PUBLISHER: M14 Intelligence | PRODUCT CODE: 1771254

PUBLISHER: M14 Intelligence | PRODUCT CODE: 1771254

4D Imaging Radar in Autonomous Vehicles - Industry, Market, and Competition Analysis, Edition 2025

In-cabin and Exterior Sensing Applications of 4D imaging radar in ADAS and Autonomous Vehicles; 60 GHz, 76-81 GHz, and 140 GHz Band, SAE Level 2+ and above applications, Emerging 4D imaging players competition assessment.

Key Highlights

- ADAS and AV radar module market size anticipated to grow 2.7x times between 2025 to 2035, accounting $25 billion in 2035 from $9 billion by 2025 at a CAGR of 11.7 percent

- 4D imaging radar modules expected to penetrate over 56 percent by 2035, a jump of 45% from the current market penetration

- By 2035, with the rise of autonomous vehicles and cost reductions, 4D radar could dominate short- and medium-range applications, potentially replacing conventional 3D radar in many ADAS and AV systems

- The in-cabin applications of occupant monitoring and left-child detection is a growing niche due to regulatory mandates like those from EURO NCAP

- Development of 140 GHz radar technology by TSMC, GlobalFoundries, and imec focuses on high-resolution sensing for both interior and exterior applications, though not yet commercialized, the technology is expected to strongly compete with 77GHz system by 2035

- Leading companies like Continental, Bosch, Vayyar, Arbe, Uhnder, NXP, and Tesla are driving innovation, with recent showcases at CES 2025 and IAA Mobility 2025 highlighting advancements in resolution, efficiency, and regulatory compliance.

- RFISee, RadSee, Smart Radar System, Zadar Labs, InnoSenT, Infineon, and Ainstein are prominent emerging players in the 4D imaging radar industry. Meanwhile, Texas Instruments, NXP Semiconductors, STMicroelectronics, Xilinx, and Analog Devices are leading System-on-Chip (SoC) providers actively developing 4D imaging radar solutions to support Advanced Driver Assistance Systems (ADAS) and higher levels of vehicle automation.

- Emerging start-ups such as Zendar Inc. focusing on software-defined radar with AI for dynamic resolution, Sensrad AB is a spin-out from Qamcom Group, focusing on rapid market entry, Waveye is targeting early adoption in robotaxis and urban AVs, Altos Radar partnering with Chinese OEMs (e.g., SAIC, Geely) for regional expansion, Xavveo is targeting niche markets like autonomous shuttles and industrial applications

SAMPLE VIEW

Countries Covered: Global (China, India, Japan, South Korea, US, Canada, South America, Germany, France, Italy, UK, Israel, others).

Exhaustive Coverage

M14 Intelligence with its core capabilities in understanding the key trends of autonomous, connected, electric, and shared mobility published the research on 4D imaging radar technology which talks about following important factors of the market.

- ADAS, Autonomous and Robotic Vehicles - Market Outlook

- Status of radar sensors in the ADAS and AV industry

- Understanding the potential change in the radar demand and its market size from different perspectives including - automation levels (ADAS, Level 2/2+, Level 3 and Level 4/5), range of operations (short, medium-long), and frequency band of operation (60 GHz, 76-81 GHz , and 140GHz)

- Modulation Techniques- FMCW and Digital Code Modulation (DCM)

- Radar-on-Chip and MIMO antenna design

- AI-based processing

- Market penetration trend of 4D imaging radar-on-chip sensors for in-cabin and world-facing exterior sensing applications

- Impact of frequency regulations and allocations across different geographies

- 4D imaging radar hardware chip and software solutions and how it is expected to challenge the sensor suite dynamics

- Disruptive trends like AI integration, radar-on-chip, and sensor fusion that will reshape the market

- Challenges like high costs and integration complexities, and how advancements in semiconductors and software-defined radar are addressing these hurdles

- Competition assessment of emerging leaders and start-ups, along with the strategies and developments of chip providers and tier-1s offering solutions in automotive radar market.

Market Overview

The 4D imaging radar market for autonomous vehicles is at the forefront of automotive innovation, driving the evolution of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles (AVs) . Valued at approximately USD 2 billion in 2024, the market is projected to reach USD 10 billion by 2030, with a CAGR of 38%, fueled by the increasing demand for enhanced safety, regulatory mandates, and the push for higher autonomy levels (SAE Level 4/5).

This report summary explores the adoption of radar sensors in ADAS and AVs, the penetration of 4D radar replacing 3D radar, current and future radar technologies and frequency bands, leading and emerging players, competitive strategies, recent developments, the critical role of 4D radar in AVs, and market potential for robotaxis and shuttles, with a focus on high-potential regions like Asia-Pacific.

Adoption of Radar Sensors in ADAS and Autonomous Vehicles

Radar sensors are integral to ADAS and AVs, enabling critical features like Adaptive Cruise Control (ACC), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Lane Change Assist (LCA), and Child Presence Detection (CPD) . Unlike cameras and LiDAR, radar excels in adverse weather conditions (e.g., fog, rain, snow) and low-light scenarios, providing reliable object detection and ranging. In 2024, over 169 million radar sensors were shipped globally, with an average of 0.8 long-range radars per vehicle in 2024, expected to approach 1 per vehicle by 2030. Robotaxis, such as Cruise (21 radars per vehicle) and Waymo (six high-performance 4D radars), demonstrate heavy reliance on radar for Level 4/5 autonomy, ensuring robust environmental perception. The rising adoption of ADAS, driven by consumer demand for safety and regulatory mandates (e.g., EU's Vehicle General Safety Regulations, July 2024), is accelerating radar deployment across passenger vehicles, commercial trucks, and autonomous shuttles.

Penetration of 4D Radar Technology Replacing 3D Radars

4D imaging radar, which adds velocity and elevation to the range, azimuth, and Doppler data of 3D radar, is rapidly replacing its predecessor due to superior resolution and accuracy. By 2025, 4D radar is expected to penetrate 11.4% of the automotive radar market, transitioning from a niche to a mainstream technology within 2-3 years. Unlike 3D radar, which struggles with elevation resolution and complex object separation (e.g., distinguishing a pedestrian from a vehicle), 4D radar leverages Massive MIMO, Digital Code Modulation (DCM) , and AI-driven processing to create high-resolution point clouds, rivaling LiDAR in some applications. For instance, Mercedes-Benz EQS with Drive Pilot and Hyundai IONIQ 5 with Continental's ARS540 4D radar showcase enhanced performance in poor visibility. The shift is driven by the need for precise perception in Level 3-5 autonomy and regulatory requirements for advanced safety features like Junction Pedestrian AEB.

Competitive Strategies and regional market opportunities

Established players leverage R&D, global presence, and OEM partnerships (e.g., Bosch's collaboration with Volkswagen) focusing on high-resolution radar and sensor fusion with LiDAR/cameras. On the other hand, start-ups differentiate through cost-effective designs (RadSee's COTS, Uhnder's RoC), AI integration (Waveye, Zendar), and niche applications (Sensrad's industrial focus). A collaborative approach is wherein partnership with Tier 1s and OEMs (e.g., Arbe-BAIC) is accelerating market entry for new players.

Asia-Pacific is the fastest-growing region with the highest CAGR, driven by China's EV boom and government support for smart cities. Companies like SAIC and NIO integrate 4D radar (e.g., ZF's partnership with SAIC, Dec 2022). Opportunities lie in mass-market EVs and robotaxi fleets in urban centers like Shanghai. North America holds largest revenue share, led by the US with OEMs like Ford, GM, and Tesla adopting 4D radar for BlueCruise, Super Cruise, and Autopilot. Europe shows strong growth due to stringent safety regulations (e.g., EU's 2024 mandates). For instance, Mercedes-Benz and BMW lead with Level 2+/3 systems and opportunities are evidently reflected in premium vehicles and compliance-driven markets.

Market Potential

The market for SAE Level 4/5 AVs, including robotaxis and shuttles, is a key growth driver for 4D radar. By 2035, the AV segment is expected to exhibit the highest CAGR (127%) from 2025 to 2035 within the 4D radar market, driven by the need for multiple high-performance radars (6-21 per vehicle). Cruise and Waymo deploy 4D radar extensively, with fleets exceeding 1,000 vehicles in 2024, signaling commercial robotaxi services' rise. The global 4D radar market is projected to reach USD 911 million by 2035 for Level 4/5 AVs alone, with robotaxis and shuttles consuming significant radar units for urban and highway autonomy.

Opportunities include:

- Urban Mobility: High radar demand for navigating dense environments (e.g., Waveye's urban-focused radar).

- Last-Mile Delivery: Autonomous shuttles and delivery vehicles adopting 4D radar for safety.

- Regulatory Support: Mandates for AEB and CPD boost radar integration in Level 4/5 systems.

Key Questions Answered:

- How rapidly is 4D imaging radar penetrating autonomous vehicles across SAE Levels 1-5, and what are the adoption trends?

- What is the current market size and growth potential of the 4D imaging radar market for automotive applications through 2035?

- Which ADAS features (e.g., AEB, ACC, BSM) are most reliant on 4D radar, and how do they enhance safety and performance?

- How are 4D radar costs (e.g., 77 GHz, 60 GHz, 140 GHz) evolving, and what factors drive cost erosion for mass production?

- What are the challenges of integrating 4D radar with other sensors (e.g., LiDAR, cameras) for robust sensor fusion?

- How do frequency regulations (e.g., 77 GHz, 60 GHz, 140 GHz) vary globally, and what impact do they have on 4D radar deployment?

- How 4D radar's role in in-cabin monitoring applications of occupant monitoring and left-child detection is creating market opportunity?

- Which emerging startups (e.g., Arbe, Uhnder, Zendar) are disrupting the 4D radar market, and what are their unique strategies?

- What are the competitive advantages of established players (e.g., Continental, Bosch, NXP) versus emerging startups in the 4D radar market?

- How are partnerships, mergers, and acquisitions shaping the 4D radar market, and what opportunities do they create for stakeholders?

- What investment and funding trends are supporting the growth of the 4D radar market, and how can stakeholders capitalize on them?

Get answers to the most intriguing questions in the 4D imaging radar industry!

List of Companies

|

|

Table of Contents

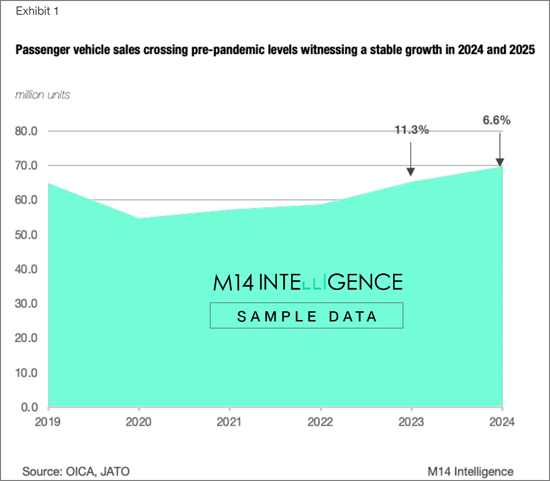

Passenger Vehicle Sales - Market Outlook

- Global Passenger Vehicle Sales, 2019-2024

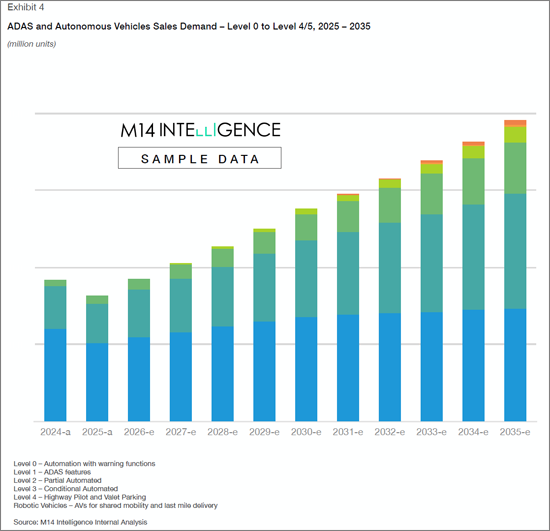

- Passenger Vehicle Sales Breakdown, by Level of Automation, L1 to L5

- ADAS and Autonomous Vehicle Market sales and forecast, 2025-2035

- China dominating the market while Europe holds strong growth potential

- Urban mobility, last-mile delivery and regulatory support will be the new revenue pockets

Status of Automotive Radar Industry - Market Outlook Volume & Value, 2025-2035

- Radar Sensor requirement per vehicle

- ASP of Radar and Expected Price Erosion

- Radar Demand by Levels of Automation

- Radar Demand by Range of Operation (LRR, MRR/SRR, In-cabin)

- Radar Demand by Frequency

- Radar Market Penetration by Frequency

- Trend towards 4D Imaging Radar is Growing Rapidly

Automotive 4D Radar Industry - Market Outlook Volume & Value, 2025-2035

- 4D Radar Market - Split by Levels of Automation

- 4D Radar Market - Split by ADAS and AV Applications

- 4D Imaging Radar for Exterior Sensing Application

- 4D Imaging Radar for In-cabin Application

Automotive 4D Radar Industry - Competition Assessment

- Profiles of Emerging Companies in Automotive 4D Radar Application

- Product Comparison and Benchmarking

- Partnership Mapping and Supplier Analysis

- OEMs, Tier-1s, and Sensor Suppliers in 4D Radar Business

- Investment in R&D by leading players

- Funding and Investment Analysis of Start-ups in 4D Radar Business