PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689815

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689815

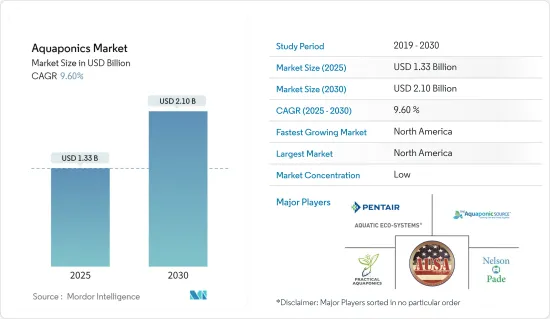

Aquaponics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Aquaponics Market size is estimated at USD 1.33 billion in 2025, and is expected to reach USD 2.10 billion by 2030, at a CAGR of 9.6% during the forecast period (2025-2030).

The COVID-19 pandemic majorly impacted the supply chain of the aquaponics market. Supply chain disruptions amid the pandemic led farmers to rear many live fishes and other aquatic species, which negatively impacted the farmers' cost, expenditure, and risk.

In 2021, North America occupied the largest share in the aquaponics market. The United States contributed the largest share in the region, followed by Canada. Aquaponic is a small but rapidly growing industry in the region, with several partnerships among educational and research institutions and private companies. This factor played a pivotal role in establishing and increasing awareness about aquaponic farms. However, mass-scale production of aquaponic crops is yet to take form in the region, although farms such as Superior Fresh and Ouroboros Farms are at the forefront of commercial aquaponics production.

Aquaponics Market Trends

Substantial Demand for Organic Produce Driving the Market

As aquaponics are free from chemical fertilizers and crop protection chemicals, with fish waste serving as the prime nutrients for plants, the demand for organically grown crops holds high potential and an untapped space for emerging aquaponic farms and aquaponic system providers. As reported by the Organic Trade Association, sales of organic fruits and vegetables rose by 5.6% to USD 17.40 billion in 2018 from USD 16.42 billion in the previous year. Thus, the United States became one of the leading markets for organically grown fruits and vegetables. Moreover, Europe holds one of the largest organic farmland areas globally, with Spain accounting for the largest share with 2,246,475.0 ha of the area under organic farming. As a result of the underlying scope for aquaponic farming in the organic produce industry, the European-funded COST Action FA1305, 'The European Union Aquaponics Hub-Realising Sustainable Integrated Fish and Vegetable Production for the EU', strengthened the network between researchers and private players. Therefore, the demand for organically grown produce is expected to drive the global aquaponics industry during the forecast period.

North America Dominates the Market

Although still a small industry in North America, aquaponic farming is expected to witness exponential growth in the coming years. In 2014, the University of Wisconsin - Stevens Point and Nelson and Pade Aquaponics entered a Public-Private Partnership (PPP) to establish an Aquaponics Innovation Center as part of the UW-System Economic Development Incentive Grant. Such initiatives have played a pivotal role in raising awareness about sustainable farming alternatives, such as aquaponics, in the region. Additionally, aquaponics is expected to help rebuild the aquaculture industry in the United States. In Wisconsin, the number of aquaculture farms recently rose from 2,300 to 2,800, with 300 out of the 500 new farms being aquaponic farms, as revealed at the Aquaculture America Conference in 2018. Currently, the United States imports more than 80.0% of the seafood it consumes annually. The rising number of aquaponic farms in the country may help it reduce its seafood import over time.

Aquaponics Industry Overview

The aquaponics market is highly fragmented, primarily due to the evolving nature of the market. Some of the most active aquaponic farms are Superior Fresh, Ouroboros Farms, Garden City Aquaponics Inc., BIGH, Deep Water Farms, and Madhavi Farms. Some major aquaponic input providers are Pentair Aquatic Eco-System Inc. (PAES), Nelson & Pade Aquaponics, Practical Aquaponics, Aquaponics USA, and The Aquaponic Source. As the market is still expanding, emerging players are strategizing product launches and capacity expansions to secure a substantial share in the market studied.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Growing System

- 5.1.1 Media Filled Beds

- 5.1.1.1 Constant Flow

- 5.1.1.2 Ebb and Flow (Flood and Drain)

- 5.1.2 Nutrient Film Technique (NFT)

- 5.1.3 Raft or Deep Water Culture (DWC)

- 5.1.1 Media Filled Beds

- 5.2 Facility Type

- 5.2.1 Poly or Glass Greenhouses

- 5.2.2 Indoor Vertical Farms

- 5.2.3 Other Facility Types

- 5.3 Fish Type

- 5.3.1 Tilapia

- 5.3.2 Catfish

- 5.3.3 Carp

- 5.3.4 Trout

- 5.3.5 Ornamental Fish

- 5.3.6 Other Fish Types

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Malaysia

- 5.4.3.4 Indonesia

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.1.1 Aquaponics Input Providers

- 6.1.2 Aquaponic Farms

- 6.2 Market Share Analysis

- 6.2.1 Aquaponics Input Providers

- 6.2.2 Aquaponic Farms

- 6.3 Company Profiles - Aquaponics Input Providers

- 6.3.1 Pentair Aquatic Eco-System Inc. (PAES)

- 6.3.2 Nelson & Pade Aquaponics

- 6.3.3 Practical Aquaponics

- 6.3.4 Aquaponics USA

- 6.3.5 The Aquaponic Source

- 6.4 Company Profile - Aquaponic Farms

- 6.4.1 Superior Fresh

- 6.4.2 Ouroboros Farms

- 6.4.3 Garden City Aquaponics Inc.

- 6.4.4 BIGH

- 6.4.5 Deep Water Farms

- 6.4.6 Madhavi Farms

- 6.4.7 ECF Farm Berlin

7 MARKET OPPORTUNITITES AND FUTURE TRENDS

8 AN ASSESSMENT OF COVID-19 IMPACT ON THE MARKET