Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640665

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640665

Fermentation Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

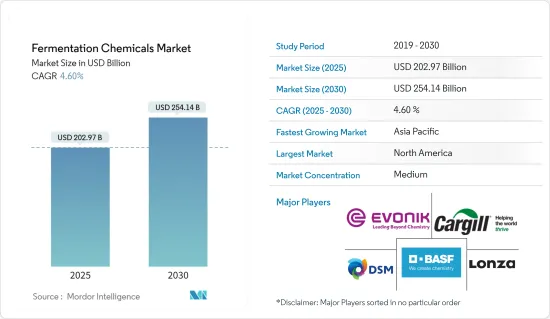

The Fermentation Chemicals Market size is estimated at USD 202.97 billion in 2025, and is expected to reach USD 254.14 billion by 2030, at a CAGR of 4.6% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the fermentation chemicals market. However, the market recovered significantly in 2021.

Key Highlights

- Over the short term, the growing demand from the methanol and ethanol industry and increasing demand from the pharmaceutical industry are major factors driving the studied market's growth.

- However, high costs due to the complexity involved in the manufacturing process are likely to restrain the growth of the studied market.

- Nevertheless, growing green chemistry opportunities will likely create lucrative growth opportunities for the global market soon.

- The North American region dominates the fermentation chemicals market, with the largest consumption coming from countries like the United States, Canada, and Mexico.

Fermentation Chemicals Market Trends

Food and Beverage Sector to Dominate the Market

- Fermentation usually signifies that the action of microorganisms is desirable. Fermentation produces alcoholic beverages such as wine, beer, and cider. Fermentation is also used to produce dairy products and leavening bread.

- Fermentation chemicals are highly demanded by the food and beverages industry as it is the oldest biotechnology used by human beings to produce safer, more stable, and better foodstuff.

- In the Asia-Pacific region, the demand for processed food is growing due to increasing lifestyle changes, disposable income of people, working professionals, and preferences for fast food. Consumers prefer ready-to-eat foods as these require considerably lesser time for cooking, are fresh, and include attractive and sturdy packaging.

- Also, China is expected to continue to be Asia's largest food market, and India and Southeast Asia will witness the most significant increases in food spending.

- The market for food processing in North America is robust due to the excessive dependence of people on packaged food products and the strong foothold of the food processing companies. PepsiCo, Tyson Foods, and Nestle are large food processing companies operating in the region.

- Germany is by far Europe's largest market for foods and beverages, home to more than 83 million of the world's wealthiest consumers. In 2023, the German food market is expected to generate USD 245.50 billion in revenue. The market is expected to grow annually by 3.64% between 2023 to 2027.

- According to OIV (International Organisation of Vine and Wine), global wine production in 2022 amounted to about 258 million hectoliters.

- Additionally, in 2022, Italy was the world's top wine producer and exported the most wine, amounting to 21.9 million hectoliters. The top exporters were the other two top wine producers. France exported 14 million hectoliters, while Spain exported 21.2 million.

- Such factors likely support the demand for the studied market from the food and beverages segment.

North America to Dominate the Market

- North America currently accounts for the highest global fermentation chemicals market share.

- The pharmaceutical industry highly drives the market for North America in the United States and its growing focus to turn itself into a green industry.

- In North America, the United States accounts for the largest share of the revenue generated by global pharmaceutical sales. In 2024, the United States is projected to spend between USD 605 and 635 billion on medicines, according to AstraZeneca. It will make the country achieve the highest pharmaceutical spending by far.

- Canada's pharmaceuticals market is the ninth-largest globally, with a 2.1% share of global market sales. The pharmaceutical sector in Canada is progressing under direct support from the government. For instance, in August 2021, the government of Canada announced new investments in diabetes research.

- Recently, the food & beverage industry witnessed major growth in the United States, likely to drive the market studied.

- In March 2022, Nestle announced its plans to invest USD 675 million in a new plant in Metro Phoenix, Arizona, the United States, to produce beverages, including oat milk coffee creamers, as consumer demand for plant-based products increases. The plant is expected to be operational in 2024.

- Additionally, there is an increasing demand for fermentation chemicals from Canada and Mexico for use in the pharmaceutical, food & beverage industries.

- Therefore, the abovementioned factors contribute to the increasing demand for the fermentation chemicals market in North America during the forecast period.

Fermentation Chemicals Industry Overview

The global fermentation chemicals market is partially consolidated in nature. The major players include BASF SE, Cargill, Incorporated., Evonik Industries AG, DSM, and Lonza, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 56541

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Methanol and Ethanol Industry

- 4.1.2 Increasing Demand from the Pharmaceutical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost Due to the Complexity Involved in the Manufacturing Process

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Alcohols

- 5.1.2 Organic Acids

- 5.1.3 Enzymes

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Industrial

- 5.2.2 Food and Beverage

- 5.2.3 Pharmaceutical and Nutritional

- 5.2.4 Plastics and Fibers

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AB Enzymes

- 6.4.2 Ajinomoto Co., Inc.

- 6.4.3 ADM

- 6.4.4 BASF SE

- 6.4.5 Biocon

- 6.4.6 BioVectra

- 6.4.7 Cargill, Incorporated.

- 6.4.8 Chr. Hansen Holding A/S

- 6.4.9 DSM

- 6.4.10 Evonik Industries AG

- 6.4.11 Lonza

- 6.4.12 MicroBiopharm Japan Co., Ltd.

- 6.4.13 Novasep

- 6.4.14 Novozymes

- 6.4.15 Teva Pharmaceutical Industries Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Opportunities for Green Chemistry

- 7.2 Other Opportunities

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.