PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435219

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1435219

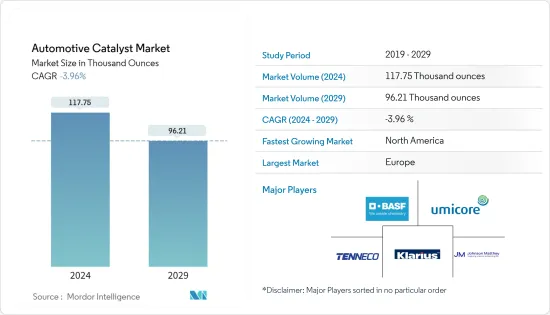

Automotive Catalyst - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Automotive Catalyst Market size is estimated at 117.75 Thousand ounces in 2024, and is expected to decline to 96.21 Thousand ounces by 2029.

The COVID-19 pandemic negatively impacted the market due to the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, stringent emission standards implemented by governments across the world and an increase in the production of automobiles are the major factors driving the growth of the market studied.

- On the flip side, the rise in the popularity of electric vehicles is hindering the growth of the market.

- However, surge in emphasis of developing nations towards the emission standards is anticipated to provide future growth opportunity to the automotive catalyst market.

- Europe is expected to dominate the market and have the largest market share globally, owing to the adoption of stringent emission standards in the region.

Automotive Catalyst Market Trends

The Passenger Cars Segment to Dominate the Market

- Internal combustion engines produce toxic emissions due to incomplete combustion in the engine.

- Apart from the fact that CO is poisonous to humans, the stagnant air masses over urban areas can hold the pollutants for long periods. When sunlight interacts with these pollutants, the formation of ground-level ozone occurs due to the chemical reaction between HC, NOx, and sunlight.

- The automotive catalyst is used in the exhaust system of vehicles to control the emission of harmful gases, such as hydrocarbons, carbon oxides, and nitrogen oxides, as these catalysts help in converting harmful gases into less toxic gases, such as nitrogen and carbon dioxide.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022, the total number of passenger cars produced globally was 61.59 million units, which showed an increase of 8% compared to 2021 and 10% compared to 2020. Therefore, an increase in the production of passenger cars is expected to create an upside demand for automotive catalysts in the forecast period.

- Increased investments and advancements in the automobile industry in India is expected to create an upside demand for automotive catalyst market. For instance, in April 2022, Tata Motors announced plans to invest USD 3.08 billion in its passenger vehicle business over the next five years. This is expected to have a positive impact on the automotive catalyst market in the country.

- In the United Kingdom, rising inflation, supply chain management issues, geopolitical unrest and COVID were the major contributors for the decrease in the production of passenger cars. For instance, according to OICA, in 2022, the country produced a total of 7,75,014 units of passenger vehicles at a 10% production decline rate as compared to 8,59,575 passenger vehicles produced in 2021. The fallout due to Brexit and the tensions between the United States and China have also significantly affected vehicle production in the country. These factors will negatively affect the market for automotive catalyst in the country.

- The governments of developing nations are taking initiatives in concern of emission control by spending hugely on new emission controlling technologies like fuel efficiency, which is expected to boost the growth of the automotive catalyst market. A four-way catalyst has better efficiency than older catalysts.

- The aforementioned factors are expected to show a significant impact on the automotive catalyst market during the forecast period.

Europe to Dominate the Market

- Europe is expected to dominate the automotive catalyst market due to the increasingly stringent emission standards in the region.

- Stringent government regulations to restrain pollution surged the demand for automotive catalysts in recent times.

- In the Passenger car segment, according to OICA, there was a decline in overall production in 2022. With a decrease of 1% compared to 2021, the automotive catalyst market is yet to see a recovery period. The major decrease in production was due to the constant change in the environmental standards set by the governing bodies. This played a vital role in the decrease of automotive catalysts from the passenger car segment in the region. Countries like Slovnia, and Uzbekistan have seen a major decrease in the demand for passenger cars while countries like Austria, Portugal, Belarus, and others have seen a surge in automotive production thereby increasing the demand for automotive catalysts in the region.

- Moreover, in Germany, the automotive industry has been hampered by the shortage of semiconductors and a limited supply of raw materials. Similarly, other factors such as the implementation of the new Worldwide Harmonized Light-Duty Vehicles Test Procedure (WLTP) and US-China trade conflicts which decreased the international automotive demand, EU-28's new emission standard which mandates carmakers to achieve average CO2 emissions of 95 grams per kilometre across newly sold vehicles had negatively affected the production of passenger cars. However, in 2022 the automobile production in the country recovered gradually from semiconductor shortages. For instance, according to OICA, around 34,80,357 passenger cars were produced in Germany in 2022, which shows an increase of 12% compared to 2021. Therefore, increase in the production of passeger car segment is expected to create an upside demand for automotive catalyst market.

- Due to the ongoing semiconductor shortages, the production of light commercial vehicles in the Europe region is declining. For instance, in 2022, according to OICA, around 21,48,379 units of light commercial vehicles were produced, which declined by 2% compared to 2021. These shortages are expected to restrict the growth of demand for automotive catalysts market in the country.

- Russia's production of light commercial vehicles has increased in the last three years due to an increase in online shopping and urbanization, which has created new retail and e-commerce platforms in the country that require efficient logistics. In contrast, the Russia-Ukraine war has resulted in economic sanctions, a jump in commodity prices, and supply chain interruptions, impacting the production of light commercial vehicles in the country, and affecting the automotive catalysts market in the country. For instance, according to OICA, in 2022, around 83,813 units of light commercial vehicles were produced, which shows a decrease of 35% compared to 2021.

- In France, due to the ongoing semiconductor shortage and supply chain shortages slightly affected the light commercial vehicles production in the country. For instance, according to OICA, in 2022 the country's light commercial vehicles production volume declined by 14% to 3,72,707 units as compared to 4,33,401 units produced in 2021.

- The abovementioned factors are expected to show a significant impact on the market in the coming years.

Automotive Catalyst Industry Overview

The Automotive Catalyst Market is partially fragmented in nature. The major players in this market (not in a particular order) include BASF SE, Tenneco Inc., Johnson Matthey, Klarius Products Ltd, and Umicore, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Automobile Production

- 4.1.2 Stringent Regulations Related to Automotive Emission

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rise in Popularity of Electric Vehicles

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Other Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CDTi Advanced Materials Inc.

- 6.4.3 CLARIANT

- 6.4.4 Cummins Inc.

- 6.4.5 DCL International Inc.

- 6.4.6 Ecocat India Pvt Ltd

- 6.4.7 Johnson Matthey

- 6.4.8 Klarius Products Ltd

- 6.4.9 N.E. CHEMCAT CORPORATION

- 6.4.10 Tenneco Inc.

- 6.4.11 Umicore

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 Surge in Emphasis of Developing Nations Towards the Emission Standards

9 Other Opportunities