PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1942449

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1942449

Consumer Mobile Video Camera Market by Product Type (Gimbal, Action, 360), Form Factor (Wearable, Handheld, Modular), Specification (Frame Rate, Sensor Size), Use Case (Sports, Vlogging, Education), Price (Flagship, High, Low) - Global Forecast to 2035

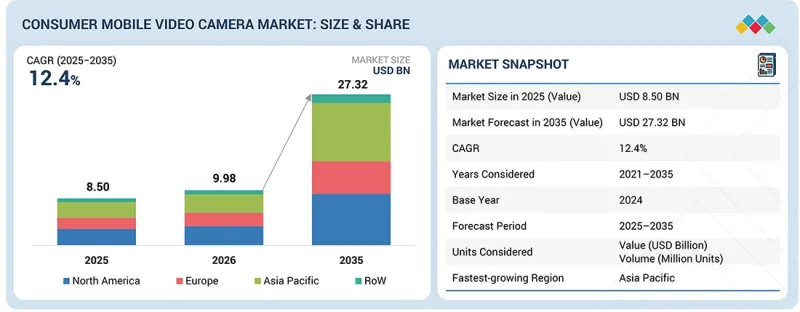

The global consumer mobile video camera market is projected to grow from USD 8.50 billion in 2025 to USD 27.32 billion by 2035, registering a CAGR of 12.4% during the forecast period. The explosive rise of video-centric social media platforms and the creator economy is a primary driving factor for the market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Billion) |

| Segments | By Product type, Form Factor, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

Platforms such as YouTube, Instagram, and TikTok, and emerging short-form and live-streaming services have transformed video creation from a niche hobby into a mainstream activity. This shift is pushing consumers, especially prosumers, vloggers, and semi-professional creators, to invest in dedicated mobile video cameras that deliver superior stabilization, low-light performance, high frame rates, and cinematic video quality beyond what smartphones can consistently offer. Additionally, the growing monetization opportunities for creators, including brand sponsorships, ad revenue, and affiliate marketing, are encouraging upgrades to action cameras, pocket gimbal cameras, and 360° cameras. This trend directly drives demand across mid- to high-price segments and supports sustained market growth across online and offline sales channels through 2035.

"By product type, the handheld pocket/gimbal cameras segment is expected to capture the largest market share during the forecast period."

The handheld pocket/gimbal cameras segment is expected to capture the largest market share in the consumer mobile video camera market during the forecast period, driven by its versatility, portability, and broad appeal across user groups. These cameras strike an optimal balance between professional-grade video quality and ease of use, making them highly attractive to general users, vloggers, and prosumers alike. Integrated mechanical or electronic stabilization, compact form factors, and seamless smartphone connectivity enable smooth, cinematic footage without requiring complex setups. The segment benefits significantly from the surge in vlogging, travel content creation, and lifestyle videography, where users prioritize lightweight devices with high-resolution video, strong low-light performance, and reliable autofocus. Continuous product innovation, such as AI-assisted tracking, enhanced battery life, modular accessories, and improved gimbal motors, is further expanding adoption. Compared to action and 360° cameras, handheld pocket/gimbal cameras offer wider use-case flexibility, supporting daily content creation, professional storytelling, and social media publishing, thereby sustaining their dominance in the overall market.

"Online sales channel is expected to hold the dominant share of the consumer mobile video camera market during the forecast period."

The online sales channel is projected to account for the dominant share of the consumer mobile video camera market during the forecast period, supported by changing consumer purchasing behavior and expanding digital retail ecosystems. E-commerce platforms provide consumers with easy access to a wide range of product options across price bands, brands, and specifications, enabling informed purchase decisions through reviews, comparison tools, and video demonstrations. For technologically advanced products such as mobile video cameras, online channels are particularly effective in communicating feature differentiation, software capabilities, and accessory compatibility. The rise of direct-to-consumer (DTC) strategies by manufacturers, combined with frequent online-exclusive discounts, bundled offerings, and financing options, further accelerates online adoption. Additionally, creators and prosumers often prefer online channels for faster access to newly launched models and ecosystem accessories. Improved logistics, flexible return policies, and strong after-sales support are reinforcing consumer confidence, positioning online sales as the primary revenue-generating channel for the market.

"The Asia Pacific is emerging as the fastest-growing region in the consumer mobile video camera market."

The Asia Pacific is projected to be the fastest-growing regional market during the forecast period, driven by rapid digitalization, a large creator population, and expanding middle-class consumer bases. Countries such as China, India, Japan, and South Korea are witnessing strong growth in social media usage, short-video platforms, and live-streaming ecosystems, which directly fuel demand for dedicated video recording devices. Rising disposable incomes and increased affordability of mid-range cameras are enabling first-time buyers to upgrade from smartphones to specialized mobile video cameras. The region also benefits from a strong manufacturing ecosystem, frequent product launches, and competitive pricing by regional and global players. Additionally, the growing adoption of video-based education, e-commerce product showcasing, and event documentation is broadening use cases beyond entertainment. Government support for digital content creation and technology adoption further strengthens the growth outlook, positioning the Asia Pacific as a key engine of future market expansion.

Breakdown of primaries

A variety of executives from key organizations operating in the consumer mobile video camera market have been interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -20%, Tier 2 - 45%, and Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 40%, and Others - 25%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 35%, and RoW - 10%

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenues: Tier 3: revenue less than USD 100 million; Tier 2: revenue between USD 100 million and USD 1 billion; and Tier 1: revenue more than USD 1 billion.

Major players profiled in this report are as follows: Major players operating in the consumer mobile video camera market include DJI (China), GoPro Inc. (US), Insta360 (China), Sony Corporation (Japan), Ricoh (Japan), AKASO Tech LLC (US), SJCAM (China), Nikon Corporation (Japan), and Panasonic Holdings Corporation (Japan).

These companies compete by continuously expanding their consumer mobile video camera portfolios, improving video resolution, image stabilization, low-light performance, and audio capture quality, and supporting diverse use cases across sports, travel, vlogging, education, and professional content creation. Strategic focus areas include compact and modular camera designs, AI-enabled shooting modes, seamless smartphone and cloud integration, and broad accessory ecosystems to enhance usability and creative flexibility. Manufacturers also emphasize durability, battery efficiency, and compatibility with editing and social media platforms to address evolving creator needs. Continued investment in imaging sensors, software-driven features, connectivity, and direct-to-consumer digital sales strategies is expected to sustain competition and drive steady innovation across the global consumer mobile video camera market.

The study provides a detailed competitive analysis of these key players in the consumer mobile video camera market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report on the consumer mobile video camera market presents a detailed analysis based on product type, form factor, price range, use case, sales channel, end user, and region. By product type, the market is segmented into handheld pocket/gimbal cameras, action cameras, and 360-degree cameras. By form factor, the market is segmented into handheld, wearable/mountable/clip-on, and modular convertible. By price range, the market is segmented into low (<USD 300), medium (USD 300 to 500), high (USD 500 to 700), and flagship above 700. By use case, the market is segmented into sports & adventure, vlogging/social media, education & training, and real estate & events. By sales channel, the market is segmented into online and offline. By end user, the market is segmented into general users, prosumers/creators/vloggers, and professionals. The regional analysis covers North America, Europe, the Asia Pacific, and the Rest of the World, supporting evaluation of adoption patterns, growth drivers, and technology trends shaping the global consumer mobile video camera market.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will help stakeholders understand the consumer mobile video camera market's pulse and provide information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (rapid growth of social media, vlogging, and creator economy, rising popularity of adventure sports, travel, and experiential lifestyles, continuous advancements in camera technology and mobile ecosystem integration), restraints (strong competition from advanced smartphone camera systems, limited product differentiation in lower-priced segments), opportunities (growing adoption of immersive, 360°, and spatial video content, expanding creator communities in emerging markets), and challenges (rapid technological change and short product lifecycles, price sensitivity, brand dominance, and customer retention) influencing the growth of the consumer mobile video camera market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product launches in the consumer mobile video camera market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the consumer mobile video camera market across varied regions)

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the consumer mobile video camera market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like DJI (China), GoPro Inc. (US), Insta360 (China), Sony Corporation (Japan), Ricoh (Japan), AKASO Tech LLC (US), SJCAM (China), Nikon Corporation (Japan), and Panasonic Holdings Corporation (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING CONSUMER MOBILE VIDEO CAMERA MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONSUMER MOBILE VIDEO CAMERA MARKET

- 3.2 CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA, BY PRODUCT TYPE AND COUNTRY

- 3.3 CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA, BY PRODUCT TYPE

- 3.4 CONSUMER MOBILE VIDEO CAMERA MARKET, BY GEOGRAPHY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Evolution of social media and video-centric digital experiences

- 4.2.1.2 Growing emphasis on adventure sports, travel, and experience-driven lifestyles

- 4.2.1.3 Rising innovation in video recording and image stabilization

- 4.2.2 RESTRAINTS

- 4.2.2.1 Intense competition from advanced smartphone camera systems

- 4.2.2.2 Limited product differentiation in lower-priced segments

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Growing popularity of 360° and spatial video content

- 4.2.3.2 Expanding content creator communities in emerging economies

- 4.2.4 CHALLENGES

- 4.2.4.1 Issues in managing short product lifecycles and rapid innovation cycles

- 4.2.4.2 Price sensitivity, brand dominance, and customer retention constraints

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL SPORTS & ADVENTURE INDUSTRY

- 5.3.4 TRENDS IN GLOBAL SOCIAL MEDIA & VLOGGING INDUSTRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF CONSUMER MOBILE VIDEO CAMERAS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF CONSUMER MOBILE VIDEO CAMERAS, BY REGION, 2021-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 852580)

- 5.7.2 EXPORT SCENARIO (HS CODE 852580)

- 5.8 KEY CONFERENCES AND EVENTS, 2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SCOTTIE DAVISON ADOPTS RICOH THETA 360-DEGREE CAMERA TO ENHANCE REAL ESTATE CONTENT CREATION

- 5.11.2 DJI POCKET 3 HELPS CONTENT CREATORS BOOST VLOG ENGAGEMENT

- 5.11.3 INSTA360 X4 EMPOWERS IMMERSIVE CREATION IN 360-VIDEO CONTENT

- 5.12 IMPACT OF 2025 US TARIFF - CONSUMER MOBILE VIDEO CAMERA MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRIES/REGIONS

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON USE CASES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, AND INNOVATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 AI-DRIVEN COMPUTATIONAL VIDEOGRAPHY

- 6.1.2 IMMERSIVE AND SPATIAL VIDEO CAPTURE

- 6.1.3 HIGH-SPEED CONNECTIVITY AND EDGE-ENABLED LIVE STREAMING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ADVANCED STABILIZATION AND MOTION-CONTROL

- 6.2.2 CLOUD-BASED EDITING AND CONTENT MANAGEMENT PLATFORMS

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 AR/VR AND MIXED-REALITY PLATFORMS

- 6.3.2 LIVE STREAMING, SOCIAL COMMERCE, AND CREATOR ECONOMY PLATFORMS

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): AI ENABLED ARCHITECTURE OPTIMIZATION AND CLOUD INTEGRATION

- 6.4.2 MID-TERM (2027-2030): HETEROGENEOUS INTEGRATION & DESIGN ECOSYSTEM EXPANSION

- 6.4.3 LONG-TERM (2030-2035+): UNIVERSAL RECONFIGURABLE COMPUTING AND SYSTEM-LEVEL CONVERGENCE

- 6.5 PATENT ANALYSIS, 2016-2025

- 6.6 IMPACT OF AI/GEN AI ON CONSUMER MOBILE VIDEO CAMERA MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES FOLLOWED BY OEMS IN CONSUMER MOBILE VIDEO CAMERA MARKET

- 6.6.3 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION IN CONSUMER MOBILE VIDEO CAMERA MARKET

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI/GEN AI-INTEGRATED CONSUMER MOBILE VIDEO CAMERAS

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 STANDARDS

- 7.1.3 REGULATIONS

- 7.1.4 CERTIFICATIONS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS USE CASES

9 CONSUMER MOBILE VIDEO CAMERA SPECIFICATIONS

- 9.1 INTRODUCTION

- 9.2 FRAME RATE: 240P, 120P, AND 60P

- 9.3 SENSOR SIZE: <=1/2.3", 1/1.3-1", AND >1"

10 CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE

- 10.1 INTRODUCTION

- 10.2 HANDHELD POCKET/GIMBAL CAMERAS

- 10.2.1 RISE IN VISUAL STORYTELLING UNDER INFLUENCE OF SOCIAL MEDIA PLATFORMS TO FOSTER SEGMENTAL GROWTH

- 10.3 ACTION CAMERAS

- 10.3.1 MOUNTING DEMAND FOR ULTRA-HIGH-DEFINITION VIDEO CAPTURE TO AUGMENT SEGMENTAL GROWTH

- 10.4 360° CAMERA

- 10.4.1 HIGH APPEAL OF IMMERSIVE AND INTERACTIVE CONTENT TO CONTRIBUTE TO SEGMENTAL GROWTH

11 CONSUMER MOBILE VIDEO CAMERA MARKET, BY FORM FACTOR

- 11.1 INTRODUCTION

- 11.2 WEARABLE/MOUNTABLE/CLIP-ON

- 11.2.1 GROWING POPULARITY OF HANDS-FREE, FIRST-PERSON CONTENT CAPTURE TO BOLSTER SEGMENTAL GROWTH

- 11.3 HANDHELD

- 11.3.1 RISING EMPHASIS ON HIGH-QUALITY, INSTANTLY SHAREABLE VIDEO ACROSS SOCIAL MEDIA PLATFORMS TO FUEL SEGMENTAL GROWTH

- 11.4 MODULAR CONVERTIBLE

- 11.4.1 CUSTOMIZATION AND ADAPTABILITY FEATURES TO BOOST SEGMENTAL GROWTH

12 CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE

- 12.1 INTRODUCTION

- 12.2 FLAGSHIP (ABOVE USD 700)

- 12.2.1 RAPID PROFESSIONALIZATION OF CONTENT CREATION TO ACCELERATE SEGMENTAL GROWTH

- 12.3 HIGH (USD 500 TO 700)

- 12.3.1 ADVANCED STABILIZATION AND RELIABLE LOW-LIGHT PERFORMANCE TO FUEL SEGMENTAL GROWTH

- 12.4 MEDIUM (USD 300 TO 500)

- 12.4.1 BALANCE OF PERFORMANCE, PORTABILITY, AND AFFORDABILITY ATTRIBUTES TO DRIVE MARKET

- 12.5 LOW (UNDER USD 300)

- 12.5.1 EASE OF USE, COMPACT DESIGN, AND OTHER ESSENTIAL FEATURES TO CONTRIBUTE TO SEGMENTAL GROWTH

13 CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 GENERAL USERS

- 13.2.1 REQUIREMENT FOR SIMPLE, COMPACT, AND AFFORDABLE DEVICES THAT REQUIRE MINIMAL SETUP TO BOLSTER SEGMENTAL GROWTH

- 13.3 PROSUMERS/CREATORS/VLOGGERS

- 13.3.1 DEMAND FOR NEAR-PROFESSIONAL VIDEO QUALITY, ADVANCED STABILIZATION, AND STRONG LOW-LIGHT PERFORMANCE TO DRIVE MARKET

- 13.4 PROFESSIONALS

- 13.4.1 NEED FOR HIGH LEVELS OF DURABILITY AND PRECISION FOR MISSION-CRITICAL APPLICATIONS TO FOSTER SEGMENTAL GROWTH

14 CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE

- 14.1 INTRODUCTION

- 14.2 SPORTS & ADVENTURE

- 14.2.1 RISING ADOPTION OF COMPACT, BODY-MOUNTED VIDEO CAMERAS TO CAPTURE STABLE FOOTAGE TO AUGMENT SEGMENTAL GROWTH

- 14.3 VLOGGING/SOCIAL MEDIA

- 14.3.1 INCREASING INVESTMENT IN DIGITAL MARKETING TO ACCELERATE SEGMENTAL GROWTH

- 14.4 EDUCATION & TRAINING

- 14.4.1 GROWING NEED FOR STABILIZATION, CONTINUOUS RECORDING, AND BETTER AUDIO INPUTS TO IMPROVE LEARNER ENGAGEMENT TO DRIVE MARKET

- 14.5 REAL ESTATE & EVENTS

- 14.5.1 INCREASE IN HYBRID EVENTS AND VIRTUAL SHOWCASES TO FUEL SEGMENTAL GROWTH

15 CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL

- 15.1 INTRODUCTION

- 15.2 ONLINE

- 15.2.1 BROADER PRODUCT AVAILABILITY AND INFORMED PURCHASING BEHAVIOR TO CONTRIBUTE TO SEGMENTAL GROWTH

- 15.3 OFFLINE

- 15.3.1 IMPULSE AND EXPERIENCE-DRIVEN PURCHASES TO ACCELERATE SEGMENTAL GROWTH

16 CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 16.2.2 US

- 16.2.2.1 Advanced technological ecosystem and adoption of emerging imaging technologies to bolster market growth

- 16.2.3 CANADA

- 16.2.3.1 Heavy investment to enhance electronic stabilization, wireless connectivity, and seamless integration features to drive market

- 16.2.4 MEXICO

- 16.2.4.1 Rapid digitalization and rise in mobile-first population to augment market growth

- 16.3 EUROPE

- 16.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 16.3.2 UK

- 16.3.2.1 Increase in vlogging and social media-led content creation to accelerate market growth

- 16.3.3 GERMANY

- 16.3.3.1 Rising outdoor mobility culture to contribute to market growth

- 16.3.4 FRANCE

- 16.3.4.1 Escalating adoption of compact video devices to capture immersive travel content to fuel market growth

- 16.3.5 SPAIN

- 16.3.5.1 Thriving tourism sector and outdoor lifestyle culture to expedite market growth

- 16.3.6 REST OF EUROPE

- 16.4 ASIA PACIFIC

- 16.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 16.4.2 CHINA

- 16.4.2.1 Growing popularity of live streaming among content creators to augment market growth

- 16.4.3 JAPAN

- 16.4.3.1 Increasing research and development of advanced and refined imaging solutions to facilitate market growth

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Rise in high-quality video creation, live streaming, and instant content sharing to fuel market growth

- 16.4.5 INDIA

- 16.4.5.1 Mounting adoption of digital technology and fast-growing creator economy to bolster market growth

- 16.4.6 REST OF ASIA PACIFIC

- 16.5 ROW

- 16.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 16.5.2 MIDDLE EAST

- 16.5.2.1 Government-led investments in smart infrastructure, public safety, and security to accelerate market growth

- 16.5.3 AFRICA

- 16.5.3.1 Rising smartphone penetration and improving broadband infrastructure to boost market growth

- 16.5.4 SOUTH AMERICA

- 16.5.4.1 Strong social media engagement and expanding creator culture to expedite market growth

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 MARKET SHARE ANALYSIS, 2024

- 17.4 COMPANY VALUATION AND FINANCIAL METRICS

- 17.5 BRAND/PRODUCT COMPARISON

- 17.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.6.1 STARS

- 17.6.2 EMERGING LEADERS

- 17.6.3 PERVASIVE PLAYERS

- 17.6.4 PARTICIPANTS

- 17.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.6.5.1 Company footprint

- 17.6.5.2 Region footprint

- 17.6.5.3 Use case footprint

- 17.6.5.4 Product type footprint

- 17.6.5.5 Form factor footprint

- 17.6.5.6 Sales channel footprint

- 17.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.7.1 PROGRESSIVE COMPANIES

- 17.7.2 RESPONSIVE COMPANIES

- 17.7.3 DYNAMIC COMPANIES

- 17.7.4 STARTING BLOCKS

- 17.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.7.5.1 Detailed list of startups/SMEs

- 17.7.5.2 Competitive benchmarking of key startups/SMEs

- 17.8 COMPETITIVE SCENARIO

- 17.8.1 PRODUCT LAUNCHES

- 17.8.2 DEALS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 DJI

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Solutions/Services offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths/Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses/Competitive threats

- 18.1.2 GOPRO INC.

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Solutions/Services offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches

- 18.1.2.3.2 Deals

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths/Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses/Competitive threats

- 18.1.3 INSTA360

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Solutions/Services offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.3.2 Deals

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths/Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses/Competitive threats

- 18.1.4 SONY CORPORATION

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Solutions/Services offered

- 18.1.4.3 MnM view

- 18.1.4.3.1 Key strengths/Right to win

- 18.1.4.3.2 Strategic choices

- 18.1.4.3.3 Weaknesses/Competitive threats

- 18.1.5 RICOH

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Solutions/Services offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths/Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses/Competitive threats

- 18.1.6 AKASO TECH LLC

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Solutions/Services offered

- 18.1.7 SJCAM

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Solutions/Services offered

- 18.1.8 NIKON CORPORATION

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Solutions/Services offered

- 18.1.9 PANASONIC HOLDINGS CORPORATION

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Solutions/Services offered

- 18.1.10 EASTMAN KODAK COMPANY

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Solutions/Services offered

- 18.1.1 DJI

- 18.2 OTHER PLAYERS

- 18.2.1 OM DIGITAL SOLUTIONS CORPORATION

- 18.2.2 NARRATIVE

- 18.2.3 PINNACLE RESPONSE

- 18.2.4 APEMAN

- 18.2.5 ORDRO

- 18.2.6 TRANSCEND INFORMATION, INC.

- 18.2.7 DRIFT

- 18.2.8 MIDLAND EUROPE S.R.L.

- 18.2.9 OCLU, LLC

- 18.2.10 ROLLEI

- 18.2.11 360FLY, INC.

- 18.2.12 IMMERVISION

- 18.2.13 DIGITAL DOMAIN

- 18.2.14 PANONO GMBH

- 18.2.15 YI TECHNOLOGY

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY DATA

- 19.1.1.1 List of key secondary sources

- 19.1.1.2 Key data from secondary sources

- 19.1.2 PRIMARY DATA

- 19.1.2.1 List of primary interview participants

- 19.1.2.2 Key data from primary sources

- 19.1.2.3 Breakdown of primaries

- 19.1.2.4 Key industry insights

- 19.1.3 SECONDARY AND PRIMARY RESEARCH

- 19.1.1 SECONDARY DATA

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 19.2.2 TOP-DOWN APPROACH

- 19.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 19.2.3 MARKET SIZE ESTIMATION FOR BASE YEAR

- 19.2.1 BOTTOM-UP APPROACH

- 19.3 DATA TRIANGULATION

- 19.4 RESEARCH ASSUMPTIONS

- 19.5 RESEARCH LIMITATIONS

- 19.6 RISK ANALYSIS

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS

List of Tables

- TABLE 1 CONSUMER MOBILE VIDEO CAMERA MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 CONSUMER MOBILE VIDEO CAMERA MARKET: STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES

- TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 5 ROLE OF COMPANIES IN CONSUMER MOBILE VIDEO CAMERA ECOSYSTEM

- TABLE 6 PRICING RANGE OF CONSUMER MOBILE VIDEO CAMERAS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE, 2024 (USD MILLION)

- TABLE 7 AVERAGE SELLING PRICE TREND OF CONSUMER MOBILE VIDEO CAMERAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 8 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 9 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 LIST OF CONFERENCES AND EVENTS, 2026

- TABLE 11 RICOH THETA 360-DEGREE SOLUTION IMPROVES IMMERSIVE PROPERTY LISTINGS AND VIRTUAL TOURS

- TABLE 12 DJI OSMO POCKET 3 HANDHELD CAMERA DRIVES CONTENT GROWTH FOR CREATORS

- TABLE 13 INSTA360 X4 360-DEGREE CAMERA ENABLES NEXT-LEVEL IMMERSIVE VIDEO STORYTELLING

- TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 15 EXPECTED CHANGE IN PRICES AND IMPACT ON USE CASES DUE TO TARIFFS

- TABLE 16 LIST OF KEY PATENTS, 2025

- TABLE 17 USE CASES OF AI/GEN AI IN CONSUMER MOBILE VIDEO CAMERA MARKET

- TABLE 18 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION

- TABLE 19 INTERCONNECTED ECOSYSTEM AND IMPACT ON CONSUMER MOBILE VIDEO CAMERA MARKET PLAYERS

- TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 CONSUMER MOBILE VIDEO CAMERA STANDARDS

- TABLE 25 CONSUMER MOBILE VIDEO CAMERA REGULATIONS

- TABLE 26 CONSUMER MOBILE VIDEO CAMERA CERTIFICATIONS

- TABLE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE USE CASES (%)

- TABLE 28 KEY BUYING CRITERIA FOR THREE USE CASES

- TABLE 29 UNMET NEEDS, BY USE CASE

- TABLE 30 CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 31 CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 32 CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (MILLION UNITS)

- TABLE 33 CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (MILLION UNITS)

- TABLE 34 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 35 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL, 2025-2035 (USD MILLION)

- TABLE 36 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 37 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE, 2025-2035 (USD MILLION)

- TABLE 38 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 39 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER, 2025-2035 (USD MILLION)

- TABLE 40 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE, 2021-2024 (USD MILLION)

- TABLE 41 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE, 2025-2035 (USD MILLION)

- TABLE 42 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 44 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 46 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN EUROPE, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 48 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 49 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 50 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 HANDHELD POCKET/GIMBAL CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ROW, BY REGION, 2025-2035 (USD MILLION)

- TABLE 52 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 53 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL, 2025-2035 (USD MILLION)

- TABLE 54 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 55 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE, 2025-2035 (USD MILLION)

- TABLE 56 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 57 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER, 2025-2035 (USD MILLION)

- TABLE 58 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE, 2021-2024 (USD MILLION)

- TABLE 59 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE, 2025-2035 (USD MILLION)

- TABLE 60 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 62 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 64 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN EUROPE, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 66 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 67 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 68 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 ACTION CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ROW, BY REGION, 2025-2035 (USD MILLION)

- TABLE 70 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 71 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL, 2025-2035 (USD MILLION)

- TABLE 72 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 73 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE, 2025-2035 (USD MILLION)

- TABLE 74 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 75 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER, 2025-2035 (USD MILLION)

- TABLE 76 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE, 2021-2024 (USD MILLION)

- TABLE 77 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE, 2025-2035 (USD MILLION)

- TABLE 78 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 80 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 82 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN EUROPE, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 84 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 86 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 360° CAMERAS: CONSUMER MOBILE VIDEO CAMERA MARKET IN ROW, BY REGION, 2025-2035 (USD MILLION)

- TABLE 88 CONSUMER MOBILE VIDEO CAMERA MARKET, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 89 CONSUMER MOBILE VIDEO CAMERA MARKET, BY FORM FACTOR, 2025-2035 (USD MILLION)

- TABLE 90 CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE, 2021-2024 (USD MILLION)

- TABLE 91 CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRICE RANGE, 2025-2035 (USD MILLION)

- TABLE 92 FLAGSHIP (ABOVE USD 700): CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 93 FLAGSHIP (ABOVE USD 700): CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 94 HIGH (USD 500 TO 700): CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 95 HIGH (USD 500 TO 700): CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 96 MEDIUM (USD 300 TO 500): CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 97 MEDIUM (USD 300 TO 500): CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 98 LOW (UNDER USD 300): CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 99 LOW (UNDER USD 300): CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 100 CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 101 CONSUMER MOBILE VIDEO CAMERA MARKET, BY END USER, 2025-2035 (USD MILLION)

- TABLE 102 GENERAL USERS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 103 GENERAL USERS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 104 PROSUMERS/CREATORS/VLOGGERS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 105 PROSUMERS/CREATORS/VLOGGERS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 106 PROFESSIONALS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 107 PROFESSIONALS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 108 CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE, 2021-2024 (USD MILLION)

- TABLE 109 CONSUMER MOBILE VIDEO CAMERA MARKET, BY USE CASE, 2025-2035 (USD MILLION)

- TABLE 110 SPORTS & ADVENTURE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 111 SPORTS & ADVENTURE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 112 VLOGGING/SOCIAL MEDIA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 113 VLOGGING/SOCIAL MEDIA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 114 EDUCATION & TRAINING: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 115 EDUCATION & TRAINING: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 116 REAL ESTATE & EVENTS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 117 REAL ESTATE & EVENTS: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 118 CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL, 2021-2024 (USD MILLION)

- TABLE 119 CONSUMER MOBILE VIDEO CAMERA MARKET, BY SALES CHANNEL, 2025-2035 (USD MILLION)

- TABLE 120 ONLINE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 121 ONLINE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 122 OFFLINE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 123 OFFLINE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 124 CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 126 CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 127 CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2025-2035 (MILLION UNITS)

- TABLE 128 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 130 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 132 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET FOR HANDHELD POCKET/GIMBAL CAMERAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET FOR HANDHELD POCKET/GIMBAL CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 134 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET FOR ACTION CAMERAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 135 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET FOR ACTION CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 136 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET FOR 360° CAMERAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET FOR 360° CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 138 US: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 139 US: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 140 CANADA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 141 CANADA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 142 MEXICO: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 143 MEXICO: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 144 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 145 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 146 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 147 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 148 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET FOR HANDHELD POCKET/GIMBAL CAMERAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET FOR HANDHELD POCKET/GIMBAL CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 150 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET FOR ACTION CAMERAS, 2021-2024 (USD MILLION)

- TABLE 151 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET FOR ACTION CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 152 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET FOR 360° CAMERAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 153 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET FOR 360° CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 154 UK: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 155 UK: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 156 GERMANY: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 157 GERMANY: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 158 FRANCE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 159 FRANCE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 160 SPAIN: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 161 SPAIN: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 162 REST OF EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 163 REST OF EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 164 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 166 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 167 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 168 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET FOR HANDHELD POCKET/GIMBAL CAMERAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET FOR HANDHELD POCKET/GIMBAL CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 170 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET FOR ACTION CAMERAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET FOR ACTION CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 172 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET FOR 360° CAMERAS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET FOR 360° CAMERAS, BY COUNTRY, 2025-2035 (USD MILLION)

- TABLE 174 CHINA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 175 CHINA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 176 JAPAN: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 177 JAPAN: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 178 SOUTH KOREA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 179 SOUTH KOREA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 180 INDIA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 181 INDIA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 182 REST OF ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 184 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 185 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 186 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 187 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET, BY REGION, 2025-2035 (USD MILLION)

- TABLE 188 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET FOR HANDHELD POCKET/GIMBAL CAMERAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 189 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET FOR HANDHELD POCKET/GIMBAL CAMERAS, BY REGION, 2025-2035 (USD MILLION)

- TABLE 190 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET FOR ACTION CAMERAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 191 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET FOR ACTION CAMERAS, BY REGION, 2025-2035 (USD MILLION)

- TABLE 192 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET FOR 360° CAMERAS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 193 ROW: CONSUMER MOBILE VIDEO CAMERA MARKET FOR 360° CAMERAS, BY REGION, 2025-2035 (USD MILLION)

- TABLE 194 MIDDLE EAST: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 196 AFRICA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 197 AFRICA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 198 SOUTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 199 SOUTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET, BY PRODUCT TYPE, 2025-2035 (USD MILLION)

- TABLE 200 CONSUMER MOBILE VIDEO CAMERA MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, MARCH 2021- DECEMBER 2025

- TABLE 201 CONSUMER MOBILE VIDEO CAMERA MARKET: DEGREE OF COMPETITION, 2024

- TABLE 202 CONSUMER MOBILE VIDEO CAMERA MARKET: REGION FOOTPRINT

- TABLE 203 CONSUMER MOBILE VIDEO CAMERA MARKET: USE CASE FOOTPRINT

- TABLE 204 CONSUMER MOBILE VIDEO CAMERA MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 205 CONSUMER MOBILE VIDEO CAMERA MARKET: FORM FACTOR FOOTPRINT

- TABLE 206 CONSUMER MOBILE VIDEO CAMERA MARKET: SALES CHANNEL FOOTPRINT

- TABLE 207 CONSUMER MOBILE VIDEO CAMERA MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 208 CONSUMER MOBILE VIDEO CAMERA MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 209 CONSUMER MOBILE VIDEO CAMERA MARKET: PRODUCT LAUNCHES, MARCH 2021-DECEMBER 2025

- TABLE 210 CONSUMER MOBILE VIDEO CAMERA MARKET: DEALS, MARCH 2021-DECEMBER 2025

- TABLE 211 DJI: COMPANY OVERVIEW

- TABLE 212 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 DJI: PRODUCT LAUNCHES

- TABLE 214 GOPRO INC.: COMPANY OVERVIEW

- TABLE 215 GOPRO INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 GOPRO INC.: PRODUCT LAUNCHES

- TABLE 217 GOPRO INC.: DEALS

- TABLE 218 INSTA360: COMPANY OVERVIEW

- TABLE 219 INSTA360: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 INSTA360: PRODUCT LAUNCHES

- TABLE 221 INSTA360: DEALS

- TABLE 222 SONY CORPORATION: COMPANY OVERVIEW

- TABLE 223 SONY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 RICOH: BUSINESS OVERVIEW

- TABLE 225 RICOH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 RICOH: PRODUCT LAUNCHES

- TABLE 227 AKASO TECH LLC: COMPANY OVERVIEW

- TABLE 228 AKASO TECH LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 SJCAM: COMPANY OVERVIEW

- TABLE 230 SJCAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 NIKON CORPORATION: COMPANY OVERVIEW

- TABLE 232 NIKON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 234 PANASONIC HOLDINGS CORPORATION: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 235 EASTMAN KODAK COMPANY: COMPANY OVERVIEW

- TABLE 236 EASTMAN KODAK COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 OM DIGITAL SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 238 NARRATIVE: COMPANY OVERVIEW

- TABLE 239 PINNACLE RESPONSE: COMPANY OVERVIEW

- TABLE 240 APEMAN: COMPANY OVERVIEW

- TABLE 241 ORDRO: COMPANY OVERVIEW

- TABLE 242 TRANSCEND INFORMATION, INC.: COMPANY OVERVIEW

- TABLE 243 DRIFT: COMPANY OVERVIEW

- TABLE 244 MIDLAND EUROPE S.R.L.: COMPANY OVERVIEW

- TABLE 245 OCLU, LLC: COMPANY OVERVIEW

- TABLE 246 ROLLEI: COMPANY OVERVIEW

- TABLE 247 360FLY, INC.: COMPANY OVERVIEW

- TABLE 248 IMMERVISION: COMPANY OVERVIEW

- TABLE 249 DIGITAL DOMAIN: COMPANY OVERVIEW

- TABLE 250 PANONO GMBH: COMPANY OVERVIEW

- TABLE 251 YI TECHNOLOGY: COMPANY OVERVIEW

- TABLE 252 MAJOR SECONDARY SOURCES

- TABLE 253 KEY INDUSTRY EXPERTS FROM DIFFERENT COMPANIES PARTICIPATED IN INTERVIEWS, BY DESIGNATION

- TABLE 254 CONSUMER MOBILE VIDEO CAMERA MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 CONSUMER MOBILE VIDEO CAMERA MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CONSUMER MOBILE VIDEO CAMERA MARKET: DURATION COVERED

- FIGURE 3 CONSUMER MOBILE VIDEO CAMERA MARKET SCENARIO

- FIGURE 4 GLOBAL CONSUMER MOBILE VIDEO CAMERA MARKET SIZE, 2021-2035

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN CONSUMER MOBILE VIDEO CAMERA MARKET, 2021-2025

- FIGURE 6 DISRUPTIVE TRENDS IMPACTING CONSUMER MOBILE VIDEO CAMERA MARKET GROWTH

- FIGURE 7 HIGH-GROWTH SEGMENTS IN CONSUMER MOBILE VIDEO CAMERA MARKET, 2025-2035

- FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2035

- FIGURE 9 GROWING USE OF SOCIAL MEDIA/ VLOGGING TO DRIVE CONSUMER MOBILE VIDEO CAMERA MARKET

- FIGURE 10 ACTION CAMERAS SEGMENT AND US HELD LARGEST SHARES OF CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA IN 2025

- FIGURE 11 ACTION CAMERAS SEGMENT TO HOLD LARGEST SHARE OF CONSUMER MOBILE VIDEO CAMERA MARKET IN NORTH AMERICA IN 2035

- FIGURE 12 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL CONSUMER MOBILE VIDEO CAMERA MARKET FROM 2025 TO 2035

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 IMPACT ANALYSIS: DRIVERS

- FIGURE 15 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 16 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 17 IMPACT ANALYSIS: CHALLENGES

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 CONSUMER MOBILE VIDEO CAMERA VALUE CHAIN ANALYSIS

- FIGURE 20 CONSUMER MOBILE VIDEO CAMERA ECOSYSTEM

- FIGURE 21 AVERAGE SELLING PRICE OF CONSUMER MOBILE VIDEO CAMERAS PROVIDED BY KEY PLAYERS, BY PRODUCT TYPE, 2024

- FIGURE 22 AVERAGE SELLING PRICE TREND OF CONSUMER MOBILE VIDEO CAMERAS IN VARIOUS REGIONS, 2021-2024

- FIGURE 23 IMPORT SCENARIO FOR HS CODE 852580-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020-2024

- FIGURE 24 EXPORT SCENARIO FOR HS CODE 852580-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020-2024

- FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, Q2 2023-Q4 2024

- FIGURE 27 PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 28 DECISION-MAKING FACTORS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE USE CASES

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE USE CASES

- FIGURE 31 CONSUMER MOBILE VIDEO CAMERA ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 32 HANDHELD POCKET/GIMBAL CAMERAS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2035

- FIGURE 33 WEARABLE/MOUNTABLE/CLIP-ON SEGMENT TO DOMINATE MARKET FROM 2025 TO 2035

- FIGURE 34 HIGH (USD 500 TO 700) SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 35 PROSUMERS/CREATORS/VLOGGERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2035

- FIGURE 36 VLOGGING/SOCIAL MEDIA SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 ONLINE SEGMENT TO HOLD LARGEST SHARE OF CONSUMER MOBILE VIDEO CAMERA MARKET IN 2035

- FIGURE 38 NORTH AMERICA TO DOMINATE CONSUMER MOBILE VIDEO CAMERA MARKET BETWEEN 2025 AND 2035

- FIGURE 39 NORTH AMERICA: CONSUMER MOBILE VIDEO CAMERA MARKET SNAPSHOT

- FIGURE 40 EUROPE: CONSUMER MOBILE VIDEO CAMERA MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: CONSUMER MOBILE VIDEO CAMERA MARKET SNAPSHOT

- FIGURE 42 MARKET SHARE ANALYSIS OF COMPANIES OFFERING CONSUMER MOBILE VIDEO CAMERAS, 2024

- FIGURE 43 COMPANY VALUATION

- FIGURE 44 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 45 BRAND/PRODUCT COMPARISON

- FIGURE 46 CONSUMER MOBILE VIDEO CAMERA MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 47 CONSUMER MOBILE VIDEO CAMERA MARKET: COMPANY FOOTPRINT

- FIGURE 48 CONSUMER MOBILE VIDEO CAMERA MARKET: COMPANY EVALUATION MATRIX (SMES/STARTUPS), 2024

- FIGURE 49 SONY CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 RICOH: COMPANY SNAPSHOT

- FIGURE 51 NIKON CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 EASTMAN KODAK COMPANY: COMPANY SNAPSHOT

- FIGURE 54 CONSUMER MOBILE VIDEO CAMERA MARKET: RESEARCH DESIGN

- FIGURE 55 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 56 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 57 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 58 CORE INSIGHTS FROM INDUSTRY PLAYERS

- FIGURE 59 CONSUMER MOBILE VIDEO CAMERA MARKET: RESEARCH APPROACH

- FIGURE 60 CONSUMER MOBILE VIDEO CAMERA MARKET: RESEARCH FLOW

- FIGURE 61 CONSUMER MOBILE VIDEO CAMERA MARKET: BOTTOM-UP APPROACH

- FIGURE 62 CONSUMER MOBILE VIDEO CAMERA MARKET: TOP-DOWN APPROACH

- FIGURE 63 CONSUMER MOBILE VIDEO CAMERA MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 64 CONSUMER MOBILE VIDEO CAMERA MARKET: DATA TRIANGULATION

- FIGURE 65 CONSUMER MOBILE VIDEO CAMERA MARKET: RESEARCH ASSUMPTIONS