PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1891775

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1891775

Sterilization Services Market by Method (Electron Beam, EtO, Steam, Gamma, X-Ray, Hydrogen Peroxide), Type (Contract Sterilization, Validation Services), Mode of Delivery (Off-Site, On-Site), End User & Region - Global Forecast to 2030

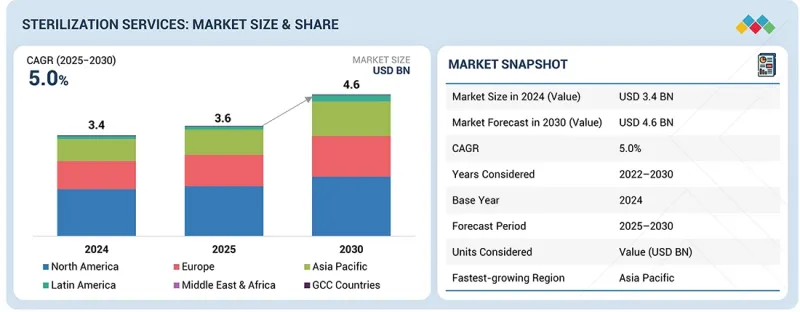

The sterilization services market is projected to reach USD 5.49 billion by 2030 from USD 3.75 billion in 2025, at a CAGR of 7.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Method, Mode of Delivery, Type, End User, and Regions |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries |

The sterilization services market is projected to grow at a CAGR of 7.9% during the forecast period. The growth of the market is fueled by the rising prevalence of hospital-acquired infections (HAIs), increasing surgical procedure volumes, heightened focus on food sterilization to combat foodborne illnesses, and the growing trend of outsourcing sterilization to specialized contract service providers. Additionally, stricter regulatory requirements for sterile packaging in the pharmaceutical and medical device sectors are further fueling market demand.

By method, the ethylene oxide (EtO) sterilization segment accounted for the largest share of the market in 2024.

Based on method, the sterilization services market has been segmented into ethylene oxide (EtO) sterilization, gamma sterilization, electron-beam (E-beam) radiation sterilization, X-ray irradiation sterilization, steam sterilization, hydrogen peroxide sterilization, and other methods. In 2024, the ethylene oxide (ETO) sterilization segment accounted for the largest share of the sterilization services market. The large share of the ethylene oxide sterilization segment is attributed to the growing demand for single-use medical devices and instruments, innovations in ETO sterilization equipment and processes, and compatibility with heat- and moisture-sensitive materials.

By end user, the medical devices segment accounted for the largest share of the market in 2024.

Based on end users, the sterilization services market has been segmented into hospitals & clinics, medical device companies, pharmaceutical & biotechnology companies, and other end users. The medical device companies segment accounted for the largest share of the sterilization services market in 2024. This segment is also expected to grow at the highest CAGR during the forecast period, owing to the stringent regulatory guidelines required for sterilizing medical device manufacturing.

By region, North America is expected to dominate the sterilization services market during the forecast period.

The Sterilization services market is segmented into six major regional segments-North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries. In 2024, North America commanded the largest share of the global sterilization services market, followed by Europe. The large share of the North American market can be attributed to the growing demand for sterilization technologies from the healthcare industry to minimize the occurrence of healthcare-associated infections (HAIs) and the consequent rise in the demand for healthcare services. Market growth in this region is characterized by the growing demand for and adoption of sterilization services because of the rising focus on healthy lifestyles and disease prevention among consumers. The subsequent increase in the prevalence of chronic diseases, the need for infection control to minimize the prevalence of HAIs, and the implementation of favorable government initiatives and stringent regulations on sterilization and disinfection also propel the growth of the market in the region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 35%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America-36%, Europe-29%, Asia Pacific-20%, Latin America-8%, Middle East & Africa-5%, GCC Countries-2%

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the sterilization services market are STERIS (Ireland), Sotera Health (US), Servizi Italia S.p.A (Italy), E-BEAM Services, Inc. (US), BGS Beta-Gamma-Service GmbH & Co. KG (Germany), Medistri SA (Switzerland), H.W. Andersen Products Ltd. (UK), Cretex Companies (US), Life Science Outsourcing, Inc. (US), Microtrol Sterilisation Services Pvt. Ltd. (India), Cosmed Group (US), Centerpiece (US), among others.

Research Coverage

This report studies the sterilization services market based on method, type, mode of delivery, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Additionally, the report analyzes micromarkets concerning their growth trends. It forecasts the revenue of the market segments in six regions.

Reasons to Buy the Report

The report will enable established and entrant/smaller firms to gauge the market's pulse, which, in turn, would help them gain a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights into the following points:

- Analysis of key drivers (rising prevalence of hospital-acquired infections, increasing surgical volumes, growing demand for food sterilization, and surge in outsourcing of sterilization services), restraints (safety concerns), opportunities (expanding pharma and MedTech production in emerging economies, potential of e-beam sterilization, reintroduction of ethylene oxide sterilization, and booming healthcare sector in emerging countries), challenges (maintenance of sterilization quality of complex and advanced medical instruments, non-compliance with sterilization protocols)

- Market Penetration: Comprehensive information on the service portfolios offered by the top players in the Sterilization services market

- Product Development/Innovation: Detailed insights into the upcoming trends, R&D activities, and service line expansion in the sterilization services market

- Market Development: Comprehensive information on lucrative countries

- Market Diversification: Exhaustive information about new services and recent developments in the sterilization services market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and services of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 SEGMENTS CONSIDERED & GEORGRAPHIC SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.1.1 Presentations of companies & primary interviews

- 2.2.1.1.2 Primary interviews

- 2.2.1.1 Company revenue estimation approach

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.5.2 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 STERILIZATION SERVICES MARKET OVERVIEW

- 4.2 ASIA PACIFIC STERILIZATION SERVICES MARKET, BY METHOD TYPE & COUNTRY (2024)

- 4.3 STERILIZATION SERVICES MARKET, BY COUNTRY, 2025-2030

- 4.4 STERILIZATION SERVICES MARKET, REGIONAL MIX, 2025 VS. 2030

- 4.5 STERILIZATION SERVICES MARKET: EMERGING ECONOMIES VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing incidence of HAIs

- 5.2.1.2 Rising volume of surgical procedures across healthcare facilities

- 5.2.1.3 Increasing prevalence of food-borne diseases and subsequent focus on food sterilization

- 5.2.1.4 Surge in outsourcing sterilization services to CROs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety concerns over reprocessed or inadequately sterilized devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential of emerging economies

- 5.2.3.2 Advantages of E-beam sterilization

- 5.2.3.3 Reintroduction of ethylene oxide sterilization

- 5.2.3.4 Expansion of healthcare sector in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Maintenance of sterilization quality for complex & advanced medical instruments

- 5.2.4.2 End-user non-compliance with sterilization protocols

- 5.2.1 DRIVERS

- 5.3 PRICING OVERVIEW: STERILIZATION SERVICES BY MODALITY

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.2 BARGAINING POWER OF SUPPLIERS

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 THREAT OF SUBSTITUTES

- 5.4.5 THREAT OF NEW ENTRANTS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 ROLE IN ECOSYSTEM

- 5.6 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 KEY BUYING CRITERIA

- 5.7 REGULATORY ANALYSIS

- 5.7.1 REGULATORY LANDSCAPE

- 5.7.1.1 North America

- 5.7.1.1.1 US

- 5.7.1.1.2 Canada

- 5.7.1.2 Europe

- 5.7.1.3 Asia Pacific

- 5.7.1.3.1 South Korea

- 5.7.1.3.2 Australia

- 5.7.1.4 Latin America

- 5.7.1.4.1 Brazil

- 5.7.1.1 North America

- 5.7.2 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2.1 North America

- 5.7.2.2 Europe

- 5.7.2.3 Asia Pacific

- 5.7.2.4 Latin America

- 5.7.2.5 Middle East & Africa

- 5.7.1 REGULATORY LANDSCAPE

- 5.8 PATENT ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Ethylene oxide (ETO) sterilization

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Plasma sterilization

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Sterilization monitoring & data analytics

- 5.9.1 KEY TECHNOLOGIES

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 VALUE CHAIN ANALYSIS

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.12.1 REVENUE SHIFT FOR STERILIZATION SERVICE PROVIDERS

- 5.13 INVESTMENT & FUNDING SCENARIO

- 5.14 MARKET POTENTIAL OF AI/GENERATIVE AI ON STERILIZATION SERVICES MARKET

- 5.14.1 KEY AI-USE CASES

- 5.14.2 FUTURE OF AI/GENERATIVE AI IN STERILIZATION SERVICES ECOSYSTEM

6 STERILIZATION SERVICES MARKET, BY METHOD

- 6.1 INTRODUCTION

- 6.2 ETHYLENE OXIDE (ETO) STERILIZATION

- 6.2.1 BROAD APPLICATIONS AND HIGH PENETRATIVE CAPABILITIES TO DRIVE MARKET

- 6.3 GAMMA STERILIZATION

- 6.3.1 ABILITY TO STERILIZE BULK PACKAGING MATERIALS WITH MINIMAL RESIDUAL TO BOOST DEMAND

- 6.4 ELECTRON-BEAM RADIATION STERILIZATION

- 6.4.1 RAPID PROCESSING AND HIGH PRECISION CAPABILITIES TO BOOST DEMAND

- 6.5 X-RAY IRRADIATION

- 6.5.1 NON-RADIOACTIVE PROPERTIES AND ADAPTABILITY TO COMPLEX CONFIGURATIONS TO AID MARKET

- 6.6 STEAM STERILIZATION

- 6.6.1 RISING PREFERENCE IN FOOD & MEDICAL INDUSTRIES TO FUEL UPTAKE

- 6.7 HYDROGEN PEROXIDE STERILIZATION

- 6.7.1 REGULATORY APPROVAL FOR VHP TESTING OF HEALTHCARE EQUIPMENT TO PROPEL MARKET

- 6.8 OTHER STERILIZATION METHODS

7 STERILIZATION SERVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 CONTRACT STERILIZATION SERVICES

- 7.2.1 RISING OUTSOURCING OF STERILIZATION PROCESSES TO THIRD-PARTY PROVIDERS FOR COST-EFFICIENCY TO PROPEL MARKET

- 7.3 STERILIZATION VALIDATION SERVICES

- 7.3.1 INCREASING FOCUS ON REGULATORY COMPLIANCE REQUIREMENTS TO SUPPORT MARKET GROWTH

8 STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY

- 8.1 INTRODUCTION

- 8.2 OFF-SITE STERILIZATION SERVICES

- 8.2.1 TREND OF OUTSOURCING DUE TO HIGHER EFFICIENCY AND AVAILABILITY OF SKILLED WORKFORCE TO PROPEL MARKET

- 8.3 ON-SITE STERILIZATION SERVICES

- 8.3.1 LOW OPERATIONAL COSTS AND LESSER TURNAROUND TIME TO BOOST DEMAND

9 STERILIZATION SERVICES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 MEDICAL DEVICE COMPANIES

- 9.2.1 HIGH UPTAKE OF ETO & E-BEAM STERILIZATION FOR STERILIZATION OF MEDICAL EQUIPMENT TO PROPEL MARKET

- 9.3 HOSPITALS & CLINICS

- 9.3.1 GROWING FOCUS ON INFECTION CONTROL FOR HAI PREVENTION TO DRIVE MARKET

- 9.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 9.4.1 INCREASING DEMAND FOR QUALITY CHECKS AND SAFETY & COMPLIANCE TO FUEL UPTAKE

- 9.5 OTHER END USERS

10 STERILIZATION SERVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Hub to several medical device company manufacturers and high healthcare expenditure to drive market

- 10.2.3 CANADA

- 10.2.3.1 Increasing number of surgical procedures and growing focus on improved patient safety to aid market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Stringent regulatory requirements for food & beverage testing and medical device manufacturing to propel market

- 10.3.3 UK

- 10.3.3.1 Rising volume of SSIs and HAIs to fuel uptake

- 10.3.4 FRANCE

- 10.3.4.1 Rising establishment of hospitals and favorable implementation of infection control measures to drive market

- 10.3.5 ITALY

- 10.3.5.1 Increasing incidence of chronic diseases to support market growth

- 10.3.6 SPAIN

- 10.3.6.1 High prevalence of respiratory infections and growing procedural volumes to fuel market

- 10.3.7 SWITZERLAND

- 10.3.7.1 Rising focus on pharmaceutical & biopharmaceutical production to support market growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 High incidence of infectious diseases and growing focus on expansion of healthcare policies to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Increasing prevalence of AMR infections to fuel market

- 10.4.4 INDIA

- 10.4.4.1 Expansion of pharmaceutical & medical device sectors to boost demand

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing focus on maintenance of sterility and hygiene compliance to aid market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Hub for medical tourism and increasing healthcare spending to support market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 High rate of nosocomial infections to boost demand

- 10.5.3 MEXICO

- 10.5.3.1 Rising establishment of pharmaceutical laboratories to aid market

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 10.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.7 GCC COUNTRIES

- 10.7.1 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

- 10.7.2 KINGDOM OF SAUDI ARABIA (KSA)

- 10.7.2.1 Government initiatives for medical device sterility adherence to boost demand

- 10.7.3 UNITED ARAB EMIRATES (UAE)

- 10.7.3.1 Healthcare innovation for clinical research capabilities to fuel uptake

- 10.7.4 OTHER GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN STERILIZATION SERVICES MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Method footprint

- 11.5.5.4 Type footprint

- 11.5.5.5 Mode of delivery footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startup/SME players

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/SERVICE COMPARATIVE ANALYSIS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 STERIS

- 12.1.1.1 Business overview

- 12.1.1.2 Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 SOTERA HEALTH COMPANY

- 12.1.2.1 Business overview

- 12.1.2.2 Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 SERVIZI ITALIA S.P.A.

- 12.1.3.1 Business overview

- 12.1.3.2 Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 E-BEAM SERVICES, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Expansions

- 12.1.5 BGS BETA-GAMMA-SERVICE GMBH & CO.KG

- 12.1.5.1 Business overview

- 12.1.5.2 Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.6 MEDISTRI SA

- 12.1.6.1 Business overview

- 12.1.6.2 Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.7 H.W. ANDERSEN PRODUCTS LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Services offered

- 12.1.8 CRETEX COMPANIES

- 12.1.8.1 Business overview

- 12.1.8.2 Services offered

- 12.1.9 LIFE SCIENCE OUTSOURCING, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 MICROTROL STERILISATION SERVICES PVT. LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Services offered

- 12.1.11 CENTERPIECE HOLDINGS LLC

- 12.1.11.1 Business overview

- 12.1.11.2 Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Expansions

- 12.1.1 STERIS

- 12.2 OTHER PLAYERS

- 12.2.1 AVANTTI MEDI CLEAR

- 12.2.2 STERIPURE

- 12.2.3 EUROPLAZ

- 12.2.4 MIDWEST STERILIZATION CORPORATION

- 12.2.5 BLUE LINE STERILIZATION SERVICES, LLC

- 12.2.6 STERIPACK GROUP LTD.

- 12.2.7 STERITEK INC.

- 12.2.8 STERLIZATION SERVICES

- 12.2.9 NEXTBEAM

- 12.2.10 MERIDIAN MEDICAL

- 12.2.11 PRINCE STERILIZATION SERVICES, LLC

- 12.2.12 C.G. LABORATORIES, INC.

- 12.2.13 PRO-TECH DESIGN AND MANUFACTURING INC.

- 12.2.14 CLORDISYS SOLUTIONS INC.

- 12.2.15 NUTEK BRAVO, LLC

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

ON STERILIZATION SERVICES

- TABLE 41 X-RAY IRRADIATION STERILIZATION SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA: X-RAY IRRADIATION STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 43 EUROPE: X-RAY IRRADIATION STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: X-RAY IRRADIATION STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 LATIN AMERICA: X-RAY IRRADIATION STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 GCC COUNTRIES: X-RAY IRRADIATION STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 KEY PLAYERS OFFERING STEAM STERILIZATION SERVICES

- TABLE 48 STEAM STERILIZATION SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: STEAM STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 EUROPE: STEAM STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: STEAM STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 LATIN AMERICA: STEAM STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 GCC COUNTRIES: STEAM STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 54 KEY PLAYERS OFFERING HYDROGEN PEROXIDE STERILIZATION SERVICES

- TABLE 55 HYDROGEN PEROXIDE STERILIZATION SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 56 NORTH AMERICA: HYDROGEN PEROXIDE STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 EUROPE: HYDROGEN PEROXIDE STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 ASIA PACIFIC: HYDROGEN PEROXIDE STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 LATIN AMERICA: HYDROGEN PEROXIDE STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 60 GCC COUNTRIES: HYDROGEN PEROXIDE STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 61 KEY PLAYERS OFFERING OTHER STERILIZATION SERVICES

- TABLE 62 OTHER STERILIZATION METHODS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: OTHER STERILIZATION METHODS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 EUROPE: OTHER STERILIZATION METHODS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: OTHER STERILIZATION METHODS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 66 LATIN AMERICA: OTHER STERILIZATION METHODS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 GCC COUNTRIES: OTHER STERILIZATION METHODS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 69 CONTRACT STERILIZATION SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: CONTRACT STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 71 EUROPE: CONTRACT STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: CONTRACT STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 LATIN AMERICA: CONTRACT STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 GCC COUNTRIES: CONTRACT STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 STERILIZATION VALIDATION SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 76 NORTH AMERICA: STERILIZATION VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 77 EUROPE: STERILIZATION VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 ASIA PACIFIC: STERILIZATION VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 LATIN AMERICA: STERILIZATION VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 GCC COUNTRIES: STERILIZATION VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 82 OFF-SITE VALIDATION SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: OFF-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 EUROPE: OFF-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: OFF-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 LATIN AMERICA: OFF-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 87 GCC COUNTRIES: OFF-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 ON-SITE VALIDATION SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: ON-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 EUROPE: ON-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 ASIA PACIFIC: ON-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 92 LATIN AMERICA: ON-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 GCC COUNTRIES: ON-SITE VALIDATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 95 METHODS OF STERILIZATION IN MEDICAL DEVICE COMPANIES

- TABLE 96 STERILIZATION SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: STERILIZATION SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 98 EUROPE: STERILIZATION SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 ASIA PACIFIC: STERILIZATION SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 LATIN AMERICA: STERILIZATION SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 GCC COUNTRIES: STERILIZATION SERVICES MARKET FOR MEDICAL DEVICE COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 STERILIZATION METHODS IN HOSPITALS & CLINICS

- TABLE 103 STERILIZATION SERVICES MARKET FOR HOSPITALS & CLINICS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 104 NORTH AMERICA: STERILIZATION SERVICES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 EUROPE: STERILIZATION SERVICES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 ASIA PACIFIC: STERILIZATION SERVICES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 LATIN AMERICA: STERILIZATION SERVICES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 108 GCC COUNTRIES: STERILIZATION SERVICES MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 109 STERILIZATION METHODS IN PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- TABLE 110 STERILIZATION SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: STERILIZATION SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, 2023-2030 (USD MILLION)

- TABLE 112 EUROPE: STERILIZATION SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 ASIA PACIFIC: STERILIZATION SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 114 LATIN AMERICA: STERILIZATION SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 GCC COUNTRIES: STERILIZATION SERVICES MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 STERILIZATION SERVICES MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: STERILIZATION SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 EUROPE: STERILIZATION SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: STERILIZATION SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 120 LATIN AMERICA: STERILIZATION SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 GCC COUNTRIES: STERILIZATION SERVICES MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 STERILIZATION SERVICES MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: MACROECONOMIC INDICATORS

- TABLE 124 NORTH AMERICA: STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 128 NORTH AMERICA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 129 US: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 130 US: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 131 US: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 132 US: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 133 CANADA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 134 CANADA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 135 CANADA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 136 CANADA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 137 EUROPE: MACROECONOMIC INDICATORS

- TABLE 138 EUROPE: STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 EUROPE: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 140 EUROPE: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 141 EUROPE: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 142 EUROPE: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 143 GERMANY: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 144 GERMANY: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 145 GERMANY: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 146 GERMANY: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 147 UK: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 148 UK: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 149 UK: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 150 UK: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 151 FRANCE: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 152 FRANCE: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 FRANCE: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 154 FRANCE: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 155 ITALY: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 156 ITALY: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 157 ITALY: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 158 ITALY: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 159 SPAIN: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 160 SPAIN: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 SPAIN: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 162 SPAIN: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 163 SWITZERLAND: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 164 SWITZERLAND: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 165 SWITZERLAND: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 166 SWITZERLAND: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 167 REST OF EUROPE: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 168 REST OF EUROPE: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 REST OF EUROPE: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 170 REST OF EUROPE: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MACROECONOMIC INDICATORS

- TABLE 172 ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 177 CHINA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 178 CHINA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 179 CHINA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 180 CHINA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 181 JAPAN: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 182 JAPAN: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 JAPAN: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 184 JAPAN: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 185 INDIA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 186 INDIA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 187 INDIA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 188 INDIA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 189 AUSTRALIA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 190 AUSTRALIA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 AUSTRALIA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 192 AUSTRALIA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 193 SOUTH KOREA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 194 SOUTH KOREA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 195 SOUTH KOREA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 196 SOUTH KOREA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: MACROECONOMIC INDICATORS

- TABLE 202 LATIN AMERICA: STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 204 LATIN AMERICA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 205 LATIN AMERICA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 206 LATIN AMERICA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 207 BRAZIL: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 208 BRAZIL: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 BRAZIL: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 210 BRAZIL: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 211 MEXICO: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 212 MEXICO: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 213 MEXICO: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 214 MEXICO: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 215 REST OF LATIN AMERICA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 216 REST OF LATIN AMERICA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 REST OF LATIN AMERICA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 218 REST OF LATIN AMERICA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: MACROECONOMIC INDICATORS

- TABLE 220 MIDDLE EAST & AFRICA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 224 GCC COUNTRIES: MACROECONOMIC INDICATORS

- TABLE 225 GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 226 GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 227 GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 228 GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 229 GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 230 KINGDOM OF SAUDI ARABIA: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 231 KINGDOM OF SAUDI ARABIA: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 232 KINGDOM OF SAUDI ARABIA: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 233 KINGDOM OF SAUDI ARABIA: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 234 UNITED ARAB EMIRATES: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 235 UNITED ARAB EMIRATES: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 UNITED ARAB EMIRATES: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 237 UNITED ARAB EMIRATES: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 238 OTHER GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY METHOD, 2023-2030 (USD MILLION)

- TABLE 239 OTHER GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 240 OTHER GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2023-2030 (USD MILLION)

- TABLE 241 OTHER GCC COUNTRIES: STERILIZATION SERVICES MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 242 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN STERILIZATION SERVICES MARKET

- TABLE 243 STERILIZATION SERVICES MARKET: DEGREE OF COMPETITION

- TABLE 244 STERILIZATION SERVICES MARKET: REGION FOOTPRINT

- TABLE 245 STERILIZATION SERVICES MARKET: METHOD FOOTPRINT

- TABLE 246 STERILIZATION SERVICES MARKET: TYPE FOOTPRINT

- TABLE 247 STERILIZATION SERVICES MARKET: MODE OF DELIVERY FOOTPRINT

- TABLE 248 STERILIZATION SERVICES MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS

- TABLE 249 STERILIZATION SERVICES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 250 STERILIZATION SERVICES MARKET: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 251 STERILIZATION SERVICES MARKET: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 252 STERIS: COMPANY OVERVIEW

- TABLE 253 STERIS: SERVICES OFFERED

- TABLE 254 STERIS: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 255 STERIS: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 256 SOTERA HEALTH COMPANY: COMPANY OVERVIEW

- TABLE 257 SOTERA HEALTH COMPANY: SERVICES OFFERED

- TABLE 258 SOTERA HEALTH COMPANY: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 259 SERVIZI ITALIA S.P.A.: COMPANY OVERVIEW

- TABLE 260 SERVIZI ITALIA S.P.A.: SERVICES OFFERED

- TABLE 261 SERVIZI ITALIA S.P.A.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 262 SERVIZI ITALIA S.P.A.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 263 E-BEAM SERVICES, INC.: COMPANY OVERVIEW

- TABLE 264 E-BEAM SERVICES, INC.: SERVICES OFFERED

- TABLE 265 E-BEAM SERVICES, INC.: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 266 BGS BETA-GAMMA-SERVICE GMBH & CO.KG: COMPANY OVERVIEW

- TABLE 267 BGS BETA-GAMMA-SERVICE GMBH & CO.KG: SERVICES OFFERED

- TABLE 268 BGS BETA-GAMMA-SERVICE GMBH & CO.KG: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 269 MEDISTRI SA: COMPANY OVERVIEW

- TABLE 270 MEDISTRI SA: SERVICES OFFERED

- TABLE 271 MEDISTRI SA: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 272 H.W. ANDERSEN PRODUCTS LTD.: COMPANY OVERVIEW

- TABLE 273 H.W. ANDERSEN PRODUCTS LTD.: SERVICES OFFERED

- TABLE 274 CRETEX COMPANIES: COMPANY OVERVIEW

- TABLE 275 CRETEX COMPANIES: SERVICES OFFERED

- TABLE 276 LIFE SCIENCE OUTSOURCING, INC.: COMPANY OVERVIEW

- TABLE 277 LIFE SCIENCE OUTSOURCING, INC.: SERVICES OFFERED

- TABLE 278 LIFE SCIENCE OUTSOURCING, INC.: DEALS, JANUARY 2022-AUGUST 2025

- TABLE 279 MICROTROL STERILISATION SERVICES PVT. LTD.: COMPANY OVERVIEW

- TABLE 280 MICROTROL STERILISATION SERVICES PVT. LTD.: SERVICES OFFERED

- TABLE 281 CENTERPIECE HOLDINGS LLC: COMPANY OVERVIEW

- TABLE 282 CENTERPIECE HOLDINGS LLC: SERVICES OFFERED

- TABLE 283 CENTERPIECE HOLDINGS LLC: EXPANSIONS, JANUARY 2022-AUGUST 2025

- TABLE 284 AVANTTI MEDI CLEAR: COMPANY OVERVIEW

- TABLE 285 STERIPURE: COMPANY OVERVIEW

- TABLE 286 EUROPLAZ: COMPANY OVERVIEW

- TABLE 287 MIDWEST STERILIZATION CORPORATION: COMPANY OVERVIEW

- TABLE 288 BLUE LINE STERILIZATION SERVICES, LLC: COMPANY OVERVIEW

- TABLE 289 STERIPACK GROUP LTD.: COMPANY OVERVIEW

- TABLE 290 STERITEK INC.: COMPANY OVERVIEW

- TABLE 291 STERILIZATION SERVICES: COMPANY OVERVIEW

- TABLE 292 NEXTBEAM: COMPANY OVERVIEW

- TABLE 293 MERIDIAN MEDICAL: COMPANY OVERVIEW

- TABLE 294 PRINCE STERILIZATION SERVICES, LLC: COMPANY OVERVIEW

- TABLE 295 C.G. LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 296 PRO-TECH DESIGN AND MANUFACTURING INC.: COMPANY OVERVIEW

- TABLE 297 CLORDISYS SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 298 NUTEK BRAVO, LLC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 STERILIZATION SERVICES MARKET: SEGMENTS CONSIDERED & GEOGRAPHIC SCOPE

- FIGURE 2 STERILIZATION SERVICES MARKET: YEARS CONSIDERED

- FIGURE 3 STERILIZATION SERVICES MARKET: RESEARCH DESIGN METHODOLOGY

- FIGURE 4 STERILIZATION SERVICES MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 STERILIZATION SERVICES MARKET: KEY PRIMARY SOURCES

- FIGURE 6 STERILIZATION SERVICES MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 STERILIZATION SERVICES MARKET: REVENUE SHARE ANALYSIS

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 STERILIZATION SERVICES MARKET: TOP-DOWN APPROACH

- FIGURE 12 STERILIZATION SERVICES MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 13 STERILIZATION SERVICES MARKET, BY METHOD, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 STERILIZATION SERVICES MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 STERILIZATION SERVICES MARKET, BY MODE OF DELIVERY, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 STERILIZATION SERVICES MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 17 GEOGRAPHIC SNAPSHOT OF STERILIZATION SERVICES MARKET

- FIGURE 18 INCREASING INCIDENCE OF HOSPITAL-ACQUIRED INFECTIONS TO DRIVE MARKET

- FIGURE 19 ETHYLENE OXIDE (ETO) STERILIZATION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN JAPAN IN 2024

- FIGURE 20 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 23 STERILIZATION SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 STERILIZATION SERVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR STERILIZATION SERVICES

- FIGURE 26 KEY BUYING CRITERIA FOR END USERS OF STERILIZATION SERVICES

- FIGURE 27 STERILIZATION SERVICES MARKET: PATENT ANALYSIS, JANUARY 2015-DECEMBER 2024

- FIGURE 28 STERILIZATION SERVICES MARKET: VALUE CHAIN ANALYSIS:

- FIGURE 29 REVENUE SHIFT IN STERILIZATION SERVICES MARKET

- FIGURE 30 INVESTMENT & FUNDING SCENARIO FOR KEY PLAYERS (2020-2025)

- FIGURE 31 KEY AI-USE CASES IN STERILIZATION SERVICES MARKET

- FIGURE 32 NORTH AMERICA: STERILIZATION SERVICES MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: STERILIZATION SERVICES MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY PLAYERS IN STERILIZATION SERVICES MARKET, 2020-2024

- FIGURE 35 MARKET SHARE ANALYSIS OF KEY PLAYERS IN STERILIZATION SERVICES MARKET (2024)

- FIGURE 36 STERILIZATION SERVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 37 STERILIZATION SERVICES MARKET: COMPANY FOOTPRINT

- FIGURE 38 STERILIZATION SERVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 39 EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 40 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025

- FIGURE 41 STERILIZATION SERVICES MARKET: BRAND/SERVICE COMPARATIVE ANALYSIS

- FIGURE 42 STERIS: COMPANY SNAPSHOT (2024)

- FIGURE 43 SOTERA HEALTH COMPANY: COMPANY SNAPSHOT (2024)