PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1819095

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1819095

Head-up Display (HUD) Market by Combiner HUD, Windshield HUD, Wearable HUD, Augmented Reality (AR) HUD, Conventional HUD, Display Unit, Video Generator/Processing Unit, and Projector/ Projection Unit - Global Forecast to 2030

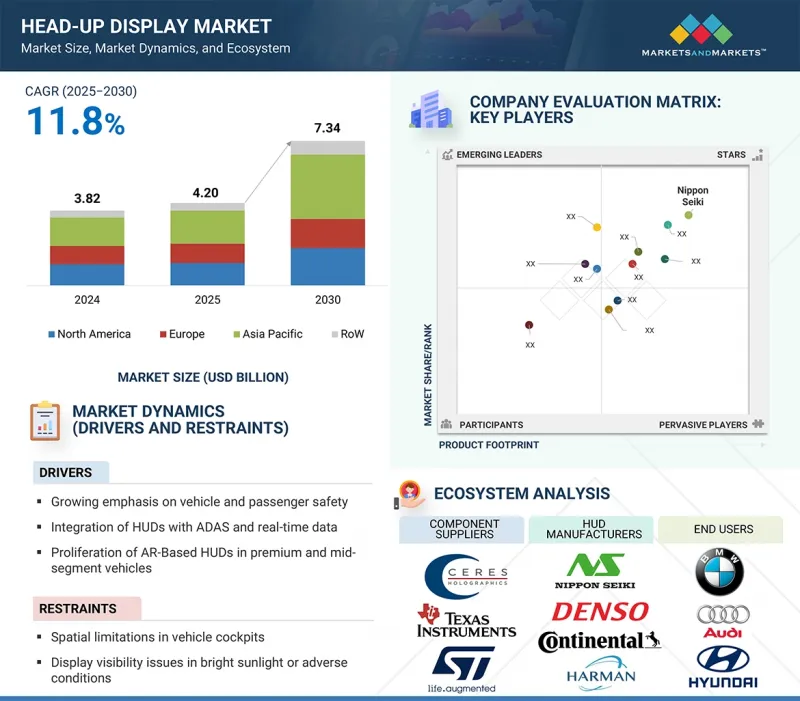

The global head-up display market is expected to reach USD 4.20 billion in 2025 and USD 7.34 billion by 2030, growing at a CAGR of 11.8% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Component, Form Factor, End User, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The head-up display market is driven by the rising demand for advanced driver-assistance systems (ADAS) that reduce driver distraction and improve situational awareness. Increasing integration of augmented reality (AR) features and connected technologies enhances navigation and real-time hazard detection. Additionally, the mounting adoption of HUDs in premium and mid-range vehicles, supported by advancements in projection and display technologies, fuels the global market growth.

"Projectors/projection units segment accounted for the largest market share in 2024."

The projectors/projection units segment accounted for the largest share of the head-up display market in 2024. It serves as the core component responsible for creating and projecting images or information onto the windshield or combiner. Its central role in determining the clarity, brightness, and resolution of the display makes it indispensable across all HUD types, from conventional to augmented reality systems. With the rising demand for advanced driver-assistance features and immersive navigation overlays, projection units are designed with higher brightness, wider fields of view, and compact form factors to fit diverse vehicle models. Technological advancements, such as laser-based and microLED projection, further enhance efficiency, durability, and visual performance, driving their preference among automakers. Given that every HUD relies on the projection unit as its primary functional element, its widespread integration across premium, mid-range, and electric vehicles secures its position as the leading component in the market in 2024.

"Automotive segment is projected to witness the highest CAGR in the head-up display market during the forecast period."

The automotive segment is projected to exhibit the highest CAGR from 2025 to 2030, driven by the rapid integration of HUDs into a range of vehicles, including mid-range and electric models. Rising consumer demand for advanced safety, real-time navigation, and immersive in-vehicle experiences pushes automakers to prioritize HUD adoption as part of their digital cockpit strategies. The increasing deployment of augmented reality HUDs and the advancements in compact and cost-efficient projection technologies make the systems more accessible beyond luxury vehicles. Additionally, the global push toward connected and autonomous driving further positions HUDs as a critical human-machine interface, ensuring their accelerated growth in the automotive sector during this period.

"India is expected to exhibit the highest CAGR in the global head-up display market from 2025 to 2030."

India is anticipated to record the highest CAGR in Asia Pacific and global head-up display markets. The country's automotive sector is experiencing robust expansion, supported by increasing production and sales of passenger and commercial vehicles and a gradual shift toward electric mobility. Rising disposable income, the growing middle-class population, and strong consumer preference for premium vehicles encourage the adoption of advanced in-vehicle technologies, including HUDs. Additionally, government-led initiatives to improve road safety and promote the integration of ADAS and connected mobility solutions foster greater deployment of HUD systems across vehicle categories. The large base of young, tech-savvy consumers, coupled with growing interest in enhanced driving experiences and navigation convenience, further accelerates the market growth. This combination of demand-side and policy-driven factors positions it as a key growth engine for HUD adoption in the Asia Pacific and global markets.

Extensive primary interviews were conducted with key industry experts in the head-up display market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level Executives - 40%, Managers - 30%, and Others - 30%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, and RoW - 10%

Nippon Seiki Co., Ltd. (Japan), Continental AG (Germany), DENSO CORPORATION (Japan), E-LEAD ELECTRONIC CO. LTD (Taiwan), BAE Systems (UK), Yazaki Corporation (Japan), HARMAN International (US), Valeo (France), Panasonic Holdings Corporation (Japan), and Garmin Ltd. (US) are some key players in the head-up display market.

Research Coverage:

This research report categorizes the head-up display market based on type (conventional HUDs, AR HUDs), component (video generators/processing units, display units, projectors/projection units, other components), end user (aviation, automotive, and other end users), form factor (windshield HUDs, combiner HUDs, wearable HUDs), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the head-up display market and forecasts the same till 2030. Apart from this, the report also consists of leadership mapping and analysis of all the companies included in the head-up display ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall head-up display market and the subsegments. This report will help stakeholders to understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (growing emphasis on vehicle and passenger safety; integration of head-up displays (HUDs) with advanced driver assistance systems (ADAS) and real-time data; proliferation of AR-Based HUDs in premium and mid-segment vehicles; technological advancements in microdisplay and projection technologies; growing consumer preference for enhanced in-vehicle user experience; rising demand for connected vehicles worldwide), restraints (spatial limitations in vehicle cockpits; display visibility issues in bright sunlight or adverse conditions; complexity in retrofitting and standardization; complex installation and maintenance), opportunities (expansion into two-wheelers and commercial vehicles, increasing interest in HUDs for electric and software-defined vehicles), and challenges (regulatory challenges; limited field of view (FOV); high expenses linked to advanced head-up displays) influencing the growth of the head-up display market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the head-up display market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the head-up display market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the head-up display market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Nippon Seiki Co., Ltd. (Japan), Continental AG (Germany), DENSO CORPORATION (Japan), E-LEAD ELECTRONIC CO. LTD (Taiwan), BAE Systems (UK), Yazaki Corporation (Japan), HARMAN International (US), Valeo (France), Panasonic Holdings Corporation (Japan), Garmin Ltd. (US) in the head-up display market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HEAD-UP DISPLAY MARKET

- 4.2 HEAD-UP DISPLAY MARKET, BY END USE

- 4.3 HEAD-UP DISPLAY MARKET, BY FORM FACTOR

- 4.4 HEAD-UP DISPLAY MARKET, BY TYPE

- 4.5 HEAD-UP DISPLAY MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing emphasis on vehicle and passenger safety

- 5.2.1.2 Rising integration of HUDs with ADAS and real-time data

- 5.2.1.3 Proliferating adoption of AR-based HUDs in premium and mid-segment vehicles

- 5.2.1.4 Rapid advances in microdisplay and projection technologies

- 5.2.1.5 Growing focus on enhanced in-vehicle user experience

- 5.2.1.6 Mounting global demand for connected vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Spatial limitations in vehicle cockpits

- 5.2.2.2 Display visibility issues in bright sunlight or adverse conditions

- 5.2.2.3 Issues related to retrofitting and standardization

- 5.2.2.4 Complex installation and maintenance

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing interest in HUDs for electric and software-defined vehicles

- 5.2.3.2 Rising application in two-wheeler and commercial vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory challenges

- 5.2.4.2 Limited field of view (FOV)

- 5.2.4.3 High expenses linked to advanced HUDs

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Waveguide optics

- 5.7.1.2 Micro-LED and OLED displays

- 5.7.1.3 Digital light processing (DLP)

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Advanced driver assistance systems (ADAS)

- 5.7.2.2 Augmented reality mapping engines

- 5.7.3 COMPLEMENTARY TECHNOLOGIES

- 5.7.3.1 Holographic optical elements (HOEs)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF AUTOMOTIVE HUDS, BY KEY PLAYER, 2024

- 5.8.2 AVERAGE SELLING PRICE OF AUTOMOTIVE HUDS, BY REGION, 2024

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 BOYD CORPORATION HELPED NAVDY DEVELOP THERMAL SOLUTION FOR HEAD-UP DISPLAYS

- 5.9.2 GX GROUP ASSISTED VISTEON IN DESIGNING COMPACT HEAD-UP DISPLAY UNIT

- 5.9.3 MITSUBISHI ELECTRIC RESEARCH LABORATORIES EVALUATED PERFORMANCE AND USER PREFERENCE OF HEAD-UP DISPLAYS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 8528)

- 5.10.2 EXPORT SCENARIO (HS CODE 8528)

- 5.11 PATENT ANALYSIS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 BARGAINING POWER OF SUPPLIERS

- 5.12.2 BARGAINING POWER OF BUYERS

- 5.12.3 THREAT OF NEW ENTRANTS

- 5.12.4 THREAT OF SUBSTITUTES

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF AI/GEN AI ON HEAD-UP DISPLAY MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 USE CASES AND IMPACT OF AI/GEN AI ON HEAD-UP DISPLAY MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON HEAD-UP DISPLAY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END USES

6 HEAD-UP DISPLAY TECHNOLOGIES

- 6.1 INTRODUCTION

- 6.2 DIGITAL HUD (LCD/LED/OLED)

- 6.3 DLP-BASED HUD

- 6.4 WAVEGUIDE-BASED HUD

- 6.5 LASER-BASED HUD

7 HEAD-UP DISPLAY FEATURES

- 7.1 INTRODUCTION

- 7.2 FIELD OF VIEW

- 7.3 RESOLUTION

- 7.4 BRIGHTNESS

- 7.5 ACCURACY

- 7.6 COMBINER TRANSMITTANCE

8 HEAD-UP DISPLAY MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 VIDEO GENERATORS/PROCESSING UNITS

- 8.2.1 RELIANCE ON ADVANCED PROCESSING POWER FOR AR INTEGRATION TO BOOST SEGMENTAL GROWTH

- 8.2.2 GRAPHICS PROCESSING UNIT (GPU)

- 8.2.3 EMBEDDED SYSTEM CONTROLLER

- 8.2.4 SIGNAL PROCESSING UNIT

- 8.2.5 AUGMENTED REALITY ENGINE

- 8.3 PROJECTORS/PROJECTION UNITS

- 8.3.1 ADVANCES IN LIQUID CRYSTAL, LASER BEAM, AND DIGITAL LIGHT PROCESSING TECHNOLOGIES TO FUEL SEGMENTAL GROWTH

- 8.4 DISPLAY UNITS

- 8.4.1 EVOLVING DISPLAY ARCHITECTURES TO ENHANCE VISUAL CLARITY TO FACILITATE SEGMENTAL GROWTH

- 8.4.2 LCD/TFT DISPLAY

- 8.4.3 OLED

- 8.4.4 DLP

- 8.4.5 LCOS

- 8.5 OTHER COMPONENTS

9 HEAD-UP DISPLAY MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 CONVENTIONAL HUDS

- 9.2.1 RISING INTEGRATION INTO MID-RANGE AND MASS-MARKET VEHICLES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.3 AR HUDS

- 9.3.1 INCREASING ADOPTION IN LUXURY CARS TO BOLSTER SEGMENTAL GROWTH

10 HEAD-UP DISPLAY MARKET, BY FORM FACTOR

- 10.1 INTRODUCTION

- 10.2 WINDSHIELD HUDS

- 10.2.1 GROWING POPULARITY AMONG MANUFACTURERS OF LUXURY AND UPPER MID-RANGE VEHICLES TO ACCELERATE SEGMENTAL GROWTH

- 10.3 COMBINER HUDS

- 10.3.1 RELIABILITY, EASE OF INTEGRATION, AND LOW COST ATTRIBUTES TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.4 WEARABLE HUDS

- 10.4.1 APPLICATION SCOPE IN HIGH-PERFORMANCE, MOBILITY-INTENSIVE ENVIRONMENTS TO FUEL SEGMENTAL GROWTH

11 HEAD-UP DISPLAY MARKET, BY END USE

- 11.1 INTRODUCTION

- 11.2 AVIATION

- 11.2.1 CIVIL AVIATION

- 11.2.1.1 Ability to provide flight path guidance, airspeed notifications, and other information to boost HUD demand

- 11.2.1.2 Civil aircraft

- 11.2.1.3 Civil helicopters

- 11.2.2 MILITARY AVIATION

- 11.2.2.1 Reliance on HUDs to support search and rescue operations and provide pilots with vital flight-related information to drive market

- 11.2.2.2 Military aircraft

- 11.2.2.3 Military helicopters

- 11.2.1 CIVIL AVIATION

- 11.3 AUTOMOTIVE

- 11.3.1 MID-RANGE VEHICLES

- 11.3.1.1 Strong focus on improving safety, efficiency, and affordability to foster segmental growth

- 11.3.2 LUXURY VEHICLES

- 11.3.2.1 Growing emphasis on personalization, immersive user experiences, and seamless integration of advanced electronics to drive market

- 11.3.1 MID-RANGE VEHICLES

- 11.4 OTHER END USES

12 HEAD-UP DISPLAY MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Increasing consumption of luxury, sports, and mid-tier vehicles to boost market growth

- 12.2.3 CANADA

- 12.2.3.1 Growing concern about passenger and vehicle safety to drive market

- 12.2.4 MEXICO

- 12.2.4.1 Dynamic evolution of automotive industry to fuel market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Increasing reliance on advanced in-vehicle electronics to accelerate market growth

- 12.3.3 UK

- 12.3.3.1 Mounting luxury car demand to augment market expansion

- 12.3.4 FRANCE

- 12.3.4.1 Growing popularity of displays offering advanced technological capabilities to drive market

- 12.3.5 ITALY

- 12.3.5.1 Strong focus on enhancing safety and user experience to foster market growth

- 12.3.6 SPAIN

- 12.3.6.1 Rising emphasis on connected mobility and safety features to boost market growth

- 12.3.7 POLAND

- 12.3.7.1 Rising automotive manufacturing and defense modernization to expedite market growth

- 12.3.8 NORDICS

- 12.3.8.1 High inclination toward safety, EV adoption, and technological innovation to fuel market growth

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Rising vehicle production to contribute to market growth

- 12.4.3 JAPAN

- 12.4.3.1 Continuous mass production of automotive components to drive market

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Mounting demand for semi-autonomous and autonomous vehicle technologies to expedite market growth

- 12.4.5 INDIA

- 12.4.5.1 Growing automobile innovation and consumer demand to augment HUD adoption

- 12.4.6 AUSTRALIA

- 12.4.6.1 Burgeoning adoption of mid-sized and luxury vehicles to bolster market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Rapid urbanization and surge in vehicle ownership to support market growth

- 12.4.8 MALAYSIA

- 12.4.8.1 Rising enforcement of road safety regulations to boost market growth

- 12.4.9 THAILAND

- 12.4.9.1 Government EV push and emergence as automotive hub to accelerate market growth

- 12.4.10 VIETNAM

- 12.4.10.1 Rapid economic growth and preference for smart features among middle class population to foster market growth

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.1.1 Government initiatives for digital transformation to contribute to market growth

- 12.5.2.2 Kuwait

- 12.5.2.2.1 Large-scale infrastructure and smart city projects to augment market growth

- 12.5.2.3 Oman

- 12.5.2.3.1 Economic diversification and aviation investments to boost HUD adoption

- 12.5.2.4 Qatar

- 12.5.2.4.1 Focus on smart city development to accelerate market growth

- 12.5.2.5 Saudi Arabia

- 12.5.2.5.1 Vision 2030 initiatives and defense modernization to drive market

- 12.5.2.6 UAE

- 12.5.2.6.1 Strong focus on luxury mobility and aviation advancements to fuel market growth

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Bahrain

- 12.5.3 AFRICA

- 12.5.3.1 South Africa

- 12.5.3.1.1 Modernization of automotive and defense industries to accelerate market growth

- 12.5.3.2 Other African countries

- 12.5.3.1 South Africa

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Strong presence of automobile assembly facilities to foster market growth

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Form factor footprint

- 13.7.5.4 End use footprint

- 13.7.5.5 Type footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 NIPPON SEIKI CO., LTD.

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches/developments

- 14.2.1.3.2 Deals

- 14.2.1.3.3 Expansions

- 14.2.1.4 MnM view

- 14.2.1.4.1 Key strengths/Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses/Competitive threats

- 14.2.2 CONTINENTAL AG

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches/developments

- 14.2.2.3.2 Deals

- 14.2.2.4 MnM view

- 14.2.2.4.1 Key strengths/Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses/Competitive threats

- 14.2.3 DENSO CORPORATION

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Key strengths/Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses/Competitive threats

- 14.2.4 PANASONIC HOLDINGS CORPORATION

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches/developments

- 14.2.4.3.2 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Key strengths/Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses/Competitive threats

- 14.2.5 VALEO

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Key strengths/Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses/Competitive threats

- 14.2.6 HARMAN INTERNATIONAL

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches/developments

- 14.2.6.3.2 Other developments

- 14.2.7 E-LEAD ELECTRONICS CO., LTD

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.8 BAE SYSTEMS

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Product launches/developments

- 14.2.9 YAZAKI CORPORATION

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.10 GARMIN LTD.

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.1 NIPPON SEIKI CO., LTD.

- 14.3 OTHER PLAYERS

- 14.3.1 THALES

- 14.3.2 HONEYWELL INTERNATIONAL INC.

- 14.3.3 CMC ELECTRONICS

- 14.3.4 COLLINS AEROSPACE

- 14.3.5 RENESAS ELECTRONICS CORPORATION

- 14.3.6 STMICROELECTRONICS

- 14.3.7 EXCELITAS TECHNOLOGIES CORP.

- 14.3.8 ELBIT SYSTEMS LTD.

- 14.3.9 VUZIX CORPORATION

- 14.3.10 FORYOU CORPORATION

- 14.3.11 HUDWAY, LLC

- 14.3.12 WAYRAY AG

- 14.3.13 ENVISICS

- 14.3.14 TEXAS INSTRUMENTS INCORPORATED

- 14.3.15 SAMTEL AVIONICS

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 HEAD-UP DISPLAY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 DATA CAPTURED FROM PRIMARY SOURCES

- TABLE 4 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 5 HEAD-UP DISPLAY MARKET: RISK ANALYSIS

- TABLE 6 APPLICATIONS THAT BENEFIT FROM HUDS

- TABLE 7 ROLE OF COMPANIES IN HEAD-UP DISPLAY ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICE OF AUTOMOTIVE HUDS PROVIDED BY KEY PLAYERS, 2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE OF AUTOMOTIVE HUDS, BY REGION, 2024 (USD)

- TABLE 10 IMPORT DATA FOR HS CODE 8528-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT ATA FOR HS CODE 8528-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 LIST OF KEY PATENTS, 2021-2024

- TABLE 13 HEAD-UP DISPLAY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END USES (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP TWO END USES

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 BASE STANDARDS OF C-ITS

- TABLE 21 EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

- TABLE 22 SECURITY AND PRIVACY STANDARDS DEVELOPED BY ETSI

- TABLE 23 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 24 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 25 HEAD-UP DISPLAY MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 26 HEAD-UP DISPLAY MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 27 HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 28 HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 30 HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2025-2030 (USD MILLION)

- TABLE 31 WINDSHIELD HUDS: HEAD-UP DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 WINDSHIELD HUDS: HEAD-UP DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 COMBINER HUDS: HEAD-UP DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 COMBINER HUDS: HEAD-UP DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 WEARABLE HUDS: HEAD-UP DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 WEARABLE HUDS: HEAD-UP DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 38 HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 39 HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (MILLION UNITS)

- TABLE 40 HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (MILLION UNITS)

- TABLE 41 AVIATION: HEAD-UP DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 AVIATION: HEAD-UP DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 AVIATION: HEAD-UP DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 AVIATION: HEAD-UP DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 AVIATION: HEAD-UP DISPLAY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 AVIATION: HEAD-UP DISPLAY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 AVIATION: HEAD-UP DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 AVIATION: HEAD-UP DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 AVIATION: HEAD-UP DISPLAY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 AVIATION: HEAD-UP DISPLAY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 AVIATION: HEAD-UP DISPLAY MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 52 AVIATION: HEAD-UP DISPLAY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 AUTOMOTIVE: HEAD-UP DISPLAY MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 54 AUTOMOTIVE: HEAD-UP DISPLAY MARKET, BY VEHICLE TYPE, 2025-2030 (USD MILLION)

- TABLE 55 AUTOMOTIVE: HEAD-UP DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 AUTOMOTIVE: HEAD-UP DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 AUTOMOTIVE: HEAD-UP DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 AUTOMOTIVE: HEAD-UP DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 AUTOMOTIVE: HEAD-UP DISPLAY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 AUTOMOTIVE: HEAD-UP DISPLAY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 AUTOMOTIVE: HEAD-UP DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 AUTOMOTIVE: HEAD-UP DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 AUTOMOTIVE: HEAD-UP DISPLAY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 AUTOMOTIVE: HEAD-UP DISPLAY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 OTHER END USES: HEAD-UP DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 OTHER END USES: HEAD-UP DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 OTHER END USES: HEAD-UP DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 OTHER END USES: HEAD-UP DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 OTHER END USES: HEAD-UP DISPLAY MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 OTHER END USES: HEAD-UP DISPLAY MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 OTHER END USES: HEAD-UP DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 OTHER END USES: HEAD-UP DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 OTHER END USES: HEAD-UP DISPLAY MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 OTHER END USES: HEAD-UP DISPLAY MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 HEAD-UP DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 HEAD-UP DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2025-2030 (USD MILLION)

- TABLE 83 US: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 84 US: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 85 US: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 86 US: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 87 CANADA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 88 CANADA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 89 CANADA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 90 CANADA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 91 MEXICO: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 92 MEXICO: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 93 MEXICO: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 94 MEXICO: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 100 EUROPE: HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2025-2030 (USD MILLION)

- TABLE 101 GERMANY: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 102 GERMANY: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 103 GERMANY: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 104 GERMANY: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 105 UK: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 106 UK: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 107 UK: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 108 UK: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 109 FRANCE: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 110 FRANCE: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 111 FRANCE: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 112 FRANCE: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 ITALY: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 114 ITALY: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 115 ITALY: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 116 ITALY: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 117 SPAIN: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 118 SPAIN: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 119 SPAIN: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 SPAIN: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 POLAND: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 122 POLAND: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 123 POLAND: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 124 POLAND: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 NORDICS: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 126 NORDICS: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 127 NORDICS: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 128 NORDICS: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 REST OF EUROPE: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 130 REST OF EUROPE: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 132 REST OF EUROPE: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2025-2030 (USD MILLION)

- TABLE 139 CHINA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 140 CHINA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 141 CHINA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 142 CHINA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 143 JAPAN: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 144 JAPAN: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 145 JAPAN: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 146 JAPAN: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 147 SOUTH KOREA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 148 SOUTH KOREA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH KOREA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 INDIA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 152 INDIA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 153 INDIA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 154 INDIA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 155 AUSTRALIA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 156 AUSTRALIA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 157 AUSTRALIA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 AUSTRALIA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 INDONESIA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 160 INDONESIA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 161 INDONESIA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 162 INDONESIA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 163 MALAYSIA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 164 MALAYSIA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 165 MALAYSIA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 MALAYSIA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 THAILAND: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 168 THAILAND: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 169 THAILAND: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 170 THAILAND: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 171 VIETNAM: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 172 VIETNAM: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 173 VIETNAM: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 174 VIETNAM: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 ROW: HEAD-UP DISPLAY MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 180 ROW: HEAD-UP DISPLAY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 181 ROW: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 182 ROW: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 183 ROW: HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2021-2024 (USD MILLION)

- TABLE 184 ROW: HEAD-UP DISPLAY MARKET, BY FORM FACTOR, 2025-2030 (USD MILLION)

- TABLE 185 MIDDLE EAST: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 187 MIDDLE EAST: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 AFRICA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 192 AFRICA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 193 AFRICA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 194 AFRICA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 195 AFRICA: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 196 AFRICA: HEAD-UP DISPLAY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 197 SOUTH AMERICA: HEAD-UP DISPLAY MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 198 SOUTH AMERICA: HEAD-UP DISPLAY MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 199 SOUTH AMERICA: HEAD-UP DISPLAY MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 200 SOUTH AMERICA: HEAD-UP DISPLAY MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 HEAD-UP DISPLAY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JULY 2025

- TABLE 202 HEAD-UP DISPLAY MARKET: DEGREE OF COMPETITION, 2024

- TABLE 203 HEAD-UP DISPLAY MARKET: REGION FOOTPRINT

- TABLE 204 HEAD-UP DISPLAY MARKET: FORM FACTOR FOOTPRINT

- TABLE 205 HEAD-UP DISPLAY MARKET: END USE FOOTPRINT

- TABLE 206 HEAD-UP DISPLAY MARKET: TYPE FOOTPRINT

- TABLE 207 HEAD-UP DISPLAY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 208 HEAD-UP DISPLAY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 209 HEAD-UP DISPLAY MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020-JULY 2025

- TABLE 210 HEAD-UP DISPLAY MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 211 NIPPON SEIKI CO., LTD.: COMPANY OVERVIEW

- TABLE 212 NIPPON SEIKI CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 NIPPON SEIKI CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 214 NIPPON SEIKI CO., LTD.: DEALS

- TABLE 215 NIPPON SEIKI CO., LTD.: EXPANSIONS

- TABLE 216 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 217 CONTINENTAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 219 CONTINENTAL AG: DEALS

- TABLE 220 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 221 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 DENSO CORPORATION: DEALS

- TABLE 223 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 224 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 PANASONIC HOLDINGS CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 226 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 227 VALEO: COMPANY OVERVIEW

- TABLE 228 VALEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 VALEO: DEALS

- TABLE 230 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 231 HARMAN INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 HARMAN INTERNATIONAL: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 233 HARMAN INTERNATIONAL: OTHER DEVELOPMENTS

- TABLE 234 E-LEAD ELECTRONIC CO. LTD: COMPANY OVERVIEW

- TABLE 235 E-LEAD ELECTRONIC CO. LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 237 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 BAE SYSTEMS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 239 YAZAKI CORPORATION: COMPANY OVERVIEW

- TABLE 240 YAZAKI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 GARMIN LTD.: COMPANY OVERVIEW

- TABLE 242 GARMIN LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 HEAD-UP DISPLAY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HEAD-UP DISPLAY MARKET: DURATION CONSIDERED

- FIGURE 3 HEAD-UP DISPLAY MARKET: RESEARCH DESIGN

- FIGURE 4 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 7 HEAD-UP DISPLAY MARKET: RESEARCH APPROACH

- FIGURE 8 HEAD-UP DISPLAY MARKET SIZE ESTIMATION - APPROACH 1 (SUPPLY SIDE)

- FIGURE 9 HEAD-UP DISPLAY MARKET SIZE ESTIMATION - APPROACH 2 (SUPPLY SIDE)

- FIGURE 10 HEAD-UP DISPLAY MARKET SIZE ESTIMATION - APPROACH 3 (DEMAND SIDE)

- FIGURE 11 HEAD-UP DISPLAY MARKET: BOTTOM-UP APPROACH

- FIGURE 12 HEAD-UP DISPLAY MARKET: TOP-DOWN APPROACH

- FIGURE 13 HEAD-UP DISPLAY MARKET: DATA TRIANGULATION

- FIGURE 14 HEAD-UP DISPLAY MARKET: RESEARCH ASSUMPTIONS

- FIGURE 15 HEAD-UP DISPLAY MARKET: RESEARCH LIMITATIONS

- FIGURE 16 GLOBAL HEAD-UP DISPLAY MARKET SIZE, 2021-2030

- FIGURE 17 CONVENTIONAL HUDS SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 18 WINDSHIELD HUDS SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 19 PROJECTORS/PROJECTION UNITS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 20 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 21 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN HEAD-UP DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 22 RISING GLOBAL DEMAND FOR SEMI-AUTONOMOUS AND ELECTRIC VEHICLES TO DRIVE HEAD-UP DISPLAY MARKET

- FIGURE 23 AUTOMOTIVE SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 24 WINDSHIELD HUDS TO DOMINATE HEAD-UP DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 25 CONVENTIONAL HUDS TO HOLD LARGER SHARE OF HEAD-UP DISPLAY MARKET IN 2030

- FIGURE 26 ASIA PACIFIC TO DOMINATE HEAD-UP DISPLAY MARKET BETWEEN 2025 AND 2030

- FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 28 DRIVERS: IMPACT ANALYSIS

- FIGURE 29 NUMBER OF ROAD ACCIDENT DEATHS, BY COUNTRY, H1 2024

- FIGURE 30 PROJECTED ANNUAL COUNT OF FATALITIES POTENTIALLY AVOIDED BY ADAS TECHNOLOGIES

- FIGURE 31 BENEFITS OF HUD FOR END USERS

- FIGURE 32 CATEGORIES OF HUD DESIGNS

- FIGURE 33 RESTRAINTS: IMPACT ANALYSIS

- FIGURE 34 OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 35 CHALLENGES: IMPACT ANALYSIS

- FIGURE 36 VALUE CHAIN ANALYSIS

- FIGURE 37 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 38 HEAD-UP DISPLAY ECOSYSTEM

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO

- FIGURE 40 AVERAGE SELLING PRICE OF AUTOMOTIVE HUDS OFFERED BY KEY PLAYERS, 2024

- FIGURE 41 IMPORT DATA FOR HS CODE 8528-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 42 EXPORT DATA FOR HS CODE 8528-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 43 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 44 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 45 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END USES

- FIGURE 46 KEY BUYING CRITERIA FOR TOP TWO END USES

- FIGURE 47 USE CASES AND IMPACT OF AI/GEN AI ON HEAD-UP DISPLAY MARKET

- FIGURE 48 PROJECTORS/PROJECTION UNITS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 49 CONVENTIONAL HUDS SEGMENT TO DOMINATE HEAD-UP DISPLAY MARKET FROM 2025 TO 2030

- FIGURE 50 WINDSHIELD HUDS SEGMENT TO CAPTURE LARGEST SHARE OF HEAD-UP DISPLAY MARKET IN 2030

- FIGURE 51 AUTOMOTIVE SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 52 ASIA PACIFIC TO RECORD HIGHEST CAGR IN HEAD-UP DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 53 NORTH AMERICA: HEAD-UP DISPLAY MARKET SNAPSHOT

- FIGURE 54 EUROPE: HEAD-UP DISPLAY MARKET SNAPSHOT

- FIGURE 55 ASIA PACIFIC: HEAD-UP DISPLAY MARKET SNAPSHOT

- FIGURE 56 ROW: HEAD-UP DISPLAY MARKET SNAPSHOT

- FIGURE 57 MARKET SHARE ANALYSIS OF COMPANIES OFFERING HEAD-UP DISPLAYS, 2024

- FIGURE 58 HEAD-UP DISPLAY MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 59 COMPANY VALUATION

- FIGURE 60 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 61 PRODUCT COMPARISON

- FIGURE 62 HEAD-UP DISPLAY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 63 HEAD-UP DISPLAY MARKET: COMPANY FOOTPRINT

- FIGURE 64 HEAD-UP DISPLAY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 65 NIPPON SEIKI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 66 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 67 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 69 VALEO: COMPANY SNAPSHOT

- FIGURE 70 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 71 E-LEAD ELECTRONIC CO. LTD: COMPANY SNAPSHOT

- FIGURE 72 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 73 YAZAKI CORPORATION: COMPANY SNAPSHOT

- FIGURE 74 GARMIN LTD.: COMPANY SNAPSHOT