOW PROFILES

- 10.4.1 DEMAND FROM HVAC, AUTOMOTIVE, AND AEROSPACE SECTORS TO BOOST MARKET

- 10.4.2 PIPES & TUBES

11 ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH

- 11.1 INTRODUCTION

- 11.2 MILL-FINISHED

- 11.2.1 LOWER PRODUCTION COSTS DRIVING DEMAND

- 11.3 ANODIZED

- 11.3.1 HIGH DURABILITY AND WEATHER RESISTANCE TO DRIVE ADOPTION

- 11.4 POWDER-COATED

- 11.4.1 AUTOMOTIVE AND EV EXPANSION TO BOOST MARKET

12 ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 CONSTRUCTION & INFRASTRUCTURE

- 12.2.1 HIGHER STRENGTH-TO-WEIGHT RATIO COMPARED TO OTHER MATERIALS TO DRIVE DEMAND

- 12.3 AUTOMOTIVE & MASS TRANSPORT

- 12.3.1 GROWING ADOPTION IN EV MANUFACTURING TO PROPEL GROWTH

- 12.4 ELECTRICAL & ELECTRONICS

- 12.4.1 SUPERIOR CONDUCTIVITY-TO-WEIGHT RATIO TO DRIVE ADOPTION

- 12.5 MACHINERY & EQUIPMENT

- 12.5.1 LIGHTWEIGHT STRUCTURE & MODULARITY TO DRIVE MARKET

- 12.6 OTHER END-USE INDUSTRIES

13 ALUMINUM EXTRUSION MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE

- 13.2.2 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE

- 13.2.3 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH

- 13.2.4 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.2.5 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY

- 13.2.6 US

- 13.2.6.1 Strategic investments and capacity expansion by key players to boost market

- 13.2.7 US: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.2.8 CANADA

- 13.2.8.1 Expansion of sustainable construction and industrial initiatives to drive market

- 13.2.9 CANADA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.3 EUROPE

- 13.3.1 EUROPE: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE

- 13.3.2 EUROPE: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE

- 13.3.3 EUROPE: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH

- 13.3.4 EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.3.5 EUROPE: ALUMINUM EXTRUSION MARKET, BY COUNTRY

- 13.3.6 GERMANY

- 13.3.6.1 Automotive lightweighting and industrial engineering to boost market

- 13.3.7 GERMANY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.3.8 FRANCE

- 13.3.8.1 Sustainable construction and transportation modernization to drive market growth

- 13.3.9 FRANCE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.3.10 UK

- 13.3.10.1 Strong supplier base to fuel growth of market

- 13.3.11 UK: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.3.12 SPAIN

- 13.3.12.1 Infrastructure development and industrial growth to drive market

- 13.3.13 SPAIN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.3.14 ITALY

- 13.3.14.1 Industrial modernization trend to drive market

- 13.3.15 ITALY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.3.16 REST OF EUROPE

- 13.3.16.1 Rest of Europe: Aluminum extrusion market, by end-use industry

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE

- 13.4.2 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE

- 13.4.3 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH

- 13.4.4 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.4.5 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY COUNTRY

- 13.4.6 CHINA

- 13.4.6.1 Expansion in electric vehicle manufacturing to drive demand

- 13.4.7 CHINA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.4.8 JAPAN

- 13.4.8.1 Electronics and electrical equipment boost specialized demand in market

- 13.4.9 JAPAN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.4.10 INDIA

- 13.4.10.1 Presence of major aluminum extrusion manufacturers drives growth

- 13.4.11 INDIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.4.12 SOUTH KOREA

- 13.4.12.1 Favorable government policies and standards to drive market

- 13.4.13 SOUTH KOREA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.4.14 REST OF ASIA PACIFIC

- 13.4.14.1 Rest of Asia Pacific: Aluminum extrusion market, by end-use industry

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT

- 13.5.2 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE

- 13.5.3 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH

- 13.5.4 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.5.5 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY

- 13.5.5.1 GCC countries

- 13.5.5.1.1 UAE

- 13.5.5.1.1.1 Presence of major aluminum producers drives growth

- 13.5.5.1.1.2 UAE: Aluminum extrusion market, by end-use industry

- 13.5.5.1.2 Saudi Arabia

- 13.5.5.1.2.1 Shift toward advanced manufacturing and lightweighting to drive growth

- 13.5.5.1.2.2 Saudi Arabia: Aluminum extrusion market, by end-use industry

- 13.5.5.1.1 UAE

- 13.5.5.2 Other GCC countries

- 13.5.5.2.1 Other GCC Countries: Aluminum extrusion market, by end-use industry

- 13.5.5.3 South Africa

- 13.5.5.3.1 Expansion of domestic manufacturing and extrusion capabilities to drive market

- 13.5.5.3.2 South Africa: Aluminum extrusion market, by end-use industry

- 13.5.5.1 GCC countries

- 13.5.6 REST OF MIDDLE EAST & AFRICA

- 13.5.6.1 Rest of Middle East & Africa: Aluminum extrusion market, By end-use industry

- 13.6 LATIN AMERICA

- 13.6.1 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE

- 13.6.2 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE

- 13.6.3 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH

- 13.6.4 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.6.5 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY

- 13.6.6 BRAZIL

- 13.6.6.1 Infrastructure development and industrial diversification

- 13.6.7 BRAZIL: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.6.8 MEXICO

- 13.6.8.1 Automotive manufacturing expansion driving Mexico aluminum extrusion market

- 13.6.9 MEXICO: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY

- 13.6.10 REST OF LATIN AMERICA

- 13.6.10.1 Rest of Latin America: Aluminum extrusion market, by end-use industry

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Product footprint

- 14.6.5.4 Alloy grade footprint

- 14.6.5.5 Surface finish footprint

- 14.6.5.6 End-use industry footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 HINDALCO INDUSTRIES LTD.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent Developments

- 15.1.1.3.1 Deals

- 15.1.1.3.2 Expansions

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 ALCOA CORPORATION

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.3 PRODUCT LAUNCHES

- 15.1.3.1 MnM view

- 15.1.3.1.1 Right to win

- 15.1.3.1.2 Strategic choices

- 15.1.3.1.3 Weaknesses and competitive threats

- 15.1.3.1 MnM view

- 15.1.4 ALUMINIUM CORPORATION OF CHINA LIMITED

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 MnM view

- 15.1.4.3.1 Right to win

- 15.1.4.3.2 Strategic choices

- 15.1.4.3.3 Weaknesses and competitive threats

- 15.1.5 RUSAL

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.6 KAISER ALUMINUM

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 MnM view

- 15.1.6.3.1 Right to win

- 15.1.6.3.2 Strategic choices

- 15.1.6.3.3 Weaknesses and competitive threats

- 15.1.7 CENTURY ALUMINUM COMPANY

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 CONSTELLIUM

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent Developments

- 15.1.8.3.1 Deals

- 15.1.9 NORSK HYDRO ASA

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 JINDAL ALUMINUM LIMITED

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 MnM view

- 15.1.10.3.1 Right to win

- 15.1.10.3.2 Strategic choices

- 15.1.10.3.3 Weaknesses and competitive threats

- 15.1.11 HAMMERER ALUMINUM INDUSTRIES

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 ALOM GROUP

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 BANCO ALUMINUM PRIVATE LIMITED

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 MAAN ALUMINIUM LIMITED

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.15 SHENZHEN ORIENTAL TURDO IRONWARES CO., LTD

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.16 ETEM

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Solutions/Services offered

- 15.1.16.3 Recent Developments

- 15.1.16.3.1 Deals

- 15.1.1 HINDALCO INDUSTRIES LTD.

- 15.2 OTHER PLAYERS

- 15.2.1 GUANGDONG ZHENHAN SPECIAL LIGHT ALLOY CO., LTD

- 15.2.2 ALBRAS

- 15.2.3 YK ALUMINIUM

- 15.2.4 ELEANOR INDUSTRIES PVT. LTD

- 15.2.5 ALUPCO

- 15.2.6 ZAHIT ALUMINYUM

- 15.2.7 ARCONIC

- 15.2.8 HULAMIN

- 15.2.9 GULF EXTRUSION

- 15.2.10 BENKAM ALU EXTRUSIONS

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Key primary interview participants

- 16.1.2.3 Breakdown of primary interviews

- 16.1.2.4 Key industry insights

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.2 TOP-DOWN APPROACH

- 16.3 BASE NUMBER CALCULATION

- 16.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 16.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 16.4 MARKET FORECAST APPROACH

- 16.4.1 SUPPLY SIDE

- 16.4.2 DEMAND SIDE

- 16.5 DATA TRIANGULATION

- 16.6 FACTOR ANALYSIS

- 16.7 RESEARCH ASSUMPTIONS

- 16.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 ALUMINUM EXTRUSION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 3 ALUMINUM EXTRUSION MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF ALUMINUM EXTRUSION IN TOP END-USE INDUSTRIES, BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE TREND OF ALUMINUM EXTRUSION, BY REGION, 2023-2024 (USD/KG)

- TABLE 6 IMPORT DATA FOR HS CODE 760421-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 760421-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- TABLE 8 ALUMINUM EXTRUSION MARKET: KEY CONFERENCES AND EVENTS, 2026

- TABLE 9 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 10 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS

- TABLE 11 ALUMINUM EXTRUSION MARKET: TOTAL NUMBER OF PATENTS, 2015-2025

- TABLE 12 TOP USE CASES AND MARKET POTENTIAL

- TABLE 13 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 14 ALUMINUM EXTRUSION MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 15 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 GLOBAL STANDARDS IN ALUMINUM EXTRUSION MARKET

- TABLE 21 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN ALUMINUM EXTRUSION MARKET

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 23 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 24 ALUMINUM EXTRUSION MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES

- TABLE 25 ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (USD MILLION)

- TABLE 26 ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (KILOTON)

- TABLE 27 6XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 6XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 29 1XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 1XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 31 5XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 5XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 33 OTHER GRADES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 OTHER GRADES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 35 ALUMINUM EXTRUSION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 36 ALUMINUM EXTRUSION MARKET, BY PRODUCT, 2023-2030 (KILOTON)

- TABLE 37 SOLID PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 SOLID PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 39 SEMI-HOLLOW PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 SEMI-HOLLOW PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 41 HOLLOW PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 HOLLOW PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 43 ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (USD MILLION)

- TABLE 44 ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (KILOTON)

- TABLE 45 MILL-FINISHED: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 MILL-FINISHED: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 47 ANODIZED: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 ANODIZED: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 49 POWDER-COATED: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 POWDER-COATED: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 51 ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 52 ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 53 CONSTRUCTION & INFRASTRUCTURE: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 CONSTRUCTION & INFRASTRUCTURE: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 55 AUTOMOTIVE & MASS TRANSPORT: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 AUTOMOTIVE & MASS TRANSPORT: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 57 ELECTRICAL & ELECTRONICS: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 ELECTRICAL & ELECTRONICS: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 59 MACHINERY & EQUIPMENT: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 MACHINERY & EQUIPMENT: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 61 OTHER END-USE INDUSTRIES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 OTHER END-USE INDUSTRIES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 63 ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 ALUMINUM EXTRUSION MARKET, BY REGION, 2023-2030 (KILOTON)

- TABLE 65 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023-2030 (KILOTON)

- TABLE 67 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (KILOTON)

- TABLE 69 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (KILOTON)

- TABLE 71 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 73 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 75 US: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 76 US: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 77 CANADA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 78 CANADA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 79 EUROPE: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 80 EUROPE: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023-2030 (KILOTON)

- TABLE 81 EUROPE: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (USD MILLION)

- TABLE 82 EUROPE: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (KILOTON)

- TABLE 83 EUROPE: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (KILOTON)

- TABLE 85 EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 86 EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 87 EUROPE: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 89 GERMANY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 90 GERMANY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 91 FRANCE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 92 FRANCE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 93 UK: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 94 UK: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 95 SPAIN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 96 SPAIN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 97 ITALY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 98 ITALY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 99 REST OF EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 100 REST OF EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 101 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 102 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023-2030 (KILOTON)

- TABLE 103 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (USD MILLION)

- TABLE 104 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (KILOTON)

- TABLE 105 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (KILOTON)

- TABLE 107 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 109 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 111 CHINA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 112 CHINA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 113 JAPAN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 114 JAPAN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 115 INDIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 116 INDIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 117 SOUTH KOREA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 118 SOUTH KOREA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 119 REST OF ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 121 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT, 2023-2030 (KILOTON)

- TABLE 123 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (KILOTON)

- TABLE 127 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 131 UAE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 132 UAE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 133 SAUDI ARABIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 134 SAUDI ARABIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 135 OTHER GCC COUNTRIES: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 136 OTHER GCC COUNTRIES: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 137 SOUTH AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 138 SOUTH AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 141 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023-2030 (USD MILLION)

- TABLE 142 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023-2030 (KILOTON)

- TABLE 143 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (USD MILLION)

- TABLE 144 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023-2030 (KILOTON)

- TABLE 145 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (USD MILLION)

- TABLE 146 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023-2030 (KILOTON)

- TABLE 147 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 148 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 149 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 150 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023-2030 (KILOTON)

- TABLE 151 BRAZIL: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 152 BRAZIL: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 153 MEXICO: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 154 MEXICO: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 155 REST OF LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 156 REST OF LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023-2030 (KILOTON)

- TABLE 157 ALUMINUM EXTRUSION MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 158 ALUMINUM EXTRUSION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 159 ALUMINUM EXTRUSION MARKET: REGION FOOTPRINT

- TABLE 160 ALUMINUM EXTRUSION MARKET: PRODUCT FOOTPRINT

- TABLE 161 ALUMINUM EXTRUSION MARKET: ALLOY GRADE FOOTPRINT

- TABLE 162 ALUMINUM EXTRUSION MARKET: SURFACE FINISH FOOTPRINT

- TABLE 163 ALUMINUM EXTRUSION MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 164 ALUMINUM EXTRUSION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 165 ALUMINUM EXTRUSION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 166 ALUMINUM EXTRUSION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 167 ALUMINUM EXTRUSION MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2025

- TABLE 168 ALUMINUM EXTRUSION MARKET: DEALS, JANUARY 2020-DECEMBER 2025

- TABLE 169 ALUMINUM EXTRUSION MARKET: EXPANSIONS, JANUARY 2020-DECEMBER 2025

- TABLE 170 HINDALCO INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 171 HINDALCO INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 HINDALCO INDUSTRIES LTD.: DEALS

- TABLE 173 HINDALCO INDUSTRIES LTD.: EXPANSIONS

- TABLE 174 ALCOA CORPORATION: COMPANY OVERVIEW

- TABLE 175 ALCOA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 ALCOA CORPORATION: PRODUCT LAUNCHES

- TABLE 177 ALUMINIUM CORPORATION OF CHINA LIMITED: COMPANY OVERVIEW

- TABLE 178 ALUMINUM CORPORATION OF CHINA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 RUSAL: COMPANY OVERVIEW

- TABLE 180 RUSAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 KAISER ALUMINUM: COMPANY OVERVIEW

- TABLE 182 KAISER ALUMINUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 CENTURY ALUMINUM COMPANY: COMPANY OVERVIEW

- TABLE 184 CENTURY ALUMINUM COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 CONSTELLIUM: COMPANY OVERVIEW

- TABLE 186 CONSTELLIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 CONSTELLIUM: DEALS

- TABLE 188 NORSK HYDRO ASA: COMPANY OVERVIEW

- TABLE 189 NORSK HYDRO ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 JINDAL ALUMINUM LIMITED: COMPANY OVERVIEW

- TABLE 191 JINDAL ALUMINUM LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 HAMMERER ALUMINUM INDUSTRIES: COMPANY OVERVIEW

- TABLE 193 HAMMERER ALUMINUM INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 ALOM GROUP: COMPANY OVERVIEW

- TABLE 195 ALOM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 BANCO ALUMINUM PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 197 BANCO ALUMINUM PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 MAAN ALUMINIUM LIMITED: COMPANY OVERVIEW

- TABLE 199 MAAN ALUMINIUM LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 SHENZHEN ORIENTAL TURDO IRONWARES CO., LTD: COMPANY OVERVIEW

- TABLE 201 SHENZHEN ORIENTAL TURDO IRONWARES CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 ETEM: COMPANY OVERVIEW

- TABLE 203 ETEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 ETEM: DEALS

- TABLE 205 GUANGDONG ZHENHAN SPECIAL LIGHT ALLOY CO., LTD: COMPANY OVERVIEW

- TABLE 206 ALBRAS: COMPANY OVERVIEW

- TABLE 207 YK ALUMINIUM.: COMPANY OVERVIEW

- TABLE 208 ELEANOR INDUSTRIES PVT. LTD: COMPANY OVERVIEW

- TABLE 209 ALUPCO: COMPANY OVERVIEW

- TABLE 210 ZAHIT ALUMINYUM: COMPANY OVERVIEW

- TABLE 211 ARCONIC: COMPANY OVERVIEW

- TABLE 212 HULAMIN: COMPANY OVERVIEW

- TABLE 213 GULF EXTRUSION: COMPANY OVERVIEW

- TABLE 214 BENKAM ALU EXTRUSIONS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 ALUMINUM EXTRUSION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL ALUMINUM EXTRUSION MARKET, 2025-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ALUMINUM EXTRUSION MARKET (2020-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF ALUMINUM EXTRUSION MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN ALUMINUM EXTRUSION MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 8 HIGH DEMAND IN CONSTRUCTION & INFRASTRUCTURE TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 9 SOLID PROFILES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 6XXX ALLOY GRADE DOMINATED ALUMINUM EXTRUSION MARKET IN 2024

- FIGURE 11 MILL-FINISHED SEGMENT LED MARKET IN 2025

- FIGURE 12 CONSTRUCTION & INFRASTRUCTURE SEGMENT WAS LARGEST IN 2025

- FIGURE 13 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ALUMINUM EXTRUSION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 LIGHTWEIGHTING POTENTIAL OF ALUMINUM EXTRUDED PRODUCTS FOR AUTOMOTIVE INDUSTRY

- FIGURE 16 ALUMINUM EXTRUSION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 ALUMINUM EXTRUSION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 ALUMINUM EXTRUSION MARKET: KEY PARTICIPANTS IN ECOSYSTEM

- FIGURE 19 ALUMINUM EXTRUSION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE TREND BY REGION, 2023-2024

- FIGURE 21 IMPORT SCENARIO FOR HS CODE 760421-COMPLIANT PRODUCTS, KEY COUNTRIES, 2020-2024

- FIGURE 22 EXPORT SCENARIO FOR HS CODE 760421-COMPLIANT PRODUCTS, KEY COUNTRIES, 2020-2024

- FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 24 PATENT ANALYSIS, BY DOCUMENT TYPE, 2015-2025

- FIGURE 25 PATENT PUBLICATION TRENDS, 2015-2025

- FIGURE 26 ALUMINUM EXTRUSION MARKET: LEGAL STATUS OF PATENTS, JANUARY 2015-DECEMBER 2025

- FIGURE 27 CHINA REGISTERED HIGHEST SHARE OF PATENTS, 2015-2025

- FIGURE 28 TOP PATENT APPLICANTS, 2015-2025

- FIGURE 29 FUTURE APPLICATIONS OF ALUMINUM EXTRUSION

- FIGURE 30 ALUMINUM EXTRUSION MARKET: DECISION-MAKING FACTORS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 32 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 33 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 34 6XXX ALLOY GRADE SEGMENT TO DOMINATE MARKET

- FIGURE 35 HOLLOW PROFILES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 MILL-FINISHED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 CONSTRUCTION & INFRASTRUCTURE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: ALUMINUM EXTRUSION MARKET SNAPSHOT

- FIGURE 40 EUROPE: ALUMINUM EXTRUSION MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET SNAPSHOT

- FIGURE 42 ALUMINUM EXTRUSION MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 43 ALUMINUM EXTRUSION MARKET SHARE ANALYSIS, 2024

- FIGURE 44 ALUMINUM EXTRUSION MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 45 ALUMINUM EXTRUSION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 ALUMINUM EXTRUSION MARKET: COMPANY FOOTPRINT

- FIGURE 47 ALUMINUM EXTRUSION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 ALUMINUM EXTRUSION MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 49 ALUMINUM EXTRUSION MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 50 HINDALCO INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 51 ALCOA CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 ALUMINIUM CORPORATION OF CHINA LIMITED: COMPANY SNAPSHOT

- FIGURE 53 RUSAL: COMPANY SNAPSHOT

- FIGURE 54 KAISER ALUMINUM: COMPANY SNAPSHOT

- FIGURE 55 CENTURY ALUMINUM COMPANY: COMPANY SNAPSHOT

- FIGURE 56 CONSTELLIUM: COMPANY SNAPSHOT

- FIGURE 57 NORSK HYDRO ASA: COMPANY SNAPSHOT

- FIGURE 58 MAAN ALUMINIUM: COMPANY SNAPSHOT

- FIGURE 59 ALUMINUM EXTRUSION MARKET: RESEARCH DESIGN

- FIGURE 60 ALUMINUM EXTRUSION MARKET: BOTTOM-UP AND TOP-DOWN APPROACH

- FIGURE 61 ALUMINUM EXTRUSION MARKET: DATA TRIANGULATION