PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1937992

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1937992

Autonomous Mobile Robots (AMR) Market by Navigation (Laser/LiDAR, Vision Guidance, SLAM, RFID Tags, Magnetic Sensors, Inertial Sensors), Type (Goods-to-person AMR, Pallet-handling AMR), Payload (<100 kg, 100-500 kg, >500 kg) - Global Forecast to 2032

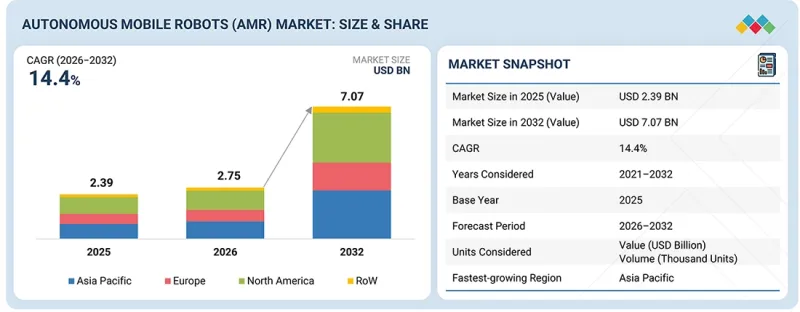

The global autonomous mobile robots market is projected to grow from USD 2.75 billion in 2026 to USD 7.07 billion by 2032, registering a CAGR of 14.4%. Growth is driven by the rising adoption of AMRs across warehouses, manufacturing plants, and distribution centers as organizations prioritize flexible material flow, labor optimization, and consistent operational performance. Companies are increasingly deploying AMRs to support picking, pallet transport, line feeding, and repetitive intralogistics tasks in dynamic environments where adaptability and safety are essential.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2026-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Payload, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

Demand is rising for AMR platforms that offer advanced navigation, real-time obstacle avoidance, and reliable performance in high-throughput operations. Continued investment in warehouse automation, e-commerce fulfillment infrastructure, and smart factory initiatives is further supporting market expansion as enterprises pursue scalable, efficient, and future-ready automation strategies.

"Hardware segment to capture significant market share in 2032"

The hardware segment is likely to capture a significant share of the autonomous mobile robots market, as it plays a vital role in making these robots function and perform well. The hardware segment includes critical components for AMR operation, such as sensors, actuators, mobility systems, and power sources. Sensors provide real-time environmental information for navigation and obstacle avoidance, while actuators enable the robot to move and manipulate objects. As industries increasingly adopt AMRs for applications such as material handling, inventory management, and logistics, demand for high-quality hardware components is rising. In addition, as technology advances, more advanced hardware solutions have been developed, thereby expanding AMR capabilities across various sectors. Further advancements in battery technology and increased sensor precision are expected to drive growth in the hardware segment, making it a mainstay in the expansion of the overall autonomous mobile robots market.

"AMRs with 100-500 kg payload capacity to capture substantial market share in 2032"

AMRs with 100-500 kg payload capacity are expected to capture a significant market share in 2032, driven by their balance of load capability, flexibility, and cost efficiency. This payload range is well-suited for a wide range of industrial applications, including manufacturing plants, warehouses, and logistics facilities, where consistent movement of materials, components, cartons, and pallets is required. AMRs in this category support smooth material flow without compromising maneuverability, making them effective in both narrow aisles and mixed traffic environments. Their ability to handle internal transport, inventory movement, line feeding, and order fulfillment tasks enhances operational efficiency while maintaining safety standards. As industries increasingly seek economical automation solutions for medium-duty material handling, demand for 100-500 kg AMRs is accelerating. These robots offer an attractive alternative to manual handling and heavier automation systems, positioning this segment as a core contributor to sustained growth in the autonomous mobile robots market.

"Asia Pacific to record highest CAGR in autonomous mobile robots market from 2026 to 2032"

Asia Pacific is expected to register the highest growth rate in the autonomous mobile robots market during the forecast period, driven by rapid industrial expansion, large-scale warehouse development, and accelerating automation across manufacturing and logistics. Strong demand from the automotive, semiconductor & electronics, e-commerce & retail, food & beverages, and logistics/3PL sectors is driving the adoption of AMRs to improve internal material flow, reduce manual handling, and sustain consistent throughput in high-volume environments. Manufacturers are increasingly deploying AMRs for picking, sorting, pallet movement, and line feeding as they respond to labor shortages, rising wages, and space constraints. Government initiatives promoting smart manufacturing, digital factories, and industrial modernization continue to strengthen adoption across China, Japan, South Korea, and India. The region benefits from a strong production base, cost-efficient manufacturing, and a growing ecosystem of AMR suppliers, integrators, and technology partners. Ongoing investments in warehouse modernization, safety enhancement, and flexible automation across greenfield and brownfield facilities are accelerating deployment. Asia Pacific is expected to remain the fastest-growing market for AMRs.

Breakdown of primaries

A variety of executives from key organizations in the autonomous mobile robots market were interviewed in depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation: C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, and RoW - 10%

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenues as of 2024: tier 3: revenue less than USD 100 million; tier 2: revenue between USD 100 million and USD 1 billion; and tier 1: revenue more than USD 1 billion.

Major players profiled in this report are as follows: Major players operating in the autonomous mobile robots market include ABB (Switzerland), KUKA SE & Co. KGaA (Germany), OMRON Global (Japan), Mobile Industrial Robots (Denmark), and Geekplus Technology Co., Ltd. (China), Zebra Technologies Corp. (US), OTTO Motors (Canada), Locus Robotics (US), Oceaneering International, Inc. (US), Wuxi Quicktron Intelligent Technology Co., Ltd. (China), SSI SCHAEFER (Germany), KNAPP AG (Austria), Jungheinrich AG (Germany), Ocado Group plc (UK), and Addverb Technologies Limited (India).

These companies compete by expanding AMR product portfolios, enhancing navigation accuracy, payload flexibility, and system reliability, and supporting deployments across warehouses, manufacturing plants, and distribution centers. Strategic focus areas include scalable AMR platforms, mixed fleet compatibility, compliance with safety standards, and seamless integration with warehouse and fulfillment operations. Continued investment in robotics innovation, facility automation, and logistics optimization is expected to sustain competition and support steady advancement across the global autonomous mobile robots market.

The study provides a detailed competitive analysis of these key players in the autonomous mobile robots market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report on the autonomous mobile robots market provides a detailed analysis by offering, payload capacity, navigation technology, industry, and region. By offering, the market is segmented into hardware and software & services, reflecting the combined role of physical robots and enabling software layers. By payload capacity, the market is classified into AMRs with payloads of less than 100 kg, 100-500 kg, and above 500 kg to address diverse material-handling requirements. In terms of navigation technology, the analysis covers laser or LiDAR, vision guidance, and other technologies such as QR codes, fiducials, magnetic or RFID tags, and inertial sensors. By industry, the market includes e-commerce and retail, automotive, chemicals, semiconductor & electronics, aviation, pulp & paper, pharmaceuticals, food & beverages, healthcare, logistics/3PL, metals & heavy machinery, and other industries, including hospitality, agriculture, printing, and textiles. The regional analysis covers North America, Europe, Asia Pacific, and Rest of the World (RoW), supporting evaluation of adoption patterns, growth drivers, and technology trends shaping the global autonomous mobile robots market.

Reasons to buy the Report

The report will help leaders/new entrants in this market by providing information on the closest approximations of overall market revenue and its subsegments. This report will help stakeholders understand the competitive landscape and gain deeper insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the autonomous mobile robots market and provides information on key drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Accelerated progress in robotics and Al, increasing focus on warehouse automation, and elevating adoption of edge computing and loT technologies), restraints (High upfront implementation costs, rising exposure to cybersecurity threats, limited availability of skilled labor), opportunities (Rising demand for efficient last-mile delivery services, growing demand for AMRs that provide customizable hardware configurations and programmable software capabilities, and shift toward smart factories and Industry 4.0), and challenges (Data integration complexities and system compatibility issues, interoperability constraints arising from non-standardized protocols, interfaces, and data formats, technical limitations affecting AMR performance in dynamic operating environments) influencing the growth of the autonomous mobile robots market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the autonomous mobile robots market

- Market Development: Comprehensive information about lucrative markets by analyzing the autonomous mobile robots market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the autonomous mobile robots market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as ABB (Switzerland), KUKA SE & CO. KGAA (Germany), OMRON Corporation (Japan), Mobile Industrial Robots (Denmark), and Geekplus Technology Co., Ltd. (China)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AUTONOMOUS MOBILE ROBOTS MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN AUTONOMOUS MOBILE ROBOTS MARKET

- 3.2 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING

- 3.3 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY

- 3.4 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY

- 3.5 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- 3.6 AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY INDUSTRY AND COUNTRY

- 3.7 AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Accelerated progress in robotics and AI

- 4.2.1.2 Increasing focus on warehouse automation

- 4.2.1.3 Increasing adoption of edge computing and IoT technologies

- 4.2.2 RESTRAINTS

- 4.2.2.1 High upfront implementation costs

- 4.2.2.2 Rising exposure to cybersecurity threats

- 4.2.2.3 Limited availability of skilled labor

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising demand for efficient last-mile delivery services

- 4.2.3.2 Growing demand for AMRs offering customizable hardware and programmable software

- 4.2.3.3 Shift toward smart factories and Industry 4.0

- 4.2.4 CHALLENGES

- 4.2.4.1 Data integration complexities and system compatibility issues

- 4.2.4.2 Interoperability constraints arising from non-standardized protocols, interfaces, and data formats

- 4.2.4.3 Technical limitations affecting AMR performance in dynamic operating environments

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN AUTONOMOUS MOBILE ROBOTS MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL E-COMMERCE INDUSTRY

- 5.2.4 TRENDS IN AUTOMOTIVE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF AUTONOMOUS MOBILE ROBOTS WITH DIFFERENT PAYLOAD CAPACITIES, BY KEY PLAYER, 2025

- 5.5.2 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS, BY PAYLOAD CAPACITY, 2021-2025

- 5.5.3 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS WITH PAYLOAD CAPACITY OF <100 KG, BY REGION, 2021-2025

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 847950)

- 5.6.2 EXPORT SCENARIO (HS CODE 847950)

- 5.7 KEY CONFERENCES AND EVENTS, 2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 OL-450S AMR BOOSTS FACILITY OUTPUT BY 30% WITH AUTOMATED ROLL CAGE HANDLING

- 5.10.2 SENGKANG GENERAL HOSPITAL ENHANCES HEALTHCARE LOGISTICS WITH MIR AMRS

- 5.11 IMPACT OF 2025 US TARIFFS-AUTONOMOUS MOBILE ROBOTS MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 SIMULTANEOUS LOCALIZATION AND MAPPING

- 6.1.2 LIDAR AND 3D MAPPING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 HUMAN-ROBOT INTERACTION

- 6.2.2 WIRELESS COMMUNICATION

- 6.2.3 INDUSTRY 4.0

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 IMPACT OF AI/GEN AI ON AUTONOMOUS MOBILE ROBOTS MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES FOLLOWED BY MANUFACTURERS IN AUTONOMOUS MOBILE ROBOTS MARKET

- 6.5.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN AUTONOMOUS MOBILE ROBOTS MARKET

- 6.5.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT AI IN AUTONOMOUS MOBILE ROBOTS MARKET

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS INDUSTRIES

9 APPLICATIONS OF AUTONOMOUS MOBILE ROBOTS

- 9.1 INTRODUCTION

- 9.2 SORTING

- 9.3 TRANSPORTATION

- 9.4 ASSEMBLY

- 9.5 INVENTORY MANAGEMENT

- 9.6 OTHER APPLICATIONS

10 BATTERY TYPES USED IN AUTONOMOUS MOBILE ROBOTS

- 10.1 INTRODUCTION

- 10.2 LEAD-BASED BATTERIES

- 10.3 LI-ION BATTERIES

- 10.4 NICKEL-BASED BATTERIES

- 10.5 SOLID-STATE BATTERIES

11 MAJOR TYPES OF AUTONOMOUS MOBILE ROBOTS

- 11.1 INTRODUCTION

- 11.2 GOODS-TO-PERSON ROBOTS

- 11.3 PALLET-HANDLING ROBOTS

- 11.4 SELF-DRIVING FORKLIFTS

- 11.5 AUTONOMOUS INVENTORY ROBOTS

12 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING

- 12.1 INTRODUCTION

- 12.2 HARDWARE

- 12.2.1 ESSENTIAL FUNCTION OF AMR HARDWARE IN ENABLING AUTONOMOUS OPERATIONS TO DRIVE DEMAND

- 12.2.2 BATTERIES

- 12.2.3 SENSORS

- 12.2.4 ACTUATORS

- 12.2.5 OTHER HARDWARE COMPONENTS

- 12.3 SOFTWARE & SERVICES

- 12.3.1 USE OF ADVANCED ALGORITHMS TO ENSURE SMOOTH AMR FUNCTIONING AND SUPPORT MARKET GROWTH

13 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY

- 13.1 INTRODUCTION

- 13.2 LASER/LIDAR

- 13.2.1 GROWING USE OF AUTONOMOUS MOBILE ROBOTS IN DETECTION AND IDENTIFICATION APPLICATIONS TO DRIVE MARKET

- 13.3 VISION GUIDANCE

- 13.3.1 ENHANCED VISION GUIDANCE IMPROVING AMR NAVIGATION TO SUPPORT GROWING DEMAND

- 13.4 OTHER NAVIGATION TECHNOLOGIES

14 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY

- 14.1 INTRODUCTION

- 14.2 <100 KG

- 14.2.1 INCREASING USE IN WAREHOUSING AND LOGISTICS OPERATIONS TO SUPPORT MARKET GROWTH

- 14.3 100-500 KG

- 14.3.1 GROWING DEPLOYMENT IN MANUFACTURING AND HEALTHCARE APPLICATIONS TO BOOST MARKET GROWTH

- 14.4 >500 KG

- 14.4.1 RISING REQUIREMENT TO TRANSPORT HEAVY-DUTY LOADS IN MANUFACTURING FACILITIES TO DRIVE MARKET

15 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- 15.1 INTRODUCTION

- 15.2 E-COMMERCE & RETAIL

- 15.2.1 INCREASING USE OF AMRS IN ONLINE RETAIL AND E-COMMERCE TO SUPPORT MARKET EXPANSION

- 15.3 AUTOMOTIVE

- 15.3.1 GROWING ADOPTION OF AMRS IN AUTOMOTIVE MANUFACTURING TO SUPPORT MARKET GROWTH

- 15.4 CHEMICALS

- 15.4.1 EXPANDING USE OF AMRS TO ENHANCE SAFETY AND PROCESS RELIABILITY IN CHEMICAL OPERATIONS TO BOOST DEMAND

- 15.5 SEMICONDUCTOR & ELECTRONICS

- 15.5.1 RISING FOCUS ON AUTOMATION AND PRECISION MANUFACTURING TO ACCELERATE AMR ADOPTION

- 15.6 AVIATION

- 15.6.1 ENHANCED AMR NAVIGATION AND INSPECTION FUNCTIONS TO SUPPORT MARKET GROWTH

- 15.7 PULP & PAPER

- 15.7.1 GROWING FOCUS ON BOOSTING MANUFACTURING EFFICIENCY AND SAFETY TO DRIVE MARKET EXPANSION

- 15.8 PHARMACEUTICALS

- 15.8.1 PRESSING NEED FOR AUTOMATION AND SAFETY COMPLIANCE TO SUPPORT MARKET GROWTH

- 15.9 FOOD & BEVERAGES

- 15.9.1 RISING EMPHASIS ON QUALITY CONTROL AND REGULATORY COMPLIANCE TO FUEL MARKET GROWTH

- 15.10 HEALTHCARE

- 15.10.1 INCREASING FOCUS ON AUTOMATION AND SAFETY COMPLIANCE TO FOSTER MARKET GROWTH

- 15.11 LOGISTICS/3PL

- 15.11.1 GROWING EMPHASIS ON INVENTORY ACCURACY IN LOGISTICS/3PL TO PROPEL MARKET

- 15.12 METALS & HEAVY MACHINERY

- 15.12.1 GROWING NEED FOR AUTOMATED MATERIAL MOVEMENT IN METALS AND HEAVY MACHINERY TO SUPPORT MARKET GROWTH

- 15.13 OTHER INDUSTRIES

16 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Growing integration of AI-powered robots in warehouses to accelerate market growth

- 16.2.2 CANADA

- 16.2.2.1 Intensifying labor shortages to strengthen demand

- 16.2.3 MEXICO

- 16.2.3.1 Booming logistics and food & beverages industries to support market growth

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 GERMANY

- 16.3.1.1 Rising adoption of automation solutions in automotive industry to drive market

- 16.3.2 UK

- 16.3.2.1 Strengthening e-commerce and retail expansion to accelerate market growth

- 16.3.3 FRANCE

- 16.3.3.1 Increasing investment in industrial digitalization to foster market growth

- 16.3.4 ITALY

- 16.3.4.1 Surging use of AMRs across industrial and logistics sectors to drive market

- 16.3.5 SPAIN

- 16.3.5.1 Rising demand from automotive and logistics sectors to create market opportunities

- 16.3.6 REST OF EUROPE

- 16.3.1 GERMANY

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Rapid expansion of e-commerce industry to augment market growth

- 16.4.2 SOUTH KOREA

- 16.4.2.1 Growing adoption of service robots to enhance manufacturing efficiency to contribute to market growth

- 16.4.3 JAPAN

- 16.4.3.1 Elevating adoption of automation in manufacturing and robotics-driven industries to support market growth

- 16.4.4 INDIA

- 16.4.4.1 Increasing adoption across e-commerce and logistics sectors to drive market

- 16.4.5 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 ROW

- 16.5.1 SOUTH AMERICA

- 16.5.1.1 Growing automation in food & beverages sector to support demand

- 16.5.2 AFRICA

- 16.5.2.1 Rising focus of manufacturing firms on streamlining workflows and strengthening product quality to create opportunities

- 16.5.3 MIDDLE EAST

- 16.5.3.1 GCC

- 16.5.3.2 Rest of Middle East

- 16.5.1 SOUTH AMERICA

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 REVENUE ANALYSIS, 2021-2024

- 17.4 MARKET SHARE ANALYSIS, 2025

- 17.5 COMPANY VALUATION AND FINANCIAL METRICS

- 17.6 BRAND/PRODUCT COMPARISON

- 17.6.1 ABB (SWITZERLAND)

- 17.6.2 OMRON CORPORATION (JAPAN)

- 17.6.3 MOBILE INDUSTRIAL ROBOTS (DENMARK)

- 17.6.4 GEEKPLUS TECHNOLOGY CO., LTD. (CHINA)

- 17.6.5 KUKA SE & CO. KGAA (GERMANY)

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 17.7.5.1 Company footprint

- 17.7.5.2 Region footprint

- 17.7.5.3 Navigation technology footprint

- 17.7.5.4 Payload capacity footprint

- 17.7.5.5 Industry footprint

- 17.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 17.8.5.1 Detailed list of key startups/SMEs

- 17.8.5.2 Competitive benchmarking of key startups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 ABB

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Solutions/Services offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches

- 18.1.1.3.2 Deals

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths/Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses/Competitive threats

- 18.1.2 KUKA SE & CO. KGAA

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Solutions/Services offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches

- 18.1.2.3.2 Deals

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths/Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses/Competitive threats

- 18.1.3 OMRON CORPORATION

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Solutions/Services offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.3.2 Expansions

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths/Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses/Competitive threats

- 18.1.4 GEEKPLUS TECHNOLOGY CO., LTD.

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Solutions/Services offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Deals

- 18.1.4.3.2 Other developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths/Right to win

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses/Competitive threats

- 18.1.5 MOBILE INDUSTRIAL ROBOTS

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Solutions/Services offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches

- 18.1.5.3.2 Deals

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths/Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses/Competitive threats

- 18.1.6 OCEANEERING INTERNATIONAL, INC.

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Solutions/Services offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Product launches

- 18.1.6.3.2 Expansions

- 18.1.6.3.3 Other developments

- 18.1.7 ZEBRA TECHNOLOGIES CORP.

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Solutions/Services offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Product launches

- 18.1.8 ADDVERB TECHNOLOGIES LIMITED

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Solutions/Services offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Deals

- 18.1.8.3.2 Expansions

- 18.1.9 KNAPP AG

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Solutions/Services offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Deals

- 18.1.9.3.2 Expansions

- 18.1.10 JUNGHEINRICH AG

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Solutions/Services offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Deals

- 18.1.10.3.2 Expansions

- 18.1.11 KION GROUP AG

- 18.1.11.1 Business overview

- 18.1.11.2 Products/Solutions/Services offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Expansions

- 18.1.12 SSI SCHAEFER

- 18.1.12.1 Business overview

- 18.1.12.2 Products/Solutions/Services offered

- 18.1.12.3 Recent developments

- 18.1.12.3.1 Deals

- 18.1.12.3.2 Other developments

- 18.1.13 OCADO GROUP PLC.

- 18.1.13.1 Business overview

- 18.1.13.2 Products/Solutions/Services offered

- 18.1.14 OTTO MOTORS

- 18.1.14.1 Business overview

- 18.1.14.2 Products/Solutions/Services offered

- 18.1.14.3 Recent developments

- 18.1.14.3.1 Product launches

- 18.1.14.3.2 Deals

- 18.1.15 LOCUS ROBOTICS

- 18.1.15.1 Business overview

- 18.1.15.2 Products/Solutions/Services offered

- 18.1.15.3 Recent developments

- 18.1.15.3.1 Product launches

- 18.1.15.3.2 Deals

- 18.1.1 ABB

- 18.2 OTHER PLAYERS

- 18.2.1 BOSTON DYNAMICS

- 18.2.2 EIRATECH ROBOTICS LTD.

- 18.2.3 GREYORANGE

- 18.2.4 ONWARD ROBOTICS

- 18.2.5 MILVUS ROBOTICS

- 18.2.6 MOVE ROBOTIC SDN. BHD.

- 18.2.7 WUXI QUICKTRON INTELLIGENT TECHNOLOGY CO., LTD.

- 18.2.8 ROBOTNIK

- 18.2.9 SCALLOG

- 18.2.10 SEEGRID

- 18.2.11 SESTO ROBOTICS

- 18.2.12 VECNA ROBOTICS

- 18.2.13 NOVUS HI-TECH ROBOTIC SYSTEMZ

- 18.2.14 AETHON, INC.

- 18.2.15 INVIA ROBOTICS, INC.

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY AND PRIMARY RESEARCH

- 19.1.2 SECONDARY DATA

- 19.1.2.1 List of major secondary sources

- 19.1.2.2 Key data from secondary sources

- 19.1.3 PRIMARY DATA

- 19.1.3.1 Primary interviews with experts

- 19.1.3.2 Key data from primary sources

- 19.1.3.3 Key industry insights

- 19.1.3.4 Breakdown of primaries

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.2 TOP-DOWN APPROACH

- 19.2.3 MARKET SIZE CALCULATION FOR BASE YEAR

- 19.3 MARKET FORECAST APPROACH

- 19.3.1 SUPPLY SIDE

- 19.3.2 DEMAND SIDE

- 19.4 DATA TRIANGULATION

- 19.5 RESEARCH ASSUMPTIONS

- 19.6 RESEARCH LIMITATIONS

- 19.7 RISK ASSESSMENT

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN AUTONOMOUS MOBILE ROBOTS MARKET

- TABLE 2 COMPARISON OF PREVIOUS AND UPDATED REPORT VERSION

- TABLE 3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS IN AUTONOMOUS MOBILE ROBOTS

- TABLE 5 AUTONOMOUS MOBILE ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 7 ROLE OF COMPANIES IN AUTONOMOUS MOBILE ROBOTS ECOSYSTEM

- TABLE 8 PRICING RANGE OF AUTONOMOUS MOBILE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD CAPACITY, 2025 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS, BY PAYLOAD CAPACITY, 2021-2025 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS WITH PAYLOAD CAPACITY OF <100 KG, BY REGION, 2021-2025 (USD)

- TABLE 11 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 13 AUTONOMOUS MOBILE ROBOTS MARKET: LIST OF CONFERENCES AND EVENTS, 2026

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 AUTONOMOUS MOBILE ROBOTS MARKET: TECHNOLOGY ROADMAP

- TABLE 16 AUTONOMOUS MOBILE ROBOTS MARKET: LIST OF APPLIED/GRANTED PATENTS, 2021-2025

- TABLE 17 TOP USE CASES AND MARKET POTENTIAL

- TABLE 18 TOP USE CASES

- TABLE 19 AUTONOMOUS MOBILE ROBOTS MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 20 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 21 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 AUTONOMOUS MOBILE ROBOTS MARKET: INDUSTRY STANDARDS

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- TABLE 27 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 28 UNMET NEEDS IN AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- TABLE 29 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 30 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 31 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 32 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 33 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 34 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 35 AUTONOMOUS MOBILE ROBOTS MARKET, 2021-2025 (THOUSAND UNITS)

- TABLE 36 AUTONOMOUS MOBILE ROBOTS MARKET, 2026-2032 (THOUSAND UNITS)

- TABLE 37 <100 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 38 <100 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 39 100-500 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 40 100-500 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 41 >500 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 42 >500 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 43 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 44 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 45 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 46 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 47 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 48 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 49 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 50 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 51 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 52 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 53 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 54 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 55 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 56 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 57 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIAP PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 58 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIAP PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 59 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 60 E-COMMERCE & RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 61 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 62 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 63 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 64 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 65 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 66 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 67 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 68 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 69 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 70 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 71 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 72 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 73 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 74 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 75 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 76 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 77 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 78 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 79 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 80 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 81 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 82 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 83 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 84 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 85 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 86 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 87 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 88 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 89 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 90 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 91 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 92 CHEMICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 93 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 94 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 95 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 96 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 97 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 98 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 99 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 100 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 101 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 102 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 103 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 104 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 105 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 106 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 107 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 108 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 109 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 110 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 111 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 112 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 113 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 114 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 115 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 116 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 117 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 118 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 119 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 120 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 121 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 122 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 123 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 124 AVIATION: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 125 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 126 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 127 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 128 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 129 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 130 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 131 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 132 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 133 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERCIA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 134 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERCIA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 135 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 136 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 137 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 138 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 139 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 140 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 141 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 142 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 143 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 144 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 145 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 146 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 147 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 148 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 149 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 150 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 151 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 152 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 153 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 154 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 155 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 156 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 157 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 158 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET, 2026-2032 (USD MILLION)

- TABLE 159 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 160 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 161 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 162 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 163 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 164 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 165 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 166 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 167 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 168 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 169 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 170 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 171 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 172 FOOD & BEVERAGES: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 173 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 174 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 175 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 176 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 177 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 178 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 179 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 180 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 181 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 182 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 183 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 184 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 185 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 186 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 187 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 188 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 189 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 190 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 191 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 192 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 193 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 194 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 195 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 196 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 197 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 198 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 199 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, 2021-2025 (USD MILLION)

- TABLE 200 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 201 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 202 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 203 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 204 LOGISTICS/3PL: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 205 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 206 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 207 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 208 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 209 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 210 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 211 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 212 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 213 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET NORTH AMERICA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 214 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET NORTH AMERICA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 215 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 216 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 217 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 218 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 219 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 220 METALS & HEAVY MACHINERY: AUTONOMOUS MOBILE ROBOTS MARKET ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 221 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2025 (USD MILLION)

- TABLE 222 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2026-2032 (USD MILLION)

- TABLE 223 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2025 (USD MILLION)

- TABLE 224 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2026-2032 (USD MILLION)

- TABLE 225 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2025 (USD MILLION)

- TABLE 226 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2026-2032 (USD MILLION)

- TABLE 227 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 228 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 229 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERCIA, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 230 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERCIA, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 231 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 232 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 233 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 234 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 235 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2025 (USD MILLION)

- TABLE 236 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2026-2032 (USD MILLION)

- TABLE 237 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 238 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 239 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 240 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 241 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 242 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 243 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 244 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 245 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 246 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 247 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 248 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 249 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 250 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 251 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2025 (USD MILLION)

- TABLE 252 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 253 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2025 (USD MILLION)

- TABLE 254 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2026-2032 (USD MILLION)

- TABLE 255 MIDDLE EAST: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2021-2025 (USD MILLION)

- TABLE 256 MIDDLE EAST: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 257 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTONOMOUS MOBILE ROBOTS MARKET, 2021-2025

- TABLE 258 AUTONOMOUS MOBILE ROBOTS MARKET: DEGREE OF COMPETITION, 2025

- TABLE 259 AUTONOMOUS MOBILE ROBOTS MARKET: REGION FOOTPRINT

- TABLE 260 AUTONOMOUS MOBILE ROBOTS MARKET: NAVIGATION TECHNOLOGY FOOTPRINT

- TABLE 261 AUTONOMOUS MOBILE ROBOTS MARKET: PAYLOAD CAPACITY FOOTPRINT

- TABLE 262 AUTONOMOUS MOBILE ROBOTS MARKET: INDUSTRY FOOTPRINT

- TABLE 263 AUTONOMOUS MOBILE ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 264 AUTONOMOUS MOBILE ROBOTS MARKET: PRODUCT LAUNCHES, OCTOBER 2021-DECEMBER 2025

- TABLE 265 AUTONOMOUS MOBILE ROBOTS MARKET: DEALS, OCTOBER 2021-DECEMBER 2025

- TABLE 266 ABB: COMPANY OVERVIEW

- TABLE 267 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 ABB: PRODUCT LAUNCHES

- TABLE 269 ABB: DEALS

- TABLE 270 KUKA SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 271 KUKA SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 KUKA SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 273 KUKA SE & CO. KGAA: DEALS

- TABLE 274 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 275 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 277 OMRON CORPORATION: EXPANSIONS

- TABLE 278 GEEKPLUS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 279 GEEKPLUS TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 GEEKPLUS TECHNOLOGY CO., LTD.: DEALS

- TABLE 281 GEEKPLUS TECHNOLOGY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 282 MOBILE INDUSTRIAL ROBOTS: COMPANY OVERVIEW

- TABLE 283 MOBILE INDUSTRIAL ROBOTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 MOBILE INDUSTRIAL ROBOTS: PRODUCT LAUNCHES

- TABLE 285 MOBILE INDUSTRIAL ROBOTS: DEALS

- TABLE 286 OCEANEERING INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 287 OCEANEERING INTERNATIONAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 OCEANEERING INTERNATIONAL, INC.: PRODUCT LAUNCHES

- TABLE 289 OCEANEERING INTERNATIONAL, INC.: EXPANSIONS

- TABLE 290 OCEANEERING INTERNATIONAL, INC.: OTHER DEVELOPMENTS

- TABLE 291 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 292 ZEBRA TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 ZEBRA TECHNOLOGIES CORP.: PRODUCT LAUNCHES

- TABLE 294 ADDVERB TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 295 ADDVERB TECHNOLOGIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 ADDVERB TECHNOLOGIES LIMITED: DEALS

- TABLE 297 ADDVERB TECHNOLOGIES LIMITED: EXPANSIONS

- TABLE 298 KNAPP AG: COMPANY OVERVIEW

- TABLE 299 KNAPP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 KNAPP AG: DEALS

- TABLE 301 KNAPP AG: EXPANSIONS

- TABLE 302 JUNGHEINRICH AG: COMPANY OVERVIEW

- TABLE 303 JUNGHEINRICH AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 JUNGHEINRICH AG: DEALS

- TABLE 305 JUNGHEINRICH AG: EXPANSIONS

- TABLE 306 KION GROUP AG: BUSINESS OVERVIEW

- TABLE 307 KION GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 KION GROUP AG: EXPANSIONS

- TABLE 309 SSI SCHAEFER: COMPANY OVERVIEW

- TABLE 310 SSI SCHAEFER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 SSI SCHAEFER: DEALS

- TABLE 312 SSI SCHAEFER: OTHER DEVELOPMENTS

- TABLE 313 OCADO GROUP PLC.: COMPANY OVERVIEW

- TABLE 314 OCADO GROUP PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 OTTO MOTORS: COMPANY OVERVIEW

- TABLE 316 OTTO MOTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 OTTO MOTORS: PRODUCT LAUNCHES

- TABLE 318 OTTO MOTORS: DEALS

- TABLE 319 LOCUS ROBOTICS: COMPANY OVERVIEW

- TABLE 320 LOCUS ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 LOCUS ROBOTICS: PRODUCT LAUNCHES

- TABLE 322 LOCUS ROBOTICS: DEALS

- TABLE 323 LIST OF KEY SECONDARY SOURCES

- TABLE 324 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 325 KEY DATA FROM PRIMARY SOURCES

- TABLE 326 AUTONOMOUS MOBILE ROBOTS MARKET: RESEARCH ASSUMPTIONS

- TABLE 327 AUTONOMOUS MOBILE ROBOTS MARKET: RISK ASSESSMENT

List of Figures

- FIGURE 1 AUTONOMOUS MOBILE ROBOTS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL AUTONOMOUS MOBILE ROBOTS MARKET, 2021-2032

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AUTONOMOUS MOBILE ROBOTS MARKET, 2021-2025

- FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF AUTONOMOUS MOBILE ROBOTS MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN AUTONOMOUS MOBILE ROBOTS MARKET, 2026-2032

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTONOMOUS MOBILE ROBOTS MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 8 GROWING DEMAND FOR AUTOMATION AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- FIGURE 9 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2032

- FIGURE 10 LASER/LIDAR SEGMENT TO SECURE LARGEST MARKET SHARE IN 2032

- FIGURE 11 100-500 KG SEGMENT TO HOLD LARGEST SHARE OF AUTONOMOUS MOBILE ROBOTS MARKET IN 2032

- FIGURE 12 E-COMMERCE & RETAIL SEGMENT TO HOLD LARGEST SHARE OF AUTONOMOUS MOBILE ROBOTS MARKET IN 2032

- FIGURE 13 E-COMMERCE & RETAIL SEGMENT AND CHINA TO HOLD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2032

- FIGURE 14 CHINA TO EXHIBIT HIGHEST CAGR IN AUTONOMOUS MOBILE ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 IMPACT ANALYSIS: DRIVERS

- FIGURE 17 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 18 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 19 IMPACT ANALYSIS: CHALLENGES

- FIGURE 20 AUTONOMOUS MOBILE ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 AUTONOMOUS MOBILE ROBOTS VALUE CHAIN ANALYSIS

- FIGURE 22 AUTONOMOUS MOBILE ROBOTS ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS, BY PAYLOAD CAPACITY, 2021-2025

- FIGURE 24 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS WITH PAYLOAD CAPACITY OF <100 KG, BY REGION, 2021-2025

- FIGURE 25 IMPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2024

- FIGURE 26 EXPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS FOR TOP 5 COUNTRIES, 2021-2024

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 29 AUTONOMOUS MOBILE ROBOTS MARKET: PATENT ANALYSIS, 2015-2025

- FIGURE 30 KEY FACTORS INFLUENCING PURCHASING DECISIONS FOR AUTONOMOUS MOBILE ROBOTS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- FIGURE 33 AUTONOMOUS MOBILE ROBOTS ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 34 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING

- FIGURE 35 HARDWARE SEGMENT TO CAPTURE PROMINENT MARKET SHARE IN 2026

- FIGURE 36 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY

- FIGURE 37 VISION GUIDANCE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY

- FIGURE 39 >500 KG SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2026 TO 2032

- FIGURE 40 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- FIGURE 41 E-COMMERCE & RETAIL SEGMENT TO CAPTURE PROMINENT MARKET SHARE IN 2032

- FIGURE 42 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION

- FIGURE 43 AUTONOMOUS MOBILE ROBOTS MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2026 TO 2032

- FIGURE 44 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET SNAPSHOT

- FIGURE 46 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET SNAPSHOT

- FIGURE 48 ROW: AUTONOMOUS MOBILE ROBOTS MARKET SNAPSHOT

- FIGURE 49 REVENUE ANALYSIS OF KEY PLAYERS IN AUTONOMOUS MOBILE ROBOTS MARKET, 2021-2024

- FIGURE 50 AUTONOMOUS MOBILE ROBOTS MARKET SHARE ANALYSIS, 2025

- FIGURE 51 COMPANY VALUATION

- FIGURE 52 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 53 AUTONOMOUS MOBILE ROBOTS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 54 AUTONOMOUS MOBILE ROBOTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 55 AUTONOMOUS MOBILE ROBOTS MARKET: COMPANY FOOTPRINT

- FIGURE 56 AUTONOMOUS MOBILE ROBOTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 57 ABB: COMPANY SNAPSHOT

- FIGURE 58 KUKA SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 59 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 OCEANEERING INTERNATIONAL, INC.: COMPANY SNAPSHOT

- FIGURE 61 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT

- FIGURE 62 JUNGHEINRICH AG: COMPANY SNAPSHOT

- FIGURE 63 KION GROUP AG: COMPANY SNAPSHOT

- FIGURE 64 OCADO GROUP PLC.: COMPANY SNAPSHOT

- FIGURE 65 AUTONOMOUS MOBILE ROBOTS MARKET: RESEARCH DESIGN

- FIGURE 66 AUTONOMOUS MOBILE ROBOTS MARKET: RESEARCH APPROACH

- FIGURE 67 KEY DATA FROM SECONDARY SOURCES

- FIGURE 68 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 69 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 70 AUTONOMOUS MOBILE ROBOTS MARKET: BOTTOM-UP APPROACH

- FIGURE 71 AUTONOMOUS MOBILE ROBOTS MARKET: TOP-DOWN APPROACH

- FIGURE 72 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 73 autonomous mobile robots market: data triangulation