PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1811758

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1811758

Home Healthcare Market by Product (Therapeutic, Testing, Screening, Monitoring, Mobility Care), Service (Nursing, Infusion Therapy, Rehabilitation, Palliative Care), Indication (Cancer, Diabetes, CVD, Respiratory, Wound Care) - Global Forecast to 2030

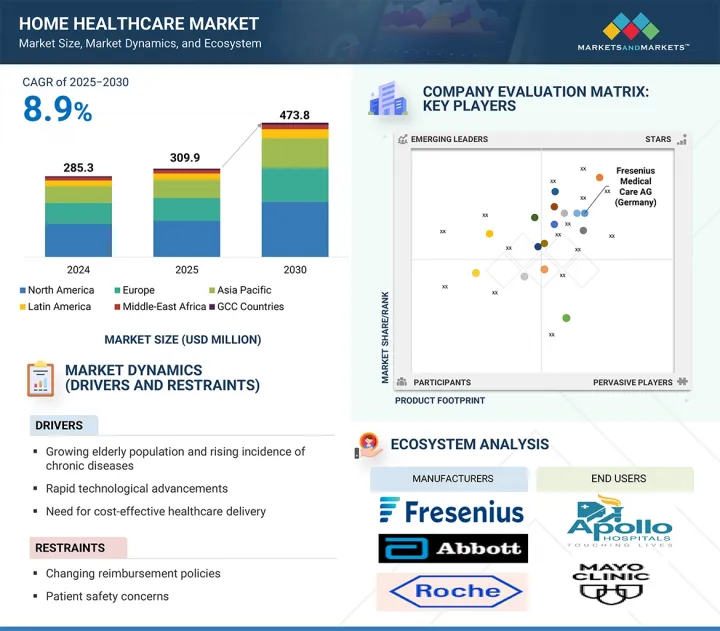

The global home healthcare market is projected to reach USD 473.8 billion by 2030 from USD 309.9 billion in 2025, at a CAGR of 8.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Service, Indication, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

The market is expanding due to a rise in lifestyle-related disorders such as high blood pressure, obesity, and cardiac conditions, which are driving greater demand for home healthcare products. Furthermore, ongoing innovation and the introduction of new product lines by leading global companies are contributing to market growth. These companies are offering a wide range of advanced technologies designed specifically for home healthcare.

The therapeutic products segment accounted for the largest share of the home healthcare market in 2024, by product.

The home healthcare market is categorized by type into therapeutic products, testing, screening, and monitoring devices, and mobility care devices. Therapeutic products accounted for the largest share. The strong growth in the therapeutic product segment is largely driven by the increasing number of people living with chronic health conditions such as diabetes, heart disease, and respiratory issues. As these long-term illnesses become more common, there is a growing demand for effective treatment solutions that can be used at home. This rising need for convenient and accessible care is fueling the expansion of the therapeutic product segment within the home healthcare market.

The skilled nursing services segment accounted for the largest market share of the home healthcare market, in 2024, by service.

The home healthcare market is segmented by service into skilled nursing services, rehabilitation therapy services, hospice & palliative care services, unskilled care services, respiratory therapy services, infusion therapy services, and pregnancy care services. Skilled nursing services hold a significant market share, mainly because of the rising number of patients who require professional medical care at home for chronic illnesses, post-surgery recovery, and age-related conditions. These services are provided by licensed nurses and include tasks such as administering medication, wound care, and monitoring vital signs. As the aging population grows and healthcare systems shift toward home-based care, the demand for skilled nursing services continues to rise, making it a key driver of growth in the home healthcare services market.

The Asia Pacific region is projected to witness the highest growth rate in the home healthcare market during the forecast period.

The global home healthcare market is divided into six key regions: North America, Europe, Latin America, Asia Pacific, the Middle East & Africa, and the GCC Countries. Among these, the Asia Pacific region, which includes countries like Japan, India, China, and others, is anticipated to present substantial growth opportunities and is projected to register the highest CAGR during the forecast period.

Several factors contribute to this growth in the Asia Pacific, including rising healthcare expenditures, increasing demand for affordable and accessible care, and a growing elderly population. Moreover, governments in the region are actively promoting home-based healthcare through supportive policies, funding initiatives, and infrastructure development. These efforts are aimed at reducing the burden on traditional healthcare facilities and improving healthcare access, thereby fueling the expansion of the home healthcare market in the Asia Pacific.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-50%, and Tier 3- 10%

- By Designation: C-level-48%, Director-level-37% and Others-15%

- By Region: North America-46%, Europe-26%, Asia Pacific-17%, Latin America- 7%, Middle East & Africa - 4% and GCC Countries - 1%

Note 1: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the home healthcare market are Fresenius Medical Care AG (Germany), Abbott (US), Linde plc (Ireland), F. Hoffmann-La Roche, Ltd (Switzerland), ResMed (US), Koninklijke Philips N.V. (Netherlands), GE Healthcare (US), A&D HOLON Holdings Company, Limited (Japan), Convatec Group PLC (UK), Amedisys (US), and OMRON Healthcare Co., Ltd. (Japan).

Research Coverage

This report segments the global home healthcare market based on various criteria: product (therapeutic products, testing, screening, and monitoring products, and mobility care products), service (skilled nursing services, rehabilitation therapy services, hospice & palliative care services, unskilled care services, respiratory therapy services, infusion therapy services and pregnancy care services), indication (cancer, respiratory diseases, mobility disorders, cardiovascular diseases & hypertension, pregnancy, wound care, diabetes, hearing disorders and other indications) and region (North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries).

The report provides an in-depth analysis of the key drivers, challenges, opportunities, and restraints influencing market growth. It also offers a detailed evaluation of leading industry players, covering their business profiles, service portfolios, strategic initiatives, acquisitions, product launches & approvals, expansions, and recent developments related to the home healthcare market. Furthermore, the report explores the competitive dynamics of emerging startups within the home healthcare ecosystem.

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the following strategies for strengthening their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (growing elderly population and rising incidence of chronic diseases, rapid technological advancements, need for cost-effective healthcare delivery, increased preference for personalized care), restraints (changing reimbursement policies, limited insurance coverage, patient safety concerns), opportunities (rising focus on telehealth, growing preference for home-based treatments) and challenges (shortage of home care workers, lack of supporting infrastructure)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the home healthcare market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the home healthcare market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the home healthcare market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Presentations of companies and primary interviews

- 2.2.1.3 Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 PARAMETRIC ASSUMPTIONS

- 2.4.2 GROWTH RATE ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 HOME HEALTHCARE MARKET OVERVIEW

- 4.2 GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.3 HOME HEALTHCARE MARKET: GEOGRAPHIC MIX

- 4.4 HOME HEALTHCARE MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing elderly population and rising incidence of chronic diseases

- 5.2.1.2 Rapid technological advancements

- 5.2.1.3 Need for cost-effective healthcare delivery

- 5.2.1.4 Increased preference for personalized care

- 5.2.2 RESTRAINTS

- 5.2.2.1 Changing reimbursement policies

- 5.2.2.2 Limited insurance coverage

- 5.2.2.3 Patient safety concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising focus on telehealth

- 5.2.3.2 Growing preference for home-based treatments

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of home care workers

- 5.2.4.2 Lack of supporting infrastructure

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY PRODUCT

- 5.4.2 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Vital sign monitoring devices

- 5.9.1.2 Wearable devices

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Health data platforms

- 5.9.2.2 Medication management system

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Augmented Reality and Virtual Reality (AR/VR)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 901890)

- 5.11.2 EXPORT DATA (HS CODE 901890)

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.1.1 North America

- 5.13.1.1.1 US

- 5.13.1.1.2 Canada

- 5.13.1.2 Europe

- 5.13.1.3 Asia Pacific

- 5.13.1.3.1 Japan

- 5.13.1.3.2 China

- 5.13.1.3.3 India

- 5.13.1.1 North America

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1 REGULATORY ANALYSIS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON HOME HEALTHCARE MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 MARKET POTENTIAL OF AI IN HOME HEALTHCARE MARKET

- 5.16.3 AI USE CASES

- 5.16.4 KEY COMPANIES IMPLEMENTING AI

- 5.16.5 FUTURE OF AI IN HOME HEALTHCARE MARKET

- 5.17 ADJACENT MARKETS FOR HOME HEALTHCARE MARKET

- 5.18 IMPACT OF US TARIFF REGULATION ON HOME HEALTHCARE MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 KEY IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Home healthcare providers

6 HOME HEALTHCARE MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 THERAPEUTIC PRODUCTS

- 6.2.1 DIALYSIS EQUIPMENT

- 6.2.1.1 Favorable reimbursement scenario for home dialysis to favor growth

- 6.2.2 WOUND CARE PRODUCTS

- 6.2.2.1 Rising geriatric population and subsequent incidence of chronic diseases to amplify growth

- 6.2.3 IV EQUIPMENT

- 6.2.3.1 Technological advancements in IV therapy to contribute to growth

- 6.2.4 SLEEP APNEA THERAPEUTIC DEVICES

- 6.2.4.1 Increasing patient preference for home-based sleep tests to bolster growth

- 6.2.5 INSULIN DELIVERY DEVICES

- 6.2.5.1 High incidence of diabetes to favor growth

- 6.2.6 OXYGEN DELIVERY SYSTEMS

- 6.2.6.1 Growing trend of using oxygen therapy for respiratory disorders to propel market

- 6.2.7 INHALERS

- 6.2.7.1 High incidence of asthma to stimulate growth

- 6.2.8 NEBULIZERS

- 6.2.8.1 Faster relief and longer symptom control to accelerate growth

- 6.2.9 VENTILATORS

- 6.2.9.1 Growing use of positive airway pressure devices for sleep apnea therapy to drive market

- 6.2.10 OTHER THERAPEUTIC PRODUCTS

- 6.2.1 DIALYSIS EQUIPMENT

- 6.3 TESTING, SCREENING, AND MONITORING PRODUCTS

- 6.3.1 BLOOD GLUCOSE MONITORS

- 6.3.1.1 Increasing preference for self-diagnosis to contribute to growth

- 6.3.2 HEARING AIDS

- 6.3.2.1 High incidence of hearing impairment to augment growth

- 6.3.3 ACTIVITY MONITORS & WRISTBANDS

- 6.3.3.1 Increasing awareness about health and fitness to sustain growth

- 6.3.4 ECG/EKG DEVICES

- 6.3.4.1 High prevalence of cardiovascular diseases to support growth

- 6.3.5 TEMPERATURE MONITORING DEVICES

- 6.3.5.1 Rising use of digital thermometers for quick and accurate results to aid growth

- 6.3.6 HEART RATE MONITORS

- 6.3.6.1 Need for real-time monitoring to advance growth

- 6.3.7 PULSE OXIMETERS

- 6.3.7.1 Rising disease incidence and wide usage of pulse oximetry to promote growth

- 6.3.8 OVULATION & PREGNANCY TEST KITS

- 6.3.8.1 Privacy, convenience, accessibility, and quick results to facilitate growth

- 6.3.9 BLOOD PRESSURE MONITORS

- 6.3.9.1 Growing integration of pressure monitoring devices with digital health platforms to boost market

- 6.3.10 HIV TEST KITS

- 6.3.10.1 Increasing number of HIV-infected individuals globally to favor growth

- 6.3.11 FETAL MONITORING DEVICES

- 6.3.11.1 Increasing reliance on remote-based care to promote growth

- 6.3.12 HOLTER & EVENT MONITORS

- 6.3.12.1 Portability and storage attributes to aid growth

- 6.3.13 DRUG & ALCOHOL TEST KITS

- 6.3.13.1 Rise in drug abuse and alcohol consumption to support growth

- 6.3.14 COAGULATION MONITORING PRODUCTS

- 6.3.14.1 Rising incidence of deep vein thrombosis, pulmonary embolism, and hemophilia to foster growth

- 6.3.15 PEAK FLOW METERS

- 6.3.15.1 High portability and cost-efficiency to increase adoption

- 6.3.16 COLON CANCER TEST KITS

- 6.3.16.1 High incidence of colorectal cancer to drive market

- 6.3.17 EEG DEVICES

- 6.3.17.1 Wide patient population for epilepsy to fuel market

- 6.3.18 HOME SLEEP TESTING DEVICES

- 6.3.18.1 Need for specialized care at home to spur growth

- 6.3.19 CHOLESTEROL TESTING PRODUCTS

- 6.3.19.1 Rising obesity levels and cardiovascular incidence to augment growth

- 6.3.20 HOME HBA1C TEST KITS

- 6.3.20.1 Increasing recommendations for regular testing and favorable clinical outcomes to aid growth

- 6.3.1 BLOOD GLUCOSE MONITORS

- 6.4 MOBILITY CARE PRODUCTS

- 6.4.1 WHEELCHAIRS

- 6.4.1.1 Need for patient mobility with less pain and fatigue to fuel market

- 6.4.2 MOBILITY SCOOTERS

- 6.4.2.1 Increasing demand for mobility-assisted devices to facilitate growth

- 6.4.3 WALKERS & ROLLATORS

- 6.4.3.1 Rising prevalence for gait disorders, osteoarthritis, and other degenerative joint diseases to aid growth

- 6.4.4 CRUTCHES

- 6.4.4.1 Increasing use of crutches during post-operative recovery to boost market

- 6.4.5 CANES

- 6.4.5.1 Low cost, ease of use, and wide availability to contribute to growth

- 6.4.1 WHEELCHAIRS

7 HOME HEALTHCARE MARKET, BY SERVICE

- 7.1 INTRODUCTION

- 7.2 SKILLED NURSING SERVICES

- 7.2.1 NEED FOR SPECIFIC PLAN OF CARE TO PROMOTE GROWTH

- 7.3 REHABILITATION THERAPY SERVICES

- 7.3.1 RISING DEMAND FOR IN-HOME CARE PERSONNEL TO STIMULATE GROWTH

- 7.4 HOSPICE & PALLIATIVE CARE SERVICES

- 7.4.1 INCREASING GERIATRIC POPULATION TO FACILITATE GROWTH

- 7.5 UNSKILLED CARE SERVICES

- 7.5.1 HIGHER AFFORDABILITY THAN HOSPITAL OR NURSING HOME SERVICES TO AID GROWTH

- 7.6 RESPIRATORY THERAPY SERVICES

- 7.6.1 GROWING PREVALENCE OF RESPIRATORY DISORDERS TO DRIVE MARKET

- 7.7 INFUSION THERAPY SERVICES

- 7.7.1 SAFE AND EFFECTIVE ALTERNATIVE TO INPATIENT CARE TO ENCOURAGE GROWTH

- 7.8 PREGNANCY CARE SERVICES

- 7.8.1 NEED FOR BETTER MANAGEMENT OF HIGH-RISK PREGNANCIES AND COMPLICATIONS TO ENSURE GROWTH

8 HOME HEALTHCARE MARKET, BY INDICATION

- 8.1 INTRODUCTION

- 8.2 CANCER

- 8.2.1 INCREASING PREFERENCE FOR AT-HOME TREATMENT TO EXPEDITE GROWTH

- 8.3 RESPIRATORY DISEASES

- 8.3.1 RISING INCIDENCE OF CHRONIC DISEASES TO SUSTAIN GROWTH

- 8.4 MOBILITY DISORDERS

- 8.4.1 GROWING GERIATRIC POPULATION TO BOOST MARKET

- 8.5 PREGNANCY

- 8.5.1 RISING FOCUS ON BETTER CARE AND MONITORING DURING PREGNANCY TO AID GROWTH

- 8.6 CARDIOVASCULAR DISEASES & HYPERTENSION

- 8.6.1 GROWING HEALTH AWARENESS TO DRIVE MARKET

- 8.7 WOUND CARE

- 8.7.1 INCREASING NUMBER OF ROAD ACCIDENTS AND TRAUMA INJURIES TO BOLSTER GROWTH

- 8.8 DIABETES

- 8.8.1 SHIFT IN CONSUMER PREFERENCE FROM TRADITIONAL TO MULTIFUNCTIONAL BLOOD GLUCOSE METERS TO SPUR GROWTH

- 8.9 HEARING DISORDERS

- 8.9.1 WORLDWIDE INCREASE IN HEARING DISABILITIES TO FOSTER GROWTH

- 8.10 OTHER INDICATIONS

9 HOME HEALTHCARE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Significant demographic change to contribute to growth

- 9.2.3 CANADA

- 9.2.3.1 Growing elderly population to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Increasing demand for healthcare services to bolster growth

- 9.3.3 UK

- 9.3.3.1 Aging population and rising patient pool to expedite growth

- 9.3.4 FRANCE

- 9.3.4.1 Favorable government support to boost market

- 9.3.5 ITALY

- 9.3.5.1 Universal eligibility for home care to favor growth

- 9.3.6 SPAIN

- 9.3.6.1 Upsurge in elderly population to accelerate growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 High life expectancy and growing healthcare innovations to fuel market

- 9.4.3 CHINA

- 9.4.3.1 Increasing cases of diabetes and diabetic foot ulcers to favor growth

- 9.4.4 INDIA

- 9.4.4.1 Rising disposable income and focus on personalized care to spur growth

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 RISING HEALTHCARE NEEDS TO AID GROWTH

- 9.5.2 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING INVESTMENTS IN HEALTHCARE INFRASTRUCTURE TO PROPEL MARKET

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 DIGITAL TRANSFORMATION AND EXPANDING PUBLIC-PRIVATE PARTNERSHIPS TO FUEL MARKET

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Product & service footprint

- 10.7.5.4 Product footprint

- 10.7.5.5 End-user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 FRESENIUS MEDICAL CARE AG

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 ABBOTT

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 LINDE PLC

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses and competitive threats

- 11.1.4 F. HOFFMANN-LA ROCHE LTD

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and approvals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 RESMED

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and approvals

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 KONINKLIJKE PHILIPS N.V.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and approvals

- 11.1.6.3.2 Deals

- 11.1.7 GE HEALTHCARE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 A&D HOLON HOLDINGS COMPANY, LIMITED

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 CONVATEC GROUP PLC

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches and approvals

- 11.1.9.4 Recent developments

- 11.1.9.4.1 Expansions

- 11.1.10 AMEDISYS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/solutions/services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 OMRON HEALTHCARE CO., LTD.

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.1 FRESENIUS MEDICAL CARE AG

- 11.2 OTHER PLAYERS

- 11.2.1 INVACARE CORPORATION

- 11.2.2 BAYADA HOME HEALTH CARE

- 11.2.3 DRIVE DEVILBISS HEALTHCARE

- 11.2.4 SUNRISE MEDICAL

- 11.2.5 ROMA MEDICAL

- 11.2.6 CAREMAX REHABILITATION EQUIPMENT CO., LTD.

- 11.2.7 VITALOGRAPH

- 11.2.8 ADVITA PFLEGEDIENST GMBH

- 11.2.9 THE RENAFAN GROUP

- 11.2.10 CONTEC MEDICAL SYSTEMS CO., LTD.

- 11.2.11 B. BRAUN SE

- 11.2.12 BAXTER

- 11.2.13 MEDLINE INDUSTRIES

- 11.2.14 ADVIN HEALTH CARE

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 HOME HEALTHCARE MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 HOME HEALTHCARE MARKET: RISK ANALYSIS

- TABLE 3 GERIATRIC POPULATION, 2022 VS. 2050 (MILLION)

- TABLE 4 PRODUCT LAUNCHES BY KEY PLAYERS, 2022-2024

- TABLE 5 AVERAGE SELLING PRICING TREND OF HOME HEALTHCARE PRODUCTS, BY TYPE, 2023-2025 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF HOME HEALTHCARE PRODUCTS, BY KEY PLAYER, 2023-2025 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF HOME HEALTHCARE PRODUCTS, BY REGION, 2023-2025 (USD)

- TABLE 8 HOME HEALTHCARE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 9 HOME HEALTHCARE MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2024

- TABLE 10 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 HOME HEALTHCARE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 13 US FDA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 14 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 15 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 16 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND REVIEWING BODIES

- TABLE 17 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 HOME HEALTHCARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF HOME HEALTHCARE PRODUCTS (%)

- TABLE 25 KEY BUYING CRITERIA FOR HOME HEALTHCARE PRODUCTS

- TABLE 26 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 27 HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 28 KEY THERAPEUTIC PRODUCTS OFFERED

- TABLE 29 HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 30 HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 HOME HEALTHCARE MARKET FOR DIALYSIS EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 HOME HEALTHCARE MARKET FOR WOUND CARE PRODUCTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 HOME HEALTHCARE MARKET FOR IV EQUIPMENT, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 HOME HEALTHCARE MARKET FOR SLEEP APNEA THERAPEUTIC DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 HOME HEALTHCARE MARKET FOR INSULIN DELIVERY DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 HOME HEALTHCARE MARKET FOR OXYGEN DELIVERY SYSTEMS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 HOME HEALTHCARE MARKET FOR INHALERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 HOME HEALTHCARE MARKET FOR NEBULIZERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 HOME HEALTHCARE MARKET FOR VENTILATORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 HOME HEALTHCARE MARKET FOR OTHER THERAPEUTIC PRODUCTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 KEY TESTING, SCREENING, AND MONITORING PRODUCTS OFFERED BY MAJOR COMPANIES

- TABLE 42 HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 43 HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS MARKET, BY TYPE, 2023-2030 (MILLION UNITS)

- TABLE 44 HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 HOME HEALTHCARE MARKET FOR BLOOD GLUCOSE MONITORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 HOME HEALTHCARE MARKET FOR HEARING AIDS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 47 HOME HEALTHCARE MARKET FOR ACTIVITY MONITORS & WRISTBANDS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 48 HOME HEALTHCARE MARKET FOR ECG/EKG DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 HOME HEALTHCARE MARKET FOR TEMPERATURE MONITORING DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 50 HOME HEALTHCARE MARKET FOR HEART RATE MONITORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 51 KEY INNOVATIONS IN PULSE OXIMETERS BY MAJOR COMPANIES

- TABLE 52 HOME HEALTHCARE MARKET FOR PULSE OXIMETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 53 HOME HEALTHCARE MARKET FOR OVULATION & PREGNANCY TEST KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 54 HOME HEALTHCARE MARKET FOR BLOOD PRESSURE MONITORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 NUMBER OF PEOPLE LIVING WITH HIV VS. NEW HIV CASES, BY REGION, 2023

- TABLE 56 HOME HEALTHCARE MARKET FOR HIV TEST KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 57 HOME HEALTHCARE MARKET FOR FETAL MONITORING DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 58 HOME HEALTHCARE MARKET FOR HOLTER & EVENT MONITORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 59 HOME HEALTHCARE MARKET FOR DRUG & ALCOHOL TEST KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 60 HOME HEALTHCARE MARKET FOR COAGULATION MONITORING PRODUCTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 HOME HEALTHCARE MARKET FOR PEAK FLOW METERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 62 HOME HEALTHCARE MARKET FOR COLON CANCER TEST KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 HOME HEALTHCARE MARKET FOR EEG DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 64 HOME HEALTHCARE MARKET FOR HOME SLEEP TESTING DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 65 HOME HEALTHCARE MARKET FOR CHOLESTEROL TESTING PRODUCTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 HOME HEALTHCARE MARKET FOR HOME HBA1C TEST KITS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 67 KEY MOBILITY CARE PRODUCTS OFFERED BY MAJOR PLAYERS

- TABLE 68 HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 HOME HEALTHCARE MARKET FOR WHEELCHAIRS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 71 HOME HEALTHCARE MARKET FOR MOBILITY SCOOTERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 HOME HEALTHCARE MARKET FOR WALKERS & ROLLATORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 73 HOME HEALTHCARE MARKET FOR CRUTCHES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 74 HOME HEALTHCARE MARKET FOR CANES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 75 HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 76 HOME HEALTHCARE SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 HOME HEALTHCARE MARKET FOR SKILLED NURSING SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 78 HOME HEALTHCARE MARKET FOR REHABILITATION THERAPY SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 79 HOME HEALTHCARE MARKET FOR HOSPICE & PALLIATIVE CARE SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 80 HOME HEALTHCARE MARKET FOR UNSKILLED SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 81 HOME HEALTHCARE MARKET FOR RESPIRATORY THERAPY SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 HOME HEALTHCARE MARKET FOR INFUSION THERAPY SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 HOME HEALTHCARE MARKET FOR PREGNANCY CARE SERVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 84 HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 85 HOME HEALTHCARE INDICATIONS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 86 INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (MILLION)

- TABLE 87 HOME HEALTHCARE MARKET FOR CANCER, BY REGION, 2023-2030 (USD MILLION)

- TABLE 88 HOME HEALTHCARE MARKET FOR RESPIRATORY DISEASES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 HOME HEALTHCARE MARKET FOR MOBILITY DISORDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 90 HOME HEALTHCARE MARKET FOR PREGNANCY, BY REGION, 2023-2030 (USD MILLION)

- TABLE 91 HOME HEALTHCARE MARKET FOR CARDIOVASCULAR DISEASES & HYPERTENSION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 92 HOME HEALTHCARE MARKET FOR WOUND CARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 HOME HEALTHCARE MARKET FOR DIABETES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 94 HOME HEALTHCARE MARKET FOR HEARING DISORDERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 95 HOME HEALTHCARE MARKET FOR OTHER INDICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 96 HOME HEALTHCARE MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 98 NORTH AMERICA: HOME HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 106 US: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 107 US: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 108 US: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 109 US: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 110 US: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 111 US: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 US: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 113 CANADA: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 114 CANADA: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 115 CANADA: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 CANADA: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 117 CANADA: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 118 CANADA: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 119 CANADA: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 EUROPE: KEY MACROECONOMIC INDICATORS

- TABLE 121 EUROPE: HOME HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 EUROPE: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 123 EUROPE: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 124 EUROPE: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 125 EUROPE: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 126 EUROPE: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 EUROPE: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 128 EUROPE: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 129 GERMANY: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 130 GERMANY: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 131 GERMANY: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 132 GERMANY: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 133 GERMANY: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 134 GERMANY: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 GERMANY: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 136 UK: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 137 UK: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 138 UK: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 139 UK: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 140 UK: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 UK: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 UK: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 143 FRANCE: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 144 FRANCE: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 145 FRANCE: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 FRANCE: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 147 FRANCE: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 148 FRANCE: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 FRANCE: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 ITALY: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 151 ITALY: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 152 ITALY: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 ITALY: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 ITALY: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 155 ITALY: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 156 ITALY: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 SPAIN: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 158 SPAIN: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 159 SPAIN: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 SPAIN: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 SPAIN: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 SPAIN: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 163 SPAIN: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 164 REST OF EUROPE: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 165 REST OF EUROPE: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 166 REST OF EUROPE: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 REST OF EUROPE: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 170 REST OF EUROPE: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 172 ASIA PACIFIC: HOME HEALTHCARE MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 180 JAPAN: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 181 JAPAN: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 182 JAPAN: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 JAPAN: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 JAPAN: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 JAPAN: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 186 JAPAN: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 CHINA: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD MILLION)

- TABLE 188 CHINA: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 189 CHINA: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 CHINA: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 CHINA: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 CHINA: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 CHINA: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 194 INDIA: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD BILLION)

- TABLE 195 INDIA: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 196 INDIA: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 197 INDIA: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 INDIA: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 INDIA: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 INDIA: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD BILLION)

- TABLE 202 REST OF ASIA PACIFIC: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 209 LATIN AMERICA: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD BILLION)

- TABLE 210 LATIN AMERICA: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 211 LATIN AMERICA: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 212 LATIN AMERICA: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 LATIN AMERICA: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 LATIN AMERICA: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 215 LATIN AMERICA: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 217 MIDDLE EAST & AFRICA: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD BILLION)

- TABLE 218 MIDDLE EAST & AFRICA: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 GCC COUNTRIES: KEY MACROECONOMIC INDICATORS

- TABLE 225 GCC COUNTRIES: HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023-2030 (USD BILLION)

- TABLE 226 GCC COUNTRIES: HOME HEALTHCARE MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 227 GCC COUNTRIES: HOME HEALTHCARE MARKET FOR THERAPEUTIC PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 GCC COUNTRIES: HOME HEALTHCARE MARKET FOR TESTING, SCREENING, AND MONITORING PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 229 GCC COUNTRIES: HOME HEALTHCARE MARKET FOR MOBILITY CARE PRODUCTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 GCC COUNTRIES: HOME HEALTHCARE SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 231 GCC COUNTRIES: HOME HEALTHCARE INDICATIONS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 HOME HEALTHCARE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2022-JUNE 2025

- TABLE 233 HOME HEALTHCARE MARKET: DEGREE OF COMPETITION, 2024 (%)

- TABLE 234 HOME HEALTHCARE MARKET: REGION FOOTPRINT

- TABLE 235 HOME HEALTHCARE MARKET: PRODUCT & SERVICE FOOTPRINT

- TABLE 236 HOME HEALTHCARE MARKET: PRODUCT FOOTPRINT

- TABLE 237 HOME HEALTHCARE MARKET: END-USER FOOTPRINT

- TABLE 238 HOME HEALTHCARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 239 HOME HEALTHCARE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 240 HOME HEALTHCARE MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 241 HOME HEALTHCARE MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 242 HOME HEALTHCARE MARKET: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 243 FRESENIUS MEDICAL CARE AG: COMPANY OVERVIEW

- TABLE 244 FRESENIUS MEDICAL CARE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 FRESENIUS MEDICAL CARE AG: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 246 FRESENIUS MEDICAL CARE AG: DEALS, JANUARY 2022-JUNE 2025

- TABLE 247 FRESENIUS MEDICAL CARE AG: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 248 ABBOTT: COMPANY OVERVIEW

- TABLE 249 ABBOTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 ABBOTT: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 251 ABBOTT: DEALS, JANUARY 2022-JUNE 2025

- TABLE 252 ABBOTT: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 253 LINDE PLC: COMPANY OVERVIEW

- TABLE 254 LINDE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 F. HOFFMANN-LA ROCHE LTD: COMPANY OVERVIEW

- TABLE 256 F. HOFFMAN-LA ROCHE LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 F. HOFFMAN-LA ROCHE LTD: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 258 RESMED: COMPANY OVERVIEW

- TABLE 259 RESMED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 RESMED: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 261 RESMED: DEALS, JANUARY 2022-JUNE 2025

- TABLE 262 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 263 KONINKLIJKE PHILIPS N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 265 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 266 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 267 GE HEALTHCARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 GE HEALTHCARE: DEALS, JANUARY 2022-JUNE 2025

- TABLE 269 A&D HOLON HOLDINGS COMPANY, LIMITED: COMPANY OVERVIEW

- TABLE 270 A&D HOLON HOLDINGS COMPANY, LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 271 CONVATEC GROUP PLC: COMPANY OVERVIEW

- TABLE 272 CONVATEC GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 CONVATEC GROUP PLC: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 274 CONVATEC GROUP PLC: DEALS, JANUARY 2022-JUNE 2025

- TABLE 275 CONVATEC GROUP PLC: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 276 AMEDISYS: COMPANY OVERVIEW

- TABLE 277 AMEDISYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 AMEDISYS: DEALS, JANUARY 2022-JUNE 2025

- TABLE 279 OMRON HEALTHCARE CO., LTD.: COMPANY OVERVIEW

- TABLE 280 OMRON HEALTHCARE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 OMRON HEALTHCARE CO., LTD.: DEALS, JANUARY 2022-JUNE 2025

- TABLE 282 INVACARE CORPORATION: COMPANY OVERVIEW

- TABLE 283 BAYADA HOME HEALTH CARE: COMPANY OVERVIEW

- TABLE 284 DRIVE DEVILBISS HEALTHCARE: COMPANY OVERVIEW

- TABLE 285 SUNRISE MEDICAL: COMPANY OVERVIEW

- TABLE 286 ROMA MEDICAL: COMPANY OVERVIEW

- TABLE 287 CAREMAX REHABILITATION EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 288 VITALOGRAPH: COMPANY OVERVIEW

- TABLE 289 ADVITA PFLEGEDIENST GMBH: COMPANY OVERVIEW

- TABLE 290 THE RENAFAN GROUP: COMPANY OVERVIEW

- TABLE 291 CONTEC MEDICAL SYSTEMS CO., LTD.: COMPANY OVERVIEW

- TABLE 292 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 293 BAXTER: COMPANY OVERVIEW

- TABLE 294 MEDLINE INDUSTRIES: COMPANY OVERVIEW

- TABLE 295 ADVIN HEALTH CARE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HOME HEALTHCARE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HOME HEALTHCARE MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 6 HOME HEALTHCARE MARKET: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 HOME HEALTHCARE MARKET: PARAMETRIC ASSUMPTIONS

- FIGURE 9 HOME HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030 (USD BILLION)

- FIGURE 10 HOME HEALTHCARE MARKET, BY PRODUCT, 2025 VS. 2030 (USD BILLION)

- FIGURE 11 HOME HEALTHCARE MARKET, BY SERVICE, 2025 VS. 2030 (USD BILLION)

- FIGURE 12 HOME HEALTHCARE MARKET, BY INDICATION, 2025 VS. 2030 (USD BILLION)

- FIGURE 13 HOME HEALTHCARE MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 14 GROWING ELDERLY POPULATION AND HIGH INCIDENCE OF CHRONIC DISEASES TO DRIVE MARKET

- FIGURE 15 JAPAN TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 DEVELOPED MARKETS TO HAVE LARGER SHARE DURING FORECAST PERIOD

- FIGURE 18 HOME HEALTHCARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 HOME HEALTHCARE MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 HOME HEALTHCARE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 HOME HEALTHCARE MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 HOME HEALTHCARE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 HOME HEALTHCARE MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 24 HOME HEALTHCARE MARKET: PATENT ANALYSIS, JANUARY 2015-DECEMBER 2024

- FIGURE 25 CANADA: APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 26 EUROPE: CE APPROVAL PROCESS FOR MEDICAL DEVICES

- FIGURE 27 HOME HEALTHCARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF HOME HEALTHCARE PRODUCTS

- FIGURE 29 KEY BUYING CRITERIA FOR HOME HEALTHCARE PRODUCTS

- FIGURE 30 AI USE CASES

- FIGURE 31 ADJACENT MARKETS FOR HOME HEALTHCARE MARKET

- FIGURE 32 NORTH AMERICA: HOME HEALTHCARE MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: HOME HEALTHCARE MARKET SNAPSHOT

- FIGURE 34 HOME HEALTHCARE MARKET: REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS, 2022-2024 (USD MILLION)

- FIGURE 35 HOME HEALTHCARE MARKET SHARE ANALYSIS, 2024 (%)

- FIGURE 36 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 37 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 38 HOME HEALTHCARE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 39 HOME HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 HOME HEALTHCARE MARKET: COMPANY FOOTPRINT

- FIGURE 41 HOME HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 FRESENIUS MEDICAL CARE AG: COMPANY SNAPSHOT (2024)

- FIGURE 43 ABBOTT: COMPANY SNAPSHOT (2024)

- FIGURE 44 LINDE PLC: COMPANY SNAPSHOT (2024)

- FIGURE 45 F. HOFFMANN-LA ROCHE LTD: COMPANY SNAPSHOT (2024)

- FIGURE 46 RESMED: COMPANY SNAPSHOT (2024)

- FIGURE 47 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2024)

- FIGURE 48 GE HEALTHCARE: COMPANY SNAPSHOT (2024)

- FIGURE 49 A&D HOLON HOLDINGS COMPANY, LIMITED: COMPANY SNAPSHOT (2024)

- FIGURE 50 CONVATEC GROUP PLC: COMPANY SNAPSHOT (2024)

- FIGURE 51 AMEDISYS: COMPANY SNAPSHOT (2024)

- FIGURE 52 OMRON HEALTHCARE CO., LTD.: COMPANY SNAPSHOT (2024)