PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1936069

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1936069

Liquid Cooled EV Charging Cable Market by Cable Power Capacity, Cable Length, Cable Diameter, Application, Jacket Material, Cooling Fluid, and Region - Global Forecast to 2032

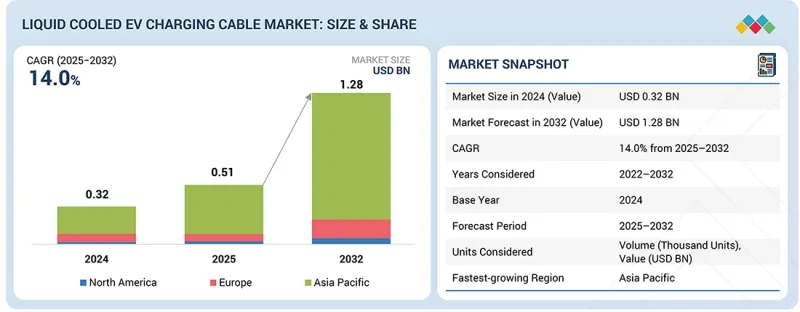

The liquid cooled EV charging cable market is projected to grow from USD 0.51 billion in 2025 to USD 1.28 billion by 2032, at a CAGR of 14.0%. The market is advancing as vehicle platforms are increasingly adopting 800 V electrical architectures. Additionally, high system voltages are enabling faster charging and raising current and thermal management requirements at the cable level.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Thousand Units) and Value (USD Million) |

| Segments | Cable Power Capacity, Cable Length, Cable Diameter, Application, Jacket Material, Cooling Fluid |

| Regions covered | Asia Pacific, Europe, North America |

Charging infrastructure operators are prioritizing cable solutions that can sustain repeated high-power charging sessions without compromising safety or handling. Liquid cooling supports compact cable designs while maintaining thermal stability under elevated loads. In parallel, increasing standardization across charger platforms is simplifying deployment across regions, while improvements in flexibility and ergonomics are supporting broader adoption in public and commercial charging locations.

"By application, the ultrafast charging segment is projected to account for the largest market during the forecast period."

The ultrafast charging segment is projected to account for the largest share in the liquid cooled EV charging cable market because it addresses the immediate high-volume demand of passenger EVs and light commercial vehicles, which represent the majority of global EV fleets today. The scale of public and semi-public charging infrastructure, particularly along highways and urban corridors, is expanding rapidly to meet rising EV adoption, creating extensive deployment opportunities for 350 kW and above charging stations. Unlike megawatt charging, which targets a relatively smaller fleet of heavy-duty vehicles and select luxury EVs, ultrafast charging serves a far larger base of vehicles requiring frequent, short-duration charges, driving consistent utilization of liquid cooled cables. Additionally, the growth of 800 V EV architectures in high-end passenger vehicles is accelerating the need for liquid cooled solutions, as these vehicles can exploit higher current flows safely and efficiently.

"By cable length, the 5-8 meters segment is projected to account for the largest market during the forecast period."

The 5-8 meters segment is projected to dominate the liquid cooled EV charging cable market during the forecast period as these cables deliver the most efficient balance between electrical performance, thermal control, and deployment economics at high-power charging sites. These cables minimize voltage drop and signal dilution during high current DC charging while avoiding the excess copper, coolant volume, and reinforcement costs associated with longer cable runs. They allow optimized coolant circulation with lower pressure losses, which helps maintain stable conductor temperatures during sustained ultra-fast charging. Cables in this length range enable flexible cable routing around standard charger pedestals and vehicle parking layouts without introducing additional joints or connectors, reducing installation time and potential failure points. Charger manufacturers and operators are standardizing this length as the most reliable and cost-efficient specification for large-scale public fast charging deployments.

"Europe is projected to be the fastest-growing market during the forecast period."

Europe is emerging as the fastest-growing region in the liquid cooled EV charging cable market, as public and fleet charging infrastructure is increasingly shifting toward high-power DC and ultrafast charging. Automakers in Europe are actively deploying 800 V vehicle platforms, which are increasing current density at charging interfaces and making air-cooled cables less practical at high power levels. Public charging operators are installing more 150 kW to 350 kW chargers along highways, urban hubs, and logistics corridors, where high utilization rates are pushing thermal limits. Liquid cooled cables are therefore becoming the preferred solution to manage heat, improve ergonomics, and maintain charging consistency under continuous use. Regional competitive landscape includes global and local suppliers, such as HUBER+SUHNER (Switzerland), Phoenix Contact (Germany), and Leoni (Germany).

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: EV Charging Cable Manufacturers - 40%, Charging Station Providers - 40%, Others - 20%

- By Designation: CXOs - 20%, Directors - 30%, Others - 50%

- By Country: North America - 30%, Europe - 30%, Asia Pacific - 40%

The liquid cooled EV charging cable market is dominated by global players such as Phoenix Contact (Germany), HUBER+SUHNER (Switzerland), BRUGG eConnect (Switzerland), Sinbon Electronics Co., Ltd. (Taiwan), and LEONI (Germany). These companies have adopted strategies such as product launches, strategic deals, and geographic expansions to strengthen their market presence and technological capabilities.

Research Coverage:

The report covers the liquid cooled EV charging cable market by cable power capacity (300-499 kW, 500-900 kW, above 900 kW), application (ultrafast charging and megawatt charging), cable length (below 5 meters, 5-8 meters, and above 8 meters), cable diameter (below 30 mm, 30-50 mm, and above 50 mm), jacket material (rubber, thermoplastic elastomer, and polyvinyl chloride), cooling fluid (water glycol and others), and region (Asia Pacific, Europe and North America). It covers the competitive landscape and company profiles of the major players in the liquid cooled EV charging cable market ecosystem.

The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- This report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall testing of the liquid cooled EV charging cable ecosystem and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- This report will also help stakeholders understand the market's pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising demand for ultrafast and megawatt charging, growing shift to 800 V EV Architecture, need for improved cable design with quick heat dissipation qualities), restraints (high maintenance cost, high installation and service complexity), challenges (regulatory uncertainty with coolant systems), and opportunities (advancements in dielectric coolants and material technology, growing use case for heavy duty truck charging)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the liquid cooled EV charging cable market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the liquid cooled EV charging cable market

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like Phoenix Contact (Germany), HUBER+SUHNER (Switzerland), BRUGG eConnect (Switzerland), Sinbon Electronics Co., Ltd. (Taiwan), and LEONI (Germany), among others, in the liquid cooled EV charging cable market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS & KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN LIQUID COOLED EV CHARGING CABLE MARKET

- 2.4 HIGH GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIQUID COOLED EV CHARGING CABLE MARKET

- 3.2 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY

- 3.3 LIQUID COOLED EV CHARGING CABLE MARKET, BY APPLICATION

- 3.4 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE LENGTH

- 3.5 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE DIAMETER

- 3.6 LIQUID COOLED EV CHARGING CABLE MARKET, BY JACKET MATERIAL

- 3.7 LIQUID COOLED EV CHARGING CABLE MARKET, BY COOLING FLUID

- 3.8 LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising demand for ultrafast and megawatt charging

- 4.2.1.2 Growing shift to 800V EV architecture

- 4.2.1.3 Need for improved cable design with fast heat dissipation qualities

- 4.2.2 RESTRAINTS

- 4.2.2.1 High maintenance cost

- 4.2.2.2 High installation and service complexity

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Advancements in dielectric coolant and material technology

- 4.2.3.2 Increasing use cases for heavy-duty truck charging

- 4.2.4 CHALLENGES

- 4.2.4.1 Regulatory uncertainty with coolant systems

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 SIMPLIFIED AND LOW-MAINTENANCE COOLANT MANAGEMENT

- 4.3.2 LACK OF HARMONIZED SAFETY AND CERTIFICATION STANDARDS FOR COOLANTS

- 4.3.3 COST-OPTIMIZED SOLUTIONS FOR MID-POWER FAST CHARGING (250-350 KW)

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY KEY PLAYERS IN LIQUID COOLED EV CHARGING CABLE MARKET

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT FROM NEW ENTRANTS

- 5.1.2 BARGAINING POWER OF SUPPLIERS

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 THREAT FROM SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL LIQUID COOLED EV CHARGING CABLE INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 RAW MATERIAL AND COMPONENT SUPPLIERS

- 5.4.2 LIQUID COOLED EV CHARGING CABLE AND CONNECTOR MANUFACTURERS

- 5.4.3 THERMAL MANAGEMENT AND COOLING TECHNOLOGY PROVIDERS

- 5.4.4 CHARGING EQUIPMENT OEMS

- 5.4.5 VEHICLE OEMS

- 5.4.6 EV CHARGING INFRASTRUCTURE OPERATORS

- 5.4.7 TESTING, CERTIFICATION, AND STANDARD BODIES

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE FOR LIQUID COOLED EV CHARGING CABLES, BY KEY PLAYER

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5.3 INDICATIVE PRICING ANALYSIS, BY CABLE POWER CAPACITY

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO

- 5.6.2 EXPORT SCENARIO

- 5.7 KEY CONFERENCES & EVENTS, 2026-2027

- 5.8 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT & FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ENABLING ULTRAFAST CHARGING THROUGH LIQUID COOLED CABLE ARCHITECTURE

- 5.10.2 SCALING HIGH-POWER CHARGING THROUGH DEPLOYMENT OF LIQUID COOLED CABLES

- 5.10.3 IMPROVING RELIABILITY OF DC FAST CHARGING CABLES THROUGH LIQUID COOLING

- 5.10.4 DEPLOYING LIQUID COOLED CHARGING CABLES TO SUPPORT RELIABLE HIGH-POWER DC CHARGING

- 5.10.5 INTEGRATION OF LIQUID COOLED CABLES IN ULTRAFAST DC CHARGING SYSTEMS

- 5.11 IMPACT OF 2025 US TARIFF

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRY/REGION

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

- 5.12 MNM INSIGHTS INTO KEY PLAYERS

- 5.13 EV CHARGING POINTS ACROSS REGIONS

- 5.13.1 PARC GLOBAL EV CHARGING POINTS, 2021-2024 (THOUSAND UNITS)

- 5.13.2 PARC GLOBAL EV CHARGING POINTS, 2025-2032 (THOUSAND UNITS)

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 FLUORINATED DIELECTRICS IN LIQUID COOLED EV CHARGING CABLES

- 6.1.2 CONNECTOR-INTEGRATED MICRO-CHANNEL LIQUID COOLING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 SHARED THERMAL LOOP INTEGRATION BETWEEN CHARGERS AND CABLES

- 6.2.2 BATTERY-BUFFERED MEGA CHARGING

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 SHARED THERMAL LOOP INTEGRATION BETWEEN CHARGERS AND CABLES

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.5.1 INTRODUCTION

- 6.6 FUTURE APPLICATIONS

- 6.6.1 DEPOT CHARGING FOR COMMERCIAL FLEETS

- 6.6.2 BATTERY-BUFFERED AND GRID-CONSTRAINED CHARGING STATIONS

- 6.7 IMPACT OF AI ON LIQUID COOLED EV CHARGING CABLE MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 BEST PRACTICES FOLLOWED BY MANUFACTURERS/OEMS IN LIQUID COOLED EV CHARGING CABLE MARKET

- 6.7.3 CASE STUDIES RELATED TO IMPLEMENTATION OF AI IN LIQUID COOLED EV CHARGING CABLE MARKET

- 6.7.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.5 CLIENTS' READINESS TO ADOPT AI-INTEGRATED LIQUID COOLED EV CHARGING CABLES

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 REGULATORY FRAMEWORK

- 7.2 SUSTAINABILITY INITIATIVES

- 7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND EVALUATION CRITERIA

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.3.1 MAINTENANCE READINESS AND OPERATIONAL CAPABILITY GAPS

- 8.3.2 STANDARDIZATION AND INTEROPERABILITY LIMITATIONS

- 8.3.3 UNCERTAIN UTILIZATION ECONOMICS

- 8.4 UNMET NEEDS OF VARIOUS END USERS

- 8.4.1 SUSTAINED ULTRA-HIGH-POWER DELIVERY WITHOUT THERMAL DERATING

- 8.4.2 REDUCTION IN CABLE WEIGHT AND HANDLING COMPLEXITY

- 8.4.3 PUBLIC DC FAST-CHARGING NETWORK OPERATORS

- 8.4.4 HEAVY DUTY AND COMMERCIAL FLEET CHARGING OPERATORS

9 LIQUID COOLED EV CHARGING CABLE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 ULTRAFAST CHARGING

- 9.2.1 NEED FOR HIGH POWER DENSITY AND HEAT MANAGEMENT IN ULTRAFAST CHARGING TO DRIVE DEMAND

- 9.3 MEGAWATT CHARGING

- 9.3.1 HEAVY DUTY EV ELECTRIFICATION TO DRIVE DEMAND FOR MEGAWATT LIQUID COOLED CHARGING CABLES

- 9.4 KEY PRIMARY INSIGHTS

10 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE DIAMETER

- 10.1 INTRODUCTION

- 10.2 BELOW 30 MM

- 10.2.1 LIMITED THERMAL MASS TO DRIVE HIGH-VELOCITY COOLANT FLOW IN COMPACT LIQUID COOLED CABLES

- 10.3 30-50 MM

- 10.3.1 350 KW CLASS CHARGING EVENTS TO FAVOR 30-50 MM DIAMETER DESIGNS

- 10.4 ABOVE 50 MM

- 10.4.1 MEGAWATT CHARGING REQUIREMENTS TO DRIVE ADOPTION OF ABOVE 50 MM CABLE DIAMETERS

- 10.5 KEY PRIMARY INSIGHTS

11 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE LENGTH

- 11.1 INTRODUCTION

- 11.2 BELOW 5 METERS

- 11.2.1 SPACE-CONSTRAINED CHARGING ENVIRONMENTS TO DRIVE ADOPTION OF BELOW 5 METER LIQUID COOLED CABLES

- 11.3 5-8 METERS

- 11.3.1 NEED FOR STANDARDIZATION TO DRIVE PREFERENCE TOWARD CABLES WITH LENGTH BETWEEN 5 AND 8 METERS

- 11.4 ABOVE 8 METERS

- 11.4.1 NEED FOR ADEQUATE CABLE REACH AT COMPLEX SITES TO SUPPORT GROWTH

- 11.5 KEY PRIMARY INSIGHTS

12 LIQUID COOLED EV CHARGING CABLE MARKET, BY COOLING TECHNOLOGY

- 12.1 INTRODUCTION

- 12.2 WATER GLYCOL

- 12.2.1 NEED FOR HIGH POWER DENSITY AND HEAT MANAGEMENT TO DRIVE DEMAND FOR ULTRAFAST LIQUID COOLED CABLES

- 12.3 OTHERS

- 12.4 KEY PRIMARY INSIGHTS

13 LIQUID COOLED EV CHARGING CABLE MARKET, BY JACKET MATERIAL

- 13.1 INTRODUCTION

- 13.2 RUBBER

- 13.2.1 NEED FOR SPACE-CONSTRAINED CHARGING ENVIRONMENTS TO DRIVE MARKET

- 13.3 THERMOPLASTIC ELASTOMER

- 13.3.1 FOCUS ON HIGH DC CHARGING POWER TO INCREASE RELIANCE ON THERMOPLASTIC ELASTOMER JACKETS

- 13.4 POLYVINYL CHLORIDE

- 13.4.1 NEED FOR DEPLOYMENT OF PRICE-FOCUSED CHARGING CABLES TO SUSTAIN USE OF PVC JACKET MATERIALS

- 13.5 KEY PRIMARY INSIGHTS

14 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY

- 14.1 INTRODUCTION

- 14.2 300-499 KW

- 14.2.1 STANDARDIZATION OF 350 KW DC CHARGERS TO DRIVE SCALED ADOPTION OF 300-499 KW CABLE SYSTEMS

- 14.3 500-900 KW

- 14.3.1 RISING USE OF HIGH-VOLTAGE EV PLATFORMS TO ENABLE ADOPTION OF 500-900 KW CABLE SYSTEMS

- 14.4 > 900 KW

- 14.4.1 NEED FOR MEGAWATT CHARGING SYSTEMS TO PROPEL DEMAND FOR ABOVE 900 KW CABLE ARCHITECTURES

- 14.5 KEY PRIMARY INSIGHTS

15 LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 CHINA

- 15.2.1.1 Adoption of high-power EVs to drive market growth

- 15.2.2 INDIA

- 15.2.2.1 Increasing demand for chargers with power capacity of 120 kW to drive market

- 15.2.3 JAPAN

- 15.2.3.1 Stringent thermal and space constraints to drive adoption of liquid cooled high-power charging cables

- 15.2.4 SOUTH KOREA

- 15.2.4.1 Adoption of high-voltage EV platforms to drive shift toward ultrafast liquid cooled charging infrastructure

- 15.2.1 CHINA

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 Consumer demand for ultrafast 1 and 2 charger integration to drive growth

- 15.3.2 FRANCE

- 15.3.2.1 Focus on smart grid investments and cross-sector partnerships to drive growth

- 15.3.3 ITALY

- 15.3.3.1 Cross-sector collaboration and renewable integration to drive growth

- 15.3.4 SPAIN

- 15.3.4.1 Strategic collaborations between energy firms, technology companies, and city authorities to drive market

- 15.3.5 UK

- 15.3.5.1 Consolidation of high-power charging hubs to drive adoption of liquid cooled cables

- 15.3.6 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 NORTH AMERICA

- 15.4.1 US

- 15.4.1.1 Large-scale adoption of EVs and high-power DC charging to boost demand

- 15.4.2 CANADA

- 15.4.2.1 Expansion of high-power DC charging networks to accelerate adoption of liquid cooled cables

- 15.4.1 US

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 MARKET SHARE OF KEY PLAYERS, 2026

- 16.4 REVENUE ANALYSIS OF KEY PLAYERS

- 16.5 COMPANY VALUATION AND FINANCIAL METRICS

- 16.5.1 COMPANY VALUATION

- 16.5.2 FINANCIAL METRICS

- 16.6 BRAND/PRODUCT COMPARISON

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2026

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Cable power capacity footprint

- 16.7.5.4 Cooling fluid footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2026

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.8.5.1 List of startups/SMEs

- 16.8.5.2 Competitive benchmarking of startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.9.2 DEALS

- 16.9.3 EXPANSION

- 16.9.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 PHOENIX CONTACT

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches/developments

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths/Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 BRUGG GROUP AG

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 MnM view

- 17.1.2.3.1 Key strengths/Right to win

- 17.1.2.3.2 Strategic choices

- 17.1.2.3.3 Weaknesses & competitive threats

- 17.1.3 SINBON ELECTRONICS CO., LTD.

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Expansion

- 17.1.3.3.2 Other developments

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths/Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 HUBER+SUHNER

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches/developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths/Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 LEONI AG

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths/Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses & competitive threats

- 17.1.6 OMG EV CABLE

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.7 KEMPOWER

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches/developments

- 17.1.8 FIVER NEW ENERGY TECHNOLOGY CO., LTD

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.9 SHANGHAI MIDA EV POWER CO., LTD.

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.10 COROFLEX

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches/developments

- 17.1.10.3.2 Expansion

- 17.1.10.3.3 Other developments

- 17.1.11 TE CONNECTIVITY

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches/developments

- 17.1.12 ZHEJIANG YONGGUI ELECTRIC EQUIPMENT CO., LTD.

- 17.1.12.1 Business overview

- 17.1.12.2 Products offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches/developments

- 17.1.12.3.2 Deals

- 17.1.12.3.3 Expansion

- 17.1.1 PHOENIX CONTACT

- 17.2 OTHER PLAYERS

- 17.2.1 CALEDONIAN CABLES LTD.

- 17.2.2 SAICHUAN ELECTRONIC CO., LTD.

- 17.2.3 SUZHOU YIHANG ELECTRONIC SCIENCE & TECHNOLOGY CO., LTD.

- 17.2.4 QINGDAO PENODA ELECTRICAL CO., LTD.

- 17.2.5 TOTCABLES

- 17.2.6 CPC

- 17.2.7 ITT INC.

- 17.2.8 TEISON ENERGY TECHNOLOGY CO., LTD.

- 17.2.9 LS CABLE & SYSTEM LTD.

- 17.2.10 SOUTHWIRE COMPANY, LLC

- 17.2.11 VOSS

- 17.2.12 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- 17.2.13 JOHNSON ELECTRIC HOLDINGS LIMITED

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 List of secondary sources

- 18.1.1.2 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary interviewees: Demand and supply sides

- 18.1.2.2 Key industry insights and breakdown of primary interviews

- 18.1.2.3 List of primary participants

- 18.1.1 SECONDARY DATA

- 18.2 MARKET SIZE ESTIMATION

- 18.2.1 BOTTOM-UP APPROACH

- 18.2.2 TOP-DOWN APPROACH

- 18.3 DATA TRIANGULATION

- 18.4 FACTOR ANALYSIS

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 RESEARCH LIMITATIONS

- 18.7 RISK ASSESSMENT

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS

List of Tables

- TABLE 1 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY

- TABLE 2 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE LENGTH

- TABLE 3 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE DIAMETER

- TABLE 4 LIQUID COOLED EV CHARGING CABLE MARKET, BY APPLICATION

- TABLE 5 LIQUID COOLED EV CHARGING CABLE MARKET, BY JACKET MATERIAL

- TABLE 6 LIQUID COOLED EV CHARGING CABLE MARKET, BY COOLING FLUID

- TABLE 7 CURRENCY EXCHANGE RATES, 2020-2025

- TABLE 8 LIQUID COOLED EV CHARGING CABLE REQUIREMENTS FOR CHARGER POWER RANGES

- TABLE 9 COMPANIES PROVIDING LIQUID COOLED EV CHARGING CABLES ABOVE 800V

- TABLE 10 COMPARISON BETWEEN AIR-COOLED AND LIQUID COOLED EV CHARGING CABLES

- TABLE 11 LIQUID COOLED EV CHARGING CABLE MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 12 STRATEGIC MOVES BY KEY PLAYERS IN LIQUID COOLED EV CHARGING CABLE ECOSYSTEM

- TABLE 13 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2030

- TABLE 14 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 15 AVERAGE SELLING PRICE OF LIQUID COOLED EV CHARGING CABLES, BY KEY PLAYER, 2026 (USD THOUSAND)

- TABLE 16 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2025 (USD THOUSAND)

- TABLE 17 INDICATIVE PRICING ANALYSIS, BY CABLE POWER CAPACITY, 2024-2026 (USD THOUSAND)

- TABLE 18 IMPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 19 EXPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 20 KEY CONFERENCES & EVENTS, 2026-2027

- TABLE 21 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 22 PRODUCT-RELATED TARIFF SET BY US FOR LIQUID COOLING EV CHARGING CABLES

- TABLE 23 NUMBER OF PRODUCTS OFFERED BY MANUFACTURERS OF LIQUID COOLED EV CHARGING CABLES

- TABLE 24 PARC GLOBAL EV CHARGING POINTS, 2021-2024 (THOUSAND UNITS)

- TABLE 25 PARC GLOBAL EV CHARGING POINTS, 2025-2032 (THOUSAND UNITS)

- TABLE 26 KEY PATENTS IN LIQUID COOLED EV CHARGING CABLE MARKET, 2021-2025

- TABLE 27 IMPLEMENTATION OF AI: BEST PRACTICES FOLLOWED BY MANUFACTURERS/OEMS

- TABLE 28 USE OF AI-BASED TEMPERATURE PREDICTION MODELS TO ADDRESS RISING THERMAL STRESS IN HIGH-POWER EV CHARGING CABLES

- TABLE 29 USE OF AI-ENABLED INFRASTRUCTURE OPTIMIZATION TO IMPROVE CHARGING EFFICIENCY

- TABLE 30 IMPACT OF ECOSYSTEM PARTICIPANTS ON LIQUID COOLED EV CHARGING MARKET

- TABLE 31 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 33 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 34 GLOBAL REGULATORY STANDARDS

- TABLE 35 NORTH AMERICA: REGULATORY STANDARDS

- TABLE 36 EUROPE: REGULATORY STANDARDS

- TABLE 37 ASIA PACIFIC: REGULATORY STANDARDS

- TABLE 38 POLICY INITIATIVES IMPACTING LIQUID COOLED EV CHARGING CABLE MARKET

- TABLE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY CABLE LENGTH

- TABLE 40 KEY BUYING CRITERIA, BY CABLE LENGTH

- TABLE 41 LIQUID COOLED EV CHARGING CABLE MARKET, BY APPLICATION, 2022-2024 (THOUSAND UNITS)

- TABLE 42 LIQUID COOLED EV CHARGING CABLE MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 43 LIQUID COOLED EV CHARGING CABLE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 44 LIQUID COOLED EV CHARGING CABLE MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 45 ULTRAFAST CHARGING: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 46 ULTRAFAST CHARGING: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 47 ULTRAFAST CHARGING: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 48 ULTRAFAST CHARGING: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 MEGAWATT CHARGING: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 50 MEGAWATT CHARGING: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 51 MEGAWATT CHARGING: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 52 MEGAWATT CHARGING: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE DIAMETER, 2022-2024 (THOUSAND UNITS)

- TABLE 54 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE DIAMETER, 2025-2032 (THOUSAND UNITS)

- TABLE 55 BELOW 30 MM: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 56 BELOW 30 MM: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 57 30-50 MM: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 58 30-50 MM: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 59 ABOVE 50 MM: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 60 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE LENGTH, 2022-2024 (THOUSAND UNITS)

- TABLE 61 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE LENGTH, 2025-2032 (THOUSAND UNITS)

- TABLE 62 BELOW 5 METERS: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 63 BELOW 5 METERS: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 64 5-8 METERS: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 65 5-8 METERS: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 66 ABOVE 8 METERS: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 67 ABOVE 8 METERS: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 68 LIQUID COOLED EV CHARGING CABLE MARKET, BY COOLING TECHNOLOGY, 2022-2024 (THOUSAND UNITS)

- TABLE 69 LIQUID COOLED EV CHARGING CABLE MARKET, BY COOLING TECHNOLOGY, 2025-2032 (THOUSAND UNITS)

- TABLE 70 WATER GLYCOL: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 71 WATER GLYCOL: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 72 OTHERS: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 73 OTHERS: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 74 LIQUID COOLED EV CHARGING CABLE MARKET, BY JACKET MATERIAL, 2022-2024 (THOUSAND UNITS)

- TABLE 75 LIQUID COOLED EV CHARGING CABLE MARKET, BY JACKET MATERIAL, 2025-2032 (THOUSAND UNITS)

- TABLE 76 RUBBER: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 77 RUBBER: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 78 THERMOPLASTIC ELASTOMER: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 79 THERMOPLASTIC ELASTOMER: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 80 POLYVINYL CHLORIDE: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 81 POLYVINYL CHLORIDE: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 82 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 83 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 84 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 85 LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 86 300-499 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 87 300-499 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 88 300-499 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 89 300-499 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 500-900 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 91 500-900 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 92 500-900 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 93 500-900 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 94 > 900 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 95 > 900 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 96 > 900 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 97 > 900 KW: LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 98 LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (THOUSAND UNITS)

- TABLE 99 LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 100 LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 101 LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 102 ASIA PACIFIC: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2022-2024 (THOUSAND UNITS)

- TABLE 103 ASIA PACIFIC: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 104 ASIA PACIFIC: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 106 CHINA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 107 CHINA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 108 CHINA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 109 CHINA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 110 INDIA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 111 INDIA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 112 JAPAN: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 113 JAPAN: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 114 SOUTH KOREA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 115 SOUTH KOREA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 116 SOUTH KOREA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 117 SOUTH KOREA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 118 EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2022-2024 (THOUSAND UNITS)

- TABLE 119 EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 120 EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 121 EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 122 GERMANY: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 123 GERMANY: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 124 GERMANY: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 125 GERMANY: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 126 FRANCE: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 127 FRANCE: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 128 FRANCE: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 129 FRANCE: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 130 ITALY: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 131 ITALY: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 132 ITALY: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 133 ITALY: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 134 SPAIN: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 135 SPAIN: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 136 SPAIN: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 137 SPAIN: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 138 UK: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 139 UK: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 140 UK: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 141 UK: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 142 REST OF EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 143 REST OF EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 144 REST OF EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 145 REST OF EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 146 NORTH AMERICA: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2022-2024 (THOUSAND UNITS)

- TABLE 147 NORTH AMERICA: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 148 NORTH AMERICA: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 149 NORTH AMERICA: LIQUID COOLED EV CHARGING CABLE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 150 US: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 151 US: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 152 US: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 153 US: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 154 CANADA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (THOUSAND UNITS)

- TABLE 155 CANADA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (THOUSAND UNITS)

- TABLE 156 CANADA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2022-2024 (USD MILLION)

- TABLE 157 CANADA: LIQUID COOLED EV CHARGING CABLE MARKET, BY CABLE POWER CAPACITY, 2025-2032 (USD MILLION)

- TABLE 158 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-DECEMBER 2025

- TABLE 159 LIQUID COOLED EV CHARGING CABLE MARKET: REGION FOOTPRINT

- TABLE 160 LIQUID COOLED EV CHARGING CABLE MARKET: CABLE POWER CAPACITY FOOTPRINT

- TABLE 161 LIQUID COOLED EV CHARGING CABLE MARKET: COOLING FLUID FOOTPRINT

- TABLE 162 EV CHARGING STATION MARKET: LIST OF STARTUPS/SMES

- TABLE 163 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 164 LIQUID COOLED EV CHARGING CABLE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-DECEMBER 2025

- TABLE 165 LIQUID COOLED EV CHARGING CABLE MARKET: DEALS, JANUARY 2021-DECEMBER 2025

- TABLE 166 LIQUID COOLED EV CHARGING CABLE MARKET: EXPANSION, JANUARY 2021-DECEMBER 2025

- TABLE 167 LIQUID COOLED EV CHARGING CABLE MARKET: OTHER DEVELOPMENTS, JANUARY 2021-DECEMBER 2025

- TABLE 168 PHOENIX CONTACT: COMPANY OVERVIEW

- TABLE 169 PHOENIX CONTACT: PRODUCTS OFFERED

- TABLE 170 PHOENIX CONTACT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 171 PHOENIX CONTACT: DEALS

- TABLE 172 PHOENIX CONTACT: OTHER DEVELOPMENTS

- TABLE 173 BRUGG ECONNECT: COMPANY OVERVIEW

- TABLE 174 BRUGG ECONNECT: MAJOR PRODUCTS OFFERED ACROSS CATEGORIES

- TABLE 175 BRUGG ECONNECT: PRODUCTS OFFERED

- TABLE 176 SINBON ELECTRONICS CO., LTD.: COMPANY OVERVIEW

- TABLE 177 SINBON ELECTRONICS CO., LTD.: PRODUCTS OFFERED

- TABLE 178 SINBON ELECTRONICS CO., LTD.: EXPANSION

- TABLE 179 SINBON ELECTRONICS CO., LTD.: OTHER DEVELOPMENTS

- TABLE 180 HUBER+SUHNER: COMPANY OVERVIEW

- TABLE 181 HUBER+SUHNER: PRODUCTS OFFERED

- TABLE 182 HUBER+SUHNER: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 183 LEONI AG: COMPANY OVERVIEW

- TABLE 184 LEONI AG: PRODUCTS OFFERED

- TABLE 185 LEONI AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 186 LEONI AG: DEALS

- TABLE 187 LEONI AG: OTHER DEVELOPMENTS

- TABLE 188 OMG EV CABLE: COMPANY OVERVIEW

- TABLE 189 OMG EV CABLE: PRODUCTS OFFERED

- TABLE 190 KEMPOWER: COMPANY OVERVIEW

- TABLE 191 KEMPOWER: PRODUCTS OFFERED

- TABLE 192 KEMPOWER: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 193 FIVER NEW ENERGY TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 194 FIVER NEW ENERGY TECHNOLOGY CO., LTD: PRODUCTS OFFERED

- TABLE 195 SHANGHAI MIDA EV POWER CO., LTD.: COMPANY OVERVIEW

- TABLE 196 SHANGHAI MIDA EV POWER CO., LTD.: PRODUCTS OFFERED

- TABLE 197 COROFLEX: COMPANY OVERVIEW

- TABLE 198 COROFLEX: PRODUCTS OFFERED

- TABLE 199 COROFLEX: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 200 COROFLEX: EXPANSION

- TABLE 201 COROFLEX: OTHER DEVELOPMENTS

- TABLE 202 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 203 TE CONNECTIVITY: PRODUCTS OFFERED

- TABLE 204 TE CONNECTIVITY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 205 ZHEJIANG YONGGUI ELECTRIC EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 206 ZHEJIANG YONGGUI ELECTRIC EQUIPMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 207 ZHEJIANG YONGGUI ELECTRIC EQUIPMENT CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 208 ZHEJIANG YONGGUI ELECTRIC EQUIPMENT CO., LTD.: DEALS

- TABLE 209 ZHEJIANG YONGGUI ELECTRIC EQUIPMENT CO., LTD.: EXPANSION

- TABLE 210 CALEDONIAN CABLES LTD.: COMPANY OVERVIEW

- TABLE 211 SAICHUAN ELECTRONIC CO., LTD.: COMPANY OVERVIEW

- TABLE 212 SUZHOU YIHANG ELECTRONIC SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 213 QINGDAO PENODA ELECTRICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 214 TOTCABLES: COMPANY OVERVIEW

- TABLE 215 CPC: COMPANY OVERVIEW

- TABLE 216 ITT INC.: COMPANY OVERVIEW

- TABLE 217 TEISON ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 218 LS CABLE & SYSTEM LTD.: COMPANY OVERVIEW

- TABLE 219 SOUTHWIRE COMPANY, LLC: COMPANY OVERVIEW

- TABLE 220 VOSS: COMPANY OVERVIEW

- TABLE 221 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 222 JOHNSON ELECTRIC HOLDINGS LIMITED: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET SCENARIO

- FIGURE 2 LIQUID COOLED EV CHARGING CABLE MARKET, 2022-2032 (USD MILLION)

- FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN LIQUID COOLED EV CHARGING CABLE MARKET, 2020-2025

- FIGURE 4 DISRUPTIONS INFLUENCING GROWTH OF LIQUID COOLED EV CHARGING CABLE MARKET

- FIGURE 5 MEGAWATT CHARGING TO ACHIEVE HIGHER CAGR THAN ULTRAFAST CHARGING APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 6 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 7 RISING DEPLOYMENT OF ULTRAFAST DC CHARGING SYSTEMS TO DRIVE DEMAND FOR LIQUID COOLED EV CHARGING CABLES

- FIGURE 8 500-900 KW SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 ULTRAFAST CHARGING SEGMENT TO LEAD MARKET BY 2032

- FIGURE 10 5-8 METERS SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2032

- FIGURE 11 30-50 MM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 THERMOPLASTIC ELASTOMER SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2032

- FIGURE 13 WATER GLYCOL SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 15 LIQUID COOLED EV CHARGING CABLE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 CABLE WITH IMMERSION COOLING FOR ULTRAFAST CHARGING

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 SUPPLY CHAIN ANALYSIS

- FIGURE 19 ECOSYSTEM ANALYSIS

- FIGURE 20 AVERAGE SELLING PRICE TREND, BY REGION, 2024-2026 (USD THOUSAND)

- FIGURE 21 INDICATIVE PRICING ANALYSIS, BY CABLE POWER CAPACITY, 2024-2026 (USD THOUSAND)

- FIGURE 22 IMPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD BILLION)

- FIGURE 23 EXPORT DATA FOR HS CODE 8544-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 24 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 INVESTMENT & FUNDING SCENARIO, 2022-2025 (USD BILLION)

- FIGURE 26 IMPACT OF FLUORINATED DIELECTRIC-BASED LIQUID COOLED EV CHARGING CABLES

- FIGURE 27 MICRO-CHANNEL AND DIRECT LIQUID COOLING IMPACT ON HPC CABLES

- FIGURE 28 INTEGRATED COOLING LOOP DESIGN FOR HIGH-POWER EV CHARGER AND LIQUID COOLED CABLE

- FIGURE 29 BATTERY-BUFFERED DC FAST CHARGING

- FIGURE 30 TEMPERATURE SENSORS

- FIGURE 31 LIQUID COOLED EV CHARGING CABLE TECHNOLOGY AND PRODUCT ROADMAP

- FIGURE 32 PATENT ANALYSIS

- FIGURE 33 INTERCONNECTED ECOSYSTEM OF LIQUID COOLED EV CHARGING CABLES AND MARKET IMPACT

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY CABLE LENGTH

- FIGURE 35 KEY BUYING CRITERIA, BY CABLE LENGTH

- FIGURE 36 ULTRAFAST CHARGING SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 37 30-50 MM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 5-8 METERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 39 WATER GLYCOL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 40 THERMOPLASTIC ELASTOMER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 41 500-900 KW SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 42 LIQUID COOLED EV CHARGING CABLE MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 43 ASIA PACIFIC: LIQUID COOLED EV CHARGING CABLE MARKET SNAPSHOT

- FIGURE 44 EUROPE: LIQUID COOLED EV CHARGING CABLE MARKET SNAPSHOT

- FIGURE 45 NORTH AMERICA: LIQUID COOLED EV CHARGING CABLE MARKET SNAPSHOT

- FIGURE 46 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2026

- FIGURE 47 MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS, 2026

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2025 (USD BILLION)

- FIGURE 49 COMPANY VALUATION OF KEY PLAYERS, 2025 (USD BILLION)

- FIGURE 50 FINANCIAL METRICS OF KEY PLAYERS, 2025

- FIGURE 51 BRAND/PRODUCT COMPARISON

- FIGURE 52 LIQUID COOLED EV CHARGING CABLE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2026

- FIGURE 53 LIQUID COOLED EV CHARGING CABLE MARKET: COMPANY FOOTPRINT

- FIGURE 54 LIQUID COOLED EV CHARGING CABLE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2026

- FIGURE 55 BRUGG GROUP: SUBSIDIARIES

- FIGURE 56 BRUGG ECONNECT: COMPANY SNAPSHOT

- FIGURE 57 HUBER+SUHNER: COMPANY SNAPSHOT

- FIGURE 58 KEMPOWER: COMPANY SNAPSHOT

- FIGURE 59 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 60 LIQUID COOLED EV CHARGING CABLE MARKET: RESEARCH DESIGN

- FIGURE 61 RESEARCH DESIGN MODEL

- FIGURE 62 KEY INDUSTRY INSIGHTS

- FIGURE 63 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 64 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 65 BOTTOM-UP APPROACH

- FIGURE 66 TOP-DOWN APPROACH

- FIGURE 67 DATA TRIANGULATION

- FIGURE 68 MARKET GROWTH PROJECTIONS FROM SUPPLY-SIDE DRIVERS